Professional Documents

Culture Documents

Where Does Income Come From?

Where Does Income Come From?

Uploaded by

Shreya RaiCopyright:

Available Formats

You might also like

- Fine Print Pay Stub 1Document3 pagesFine Print Pay Stub 1api-585050784100% (1)

- TCS Feb Payslip PDFDocument2 pagesTCS Feb Payslip PDFNikhilreddy SingireddyNo ratings yet

- Tax Planning DefinitionDocument7 pagesTax Planning DefinitionAlex MasonNo ratings yet

- How To Calculate TDS From SalaryDocument3 pagesHow To Calculate TDS From SalaryNaveen Kumar NaiduNo ratings yet

- Assignment 5: Legal Aspects of Business MS5210Document6 pagesAssignment 5: Legal Aspects of Business MS5210karanNo ratings yet

- LLB 11Document6 pagesLLB 11shubsNo ratings yet

- How To Calculate Income TaxDocument4 pagesHow To Calculate Income TaxCharishma Sekhar.KNo ratings yet

- 5 Tax InstrumentsDocument3 pages5 Tax InstrumentsktsnlNo ratings yet

- Some Terms in Income Tax ClarifiedDocument9 pagesSome Terms in Income Tax ClarifiedAnonymous ATg0gvcf9No ratings yet

- DT NotesDocument41 pagesDT NotesHariprasad bhatNo ratings yet

- Taxation ProjectDocument12 pagesTaxation ProjectMohal gargNo ratings yet

- Income Tax Deductions From SalaryDocument34 pagesIncome Tax Deductions From SalaryPaymaster Services100% (2)

- Tax Planning For Salaried IndividualsDocument20 pagesTax Planning For Salaried IndividualsRAJNo ratings yet

- 2.1 Discuss The Different Components of SalaryDocument11 pages2.1 Discuss The Different Components of SalarymohithNo ratings yet

- Occupation GuidelinesDocument160 pagesOccupation Guidelinesjo lamosNo ratings yet

- Optimizing On TaxDocument2 pagesOptimizing On TaxvijaysNo ratings yet

- 8 SMART Ways To Lower Your Tax LiabilityDocument6 pages8 SMART Ways To Lower Your Tax LiabilityansplanetNo ratings yet

- Saving Income Tax - Understanding Section 80C DeductionsDocument6 pagesSaving Income Tax - Understanding Section 80C DeductionsAbhishek JainNo ratings yet

- SodapdfDocument8 pagesSodapdfjacs sisonNo ratings yet

- Unit V HR OperationsDocument43 pagesUnit V HR OperationssnehalNo ratings yet

- Interest IncomeDocument4 pagesInterest Incomenikhil khajuriaNo ratings yet

- The Payments That You Make To Your PF Are Counted Towards Sec 80CDocument4 pagesThe Payments That You Make To Your PF Are Counted Towards Sec 80CManu VermaNo ratings yet

- Salary, Net Salary, Gross Salary, Cost To Company Are They Same or Different. For Most People It IsDocument6 pagesSalary, Net Salary, Gross Salary, Cost To Company Are They Same or Different. For Most People It IsAnonymous CwxsRiwNo ratings yet

- Pay Less Tax,: Ways To LegallyDocument1 pagePay Less Tax,: Ways To LegallyGauravNo ratings yet

- Basics of Personal FinanceDocument15 pagesBasics of Personal FinanceAnjali TejaniNo ratings yet

- Chapter AnswersDocument20 pagesChapter Answerslynn_mach_1100% (3)

- 8TH Sem Tax Paper PDFDocument25 pages8TH Sem Tax Paper PDFAnamika VatsaNo ratings yet

- SalariesDocument6 pagesSalariesrichaNo ratings yet

- Grants and Subsidies: A Tax Guide For Organisations That Receive A Grant or SubsidyDocument18 pagesGrants and Subsidies: A Tax Guide For Organisations That Receive A Grant or SubsidyHimadhar SaduNo ratings yet

- Income Tax and Its DeductionsDocument7 pagesIncome Tax and Its DeductionsCanadaupdatesNo ratings yet

- Saving Income Tax - Understanding Section 80C DeductionsDocument4 pagesSaving Income Tax - Understanding Section 80C DeductionsArun SinghNo ratings yet

- Making The Best of Tax Saving OptionsDocument12 pagesMaking The Best of Tax Saving Optionssumit_shindeNo ratings yet

- Interest On PPF Is Proposed To Increase To 8.60% and Investment Limit Is Also Expected To Increase To Rs. 1,00,000/-Very SoonDocument3 pagesInterest On PPF Is Proposed To Increase To 8.60% and Investment Limit Is Also Expected To Increase To Rs. 1,00,000/-Very Soonanshushah_144850168No ratings yet

- Tax Structure in India: Edited and Complied Study Material by (Dr. Durdana Ovais)Document7 pagesTax Structure in India: Edited and Complied Study Material by (Dr. Durdana Ovais)Harshita MarmatNo ratings yet

- Tax Law Snapshot 2014Document4 pagesTax Law Snapshot 2014HosameldeenSalehNo ratings yet

- Create Wealth The Contrarian WayDocument3 pagesCreate Wealth The Contrarian WaymayusawantNo ratings yet

- Dfi 201 Lec Three Managing Taxes Teaching NotesDocument14 pagesDfi 201 Lec Three Managing Taxes Teaching Notesraina mattNo ratings yet

- Lecture 1 - Introduction To Income TaxDocument27 pagesLecture 1 - Introduction To Income TaxMimi kupiNo ratings yet

- 05b Concept of Taxable IncomeDocument36 pages05b Concept of Taxable IncomeGolden ChildNo ratings yet

- It-Is Time-Reap Benefits of RADocument2 pagesIt-Is Time-Reap Benefits of RAAnnie MooreNo ratings yet

- TAX ON INTEREST INCOME: Interest On Saving Bank Account: Tax, 80TTA, ITRDocument4 pagesTAX ON INTEREST INCOME: Interest On Saving Bank Account: Tax, 80TTA, ITRcmlcbhtidNo ratings yet

- Patna University IMPORTANT THEORY QUESTION TAXATION 2023Document49 pagesPatna University IMPORTANT THEORY QUESTION TAXATION 2023satishksatish777No ratings yet

- Taxes Summary Test NotesDocument10 pagesTaxes Summary Test NotesfemiadegbayoNo ratings yet

- Lesson 1: Employee CompensationDocument22 pagesLesson 1: Employee Compensationwilhelmina romanNo ratings yet

- Untitled DocumentDocument3 pagesUntitled DocumentbshivamofficialNo ratings yet

- Tax 2Document20 pagesTax 2ABHISHEK SINGH 2124600No ratings yet

- B9-057 - VanshPatel - Assignment 4Document6 pagesB9-057 - VanshPatel - Assignment 4Vansh PatelNo ratings yet

- Complete FinanceDocument5 pagesComplete FinanceKappala AbhishekNo ratings yet

- TaxationDocument7 pagesTaxationRahul Singh DeoNo ratings yet

- Tax Planning For Year 2010Document24 pagesTax Planning For Year 2010Mehak BhargavaNo ratings yet

- Choice of Accounting SystemDocument4 pagesChoice of Accounting SystemAnkush At Shiv ShaktiNo ratings yet

- Lesson - Eco1Document19 pagesLesson - Eco1Prudente, Jean Ericalyn R. - BSBA 3FNo ratings yet

- 80C Deduction - Tax Deduction Under Section 80C and Tax PlanningDocument121 pages80C Deduction - Tax Deduction Under Section 80C and Tax PlanningRaamakrishnan Narayanan SankaranarayananNo ratings yet

- Preparing For EOFY June 2011Document2 pagesPreparing For EOFY June 2011nsfpNo ratings yet

- Tax PlanningDocument3 pagesTax Planningjoseph_gopu17919No ratings yet

- How To Save Income Tax On Income From Salary For IndividualsDocument12 pagesHow To Save Income Tax On Income From Salary For IndividualsIndiranNo ratings yet

- Australian Taxation Income and DeductionsDocument7 pagesAustralian Taxation Income and Deductionsgagangrewal588No ratings yet

- Tax GuideDocument27 pagesTax GuideanjaliNo ratings yet

- Planning For RetirementDocument9 pagesPlanning For RetirementMaimai DuranoNo ratings yet

- 413sol3 04Document17 pages413sol3 04drtoeNo ratings yet

- Maximizing Your Wealth: A Comprehensive Guide to Understanding Gross and Net SalaryFrom EverandMaximizing Your Wealth: A Comprehensive Guide to Understanding Gross and Net SalaryNo ratings yet

- Business: Loans, Debt, Trusts, Grants, Investing, Scholarships, Mortgages, Dividends, Tax Avoidance, and MoreFrom EverandBusiness: Loans, Debt, Trusts, Grants, Investing, Scholarships, Mortgages, Dividends, Tax Avoidance, and MoreNo ratings yet

- Early Life: The Success of PaytmDocument3 pagesEarly Life: The Success of PaytmShreya RaiNo ratings yet

- Money SupplyDocument6 pagesMoney SupplyShreya RaiNo ratings yet

- WE OB II OD&CM - 6 SKDocument26 pagesWE OB II OD&CM - 6 SKShreya RaiNo ratings yet

- WE OB Groups 1&2Document31 pagesWE OB Groups 1&2Shreya RaiNo ratings yet

- Infomation Package For Candidates NorthvoltDocument10 pagesInfomation Package For Candidates NorthvoltFrancisco de Asís Galván DíazNo ratings yet

- Honda Annual Report 2018-19Document88 pagesHonda Annual Report 2018-19Shubhra PujariNo ratings yet

- TAXATION LESSON NO 4 PART 1 Computation of Income Under RA8424 UP TO DE MINIMIS BENEFITSDocument13 pagesTAXATION LESSON NO 4 PART 1 Computation of Income Under RA8424 UP TO DE MINIMIS BENEFITSJhe CaNo ratings yet

- Retired NPS: Life Ka Sahara, HamaraDocument1 pageRetired NPS: Life Ka Sahara, HamaraAarav AkashNo ratings yet

- Public Sector AccountingDocument394 pagesPublic Sector AccountingUMUHIRE JulienNo ratings yet

- Notification 2 2013Document11 pagesNotification 2 2013Venkatesh GaviniNo ratings yet

- Superintendent ContractDocument8 pagesSuperintendent ContractinforumdocsNo ratings yet

- Contoh Soal UTBK SNBT 2023 TPS Literasi Bahasa Inggris (RESMI)Document11 pagesContoh Soal UTBK SNBT 2023 TPS Literasi Bahasa Inggris (RESMI)Shally PramithaNo ratings yet

- Test 1 Tax 667 - Mac 2019Document4 pagesTest 1 Tax 667 - Mac 2019Fakhrul Haziq Md FarisNo ratings yet

- Fnstpb402 Task 2Document19 pagesFnstpb402 Task 2Rabin BidariNo ratings yet

- Tos Business Math - FinalsDocument5 pagesTos Business Math - FinalsMarilyn Nelmida TamayoNo ratings yet

- Severance Pay Worksheet - Domestic EmployeeDocument3 pagesSeverance Pay Worksheet - Domestic EmployeeJullion CooperNo ratings yet

- Kuepper S Day Care Is A Large Daycare Center in SouthDocument1 pageKuepper S Day Care Is A Large Daycare Center in SouthHassan JanNo ratings yet

- All India Bank Pensioners' & Retirees' Confederation (A.I.B.P.A.R.C.)Document2 pagesAll India Bank Pensioners' & Retirees' Confederation (A.I.B.P.A.R.C.)Vijay IyerNo ratings yet

- Bacc101 Taxation Final Exam Summer 2023Document7 pagesBacc101 Taxation Final Exam Summer 2023Jenmark John JacolbeNo ratings yet

- Draft Circular (F.no 354/127/2012-Tru), Dated 27-7-2012Document2 pagesDraft Circular (F.no 354/127/2012-Tru), Dated 27-7-2012shreyajatiaNo ratings yet

- Employee BenefitsDocument20 pagesEmployee BenefitsKezNo ratings yet

- Speaking and Writing: Work: I - Speaking Task 1 Read The Passage and Answer The Following QuestionsDocument5 pagesSpeaking and Writing: Work: I - Speaking Task 1 Read The Passage and Answer The Following QuestionsMy Mieu Dang ThiNo ratings yet

- PrintDocument28 pagesPrintTanvir MahmudNo ratings yet

- Revised Punjab Leave Rules 1981 UpdatedDocument39 pagesRevised Punjab Leave Rules 1981 UpdatedMuhammad Sumair83% (6)

- Net Pay 25,021.51: Confidential Payslip Fold LineDocument1 pageNet Pay 25,021.51: Confidential Payslip Fold LineTumelo MoloiNo ratings yet

- Suitability Analysis FormDocument5 pagesSuitability Analysis FormshahnawazNo ratings yet

- Phil. Guaranty Co. Vs CIR, GR No. L-022074Document10 pagesPhil. Guaranty Co. Vs CIR, GR No. L-022074Gwen Alistaer CanaleNo ratings yet

- OPIN ERPNext Payroll Module Overview v2 07022023Document15 pagesOPIN ERPNext Payroll Module Overview v2 07022023Majeed Yusuf100% (1)

- Insurance NotesDocument46 pagesInsurance Notespuru100% (1)

- Performance Audit Report On Management of Property Investments As Implemented by NSSF and PSSFDocument166 pagesPerformance Audit Report On Management of Property Investments As Implemented by NSSF and PSSFSwahibu MgamboNo ratings yet

- RSPL Limited: Payslip For The Month of JUNE 2021Document1 pageRSPL Limited: Payslip For The Month of JUNE 2021Manju ManjappaNo ratings yet

- ACTL3151 UNSW Tutorial ExerciseDocument124 pagesACTL3151 UNSW Tutorial ExercisedhphgvyieNo ratings yet

Where Does Income Come From?

Where Does Income Come From?

Uploaded by

Shreya RaiOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Where Does Income Come From?

Where Does Income Come From?

Uploaded by

Shreya RaiCopyright:

Available Formats

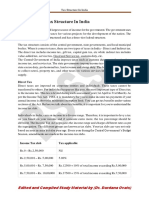

Now I will be talking about income, how the income is spent, received and overview of deductions.

Before starting I want to brief a little about income. So basically Income refers to the money that is

is earned by an individual for providing service or as an exchange for providing a product.

The income earned by an individual is used to fund their day-to-day expenditures, as

well as fund investments.

So the First question is

Where Does Income Come From?

There are various terms for income because there are various ways of earning income. Income

from employment or self-employment is wages or salary. Deposit accounts, like savings accounts,

earn interest, which could also come from lending. Owning stock entitles the shareholder to a

dividend, if there is one. Owning a piece of a partnership or a privately held corporation entitles

one to a draw. Some of the most common types 0f inc0me come from salaries, revenue from self

employment, commissions and bonuses, pensions, interest etc.

Second is

Where Does Income Go?

Most of the Income are used as Expenses for items or resources that are used up or consumed in

the course of daily living. Expenses recur because food, housing, clothing, energy, and so on are

used up on a daily basis.

For companies, make income earn during a specific period is obtained by summing all the

revenue earn by the business minus taxes and business expenses.

Taxable Income is the amount used to calculate how much tax an individual owes the

government. All the salaries, wages, dividends, interest received, pension, or capital gains

earned during the year are taken into account when calculating taxable income.

Overview of Deduction-

Deduction refers to claims made to reduce your taxable income arising from various

investment and expenses incurred by tax payer. Thus, income tax deduction reduces your

overall tax liability. It is a kind of tax benefit which help you save tax. However, the amount

of tax you can save depend on the type of tax benefit you claim.

There are various income deductions. Some of them are-

Deductions on Investments

Section 80C is one of the most popular and favourite sections amongst the taxpayers as it

allows to reduce taxable income by making tax saving investments or incurring eligible

expenses. It allows a maximum deduction of Rs 1.5 lakh every year from the taxpayers

total income.

It is important to note that overall limit including the subsections for claiming

deduction is Rs 1.5 lakh except an additional deduction of Rs 50,000 allowed u/s

80CCD(1b)

Insurance Premium

Pension Contribution

Section 80 TTA – Interest on Savings Account

Section 80E – Interest on Education Loan

Section 80EE – Interest on Home Loan

Section 80D – Medical Insurance

Section 80DD – Disabled Dependent

Section 80DDB – Medical Expenditure

Section 80U Physical Disability

Section 80G Donations

Section 80TTB Interest Income

And many more. That’s all from my side.

You might also like

- Fine Print Pay Stub 1Document3 pagesFine Print Pay Stub 1api-585050784100% (1)

- TCS Feb Payslip PDFDocument2 pagesTCS Feb Payslip PDFNikhilreddy SingireddyNo ratings yet

- Tax Planning DefinitionDocument7 pagesTax Planning DefinitionAlex MasonNo ratings yet

- How To Calculate TDS From SalaryDocument3 pagesHow To Calculate TDS From SalaryNaveen Kumar NaiduNo ratings yet

- Assignment 5: Legal Aspects of Business MS5210Document6 pagesAssignment 5: Legal Aspects of Business MS5210karanNo ratings yet

- LLB 11Document6 pagesLLB 11shubsNo ratings yet

- How To Calculate Income TaxDocument4 pagesHow To Calculate Income TaxCharishma Sekhar.KNo ratings yet

- 5 Tax InstrumentsDocument3 pages5 Tax InstrumentsktsnlNo ratings yet

- Some Terms in Income Tax ClarifiedDocument9 pagesSome Terms in Income Tax ClarifiedAnonymous ATg0gvcf9No ratings yet

- DT NotesDocument41 pagesDT NotesHariprasad bhatNo ratings yet

- Taxation ProjectDocument12 pagesTaxation ProjectMohal gargNo ratings yet

- Income Tax Deductions From SalaryDocument34 pagesIncome Tax Deductions From SalaryPaymaster Services100% (2)

- Tax Planning For Salaried IndividualsDocument20 pagesTax Planning For Salaried IndividualsRAJNo ratings yet

- 2.1 Discuss The Different Components of SalaryDocument11 pages2.1 Discuss The Different Components of SalarymohithNo ratings yet

- Occupation GuidelinesDocument160 pagesOccupation Guidelinesjo lamosNo ratings yet

- Optimizing On TaxDocument2 pagesOptimizing On TaxvijaysNo ratings yet

- 8 SMART Ways To Lower Your Tax LiabilityDocument6 pages8 SMART Ways To Lower Your Tax LiabilityansplanetNo ratings yet

- Saving Income Tax - Understanding Section 80C DeductionsDocument6 pagesSaving Income Tax - Understanding Section 80C DeductionsAbhishek JainNo ratings yet

- SodapdfDocument8 pagesSodapdfjacs sisonNo ratings yet

- Unit V HR OperationsDocument43 pagesUnit V HR OperationssnehalNo ratings yet

- Interest IncomeDocument4 pagesInterest Incomenikhil khajuriaNo ratings yet

- The Payments That You Make To Your PF Are Counted Towards Sec 80CDocument4 pagesThe Payments That You Make To Your PF Are Counted Towards Sec 80CManu VermaNo ratings yet

- Salary, Net Salary, Gross Salary, Cost To Company Are They Same or Different. For Most People It IsDocument6 pagesSalary, Net Salary, Gross Salary, Cost To Company Are They Same or Different. For Most People It IsAnonymous CwxsRiwNo ratings yet

- Pay Less Tax,: Ways To LegallyDocument1 pagePay Less Tax,: Ways To LegallyGauravNo ratings yet

- Basics of Personal FinanceDocument15 pagesBasics of Personal FinanceAnjali TejaniNo ratings yet

- Chapter AnswersDocument20 pagesChapter Answerslynn_mach_1100% (3)

- 8TH Sem Tax Paper PDFDocument25 pages8TH Sem Tax Paper PDFAnamika VatsaNo ratings yet

- SalariesDocument6 pagesSalariesrichaNo ratings yet

- Grants and Subsidies: A Tax Guide For Organisations That Receive A Grant or SubsidyDocument18 pagesGrants and Subsidies: A Tax Guide For Organisations That Receive A Grant or SubsidyHimadhar SaduNo ratings yet

- Income Tax and Its DeductionsDocument7 pagesIncome Tax and Its DeductionsCanadaupdatesNo ratings yet

- Saving Income Tax - Understanding Section 80C DeductionsDocument4 pagesSaving Income Tax - Understanding Section 80C DeductionsArun SinghNo ratings yet

- Making The Best of Tax Saving OptionsDocument12 pagesMaking The Best of Tax Saving Optionssumit_shindeNo ratings yet

- Interest On PPF Is Proposed To Increase To 8.60% and Investment Limit Is Also Expected To Increase To Rs. 1,00,000/-Very SoonDocument3 pagesInterest On PPF Is Proposed To Increase To 8.60% and Investment Limit Is Also Expected To Increase To Rs. 1,00,000/-Very Soonanshushah_144850168No ratings yet

- Tax Structure in India: Edited and Complied Study Material by (Dr. Durdana Ovais)Document7 pagesTax Structure in India: Edited and Complied Study Material by (Dr. Durdana Ovais)Harshita MarmatNo ratings yet

- Tax Law Snapshot 2014Document4 pagesTax Law Snapshot 2014HosameldeenSalehNo ratings yet

- Create Wealth The Contrarian WayDocument3 pagesCreate Wealth The Contrarian WaymayusawantNo ratings yet

- Dfi 201 Lec Three Managing Taxes Teaching NotesDocument14 pagesDfi 201 Lec Three Managing Taxes Teaching Notesraina mattNo ratings yet

- Lecture 1 - Introduction To Income TaxDocument27 pagesLecture 1 - Introduction To Income TaxMimi kupiNo ratings yet

- 05b Concept of Taxable IncomeDocument36 pages05b Concept of Taxable IncomeGolden ChildNo ratings yet

- It-Is Time-Reap Benefits of RADocument2 pagesIt-Is Time-Reap Benefits of RAAnnie MooreNo ratings yet

- TAX ON INTEREST INCOME: Interest On Saving Bank Account: Tax, 80TTA, ITRDocument4 pagesTAX ON INTEREST INCOME: Interest On Saving Bank Account: Tax, 80TTA, ITRcmlcbhtidNo ratings yet

- Patna University IMPORTANT THEORY QUESTION TAXATION 2023Document49 pagesPatna University IMPORTANT THEORY QUESTION TAXATION 2023satishksatish777No ratings yet

- Taxes Summary Test NotesDocument10 pagesTaxes Summary Test NotesfemiadegbayoNo ratings yet

- Lesson 1: Employee CompensationDocument22 pagesLesson 1: Employee Compensationwilhelmina romanNo ratings yet

- Untitled DocumentDocument3 pagesUntitled DocumentbshivamofficialNo ratings yet

- Tax 2Document20 pagesTax 2ABHISHEK SINGH 2124600No ratings yet

- B9-057 - VanshPatel - Assignment 4Document6 pagesB9-057 - VanshPatel - Assignment 4Vansh PatelNo ratings yet

- Complete FinanceDocument5 pagesComplete FinanceKappala AbhishekNo ratings yet

- TaxationDocument7 pagesTaxationRahul Singh DeoNo ratings yet

- Tax Planning For Year 2010Document24 pagesTax Planning For Year 2010Mehak BhargavaNo ratings yet

- Choice of Accounting SystemDocument4 pagesChoice of Accounting SystemAnkush At Shiv ShaktiNo ratings yet

- Lesson - Eco1Document19 pagesLesson - Eco1Prudente, Jean Ericalyn R. - BSBA 3FNo ratings yet

- 80C Deduction - Tax Deduction Under Section 80C and Tax PlanningDocument121 pages80C Deduction - Tax Deduction Under Section 80C and Tax PlanningRaamakrishnan Narayanan SankaranarayananNo ratings yet

- Preparing For EOFY June 2011Document2 pagesPreparing For EOFY June 2011nsfpNo ratings yet

- Tax PlanningDocument3 pagesTax Planningjoseph_gopu17919No ratings yet

- How To Save Income Tax On Income From Salary For IndividualsDocument12 pagesHow To Save Income Tax On Income From Salary For IndividualsIndiranNo ratings yet

- Australian Taxation Income and DeductionsDocument7 pagesAustralian Taxation Income and Deductionsgagangrewal588No ratings yet

- Tax GuideDocument27 pagesTax GuideanjaliNo ratings yet

- Planning For RetirementDocument9 pagesPlanning For RetirementMaimai DuranoNo ratings yet

- 413sol3 04Document17 pages413sol3 04drtoeNo ratings yet

- Maximizing Your Wealth: A Comprehensive Guide to Understanding Gross and Net SalaryFrom EverandMaximizing Your Wealth: A Comprehensive Guide to Understanding Gross and Net SalaryNo ratings yet

- Business: Loans, Debt, Trusts, Grants, Investing, Scholarships, Mortgages, Dividends, Tax Avoidance, and MoreFrom EverandBusiness: Loans, Debt, Trusts, Grants, Investing, Scholarships, Mortgages, Dividends, Tax Avoidance, and MoreNo ratings yet

- Early Life: The Success of PaytmDocument3 pagesEarly Life: The Success of PaytmShreya RaiNo ratings yet

- Money SupplyDocument6 pagesMoney SupplyShreya RaiNo ratings yet

- WE OB II OD&CM - 6 SKDocument26 pagesWE OB II OD&CM - 6 SKShreya RaiNo ratings yet

- WE OB Groups 1&2Document31 pagesWE OB Groups 1&2Shreya RaiNo ratings yet

- Infomation Package For Candidates NorthvoltDocument10 pagesInfomation Package For Candidates NorthvoltFrancisco de Asís Galván DíazNo ratings yet

- Honda Annual Report 2018-19Document88 pagesHonda Annual Report 2018-19Shubhra PujariNo ratings yet

- TAXATION LESSON NO 4 PART 1 Computation of Income Under RA8424 UP TO DE MINIMIS BENEFITSDocument13 pagesTAXATION LESSON NO 4 PART 1 Computation of Income Under RA8424 UP TO DE MINIMIS BENEFITSJhe CaNo ratings yet

- Retired NPS: Life Ka Sahara, HamaraDocument1 pageRetired NPS: Life Ka Sahara, HamaraAarav AkashNo ratings yet

- Public Sector AccountingDocument394 pagesPublic Sector AccountingUMUHIRE JulienNo ratings yet

- Notification 2 2013Document11 pagesNotification 2 2013Venkatesh GaviniNo ratings yet

- Superintendent ContractDocument8 pagesSuperintendent ContractinforumdocsNo ratings yet

- Contoh Soal UTBK SNBT 2023 TPS Literasi Bahasa Inggris (RESMI)Document11 pagesContoh Soal UTBK SNBT 2023 TPS Literasi Bahasa Inggris (RESMI)Shally PramithaNo ratings yet

- Test 1 Tax 667 - Mac 2019Document4 pagesTest 1 Tax 667 - Mac 2019Fakhrul Haziq Md FarisNo ratings yet

- Fnstpb402 Task 2Document19 pagesFnstpb402 Task 2Rabin BidariNo ratings yet

- Tos Business Math - FinalsDocument5 pagesTos Business Math - FinalsMarilyn Nelmida TamayoNo ratings yet

- Severance Pay Worksheet - Domestic EmployeeDocument3 pagesSeverance Pay Worksheet - Domestic EmployeeJullion CooperNo ratings yet

- Kuepper S Day Care Is A Large Daycare Center in SouthDocument1 pageKuepper S Day Care Is A Large Daycare Center in SouthHassan JanNo ratings yet

- All India Bank Pensioners' & Retirees' Confederation (A.I.B.P.A.R.C.)Document2 pagesAll India Bank Pensioners' & Retirees' Confederation (A.I.B.P.A.R.C.)Vijay IyerNo ratings yet

- Bacc101 Taxation Final Exam Summer 2023Document7 pagesBacc101 Taxation Final Exam Summer 2023Jenmark John JacolbeNo ratings yet

- Draft Circular (F.no 354/127/2012-Tru), Dated 27-7-2012Document2 pagesDraft Circular (F.no 354/127/2012-Tru), Dated 27-7-2012shreyajatiaNo ratings yet

- Employee BenefitsDocument20 pagesEmployee BenefitsKezNo ratings yet

- Speaking and Writing: Work: I - Speaking Task 1 Read The Passage and Answer The Following QuestionsDocument5 pagesSpeaking and Writing: Work: I - Speaking Task 1 Read The Passage and Answer The Following QuestionsMy Mieu Dang ThiNo ratings yet

- PrintDocument28 pagesPrintTanvir MahmudNo ratings yet

- Revised Punjab Leave Rules 1981 UpdatedDocument39 pagesRevised Punjab Leave Rules 1981 UpdatedMuhammad Sumair83% (6)

- Net Pay 25,021.51: Confidential Payslip Fold LineDocument1 pageNet Pay 25,021.51: Confidential Payslip Fold LineTumelo MoloiNo ratings yet

- Suitability Analysis FormDocument5 pagesSuitability Analysis FormshahnawazNo ratings yet

- Phil. Guaranty Co. Vs CIR, GR No. L-022074Document10 pagesPhil. Guaranty Co. Vs CIR, GR No. L-022074Gwen Alistaer CanaleNo ratings yet

- OPIN ERPNext Payroll Module Overview v2 07022023Document15 pagesOPIN ERPNext Payroll Module Overview v2 07022023Majeed Yusuf100% (1)

- Insurance NotesDocument46 pagesInsurance Notespuru100% (1)

- Performance Audit Report On Management of Property Investments As Implemented by NSSF and PSSFDocument166 pagesPerformance Audit Report On Management of Property Investments As Implemented by NSSF and PSSFSwahibu MgamboNo ratings yet

- RSPL Limited: Payslip For The Month of JUNE 2021Document1 pageRSPL Limited: Payslip For The Month of JUNE 2021Manju ManjappaNo ratings yet

- ACTL3151 UNSW Tutorial ExerciseDocument124 pagesACTL3151 UNSW Tutorial ExercisedhphgvyieNo ratings yet