Professional Documents

Culture Documents

Goods-And-Services-Tax-Gst Solved MCQs (Set-4)

Goods-And-Services-Tax-Gst Solved MCQs (Set-4)

Uploaded by

Ayushi BhardwajCopyright:

Available Formats

You might also like

- Goods-And-Services-Tax-Gst Solved MCQs (Set-1)Document8 pagesGoods-And-Services-Tax-Gst Solved MCQs (Set-1)Ayushi BhardwajNo ratings yet

- GST MCQ S Ca Shiva Teja PDFDocument172 pagesGST MCQ S Ca Shiva Teja PDFGiri SukumarNo ratings yet

- GST - IMP D.Tax (AKD) - 2Document15 pagesGST - IMP D.Tax (AKD) - 2algoscale techNo ratings yet

- Goods and Services Tax (Question Bank For Internal)Document14 pagesGoods and Services Tax (Question Bank For Internal)rupalNo ratings yet

- Model Question Paper - IGST Act.: (2 Marks Each) Multiple Choice QuestionsDocument25 pagesModel Question Paper - IGST Act.: (2 Marks Each) Multiple Choice QuestionsShyam Prasad100% (1)

- GST Mcq'sDocument43 pagesGST Mcq'sSuraj PawarNo ratings yet

- Important MCQ of GST: Igp-Cs GST Mcqs CA Vivek GabaDocument16 pagesImportant MCQ of GST: Igp-Cs GST Mcqs CA Vivek GabaammmajisNo ratings yet

- Company Law: MCQ LLB Ii and BSL IvDocument25 pagesCompany Law: MCQ LLB Ii and BSL IvajayNo ratings yet

- Top 30 MCQ Goods & Service TaxDocument3 pagesTop 30 MCQ Goods & Service TaxEthan HuntNo ratings yet

- Important MCQS-GSTDocument47 pagesImportant MCQS-GSTHrishit Raj SardaNo ratings yet

- Chrome: Built For Business: Ncert Books PDFDocument14 pagesChrome: Built For Business: Ncert Books PDFRISHABH TOMARNo ratings yet

- Audit MCQDocument141 pagesAudit MCQAkshay TapariaNo ratings yet

- MCQ Acc. EpfoDocument43 pagesMCQ Acc. EpfoArushi SinghNo ratings yet

- Mcqs On Basic Concept of Income Tax, Residential Status & Exempt IncomeDocument6 pagesMcqs On Basic Concept of Income Tax, Residential Status & Exempt IncomePradeep SethyNo ratings yet

- Ncert Books PDF: General Financial Rules 2017: WORKSDocument3 pagesNcert Books PDF: General Financial Rules 2017: WORKSRISHABH TOMARNo ratings yet

- IDT MCQ's - June 21 & Dec 21 ExamsDocument99 pagesIDT MCQ's - June 21 & Dec 21 ExamsDinesh GadkariNo ratings yet

- Chapter 1 Mcqs On Income Tax Rates and Basic Concept of Income TaxDocument27 pagesChapter 1 Mcqs On Income Tax Rates and Basic Concept of Income TaxSatheesh KannaNo ratings yet

- General Financial Rules 2017 - Chapter 6: Procurement of Goods and ServicesDocument18 pagesGeneral Financial Rules 2017 - Chapter 6: Procurement of Goods and ServicesProf. Manpreet Singh GillNo ratings yet

- Goods and Services Tax: Multiple Choice QuestionsDocument20 pagesGoods and Services Tax: Multiple Choice QuestionsDhruti AthaNo ratings yet

- SJC MCQ Book Cma InterDocument144 pagesSJC MCQ Book Cma InterDalwinder SinghNo ratings yet

- Government AccountingDocument12 pagesGovernment AccountingCyd BiadnesNo ratings yet

- IlglDocument84 pagesIlglMohan AzmeeraNo ratings yet

- MCQs in Regulation of Audit AccountsDocument17 pagesMCQs in Regulation of Audit AccountsDeepankarNo ratings yet

- Summarize MCQs PDFDocument32 pagesSummarize MCQs PDFRam IyerNo ratings yet

- CIVIL Accounts Manual (Chapter 3) : (B) by Pay and Accounts Office of The Ministry/Dept. After Proper Pre-CheckDocument4 pagesCIVIL Accounts Manual (Chapter 3) : (B) by Pay and Accounts Office of The Ministry/Dept. After Proper Pre-CheckManohar SharmaNo ratings yet

- Income Tax MCQ 1Document9 pagesIncome Tax MCQ 1mohammedumair100% (3)

- Chapter 1 MCQs On Income Tax Rates and Basic Concept of Income TaxDocument28 pagesChapter 1 MCQs On Income Tax Rates and Basic Concept of Income TaxMeenal Luther100% (1)

- GST MCQDocument73 pagesGST MCQtongocharliNo ratings yet

- General Financial Rules 2017 - Chapter 8: Contract ManagementDocument3 pagesGeneral Financial Rules 2017 - Chapter 8: Contract ManagementBijay Keshari100% (1)

- Custom MCQ - 1 by VGDocument9 pagesCustom MCQ - 1 by VGIS WING AP100% (1)

- MCQ On Direct TaxDocument3 pagesMCQ On Direct TaxVarsha SinhaNo ratings yet

- Forest Accounts MCQDocument12 pagesForest Accounts MCQAJAY DIMRINo ratings yet

- MCQs of Residential Status - Incidence of Tax by CA Kishan KR SirDocument13 pagesMCQs of Residential Status - Incidence of Tax by CA Kishan KR SirHetvi VoraNo ratings yet

- MCQ Accounts For 10+2 TS Grewal SirDocument66 pagesMCQ Accounts For 10+2 TS Grewal SirYash ChhabraNo ratings yet

- Chapter - 18 Pay and Allowances - MCQDocument3 pagesChapter - 18 Pay and Allowances - MCQNRKNo ratings yet

- It MCQDocument31 pagesIt MCQbigbulleye6078No ratings yet

- Income Tax MCQ With Answers PDFDocument19 pagesIncome Tax MCQ With Answers PDFAman Pandit100% (1)

- BASIC Accounting MCQ FOR GOVT EXAMSDocument48 pagesBASIC Accounting MCQ FOR GOVT EXAMSßläcklìsètèdTȜèNo ratings yet

- Law Question Paper Cat Dec 29Document10 pagesLaw Question Paper Cat Dec 29shibin cpNo ratings yet

- MCQ On TDS, TCS & Advance TaxDocument15 pagesMCQ On TDS, TCS & Advance TaxPrakhar GuptaNo ratings yet

- Cost Accounting Objective (MCQ)Document243 pagesCost Accounting Objective (MCQ)mirjapur0% (1)

- CCS Pension RulesDocument19 pagesCCS Pension Rulesanandanayak.k1No ratings yet

- MCQ CPWA Code Chapter-10Document14 pagesMCQ CPWA Code Chapter-10Biswajit JenaNo ratings yet

- PC-5 Constitution of India, Acts and Regulation: Prepared by Deepak Kumar Rahi, AAO (AMG V/Patna)Document34 pagesPC-5 Constitution of India, Acts and Regulation: Prepared by Deepak Kumar Rahi, AAO (AMG V/Patna)Exam Preparation Coaching ClassesNo ratings yet

- Company Law MCQ NotesDocument223 pagesCompany Law MCQ NotesTanmay ChaitanyaNo ratings yet

- Chapter 1 MCQs On Income Tax Rates and Basic Concept of Income TaxDocument25 pagesChapter 1 MCQs On Income Tax Rates and Basic Concept of Income TaxSonu KumarNo ratings yet

- MCQ of GSTDocument23 pagesMCQ of GSTOnline tally guide100% (2)

- Ccs (Conduct) RulesDocument3 pagesCcs (Conduct) RulesKawaljeetNo ratings yet

- MCQ - Unit 2Document15 pagesMCQ - Unit 2Niraj PandeyNo ratings yet

- CSMA (Central Services Medical Attendance)Document16 pagesCSMA (Central Services Medical Attendance)Vaishu YadavNo ratings yet

- MCQ On Income TaxDocument76 pagesMCQ On Income Taxnavya sreeNo ratings yet

- GFR FormsDocument2 pagesGFR FormsSaurav GhoshNo ratings yet

- Pwa MCQDocument7 pagesPwa MCQSureshNo ratings yet

- GST MCQ For Nov 2023 TdsDocument15 pagesGST MCQ For Nov 2023 TdsNikiNo ratings yet

- Pages From Manual For Procurement of Goods 2017 - 0 - 0Document11 pagesPages From Manual For Procurement of Goods 2017 - 0 - 0pramod_kmr73No ratings yet

- Goods-And-Services-Tax-Gst Solved MCQs (Set-3)Document8 pagesGoods-And-Services-Tax-Gst Solved MCQs (Set-3)Ayushi BhardwajNo ratings yet

- Goods-And-Services-Tax-Gst Solved MCQs (Set-5)Document8 pagesGoods-And-Services-Tax-Gst Solved MCQs (Set-5)Ayushi BhardwajNo ratings yet

- Goods-And-Services-Tax-Gst (Set 1)Document21 pagesGoods-And-Services-Tax-Gst (Set 1)aftabahmad780043No ratings yet

- Unit-2-Goods-And-Services-Tax-Gst (Set 1)Document5 pagesUnit-2-Goods-And-Services-Tax-Gst (Set 1)aftabahmad780043No ratings yet

- Unit-3-Goods-And-Services-Tax-Gst (Set 1)Document5 pagesUnit-3-Goods-And-Services-Tax-Gst (Set 1)aftabahmad780043No ratings yet

- Tax Invoice: Shipping Address: Sold By: Invoice DetailsDocument1 pageTax Invoice: Shipping Address: Sold By: Invoice DetailsONLINE FASHIONNo ratings yet

- BIR Abatement FormDocument1 pageBIR Abatement FormJecky Delos ReyesNo ratings yet

- SC746Document1 pageSC746Indîan NetizenNo ratings yet

- GST Drc-01aDocument2 pagesGST Drc-01aMadhu KumarNo ratings yet

- 11Document2 pages11Kristine Ira ConcepcionNo ratings yet

- Roth Conversion Strategies To ConsiderDocument5 pagesRoth Conversion Strategies To Considerkj4892No ratings yet

- Party Name: Kamayani Agencies Pvt. LTDDocument6 pagesParty Name: Kamayani Agencies Pvt. LTDSanjay JainNo ratings yet

- TF10000095Document1 pageTF10000095Andry SetyosoNo ratings yet

- Student's 1098T Form PDFDocument1 pageStudent's 1098T Form PDFVexel 22No ratings yet

- September 08 - Chapter 6-Capital Gains Taxation (Assignment)Document3 pagesSeptember 08 - Chapter 6-Capital Gains Taxation (Assignment)anitaNo ratings yet

- Rev Regs 16-2005 Sec 4.114-2 As Amended by RR 4-2007Document2 pagesRev Regs 16-2005 Sec 4.114-2 As Amended by RR 4-2007Catherine Rae EspinosaNo ratings yet

- Tax SparingDocument2 pagesTax SparingPons Mac PacienteNo ratings yet

- Capital Gains TaxDocument3 pagesCapital Gains TaxMary Christen Canlas0% (1)

- GST Model Question Paper 2Document14 pagesGST Model Question Paper 2GybcNo ratings yet

- Withholding Tax Statement Report Run On: Thursday, September 8, 2022 9:58:13 AMDocument1 pageWithholding Tax Statement Report Run On: Thursday, September 8, 2022 9:58:13 AMDDC&P INo ratings yet

- Set Off and Carry Forward of Losses An AnalysisDocument6 pagesSet Off and Carry Forward of Losses An AnalysisRam IyerNo ratings yet

- Navneet Pay SlipDocument1 pageNavneet Pay Slipdeepak_sharma9323No ratings yet

- Jeeves InsuranceDocument1 pageJeeves InsuranceJEEVAN BONDARNo ratings yet

- F6 - Taxation - CHP 9: Assessable Trading Income / Basis of AssessmentDocument16 pagesF6 - Taxation - CHP 9: Assessable Trading Income / Basis of AssessmentAbraham JuleNo ratings yet

- Reminders - Due DatesDocument7 pagesReminders - Due Datesdhuno teeNo ratings yet

- Week 9 - Amalgamations and Wind UpsDocument15 pagesWeek 9 - Amalgamations and Wind UpsMike RaitsinNo ratings yet

- 0 233829.carneaDocument10 pages0 233829.carneakamlesh singhNo ratings yet

- 83 (B) ElectionDocument2 pages83 (B) ElectionjbcairnsNo ratings yet

- Luminous Power Technologies Private Limited: Earnings DeductionsDocument1 pageLuminous Power Technologies Private Limited: Earnings Deductionssathish kumar.kNo ratings yet

- Bill To / Ship To:: Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total AmountDocument1 pageBill To / Ship To:: Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total AmountMohit SachdevNo ratings yet

- Ss Ahuja Comp PDFDocument2 pagesSs Ahuja Comp PDFSwaran AhujaNo ratings yet

- Invoice PDFDocument1 pageInvoice PDFSHASHANKNo ratings yet

- Vat 2Document4 pagesVat 2Allen KateNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)SEED SEEDNo ratings yet

- NoticeDocument4 pagesNoticeAl OkNo ratings yet

Goods-And-Services-Tax-Gst Solved MCQs (Set-4)

Goods-And-Services-Tax-Gst Solved MCQs (Set-4)

Uploaded by

Ayushi BhardwajOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Goods-And-Services-Tax-Gst Solved MCQs (Set-4)

Goods-And-Services-Tax-Gst Solved MCQs (Set-4)

Uploaded by

Ayushi BhardwajCopyright:

Available Formats

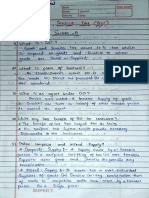

Goods and Services Tax (GST) MCQs [set-4]

Chapter: Unit 2

76. A person is having multiple business requires registration

A. Single

B. Each business separately

o m

C. Either A or B

.c

D. None of the above

te

a

Answer: B

q M

csupplies made

77. Zero rated supply includes

A. By SEZ unit in India

M

B. To SEZ unit in India

C. Both (a & (b) above

D. None of the above

Answer: B

Chapter: Unit 3

78. With the introduction of GST, imports will be—

A. more expensive

B. cheaper

C. neutral with no change

D. None of the above

Answer: A

79. Compensation to states under GST (Compensation to States) Act, 2017

Download more at McqMate.com

is paid by

A. Central Government from consolidated fund of India

B. Central Government from GST compensation fund of India

C. Central Government directly from the collection of compensation cess

D. GST Council under Constitution of India.

Answer: B

taxes is excluded o m

80. While computing compensation to states, tax revenue of this tax/ these

.c

te

A. petroleum crude, diesel, petrol, ATF and natural gas

B. Alcohol for human consumption a

q M

C. entertainment tax collected by local authorities

c

D. All of the above

Answer: D

M

81. Input tax credit on compensation cess paid under GST (Compensation

to States) Act, 2017.

A. is not available

B. is available

C. is available but not fully

D. is available after one year

Answer: B

82. Input tax credit under GST (Compensation to States) Act, 2017 includes

GST Compensation Cess charged on any supply of

A. Goods and/or services,

B. Goods imported

C. GST Compensation Cess payable on reverse charge basis;

Download more at McqMate.com

D. All of the above

Answer: D

83. Maximum rate of CGST prescribed by law for intrastate supply made

is----

A. 18%

B. 20%

C. 40%

o m

D. 28%+cess

.c

Answer: B

te

a

q M

84. Input tax credit on Compensation cess paid under GST (Compensation

c

to States) Act, 2017 is available for payment of

A. IGST only

M

B. IGST and CGST only

C. compensation under GST (Compensation to States) Act

D. None of the above

Answer: C

85. Zero rated supply includes supplies made

A. By SEZ unit in India

B. To SEZ unit in India

C. Both (a & (b above

D. None of the above

Answer: B

86. The first committee to design GST model was headed by

A. Vijay Kelkar

Download more at McqMate.com

B. Asim Das Gupta

C. Dr. Chidambaram

D. None of the above

Answer: B

87. First discussion paper (FDP) which formed the basis for GST in 2009

was released by

A. Union Finance Ministry

o m

B. Dr. Manmohan Singh

.c

C. GST Council

te

a

D. Empowered Committee

q M

Answer: D

c

M

88. Roll out of GST requires constitutional amendment because

A. existing laws were cascading

B. the powers of levy were exclusive

C. there are separate laws for goods and services

D. All of the above

Answer: D

89. Works contract under GST is goods used in work relating to

A. Immovable property

B. Both movable and immovable property

C. Immovable property treated as supply of service

D. Immovable property treated as supply of goods

Answer: C

90. A supplier is liable to get registered under GST if his aggregate

turnover in a financial year crosses Rs. 20 lakh in a state or UT other than

Download more at McqMate.com

special category states if he is

A. an interstate supplier

B. an intra-state supplier

C. Electronic commerce operator

D. Person liable to pay GST under reverse charge

Answer: B

91. Registration under GST is not compulsory to

o m

A. Casual taxable person

.c

te

B. Input service distributor

a

C. Non-resident taxable person

q M

D. None of the above

c

Answer: D M

92. One of the following states does not fall under special category given

under Art. 279A of the Constitution

A. Himachal Pradesh

B. Uttarakhand

C. Chhattisgarh

D. Jammu & Kashmir

Answer: C

93. Exemption from registration is available to

A. Central & State Govt. Departments

B. Agriculturists

C. a) & b) above

D. None of the above

Answer: B

Download more at McqMate.com

94. Address for delivery

A. Recipient address mentioned in the tax invoice

B. Recipient address mentioned in the delivery challan

C. Recipient address not necessary

D. Recipient address mentioned in the Gate pass

Answer: A

95. When President assent was obtained for central GST? o m

.c

A. 18th April 2017

te

a

B. 22nd April 2017

q M

C. 5th April 2017

c

D. 12th April 2017

M

Answer: D

96. What is applicability of GST?

A. Applicable all over India except Sikkim

B. Applicable all over India except Jammu and Kashmir

C. Applicable all over India

D. Applicable all over India except Nagaland

Answer: C

97. Money means

A. Indian legal tender

B. Foreign currency

C. Cheque/promissory note

D. All the above

Answer: D

Download more at McqMate.com

98. Non-taxable territory means

A. Outside taxable territory

B. Inside taxable territory

C. Inter-state taxable territory

D. None of the above

Answer: A

99. Person includes o m

.c

A. Individual

te

a

B. HUF

q M

C. LLP

c

D. All the above

M

Answer: D

Chapter: Unit 4

100. Goods and Service Tax council referred in which section

A. 279A of the constitution

B. 276 of the constitution

C. 277 of the constitution

D. 279 of the constitution

Answer: A

Download more at McqMate.com

Take Quick Mock/Practice test on this topic HERE

For Discussion / Reporting / Correction of any MCQ please visit discussion page by clicking on

'answer' of respective MCQ.

McqMate is also available on

PlayStore

o m

.c

te

a

q M

c

M

Download more at McqMate.com

You might also like

- Goods-And-Services-Tax-Gst Solved MCQs (Set-1)Document8 pagesGoods-And-Services-Tax-Gst Solved MCQs (Set-1)Ayushi BhardwajNo ratings yet

- GST MCQ S Ca Shiva Teja PDFDocument172 pagesGST MCQ S Ca Shiva Teja PDFGiri SukumarNo ratings yet

- GST - IMP D.Tax (AKD) - 2Document15 pagesGST - IMP D.Tax (AKD) - 2algoscale techNo ratings yet

- Goods and Services Tax (Question Bank For Internal)Document14 pagesGoods and Services Tax (Question Bank For Internal)rupalNo ratings yet

- Model Question Paper - IGST Act.: (2 Marks Each) Multiple Choice QuestionsDocument25 pagesModel Question Paper - IGST Act.: (2 Marks Each) Multiple Choice QuestionsShyam Prasad100% (1)

- GST Mcq'sDocument43 pagesGST Mcq'sSuraj PawarNo ratings yet

- Important MCQ of GST: Igp-Cs GST Mcqs CA Vivek GabaDocument16 pagesImportant MCQ of GST: Igp-Cs GST Mcqs CA Vivek GabaammmajisNo ratings yet

- Company Law: MCQ LLB Ii and BSL IvDocument25 pagesCompany Law: MCQ LLB Ii and BSL IvajayNo ratings yet

- Top 30 MCQ Goods & Service TaxDocument3 pagesTop 30 MCQ Goods & Service TaxEthan HuntNo ratings yet

- Important MCQS-GSTDocument47 pagesImportant MCQS-GSTHrishit Raj SardaNo ratings yet

- Chrome: Built For Business: Ncert Books PDFDocument14 pagesChrome: Built For Business: Ncert Books PDFRISHABH TOMARNo ratings yet

- Audit MCQDocument141 pagesAudit MCQAkshay TapariaNo ratings yet

- MCQ Acc. EpfoDocument43 pagesMCQ Acc. EpfoArushi SinghNo ratings yet

- Mcqs On Basic Concept of Income Tax, Residential Status & Exempt IncomeDocument6 pagesMcqs On Basic Concept of Income Tax, Residential Status & Exempt IncomePradeep SethyNo ratings yet

- Ncert Books PDF: General Financial Rules 2017: WORKSDocument3 pagesNcert Books PDF: General Financial Rules 2017: WORKSRISHABH TOMARNo ratings yet

- IDT MCQ's - June 21 & Dec 21 ExamsDocument99 pagesIDT MCQ's - June 21 & Dec 21 ExamsDinesh GadkariNo ratings yet

- Chapter 1 Mcqs On Income Tax Rates and Basic Concept of Income TaxDocument27 pagesChapter 1 Mcqs On Income Tax Rates and Basic Concept of Income TaxSatheesh KannaNo ratings yet

- General Financial Rules 2017 - Chapter 6: Procurement of Goods and ServicesDocument18 pagesGeneral Financial Rules 2017 - Chapter 6: Procurement of Goods and ServicesProf. Manpreet Singh GillNo ratings yet

- Goods and Services Tax: Multiple Choice QuestionsDocument20 pagesGoods and Services Tax: Multiple Choice QuestionsDhruti AthaNo ratings yet

- SJC MCQ Book Cma InterDocument144 pagesSJC MCQ Book Cma InterDalwinder SinghNo ratings yet

- Government AccountingDocument12 pagesGovernment AccountingCyd BiadnesNo ratings yet

- IlglDocument84 pagesIlglMohan AzmeeraNo ratings yet

- MCQs in Regulation of Audit AccountsDocument17 pagesMCQs in Regulation of Audit AccountsDeepankarNo ratings yet

- Summarize MCQs PDFDocument32 pagesSummarize MCQs PDFRam IyerNo ratings yet

- CIVIL Accounts Manual (Chapter 3) : (B) by Pay and Accounts Office of The Ministry/Dept. After Proper Pre-CheckDocument4 pagesCIVIL Accounts Manual (Chapter 3) : (B) by Pay and Accounts Office of The Ministry/Dept. After Proper Pre-CheckManohar SharmaNo ratings yet

- Income Tax MCQ 1Document9 pagesIncome Tax MCQ 1mohammedumair100% (3)

- Chapter 1 MCQs On Income Tax Rates and Basic Concept of Income TaxDocument28 pagesChapter 1 MCQs On Income Tax Rates and Basic Concept of Income TaxMeenal Luther100% (1)

- GST MCQDocument73 pagesGST MCQtongocharliNo ratings yet

- General Financial Rules 2017 - Chapter 8: Contract ManagementDocument3 pagesGeneral Financial Rules 2017 - Chapter 8: Contract ManagementBijay Keshari100% (1)

- Custom MCQ - 1 by VGDocument9 pagesCustom MCQ - 1 by VGIS WING AP100% (1)

- MCQ On Direct TaxDocument3 pagesMCQ On Direct TaxVarsha SinhaNo ratings yet

- Forest Accounts MCQDocument12 pagesForest Accounts MCQAJAY DIMRINo ratings yet

- MCQs of Residential Status - Incidence of Tax by CA Kishan KR SirDocument13 pagesMCQs of Residential Status - Incidence of Tax by CA Kishan KR SirHetvi VoraNo ratings yet

- MCQ Accounts For 10+2 TS Grewal SirDocument66 pagesMCQ Accounts For 10+2 TS Grewal SirYash ChhabraNo ratings yet

- Chapter - 18 Pay and Allowances - MCQDocument3 pagesChapter - 18 Pay and Allowances - MCQNRKNo ratings yet

- It MCQDocument31 pagesIt MCQbigbulleye6078No ratings yet

- Income Tax MCQ With Answers PDFDocument19 pagesIncome Tax MCQ With Answers PDFAman Pandit100% (1)

- BASIC Accounting MCQ FOR GOVT EXAMSDocument48 pagesBASIC Accounting MCQ FOR GOVT EXAMSßläcklìsètèdTȜèNo ratings yet

- Law Question Paper Cat Dec 29Document10 pagesLaw Question Paper Cat Dec 29shibin cpNo ratings yet

- MCQ On TDS, TCS & Advance TaxDocument15 pagesMCQ On TDS, TCS & Advance TaxPrakhar GuptaNo ratings yet

- Cost Accounting Objective (MCQ)Document243 pagesCost Accounting Objective (MCQ)mirjapur0% (1)

- CCS Pension RulesDocument19 pagesCCS Pension Rulesanandanayak.k1No ratings yet

- MCQ CPWA Code Chapter-10Document14 pagesMCQ CPWA Code Chapter-10Biswajit JenaNo ratings yet

- PC-5 Constitution of India, Acts and Regulation: Prepared by Deepak Kumar Rahi, AAO (AMG V/Patna)Document34 pagesPC-5 Constitution of India, Acts and Regulation: Prepared by Deepak Kumar Rahi, AAO (AMG V/Patna)Exam Preparation Coaching ClassesNo ratings yet

- Company Law MCQ NotesDocument223 pagesCompany Law MCQ NotesTanmay ChaitanyaNo ratings yet

- Chapter 1 MCQs On Income Tax Rates and Basic Concept of Income TaxDocument25 pagesChapter 1 MCQs On Income Tax Rates and Basic Concept of Income TaxSonu KumarNo ratings yet

- MCQ of GSTDocument23 pagesMCQ of GSTOnline tally guide100% (2)

- Ccs (Conduct) RulesDocument3 pagesCcs (Conduct) RulesKawaljeetNo ratings yet

- MCQ - Unit 2Document15 pagesMCQ - Unit 2Niraj PandeyNo ratings yet

- CSMA (Central Services Medical Attendance)Document16 pagesCSMA (Central Services Medical Attendance)Vaishu YadavNo ratings yet

- MCQ On Income TaxDocument76 pagesMCQ On Income Taxnavya sreeNo ratings yet

- GFR FormsDocument2 pagesGFR FormsSaurav GhoshNo ratings yet

- Pwa MCQDocument7 pagesPwa MCQSureshNo ratings yet

- GST MCQ For Nov 2023 TdsDocument15 pagesGST MCQ For Nov 2023 TdsNikiNo ratings yet

- Pages From Manual For Procurement of Goods 2017 - 0 - 0Document11 pagesPages From Manual For Procurement of Goods 2017 - 0 - 0pramod_kmr73No ratings yet

- Goods-And-Services-Tax-Gst Solved MCQs (Set-3)Document8 pagesGoods-And-Services-Tax-Gst Solved MCQs (Set-3)Ayushi BhardwajNo ratings yet

- Goods-And-Services-Tax-Gst Solved MCQs (Set-5)Document8 pagesGoods-And-Services-Tax-Gst Solved MCQs (Set-5)Ayushi BhardwajNo ratings yet

- Goods-And-Services-Tax-Gst (Set 1)Document21 pagesGoods-And-Services-Tax-Gst (Set 1)aftabahmad780043No ratings yet

- Unit-2-Goods-And-Services-Tax-Gst (Set 1)Document5 pagesUnit-2-Goods-And-Services-Tax-Gst (Set 1)aftabahmad780043No ratings yet

- Unit-3-Goods-And-Services-Tax-Gst (Set 1)Document5 pagesUnit-3-Goods-And-Services-Tax-Gst (Set 1)aftabahmad780043No ratings yet

- Tax Invoice: Shipping Address: Sold By: Invoice DetailsDocument1 pageTax Invoice: Shipping Address: Sold By: Invoice DetailsONLINE FASHIONNo ratings yet

- BIR Abatement FormDocument1 pageBIR Abatement FormJecky Delos ReyesNo ratings yet

- SC746Document1 pageSC746Indîan NetizenNo ratings yet

- GST Drc-01aDocument2 pagesGST Drc-01aMadhu KumarNo ratings yet

- 11Document2 pages11Kristine Ira ConcepcionNo ratings yet

- Roth Conversion Strategies To ConsiderDocument5 pagesRoth Conversion Strategies To Considerkj4892No ratings yet

- Party Name: Kamayani Agencies Pvt. LTDDocument6 pagesParty Name: Kamayani Agencies Pvt. LTDSanjay JainNo ratings yet

- TF10000095Document1 pageTF10000095Andry SetyosoNo ratings yet

- Student's 1098T Form PDFDocument1 pageStudent's 1098T Form PDFVexel 22No ratings yet

- September 08 - Chapter 6-Capital Gains Taxation (Assignment)Document3 pagesSeptember 08 - Chapter 6-Capital Gains Taxation (Assignment)anitaNo ratings yet

- Rev Regs 16-2005 Sec 4.114-2 As Amended by RR 4-2007Document2 pagesRev Regs 16-2005 Sec 4.114-2 As Amended by RR 4-2007Catherine Rae EspinosaNo ratings yet

- Tax SparingDocument2 pagesTax SparingPons Mac PacienteNo ratings yet

- Capital Gains TaxDocument3 pagesCapital Gains TaxMary Christen Canlas0% (1)

- GST Model Question Paper 2Document14 pagesGST Model Question Paper 2GybcNo ratings yet

- Withholding Tax Statement Report Run On: Thursday, September 8, 2022 9:58:13 AMDocument1 pageWithholding Tax Statement Report Run On: Thursday, September 8, 2022 9:58:13 AMDDC&P INo ratings yet

- Set Off and Carry Forward of Losses An AnalysisDocument6 pagesSet Off and Carry Forward of Losses An AnalysisRam IyerNo ratings yet

- Navneet Pay SlipDocument1 pageNavneet Pay Slipdeepak_sharma9323No ratings yet

- Jeeves InsuranceDocument1 pageJeeves InsuranceJEEVAN BONDARNo ratings yet

- F6 - Taxation - CHP 9: Assessable Trading Income / Basis of AssessmentDocument16 pagesF6 - Taxation - CHP 9: Assessable Trading Income / Basis of AssessmentAbraham JuleNo ratings yet

- Reminders - Due DatesDocument7 pagesReminders - Due Datesdhuno teeNo ratings yet

- Week 9 - Amalgamations and Wind UpsDocument15 pagesWeek 9 - Amalgamations and Wind UpsMike RaitsinNo ratings yet

- 0 233829.carneaDocument10 pages0 233829.carneakamlesh singhNo ratings yet

- 83 (B) ElectionDocument2 pages83 (B) ElectionjbcairnsNo ratings yet

- Luminous Power Technologies Private Limited: Earnings DeductionsDocument1 pageLuminous Power Technologies Private Limited: Earnings Deductionssathish kumar.kNo ratings yet

- Bill To / Ship To:: Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total AmountDocument1 pageBill To / Ship To:: Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total AmountMohit SachdevNo ratings yet

- Ss Ahuja Comp PDFDocument2 pagesSs Ahuja Comp PDFSwaran AhujaNo ratings yet

- Invoice PDFDocument1 pageInvoice PDFSHASHANKNo ratings yet

- Vat 2Document4 pagesVat 2Allen KateNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)SEED SEEDNo ratings yet

- NoticeDocument4 pagesNoticeAl OkNo ratings yet