Professional Documents

Culture Documents

Foreign Account Tax Compliance Act

Foreign Account Tax Compliance Act

Uploaded by

jerald tanOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Foreign Account Tax Compliance Act

Foreign Account Tax Compliance Act

Uploaded by

jerald tanCopyright:

Available Formats

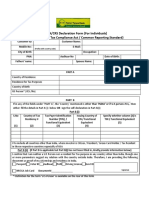

A7 - Foreign AccountTax Compliance Act (FATCA) Due Diligence Form

CIF Number

(for internal use)

I. ON YOUR OBLIGATION TO PAY TAXES TO THE U.S. IRS

I am a U.S. Citizen If ‘Yes’, provide your U.S. SS / TIN Number I hold permanent

resident status in the U.S.

(If ‘Yes’, you must provide a U.S.

address in the next section - ‘US

Indicia’)

I meet the ‘Substantial Presence Test’ as defined by U.S. IRS

II. ON YOUR U.S. INDICIA

I have a U.S. Telephone Number If ‘Yes’, provide your U.S. Telephone Number

I have a U.S. Address If ‘Yes’, provide your U.S. Address and / or P.O. Box Number

Unit No. Building / No. Block. Street Subdivision / District / Town

City State ZIP P.O. Box Number

I have standing instructions for regular transfer of funds to an account in the U.S I have granted a Power of Attorney to a person with a U.S. address

CUSTOMER UNDERTAKING Signature over Printed Name

By signing, I hereby certify that the information in this form is true and correct Date Signed

to the best of my knowledge. I undertake to advise BDO Group and provide (mm / dd / yyyy)

documentation for any changes to the above information.

/ /

BDO Unibank, Inc. is regulated by the Bangko Sentral ng Pilipinas.

Tel. No.: (02) 8708-7087; Email: consumeraffairs@bsp.gov.ph. REVISED AS OF MAY 2022

The BDO, BDO Unibank, and other BDO-related trademarks are owned by BDO Unibank, Inc.

You might also like

- Customer Information Sheet (Individual)Document1 pageCustomer Information Sheet (Individual)Ellehcir DandoNo ratings yet

- BPI Customer Information Sheet 2019Document1 pageBPI Customer Information Sheet 2019Ria de los Santos100% (1)

- Business SignatoryDocument2 pagesBusiness SignatoryYangee PeñaflorNo ratings yet

- PNB Customer Information Form IndividualDocument1 pagePNB Customer Information Form IndividualBrittaney BatoNo ratings yet

- CIT 0001 E Application For A Citizenship Certificate Proof of CitizenshipDocument7 pagesCIT 0001 E Application For A Citizenship Certificate Proof of Citizenshiprogertitle100% (1)

- OCHMarketRentApplication EnglishDocument2 pagesOCHMarketRentApplication EnglishCena JohnNo ratings yet

- Beyonce Knowles-Carter Et Al v. Eleven LLC Complaint PDFDocument96 pagesBeyonce Knowles-Carter Et Al v. Eleven LLC Complaint PDFMark JaffeNo ratings yet

- FATCA Due Diligence Form - PersonalDocument2 pagesFATCA Due Diligence Form - Personalreignchan640No ratings yet

- N 400Document10 pagesN 400joshuayoon100% (1)

- Foreign Account Tax Compliance Act QuestionnaireDocument1 pageForeign Account Tax Compliance Act QuestionnaireHerwin NavarreteNo ratings yet

- Customer Information Sheet (Individual)Document1 pageCustomer Information Sheet (Individual)Dyrla Orcullo TubillaNo ratings yet

- Cit0002e 2Document7 pagesCit0002e 2soran.gulpy1982No ratings yet

- Formulario n4003Document20 pagesFormulario n4003andykam26No ratings yet

- US Internal Revenue Service: f1040c - 1992Document4 pagesUS Internal Revenue Service: f1040c - 1992IRSNo ratings yet

- Nri Customer Updation Form For KycDocument1 pageNri Customer Updation Form For KycBubulNo ratings yet

- Application For Citizenship and Issuance of Certificate Under Section 322Document13 pagesApplication For Citizenship and Issuance of Certificate Under Section 322Julio OrtegaNo ratings yet

- 5.tax Interview Questions Virtual Interview FiverrDocument4 pages5.tax Interview Questions Virtual Interview Fiverrfrantzloppe05No ratings yet

- N 400frco VegaDocument20 pagesN 400frco VegaGiselle LNo ratings yet

- Emp Bus SPC AirportsDocument1 pageEmp Bus SPC AirportsShami MudunkotuwaNo ratings yet

- Fatca Crs Declaration Individuals PDFDocument2 pagesFatca Crs Declaration Individuals PDFfujstructuralNo ratings yet

- Form I-485, Application To Register Permanent Residence or Adjust StatusDocument6 pagesForm I-485, Application To Register Permanent Residence or Adjust StatusAnonymous MMKc1kkPNo ratings yet

- Please Provide Complete Details and Indicate NOT APPLICABLE To Items/sections As Deemed AppropriateDocument1 pagePlease Provide Complete Details and Indicate NOT APPLICABLE To Items/sections As Deemed AppropriateRhys PalmaNo ratings yet

- A. Foreign Account Tax Compliance Act (FATCA) Due Diligence FormDocument1 pageA. Foreign Account Tax Compliance Act (FATCA) Due Diligence FormTin-tin Reyes Jr.No ratings yet

- I-589 CompletoDocument12 pagesI-589 CompletoGrenNe FuenBarNo ratings yet

- Camskra Kyc Application Form-IndividualDocument2 pagesCamskra Kyc Application Form-IndividualN V Sumanth VallabhaneniNo ratings yet

- Msp10861 Hospitalisation Benefit Claim Form 420Document7 pagesMsp10861 Hospitalisation Benefit Claim Form 420Anush VedhNo ratings yet

- New Visa FormDocument1 pageNew Visa Formstorekhan61No ratings yet

- Personal Loan Form Form New To Bdo Client Jul 2022Document6 pagesPersonal Loan Form Form New To Bdo Client Jul 2022Mark BondocNo ratings yet

- FINAL PL Form NewDocument8 pagesFINAL PL Form NewEpifanio Delos SantosNo ratings yet

- Bond Application For IndividualDocument2 pagesBond Application For Individualmatthew domingoNo ratings yet

- Draft NOT FOR Production: Form I-485, Application To Register Permanent Residence or Adjust StatusDocument6 pagesDraft NOT FOR Production: Form I-485, Application To Register Permanent Residence or Adjust StatusSumNo ratings yet

- 4.fatca Self Declaraton Form Individuals PDFDocument2 pages4.fatca Self Declaraton Form Individuals PDFbala krishnanNo ratings yet

- Immigrant Petition by Regional Center Investor: Department of Homeland Security Uscis Form I-526EDocument16 pagesImmigrant Petition by Regional Center Investor: Department of Homeland Security Uscis Form I-526EDarshan pipaliyaNo ratings yet

- Application I 765Document7 pagesApplication I 765Jiuber PinedaNo ratings yet

- US Internal Revenue Service: f13614Document2 pagesUS Internal Revenue Service: f13614IRSNo ratings yet

- Account Details Modification Deletion FormDocument2 pagesAccount Details Modification Deletion Formprabath_tooNo ratings yet

- PPTC 054Document6 pagesPPTC 054paktiksooNo ratings yet

- Account Opening Form For FI 24 08 2014Document1 pageAccount Opening Form For FI 24 08 2014Shyam RoutNo ratings yet

- US Internal Revenue Service: f1040c - 2005Document4 pagesUS Internal Revenue Service: f1040c - 2005IRSNo ratings yet

- I-589 Anotaciones InglésDocument12 pagesI-589 Anotaciones InglésRod Peña Ray100% (1)

- Form I-485, Application To Register Permanent Residence or Adjust StatusDocument6 pagesForm I-485, Application To Register Permanent Residence or Adjust Statusw_tahanNo ratings yet

- U.S. Departing Alien Income Tax ReturnDocument14 pagesU.S. Departing Alien Income Tax ReturnViorel OdajiuNo ratings yet

- Inz1000 PDFDocument32 pagesInz1000 PDFAbisath 0131No ratings yet

- Application N-400-2Document15 pagesApplication N-400-2nicolas lopezNo ratings yet

- Sav 2966Document2 pagesSav 2966Michael100% (1)

- Intake/Interview & Quality Review Sheet: (October 2020) OMB Number 1545-1964Document4 pagesIntake/Interview & Quality Review Sheet: (October 2020) OMB Number 1545-1964va.amazonsellercentralNo ratings yet

- Fillable W-8BEN 2023Document2 pagesFillable W-8BEN 2023marioNo ratings yet

- (A) Insuredperson'S Particulars (B) Employer'S ParticularsDocument2 pages(A) Insuredperson'S Particulars (B) Employer'S Particularsraziqkhan0078129No ratings yet

- IRS fw7Document8 pagesIRS fw7Victor IkeNo ratings yet

- Application For Employment AuthorizationDocument7 pagesApplication For Employment AuthorizationTatiana SuarezNo ratings yet

- Banking App FormDocument20 pagesBanking App Formjustin.toddNo ratings yet

- Form - 13 (A2Z)Document2 pagesForm - 13 (A2Z)daskuntal2285No ratings yet

- Form I-134, Affidavit of Support: Residing atDocument2 pagesForm I-134, Affidavit of Support: Residing atCrissy caveNo ratings yet

- Statement Regarding Marriage: SSA-753 (07-2015) Uf (07-2015)Document3 pagesStatement Regarding Marriage: SSA-753 (07-2015) Uf (07-2015)raex_innoNo ratings yet

- Ds 157Document5 pagesDs 157TORAJ INTEAASHI RCBSNo ratings yet

- The Secret To Getting Your K-1 (Fіаnсé) Visa Approved: Step By Step Guide With Legal TipsFrom EverandThe Secret To Getting Your K-1 (Fіаnсé) Visa Approved: Step By Step Guide With Legal TipsNo ratings yet

- US Immigration Exam Study Guide in English and Albanian: Study Guides for the US Immigration TestFrom EverandUS Immigration Exam Study Guide in English and Albanian: Study Guides for the US Immigration TestNo ratings yet

- Immigration and Family Law: An Attorney's Toolbox of Best PracticesFrom EverandImmigration and Family Law: An Attorney's Toolbox of Best PracticesNo ratings yet

- Administration of JusticeDocument8 pagesAdministration of JusticeWasif SajjadNo ratings yet

- BFSI RFP 21122020 FinalDocument43 pagesBFSI RFP 21122020 FinalSEED GLOBALNo ratings yet

- IndictmentDocument2 pagesIndictmentCBS Austin WebteamNo ratings yet

- 7 - Alex Ferrer Vs NLRCDocument6 pages7 - Alex Ferrer Vs NLRCMaan VillarNo ratings yet

- Tugas Analisis Jurnal Legal DraftingDocument17 pagesTugas Analisis Jurnal Legal DraftingKadek DharmaNo ratings yet

- Solar Harvest, Inc. v. Davao Corrugated Carton CorporationDocument3 pagesSolar Harvest, Inc. v. Davao Corrugated Carton CorporationNaiza Mae R. BinayaoNo ratings yet

- Reyes-Mesugas v. ReyesDocument2 pagesReyes-Mesugas v. ReyesMaegan Labor INo ratings yet

- LTD Cases 5Document60 pagesLTD Cases 5Jalieca Lumbria GadongNo ratings yet

- Code of Criminal ProcedureDocument1,236 pagesCode of Criminal ProcedureGlen C. ChadwickNo ratings yet

- Flagpole Regulations: Zoning Districts SizeDocument1 pageFlagpole Regulations: Zoning Districts SizeHossam SeifNo ratings yet

- People Vs FabreDocument13 pagesPeople Vs FabreBo DistNo ratings yet

- Dakotah Earley LawsuitDocument13 pagesDakotah Earley LawsuitTodd Feurer100% (1)

- ILLEGAL RECRUITMENT CASES v2Document110 pagesILLEGAL RECRUITMENT CASES v2chela capiralNo ratings yet

- Government Contracts Session 6Document55 pagesGovernment Contracts Session 6Floyd MagoNo ratings yet

- Booster BylawsDocument11 pagesBooster Bylawsapi-418226967No ratings yet

- Central Bank of The Philippines v. CA (1992)Document2 pagesCentral Bank of The Philippines v. CA (1992)Masterbolero100% (1)

- Cagayan Fishing v. SandikoDocument1 pageCagayan Fishing v. Sandikomkab100% (1)

- Geronimo v. Pascual-AnswerDocument2 pagesGeronimo v. Pascual-AnswerAnna AbadNo ratings yet

- Assignment of NGo EmergenceDocument13 pagesAssignment of NGo EmergencesakibulNo ratings yet

- Cornelius Maple, Jr. v. Patricia Herron, Judge, Cleveland County Larry A. Fields Cory Flowers The Oklahoma Legislature, 56 F.3d 77, 10th Cir. (1995)Document2 pagesCornelius Maple, Jr. v. Patricia Herron, Judge, Cleveland County Larry A. Fields Cory Flowers The Oklahoma Legislature, 56 F.3d 77, 10th Cir. (1995)Scribd Government DocsNo ratings yet

- Edooni Service AgreementDocument8 pagesEdooni Service AgreementKeshav AgarwalNo ratings yet

- David Vs ArroyoDocument5 pagesDavid Vs ArroyoCarl IlaganNo ratings yet

- Leadership Style of Raul RocoDocument25 pagesLeadership Style of Raul RocoRadee King CorpuzNo ratings yet

- 3 Branches of Philippine GovernmentDocument3 pages3 Branches of Philippine GovernmentEnzo Ivan TILANDOCANo ratings yet

- Andhra Pradesh Registration of Horticulture Nurseries (Regulation) Act, PDFDocument17 pagesAndhra Pradesh Registration of Horticulture Nurseries (Regulation) Act, PDFLatest Laws TeamNo ratings yet

- Aleatory ContractsDocument3 pagesAleatory ContractsIvanna BasteNo ratings yet

- Clemency Power of President: QuestionsDocument3 pagesClemency Power of President: QuestionsDavid JobesNo ratings yet

- Heirs of Ureta vs. Heirs of UretaDocument6 pagesHeirs of Ureta vs. Heirs of UretaMae Anne PioquintoNo ratings yet

- United States v. Kevin McRae, 4th Cir. (2013)Document4 pagesUnited States v. Kevin McRae, 4th Cir. (2013)Scribd Government DocsNo ratings yet