Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

20 viewsIT Form 16 Back - WWW - Ibadi.in

IT Form 16 Back - WWW - Ibadi.in

Uploaded by

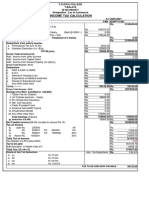

KATHI JAYAThis document contains details of an individual's income tax deductions and calculations for the tax year. It summarizes income, deductions claimed under various sections of Chapter VI A, aggregate deductions, taxable income, tax payable, rebates, health and education cess, total tax payable, tax deducted at source by the employer, and net tax to be paid. The employer certified that taxes deducted from the employee's salary were deposited to the central government accounts as per details provided in transaction-wise entries.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- BIO102 Practice ExamDocument10 pagesBIO102 Practice ExamKathy YuNo ratings yet

- Bohemian Grove Full Member List LEAK 2023Document13 pagesBohemian Grove Full Member List LEAK 2023twisteddick100% (1)

- Compressor Valves and Unloaders For Reciprocating CompressorsDocument19 pagesCompressor Valves and Unloaders For Reciprocating CompressorsGeorge Dom100% (2)

- Form 16 Excel FormatDocument12 pagesForm 16 Excel Formatankeet3No ratings yet

- C - Program Files (x86) - Folklore Payroll - ITReports - FORM16 - FORM16 - 02358756 PDFDocument5 pagesC - Program Files (x86) - Folklore Payroll - ITReports - FORM16 - FORM16 - 02358756 PDFPrudhvi Raj ChowdaryNo ratings yet

- Nihongo Connections-Part 1Document285 pagesNihongo Connections-Part 1Julie BruchNo ratings yet

- IT Form 16 Back - WWW - Ibadi.inDocument1 pageIT Form 16 Back - WWW - Ibadi.inGOKUL HD LIVE EVENTSNo ratings yet

- Form 16 - 2saDocument1 pageForm 16 - 2saNarendra KumarNo ratings yet

- Income Tax Calculation 2023-24 (Old Tax Regime) : Annexure - IiDocument1 pageIncome Tax Calculation 2023-24 (Old Tax Regime) : Annexure - IiGOKUL HD LIVE EVENTSNo ratings yet

- Jammu Kashmir Employee From 16Document6 pagesJammu Kashmir Employee From 16mrnavkhanNo ratings yet

- Income Tax CalculationDocument2 pagesIncome Tax CalculationMadhan Kumar BobbalaNo ratings yet

- B) Excess of Rent Paid Over 10% of Basic+DADocument4 pagesB) Excess of Rent Paid Over 10% of Basic+DAHaresh RajputNo ratings yet

- Periyar University: (NAAC Reaccredited With 'A++' Grade - State University-NIRF Rank 73-ARIIA RANK 10)Document2 pagesPeriyar University: (NAAC Reaccredited With 'A++' Grade - State University-NIRF Rank 73-ARIIA RANK 10)Indumadhi SalemNo ratings yet

- Form 16Document3 pagesForm 16Apte SatishNo ratings yet

- Anticipatory Income Tax Statement 2024-25 (MANJUSHA - 27.01.2024)Document5 pagesAnticipatory Income Tax Statement 2024-25 (MANJUSHA - 27.01.2024)prialiapradeepNo ratings yet

- F0RM NO. 16 (See Rule 31 (1) (A) ) (Annexure-B) : (B) Tax On EmploymentDocument1 pageF0RM NO. 16 (See Rule 31 (1) (A) ) (Annexure-B) : (B) Tax On EmploymentSourabhthakral_1No ratings yet

- Old Scheme: Radhamani K SDocument4 pagesOld Scheme: Radhamani K SSUREMAN FINANCIAL SERVICESNo ratings yet

- IT Statement 20-21Document2 pagesIT Statement 20-21Santhosh KumarNo ratings yet

- Oofits: Qualifying (27 885) U/S 8octo Donation Rounded Off U/S 288A of Tax of DR For AyDocument8 pagesOofits: Qualifying (27 885) U/S 8octo Donation Rounded Off U/S 288A of Tax of DR For AyKushagra BurmanNo ratings yet

- B Praveen 20-21Document2 pagesB Praveen 20-21psyamala2004No ratings yet

- Ecr CHLN Rec GRCDP0043475000 1212204007476 1651122031576 2022042837831576920Document1 pageEcr CHLN Rec GRCDP0043475000 1212204007476 1651122031576 2022042837831576920Shaik BashaNo ratings yet

- Form No. 16: (See Rule 31 (1) (A) )Document5 pagesForm No. 16: (See Rule 31 (1) (A) )amit kr AdhikaryNo ratings yet

- Automated Form 16 FY 10-11Document8 pagesAutomated Form 16 FY 10-11Pranab BanerjeeNo ratings yet

- Form No.16 Aa-1Document2 pagesForm No.16 Aa-1Vishnu Vardhan ANo ratings yet

- Amma Income TaxDocument5 pagesAmma Income Taxraghuraman1511No ratings yet

- Anb Form 16 ITR (Saral II) 2010 ModelDocument7 pagesAnb Form 16 ITR (Saral II) 2010 Modelvanbu1967No ratings yet

- Income Tax Calculator For F.Y 2020 21 A.Y 2021 22 ArthikDishaDocument8 pagesIncome Tax Calculator For F.Y 2020 21 A.Y 2021 22 ArthikDishaGeetanjali BarejaNo ratings yet

- Income Tax Calculator For F.Y 2020 21 A.Y 2021 22 ArthikDishaDocument7 pagesIncome Tax Calculator For F.Y 2020 21 A.Y 2021 22 ArthikDishaSARAVANAN PNo ratings yet

- Ecr CHLN Rec GRCDP0043475000 1212203002720 1646735919520 2022030858119520249Document1 pageEcr CHLN Rec GRCDP0043475000 1212203002720 1646735919520 2022030858119520249Shaik BashaNo ratings yet

- Income Tax Statement For Financial Year 2023-24 (Assessment Year 2024-25)Document1 pageIncome Tax Statement For Financial Year 2023-24 (Assessment Year 2024-25)ikbalbahar1992No ratings yet

- Adobe Scan 19-Jun-2023Document3 pagesAdobe Scan 19-Jun-2023Nirmala DeviNo ratings yet

- Form 16 651746Document4 pagesForm 16 651746Arslan1112No ratings yet

- NitishDocument1 pageNitishkaushikdutta176No ratings yet

- PF Challan Oct 22Document1 pagePF Challan Oct 22M/s, TAPAN ENGINEERING SERVICENo ratings yet

- Income Tax Planner FY 2020-21Document12 pagesIncome Tax Planner FY 2020-21RedNo ratings yet

- Tds 16 NDocument3 pagesTds 16 Nssanju_bhatNo ratings yet

- Details of Salary Paid and Any Other Income and Tax DeductedDocument3 pagesDetails of Salary Paid and Any Other Income and Tax DeductedAYUSH PRADHANNo ratings yet

- ECR CHLN May-2023Document1 pageECR CHLN May-2023Pradeep SaraswatNo ratings yet

- Ecr CHLN Rec GRCDP0075620000 1212207007746 1659013738489 2022072867138490836Document1 pageEcr CHLN Rec GRCDP0075620000 1212207007746 1659013738489 2022072867138490836VS Avilala-2No ratings yet

- Details of Salary Paid and Any Other Income and Tax DeductedDocument3 pagesDetails of Salary Paid and Any Other Income and Tax DeductedRajesh KharmaleNo ratings yet

- T K ArumugamDocument7 pagesT K ArumugamThangamNo ratings yet

- CONVEYANCE Exemption HRA Exemption: 9394 Rs. Rs. 0Document2 pagesCONVEYANCE Exemption HRA Exemption: 9394 Rs. Rs. 0Akshay ShettyNo ratings yet

- IT Calculator 2018 LiteDocument6 pagesIT Calculator 2018 LiteHr PoonamNo ratings yet

- ECR_CHLN_REC_ORBBS2056720000_3602303020287_1680142579049_2023033027979049750Document1 pageECR_CHLN_REC_ORBBS2056720000_3602303020287_1680142579049_2023033027979049750rana1979No ratings yet

- Computation of Toatal IncomeDocument4 pagesComputation of Toatal IncomePRITAM PATRANo ratings yet

- Ecr CHLN Rec Mrnoi1627714000 4372005006244 1589531030815 2020051550030815546 PDFDocument1 pageEcr CHLN Rec Mrnoi1627714000 4372005006244 1589531030815 2020051550030815546 PDFRanjit SamalNo ratings yet

- Praveen B 21-22Document2 pagesPraveen B 21-22psyamala2004No ratings yet

- Ecr CHLN Rec Apkkp1627658000 1282108005089 1628935903507 2021081456503507148Document1 pageEcr CHLN Rec Apkkp1627658000 1282108005089 1628935903507 2021081456503507148Gomathi consultancyNo ratings yet

- ECR - CHLN - REC - Jeet RamDocument1 pageECR - CHLN - REC - Jeet Rampro gamingNo ratings yet

- Res FormDocument1,320 pagesRes FormAnonymous pKsr5vNo ratings yet

- Form16 2982Document3 pagesForm16 2982yogesh magarNo ratings yet

- PART B (Annexure)Document4 pagesPART B (Annexure)AnbarasanNo ratings yet

- July 22 CDocument1 pageJuly 22 CPritam KumarNo ratings yet

- Ecr CHLN Rec Apkkp0068211000 1282310006315 1697285648378 2023101463848378762Document1 pageEcr CHLN Rec Apkkp0068211000 1282310006315 1697285648378 2023101463848378762aravindm1110No ratings yet

- Salary Computation Ass Yr 2017-18Document2 pagesSalary Computation Ass Yr 2017-18CA Kaushik Ranjan GoswamiNo ratings yet

- FORM No. 16: Details of Salary Paid and Any Other Income and Tax DeductedDocument3 pagesFORM No. 16: Details of Salary Paid and Any Other Income and Tax DeductedMadhan Kumar BobbalaNo ratings yet

- Principles of Taxation - DeductionsDocument7 pagesPrinciples of Taxation - Deductions20047 BHAVANDEEP SINGHNo ratings yet

- Developed By-Office Automation Division, IIT Kanpur Page No.1Document2 pagesDeveloped By-Office Automation Division, IIT Kanpur Page No.1Kishan OmarNo ratings yet

- Income Tax Declaration Form FY 22 23 AY 23 24Document2 pagesIncome Tax Declaration Form FY 22 23 AY 23 24Aamer ShaikNo ratings yet

- 2017-18 - Part B - 1Document4 pages2017-18 - Part B - 1getajaykaushalNo ratings yet

- ECR_CHLN_REC_ORBBS2056720000_3602303020286_1680142540038_2023033027940038672Document1 pageECR_CHLN_REC_ORBBS2056720000_3602303020286_1680142540038_2023033027940038672rana1979No ratings yet

- Ecr CHLN Rec CBSLM1565053000 4132106003683 1623491367210 2021061255167210543Document1 pageEcr CHLN Rec CBSLM1565053000 4132106003683 1623491367210 2021061255167210543Kbg ConsultancyNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- Devoir de Synthèse N°1 - Anglais - 2ème Lettres (2019-2020) Mme Rahmeni JamilaDocument5 pagesDevoir de Synthèse N°1 - Anglais - 2ème Lettres (2019-2020) Mme Rahmeni JamilaSassi LassaadNo ratings yet

- Flashcards 2601-2800Document191 pagesFlashcards 2601-2800kkenNo ratings yet

- LSS BB Body of KnowledgeDocument5 pagesLSS BB Body of KnowledgeVigneshNo ratings yet

- Manual DVRDocument73 pagesManual DVRjavriverNo ratings yet

- PAPERSDocument5 pagesPAPERSAlfia AlfiNo ratings yet

- Mill Test A36Document3 pagesMill Test A36Dang TranNo ratings yet

- General Specification For PaintingDocument15 pagesGeneral Specification For PaintingDeddy PratamaNo ratings yet

- Ph0101 Unit 4 Lecture-7: Point Imperfections Line Imperfections Surface Imperfections Volume ImperfectionsDocument41 pagesPh0101 Unit 4 Lecture-7: Point Imperfections Line Imperfections Surface Imperfections Volume Imperfectionskelompok 16No ratings yet

- Fire Awareness PresentationDocument37 pagesFire Awareness Presentationshailu178No ratings yet

- Manuals Ezr Pressure Reducing Regulator Instruction Manual Fisher en en 5916804 PDFDocument40 pagesManuals Ezr Pressure Reducing Regulator Instruction Manual Fisher en en 5916804 PDF商康康(JACK)No ratings yet

- P To P CycleDocument5 pagesP To P CycleJaved AhmadNo ratings yet

- Brain Teasers: GMAT: Problem SolvingDocument5 pagesBrain Teasers: GMAT: Problem SolvingHarsh MalhotraNo ratings yet

- TRIP Moving South Carolina Forward Report September 2021Document21 pagesTRIP Moving South Carolina Forward Report September 2021WMBF NewsNo ratings yet

- Daihatsu Gensets Diesel EngineDocument20 pagesDaihatsu Gensets Diesel Enginexyz1002100% (1)

- 2nd Year Past Keys Hafiz BilalDocument33 pages2nd Year Past Keys Hafiz Bilalsibtainm001No ratings yet

- 500-Piso English Series BanknoteDocument24 pages500-Piso English Series BanknoteSehyoonaa KimNo ratings yet

- Ultrasonic Testing of Materials 155Document1 pageUltrasonic Testing of Materials 155joNo ratings yet

- Prototype TutorialDocument451 pagesPrototype TutorialMariela DemarkNo ratings yet

- A Case Study of Exploiting Data Mining TechniquesDocument8 pagesA Case Study of Exploiting Data Mining TechniquesAdam GraphiandanaNo ratings yet

- @must Read Before InstallDocument3 pages@must Read Before InstallClip ClapsNo ratings yet

- ICOM-CC 2017 Copenhagen 507Document11 pagesICOM-CC 2017 Copenhagen 507Cristi CostinNo ratings yet

- LogDocument706 pagesLogChú BìnhNo ratings yet

- Idea Sub Hackathon 22Document9 pagesIdea Sub Hackathon 22Vaibhav KhatingNo ratings yet

- K-2 Ela-1Document219 pagesK-2 Ela-1Julie SuteraNo ratings yet

- T14 CalculatorDocument5 pagesT14 CalculatorUsamaNo ratings yet

- ELEN 3018 - Macro Test - 2013 - ADocument1 pageELEN 3018 - Macro Test - 2013 - AsirlordbookwormNo ratings yet

IT Form 16 Back - WWW - Ibadi.in

IT Form 16 Back - WWW - Ibadi.in

Uploaded by

KATHI JAYA0 ratings0% found this document useful (0 votes)

20 views1 pageThis document contains details of an individual's income tax deductions and calculations for the tax year. It summarizes income, deductions claimed under various sections of Chapter VI A, aggregate deductions, taxable income, tax payable, rebates, health and education cess, total tax payable, tax deducted at source by the employer, and net tax to be paid. The employer certified that taxes deducted from the employee's salary were deposited to the central government accounts as per details provided in transaction-wise entries.

Original Description:

Original Title

IT Form 16 Back - Www.ibadi.in (1)

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document contains details of an individual's income tax deductions and calculations for the tax year. It summarizes income, deductions claimed under various sections of Chapter VI A, aggregate deductions, taxable income, tax payable, rebates, health and education cess, total tax payable, tax deducted at source by the employer, and net tax to be paid. The employer certified that taxes deducted from the employee's salary were deposited to the central government accounts as per details provided in transaction-wise entries.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

20 views1 pageIT Form 16 Back - WWW - Ibadi.in

IT Form 16 Back - WWW - Ibadi.in

Uploaded by

KATHI JAYAThis document contains details of an individual's income tax deductions and calculations for the tax year. It summarizes income, deductions claimed under various sections of Chapter VI A, aggregate deductions, taxable income, tax payable, rebates, health and education cess, total tax payable, tax deducted at source by the employer, and net tax to be paid. The employer certified that taxes deducted from the employee's salary were deposited to the central government accounts as per details provided in transaction-wise entries.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

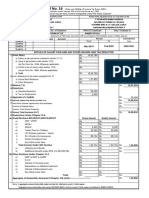

b) NPS U/s 80CCD (1)

National Pension Scheme U/s 80CCD (1B) Rs. 0

Total Amount of Section a and b Rs. 150000 150000

Other Section Under Chapter VI A Gross Qualifying

B)

( Under Section 80E, 80G, 80TTA, 80G, 80DD etc. ) Amount Amount

80G EWF, SWF & CMRF Rs. 0 0

Interest of Housing Loan U/s

24B Rs. 0 0

24

80G Donations to Charities Rs. 0 0

Disabled Person (PH) ( Rule

80U Rs. 0 0

11A)

Employees Health Cards

80D Rs. 2700 2700

Premium in AP

Employer Contribution

80CCD(2) Rs. 0 0

Towards CPS

80E Interest of Educational

Rs. 0 0

Loan

Additional Benefit CPS

Employee U/s 80CCD (1B) Rs. 0 0

(upto Rs.50,000/-)

Total Under Sections 80G,80E,80DD ete.. Rs. 2700

10 Aggregate of Deductible Amounts U/Chapter VIA (A+B) Rs. 152700

11 Net Taxable Income (Column 8- Column 10) Rs. 689204

Tax on Income(Rounded) 689200

a) Upto 2,50,000 Rs. Nil

b) 2,50,001/- to 5,00,000/- 5% ( 250000 @ 5% ) Rs. 12500

c) 5,00,001/- to 10,00,000/- 20% ( 189200 @ 20% ) Rs. 37840

d) Above 10,00,001/ - 30% ( 0 @ 30% ) Rs. 0

12 TAX ON TOTAL INCOME Rs. Rs. 50340

13 Tax Rebate Rs.12500/-upto Rs.5,00,000 Taxble Income( U/s 87 A - Rs. 12500 ) Rs. 0

14 TAX PAYBLE (12-13) Rs. 50340

15 Health Cess @ 1% + Education Cess @ 3% Rs. 2014

16 TAX PAYABLE (14+15) Rs. 52354

17 Less: (a) Tax deducted at source U/s 192(1) Rs.

(b)Tax Paid by the Employer on behalf of the Employee U/S 192 (1A) on perquisited U/S 17 (2) Rs. 20000

18 Less: Relief under section 89 (1) (attach details) Rs. -

19 Net Tax to be Paid Rs. 32354

DETAILS OF TAX DEDUCTED AND DEPOSITED INTO CENTRAL GOVERNMENT ACCOUNT (The employer is provide tranction - wise detai

of tax deducted and deposited )

Transfer

Education Total Tax Cheque/DD BSR Code of Date on Which vocher/chalana

Sl. No TDS Rs. Surcharge Rs.

Cess Rs. Deposited Rs. No. (if any) Bank Branch Tax Deposited Identification

No

2

3

4

5

6

6

7

8

9

10

11

12

I Sri./Smt. Sivasankaraiah k working in the capacity of do hereby certify that the sum of Rupess stated above deducted at source and

paid to the credit of the central Government. I further certify that the Information given above is true and correct based on the books of

account, documents and other available records.

Sign--

Place: ZPHS,BOYS,KOTAPALLI,PILER Signature of the person responsible for deduction of tax

Date: Full Name : Sivasankaraiah k;

Programme Developed by S Seshadri - www.apteacher.net, www.ibadi.in mail:sesadri@gmail.com

You might also like

- BIO102 Practice ExamDocument10 pagesBIO102 Practice ExamKathy YuNo ratings yet

- Bohemian Grove Full Member List LEAK 2023Document13 pagesBohemian Grove Full Member List LEAK 2023twisteddick100% (1)

- Compressor Valves and Unloaders For Reciprocating CompressorsDocument19 pagesCompressor Valves and Unloaders For Reciprocating CompressorsGeorge Dom100% (2)

- Form 16 Excel FormatDocument12 pagesForm 16 Excel Formatankeet3No ratings yet

- C - Program Files (x86) - Folklore Payroll - ITReports - FORM16 - FORM16 - 02358756 PDFDocument5 pagesC - Program Files (x86) - Folklore Payroll - ITReports - FORM16 - FORM16 - 02358756 PDFPrudhvi Raj ChowdaryNo ratings yet

- Nihongo Connections-Part 1Document285 pagesNihongo Connections-Part 1Julie BruchNo ratings yet

- IT Form 16 Back - WWW - Ibadi.inDocument1 pageIT Form 16 Back - WWW - Ibadi.inGOKUL HD LIVE EVENTSNo ratings yet

- Form 16 - 2saDocument1 pageForm 16 - 2saNarendra KumarNo ratings yet

- Income Tax Calculation 2023-24 (Old Tax Regime) : Annexure - IiDocument1 pageIncome Tax Calculation 2023-24 (Old Tax Regime) : Annexure - IiGOKUL HD LIVE EVENTSNo ratings yet

- Jammu Kashmir Employee From 16Document6 pagesJammu Kashmir Employee From 16mrnavkhanNo ratings yet

- Income Tax CalculationDocument2 pagesIncome Tax CalculationMadhan Kumar BobbalaNo ratings yet

- B) Excess of Rent Paid Over 10% of Basic+DADocument4 pagesB) Excess of Rent Paid Over 10% of Basic+DAHaresh RajputNo ratings yet

- Periyar University: (NAAC Reaccredited With 'A++' Grade - State University-NIRF Rank 73-ARIIA RANK 10)Document2 pagesPeriyar University: (NAAC Reaccredited With 'A++' Grade - State University-NIRF Rank 73-ARIIA RANK 10)Indumadhi SalemNo ratings yet

- Form 16Document3 pagesForm 16Apte SatishNo ratings yet

- Anticipatory Income Tax Statement 2024-25 (MANJUSHA - 27.01.2024)Document5 pagesAnticipatory Income Tax Statement 2024-25 (MANJUSHA - 27.01.2024)prialiapradeepNo ratings yet

- F0RM NO. 16 (See Rule 31 (1) (A) ) (Annexure-B) : (B) Tax On EmploymentDocument1 pageF0RM NO. 16 (See Rule 31 (1) (A) ) (Annexure-B) : (B) Tax On EmploymentSourabhthakral_1No ratings yet

- Old Scheme: Radhamani K SDocument4 pagesOld Scheme: Radhamani K SSUREMAN FINANCIAL SERVICESNo ratings yet

- IT Statement 20-21Document2 pagesIT Statement 20-21Santhosh KumarNo ratings yet

- Oofits: Qualifying (27 885) U/S 8octo Donation Rounded Off U/S 288A of Tax of DR For AyDocument8 pagesOofits: Qualifying (27 885) U/S 8octo Donation Rounded Off U/S 288A of Tax of DR For AyKushagra BurmanNo ratings yet

- B Praveen 20-21Document2 pagesB Praveen 20-21psyamala2004No ratings yet

- Ecr CHLN Rec GRCDP0043475000 1212204007476 1651122031576 2022042837831576920Document1 pageEcr CHLN Rec GRCDP0043475000 1212204007476 1651122031576 2022042837831576920Shaik BashaNo ratings yet

- Form No. 16: (See Rule 31 (1) (A) )Document5 pagesForm No. 16: (See Rule 31 (1) (A) )amit kr AdhikaryNo ratings yet

- Automated Form 16 FY 10-11Document8 pagesAutomated Form 16 FY 10-11Pranab BanerjeeNo ratings yet

- Form No.16 Aa-1Document2 pagesForm No.16 Aa-1Vishnu Vardhan ANo ratings yet

- Amma Income TaxDocument5 pagesAmma Income Taxraghuraman1511No ratings yet

- Anb Form 16 ITR (Saral II) 2010 ModelDocument7 pagesAnb Form 16 ITR (Saral II) 2010 Modelvanbu1967No ratings yet

- Income Tax Calculator For F.Y 2020 21 A.Y 2021 22 ArthikDishaDocument8 pagesIncome Tax Calculator For F.Y 2020 21 A.Y 2021 22 ArthikDishaGeetanjali BarejaNo ratings yet

- Income Tax Calculator For F.Y 2020 21 A.Y 2021 22 ArthikDishaDocument7 pagesIncome Tax Calculator For F.Y 2020 21 A.Y 2021 22 ArthikDishaSARAVANAN PNo ratings yet

- Ecr CHLN Rec GRCDP0043475000 1212203002720 1646735919520 2022030858119520249Document1 pageEcr CHLN Rec GRCDP0043475000 1212203002720 1646735919520 2022030858119520249Shaik BashaNo ratings yet

- Income Tax Statement For Financial Year 2023-24 (Assessment Year 2024-25)Document1 pageIncome Tax Statement For Financial Year 2023-24 (Assessment Year 2024-25)ikbalbahar1992No ratings yet

- Adobe Scan 19-Jun-2023Document3 pagesAdobe Scan 19-Jun-2023Nirmala DeviNo ratings yet

- Form 16 651746Document4 pagesForm 16 651746Arslan1112No ratings yet

- NitishDocument1 pageNitishkaushikdutta176No ratings yet

- PF Challan Oct 22Document1 pagePF Challan Oct 22M/s, TAPAN ENGINEERING SERVICENo ratings yet

- Income Tax Planner FY 2020-21Document12 pagesIncome Tax Planner FY 2020-21RedNo ratings yet

- Tds 16 NDocument3 pagesTds 16 Nssanju_bhatNo ratings yet

- Details of Salary Paid and Any Other Income and Tax DeductedDocument3 pagesDetails of Salary Paid and Any Other Income and Tax DeductedAYUSH PRADHANNo ratings yet

- ECR CHLN May-2023Document1 pageECR CHLN May-2023Pradeep SaraswatNo ratings yet

- Ecr CHLN Rec GRCDP0075620000 1212207007746 1659013738489 2022072867138490836Document1 pageEcr CHLN Rec GRCDP0075620000 1212207007746 1659013738489 2022072867138490836VS Avilala-2No ratings yet

- Details of Salary Paid and Any Other Income and Tax DeductedDocument3 pagesDetails of Salary Paid and Any Other Income and Tax DeductedRajesh KharmaleNo ratings yet

- T K ArumugamDocument7 pagesT K ArumugamThangamNo ratings yet

- CONVEYANCE Exemption HRA Exemption: 9394 Rs. Rs. 0Document2 pagesCONVEYANCE Exemption HRA Exemption: 9394 Rs. Rs. 0Akshay ShettyNo ratings yet

- IT Calculator 2018 LiteDocument6 pagesIT Calculator 2018 LiteHr PoonamNo ratings yet

- ECR_CHLN_REC_ORBBS2056720000_3602303020287_1680142579049_2023033027979049750Document1 pageECR_CHLN_REC_ORBBS2056720000_3602303020287_1680142579049_2023033027979049750rana1979No ratings yet

- Computation of Toatal IncomeDocument4 pagesComputation of Toatal IncomePRITAM PATRANo ratings yet

- Ecr CHLN Rec Mrnoi1627714000 4372005006244 1589531030815 2020051550030815546 PDFDocument1 pageEcr CHLN Rec Mrnoi1627714000 4372005006244 1589531030815 2020051550030815546 PDFRanjit SamalNo ratings yet

- Praveen B 21-22Document2 pagesPraveen B 21-22psyamala2004No ratings yet

- Ecr CHLN Rec Apkkp1627658000 1282108005089 1628935903507 2021081456503507148Document1 pageEcr CHLN Rec Apkkp1627658000 1282108005089 1628935903507 2021081456503507148Gomathi consultancyNo ratings yet

- ECR - CHLN - REC - Jeet RamDocument1 pageECR - CHLN - REC - Jeet Rampro gamingNo ratings yet

- Res FormDocument1,320 pagesRes FormAnonymous pKsr5vNo ratings yet

- Form16 2982Document3 pagesForm16 2982yogesh magarNo ratings yet

- PART B (Annexure)Document4 pagesPART B (Annexure)AnbarasanNo ratings yet

- July 22 CDocument1 pageJuly 22 CPritam KumarNo ratings yet

- Ecr CHLN Rec Apkkp0068211000 1282310006315 1697285648378 2023101463848378762Document1 pageEcr CHLN Rec Apkkp0068211000 1282310006315 1697285648378 2023101463848378762aravindm1110No ratings yet

- Salary Computation Ass Yr 2017-18Document2 pagesSalary Computation Ass Yr 2017-18CA Kaushik Ranjan GoswamiNo ratings yet

- FORM No. 16: Details of Salary Paid and Any Other Income and Tax DeductedDocument3 pagesFORM No. 16: Details of Salary Paid and Any Other Income and Tax DeductedMadhan Kumar BobbalaNo ratings yet

- Principles of Taxation - DeductionsDocument7 pagesPrinciples of Taxation - Deductions20047 BHAVANDEEP SINGHNo ratings yet

- Developed By-Office Automation Division, IIT Kanpur Page No.1Document2 pagesDeveloped By-Office Automation Division, IIT Kanpur Page No.1Kishan OmarNo ratings yet

- Income Tax Declaration Form FY 22 23 AY 23 24Document2 pagesIncome Tax Declaration Form FY 22 23 AY 23 24Aamer ShaikNo ratings yet

- 2017-18 - Part B - 1Document4 pages2017-18 - Part B - 1getajaykaushalNo ratings yet

- ECR_CHLN_REC_ORBBS2056720000_3602303020286_1680142540038_2023033027940038672Document1 pageECR_CHLN_REC_ORBBS2056720000_3602303020286_1680142540038_2023033027940038672rana1979No ratings yet

- Ecr CHLN Rec CBSLM1565053000 4132106003683 1623491367210 2021061255167210543Document1 pageEcr CHLN Rec CBSLM1565053000 4132106003683 1623491367210 2021061255167210543Kbg ConsultancyNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- Devoir de Synthèse N°1 - Anglais - 2ème Lettres (2019-2020) Mme Rahmeni JamilaDocument5 pagesDevoir de Synthèse N°1 - Anglais - 2ème Lettres (2019-2020) Mme Rahmeni JamilaSassi LassaadNo ratings yet

- Flashcards 2601-2800Document191 pagesFlashcards 2601-2800kkenNo ratings yet

- LSS BB Body of KnowledgeDocument5 pagesLSS BB Body of KnowledgeVigneshNo ratings yet

- Manual DVRDocument73 pagesManual DVRjavriverNo ratings yet

- PAPERSDocument5 pagesPAPERSAlfia AlfiNo ratings yet

- Mill Test A36Document3 pagesMill Test A36Dang TranNo ratings yet

- General Specification For PaintingDocument15 pagesGeneral Specification For PaintingDeddy PratamaNo ratings yet

- Ph0101 Unit 4 Lecture-7: Point Imperfections Line Imperfections Surface Imperfections Volume ImperfectionsDocument41 pagesPh0101 Unit 4 Lecture-7: Point Imperfections Line Imperfections Surface Imperfections Volume Imperfectionskelompok 16No ratings yet

- Fire Awareness PresentationDocument37 pagesFire Awareness Presentationshailu178No ratings yet

- Manuals Ezr Pressure Reducing Regulator Instruction Manual Fisher en en 5916804 PDFDocument40 pagesManuals Ezr Pressure Reducing Regulator Instruction Manual Fisher en en 5916804 PDF商康康(JACK)No ratings yet

- P To P CycleDocument5 pagesP To P CycleJaved AhmadNo ratings yet

- Brain Teasers: GMAT: Problem SolvingDocument5 pagesBrain Teasers: GMAT: Problem SolvingHarsh MalhotraNo ratings yet

- TRIP Moving South Carolina Forward Report September 2021Document21 pagesTRIP Moving South Carolina Forward Report September 2021WMBF NewsNo ratings yet

- Daihatsu Gensets Diesel EngineDocument20 pagesDaihatsu Gensets Diesel Enginexyz1002100% (1)

- 2nd Year Past Keys Hafiz BilalDocument33 pages2nd Year Past Keys Hafiz Bilalsibtainm001No ratings yet

- 500-Piso English Series BanknoteDocument24 pages500-Piso English Series BanknoteSehyoonaa KimNo ratings yet

- Ultrasonic Testing of Materials 155Document1 pageUltrasonic Testing of Materials 155joNo ratings yet

- Prototype TutorialDocument451 pagesPrototype TutorialMariela DemarkNo ratings yet

- A Case Study of Exploiting Data Mining TechniquesDocument8 pagesA Case Study of Exploiting Data Mining TechniquesAdam GraphiandanaNo ratings yet

- @must Read Before InstallDocument3 pages@must Read Before InstallClip ClapsNo ratings yet

- ICOM-CC 2017 Copenhagen 507Document11 pagesICOM-CC 2017 Copenhagen 507Cristi CostinNo ratings yet

- LogDocument706 pagesLogChú BìnhNo ratings yet

- Idea Sub Hackathon 22Document9 pagesIdea Sub Hackathon 22Vaibhav KhatingNo ratings yet

- K-2 Ela-1Document219 pagesK-2 Ela-1Julie SuteraNo ratings yet

- T14 CalculatorDocument5 pagesT14 CalculatorUsamaNo ratings yet

- ELEN 3018 - Macro Test - 2013 - ADocument1 pageELEN 3018 - Macro Test - 2013 - AsirlordbookwormNo ratings yet