Professional Documents

Culture Documents

Soal Chapter 1 Hal. 46 P1 - 1 Acquisition Journal Entries (Ebook Beam)

Soal Chapter 1 Hal. 46 P1 - 1 Acquisition Journal Entries (Ebook Beam)

Uploaded by

SECRET MENU0 ratings0% found this document useful (0 votes)

642 views2 pagesPhen Ltd. acquired the net assets of Sung Ltd. for $1,000,000 cash and 500,000 shares worth $10 million. [1] To record the acquisition, Phen Ltd. debited Investment in Sung Ltd. for $11 million and credited common stock and additional paid-in capital. [2] Phen Ltd. then recorded the individual assets and liabilities of Sung Ltd. on its books, debiting assets and crediting liabilities, and recognized a $2.3 million gain from the bargain purchase. [3]

Original Description:

AKl 2

Original Title

soal chapter 1 hal. 46 P1 – 1 Acquisition journal entries (Ebook Beam)

Copyright

© © All Rights Reserved

Available Formats

DOC, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentPhen Ltd. acquired the net assets of Sung Ltd. for $1,000,000 cash and 500,000 shares worth $10 million. [1] To record the acquisition, Phen Ltd. debited Investment in Sung Ltd. for $11 million and credited common stock and additional paid-in capital. [2] Phen Ltd. then recorded the individual assets and liabilities of Sung Ltd. on its books, debiting assets and crediting liabilities, and recognized a $2.3 million gain from the bargain purchase. [3]

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

Download as doc, pdf, or txt

0 ratings0% found this document useful (0 votes)

642 views2 pagesSoal Chapter 1 Hal. 46 P1 - 1 Acquisition Journal Entries (Ebook Beam)

Soal Chapter 1 Hal. 46 P1 - 1 Acquisition Journal Entries (Ebook Beam)

Uploaded by

SECRET MENUPhen Ltd. acquired the net assets of Sung Ltd. for $1,000,000 cash and 500,000 shares worth $10 million. [1] To record the acquisition, Phen Ltd. debited Investment in Sung Ltd. for $11 million and credited common stock and additional paid-in capital. [2] Phen Ltd. then recorded the individual assets and liabilities of Sung Ltd. on its books, debiting assets and crediting liabilities, and recognized a $2.3 million gain from the bargain purchase. [3]

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

Download as doc, pdf, or txt

You are on page 1of 2

Soal

:

Jawablah soal chapter 1 hal. 46 P1 – 1 Acquisition journal entries (Ebook Beam)

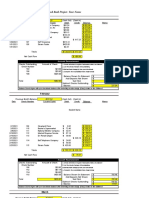

P1-1

Acquisition journal entries

Phen Ltd. issued 500,000 common shares of $10 at par and paid $1,000,000 for the net assets of

Sung Ltd. on August 17, 2014. The market value of Phen Ltd.’s stocks was $20 per share at the time.

Sung Ltd. was dissolved immediately after the acquisition. The information related to Sung Ltd.’s net

assets is as follows (in thousands) :

Book Value Fair Value

Cash $ 2,000 $ 2,000

Trade receivables 800 600

Inventories 3,200 3,000

Prepaid expenses 1,000 1,000

Land 6,000 6,800

Building-net 10,000 10,100

Equipment-net 3,500 3,000

Trade payable 1,300 1,500

Notes payable 4,300 4,600

Bonds payable 6,600 7,100

Common stock, $5 par 5,300

Retained Earnings 9,000

REQUIRED : Prepare the necessary journal entries for the acquisition.

Jawaban :

The entry to record the acquisition of the assets :

Investment in Sung Ltd. (+A) $11.000.000*

Common stock, $10 par (+SE) $5.000.000**

Additional paid-in-capital (+SE) $5.000.000***

Cash (-A) $1.000.000

*(500.000 shares x $20) + $1.000.000

** 500.000 shares x $10

***500.000 shares x ($20 - $10)

The entry to record Sung Ltd.’s assets directly on Phen Ltd.’s books :

Cash (+A) $2.000.000

Trade receivables (+A) $600.000

Inventories (+A) $3.000.000

Prepaid expenses (+A) $1.000.000

Land (+A) $6.800.000

Building-net (+A) $10.100.000

Equipment-net (+A) $3.000.000

Trade payable (+L) $1.500.000

Notes payable (+L) $4.600.000

Bonds payable (+L) $7.100.000

Investment in Sung Ltd.(+A) $11.000.000

Gain from bargain purchase (Ga, +SE) $2.300.000*

*Fair value net assets acquired

= $2.000.000 + $600.000 + $3.000.000 + $1.000.000 + $6.800.000 + $10.100.000 +

$3.000.000 - $1.500.000 - $4.600.000 - $7.100.000

= $13.300.000

Acquisition cost = $11.000.000

Gain from bargain purchase = $13.300.000 - $11.000.000 = $2.300.000

You might also like

- Yustika Adiningsih, AKL 1a 2021 E3-4Document1 pageYustika Adiningsih, AKL 1a 2021 E3-4yes iNo ratings yet

- Sheet at Acquisition: A. P.3-2. Allocation Schedule For Fair Value/book Value Differential and Consolidated BalanceDocument4 pagesSheet at Acquisition: A. P.3-2. Allocation Schedule For Fair Value/book Value Differential and Consolidated BalancePrince Frederic Mangambu100% (1)

- Wahyudi-Syaputra Assignment-2 Akl-IiDocument4 pagesWahyudi-Syaputra Assignment-2 Akl-IiWahyudi Syaputra100% (1)

- Pindi Yulinar Rosita - 008201905023 - Exercise Chapter 2Document43 pagesPindi Yulinar Rosita - 008201905023 - Exercise Chapter 2Pindi Yulinar100% (5)

- Nurul Aryani - AKL1 - QUIZ 4 - SOAL 1Document1 pageNurul Aryani - AKL1 - QUIZ 4 - SOAL 1Nurul AryaniNo ratings yet

- Solution - Chapter 1Document8 pagesSolution - Chapter 1Nezo Qawasmeh75% (4)

- E 4-8 (APPENDIX B) Journal Entries and Computations (Cost and Equity Methods)Document10 pagesE 4-8 (APPENDIX B) Journal Entries and Computations (Cost and Equity Methods)Lusiana Purnama SariNo ratings yet

- Ch2 TB Moodle 20201030Document6 pagesCh2 TB Moodle 20201030Wang JukNo ratings yet

- Acct 6065 Second Exam Spring 202104262021Document14 pagesAcct 6065 Second Exam Spring 202104262021Michael Pirone100% (1)

- Kelompok3 Tugas3 AKLDocument4 pagesKelompok3 Tugas3 AKLsyifa fr100% (1)

- Homework Ch2Document33 pagesHomework Ch2Keith Joanne SantiagoNo ratings yet

- Tugas Pertemuan 2 - Alya Sufi Ikrima - 041911333248Document3 pagesTugas Pertemuan 2 - Alya Sufi Ikrima - 041911333248Alya Sufi IkrimaNo ratings yet

- AUD Bank ReconciliationDocument8 pagesAUD Bank ReconciliationShaine PacsonNo ratings yet

- Forum3 AklDocument2 pagesForum3 AklFransiscaNo ratings yet

- NURUL ARYANI - AKL1 - Forum2 Soal 2Document2 pagesNURUL ARYANI - AKL1 - Forum2 Soal 2Nurul AryaniNo ratings yet

- Beams - Intercom Profit Transaction - BondsDocument12 pagesBeams - Intercom Profit Transaction - BondsAnggit Ponco100% (1)

- Beams AdvAcc11 Chapter17Document22 pagesBeams AdvAcc11 Chapter17husnaini dwi wanriNo ratings yet

- Chp3 Advanced Acc Beams 11eDocument21 pagesChp3 Advanced Acc Beams 11eFelixNovendraNo ratings yet

- Home Assignment Ch.1Document6 pagesHome Assignment Ch.1Sausan SaniaNo ratings yet

- 10 International NegotiationsDocument30 pages10 International Negotiationsblueindia100% (5)

- Tugas Asdos AklDocument6 pagesTugas Asdos AklNicholas AlexanderNo ratings yet

- Sherlin - 198110790 - Tugas 1 Akuntansi Keuangan LanjutanDocument6 pagesSherlin - 198110790 - Tugas 1 Akuntansi Keuangan LanjutanSherlin KhuNo ratings yet

- Tugas Pertemuan 1 - Alya Sufi Ikrima - 041911333248Document3 pagesTugas Pertemuan 1 - Alya Sufi Ikrima - 041911333248Alya Sufi Ikrima0% (1)

- $20 To Acquire PT Sumber Tbk. The Fair Value of The Stock at The Time Was $40 Per Share. PTDocument4 pages$20 To Acquire PT Sumber Tbk. The Fair Value of The Stock at The Time Was $40 Per Share. PTBryan LukeNo ratings yet

- Jawaban Kuis No.1 Akl 2 - Post - TM 3 - Renanda Putri - 43216120238Document2 pagesJawaban Kuis No.1 Akl 2 - Post - TM 3 - Renanda Putri - 43216120238Renanda PutriNo ratings yet

- Akl Soal 3 - Kelompok 2Document9 pagesAkl Soal 3 - Kelompok 2M KhairiNo ratings yet

- Jawaban No 1 Pam Corporation Journal Entries in Thousand Rupiah) Date Journal DebitDocument4 pagesJawaban No 1 Pam Corporation Journal Entries in Thousand Rupiah) Date Journal DebitDaniel cristoferNo ratings yet

- Ch03 Beams12ge SMDocument22 pagesCh03 Beams12ge SMWira Moki50% (2)

- Chapter 10 Test Bank Subsidiary Preferred Stock, Cosolidated Earnings Per Share, and Consolidated Income TaxationDocument27 pagesChapter 10 Test Bank Subsidiary Preferred Stock, Cosolidated Earnings Per Share, and Consolidated Income TaxationAlfi Wahyu TifaniNo ratings yet

- Advance Acc P2Document7 pagesAdvance Acc P2Putri anjjarwatiNo ratings yet

- Pert 1 - AKL - CH 3 - 2019-2020Document2 pagesPert 1 - AKL - CH 3 - 2019-2020Nova Yuliani0% (1)

- Nurul Aryani - Quis 2Document3 pagesNurul Aryani - Quis 2Nurul AryaniNo ratings yet

- This Study Resource Was: Consolidation Workpapers (Upstream Sales, Noncontrolling Interest)Document9 pagesThis Study Resource Was: Consolidation Workpapers (Upstream Sales, Noncontrolling Interest)Muhammad MalikNo ratings yet

- Stock Investments - Investor Accounting & ReportingDocument46 pagesStock Investments - Investor Accounting & ReportingaruminawatiNo ratings yet

- Forum 1Document1 pageForum 1Nurul AryaniNo ratings yet

- Tugas Minggu 7 Akl Nama: Hidayani Puteri NIM: 20043136Document8 pagesTugas Minggu 7 Akl Nama: Hidayani Puteri NIM: 20043136Hidayani Puteri100% (1)

- Beams Aa13e SM 08Document36 pagesBeams Aa13e SM 08Akila Kirana RatriNo ratings yet

- Chap 6 SolutionsDocument28 pagesChap 6 SolutionslalaaprilaNo ratings yet

- ch12 Beams12ge SMDocument13 pagesch12 Beams12ge SMElga AstriNo ratings yet

- Tugas Pertemuan 4 - Alya Sufi Ikrima - 041911333248Document5 pagesTugas Pertemuan 4 - Alya Sufi Ikrima - 041911333248Alya Sufi IkrimaNo ratings yet

- CH 8Document13 pagesCH 8doc nurfatkhiyahNo ratings yet

- Beams Aa13e SM 01Document14 pagesBeams Aa13e SM 01jiajiaNo ratings yet

- Bryan Luke AKL SP WEEK 3Document6 pagesBryan Luke AKL SP WEEK 3Bryan LukeNo ratings yet

- NURUL ARYANI - AKL1 - Forum 2Document3 pagesNURUL ARYANI - AKL1 - Forum 2Nurul AryaniNo ratings yet

- Bab 6 Intercompany Profit TransactionsDocument2 pagesBab 6 Intercompany Profit TransactionsAnonymous dMkY9G2No ratings yet

- P2 1Document2 pagesP2 1Febi100% (1)

- Chapter 5 Advanced AccountingDocument19 pagesChapter 5 Advanced AccountingMarife De Leon VillalonNo ratings yet

- Tugas Akuntansi Keuangan LanjutanDocument8 pagesTugas Akuntansi Keuangan LanjutanMin DaeguNo ratings yet

- Tugas Pertemuan 3 - Alya Sufi Ikrima - 041911333248Document5 pagesTugas Pertemuan 3 - Alya Sufi Ikrima - 041911333248Alya Sufi IkrimaNo ratings yet

- Jawaban E6-7Document1 pageJawaban E6-7UNY Wayan anissatunNo ratings yet

- Advanced Accounting: Stock Investments - Investor Accounting and ReportingDocument30 pagesAdvanced Accounting: Stock Investments - Investor Accounting and ReportingNafilah Rahma100% (1)

- KuisDocument11 pagesKuismc2hin9No ratings yet

- ACCT 412 Chapter 7 SolutionsDocument13 pagesACCT 412 Chapter 7 SolutionsJose T100% (2)

- Chapter 2 Advanced AccountingDocument9 pagesChapter 2 Advanced AccountingMohamad Adel Al AyoubiNo ratings yet

- AKL PartnershipDocument3 pagesAKL PartnershipNanda Latifa PutriNo ratings yet

- Modul Lab Akuntansi Lanjutan Ii - P 21.22Document34 pagesModul Lab Akuntansi Lanjutan Ii - P 21.22christin melinaNo ratings yet

- Yohannes Sinaga - 023001801165 - AKL - Bab4 2Document6 pagesYohannes Sinaga - 023001801165 - AKL - Bab4 2Yohannes SinagaNo ratings yet

- Accounting Assignment cpt-1Document9 pagesAccounting Assignment cpt-1Parvez RahmanNo ratings yet

- Accounting BusinessDocument11 pagesAccounting BusinessLyndonNo ratings yet

- Solutions Exercises Financial AccountingDocument11 pagesSolutions Exercises Financial Accountingddd huangNo ratings yet

- Soal Jawaban AKL CHP 1Document5 pagesSoal Jawaban AKL CHP 1Allpacino DesellaNo ratings yet

- Group 9 - Chapter 2Document7 pagesGroup 9 - Chapter 2Joshua SanotaNo ratings yet

- Shaping Business Opportunities IDocument7 pagesShaping Business Opportunities IMuhammad JavedNo ratings yet

- Mini Case9 DisneyDocument7 pagesMini Case9 DisneyHasbi AsidikNo ratings yet

- Mary Grace Padin (The Philippine Star) - January 17, 2019 - 12:00amDocument4 pagesMary Grace Padin (The Philippine Star) - January 17, 2019 - 12:00amsmileseptemberNo ratings yet

- Wa Pay Sure NiDocument29 pagesWa Pay Sure NiCharles Elquime GalaponNo ratings yet

- Global Strategies and The Multinational Corporation: OutlineDocument29 pagesGlobal Strategies and The Multinational Corporation: OutlineRifatalmaNo ratings yet

- Inventions of The Industrial Revolution NotesDocument2 pagesInventions of The Industrial Revolution Notes1namillied08No ratings yet

- Suspicious Transactions 23rd FebDocument18 pagesSuspicious Transactions 23rd FebJos ButtlerNo ratings yet

- Wel Come To 10 STD Social Science WorldDocument34 pagesWel Come To 10 STD Social Science Worldmithul souravNo ratings yet

- Cms Files 255856 1700662587ABRAPA COTTON BRAZIL REPORT - 2023 11Document8 pagesCms Files 255856 1700662587ABRAPA COTTON BRAZIL REPORT - 2023 11Akib KhanNo ratings yet

- Commercial Correspondence: Thu Giang Hoang Faculty of English For Specific PurposesDocument23 pagesCommercial Correspondence: Thu Giang Hoang Faculty of English For Specific Purposesvuthinga2007No ratings yet

- EngroFert Annual Report 2022 FinalDocument230 pagesEngroFert Annual Report 2022 FinalRaja MohsinNo ratings yet

- Combined SGMA 591Document46 pagesCombined SGMA 591Steve BallerNo ratings yet

- 1 s2.0 S1672630818300052 MainDocument8 pages1 s2.0 S1672630818300052 MainAtif NaeemNo ratings yet

- Rochester Electronics Receives IATF-16949 Letter of ConformanceDocument4 pagesRochester Electronics Receives IATF-16949 Letter of ConformancePR.comNo ratings yet

- Poultry Farming Business Plan ExampleDocument36 pagesPoultry Farming Business Plan ExampleBER LUKENo ratings yet

- Supply Chain Management: Strategy, Planning, and Operation, 5/e Authors: Sunil Chopra, Peter Meindl and D. V. KalraDocument18 pagesSupply Chain Management: Strategy, Planning, and Operation, 5/e Authors: Sunil Chopra, Peter Meindl and D. V. KalraMd. Rezaul Islam TusharNo ratings yet

- 2015 Agstar Vendor Directory July 2015 508 072715Document64 pages2015 Agstar Vendor Directory July 2015 508 072715Mbamali ChukwunenyeNo ratings yet

- Ibe Question PaperDocument2 pagesIbe Question PaperPranjali BorkarNo ratings yet

- Federal Compensation Regulation 135-2007Document8 pagesFederal Compensation Regulation 135-2007yibeltal0% (1)

- Nstedb Tbi ListDocument9 pagesNstedb Tbi ListAjay SocialveinsNo ratings yet

- Kiri Romogi Multi-Purpose Cooperative Society PDFDocument38 pagesKiri Romogi Multi-Purpose Cooperative Society PDFMuno InnocentNo ratings yet

- Perubahan Dana Jaminan Over Night MarginDocument2 pagesPerubahan Dana Jaminan Over Night MarginRizal SafrudinNo ratings yet

- Morning: EPF Members' Savings Worrying After RM145 Bil Withdrawals - MOFDocument30 pagesMorning: EPF Members' Savings Worrying After RM145 Bil Withdrawals - MOFRichard OonNo ratings yet

- Checkbook Project Excel Ve - Template - Sheet1Document7 pagesCheckbook Project Excel Ve - Template - Sheet1api-584774449No ratings yet

- Premium Beauty and Personal Care in VietnamDocument10 pagesPremium Beauty and Personal Care in VietnamTuyến Đặng ThịNo ratings yet

- Clientes - DespachosDocument7 pagesClientes - DespachosSebastian Rz RzNo ratings yet

- Presentation - Chartering ProcessDocument13 pagesPresentation - Chartering ProcessNuman Kooliyat Ismeth100% (1)

- RefffDocument3 pagesRefffNyasclemNo ratings yet