Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

44 viewsAccounting Scandals Enron Scandal (2001)

Accounting Scandals Enron Scandal (2001)

Uploaded by

TRÂN PHẠM NGỌC BẢOThe document summarizes several major accounting scandals from 2001-2008, including Enron inflating assets and hiding debts which led to bankruptcy, WorldCom falsely reporting billions in costs and revenues leading to job losses, and Bernie Madoff operating the largest Ponzi scheme in history tricking investors out of $64.8 billion. The scandals involved deception around financial reporting through falsifying records, hiding debts, and fabricating transactions, with CEOs and executives usually responsible and facing penalties like prison time after investigations uncovered the fraud.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You might also like

- 1 - Assignment - Case Study - Group4Document4 pages1 - Assignment - Case Study - Group4Jiya SehgalNo ratings yet

- Bus. Math Essay Decimal Fraction PercentageDocument1 pageBus. Math Essay Decimal Fraction PercentageLe Gumi100% (2)

- Tyco Fraud Case StudyDocument12 pagesTyco Fraud Case StudySumit Sharma100% (1)

- Ethical Issues - Inside JobDocument5 pagesEthical Issues - Inside JobMaimana Javed0% (1)

- CH - 9 Assessing The Risk of Material MisstatementDocument14 pagesCH - 9 Assessing The Risk of Material MisstatementOmar C100% (2)

- FD ReceiptDocument2 pagesFD ReceiptManjit Debbarma100% (1)

- TOP 10 Corporate Scandal: Chronological OrderDocument11 pagesTOP 10 Corporate Scandal: Chronological OrderNiken PratiwiNo ratings yet

- The 10 Worst Corporate Accounting Scandals of All TimeDocument4 pagesThe 10 Worst Corporate Accounting Scandals of All TimeNadie LrdNo ratings yet

- The 10 Worst Corporate Accounting Scandals of All Time..Document5 pagesThe 10 Worst Corporate Accounting Scandals of All Time..Tamirat Eshetu Wolde100% (1)

- The 10 Worst Corporate Accounting Scandals of All TimeDocument4 pagesThe 10 Worst Corporate Accounting Scandals of All TimeFarris Althaf PratamaNo ratings yet

- The 10 Worst Corporate Accounting Scandals of All TimeDocument5 pagesThe 10 Worst Corporate Accounting Scandals of All TimePrince RyanNo ratings yet

- Accounting ScandalsDocument4 pagesAccounting Scandalsyakubu I saidNo ratings yet

- The 10 Worst Corporate Accounting Scandals of All TimeDocument7 pagesThe 10 Worst Corporate Accounting Scandals of All TimeIan ChanNo ratings yet

- Top 10 Corporate Scandals: 10. Union CarbideDocument13 pagesTop 10 Corporate Scandals: 10. Union CarbideSandiep SinghNo ratings yet

- White Collar CrimesDocument9 pagesWhite Collar CrimesandrewNo ratings yet

- Sec. 807. Criminal Penalties For Defrauding Shareholders of Publicly Traded CompaniesDocument6 pagesSec. 807. Criminal Penalties For Defrauding Shareholders of Publicly Traded CompaniesJungkookie BaeNo ratings yet

- 25 Biggest Corporate Scandals EverDocument5 pages25 Biggest Corporate Scandals EverSilvia Ahmad KhattakNo ratings yet

- Sarbanes Oxley Act, 2002 - FinalDocument153 pagesSarbanes Oxley Act, 2002 - FinalHOD CommerceNo ratings yet

- Green Acc (Group)Document3 pagesGreen Acc (Group)Wong Hui HuiNo ratings yet

- Assignment #1Document3 pagesAssignment #1SandyNo ratings yet

- 10 1 1 692 7701 PDFDocument35 pages10 1 1 692 7701 PDFJulie Anthonette RistonNo ratings yet

- Compilation of Accounting ScandalsDocument7 pagesCompilation of Accounting ScandalsYelyah HipolitoNo ratings yet

- WorldCom ScandalDocument2 pagesWorldCom ScandalKerry1201No ratings yet

- BUS 401.3 Movie Assignment On: Inside Job'Document4 pagesBUS 401.3 Movie Assignment On: Inside Job'Nabil HuqNo ratings yet

- Agency ProblemDocument13 pagesAgency ProblemБахытжан КазангаповNo ratings yet

- Accounting FraudsDocument35 pagesAccounting FraudsSana Ismail100% (1)

- Current Business Affairs: Assignment-1Document17 pagesCurrent Business Affairs: Assignment-1Salman JanNo ratings yet

- EntrinaDocument7 pagesEntrinaevemil berdinNo ratings yet

- WorldCom Was Founded in 1983 As Long Distance Discount Services PDFDocument3 pagesWorldCom Was Founded in 1983 As Long Distance Discount Services PDFJamilleNo ratings yet

- Fraud CasesDocument8 pagesFraud CasesJM Tomas RubianesNo ratings yet

- Tyco InternationalDocument2 pagesTyco InternationalMichael FordNo ratings yet

- Jean Ramirez - Inside Job Movie ReviewDocument14 pagesJean Ramirez - Inside Job Movie ReviewJean Paul RamirezNo ratings yet

- Assignment - 5: International Finance and Forex ManagementDocument8 pagesAssignment - 5: International Finance and Forex ManagementAnika VarkeyNo ratings yet

- Tyco Fraud Case StudyDocument12 pagesTyco Fraud Case Studybb2No ratings yet

- The Corporate Scandal SheetDocument4 pagesThe Corporate Scandal SheetAngelo LincoNo ratings yet

- Muhammad Syahrin Bin Zulkefly 2019848422 BA242 5B FIN657 Sir Mohd Husnin Bin Mat YusofDocument3 pagesMuhammad Syahrin Bin Zulkefly 2019848422 BA242 5B FIN657 Sir Mohd Husnin Bin Mat YusofsyahrinNo ratings yet

- Inside JobDocument52 pagesInside JobMariaNo ratings yet

- Auditing and Corporate Governance: Group No. - 6Document13 pagesAuditing and Corporate Governance: Group No. - 6Sonali ChauhanNo ratings yet

- Motives and Consequences of Fraudulent Financial ReportingDocument8 pagesMotives and Consequences of Fraudulent Financial ReportingAndreea VioletaNo ratings yet

- PWC Negligence Over Colonial BankDocument8 pagesPWC Negligence Over Colonial BankPurnima Sidhant BabbarNo ratings yet

- Tyco ScandalDocument5 pagesTyco ScandalJeraldine CerdanNo ratings yet

- Tyco InternationalDocument14 pagesTyco InternationalCharisse Nhet Clemente100% (1)

- Cases Involving Auditors' NegligenceDocument5 pagesCases Involving Auditors' NegligenceJaden EuNo ratings yet

- Solution Manual For Ethical Obligations and Decision Making in Accounting Text and Cases 4th EditionDocument36 pagesSolution Manual For Ethical Obligations and Decision Making in Accounting Text and Cases 4th Editionbemasterdurga.qkgo100% (53)

- Welcome To Our PresentationDocument38 pagesWelcome To Our PresentationMahbubul Islam KoushickNo ratings yet

- WORLDCOM SCANDAL Audit PresentationDocument11 pagesWORLDCOM SCANDAL Audit PresentationDeepanshu 241 KhannaNo ratings yet

- Ankit Jain Rohan Sharma Tushar Shigwan Sneha Agrawal Sujay Bachewar Abhinandan Nandanikar Abhilash Nair Payal ModyDocument20 pagesAnkit Jain Rohan Sharma Tushar Shigwan Sneha Agrawal Sujay Bachewar Abhinandan Nandanikar Abhilash Nair Payal ModypuneethkunderNo ratings yet

- Examples of Agency ProblemsDocument3 pagesExamples of Agency ProblemsdaleNo ratings yet

- Worldcom: Corporate FraudDocument10 pagesWorldcom: Corporate FraudGhazanfarNo ratings yet

- Central Indiana Chapter #52Document14 pagesCentral Indiana Chapter #52MaxNo ratings yet

- WorldCom CaseDocument9 pagesWorldCom CaseunjustvexationNo ratings yet

- Summary of Case StudiesDocument3 pagesSummary of Case StudiesHoward Rivera RarangolNo ratings yet

- Scandal FRAPPTDocument31 pagesScandal FRAPPTUtkarsh SinghNo ratings yet

- PART 1: How We Got Here?Document5 pagesPART 1: How We Got Here?Abdul Wahab ShahidNo ratings yet

- Business Policy Ass 1Document5 pagesBusiness Policy Ass 1Areej TajammalNo ratings yet

- TycoDocument10 pagesTycoAnna0082No ratings yet

- Tyco Scandal: I. CompanyDocument5 pagesTyco Scandal: I. CompanyAngelika Alonzo CayogNo ratings yet

- Worldcom ScamDocument2 pagesWorldcom ScamSHASHANK MAHESHWARINo ratings yet

- Corporate Scandals and Their Macroeconomic ImpactDocument49 pagesCorporate Scandals and Their Macroeconomic ImpacthimusNo ratings yet

- Case 1.8Document4 pagesCase 1.8Ian Chen100% (1)

- Inside Job NotesDocument18 pagesInside Job NotesIrish Mae T. EspallardoNo ratings yet

- Other People's Money: The Corporate Mugging of AmericaFrom EverandOther People's Money: The Corporate Mugging of AmericaRating: 4.5 out of 5 stars4.5/5 (2)

- FinTech Rising: Navigating the maze of US & EU regulationsFrom EverandFinTech Rising: Navigating the maze of US & EU regulationsRating: 5 out of 5 stars5/5 (1)

- IFAC - The-CFO-and-Finance-Function-Role-in-Value-Creation - 2020Document16 pagesIFAC - The-CFO-and-Finance-Function-Role-in-Value-Creation - 2020TRÂN PHẠM NGỌC BẢONo ratings yet

- The Sarbanes-Oxley Act at 15Document31 pagesThe Sarbanes-Oxley Act at 15TRÂN PHẠM NGỌC BẢONo ratings yet

- Business Entity Comparison OverviewDocument6 pagesBusiness Entity Comparison OverviewTRÂN PHẠM NGỌC BẢONo ratings yet

- Agency Theory, Kaplan UkDocument4 pagesAgency Theory, Kaplan UkTRÂN PHẠM NGỌC BẢONo ratings yet

- HRM370-CASE 1-NCC BankDocument16 pagesHRM370-CASE 1-NCC BankOishee AhmedNo ratings yet

- The Benefits and Challenges of Sustainable Agriculture PracticesDocument2 pagesThe Benefits and Challenges of Sustainable Agriculture PracticesSMA MAKARIOSNo ratings yet

- Sourcing in Apparel IndustriesDocument9 pagesSourcing in Apparel Industriesarun.shukla83% (6)

- Amazon Case StudyDocument1 pageAmazon Case StudyMuneebNo ratings yet

- 1552629478-2691 M3M India Holdings Gurgaon BS + LP SAHU FINAL PDFDocument64 pages1552629478-2691 M3M India Holdings Gurgaon BS + LP SAHU FINAL PDFParas GuliaNo ratings yet

- Group Assignment MGT (AC1101A) LatestDocument6 pagesGroup Assignment MGT (AC1101A) LatestSyaza Aisyah0% (1)

- Report Writing@@@Document15 pagesReport Writing@@@satya narayanaNo ratings yet

- LogisticsDocument15 pagesLogisticsAbdiNo ratings yet

- Bond AccountingDocument10 pagesBond AccountingDaniela HogasNo ratings yet

- Nimrah Front PagesDocument18 pagesNimrah Front PagesAnwar IqbalNo ratings yet

- 269C Helicopter: Alert Service BulletinDocument10 pages269C Helicopter: Alert Service BulletinHenry VillamilNo ratings yet

- Power BI Resume 02Document2 pagesPower BI Resume 02haribabu madaNo ratings yet

- 2014 IOMA Derivatives Market SurveyDocument45 pages2014 IOMA Derivatives Market SurveyasifNo ratings yet

- Video - Ice CreamDocument2 pagesVideo - Ice CreamRosy HernandezNo ratings yet

- Empirical Determination of Labour Output For Floor Screed and Tile Finishes For Construction Work in AbujaDocument112 pagesEmpirical Determination of Labour Output For Floor Screed and Tile Finishes For Construction Work in AbujaAman PeterNo ratings yet

- Functions of ECGCDocument20 pagesFunctions of ECGCpankul_90100% (2)

- Rayban MetaphorsDocument5 pagesRayban MetaphorsVishaal Kumaran J 2027825No ratings yet

- Omar - Confidentiality ActivityDocument6 pagesOmar - Confidentiality ActivityOMAR ID-AGRAMNo ratings yet

- 1411 2782 1 SMDocument27 pages1411 2782 1 SMYulindo Laksa DiartaNo ratings yet

- R12.2.10 TOI Implement - and - Use Cost Management - Cost Management Command CenterDocument27 pagesR12.2.10 TOI Implement - and - Use Cost Management - Cost Management Command CenterPrasannaNo ratings yet

- Vocabulary For MeetingsDocument3 pagesVocabulary For MeetingsMarcia OhtaNo ratings yet

- MIS BasicsDocument23 pagesMIS Basicssai pawanismNo ratings yet

- Master Thesis Uzh EconomicsDocument4 pagesMaster Thesis Uzh Economicsfjgjdhzd100% (1)

- IB Fall 2023 - Lecture 5 - CH 5 - Theories of International Trade N InvestmentDocument57 pagesIB Fall 2023 - Lecture 5 - CH 5 - Theories of International Trade N InvestmentMansoor AliNo ratings yet

- Chapter 11Document101 pagesChapter 11Kim FloresNo ratings yet

- Dominican Businesses Plaza LamaDocument3 pagesDominican Businesses Plaza LamaelisandraNo ratings yet

Accounting Scandals Enron Scandal (2001)

Accounting Scandals Enron Scandal (2001)

Uploaded by

TRÂN PHẠM NGỌC BẢO0 ratings0% found this document useful (0 votes)

44 views3 pagesThe document summarizes several major accounting scandals from 2001-2008, including Enron inflating assets and hiding debts which led to bankruptcy, WorldCom falsely reporting billions in costs and revenues leading to job losses, and Bernie Madoff operating the largest Ponzi scheme in history tricking investors out of $64.8 billion. The scandals involved deception around financial reporting through falsifying records, hiding debts, and fabricating transactions, with CEOs and executives usually responsible and facing penalties like prison time after investigations uncovered the fraud.

Original Description:

This is an useful material of corporate finance

Original Title

Accounting Scandals

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document summarizes several major accounting scandals from 2001-2008, including Enron inflating assets and hiding debts which led to bankruptcy, WorldCom falsely reporting billions in costs and revenues leading to job losses, and Bernie Madoff operating the largest Ponzi scheme in history tricking investors out of $64.8 billion. The scandals involved deception around financial reporting through falsifying records, hiding debts, and fabricating transactions, with CEOs and executives usually responsible and facing penalties like prison time after investigations uncovered the fraud.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

44 views3 pagesAccounting Scandals Enron Scandal (2001)

Accounting Scandals Enron Scandal (2001)

Uploaded by

TRÂN PHẠM NGỌC BẢOThe document summarizes several major accounting scandals from 2001-2008, including Enron inflating assets and hiding debts which led to bankruptcy, WorldCom falsely reporting billions in costs and revenues leading to job losses, and Bernie Madoff operating the largest Ponzi scheme in history tricking investors out of $64.8 billion. The scandals involved deception around financial reporting through falsifying records, hiding debts, and fabricating transactions, with CEOs and executives usually responsible and facing penalties like prison time after investigations uncovered the fraud.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 3

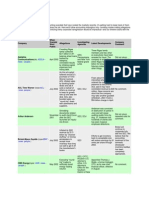

ACCOUNTING SCANDALS

ENRON SCANDAL (2001)

Company: Houston-based commodities, energy and service corporation

What happened: Shareholders lost $74 billion, thousands of employees and

investors lost their retirement accounts, and many employees lost their jobs.

Main players: CEO Jeff Skilling and former CEO Ken Lay.

How they did it: Kept huge debts off balance sheets.

How they got caught: Turned in by internal whistleblower Sherron Watkins; high

stock prices fueled external suspicions.

Penalties: Lay died before serving time; Skilling got 24 years in prison. The

company filed for bankruptcy. Arthur Andersen was found guilty of fudging

Enron's accounts.

Fun fact: Fortune Magazine named Enron "America's Most Innovative Company"

6 years in a row prior to the scandal.

WORLDCOM SCANDAL (2002)

Company: Telecommunications company; now MCI, Inc.

What happened: Inflated assets by as much as $11 billion, leading to 30,000 lost

jobs and $180 billion in losses for investors.

Main player: CEO Bernie Ebbers

How he did it: Underreported line costs by capitalizing rather than expensing and

inflated revenues with fake accounting entries.

How he got caught: WorldCom's internal auditing department uncovered $3.8

billion of fraud.

Penalties: CFO was fired, controller resigned, and the company filed for

bankruptcy. Ebbers sentenced to 25 years for fraud, conspiracy and filing false

documents with regulators.

Fun fact: Within weeks of the scandal, Congress passed the Sarbanes-Oxley

Act, introducing the most sweeping set of new business regulations since the

1930s.

TYCO SCANDAL (2002)

Company: New Jersey-based blue-chip Swiss security systems.

What happened: CEO and CFO stole $150 million and inflated company income

by $500 million.

Main players: CEO Dennis Kozlowski and former CFO Mark Swartz.

How they did it: Siphoned money through unapproved loans and fraudulent stock

sales. Money was smuggled out of company disguised as executive bonuses or

benefits.

How they got caught: SEC and Manhattan D.A. investigations uncovered

questionable accounting practices, including large loans made to Kozlowski that

were then forgiven.

Penalties: Kozlowski and Swartz were sentenced to 8-25 years in prison. A

class-action lawsuit forced Tyco to pay $2.92 billion to investors.

Fun fact: At the height of the scandal Kozlowski threw a $2 million birthday party

for his wife on a Mediterranean island, complete with a Jimmy Buffet

performance.

HEALTHSOUTH SCANDAL (2003)

Company: Largest publicly traded health care company in the U.S.

What happened: Earnings numbers were allegedly inflated $1.4 billion to meet

stockholder expectations.

Main player: CEO Richard Scrushy.

How he did it: Allegedly told underlings to make up numbers and transactions

from 1996-2003.

How he got caught: Sold $75 million in stock a day before the company posted a

huge loss, triggering SEC suspicions.

Penalties: Scrushy was acquitted of all 36 counts of accounting fraud, but

convicted of bribing the governor of Alabama, leading to a 7-year prison

sentence.

Fun fact: Scrushy now works as a motivational speaker and maintains his

innocence.

FREDDIE MAC (2003)

Company: Federally backed mortgage-financing giant.

What happened: $5 billion in earnings were misstated.

Main players: President/COO David Glenn, Chairman/CEO Leland Brendsel, ex-

CFO Vaughn Clarke, former senior VPs Robert Dean and Nazir Dossani.

How they did it: Intentionally misstated and understated earnings on the books.

How they got caught: An SEC investigation.

Penalties: $125 million in fines and the firing of Glenn, Clarke and Brendsel.

Fun fact: 1 year later, the other federally backed mortgage financing company,

Fannie Mae, was caught in an equally stunning accounting scandal.

AMERICAN INTERNATIONAL GROUP (AIG) SCANDAL (2005)

Company: Multinational insurance corporation.

What happened: Massive accounting fraud to the tune of $3.9 billion was alleged,

along with bid-rigging and stock price manipulation.

Main player: CEO Hank Greenberg.

How he did it: Allegedly booked loans as revenue, steered clients to insurers with

whom AIG had payoff agreements, and told traders to inflate AIG stock price.

How he got caught: SEC regulator investigations, possibly tipped off by a

whistleblower.

Penalties: Settled with the SEC for $10 million in 2003 and $1.64 billion in 2006,

with a Louisiana pension fund for $115 million, and with 3 Ohio pension funds for

$725 million. Greenberg was fired, but has faced no criminal charges.

Fun fact: After posting the largest quarterly corporate loss in history in 2008

($61.7 billion) and getting bailed out with taxpayer dollars, AIG execs rewarded

themselves with over $165 million in bonuses .

LEHMAN BROTHERS SCANDAL (2008)

Company: Global financial services firm.

What happened: Hid over $50 billion in loans disguised as sales.

Main players: Lehman executives and the company's auditors, Ernst & Young.

How they did it: Allegedly sold toxic assets to Cayman Island banks with the

understanding that they would be bought back eventually. Created the

impression Lehman had $50 billion more cash and $50 billion less in toxic assets

than it really did.

How they got caught: Went bankrupt.

Penalties: Forced into the largest bankruptcy in U.S. history. SEC didn't

prosecute due to lack of evidence.

Fun fact: In 2007 Lehman Brothers was ranked the #1 "Most Admired Securities

Firm" by Fortune Magazine.

BERNIE MADOFF SCANDAL (2008)

Company: Bernard L. Madoff Investment Securities LLC was a Wall Street

investment firm founded by Madoff.

What happened: Tricked investors out of $64.8 billion through the largest Ponzi

scheme in history.

Main players: Bernie Madoff, his accountant, David Friehling, and Frank

DiPascalli.

How they did it: Investors were paid returns out of their own money or that of

other investors rather than from profits.

How they got caught: Madoff told his sons about his scheme and they reported

him to the SEC. He was arrested the next day.

Penalties: 150 years in prison for Madoff + $170 billion restitution. Prison time for

Friehling and DiPascalli.

Fun fact: Madoff's fraud was revealed just months after the 2008 U.S. financial

collapse.

You might also like

- 1 - Assignment - Case Study - Group4Document4 pages1 - Assignment - Case Study - Group4Jiya SehgalNo ratings yet

- Bus. Math Essay Decimal Fraction PercentageDocument1 pageBus. Math Essay Decimal Fraction PercentageLe Gumi100% (2)

- Tyco Fraud Case StudyDocument12 pagesTyco Fraud Case StudySumit Sharma100% (1)

- Ethical Issues - Inside JobDocument5 pagesEthical Issues - Inside JobMaimana Javed0% (1)

- CH - 9 Assessing The Risk of Material MisstatementDocument14 pagesCH - 9 Assessing The Risk of Material MisstatementOmar C100% (2)

- FD ReceiptDocument2 pagesFD ReceiptManjit Debbarma100% (1)

- TOP 10 Corporate Scandal: Chronological OrderDocument11 pagesTOP 10 Corporate Scandal: Chronological OrderNiken PratiwiNo ratings yet

- The 10 Worst Corporate Accounting Scandals of All TimeDocument4 pagesThe 10 Worst Corporate Accounting Scandals of All TimeNadie LrdNo ratings yet

- The 10 Worst Corporate Accounting Scandals of All Time..Document5 pagesThe 10 Worst Corporate Accounting Scandals of All Time..Tamirat Eshetu Wolde100% (1)

- The 10 Worst Corporate Accounting Scandals of All TimeDocument4 pagesThe 10 Worst Corporate Accounting Scandals of All TimeFarris Althaf PratamaNo ratings yet

- The 10 Worst Corporate Accounting Scandals of All TimeDocument5 pagesThe 10 Worst Corporate Accounting Scandals of All TimePrince RyanNo ratings yet

- Accounting ScandalsDocument4 pagesAccounting Scandalsyakubu I saidNo ratings yet

- The 10 Worst Corporate Accounting Scandals of All TimeDocument7 pagesThe 10 Worst Corporate Accounting Scandals of All TimeIan ChanNo ratings yet

- Top 10 Corporate Scandals: 10. Union CarbideDocument13 pagesTop 10 Corporate Scandals: 10. Union CarbideSandiep SinghNo ratings yet

- White Collar CrimesDocument9 pagesWhite Collar CrimesandrewNo ratings yet

- Sec. 807. Criminal Penalties For Defrauding Shareholders of Publicly Traded CompaniesDocument6 pagesSec. 807. Criminal Penalties For Defrauding Shareholders of Publicly Traded CompaniesJungkookie BaeNo ratings yet

- 25 Biggest Corporate Scandals EverDocument5 pages25 Biggest Corporate Scandals EverSilvia Ahmad KhattakNo ratings yet

- Sarbanes Oxley Act, 2002 - FinalDocument153 pagesSarbanes Oxley Act, 2002 - FinalHOD CommerceNo ratings yet

- Green Acc (Group)Document3 pagesGreen Acc (Group)Wong Hui HuiNo ratings yet

- Assignment #1Document3 pagesAssignment #1SandyNo ratings yet

- 10 1 1 692 7701 PDFDocument35 pages10 1 1 692 7701 PDFJulie Anthonette RistonNo ratings yet

- Compilation of Accounting ScandalsDocument7 pagesCompilation of Accounting ScandalsYelyah HipolitoNo ratings yet

- WorldCom ScandalDocument2 pagesWorldCom ScandalKerry1201No ratings yet

- BUS 401.3 Movie Assignment On: Inside Job'Document4 pagesBUS 401.3 Movie Assignment On: Inside Job'Nabil HuqNo ratings yet

- Agency ProblemDocument13 pagesAgency ProblemБахытжан КазангаповNo ratings yet

- Accounting FraudsDocument35 pagesAccounting FraudsSana Ismail100% (1)

- Current Business Affairs: Assignment-1Document17 pagesCurrent Business Affairs: Assignment-1Salman JanNo ratings yet

- EntrinaDocument7 pagesEntrinaevemil berdinNo ratings yet

- WorldCom Was Founded in 1983 As Long Distance Discount Services PDFDocument3 pagesWorldCom Was Founded in 1983 As Long Distance Discount Services PDFJamilleNo ratings yet

- Fraud CasesDocument8 pagesFraud CasesJM Tomas RubianesNo ratings yet

- Tyco InternationalDocument2 pagesTyco InternationalMichael FordNo ratings yet

- Jean Ramirez - Inside Job Movie ReviewDocument14 pagesJean Ramirez - Inside Job Movie ReviewJean Paul RamirezNo ratings yet

- Assignment - 5: International Finance and Forex ManagementDocument8 pagesAssignment - 5: International Finance and Forex ManagementAnika VarkeyNo ratings yet

- Tyco Fraud Case StudyDocument12 pagesTyco Fraud Case Studybb2No ratings yet

- The Corporate Scandal SheetDocument4 pagesThe Corporate Scandal SheetAngelo LincoNo ratings yet

- Muhammad Syahrin Bin Zulkefly 2019848422 BA242 5B FIN657 Sir Mohd Husnin Bin Mat YusofDocument3 pagesMuhammad Syahrin Bin Zulkefly 2019848422 BA242 5B FIN657 Sir Mohd Husnin Bin Mat YusofsyahrinNo ratings yet

- Inside JobDocument52 pagesInside JobMariaNo ratings yet

- Auditing and Corporate Governance: Group No. - 6Document13 pagesAuditing and Corporate Governance: Group No. - 6Sonali ChauhanNo ratings yet

- Motives and Consequences of Fraudulent Financial ReportingDocument8 pagesMotives and Consequences of Fraudulent Financial ReportingAndreea VioletaNo ratings yet

- PWC Negligence Over Colonial BankDocument8 pagesPWC Negligence Over Colonial BankPurnima Sidhant BabbarNo ratings yet

- Tyco ScandalDocument5 pagesTyco ScandalJeraldine CerdanNo ratings yet

- Tyco InternationalDocument14 pagesTyco InternationalCharisse Nhet Clemente100% (1)

- Cases Involving Auditors' NegligenceDocument5 pagesCases Involving Auditors' NegligenceJaden EuNo ratings yet

- Solution Manual For Ethical Obligations and Decision Making in Accounting Text and Cases 4th EditionDocument36 pagesSolution Manual For Ethical Obligations and Decision Making in Accounting Text and Cases 4th Editionbemasterdurga.qkgo100% (53)

- Welcome To Our PresentationDocument38 pagesWelcome To Our PresentationMahbubul Islam KoushickNo ratings yet

- WORLDCOM SCANDAL Audit PresentationDocument11 pagesWORLDCOM SCANDAL Audit PresentationDeepanshu 241 KhannaNo ratings yet

- Ankit Jain Rohan Sharma Tushar Shigwan Sneha Agrawal Sujay Bachewar Abhinandan Nandanikar Abhilash Nair Payal ModyDocument20 pagesAnkit Jain Rohan Sharma Tushar Shigwan Sneha Agrawal Sujay Bachewar Abhinandan Nandanikar Abhilash Nair Payal ModypuneethkunderNo ratings yet

- Examples of Agency ProblemsDocument3 pagesExamples of Agency ProblemsdaleNo ratings yet

- Worldcom: Corporate FraudDocument10 pagesWorldcom: Corporate FraudGhazanfarNo ratings yet

- Central Indiana Chapter #52Document14 pagesCentral Indiana Chapter #52MaxNo ratings yet

- WorldCom CaseDocument9 pagesWorldCom CaseunjustvexationNo ratings yet

- Summary of Case StudiesDocument3 pagesSummary of Case StudiesHoward Rivera RarangolNo ratings yet

- Scandal FRAPPTDocument31 pagesScandal FRAPPTUtkarsh SinghNo ratings yet

- PART 1: How We Got Here?Document5 pagesPART 1: How We Got Here?Abdul Wahab ShahidNo ratings yet

- Business Policy Ass 1Document5 pagesBusiness Policy Ass 1Areej TajammalNo ratings yet

- TycoDocument10 pagesTycoAnna0082No ratings yet

- Tyco Scandal: I. CompanyDocument5 pagesTyco Scandal: I. CompanyAngelika Alonzo CayogNo ratings yet

- Worldcom ScamDocument2 pagesWorldcom ScamSHASHANK MAHESHWARINo ratings yet

- Corporate Scandals and Their Macroeconomic ImpactDocument49 pagesCorporate Scandals and Their Macroeconomic ImpacthimusNo ratings yet

- Case 1.8Document4 pagesCase 1.8Ian Chen100% (1)

- Inside Job NotesDocument18 pagesInside Job NotesIrish Mae T. EspallardoNo ratings yet

- Other People's Money: The Corporate Mugging of AmericaFrom EverandOther People's Money: The Corporate Mugging of AmericaRating: 4.5 out of 5 stars4.5/5 (2)

- FinTech Rising: Navigating the maze of US & EU regulationsFrom EverandFinTech Rising: Navigating the maze of US & EU regulationsRating: 5 out of 5 stars5/5 (1)

- IFAC - The-CFO-and-Finance-Function-Role-in-Value-Creation - 2020Document16 pagesIFAC - The-CFO-and-Finance-Function-Role-in-Value-Creation - 2020TRÂN PHẠM NGỌC BẢONo ratings yet

- The Sarbanes-Oxley Act at 15Document31 pagesThe Sarbanes-Oxley Act at 15TRÂN PHẠM NGỌC BẢONo ratings yet

- Business Entity Comparison OverviewDocument6 pagesBusiness Entity Comparison OverviewTRÂN PHẠM NGỌC BẢONo ratings yet

- Agency Theory, Kaplan UkDocument4 pagesAgency Theory, Kaplan UkTRÂN PHẠM NGỌC BẢONo ratings yet

- HRM370-CASE 1-NCC BankDocument16 pagesHRM370-CASE 1-NCC BankOishee AhmedNo ratings yet

- The Benefits and Challenges of Sustainable Agriculture PracticesDocument2 pagesThe Benefits and Challenges of Sustainable Agriculture PracticesSMA MAKARIOSNo ratings yet

- Sourcing in Apparel IndustriesDocument9 pagesSourcing in Apparel Industriesarun.shukla83% (6)

- Amazon Case StudyDocument1 pageAmazon Case StudyMuneebNo ratings yet

- 1552629478-2691 M3M India Holdings Gurgaon BS + LP SAHU FINAL PDFDocument64 pages1552629478-2691 M3M India Holdings Gurgaon BS + LP SAHU FINAL PDFParas GuliaNo ratings yet

- Group Assignment MGT (AC1101A) LatestDocument6 pagesGroup Assignment MGT (AC1101A) LatestSyaza Aisyah0% (1)

- Report Writing@@@Document15 pagesReport Writing@@@satya narayanaNo ratings yet

- LogisticsDocument15 pagesLogisticsAbdiNo ratings yet

- Bond AccountingDocument10 pagesBond AccountingDaniela HogasNo ratings yet

- Nimrah Front PagesDocument18 pagesNimrah Front PagesAnwar IqbalNo ratings yet

- 269C Helicopter: Alert Service BulletinDocument10 pages269C Helicopter: Alert Service BulletinHenry VillamilNo ratings yet

- Power BI Resume 02Document2 pagesPower BI Resume 02haribabu madaNo ratings yet

- 2014 IOMA Derivatives Market SurveyDocument45 pages2014 IOMA Derivatives Market SurveyasifNo ratings yet

- Video - Ice CreamDocument2 pagesVideo - Ice CreamRosy HernandezNo ratings yet

- Empirical Determination of Labour Output For Floor Screed and Tile Finishes For Construction Work in AbujaDocument112 pagesEmpirical Determination of Labour Output For Floor Screed and Tile Finishes For Construction Work in AbujaAman PeterNo ratings yet

- Functions of ECGCDocument20 pagesFunctions of ECGCpankul_90100% (2)

- Rayban MetaphorsDocument5 pagesRayban MetaphorsVishaal Kumaran J 2027825No ratings yet

- Omar - Confidentiality ActivityDocument6 pagesOmar - Confidentiality ActivityOMAR ID-AGRAMNo ratings yet

- 1411 2782 1 SMDocument27 pages1411 2782 1 SMYulindo Laksa DiartaNo ratings yet

- R12.2.10 TOI Implement - and - Use Cost Management - Cost Management Command CenterDocument27 pagesR12.2.10 TOI Implement - and - Use Cost Management - Cost Management Command CenterPrasannaNo ratings yet

- Vocabulary For MeetingsDocument3 pagesVocabulary For MeetingsMarcia OhtaNo ratings yet

- MIS BasicsDocument23 pagesMIS Basicssai pawanismNo ratings yet

- Master Thesis Uzh EconomicsDocument4 pagesMaster Thesis Uzh Economicsfjgjdhzd100% (1)

- IB Fall 2023 - Lecture 5 - CH 5 - Theories of International Trade N InvestmentDocument57 pagesIB Fall 2023 - Lecture 5 - CH 5 - Theories of International Trade N InvestmentMansoor AliNo ratings yet

- Chapter 11Document101 pagesChapter 11Kim FloresNo ratings yet

- Dominican Businesses Plaza LamaDocument3 pagesDominican Businesses Plaza LamaelisandraNo ratings yet