Professional Documents

Culture Documents

New Final SOP-Rev-1

New Final SOP-Rev-1

Uploaded by

Chandan ChatterjeeOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

New Final SOP-Rev-1

New Final SOP-Rev-1

Uploaded by

Chandan ChatterjeeCopyright:

Available Formats

Document Ref.

: Issue Date:

CU/SOP/FIND/24 2nd April, 2022

Issue No.: Revision No.:

01 00

Document Title:

STANDARD OPERATING PROCEDURE FOR FINANCIAL RESOURCES MANAGEMENT

MORTEX GROUP

STANDARD OPERATING PROCEDURE

FINANCE & ACCOUNTS

Controlled Copy: Circulation Authorized by the Management Representative. Page 1 of 23

Document Ref.: Issue Date:

CU/SOP/FIND/24 2nd April, 2022

Issue No.: Revision No.:

01 00

Document Title:

STANDARD OPERATING PROCEDURE FOR FINANCIAL RESOURCES MANAGEMENT

DOCUMENT REVIEW SHEET

The signatures below certify that this Standard Operating Procedure has been reviewed and

accepted, and demonstrates that the signatories are aware of all the requirements contained

herein and are committed to ensuring their provision.

Action Name & Signature Position Date

Prepared & revised

by

Reviewed by

Approved by

AMENDMENT RECORD

This Standard Operating Procedure is reviewed regularly to ensure relevance to the systems and

process that it defines. A record of contextual additions or omissions is given below:

Amendment Record Sheet

Amendment Issue No. Revision Page No. Subject of Revised Reviewed

Date No. Review / By &

Modification Approved

By

Controlled Copy: Circulation Authorized by the Management Representative. Page 2 of 23

Document Ref.: Issue Date:

CU/SOP/FIND/24 2nd April, 2022

Issue No.: Revision No.:

01 00

Document Title:

STANDARD OPERATING PROCEDURE FOR FINANCIAL RESOURCES MANAGEMENT

TABLE OF CONTENTS

A. FOREWORD........................................................................................................................

B. OBJECTIVES AND SCOPE................................................................................................

B.1. OBJECTIVES...........................................................................................................

B.2. SCOPE......................................................................................................................

C. DELEGATION OF AUTHORITIES....................................................................................

D. PROCESS FOR ACCOUNTING OF……...........................................................................

D.1. FIXED ASSET..........................................................................................................

D.2. INVESTMENT……………………………………………………….……………8

D.3. INVENTORY............................................................................................................

D.4. TRADE RECEIVABLE..........................................................................................

D.5. CASH & BANK……………………………………………………………...11

D.6. BORROWINGS……………………………………………………………...12

D.7. TRADE PAYABLES………………………………………………………...14

D.8. STATUTORY DUES………………………………………………………...15

D.9. PAYROLL...…………………………………………………………………16

D.10 BUDGETING…………………………………………………………………..16

E. MIS REPORTS………………………………………………………………………20

F. DOCUMENTATION………………………………………………………………..22

G. KEY PERFORMANCE INDICATORS…………………………………………………….23

Controlled Copy: Circulation Authorized by the Management Representative. Page 3 of 23

Document Ref.: Issue Date:

CU/SOP/FIND/24 2nd April, 2022

Issue No.: Revision No.:

01 00

Document Title:

STANDARD OPERATING PROCEDURE FOR FINANCIAL RESOURCES MANAGEMENT

A. FOREWORD

The Group believes that robust policies are critical to its long‐term sustainability and growth.

This Standard Operating Procedures (SOP) Manual is a key component of the policy framework

of the Group and is created with a view to proactively address the risks inherent in business

processes and institute strong controls across these processes.

This SOP Manual articulates the Group’s philosophy with regard to Procurement process and

details the accounting procedures to be followed in the course of this process.

The SOP lays down the responsibilities of various Executives involved in the process and

provides work instructions for constituent activities, wherever deemed necessary. The Group

acknowledges the need for constant revision to the SOP, based on changes in the operating

environment, and actively encourages executives to provide recommendations for revisions

through the prescribed process.

The Group places utmost importance on adherence to the provisions of this SOP and any

deviation from the laid down policies and procedures would require express approval of Board

of Directors (BOD).

This Manual emphasizes that it is the responsibility of all executives of the Group to ensure

compliance requirements of the Manual.

Controlled Copy: Circulation Authorized by the Management Representative. Page 4 of 23

Document Ref.: Issue Date:

CU/SOP/FIND/24 2nd April, 2022

Issue No.: Revision No.:

01 00

Document Title:

STANDARD OPERATING PROCEDURE FOR FINANCIAL RESOURCES MANAGEMENT

B. OBJECTIVE AND SCOPE

B.1. OBJECTIVES

Finance and Accounts are the nerve center of any organization, the framework through which

business performance can be measured internally and externally. The aim of this SOP is to lay

down necessary directives for the smooth and efficient functioning of the Finance & Accounts

Department. This document seeks to lay down the procedures adopted at Mortex India (the

Group) in a manner that aids standardization of procedures related to finance function. It is

designed to provide a consistent accounting / financial framework and internal controls by

encapsulating the best practices relating to the finance function of the Group in a comprehensive

document. The manual provides guidelines to execute, maintain or change the procedures related

to the Finance Department. It sets out the basic framework within which the financial data is

prepared and communicated. The document may also be used as training material for new

employees and a reference tool for existing employees. The procedures covered include:

Delegation of Authorities

General Accounting and book keeping

B.2. SCOPE

This SOP contains the detailed procedures that are required to be carried out by the finance

department to meet the overall objective.

Controlled Copy: Circulation Authorized by the Management Representative. Page 5 of 23

Document Ref.: Issue Date:

CU/SOP/FIND/24 2nd April, 2022

Issue No.: Revision No.:

01 00

Document Title:

STANDARD OPERATING PROCEDURE FOR FINANCIAL RESOURCES MANAGEMENT

C. DELEGATION OF AUTHORITIES

As per Annexure Attached

Controlled Copy: Circulation Authorized by the Management Representative. Page 6 of 23

Document Ref.: Issue Date:

CU/SOP/FIND/24 2nd April, 2022

Issue No.: Revision No.:

01 00

Document Title:

STANDARD OPERATING PROCEDURE FOR FINANCIAL RESOURCES MANAGEMENT

D. PROCESS

D.1. FIXED ASSET

On procurement of fixed asset, the approved invoice along with supporting should be

handed over to the assigned accounts personnel by the respective department and it

should be recorded in the software within three days from the date of receipt of invoice.

In case of any discrepancy, the issue should be highlighted to the respective user within

the timeline mentioned above. If the discrepancy is not resolved within seven days from

intimation, the matter should be escalated to the immediate reporting authority. Since,

invoice for fixed asset has to be booked in the software on the date the asset is put to use,

if back dated invoices are received from any department, necessary approvals should be

taken before booking such invoices. This will help in ensuring timely receipt and

accounting of invoices.

Depreciation utility should be run every month and depreciation as per companies act

2013 should be posted in the books by 5th of every month. Further, depreciation as per

income tax act, 1961 should also be calculated from the software and posted in books

accordingly.

Fixed Asset Register (FAR) should be maintained in the software (currently Tally). The

FAR will contain the following details:

Asset Code

Asset Account Code (not in system now)

Class & description of asset, model no. & date of purchase

Quantity

Location & department using the asset

Value of asset (gross block, net block)

Useful life of the asset & depreciation rate

Unit of measurement

Depreciation (accumulated depreciation and depreciation for the year)

Details of transfer and disposal

WDV of assets

The Accounts Officer will paste the asset code sticker against the asset entry in the FAR

Controlled Copy: Circulation Authorized by the Management Representative. Page 7 of 23

Document Ref.: Issue Date:

CU/SOP/FIND/24 2nd April, 2022

Issue No.: Revision No.:

01 00

Document Title:

STANDARD OPERATING PROCEDURE FOR FINANCIAL RESOURCES MANAGEMENT

and on the physical asset. Finance manager would conduct physical verification of fixed

assets on a quarterly basis and submit the report to CEO Finance / BOD.

D.2. INVESTMENT

Investments should be classified (long term / short term) and recorded in the software

properly. While finalizing financial statements long term investments should be recorded

at cost itself while short term investments should be recorded at lower of cost or fair

value.

Income generated from these investments should be prudently recorded in the financial

statements. TDS deducted on income should be reconciled from 26AS on a quarterly

basis and accounted in books accordingly.

FREQUEN

NR PROCEDURE CY RESPONSIBLE

PERSON

Investments

All Investment Register Report must be complied by

the Accounts officer/Executive and Credit Control,

entailing all investments and it must be reconciled to

the General ledger with interest rates, types of

investment, date of maturity, account number, amount

and the name of the financial institution, where the Monthly

1. amount is held. basis CFO/Manager

An Investment Register/ report must be reviewed by the

CFO/Manager, and be submitted to Directors for Monthly

2 information. basis CFO/Manager

CFO/Manager

The additions or withdrawals must be approved as per

3 Investment Policy. On going

Controlled Copy: Circulation Authorized by the Management Representative. Page 8 of 23

Document Ref.: Issue Date:

CU/SOP/FIND/24 2nd April, 2022

Issue No.: Revision No.:

01 00

Document Title:

STANDARD OPERATING PROCEDURE FOR FINANCIAL RESOURCES MANAGEMENT

D.3. INVENTORY

Inventories are required to be monitored very diligently. Accounts Officer should cross

verify that stock as per records are actually present in the warehouse at regular intervals

(monthly). No kind of discrepancy should exist. In case of any discrepancy, it should be

urgently investigated and resolved and if the discrepancy still persists the same should be

informed to the immediate reporting authority and recorded in books accordingly.

Benefits of inventory accounting are:

Healthy and steady cashflows: By properly analyzing the inventory needs, cash

will not be trapped in unnecessary inventory.

Increase in overall sales: Inventory accounting helps in the calculation of the

reorder levels. Through this, the business never runs out of stock since orders are

placed in time.

Reduction in storage cost: The identification of slow-moving goods is key to

reducing storage costs.

Maximation of profits: Inventory accounting helps identify areas for cost cutting

and maximizing the profit margin.

Facilitates better decision making: Inventory accounting aids in the preparation

of financial and revenue projections, thus helping the business owner make sound

decisions.

Inventory accounting is mainly focused on analyzing the needs and requirements of the

business with regard to inventory levels. The business puts this information to use in a

way that targets high sales and profitability. The valuation of inventories may be done

based on FIFO, LIFO or weighted average methods, as the case may be. The following

are some of the best common methods of inventory accounting:

Economic Order Quantity (EOQ): Inventory has cost components such as

ordering cost and carrying cost. Often, without proper planning, these costs tend

to escalate. EOQ aims to eliminate wasteful spending when it comes to inventory

orders and replenishment. EOQ is the optimum quantity for a particular order to

reduce the carrying cost and order cost to an acceptable level.

Just in Time (JIT): JIT is an inventory management technique that is focused on

cost-cutting and optimal order time. Under JIT, the order is placed with the

Controlled Copy: Circulation Authorized by the Management Representative. Page 9 of 23

Document Ref.: Issue Date:

CU/SOP/FIND/24 2nd April, 2022

Issue No.: Revision No.:

01 00

Document Title:

STANDARD OPERATING PROCEDURE FOR FINANCIAL RESOURCES MANAGEMENT

suppliers so that the inventory arrives only when it is needed. This helps facilitate

control over storage costs by placing orders only when the inventory levels are

significantly low. JIT aids in better inventory management, reduction of inventory

waste and smooth cash flows.

ABC analysis: Under the ABC analysis, the products are ranked into A, B, and C

groups (A being the highest) based on their importance to the business. Metrics

such as demand, cost, and other criteria help arrive at the product’s particular

rank. ABC analysis helps improve the inventory turnover rate, thus boosting sales

and reducing unnecessary storage costs.

Fast, slow and non-moving: This is a method with a focus on the movement of

goods. Based on the customers demand for the goods, the inventory is divided

into fast, slow, and non-moving goods. The fast moving goods will be reordered

frequently, whereas the non-moving goods may not have a repeat order.

D.4. TRADE RECEIVABLE

Accounts or trade receivable is the amount owed to a company when it provides goods

and/or services on credit. The accounting SOP manual helps to streamline and optimize

the collection cycle time, credit policy, sales, invoicing, and billing process, with a focus

on the legitimacy and accuracy of bills and invoices. Once the sale bill is generated

(documentation team generates in case of export sale) following steps should be

followed:

Customer set up

All responsible employees for promptly reporting any sales on a credit basis

to Manager-Accounts unless the department in which the employee works

has been delegated the authority, by this procedures, to invoice the agency

that has received the service/material.

Employees should contact the Account Manager office for credit information

prior to delivery of any materials or services.

Unless specifically authorized to do so in this policy, no department, office, or

division of the company may prepare any billings to any agency or person for

services or materials sold.

All invoice formats shall be approved by the Manager and followed by

Director as per existing Credit Policy.

Payments on all invoices are to be directed to Manager-Finance.

Controlled Copy: Circulation Authorized by the Management Representative. Page 10 of 23

Document Ref.: Issue Date:

CU/SOP/FIND/24 2nd April, 2022

Issue No.: Revision No.:

01 00

Document Title:

STANDARD OPERATING PROCEDURE FOR FINANCIAL RESOURCES MANAGEMENT

All the bills needs to be entered in the manual register (as well as excel in case of

export) by Accounts Officer highlighting invoice no, invoice date, material

supplied, quantity, rate, transporter details, shipping details. Manual register is

maintained party-wise in case of domestic sales. In case of export sales, the sale

bills are also to be tagged against purchase bills in excel.

Bills should then be entered in software by Accounts Executive.

Regular follow up to be made to party by Accounts Officer for payment collection

in respect of domestic sales.

Terms of payments for all billings issued or to be issued by the Company shall be

prescribed by the Director and above.

Accounts Officer is responsible for follow-up on all accounts receivable which

have not been paid in accord with terms of the credit agreement.

Error in the original billing. There may have been an error made when a billing

was originally requested or an invoice should never have been requested in the

first place. While this may happen on occasion, departments should be very

certain that an account receivable does, in fact, exist before requesting a billing.

Also, a billing may have to be replaced by another when some of the billing data

is found to be incorrect.

KPI would be in this area 1) Reducing Average Days Collection, 2) Decrease

Your Collection Cycle Time 3) Reduction in Billing errors 4) Reduction in credit

terms.

Balance confirmation shall be obtained (either monthly or quarterly) to identify if any

error or discrepancy exists and if so then it should be resolved.

D.5. CASH & BANK

Cash payments would be avoided as far as possible. Only petty bills or imprest accounts

can be paid in cash for the following petty expenses:

Expenditure for refreshments during official meetings.

Staff conveyance

Office maintenance of petty nature

Printing & Stationery of petty nature

Any other petty expense

Controlled Copy: Circulation Authorized by the Management Representative. Page 11 of 23

Document Ref.: Issue Date:

CU/SOP/FIND/24 2nd April, 2022

Issue No.: Revision No.:

01 00

Document Title:

STANDARD OPERATING PROCEDURE FOR FINANCIAL RESOURCES MANAGEMENT

Cash Payments above Rs. 10000/- should not be made against a single bill. Cash

payments to be made only after approval of Finance Manager on receipt of the bill for

payment. It is also ensured that the complete approval note along with the bill is prepared

by the Accounts Officer before handing over it to the Finance Manager.

Bank payments (i.e. Issue of cheques / RTGS / NEFT / Remittance / Direct Debit). For

making any bank payments following steps should be followed:

Suppliers bills should be pre-approved by Management / CFO / documentation

team and vendor bills should be pre-approved by Manager Finance.

In case of cheque payment its details are entered in issue register maintained

manually by Accounts Officer highlighting the cheque no, date, party name and

amount. Details of online / offline payments are sent by Accounts Officer to

Accounts Executive for entry to be done in software.

Bank Receipts (i.e. Receipt of cheques / RTSG / NEFT). For accounting any bank

receipts following steps should be followed:

Domestic Receipts: Once the payment is received then the same needs to be

entered in receipt register (maintained manually) and party-wise ledger by

Accounts Officer highlighting date of receipt, mode of receipt, party name,

amount, bill no. against which the payment is received. The receipts are then

entered in software by Accounts Executive.

Foreign Receipts: Once the forex receipt voucher is received from the Finance

Department, it is simply accounted for in the software by Accounts Executive.

Finance Department / Bank Documentation Team prepares final bill for banking

purpose to which is attached shipping bill highlighting the drawback amount.

Receivable entry for which is posted in software by Accounts Executive

immediately. Once the drawback amount is received, they are then posted in

receipt register (maintained manually) along-with the sale bill detail against

which the drawback is received by Accounts Officer. After the above steps, these

receipts are entered in software by Accounts Executive. Tagging of receivable

and receipt entry is done in software by Assistant Manager.

Bank Reconciliation Statement: Domestic transactions are checked on daily basis,

however foreign transactions are checked at the time of preparing BRS at month end by

Assistant Manager. The major check point at this stage is the amount of Packing Credit

Controlled Copy: Circulation Authorized by the Management Representative. Page 12 of 23

Document Ref.: Issue Date:

CU/SOP/FIND/24 2nd April, 2022

Issue No.: Revision No.:

01 00

Document Title:

STANDARD OPERATING PROCEDURE FOR FINANCIAL RESOURCES MANAGEMENT

which is cross checked with the PC diary and PC sheet maintained by the Finance

Department. BRS should be prepared on weekly basis.

D.6. BORROWINGS

The Group is involved in export business and hence taking bank limits is a day to day

affair. All the borrowings should be prudently recorded in books of accounts. The group

has 3 kind of loans:

Letter of Credit: A letter of credit or LC is a written document issued by the

importer’s bank (opening bank) on importer’s behalf. Through its issuance, the

exporter is assured that the issuing bank will make payment to the exporter for the

international trade conducted between both the parties. The importer is the

applicant of the LC, while the exporter is the beneficiary.

Packing Credit: ‘Pre-shipment/Packing Credit’ means any loan or advance

granted or any other credit provided by a bank to an exporter for financing the

purchase, processing, manufacturing or packing of goods prior to shipment, on

the basis of letter of credit opened in his favour or in favour of some other person,

by an overseas buyer or a confirmed and irrevocable order for the export of goods

from India or any other evidence of an order for export from India having been

placed on the exporter or some other person, unless lodgement of export orders or

letter of credit with the bank has been waived.

Inter Company Loans: Intercompany loan is the amount lent or advance given

by one company (in a group of companies) to another company (in the same

group of companies) for various purposes including to help the cashflow of the

borrowing company or to fund the fixed assets or to fund the normal business

operations of the borrowing company, which gives rise to interest income to

lending company & interest expense to borrowing company.

Interest on loan should be properly recorded in the books of accounts. TDS should also

be deducted and accounted for in accordance with the provisions of Income Tac Act,

1961.

Documents to be submitted for taking new bank limit and its renewal are:

Controlled Copy: Circulation Authorized by the Management Representative. Page 13 of 23

Document Ref.: Issue Date:

CU/SOP/FIND/24 2nd April, 2022

Issue No.: Revision No.:

01 00

Document Title:

STANDARD OPERATING PROCEDURE FOR FINANCIAL RESOURCES MANAGEMENT

Brief profile of the company and its directors / partners to be submitted.

KYC of company and its directors / partners.

Audited accounts of previous 3 financial years.

Credit Monitoring Arrangement Report i.e. projected performance of coming 2

financial year.

Projected financial statement of current year.

Audited Accounts of previous financial year of its directors / partners.

Income Tax Return of previous 3 financial year to be given.

Bank Statement of last 6 to 12 months required.

Credit rating from CARE CRISIL to be submitted. To procure the same we need

to give the agency contact details of bank from which limit is taken, complete

details of utilization of loan on monthly basis, export details (country-wise) and

details of Auditors.

List of top 5-10 suppliers, details of debtors / creditors, Stock statement and

Debtors Statement as required by bank.

For taking bank limit the company generally give Fixed Deposits as collateral and

sometimes property of partners & directors are also used to be given as collateral.

Pari Pasu Statement needs to be submitted.

D.7. TRADE PAYABLES

Accounts Payable consists of all short-term debts owed to creditors (to be paid off within

a year or so) and are shown as a current liability on the company’s balance sheet. The

Accounts payable process is an integral part of the P2P (procure-to-pay) workflow. Part

of the accounts SOP, P2P covers the entire process chain, right from procurement,

purchase, and invoice processing to the final vendor payments. Once the purchase bill /

vendor bill is received following steps should be followed:

Purchase bills needs to be entered in the manual register by Accounts Officer

highlighting invoice no, invoice date, material procured, quantity, rate. In case of

export related purchase, they are to be tagged against corresponding sale in excel

as well as manual register by Accounts Officer.

Vendor bills are also to be entered in manual register maintained by Accounts

Officer against the corresponding sale invoices. This process helps in cross

verification that multiple vendor bills are not accounted for against a single sale

transaction.

Controlled Copy: Circulation Authorized by the Management Representative. Page 14 of 23

Document Ref.: Issue Date:

CU/SOP/FIND/24 2nd April, 2022

Issue No.: Revision No.:

01 00

Document Title:

STANDARD OPERATING PROCEDURE FOR FINANCIAL RESOURCES MANAGEMENT

Bills should then be entered in software by Accounts Executive.

Balance confirmation shall be obtained (either monthly or quarterly) to identify if any

error or discrepancy exists and if so then it should be resolved

D.8. STATUTORY DUES

Statutory Compliances include TDS, GST, Advance Tax, Professional Tax, Provident

Fund.

Tax Deducted at Source (TDS) needs to be deducted at the time of payment or credit,

whichever is earlier. Deducted amount is to deposited with the Government within of the

7th of the following month. TDS return is to be filed quarterly within 30th of the

following month. To ensure timely filing of TDS Return, details is to be submitted with

the consultant on a timely basis.

A GST return is a document containing details of all income/sales and/or

expense/purchase which a taxpayer (every GSTIN) is required to file with the tax

administrative authorities. This is used by tax authorities to calculate net tax liability.

Types of GST returns to be filed are:

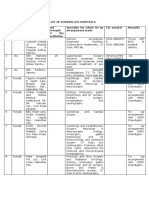

Return Description Frequency Due Date

GSTR 1 Details of outward supplies of Monthly 11th of the next

taxable goods and/or services month

affected.

GSTR 3B Return in which summary of Monthly 20th of the next

outward supplies along with month

input tax credit is declared and

payment of tax is affected by

the taxpayer.

GSTR 9 Annual return for a normal Annually 31st December of the

taxpayer. next financial year

GSTR 9C Certified reconciliation Annually 31st December of the

statement next financial year

Advance Tax, Professional Tax, Provident Fund are required to be deposited with the

Government Authority as per the provision of Income Tax Act, 1961.

Controlled Copy: Circulation Authorized by the Management Representative. Page 15 of 23

Document Ref.: Issue Date:

CU/SOP/FIND/24 2nd April, 2022

Issue No.: Revision No.:

01 00

Document Title:

STANDARD OPERATING PROCEDURE FOR FINANCIAL RESOURCES MANAGEMENT

D.9. PAYROLL

Accounts Officer will prepare monthly salary sheet by 5th of every month based on the

attendance and leave records of the employee.

TDS deduction would be checked with the computation of taxable income prepared for

each employee and tax deducted so far before the current month.

Any adjustments for any advances or loans taken by the employee would be made before

the approval of salary.

In case of new employees, appointment letters would be checked along with other

relevant documents such as last employers, relieving certificate, experience certificate.

While preparing the TDS calculations, last employers Form 16 should be considered.

The salary sheet would then be checked and approved by Manager Finance.

In case of any employee leaving the company, full and final settlement account would be

prepared Accounts Officer and approved by Assistant Manager. The Assistant Manager

would check the following documents before making full and final payment: Letter of

Resignation, acceptance of resignation, any loans / staff advance / imprest outstanding,

any TDS short deducted on the basis of declaration not received, copy of tax saving

investments such as payment of LIC premiums, PPF, House rent receipts, home loan

certificates for which credit has been taken etc., any office equipment such as laptop,

mobile handed over.

Accounts Officer will then release payments.

D.10. BUDGETING

1.1. Policy

1.1.1. Company will have an activity plan for achieving the desired targets/results

assigned to it in accordance with implementation plan.

1.1.2. The plan will be reviewed regularly on quarterly basis and as per need to ascertain

Controlled Copy: Circulation Authorized by the Management Representative. Page 16 of 23

Document Ref.: Issue Date:

CU/SOP/FIND/24 2nd April, 2022

Issue No.: Revision No.:

01 00

Document Title:

STANDARD OPERATING PROCEDURE FOR FINANCIAL RESOURCES MANAGEMENT

progress made towards achieving the desired targets as well as to keep the plan

update.

1.1.3. The activity plan will be used as framework for forecasting program or area budget

estimates.

1.1.4. Budget functions of Company will be overseen by the following;

Tasks Implemented by

Preparation of program budget estimates Director/CFO

Review, finalization, implementation, Director/CFO &Finance

Monitoring, and revision of budgets Manager

1.1.5. BOD will approve annual budget.

1.2. Responsibility

1.2.1. Monitoring and review of budget will rest with the Finance.

1.1.

1.1.

1.2.

1.3. Procedure

Process Overview

The budget process will involve the following major steps:

Development of a calendar of activities necessary to finish the process and the schedule dates

for compilation of each step by respective Projects;

Development of preliminary estimates for use by the Projects evaluating the reasonableness of

the estimates;

The development and submission of budgetary estimates by the Projects;

Compilation and review of budget estimates by Finance;

Presentation of budget document to the CFO for adoption; and

CFO will present Budget in BOD for final approval.

Program Forecast

1.3.1. Basic planning and budget input data will be gathered for the program forecasts by the

Projectss through:

Vision and Mission

Demand;

Products/Service

Program activity plan; and

Controlled Copy: Circulation Authorized by the Management Representative. Page 17 of 23

Document Ref.: Issue Date:

CU/SOP/FIND/24 2nd April, 2022

Issue No.: Revision No.:

01 00

Document Title:

STANDARD OPERATING PROCEDURE FOR FINANCIAL RESOURCES MANAGEMENT

Personnel requirements for the next year as discussed with the Manager HR&A with

the consultation of relevant department head.

1.3.2. All program plans and budgets will be prepared by the CFOs. The forecasts will include:

Overview of planned activities and budgets;

Income and expenditure wise plans and budgets; and

1.3.3. The prepared plan and budget is mutually reviewed, discussed and revision, if any with

Finance, and accordingly will be amended before its submission to CFO who then will

present in front of BOD.

1.3.4. After review by the Operation and Finance, the reviewed budget with plan will be

distributed among concerned operational departments.

Draft Annual Budget

1.3.5. Based on the plans, Finance Manager will prepare budgets. Manager F&A will assist

during the compilation by Asst Mangers/Officers

1.3.6. Draft annual plan and budget will be presented to BOD by CFO for final consideration and

review before approval.

1.3.7. Manager F&A will review of preliminary program plans and budget forecasts in

coordination of CFO or other HOD..

1.3.8. The information supplied will be reviewed in terms of accuracy, possible problems in

implementing proposed programs and reasons for substantial variations between

projections and cost incurred during previous years. As a result:

The contents of the final budget will be finalized; and

The draft annual plan and budget will be revised, if necessary.

Final Budget Document

1.3.9. After having been reviewed and revised as necessary, Manager F&A will compile Draft

Annual Plan and budget into a Final Budget document. The document will include:

The comparison of planned activities and budgets of the current year with actual

achievement and income/utilization;

The highlights of the proposed budget in terms of program expansion and planned

activities;

An outline of problem areas which have not been reconciled/addressed within the

current budget; and

A review of the budget increases, if any, caused by changes and increases (such as

salaries);

1.3.10. After having been compiled and approved by the BOD, the final budget document will be

submitted to CFO for review and recommendations.

Controlled Copy: Circulation Authorized by the Management Representative. Page 18 of 23

Document Ref.: Issue Date:

CU/SOP/FIND/24 2nd April, 2022

Issue No.: Revision No.:

01 00

Document Title:

STANDARD OPERATING PROCEDURE FOR FINANCIAL RESOURCES MANAGEMENT

Approval and Adoption of the Budget

1.3.11. CFO will give final approval on the plans and budgets forwarded by the BOD.

1.3.12. After approval by the BOD, the annual plan and budget will be distributed as follows:

1st Copy Chief Executive Offier

2 Copy

nd

Operations Manager

3 Copy

rd

Manager F&A

4 Copy

th

File

Execution of the Budget

1.3.13. All departments under supervision of Internal Auditor (IA) will be responsible for

keeping track of progress against activity plans and budget. This function will comprises:

Reviewing transactions for conformity with the planned activities;

Assuring that no transaction occur unless approved in accordance with budget and

SOPs; and

Reporting activity status and budget utilization on monthly/quarterly and annual basis

on the specified budgeting and reporting formats.

1.3.14. The progress being made towards objectives will be reviewed and evaluated, on monthly

basis by IA & Finance.

Monitoring and Control

1.3.15. To ascertain the progress being made towards the prescribed objectives, an effective and

efficient budgetary information system will be established. The Financial Information

System will be capable of:

Providing management at all levels, on timely basis, with accurate and relevant

informative data on performance towards each goal;

Comparative analysis of planned statistics with current results; and

Supporting management in taking corrective actions, wherever necessary, to lay down

adequate and accountable future plans.

1.3.16. Manager F&A will prepare the following reports (at the minimum) based no the current

information available on monthly basis during the execution:

1.3.17. Activity plans and budgets will be revised during the financial year in order to adjust

projections to meet changing conditions. The potential budget revisions may be:

Budget Expansions Represent enhancement to departmental/program base budget e.g.

by adding new budget line or increment in already apportioned budget.

Budget Contractions Represent deletion of budget line or decrease in already

apportioned amount.

Controlled Copy: Circulation Authorized by the Management Representative. Page 19 of 23

Document Ref.: Issue Date:

CU/SOP/FIND/24 2nd April, 2022

Issue No.: Revision No.:

01 00

Document Title:

STANDARD OPERATING PROCEDURE FOR FINANCIAL RESOURCES MANAGEMENT

Budget Transfer Represent transfer of funds from one budget line to another.

1.3.18. Manager F&A will prepare Budget Revision Form and forwarded to respective

Operation Managers and CFO for authorization and approval.

1.3.19. The revision request reviewed by PM will be forwarded Manager F&A who will forward

to CE for final review, after approval and the budget will be adjusted accordingly.

E. MIS REPORTS

MIS Reports are required by the management to access the performance of the organization and

allow for faster decision making. Multiple reports that are being prepared in the group are:

Sale Purchase Report: It helps to release party payments. This report is required to be

prepared by Assistant Manager and submitted to Management / CFO / Manager Finance

and Operations Team on daily basis within the time frame decided by the management.

Steps to prepare the same are mentioned below:

Purchase report is to be prepared from dispatch detail sheet received from

Operations team. Dispatch detail sheet for Vizag export is received same day

evening while for Kolkata it is received next day morning within 11.30 am.

A combined sheet named as Purchase Report is prepared from above two dispatch

detail sheet.

Payment to various parties are made by Accounts Officer who then sends payment

report at day end via mail to all the person responsible for payment decision

making i.e. Manager Finance / Assistant Manager / Accounts Executive.

The above payment details is then compiled with the Purchase Report and finally

all the ledgers (party-wise) is updated to know the actual outstanding amount as

on the respective date.

Payment details are cross verified from bank statement and purchase details are

cross verified with e-way bill generated from portal.

Sauda Khata: This is basically a report which records the rates at which multiple purchase

orders are placed. As soon as management places a purchase order information for the

same is shared with Operations Team / Manager Finance and Assistant Manager.

Purchase Register is then updated in excel once the order is finalized but purchase order

date is updated only when order is actually being placed. Information for placement of

Controlled Copy: Circulation Authorized by the Management Representative. Page 20 of 23

Document Ref.: Issue Date:

CU/SOP/FIND/24 2nd April, 2022

Issue No.: Revision No.:

01 00

Document Title:

STANDARD OPERATING PROCEDURE FOR FINANCIAL RESOURCES MANAGEMENT

order is received via mail from Operations Team. This report is also prepared by Assistant

Manager.

Transporter Report: It is prepared to release transporter payments. This report is required

to be prepared by Assistant Manager and submitted to the Management / Manager Finance.

It is prepared from the dispatch sheet provided by Operations Team. Data of this sheet is

then segregated company-wise and transporter-wise and individual ledgers maintained in

excel are also updated. Following steps are to be followed to release transporter payments:

Bills are received directly from reception by Compliance Team, team responsible

for vendor payments.

Excel is updated company-wise and transporter-wise i.e bill no. date of transport,

rate, weighment, cab no.

Any kind of detention and shortage is required to be checked. If the same is ok

then payment is released. In case of discrepancy the same need to be confirmed by

Operations team.

Sale invoice no is updated in transporter’s bill (i.e that this transporters bill is for

which sale).

Transporter bill is then passed to Accounts Officer who updates the hand register.

Finally the bill is checked by Manager Finance and payment approval is given.

Procedure for Vendor Payments:

Documentation team maintains a loading diary in which all sale related details is

mentioned i.e invoice no., quantity, destination, F&F, CHA, inspection (these

details are received by them directly from Management). These details are

required to check vendor bills. Once Assistant Manager & Accounts Executive

(from Compliance Team) receives vendor bills they give the same to Accounts

Executive (from Accounts Team) to post the entry in software.

After the entries are done, these bills are then checked by Compliance Team

(Assistant Manager for transport, Accounts Executive for F&F CHA Inspection)

with the details supplied to them by documentation team.

Vendor party MIS report is prepared highlighting Invoice No. Date, Gross

Amount, TDS amount, any deduction payment date.

All the vendor party details are manually entered in register by Accounts

Executive (from Compliance Team).

Controlled Copy: Circulation Authorized by the Management Representative. Page 21 of 23

Document Ref.: Issue Date:

CU/SOP/FIND/24 2nd April, 2022

Issue No.: Revision No.:

01 00

Document Title:

STANDARD OPERATING PROCEDURE FOR FINANCIAL RESOURCES MANAGEMENT

Ocean freight charges are fixed before hand by documentation team (loading

diary) and few are on actual incurred basis i.e. terminal handling charges,

documentation charges, seal charges, mandatory user charges (logistics team

confirms these charges and supporting are also attached with the bill. Custom Port

charges etc depends on shipping line. Out-movement charges, storage charges,

shifting charges are some other charges which are not fixed but are incurred on

actual basis and confirmation is received from logistics team along with proper

supporting.

If billing is less then agreed rate, no issue payment is released immediately. If

billing is done at a higher rate, then conformation is to be taken from Manager

Finance and Logistics team. In most cases they have the information. If not then

confirmation to be taken from Management.

Payment intimation is received from Manager Finance verbally. Once the

intimation is received details for payment are sent to Accounts Officer (from

Accounts team) to release payment. Once the payment is made, payment details is

sent to respective parties immediately.

F. DOCUMENTATION

The following are the documents that need to be documented:

Fixed Asset Register

Stock Taking Report

Debtors Ledger

Cash Book

Cheques

Bank Statements & Bank Reconciliation Statement

Account Confirmations

Creditors Ledger

Memos

Project Payment Certificate

Payment Vouchers

All export related documents

Financial Statements

Budgets

Controlled Copy: Circulation Authorized by the Management Representative. Page 22 of 23

Document Ref.: Issue Date:

CU/SOP/FIND/24 2nd April, 2022

Issue No.: Revision No.:

01 00

Document Title:

STANDARD OPERATING PROCEDURE FOR FINANCIAL RESOURCES MANAGEMENT

Statement of Financial Position (Balance sheet)

Statement of Financial Activities (income statement)

Statement of Changes in Financial Position (cash Flow Statement)

Statement of portfolio

G. KEY PERFORMANCE INDICATORS

The following are the indicators:

Operating Cash Flow Accounts Payable Turnover Earnings Per Share

Unlevered Free Cash Flow Cash Conversion Cycle Price-to-Earnings Per Share Ratio

Levered Cash Flow Return on Assets Book Value Per Share

Net Present Value Return on Equity Price-to-Book Value Ratio

Future Value Return on Investment Price-to-Sales Ratio

Break Even Point Total-Debt-to-Assets Ratio Price-to-Cash Flow Ratio

Payback Period Total-Debt-to-Equity Ratio Average Annual Growth Rate

Discounted Payback Period Degree of Financial Leverage Compound Average Growth Rate

Internal Rate of Return Interest Coverage Ratio

Working Capital Gross Profit Margin

Quick Ratio Operating Profit Margin

Current Ratio Net Profit Margin

Controlled Copy: Circulation Authorized by the Management Representative. Page 23 of 23

You might also like

- KEPL MR 06 - Management Review MeetingDocument2 pagesKEPL MR 06 - Management Review MeetingAvijit SenNo ratings yet

- Compliance Sop 2023Document37 pagesCompliance Sop 2023Wan Muhammad ZamyrNo ratings yet

- Draft SLAuS For Non SBE Audits - 29-08-2018Document20 pagesDraft SLAuS For Non SBE Audits - 29-08-2018Sanath FernandoNo ratings yet

- Historical Financial Analysis - CA Rajiv SinghDocument78 pagesHistorical Financial Analysis - CA Rajiv Singhవిజయ్ పి100% (1)

- Sharpen Your Auditing SkillsDocument6 pagesSharpen Your Auditing SkillsVeronica HernandezNo ratings yet

- Failure of Risk Management On Lehman BrothersDocument34 pagesFailure of Risk Management On Lehman Brotherssubsidyscope_bailoutNo ratings yet

- 24 SOP Finance DepartmentDocument22 pages24 SOP Finance DepartmentMisbahun haidirNo ratings yet

- Sop-Finance 2Document13 pagesSop-Finance 2Faruq Jabar Rabbani100% (1)

- Information Systems Strategic ManagementDocument24 pagesInformation Systems Strategic ManagementKundayi ChinyongoNo ratings yet

- Kuliah 11 Audit Dan Tata Kelola TIDocument90 pagesKuliah 11 Audit Dan Tata Kelola TIRonn SaguntaNo ratings yet

- Rapid Application Development Model PresentationDocument19 pagesRapid Application Development Model Presentationcosmas crymore MugwandaNo ratings yet

- NSA Audit ReportDocument6 pagesNSA Audit ReportNaveen GuptaNo ratings yet

- Draft Disposal Manual 2013Document127 pagesDraft Disposal Manual 2013balarajuNo ratings yet

- BC ISO22301 Sep 20Document11 pagesBC ISO22301 Sep 20MorganNo ratings yet

- Policy and Procedure ManualDocument6 pagesPolicy and Procedure ManualDebbie LangolfNo ratings yet

- Public Sector Companies (Corporate Governance Compliance) Guidelines, 2013Document8 pagesPublic Sector Companies (Corporate Governance Compliance) Guidelines, 2013wakhanNo ratings yet

- Pub100373 PDFDocument12 pagesPub100373 PDFedgelcer100% (1)

- Employee EngagementDocument11 pagesEmployee EngagementAdeelSiddiqueNo ratings yet

- Vcare Burglar Alarm: Terms and ConditionsDocument1 pageVcare Burglar Alarm: Terms and ConditionsJoranne Gregorio100% (1)

- WIP IA Manual - Audit Program - PayablesDocument6 pagesWIP IA Manual - Audit Program - PayablesMuhammad Faris Ammar Bin ZainuddinNo ratings yet

- Audit Planning & Documentation - Taxguru - inDocument8 pagesAudit Planning & Documentation - Taxguru - inNino NakanoNo ratings yet

- EIS List of Important Questions M 22 4f21b36b 4722 4dd9 A9c8 8579e865858bDocument480 pagesEIS List of Important Questions M 22 4f21b36b 4722 4dd9 A9c8 8579e865858bHarsh GoenkaNo ratings yet

- QMS Audit Plan SampleDocument2 pagesQMS Audit Plan Samplekkmajuteguh100% (1)

- Vendor Registeration FormDocument6 pagesVendor Registeration FormParik AnandNo ratings yet

- Audit and Risk Committee CharterDocument11 pagesAudit and Risk Committee CharterKarine SNo ratings yet

- 2004 Internal Audit ReportDocument62 pages2004 Internal Audit ReportriobmNo ratings yet

- Finance Service Level AgreementDocument4 pagesFinance Service Level AgreementJorge Luis Robles CorderoNo ratings yet

- Internal Audit Dashboard Ver. 1Document18 pagesInternal Audit Dashboard Ver. 1Fazal KarimNo ratings yet

- Warehouse Management SystemDocument2 pagesWarehouse Management SystemAnkur PandeyNo ratings yet

- Flow Chart CommercialDocument19 pagesFlow Chart CommercialAndi ChristianNo ratings yet

- Requisition and Purchasing PolicyDocument10 pagesRequisition and Purchasing PolicySenpai KazuNo ratings yet

- Sr. Administration Manager / HR Head Office Administration & HR Director Administration & Regulatory AffairsDocument2 pagesSr. Administration Manager / HR Head Office Administration & HR Director Administration & Regulatory AffairsmbabluNo ratings yet

- Awareness ISO 37001 Danang - ImplementationDocument127 pagesAwareness ISO 37001 Danang - ImplementationdanangNo ratings yet

- Best Practices in Planning and Conducting Risk-Based Internal AuditDocument5 pagesBest Practices in Planning and Conducting Risk-Based Internal Auditsheran23No ratings yet

- QACON 05 Non Conformance and Corrective ActionDocument3 pagesQACON 05 Non Conformance and Corrective ActionKannan MurugesanNo ratings yet

- How To Budget An ISO 45001 Implementation ProjectDocument12 pagesHow To Budget An ISO 45001 Implementation ProjectShahnawaz PathanNo ratings yet

- Accounting For Non Accountants Public Program by iTrainingExpert 2015 PDFDocument2 pagesAccounting For Non Accountants Public Program by iTrainingExpert 2015 PDFiTrainingExpertNo ratings yet

- Jadwal Internal Audit SMKIDocument20 pagesJadwal Internal Audit SMKIRosyid SNo ratings yet

- Event Planning Proposal: Title of Proposed EventDocument3 pagesEvent Planning Proposal: Title of Proposed EventShrestha AnutzNo ratings yet

- Risk Assessment Record: Residual RatingDocument2 pagesRisk Assessment Record: Residual RatingRome AdolNo ratings yet

- Finance AccountsDocument13 pagesFinance AccountsVishal ChaudharyNo ratings yet

- Internal Audit ProcedureDocument5 pagesInternal Audit ProcedureEden Mae de GuzmanNo ratings yet

- Clause Based ChecklistDocument9 pagesClause Based ChecklistLim Kim YookNo ratings yet

- Bad Debts ProcedureDocument3 pagesBad Debts ProcedureCM_NguyenNo ratings yet

- Balanced Scorecard TemplateDocument3 pagesBalanced Scorecard TemplateVanny Joyce BaluyutNo ratings yet

- Finance Department FunctionsDocument4 pagesFinance Department Functionsmuhammad saadNo ratings yet

- Quality Management ProcessesDocument9 pagesQuality Management Processesselinasimpson0701No ratings yet

- General Controls General Control Area Control Notes: Audit Plan Worksheet (Audited As of Date)Document7 pagesGeneral Controls General Control Area Control Notes: Audit Plan Worksheet (Audited As of Date)Aziza Pusthika TanayaNo ratings yet

- Finance DepartmentDocument4 pagesFinance DepartmentKarthick Kaiser100% (1)

- IAF MD 22 2019 Application ISO 17021-1 For Certification K3Document22 pagesIAF MD 22 2019 Application ISO 17021-1 For Certification K3imam santosoNo ratings yet

- Overtime Audit Report-EDocument0 pagesOvertime Audit Report-EGarto Emmanuel SalimNo ratings yet

- Internal ControlDocument58 pagesInternal ControlStephen JamesNo ratings yet

- Capital Expenditure Request FormDocument1 pageCapital Expenditure Request FormMohamed IsmailNo ratings yet

- Audit Planning TechniquesDocument12 pagesAudit Planning TechniquesRahul KadamNo ratings yet

- Audit Notification Letter Rev. 01 - Warma TrierindoDocument2 pagesAudit Notification Letter Rev. 01 - Warma TrierindoEHSS Head OfficeNo ratings yet

- Auditcommitteeleadingpractices bb2278 February2012Document15 pagesAuditcommitteeleadingpractices bb2278 February2012Darius RamNo ratings yet

- Audit Plan Template For Internal Audit of Medical CollegeDocument5 pagesAudit Plan Template For Internal Audit of Medical CollegeJayabrata MajumdarNo ratings yet

- Training Workshop On IT AuditingDocument2 pagesTraining Workshop On IT AuditingOluwaseun MatthewNo ratings yet

- Wiley Not-for-Profit GAAP 2017: Interpretation and Application of Generally Accepted Accounting PrinciplesFrom EverandWiley Not-for-Profit GAAP 2017: Interpretation and Application of Generally Accepted Accounting PrinciplesNo ratings yet

- KMC Draft Under section189_3rd Qtr-16-17Document5 pagesKMC Draft Under section189_3rd Qtr-16-17Chandan ChatterjeeNo ratings yet

- LvSummaryAdv1 Nov23Document8 pagesLvSummaryAdv1 Nov23Chandan ChatterjeeNo ratings yet

- ECR_CHLN_ACK_WBPRB1364026000_4781705001417_1494404130604_2017051049530604605Document1 pageECR_CHLN_ACK_WBPRB1364026000_4781705001417_1494404130604_2017051049530604605Chandan ChatterjeeNo ratings yet

- Workmen Compensation CalculationDocument2 pagesWorkmen Compensation CalculationChandan ChatterjeeNo ratings yet

- address proof_0001Document2 pagesaddress proof_0001Chandan ChatterjeeNo ratings yet

- Pollution-1_mergedDocument2 pagesPollution-1_mergedChandan ChatterjeeNo ratings yet

- Arun Sarkar Assessee NoDocument1 pageArun Sarkar Assessee NoChandan ChatterjeeNo ratings yet

- 4781512002568_Sept15-U2Document5 pages4781512002568_Sept15-U2Chandan ChatterjeeNo ratings yet

- Legal Notice-138 NI ActDocument2 pagesLegal Notice-138 NI ActChandan ChatterjeeNo ratings yet

- DOL1Document5 pagesDOL1Chandan ChatterjeeNo ratings yet

- RTI KMCDocument2 pagesRTI KMCChandan ChatterjeeNo ratings yet

- Salary WBTLO0047925000ECR (052024) 04062024 2024061738970212355Document3 pagesSalary WBTLO0047925000ECR (052024) 04062024 2024061738970212355Chandan ChatterjeeNo ratings yet

- Hold Salary SheetDocument14 pagesHold Salary SheetChandan ChatterjeeNo ratings yet

- FORM3AREVISEDDET1-Amit Ranjan RoyDocument16 pagesFORM3AREVISEDDET1-Amit Ranjan RoyChandan ChatterjeeNo ratings yet

- Canteen Dect23Document1 pageCanteen Dect23Chandan ChatterjeeNo ratings yet

- Full and Final SettlementDocument2 pagesFull and Final SettlementChandan ChatterjeeNo ratings yet

- Ravirala Laxmaiah Vs State of A PDocument6 pagesRavirala Laxmaiah Vs State of A PChandan ChatterjeeNo ratings yet

- Audit Animal HouseDocument23 pagesAudit Animal HouseChandan ChatterjeeNo ratings yet

- CV EvaluationDocument2 pagesCV EvaluationChandan ChatterjeeNo ratings yet

- Sr. No. Name Date of Birth Relationship With Member Guardian Name Guardian's Relationship With MemberDocument2 pagesSr. No. Name Date of Birth Relationship With Member Guardian Name Guardian's Relationship With MemberChandan ChatterjeeNo ratings yet

- Supreme - Judgement - 18-Dec-2019-Bank GuranteeDocument20 pagesSupreme - Judgement - 18-Dec-2019-Bank GuranteeChandan ChatterjeeNo ratings yet

- A Look at Workplace EthicsDocument18 pagesA Look at Workplace EthicsChandan ChatterjeeNo ratings yet

- Employee'S Provident Fund: Electronic Challan Cum Return (Ecr)Document5 pagesEmployee'S Provident Fund: Electronic Challan Cum Return (Ecr)Chandan ChatterjeeNo ratings yet

- Ecr CHLN Rec Wbtlo0047925000 4712404003953 1712746534443 2024041059134443702Document1 pageEcr CHLN Rec Wbtlo0047925000 4712404003953 1712746534443 2024041059134443702Chandan ChatterjeeNo ratings yet

- Employee'S Provident Fund: Electronic Challan Cum Return (Ecr)Document2 pagesEmployee'S Provident Fund: Electronic Challan Cum Return (Ecr)Chandan ChatterjeeNo ratings yet

- Ecr CHLN Rec WBPRB1364026000 4782404002607 1712746022881 2024041058622881222Document1 pageEcr CHLN Rec WBPRB1364026000 4782404002607 1712746022881 2024041058622881222Chandan ChatterjeeNo ratings yet

- UntitledDocument38 pagesUntitledChandan ChatterjeeNo ratings yet

- Cgewho - 3Document26 pagesCgewho - 3Chandan ChatterjeeNo ratings yet

- The Employees' Pension SchemeDocument2 pagesThe Employees' Pension SchemeChandan ChatterjeeNo ratings yet

- Employees' State Insurance Corporation E-Pehchan Card: Insured Person: Insurance No.: Date of RegistrationDocument3 pagesEmployees' State Insurance Corporation E-Pehchan Card: Insured Person: Insurance No.: Date of RegistrationChandan ChatterjeeNo ratings yet

- Annual Report 2022-23Document180 pagesAnnual Report 2022-23Md Shahnawaz IslamNo ratings yet

- Payhawk Ebook How To Manage Month End Close Like A ProDocument11 pagesPayhawk Ebook How To Manage Month End Close Like A ProCorneliu Bajenaru - Talisman Consult SRLNo ratings yet

- Advt For Eligible Emp Promotion WB Audit&Accounts Service18Document5 pagesAdvt For Eligible Emp Promotion WB Audit&Accounts Service18Ranajoy BhadraNo ratings yet

- F2848 - Power of Attorney and Declaration of Representative - InstructionsDocument6 pagesF2848 - Power of Attorney and Declaration of Representative - InstructionsAutochthon Gazette100% (4)

- Activity#1Document7 pagesActivity#1April joy AgustinNo ratings yet

- SME Evaluation Matrix Original TemplateDocument3 pagesSME Evaluation Matrix Original TemplateLarimel ValdezNo ratings yet

- Solution Manual For Financial Accounting Theory and Analysis Text and Cases, 11th EditionDocument20 pagesSolution Manual For Financial Accounting Theory and Analysis Text and Cases, 11th EditionYousef ShahwanNo ratings yet

- DHF Best Practice Guide Door and Window Bolts To BS en 12051Document5 pagesDHF Best Practice Guide Door and Window Bolts To BS en 12051parathasiNo ratings yet

- Kapco International Limited: (400100) Disclosure of General Information About CompanyDocument115 pagesKapco International Limited: (400100) Disclosure of General Information About CompanyBhagwan BachaiNo ratings yet

- ZZZZ Best AnsDocument9 pagesZZZZ Best AnsMatthew ChangNo ratings yet

- Sample Gorilla in The Midst GuideDocument11 pagesSample Gorilla in The Midst GuideAkhtar QuddusNo ratings yet

- Impact of Auditing in Government ParastatalsDocument97 pagesImpact of Auditing in Government ParastatalsSunday SamsonNo ratings yet

- Soal Uas Seminar Akuntansi by AnggiDocument144 pagesSoal Uas Seminar Akuntansi by AnggiAnggi SyaifulNo ratings yet

- VELUX Group CR Report 2013Document72 pagesVELUX Group CR Report 2013CSRMedia NetworkNo ratings yet

- PSA 420 Asg 15 PagesDocument20 pagesPSA 420 Asg 15 Pagesfahmyzahid5818No ratings yet

- 2 General Awareness Training (Gat) For Iso 14001-2015 Ems PDFDocument4 pages2 General Awareness Training (Gat) For Iso 14001-2015 Ems PDFSiddhartha Sankar RoyNo ratings yet

- Materials Management Business Blueprint V1.0Document27 pagesMaterials Management Business Blueprint V1.0shailNo ratings yet

- Butuan City Water District Agusan Del Norte Executive Summary 2020Document13 pagesButuan City Water District Agusan Del Norte Executive Summary 2020Virgo Philip Wasil ButconNo ratings yet

- Cost Accounting - Meaning and ScopeDocument27 pagesCost Accounting - Meaning and ScopemenakaNo ratings yet

- Table of Content  " LANDDocument3 pagesTable of Content  " LANDEdo-Abasi EkereNo ratings yet

- MAS - Responsibility AccountingDocument12 pagesMAS - Responsibility AccountingAzureBlazeNo ratings yet

- AL RAFEE Credit Application FormDocument3 pagesAL RAFEE Credit Application FormNithin M NambiarNo ratings yet

- Fundamentals of Auditing and Assurance Services: LS 1.20 Psa 120: Framework of The Philippine Standards of AuditingDocument4 pagesFundamentals of Auditing and Assurance Services: LS 1.20 Psa 120: Framework of The Philippine Standards of AuditingSkye LeeNo ratings yet

- BHEL Project Abhinov SinghDocument62 pagesBHEL Project Abhinov SinghAbhinov SinghNo ratings yet

- Second Division: Republic of The Philippines Ourt of Tax App ALS Quezon TYDocument48 pagesSecond Division: Republic of The Philippines Ourt of Tax App ALS Quezon TYyakyakxxNo ratings yet

- Audit Report: International Standards On Auditing (ISA) 700Document5 pagesAudit Report: International Standards On Auditing (ISA) 700FarhanChowdhuryMehdiNo ratings yet

- Take A Groufie ProposalDocument3 pagesTake A Groufie ProposalClaire Padilla MontemayorNo ratings yet

- CPA Adeel ResumeDocument2 pagesCPA Adeel ResumeMH ULTRANo ratings yet

- Chingaya Joshua EconomicsDocument81 pagesChingaya Joshua EconomicsBiPiend Nguyễn100% (1)