Professional Documents

Culture Documents

Acc 407 Individual Assignment 1 Semester 1, 2022

Acc 407 Individual Assignment 1 Semester 1, 2022

Uploaded by

Saaliha SaabiraCopyright:

Available Formats

You might also like

- SolutionDocument6 pagesSolutionJhazzie Dolor100% (1)

- Learning Chess Workbook Step 5 PDFDocument60 pagesLearning Chess Workbook Step 5 PDFviraaj100% (24)

- LATIHAN Soal Uas AMDocument5 pagesLATIHAN Soal Uas AMqinthara alfarisiNo ratings yet

- Ca (Bsaf - Bba.mba)Document5 pagesCa (Bsaf - Bba.mba)kashif aliNo ratings yet

- Group 7 Tutorial AnswersDocument27 pagesGroup 7 Tutorial AnswersKwang Yi Juin0% (1)

- Benefits of Advanced Technology During This PandemicDocument32 pagesBenefits of Advanced Technology During This PandemicEmmanuel James SevillaNo ratings yet

- BMAT 112 Week 20 4th Exam by Nae NaeDocument14 pagesBMAT 112 Week 20 4th Exam by Nae NaeKristine Mae Pazo Gaspar86% (7)

- Exercises in Operational Budgeting - Solve in Excel Spread SheetDocument2 pagesExercises in Operational Budgeting - Solve in Excel Spread SheetClaire BarbaNo ratings yet

- Problems: Set B: Type of Inventory January 1 April 1 July 1Document3 pagesProblems: Set B: Type of Inventory January 1 April 1 July 1Iffat AftabNo ratings yet

- Acc 407 (Ashneel)Document8 pagesAcc 407 (Ashneel)Saaliha SaabiraNo ratings yet

- Faculty of Business and Management BBA/DBA 211 Managerial AccountingDocument4 pagesFaculty of Business and Management BBA/DBA 211 Managerial AccountingMichael AronNo ratings yet

- CH 23 Exercises ProblemsDocument4 pagesCH 23 Exercises ProblemsAhmed El KhateebNo ratings yet

- Assignment On CH 3 and 4 Cost 2Document4 pagesAssignment On CH 3 and 4 Cost 2sadiya AbrahimNo ratings yet

- Illustration: Preparation of Master Budget (Manufacturing Company)Document4 pagesIllustration: Preparation of Master Budget (Manufacturing Company)shimelis100% (1)

- Management Accounting ExercisesDocument82 pagesManagement Accounting ExercisesPetrinaNo ratings yet

- BUSI3008 Assignment 1 Winter 2022Document2 pagesBUSI3008 Assignment 1 Winter 2022akashtanotra3No ratings yet

- Budget Practice 2023Document2 pagesBudget Practice 2023Nhi PhạmNo ratings yet

- Master BudgetDocument2 pagesMaster BudgetAli SwizzleNo ratings yet

- Assignment of Management Accounting TechniquesDocument6 pagesAssignment of Management Accounting TechniquesSaniaNo ratings yet

- Quiz 2Document4 pagesQuiz 2VAIBHAV RAJNo ratings yet

- Task 3 Master Budget QuesDocument2 pagesTask 3 Master Budget QuesNgọc Trâm TrầnNo ratings yet

- Cash Sales Credit Sales: ACCT201B Practice Questions Chapter 8Document9 pagesCash Sales Credit Sales: ACCT201B Practice Questions Chapter 8GuinevereNo ratings yet

- EXERCISECHAPTER2Document8 pagesEXERCISECHAPTER2Bạch ThanhNo ratings yet

- Cost AccountingDocument37 pagesCost Accountingtito mohamedNo ratings yet

- Cost Accounting Self Assessment Materials Labor and OverheadDocument4 pagesCost Accounting Self Assessment Materials Labor and OverheadDarwyn HonaNo ratings yet

- Tutorial 1Document5 pagesTutorial 1FEI FEINo ratings yet

- 9 Cost ProductionDocument11 pages9 Cost Productionmikaella eugenioNo ratings yet

- Financial Statements ER Problem 2 SolutionDocument11 pagesFinancial Statements ER Problem 2 SolutionSYED ALI SHAH SYED MUKHTIYAR ALINo ratings yet

- Cost II - Assignment & WorksheetDocument7 pagesCost II - Assignment & WorksheetBeamlak WegayehuNo ratings yet

- Rift Valley University Yeka Campus Department of Accounting and Finance Assignment Of: Cost and ManagementiiDocument8 pagesRift Valley University Yeka Campus Department of Accounting and Finance Assignment Of: Cost and ManagementiiGet Habesha0% (1)

- Accountancy and Auditing-2017Document5 pagesAccountancy and Auditing-2017Jassmine RoseNo ratings yet

- ACT202 Midterm ExamDocument2 pagesACT202 Midterm ExamSalahuddin BadhonNo ratings yet

- Sha1 ACT 202 FINAL EXAM-Fall 2020: Answer The Following Questions and Remember To Show All Necessary WorkingsDocument5 pagesSha1 ACT 202 FINAL EXAM-Fall 2020: Answer The Following Questions and Remember To Show All Necessary WorkingsMahi100% (1)

- Tutorial 1Document4 pagesTutorial 1jasonneo999No ratings yet

- Exercises For The Course Cost and Management Accounting IIDocument8 pagesExercises For The Course Cost and Management Accounting IIDawit AmahaNo ratings yet

- Operational Budget Assignment IIIDocument7 pagesOperational Budget Assignment IIIzeritu tilahunNo ratings yet

- Worksheet For Cost and Management Accounting II (Acct 212)Document5 pagesWorksheet For Cost and Management Accounting II (Acct 212)Bereket DesalegnNo ratings yet

- Cost Accounting 1 ACT201 InstructorsDocument4 pagesCost Accounting 1 ACT201 InstructorsAdhamNo ratings yet

- Cost I AssignmentDocument7 pagesCost I AssignmentibsaashekaNo ratings yet

- Cost Concepts Class ExercisesDocument7 pagesCost Concepts Class ExercisesAngel Alejo AcobaNo ratings yet

- CH 09Document3 pagesCH 09ghsoub77750% (2)

- Practical Case Financial BudgetDocument17 pagesPractical Case Financial BudgetScribdTranslationsNo ratings yet

- Answer Key To Test #2 - ACCT-312 - Fall 2019Document6 pagesAnswer Key To Test #2 - ACCT-312 - Fall 2019Amir ContrerasNo ratings yet

- Planning, Performance and EvaluationDocument26 pagesPlanning, Performance and EvaluationJoan LauNo ratings yet

- Meiktila University of Economics MBA 112Document2 pagesMeiktila University of Economics MBA 112ApicalMitten 502No ratings yet

- Chapter 3 - Part 2Document9 pagesChapter 3 - Part 2Aya MasoudNo ratings yet

- Acctg15 Job-Order QuizDocument3 pagesAcctg15 Job-Order QuizJemar Murillo DalaganNo ratings yet

- Managerial Accounting JONGAY (AutoRecovered)Document24 pagesManagerial Accounting JONGAY (AutoRecovered)Jhoy AmoscoNo ratings yet

- Cost & MGMT Acct II, AssignmentDocument3 pagesCost & MGMT Acct II, AssignmentAshenafi TamireNo ratings yet

- Ae 191 F-Test 1Document3 pagesAe 191 F-Test 1Venus PalmencoNo ratings yet

- AF102 DFL ExamDocument9 pagesAF102 DFL ExamTetzNo ratings yet

- Managerial Accounting Trial Essay Questions - V3Document2 pagesManagerial Accounting Trial Essay Questions - V3Nhật Nam BùiNo ratings yet

- Particulars: (Format and Additional Data Provided - Statement of Income and Expense Tab)Document7 pagesParticulars: (Format and Additional Data Provided - Statement of Income and Expense Tab)Jhoanne Marie TederaNo ratings yet

- Answer Key To Test #1 - ACCT-312 - Fall 2019Document8 pagesAnswer Key To Test #1 - ACCT-312 - Fall 2019Amir ContrerasNo ratings yet

- Assignment2revised1Document5 pagesAssignment2revised1Pankaj KhannaNo ratings yet

- Review Problem: Budget Schedules: RequiredDocument8 pagesReview Problem: Budget Schedules: RequiredShafa AlyaNo ratings yet

- Kuis UTS Genap 21-22 ACCDocument3 pagesKuis UTS Genap 21-22 ACCNatasya FlorenciaNo ratings yet

- Bai Tap On Tap QTDNDocument4 pagesBai Tap On Tap QTDNDuyên Nguyễn Nữ KỳNo ratings yet

- Mock Exam MG T Acct 2022Document2 pagesMock Exam MG T Acct 2022Bình AnNo ratings yet

- Budgeting Handout2Document11 pagesBudgeting Handout2Gva Umayam100% (1)

- GivenDocument17 pagesGivenApurvAdarshNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- 2017 International Comparison Program in Asia and the Pacific: Purchasing Power Parities and Real Expenditures—A Summary ReportFrom Everand2017 International Comparison Program in Asia and the Pacific: Purchasing Power Parities and Real Expenditures—A Summary ReportNo ratings yet

- 2a. TablesDocument9 pages2a. TablesSaaliha SaabiraNo ratings yet

- CSC511 Introduction To C++Document12 pagesCSC511 Introduction To C++Saaliha SaabiraNo ratings yet

- 4a. Using The If FunctionDocument4 pages4a. Using The If FunctionSaaliha SaabiraNo ratings yet

- Lecture Topic 4 StudentDocument36 pagesLecture Topic 4 StudentSaaliha SaabiraNo ratings yet

- Eth501sem Week 9 Lecture On Prejudice Discrimination and EthicsDocument31 pagesEth501sem Week 9 Lecture On Prejudice Discrimination and EthicsSaaliha SaabiraNo ratings yet

- Week 3 Tutorial 1Document3 pagesWeek 3 Tutorial 1Saaliha SaabiraNo ratings yet

- Final ProjectDocument13 pagesFinal ProjectSaaliha SaabiraNo ratings yet

- Fin 501: Mid - Semester Exam: Campus Day Time RoomDocument2 pagesFin 501: Mid - Semester Exam: Campus Day Time RoomSaaliha SaabiraNo ratings yet

- An Introduction To Programming With C++ Eighth Edition: Variables and ConstantsDocument34 pagesAn Introduction To Programming With C++ Eighth Edition: Variables and ConstantsSaaliha SaabiraNo ratings yet

- If Function PracticeDocument12 pagesIf Function PracticeSaaliha SaabiraNo ratings yet

- Suggested Solution 1Document5 pagesSuggested Solution 1Saaliha SaabiraNo ratings yet

- FIN501 Assignment - GroupDocument4 pagesFIN501 Assignment - GroupSaaliha SaabiraNo ratings yet

- Collegeof Business 2Document12 pagesCollegeof Business 2Saaliha SaabiraNo ratings yet

- Quiz 2 Notice - FIN 501Document1 pageQuiz 2 Notice - FIN 501Saaliha SaabiraNo ratings yet

- Step 1: Analyse Your Essay QuestionDocument2 pagesStep 1: Analyse Your Essay QuestionSaaliha SaabiraNo ratings yet

- Eth-501-1 Debate Assignment Appendix BDocument2 pagesEth-501-1 Debate Assignment Appendix BSaaliha SaabiraNo ratings yet

- Fin 501: Fundamentals of Finance: Tutorial 2 SolutionDocument3 pagesFin 501: Fundamentals of Finance: Tutorial 2 SolutionSaaliha SaabiraNo ratings yet

- Spreadsheet AssignmentDocument13 pagesSpreadsheet AssignmentSaaliha SaabiraNo ratings yet

- Spreadsheet AssignmentDocument13 pagesSpreadsheet AssignmentSaaliha SaabiraNo ratings yet

- Acc 407 (Ashneel)Document8 pagesAcc 407 (Ashneel)Saaliha SaabiraNo ratings yet

- Step 1: Analyse Your Essay QuestionDocument2 pagesStep 1: Analyse Your Essay QuestionSaaliha SaabiraNo ratings yet

- Eth-501-0 Debate Assignment Appendix CDocument4 pagesEth-501-0 Debate Assignment Appendix CSaaliha SaabiraNo ratings yet

- Does HRM Lead To Improved Organized PerformanceDocument13 pagesDoes HRM Lead To Improved Organized PerformanceSaaliha SaabiraNo ratings yet

- Somewhere Over The Rainbow - Eva Cassidy - GuitarDocument1 pageSomewhere Over The Rainbow - Eva Cassidy - GuitarOtto Pereira0% (1)

- Describe Your SchoolDocument9 pagesDescribe Your Schoolkarthika4a50% (4)

- Wisdom by Lester Levenson III Freedom Technique III Transformation (PDFDrive)Document147 pagesWisdom by Lester Levenson III Freedom Technique III Transformation (PDFDrive)MDG WD100% (2)

- The Rivera ReportsDocument228 pagesThe Rivera ReportsPaul William Hoye100% (2)

- Maharashtra State Board of Secondary & Higher Secondary Education, PuneDocument14 pagesMaharashtra State Board of Secondary & Higher Secondary Education, PuneAjinkya DahivadeNo ratings yet

- CLIA Board MTG Minutes 5-31-11 WebsiteDocument1 pageCLIA Board MTG Minutes 5-31-11 WebsiteadmincliaNo ratings yet

- College of Business Administration University of Pittsburgh BUSFIN 1030Document24 pagesCollege of Business Administration University of Pittsburgh BUSFIN 1030John P ReddenNo ratings yet

- Gess SC 8 Course OutlineDocument4 pagesGess SC 8 Course Outlineapi-264733993No ratings yet

- InterviewDocument3 pagesInterviewThiya NalluNo ratings yet

- Principles of Operations Management 8th Edition Heizer Solutions ManualDocument5 pagesPrinciples of Operations Management 8th Edition Heizer Solutions Manualjosephbrowntdnebozsrw100% (14)

- IT Amendment Act, 2008 - An Act To Amend The IT Act 2000Document3 pagesIT Amendment Act, 2008 - An Act To Amend The IT Act 2000sbhatlaNo ratings yet

- CertIFR Module-2Document46 pagesCertIFR Module-2Tran AnhNo ratings yet

- Islamic Business Plan: Opportunity and Creativity To SuccessDocument15 pagesIslamic Business Plan: Opportunity and Creativity To SuccessAnindito W WicaksonoNo ratings yet

- Check My Twitter Account @nursetopia or IG @nursetopia1 For More Nursing Test Banks, Sample Exam, Reviewers, and NotesDocument9 pagesCheck My Twitter Account @nursetopia or IG @nursetopia1 For More Nursing Test Banks, Sample Exam, Reviewers, and NotesNurse UtopiaNo ratings yet

- Leadership Programs in Healthcare - INSEAD Healthcare ClubDocument14 pagesLeadership Programs in Healthcare - INSEAD Healthcare ClubkennyNo ratings yet

- Reducing Misconceptions PDFDocument11 pagesReducing Misconceptions PDFViorelNo ratings yet

- 50 Vol4 EpaperDocument32 pages50 Vol4 EpaperThesouthasian TimesNo ratings yet

- AggressionDocument9 pagesAggressionapi-645961517No ratings yet

- Legal Principles in Shipping Business 2014Document3 pagesLegal Principles in Shipping Business 2014MarvinNo ratings yet

- Aadhaar CardDocument1 pageAadhaar CardkailashhapaserNo ratings yet

- Manager-Magazin 2006 10 48923426Document10 pagesManager-Magazin 2006 10 48923426Neel DoshiNo ratings yet

- MR 2018 5 e 9 BorszekiDocument38 pagesMR 2018 5 e 9 BorszekiborszekijNo ratings yet

- Dayao v. ComelecDocument15 pagesDayao v. ComelecRichelle CartinNo ratings yet

- Augusta-Waterville, ME (2022)Document62 pagesAugusta-Waterville, ME (2022)ravee12No ratings yet

- Obama and The War Against JewsDocument56 pagesObama and The War Against JewsUniversalgeni100% (2)

- Jamshedpur DraftDocument45 pagesJamshedpur DraftArangNo ratings yet

- Water Supply Technical ProposalDocument34 pagesWater Supply Technical ProposalAsif Iqbal Dawar67% (6)

Acc 407 Individual Assignment 1 Semester 1, 2022

Acc 407 Individual Assignment 1 Semester 1, 2022

Uploaded by

Saaliha SaabiraOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Acc 407 Individual Assignment 1 Semester 1, 2022

Acc 407 Individual Assignment 1 Semester 1, 2022

Uploaded by

Saaliha SaabiraCopyright:

Available Formats

COLLEGE OF BUSINESS, HOSPITALITY AND TOURISM STUDIES

SCHOOL OF ACCOUNTING

ACC 407 – Budget Process

Semester 1 2022

Instructions:

This is an individual assignment.

Both questions are compulsory

The assignment must comply with normal academic requirements. Refer to the course outline

and regulation concerned with plagiarism and copying!

The assignment weighting is 10% towards the overall assessment.

You need to upload your assignment on Moodle on or before 8th May 2022. There is no

need to submit the hard copy.

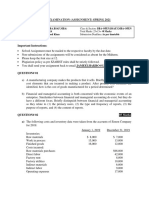

Question 1

Bacon Inc. is preparing its annual budgets for the year ending December 31, 2017. Accounting

assistants furnish the following data.

Product A Product B

Sales Budget:

Anticipated volume in units 410 000 250 000

Unit selling price $25 $35

Production budget:

Desired ending finished goods units 20 000 25 000

Beginning finished goods units 30 000 15 000

Direct material budget:

Direct material per unit (pounds) 2 3

Desired ending direct material pounds 50 000 10 000

Beginning direct materials pounds 40 000 20 000

Cost per pound $2 $3

Direct labor budget:

Direct labor time per unit 0.5 0.75

Direct labor rate per hour $12 $12

Budgeted income statement:

Total unit cost $12 $22

An accounting assistant has prepared the detailed manufacturing overhead budget and selling and

administrative expense budget. The latter shows selling expenses of $750 000 for Product A and

$580 000 for Product B, and administrative expenses of $420 000 for Product A and $380 000

for Product B. Income taxes are expected to be 20%.

Required:

Prepare the following budgets for the year. Show data for each product. Quarterly budgets need

not be prepared.

a) Sales (5 marks)

b) Production (5 marks)

c) Direct materials (5 marks)

d) Direct labor (5 marks)

e) Income statement (10 marks)

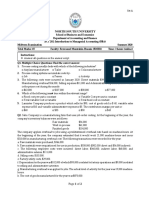

Question 2

Northern Swit is famous in making ice cream. One unique flavor of ice cream produced by

Northern Swits is Black Raspberry Crunch. Assume that Northern Swits prepares monthly cash

budget. The following information is provided by their accountant Kritesh for the year 2016:

August (2016) September (2016)

$ $

Sales 460,000 412,000

Direct material purchased 185,000 210,000

Direct Labour 70,000 85,000

Manufacturing overhead 50,000 65,000

Selling and administrative expenses 85,000 95,000

Collections are expected to be 75% in the month of sale, and 25% in the month following sale.

Northern Swits pays 60% of the direct materials purchases in cash in the month of purchase, and

the balance due in the month following the purchase. All other items are paid in the month

incurred.

Other information:

Sales July 2016: $380,000

Purchase of direct materials: July 2016: $175,000

Other receipts: August – Donation received $2,000

September – sale of used equipment $4,000

Other disbursement: September- Purchased equipment 4,000

Repaid debt: August $30,000

Required:

1. Prepare the schedules of expected cash collection of Northern Swits from customers for

August and September. (7.5 marks)

2. Prepare the schedules of expected cash payment of Northern Swits for August and

September . (7.5 marks)

The End.

You might also like

- SolutionDocument6 pagesSolutionJhazzie Dolor100% (1)

- Learning Chess Workbook Step 5 PDFDocument60 pagesLearning Chess Workbook Step 5 PDFviraaj100% (24)

- LATIHAN Soal Uas AMDocument5 pagesLATIHAN Soal Uas AMqinthara alfarisiNo ratings yet

- Ca (Bsaf - Bba.mba)Document5 pagesCa (Bsaf - Bba.mba)kashif aliNo ratings yet

- Group 7 Tutorial AnswersDocument27 pagesGroup 7 Tutorial AnswersKwang Yi Juin0% (1)

- Benefits of Advanced Technology During This PandemicDocument32 pagesBenefits of Advanced Technology During This PandemicEmmanuel James SevillaNo ratings yet

- BMAT 112 Week 20 4th Exam by Nae NaeDocument14 pagesBMAT 112 Week 20 4th Exam by Nae NaeKristine Mae Pazo Gaspar86% (7)

- Exercises in Operational Budgeting - Solve in Excel Spread SheetDocument2 pagesExercises in Operational Budgeting - Solve in Excel Spread SheetClaire BarbaNo ratings yet

- Problems: Set B: Type of Inventory January 1 April 1 July 1Document3 pagesProblems: Set B: Type of Inventory January 1 April 1 July 1Iffat AftabNo ratings yet

- Acc 407 (Ashneel)Document8 pagesAcc 407 (Ashneel)Saaliha SaabiraNo ratings yet

- Faculty of Business and Management BBA/DBA 211 Managerial AccountingDocument4 pagesFaculty of Business and Management BBA/DBA 211 Managerial AccountingMichael AronNo ratings yet

- CH 23 Exercises ProblemsDocument4 pagesCH 23 Exercises ProblemsAhmed El KhateebNo ratings yet

- Assignment On CH 3 and 4 Cost 2Document4 pagesAssignment On CH 3 and 4 Cost 2sadiya AbrahimNo ratings yet

- Illustration: Preparation of Master Budget (Manufacturing Company)Document4 pagesIllustration: Preparation of Master Budget (Manufacturing Company)shimelis100% (1)

- Management Accounting ExercisesDocument82 pagesManagement Accounting ExercisesPetrinaNo ratings yet

- BUSI3008 Assignment 1 Winter 2022Document2 pagesBUSI3008 Assignment 1 Winter 2022akashtanotra3No ratings yet

- Budget Practice 2023Document2 pagesBudget Practice 2023Nhi PhạmNo ratings yet

- Master BudgetDocument2 pagesMaster BudgetAli SwizzleNo ratings yet

- Assignment of Management Accounting TechniquesDocument6 pagesAssignment of Management Accounting TechniquesSaniaNo ratings yet

- Quiz 2Document4 pagesQuiz 2VAIBHAV RAJNo ratings yet

- Task 3 Master Budget QuesDocument2 pagesTask 3 Master Budget QuesNgọc Trâm TrầnNo ratings yet

- Cash Sales Credit Sales: ACCT201B Practice Questions Chapter 8Document9 pagesCash Sales Credit Sales: ACCT201B Practice Questions Chapter 8GuinevereNo ratings yet

- EXERCISECHAPTER2Document8 pagesEXERCISECHAPTER2Bạch ThanhNo ratings yet

- Cost AccountingDocument37 pagesCost Accountingtito mohamedNo ratings yet

- Cost Accounting Self Assessment Materials Labor and OverheadDocument4 pagesCost Accounting Self Assessment Materials Labor and OverheadDarwyn HonaNo ratings yet

- Tutorial 1Document5 pagesTutorial 1FEI FEINo ratings yet

- 9 Cost ProductionDocument11 pages9 Cost Productionmikaella eugenioNo ratings yet

- Financial Statements ER Problem 2 SolutionDocument11 pagesFinancial Statements ER Problem 2 SolutionSYED ALI SHAH SYED MUKHTIYAR ALINo ratings yet

- Cost II - Assignment & WorksheetDocument7 pagesCost II - Assignment & WorksheetBeamlak WegayehuNo ratings yet

- Rift Valley University Yeka Campus Department of Accounting and Finance Assignment Of: Cost and ManagementiiDocument8 pagesRift Valley University Yeka Campus Department of Accounting and Finance Assignment Of: Cost and ManagementiiGet Habesha0% (1)

- Accountancy and Auditing-2017Document5 pagesAccountancy and Auditing-2017Jassmine RoseNo ratings yet

- ACT202 Midterm ExamDocument2 pagesACT202 Midterm ExamSalahuddin BadhonNo ratings yet

- Sha1 ACT 202 FINAL EXAM-Fall 2020: Answer The Following Questions and Remember To Show All Necessary WorkingsDocument5 pagesSha1 ACT 202 FINAL EXAM-Fall 2020: Answer The Following Questions and Remember To Show All Necessary WorkingsMahi100% (1)

- Tutorial 1Document4 pagesTutorial 1jasonneo999No ratings yet

- Exercises For The Course Cost and Management Accounting IIDocument8 pagesExercises For The Course Cost and Management Accounting IIDawit AmahaNo ratings yet

- Operational Budget Assignment IIIDocument7 pagesOperational Budget Assignment IIIzeritu tilahunNo ratings yet

- Worksheet For Cost and Management Accounting II (Acct 212)Document5 pagesWorksheet For Cost and Management Accounting II (Acct 212)Bereket DesalegnNo ratings yet

- Cost Accounting 1 ACT201 InstructorsDocument4 pagesCost Accounting 1 ACT201 InstructorsAdhamNo ratings yet

- Cost I AssignmentDocument7 pagesCost I AssignmentibsaashekaNo ratings yet

- Cost Concepts Class ExercisesDocument7 pagesCost Concepts Class ExercisesAngel Alejo AcobaNo ratings yet

- CH 09Document3 pagesCH 09ghsoub77750% (2)

- Practical Case Financial BudgetDocument17 pagesPractical Case Financial BudgetScribdTranslationsNo ratings yet

- Answer Key To Test #2 - ACCT-312 - Fall 2019Document6 pagesAnswer Key To Test #2 - ACCT-312 - Fall 2019Amir ContrerasNo ratings yet

- Planning, Performance and EvaluationDocument26 pagesPlanning, Performance and EvaluationJoan LauNo ratings yet

- Meiktila University of Economics MBA 112Document2 pagesMeiktila University of Economics MBA 112ApicalMitten 502No ratings yet

- Chapter 3 - Part 2Document9 pagesChapter 3 - Part 2Aya MasoudNo ratings yet

- Acctg15 Job-Order QuizDocument3 pagesAcctg15 Job-Order QuizJemar Murillo DalaganNo ratings yet

- Managerial Accounting JONGAY (AutoRecovered)Document24 pagesManagerial Accounting JONGAY (AutoRecovered)Jhoy AmoscoNo ratings yet

- Cost & MGMT Acct II, AssignmentDocument3 pagesCost & MGMT Acct II, AssignmentAshenafi TamireNo ratings yet

- Ae 191 F-Test 1Document3 pagesAe 191 F-Test 1Venus PalmencoNo ratings yet

- AF102 DFL ExamDocument9 pagesAF102 DFL ExamTetzNo ratings yet

- Managerial Accounting Trial Essay Questions - V3Document2 pagesManagerial Accounting Trial Essay Questions - V3Nhật Nam BùiNo ratings yet

- Particulars: (Format and Additional Data Provided - Statement of Income and Expense Tab)Document7 pagesParticulars: (Format and Additional Data Provided - Statement of Income and Expense Tab)Jhoanne Marie TederaNo ratings yet

- Answer Key To Test #1 - ACCT-312 - Fall 2019Document8 pagesAnswer Key To Test #1 - ACCT-312 - Fall 2019Amir ContrerasNo ratings yet

- Assignment2revised1Document5 pagesAssignment2revised1Pankaj KhannaNo ratings yet

- Review Problem: Budget Schedules: RequiredDocument8 pagesReview Problem: Budget Schedules: RequiredShafa AlyaNo ratings yet

- Kuis UTS Genap 21-22 ACCDocument3 pagesKuis UTS Genap 21-22 ACCNatasya FlorenciaNo ratings yet

- Bai Tap On Tap QTDNDocument4 pagesBai Tap On Tap QTDNDuyên Nguyễn Nữ KỳNo ratings yet

- Mock Exam MG T Acct 2022Document2 pagesMock Exam MG T Acct 2022Bình AnNo ratings yet

- Budgeting Handout2Document11 pagesBudgeting Handout2Gva Umayam100% (1)

- GivenDocument17 pagesGivenApurvAdarshNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- 2017 International Comparison Program in Asia and the Pacific: Purchasing Power Parities and Real Expenditures—A Summary ReportFrom Everand2017 International Comparison Program in Asia and the Pacific: Purchasing Power Parities and Real Expenditures—A Summary ReportNo ratings yet

- 2a. TablesDocument9 pages2a. TablesSaaliha SaabiraNo ratings yet

- CSC511 Introduction To C++Document12 pagesCSC511 Introduction To C++Saaliha SaabiraNo ratings yet

- 4a. Using The If FunctionDocument4 pages4a. Using The If FunctionSaaliha SaabiraNo ratings yet

- Lecture Topic 4 StudentDocument36 pagesLecture Topic 4 StudentSaaliha SaabiraNo ratings yet

- Eth501sem Week 9 Lecture On Prejudice Discrimination and EthicsDocument31 pagesEth501sem Week 9 Lecture On Prejudice Discrimination and EthicsSaaliha SaabiraNo ratings yet

- Week 3 Tutorial 1Document3 pagesWeek 3 Tutorial 1Saaliha SaabiraNo ratings yet

- Final ProjectDocument13 pagesFinal ProjectSaaliha SaabiraNo ratings yet

- Fin 501: Mid - Semester Exam: Campus Day Time RoomDocument2 pagesFin 501: Mid - Semester Exam: Campus Day Time RoomSaaliha SaabiraNo ratings yet

- An Introduction To Programming With C++ Eighth Edition: Variables and ConstantsDocument34 pagesAn Introduction To Programming With C++ Eighth Edition: Variables and ConstantsSaaliha SaabiraNo ratings yet

- If Function PracticeDocument12 pagesIf Function PracticeSaaliha SaabiraNo ratings yet

- Suggested Solution 1Document5 pagesSuggested Solution 1Saaliha SaabiraNo ratings yet

- FIN501 Assignment - GroupDocument4 pagesFIN501 Assignment - GroupSaaliha SaabiraNo ratings yet

- Collegeof Business 2Document12 pagesCollegeof Business 2Saaliha SaabiraNo ratings yet

- Quiz 2 Notice - FIN 501Document1 pageQuiz 2 Notice - FIN 501Saaliha SaabiraNo ratings yet

- Step 1: Analyse Your Essay QuestionDocument2 pagesStep 1: Analyse Your Essay QuestionSaaliha SaabiraNo ratings yet

- Eth-501-1 Debate Assignment Appendix BDocument2 pagesEth-501-1 Debate Assignment Appendix BSaaliha SaabiraNo ratings yet

- Fin 501: Fundamentals of Finance: Tutorial 2 SolutionDocument3 pagesFin 501: Fundamentals of Finance: Tutorial 2 SolutionSaaliha SaabiraNo ratings yet

- Spreadsheet AssignmentDocument13 pagesSpreadsheet AssignmentSaaliha SaabiraNo ratings yet

- Spreadsheet AssignmentDocument13 pagesSpreadsheet AssignmentSaaliha SaabiraNo ratings yet

- Acc 407 (Ashneel)Document8 pagesAcc 407 (Ashneel)Saaliha SaabiraNo ratings yet

- Step 1: Analyse Your Essay QuestionDocument2 pagesStep 1: Analyse Your Essay QuestionSaaliha SaabiraNo ratings yet

- Eth-501-0 Debate Assignment Appendix CDocument4 pagesEth-501-0 Debate Assignment Appendix CSaaliha SaabiraNo ratings yet

- Does HRM Lead To Improved Organized PerformanceDocument13 pagesDoes HRM Lead To Improved Organized PerformanceSaaliha SaabiraNo ratings yet

- Somewhere Over The Rainbow - Eva Cassidy - GuitarDocument1 pageSomewhere Over The Rainbow - Eva Cassidy - GuitarOtto Pereira0% (1)

- Describe Your SchoolDocument9 pagesDescribe Your Schoolkarthika4a50% (4)

- Wisdom by Lester Levenson III Freedom Technique III Transformation (PDFDrive)Document147 pagesWisdom by Lester Levenson III Freedom Technique III Transformation (PDFDrive)MDG WD100% (2)

- The Rivera ReportsDocument228 pagesThe Rivera ReportsPaul William Hoye100% (2)

- Maharashtra State Board of Secondary & Higher Secondary Education, PuneDocument14 pagesMaharashtra State Board of Secondary & Higher Secondary Education, PuneAjinkya DahivadeNo ratings yet

- CLIA Board MTG Minutes 5-31-11 WebsiteDocument1 pageCLIA Board MTG Minutes 5-31-11 WebsiteadmincliaNo ratings yet

- College of Business Administration University of Pittsburgh BUSFIN 1030Document24 pagesCollege of Business Administration University of Pittsburgh BUSFIN 1030John P ReddenNo ratings yet

- Gess SC 8 Course OutlineDocument4 pagesGess SC 8 Course Outlineapi-264733993No ratings yet

- InterviewDocument3 pagesInterviewThiya NalluNo ratings yet

- Principles of Operations Management 8th Edition Heizer Solutions ManualDocument5 pagesPrinciples of Operations Management 8th Edition Heizer Solutions Manualjosephbrowntdnebozsrw100% (14)

- IT Amendment Act, 2008 - An Act To Amend The IT Act 2000Document3 pagesIT Amendment Act, 2008 - An Act To Amend The IT Act 2000sbhatlaNo ratings yet

- CertIFR Module-2Document46 pagesCertIFR Module-2Tran AnhNo ratings yet

- Islamic Business Plan: Opportunity and Creativity To SuccessDocument15 pagesIslamic Business Plan: Opportunity and Creativity To SuccessAnindito W WicaksonoNo ratings yet

- Check My Twitter Account @nursetopia or IG @nursetopia1 For More Nursing Test Banks, Sample Exam, Reviewers, and NotesDocument9 pagesCheck My Twitter Account @nursetopia or IG @nursetopia1 For More Nursing Test Banks, Sample Exam, Reviewers, and NotesNurse UtopiaNo ratings yet

- Leadership Programs in Healthcare - INSEAD Healthcare ClubDocument14 pagesLeadership Programs in Healthcare - INSEAD Healthcare ClubkennyNo ratings yet

- Reducing Misconceptions PDFDocument11 pagesReducing Misconceptions PDFViorelNo ratings yet

- 50 Vol4 EpaperDocument32 pages50 Vol4 EpaperThesouthasian TimesNo ratings yet

- AggressionDocument9 pagesAggressionapi-645961517No ratings yet

- Legal Principles in Shipping Business 2014Document3 pagesLegal Principles in Shipping Business 2014MarvinNo ratings yet

- Aadhaar CardDocument1 pageAadhaar CardkailashhapaserNo ratings yet

- Manager-Magazin 2006 10 48923426Document10 pagesManager-Magazin 2006 10 48923426Neel DoshiNo ratings yet

- MR 2018 5 e 9 BorszekiDocument38 pagesMR 2018 5 e 9 BorszekiborszekijNo ratings yet

- Dayao v. ComelecDocument15 pagesDayao v. ComelecRichelle CartinNo ratings yet

- Augusta-Waterville, ME (2022)Document62 pagesAugusta-Waterville, ME (2022)ravee12No ratings yet

- Obama and The War Against JewsDocument56 pagesObama and The War Against JewsUniversalgeni100% (2)

- Jamshedpur DraftDocument45 pagesJamshedpur DraftArangNo ratings yet

- Water Supply Technical ProposalDocument34 pagesWater Supply Technical ProposalAsif Iqbal Dawar67% (6)