Professional Documents

Culture Documents

Cbtax01 Chapter 9 (Activity)

Cbtax01 Chapter 9 (Activity)

Uploaded by

Ariane Cuayzon0 ratings0% found this document useful (0 votes)

3 views2 pagesThis document provides definitions for tax-related terms:

A tax credit certificate shows tax overpayments and can be used to pay tax liabilities or converted to cash. Tax credits can be forfeited if not used within five years or if a business no longer qualifies. Tax liens allow tax authorities to claim property for unpaid taxes, preventing its sale until paid. Abatements reduce tax amounts for new construction to encourage development. Forfeiture is losing money or property for breaking a contract. A levy is the total tax amount a government can collect, and actual distraint involves physically seizing personal property to pay debts.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document provides definitions for tax-related terms:

A tax credit certificate shows tax overpayments and can be used to pay tax liabilities or converted to cash. Tax credits can be forfeited if not used within five years or if a business no longer qualifies. Tax liens allow tax authorities to claim property for unpaid taxes, preventing its sale until paid. Abatements reduce tax amounts for new construction to encourage development. Forfeiture is losing money or property for breaking a contract. A levy is the total tax amount a government can collect, and actual distraint involves physically seizing personal property to pay debts.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

3 views2 pagesCbtax01 Chapter 9 (Activity)

Cbtax01 Chapter 9 (Activity)

Uploaded by

Ariane CuayzonThis document provides definitions for tax-related terms:

A tax credit certificate shows tax overpayments and can be used to pay tax liabilities or converted to cash. Tax credits can be forfeited if not used within five years or if a business no longer qualifies. Tax liens allow tax authorities to claim property for unpaid taxes, preventing its sale until paid. Abatements reduce tax amounts for new construction to encourage development. Forfeiture is losing money or property for breaking a contract. A levy is the total tax amount a government can collect, and actual distraint involves physically seizing personal property to pay debts.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 2

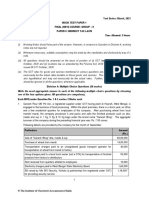

ICCT Colleges Foundation, Inc.

Income Taxation – CBTAX01

CHAPTER 4 – ACTIVITY / ASSIGNMENT

Answer the following questions/statements in not less than 5 sentences.

1. In your own words, explain the following and give examples.

a. Tax credit certificate (TCC)

• It's a document that shows the amount owed to a taxpayer as a result of an

overpayment or inaccurate tax payment. It shows your tax credits, exemptions,

and rate range for the tax year, as well as your basic universal charge rates and

rate range, and your employment identifier, which is a unique reference issued by

your company for your employment. According to the BIR, taxpayers can use the

TCC to settle any tax liabilities through a tax debit note, or it can be converted into

cash "if the taxpayer-owner has no purpose for it." TCCs which have already

expired when the restrictions take effect will be automatically cancelled by the BIR.

TCC that have been abandoned for more than a year will be converted to cash,

according to the BIR.

b. Forfeiture of tax credit

• It involves contractor certificate revocation, inspection, the consequences of failing

to enable inspection, and collection. A tax credit certificate that has been issued in

accordance with the relevant provisions of this Code but has not been used after

five years from the date of issue. If the forfeiture is the result of the contractor's

action rather than the taxpayer's, these taxes will be assessed against the

contractor rather than the taxpayer. If the taxpayer's property inside the Local

Enterprise Zone for which a credit has been granted is sold or ceases to be used

as a business during any tax year. If the taxpayer ceases to operate such a

business at said location, or if the taxpayer employs fewer than the number of

people required by this article.

c. Enforcement of tax lien

• It is a claim made by a tax authority against a piece of real estate due to a

taxpayer's inability to pay taxes. Tax lien enforcement solutions aimed in all facets

of out-of-state tax debt collection. For both out-of-state tax debtors and their assets,

tax lien enforcement performs extensive location and asset searches. A property

with such a tax lien cannot be transferred by the owner, making it difficult for the

owner to avoid paying the tax. Since a property holder cannot sell a property with

a lien on it, tax liens are highly effective for tax enforcement.

d. Abatement

• It is a decrease or exemption in the amount of tax that an individual or business

must pay. On new construction, rehabilitation, major upgrades, tax abatement

programs reduce or eliminate the amount of property taxes that owners pay. The

objective of this program is to attract purchasers to places with low demand, such

as restored city neighborhoods. To qualify for the tax abatement, properties are

frequently required to stay owner-occupied. The tax abatement will remain with the

property if it is sold from one holder to another. A person’s property tax payment

will not be totally eliminated by the abatements; they will still have to pay taxes on

the value of the property before it was improved.

e. Forfeiture

• It refers to the loss of the any property, money, or assets in which there is no

acknowledgment or compensation. Forfeiture is a form of payment for breaching a

contract's conditions. A party which fails to complete their contractual obligations

or fails their responsibility forfeits the contract assets or rights. The objective of

forfeiture is to reimburse the party that has been damaged by the contract's non-

performance. A forfeiture happens when a person fails to meet its contractual

payment obligations. It can also be used as a punishment for illegal business

practices.

f. Levy

• A levy is an amount of money which you must pay to the government, such as a

tax. A levy is just the entire amount of money that a local government can get with

a tax rate. A levy is a judicially transfer of your property to pay back a tax debt.

Liens are not the same as levies. A levy is when the property is taken to settle the

debt. The Internal Revenue Service may take your tax return or property if you do

not pay your taxes. Other assets, such as bank accounts, rental income, and

retirement accounts, might be seized by tax officials.

g. Actual distraint

• It is a physical confiscation or seizure of personal belongings. Actual distraint is

where t The property is being physically taken. This includes not only the physical

confiscation of personal property, but also debt collectors. If the bankruptcy is not

for cash but for other personal property, the property must always be disposed at

a public auction. The payments would be used to address the debt. The excess

from this will be given back to the taxpayer.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5825)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Chase 02-29-24Document5 pagesChase 02-29-24Riad Hossain100% (1)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Chris SoCal Gas BillDocument2 pagesChris SoCal Gas BillChristian Howayek100% (1)

- Statement ChaseDocument4 pagesStatement ChaseYoel Cabrera100% (1)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Accounting For Labor - ExercisesDocument3 pagesAccounting For Labor - ExercisesAmy SpencerNo ratings yet

- IDFCFIRSTBankstatement 10110872462 213022617Document2 pagesIDFCFIRSTBankstatement 10110872462 213022617SATISH SNEHINo ratings yet

- Yes Bank Mitc Byoc PDFDocument13 pagesYes Bank Mitc Byoc PDFHarinder SinghNo ratings yet

- StatementDocument15 pagesStatementVishal BawaneNo ratings yet

- Invoice DocumentDocument1 pageInvoice DocumentALL IN ONENo ratings yet

- Bmtax CompilationDocument50 pagesBmtax CompilationMarco Alexander O. AgtagNo ratings yet

- Receipt 1Document2 pagesReceipt 1Ellivelton NarcisoNo ratings yet

- Taxn 1000 First Term Exam Sy 2021-2022 QuestionsDocument8 pagesTaxn 1000 First Term Exam Sy 2021-2022 QuestionsLAIJANIE CLAIRE ALVAREZNo ratings yet

- Bus Bar Trunking System: Product Name Brand Capacity HS CodeDocument3 pagesBus Bar Trunking System: Product Name Brand Capacity HS CodeEast West Medical College & HospitalNo ratings yet

- Counter Sale Tax InvoiceDocument2 pagesCounter Sale Tax Invoicesajidsufi1999No ratings yet

- 20 Traders Royal Bank V Radio Phil NetworkDocument2 pages20 Traders Royal Bank V Radio Phil NetworkMichelle BernardoNo ratings yet

- Format of Undertaking by A Foreign Nation in Case of Absence of PANDocument1 pageFormat of Undertaking by A Foreign Nation in Case of Absence of PANGaurav Kumar SharmaNo ratings yet

- Case 2Document2 pagesCase 2leshz zynNo ratings yet

- ICMAP Business Law Past PapersDocument5 pagesICMAP Business Law Past Papersmuhzahid786No ratings yet

- Jurnal SalaryDocument2 pagesJurnal SalaryPorma SiringoNo ratings yet

- Aaecd6222a 2022Document5 pagesAaecd6222a 2022Gaurav AgarwalNo ratings yet

- MTP May 2021 QDocument10 pagesMTP May 2021 QÑïkêţ BäûðhåNo ratings yet

- Cams One Time MandateDocument2 pagesCams One Time Mandatepiyush agarwalNo ratings yet

- Muhammad Tahir S/O Muhammad Irshad Scheme No1 Abul Khair: Web Generated BillDocument1 pageMuhammad Tahir S/O Muhammad Irshad Scheme No1 Abul Khair: Web Generated BillUsama Elec15No ratings yet

- 24.06.2019 - 45TGZPXA GEDA ProformaDocument2 pages24.06.2019 - 45TGZPXA GEDA ProformaSisay TakeleNo ratings yet

- 2022MHI000564 C NatvarlalDocument2 pages2022MHI000564 C NatvarlalDEEPAK GUPTANo ratings yet

- IDFC Startup NewBusinessCA SOCDocument2 pagesIDFC Startup NewBusinessCA SOCdhruvsaidavaNo ratings yet

- TAX317 SS JUN2019. (Rate 2021.for Students)Document10 pagesTAX317 SS JUN2019. (Rate 2021.for Students)izzahNo ratings yet

- Output VatDocument16 pagesOutput VatLica Dapitilla Perin100% (1)

- Running Head: Apple Pay and Paypal 1Document3 pagesRunning Head: Apple Pay and Paypal 1Ayesha IftikharNo ratings yet

- Module 2 Transcript Federal Taxation I Individuals Employees and Sole ProprietorsDocument66 pagesModule 2 Transcript Federal Taxation I Individuals Employees and Sole ProprietorsFreddy MolinaNo ratings yet

- Balance - Statement (2) - OCR AppliedDocument14 pagesBalance - Statement (2) - OCR AppliedMaster's FameNo ratings yet