Professional Documents

Culture Documents

Performance Analysis of Financial Ratios - Indian Public Non-Life Insurance Sector

Performance Analysis of Financial Ratios - Indian Public Non-Life Insurance Sector

Uploaded by

Dr Bhadrappa HaralayyaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Performance Analysis of Financial Ratios - Indian Public Non-Life Insurance Sector

Performance Analysis of Financial Ratios - Indian Public Non-Life Insurance Sector

Uploaded by

Dr Bhadrappa HaralayyaCopyright:

Available Formats

Available ONLINE at www.ijcae.

org

IJCAE, Vol.4 Issue 3, September 2013, 87-10

ISSN NO: 0988-0382E

R

REES

SEEA

ARRC

CHH A

ARRT

TIIC

CLLE

E

PERFORMANCE ANALYSIS OF FINANCIAL RATIOS -INDIAN

PUBLIC NON-LIFE INSURANCE SECTOR

Dr. Jeelan Basha.V

Asst. Professor in Commerce Studies,

Govt. First Grade College,

M.M.Halli-583222, Bellary (DIST), Karnataka

Bhadrappa S Haralayya

Asst Professor

Dept of MBA

Lingarajappa Engineering College,

Bidar,Karnataka

ABSTRACT

Performance evaluation is an art through which one can learn about the efficiency achieved in the

working of a particular organization. As regards performance evaluation of an organization, there are various

measures to analyze performance of any organization. These measures are broadly classified into two

categories namely, financial and non-financial factors. Among financial factors, the most important is Financial

Ratios. Analysis through ratios is compared to Doctor’ kit for diagnosing the performance of the firm. It is the

evaluation of a firms’ prospect for survival and growth. An analyst should develop the skill of identifying red

flags. They should be used only to evaluate the performance of the firm as a whole. They, by themselves do not

provide any insight into the performance of the firm.

ISSN NO: 0988 – 0382E www.ijcae.org Page | 87

Dr. Jeelan Basha.V et. al / International Journal of Communications And Engineering Vol. 4 Issue 3, Sept. 2013

1. INTRODUCTION

As per the World Insurance Report, published by the reinsurance major “Swiss Re” the premium in

non-life insurance business grew by 1.9 per cent. Latin America reported remarkably high growth. The Report

mentions that the year 2011 witnessed exceptionally high catastrophe losses in Japan, Australia, and the United

States, while European countries generally enjoyed low catastrophe claims. In 2011, total economic losses to

Society due to disasters (both insured and uninsured) reached an estimated USD 370 billion, compared to USD

226 billion in 2010. The earthquake in Japan, the country’s worst on record in terms of magnitude, alone

accounted for 57 percent of global economic losses. The insured losses from natural catastrophes appeared to be

to the tune of USD 110 billion.

As at end-September 2012, there are fifty-two insurance companies operating in India; of which

twenty-four are in the life insurance business and twenty-seven are in non-life insurance business. Of the fifty

two companies presently in operations, eight are in the public sector - two are specialized insurers, namely

ECGC and AIC, one in life insurance namely LIC, four in general insurance.

The public sector insurers exhibited growth in 2011-12 at 21.50 per cent; as against the previous year’s

growth rate of 21.84 percent. The private sector general insurers registered a growth of 28.06 per cent, which is

higher than 24.67 percent achieved during the previous year.

Methodology:

In order to achieve the objectives of the study, secondary data is used. The main secondary data

includes annual report of Insurance Regulatory Development Authority, Department of Economic Affairs in the

Ministry of Finance, Business world, Business Today. Apart from publications, number of websites is also

accessed to gather the information for the study. Selected 111 private companies from whole sale & retail trade

and 64 private compare from Real Estate sectors are chosen for the analysis. Data from IRDA Bulletin for the

last six years from 2006-07 to 20011-12 is made available. To analyse the data, financial ratios as well as

descriptive statistics are used. The descriptive statistics like mean, standard deviation, skewness, kurtosis, and

coefficient of variation.

Objective of the study is:

To study financial ratios of Indian public Non-life Insurance sector

Scope of the study:

This study covers only Indian public non-life Insurance Sector. It includes General Insurance Business

covering National Insurance Co. Ltd., New India Assurances Co. Ltd., Oriental Insurance Co. Ltd. and United

India Insurance Co. Ltd. This provides, inter alia, a brief analysis by size and industry.

Findings:

1. RONW, ROTA and ROI of public non-life Insurance sector gradually decrease except last year during

the study period with average of 0.096, 0.017 and 0.036 respectively.

2. Dividend payout ratio fluctuates sharply with standard deviation of 0.177 and mean of 0.143.

3. Current Ratio/Short Term Solvency position of public non-financial Insurance sector is more or less

constant with Coefficient of Variation of 0.088 and average of 0.465.

4. Commission Expense Ratio has been reducing at snail’s pace during the study period with an average

of 0.083.

ISSN NO: 0988 – 0382E www.ijcae.org Page | 88

Dr. Jeelan Basha.V et. al / International Journal of Communications And Engineering Vol. 4 Issue 3, Sept. 2013

5. Operating Expense Ratio has highly consistent with Coefficient of Variation of 0.069 and an average of

0.229 over the study period.

6. Claims incurred ratio is an average of 84.802 percent of Net Earned Premium with Standard Deviation

of 8.974

7. Investment income ratio oscillates during the study period with an average and Standard Deviation of

0.492 and 0.289 respectively.

8. Net earnings ratio more or less, decreases during the study period with an average and standard

deviation of 0.133 and 0.148 respectively.

CONCLUSION

In nut shell, Financial Ratios cannot lead to appropriate managerial actions for maintaining or

improving the performance. They, at best guide one to the right questions. Therefore, managers usually use

financial ratios to understand economic consequences of their decisions. For much more meaningful analysis,

they should be used in conjunction with non-financial ratios or other non-financial measures of performance in

different activities of the firm. This study undoubtedly helps in highlighting the strengths, weaknesses,

opportunities, opportunities and threat of the organization. This is immensely useful for the investors to know

survival and competence of sectors.

REFERENCES:

1. “Finances of Non-government and Non-financial Private Limited Companies: 2010-11” RBI Monthly

Bulletin 2012, October, Pp 1895-1928.

2. “Finances of Private Limited Companies, 2007-08” RBI Monthly Bulletin 2009, October, Pp 1895-

1928.

3. Dr. Jeelan Basha.V, “FDI Companies-A review” The Management Accountant, June 2012, Pp- 665-66.

4. http://www.irda.gov.in

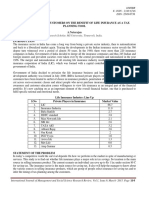

Appendix-1. Financial Ratios of Public Non-life Insurance Sector

Financial Ratios 2011-12 2010-11 2009-10 2008-09 2007-08 2006-07

1. RONW 0.071 -0.011 0.086 0.030 0.160 0.241

2. ROTA 0.011 -0.002 0.014 0.006 0.028 0.043

3. ROI 0.023 0.000 0.030 0.019 0.059 0.083

4. D/P Ratio 0.102 -0.186 0.210 0.330 0.204 0.200

5. Current Ratio 0.447 0.445 0.526 0.507 0.442 0.424

6. Commission Exp. Ratio 0.074 0.074 0.084 0.087 0.088 0.093

7. Operating Expense Ratio 0.215 0.253 0.241 0.228 0.211 0.226

8. Claims Incurred Ratio 89.22 97.030 88.270 76.840 72.230 85.220

9. Investment Income Ratio 0.298 0.388 0.374 0.321 1.062 0.506

10. Net Earnings Ratio 0.046 -0.008 0.076 0.054 0.375 0.254

ISSN NO: 0988 – 0382E www.ijcae.org Page | 89

Dr. Jeelan Basha.V et. al / International Journal of Communications And Engineering Vol. 4 Issue 3, Sept. 2013

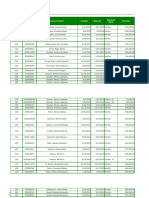

Appendix-2. Statistical Description of Public Non-life Insurance Sector

Financial Ratios Sum Average S.D C.V. Skew Kurt

1. RONW 0.577 0.096 0.091 0.949 0.695 -0.116

2. ROTA 0.1 0.017 0.016 0.976 0.822 0.074

3. ROI 0.214 0.036 0.030 0.844 0.733 -0.241

4. D/P Ratio 0.86 0.143 0.177 1.234 -1.551 3.074

5. Current Ratio 2.791 0.465 0.041 0.088 0.877 -1.264

6. Commission Exp. Ratio 0.5 0.083 0.008 0.093 -0.363 -1.578

7. Operating Expense Ratio 1.374 0.229 0.016 0.069 0.527 -0.695

8. Claims Incurred Ratio 508.81 84.802 8.974 0.106 -0.222 -0.651

9. Investment Income Ratio 2.949 0.492 0.289 0.587 2.129 4.683

10. Net Earnings Ratio 0.797 0.133 0.148 1.117 1.088 -0.258

ISSN NO: 0988 – 0382E www.ijcae.org Page | 90

You might also like

- Full Download Ebook Ebook PDF Macroeconomics Global Edition 13th Edition PDFDocument41 pagesFull Download Ebook Ebook PDF Macroeconomics Global Edition 13th Edition PDFcarol.martinez79496% (50)

- PT1 QuestionDocument11 pagesPT1 Questionfengfa2000No ratings yet

- Financial Statements Analysis Case StudyDocument17 pagesFinancial Statements Analysis Case StudychrisNo ratings yet

- HSE - Injury Frequency RatesDocument6 pagesHSE - Injury Frequency RatesFranko Encalada ValenciaNo ratings yet

- An Introduction Abt Cement IndustryDocument6 pagesAn Introduction Abt Cement IndustrySiddharth ShahNo ratings yet

- Sample PfrsDocument7 pagesSample PfrsClint AbenojaNo ratings yet

- The Effect of Capital Structure and Profitability On The Value of The Company Health Sub-Sector On The Indonesia Stock ExchangeDocument9 pagesThe Effect of Capital Structure and Profitability On The Value of The Company Health Sub-Sector On The Indonesia Stock ExchangeIJAR JOURNALNo ratings yet

- IJCRT2104543Document8 pagesIJCRT2104543Sri KamalNo ratings yet

- The Effect of Current Ratio, Return On Equity, Return On Asset, Earning Per Share To The Price of Stock of Go-Public Food and Beverages Company in Indonesian Stock ExchangeDocument7 pagesThe Effect of Current Ratio, Return On Equity, Return On Asset, Earning Per Share To The Price of Stock of Go-Public Food and Beverages Company in Indonesian Stock ExchangeNabila AriantiNo ratings yet

- IJPUB1704007Document5 pagesIJPUB1704007rakshithaanand01No ratings yet

- Ijm 08 06 006Document6 pagesIjm 08 06 006pratyay gangulyNo ratings yet

- Corporate Mechanism in Axiata Group BHD: Universiti Utara MalaysiaDocument15 pagesCorporate Mechanism in Axiata Group BHD: Universiti Utara MalaysiaAmin AkasyafNo ratings yet

- HeriyantoDocument4 pagesHeriyantoIhsan FajrulNo ratings yet

- Jurnal Kelompok 2Document6 pagesJurnal Kelompok 2Siti Imas MasitohNo ratings yet

- An Overview of The Financial Performance of Indian Tyre Industry - Comparison Among Leading Tyre CompaniesDocument3 pagesAn Overview of The Financial Performance of Indian Tyre Industry - Comparison Among Leading Tyre CompaniesLucky khandelwalNo ratings yet

- A Financial Ratio Analysis of National Fertilizers Limited: Prof - Mehul B.ShahDocument7 pagesA Financial Ratio Analysis of National Fertilizers Limited: Prof - Mehul B.ShahSAIsanker DAivAMNo ratings yet

- The Effect of Liquidity Profitability and Solvability To The Financial Distress 1528 2635 23 6 478Document17 pagesThe Effect of Liquidity Profitability and Solvability To The Financial Distress 1528 2635 23 6 478Yoddy PutraNo ratings yet

- IJCRT2104464Document11 pagesIJCRT2104464Kshama KadwadNo ratings yet

- Automobile Industry PresentationDocument25 pagesAutomobile Industry PresentationMurali DaranNo ratings yet

- Leverage Firm PerformanceDocument27 pagesLeverage Firm PerformancedevinaNo ratings yet

- An Analysis of Financial Performance of Infosys Limited: Dr. B Navaneetha, K Elakkia, R Keerthi Sowndarya, P NigethaDocument11 pagesAn Analysis of Financial Performance of Infosys Limited: Dr. B Navaneetha, K Elakkia, R Keerthi Sowndarya, P NigethaAzziya AniNo ratings yet

- Final Presentation BKH1810036F - Tama DharDocument19 pagesFinal Presentation BKH1810036F - Tama DharArpita Dhar TamaNo ratings yet

- Operating Leases, Operating Leverage, Operational Inflexibility andDocument5 pagesOperating Leases, Operating Leverage, Operational Inflexibility andVeronica PrettyNo ratings yet

- VV549Document7 pagesVV549Fred MillerNo ratings yet

- Awareness Among Customers On The Benefit of Life Insurance As A Tax Planning ToolDocument7 pagesAwareness Among Customers On The Benefit of Life Insurance As A Tax Planning ToolNIKHIL T NNo ratings yet

- 20213015-IFIC-Rittick SahaDocument7 pages20213015-IFIC-Rittick Sahariazul haqueNo ratings yet

- Comparative Study of Nonperforming Assets of Public Sector and Private Sector BanksDocument11 pagesComparative Study of Nonperforming Assets of Public Sector and Private Sector Banksvenkat thejNo ratings yet

- A Report On Financial Analysis On BHARTI AIRTEL LTDDocument27 pagesA Report On Financial Analysis On BHARTI AIRTEL LTDJeet DhanakNo ratings yet

- HVTC 04Document11 pagesHVTC 04minhnguyennhat2003No ratings yet

- An Empirical Study of Profitability Analysis of Selected Steel Companies in IndiaDocument17 pagesAn Empirical Study of Profitability Analysis of Selected Steel Companies in Indiamuktisolia17No ratings yet

- Finance For ManagersDocument17 pagesFinance For ManagersIkramNo ratings yet

- Presentation 1Document25 pagesPresentation 1abrehamNo ratings yet

- Economics ProjectDocument20 pagesEconomics ProjectSahil ChandaNo ratings yet

- Determinants of Deposit MobilizationDocument6 pagesDeterminants of Deposit MobilizationFikir GebregziabherNo ratings yet

- Financial Analysis of Astrazeneca and GSKDocument29 pagesFinancial Analysis of Astrazeneca and GSKBhavishNo ratings yet

- Analyzing Financial Soudness of Tata CommunicationsDocument14 pagesAnalyzing Financial Soudness of Tata CommunicationsIJAR JOURNALNo ratings yet

- 66 Epra+journals+13047Document3 pages66 Epra+journals+13047avani4593No ratings yet

- Altman Z, Messod Beneish M, Piotroski F-ScoresDocument4 pagesAltman Z, Messod Beneish M, Piotroski F-ScoresInternational Journal in Management Research and Social ScienceNo ratings yet

- Batch 2014-2017Document75 pagesBatch 2014-2017Rudra Ashish KaulNo ratings yet

- A Study On Financial Performance Analysis of Bharti Airtel LimitedDocument6 pagesA Study On Financial Performance Analysis of Bharti Airtel LimitedInternational Journal of Business Marketing and ManagementNo ratings yet

- BISE: Jurnal Pendidikan Bisnis Dan EkonomiDocument5 pagesBISE: Jurnal Pendidikan Bisnis Dan Ekonomiyoseph2009No ratings yet

- IJCRT2207383Document9 pagesIJCRT2207383nidhi devaleNo ratings yet

- International Review of Financial Analysis: Chunmi Jeon, Seongjae Mun, Seung Hun HanDocument14 pagesInternational Review of Financial Analysis: Chunmi Jeon, Seongjae Mun, Seung Hun HanPretty SavageNo ratings yet

- Market Outlook 25th August 2011Document3 pagesMarket Outlook 25th August 2011Angel BrokingNo ratings yet

- Brm. ProjectDocument21 pagesBrm. ProjectShailesh ModiNo ratings yet

- Market Outlook 22nd August 2011Document4 pagesMarket Outlook 22nd August 2011Angel BrokingNo ratings yet

- Working Capital Management in Indian Pap 2 PDFDocument11 pagesWorking Capital Management in Indian Pap 2 PDFBiniam NegaNo ratings yet

- CLM21 Tut 3 Group 5 1Document20 pagesCLM21 Tut 3 Group 5 1Huế HoàngNo ratings yet

- Non-Performing Assets: A Study of State Bank of India: Dr.D.Ganesan R.SanthanakrishnanDocument8 pagesNon-Performing Assets: A Study of State Bank of India: Dr.D.Ganesan R.SanthanakrishnansusheelNo ratings yet

- Valuation For Nestlé Lanka PLCDocument20 pagesValuation For Nestlé Lanka PLCErandika Lakmali GamageNo ratings yet

- Financial Ratio AnalysisDocument5 pagesFinancial Ratio AnalysisIrin HaNo ratings yet

- Beacon Pharma Ltd. - UpdateDocument12 pagesBeacon Pharma Ltd. - UpdateMd. Mustak AhmedNo ratings yet

- Working Capital Management TruthbehindcurtainDocument8 pagesWorking Capital Management Truthbehindcurtainrinkubhoi98319No ratings yet

- ValuEngine Weekly Newsletter July 9, 2010Document13 pagesValuEngine Weekly Newsletter July 9, 2010ValuEngine.comNo ratings yet

- Sickness of EnterprisesDocument7 pagesSickness of EnterprisesnarennariNo ratings yet

- A Study On Financial Performance of The RAMCO Cements Ltd-1237 PDFDocument5 pagesA Study On Financial Performance of The RAMCO Cements Ltd-1237 PDFNagaveni MNo ratings yet

- Itv Positif 2Document20 pagesItv Positif 2Brownie BNo ratings yet

- Case Stdy.2Document4 pagesCase Stdy.2Anusha SharmaNo ratings yet

- Accounts Receivable ManagementDocument5 pagesAccounts Receivable ManagementPranjal AgarwalNo ratings yet

- 204-Article Text-1386-1-10-20191025Document10 pages204-Article Text-1386-1-10-20191025IsnaynisabilaNo ratings yet

- Presentation AMADocument20 pagesPresentation AMAMrNo ratings yet

- Swot of Sri Lankan Insurance Sector: An Empirical StudyDocument22 pagesSwot of Sri Lankan Insurance Sector: An Empirical StudyMallikarjun DNo ratings yet

- Degree of Leverage: Empirical Analysis from the Insurance SectorFrom EverandDegree of Leverage: Empirical Analysis from the Insurance SectorNo ratings yet

- Review On Employees Job SatisfactionDocument9 pagesReview On Employees Job SatisfactionDr Bhadrappa HaralayyaNo ratings yet

- Review On Effect of Branding On Consumer Buying BehaviourDocument10 pagesReview On Effect of Branding On Consumer Buying BehaviourDr Bhadrappa HaralayyaNo ratings yet

- Review On Consumer Buying BehaviorDocument8 pagesReview On Consumer Buying BehaviorDr Bhadrappa HaralayyaNo ratings yet

- Review On Credit RiskDocument13 pagesReview On Credit RiskDr Bhadrappa HaralayyaNo ratings yet

- THESIS-The Productive Efficiency of Banks in Developing Country With Special Reference To Banks & Financial InstitutionDocument292 pagesTHESIS-The Productive Efficiency of Banks in Developing Country With Special Reference To Banks & Financial InstitutionDr Bhadrappa HaralayyaNo ratings yet

- 9.105611 Service Quality and Customer Satisfaction For Banking SystemDocument8 pages9.105611 Service Quality and Customer Satisfaction For Banking SystemDr Bhadrappa HaralayyaNo ratings yet

- Jetir2105840 Paper Analysis of Bank Performance Using Camel ApproachDocument10 pagesJetir2105840 Paper Analysis of Bank Performance Using Camel ApproachDr Bhadrappa HaralayyaNo ratings yet

- Review On Promotion Mix StrategyDocument10 pagesReview On Promotion Mix StrategyDr Bhadrappa HaralayyaNo ratings yet

- Quest Journal Review On Mutual Funds in Financial ServicesDocument6 pagesQuest Journal Review On Mutual Funds in Financial ServicesDr Bhadrappa HaralayyaNo ratings yet

- Tojqi Paper Technical Efficiency Affecting Factors in Indian Banking Sector An Empirical AnalysisDocument18 pagesTojqi Paper Technical Efficiency Affecting Factors in Indian Banking Sector An Empirical AnalysisDr Bhadrappa HaralayyaNo ratings yet

- Study On Performance of Foreign Banks in IndiaDocument7 pagesStudy On Performance of Foreign Banks in IndiaDr Bhadrappa HaralayyaNo ratings yet

- Chapter 14Document16 pagesChapter 14Dr Bhadrappa HaralayyaNo ratings yet

- E-Finance and The Financial Services IndustryDocument7 pagesE-Finance and The Financial Services IndustryDr Bhadrappa HaralayyaNo ratings yet

- IRE-1702750 Study On Model and Camel Analysis of BankingDocument16 pagesIRE-1702750 Study On Model and Camel Analysis of BankingDr Bhadrappa HaralayyaNo ratings yet

- Flusserstudies Paper Implications of Banking Sector On Economic Development in IndiaDocument13 pagesFlusserstudies Paper Implications of Banking Sector On Economic Development in IndiaDr Bhadrappa HaralayyaNo ratings yet

- Irjhis2105025 Study On Productive Efficiency of Banks in Developing CountryDocument11 pagesIrjhis2105025 Study On Productive Efficiency of Banks in Developing CountryDr Bhadrappa HaralayyaNo ratings yet

- Emerging Global Strategies For Indian Industry Bhadrappa HaralayyaDocument10 pagesEmerging Global Strategies For Indian Industry Bhadrappa HaralayyaDr Bhadrappa HaralayyaNo ratings yet

- Chapter 18Document27 pagesChapter 18Dr Bhadrappa HaralayyaNo ratings yet

- HST - 0621-151 Paper Analysis of Bank Productivity Using Panel Causality TestDocument16 pagesHST - 0621-151 Paper Analysis of Bank Productivity Using Panel Causality TestDr Bhadrappa HaralayyaNo ratings yet

- Chapter 16Document18 pagesChapter 16Dr Bhadrappa HaralayyaNo ratings yet

- Chapter-13 Profitability Matrix of Banks by HMTFP and FPTFPDocument16 pagesChapter-13 Profitability Matrix of Banks by HMTFP and FPTFPDr Bhadrappa HaralayyaNo ratings yet

- Chapter 12Document18 pagesChapter 12Dr Bhadrappa HaralayyaNo ratings yet

- Chapter 17Document15 pagesChapter 17Dr Bhadrappa HaralayyaNo ratings yet

- Chapter 11Document15 pagesChapter 11Dr Bhadrappa HaralayyaNo ratings yet

- Chapter-9 Bank Productivity Using Panel Causality TestDocument18 pagesChapter-9 Bank Productivity Using Panel Causality TestDr Bhadrappa HaralayyaNo ratings yet

- Assignment #2Document4 pagesAssignment #2beny SahagunNo ratings yet

- Derivagem - Version 1.52: "Options, Futures and Other Derivatives" 7/E "Fundamentals of Futures and Options Markets" 6/EDocument61 pagesDerivagem - Version 1.52: "Options, Futures and Other Derivatives" 7/E "Fundamentals of Futures and Options Markets" 6/Eمحمد احمد جیلانیNo ratings yet

- Guide To Original Issue Discount (OID) Instruments: Publication 1212Document17 pagesGuide To Original Issue Discount (OID) Instruments: Publication 1212ChaseF31ckzwhrNo ratings yet

- PrelimsDocument5 pagesPrelimsJamii Dalidig MacarambonNo ratings yet

- Solutions To Exercises and Problems - Budgeting: GivenDocument8 pagesSolutions To Exercises and Problems - Budgeting: GivenTiến AnhNo ratings yet

- Financial Management Toolkit For Recipients of Eu Funds For External ActionsDocument12 pagesFinancial Management Toolkit For Recipients of Eu Funds For External ActionsGeorge BekatorosNo ratings yet

- Motel Business PlanDocument14 pagesMotel Business PlanDinkisaNo ratings yet

- Harshita Palor - QSS GlobalDocument3 pagesHarshita Palor - QSS GlobalParvesh BarakNo ratings yet

- Accountancy Unit Test 1 Paper Shalom 2ndDocument4 pagesAccountancy Unit Test 1 Paper Shalom 2ndTûshar ThakúrNo ratings yet

- Recent Trends and Development of Banking System in IndiaDocument5 pagesRecent Trends and Development of Banking System in Indiavishnu priya v 149No ratings yet

- Introducing New Market OfferingsDocument26 pagesIntroducing New Market OfferingsarjunNo ratings yet

- QTTC c4Document38 pagesQTTC c4Totrinh BuiNo ratings yet

- Lead Singapore and MalaysiaDocument30 pagesLead Singapore and Malaysiav6185666No ratings yet

- Corporate Finance 4th Edition Berk Test BankDocument26 pagesCorporate Finance 4th Edition Berk Test BankAshleyMaciasowbj100% (61)

- Dx55we enDocument8 pagesDx55we enramdana satriaNo ratings yet

- Project Pt.2 - OPTP CustomersDocument5 pagesProject Pt.2 - OPTP CustomersNaveed SheikhNo ratings yet

- Adjusting Entries Discussion and Solution5Document23 pagesAdjusting Entries Discussion and Solution5Garp BarrocaNo ratings yet

- 08 Vipin Kumar 0Document30 pages08 Vipin Kumar 0Deep BanerjeeNo ratings yet

- Roll No:-Subject: - Marketing Standard: - 12 Commerce - A School Name: - Shree Swaminarayan AcademyDocument35 pagesRoll No:-Subject: - Marketing Standard: - 12 Commerce - A School Name: - Shree Swaminarayan AcademyHarsh MehtaNo ratings yet

- Tata Motors ReportDocument5 pagesTata Motors ReportrastehertaNo ratings yet

- Hall A&DDocument1 pageHall A&DGargagas gasgasfwrNo ratings yet

- SCR Auto FinalDocument154 pagesSCR Auto FinalNikka AnastacioNo ratings yet

- Entrepreneurship Case StudyDocument1 pageEntrepreneurship Case StudyAkansha PatwaNo ratings yet

- Public Notice No 2Document98 pagesPublic Notice No 2Rajat MehtaNo ratings yet

- Reference: 2019 Edition Philippine Income Tax Volume 1 by C. Llamado and J. de Vera)Document26 pagesReference: 2019 Edition Philippine Income Tax Volume 1 by C. Llamado and J. de Vera)Aira PartiNo ratings yet

- Company Law Summary NotesDocument181 pagesCompany Law Summary NotesumeshNo ratings yet

- Scan Doc0002Document2 pagesScan Doc0002anupamsinghwalNo ratings yet