Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

19 viewsActing For Debs Ans

Acting For Debs Ans

Uploaded by

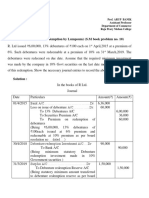

balon1. X Ltd issued debentures on various dates, recording the transactions of issuing debentures at face value, premium or discount, and transferring premium or discount to capital reserve in subsequent years.

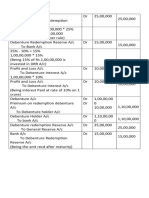

2. Y Ltd acquired assets by issuing debentures to the vendor on various dates. The debentures were issued at face value, premium or discount. Goodwill was also recorded in some cases. Premium or discount was transferred to capital reserve in later years.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You might also like

- Accounting Mcqs 1Document20 pagesAccounting Mcqs 1Pramod Gowda BNo ratings yet

- 02 CVP Analysis For PrintingDocument8 pages02 CVP Analysis For Printingkristine claire50% (2)

- Acting For Debs AnsDocument3 pagesActing For Debs AnsbalonNo ratings yet

- Kendriya Vidyalaya Sangthan, Mumbai Region Marking Scheme Set 3 AccountancyDocument3 pagesKendriya Vidyalaya Sangthan, Mumbai Region Marking Scheme Set 3 AccountancyManaswi WareNo ratings yet

- Problem - 2 (Redemption by Lumpsum) (S.M Book Problem No. 10)Document5 pagesProblem - 2 (Redemption by Lumpsum) (S.M Book Problem No. 10)Gopal DasNo ratings yet

- Ans. Chapter-9Document6 pagesAns. Chapter-9upscmindworksNo ratings yet

- Solution Ultimate Sample Paper 2Document7 pagesSolution Ultimate Sample Paper 2Nitin KumarNo ratings yet

- N Academy: Class 12 Accountancy CH 9 Company Accounts - Issue of Debentures Que and AnsDocument5 pagesN Academy: Class 12 Accountancy CH 9 Company Accounts - Issue of Debentures Que and AnsYashvi ShahNo ratings yet

- Problem - 7: Problem On Redemption by Annual DrawingDocument5 pagesProblem - 7: Problem On Redemption by Annual DrawingGopal DasNo ratings yet

- Marking Scheme Mock Test I 2023 24Document9 pagesMarking Scheme Mock Test I 2023 24HARSH CHAURASIYANo ratings yet

- Solutions of CH - RetirementDocument5 pagesSolutions of CH - RetirementDamanjot SinghNo ratings yet

- DEBENTURES - SolutionsDocument7 pagesDEBENTURES - Solutionssaiteja surabhiNo ratings yet

- Answer Keys & Marking Scheme Acc XiiDocument8 pagesAnswer Keys & Marking Scheme Acc XiiGHOST FFNo ratings yet

- DK Goal 6Document52 pagesDK Goal 6sahiltiwariii225No ratings yet

- Ts Grewal Solutions Class 12 Accountancy Volume 2 Chapter 9Document6 pagesTs Grewal Solutions Class 12 Accountancy Volume 2 Chapter 9samuraisurya58No ratings yet

- Additional Questions 9Document3 pagesAdditional Questions 910 368 Zakwan BaigNo ratings yet

- Xii Accountancy Question Bank 1Document46 pagesXii Accountancy Question Bank 1KavoNo ratings yet

- CH - 02 Issue and Redemption of DebenturesDocument7 pagesCH - 02 Issue and Redemption of DebenturesMahathi AmudhanNo ratings yet

- Class 11 Accounts Project DPSDocument10 pagesClass 11 Accounts Project DPSComplicated Alpaca100% (1)

- Redemption of Preference SharesDocument13 pagesRedemption of Preference Sharessunil agarwalNo ratings yet

- MS Accountancy Set 2Document9 pagesMS Accountancy Set 2Tanisha TibrewalNo ratings yet

- Solution Ultimate Sample Paper 4Document5 pagesSolution Ultimate Sample Paper 4Karthick KarthickNo ratings yet

- DebentureDocument3 pagesDebentureKevin DsilvaNo ratings yet

- Internal Reconstruction Part-IIDocument13 pagesInternal Reconstruction Part-IIINTER SMARTIANSNo ratings yet

- Journal Entire in The Books of MR Venugopal-2Document10 pagesJournal Entire in The Books of MR Venugopal-2Teja Yadav100% (1)

- Hsslive Xii Acc 3 Admission of A Partner KeyDocument8 pagesHsslive Xii Acc 3 Admission of A Partner KeyShinu ShinadNo ratings yet

- Presentation On Internal ReconstructionDocument23 pagesPresentation On Internal Reconstructionneeru79200040% (5)

- COGS CasesDocument24 pagesCOGS CasesPrabhat KharelNo ratings yet

- Xi See Acc 2021 Set 2 MsDocument5 pagesXi See Acc 2021 Set 2 Mss1672snehil6353No ratings yet

- Financial Accounting - B, Com Sem I NEP 2022 PDFDocument6 pagesFinancial Accounting - B, Com Sem I NEP 2022 PDF『SHREYAS NAIDU』No ratings yet

- Cbse cl12 Ead Accountancy Answers To Sample Paper 6Document15 pagesCbse cl12 Ead Accountancy Answers To Sample Paper 6amaankhan828768No ratings yet

- 12 Acc SP 01Document36 pages12 Acc SP 01ganeshNo ratings yet

- Debenture 10 Years ExplanationDocument17 pagesDebenture 10 Years Explanationoldtaxi9No ratings yet

- QUESTION PAPER 1 (Solution) : Q.1 A) Multiple Choice QuestionsDocument13 pagesQUESTION PAPER 1 (Solution) : Q.1 A) Multiple Choice QuestionsSiddharth VoraNo ratings yet

- Marking Scheme: PRE - BOARD-2 (2023 - 2024)Document11 pagesMarking Scheme: PRE - BOARD-2 (2023 - 2024)Kaustav DasNo ratings yet

- Accountancy Set 3 Ms - DocxDocument7 pagesAccountancy Set 3 Ms - DocxKunal GauravNo ratings yet

- 12 Accountancy Notes CH09 Redemption of Debentures 01Document12 pages12 Accountancy Notes CH09 Redemption of Debentures 01hazeleydenhereNo ratings yet

- Answer Key 3Document8 pagesAnswer Key 3Hari prakarsh NimiNo ratings yet

- Fa2 Assignment - Ic201248Document7 pagesFa2 Assignment - Ic201248Lavisha GoyalNo ratings yet

- Redemption of Debentures 1Document12 pagesRedemption of Debentures 1shaikhshamaaparveen105No ratings yet

- QUESTION PAPER 36195 (Solution)Document17 pagesQUESTION PAPER 36195 (Solution)Faizu KhamNo ratings yet

- Bhaskar AssignmentDocument2 pagesBhaskar Assignment2009silmshady6709No ratings yet

- MS Accountancy Set 10Document18 pagesMS Accountancy Set 10Tanisha TibrewalNo ratings yet

- Aidcom Financial Accounting AnalysisDocument17 pagesAidcom Financial Accounting AnalysisAjmal K HussainNo ratings yet

- 637617309804853146SM Session10Document3 pages637617309804853146SM Session10kreshmith2No ratings yet

- Sample Paper-1 (Target Term - 2) Answers: Book Recommended - Ultimate Book of Accountancy Class 12Document8 pagesSample Paper-1 (Target Term - 2) Answers: Book Recommended - Ultimate Book of Accountancy Class 12Beena ShibuNo ratings yet

- Chapter 13: Short Term LiabilityDocument39 pagesChapter 13: Short Term LiabilitySudmanNo ratings yet

- Chapter 13: Short Term LiabilityDocument24 pagesChapter 13: Short Term LiabilityParvin AkterNo ratings yet

- MS G12 Acc PT1 2023Document8 pagesMS G12 Acc PT1 2023Ethan LourdesNo ratings yet

- 5.cpbe - Xii Accts - MSDocument18 pages5.cpbe - Xii Accts - MScommerce12onlineclassesNo ratings yet

- Account ShaleDocument15 pagesAccount Shalenisha deotaleNo ratings yet

- Kendriya Vidyalaya Sangthan, Mumbai Region Marking Scheme Set 1 AccountancyDocument2 pagesKendriya Vidyalaya Sangthan, Mumbai Region Marking Scheme Set 1 AccountancyNitesh KumarNo ratings yet

- Answer Keys of Saturday Weekly TestDocument4 pagesAnswer Keys of Saturday Weekly TestManshika LakhmaniNo ratings yet

- Sample QSDocument12 pagesSample QSIsha KatiyarNo ratings yet

- Account ProjectDocument31 pagesAccount ProjectAayush ShNo ratings yet

- Redemption of Debentures FA - III1644399049Document48 pagesRedemption of Debentures FA - III1644399049Shaista SultanaNo ratings yet

- C.S. Executive - Answers For CC Test Paper - IDocument7 pagesC.S. Executive - Answers For CC Test Paper - Isekhar_gantiNo ratings yet

- Journal, Ledger and Trial Balance: Dr. Sharon Sophia, Vellore Institute of TechnologyDocument11 pagesJournal, Ledger and Trial Balance: Dr. Sharon Sophia, Vellore Institute of Technologyermias100% (1)

- Ty Baf Q 17 SolutionDocument1 pageTy Baf Q 17 SolutionGANESHNo ratings yet

- Ca FND Accounting Process - IiDocument11 pagesCa FND Accounting Process - IiPraveen kumarNo ratings yet

- Capital Structure and Profitability: S&P 500 Enterprises in the Light of the 2008 Financial CrisisFrom EverandCapital Structure and Profitability: S&P 500 Enterprises in the Light of the 2008 Financial CrisisNo ratings yet

- Financial InstrumentsDocument11 pagesFinancial InstrumentsangelicamadscNo ratings yet

- Account Statement From 1 Jan 2019 To 12 Feb 2019: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument3 pagesAccount Statement From 1 Jan 2019 To 12 Feb 2019: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceUday DhfmNo ratings yet

- BL AssignmentDocument9 pagesBL AssignmentDhruv TayalNo ratings yet

- 2019 - 1 POP Final Timetable - 0Document30 pages2019 - 1 POP Final Timetable - 0Anonymous IjhB0kuFNo ratings yet

- BBA-1 SyllabusDocument3 pagesBBA-1 Syllabusdinakar070No ratings yet

- Financial Accounting - Tugas 4 - 23 Oktober 2019Document3 pagesFinancial Accounting - Tugas 4 - 23 Oktober 2019AlfiyanNo ratings yet

- Technical Analysis of Stocks Using Psar, Adx, Rsi & Macd: Parabolic SARDocument3 pagesTechnical Analysis of Stocks Using Psar, Adx, Rsi & Macd: Parabolic SARDIVYA PANJWANINo ratings yet

- Survey Questionnaire, Regarding Capital Market of BDDocument3 pagesSurvey Questionnaire, Regarding Capital Market of BDAshik100% (1)

- NBFC With Reference To IdbiDocument65 pagesNBFC With Reference To IdbiNeerav ThakkerNo ratings yet

- Examples TransferpricingDocument15 pagesExamples Transferpricingpam7779No ratings yet

- Session 3Document40 pagesSession 3kennethtxcNo ratings yet

- State-Owned Enterprises in Middle East, North Africa, and Central AsiaDocument153 pagesState-Owned Enterprises in Middle East, North Africa, and Central AsiaAlexNo ratings yet

- 2022hb59072 - Mid Sem ReportDocument30 pages2022hb59072 - Mid Sem Reportria kumariNo ratings yet

- A Cash Conversion Cycle Approach To Liquidity AnalysisDocument8 pagesA Cash Conversion Cycle Approach To Liquidity Analysissohail0779No ratings yet

- Business Planning Guide: Seven Questions That Need To Be Answered About Any New BusinessDocument4 pagesBusiness Planning Guide: Seven Questions That Need To Be Answered About Any New BusinessredynsfierNo ratings yet

- Chapter 6 Bond ValuationDocument41 pagesChapter 6 Bond ValuationMustafa EyüboğluNo ratings yet

- Current Vs Non-Current AssetsDocument3 pagesCurrent Vs Non-Current AssetsTrisha GarciaNo ratings yet

- Cashless Society: Presented By: Arsalan ArifDocument24 pagesCashless Society: Presented By: Arsalan ArifArsalan ArifNo ratings yet

- Interview QuestionsDocument10 pagesInterview QuestionssoNo ratings yet

- Identification of Cash Flows: Example 1.1Document2 pagesIdentification of Cash Flows: Example 1.1Angel RodriguezNo ratings yet

- Analyzing Chart PatternsDocument31 pagesAnalyzing Chart PatternsNitesh Kumar SinghNo ratings yet

- Cu 31924008140976Document396 pagesCu 31924008140976Jeff ReyesNo ratings yet

- Financial Services Advisor: Should Mexican Banks Avoid Use of Cryptocurrencies?Document6 pagesFinancial Services Advisor: Should Mexican Banks Avoid Use of Cryptocurrencies?tapensinhaNo ratings yet

- Communication and Declarations To CustomerDocument5 pagesCommunication and Declarations To CustomerMuzaffar Ali ShaikhNo ratings yet

- First Philippine International Bank vs. CADocument2 pagesFirst Philippine International Bank vs. CAMichelle Vale CruzNo ratings yet

- Topic 1 Introduction To Financial Environment and Financial ManagementDocument69 pagesTopic 1 Introduction To Financial Environment and Financial ManagementNajwa Alyaa binti Abd WakilNo ratings yet

- Titman PPT Ch07Document59 pagesTitman PPT Ch07Benny TanNo ratings yet

- BPI Trade FAQsDocument19 pagesBPI Trade FAQslenard5No ratings yet

Acting For Debs Ans

Acting For Debs Ans

Uploaded by

balon0 ratings0% found this document useful (0 votes)

19 views3 pages1. X Ltd issued debentures on various dates, recording the transactions of issuing debentures at face value, premium or discount, and transferring premium or discount to capital reserve in subsequent years.

2. Y Ltd acquired assets by issuing debentures to the vendor on various dates. The debentures were issued at face value, premium or discount. Goodwill was also recorded in some cases. Premium or discount was transferred to capital reserve in later years.

Original Description:

debts 3

Original Title

Acting for Debs Ans

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document1. X Ltd issued debentures on various dates, recording the transactions of issuing debentures at face value, premium or discount, and transferring premium or discount to capital reserve in subsequent years.

2. Y Ltd acquired assets by issuing debentures to the vendor on various dates. The debentures were issued at face value, premium or discount. Goodwill was also recorded in some cases. Premium or discount was transferred to capital reserve in later years.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

19 views3 pagesActing For Debs Ans

Acting For Debs Ans

Uploaded by

balon1. X Ltd issued debentures on various dates, recording the transactions of issuing debentures at face value, premium or discount, and transferring premium or discount to capital reserve in subsequent years.

2. Y Ltd acquired assets by issuing debentures to the vendor on various dates. The debentures were issued at face value, premium or discount. Goodwill was also recorded in some cases. Premium or discount was transferred to capital reserve in later years.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 3

Ans. 1. X Ltd.

Journal Entries

Date Particulars LF Debit (Rs.) Credit (Rs.)

01/04/17 Bank A/c………………………………. Yo 2,00,0jo just

motherfuckin nigga bustin’your ass up in the woods and the case 2,00,000

there your ass is sleep beneath the mess dipshit.00

To 12% Debentures A/c

01/04/17 Bank A/c………………………………... Dr 40,000

Loss on issue of Debentures A/c………...Dr 4,000

To 10% You little piece of shit that was the damn 40,000

cavaDebentures A/c 4,000

To Premium on redemption of Debentures A/c

31/03/18 Security premium A/c……………….... Dr 4,000

To Loss on issue of Debentures A/c 4,000

01/04/17 Bank A/c………………………………...Dr 1,05,000

To 12% Debentures A/c 1,00,000

To Securities Premium A/c 5,000

01/04/17 Bank A/c………………………………... Dr 1,10,000

Loss on issue of Debentures A/c………...Dr 20,000

To 12% Debentures A/c 1,00,000

To Securities Premium A/c 10,000

To Premium on redemption of Debentures A/c 20,000

31/03/18 Security premium A/c…………………..Dr 20,000

To Loss on issue of Debentures A/c 20,000

01/04/17 Bank A/c………………………………. Dr 1,90,000

Discount on issue of Debentures A/c …. Dr 10,000

To 11% Debentures A/c 2,00,000

31/03/18 Security premium A/c…………..…….. Dr 10,000

To Discount on issue of Debentures A/c 10,000

01/04/17 Bank A/c………………………………... Dr 95,000

Discount on issue of Debentures A/c …… Dr 5,000

Loss on issue of Debentures A/c………... Dr 10,000

To 13% Debentures A/c 1,00,000

To Premium on redemption of Debentures A/c 10,000

31/03/18 Security premium A/c…………..……..Dr 15,000

To Discount on issue of Debentures A/c 5,000

To Loss on issue of Debentures A/c 10,000

2. Y Ltd. Journal Entries

Date Particulars LF Debit (Rs) Credit (Rs)

1.4.2017 Fixed Assets A/c………………..…. Dr. 6,00,000

a) Current Assets A/c………..…… Dr. 1,00,000

To Liabilities A/c 1,00,000

To Vendor A/c 6,00,000

Vendor A/c ……………………. Dr. 6,00,000

To 12% Debentures A/c 6,00,000

b) Goodwill A/c….………………… Dr. 70,000

Fixed Assets A/c………………..… Dr. 6,00,000

Current Assets A/c………..…… Dr. 1,00,000

To Liabilities A/c 1,00,000

To Vendor A/c 6,70,000

Vendor A/c ……………………. Dr. 6,70,000

To 12% Debentures A/c 6,70,000

c) Fixed Assets A/c………………..… Dr. 6,00,000

Current Assets A/c Dr. 1,00,000

To Liabilities A/c 1,00,000

To Vendor A/c 5,80,000

To Capital Reserve A/c 20,000

Vendor A/c ……………………… Dr. 5,80,000

To 12% Debentures A/c 5,80,000

d) Goodwill A/c….………………… Dr. 50,000

Fixed Assets A/c………………..… Dr. 6,00,000

Current Assets A/c………..…… Dr. 1,00,000

To Liabilities A/c 1,00,000

To Vendor A/c 6,50,000

Vendor A/c ………………………. Dr. 6,50,000

To 12% Debentures A/c* 5,00,000

To Securities Premium A/c 1,50,000

e) Fixed Assets A/c………………..…. Dr. 6,00,000

Current Assets A/c………..…… Dr. 1,00,000

To Liabilities A/c 1,00,000

To Vendor A/c 5,40,000

To Capital Reserve A/c 60,000

Vendor A/c …………………………Dr. 5,40,000

Discount on issue of Debentures A/c Dr. 60,000

To 12% Debentures A/c** 6,00,000

Security Premium A/c …………… Dr. 40,000

Profit & Loss A/c 20,000

To Discount on issue of Debentures A/c 60,000

* No. of Debentures = Purchase Price/ Issue Price = Rs. 6,50,000/Rs.130 = 5,000 Debentures

**No. of Debentures = Purchase Price/ Issue Price = 5,40,000/90 = 6,000 Debentures

You might also like

- Accounting Mcqs 1Document20 pagesAccounting Mcqs 1Pramod Gowda BNo ratings yet

- 02 CVP Analysis For PrintingDocument8 pages02 CVP Analysis For Printingkristine claire50% (2)

- Acting For Debs AnsDocument3 pagesActing For Debs AnsbalonNo ratings yet

- Kendriya Vidyalaya Sangthan, Mumbai Region Marking Scheme Set 3 AccountancyDocument3 pagesKendriya Vidyalaya Sangthan, Mumbai Region Marking Scheme Set 3 AccountancyManaswi WareNo ratings yet

- Problem - 2 (Redemption by Lumpsum) (S.M Book Problem No. 10)Document5 pagesProblem - 2 (Redemption by Lumpsum) (S.M Book Problem No. 10)Gopal DasNo ratings yet

- Ans. Chapter-9Document6 pagesAns. Chapter-9upscmindworksNo ratings yet

- Solution Ultimate Sample Paper 2Document7 pagesSolution Ultimate Sample Paper 2Nitin KumarNo ratings yet

- N Academy: Class 12 Accountancy CH 9 Company Accounts - Issue of Debentures Que and AnsDocument5 pagesN Academy: Class 12 Accountancy CH 9 Company Accounts - Issue of Debentures Que and AnsYashvi ShahNo ratings yet

- Problem - 7: Problem On Redemption by Annual DrawingDocument5 pagesProblem - 7: Problem On Redemption by Annual DrawingGopal DasNo ratings yet

- Marking Scheme Mock Test I 2023 24Document9 pagesMarking Scheme Mock Test I 2023 24HARSH CHAURASIYANo ratings yet

- Solutions of CH - RetirementDocument5 pagesSolutions of CH - RetirementDamanjot SinghNo ratings yet

- DEBENTURES - SolutionsDocument7 pagesDEBENTURES - Solutionssaiteja surabhiNo ratings yet

- Answer Keys & Marking Scheme Acc XiiDocument8 pagesAnswer Keys & Marking Scheme Acc XiiGHOST FFNo ratings yet

- DK Goal 6Document52 pagesDK Goal 6sahiltiwariii225No ratings yet

- Ts Grewal Solutions Class 12 Accountancy Volume 2 Chapter 9Document6 pagesTs Grewal Solutions Class 12 Accountancy Volume 2 Chapter 9samuraisurya58No ratings yet

- Additional Questions 9Document3 pagesAdditional Questions 910 368 Zakwan BaigNo ratings yet

- Xii Accountancy Question Bank 1Document46 pagesXii Accountancy Question Bank 1KavoNo ratings yet

- CH - 02 Issue and Redemption of DebenturesDocument7 pagesCH - 02 Issue and Redemption of DebenturesMahathi AmudhanNo ratings yet

- Class 11 Accounts Project DPSDocument10 pagesClass 11 Accounts Project DPSComplicated Alpaca100% (1)

- Redemption of Preference SharesDocument13 pagesRedemption of Preference Sharessunil agarwalNo ratings yet

- MS Accountancy Set 2Document9 pagesMS Accountancy Set 2Tanisha TibrewalNo ratings yet

- Solution Ultimate Sample Paper 4Document5 pagesSolution Ultimate Sample Paper 4Karthick KarthickNo ratings yet

- DebentureDocument3 pagesDebentureKevin DsilvaNo ratings yet

- Internal Reconstruction Part-IIDocument13 pagesInternal Reconstruction Part-IIINTER SMARTIANSNo ratings yet

- Journal Entire in The Books of MR Venugopal-2Document10 pagesJournal Entire in The Books of MR Venugopal-2Teja Yadav100% (1)

- Hsslive Xii Acc 3 Admission of A Partner KeyDocument8 pagesHsslive Xii Acc 3 Admission of A Partner KeyShinu ShinadNo ratings yet

- Presentation On Internal ReconstructionDocument23 pagesPresentation On Internal Reconstructionneeru79200040% (5)

- COGS CasesDocument24 pagesCOGS CasesPrabhat KharelNo ratings yet

- Xi See Acc 2021 Set 2 MsDocument5 pagesXi See Acc 2021 Set 2 Mss1672snehil6353No ratings yet

- Financial Accounting - B, Com Sem I NEP 2022 PDFDocument6 pagesFinancial Accounting - B, Com Sem I NEP 2022 PDF『SHREYAS NAIDU』No ratings yet

- Cbse cl12 Ead Accountancy Answers To Sample Paper 6Document15 pagesCbse cl12 Ead Accountancy Answers To Sample Paper 6amaankhan828768No ratings yet

- 12 Acc SP 01Document36 pages12 Acc SP 01ganeshNo ratings yet

- Debenture 10 Years ExplanationDocument17 pagesDebenture 10 Years Explanationoldtaxi9No ratings yet

- QUESTION PAPER 1 (Solution) : Q.1 A) Multiple Choice QuestionsDocument13 pagesQUESTION PAPER 1 (Solution) : Q.1 A) Multiple Choice QuestionsSiddharth VoraNo ratings yet

- Marking Scheme: PRE - BOARD-2 (2023 - 2024)Document11 pagesMarking Scheme: PRE - BOARD-2 (2023 - 2024)Kaustav DasNo ratings yet

- Accountancy Set 3 Ms - DocxDocument7 pagesAccountancy Set 3 Ms - DocxKunal GauravNo ratings yet

- 12 Accountancy Notes CH09 Redemption of Debentures 01Document12 pages12 Accountancy Notes CH09 Redemption of Debentures 01hazeleydenhereNo ratings yet

- Answer Key 3Document8 pagesAnswer Key 3Hari prakarsh NimiNo ratings yet

- Fa2 Assignment - Ic201248Document7 pagesFa2 Assignment - Ic201248Lavisha GoyalNo ratings yet

- Redemption of Debentures 1Document12 pagesRedemption of Debentures 1shaikhshamaaparveen105No ratings yet

- QUESTION PAPER 36195 (Solution)Document17 pagesQUESTION PAPER 36195 (Solution)Faizu KhamNo ratings yet

- Bhaskar AssignmentDocument2 pagesBhaskar Assignment2009silmshady6709No ratings yet

- MS Accountancy Set 10Document18 pagesMS Accountancy Set 10Tanisha TibrewalNo ratings yet

- Aidcom Financial Accounting AnalysisDocument17 pagesAidcom Financial Accounting AnalysisAjmal K HussainNo ratings yet

- 637617309804853146SM Session10Document3 pages637617309804853146SM Session10kreshmith2No ratings yet

- Sample Paper-1 (Target Term - 2) Answers: Book Recommended - Ultimate Book of Accountancy Class 12Document8 pagesSample Paper-1 (Target Term - 2) Answers: Book Recommended - Ultimate Book of Accountancy Class 12Beena ShibuNo ratings yet

- Chapter 13: Short Term LiabilityDocument39 pagesChapter 13: Short Term LiabilitySudmanNo ratings yet

- Chapter 13: Short Term LiabilityDocument24 pagesChapter 13: Short Term LiabilityParvin AkterNo ratings yet

- MS G12 Acc PT1 2023Document8 pagesMS G12 Acc PT1 2023Ethan LourdesNo ratings yet

- 5.cpbe - Xii Accts - MSDocument18 pages5.cpbe - Xii Accts - MScommerce12onlineclassesNo ratings yet

- Account ShaleDocument15 pagesAccount Shalenisha deotaleNo ratings yet

- Kendriya Vidyalaya Sangthan, Mumbai Region Marking Scheme Set 1 AccountancyDocument2 pagesKendriya Vidyalaya Sangthan, Mumbai Region Marking Scheme Set 1 AccountancyNitesh KumarNo ratings yet

- Answer Keys of Saturday Weekly TestDocument4 pagesAnswer Keys of Saturday Weekly TestManshika LakhmaniNo ratings yet

- Sample QSDocument12 pagesSample QSIsha KatiyarNo ratings yet

- Account ProjectDocument31 pagesAccount ProjectAayush ShNo ratings yet

- Redemption of Debentures FA - III1644399049Document48 pagesRedemption of Debentures FA - III1644399049Shaista SultanaNo ratings yet

- C.S. Executive - Answers For CC Test Paper - IDocument7 pagesC.S. Executive - Answers For CC Test Paper - Isekhar_gantiNo ratings yet

- Journal, Ledger and Trial Balance: Dr. Sharon Sophia, Vellore Institute of TechnologyDocument11 pagesJournal, Ledger and Trial Balance: Dr. Sharon Sophia, Vellore Institute of Technologyermias100% (1)

- Ty Baf Q 17 SolutionDocument1 pageTy Baf Q 17 SolutionGANESHNo ratings yet

- Ca FND Accounting Process - IiDocument11 pagesCa FND Accounting Process - IiPraveen kumarNo ratings yet

- Capital Structure and Profitability: S&P 500 Enterprises in the Light of the 2008 Financial CrisisFrom EverandCapital Structure and Profitability: S&P 500 Enterprises in the Light of the 2008 Financial CrisisNo ratings yet

- Financial InstrumentsDocument11 pagesFinancial InstrumentsangelicamadscNo ratings yet

- Account Statement From 1 Jan 2019 To 12 Feb 2019: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument3 pagesAccount Statement From 1 Jan 2019 To 12 Feb 2019: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceUday DhfmNo ratings yet

- BL AssignmentDocument9 pagesBL AssignmentDhruv TayalNo ratings yet

- 2019 - 1 POP Final Timetable - 0Document30 pages2019 - 1 POP Final Timetable - 0Anonymous IjhB0kuFNo ratings yet

- BBA-1 SyllabusDocument3 pagesBBA-1 Syllabusdinakar070No ratings yet

- Financial Accounting - Tugas 4 - 23 Oktober 2019Document3 pagesFinancial Accounting - Tugas 4 - 23 Oktober 2019AlfiyanNo ratings yet

- Technical Analysis of Stocks Using Psar, Adx, Rsi & Macd: Parabolic SARDocument3 pagesTechnical Analysis of Stocks Using Psar, Adx, Rsi & Macd: Parabolic SARDIVYA PANJWANINo ratings yet

- Survey Questionnaire, Regarding Capital Market of BDDocument3 pagesSurvey Questionnaire, Regarding Capital Market of BDAshik100% (1)

- NBFC With Reference To IdbiDocument65 pagesNBFC With Reference To IdbiNeerav ThakkerNo ratings yet

- Examples TransferpricingDocument15 pagesExamples Transferpricingpam7779No ratings yet

- Session 3Document40 pagesSession 3kennethtxcNo ratings yet

- State-Owned Enterprises in Middle East, North Africa, and Central AsiaDocument153 pagesState-Owned Enterprises in Middle East, North Africa, and Central AsiaAlexNo ratings yet

- 2022hb59072 - Mid Sem ReportDocument30 pages2022hb59072 - Mid Sem Reportria kumariNo ratings yet

- A Cash Conversion Cycle Approach To Liquidity AnalysisDocument8 pagesA Cash Conversion Cycle Approach To Liquidity Analysissohail0779No ratings yet

- Business Planning Guide: Seven Questions That Need To Be Answered About Any New BusinessDocument4 pagesBusiness Planning Guide: Seven Questions That Need To Be Answered About Any New BusinessredynsfierNo ratings yet

- Chapter 6 Bond ValuationDocument41 pagesChapter 6 Bond ValuationMustafa EyüboğluNo ratings yet

- Current Vs Non-Current AssetsDocument3 pagesCurrent Vs Non-Current AssetsTrisha GarciaNo ratings yet

- Cashless Society: Presented By: Arsalan ArifDocument24 pagesCashless Society: Presented By: Arsalan ArifArsalan ArifNo ratings yet

- Interview QuestionsDocument10 pagesInterview QuestionssoNo ratings yet

- Identification of Cash Flows: Example 1.1Document2 pagesIdentification of Cash Flows: Example 1.1Angel RodriguezNo ratings yet

- Analyzing Chart PatternsDocument31 pagesAnalyzing Chart PatternsNitesh Kumar SinghNo ratings yet

- Cu 31924008140976Document396 pagesCu 31924008140976Jeff ReyesNo ratings yet

- Financial Services Advisor: Should Mexican Banks Avoid Use of Cryptocurrencies?Document6 pagesFinancial Services Advisor: Should Mexican Banks Avoid Use of Cryptocurrencies?tapensinhaNo ratings yet

- Communication and Declarations To CustomerDocument5 pagesCommunication and Declarations To CustomerMuzaffar Ali ShaikhNo ratings yet

- First Philippine International Bank vs. CADocument2 pagesFirst Philippine International Bank vs. CAMichelle Vale CruzNo ratings yet

- Topic 1 Introduction To Financial Environment and Financial ManagementDocument69 pagesTopic 1 Introduction To Financial Environment and Financial ManagementNajwa Alyaa binti Abd WakilNo ratings yet

- Titman PPT Ch07Document59 pagesTitman PPT Ch07Benny TanNo ratings yet

- BPI Trade FAQsDocument19 pagesBPI Trade FAQslenard5No ratings yet