Professional Documents

Culture Documents

Punzalan, Eloisa Bsba 3Fm I. Essay I.1 Define/ Explain The Three Types of Investment Companies 10pts

Punzalan, Eloisa Bsba 3Fm I. Essay I.1 Define/ Explain The Three Types of Investment Companies 10pts

Uploaded by

Dar , john Joshua S.Copyright:

Available Formats

You might also like

- Chapter 1 (Overview of Financial Management)Document25 pagesChapter 1 (Overview of Financial Management)araso100% (1)

- Building A Good Vol SurfaceDocument49 pagesBuilding A Good Vol SurfaceFabio ZenNo ratings yet

- IapmDocument8 pagesIapmjohn doeNo ratings yet

- Investments AssignmentDocument4 pagesInvestments Assignmentapi-276122905No ratings yet

- Introduction To Investment ManagementDocument11 pagesIntroduction To Investment ManagementAsif Abdullah KhanNo ratings yet

- Lesson 4Document26 pagesLesson 4San Isidro AgnesNo ratings yet

- 1.1 Introduction To Investment DecisionsDocument55 pages1.1 Introduction To Investment DecisionsPREETNo ratings yet

- Investments AssignmentDocument5 pagesInvestments Assignmentapi-276122961No ratings yet

- Investment Assets Funds and Variable ContractDocument40 pagesInvestment Assets Funds and Variable ContractLiza Tooma-DescargarNo ratings yet

- Investments AssignmentDocument5 pagesInvestments Assignmentapi-276011473No ratings yet

- Investments AssignmentDocument5 pagesInvestments Assignmentapi-276011592No ratings yet

- EED 127 (Assignment)Document2 pagesEED 127 (Assignment)abdulmajeedabdussalam09No ratings yet

- Investments AssignmentDocument6 pagesInvestments Assignmentapi-276231812No ratings yet

- Investments AssignmentDocument5 pagesInvestments Assignmentapi-276122943No ratings yet

- Investments AssignmentDocument6 pagesInvestments Assignmentapi-276123292No ratings yet

- Fund Advantages and DisadvantagesDocument12 pagesFund Advantages and Disadvantagesratnesh_bth5776No ratings yet

- International Investment and Portfolio Management: AssignmentDocument8 pagesInternational Investment and Portfolio Management: AssignmentJebin JamesNo ratings yet

- Lesson 3-Intro. To InvestmentsDocument18 pagesLesson 3-Intro. To InvestmentsNestor Dela CruzNo ratings yet

- Module - 01 - INVESTMENTDocument19 pagesModule - 01 - INVESTMENTPushkar PandeyNo ratings yet

- BB Project 2Document76 pagesBB Project 2Dev ShahNo ratings yet

- M4 Assignment 1Document4 pagesM4 Assignment 1Lorraine CaliwanNo ratings yet

- Insurance As An Investment StrategyDocument33 pagesInsurance As An Investment StrategySimran khandareNo ratings yet

- Managerial Finance Basic TermsDocument11 pagesManagerial Finance Basic Termsmadnansajid8765No ratings yet

- Var TrainingDocument83 pagesVar TrainingplukmarkjoshuasamudioNo ratings yet

- Investment and Profolio ManagementDocument7 pagesInvestment and Profolio Managementhearthelord66No ratings yet

- Introduction To Investment Analysis & Portfolio ManagementDocument42 pagesIntroduction To Investment Analysis & Portfolio ManagementAnup Verma100% (1)

- Phani 3projectDocument73 pagesPhani 3projectVenkat Shyam BabuNo ratings yet

- Investments AssignmentDocument5 pagesInvestments Assignmentapi-288241922No ratings yet

- Investments AssignmentDocument6 pagesInvestments Assignmentapi-276122886No ratings yet

- Chapter 1Document13 pagesChapter 1shahulsuccessNo ratings yet

- BIN - 328 - INVESTMENT - and PORTFOLIO MANAGEMENT - IDocument143 pagesBIN - 328 - INVESTMENT - and PORTFOLIO MANAGEMENT - IBenjaminNo ratings yet

- Synopsis IDocument21 pagesSynopsis Iankurk124No ratings yet

- Ba5012 Security Analysis and Portfolio ManagementDocument13 pagesBa5012 Security Analysis and Portfolio ManagementShobanashree RNo ratings yet

- Introduction To Investment 1.1. Definition of Investment: Chapter OneDocument12 pagesIntroduction To Investment 1.1. Definition of Investment: Chapter OneSeid KassawNo ratings yet

- Module 1 Mutual FundsDocument11 pagesModule 1 Mutual FundsVelante IrafrankNo ratings yet

- What Is InvestmentDocument10 pagesWhat Is InvestmentAnwar khanNo ratings yet

- Session No.1 / Week No. 1: Cities of Mandaluyong and PasigDocument13 pagesSession No.1 / Week No. 1: Cities of Mandaluyong and PasigMilky CoffeeNo ratings yet

- Comparative Analysis of Investment Alternatives: Personal Financial PlanningDocument12 pagesComparative Analysis of Investment Alternatives: Personal Financial Planningwish_coolalok8995No ratings yet

- Portfolio Management Investment AvenuesDocument20 pagesPortfolio Management Investment AvenuesRiyana EdwinNo ratings yet

- Investement Analysis and Portfolio Management Chapter 1Document8 pagesInvestement Analysis and Portfolio Management Chapter 1Oumer Shaffi100% (3)

- Financial Sectors of India: A Presentation By:-Aashima Gelda Parul University, VadodaraDocument20 pagesFinancial Sectors of India: A Presentation By:-Aashima Gelda Parul University, VadodaraRamachandran SwamiNo ratings yet

- Mutual Fund Notes For B.COM IV Sem Section-ADocument7 pagesMutual Fund Notes For B.COM IV Sem Section-Autkarsh sinhaNo ratings yet

- On Financial SectorsDocument18 pagesOn Financial Sectorsabhishek singhNo ratings yet

- Investment EnvironmentDocument25 pagesInvestment EnvironmentK-Ayurveda WelexNo ratings yet

- Mutual FundsDocument12 pagesMutual FundsMargaret MarieNo ratings yet

- PDF Document 2Document26 pagesPDF Document 2geraldine biasongNo ratings yet

- Investments in Financial MarketsDocument14 pagesInvestments in Financial MarketsCleo Coleen Lambo FortunadoNo ratings yet

- Part I - Investing in StocksDocument97 pagesPart I - Investing in StocksPJ DavisNo ratings yet

- A Brief of How Mutual Funds WorkDocument12 pagesA Brief of How Mutual Funds WorkAitham Anil KumarNo ratings yet

- Advantages of Mutual FundsDocument5 pagesAdvantages of Mutual Fundskmadhura21No ratings yet

- Welcome To The Mutual Funds Resource CenterDocument6 pagesWelcome To The Mutual Funds Resource CentersivaranjinirathinamNo ratings yet

- Investment 1Document9 pagesInvestment 1Rocky KumarNo ratings yet

- Bus. Finance Q2 - W1 (ANSWER)Document3 pagesBus. Finance Q2 - W1 (ANSWER)Rory GdLNo ratings yet

- Mutual Funds: A Brief History of The Mutual FundDocument9 pagesMutual Funds: A Brief History of The Mutual FundthulasikNo ratings yet

- The Basics For Investing in StocksDocument16 pagesThe Basics For Investing in StocksAditya KapoorNo ratings yet

- Investing - BVC ArticleDocument3 pagesInvesting - BVC ArticleayraNo ratings yet

- Week 11 FinmarDocument5 pagesWeek 11 FinmarJoleen DoniegoNo ratings yet

- Compare and Contrast The Different Types of Investments ABMDocument13 pagesCompare and Contrast The Different Types of Investments ABM1DerfulHarrehNo ratings yet

- Task Number 2Document27 pagesTask Number 2Vishnu PrasadNo ratings yet

- Investments AssignmentDocument6 pagesInvestments Assignmentapi-276011208No ratings yet

- Introduction of Mutual FundDocument50 pagesIntroduction of Mutual FundPranav ViraNo ratings yet

- People of The Philippines, Plaintiff-Appellee, vs. Bryan Ganaba Y Nam-Ay, Accused-Appellant. DecisionDocument26 pagesPeople of The Philippines, Plaintiff-Appellee, vs. Bryan Ganaba Y Nam-Ay, Accused-Appellant. DecisionDar , john Joshua S.No ratings yet

- Sapphire Feasib Last Na Chap 1 9Document163 pagesSapphire Feasib Last Na Chap 1 9Dar , john Joshua S.No ratings yet

- Rico 6Document1 pageRico 6Dar , john Joshua S.No ratings yet

- Final Thesis Chapter 1-4Document67 pagesFinal Thesis Chapter 1-4Dar , john Joshua S.No ratings yet

- Final Na To ParDocument58 pagesFinal Na To ParDar , john Joshua S.No ratings yet

- Metro Manila College: College of Accountancy, Business Administration and ManagementDocument11 pagesMetro Manila College: College of Accountancy, Business Administration and ManagementDar , john Joshua S.No ratings yet

- Your Future: Metro Manila College Humanities and Social SciencesDocument11 pagesYour Future: Metro Manila College Humanities and Social SciencesDar , john Joshua S.No ratings yet

- Rico 8Document1 pageRico 8Dar , john Joshua S.No ratings yet

- Meaning of My LifeDocument3 pagesMeaning of My LifeDar , john Joshua S.No ratings yet

- Sample of Affidavit of Arresting OfficersDocument3 pagesSample of Affidavit of Arresting OfficersDar , john Joshua S.No ratings yet

- What Kind of Leader As A Future Law Enforcer?: Sison, Arvin R. BS Criminology-4 Year Reaction Paper # 1Document4 pagesWhat Kind of Leader As A Future Law Enforcer?: Sison, Arvin R. BS Criminology-4 Year Reaction Paper # 1Dar , john Joshua S.No ratings yet

- Building My CharacterDocument3 pagesBuilding My CharacterDar , john Joshua S.No ratings yet

- Me, Myself & I: Macapanas, Jessa Mae E. BS Criminology - 4 Year Reaction Paper #2Document3 pagesMe, Myself & I: Macapanas, Jessa Mae E. BS Criminology - 4 Year Reaction Paper #2Dar , john Joshua S.No ratings yet

- Me, Myself & I: Sison, Arvin R. BS Criminology-4 Year Reaction Paper # 2Document3 pagesMe, Myself & I: Sison, Arvin R. BS Criminology-4 Year Reaction Paper # 2Dar , john Joshua S.No ratings yet

- People of The Philippines, Plaintiff-Appellee, vs. Bryan Ganaba Y Nam-Ay, Accused-Appellant. DecisionDocument44 pagesPeople of The Philippines, Plaintiff-Appellee, vs. Bryan Ganaba Y Nam-Ay, Accused-Appellant. DecisionDar , john Joshua S.No ratings yet

- What Kind of Leader As A Future Law Enforcer?: Macapanas, Jessa Mae E. BS Criminology - 4 Year Reaction Paper #1Document4 pagesWhat Kind of Leader As A Future Law Enforcer?: Macapanas, Jessa Mae E. BS Criminology - 4 Year Reaction Paper #1Dar , john Joshua S.No ratings yet

- Money and Banking Business Form 4 Topical Questions and AnswersDocument12 pagesMoney and Banking Business Form 4 Topical Questions and AnswersvngerechaNo ratings yet

- PDFDocument222 pagesPDFAman Jain100% (1)

- Ch11 Corporations - Organization, Share Transactions, Dividends, and Retained EarningsDocument101 pagesCh11 Corporations - Organization, Share Transactions, Dividends, and Retained EarningsAhlan Jufri AbdullahNo ratings yet

- Investment Portfolio ManagementDocument20 pagesInvestment Portfolio ManagementSURYANAGENDRA100% (1)

- Pinoy Millionaire Game Plan The BlueprintDocument22 pagesPinoy Millionaire Game Plan The BlueprintKristian AguilarNo ratings yet

- Lecture 27 Rate of Return AnalysisDocument32 pagesLecture 27 Rate of Return AnalysisDevyansh GuptaNo ratings yet

- Ratio Analysis - BBA ClassDocument27 pagesRatio Analysis - BBA ClassSophiya PrabinNo ratings yet

- Ing: 3M Co - Oferta de CanjeDocument6 pagesIng: 3M Co - Oferta de CanjePablo AlloNo ratings yet

- PESTEL Analysis of Indian Capital MarketDocument4 pagesPESTEL Analysis of Indian Capital MarketRohith50% (2)

- Role of MNCDocument3 pagesRole of MNCnirmal_987No ratings yet

- Canada Wide Savings, Loan and Trust Company - For WriterDocument17 pagesCanada Wide Savings, Loan and Trust Company - For WriterunveiledtopicsNo ratings yet

- Certificate in MMDocument16 pagesCertificate in MMAye Pa Pa MoeNo ratings yet

- Chapter 3 - Financial Statement AnalysisDocument4 pagesChapter 3 - Financial Statement AnalysisErlinda NavalloNo ratings yet

- 12 BibliographyDocument12 pages12 BibliographyAn Zel SNo ratings yet

- Mba Project - HR Projects Finance Project Marketing Projects Mcom Projects BBM Project Mphil Projects Titles.6612337Document8 pagesMba Project - HR Projects Finance Project Marketing Projects Mcom Projects BBM Project Mphil Projects Titles.6612337pritam23janNo ratings yet

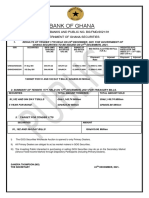

- Auctresults 1778Document1 pageAuctresults 1778Fuaad DodooNo ratings yet

- Brave Brands AccountingDocument6 pagesBrave Brands AccountingNgoni MukukuNo ratings yet

- FYT - Equity Investment 101Document12 pagesFYT - Equity Investment 101Lê Thị Thanh HàNo ratings yet

- IT Rates - Ready RecknorDocument2 pagesIT Rates - Ready RecknorHitesh PandyaNo ratings yet

- MAS With Answers PDFDocument13 pagesMAS With Answers PDF蔡嘉慧100% (1)

- Financial Management Thesis SampleDocument8 pagesFinancial Management Thesis Samplebk4p4b1c100% (3)

- Gs SustainDocument115 pagesGs Sustainalan_s1No ratings yet

- BM DLP Week 8Document7 pagesBM DLP Week 8Gift Anne ClarionNo ratings yet

- Agriculture Development Bank Intership ReportDocument43 pagesAgriculture Development Bank Intership ReportSujan Bajracharya60% (5)

- Accoutancy XII Practice Paper - 2024 (NEW)Document12 pagesAccoutancy XII Practice Paper - 2024 (NEW)Fatima IslamNo ratings yet

- PNC INFRATECH - ASM ProjectDocument11 pagesPNC INFRATECH - ASM ProjectAbhijeet kohatNo ratings yet

- 09 Handout 1Document10 pages09 Handout 1Raizel BariaNo ratings yet

- Computation of Gross ProfitDocument21 pagesComputation of Gross ProfitedreleneNo ratings yet

Punzalan, Eloisa Bsba 3Fm I. Essay I.1 Define/ Explain The Three Types of Investment Companies 10pts

Punzalan, Eloisa Bsba 3Fm I. Essay I.1 Define/ Explain The Three Types of Investment Companies 10pts

Uploaded by

Dar , john Joshua S.Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Punzalan, Eloisa Bsba 3Fm I. Essay I.1 Define/ Explain The Three Types of Investment Companies 10pts

Punzalan, Eloisa Bsba 3Fm I. Essay I.1 Define/ Explain The Three Types of Investment Companies 10pts

Uploaded by

Dar , john Joshua S.Copyright:

Available Formats

PUNZALAN, ELOISA

BSBA 3FM

I. Essay

I.1 Define/ explain the three types of investment companies 10pts

1. SHARES- hares are a sort of growth investment since they can help you expand your

initial investment over time. If you own stock, you may earn dividends, which are

essentially a percentage of a company's profit distributed to its shareholders.

Furthermore, the value of your stock may fall below the price at which you bought

it. Shares are best suited to long-term investors who can tolerate the ups and downs

because prices can change substantially from day to day. Shares, sometimes known

as equities, have historically outperformed other investments. Shares, on the other

hand, are one of the riskiest investments.

2. PROPERTY- Property is also known as a growth investment since the price of houses

and other assets can rise dramatically over a medium to long period of time.

Property, like equities, has the potential to lose value and is therefore risky. You can

purchase a home directly or indirectly through a property investment fund.

3. FIXED INTEREST- Bonds are the most well-known fixed-interest investments, and they

entail governments or businesses borrowing money from investors and repaying it with

interest. Bonds are also considered a defensive investment because they offer lower

potential profits and fewer risk than stocks or real estate. They can also be sold quickly,

much like cash, but capital losses are possible.

1.2 Enumerate/Discuss the different sources of revenue for an insurance company and

give example for each

For insurance companies, underwriting revenues come from the cash collected on insurance policy

premiums, minus money paid out on claims and for operating the business. For instance, let's say EP

Insurance Corporation earned 5 million from the paid out by customers for their policies in a year's time.

Let's also say that EP Insurance Corp. paid 4 million in claims in the same year. That means on the

underwriting side, EP Insurance earned a profit of 1 million (5 million minus 4 million = 1 million). Make

no mistake, insurance company underwriters go to great lengths to make sure the financial math works

in their favor. The entire life insurance underwriting process is very thorough to ensure a potential

customer actually qualifies for an insurance policy. The applicant is vetted thoroughly and key metrics

like health, age, annual income, gender, and even credit history are measured, with the goal of landing

at a premium cost level where the insurance company gains maximum advantage from a risk point of

view. That's important, as the insurance company underwriting business model ensures that insurers

stand a good chance of making additional income by not having to pay out on the policies they sell.

Insurance companies work very hard on crunching the data and algorithms that indicate the risk of

having to pay out on a specific policy. If the data tells them the risk is too high, an insurer either doesn't

offer the policy or will charge the customer more for offering insurance protection. If the risk is low, the

insurance company will happily offer a customer a policy, knowing that its risk of ever paying out on that

policy is comfortably low.

You might also like

- Chapter 1 (Overview of Financial Management)Document25 pagesChapter 1 (Overview of Financial Management)araso100% (1)

- Building A Good Vol SurfaceDocument49 pagesBuilding A Good Vol SurfaceFabio ZenNo ratings yet

- IapmDocument8 pagesIapmjohn doeNo ratings yet

- Investments AssignmentDocument4 pagesInvestments Assignmentapi-276122905No ratings yet

- Introduction To Investment ManagementDocument11 pagesIntroduction To Investment ManagementAsif Abdullah KhanNo ratings yet

- Lesson 4Document26 pagesLesson 4San Isidro AgnesNo ratings yet

- 1.1 Introduction To Investment DecisionsDocument55 pages1.1 Introduction To Investment DecisionsPREETNo ratings yet

- Investments AssignmentDocument5 pagesInvestments Assignmentapi-276122961No ratings yet

- Investment Assets Funds and Variable ContractDocument40 pagesInvestment Assets Funds and Variable ContractLiza Tooma-DescargarNo ratings yet

- Investments AssignmentDocument5 pagesInvestments Assignmentapi-276011473No ratings yet

- Investments AssignmentDocument5 pagesInvestments Assignmentapi-276011592No ratings yet

- EED 127 (Assignment)Document2 pagesEED 127 (Assignment)abdulmajeedabdussalam09No ratings yet

- Investments AssignmentDocument6 pagesInvestments Assignmentapi-276231812No ratings yet

- Investments AssignmentDocument5 pagesInvestments Assignmentapi-276122943No ratings yet

- Investments AssignmentDocument6 pagesInvestments Assignmentapi-276123292No ratings yet

- Fund Advantages and DisadvantagesDocument12 pagesFund Advantages and Disadvantagesratnesh_bth5776No ratings yet

- International Investment and Portfolio Management: AssignmentDocument8 pagesInternational Investment and Portfolio Management: AssignmentJebin JamesNo ratings yet

- Lesson 3-Intro. To InvestmentsDocument18 pagesLesson 3-Intro. To InvestmentsNestor Dela CruzNo ratings yet

- Module - 01 - INVESTMENTDocument19 pagesModule - 01 - INVESTMENTPushkar PandeyNo ratings yet

- BB Project 2Document76 pagesBB Project 2Dev ShahNo ratings yet

- M4 Assignment 1Document4 pagesM4 Assignment 1Lorraine CaliwanNo ratings yet

- Insurance As An Investment StrategyDocument33 pagesInsurance As An Investment StrategySimran khandareNo ratings yet

- Managerial Finance Basic TermsDocument11 pagesManagerial Finance Basic Termsmadnansajid8765No ratings yet

- Var TrainingDocument83 pagesVar TrainingplukmarkjoshuasamudioNo ratings yet

- Investment and Profolio ManagementDocument7 pagesInvestment and Profolio Managementhearthelord66No ratings yet

- Introduction To Investment Analysis & Portfolio ManagementDocument42 pagesIntroduction To Investment Analysis & Portfolio ManagementAnup Verma100% (1)

- Phani 3projectDocument73 pagesPhani 3projectVenkat Shyam BabuNo ratings yet

- Investments AssignmentDocument5 pagesInvestments Assignmentapi-288241922No ratings yet

- Investments AssignmentDocument6 pagesInvestments Assignmentapi-276122886No ratings yet

- Chapter 1Document13 pagesChapter 1shahulsuccessNo ratings yet

- BIN - 328 - INVESTMENT - and PORTFOLIO MANAGEMENT - IDocument143 pagesBIN - 328 - INVESTMENT - and PORTFOLIO MANAGEMENT - IBenjaminNo ratings yet

- Synopsis IDocument21 pagesSynopsis Iankurk124No ratings yet

- Ba5012 Security Analysis and Portfolio ManagementDocument13 pagesBa5012 Security Analysis and Portfolio ManagementShobanashree RNo ratings yet

- Introduction To Investment 1.1. Definition of Investment: Chapter OneDocument12 pagesIntroduction To Investment 1.1. Definition of Investment: Chapter OneSeid KassawNo ratings yet

- Module 1 Mutual FundsDocument11 pagesModule 1 Mutual FundsVelante IrafrankNo ratings yet

- What Is InvestmentDocument10 pagesWhat Is InvestmentAnwar khanNo ratings yet

- Session No.1 / Week No. 1: Cities of Mandaluyong and PasigDocument13 pagesSession No.1 / Week No. 1: Cities of Mandaluyong and PasigMilky CoffeeNo ratings yet

- Comparative Analysis of Investment Alternatives: Personal Financial PlanningDocument12 pagesComparative Analysis of Investment Alternatives: Personal Financial Planningwish_coolalok8995No ratings yet

- Portfolio Management Investment AvenuesDocument20 pagesPortfolio Management Investment AvenuesRiyana EdwinNo ratings yet

- Investement Analysis and Portfolio Management Chapter 1Document8 pagesInvestement Analysis and Portfolio Management Chapter 1Oumer Shaffi100% (3)

- Financial Sectors of India: A Presentation By:-Aashima Gelda Parul University, VadodaraDocument20 pagesFinancial Sectors of India: A Presentation By:-Aashima Gelda Parul University, VadodaraRamachandran SwamiNo ratings yet

- Mutual Fund Notes For B.COM IV Sem Section-ADocument7 pagesMutual Fund Notes For B.COM IV Sem Section-Autkarsh sinhaNo ratings yet

- On Financial SectorsDocument18 pagesOn Financial Sectorsabhishek singhNo ratings yet

- Investment EnvironmentDocument25 pagesInvestment EnvironmentK-Ayurveda WelexNo ratings yet

- Mutual FundsDocument12 pagesMutual FundsMargaret MarieNo ratings yet

- PDF Document 2Document26 pagesPDF Document 2geraldine biasongNo ratings yet

- Investments in Financial MarketsDocument14 pagesInvestments in Financial MarketsCleo Coleen Lambo FortunadoNo ratings yet

- Part I - Investing in StocksDocument97 pagesPart I - Investing in StocksPJ DavisNo ratings yet

- A Brief of How Mutual Funds WorkDocument12 pagesA Brief of How Mutual Funds WorkAitham Anil KumarNo ratings yet

- Advantages of Mutual FundsDocument5 pagesAdvantages of Mutual Fundskmadhura21No ratings yet

- Welcome To The Mutual Funds Resource CenterDocument6 pagesWelcome To The Mutual Funds Resource CentersivaranjinirathinamNo ratings yet

- Investment 1Document9 pagesInvestment 1Rocky KumarNo ratings yet

- Bus. Finance Q2 - W1 (ANSWER)Document3 pagesBus. Finance Q2 - W1 (ANSWER)Rory GdLNo ratings yet

- Mutual Funds: A Brief History of The Mutual FundDocument9 pagesMutual Funds: A Brief History of The Mutual FundthulasikNo ratings yet

- The Basics For Investing in StocksDocument16 pagesThe Basics For Investing in StocksAditya KapoorNo ratings yet

- Investing - BVC ArticleDocument3 pagesInvesting - BVC ArticleayraNo ratings yet

- Week 11 FinmarDocument5 pagesWeek 11 FinmarJoleen DoniegoNo ratings yet

- Compare and Contrast The Different Types of Investments ABMDocument13 pagesCompare and Contrast The Different Types of Investments ABM1DerfulHarrehNo ratings yet

- Task Number 2Document27 pagesTask Number 2Vishnu PrasadNo ratings yet

- Investments AssignmentDocument6 pagesInvestments Assignmentapi-276011208No ratings yet

- Introduction of Mutual FundDocument50 pagesIntroduction of Mutual FundPranav ViraNo ratings yet

- People of The Philippines, Plaintiff-Appellee, vs. Bryan Ganaba Y Nam-Ay, Accused-Appellant. DecisionDocument26 pagesPeople of The Philippines, Plaintiff-Appellee, vs. Bryan Ganaba Y Nam-Ay, Accused-Appellant. DecisionDar , john Joshua S.No ratings yet

- Sapphire Feasib Last Na Chap 1 9Document163 pagesSapphire Feasib Last Na Chap 1 9Dar , john Joshua S.No ratings yet

- Rico 6Document1 pageRico 6Dar , john Joshua S.No ratings yet

- Final Thesis Chapter 1-4Document67 pagesFinal Thesis Chapter 1-4Dar , john Joshua S.No ratings yet

- Final Na To ParDocument58 pagesFinal Na To ParDar , john Joshua S.No ratings yet

- Metro Manila College: College of Accountancy, Business Administration and ManagementDocument11 pagesMetro Manila College: College of Accountancy, Business Administration and ManagementDar , john Joshua S.No ratings yet

- Your Future: Metro Manila College Humanities and Social SciencesDocument11 pagesYour Future: Metro Manila College Humanities and Social SciencesDar , john Joshua S.No ratings yet

- Rico 8Document1 pageRico 8Dar , john Joshua S.No ratings yet

- Meaning of My LifeDocument3 pagesMeaning of My LifeDar , john Joshua S.No ratings yet

- Sample of Affidavit of Arresting OfficersDocument3 pagesSample of Affidavit of Arresting OfficersDar , john Joshua S.No ratings yet

- What Kind of Leader As A Future Law Enforcer?: Sison, Arvin R. BS Criminology-4 Year Reaction Paper # 1Document4 pagesWhat Kind of Leader As A Future Law Enforcer?: Sison, Arvin R. BS Criminology-4 Year Reaction Paper # 1Dar , john Joshua S.No ratings yet

- Building My CharacterDocument3 pagesBuilding My CharacterDar , john Joshua S.No ratings yet

- Me, Myself & I: Macapanas, Jessa Mae E. BS Criminology - 4 Year Reaction Paper #2Document3 pagesMe, Myself & I: Macapanas, Jessa Mae E. BS Criminology - 4 Year Reaction Paper #2Dar , john Joshua S.No ratings yet

- Me, Myself & I: Sison, Arvin R. BS Criminology-4 Year Reaction Paper # 2Document3 pagesMe, Myself & I: Sison, Arvin R. BS Criminology-4 Year Reaction Paper # 2Dar , john Joshua S.No ratings yet

- People of The Philippines, Plaintiff-Appellee, vs. Bryan Ganaba Y Nam-Ay, Accused-Appellant. DecisionDocument44 pagesPeople of The Philippines, Plaintiff-Appellee, vs. Bryan Ganaba Y Nam-Ay, Accused-Appellant. DecisionDar , john Joshua S.No ratings yet

- What Kind of Leader As A Future Law Enforcer?: Macapanas, Jessa Mae E. BS Criminology - 4 Year Reaction Paper #1Document4 pagesWhat Kind of Leader As A Future Law Enforcer?: Macapanas, Jessa Mae E. BS Criminology - 4 Year Reaction Paper #1Dar , john Joshua S.No ratings yet

- Money and Banking Business Form 4 Topical Questions and AnswersDocument12 pagesMoney and Banking Business Form 4 Topical Questions and AnswersvngerechaNo ratings yet

- PDFDocument222 pagesPDFAman Jain100% (1)

- Ch11 Corporations - Organization, Share Transactions, Dividends, and Retained EarningsDocument101 pagesCh11 Corporations - Organization, Share Transactions, Dividends, and Retained EarningsAhlan Jufri AbdullahNo ratings yet

- Investment Portfolio ManagementDocument20 pagesInvestment Portfolio ManagementSURYANAGENDRA100% (1)

- Pinoy Millionaire Game Plan The BlueprintDocument22 pagesPinoy Millionaire Game Plan The BlueprintKristian AguilarNo ratings yet

- Lecture 27 Rate of Return AnalysisDocument32 pagesLecture 27 Rate of Return AnalysisDevyansh GuptaNo ratings yet

- Ratio Analysis - BBA ClassDocument27 pagesRatio Analysis - BBA ClassSophiya PrabinNo ratings yet

- Ing: 3M Co - Oferta de CanjeDocument6 pagesIng: 3M Co - Oferta de CanjePablo AlloNo ratings yet

- PESTEL Analysis of Indian Capital MarketDocument4 pagesPESTEL Analysis of Indian Capital MarketRohith50% (2)

- Role of MNCDocument3 pagesRole of MNCnirmal_987No ratings yet

- Canada Wide Savings, Loan and Trust Company - For WriterDocument17 pagesCanada Wide Savings, Loan and Trust Company - For WriterunveiledtopicsNo ratings yet

- Certificate in MMDocument16 pagesCertificate in MMAye Pa Pa MoeNo ratings yet

- Chapter 3 - Financial Statement AnalysisDocument4 pagesChapter 3 - Financial Statement AnalysisErlinda NavalloNo ratings yet

- 12 BibliographyDocument12 pages12 BibliographyAn Zel SNo ratings yet

- Mba Project - HR Projects Finance Project Marketing Projects Mcom Projects BBM Project Mphil Projects Titles.6612337Document8 pagesMba Project - HR Projects Finance Project Marketing Projects Mcom Projects BBM Project Mphil Projects Titles.6612337pritam23janNo ratings yet

- Auctresults 1778Document1 pageAuctresults 1778Fuaad DodooNo ratings yet

- Brave Brands AccountingDocument6 pagesBrave Brands AccountingNgoni MukukuNo ratings yet

- FYT - Equity Investment 101Document12 pagesFYT - Equity Investment 101Lê Thị Thanh HàNo ratings yet

- IT Rates - Ready RecknorDocument2 pagesIT Rates - Ready RecknorHitesh PandyaNo ratings yet

- MAS With Answers PDFDocument13 pagesMAS With Answers PDF蔡嘉慧100% (1)

- Financial Management Thesis SampleDocument8 pagesFinancial Management Thesis Samplebk4p4b1c100% (3)

- Gs SustainDocument115 pagesGs Sustainalan_s1No ratings yet

- BM DLP Week 8Document7 pagesBM DLP Week 8Gift Anne ClarionNo ratings yet

- Agriculture Development Bank Intership ReportDocument43 pagesAgriculture Development Bank Intership ReportSujan Bajracharya60% (5)

- Accoutancy XII Practice Paper - 2024 (NEW)Document12 pagesAccoutancy XII Practice Paper - 2024 (NEW)Fatima IslamNo ratings yet

- PNC INFRATECH - ASM ProjectDocument11 pagesPNC INFRATECH - ASM ProjectAbhijeet kohatNo ratings yet

- 09 Handout 1Document10 pages09 Handout 1Raizel BariaNo ratings yet

- Computation of Gross ProfitDocument21 pagesComputation of Gross ProfitedreleneNo ratings yet