Professional Documents

Culture Documents

IDirect AtulAuto CoUpdate Apr22

IDirect AtulAuto CoUpdate Apr22

Uploaded by

darshanmadeOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

IDirect AtulAuto CoUpdate Apr22

IDirect AtulAuto CoUpdate Apr22

Uploaded by

darshanmadeCopyright:

Available Formats

Atul Auto (ATUAUT)

CMP: | 175 Target: | 210 (20%) Target Period: 12 months BUY

April 5, 2022

Light to emerge at end of tunnel, unlock beneficiary…

About the stock: Atul Auto (AAL) is a prominent 3-W manufacturer based out of

Company Update

Gujarat with broad-based presence across segments and fuel types. Particulars

Fourth largest 3-W player with FY21 domestic market share at 7.1% (10.3% Particulars Amount

Market capitalisation (₹ crore) 384.0

in cargo segment and 5.1% in passenger segment)

Total Debt (FY21, ₹ crore) 15.0

History of healthy capital efficiency as well as positive cash flow generation Cash & Inv. (FY21, ₹ crore) 19.0

EV (₹ crore) 379.9

52 week H/L (₹) 270 / 146

Equity capital (₹ crore) 11.0

Q3FY22 Results: The company posted dismal Q3FY22 results.

Face value (₹) 5.0

Revenues rose 14% QoQ to | 91.3 crore amid 12.5% volume growth to Shareholding pattern

5,168 units and 2% ASP increase to | 1.76 lakhs/unit Mar'21 Jun'21 Sep'21 Dec'21

Margins came in negative at -8%, down 235 bps QoQ Promoter 52.7 52.7 52.7 52.7

DII 5.9 2.4 0.6 0.5

Consequent loss was at | 8.5 crore FII 1.4 - 0.0 0.2

Others 40.0 44.9 46.7 46.6

Price Chart

What should investors do? AAL’s share price has de-grown at ~18% CAGR from 20000 400

~| 470 in April 2017, heavily underperforming the Nifty Auto index in that time. 15000 300

ICICI Securities – Retail Equity Research

10000 200

We retain our BUY rating on AAL tracking impending launch in the EV space

5000 100

and believe the company to benefit from reopening of schools and colleges

0 0

Target Price and Valuation: We value AAL at revised target price of | 210 i.e. 20x

Oct-19

Oct-20

Oct-21

Apr-19

Apr-20

Apr-21

Apr-22

P/E on FY24E core auto business and 1.3x P/B to investment in subsidiaries

Nifty (LHS) AAL (RHS)

Key triggers for future price performance: Recent event & key risks

Posted muted Q3FY22 results

We build ~19%, ~22% volume, revenue CAGR, respectively, in FY21-24E

on depleted base aided by economy re-opening, easing of 3-W financing Key Risk: (i) Softer than

worries anticipated 3-W recovery over

Introduction of own lithium ion 3-W offering would be key to combat FY22E-24E, (ii) delay in own EV

technological disruption in the space product launch in 3-W space

Post loss at PAT (FY21-22E), AAL is seen clocking ~| 19 crore PAT by FY24E

Research Analyst

Higher utilisation to spur margins, RoCE to ~8% levels by FY24E

Shashank Kanodia, CFA

shashank.kanodia@icicisecurities.com

Raghvendra Goyal

Alternate Stock Idea: Besides AAL, in our coverage we like Tata Motors raghvendra.goyal@icicisecurities.com

Long term value drivers (EV transition, deleveraging & FCF focus) intact

BUY with target price of | 550

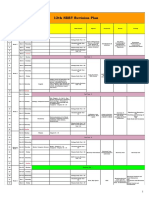

Key Financial Summary

5 year CAGR 3 year CAGR

Key Financials (₹ crore) FY19 FY20 FY21 FY22E FY23E FY24E

(FY16-21) (FY21-24E)

Total Operating Income 666.8 625.3 295.9 -11.0% 292.2 453.7 534.2 21.8%

EBITDA 81.5 71.3 (7.6) PL (24.4) 18.1 40.1 LP

EBITDA Margins (%) 12.2 11.4 (2.6) (8.3) 4.0 7.5

Net Profit 53.1 52.4 (10.2) PL (26.7) 1.3 18.5 LP

EPS (₹) 24.2 23.9 (4.6) (12.2) 0.6 8.4

P/E 7.2 7.3 NM NM NM 20.7

RoNW (%) 20.5 17.3 (3.5) (10.0) 0.5 6.5

RoCE (%) 28.8 21.1 (4.6) (9.8) 1.6 7.7

Source: Company, ICICI Direct Research

Company Update | Atul Auto ICICI Direct Research

Financial story in charts

Exhibit 1: Topline and margin trend

700 15.0

600 11.4

10.0

500 7.5

5.0 We expect sales to grow at a CAGR of ~22% over

₹ crore

400 4.0

FY21-24E backed by ~19.4% volume CAGR, albeit

%

300 on low base. With operating leverage at play,

-

EBITDA margins are seen improving to 7.5% by FY24

200 (2.6)

(5.0)

100

625

296

292

454

534

(8.3)

- (10.0)

FY20 FY21 FY22E FY23E FY24E

Total Operating Income EBITDA margins RHS)

Source: Company, ICICI Direct Research

Exhibit 2: Trend in PAT and EPS

60 30.0

50 25.0

23.9

40 20.0

30

15.0

20 With loss expectation for FY22E, we expect the

₹ crore

10.0

10 8.4 company to just breakeven at PAT level in FY23E and

₹

19

52

5.0 thereafter clock meaningful PAT in FY24E

-

0.6 -

(10)

(27)

(10)

(20) (4.6) (5.0)

(30) (10.0)

(12.2)

(40) (15.0)

FY20 FY21 FY22E FY23E FY24E

PAT EPS (RHS)

Source: Company, ICICI Direct Research

Exhibit 3: Valuation Summary

Sales Grow th EPS Grow th PE EV/EBITDA RoNW RoCE

(₹ crore) (% ) (₹) (% ) (x ) (x ) (% ) (% )

FY20 625.3 (6.2) 23.9 (1.4) 7.3 5.4 17.3 21.1

FY21 295.9 (52.7) (4.6) NM NM -49.9 (3.5) (4.6)

FY22E 292.2 (1.2) (12.2) NM NM -18.9 (10.0) (9.8)

FY23E 453.7 55.3 0.6 NM NM 25.4 0.5 1.6

FY24E 534.2 17.7 8.4 NM 20.7 10.9 6.5 7.7

Source: Company, ICICI Direct Research

Exhibit 4: SoTP (target price) table

Particulars Amount

FY24E PAT (₹ crore) 18.5

PE Multiple (x) 20.0

Core Auto Business Equity Value (₹ crore) 370.5

Long Term Investments (WoS, ₹ crore) 68.9

P/B Multiple (x) 1.3

Subsidiaries Value (₹ crore) 89.6

Total Equity Value (₹ crore) 460.1

No of Share (crore) 2.2

Target Price (₹/share) 210

Source: ICICI Direct Research

ICICI Securities | Retail Research 2

Company Update | Atul Auto ICICI Direct Research

Financial Summary

Exhibit 5: Profit and loss statement | crore Exhibit 6: Cash flow statement | crore

(Year-end March) FY21 FY22E FY23E FY24E (Year-end March) FY21 FY22E FY23E FY24E

Net Sales 290.3 284.2 444.9 524.5 Profit after Tax -10.2 -26.7 1.3 18.5

Other Operating Income 5.6 8.1 8.9 9.7 Add: Depreciation 6.6 9.6 12.7 13.4

Total Operating Income 295.9 292.2 453.7 534.2 (Inc)/dec in Current Assets 42.2 -1.0 -44.4 -24.1

Growth (%) -55.6 -1.2 55.3 17.7 Inc/(dec) in CL and Provisions 3.1 2.6 40.8 20.3

Raw Material Expenses 239.2 240.3 353.9 411.3 Others -1.0 1.4 3.7 1.9

Employee Expenses 37.7 41.4 45.4 50.8 CF from operating activities 40.6 -14.0 14.1 30.0

Other Operating Expense 26.6 35.0 36.3 32.1 (Inc)/dec in Investments -14.9 -35.0 -5.0 0.0

Total Operating Expenditure 303.5 316.6 435.6 494.1 (Inc)/dec in Fixed Assets -35.1 -20.0 -5.0 -5.0

EBITDA -7.6 -24.4 18.1 40.1 Others 1.1 2.2 2.7 2.9

Growth (%) -109.4 219.9 -174.4 120.7 CF from investing activities -48.8 -52.8 -7.3 -2.1

Depreciation 6.6 9.6 12.7 13.4 Issue/(Buy back) of Equity 0.0 0.0 0.0 0.0

Interest 0.9 4.0 6.4 4.8 Inc/(dec) in loan funds 15.0 65.0 0.0 -20.0

Other Income 1.9 2.6 2.7 2.9 Interest and Dividend outgo -0.9 -4.0 -6.4 -4.8

PBT -13.2 -35.4 1.8 24.8 Inc/(dec) in Share Cap 0.0 0.0 0.0 0.0

Excep. charge & P/L from Asso. 0.0 0.0 0.0 0.0 Others -0.2 0.0 0.0 0.0

Total Tax -3.0 -8.8 0.4 6.2 CF from financing activities 13.9 61.0 -6.4 -24.8

PAT -10.2 -26.7 1.3 18.5 Net Cash flow 6.2 -5.8 0.4 3.1

Growth (%) -119.2 161.4 -105.0 1,299.8 Opening Cash 2.4 8.5 2.7 3.2

EPS (₹) -4.6 -12.2 0.6 8.4 Closing Cash 8.5 2.7 3.2 6.3

Source: Company, ICICI Direct Research Source: Company, ICICI Direct Research

Exhibit 7: Balance Sheet | crore Exhibit 8: Key ratios

(Year-end March) FY21 FY22E FY23E FY24E (Year-end March) FY21 FY22E FY23E FY24E

Liabilities Per share data (₹)

Equity Capital 11.0 11.0 11.0 11.0 EPS -4.6 -12.2 0.6 8.4

Reserve and Surplus 282.3 255.6 256.9 275.4 Cash EPS -1.7 -7.8 6.4 14.5

Total Shareholders funds 293.2 266.6 267.9 286.4 BV 133.7 121.5 122.1 130.5

Total Debt 15.0 80.0 80.0 60.0 DPS 0.0 0.0 0.0 0.0

Deferred Tax Liability 0.4 0.4 0.4 0.4 Cash Per Share (Incl Invst) 8.7 1.5 1.7 3.1

Minority Interest / Others 0.7 0.3 0.3 0.3 Operating Ratios (% )

Total Liabilities 309.3 347.2 348.5 347.1 EBITDA Margin -2.6 -8.3 4.0 7.5

Assets PAT Margin -3.4 -9.1 0.3 3.5

Gross Block 153.7 302.2 317.2 327.2 Inventory days 63.1 65.0 50.0 50.0

Less: Acc Depreciation 64.4 74.0 86.7 100.1 Debtor days 29.3 30.0 40.0 40.0

Net Block 89.4 228.2 230.5 227.2 Creditor days 59.3 60.0 60.0 60.0

Capital WIP 148.5 20.0 10.0 5.0 Return Ratios (% )

Total Fix ed Assets 237.9 248.2 240.5 232.2 RoE -3.5 -10.0 0.5 6.5

Investments & Goodwill 29.8 64.8 69.8 69.8 RoCE -4.6 -9.8 1.6 7.7

Inventory 51.1 52.0 62.2 73.2 RoIC -10.0 -10.5 1.6 8.0

Debtors 23.7 24.0 49.7 58.5 Valuation Ratios (x )

Loans and Advances 9.7 9.6 14.9 17.5 P/E -37.6 -14.4 290.1 20.7

Other Current Assets 6.0 5.9 9.2 10.8 EV / EBITDA -49.9 -18.9 25.4 10.9

Cash 8.5 2.7 3.2 6.3 EV / Net Sales 1.3 1.6 1.0 0.8

Total Current Assets 99.1 94.3 139.1 166.3 Market Cap / Sales 1.3 1.3 0.8 0.7

Current Liabilities 67.3 69.9 108.4 127.6 Price to Book Value 1.3 1.4 1.4 1.3

Provisions 4.2 4.1 6.4 7.6 Solvency Ratios

Current Liabilities & Prov 71.4 74.1 114.9 135.2 Debt/EBITDA -2.0 -3.3 4.4 1.5

Net Current Assets 27.6 20.2 24.2 31.1 Debt / Equity 0.1 0.3 0.3 0.2

Others Assets 14.0 14.0 14.0 14.0 Current Ratio 1.7 1.7 1.7 1.7

Application of Funds 309.3 347.2 348.5 347.1 Quick Ratio 0.8 0.8 0.9 0.9

Source: Company, ICICI Direct Research Source: Company, ICICI Direct Research

ICICI Securities | Retail Research 3

Company Update | Atul Auto ICICI Direct Research

RATING RATIONALE

ICICI Direct endeavors to provide objective opinions and recommendations. ICICI Direct assigns ratings to its

stocks according -to their notional target price vs. current market price and then categorizes them as Buy, Hold,

Reduce and Sell. The performance horizon is two years unless specified and the notional target price is defined

as the analysts' valuation for a stock

Buy: >15%

Hold: -5% to 15%;

Reduce: -15% to -5%;

Sell: <-15%

Pankaj Pandey Head – Research pankaj.pandey@icicisecurities.com

ICICI Direct Research Desk,

ICICI Securities Limited,

1st Floor, Akruti Trade Centre,

Road No 7, MIDC,

Andheri (East)

Mumbai – 400 093

research@icicidirect.com

ICICI Securities | Retail Research 4

Company Update | Atul Auto ICICI Direct Research

ANALYST CERTIFICATION

I/We, Shashank Kanodia, CFA, MBA (Capital Markets), and Raghvendra Goyal, CA, Research Analysts, authors and the names subscribed to this report, hereby certify that all of the views expressed in this research report accurately

reflect our views about the subject issuer(s) or securities. We also certify that no part of our compensation was, is, or will be directly or indirectly related to the specific recommendation(s) or view(s) in this report. It is also confirmed

that above mentioned Analysts of this report have not received any compensation from the companies mentioned in the report in the preceding twelve months and do not serve as an officer, director or employee of the companies

mentioned in the report.

Terms & conditions and other disclosures:

ICICI Securities Limited (ICICI Securities) is a full-service, integrated investment banking and is, inter alia, engaged in the business of stock brokering and distribution of financial products.

ICICI Securities is Sebi registered stock broker, merchant banker, investment adviser, portfolio manager and Research Analyst. ICICI Securities is registered with Insurance Regulatory Development Authority of India Limited (IRDAI)

as a composite corporate agent and with PFRDA as a Point of Presence. ICICI Securities Limited Research Analyst SEBI Registration Number – INH000000990. ICICI Securities Limited SEBI Registration is INZ000183631 for stock

broker. ICICI Securities is a subsidiary of ICICI Bank which is India’s largest private sector bank and has its various subsidiaries engaged in businesses of housing finance, asset management, life insurance, general insurance, venture

capital fund management, etc. (“associates”), the details in respect of which are available on www.icicibank.com.

ICICI Securities is one of the leading merchant bankers/ underwriters of securities and participate in virtually all securities trading markets in India. We and our associates might have investment banking and other business relationship

with a significant percentage of companies covered by our Investment Research Department. ICICI Securities and its analysts, persons reporting to analysts and their relatives are generally prohibited from maintaining a financial

interest in the securities or derivatives of any companies that the analysts cover.

Recommendation in reports based on technical and derivative analysis centre on studying charts of a stock's price movement, outstanding positions, trading volume etc as opposed to focusing on a company's fundamentals and, as

such, may not match with the recommendation in fundamental reports. Investors may visit icicidirect.com to view the Fundamental and Technical Research Reports.

Our proprietary trading and investment businesses may make investment decisions that are inconsistent with the recommendations expressed herein.

ICICI Securities Limited has two independent equity research groups: Institutional Research and Retail Research. This report has been prepared by the Retail Research. The views and opinions expressed in this document may or may

not match or may be contrary with the views, estimates, rating, and target price of the Institutional Research.

The information and opinions in this report have been prepared by ICICI Securities and are subject to change without any notice. The report and information contained herein is strictly confidential and meant solely for the selected

recipient and may not be altered in any way, transmitted to, copied or distributed, in part or in whole, to any other person or to the media or reproduced in any form, without prior written consent of ICICI Securities. While we would

endeavour to update the information herein on a reasonable basis, ICICI Securities is under no obligation to update or keep the information current. Also, there may be regulatory, compliance or other reasons that may prevent ICICI

Securities from doing so. Non-rated securities indicate that rating on a particular security has been suspended temporarily and such suspension is in compliance with applicable regulations and/or ICICI Securities policies, in

circumstances where ICICI Securities might be acting in an advisory capacity to this company, or in certain other circumstances.

This report is based on information obtained from public sources and sources believed to be reliable, but no independent verification has been made nor is its accuracy or completeness guaranteed. This report and information herein

is solely for informational purpose and shall not be used or considered as an offer document or solicitation of offer to buy or sell or subscribe for securities or other financial instruments. Though disseminated to all the customers

simultaneously, not all customers may receive this report at the same time. ICICI Securities will not treat recipients as customers by virtue of their receiving this report. Nothing in this report constitutes investment, legal, accounting

and tax advice or a representation that any investment or strategy is suitable or appropriate to your specific circumstances. The securities discussed and opinions expressed in this report may not be suitable for all investors, who

must make their own investment decisions, based on their own investment objectives, financial positions and needs of specific recipient. This may not be taken in substitution for the exercise of independent judgment by any recipient.

The recipient should independently evaluate the investment risks. The value and return on investment may vary because of changes in interest rates, foreign exchange rates or any other reason. ICICI Securities accepts no liabilities

whatsoever for any loss or damage of any kind arising out of the use of this report. Past performance is not necessarily a guide to future performance. Investors are advised to see Risk Disclosure Document to understand the risks

associated before investing in the securities markets. Actual results may differ materially from those set forth in projections. Forward-looking statements are not predictions and may be subject to change without notice.

ICICI Securities or its associates might have managed or co-managed public offering of securities for the subject company or might have been mandated by the subject company for any other assignment in the past twelve months.

ICICI Securities or its associates might have received any compensation from the companies mentioned in the report during the period preceding twelve months from the date of this report for services in respect of managing or co-

managing public offerings, corporate finance, investment banking or merchant banking, brokerage services or other advisory service in a merger or specific transaction.

ICICI Securities or its associates might have received any compensation for products or services other than investment banking or merchant banking or brokerage services from the companies mentioned in the report in the past twelve

months.

ICICI Securities encourages independence in research report preparation and strives to minimize conflict in preparation of research report. ICICI Securities or its associates or its analysts did not receive any compensation or other

benefits from the companies mentioned in the report or third party in connection with preparation of the research report. Accordingly, neither ICICI Securities nor Research Analysts and their relatives have any material conflict of

interest at the time of publication of this report.

Compensation of our Research Analysts is not based on any specific merchant banking, investment banking or brokerage service transactions.

ICICI Securities or its subsidiaries collectively or Research Analysts or their relatives do not own 1% or more of the equity securities of the Company mentioned in the report as of the last day of the month preceding the publication of

the research report.

Since associates of ICICI Securities and ICICI Securities as a entity are engaged in various financial service businesses, they might have financial interests or actual/ beneficial ownership of one percent or more or other material conflict

of interest various companies including the subject company/companies mentioned in this report.

ICICI Securities may have issued other reports that are inconsistent with and reach different conclusion from the information presented in this report.

Neither the Research Analysts nor ICICI Securities have been engaged in market making activity for the companies mentioned in the report.

We submit that no material disciplinary action has been taken on ICICI Securities by any Regulatory Authority impacting Equity Research Analysis activities.

This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction, where such distribution, publication, availability or use

would be contrary to law, regulation or which would subject ICICI Securities and affiliates to any registration or licensing requirement within such jurisdiction. The securities described herein may or may not be eligible for sale in all

jurisdictions or to certain category of investors. Persons in whose possession this document may come are required to inform themselves of and to observe such restriction.

ICICI Securities | Retail Research 5

You might also like

- Ch16 Beams12ge SMDocument46 pagesCh16 Beams12ge SMverlyarin81% (16)

- Pop - A Aj GowerDocument2 pagesPop - A Aj GowerScavat NgwaneNo ratings yet

- The Boston Globe 11-2021Document158 pagesThe Boston Globe 11-2021kapap lotar00No ratings yet

- Texas Instruments Inc.: NSM Acquisition: Buying Analog, Sending Mixed Signals To InvestorsDocument11 pagesTexas Instruments Inc.: NSM Acquisition: Buying Analog, Sending Mixed Signals To Investorsnate_dawg2No ratings yet

- US Equity Research: Quantifying Euro ExposureDocument56 pagesUS Equity Research: Quantifying Euro Exposurebenjaminz1No ratings yet

- Loccitane QuestionsDocument2 pagesLoccitane QuestionsMarat SafarliNo ratings yet

- Reliance Industries LTDDocument17 pagesReliance Industries LTDShArp ,No ratings yet

- Angel One Q4FY22 ResultsDocument6 pagesAngel One Q4FY22 ResultsdarshanmadeNo ratings yet

- Morning Pack: Regional EquitiesDocument59 pagesMorning Pack: Regional Equitiesmega_richNo ratings yet

- Mindtree-Q4FY22 MOFSLDocument12 pagesMindtree-Q4FY22 MOFSLdarshanmadeNo ratings yet

- Industrial OutputDocument7 pagesIndustrial OutputAishwarya Mani KachhalNo ratings yet

- BUY Bank of India: Performance HighlightsDocument12 pagesBUY Bank of India: Performance Highlightsashish10mca9394No ratings yet

- Equitas Small Finance Bank: BanksDocument16 pagesEquitas Small Finance Bank: BanksS UDAY KUMARNo ratings yet

- Wired Weekly: Singapore Traders SpectrumDocument13 pagesWired Weekly: Singapore Traders SpectrumInvest StockNo ratings yet

- Macro 1Document107 pagesMacro 1ChangeBunnyNo ratings yet

- Financial Statement Analysis and Security Valuation: - October 19, 2022 Arnt VerriestDocument62 pagesFinancial Statement Analysis and Security Valuation: - October 19, 2022 Arnt VerriestfelipeNo ratings yet

- JP Morgan Equity Strategy August 2010Document90 pagesJP Morgan Equity Strategy August 2010alan_s1No ratings yet

- VCB - JP MorganDocument23 pagesVCB - JP MorganNam Phuong DangNo ratings yet

- HDFC Life - 1QFY20 Result - SharekhanDocument7 pagesHDFC Life - 1QFY20 Result - SharekhandarshanmadeNo ratings yet

- 12 NEET Revision PlanDocument2 pages12 NEET Revision Planrohith kannanNo ratings yet

- 2013-3-22 SREITs Roundup 2203131Document12 pages2013-3-22 SREITs Roundup 2203131phuawlNo ratings yet

- Best Ideas 10.3Document65 pagesBest Ideas 10.3Mallory WeilNo ratings yet

- Fixed Income StrategyDocument29 pagesFixed Income StrategyBryan ComandiniNo ratings yet

- 2007-01-18 Early Defaults Rise in Mortgage Securitization (Moody's Special Report)Document6 pages2007-01-18 Early Defaults Rise in Mortgage Securitization (Moody's Special Report)priak11No ratings yet

- Asean Strategy - JPM PDFDocument19 pagesAsean Strategy - JPM PDFRizkyAufaSNo ratings yet

- Fixed Income Asset AllocationDocument42 pagesFixed Income Asset AllocationCynric HuangNo ratings yet

- CACIB - FAST FX Model 20230206Document7 pagesCACIB - FAST FX Model 20230206G.Trading.FxNo ratings yet

- ACB - JP MorganDocument23 pagesACB - JP MorganNam Phuong DangNo ratings yet

- 2010 May - Morning Pack (DBS Group) For Asian StocksDocument62 pages2010 May - Morning Pack (DBS Group) For Asian StocksShipforNo ratings yet

- Mark-To-Actual Revision of Lower Provision, But Headwind Trend RemainsDocument11 pagesMark-To-Actual Revision of Lower Provision, But Headwind Trend RemainsbodaiNo ratings yet

- Action Note: Champion Iron LTDDocument10 pagesAction Note: Champion Iron LTDForexliveNo ratings yet

- Goldman SachsDocument20 pagesGoldman SachsViet HoangNo ratings yet

- HSC - VNM ReportDocument23 pagesHSC - VNM ReportTrưởng Vũ NhưNo ratings yet

- Britannia Equity ResearchDocument11 pagesBritannia Equity ResearchVaibhav BajpaiNo ratings yet

- 2019 Themes Strategy En-2Document44 pages2019 Themes Strategy En-2Yahia Mohammed AbdelatifNo ratings yet

- Indian Hotel JPMDocument25 pagesIndian Hotel JPMViet VuNo ratings yet

- Infosys: Growth Certainty On Explosive Deal WinsDocument2 pagesInfosys: Growth Certainty On Explosive Deal Winsmehrotraanand016912No ratings yet

- TCW Upgrade NationalDocument7 pagesTCW Upgrade NationalForexliveNo ratings yet

- Trading Strateg: April 2022 Pension Fund Rebalancing EstimatesDocument2 pagesTrading Strateg: April 2022 Pension Fund Rebalancing EstimatessirdquantsNo ratings yet

- Macro Lecture08Document64 pagesMacro Lecture08Lê Văn KhánhNo ratings yet

- Lupin Initiating Coverage Nov'091Document44 pagesLupin Initiating Coverage Nov'091api-19978586No ratings yet

- Private Equity Overview and Vulnerabilities L. Grillet Aubert enDocument92 pagesPrivate Equity Overview and Vulnerabilities L. Grillet Aubert enjessicagomez815No ratings yet

- Whitney R. Tilson and Glenn H. TongueDocument13 pagesWhitney R. Tilson and Glenn H. Tonguefarnamstreet100% (1)

- Fed To Eventually Remove The Punch Bowl: Global FX WeeklyDocument28 pagesFed To Eventually Remove The Punch Bowl: Global FX Weeklygerrich rusNo ratings yet

- Economic Outlook ": Empowering The Indonesian Economy For Stronger Recovery"Document23 pagesEconomic Outlook ": Empowering The Indonesian Economy For Stronger Recovery"fadjaradNo ratings yet

- Cacib FX DailyDocument5 pagesCacib FX DailyNova AnnuristianNo ratings yet

- CS - FX Compass Looking For Cracks 20230131Document10 pagesCS - FX Compass Looking For Cracks 20230131G.Trading.FxNo ratings yet

- Initiation - Comment Seadrill Limited: Initiating Coverage of SeadrillDocument25 pagesInitiation - Comment Seadrill Limited: Initiating Coverage of SeadrillocrandallNo ratings yet

- Key Trades and Risks August 2010Document97 pagesKey Trades and Risks August 2010Johanes Indra P. PaoNo ratings yet

- CEAT Annual Report 2019Document5 pagesCEAT Annual Report 2019Roberto GrilliNo ratings yet

- Equity Variance Swaps With Dividends OpenGammaDocument13 pagesEquity Variance Swaps With Dividends OpenGammamshchetkNo ratings yet

- TQU 7th AprilDocument12 pagesTQU 7th AprilnarnoliaNo ratings yet

- Havells India LTD (HAVL) PDFDocument5 pagesHavells India LTD (HAVL) PDFViju K GNo ratings yet

- Lecture 6 - OBS and Sovereign RisksDocument46 pagesLecture 6 - OBS and Sovereign RisksPhan ChiNo ratings yet

- ABFRL Ambit Oct16 PDFDocument33 pagesABFRL Ambit Oct16 PDFDoshi VaibhavNo ratings yet

- Global Money Notes #18Document14 pagesGlobal Money Notes #18lerhlerh100% (1)

- Nordea TaaDocument25 pagesNordea Taaintel74No ratings yet

- Riffing On Risk: Brent DonnellyDocument7 pagesRiffing On Risk: Brent DonnellyAlvinNo ratings yet

- Barclays - Global Economics Weekly PDFDocument44 pagesBarclays - Global Economics Weekly PDFRishabh VakhariaNo ratings yet

- Mahindra & Mahindra: (Mahmah)Document10 pagesMahindra & Mahindra: (Mahmah)Ashwet JadhavNo ratings yet

- IDirect Berger Q2FY23Document9 pagesIDirect Berger Q2FY23Rutuparna mohantyNo ratings yet

- Pricol - CU-IDirect-Mar 3, 2022Document6 pagesPricol - CU-IDirect-Mar 3, 2022rajesh katareNo ratings yet

- Piramal Enterprises - MOStDocument8 pagesPiramal Enterprises - MOStdarshanmadeNo ratings yet

- Mindtree-Q4FY22 MOFSLDocument12 pagesMindtree-Q4FY22 MOFSLdarshanmadeNo ratings yet

- ITC by EdelweissDocument9 pagesITC by EdelweissdarshanmadeNo ratings yet

- GAIL (India) Limited: Strong Show Led by Gas TradingDocument6 pagesGAIL (India) Limited: Strong Show Led by Gas TradingdarshanmadeNo ratings yet

- Agri Inputs: Resurgent Monsoon (0% Deficit) Bodes Well For Agrochemical CompaniesDocument13 pagesAgri Inputs: Resurgent Monsoon (0% Deficit) Bodes Well For Agrochemical CompaniesdarshanmadeNo ratings yet

- Agrochem PCDocument6 pagesAgrochem PCdarshanmadeNo ratings yet

- HDFC Life - 1QFY20 Result - SharekhanDocument7 pagesHDFC Life - 1QFY20 Result - SharekhandarshanmadeNo ratings yet

- Moil 20nov19 Kotak PCG 00153Document7 pagesMoil 20nov19 Kotak PCG 00153darshanmadeNo ratings yet

- Delivers Healthy Performance: Sector: Agri Chem Result UpdateDocument6 pagesDelivers Healthy Performance: Sector: Agri Chem Result UpdatedarshanmadeNo ratings yet

- Mahanagar Gas - 3QFY20 Result - BOBCAPS Research PDFDocument10 pagesMahanagar Gas - 3QFY20 Result - BOBCAPS Research PDFdarshanmadeNo ratings yet

- Cera SanitaryWare Company Update PDFDocument8 pagesCera SanitaryWare Company Update PDFdarshanmadeNo ratings yet

- Mahanagar Gas Limited: Low Domestic Gas Price To Drive Up MarginsDocument6 pagesMahanagar Gas Limited: Low Domestic Gas Price To Drive Up MarginsdarshanmadeNo ratings yet

- Spandana Sphoorty Financial PDFDocument4 pagesSpandana Sphoorty Financial PDFdarshanmadeNo ratings yet

- Laurus Labs Limited: Sector: Pharmaceuticals Company UpdateDocument8 pagesLaurus Labs Limited: Sector: Pharmaceuticals Company UpdatedarshanmadeNo ratings yet

- MOIL 07feb20 Kotak PCG 00210 PDFDocument6 pagesMOIL 07feb20 Kotak PCG 00210 PDFdarshanmadeNo ratings yet

- Cochin PDFDocument8 pagesCochin PDFdarshanmadeNo ratings yet

- Aditya Birla Capital: Performance HighlightsDocument3 pagesAditya Birla Capital: Performance HighlightsdarshanmadeNo ratings yet

- Bata India: Premiumisation Gaining Good TractionDocument6 pagesBata India: Premiumisation Gaining Good TractiondarshanmadeNo ratings yet

- VRLLogistics 12jul19 Kotak PCG 00069 PDFDocument7 pagesVRLLogistics 12jul19 Kotak PCG 00069 PDFdarshanmadeNo ratings yet

- Mahindra Logistics Limited: Challenging Business Outlook For The Medium TermDocument6 pagesMahindra Logistics Limited: Challenging Business Outlook For The Medium TermdarshanmadeNo ratings yet

- Us BankruptcyDocument9 pagesUs Bankruptcyhappyjourneygateway100% (1)

- NYU Lecture NotesDocument18 pagesNYU Lecture NotesHE HUNo ratings yet

- Classical Neo-Classical Interest RateDocument7 pagesClassical Neo-Classical Interest RateAppan Kandala VasudevacharyNo ratings yet

- Question Paper Code:: Reg. NoDocument6 pagesQuestion Paper Code:: Reg. Nosaranya pugazhenthiNo ratings yet

- Exam Financial Mathematics 15122023Document2 pagesExam Financial Mathematics 15122023nguyen16023No ratings yet

- QUIZ-1 Monetary Theory and PolicyDocument1 pageQUIZ-1 Monetary Theory and PolicyAltaf HussainNo ratings yet

- Topic 2: (Translations of Foreign Financial Statements)Document4 pagesTopic 2: (Translations of Foreign Financial Statements)MILBERT DE GRACIANo ratings yet

- General Companies Law Research Differences To Focus On: Rofo and RofrDocument25 pagesGeneral Companies Law Research Differences To Focus On: Rofo and RofrAyush BakshiNo ratings yet

- Agrani Bank Limited: Results 1 - 19 of 19Document1 pageAgrani Bank Limited: Results 1 - 19 of 19aktaruzzaman bethuNo ratings yet

- Income Statement: Alladin Travel Inc. Statement of Profit and Loss As of April 30, 2018Document2 pagesIncome Statement: Alladin Travel Inc. Statement of Profit and Loss As of April 30, 2018Jasmine ActaNo ratings yet

- 26,2020 Junior CoOperative Inspector Kerala Khadi & Village IndustriesDocument15 pages26,2020 Junior CoOperative Inspector Kerala Khadi & Village IndustriesarjuwavaNo ratings yet

- La Salle University College of Business and Accountancy Integrated Enhancement Course For Accountancy Multiple ChoiceDocument3 pagesLa Salle University College of Business and Accountancy Integrated Enhancement Course For Accountancy Multiple ChoiceChristal Jam LaureNo ratings yet

- Ts Grewal Solutions For Class 11 Accountancy Chapter 12 AccountingDocument58 pagesTs Grewal Solutions For Class 11 Accountancy Chapter 12 AccountingVISHAL PATILNo ratings yet

- Algorithmic Trading (Cp-At) : Certificate Program inDocument3 pagesAlgorithmic Trading (Cp-At) : Certificate Program inPrashanth IyerNo ratings yet

- Bank Reconciliation Exercises and Answers: Step-By-Step Tutorial ExerciseDocument20 pagesBank Reconciliation Exercises and Answers: Step-By-Step Tutorial ExerciseTạ Tuấn DũngNo ratings yet

- Handbook How To Do Business in GC enDocument8 pagesHandbook How To Do Business in GC enСергей МартынецNo ratings yet

- Ey 2022 WCTG WebDocument2,010 pagesEy 2022 WCTG WebPedro J Contreras ContrerasNo ratings yet

- Forex Swaps & IRS-An Introduction-VRK100 - 04102009Document10 pagesForex Swaps & IRS-An Introduction-VRK100 - 04102009RamaKrishna Vadlamudi, CFANo ratings yet

- Bond ValuationDocument18 pagesBond ValuationApurva KarnNo ratings yet

- Crypto HistoryDocument130 pagesCrypto HistorywesamNo ratings yet

- Top 30 Philippine Companies in The Stock Market 2021 by Kein ChitoDocument186 pagesTop 30 Philippine Companies in The Stock Market 2021 by Kein ChitoKirston ZarateNo ratings yet

- Vitrox q42022Document16 pagesVitrox q42022Dennis AngNo ratings yet

- PSC 2016 PDFDocument108 pagesPSC 2016 PDFRachelle AndradeNo ratings yet

- Quiz 5Document4 pagesQuiz 5gautam_hariharanNo ratings yet

- SMEGuideBook EnglishDocument87 pagesSMEGuideBook EnglishDininduUdanaNawarathnaNo ratings yet

- 2SOGS RM Lecture 3 - Time Value of MoneyDocument36 pages2SOGS RM Lecture 3 - Time Value of MoneyRight Karl-Maccoy HattohNo ratings yet

- Week 4Document22 pagesWeek 4ziyue wangNo ratings yet