Professional Documents

Culture Documents

Accounts 4

Accounts 4

Uploaded by

dante saprOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Accounts 4

Accounts 4

Uploaded by

dante saprCopyright:

Available Formats

84 Accounting & Financial Management

Unit 4: Financial Management

Notes

Structure

4.1 Introduction

4.2 Meaning

4.3 Functions

4.4 Importance of Financial Management

4.5 Risk and Return

4.6 Various Functional areas of Financial Management

4.7 Capital Budgeting

4.8 Cost of Capital

4.9 Ratio Analysis

4.10 Some Important Ratios

4.11 Summary

4.12 Check Your Progress

4.13 Questions and Exercises

4.14 Key Terms

4.15 Further Readings

Objectives

After studying this unit, you should be able to:

z Understand the Concept and meaning of Financial Management

z Discuss the risk and return, various functional areas of financial management

– capital budgeting

z Explain the cost of capital, ratio analysis

4.1 Introduction

Financial Management means planning, organizing, directing and controlling the

financial activities such as procurement and utilization of funds of the enterprise. It

means applying general management principles to financial resources of the enterprise.

Scope/Elements

Investment decisions includes investment in fixed assets (called as capital budgeting).

Investment in current assets is also a part of investment decisions called as working

capital decisions.

z Financial decisions: They relate to the raising of finance from various resources

which will depend upon decision on type of source, period of financing, cost of

financing and the returns thereby.

z Dividend decision: The finance manager has to take decision with regards to the

net profit distribution. Net profits are generally divided into two:

z Dividend for shareholders: Dividend and the rate of it has to be decided.

z Retained profits: Amount of retained profits has to be finalized which will depend

upon expansion and diversification plans of the enterprise.

Amity Directorate of Distance & Online Education

Financial Management 85

Objectives of Financial Management

The financial management is generally concerned with procurement, allocation and Notes

control of financial resources of a concern. The objectives can be:

z To ensure regular and adequate supply of funds to the concern.

z To ensure adequate returns to the shareholders which will depend upon the earning

capacity, market price of the share, expectations of the shareholders.

z To ensure optimum funds utilization. Once the funds are procured, they should be

utilized in maximum possible way at least cost.

z To ensure safety on investment, i.e., funds should be invested in safe ventures so

that adequate rate of return can be achieved.

z To plan a sound capital structure: There should be sound and fair composition of

capital so that a balance is maintained between debt and equity capital.

Functions of Financial Management

z Estimation of capital requirements: A finance manager has to make estimation

with regards to capital requirements of the company. This will depend upon

expected costs and profits and future programmes and policies of a concern.

Estimations have to be made in an adequate manner which increases earning

capacity of enterprise.

z Determination of capital composition: Once the estimation has been made, the

capital structure has to be decided. This involves short- term and long- term debt

equity analysis. This will depend upon the proportion of equity capital a company is

possessing and additional funds which have to be raised from outside parties.

z Choice of sources of funds: For additional funds to be procured, a company has

many choices like-

Issue of shares and debentures

Loans to be taken from banks and financial institutions

Public deposits to be drawn like in form of bonds.

Choice of factor will depend on relative merits and demerits of each source and

period of financing.

z Investment of funds: The finance manager has to decide to allocate funds into

profitable ventures so that there is safety on investment and regular returns is

possible.

z Disposal of surplus: The net profits decision has to be made by the finance

manager. This can be done in two ways:

z Dividend declaration: It includes identifying the rate of dividends and other

benefits like bonus.

z Retained profits: The volume has to be decided which will depend upon

expansional, innovational, diversification plans of the company.

z Management of cash: Finance manager has to make decisions with regards to

cash management. Cash is required for many purposes like payment of wages and

salaries, payment of electricity and water bills, payment to creditors, meeting

current liabilities, maintenance of enough stock, purchase of raw materials, etc.

z Financial controls: The finance manager has not only to plan, procure and utilize

the funds but he also has to exercise control over finances. This can be done

through many techniques like ratio analysis, financial forecasting, cost and profit

control, etc.

4.2 Meaning

One needs money to make money. Finance is the life-blood of business and there must

be a continuous flow of funds in and out of a business enterprise. Money makes the

Amity Directorate of Distance & Online Education

86 Accounting & Financial Management

wheels of business run smoothly. Sound plans, efficient production system and

excellent marketing network are all hampered in the absence of an adequate and timely

Notes supply of funds.

Sound financial management is as important in business as production and

marketing. A business firm requires finance to commence its operations, to continue

operations and for expansion or growth. Finance is, therefore, an important operative

function of business.

A large business firm has to raise funds from several sources and has to utilise

those funds in alternative investment opportunities. In order to ensure the most

judicious utilisation of funds and to provide a reasonable rate of return on the

investment, sound financial policies and programmes are required. Unwise financing

can drive a business into bankruptcy just as easily as a poor product, inept marketing or

high production costs.

On the other hand, adequate and economical financing can provide the firm a

differential advantage in the market place. The success of a business enterprise is

largely determined by the way its capital funds are raised, utilised and disbursed. In the

modern money-using economy, the importance of finance has increased further due to

increasing scale of operations and capital intensive techniques of production and

distribution.

In fact, finance is the bright thread running through all business activity. It influences

and limits the activities of marketing, production, purchasing and personnel

management. The success of a business is measured largely in financial terms. The

efficient organisation and administration of the finance function is thus vital to the

successful functioning of every business enterprise.

Meaning of Financial Management

Financial management may be defined as planning, organising, directing and controlling

the financial activities of an organisation. According to Guthman and Dougal, financial

management means, “the activity concerned with the planning, raising, controlling and

administering of funds used in the business.” It is concerned with the procurement and

utilisation of funds in the proper manner.

Financial activities deal with not only the procurement and utilisation of funds but

also with the assessing of needs for funds, raising required finance, capital budgeting,

distribution of surplus, financial controls, etc.

Ezra Solomon has described the nature of financial management as follows:

“Financial management is properly viewed as an integral part of overall management

rather than as a staff specially concerned with funds raising operations.

In this broader view, the central issue of financial policy is the wise use of funds and

the central process involved is a rational matching of the advantage of potential uses

against the cost of alternative potential sources so as to achieve the broad financial

goals which an enterprise sets for itself.

In addition to raising funds, financial management is directly concerned with

production, marketing and other functions within an enterprise whenever decisions are

made about the acquisition or distribution of funds.”

Objectives of Financial Management

Financial management is one of the functional areas of business. Therefore, its

objectives must be consistent with the overall objectives of business. The overall

objective of financial management is to provide maximum return to the owners on their

investment in the long- term.

Amity Directorate of Distance & Online Education

Financial Management 87

This is known as wealth maximisation. Maximisation of owners’ wealth is possible

when the capital invested initially increases over a period of time. Wealth maximisation

means maximising the market value of investment in shares of the company. Notes

Wealth of shareholders = Number of shares held ×Market price per share.

In order to maximise wealth, financial management must achieve the following

specific objectives:

z To ensure availability of sufficient funds at reasonable cost (liquidity).

z To ensure effective utilisation of funds (financial control).

z To ensure safety of funds by creating reserves, re-investing profits, etc.

(minimisation of risk).

z To ensure adequate return on investment (profitability).

z To generate and build-up surplus for expansion and growth (growth).

z To minimise cost of capital by developing a sound and economical combination of

corporate securities (economy).

z To coordinate the activities of the finance department with the activities of other

departments of the firm (cooperation).

Profit Maximisation

Very often maximisation of profits is considered to be the main objective of financial

management. Profitability is an operational concept that signifies economic efficiency.

Some writers on finance believe that it leads to efficient allocation of resources and

optimum use of capital.

It is said that profit maximisation is a simple and straightforward objective. It also

ensures the survival and growth of a business firm. But modern authors on financial

management have criticised the goal of profit maximisation.

Ezra Solomon has raised the following objections against the profit maximisation

objective:

Objections against the Profit Maximisation Objectives

z The concept is ambiguous or vague. It is amenable to different interpretations, e.g.,

long run profits, short run profits, volume of profits, rate of profit, etc.

z It ignores the timing of returns. It is based on the assumption of bigger the better

and does not take into account the time value of money. The value of benefits

received today and those received a year later are not the same.

z It ignores the quality of the expected benefits or the risk involved in prospective

earnings stream. The streams of benefits may have varying degrees of uncertainty.

Two projects may have same total expected earnings but if the earnings of one

fluctuate less widely than those of the other it will be less risky and more preferable.

More uncertain or fluctuating the expected earnings, lower is their quality.

z It does not consider the effect of dividend policy on the market price of the share.

The goal of profit maximisation implies maximising earnings per share which is not

necessarily the same as maximising market-price share. According to Solomon, “to

the extent payment of dividends can affect the market price of “the stock (or share),

the maximisation of earnings per share will not be a satisfactory objective by itself.”

z Profit maximisation objective does not take into consideration the social

responsibilities of business. It ignores the interests of workers, consumers,

government and the public in general. The exclusive attention on profit

maximisation may misguide managers to the point where they may endanger the

survival of the firm by ignoring research, executive development and other

intangible investments.

Amity Directorate of Distance & Online Education

88 Accounting & Financial Management

Wealth Maximisation

Notes Prof. Ezra Solomon has advocated wealth maximisation as the goal of financial

decision-making. Wealth maximisation or net present worth maximisation is defined as

follows: “The gross present worth of a course of action is equal to the capitalised value

of the flow of future expected benefits, discounted (or as capitalised) at a rate which

reflects their certainty or uncertainty.

Wealth or net present worth is the difference between gross present worth and the

amount of capital investment required to achieve the benefits being discussed. Any

financial action which creates wealth or which has a net present worth above zero is a

desirable one and should be undertaken.

Any financial action which does not meet this test should be rejected. If two or more

desirable courses of action are mutually exclusive (i.e., if only one can be undertaken),

then the decision should be to do that which creates most wealth or shows the greatest

amount of net present worth. In short, the operating objective for financial management

is to maximise wealth or net present worth.”

Wealth maximisation is more operationally viable and valid criterion because of the

following reasons:

z It is a precise and unambiguous concept. The wealth maximisation means

maximising the market value of shares.

z It takes into account both the quantity and quality of the expected steam of future

benefits. Adjustments are made for risk (uncertainty of expected returns) and timing

(time value of money) by discounting the cash flows,

z As a decision criterion, wealth maximisation involves a comparison of value of cost.

It is a long-term strategy emphasising the use of resources to yield economic values

higher than joint values of inputs.

z Wealth maximisation is not in conflict with the other motives like maximisation of

sales or market share. It rather helps in the achievement of these other objectives.

In fact, achievement of wealth maximisation also maximises the achievement of the

other objectives. Therefore, maximisation of wealth is the operating objective by

which financial decisions should be guided.

The above description reveals that wealth maximisation is more useful if objective

than profit maximisation. It views profits from the long-term perspective. The true index

of the value of a firm is the market price of its shares as it reflects the influence of all

such factors as earnings per share, timing of earnings, risk involved, etc.

z Thus, the wealth maximisation objective implies that the objective of financial

management should be to maximise the market price of the company’s shares in

the long-term. It is a true indicator of the company’s progress and the shareholder’s

wealth.

However, “profit maximisation can be part of a wealth maximisation strategy. Quite

often the two objectives can be pursued simultaneously but the maximisation of profits

should never be permitted to overshadow the broader objectives of wealth

maximisation.

Approaches to Financial Management

Financial management approach measures the scope of the financial management

in various fields, which include the essential part of the finance. Financial

management is not a revolutionary concept but an evolutionary. The definition and

scope of financial management has been changed from one period to another

period and applied various innovations. Theoretical points of view, financial

management approach may be broadly divided into two major parts.

Amity Directorate of Distance & Online Education

Financial Management 89

Traditional Approach

Notes

Traditional approach is the initial stage of financial management, which was followed,

in the early part of during the year 1920 to 1950. This approach is based on the past

experience and the traditionally accepted methods. Main part of the traditional approach

is rising of funds for the business concern.

Traditional approach consists of the following important area:

z Arrangement of funds from lending body.

z Arrangement of funds through various financial instruments.

z Finding out the various sources of funds.

4.3 Functions

Finance function is one of the major parts of business organization, which involves the

permanent, and continuous process of the business concern. Finance is one of the

interrelated functions which deal with personal function, marketing function, production

function and research and development activities of the business concern. At present,

every business concern concentrates more on the field of finance because, it is a very

emerging part which reflects the entire operational and profit ability position of the

concern. Deciding the proper financial function is the essential and ultimate goal of the

business organization. Finance manager is one of the important role players in the field

of finance function. He must have entire knowledge in the area of accounting, finance,

economics and management. His position is highly critical and analytical to solve

various problems related to finance. A person who deals finance related activities may

be called finance manager.

Finance manager performs the following major functions:

1. Forecasting Financial Requirements: It is the primary function of the Finance

Manager. He is responsible to estimate the financial requirement of the business

concern. He should estimate, how much finances required to acquire fixed assets

and forecast the amount needed to meet the working capital requirements in future.

2. Acquiring Necessary Capital: After deciding the financial requirement, the finance

manager should concentrate how the finance is mobilized and where it will be

available. It is also highly critical in nature.

3. Investment Decision: The finance manager must carefully select best investment

alternatives and consider the reasonable and stable return from the investment. He

must be well versed in the field of capital budgeting techniques to determine the

effective utilization of investment. The finance manager must concentrate to

principles of safety, liquidity and profitability while investing capital.

4. Cash Management: Present days cash management plays a major role in the area

of finance because proper cash management is not only essential for effective

utilization of cash but it also helps to meet the short-term liquidity position of the

concern.

5. Interrelation with Other Departments: Finance manager deals with various

functional departments such as marketing, production, personal, system, research,

development, etc. Finance manager should have sound knowledge not only in

finance related area but also well versed in other areas. He must maintain a good

relationship with all the functional departments of the business organization.

4.4 Importance of Financial Management

Finance is the lifeblood of business organization. It needs to meet the requirement of

the business concern. Each and every business concern must maintain adequate

amount of finance for their smooth running of the business concern and also maintain

the business carefully to achieve the goal of the business concern. The business goal

Amity Directorate of Distance & Online Education

90 Accounting & Financial Management

can be achieved only with the help of effective management of finance. We can’t

neglect the importance of finance at any time at and at any situation. Some of the

Notes importance of the financial management is as follows:

z Financial Planning: Financial management helps to determine the financial

requirement of the business concern and leads to take financial planning of the

concern. Financial planning is an important part of the business concern, which

helps to promotion of an enterprise.

z Acquisition of Funds: Financial management involves the acquisition of required

finance to the business concern. Acquiring needed funds play a major part of

the financial management, which involve possible source of finance at minimum

cost.

z Proper Use of Funds: Proper use and allocation of funds leads to improve the

operational efficiency of the business concern. When the finance manager uses the

funds properly, they can reduce the cost of capital and increase the value of the

firm.

z Financial Decision: Financial management helps to take sound financial decision

in the business concern. Financial decision will affect the entire business operation

of the concern. Because there is a direct relationship with various department

functions such as marketing, production personnel, etc.

z Improve Profitability: Profitability of the concern purely depends on the

effectiveness and proper utilization of funds by the business concern. Financial

management helps to improve the profitability position of the concern with the help

of strong financial control devices such as budgetary control, ratio analysis and cost

volume profit analysis.

z Increase the Value of the Firm: Financial management is very important in the

field of increasing the wealth of the investors and the business concern. Ultimate

aim of any business concern will achieve the maximum profit and higher profitability

leads to maximize the wealth of the investors as well as the nation.

z Promoting Savings: Savings are possible only when the business concern earns

higher profitability and maximizing wealth. Effective financial management helps to

promoting and mobilizing individual and corporate savings. Nowadays financial

management is also popularly known as business finance or corporate finances.

The business concern or corporate sectors cannot function without the importance

of the financial management.

Relationship of Financial Management with other Branches

Financial management is one of the important parts of overall management, which is

directly related with various functional departments like personnel, marketing and

production.

Financial management covers wide area with multidimensional approaches.

1. Financial Management and Economics: Economic concepts like micro and

macroeconomics are directly applied with the financial management approaches.

Investment decisions, micro and macro environmental factors are closely

associated with the functions of financial manager. Financial management also

uses the economic equations like money value discount factor, economic order

quantity etc. Financial economics is one of the emerging area, which provides

immense opportunities to finance, and economical areas.

2. Financial Management and Accounting: Accounting records includes the

financial information of the business concern. Hence, we can easily understand the

relationship between the financial management and accounting. In the olden

periods, both financial management and accounting are treated as a same

discipline and then it has been merged as Management Accounting because this

part is very much helpful to finance manager to take decisions. But

Amity Directorate of Distance & Online Education

Financial Management 91

nowadays financial management and accounting discipline are separate and

interrelated.

3. Financial Management or Mathematics: Modern approaches of the financial

Notes

management applied large number of mathematical and statistical tools and

techniques. They are also called as econometrics. Economic order quantity,

discount factor, time value of money, present value of money, cost of capital,

capital structure theories, dividend theories, ratio analysis and working capital

analysis are used as mathematical and statistical tools and techniques in the field

of financial management.

4. Financial Management and Production Management: Production management

is the operational part of the business concern, which helps to multiple the money

into profit. Profit of the concern depends upon the production performance.

Production performance needs finance, because production department requires

raw material, machinery, wages, operating expenses etc. These expenditures are

decided and estimated by the financial department and the finance manager

allocates the appropriate finance to production department. The financial manager

must be aware of the operational process and finance required for each process of

production activities.

5. Financial Management and Marketing: Produced goods are sold in the market

with innovative and modern approaches. For this, the marketing department needs

finance to meet their requirements. The financial manager or finance department is

responsible to allocate the adequate finance to the marketing department. Hence,

marketing and financial management are interrelated and depends on each other.

6. Financial Management and Human Resource: Financial management is also

related with human resource department, which provides manpower to all the

functional areas of the management. Financial manager should carefully evaluate

the requirement of manpower to each department and allocate the finance to the

human resource department as wages, salary, remuneration, commission, bonus,

pension and other monetary benefits to the human resource department.

Hence, financial management is directly related with human resource

management.

4.5 Risk and Return

The world of investing can be a cold, chaotic, and confusing place. In this tutorial, we'll

go through some of the theories that investors have developed in an effort to explain the

behaviour of the market. We will discuss concepts, like risk return trade-off, rupee cost

averaging and diversification, that are especially useful for individual investors.

Here are some of the fundamental concepts of finance and investment.

The Risk Return trade-off

Deciding what amount of risk you can take while remaining comfortable with your

investments is very important.

In the investing world, the dictionary definition of risk is the chance that an

investment's actual return will be different than expected. Technically, this is measured

in statistics by standard deviation. Practically, risk means you have the possibility of

losing some or even all of your original investment.

Low risks are associated with low potential returns. High risks are associated with

high potential returns. The risk return trade-off is an effort to achieve a balance between

the desire for the lowest possible risk and the highest possible return. The risk return

trade-off theory is aptly demonstrated graphically in the chart below. A higher standard

deviation means a higher risk and therefore a higher possible return.

Amity Directorate of Distance & Online Education

92 Accounting & Financial Management

Notes

A common misconception is that higher risk equals greater return. The risk return

trade-off tells us that the higher risk gives us the possibility of higher returns. There are

no guarantees. Just as risk means higher potential returns, it also means higher

potential losses.

On the lower end of the risk scale is a measure called the risk-free rate of return. It

is represented by the return on 10 year Government of India Securities because their

chance of default (i.e. not being able to repay principal and interest) is next to nothing.

This risk free rate is used as a reference for equity markets whereas the overnight repo

rate is used as a reference for debt markets. If the risk-free rate is currently 6 per cent,

this means, with virtually no risk, we can earn 6 per cent per year on our money.

The common question arises: who wants 6 per cent when index funds average 13

per cent per year over the long run (last five years)? The answer to this is that even the

entire market (represented by the index fund) carries risk. The return on index funds is

not 13 per cent every year, but rather -5 per cent one year, 25 per cent the next year,

and so on. An investor still faces substantially greater risk and volatility to get an overall

return that is higher than a predictable government security. We call this additional

return, the risk premium, which in this case is 7 per cent (13 per cent - 6 per cent).

How do you know what risk level is most appropriate for you? This isn't an easy

question to answer. Risk tolerance differs from person to person. It depends on goals,

income, personal situation, etc. Hence, an individual investor needs to arrive at his own

individual risk return trade-off based on his investment objectives, his life-stage and his

risk appetite.

Diversification

Diversification is a risk-management technique that mixes a wide variety of investments

within a portfolio in order to minimize the impact that any one security will have on the

overall performance of the portfolio.

Diversification essentially lowers the risk of your portfolio. There are three main

practices that can help you ensure the best diversification:

z Spread your portfolio among multiple investment vehicles such as cash,

stocks, bonds, mutual funds, and perhaps even some real estate. Alternately you

could invest only in mutual funds but of varied types. For example you could invest

30 per cent in equity schemes, 40 per cent in debt/income schemes and 30 per cent

in money market schemes. You could also invest in commodity funds although as

and when permitted by SEBI.

z Vary the risk in your securities: If you are investing in equity funds, then consider

large cap as well as small cap funds. And if you are investing in debt, you could

consider both long term and short term debt. It would be wise to pick investments

with varied risk levels; this will ensure that large losses are offset by other areas.

Amity Directorate of Distance & Online Education

Financial Management 93

z Vary your securities by industry: This will minimize the impact of specific risks of

certain industries

Notes

Diversification is the most important component in helping you reach your long-

range financial goals while minimizing your risk. At the same time, diversification is not

an ironclad guarantee against loss. No matter how much diversification you employ,

investing involves taking on some sort of risk.

Back to Top

Rupee Cost Averaging

If you ask any professional investor what their hardest task is, he or she will tell you that

it is timing the market. Trying to time the market is a very tricky strategy. Buying at the

absolute low and selling at the peak is nearly impossible in practice. This is why

investment professionals preach rupee cost averaging (RCA).

RCA is the process of buying fixed amounts into a security/stock/mutual fund at

fixed points in time regardless of the prevailing price. This means you buy more units of

the security at lower prices, and fewer units at higher prices. The cost per unit/share

over time therefore averages out. This reduces the risk of investing a large amount in a

single security/mutual fund at the wrong time.

This principle is very powerful and works best over long periods of time. The

Systematic Investment Plans (SIPs) launched by mutual funds work on this principle

and are therefore a highly recommended investment option.

Asset Allocation

Asset allocation is an investment portfolio technique that aims to balance risk and

create diversification by dividing assets among major categories such as bonds, stocks,

real estate, and cash. Each asset class has different levels of return and risk, so each

will behave differently over time. At the same time that one asset is increasing in value,

another may be decreasing or not increasing as much.

The underlying principle of asset allocation is that the older a person gets, the less

risk he or she should face. After you retire you may have to depend on your savings as

your only source of income. It follows that you should invest more conservatively at this

time since asset preservation is crucial.

Determining the proper mix of investments in your portfolio is extremely important.

Deciding what percentage of your portfolio you should put into stocks, mutual funds,

and low risk instruments like bonds and treasuries isn't simple, particularly for those

reaching retirement age. Imagine saving for 30 or more years in the stock market only

to see the stock market decline in the years just before your retirement! Therefore one

must change asset allocation over time to move more towards safer asset classes

(bonds, treasuries) as one gets older. To determine your asset allocation plan, we

suggest you speak to an investment advisor who can customize a plan that is right for

you.

4.6 Various Functional areas of Financial Management

Some of the functional areas covered in financial management are discussed as such:

z Determining Financial Needs: A finance manager is supposed to meet financial

needs of the enterprise. For this purpose, he should determine financial needs of

the concern. Funds are needed to meet promotional expenses, fixed and working

capital needs. The requirement of fixed assets is related to the type of industry. A

manufacturing concern will require more investments in fixed assets than a trading

concern. The working capital needs depend upon the scale of operations, larger the

scale of operations, the higher will be the needs for working capital. A wrong

assessment of financial needs may jeopardies the survival of a concern.

Amity Directorate of Distance & Online Education

94 Accounting & Financial Management

z Selecting the Sources of Funds: A number of sources may be available for

raising funds. A concern may resort to issue of share capital and debentures.

Notes Financial institutions may be requested to provide long-term funds. The working

capital needs may be met by getting cash credit or overdraft facilities from

commercial banks. A finance manager has to be very careful and cautious in

approaching different sources. The terms and conditions of banks may not be

favourable to the concern. A small concern may find difficulties in raising funds for

want of adequate securities or due to its reputation. The selection of a suitable

source of funds will influence the profitability of the concern. This selection should

be made with great caution.

z Financial Analysis and Interpretation: The analysis and interpretation of financial

statements is an important task of a finance manager. He is expected to know

about the profitability, liquidity position, short-term and long-term financial position

of the concern. For this purpose, a number of ratios have to be calculated. The

interpretation of various ratios is also essential to reach certain conclusions.

Financial analysis and interpretation has become an important area of financial

management.

z Cost-Volume-Profit Analysis: Cost-volume-profit analysis is an important tool of

profit planning. It answers questions like, what is the behaviour of cost and volume?

At what point of production a firm will be able to recover its costs? How much a firm

should produce to earn a desired profit? To understand cost-volume-profit

relationship, one should know the behaviour of costs. The costs may be subdivided

as: fixed costs, variable costs and semi-variable costs. Fixed costs remain constant

irrespective of changes in production.

An increase or decrease in volume of production will not influence fixed costs.

Variable costs, on the other hand, vary in direct proportion to change in production.

Semi-variable costs remain constant for a period and then become variable for a

short period. These costs change with the change in output but not in the same

proportion.

The first concern of a finance manager will be to recover all costs. He will aspire to

achieve break-even point at the earliest. It is a point of no-profit no-loss. Any

production beyond break-even point will bring profits to the concern. The volume of

sales, to earn a desired profit, can also be ascertained. This analysis is very helpful

in deciding the volume of output or sales. The knowledge of cost-volume profit

analysis is essential for taking important decisions about production and profits.

z Capital Budgeting: Capital budgeting is the process of making investment

decisions in capital expenditures. It is an expenditure the benefits of which are

expected to be received over a period of time exceeding one year. It is an

expenditure incurred for acquiring or improving the fixed assets, the benefits of

which are expected to be received over a number of years in future. Capital

budgeting decisions are vital to any organization. An unsound investment decision

may prove to be fatal for the very existence of the concern.

4.7 Capital Budgeting

Capital budgeting is the process of planning for projects on assets with cash flows of a

period greater than one year. These projects can be classified as:

z Replacement decisions to maintain the business

z Existing product or market expansion

z New products and services

z Regulatory, safety and environmental

z Other, including pet projects or difficult-to-evaluate projects

Amity Directorate of Distance & Online Education

Financial Management 95

Additionally, projects can be classified as mutually exclusive or independent:

Mutually exclusive projects are potential projects that are unrelated, and any

combination of those projects can be accepted. Notes

Independent projects indicate there is only one project among all possible projects

that can be accepted.

The Importance of Capital Budgeting

Capital budgeting is important for many reasons:

z Since projects approved via capital budgeting are long term, the firm becomes tied

to the project and loses some of its flexibility during that period.

z When making the decision to purchase an asset, managers need to forecast the

revenue over the life of that asset.

z Lastly, given the length of the projects, capital-budgeting decisions ultimately define

the strategic plan of the company.

(To learn about the importance of budgeting on a personal level, read 6 Reasons Why

You Need a Budget and 11 Most Common Budgeting Mistakes.)

In capital budgeting, there are a number of different approaches that can be used to

evaluate any given project, and each approach has its own distinct advantages and

disadvantages.

All other things being equal, using internal rate of return (IRR) and net present

value (NPV) measurements to evaluate projects often results in the same findings.

However, there are a number of projects for which using IRR is not as effective as using

NPV to discount cash flows. IRR's major limitation is also its greatest strength: it uses

one single discount rate to evaluate every investment.

Although using one discount rate simplifies matters, there are a number of situations

that cause problems for IRR. If an analyst is evaluating two projects, both of which

share a common discount rate, predictable cash flows, equal risk and a shorter time

horizon, IRR will probably work. The catch is that discount rates usually change

substantially over time. For example, think about using the rate of return on a T-bill in

the last 20 years as a discount rate. One-year T-bills returned between 1- 12% in the

last 20 years, so clearly the discount rate is changing.

Without modification, IRR does not account for changing discount rates, so it's just not

adequate for longer-term projects with discount rates that are expected to vary.

Another type of project for which a basic IRR calculation is ineffective is a project with a

mixture of multiple positive and negative cash flows. For example, consider a project for

which marketers must reinvent the style every couple of years to stay current in a fickle,

trendy niche market. If the project has cash flows of -$50,000 in year one (initial capital

outlay), returns of $115,000 in year two and costs of $66,000 in year three because the

marketing department needed to revise the look of the project, a single IRR can't be

used. Recall that IRR is the discount rate that makes a project break even. If market

conditions change over the years, this project can have two or more IRRs, as seen

below.

Amity Directorate of Distance & Online Education

96 Accounting & Financial Management

Thus, there are at least two solutions for IRR that make the equation equal to zero,

so there are multiple rates of return for the project that produce multiple IRRs. The

Notes advantage to using the NPV method here is that NPV can handle multiple discount

rates without any problems. Each cash flow can be discounted separately from the

others.

Another situation that causes problems for users of the IRR method is when the

discount rate of a project is not known. In order for the IRR to be considered a valid way

to evaluate a project, it must be compared to a discount rate. If the IRR is above the

discount rate, the project is feasible; if it is below, the project is considered infeasible. If

a discount rate is not known, or cannot be applied to a specific project for whatever

reason, the IRR is of limited value. In cases like this, the NPV method is superior. If a

project's NPV is above zero, then it is considered to be financially worthwhile.

So, why is the IRR method still commonly used in capital budgeting? Its popularity is

probably a direct result of its reporting simplicity. The NPV method is inherently complex

and requires assumptions at each stage - discount rate, likelihood of receiving the cash

payment, etc. The IRR method simplifies projects to a single number that management

can use to determine whether or not a project is economically viable. The result is

simple, but for any project that is long-term, that has multiple cash flows at different

discount rates or that has uncertain cash flows - in fact, for almost any project at all -

simple IRR isn't good for much more than presentation value.

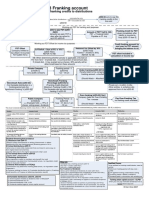

Some of the major techniques used in capital budgeting are as follows: 1. Payback

period 2. Accounting Rate of Return method 3. Net present value method 4. Internal

Rate of Return Method 5. Profitability index.

Payback Period

The payback (or payout) period is one of the most popular and widely recognized

traditional methods of evaluating investment proposals, it is defined as the number of

years required to recover the original cash outlay invested in a project, if the project

generates constant annual cash inflows, the payback period can be computed dividing

cash outlay by the annual cash inflow.

Payback period = Cash outlay (investment) / Annual cash inflow = C / A

Advantages:

z A company can have more favourable short-run effects on earnings per share by

setting up a shorter payback period.

z The riskiness of the project can be tackled by having a shorter payback period as it

may ensure guarantee against loss.

z As the emphasis in pay back is on the early recovery of investment, it gives an

insight to the liquidity of the project.

Limitations:

z It fails to take account of the cash inflows earned after the payback period.

z It is not an appropriate method of measuring the profitability of an investment

project, as it does not consider the entire cash inflows yielded by the project.

z It fails to consider the pattern of cash inflows, i.e., magnitude and timing of cash

inflows.

z Administrative difficulties may be faced in determining the maximum acceptable

payback period.

Accounting Rate of Return Method

The Accounting rate of return (ARR) method uses accounting information, as revealed

by financial statements, to measure the profit abilities of the investment proposals. The

Amity Directorate of Distance & Online Education

Financial Management 97

accounting rate of return is found out by dividing the average income after taxes by the

average investment.

Notes

ARR= Average income/Average Investment

Advantages:

z It is very simple to understand and use.

z It can be readily calculated using the accounting data.

z It uses the entire stream of incomes in calculating the accounting rate.

Limitations:

z It uses accounting, profits, not cash flows in appraising the projects.

z It ignores the time value of money; profits occurring in different periods are valued

equally.

z It does not consider the lengths of projects lives.

z It does not allow for the fact that the profit can be reinvested.

Net Present Value Method

The net present value (NPV) method is a process of calculating the present value of

cash flows (inflows and outflows) of an investment proposal, using the cost of capital as

the appropriate discounting rate, and finding out the net profit value, by subtracting the

present value of cash outflows from the present value of cash inflows.

The equation for the net present value, assuming that all cash outflows are made in

the initial year (tg), will be:

Where A1, A2…. represent cash inflows, K is the firm’s cost of capital, C is the cost

of the investment proposal and n is the expected life of the proposal. It should be noted

that the cost of capital, K, is assumed to be known, otherwise the net present, value

cannot be known.

Advantages:

z It recognizes the time value of money

z It considers all cash flows over the entire life of the project in its calculations.

z It is consistent with the objective of maximizing the welfare of the owners.

Limitations:

z It is difficult to use

z It presupposes that the discount rate which is usually the firm’s cost of capital is

known. But in practice, to understand cost of capital is quite a difficult concept.

z It may not give satisfactory answer when the projects being compared involve

different amounts of investment.

Internal Rate of Return Method

The internal rate of return (IRR) equates the present value cash inflows with the present

value of cash outflows of an investment. It is called internal rate because it depends

solely on the outlay and proceeds associated with the project and not any rate

Amity Directorate of Distance & Online Education

98 Accounting & Financial Management

determined outside the investment, it can be determined by solving the following

equation:

Notes

Advantages:

z Like the NPV method, it considers the time value of money.

z It considers cash flows over the entire life of the project.

z It satisfies the users in terms of the rate of return on capital.

z Unlike the NPV method, the calculation of the cost of capital is not a precondition.

z It is compatible with the firm’s maximising owners’ welfare.

Limitations:

z It involves complicated computation problems.

z It may not give unique answer in all situations. It may yield negative rate or multiple

rates under certain circumstances.

z It implies that the intermediate cash inflows generated by the project are reinvested

at the internal rate unlike at the firm’s cost of capital under NPV method. The latter

assumption seems to be more appropriate.

Profitability Index

It is the ratio of the present value of future cash benefits, at the required rate of return to

the initial cash outflow of the investment. It may be gross or net, net being simply gross

minus one. The formula to calculate profitability index (PI) or benefit cost (BC) ratio is as

follows.

PI = PV cash inflows/Initial cash outlay A,

z It gives due consideration to the time value of money.

z It requires more computation than the traditional method but less than the IRR

method.

z It can also be used to choose between mutually exclusive projects by calculating

the incremental benefit cost ratio.

4.8 Cost of Capital

The cost of capital is the minimum rate of return required on the investment projects to

keep the market value per share unchanged.

In other words, the cost of capital is simply the rate of return the funds used should

produce to justify their use within the firm in the light of the wealth maximisation

objective.

z Future cost and Historical cost: It is commonly known that, in decision-making,

the relevant costs are future costs are not the historical costs. The financial

decision-making is no exception. It is future cost of capital which is significant in

making financial decisions.

Amity Directorate of Distance & Online Education

Financial Management 99

z Specific cost and combined cost: The cost of each component of capital (ex-

common shares, debt etc.,) is known as specific cost of capital. The combined or

composite cost of capital is an inclusive: cost of capital from all sources. It is, thus, Notes

the weighted average cost of capital.

z Explicit cost and implicit cost: The explicit cost of capital is the internal rate of

return of the financial opportunity and arises when the capital is raised. The implicit

of capital arises when the firm considers alternative uses of the funds rained. The

methods of calculating the specific costs of different sources of funds are

discussed.

Cost of Debt

It is relatively easy to calculate cost of debt, it is rate of return or the rate of interest

specified at the time of debt issue. When a bond or debenture is issued at full face

value and to be redeemed after some period, then the before tax cost of debt is simply

the normal rate of interest.

Before tax cost of debt, Kd = Interest/ Principal

Cost of Preference Capital

The measurement of the cost of preference capital poses some conceptual difficulty. In

the case of debt, there is a binding legal obligation on the firm to pay interest and the

interest constitutes the basis to calculate the cost of debt.

However, when reference to the preference capital, it may be stated that the

payment of dividends on preference capital is not legally binding on the firm and even if

the dividends are paid, it is not a charge on earnings, rather it is a distribution or

appropriation of earnings to a class of owners. It may, therefore, be concluded, that the

dividends on preference capital do not constitute cost. This is not true.

The cost of preference capital is a function of the dividend expected by investors;

preference capital is never issued with an intention not to pay dividends. Although it is

not legally binding upon the firm to pay dividends on preference capital, yet it is

generally paid when the firm makes sufficient profits.

The preference share may be treated as a perpetual security it is irredeemable.

Thus, its cost is given by the following equation.

Where Kp is the cost of preference share, Dp represents the fixed dividend per

preference share and P is the price per- preference share.

Cost of Equity Capital

It is sometimes argued that tine equity capital is free of cost. This is not true. The

reason for advancing such an argument is that it is not legally binding on the company

to pay dividends to the common shareholders. Also, unlike the interest rate on debt or

the rate of dividend on preference capital, the dividend rate to the common

shareholders is not fixed. However, the shareholders invest their money in common

shares with an expectation of receiving dividends.

The market value of the share depends on the dividends expected by the

shareholders. Therefore, the required rate of return which equates the present value of

the expected dividends with the market value of share is the equity capita).

For the purpose of measuring the cost of equity, the equity capital will be divided

into two parts a) external equity b) retained earnings.

z External equity: The minimum rate of return which is required on the new

investment, financed by the new issue of common shares, to keep the market value

of the share unchanged is the cost of new issue of common shares (or external

equity).

Amity Directorate of Distance & Online Education

100 Accounting & Financial Management

z Retained earnings: The companies are not required to pay any dividends on

retained earnings. Therefore, it is sometimes observed that this source of finance is

Notes cost free. But retained earnings are the dividend foregone by the share holders.

The cost of retained earnings is measured by the following equation:

Kr = D/Po + g

Where Kr = Cost of retained earnings

D = Dividend

g = growth rate

Po =Market price of the share

Cost of Convertible Securities

In recent times, companies are raising finance by a new financial instrument called the

“convertible security”. It may be a bond or a debenture or a preference share.

Convertible security is considered as a means of deferred equity, financing and its cost

should, therefore, be treated so.

The expected stream of receipts from a convertible security will consist of interest/

dividend plus the expected conversion price. The expected conversion price can be

represented by the expected future market price per equity share at some future date

times the number of shares into which the security is convertible.

The cost of a convertible security, therefore is the discount rate which equates the

after tax interest or preference dividend plus the expected conversion price with the

issue price of the convertible security.

If it is assumed that all investors will convert their bonds on the same day, the cost

of a convertible bond can be found by the following equation.

Where Vc = issue price of convertible bond at time 0

R = Annual interest Payment

4.9 Ratio Analysis

Ratio is an expression of relationship between two or more items in mathematical

terms. Exhibition of meaningful and useful relation between different accounting data is

called Accounting Ratio. Ratio may be expressed as a:b (a is to b), in terms of simple

fraction, integer, or percentage.

If the current assets of a concern is ` 4,00,000 and the current liabilities is

` 2,00,000, then the ratio of current assets to current liabilities is given as 4,00,000 /

2,00,000 = 2. This is called simple ratio. Multiply a ratio by 100 to express it in terms of

percentage.

We can express the ratio between 200 and 100 in any of the following ways:

2:1

2/1

200%

2 to 1

2

Amity Directorate of Distance & Online Education

Financial Management 101

Ratios are extremely useful in drawing the financial position of a concern.

Accounting Analysis Notes

Comparative analysis and interpretation of accounting data is called Accounting

Analysis. When accounting data is expressed in relation to some other data, it conveys

some significant information to the users of data.

Ratio Analysis and its Applications

Ratio analysis is a medium to understand the financial weakness and soundness of an

organization. Keeping in mind the objective of analysis, the analyst has to select

appropriate data to calculate appropriate ratios. Interpretation depends upon the caliber

of the analyst.

Ratio analysis is useful in many ways to different concerned parties according to

their respective requirements. Ratio analysis can be used in the following ways:

z To know the financial strength and weakness of an organization.

z To measure operative efficiency of a concern.

z For the management to review past year’s activity.

z To assess level of efficiency.

z To predict the future plans of a business.

z To optimize capital structure.

z In inter and intra company comparisons.

z To measure liquidity, solvency, profitability and managerial efficiency of a concern.

z In proper utilization of assets of a company.

z In budget preparation.

z In assessing solvency of a firm, bankruptcy position of a firm, and chances of

corporate sickness.

Advantages of Ratio Analysis

z It is powerful tool to measure short and long-term solvency of a company.

z It is a tool to measure profitability and managerial efficiency of a company.

z It is an important tool to measure operating activities of a business.

z It helps in analyzing the capital structure of a company.

z Large quantitative data may be summarized using ratio analysis.

z It relates past accounting performances with the current.

z It is useful in coordinating the different functional machineries of a company.

z It helps the management in future decision-making.

z It helps in maintaining a reasonable balance between sales and purchase and

estimating working capital requirements.

Limitations of Ratio Analysis

Although Ratio Analysis is a very useful accounting tools to analyze and interpret

different accounting equations, it comes with its own set of limitations:

z If the data received from financial accounting is incorrect, then the information

derived from ratio analysis could not be reliable.

z Unauthenticated data may lead to misinterpretation of ratio analysis.

z Future prediction may not be always dependable, as ratio analysis is based on the

past performance.

Amity Directorate of Distance & Online Education

102 Accounting & Financial Management

z To get a conclusive idea about the business, a series of ratios is to be calculated. A

single ratio cannot serve the purpose.

Notes z It is not necessary that a ratio can give the real present situation of a business, as

the result is based on historical data.

z Trend analysis is done with the help of various calculated ratios that can be

distorted due to the changes in the price level.

z Ratio analysis is effective only where same accounting principles and policies are

adopted by other concerns too, otherwise inter-company comparison will not exhibit

a real picture at all.

z Through ratio analysis, special events cannot be identified. For example, maturity of

debentures cannot be identified with ratio analysis.

z For effective ratio analysis, practical experience and knowledge about particular

industry is essential. Otherwise, it may prove worthless.

z Ratio analysis is a useful tool only in the hands of an expert.

Types of Ratio

Ratios can be classified on the basis of financial statements or on the basis of functional

aspects.

Classification on the Basis of Financial Statement

z Balance Sheet Ratios: Ratios calculated from taking various data from the balance

sheet are called balance sheet ratio. For example, current ratio, liquid ratio, capital

gearing ratio, debt equity ratio, and proprietary ratio, etc.

z Revenue Statement Ratio: Ratios calculated on the basis of data appearing in the

trading account or the profit and loss account are called revenue statement ratios.

For example, operating ratio, net profit ratio, gross profit ratio, stock turnover ratio.

z Mixed or Composite Ratio: When the data from both balance sheet and revenue

statements are used, it is called mixed or composite ratio. For example, working

capital turnover ratio, inventory turnover ratio, accounts payable turnover ratio, fixed

assets turnover ratio, return of net worth ratio, return on investment ratio.

Classification of Ratios on the Basis of Financial Statements

Balance Sheet Ratios Profit and Loss A/c Composite or Mixed Ratios

Ratios

Current Ratio Gross Profit Ratio Stock Turnover Ratio

Liquid Ratio Operating Ratio Receivable Turnover Ratio

Absolute Liquid Ratio Operating Profit Ratio Payable Turnover Ratio

Debt Equity Ratio Net Profit Ratio Fixed Assets Turnover Ratio

Proprietorship Ratio Cash Profit Ratio Total Assets Turnover Ratio

Capita Gearing Ratio Expenses Ratio Working Capital Turnover

Assets Proprietorship Ratio Interest Coverage Ratio

Capital Inventory to Ratio Capital Turnover Ratio

Working Capital Ratio Return on Capital Employed

Ratio of Current Assets to Return on Equity Ratio

Fixed Assets Return on Shareholders Fund

Capital Turnover Ratio

Classification on the Basis of Financial Aspects

Ratios can be further classified based on their functional aspects as discussed below.

Amity Directorate of Distance & Online Education

Financial Management 103

z Liquidity Ratios: Liquidity ratios are used to find out the short-term paying capacity

of a firm, to comment short term solvency of the firm, or to meet its current liabilities.

Similarly, turnover ratios are calculated to know the efficiency of liquid resources of Notes

the firm, Accounts Receivable (Debtors) Turnover Ratio and Accounts Payable

(Creditors).

z Long-Term Solvency and Leverage Ratios: Debt equity ratio and interest

coverage ratio are calculated to know the efficiency of a firm to pay long-term debts

and to meet interest costs. Leverage ratios are calculated to know the proportion of

debt and equity in the financing of a firm.

z Activity Ratios: Activity ratios are also called turnover ratios. Activity ratios

measure the efficiency with which the resources of a firm are employed.

z Profitability Ratios: The results of business operations can be calculated through

profitability ratios. These ratios can also be used to know the overall performance

and effectiveness of a firm. Two types of profitability ratios are calculated in relation

to sales and investments.

Functional Classification of Ratios

Liquidity Long-Term Activity Ratios Profit Abilities

Ratios Solvency and Asset Management Ratios

Leverage Ratios Ratios

(A) Current Debt/Equity Ratio Inventory Turnover (A) In relation to

Ratio Debt to total Ratio sales

Liquid Ratio Capital Ratio Debtors Turnover Gross Profit Ratio

Absolute Liquid Interest Coverage Ratio Operating Ratio

or Cash Ratios Ratio Fixed Assets Operating Ratio

Interval Cash Flow/ Debt Turnover Ratio Operative Profit Ratio

Measure Capital Gearing Total Assets Net Profit Ratio

(B) Debtors Turnover Ratio

Expenses Ratio

Turnover Ratio Working Capital

(B) In relation to

Creditor Turnover Ratio

Investments

Turnover Ratio Payable Turnover

Return on Investment

Inventory Ratio

Return on Capital

Turnover Ratio Capital Employed

Turnover Ratio Return on Equity

Return on Total

Resources

Earnings per Share

Price Earnings Ratio

4.10 Some Important Ratios

In themselves, the raw numbers on your balance sheet, income statement and cash

flow statement have limited value. Of far greater value, when it comes to evaluating

your company's financial performance and making critical management decisions, are

certain ratios that you can extract from these documents.

When tracked and measured on a regular basis, these key financial ratios allow you to:

z get a more accurate reading of your company's financial performance

z compare performance against the previous year, the current budget and your

industry as a whole

z establish benchmarks to see where you are going and how you are doing.

The secret to effective financial management lies in knowing which ratios to track

and what they tell you about the state of your business.

Amity Directorate of Distance & Online Education

104 Accounting & Financial Management

Too many CEOs look at gross sales and revenues on the income statement and

nothing else. If sales look good, they figure everything else must be in order. In reality,

Notes you can have healthy sales growth and still be headed for financial disaster. The only

way to know that is to pay attention to the ratios that tell you what's really going on in

the business.

These ratios can be divided into three categories:

z Balance sheet ratios

z Profit and loss ratios

z Key operating ratios.

z Balance sheet ratios: The balance sheet gives the truest picture of the overall

health of the business. It acts as a snapshot, telling you where the business stands

at a given point in time. Unlike the profit and loss (income) statement, which gives a

historical record that never changes, the balance sheet is a living, breathing

document that changes on a daily basis.

The three most important balance sheet ratios are as follows.

Current ratio measures whether you have enough current assets (defined as

anything that can be turned into cash within a year) to meet your current liabilities.

Current ratio formula: Current assets divided by current liabilities

Quick ratio measures the company's ability to meet financial obligations using

only liquid current assets: cash or assets that can be turned into cash within 90

days. (The quick ratio does not include inventory because, if you have to

liquidate, you never get full value for inventory.)

Quick ratio formula: (Current assets minus inventory) divided by current liabilities

Debt-to-equity ratio measures how much of the company is financed by

borrowing versus owner equity. This ratio plays a major role in determining how

much you can borrow and at what interest rate.

Debt-to-equity ratio formula: Net worth divided by total liabilities

Uses of balance sheet ratios: Balance sheet ratios are crucial because they

measure the amount of risk in the business. The current and quick ratios (also

known as liquidity ratios) measure the company's ability to survive a short-term

financial crisis. The debt-to-equity ratio (also known as the safety ratio)

measures the company's ability to survive over the long term.

If sales and revenues continue to climb while these three measures show a

decline – a frequent scenario in fast-growth companies – you have a real

problem on your hands.

Profit and loss ratios: The profit and loss (P&L) statement focuses on revenues,

expenses and net income (or loss) over a defined period of time. It measures

the company's ability to turn sales and revenues into profits – a key ingredient

for long-term success.

The most important P&L ratios include the following.

Gross profit ratio measures how much money you bring in after subtracting the

costs of goods sold.

Gross profit ratio formula: Revenues minus cost of goods sold

Gross margin ratio measures how much it costs to obtain sales.

Gross margin ratio formula: Net sales minus cost of goods sold

Net operating profit ratio represents how much money you have left over,

before interest, depreciation and taxes, after all expenses are taken out. Some

Amity Directorate of Distance & Online Education

Financial Management 105

people also refer to this as EBITDA (earnings before interest, taxes,

depreciation and amortisation).

Notes

Net operating profit ratio formula: Gross margin minus selling, general and

administrative expenses

Net profit ratio measures how much money is left over after all expenses are

taken out.

Net profit ratio formula: (Net operating profit plus income) minus (other

expenses plus taxes)

Uses of profit and loss ratios: In our opinion, gross margin (and its relationship

to expenses) is the most important P&L ratio. You need to pay attention to all of

the P&L ratios, because they affect your profitability. But if you lose the gross

margin battle, you can do a lot of other things right and still go out of business.

You can have a high gross margin and still have expenses higher than your

gross margin. The key is the relationship of gross margin to expenses.

z Key operating ratios: The following ratios combine information from the balance

sheet and income statement to provide a more sophisticated picture of what is

happening in the business.

Gross profit ratio measures the percentage of every £ of sales that becomes gross

profit. For example, a gross profit ratio of 40% means that you earn 40 pence at the

gross profit level for every £ of sales.

Gross profit ratio formula: Gross profit divided by sales

Pre-tax profit ratio measures how much you make at the net profit level for every £

of sales you generate.

Pre-tax profit ratio formula: Pre-tax profit divided by sales

Sales-to-assets ratio measures the amount of sales generated for every £ of assets

employed in the business. For example, a sales-to-assets ratio of 2.5 means that

you generate £2.50 in sales for every £ of assets in the business.

Sales-to-assets ratio formula: Total assets divided by sales

Return on assets ratio measures how much profit you generate for every £ in

assets.

Return on assets ratio formula: Pre-tax profits divided by total assets

Return on equity ratio measures the return on every £ you have invested in the

business.

Return on equity ratio formula: Pre-tax profit divided by equity

Inventory turnover ratio measures how many times a year you turn over your

inventory. If you use sales cost, you must also use inventory cost. If you use selling

price (which retail businesses typically do), you must also use inventory selling

price. You can use either cost or selling price, so long as you are consistent.

Inventory turnover ratio formula: Sales divided by average inventory

Days in inventory ratio measures how long, on average, it takes to turn over your

inventory.

Days in inventory ratio formula: Inventory turnover divided by 365 days

Accounts receivable turnover ratio measures how many times a year you collect

your accounts receivable.

Accounts receivable turnover ratio formula: Sales divided by accounts receivable

Amity Directorate of Distance & Online Education

106 Accounting & Financial Management

Collection period ratio measures how often, on average, you collect your

accounts receivable.

Notes

Collection period ratio formula: Accounts receivable turnover divided by 365 days

Accounts payable turnover ratio measures how many times a year you pay your

accounts payable. As with the inventory turnover ratio, you can use cost or selling

price, as long as you use the same factor on both sides of the equation.

Accounts payable turnover ratio formula: Cost of goods sold divided by average

accounts payable

Payable period ratio measures, on average, how often you pay your accounts

payable.

Payable period ratio formula: Accounts payable turnover divided by 365 days

Uses of key operating ratios

Why bother tracking these seemingly arcane ratios? Because they tell you how efficient

your company is at generating and using cash. More important, they tell you what's

happening to your cash flow.

The raw numbers on the monthly cash flow statement are important because they

tell you how much cash you have on hand and how the cash got used last month. But

these operating ratios tell you what's going to happen to your cash flow in the near

future. If you're going to run out of cash, you need to know while you still have time to

do something about it.

How to get better ratios

The whole purpose of studying ratios is to make them better. To improve your ratios, we

recommend the following.

To improve your balance sheet ratios:

z Speed up inventory turnover: This improves cash flow and reduces risk, because

inventory always carries a certain amount of obsolescence risk.

z Consider leasing rather than purchasing equipment: In many cases leasing is

more cost effective, especially if the technology is changing quickly in your industry.

z Reduce the time it takes to collect receivables: This is one of the easiest ways

to increase cash flow, if you pay attention to it.

z Get increased day terms: If you can extend your payables to 60 or 90 days

without increasing the cost of goods, in essence you get your vendors to finance the

business. However, get your price first and then go for additional days.

z To improve your profit and loss ratios:

z Leverage sales over fixed costs: Strive to get more effective and efficient so that

you can improve sales without increasing costs. We recommend the following:

Sell more to existing customers.

Work on closing skills.

Sell at the right level. Don't waste time trying to sell to people who can't make

the decision.

Identify segments of your business where more potential exists.

Review how you incentive your sales mix. Make sure the compensation

programme for your sales team is in alignment with the best interests of the

company.

Pay sales people for receivables that get collected, not just for making sales.

Hold the sales team accountable for desired results.

Amity Directorate of Distance & Online Education

Financial Management 107

z Increase gross margins: We suggest attacking margins from three angles:

z Cost: Constantly work to lower your cost of goods sold.

Notes

z Value: Are you getting paid for all the value you provide customers?

z Velocity: The faster you move things through the business, the faster you collect

cash. Focus on increasing velocity to generate more cash and improve margins.

z Review pricing opportunities: Consider giving lower costs in rebate form after

customers achieve certain purchasing levels. This allows you to keep the cash flow

while forcing customers to buy more in order to receive the discount.

z Use zero-based budgeting: Don't let your people automatically submit budget

increases every year. Instead, have them start with a blank piece of paper and cost-

justify everything they do.

z Compensate people for productivity rather than time: Have some element in

your compensation programme that is tied to productivity. When you pay for time,

you get time, which requires more supervision and increases costs.

z Outsource when it's economically advantageous: Study your non-core

processes and look for things that other companies can do more cheaply.

Conversely, there may be things you are so good at that you can do them for other

companies.

4.11 Summary

Financial management refers to the efficient and effective management of money

(funds) in such a manner as to accomplish the objectives of the organization. It is the

specialized function directly associated with the top management. The significance of

this function is not seen in the 'Line' but also in the capacity of 'Staff' in overall of a

company. It has been defined differently by different experts in the field.

The term typically applies to an organization or company's financial strategy,

while personal finance or financial life management refers to an individual's