Professional Documents

Culture Documents

2022 April Far

2022 April Far

Uploaded by

Xavier XandersOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2022 April Far

2022 April Far

Uploaded by

Xavier XandersCopyright:

Available Formats

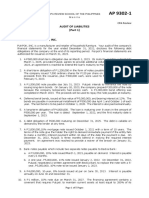

ReSA - THE REVIEW SCHOOL OF ACCOUNTANCY

CPA Review Batch 43 May 2022 CPALE 24 April 2022 8:00 – 11:00 AM

FINANCIAL ACCOUNTING & REPORTING FINAL PRE-BOARD EXAMINATION

INSTRUCTIONS: Select the correct answer for each of the questions. Mark only one

answer for each item by shading the box corresponding to the letter of your choice on

the answer sheet provided. STRICTLY NO ERASURES ALLOWED. Use pencil no. 2 only.

1. On December 31, 2022, the cash account of Shop Company shows the following

composition:

Petty cash fund, P180,000; Cash in bank (payroll fun +d), P2,000,000; Interest and

dividend fund, P250,000; Tax fund, P120,000; Cash in bank (current account),

P3,000,000; Certificate of deposit (terms 90 days), P1,000,000; Certificate of

deposit (terms 180 days), P1,500,000; Cash in foreign bank-restricted, P500,000;

Money market fund, (60 days), P500,000; Money market funds (6 months), P900,000;

Customer’s check dated February 15, 2023, P60,000; Customer’s check dated December

30, 2022 returned for lack of funds, P40,000; A 30-day BSP treasury bill, P1,000,000;

A 3-year BSP treasury bill acquired three months prior to maturity, P1,200,000;

Sinking fund cash, P800,000;Contingent fund, P900,000 Fund for the acquisition of

fixed asset, P500,000; Travelers’ checks, P60,000; and Cashiers’ checks, P100,000.

What is the correct cash and cash equivalents balance to be reported by Shop Company

on December 31, 2022?

a. P9,410,000

b. P9,320,000

c. P9,170,000

d. P9,780,000

2. The cash balance of Winter Company had the following information:

Descriptions November December

Cash balances per book P1,200,000 P1,450,000

Cash balances per bank 1,400,000 1,838,500

Bank service charges 12,000 11,500

NSF checks 100,000 150,000

Notes collected by the bank 350,000 410,000

Deposit in transit 320,000 ?

Outstanding checks ? 185,000

Book debit error 25,000 –

Book credit error 50,000 70,000

Bank credit error – 65,000

Bank debit error 75,000 90,000

Bank receipts 2,550,000

Book disbursements 1,920,000

Note: errors were corrected in the following period. No other errors

affecting the cash balances.

Statement 1: The amount of deposit in transit as of December 31, 2022 is P90,000.

Statement 2: The amount of outstanding checks as of November 30, 2022 is P272,000.

a. Only statement 1 is true

b. Only statement 2 is true

c. Both statements are true

d. Both statements are false

3. The following is the summary of transactions of Trust Company in 2021 and 2022:

2022 2021

Credit sales P6,000,000 P5,620,000

Collections of outstanding receivables 5,830,000 4,800,000

Accounts written off 60,000 20,000

Recovery of accounts previously written 15,000 none

off

Days past invoice date at December 31

0 – 30 600,000 500,000

31 – 90 150,000 180,000

91 – 180 110,000 ?

Over 180 ? 30,000

The company’s policy to provide allowance on its account receivable at year end as

follows: 0-30 days – 2%; 31-90 days – 5%; 91-180 days – 10%; and over 180 days –

20%.

Statement 1: The amount of uncollectible account expense in 2022 is P50,500.

Statement 2: The net realizable value of the accounts receivable as of December 31,

2022 is P869,500.

Page 1 of 23 0915-2303213 resacpareview@gmail.com

FINANCIAL ACCOUNTING & REPORTING

ReSA Batch 43 - May 2022 CPALE Batch

24 April 2022 8:00 AM to 11:00 AM FAR Final Pre-Board Exam

a. Only statement 1 is true

b. Only statement 2 is true

c. Both statements are true

d. Both statements are false

Use the following for the next two (2) questions:

The details of the accounts receivable of Dolomite Corporation as December 31, 2022

shows the following:

Beginning balance P3,450,000

Sales on account made to customers 2,800,000

Collection of accounts receivable during the year 4,200,000

Accounts written off as uncollectible 90,000

The following transactions were included in the recorded transactions during the

year:

a. Invoice dated December 28, 2022 for P350,000 was shipped and received by the

buyer on December 31, 2022, this invoice was recorded in the book at P35,000.

b. Invoice dated and recorded on November 30, 2022 was erroneously priced at P32

per unit. There were 11,000 units of goods delivered which were received on

December 10, 2022. The agreed price should be at P22 per unit only.

Dolomite’s policy is to provide 5% of the outstanding balance of accounts receivable

as uncollectible and there is beginning balance of allowance for bad debts of P40,000.

4. Statement 1: The amount of bad debt expense in 2022 is P158,250.

Statement 2: The ending balance of allowance for bad debts is P108,250

a. Only statement 1 is true

b. Only statement 2 is true

c. Both statements are true

d. Both statements are false

5. Statement 1: Adjusting entry to adjust the balance of allowance for bad debts

include a credit of P102,250

Statement 2: The net realizable value of accounts receivable as of December 31,

2022 is P2,056,750.

a. Only statement 1 is true

b. Only statement 2 is true

c. Both statements are true

d. Both statements are false

6. On January 1, 2022, Decathlon Company sold an equipment costing P10,000,000 and

accumulated depreciation of P2,500,000. Decathlon received a P1,000,000 cash and a

10%, 7-year, P7,000,000 note receivable every December 31 in equal annual

installment of P1,000,000 plus interest starting December 31, 2022. Interest

effective on this note when received is at 8%.

Statement 1: The amount of gain (loss) on sale should Decathlon recognized on January

1, 2022 is P948,407.

Statement 2: The interest income in Decathlon’s statement of comprehensive income

for the period ending December 31, 2022 is P595,873.

a. Only statement 1 is true

b. Only statement 2 is true

c. Both statements are true

d. Both statements are false

7. Jude Company has several manufacturing plants all over the country. On December 29,

2022, a super typhoon hit the province of Bicol where one of the entity’s large and

major manufacturing plant is located. Because of the damages caused by the calamity,

the entity decided to abandon the plant which constitute a major line of business.

All work stop at the manufacturing plant during the year ended 2022. The carrying

amount of the entire manufacturing plant amounted only to P2,000,000 as of the end

of the year. The operations of this manufacturing plant managed to generate P100,000

profit from operations before tax. The prevailing tax rate was at 30%. The fair

value less cost to sell was determined to be P1,990,000 and the value in use was at

P1,950,000 at the end of the year. How much should be reported as non-current asset

held for sale as of December 31, 2022?

a. P0

b. P1,990,000

c. P1,950,000

d. P2,000,000

Page 2 of 23 0915-2303213 resacpareview@gmail.com

FINANCIAL ACCOUNTING & REPORTING

ReSA Batch 43 - May 2022 CPALE Batch

24 April 2022 8:00 AM to 11:00 AM FAR Final Pre-Board Exam

8. Lany Incorporated had the following balances of assets and liabilities in 2022:

Beginning balances:

Cash and cash equivalents P250,000 Accounts payable P120,000

Trade and other receivables 150,000 Notes payable 80,000

Inventories 210,000 Bonds payable 200,000

Prepaid expenses 50,000 Mortgage payable 240,000

Property, plant and equipment -

net 350,000

Ending balances:

Cash and cash equivalents P230,000 Accounts payable P100,000

Trade and other receivables 250,000 Notes payable 60,000

Inventories 300,000 Bonds payable 170,000

Prepaid expenses 40,000 Mortgage payable 240,000

Property, plant and equipment -

net 300,000

How much is the net income in 2022 if Lany Incorporated have contributed a total of

P250,000 and withdrawn P150,000 during the year?

a. P180,000

b. P150,000

c. P120,000

d. P80,000

9. On January 2, 2021, Puma Company receives a government loan of P2,000,000 paying a

coupon interest of 1% per year. The loan is repayable at the end of year 6. Puma

Company’s borrowing cost is 7% per annum. The below-market interest is provided by

the government to enable Puma Company to bear cost of 1% per annum on the nominal

value of the loan.

Statement 1: Puma Company should recognize income from government grant amounting

to P85,558 for the year ended December 31, 2022?

Statement 2: Puma Company should report P314,918 deferred income from government

grant on December 31, 2023?

a. Only statement 1 is true

b. Only statement 2 is true

c. Both statements are true

d. Both statements are false

10. Matcha Company asks you to review its December 31, 2022, inventory values and

prepare the necessary adjustments to the books. The following information is given

to you.

[1.] Matcha uses the periodic method of recording inventory. A physical count

reveals P2,348,900 inventory on hand at Dec. 31, 2022.

[2.] Not included in the physical count of inventory is P134,200 of merchandise

purchased on Dec. 15 from Standing. This merchandise was shipped F.O.B. shipping

point on Dec. 29 and arrived in Jan. The invoice arrived and was recorded on

Dec. 31.

[3.] Included in inventory is merchandise sold to Oval on Dec. 30, F.O.B.

destination. This merchandise was shipped after it was counted. The invoice was

prepared and recorded as a sale on account for P128,000 on Dec. 31. The

merchandise cost P73,500, and Oval received it on Jan. 3.

[4.] Included in inventory was merchandise received from Owl on Dec. 31 with an

invoice price of P156,300. The merchandise was shipped F.O.B destination. The

invoice, which has not yet arrived, has not been recorded.

[5.] Not included in inventory is P85,400 of merchandise purchased from Oxygen

Industries. The merchandise was received on Dec. 31 after the inventory had been

counted. The invoice was received and recorded on Dec. 30.

[6.] Included in inventory was P104,380 of inventory held by Matcha on consignment

from Ovoid Industries.

[7.] Included in inventory is merchandise sold to Kemp F.O.B. shipping point. This

merchandise was shipped after it was counted. The invoice was prepared and

recorded as a sale for P189,000 on Dec. 31. The cost of this merchandise was

P105,200, and Kemp received the merchandise on Jan. 5.

[8.] Excluded from inventory was carton labeled “Please accept for credit.” This

carton contains merchandise costing P15,000 which had been sold to a customer

for P25,000. No entry had been made to the books to reflect the return, but none

of the returned merchandise seemed damaged.

Page 3 of 23 0915-2303213 resacpareview@gmail.com

FINANCIAL ACCOUNTING & REPORTING

ReSA Batch 43 - May 2022 CPALE Batch

24 April 2022 8:00 AM to 11:00 AM FAR Final Pre-Board Exam

The adjusted inventory cost of Matcha Company at December 31, 2022 should be?

a. P2,188,720

b. P2,225,620

c. P2,373,920

d. P2,473,420

11. On April 1, 2021 Jack Frost Co. purchased a P200,000 at face value bond investment

that will mature on April 1, 2027. Interest on this bond is collectible every April

1 starting 2022, Jack Frost Co. account for this investment based on business model

of collecting contractual cash flows and to sell when circumstances warrant. Jack

Frost Co. paid transaction cost of P10,160 to acquire the investment. The bond

after transaction cost will yield 5% interest. Effective interest at the end of

2021, and 2023 were 3%, and 6%, respectively. While the investment is quoted at

105 on December 31, 2022. Jack Frost Co. reported interest income of P7,881 in 2021

on this bond, amortization of P1,119 and cumulative balance in other comprehensive

income of P19,707 at the end of 2021. How much is the correct interest income that

Jack Frost should report in its Statement of Comprehensive income for the period

ending December 31, 2022?

a. P10,452

b. P10,508

c. P10,635

d. P10,712

12. On January 2, 2021, Review Inc. acquired 15% interest in Resa Co. by paying

P1,500,000 for 7,500 ordinary shares. On this date, the net assets of Resa Co.

totaled P9 million. The investment was designated as a financial asset at fair

value through other comprehensive income. The fair values of Resa Co.’s identifiable

assets and liabilities approximate their book values. On August 1, 2021, Review

received dividends of P4 per share from Resa Co. Fair value of the shares on

December 31, 2021 was P190. Net income reported by Resa for the year ended December

31, 2021 amounted to P1,500,000.

On July 1, 2022, Review Inc. paid P1 million to purchase 5,000 additional shares of

Resa Co. from another shareholder. On this date the fair value of the net assets

exceeds carrying value by P500,000 attributable to depreciable asset with estimated

remaining life of 5 years. On February 1, 2022, cash dividends of P5 per share was

received from Resa Co. while another dividends of P6 per share was received on

August 1, 2022. Net income reported for the year ended amounted to P1,500,000 with

P800,000 being earned for the second half (July – December) six months ended December

31, 2022. What is the carrying value of the investment as of December 31, 2022?

a. P2,577,500

b. P2,612,500

c. P2,712,500

d. P2,881,500

Use the following for the next three (3) questions:

Data given for three different companies were as follows:

Lotus Co. started its business in 2021. It sells printers with three year warranty

cost as percentage of sales. Based on past experience, it is estimated that 3% will be

repaired during the first year of warranty, 5% will be repaired during the second year

of warranty and 8% will be in the third year. In 2021 and 2022,the company able to

sell 7,000 and 8,600 units respectively at a selling price of P4,500 per unit. The

company also incurred actual repair costs of P P1,250,000 and P2,110,000 in 2021 and

2022, respectively.

Sunflower Co. issues on December 31 2020, 15-year bonds of P5,000,000 for P5,380,304

to yield 10%. Interest is payable annually on December 31, at 11%. On June 30, 2022,

Sunflower retires 2,000 of its own P1,000 bonds at 96 including accrued interest. The

accounting period of Sunflower is the calendar year.

Gumamela Co. records its purchases at gross amount but wishes to change to recording

purchases net of purchase discounts. Discounts available on purchases recorded from

January 1, 2022 to December 31, 2022, totaled P10,000. Of this amount, P1,000 is still

available in the accounts payable balance. The balances in Gumamela's accounts as of

and for the year ended December 31, 2022, before conversion are: Purchases, P500,000;

Purchase discounts taken, P4,000; Accounts payable, P150,000.

Page 4 of 23 0915-2303213 resacpareview@gmail.com

FINANCIAL ACCOUNTING & REPORTING

ReSA Batch 43 - May 2022 CPALE Batch

24 April 2022 8:00 AM to 11:00 AM FAR Final Pre-Board Exam

13. The amount of warranty liability reported in Lotus Company’s December 31, 2022

Statement of Financial Position assuming an assurance type warranty should be:

a. P6,782,000

b. P6,845,000

c. P7,872,000

d. P7,922,000

14. Sunflower Company’s gain (loss) on retirement of bonds is?

a. P109,434 gain

b. P109,434 loss

c. P334,700 gain

d. P334,700 loss

15. Gumamela Company’s entry to record the conversion in the recording of purchases

from the gross to net method shall include the following EXCEPT:

a. Debit to purchases of P10,000

b. Debit to accounts payable of P1,000

c. Debit to purchase discount lost of P5,000

d. Debit to purchase discount of P4,000

Use the following for the next three (3) questions:

Relevant data for three different companies were as follows:

Basil Company inaugurated a premiums promotional campaign at the beginning of 2021.

Two stickers are included for every sachet of shampoo sold. These stickers will be

used to redeem a hair brush. To claim one hair brush, a customer shall present 30

stickers. Each sachet of shampoo is sold at P15 while the hair brush had a cost of P5

each. The following is the summary of the promotional campaign for years 2021 and 2022:

2021 2022

Total sachet of shampoo sold 300,000 562,500

Total stickers presented for redemption 405,000 825,000

The company estimates that only 80% of the stickers will be presented for redemption.

The hair brush can be sold separately at P10 if not use in premium promotional program.

Pesto Company started its business in selling printers with three-year warranty. It

estimates its warranty cost as a percentage of peso sales. Based on past experience,

it is estimated that 3% will be repaired during the first year of warranty, 5% will be

repaired during the second year of warranty and 7% will be repaired in the third year.

The product warranty provides service other than agreed upon specification. In 2021

and 2022, the company was able to sell 10,000 units and 12,500 units, respectively at

a total price of P7,000 per unit. The company also incurred actual repair costs of

P3,500,000 and P9,500,000 in 2021 and 2022, respectively. The selling price of the

warranty is P2,000 per unit. The printer is selling at P5,000 if without the warranty.

The liability for compensated absences of Tomato Company had a beginning balance of

P555,000, it represents the probable unused sick leave and vacation leave in 2021 and

prior to 2021 carried over to 2022. The company’s policy is to allow the employees to

carry over unused leaves over two years from year of grant, thereafter, it shall

expire. Salary rate for current year (2022) increased by 7%. The balance cumulative

unused sick leave and vacation leave are as follows:

Prior to 2021 leaves carried over to 2022 300 days

Leaves earned in 2022 carried over to 2023 600 days

2021 leaves earned carried over to 2022 625 days

Prior to 2021 leaves used in 2022 720 days

Of the total leaves used in 2022, from prior to 2021 leaves used in 2022, 285 were

earned by employee prior to 2021.

16. Basil Company should reported unearned premium income at the end of December 31,

2022 of?

a. P24,142

b. P37,524

c. P48,283

d. P49,817

17. Pesto Company should report unearned warranty income at the end of December 31,

2022 of?

a. P10,625,000

b. P16,000,000

c. P21,666,667

d. P29,333,333

Page 5 of 23 0915-2303213 resacpareview@gmail.com

FINANCIAL ACCOUNTING & REPORTING

ReSA Batch 43 - May 2022 CPALE Batch

24 April 2022 8:00 AM to 11:00 AM FAR Final Pre-Board Exam

18. Tomato Company should report liability for compensated absences at the end of

December 31, 2022 of?

a. P302,625

b. P418,340

c. P507,180

d. P523,735

Use the following for the next four (4) questions:

Information provided relative to three different companies follows:

Jollibee Company purchased an equipment at P6,500,000 on January 1, 2020 which will be

used for a total of 10 years, no salvage value. Jollibee accounted for this equipment

using the revaluation model. The value in use of the assets during the three revaluation

dates were P5,556,000, P4,413,000 and P4,240,000 on December 31, 2020; 2021; and 2022.

While the fair values are P5,500,000, P4,620,000; and P4,770,000; respectively for

2020, 2021 and 2022 with cost to sell of P100,000; P120,000; and P110,000, respectively.

On February 1, 2022 McDonalds Company purchased an equipment from Shakey’s Corporation

in exchange for a seven-year, non-interest-bearing note requiring five payments of

P110,500 and two payments of P140,500. The first five payment of P110,500 is to be

made on February 1, 2023 – 2027, and the others are due annually on February 2, 2028

and 2029. At date of issuance, the prevailing rate of interest for this type of note

was 9%. In addition, McDonalds paid cash of P75,000 as down-payment, and incurred

installation cost of P15,000; Testing cost of P10,000 and paid insurance of P5,000

while the equipment is in transit.

Popeye’s Company constructed its own building which qualifies for interest

capitalization. Popeye’s incurred the following cost and had the following outstanding

borrowings while the building is under construction.

January 1, 2022 P3,000,000

March 31, 2022 2,500,000

June 30, 2022 2,100,000

November 1, 2022 1,275,000

September 1, 2023 5,575,200

Outstanding borrowings:

Dated January 1, 2022 - 3,000,000; 7% (specific)

Dated January 1, 2022 - 2,000,000; 10% (general)

Dated January 1, 2023 - 4,000,000; 8% (general)

The construction was completed on December 31, 2023 and ready for its intended use.

19. How much is the gain on reversal should Jollibee Company recognize in its income

statement for the year ended December 31, 2022?

a. P110,000

b. P412,650

c. P612,500

d. P722,500

20. What amount should McDonalds initially recognized the equipment on February 2,

2022?

a. P620,440

b. P695,440

c. P1,136,936

d. P1,241,936

21. How much is the initial cost of the building when completed on December 31, 2023

in Popeye’s financial position?

a. P15,590,200

b. P15,673,267

c. P15,889,711

d. P15,925,333

22. How much of interest should Popeye capitalized in 2023 related to self-constructed

building?

a. P915,761

b. P865,333

c. P730,000

d. P715,711

Page 6 of 23 0915-2303213 resacpareview@gmail.com

FINANCIAL ACCOUNTING & REPORTING

ReSA Batch 43 - May 2022 CPALE Batch

24 April 2022 8:00 AM to 11:00 AM FAR Final Pre-Board Exam

The following costs are incurred by Ilang-ilang Corporation:

Goodwill purchased in a business combination 500,000

Cost of developing website for the promotion and advertisement 150,000

of the entity’s products and services

Cost incurred in the corporation’s formation and organization 230,000

Operating losses incurred in the start-up of the business 130,000

Initial franchise fees paid 175,000

Continuing franchise fees 50,000

Internally generated goodwill 800,000

Cost of purchasing a patent from an inventor 137,000

Cost of leasehold improvement 70,000

Legal costs incurred in successfully defending a patent 55,500

Internally generated customer list 40,000

Cost of purchasing a trademark 250,000

Computer software for a computer-controlled machine that cannot

operate without that specific software 325,500

23. How much from the above items can be recognized as intangible assets including

goodwill?

a. P1,062,000

b. P1,132,000

c. P1,172,000

d. P1,387,500

Everlasting Corporation provided the following information regarding its Research JPB-

04 included in the company’s Intangible account as of December 31, 2022:

Research JPB-04 is for a research project which consists of the following charges:

Salaries of research staff P18,000

Patent acquired solely for the use in the project 12,000

Special equipment acquired and useful for various

Similar research activities 10,000

Patent acquired for use in several research

Projects including JPB-04 16,000

The equipment and patents have been found to be useful for approximately four years.

Both the patents and equipment were acquired at the beginning of 2022.

24. How much should be recognized as research and development expense for the year

2022?

a. P56,000

b. P36,500

c. P35,200

d. P26,000

Helsinki Company was able to patent one of its new machines with the Intellectual

Property Office of the Philippines on January 3, 2022. The cost of the patent recorded

by the client included the following items:

Purchase of special equipment for used in operations P1,650,000

Research salaries and fringe benefits for engineers and scientists 310,000

Cost of testing prototype 420,000

Legal cost of filing for patent 375,000

Fees paid to government patent office 125,000

Drawings required by patent office to be filed with patent application 88,000

25. How much is the initial cost of the patent?

a. P588,000

b. P1,008,000

c. P1,318,000

d. P2,968,000

On January 1, 2022, Iced Latte Corporation issued 5,000 10-year bonds of 12% P1,000

face value, each with warrants to acquire ordinary shares at P60 per share. The interest

on the bonds is payable annually every December 31. Each bond contains one warrant

which can be used to acquire 5 shares of P50 par value ordinary shares. It is estimated

that without the warrants, the bonds would sell at 98. The bond price with warrants is

105.

Page 7 of 23 0915-2303213 resacpareview@gmail.com

FINANCIAL ACCOUNTING & REPORTING

ReSA Batch 43 - May 2022 CPALE Batch

24 April 2022 8:00 AM to 11:00 AM FAR Final Pre-Board Exam

26. What amount is allocated to equity upon issuance of bonds?

a. P250,000

b. P300,000

c. P350,000

d. P400,000

Salted Caramel Corporation issued P1,500,000 of 8% bonds on October 1, 2020 due on

October 1, 2023 at 105. The interest is to be paid twice a year on April 1 and October

1. When the bonds was issued, the prevailing market rate was 10% without the conversion

privilege. The corporation closes its books annually on December 31. Each P1,000 bond

is convertible into 10 shares of P100 par value ordinary share. The bonds were retired

on April 1, 2023 at 102 and on this date, the prevailing market rate was 9% without

the conversion privilege.

27. How much gain (loss) should Salted Caramel record upon retirement of these bonds?

a. P37,177 gain

b. P37,177 loss

c. P7,109 gain

d. P7,109 loss

White Mocha Company has an overdue note payable to Australia Bank of P9,000,000 and

recorded accrued interest of P 810,000. On December 31, 2022, Australia Bank agreed to

the following restructuring agreement:

• Reduce the principal obligation by P1,000,000

• Waive the P 810,000 accrued interest

• Extend the maturity date to December 31, 2024.

• Annual interest of 9% of the new principal is to be paid on December 31, 2023

and December 31, 2024.

• The prevailing market interest rate for similar debt instrument on the date of

restructuring is 10%

28. How much is the gain on debt restructuring?

a. P2,008,948

b. P1,809,864

c. P1,199,032

d. P0

Matcha Corp. had P500,000 net income in 2022. On January 1, 2022, there were 200,000

shares of ordinary outstanding. On April 1, 20,000 shares were issued and on September

1, bought 30,000 shares of treasury shares. There are 30,000 options to buy ordinary

shares at P40 per share. The market price of the ordinary shares averaged P50 during

2022. The tax rate is 40%.

During 2022, there were 40,000 shares of cumulative preference shares outstanding. The

preference has P100 par, pays dividend of P3.50 per year, and is convertible into three

shares of ordinary.

Matcha issued P2,000,000 of 8% convertible bonds at face value during 2021. Each P1,000

bond is convertible into 20 shares of ordinary.

29. How much is the basic earnings per share for 2022?

a. P1.71

b. P1.76

c. P1.60

d. P1.17

30. How much is the diluted earnings per share for 2022?

a. P1.71

b. P1.68

c. P1.51

d. P1.46

Use the following for the next two (2) questions:

The following data were summarized for two different companies:

An equipment was purchased on January 2, 2019 by Summer Incorporated from a private

individual paying cash of P2,000,000; issuing 10,000 of its P100 par value shares (with

fair value of P120 on January 2, 2019); and a 3-year, non-interest bearing, P3,000,000

face value notes payable. Prevailing rate of interest on the notes payable on January

2, 2019 was at 12%. Summer uses SYD in depreciating this equipment and estimates useful

life of 8 years with P50,000 residual value.

Page 8 of 23 0915-2303213 resacpareview@gmail.com

FINANCIAL ACCOUNTING & REPORTING

ReSA Batch 43 - May 2022 CPALE Batch

24 April 2022 8:00 AM to 11:00 AM FAR Final Pre-Board Exam

Winter Company purchased on January 2, 2019, a new set of furniture and fixtures by

issuing 5,000 of its P100 par value shares (FV on this date is P110), in addition to

P200,000 cash paid in connection to purchase. The P200,000 is broken as follows:

Freight and delivery charges P80,000

Non-refundable purchase taxes 70,000

Furniture cover* 50,000

Total P200,000

*the furniture cover was requested by the company president because he wanted his office furniture

looks good. The cover does not enhance the asset.

The furniture and fixture is depreciated using 1.5 declining balance with an estimated

useful life of four years and salvage value of P80,000.

31. How much depreciation expense should Summer Company recognized in its income

statement for the year ending December 31, 2022?

a. P587,260

b. P734,075

c. P741,020

d. P592,816

32. What is the amount of depreciation expense – furniture and fixtures should Winter

Company recognized in its December 31, 2022 income statement?

a. P56,726

b. P64,087

c. P90,898

d. P102,539

Moana Corporation’s December 31, 2022 balance sheet reports the following shareholders’

equity:

10% Cumulative Preference share capital, P100 par value per share,

30,000 shares issued and outstanding, liquidation value of P105 P3,000,000

Ordinary share capital, P100 par value, 60,000 shares issued 6,000,000

Share premium 500,000

Treasury shares, (ordinary) 5,000 shares at cost 600,000

Retained Earnings 4,000,000

Subscribed ordinary share, net of P400,000 subscription receivable 1,000,000

Revaluation surplus 700,000

Preference dividends have not been paid since last year up to the end of 2022.

33. What is the book value per share on ordinary share?

a. 173.08

b. 163.04

c. 166.92

d. 157.25

34. What is the book value per share on preference share?

a. 125.00

b. 115.00

c. 120.00

d. 105.00

Mary Grace Company issued all of its authorized ordinary shares for P250 in 2021. On

January 3, 2022, Mary Grace acquired 20,000 shares of its share at P200 per share and

retired them. Mary Grace accounts as at December 31, 2021 follow:

Ordinary shares, P100 par value, 100,000 shares authorized P 10,000,000

Share premium 15,000,000

Retained earnings 6,500,000

35. What should be the total shareholders’ equity immediately after the retirement of

the shares?

a. P27,000,000

b. P27,500,000

c. P28,000,000

d. P28,500,000

Use the following for the next two (2) questions:

On February 2, 2022, Frankie’s Corp. was authorized to issue 1,200,000 shares of

ordinary share at P15 par value per share and 500,000 shares of 7% preference share at

P100 par value. During the first year of operations, 500,000 ordinary shares were

issued at P28 per share and 60,000 preference shares for P130 per share. 6,000 ordinary

shares were issued in payment of a current operating debt of P186,000.

Page 9 of 23 0915-2303213 resacpareview@gmail.com

FINANCIAL ACCOUNTING & REPORTING

ReSA Batch 43 - May 2022 CPALE Batch

24 April 2022 8:00 AM to 11:00 AM FAR Final Pre-Board Exam

In addition, on December 10, 2022, subscriptions for 50,000 shares of ordinary share

were taken at a purchase price of P30. Sixty percent of the subscribed shares were

paid on December 15, 2022. In the first year of operation, the net income was

P1,420,000. During the year, dividends of P360,000 were paid to shareholders. At the

end of the year, total liabilities were P820,000.

36. How much is the contributed capital at the end of the first year.

a. P22,886,000

b. P22,754,000

c. P21,985,000

d. P21,856,000

37. How much is the total shareholders' equity at the end of the first year.

a. P23,946,000

b. P24,126,000

c. P23,736,000

d. P24,636,000

The shareholders' equity section of Ramen Nagi Corporation as of December 31, 2021,

contained the following accounts:

Ordinary share, 2,000,000 shares authorized; 1,000,000 shares issued P3,000,000

and outstanding

Share premium 4,000,000

Retained earnings 6,000,000

Ramen Nagi’s board of directors declared a 10 percent bonus issue on April 1, 2022,

when the market value of the share was P7 per share. Accordingly, 100,000 new shares

were issued. Ramen Nagi’s entire share has a par value of P3 per share.

38. Assuming Ramen Nagi sustained a net loss of P1,200,000 for the quarter ended March

31, 2022, what amount should Ramen Nagi report as retained earnings as of April 1,

2022?

a. P3,960,000

b. P3,990,000

c. P4,100,000

d. P4,210,000

Use the following for the next two (2) questions:

On January 1, 2022, Miller Textiles leased a cutting machine from Good Machinery. The

lease is for five years with bargain purchase option of P100,000. It is reasonably

certain that Miller will exercise the option at the end of the lease period. The

machine has an estimated useful life of 8 years with zero residual value. The lease

calls for Miller to make annual payments of P250,000 due at the beginning of each year.

Miller uses the straight-line method of depreciation and pays 10% interest on borrowed

money.

The lease contract also requires Miller to make variable lease payments based on the

increase in consumer price index (CPI) at the start of each year compared to the CPI

on January 1, 2022. The CPI is 110 on January, 2022, and 120 on January 1, 2023.

39. What is the carrying amount of the right-of-use asset at the end of 2022?

a. P895,820

b. P899,819

c. P966,489

d. P995,224

40. How much is the increase or decrease in lease liability due to remeasurement on

January 1, 2023?

a. P79,247 increase

b. P69,872 increase

c. P65,829 decrease

d. P69,953 decrease

41. At the beginning of 2022, Evans Industries acquired a machine with fair value of

P6,074,699 by signing a 4-year lease, which is the expected useful life of the

machine passing. The lease is payable in four equal annual payments of P2 million

at the end of each year. The implicit rate in the lease is 12%. What is the initial

cost of the right of-use-asset?

a. P6,074,699

b. P6,000,000

c. P7,925,389

d. P8,000,000

Page 10 of 23 0915-2303213 resacpareview@gmail.com

FINANCIAL ACCOUNTING & REPORTING

ReSA Batch 43 - May 2022 CPALE Batch

24 April 2022 8:00 AM to 11:00 AM FAR Final Pre-Board Exam

42. On January 1, 2022, Dire Corporation signed a ten-year noncancelable lease for

certain machinery. The terms of the lease called for Dire to make annual payments

of P150,000 at the end of each year for ten years with title to pass to Dire at

the end of this period. The machinery has an estimated useful life of 15 years.

Dire uses the straight-line method of depreciation for all of its fixed assets.

Dire accordingly accounted for this lease transaction as a finance lease. The

interest rate of 8% is implicit in the lease. Dire has an option to purchase the

asset at the end of lease term at P120,000 which is reasonably certain to exercise

by Dire. Estimated residual value at the end of 10 years is P100,000 and end of 15

years is P80,000. Dire incurred a total of P350,000 direct cost to enter the lease.

Dire should record for 2022:

a. lease expense of P150,000.

b. interest expense of P80,521 and depreciation expense of P85,101.

c. interest expense of P84,968 and depreciation expense of P88,806.

d. interest expense of P85,681 and depreciation expense of P131,210.

43. Porcha Corp.'s transactions for the year ended December 31, 2022 included the

following:

• Acquired 50% of Ford Corp.'s ordinary shares for P180,000 cash which was borrowed

from a bank.

• Issued 5,000 shares of its preference shares for land having a fair value of

P320,000.

• Issued 500 of its 11% debenture bonds, due 2026, for P392,000 cash.

• Purchased a patent for P220,000 cash.

• Paid P120,000 toward a bank loan.

• Sold available-for-sale securities for P796,000.

• Had a net increase in returnable customer deposits (long-term) of P88,000.

Porcha’s net cash provided by investing activities for 2022 was

a. P296,000

b. P396,000

c. P476,000

d. P616,000

Use the following for the next two (2) questions:

On January 1, 2022, Guevara’s Company reported the fair value of plan assets at

P6,700,000 and defined benefit obligation at P6,100,000. Transactions affecting the

balances for the current year are as follows:

Current service cost P1,125,000

Past service cost 325,000

Contribution to the plan 1,290,000

Benefits paid to retirees at scheduled date 800,000

Actual return on plan assets 837,500

Decrease in defined benefit obligation due to changes

in actuarial assumption 135,000

Rate of return on high quality corporate bonds 10%

44. How much is the amount of benefit expense reported in its statement of comprehensive

income as a component of profit or loss?

a. P948,000

b. P1,074,000

c. P1,390,000

d. P1,510,000

45. How much is the amount reported in its December 31, 2022 statement of financial

position as pension asset or liability?

a. P532,500 asset

b. P532,500 liability

c. P802,500 asset

d. P802,500 liability

46. Juancho Company encourages its employees older than 60 years to extend their

employment with the entity by promising a lump sum benefit equal to 5% of final

salary for each year of service they remain employed by the entity after their 60th

birthday provided they remain employed until they are 65, at which time, in

accordance with local laws, employees are required to retire. The benefit is payable

to the employees on retirement. There are five (5) employees entitled for the

benefit whose 60th birthday is on January 1, 2021.

Page 11 of 23 0915-2303213 resacpareview@gmail.com

FINANCIAL ACCOUNTING & REPORTING

ReSA Batch 43 - May 2022 CPALE Batch

24 April 2022 8:00 AM to 11:00 AM FAR Final Pre-Board Exam

Their salary rates for the year ended December 31, 2021 is P1,000,000. In 2021 the

entity made the following assumptions:

• Employees salary rate should increase by 9% compounded each year.

• The rate of return on quality corporate bonds is 12%.

• The employee salary rate for 2022 is P1,120,000.

How much is the current service cost in 2022?

a. P224,271

b. P261,281

c. P258,097

d. P263,908

Use the following for the next two (2) questions:

The accountant of Honda Company presented to you the following information in 2022:

Pre-tax financial income P3,000,000

Impairment loss on Machinery 50,000

Unearned rental income 350,000

Prepaid advertising expense 250,000

Interest income on time deposit 80,000

Excess tax depreciation over accounting depreciation 520,000

Installment sale which will be recognized as taxable income

upon collection 900,000

Bad debts expense using a method under accrual basis 75,000

Provision for warranty 180,000

Unrealized loss on trading securities 20,000

Impairment loss on goodwill 30,000

Income tax rate is constant at 30% for all years.

47. How much is the deferred tax asset at December 31, 2022?

a. P501,000

b. P202,500

c. P298,500

d. P586,500

48. How much is the deferred tax liability at December 31, 2022?

a. P501,000

b. P202,500

c. P298,500

d. P586,500

49. On December 1, 2022, Telon Corp. engaged the following transactions:

• The company pledge P600,000 of its accounts receivable as a security for a

P500,000 loan with Yupy Bank.

• Factored P1,300,000 of accounts receivable without recourse on a notification

basis with Yalong Finance Company. Yalong Finance charged a factoring fee of 10%

of the amount of receivable factored and withheld 15% of the receivable factored.

• A customer’s P700,000, 7-month, 5% note receivable dated August 1, 2022 was

discounted with Yummy Bank at 8% discount rate on a with recourse basis.

How much is the total cash received from the financing of receivables?

a. P2,181,008

b. P2,218,006

c. P2,197,206

d. P2,132,005

50. On January 1, 2022, Canada Corp. purchased, 5-year bonds with a face value of

P7,500,000 and a stated interest rate of 10% per year payable semi-annually every

June 30 and December 31. The bonds were acquired to yield 11%. These were recorded

as financial assets at amortized cost. On July 31, 2024, the bonds were sold at

111 including accrued interest. How much is the purchase price of the bonds?

a. P7,217,339

b. P7,262,927

c. P7,331,291

d. P7,341,291

Page 12 of 23 0915-2303213 resacpareview@gmail.com

FINANCIAL ACCOUNTING & REPORTING

ReSA Batch 43 - May 2022 CPALE Batch

24 April 2022 8:00 AM to 11:00 AM FAR Final Pre-Board Exam

51. For a sale to be highly probable, the following should be evident, except

a. The appropriate level of management must be committed to a plan to sell

the asset (or disposal group), and an active programme to locate a buyer

and complete the plan must have been initiated.

b. The asset (or disposal group) must be actively marketed for sale at a price

that is reasonable in relation to its current fair value.

c. The sale should be expected to qualify for recognition as a completed sale

within one year after the reporting period.

d. Actions required to complete the plan should indicate that it is unlikely

that significant changes to the plan will be made or that the plan will be

withdrawn.

52. Statement 1: Bank service charge is a book reconciling item and will never affect

the bank proof of cash.

Statement 2: The notes collected by the bank in prior period is added to current

months receipts to arrive at the book adjusted cash balance.

a. Only statement 1 is true

b. Only statement 2 is true

c. Both statements are true

d. Both statements are false

53. The book recorded a check disbursement in November for P15,000, the correct amount

is P25,000. This was corrected in December. How would this affect the book proof

of cash?

a. November cash balance is reduced by P10,000 while the disbursement is

reduced by P10,000.

b. November cash balance is reduced by P10,000 while the receipts is increased

by P10,000.

c. November and December cash balances are both reduced by P10,000.

d. November cash balance is reduced by P10,000 while the disbursement is

increased by P10,000.

54. Assuming that your provisions for bad debts increase by 50% from prior period

provision for bad debt while your ending balance of allowance remains the same.

Which of the following is true?

a. the ratio of write-off and beginning balance of allowance is higher than

the ratio of write-off and ending balance of allowance.

b. the ratio of write-off and beginning balance of allowance is less than the

ratio of write-off and ending balance of allowance.

c. the ratio of write-off and beginning balance of allowance is equal to the

ratio of write-off and ending balance of allowance.

d. Not determinable.

55. When the allowance method of recognizing bad debt expense is used, the allowance

for doubtful accounts would decrease when

a. Specific account receivable is collected

b. Account previously written off is collected

c. Specific uncollectible account is written off

d. Account previously written off becomes collectible

56. For which type of investments would unrealized holding gain or loss be recorded

directly in an owner’s equity account?

a. Investment in associates

b. Equity investment at fair value through OCI

c. Equity investment at fair value through P&L

d. Debt investment at amortized cost

57. If the combined market value of equity investment at fair value through profit or

loss at the end of the year is more than the market value of the same portfolio of

trading securities at the beginning of the year, the difference should be accounted

for by:

a. reporting an unrealized loss in security investment in the stockholders’

equity section of the balance sheet

b. reporting an unrealized loss in security investments in the income

statement

c. reporting an unrealized gain in security investments in the income

statement

d. a footnote to the financial statements

Page 13 of 23 0915-2303213 resacpareview@gmail.com

FINANCIAL ACCOUNTING & REPORTING

ReSA Batch 43 - May 2022 CPALE Batch

24 April 2022 8:00 AM to 11:00 AM FAR Final Pre-Board Exam

58. Which of the following statements regarding debt securities classified at fair

value through profit or loss is incorrect?

a. They are held primarily to be sold in a short period of time.

b. Unrealized holding gains and losses are reported in the profit or loss.

c. Any discount or premium on debt securities is amortized using the effective

interest method.

d. Gain on sale is the excess of net selling price over the previous fair

value of securities sold.

59. Which of the following costs generally would be capitalized to a property, plant

and equipment account?

a. interest on debt incurred to purchase the item

b. property taxes relating to periods after acquisitions

c. import duties incurred on purchase

d. freight-out

60. Which statements are correct concerning measurement of cost of property, plant and

equipment?

I. The purchase price of an item of property, plant and equipment is the cash price

equivalent at the date of recognition

II. If payment is deferred beyond normal credit terms, the difference between the

cash price equivalent and total payment is recognized as interest expense over the

life of the asset.

III. If an item of property, plant and equipment is acquired in exchange for a

nonmonetary asset or a combination of monetary and nonmonetary asset, the cost of

such item is measured at fair value unless the exchange transaction lacks commercial

substance or fair value of either asset received or given up is not reliably

determinable.

IV. If an entity is able to determine reliably the fair value of both the asset

given up and asset received in an exchange, the fair value of the asset given up is

used to measure the cost of asset received in exchange.

a. I and IV only

b. I, II and III

c. I, III and IV

d. All statements are correct

61. Identify the cost formula that is described in the following statements:

Statement 1: The cost formula in which the oldest cost incurred rarely have an

effect on the ending inventory valuation.

Statement 2: The cost formula in which the cost of each item is determined from

weighted average of the cost of similar items at the beginning of each period and

the cost of similar items purchased or produced during the period.

a. Specific Identification, Weighted Average

b. FIFO, Weighted Average

c. Specific Identification, Moving Average

d. FIFO, Moving Average

62. Under PFRS 8, which of the following is not a criterion used to determine reportable

segments?

a. Segment assets

b. Segment liabilities

c. Segment sales

d. Segment operating profit or loss

63. An overstatement in reported profit may result from failure to record

a. An accrued expense

b. A contingent liability

c. Amortization of premium on bonds payable

d. Dividends in arrears on outstanding preference share

64. Which of the following is true about the preparation of statement of comprehensive

income?

a. Income from operation includes finance cost

b. Income from continuing operation plus income from discontinued operation

equals total comprehensive income already

c. Income tax related to discontinued operation shall not be disclosed on the

face of income statement

d. Other comprehensive income shall be disclosed on the face of income

statement after tax

Page 14 of 23 0915-2303213 resacpareview@gmail.com

FINANCIAL ACCOUNTING & REPORTING

ReSA Batch 43 - May 2022 CPALE Batch

24 April 2022 8:00 AM to 11:00 AM FAR Final Pre-Board Exam

65. In a lease that is appropriately recorded as a direct-financing lease by the lessor,

unearned income

a. should be amortized over the period of the lease using the effective

interest method.

b. should be amortized over the period of the lease using the straight-line

method.

c. does not arise.

d. should be recognized at the lease's expiration.

66. In order to properly record a direct-financing lease, the lessor needs to know how

to calculate the lease receivable. The lease receivable in a direct-financing lease

is best defined as

a. the amount of funds the lessor has tied up in the asset which is the

subject of the direct-financing lease.

b. the difference between the lease payments receivable and the fair value of

the leased property.

c. the present value of minimum lease payments.

d. the total book value of the asset less any accumulated depreciation

recorded by the lessor prior to the lease agreement.

67. Government grants related to depreciable assets are

a. Recognized as income when the grants are received.

b. Recognized as income at the end of the useful life of the asset received.

c. Recognized as income over the periods and on the same basis as depreciation

for that asset.

d. Not recognized.

68. In the cash flow statement, alternatively interest received and dividend received

may be classified as cash flow from

a. Operating activities

b. Investing activities

c. Financing activities

d. Revenue activities

69. The new conceptual framework is composed of eighth chapters, which of the following

are correct?

I. Chapter 1: The Objective of General Purpose Financial Reporting

II. Chapter 2: Financial Statement and the Reporting Entity

III. Chapter 3: Qualitative Characteristics of Useful Financial Information

IV. Chapter 4: Recognition and Derecognition

V. Chapter 5: Measurement

VI. Chapter 6: Elements of the Financial Statements

VII. Chapter 7: Presentation and Disclosure

VIII. Chapter 8: Concepts of Capital and Capital Maintenance

a. I, III, VI, VIII

b. I, IV, V, VI, VIII

c. I, VI, VII, VIII

d. I, VII, VIII

e. I, IV, VII, VIII

70. The Conceptual Framework provides the foundation for Standards, except:

a. contribute to transparency by enhancing the international comparability

and quality of financial information, enabling investors and other market

participants to make informed economic decisions.

b. strengthen accountability by reducing the information gap between the

providers of capital and the people to whom they have entrusted their

money.

c. contribute to economic efficiency by helping investors to identify

opportunities and risks across the world, thus improving capital

allocation.

d. assist preparers to develop consistent accounting policies when no standard

applies to a particular transaction or other event, or when a Standard

allows a choice of accounting policy

- E N D -

Page 15 of 23 0915-2303213 resacpareview@gmail.com

FINANCIAL ACCOUNTING & REPORTING

ReSA Batch 43 - May 2022 CPALE Batch

24 April 2022 8:00 AM to 11:00 AM FAR Final Pre-Board Exam

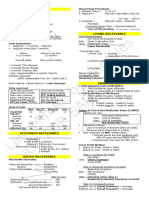

ANSWERS & SOLUTIONS/CLARIFICATIONS

1 A 26 C 51 C

2 A 27 D 52 A

3 B 28 A 53 A

4 C 29 B 54 C

5 B 30 C 55 C

6 C 31 B 56 B

7 A 32 C 57 C

8 D 33 B 58 C

9 C 34 A 59 C

10 C 35 B 60 C

11 A 36 A 61 B

12 B 37 A 62 B

13 C 38 C 63 A

14 C 39 C 64 C

15 C 40 A 65 A

16 C 41 A 66 C

17 D 42 C 67 C

18 C 43 B 68 B

19 C 44 C 69 D

20 B 45 C 70 D

21 A 46 C

22 C 47 B

23 A 48 A

24 B 49 A

25 A 50 A

Page 16 of 23 0915-2303213 resacpareview@gmail.com

FINANCIAL ACCOUNTING & REPORTING

ReSA Batch 43 - May 2022 CPALE Batch

24 April 2022 8:00 AM to 11:00 AM FAR Final Pre-Board Exam

Page 17 of 23 0915-2303213 resacpareview@gmail.com

FINANCIAL ACCOUNTING & REPORTING

ReSA Batch 43 - May 2022 CPALE Batch

24 April 2022 8:00 AM to 11:00 AM FAR Final Pre-Board Exam

Page 18 of 23 0915-2303213 resacpareview@gmail.com

FINANCIAL ACCOUNTING & REPORTING

ReSA Batch 43 - May 2022 CPALE Batch

24 April 2022 8:00 AM to 11:00 AM FAR Final Pre-Board Exam

Page 19 of 23 0915-2303213 resacpareview@gmail.com

FINANCIAL ACCOUNTING & REPORTING

ReSA Batch 43 - May 2022 CPALE Batch

24 April 2022 8:00 AM to 11:00 AM FAR Final Pre-Board Exam

Page 20 of 23 0915-2303213 resacpareview@gmail.com

FINANCIAL ACCOUNTING & REPORTING

ReSA Batch 43 - May 2022 CPALE Batch

24 April 2022 8:00 AM to 11:00 AM FAR Final Pre-Board Exam

Page 21 of 23 0915-2303213 resacpareview@gmail.com

FINANCIAL ACCOUNTING & REPORTING

ReSA Batch 43 - May 2022 CPALE Batch

24 April 2022 8:00 AM to 11:00 AM FAR Final Pre-Board Exam

Page 22 of 23 0915-2303213 resacpareview@gmail.com

FINANCIAL ACCOUNTING & REPORTING

ReSA Batch 43 - May 2022 CPALE Batch

24 April 2022 8:00 AM to 11:00 AM FAR Final Pre-Board Exam

Page 23 of 23 0915-2303213 resacpareview@gmail.com

You might also like

- Far 2019Document23 pagesFar 2019Princess KeithNo ratings yet

- PRTC - TAX-Final PB - May 2022Document16 pagesPRTC - TAX-Final PB - May 2022Luna VNo ratings yet

- ReSA CPA Review Batch 45 Pre-Recorded Lecture VideosDocument2 pagesReSA CPA Review Batch 45 Pre-Recorded Lecture VideosMarielle GonzalvoNo ratings yet

- RESA FAR PreWeek (B43)Document10 pagesRESA FAR PreWeek (B43)MellaniNo ratings yet

- ReSA B44 FAR Final PB Exam Questions Answers and SolutionsDocument22 pagesReSA B44 FAR Final PB Exam Questions Answers and SolutionsWesNo ratings yet

- ReSA B44 FAR First PB Exam Questions Answers SolutionsDocument17 pagesReSA B44 FAR First PB Exam Questions Answers SolutionsWesNo ratings yet

- PRTC TAX-1stPB 0522 220221 091723Document16 pagesPRTC TAX-1stPB 0522 220221 091723MOTC INTERNAL AUDIT SECTIONNo ratings yet

- FAR PreBoard (1) CPAR BATCH90Document18 pagesFAR PreBoard (1) CPAR BATCH90Bella ChoiNo ratings yet

- Cash To Accrual Single Entry With AnswersDocument9 pagesCash To Accrual Single Entry With AnswersHazel PachecoNo ratings yet

- AFAR May2021 1st Preboard With AnswerDocument28 pagesAFAR May2021 1st Preboard With Answerlllll100% (3)

- FAR 1 Reviewer AnswerDocument27 pagesFAR 1 Reviewer AnswerZace Hayo100% (1)

- ReSA B43 AFAR First PB Exam Questions, Answers & SolutionsDocument22 pagesReSA B43 AFAR First PB Exam Questions, Answers & SolutionsBella Choi100% (1)

- Agamata MAS Reviewer 05 CVP Analysisx PDFDocument70 pagesAgamata MAS Reviewer 05 CVP Analysisx PDFJanine Lerum100% (1)

- ReSA B43 FAR First PB Exam Questions Answers SolutionsDocument14 pagesReSA B43 FAR First PB Exam Questions Answers Solutionsrtenaja100% (1)

- Reviewer ExamDocument73 pagesReviewer ExamZalaR0cksNo ratings yet

- ReSA B45 AFAR First PB Exam - Questions, Answers - SolutionsDocument23 pagesReSA B45 AFAR First PB Exam - Questions, Answers - SolutionsDhainne Enriquez100% (1)

- ReSA B42 FAR Final PB Exam - Questions, Answers - SolutionsDocument24 pagesReSA B42 FAR Final PB Exam - Questions, Answers - SolutionsLuna V100% (2)

- FAR Summary Lecture (14 May 2021)Document10 pagesFAR Summary Lecture (14 May 2021)rav danoNo ratings yet

- Polytechnic University of The Philippines: Use The Following Information For The Next Two (2) QuestionsDocument2 pagesPolytechnic University of The Philippines: Use The Following Information For The Next Two (2) QuestionsSean ThyrdeeNo ratings yet

- MAS AbitiagoDocument6 pagesMAS AbitiagoJoris YapNo ratings yet

- FAR 1st PreboardDocument10 pagesFAR 1st PreboardLui100% (2)

- CPA Review School of The Philippin: First Pre-Board Examination Regulatory Framework For Business TransactionsDocument11 pagesCPA Review School of The Philippin: First Pre-Board Examination Regulatory Framework For Business TransactionsSophia PerezNo ratings yet

- ReSA B43 TAX Final PB Exam - Questions, Answers & SolutionsDocument17 pagesReSA B43 TAX Final PB Exam - Questions, Answers & SolutionsBernadette PanicanNo ratings yet

- AP-100 (Error Correction, Accounting Changes, Cash-Accrual & Single Entry)Document4 pagesAP-100 (Error Correction, Accounting Changes, Cash-Accrual & Single Entry)Dethzaida AsebuqueNo ratings yet

- Property, Plant and Equipment Sample Problems: Problem 1Document10 pagesProperty, Plant and Equipment Sample Problems: Problem 1Mark Gelo Winchester0% (1)

- AUDIT - 1ST Preboard (SET A)Document13 pagesAUDIT - 1ST Preboard (SET A)KriztleKateMontealtoGelogo0% (1)

- Darrell Joe O. Asuncion, Cpa, Mba Instructions: Choose The Best Answer For Each of The Following. Mark TheDocument8 pagesDarrell Joe O. Asuncion, Cpa, Mba Instructions: Choose The Best Answer For Each of The Following. Mark TheSer Crz JyNo ratings yet

- Audit of PPE - Homework - AnswersDocument15 pagesAudit of PPE - Homework - AnswersMarnelli CatalanNo ratings yet

- Rey Ocampo Online! Auditing Problems: Audit of InvestmentsDocument4 pagesRey Ocampo Online! Auditing Problems: Audit of InvestmentsSchool FilesNo ratings yet

- 9.1 Equity Investments at Fair Value PDFDocument4 pages9.1 Equity Investments at Fair Value PDFJorufel PapasinNo ratings yet

- C. Either A or B.: Discussion ProblemsDocument8 pagesC. Either A or B.: Discussion ProblemsGlen JavellanaNo ratings yet

- CHAPTER 8 - Audit of Liabilities: Problem 1Document27 pagesCHAPTER 8 - Audit of Liabilities: Problem 1Mikaela Gale CatabayNo ratings yet

- AFAR-03 (Corporate Liquidation)Document6 pagesAFAR-03 (Corporate Liquidation)Maricris AlilinNo ratings yet

- Auditing Problems Test Banks - LIABILITIES Part 1Document5 pagesAuditing Problems Test Banks - LIABILITIES Part 1Alliah Mae Arbasto0% (1)

- ReSA B44 AUD First PB Exam Questions Answers SolutionsDocument19 pagesReSA B44 AUD First PB Exam Questions Answers SolutionsWesNo ratings yet

- Sharedolders Reviewer Part 1Document31 pagesSharedolders Reviewer Part 1Aira Rhialyn MangubatNo ratings yet

- Practice AcctngDocument7 pagesPractice AcctngRubiliza GailoNo ratings yet

- Quiz For 3rd ExamDocument2 pagesQuiz For 3rd ExamSantiago BuladacoNo ratings yet

- At Professional Responsibilities and Other Topics With AnswersDocument27 pagesAt Professional Responsibilities and Other Topics With AnswersShielle AzonNo ratings yet

- ReSA FPB B37 PDFDocument75 pagesReSA FPB B37 PDFMay LittNo ratings yet

- Quiz Ins Sales Oct5Document6 pagesQuiz Ins Sales Oct5AlexNo ratings yet

- Compilation of MCQDocument34 pagesCompilation of MCQDaphnie Bolo100% (1)

- Unit 7 Audit of Property Plant and Equipment Handout Final t21516Document10 pagesUnit 7 Audit of Property Plant and Equipment Handout Final t21516Mikaella BengcoNo ratings yet

- T R S A: HE Eview Chool of CcountancyDocument12 pagesT R S A: HE Eview Chool of CcountancyNamnam KimNo ratings yet

- Corporate LiquidationDocument3 pagesCorporate LiquidationJasmine Marie Ng CheongNo ratings yet

- Problem No. 1: Practice Set Property Plant and EquipmentDocument4 pagesProblem No. 1: Practice Set Property Plant and EquipmentFiona MoralesNo ratings yet

- Tax 1st Preboard Questionnaire BDocument6 pagesTax 1st Preboard Questionnaire BAlexis Kaye DayagNo ratings yet

- AUD-Audit of PPE With AnswersDocument34 pagesAUD-Audit of PPE With AnswersOlive Grace Caniedo100% (1)

- The Review Schooj. of AccountancyDocument17 pagesThe Review Schooj. of AccountancyYukiNo ratings yet

- QUIZ 4.1 Investments PDFDocument4 pagesQUIZ 4.1 Investments PDFGirly CrisostomoNo ratings yet

- Final Proj Sy2022-23 Agrigulay Corp.Document4 pagesFinal Proj Sy2022-23 Agrigulay Corp.Jan Elaine CalderonNo ratings yet

- The University of Manila College of Business Administration and Accountacy Integrated CPA Review and Refresher Program Pre-Final Examination AE 16Document5 pagesThe University of Manila College of Business Administration and Accountacy Integrated CPA Review and Refresher Program Pre-Final Examination AE 16ana rosemarie enaoNo ratings yet

- Reviewer For Final Examination - ProblemsDocument11 pagesReviewer For Final Examination - Problemsreynald animosNo ratings yet

- 2816 Solution To Long Term Construction ContractsDocument47 pages2816 Solution To Long Term Construction ContractsPhoeza Espinosa Villanueva100% (1)

- Reviewer in PPEDocument16 pagesReviewer in PPEDewi Leigh Ann Mangubat50% (2)

- Cpa Review School of The Philippines ManilaDocument3 pagesCpa Review School of The Philippines ManilaAljur SalamedaNo ratings yet

- Prelim ReviewDocument41 pagesPrelim ReviewKrisan Rivera100% (1)

- Auditing Integration ReceivablesDocument6 pagesAuditing Integration ReceivablesDonalyn BannagaoNo ratings yet

- Lesson 2-ACCOUNTS RECEIVABLES-2021NADocument5 pagesLesson 2-ACCOUNTS RECEIVABLES-2021NAandreaNo ratings yet

- Audit Ar With SolutionsDocument14 pagesAudit Ar With Solutionsbobo kaNo ratings yet

- BotonDocument4 pagesBotonsheridaNo ratings yet

- Design and Implementation of A Computerized Tax Collection SystemnDocument26 pagesDesign and Implementation of A Computerized Tax Collection SystemnIbrahim Abdulrazaq YahayaNo ratings yet

- Set Off & Carry Forward of LossesDocument21 pagesSet Off & Carry Forward of LossesanchalNo ratings yet

- 2-1-Maynard-Company-A Compress - Prepare BalanceDocument1 page2-1-Maynard-Company-A Compress - Prepare Balancesparsh.official.limited23No ratings yet

- Business Math 2nd Quarter With Answer KeyDocument5 pagesBusiness Math 2nd Quarter With Answer KeyEMILL ASUNCIONNo ratings yet

- Chapter 4: Adjusting The Accounts and Preparing Financial StatementsDocument8 pagesChapter 4: Adjusting The Accounts and Preparing Financial StatementsDanh PhanNo ratings yet

- Taxation For Professional Services: TopicDocument35 pagesTaxation For Professional Services: TopicLANCENo ratings yet

- ACC - Nguyen Thanh Tung - Indi 2Document4 pagesACC - Nguyen Thanh Tung - Indi 2Nguyen Thanh Tung (K15 HL)No ratings yet

- Donor's Tax 2024Document6 pagesDonor's Tax 2024Michael BongalontaNo ratings yet

- Schedule'C'Form With AnnexinstructionsDocument4 pagesSchedule'C'Form With AnnexinstructionsAmanuelNo ratings yet

- IAS 12 - Deferred TaxationDocument3 pagesIAS 12 - Deferred TaxationDawar Hussain (WT)No ratings yet

- Ti51164Document2 pagesTi51164Musa BabaNo ratings yet

- Cia1002 Fsa Lecture DZDocument53 pagesCia1002 Fsa Lecture DZathirah jamaludinNo ratings yet

- Impact Incidence ShiftingDocument2 pagesImpact Incidence ShiftingRuhul AminNo ratings yet

- Orb201005 800-012Document3 pagesOrb201005 800-012rahul anjaliNo ratings yet

- Payslip February-2023Document1 pagePayslip February-2023kashif shaikhNo ratings yet

- Me Mid Term Question PaperDocument3 pagesMe Mid Term Question Papervansh sharmaNo ratings yet

- Capital Gains Tax ReviewerDocument14 pagesCapital Gains Tax ReviewerCleah WaskinNo ratings yet

- Q1 Summative ExamDocument2 pagesQ1 Summative Examaibee patatagNo ratings yet

- Annex A. Understanding The Subject Matter TemplateDocument6 pagesAnnex A. Understanding The Subject Matter TemplateSittie RahmaNo ratings yet

- Acc 6050: Accounting and Financial ReportingDocument5 pagesAcc 6050: Accounting and Financial ReportingDEE0% (1)

- FAR Last Minute by HerculesDocument10 pagesFAR Last Minute by Herculesjanjan3256No ratings yet

- TDS - Applicability On Any Type of Development AgreementDocument2 pagesTDS - Applicability On Any Type of Development Agreementparasshah.kljNo ratings yet

- CHAPTER 2 StudentDocument10 pagesCHAPTER 2 Studentfelicia tanNo ratings yet

- Ebook Ebook PDF Pearsons Federal Taxation 2018 Individuals 31st Edition PDFDocument41 pagesEbook Ebook PDF Pearsons Federal Taxation 2018 Individuals 31st Edition PDFmichael.johnson225100% (41)

- CFS MCQS (35) - UnattmeptedDocument31 pagesCFS MCQS (35) - UnattmeptedpanganikhithaNo ratings yet

- Media Industry ReportDocument40 pagesMedia Industry ReportSargam SinghalNo ratings yet

- Jayvion Stub 2Document1 pageJayvion Stub 2raheemtimo1No ratings yet

- Paper15 Set1 SolDocument20 pagesPaper15 Set1 Solpiyushshukla9642No ratings yet

- Far160 Pyq Feb2023Document8 pagesFar160 Pyq Feb2023nazzyusoffNo ratings yet