Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

17 viewsSC A.C. No. 10-2000

SC A.C. No. 10-2000

Uploaded by

ambahomoThis circular instructs lower court judges to exercise caution, prudence, and judiciousness when issuing writs of execution to satisfy money judgments against government agencies and local government units. It cites jurisprudence that government funds and properties for public use cannot be seized under writs of execution. However, government properties not used for public purposes may be subject to execution. Judges are told to follow rules of the Commission on Audit for determining state liability and enforcing money claims against the government.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- Rent AgreementDocument5 pagesRent AgreementAjinkya BagadeNo ratings yet

- Consti II Case Digests AteneoDocument407 pagesConsti II Case Digests AteneoKristinaCuetoNo ratings yet

- Pub Corp Review II Case DigestDocument137 pagesPub Corp Review II Case DigestMikMik UyNo ratings yet

- Churchill v. RaffertyDocument2 pagesChurchill v. RaffertyCristelle Elaine ColleraNo ratings yet

- TCUs TRUST CAPITAL UNITS BLUE BORDER EDITABLEDocument1 pageTCUs TRUST CAPITAL UNITS BLUE BORDER EDITABLEBIGBOY100% (1)

- SC Administrative Circular No 10-2000Document2 pagesSC Administrative Circular No 10-2000henzencameroNo ratings yet

- MEMORANDUM Section 26 pd1445Document3 pagesMEMORANDUM Section 26 pd1445troll warlordsNo ratings yet

- CONSTI 2 Midterm PointersDocument10 pagesCONSTI 2 Midterm PointersRommel P. Abas100% (1)

- CONSTI 2 Midterm PointersDocument8 pagesCONSTI 2 Midterm Pointersbeb_0527100% (1)

- Case Title G.R. No. Main Topic Other Related Topic DateDocument4 pagesCase Title G.R. No. Main Topic Other Related Topic DateKJPL_1987No ratings yet

- State Powers: Eminent Domain: (1) The Expropriator Must Enter A Private PropertyDocument6 pagesState Powers: Eminent Domain: (1) The Expropriator Must Enter A Private PropertyviasuerzaNo ratings yet

- Aryssa Jane R. Salmorin BSED II-Social StudiesDocument33 pagesAryssa Jane R. Salmorin BSED II-Social StudiespearlNo ratings yet

- Vda de Tantoco v. Municipal Council of IloiloDocument6 pagesVda de Tantoco v. Municipal Council of IloiloRon Jacob AlmaizNo ratings yet

- Police Power Case DigestDocument28 pagesPolice Power Case DigestKevin Law100% (1)

- Petitioners vs. vs. Respondents: en BancDocument8 pagesPetitioners vs. vs. Respondents: en BancJela SyNo ratings yet

- 05 Ong Suco V MalonesDocument19 pages05 Ong Suco V MalonesDustin NitroNo ratings yet

- Sumulong V GuerreroDocument3 pagesSumulong V GuerreroRaymond Panotes100% (1)

- Bagatsing Vs RamirezDocument1 pageBagatsing Vs RamirezzahreenamolinaNo ratings yet

- Metropolitan Waterworks and Sewerage System v. Quezon CityDocument47 pagesMetropolitan Waterworks and Sewerage System v. Quezon CitycitizenNo ratings yet

- Land Bank of The Philippines vs. Cacayuran (G.R. No. 191667, April 17, 2013)Document16 pagesLand Bank of The Philippines vs. Cacayuran (G.R. No. 191667, April 17, 2013)Fergen Marie WeberNo ratings yet

- Rule 67 ExpropriationDocument11 pagesRule 67 ExpropriationKarla Mae Dela Peña100% (1)

- Constitutional Law - Ii (Law 112) : Inherent Powers of The State Police PowerDocument34 pagesConstitutional Law - Ii (Law 112) : Inherent Powers of The State Police PowerChristjohn VillaluzNo ratings yet

- 2021 JC - The Law Pertaining To State and Its Relationship With Its CitizensDocument29 pages2021 JC - The Law Pertaining To State and Its Relationship With Its CitizensJemMoralesNo ratings yet

- Sumulong V Guerrero DigestDocument6 pagesSumulong V Guerrero Digestnikka dinerosNo ratings yet

- Eminent DomainDocument9 pagesEminent Domaincliff mascardoNo ratings yet

- Money Judgment Against Government AgenciesDocument2 pagesMoney Judgment Against Government AgenciesMary BeleyNo ratings yet

- Facts of The CaseDocument6 pagesFacts of The CaseDona M. ValbuenaNo ratings yet

- 132124-1989-Philippine Rock Industries Inc. v. Board Of20190522-5466-Sb0or7Document6 pages132124-1989-Philippine Rock Industries Inc. v. Board Of20190522-5466-Sb0or7Kat ObreroNo ratings yet

- 3 GR No. 280496-2020-Philippine - Heart - Center - v. - Local - GovernmentDocument10 pages3 GR No. 280496-2020-Philippine - Heart - Center - v. - Local - GovernmentthebeautyinsideNo ratings yet

- ExpropriationDocument5 pagesExpropriationBINAYAO NAIZA MAENo ratings yet

- First Division (G.R. No. 225409, March 11, 2020)Document15 pagesFirst Division (G.R. No. 225409, March 11, 2020)Auxl Reign Nava0% (1)

- Rabuco V Villegas FactsDocument10 pagesRabuco V Villegas Factscamille6navarroNo ratings yet

- Untitled 3Document12 pagesUntitled 3Jamaica Kim JimenezNo ratings yet

- Mactan Cebu International Airport Authority v. Marcos, Et Al 261 Scra 667Document11 pagesMactan Cebu International Airport Authority v. Marcos, Et Al 261 Scra 667Joshua RodriguezNo ratings yet

- Poli Cases - Part IVDocument51 pagesPoli Cases - Part IVJoshuaLavegaAbrinaNo ratings yet

- Churchill v. Rafferty, 1915Document25 pagesChurchill v. Rafferty, 1915Jaime SiaNo ratings yet

- Page 16-Full CaseDocument195 pagesPage 16-Full CaseAdri MillerNo ratings yet

- Sumulong Vs GuerreroDocument5 pagesSumulong Vs GuerreroPaolo CruzNo ratings yet

- Week9 CLJ-102Document42 pagesWeek9 CLJ-102Angie SantosNo ratings yet

- Eminent Domain Consti 2Document3 pagesEminent Domain Consti 2LC TNo ratings yet

- Diaz vs. Secretary of Finance, 654 SCRA 96, G.R. No. 193007 July 19, 2011Document24 pagesDiaz vs. Secretary of Finance, 654 SCRA 96, G.R. No. 193007 July 19, 2011Alfred GarciaNo ratings yet

- Philippine Heart Center vs. Local Government of Quezon City GR No. 225409 11 March 2020.Document15 pagesPhilippine Heart Center vs. Local Government of Quezon City GR No. 225409 11 March 2020.TobyNo ratings yet

- G.R. No. 225409Document15 pagesG.R. No. 225409Ann ChanNo ratings yet

- Eminent Domain and Due ProcessDocument8 pagesEminent Domain and Due Processeight_bestNo ratings yet

- SPOUSES ANTONIO and FE YUSAY vs. CADocument3 pagesSPOUSES ANTONIO and FE YUSAY vs. CAGwaine C. GelindonNo ratings yet

- Petitioner-Appellant Vs Vs Respondent-Appellees A. M. Zarate, Jose Agbulos, No AppearanceDocument5 pagesPetitioner-Appellant Vs Vs Respondent-Appellees A. M. Zarate, Jose Agbulos, No AppearanceHans LazaroNo ratings yet

- Eminent Domain Case Digest 1-25Document57 pagesEminent Domain Case Digest 1-25Eunice KanapiNo ratings yet

- I. The Principle of Separation of PowersDocument5 pagesI. The Principle of Separation of PowersJerome BrusasNo ratings yet

- Taisei Shimizu v. COA GR No. 238671Document3 pagesTaisei Shimizu v. COA GR No. 238671Reigh Harvy CantaNo ratings yet

- Fundamental Powers of The StateDocument5 pagesFundamental Powers of The Stateramo.narvas.upNo ratings yet

- Notes in Political Law (For 2019 Bar) Jose Edmund E. Guillen, LL.B, LL.MDocument32 pagesNotes in Political Law (For 2019 Bar) Jose Edmund E. Guillen, LL.B, LL.MIman Marion100% (3)

- City of Davao vs. Intestate Estate of Amado S. DalisayDocument25 pagesCity of Davao vs. Intestate Estate of Amado S. Dalisayanon_614984256No ratings yet

- Notes and Cases On Constitutional Law IiDocument92 pagesNotes and Cases On Constitutional Law Iimau_baytingNo ratings yet

- Reviewer in Political Law2Document154 pagesReviewer in Political Law2Legal OfficerNo ratings yet

- Module 10.5 - 10.6Document28 pagesModule 10.5 - 10.6Codee Aeron RipaldaNo ratings yet

- Tantoco Vs Municipal CouncilDocument4 pagesTantoco Vs Municipal CouncilWilliam Christian Dela CruzNo ratings yet

- 01 Jose J. Ferrer JR V City Mayor Herbert Bautista Et Al GR 210551 June 30 2015Document4 pages01 Jose J. Ferrer JR V City Mayor Herbert Bautista Et Al GR 210551 June 30 2015Nojoma PangandamanNo ratings yet

- Constitutional Law 2 Case DigestDocument14 pagesConstitutional Law 2 Case Digestprince pacasum0% (1)

- Hermano RosasDocument4 pagesHermano RosasAngel Pagaran AmarNo ratings yet

- TAX5Document4 pagesTAX5D GNo ratings yet

- Constitution of the State of Minnesota — 1974 VersionFrom EverandConstitution of the State of Minnesota — 1974 VersionNo ratings yet

- Bernardo Vs NLRCDocument8 pagesBernardo Vs NLRCambahomoNo ratings yet

- Handouts Industrial Psychology PDFDocument29 pagesHandouts Industrial Psychology PDFambahomoNo ratings yet

- Chap 9 Special Rules of Court On ADR FINAL PDFDocument12 pagesChap 9 Special Rules of Court On ADR FINAL PDFambahomoNo ratings yet

- Consti1 COURSE OUTLINE and Case ListDocument8 pagesConsti1 COURSE OUTLINE and Case ListambahomoNo ratings yet

- Chap 9 Special Rules of Court On ADR Ver 1 PDFDocument8 pagesChap 9 Special Rules of Court On ADR Ver 1 PDFambahomoNo ratings yet

- Chap 9 Special Rules of Court On ADR FINAL PDFDocument12 pagesChap 9 Special Rules of Court On ADR FINAL PDFambahomoNo ratings yet

- Case Digest Soriano VS Lista & Sandoval VS ComelecDocument3 pagesCase Digest Soriano VS Lista & Sandoval VS ComelecambahomoNo ratings yet

- Case 1Document5 pagesCase 1ambahomoNo ratings yet

- Case Compilation July 23Document8 pagesCase Compilation July 23ambahomoNo ratings yet

- Case Digest LAST - People Vs Jalosjos and Tirol Vs COADocument3 pagesCase Digest LAST - People Vs Jalosjos and Tirol Vs COAambahomoNo ratings yet

- Bognot vs. RRI Lending Corporation Case DigestDocument1 pageBognot vs. RRI Lending Corporation Case Digestambahomo100% (1)

- BP 22 DefendantDocument6 pagesBP 22 DefendantambahomoNo ratings yet

- College of Arts and Sciences: City of Malabon UniversityDocument12 pagesCollege of Arts and Sciences: City of Malabon UniversityRichard GomezNo ratings yet

- EULADocument2 pagesEULAMary Valentina Gamba CasallasNo ratings yet

- The Hierarchy of LawsDocument2 pagesThe Hierarchy of LawsBakekokfundaNo ratings yet

- HombaleFilms-Release-Form (1) 220821 014708Document3 pagesHombaleFilms-Release-Form (1) 220821 014708Rohit RoyNo ratings yet

- Novice Moot Rules 2023-1 PDFDocument11 pagesNovice Moot Rules 2023-1 PDFshreyaNo ratings yet

- Measuring Units Worksheet: Name: - DateDocument2 pagesMeasuring Units Worksheet: Name: - Datemudit mathurNo ratings yet

- Nicolas Y. Cervantes v. Court of Appeals, GR No. 125138, March 2, 1999Document5 pagesNicolas Y. Cervantes v. Court of Appeals, GR No. 125138, March 2, 1999RPSA CPANo ratings yet

- 1 Part of PPT 1 - Types of Tenure SystemsDocument78 pages1 Part of PPT 1 - Types of Tenure SystemsMeku TjikuzuNo ratings yet

- Planters Products Inc v. Fertiphil CorporationDocument1 pagePlanters Products Inc v. Fertiphil CorporationAnsai Claudine CaluganNo ratings yet

- Unit 2Document12 pagesUnit 2Aman GuptaNo ratings yet

- Invitation To TreatDocument1 pageInvitation To TreatlsNo ratings yet

- Chapter 8-Philippine Legal CitationsDocument30 pagesChapter 8-Philippine Legal CitationsZoe Yzabel EgarNo ratings yet

- Mittal School of Business Lovely Professional UniversityDocument10 pagesMittal School of Business Lovely Professional UniversitySaqlain MustaqeNo ratings yet

- Ra 9225 An Act Allowing Illegitimate Children To Use The Surname of Their FatherDocument10 pagesRa 9225 An Act Allowing Illegitimate Children To Use The Surname of Their FatherAJ SantosNo ratings yet

- Legal Notice... Ahsan Ali ShahDocument3 pagesLegal Notice... Ahsan Ali Shahfahadkhan.00769hdNo ratings yet

- G1 ObliconDocument46 pagesG1 ObliconFrancis AlvarNo ratings yet

- Formalities and ExceptionsDocument17 pagesFormalities and ExceptionsnishaaaNo ratings yet

- Applied Pharmacology For The Dental Hygienist 7th Edition Haveles Solutions ManualDocument34 pagesApplied Pharmacology For The Dental Hygienist 7th Edition Haveles Solutions Manualatop.remiped25zad100% (16)

- ELTT TitanMagazine Veldt-GallantDocument12 pagesELTT TitanMagazine Veldt-GallantLudovic Draiganix Grondin100% (1)

- LKPM Q2 2022Document4 pagesLKPM Q2 2022Iqbal HattaNo ratings yet

- Villafuerte Vs RobredoDocument2 pagesVillafuerte Vs RobredoElyn ApiadoNo ratings yet

- Agency, Trust, and Partnership DoctrinesDocument46 pagesAgency, Trust, and Partnership DoctrinesAlvin100% (1)

- Adobe Scan 11 Sep 2021Document14 pagesAdobe Scan 11 Sep 2021Saswat PattnaikNo ratings yet

- DTR New 2023 2024Document22 pagesDTR New 2023 2024Rogelia condes floresNo ratings yet

- ASRSolutionDocument3 pagesASRSolutionI TecNo ratings yet

- Tax Bar Qs On General Principles 1987 2019 1Document8 pagesTax Bar Qs On General Principles 1987 2019 1AbseniNalangKhoUyNo ratings yet

- A4 K-2 CONTRACT - BondDocument4 pagesA4 K-2 CONTRACT - BondKishore KumarNo ratings yet

- 004 Virtusio Vs Atty. Grenalyn Virtusio, A.C. No. 6753, September 5, 2012Document2 pages004 Virtusio Vs Atty. Grenalyn Virtusio, A.C. No. 6753, September 5, 2012Gi NoNo ratings yet

SC A.C. No. 10-2000

SC A.C. No. 10-2000

Uploaded by

ambahomo0 ratings0% found this document useful (0 votes)

17 views2 pagesThis circular instructs lower court judges to exercise caution, prudence, and judiciousness when issuing writs of execution to satisfy money judgments against government agencies and local government units. It cites jurisprudence that government funds and properties for public use cannot be seized under writs of execution. However, government properties not used for public purposes may be subject to execution. Judges are told to follow rules of the Commission on Audit for determining state liability and enforcing money claims against the government.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis circular instructs lower court judges to exercise caution, prudence, and judiciousness when issuing writs of execution to satisfy money judgments against government agencies and local government units. It cites jurisprudence that government funds and properties for public use cannot be seized under writs of execution. However, government properties not used for public purposes may be subject to execution. Judges are told to follow rules of the Commission on Audit for determining state liability and enforcing money claims against the government.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

17 views2 pagesSC A.C. No. 10-2000

SC A.C. No. 10-2000

Uploaded by

ambahomoThis circular instructs lower court judges to exercise caution, prudence, and judiciousness when issuing writs of execution to satisfy money judgments against government agencies and local government units. It cites jurisprudence that government funds and properties for public use cannot be seized under writs of execution. However, government properties not used for public purposes may be subject to execution. Judges are told to follow rules of the Commission on Audit for determining state liability and enforcing money claims against the government.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 2

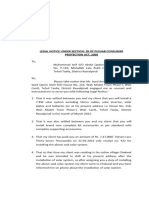

October 25, 2000

SUPREME COURT ADMINISTRATIVE CIRCULAR NO. 10-00

TO : All Judges of Lower Courts

SUBJECT : Exercise of Utmost Caution, Prudence and Judiciousness in

the Issuance of Writs of Execution to Satisfy Money

Judgments Against Government Agencies and Local

Government Units

In order to prevent possible circumvention of the rules and procedures

of the Commission on audit, judges are hereby enjoined to observe utmost

caution, prudence and judiciousness in the issuance of writs of execution to

satisfy money judgments against government agencies and local

government units.

Judges should bear in mind that in Commissioner of Public Highways v.

San Diego (31 SCRA 617, 625 [1970]), this Court explicitly stated:

The universal rule that where the State gives its consent to be

sued by private parties either by general or special law, it may limit

claimant's action 'only up to the completion of proceedings anterior to

the stage of execution' and that the power of the Court ends when the

judgment is rendered, since government funds and properties may not

be seized under writs of execution or garnishment to satisfy such

judgments, is based on obvious considerations of public policy.

Disbursements of public funds must be covered by the corresponding

appropriation as required by law. The functions and public services

rendered by the State cannot be allowed to be paralyzed or disrupted

by the diversion of public funds from their legitimate and specific

objects, as appropriated by law.

Moreover, it is settled jurisprudence that upon determination of State

liability, the prosecution, enforcement or satisfaction thereof must still be

pursued in accordance with the rules and procedures laid down in P.D. No.

1445, otherwise known as the Government Auditing Code of the Philippines

(Department of Agriculture v. NLRC, 227 SCRA 693, 701-02 [1993] citing

Republic vs. Villasor, 54 SCRA 84 [1973]). All money claims against the

Government must first be filed with the Commission on Audit which must act

upon it within sixty days. Rejection of the claim will authorize the claimant to

elevate the matter to the Supreme Court on certiorari and in effect sue the

State thereby (P.D. 1445, Sections 49-50).

However, notwithstanding the rule that government properties are not

subject to levy and execution unless otherwise provided for by statute

(Republic v. Palacio , 23 SCRA 899 [1968]; Commissioner of Public Highways

v. San Diego , supra) or municipal ordinance (Municipality of Makati v. Court

of Appeals, 190 SCRA 206 [1990]), the Court has, in various instances,

distinguished between government funds and properties for public use and

CD Technologies Asia, Inc. © 2021 cdasiaonline.com

those not held for public use. Thus, Viuda de Tan Toco v. Municipal Council

of Iloilo (49 Phil. 52 [1926]), the Court ruled that "[w]here property of a

municipal or other public corporation is sought to be subjected to execution

to satisfy judgments recovered against such corporation, the question as to

whether such property is leviable or not is to be determined by the usage

and purposes for which it is held." The following can be culled from Viuda de

Tan Toco v. Municipal Council of Iloilo:

1. Properties held for public uses — and generally everything held

for governmental purposes — are not subject to levy and sale

under execution against such corporation. The same rule applies

to funds in the hands of a public officer and taxes due to a

municipal corporation.

2. Where a municipal corporation owns in its proprietary capacity,

as distinguished from its public or governmental capacity,

property not used or used for a public purpose but for quasi

private purposes, it is the general rule that such property may be

seized and sold under execution against the corporation.

3. Property held for public purposes is not subject to execution

merely because it is temporarily used for private purposes. If the

public use is wholly abandoned, such property becomes subject

to execution.

This Administrative Circular shall take effect immediately and the Court

Administrator shall see to it that it is faithfully implemented. CaHcET

Issued this 25th day of October 2000 in the City of Manila.

(SGD.) HILARIO G. DAVIDE, JR.

Chief Justice

CD Technologies Asia, Inc. © 2021 cdasiaonline.com

You might also like

- Rent AgreementDocument5 pagesRent AgreementAjinkya BagadeNo ratings yet

- Consti II Case Digests AteneoDocument407 pagesConsti II Case Digests AteneoKristinaCuetoNo ratings yet

- Pub Corp Review II Case DigestDocument137 pagesPub Corp Review II Case DigestMikMik UyNo ratings yet

- Churchill v. RaffertyDocument2 pagesChurchill v. RaffertyCristelle Elaine ColleraNo ratings yet

- TCUs TRUST CAPITAL UNITS BLUE BORDER EDITABLEDocument1 pageTCUs TRUST CAPITAL UNITS BLUE BORDER EDITABLEBIGBOY100% (1)

- SC Administrative Circular No 10-2000Document2 pagesSC Administrative Circular No 10-2000henzencameroNo ratings yet

- MEMORANDUM Section 26 pd1445Document3 pagesMEMORANDUM Section 26 pd1445troll warlordsNo ratings yet

- CONSTI 2 Midterm PointersDocument10 pagesCONSTI 2 Midterm PointersRommel P. Abas100% (1)

- CONSTI 2 Midterm PointersDocument8 pagesCONSTI 2 Midterm Pointersbeb_0527100% (1)

- Case Title G.R. No. Main Topic Other Related Topic DateDocument4 pagesCase Title G.R. No. Main Topic Other Related Topic DateKJPL_1987No ratings yet

- State Powers: Eminent Domain: (1) The Expropriator Must Enter A Private PropertyDocument6 pagesState Powers: Eminent Domain: (1) The Expropriator Must Enter A Private PropertyviasuerzaNo ratings yet

- Aryssa Jane R. Salmorin BSED II-Social StudiesDocument33 pagesAryssa Jane R. Salmorin BSED II-Social StudiespearlNo ratings yet

- Vda de Tantoco v. Municipal Council of IloiloDocument6 pagesVda de Tantoco v. Municipal Council of IloiloRon Jacob AlmaizNo ratings yet

- Police Power Case DigestDocument28 pagesPolice Power Case DigestKevin Law100% (1)

- Petitioners vs. vs. Respondents: en BancDocument8 pagesPetitioners vs. vs. Respondents: en BancJela SyNo ratings yet

- 05 Ong Suco V MalonesDocument19 pages05 Ong Suco V MalonesDustin NitroNo ratings yet

- Sumulong V GuerreroDocument3 pagesSumulong V GuerreroRaymond Panotes100% (1)

- Bagatsing Vs RamirezDocument1 pageBagatsing Vs RamirezzahreenamolinaNo ratings yet

- Metropolitan Waterworks and Sewerage System v. Quezon CityDocument47 pagesMetropolitan Waterworks and Sewerage System v. Quezon CitycitizenNo ratings yet

- Land Bank of The Philippines vs. Cacayuran (G.R. No. 191667, April 17, 2013)Document16 pagesLand Bank of The Philippines vs. Cacayuran (G.R. No. 191667, April 17, 2013)Fergen Marie WeberNo ratings yet

- Rule 67 ExpropriationDocument11 pagesRule 67 ExpropriationKarla Mae Dela Peña100% (1)

- Constitutional Law - Ii (Law 112) : Inherent Powers of The State Police PowerDocument34 pagesConstitutional Law - Ii (Law 112) : Inherent Powers of The State Police PowerChristjohn VillaluzNo ratings yet

- 2021 JC - The Law Pertaining To State and Its Relationship With Its CitizensDocument29 pages2021 JC - The Law Pertaining To State and Its Relationship With Its CitizensJemMoralesNo ratings yet

- Sumulong V Guerrero DigestDocument6 pagesSumulong V Guerrero Digestnikka dinerosNo ratings yet

- Eminent DomainDocument9 pagesEminent Domaincliff mascardoNo ratings yet

- Money Judgment Against Government AgenciesDocument2 pagesMoney Judgment Against Government AgenciesMary BeleyNo ratings yet

- Facts of The CaseDocument6 pagesFacts of The CaseDona M. ValbuenaNo ratings yet

- 132124-1989-Philippine Rock Industries Inc. v. Board Of20190522-5466-Sb0or7Document6 pages132124-1989-Philippine Rock Industries Inc. v. Board Of20190522-5466-Sb0or7Kat ObreroNo ratings yet

- 3 GR No. 280496-2020-Philippine - Heart - Center - v. - Local - GovernmentDocument10 pages3 GR No. 280496-2020-Philippine - Heart - Center - v. - Local - GovernmentthebeautyinsideNo ratings yet

- ExpropriationDocument5 pagesExpropriationBINAYAO NAIZA MAENo ratings yet

- First Division (G.R. No. 225409, March 11, 2020)Document15 pagesFirst Division (G.R. No. 225409, March 11, 2020)Auxl Reign Nava0% (1)

- Rabuco V Villegas FactsDocument10 pagesRabuco V Villegas Factscamille6navarroNo ratings yet

- Untitled 3Document12 pagesUntitled 3Jamaica Kim JimenezNo ratings yet

- Mactan Cebu International Airport Authority v. Marcos, Et Al 261 Scra 667Document11 pagesMactan Cebu International Airport Authority v. Marcos, Et Al 261 Scra 667Joshua RodriguezNo ratings yet

- Poli Cases - Part IVDocument51 pagesPoli Cases - Part IVJoshuaLavegaAbrinaNo ratings yet

- Churchill v. Rafferty, 1915Document25 pagesChurchill v. Rafferty, 1915Jaime SiaNo ratings yet

- Page 16-Full CaseDocument195 pagesPage 16-Full CaseAdri MillerNo ratings yet

- Sumulong Vs GuerreroDocument5 pagesSumulong Vs GuerreroPaolo CruzNo ratings yet

- Week9 CLJ-102Document42 pagesWeek9 CLJ-102Angie SantosNo ratings yet

- Eminent Domain Consti 2Document3 pagesEminent Domain Consti 2LC TNo ratings yet

- Diaz vs. Secretary of Finance, 654 SCRA 96, G.R. No. 193007 July 19, 2011Document24 pagesDiaz vs. Secretary of Finance, 654 SCRA 96, G.R. No. 193007 July 19, 2011Alfred GarciaNo ratings yet

- Philippine Heart Center vs. Local Government of Quezon City GR No. 225409 11 March 2020.Document15 pagesPhilippine Heart Center vs. Local Government of Quezon City GR No. 225409 11 March 2020.TobyNo ratings yet

- G.R. No. 225409Document15 pagesG.R. No. 225409Ann ChanNo ratings yet

- Eminent Domain and Due ProcessDocument8 pagesEminent Domain and Due Processeight_bestNo ratings yet

- SPOUSES ANTONIO and FE YUSAY vs. CADocument3 pagesSPOUSES ANTONIO and FE YUSAY vs. CAGwaine C. GelindonNo ratings yet

- Petitioner-Appellant Vs Vs Respondent-Appellees A. M. Zarate, Jose Agbulos, No AppearanceDocument5 pagesPetitioner-Appellant Vs Vs Respondent-Appellees A. M. Zarate, Jose Agbulos, No AppearanceHans LazaroNo ratings yet

- Eminent Domain Case Digest 1-25Document57 pagesEminent Domain Case Digest 1-25Eunice KanapiNo ratings yet

- I. The Principle of Separation of PowersDocument5 pagesI. The Principle of Separation of PowersJerome BrusasNo ratings yet

- Taisei Shimizu v. COA GR No. 238671Document3 pagesTaisei Shimizu v. COA GR No. 238671Reigh Harvy CantaNo ratings yet

- Fundamental Powers of The StateDocument5 pagesFundamental Powers of The Stateramo.narvas.upNo ratings yet

- Notes in Political Law (For 2019 Bar) Jose Edmund E. Guillen, LL.B, LL.MDocument32 pagesNotes in Political Law (For 2019 Bar) Jose Edmund E. Guillen, LL.B, LL.MIman Marion100% (3)

- City of Davao vs. Intestate Estate of Amado S. DalisayDocument25 pagesCity of Davao vs. Intestate Estate of Amado S. Dalisayanon_614984256No ratings yet

- Notes and Cases On Constitutional Law IiDocument92 pagesNotes and Cases On Constitutional Law Iimau_baytingNo ratings yet

- Reviewer in Political Law2Document154 pagesReviewer in Political Law2Legal OfficerNo ratings yet

- Module 10.5 - 10.6Document28 pagesModule 10.5 - 10.6Codee Aeron RipaldaNo ratings yet

- Tantoco Vs Municipal CouncilDocument4 pagesTantoco Vs Municipal CouncilWilliam Christian Dela CruzNo ratings yet

- 01 Jose J. Ferrer JR V City Mayor Herbert Bautista Et Al GR 210551 June 30 2015Document4 pages01 Jose J. Ferrer JR V City Mayor Herbert Bautista Et Al GR 210551 June 30 2015Nojoma PangandamanNo ratings yet

- Constitutional Law 2 Case DigestDocument14 pagesConstitutional Law 2 Case Digestprince pacasum0% (1)

- Hermano RosasDocument4 pagesHermano RosasAngel Pagaran AmarNo ratings yet

- TAX5Document4 pagesTAX5D GNo ratings yet

- Constitution of the State of Minnesota — 1974 VersionFrom EverandConstitution of the State of Minnesota — 1974 VersionNo ratings yet

- Bernardo Vs NLRCDocument8 pagesBernardo Vs NLRCambahomoNo ratings yet

- Handouts Industrial Psychology PDFDocument29 pagesHandouts Industrial Psychology PDFambahomoNo ratings yet

- Chap 9 Special Rules of Court On ADR FINAL PDFDocument12 pagesChap 9 Special Rules of Court On ADR FINAL PDFambahomoNo ratings yet

- Consti1 COURSE OUTLINE and Case ListDocument8 pagesConsti1 COURSE OUTLINE and Case ListambahomoNo ratings yet

- Chap 9 Special Rules of Court On ADR Ver 1 PDFDocument8 pagesChap 9 Special Rules of Court On ADR Ver 1 PDFambahomoNo ratings yet

- Chap 9 Special Rules of Court On ADR FINAL PDFDocument12 pagesChap 9 Special Rules of Court On ADR FINAL PDFambahomoNo ratings yet

- Case Digest Soriano VS Lista & Sandoval VS ComelecDocument3 pagesCase Digest Soriano VS Lista & Sandoval VS ComelecambahomoNo ratings yet

- Case 1Document5 pagesCase 1ambahomoNo ratings yet

- Case Compilation July 23Document8 pagesCase Compilation July 23ambahomoNo ratings yet

- Case Digest LAST - People Vs Jalosjos and Tirol Vs COADocument3 pagesCase Digest LAST - People Vs Jalosjos and Tirol Vs COAambahomoNo ratings yet

- Bognot vs. RRI Lending Corporation Case DigestDocument1 pageBognot vs. RRI Lending Corporation Case Digestambahomo100% (1)

- BP 22 DefendantDocument6 pagesBP 22 DefendantambahomoNo ratings yet

- College of Arts and Sciences: City of Malabon UniversityDocument12 pagesCollege of Arts and Sciences: City of Malabon UniversityRichard GomezNo ratings yet

- EULADocument2 pagesEULAMary Valentina Gamba CasallasNo ratings yet

- The Hierarchy of LawsDocument2 pagesThe Hierarchy of LawsBakekokfundaNo ratings yet

- HombaleFilms-Release-Form (1) 220821 014708Document3 pagesHombaleFilms-Release-Form (1) 220821 014708Rohit RoyNo ratings yet

- Novice Moot Rules 2023-1 PDFDocument11 pagesNovice Moot Rules 2023-1 PDFshreyaNo ratings yet

- Measuring Units Worksheet: Name: - DateDocument2 pagesMeasuring Units Worksheet: Name: - Datemudit mathurNo ratings yet

- Nicolas Y. Cervantes v. Court of Appeals, GR No. 125138, March 2, 1999Document5 pagesNicolas Y. Cervantes v. Court of Appeals, GR No. 125138, March 2, 1999RPSA CPANo ratings yet

- 1 Part of PPT 1 - Types of Tenure SystemsDocument78 pages1 Part of PPT 1 - Types of Tenure SystemsMeku TjikuzuNo ratings yet

- Planters Products Inc v. Fertiphil CorporationDocument1 pagePlanters Products Inc v. Fertiphil CorporationAnsai Claudine CaluganNo ratings yet

- Unit 2Document12 pagesUnit 2Aman GuptaNo ratings yet

- Invitation To TreatDocument1 pageInvitation To TreatlsNo ratings yet

- Chapter 8-Philippine Legal CitationsDocument30 pagesChapter 8-Philippine Legal CitationsZoe Yzabel EgarNo ratings yet

- Mittal School of Business Lovely Professional UniversityDocument10 pagesMittal School of Business Lovely Professional UniversitySaqlain MustaqeNo ratings yet

- Ra 9225 An Act Allowing Illegitimate Children To Use The Surname of Their FatherDocument10 pagesRa 9225 An Act Allowing Illegitimate Children To Use The Surname of Their FatherAJ SantosNo ratings yet

- Legal Notice... Ahsan Ali ShahDocument3 pagesLegal Notice... Ahsan Ali Shahfahadkhan.00769hdNo ratings yet

- G1 ObliconDocument46 pagesG1 ObliconFrancis AlvarNo ratings yet

- Formalities and ExceptionsDocument17 pagesFormalities and ExceptionsnishaaaNo ratings yet

- Applied Pharmacology For The Dental Hygienist 7th Edition Haveles Solutions ManualDocument34 pagesApplied Pharmacology For The Dental Hygienist 7th Edition Haveles Solutions Manualatop.remiped25zad100% (16)

- ELTT TitanMagazine Veldt-GallantDocument12 pagesELTT TitanMagazine Veldt-GallantLudovic Draiganix Grondin100% (1)

- LKPM Q2 2022Document4 pagesLKPM Q2 2022Iqbal HattaNo ratings yet

- Villafuerte Vs RobredoDocument2 pagesVillafuerte Vs RobredoElyn ApiadoNo ratings yet

- Agency, Trust, and Partnership DoctrinesDocument46 pagesAgency, Trust, and Partnership DoctrinesAlvin100% (1)

- Adobe Scan 11 Sep 2021Document14 pagesAdobe Scan 11 Sep 2021Saswat PattnaikNo ratings yet

- DTR New 2023 2024Document22 pagesDTR New 2023 2024Rogelia condes floresNo ratings yet

- ASRSolutionDocument3 pagesASRSolutionI TecNo ratings yet

- Tax Bar Qs On General Principles 1987 2019 1Document8 pagesTax Bar Qs On General Principles 1987 2019 1AbseniNalangKhoUyNo ratings yet

- A4 K-2 CONTRACT - BondDocument4 pagesA4 K-2 CONTRACT - BondKishore KumarNo ratings yet

- 004 Virtusio Vs Atty. Grenalyn Virtusio, A.C. No. 6753, September 5, 2012Document2 pages004 Virtusio Vs Atty. Grenalyn Virtusio, A.C. No. 6753, September 5, 2012Gi NoNo ratings yet