Professional Documents

Culture Documents

The Economist Guide To Business Planning Generic Business Model

The Economist Guide To Business Planning Generic Business Model

Uploaded by

joseCopyright:

Available Formats

You might also like

- Business Value Assessment TemplateDocument17 pagesBusiness Value Assessment TemplateAlina Molesag100% (2)

- Financial Position and Performance of FirstGroup PLC.Document17 pagesFinancial Position and Performance of FirstGroup PLC.Mohammad MollaNo ratings yet

- Rolito DionelaDocument40 pagesRolito DionelaRolito Dionela50% (2)

- Dmp3e Ch05 Solutions 02.28.10 FinalDocument37 pagesDmp3e Ch05 Solutions 02.28.10 Finalmichaelkwok1No ratings yet

- Control: The Management Control Process: Changes From Eleventh EditionDocument25 pagesControl: The Management Control Process: Changes From Eleventh EditionAlka Narayan100% (1)

- SDASDDocument9 pagesSDASDRocelle LAQUINo ratings yet

- 13 Week Cash Flow ModelDocument16 pages13 Week Cash Flow ModelASChipLeadNo ratings yet

- Beams - Intercom Profit Transaction - BondsDocument12 pagesBeams - Intercom Profit Transaction - BondsAnggit Ponco100% (1)

- Model 2 Feb 05 V7.0 BlankDocument19 pagesModel 2 Feb 05 V7.0 BlanknicoweissNo ratings yet

- Segment & Interim ReportDocument12 pagesSegment & Interim ReportMuhammad ZulhisyamNo ratings yet

- Build Your Business Build Your Business: Performance Summary Performance SummaryDocument6 pagesBuild Your Business Build Your Business: Performance Summary Performance Summaryarun kumarNo ratings yet

- Mindtree: Reference ModelDocument54 pagesMindtree: Reference ModelLiontiniNo ratings yet

- Project Business StepsDocument33 pagesProject Business StepsVamshi Krishna KamajaNo ratings yet

- MAA703 T1 2024 Group Assignment Assessment-2ADocument7 pagesMAA703 T1 2024 Group Assignment Assessment-2Atitli.pramanik.8No ratings yet

- Module 1 - Merge Result - Business DevelopmentDocument39 pagesModule 1 - Merge Result - Business DevelopmenthadrifaNo ratings yet

- Kaju NotesDocument18 pagesKaju NotesDurgeh BarodeNo ratings yet

- Corporate Finance-Darko Jovanović 2015Document17 pagesCorporate Finance-Darko Jovanović 2015Darko JovanovicNo ratings yet

- Reporting For Control: Prepared by Shannon Butler, Cpa, Ca Carleton UniversityDocument48 pagesReporting For Control: Prepared by Shannon Butler, Cpa, Ca Carleton UniversityMariela CNo ratings yet

- Amtel Holdings BerhadDocument9 pagesAmtel Holdings Berhadwaryloges7gmailcomNo ratings yet

- MK Business UnderstandingDocument18 pagesMK Business UnderstandingDurgeh BarodeNo ratings yet

- 2009 10 Brand Valuation Additional InformationDocument2 pages2009 10 Brand Valuation Additional InformationAnuja BhakuniNo ratings yet

- ACC - ACF1200 Workbook Topic 9Document8 pagesACC - ACF1200 Workbook Topic 9wesley hudsonNo ratings yet

- 30 - 31. IGCSE - Business Studies - Costs Scale of Production and Break-Even Analysis - AssignmentDocument7 pages30 - 31. IGCSE - Business Studies - Costs Scale of Production and Break-Even Analysis - Assignmentdung luongtuanNo ratings yet

- Business Plan Booklet 1Document3 pagesBusiness Plan Booklet 1Amr AbdelMoneimNo ratings yet

- Capital StructureDocument14 pagesCapital StructureGouri LakshmiNo ratings yet

- REDMOND, Wash. - October 23, 2019 - Microsoft Corp. Today Announced The Following Results ForDocument10 pagesREDMOND, Wash. - October 23, 2019 - Microsoft Corp. Today Announced The Following Results ForRochak JainNo ratings yet

- Lecture 27Document34 pagesLecture 27Riaz Baloch NotezaiNo ratings yet

- Camp GTM Strategy TemplateDocument42 pagesCamp GTM Strategy TemplateNiket MankadNo ratings yet

- GR 9 Project Business Plan T3 2023Document12 pagesGR 9 Project Business Plan T3 2023kwazy dlaminiNo ratings yet

- ACC 404 RatiosDocument11 pagesACC 404 RatiosMahmud TuhinNo ratings yet

- Investment AnalysisDocument11 pagesInvestment AnalysisFendi SamsudinNo ratings yet

- SM05 PorterNoASfsfddrton FA 8eDocument85 pagesSM05 PorterNoASfsfddrton FA 8eKia PottsNo ratings yet

- 01 Financial Modelling For Short Decision MakingDocument32 pages01 Financial Modelling For Short Decision Makingjanuar baharuliNo ratings yet

- Cost-Volume-Profit Relationships: Learning ObjectivesDocument27 pagesCost-Volume-Profit Relationships: Learning ObjectivesChau ToNo ratings yet

- HDFC PPT FinalDocument12 pagesHDFC PPT FinalRISHABH RAJ-DM 21DM237No ratings yet

- Module 8: Browse Application Areas Module Overview: ObjectivesDocument54 pagesModule 8: Browse Application Areas Module Overview: ObjectivesmatejkahuNo ratings yet

- Thoughtco Business PlanDocument12 pagesThoughtco Business PlanBlackjackNo ratings yet

- Semester May 2012: Faculty of Business and ManagementDocument23 pagesSemester May 2012: Faculty of Business and ManagementFarah ismailNo ratings yet

- 1 - Statement of Comprehensive IncomeDocument4 pages1 - Statement of Comprehensive IncomeOusy 14No ratings yet

- Contents Page: Business PlanDocument43 pagesContents Page: Business Plankasahun bedasoNo ratings yet

- Case Study of PUNE HotelDocument10 pagesCase Study of PUNE HoteluvavaliyaNo ratings yet

- 541 Case 2Document21 pages541 Case 2Σταυρος ΑνιNo ratings yet

- Ratio AnalysisDocument16 pagesRatio AnalysisAbdul RehmanNo ratings yet

- BBA 4002 Budgeting and Control (Industrial Project Paper)Document33 pagesBBA 4002 Budgeting and Control (Industrial Project Paper)AusLiowLiowNo ratings yet

- Managerial ReportDocument31 pagesManagerial ReportQuỳnh QuỳnhNo ratings yet

- SAMIL Presentation On Results Q4FY24Document36 pagesSAMIL Presentation On Results Q4FY24SREEKANTHNo ratings yet

- Background KnowledgeDocument7 pagesBackground Knowledgeanamsaeed1No ratings yet

- 01 DAIS Question Module 03 Finance HANDOUT 933680800790651Document5 pages01 DAIS Question Module 03 Finance HANDOUT 933680800790651ronny nyagakaNo ratings yet

- 1acc0807 Cw1 Cost AccountingDocument3 pages1acc0807 Cw1 Cost AccountingLiliana Martinez100% (1)

- Business Feasibility AfzalDocument6 pagesBusiness Feasibility AfzalSonam RajKumarNo ratings yet

- ACC51112 Responsibility Accounting WITH ANSWERSDocument8 pagesACC51112 Responsibility Accounting WITH ANSWERSjasNo ratings yet

- Smart Task 03 SubmissionDocument13 pagesSmart Task 03 SubmissionRAVI KUMARNo ratings yet

- JPR 54079 DailmerAG EquityResearch Report 1303Document35 pagesJPR 54079 DailmerAG EquityResearch Report 1303André Fonseca100% (1)

- JMIA Q3 22 ER 17.11.22 VFDocument20 pagesJMIA Q3 22 ER 17.11.22 VFSparta ElnNo ratings yet

- NTPC Anta: A Project Study Report On Training Undertaken atDocument17 pagesNTPC Anta: A Project Study Report On Training Undertaken atPradeep SharmaNo ratings yet

- Aa-Plc 2013Document44 pagesAa-Plc 2013gaja babaNo ratings yet

- So Sánh Gi A Unilever Và JohnsonDocument26 pagesSo Sánh Gi A Unilever Và JohnsonAnh NgocNo ratings yet

- Powerpoint Pitchbook Sample Template PackDocument6 pagesPowerpoint Pitchbook Sample Template PackSreekanth101No ratings yet

- CH 01Document11 pagesCH 01Zohaib ImtiazNo ratings yet

- Working Capital Management at Ing Vysya Bank: By: Kanhaiya Lal KediaDocument20 pagesWorking Capital Management at Ing Vysya Bank: By: Kanhaiya Lal Kedia2473314No ratings yet

- Final Examin Econ 1Document2 pagesFinal Examin Econ 1Ysabel Grace BelenNo ratings yet

- Word Write Soln - Newell Design Manufacturing Valuation Decision MakingDocument7 pagesWord Write Soln - Newell Design Manufacturing Valuation Decision Makingalka murarkaNo ratings yet

- 2010 - Annual - Report - Cover:Layout 1 2/5/2010 4:12 PMDocument54 pages2010 - Annual - Report - Cover:Layout 1 2/5/2010 4:12 PMFoo Leung Tsz KinNo ratings yet

- Official Guide to Financial Accounting using TallyPrime: Managing your Business Just Got SimplerFrom EverandOfficial Guide to Financial Accounting using TallyPrime: Managing your Business Just Got SimplerNo ratings yet

- Financial Statement AnalysisDocument4 pagesFinancial Statement AnalysisLea AndreleiNo ratings yet

- FIN 534 Homework Chap.2Document3 pagesFIN 534 Homework Chap.2Jenna KiragisNo ratings yet

- Financial Statement Analysis Tesco TargetDocument6 pagesFinancial Statement Analysis Tesco Targetnormalty100% (3)

- PS 5 - Chapter 6 - The Measurement Approach To Decision Usefulness (Solutions)Document17 pagesPS 5 - Chapter 6 - The Measurement Approach To Decision Usefulness (Solutions)Matteo VidottoNo ratings yet

- Hilton6e SM08Document70 pagesHilton6e SM08Eych MendozaNo ratings yet

- Chap 6 - Other Non-Dcf ApproachesDocument31 pagesChap 6 - Other Non-Dcf Approachesrafat.jalladNo ratings yet

- Qualifying Exam Review Qs Final & Answers2Document30 pagesQualifying Exam Review Qs Final & Answers2hy050796x82% (11)

- Loss of Significant InfluenceDocument2 pagesLoss of Significant InfluenceAngeline RamirezNo ratings yet

- IAS 36 Impairment of AssetsDocument45 pagesIAS 36 Impairment of AssetsvidiNo ratings yet

- Problem 3&5Document17 pagesProblem 3&5panda 1No ratings yet

- Practical Accounting 2Document7 pagesPractical Accounting 2Irish Joy AlaskaNo ratings yet

- 100 To 1 in The Stock Market SummaryDocument28 pages100 To 1 in The Stock Market SummaryRamanReet SinghNo ratings yet

- This Study Resource Was: Bonds PayableDocument8 pagesThis Study Resource Was: Bonds PayableAlexis NievesNo ratings yet

- Research Paper On Financial Analysis of A CompanyDocument8 pagesResearch Paper On Financial Analysis of A Companyefg7a0t1No ratings yet

- Exercises Lesson 3 Balance Sheet: Financial AccountingDocument11 pagesExercises Lesson 3 Balance Sheet: Financial AccountingElena LuizaNo ratings yet

- Accounting For Partnership: Part 2Document15 pagesAccounting For Partnership: Part 2Lady Fe DielNo ratings yet

- BookkeepingDocument20 pagesBookkeepingzhanel bekenovaNo ratings yet

- Review Sheet Midterm PDFDocument12 pagesReview Sheet Midterm PDFeleNo ratings yet

- Quiz 1 Final ExamDocument6 pagesQuiz 1 Final ExamNica Jane MacapinigNo ratings yet

- FinTree - FRA Sixty Minute Guide PDFDocument38 pagesFinTree - FRA Sixty Minute Guide PDFkamleshNo ratings yet

- Financial Accounting Chap 4Document119 pagesFinancial Accounting Chap 4Zexi WUNo ratings yet

- 12 Podar International School QPDocument2 pages12 Podar International School QPAkshat KhetanNo ratings yet

- Horizontal and Vertical Analaysis: Karysse Arielle Noel Jalao Financial Management Bsac-2BDocument10 pagesHorizontal and Vertical Analaysis: Karysse Arielle Noel Jalao Financial Management Bsac-2BKarysse Arielle Noel JalaoNo ratings yet

- ChapDocument74 pagesChapTote FrotyNo ratings yet

- Business Combination at The Date of AcquisitionDocument2 pagesBusiness Combination at The Date of AcquisitionDarren Joy CoronaNo ratings yet

- Financial Ratio AnalysisDocument10 pagesFinancial Ratio AnalysisSehat TanNo ratings yet

The Economist Guide To Business Planning Generic Business Model

The Economist Guide To Business Planning Generic Business Model

Uploaded by

joseOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The Economist Guide To Business Planning Generic Business Model

The Economist Guide To Business Planning Generic Business Model

Uploaded by

joseCopyright:

Available Formats

Mobile Business Planning Model

The Economist Guide to Business Planning

Generic Business Model

About The Model Model Set-Up Operational Forecasts Accounting

Financial Results

© Coleago Consulting Ltd www.coleago.com Version 1.0 - 1st May 2003

Confidential File Name: 598331723.xls Print Date: 06/28/2022 Page: 1

Mobile Business Planning Model

About the Model

This model has been designed to be used in conjunction with The Economists Guide to Business Modelling. The model was developed by

Graham Friend and remains the copyright of Profile Books. Neither Profile Books, The Economist or Coleago Consulting Ltd accpets any

responsibility for any losses, accidents or events that occur directly or indirectly as a result of the use of the model.

For further information on consulting, bespoke modelling and business modelling training courses please contact Graham Friend at

graham.friend@coleago.com.

Confidential File Name: 598331723.xls Print Date: 06/28/2022 Page: 2

Mobile Business Planning Model

Model Set Up Your Task

The basis information required in this sheet will be used throughout the model. All cells with blue font are a required input.

Range Name

Business Imperative Widgets Limited Company_Name

Currency € Currency

Units Thousands Units

Years 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 Years

Confidential File Name: 598331723.xls Print Date: 06/28/2022 Page: 3

Mobile Business Planning Model

Operational Forecasts

Operational Forecasts

Revenue

This section examines revenues, costs of sale and operating costs.

Cost of Sales

Operating Costs

Confidential File Name: 598331723.xls Print Date: 06/28/2022 Page: 4

Mobile Business Planning Model

Revenue Your Task

Widgets Limited Enter the assumptions as indicated below to create a revenue

Units as Specified forecast.

Year 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012

Revenue Line 1

Revenue Description Widget Revenue_Description_1

Opening Customers - 000s -

Closing Customers - 000s 50 150 330 890 1,900 3,330 4,880 5,960 6,350 6,480 Closing_Customers_1

Sales of Widget per Customer 2.0 1.8 1.7 1.6 1.5 1.4 1.3 1.3 1.3 1.3 Sales_per_Customer_1

Widget Selling Price - € 37 36 35 34 32 30 28 25 23 22 Selling_Price_1

Average Customers 25 100 240 610 1,395 2,615 4,105 5,420 6,155 6,415 Average_Customers_1

Total Revenue 1 1,850 6,480 14,280 33,184 66,960 109,830 149,422 176,150 184,035 183,469 Total_Revenue_1

Revenue Line 2

Revenue Description Revenue_Description_2

Opening Customers - 000s

Closing Customers - 000s Closing_Customers_2

Sales of Widget per Customer Sales_per_Customer_2

Widget Selling Price - € Selling_Price_2

Average Customers - - - - - - - - - - Average_Customers_2

Total Revenue 2 - - - - - - - - - - Total_Revenue_2

Confidential File Name: 598331723.xls Print Date: 06/28/2022 Page: 5

Mobile Business Planning Model

Cost of Sales Your Task

Widgets Limited Enter the assumptions required below to generate a cost of sales

Units as Specified forecast.

Year 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012

Cost of Sales Item 1

Cost of Sales Description 1 Zapper Cost_of_Sales_Description_1

Zapper Quantity Purchased - 000s 55 200 450 1,100 2,300 4,100 5,900 7,750 8,800 9,200 Quantity_of_Stock_1

Zapper Cost per Unit of Stock - € 15.0 14.6 14.2 13.8 13.7 13.3 13.1 11.6 10.7 10.2 Cost_of_Stock_1

Total Cost of Sales 1 750 2,628 5,794 13,469 28,667 48,691 69,908 81,734 85,616 85,063 Cost_of_Sales_1

Cost of Sales Item 2

Cost of Sales Description 2 Cost_of_Sales_Description_2

Quantity Purchased - 000s Quantity_of_Stock_2

Cost per Unit of Stock - € Cost_of_Stock_2

Total Cost of Sales 2 - - - - - - - - - - Cost_of_Sales_2

Confidential File Name: 598331723.xls Print Date: 06/28/2022 Page: 6

Mobile Business Planning Model

Operating Costs Your Task

Widgets Limited This section examines staff costs, other operating costs and bad debt. Enter

€ Thousands the assumptions as indicated below.

Year 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012

Staff Cost Assumptions

Headcount 22 28 30 35 40 61 125 175 199 205 Headcount_Ratio

Opening Salary 35 Opening_Salary

Salary Growth 3% Salary_Growth

Additional Salary Costs 30% 30% 30% 30% 30% 30% 30% 30% 30% 30% Additional_Salary_Costs

Staff Numbers

Opening Staff -

Closing Number of Staff 22 28 30 35 40 61 125 175 199 205

Average Number of Staff 11 25 29 33 38 51 93 150 187 202 Average_Staff

Salary Costs

Salary Levels 35 36 37 38 39 41 42 43 44 46 Salary

Total Salary Costs 385 901 1,077 1,243 1,477 2,049 3,887 6,457 8,291 9,225

Additional Employment Costs 116 270 323 373 443 615 1,166 1,937 2,487 2,767

Total Staff Costs 501 1,172 1,400 1,616 1,920 2,664 5,053 8,394 10,778 11,992 Staff_Costs

Operating Costs - 000s

Rent 2,100 2,200 2,320 2,520 3,090 3,190 3,280 3,360 3,480 3,590 Operating_Costs_3

Light and Heat 210 221 235 255 310 320 330 340 350 360 Operating_Costs_4

Advertising 1,500 1,800 2,400 3,200 3,930 4,370 4,520 4,630 4,740 4,800 Operating_Costs_5

Legal and Professional 600 800 1,000 1,100 1,200 1,260 1,330 1,390 1,460 1,530 Operating_Costs_6

Telephone, Fax and IT 550 700 750 875 920 1,220 1,500 1,750 1,990 2,050 Operating_Costs_7

Stationery 300 310 320 335 450 600 900 1,200 1,300 1,350 Operating_Costs_8

Leasing of Equipment 2,000 2,040 2,080 2,400 2,600 2,700 2,800 2,850 2,900 2,970 Operating_Costs_9

Travel and Subsistence 220 280 300 350 600 800 1,250 1,750 1,990 2,050 Operating_Costs_10

Bad Debt

Zapper Bad Debt Rate 3% 3% 3% 3% 3% 3% 3% 3% 3% 3% Bad_Debt_Rate_1

Bad Debt Rate Bad_Debt_Rate_2

Zapper Bad Debt 56 194 428 996 2,009 3,295 4,483 5,285 5,521 5,504

Bad Debt 0 0 0 0 0 0 0 0 0 0

Total Bad Debt 56 194 428 996 2,009 3,295 4,483 5,285 5,521 5,504 Total_Bad_Debt

Confidential File Name: 598331723.xls Print Date: 06/28/2022 Page: 7

Mobile Business Planning Model

Accounting

Accounting

Depreciation

This section performs basic accounting operations necessary to produce the financial statements.

Amortisation

Working Capital

Financing

Taxation

Confidential File Name: 598331723.xls Print Date: 06/28/2022 Page: 8

Mobile Business Planning Model

Depreciation

Your Task

Widgets Limited Enter the assumptions relating to capital expenditure and depreciation.

€ Thousands

Year 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012

Assumptions

Capital Expenditure 55,000 20,000 5,000 5,000 20,000 8,000 8,000 8,000 8,000 8,000 Capital_Expenditure

Depreciation Period 8 Depreciation_Period

Depreciation of Opening Gross Capex Opening_Depreciation_Capex

Gross Capex to Date

Accumulated Depreciation to Date

Tangible Fixed Asset Account

Opening Balance 0 55,000 75,000 80,000 85,000 105,000 113,000 121,000 129,000 137,000

Capital Expenditure 55,000 20,000 5,000 5,000 20,000 8,000 8,000 8,000 8,000 8,000

Closing Balance 55,000 75,000 80,000 85,000 105,000 113,000 121,000 129,000 137,000 145,000 Gross_Fixed_Assets

Depreciation Account

Opening Balance 0 3,438 11,563 21,250 31,563 43,438 57,063 71,688 87,313 100,500

Depreciation Charge 3,438 8,125 9,688 10,313 11,875 13,625 14,625 15,625 13,188 9,500

Closing Balance 3,438 11,563 21,250 31,563 43,438 57,063 71,688 87,313 100,500 110,000 Accumulated_Depreciation

Tangible Net Book Value 51,563 63,438 58,750 53,438 61,563 55,938 49,313 41,688 36,500 35,000 Tangible_Net_Book_Value

Depreciation Workings

Opening Fixed Assets 0 0 0 0 0 0 0 0 0 0 0

2003 55,000 3,438 6,875 6,875 6,875 6,875 6,875 6,875 6,875 3,438

2004 20,000 1,250 2,500 2,500 2,500 2,500 2,500 2,500 2,500 1,250

2005 5,000 313 625 625 625 625 625 625 625

2006 5,000 313 625 625 625 625 625 625

2007 20,000 1,250 2,500 2,500 2,500 2,500 2,500

2008 8,000 500 1,000 1,000 1,000 1,000

2009 8,000 500 1,000 1,000 1,000

2010 8,000 500 1,000 1,000

2011 8,000 500 1,000

2012 8,000 500

3,438 8,125 9,688 10,313 11,875 13,625 14,625 15,625 13,188 9,500 Depreciation_Charge

Confidential File Name: 598331723.xls Print Date: 06/28/2022 Page: 9

Mobile Business Planning Model

Amortisation Your Task

Widgets Limited Enter the assumptions relating to expenditure on intangible assets and their

€ Thousands amortisation.

Year 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012

Assumptions

Intangible Expenditure 10,000 10,000 10,000 Intangible_Expenditure

Amortisation Period 4 Amortisation_Period

Amortisation of Opening Intangible Spend Opening_Amortisation

Gross Intangible Expenditure to Date

Accumulated Amortisation

Intangible Fixed Asset Account

Opening Balance 0 10,000 10,000 10,000 20,000 20,000 20,000 20,000 30,000 30,000

Capital Expenditure 10,000 0 0 10,000 0 0 0 10,000 0 0

Closing Balance 10,000 10,000 10,000 20,000 20,000 20,000 20,000 30,000 30,000 30,000 Gross_Intangible_Fixed_Assets

Amortisation Account

Opening Balance 0 1,250 3,750 6,250 10,000 13,750 16,250 18,750 21,250 23,750

Amortisation Charge 1,250 2,500 2,500 3,750 3,750 2,500 2,500 2,500 2,500 2,500

Closing Balance 1,250 3,750 6,250 10,000 13,750 16,250 18,750 21,250 23,750 26,250 Accumulated_Amortisation

Intangible Net Book Value 8,750 6,250 3,750 10,000 6,250 3,750 1,250 8,750 6,250 3,750 Intangible_Net_Book_Value

Amortisation Workings

Opening Intangible Assets 0 0 0 0 0 0 0 0 0 0 0

2003 10,000 1,250 2,500 2,500 2,500 1,250

2004 0 0 0 0 0 0

2005 0 0 0 0 0 0

2006 10,000 1,250 2,500 2,500 2,500 1,250

2007 0 0 0 0 0 0

2008 0 0 0 0 0 0

2009 0 0 0 0 0

2010 10,000 1,250 2,500 2,500

2011 0 0 0

2012 0 0

1,250 2,500 2,500 3,750 3,750 2,500 2,500 2,500 2,500 2,500 Amortisation_Charge

Confidential File Name: 598331723.xls Print Date: 06/28/2022 Page: 10

Mobile Business Planning Model

Working Capital Your Task

Widgets Limited Enter assumptions relating to debtor and creditor days.

€ Thousands

Year 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012

Widget Debtors Account

Widget Debtor Days 30 30 30 30 30 30 30 30 30 30 Debtor_Days_1

Opening Balance 0 152 533 1,174 2,727 5,504 9,027 12,281 14,478 15,126

Sales in the Period 1,850 6,480 14,280 33,184 66,960 109,830 149,422 176,150 184,035 183,469

Cash Received (1,698) (6,099) (13,639) (31,630) (64,184) (106,306) (146,168) (173,953) (183,386) (183,515)

Closing Balance 152 533 1,174 2,727 5,504 9,027 12,281 14,478 15,126 15,080 Debtors_1

Debtors Account

Debtor Days Debtor_Days_2

Opening Balance 0 0 0 0 0 0 0 0 0 0

Sales in the Period 0 0 0 0 0 0 0 0 0 0

Cash Received 0 0 0 0 0 0 0 0 0 0

Closing Balance 0 0 0 0 0 0 0 0 0 0 Debtors_2

Zapper Stock Account

Opening Stock 0 75 367 963 2,675 5,517 11,356 18,738 26,904 35,448

Stock Purchased 825 2,920 6,390 15,180 31,510 54,530 77,290 89,900 94,160 93,840 Cost_of_stock_purchased_1

Cost of Goods Sold (750) (2,628) (5,794) (13,469) (28,667) (48,691) (69,908) (81,734) (85,616) (85,063)

Closing Stock 75 367 963 2,675 5,517 11,356 18,738 26,904 35,448 44,225 Stock_1

Zapper Creditors Account

Zapper Creditor Days 30 30 30 30 30 30 30 30 30 30 Creditor_Days_1

Opening Balance 0 68 240 525 1,248 2,590 4,482 6,353 7,389 7,739

Costs in the Period 825 2,920 6,390 15,180 31,510 54,530 77,290 89,900 94,160 93,840

Cash Paid (757) (2,748) (6,105) (14,458) (30,168) (52,638) (75,419) (88,864) (93,810) (93,866)

Closing Balance 68 240 525 1,248 2,590 4,482 6,353 7,389 7,739 7,713 Creditors_1

Stock Account

Opening Stock 0 0 0 0 0 0 0 0 0 0

Stock Purchased 0 0 0 0 0 0 0 0 0 0 Cost_of_stock_purchased_2

Cost of Goods Sold 0 0 0 0 0 0 0 0 0 0

Closing Stock 0 0 0 0 0 0 0 0 0 0 Stock_2

Creditors Account

Creditor Days Creditor_Days_2

Opening Balance 0 0 0 0 0 0 0 0 0 0

Costs in the Period 0 0 0 0 0 0 0 0 0 0

Cash Paid 0 0 0 0 0 0 0 0 0 0

Closing Balance 0 0 0 0 0 0 0 0 0 0 Creditors_2

Capital Expenditure Creditors Account

Capex Creditor Days 20 20 20 20 20 20 20 20 20 20 Capex_Creditor_Days

Opening Balance 0 3,014 1,096 274 274 1,096 438 438 438 438

Costs in the Period 55,000 20,000 5,000 5,000 20,000 8,000 8,000 8,000 8,000 8,000

Cash Paid (51,986) (21,918) (5,822) (5,000) (19,178) (8,658) (8,000) (8,000) (8,000) (8,000) Capex_Paid

Closing Balance 3,014 1,096 274 274 1,096 438 438 438 438 438 Capex_Creditors

Intangible Expenditure Creditors Account

Intangible Creditor Days 180 180 180 180 180 180 180 180 180 180 Intangible_Creditor_Days

Opening Balance 0 4,932 0 0 4,932 0 0 0 4,932 0

Costs in the Period 10,000 0 0 10,000 0 0 0 10,000 0 0

Cash Paid (5,068) (4,932) 0 (5,068) (4,932) 0 0 (5,068) (4,932) 0 Intangibles_Paid

Closing Balance 4,932 0 0 4,932 0 0 0 4,932 0 0 Intangible_Creditors

Confidential File Name: 598331723.xls Print Date: 06/28/2022 Page: 11

Mobile Business Planning Model

Financing Your Task

Widgets Limited Enter assumptions relating to the financing of the business.

€ Thousands

Year 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012

Financing Assumptions

Equity Issued 38,490 18,450 8,650 2,260 4,060 Equity_Issued

Debt Raised 19,245 9,220 4,315 1,130 2,027 Debt_Issued

Debt Repaid 8,984 8,984 8,984 Debt_Repaid

Interest Rate on Debt 5% 5% 5% 5% 5% 5% 5% 5% 5% 5% Interest_On_Debt

Interest Rate on Overdraft 6% 6% 6% 6% 6% 6% 6% 6% 6% 6% Interest_On_Overdraft

Interest on Cash Deposits 4% 4% 4% 4% 4% 4% 4% 4% 4% 4% Interest_On_Deposits

Dividend Proportion 75% 75% 75% 75% 75% 75% 75% 75% 75% 75% Dividend_Proportion

Equity Account

Opening Balance 0 38,490 56,940 65,590 67,850 71,910 71,910 71,910 71,910 71,910

Equity Issued 38,490 18,450 8,650 2,260 4,060 0 0 0 0 0 Equity_Created

Closing Balance 38,490 56,940 65,590 67,850 71,910 71,910 71,910 71,910 71,910 71,910 Closing_Equity

Debt Account

Opening Balance 0 19,245 28,465 32,780 33,910 35,937 26,953 17,969 8,985 8,985

Debt Raised 19,245 9,220 4,315 1,130 2,027 0 0 0 0 0 Debt_Created

Debt Repaid 0 0 0 0 0 (8,984) (8,984) (8,984) 0 0 Debt_Retired

Closing Balance 19,245 28,465 32,780 33,910 35,937 26,953 17,969 8,985 8,985 8,985 Closing_Debt

Interest on Debt Account

Interest Charge 481 1,193 1,531 1,667 1,746 1,572 1,123 674 449 449 Debt_Interest_Charge

Interest on Overdraft

Interest Charge 213 648 837 979 1,275 1,006 307 0 0 0 Overdraft_Interest_Charge

Interest Income on Short Term Deposits

Interest Income 0 0 0 0 0 0 313 781 1,006 1,171 Interest_Income

Shares In Issue

Opening Shares in Issue - 38,490 56,940 65,590 67,850 71,910 71,910 71,910 71,910 71,910

Shares Issued During the Year 38,490 18,450 8,650 2,260 4,060 - - - - -

Shares Repurchased During the Year

Closing Shares in Issue 38,490 56,940 65,590 67,850 71,910 71,910 71,910 71,910 71,910 71,910

Average Shares in the Year 19,245 47,715 61,265 66,720 69,880 71,910 71,910 71,910 71,910 71,910 Average_Shares

Confidential File Name: 598331723.xls Print Date: 06/28/2022 Page: 12

Mobile Business Planning Model

Taxation Your Task

Widgets Limited Enter the tax rate, tax creditor days and any adjustments to profits liable to

€ Thousands corporation tax in the "Profit Adjustments" row.

Year 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012

Taxation Assumptions

Tax Rate 30% 30% 30% 30% 30% 30% 30% 30% 30% 30% Taxation_Rate

Tax Creditor Days 365 365 365 365 365 365 365 365 365 365 Tax_Creditor_Days

Profit Adjustments Profit_Adjustments

Profit and Loss Taxation Workings

Profits / (Loss) Before Tax (12,318) (18,331) (17,303) (10,640) 2,618 22,017 35,826 45,451 48,778 50,932

Profits Before Losses 0 0 0 0 2,618 22,017 35,826 45,451 48,778 50,932

Losses Carried Forward 0 0 0 0 (2,618) (22,017) (33,957) 0 0 0

Other Adjustments 0 0 0 0 0 0 0 0 0 0

Profits Liable to Corporation Tax 0 0 0 0 0 0 1,869 45,451 48,778 50,932 Profits_Liable_To_Tax

Corporation Tax 0 0 0 0 0 0 561 13,635 14,633 15,279 Corporation_Tax_Charge

Corporation Tax Account

Opening Balance 0 0 0 0 0 0 0 561 13,635 14,633

Tax Charge in the Period 0 0 0 0 0 0 561 13,635 14,633 15,279

Tax Paid 0 0 0 0 0 0 0 (561) (13,635) (14,633) Tax_Paid

Closing Balance 0 0 0 0 0 0 561 13,635 14,633 15,279 Taxation_Creditor

Losses Account

Opening Losses - 12,318 30,649 47,952 58,592 55,974 33,957 0 0 0

Increase in Losses in the Period 12,318 18,331 17,303 10,640 0 0 0 0 0 0

Losses Utilised 0 0 0 0 (2,618) (22,017) (33,957) 0 0 0 Losses_Utilised

Closing Losses 12,318 30,649 47,952 58,592 55,974 33,957 0 0 0 0

Valuation Taxation Workings

Profit Before Interest and Tax (11,624) (16,490) (14,934) (7,994) 5,639 24,595 36,944 45,343 48,222 50,210

Profits Before Losses 0 0 0 0 5,639 24,595 36,944 45,343 48,222 50,210

Losses Carried Forward 0 0 0 0 (5,639) (24,595) (20,808) 0 0 0

Other Adjustments 0 0 0 0 0 0 0 0 0 0

Profits Liable to Corporation Tax 0 0 0 0 0 0 16,136 45,343 48,222 50,210

Corporation Tax 0 0 0 0 0 0 4,841 13,603 14,466 15,063

Corporation Tax Account

Opening Balance 0 0 0 0 0 0 0 4,841 13,603 14,466

Tax Charge in the Period 0 0 0 0 0 0 4,841 13,603 14,466 15,063

Tax Paid 0 0 0 0 0 0 0 (4,841) (13,603) (14,466) Valuation_Tax_Paid

Closing Balance 0 0 0 0 0 0 4,841 13,603 14,466 15,063

Losses Account

Opening Losses - 11,624 28,114 43,048 51,042 45,403 20,808 0 0 0

Increase in Losses in the Period 11,624 16,490 14,934 7,994 0 0 0 0 0 0

Losses Utilised 0 0 0 0 (5,639) (24,595) (20,808) 0 0 0

Closing Losses 11,624 28,114 43,048 51,042 45,403 20,808 0 0 0 0

Confidential File Name: 598331723.xls Print Date: 06/28/2022 Page: 13

Mobile Business Planning Model

Financial Results

Financial Results

Profit and Loss

This chapter contains the financial results from the model.

Balance Sheet

Cash Flow Statement

Ratios

Valuation

Confidential File Name: 598331723.xls Print Date: 06/28/2022 Page: 14

Mobile Business Planning Model

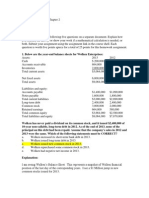

Profit and Loss Information Only

Widgets Limited No inputs are required in this section.

€ Thousands

Year 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012

Widget 1,850 6,480 14,280 33,184 66,960 109,830 149,422 176,150 184,035 183,469

0 0 0 0 0 0 0 0 0 0 0

Total Revenue 1,850 6,480 14,280 33,184 66,960 109,830 149,422 176,150 184,035 183,469

Zapper (750) (2,628) (5,794) (13,469) (28,667) (48,691) (69,908) (81,734) (85,616) (85,063)

0 0 0 0 0 0 0 0 0 0 0

Total Cost of Sales (750) (2,628) (5,794) (13,469) (28,667) (48,691) (69,908) (81,734) (85,616) (85,063)

Gross Profit 1,100 3,852 8,486 19,715 38,293 61,139 79,514 94,416 98,418 98,406

Bad Debt (56) (194) (428) (996) (2,009) (3,295) (4,483) (5,285) (5,521) (5,504)

Staff Costs (501) (1,172) (1,400) (1,616) (1,920) (2,664) (5,053) (8,394) (10,778) (11,992)

Rent (2,100) (2,200) (2,320) (2,520) (3,090) (3,190) (3,280) (3,360) (3,480) (3,590)

Light and Heat (210) (221) (235) (255) (310) (320) (330) (340) (350) (360)

Advertising (1,500) (1,800) (2,400) (3,200) (3,930) (4,370) (4,520) (4,630) (4,740) (4,800)

Legal and Professional (600) (800) (1,000) (1,100) (1,200) (1,260) (1,330) (1,390) (1,460) (1,530)

Telephone, Fax and IT (550) (700) (750) (875) (920) (1,220) (1,500) (1,750) (1,990) (2,050)

Stationery (300) (310) (320) (335) (450) (600) (900) (1,200) (1,300) (1,350)

Leasing of Equipment (2,000) (2,040) (2,080) (2,400) (2,600) (2,700) (2,800) (2,850) (2,900) (2,970)

Travel and Subsistence (220) (280) (300) (350) (600) (800) (1,250) (1,750) (1,990) (2,050)

Total Operating Costs (8,036) (9,717) (11,233) (13,646) (17,029) (20,419) (25,445) (30,948) (34,509) (36,196)

Operating Profit (6,936) (5,865) (2,747) 6,069 21,264 40,720 54,069 63,468 63,909 62,210

Depreciation (3,438) (8,125) (9,688) (10,313) (11,875) (13,625) (14,625) (15,625) (13,188) (9,500)

Amortisation (1,250) (2,500) (2,500) (3,750) (3,750) (2,500) (2,500) (2,500) (2,500) (2,500)

Profits Before Interest and Tax (11,624) (16,490) (14,934) (7,994) 5,639 24,595 36,944 45,343 48,222 50,210

Interest Paid on Debt (481) (1,193) (1,531) (1,667) (1,746) (1,572) (1,123) (674) (449) (449)

Interest Paid on Overdrafts (213) (648) (837) (979) (1,275) (1,006) (307) 0 0 0

Interest Received on Cash Deposits 0 0 0 0 0 0 313 781 1,006 1,171

Profit Before Tax (12,318) (18,331) (17,303) (10,640) 2,618 22,017 35,826 45,451 48,778 50,932

Taxation 0 0 0 0 0 0 (561) (13,635) (14,633) (15,279)

Profit After Tax (12,318) (18,331) (17,303) (10,640) 2,618 22,017 35,265 31,815 34,145 35,652

Dividends Declared 0 0 0 0 0 0 (1,308) (23,862) (25,609) (26,739)

Retained Profit for the Year (12,318) (18,331) (17,303) (10,640) 2,618 22,017 33,957 7,954 8,536 8,913

Confidential File Name: 598331723.xls Print Date: 06/28/2022 Page: 15

Mobile Business Planning Model

Balance Sheet Information Only

Widgets Limited No inputs are required in this section.

€ Thousands

Year 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012

Tangible Fixed Assets 0 51,563 63,438 58,750 53,438 61,563 55,938 49,313 41,688 36,500 35,000

Intangible Fixed Assets 0 8,750 6,250 3,750 10,000 6,250 3,750 1,250 8,750 6,250 3,750

Total Fixed Assets 0 60,313 69,688 62,500 63,438 67,813 59,688 50,563 50,438 42,750 38,750

Widget Debtors 0 152 533 1,174 2,727 5,504 9,027 12,281 14,478 15,126 15,080

Debtors 0 0 0 0 0 0 0 0 0 0 0

Zapper Stock 0 75 367 963 2,675 5,517 11,356 18,738 26,904 35,448 44,225

Stock 0 0 0 0 0 0 0 0 0 0 0

Cash at Bank 0 0 0 0 0 0 0 15,649 23,423 26,872 31,674

Total Current Assets 0 227 900 2,137 5,402 11,021 20,383 46,668 64,805 77,446 90,979

Zapper Creditors 0 (68) (240) (525) (1,248) (2,590) (4,482) (6,353) (7,389) (7,739) (7,713)

Creditors 0 0 0 0 0 0 0 0 0 0 0

Capital Expenditure Creditor 0 (3,014) (1,096) (274) (274) (1,096) (438) (438) (438) (438) (438)

Intangible Expenditure Creditor 0 (4,932) 0 0 (4,932) 0 0 0 (4,932) 0 0

Taxation Creditor 0 0 0 0 0 0 0 (561) (13,635) (14,633) (15,279)

Overdraft 0 (7,109) (14,495) (13,420) (19,218) (23,275) (10,244) 0 0 0 0

Total Current Liabilities 0 (15,122) (15,831) (14,219) (25,671) (26,961) (15,165) (7,352) (26,394) (22,811) (23,431)

Net Current Assets 0 (14,895) (14,931) (12,082) (20,269) (15,940) 5,219 39,317 38,411 54,635 67,548

Total Assets less Current Liabilities 0 45,417 54,756 50,418 43,168 51,873 64,906 89,879 88,849 97,385 106,298

Equity 0 38,490 56,940 65,590 67,850 71,910 71,910 71,910 71,910 71,910 71,910

Retained Profits 0 (12,318) (30,649) (47,952) (58,592) (55,974) (33,957) 0 7,954 16,490 25,403

Debt 0 19,245 28,465 32,780 33,910 35,937 26,953 17,969 8,985 8,985 8,985

Total Capital Employed 0 45,417 54,756 50,418 43,168 51,873 64,906 89,879 88,849 97,385 106,298

Check 0 0 0 0 0 0 0 0 0 0 0

Confidential File Name: 598331723.xls Print Date: 06/28/2022 Page: 16

Mobile Business Planning Model

Cash Flow Information Only

Widgets Limited No inputs are required in this section.

€ Thousands

Year 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012

Operating Profit / (Loss) (6,936) (5,865) (2,747) 6,069 21,264 40,720 54,069 63,468 63,909 62,210

Widget Debtors (152) (381) (641) (1,554) (2,776) (3,524) (3,254) (2,197) (648) 46

Debtors 0 0 0 0 0 0 0 0 0 0

Zapper Stock (75) (292) (596) (1,711) (2,843) (5,839) (7,382) (8,166) (8,544) (8,777)

Stock 0 0 0 0 0 0 0 0 0 0

Zapper Creditors 68 172 285 722 1,342 1,892 1,871 1,036 350 (26)

Creditors 0 0 0 0 0 0 0 0 0 0

Movement in Working Capital (159) (500) (952) (2,542) (4,277) (7,470) (8,765) (9,327) (8,842) (8,757)

Cashflow from Operating Activities (7,095) (6,365) (3,699) 3,526 16,987 33,250 45,303 54,141 55,067 53,453

Tangible Capital Expenditure (51,986) (21,918) (5,822) (5,000) (19,178) (8,658) (8,000) (8,000) (8,000) (8,000)

Intangible Capital Expenditure (5,068) (4,932) 0 (5,068) (4,932) 0 0 (5,068) (4,932) 0

Tax Paid 0 0 0 0 0 0 0 (561) (13,635) (14,633)

Cashflow before Financial Cashflows (64,150) (33,215) (9,521) (6,542) (7,123) 24,592 37,303 40,512 28,501 30,819

Interest Paid on Debt (481) (1,193) (1,531) (1,667) (1,746) (1,572) (1,123) (674) (449) (449)

Interest Paid on Overdrafts (213) (648) (837) (979) (1,275) (1,006) (307) 0 0 0

Interest Received on Cash Deposits 0 0 0 0 0 0 313 781 1,006 1,171

Cashflow before Financing (64,844) (35,056) (11,890) (9,189) (10,144) 22,015 36,186 40,620 29,057 31,541

Equity Issued 38,490 18,450 8,650 2,260 4,060 0 0 0 0 0

Debt Issued 19,245 9,220 4,315 1,130 2,027 0 0 0 0 0

Debt Repaid 0 0 0 0 0 (8,984) (8,984) (8,984) 0 0

Cashflow for the Period Before Dividends (7,109) (7,386) 1,075 (5,799) (4,057) 13,031 27,202 31,636 29,057 31,541

Dividends Paid 0 0 0 0 0 0 (1,308) (23,862) (25,609) (26,739)

Cashflow for the Period (7,109) (7,386) 1,075 (5,799) (4,057) 13,031 25,893 7,774 3,449 4,802

Cash Account

Opening Cash Balance 0 (7,109) (14,495) (13,420) (19,218) (23,275) (10,244) 15,649 23,423 26,872

Cash Movement in the Year (7,109) (7,386) 1,075 (5,799) (4,057) 13,031 25,893 7,774 3,449 4,802

Closing Cash Balance (7,109) (14,495) (13,420) (19,218) (23,275) (10,244) 15,649 23,423 26,872 31,674

Confidential File Name: 598331723.xls Print Date: 06/28/2022 Page: 17

Mobile Business Planning Model

Ratios Information Only

Widgets Limited No user inputs are required in this section.

Year 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012

Profitability

Gross Profit Margin 59.5% 59.4% 59.4% 59.4% 57.2% 55.7% 53.2% 53.6% 53.5% 53.6%

Operating Profit Margin (EBITDA Margin) -374.9% -90.5% -19.2% 18.3% 31.8% 37.1% 36.2% 36.0% 34.7% 33.9%

Profit Before Tax Margin (PBT Margin) -665.8% -282.9% -121.2% -32.1% 3.9% 20.0% 24.0% 25.8% 26.5% 27.8%

Earnings Per Share (EPS) (0.64) (0.38) (0.28) (0.16) 0.04 0.31 0.49 0.44 0.47 0.50

Liquidity and the Balance Sheet

Current Ratio 0.02 0.06 0.15 0.21 0.41 1.34 6.35 2.46 3.40 3.88

Quick Ratio 0.01 0.03 0.08 0.11 0.20 0.60 3.80 1.44 1.84 2.00

Net Book Value of Assets 60,312.5 69,687.5 62,500.0 63,437.5 67,812.5 59,687.5 50,562.5 50,437.5 42,750.0 38,750.0

Capital Expenditure to Depreciation 15.1 2.7 0.6 0.5 1.6 0.6 0.5 0.5 0.6 0.8

Asset Turnover 0.0 0.1 0.3 0.8 1.3 1.7 1.7 2.0 1.9 1.7

Debtor Days 15.0 19.3 21.8 21.5 22.4 24.1 26.0 27.7 29.4 30.0

Creditor Days 22.2 43.5 17.1 35.6 26.5 20.2 20.7 28.4 28.7 23.1

Stock Turnover Days 36.5 51.0 60.7 72.5 70.2 85.1 97.8 120.1 151.1 189.8

Returns

Return on Average Capital Employed (ROACE) 0.0% 0.0% 0.0% 0.0% 8.2% 32.7% 42.8% 41.3% 41.1% 40.2%

Return On Total Average Assets (ROTAA) 0.0% 0.0% 0.0% 0.0% 11.9% 42.1% 41.5% 35.5% 36.3% 34.5%

Return on Equity (ROE) 0.0% 0.0% 0.0% 0.0% 16.4% 58.0% 49.0% 39.8% 38.6% 36.6%

Dividend Cover 0.0 0.0 0.0 0.0 0.0 0.0 27.0 1.3 1.3 1.3

Financial

Gearing 42.4% 52.0% 65.0% 78.6% 69.3% 41.5% 20.0% 10.1% 9.2% 8.5%

Debt - Equity Ratio 73.5% 108.3% 185.8% 366.3% 225.5% 71.0% 25.0% 11.3% 10.2% 9.2%

Interest Cover 0.0 0.0 0.0 2.3 7.0 15.8 37.8 94.2 142.3 138.5

Confidential File Name: 598331723.xls Print Date: 06/28/2022 Page: 18

Mobile Business Planning Model

Valuation Your Task

Widgets Limited Normalise the final year cash flow if required. Select the basis for valuation.

€ Thousands

Year 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012

Valuation Assumptions

Discount Rate 7.7% Discount_Rate

Terminal Value Growth Rate 2.0% Terminal_Value_Rate

EBITDA Exit Multiple 8 EBITDA_Exit_Multiple

Prospective Widgets Limited Company Comparable Valuation Metrics

2004

PE Ratio PE_Ratio

EV / EBITDA EV_EBITDA

EV / SALES 30 EV_Sales

EV / Customer 1,500 EV_Customer

Free Cash Flow

Operating Cash Flow (7,095) (6,365) (3,699) 3,526 16,987 33,250 45,303 54,141 55,067 53,453

Capital Expenditure (51,986) (21,918) (5,822) (5,000) (19,178) (8,658) (8,000) (8,000) (8,000) (8,000)

Intangibles Expenditure (5,068) (4,932) 0 (5,068) (4,932) 0 0 (5,068) (4,932) 0

Cash Taxes 0 0 0 0 0 0 0 (4,841) (13,603) (14,466)

Free Cash Flow (64,150) (33,215) (9,521) (6,542) (7,123) 24,592 37,303 36,232 28,533 30,986 Free_Cash_Flow

Discount Factor

Discount Factor 1.04 1.12 1.20 1.30 1.40 1.50 1.62 1.74 1.88 2.02 Discount_Factor

NPV of Free Cash Flow

NPV of Free Cash Flow (61,814) (29,717) (7,909) (5,046) (5,101) 16,354 23,033 20,772 15,188 15,315

Total NPV of Free Cash Flow (18,927)

Terminal Value

Method 1: Terminal Value Growth Rate Method 2: EBITDA Exit Multiple

Final Year Cash Flow 30,986 Final Year EBITDA 62,210

Final Year Cash Grown 1 year by Growth Rate 31,606 Final Year Company Value 497,679

Perpetuity Calculation 554,494

NPV of Final Cash Flow to Perpetuity 274,062

Terminal Value - Method 1 274,062 Terminal Value - Method 2 245,980

Terminal Value EBITDA

DCF Based Company Valuation Growth Rate Exit Multiple

Forecast Cash Flows (18,927) (18,927)

Terminal Value 274,062 245,980

Enterprise Value 255,135 227,054

Less: Net Debt (26,354) (26,354)

Equity Value 228,780 200,699

Comparable Company Valuations

Enterprise Net Equity

Value Debt Value

PE Ratio n/a

EV / EBITDA n/a (26,354) n/a

EV / SALES 194,400 (26,354) 168,046

EV / Customer 225,000 (26,354) 198,646

Confidential File Name: 598331723.xls Print Date: 06/28/2022 Page: 19

You might also like

- Business Value Assessment TemplateDocument17 pagesBusiness Value Assessment TemplateAlina Molesag100% (2)

- Financial Position and Performance of FirstGroup PLC.Document17 pagesFinancial Position and Performance of FirstGroup PLC.Mohammad MollaNo ratings yet

- Rolito DionelaDocument40 pagesRolito DionelaRolito Dionela50% (2)

- Dmp3e Ch05 Solutions 02.28.10 FinalDocument37 pagesDmp3e Ch05 Solutions 02.28.10 Finalmichaelkwok1No ratings yet

- Control: The Management Control Process: Changes From Eleventh EditionDocument25 pagesControl: The Management Control Process: Changes From Eleventh EditionAlka Narayan100% (1)

- SDASDDocument9 pagesSDASDRocelle LAQUINo ratings yet

- 13 Week Cash Flow ModelDocument16 pages13 Week Cash Flow ModelASChipLeadNo ratings yet

- Beams - Intercom Profit Transaction - BondsDocument12 pagesBeams - Intercom Profit Transaction - BondsAnggit Ponco100% (1)

- Model 2 Feb 05 V7.0 BlankDocument19 pagesModel 2 Feb 05 V7.0 BlanknicoweissNo ratings yet

- Segment & Interim ReportDocument12 pagesSegment & Interim ReportMuhammad ZulhisyamNo ratings yet

- Build Your Business Build Your Business: Performance Summary Performance SummaryDocument6 pagesBuild Your Business Build Your Business: Performance Summary Performance Summaryarun kumarNo ratings yet

- Mindtree: Reference ModelDocument54 pagesMindtree: Reference ModelLiontiniNo ratings yet

- Project Business StepsDocument33 pagesProject Business StepsVamshi Krishna KamajaNo ratings yet

- MAA703 T1 2024 Group Assignment Assessment-2ADocument7 pagesMAA703 T1 2024 Group Assignment Assessment-2Atitli.pramanik.8No ratings yet

- Module 1 - Merge Result - Business DevelopmentDocument39 pagesModule 1 - Merge Result - Business DevelopmenthadrifaNo ratings yet

- Kaju NotesDocument18 pagesKaju NotesDurgeh BarodeNo ratings yet

- Corporate Finance-Darko Jovanović 2015Document17 pagesCorporate Finance-Darko Jovanović 2015Darko JovanovicNo ratings yet

- Reporting For Control: Prepared by Shannon Butler, Cpa, Ca Carleton UniversityDocument48 pagesReporting For Control: Prepared by Shannon Butler, Cpa, Ca Carleton UniversityMariela CNo ratings yet

- Amtel Holdings BerhadDocument9 pagesAmtel Holdings Berhadwaryloges7gmailcomNo ratings yet

- MK Business UnderstandingDocument18 pagesMK Business UnderstandingDurgeh BarodeNo ratings yet

- 2009 10 Brand Valuation Additional InformationDocument2 pages2009 10 Brand Valuation Additional InformationAnuja BhakuniNo ratings yet

- ACC - ACF1200 Workbook Topic 9Document8 pagesACC - ACF1200 Workbook Topic 9wesley hudsonNo ratings yet

- 30 - 31. IGCSE - Business Studies - Costs Scale of Production and Break-Even Analysis - AssignmentDocument7 pages30 - 31. IGCSE - Business Studies - Costs Scale of Production and Break-Even Analysis - Assignmentdung luongtuanNo ratings yet

- Business Plan Booklet 1Document3 pagesBusiness Plan Booklet 1Amr AbdelMoneimNo ratings yet

- Capital StructureDocument14 pagesCapital StructureGouri LakshmiNo ratings yet

- REDMOND, Wash. - October 23, 2019 - Microsoft Corp. Today Announced The Following Results ForDocument10 pagesREDMOND, Wash. - October 23, 2019 - Microsoft Corp. Today Announced The Following Results ForRochak JainNo ratings yet

- Lecture 27Document34 pagesLecture 27Riaz Baloch NotezaiNo ratings yet

- Camp GTM Strategy TemplateDocument42 pagesCamp GTM Strategy TemplateNiket MankadNo ratings yet

- GR 9 Project Business Plan T3 2023Document12 pagesGR 9 Project Business Plan T3 2023kwazy dlaminiNo ratings yet

- ACC 404 RatiosDocument11 pagesACC 404 RatiosMahmud TuhinNo ratings yet

- Investment AnalysisDocument11 pagesInvestment AnalysisFendi SamsudinNo ratings yet

- SM05 PorterNoASfsfddrton FA 8eDocument85 pagesSM05 PorterNoASfsfddrton FA 8eKia PottsNo ratings yet

- 01 Financial Modelling For Short Decision MakingDocument32 pages01 Financial Modelling For Short Decision Makingjanuar baharuliNo ratings yet

- Cost-Volume-Profit Relationships: Learning ObjectivesDocument27 pagesCost-Volume-Profit Relationships: Learning ObjectivesChau ToNo ratings yet

- HDFC PPT FinalDocument12 pagesHDFC PPT FinalRISHABH RAJ-DM 21DM237No ratings yet

- Module 8: Browse Application Areas Module Overview: ObjectivesDocument54 pagesModule 8: Browse Application Areas Module Overview: ObjectivesmatejkahuNo ratings yet

- Thoughtco Business PlanDocument12 pagesThoughtco Business PlanBlackjackNo ratings yet

- Semester May 2012: Faculty of Business and ManagementDocument23 pagesSemester May 2012: Faculty of Business and ManagementFarah ismailNo ratings yet

- 1 - Statement of Comprehensive IncomeDocument4 pages1 - Statement of Comprehensive IncomeOusy 14No ratings yet

- Contents Page: Business PlanDocument43 pagesContents Page: Business Plankasahun bedasoNo ratings yet

- Case Study of PUNE HotelDocument10 pagesCase Study of PUNE HoteluvavaliyaNo ratings yet

- 541 Case 2Document21 pages541 Case 2Σταυρος ΑνιNo ratings yet

- Ratio AnalysisDocument16 pagesRatio AnalysisAbdul RehmanNo ratings yet

- BBA 4002 Budgeting and Control (Industrial Project Paper)Document33 pagesBBA 4002 Budgeting and Control (Industrial Project Paper)AusLiowLiowNo ratings yet

- Managerial ReportDocument31 pagesManagerial ReportQuỳnh QuỳnhNo ratings yet

- SAMIL Presentation On Results Q4FY24Document36 pagesSAMIL Presentation On Results Q4FY24SREEKANTHNo ratings yet

- Background KnowledgeDocument7 pagesBackground Knowledgeanamsaeed1No ratings yet

- 01 DAIS Question Module 03 Finance HANDOUT 933680800790651Document5 pages01 DAIS Question Module 03 Finance HANDOUT 933680800790651ronny nyagakaNo ratings yet

- 1acc0807 Cw1 Cost AccountingDocument3 pages1acc0807 Cw1 Cost AccountingLiliana Martinez100% (1)

- Business Feasibility AfzalDocument6 pagesBusiness Feasibility AfzalSonam RajKumarNo ratings yet

- ACC51112 Responsibility Accounting WITH ANSWERSDocument8 pagesACC51112 Responsibility Accounting WITH ANSWERSjasNo ratings yet

- Smart Task 03 SubmissionDocument13 pagesSmart Task 03 SubmissionRAVI KUMARNo ratings yet

- JPR 54079 DailmerAG EquityResearch Report 1303Document35 pagesJPR 54079 DailmerAG EquityResearch Report 1303André Fonseca100% (1)

- JMIA Q3 22 ER 17.11.22 VFDocument20 pagesJMIA Q3 22 ER 17.11.22 VFSparta ElnNo ratings yet

- NTPC Anta: A Project Study Report On Training Undertaken atDocument17 pagesNTPC Anta: A Project Study Report On Training Undertaken atPradeep SharmaNo ratings yet

- Aa-Plc 2013Document44 pagesAa-Plc 2013gaja babaNo ratings yet

- So Sánh Gi A Unilever Và JohnsonDocument26 pagesSo Sánh Gi A Unilever Và JohnsonAnh NgocNo ratings yet

- Powerpoint Pitchbook Sample Template PackDocument6 pagesPowerpoint Pitchbook Sample Template PackSreekanth101No ratings yet

- CH 01Document11 pagesCH 01Zohaib ImtiazNo ratings yet

- Working Capital Management at Ing Vysya Bank: By: Kanhaiya Lal KediaDocument20 pagesWorking Capital Management at Ing Vysya Bank: By: Kanhaiya Lal Kedia2473314No ratings yet

- Final Examin Econ 1Document2 pagesFinal Examin Econ 1Ysabel Grace BelenNo ratings yet

- Word Write Soln - Newell Design Manufacturing Valuation Decision MakingDocument7 pagesWord Write Soln - Newell Design Manufacturing Valuation Decision Makingalka murarkaNo ratings yet

- 2010 - Annual - Report - Cover:Layout 1 2/5/2010 4:12 PMDocument54 pages2010 - Annual - Report - Cover:Layout 1 2/5/2010 4:12 PMFoo Leung Tsz KinNo ratings yet

- Official Guide to Financial Accounting using TallyPrime: Managing your Business Just Got SimplerFrom EverandOfficial Guide to Financial Accounting using TallyPrime: Managing your Business Just Got SimplerNo ratings yet

- Financial Statement AnalysisDocument4 pagesFinancial Statement AnalysisLea AndreleiNo ratings yet

- FIN 534 Homework Chap.2Document3 pagesFIN 534 Homework Chap.2Jenna KiragisNo ratings yet

- Financial Statement Analysis Tesco TargetDocument6 pagesFinancial Statement Analysis Tesco Targetnormalty100% (3)

- PS 5 - Chapter 6 - The Measurement Approach To Decision Usefulness (Solutions)Document17 pagesPS 5 - Chapter 6 - The Measurement Approach To Decision Usefulness (Solutions)Matteo VidottoNo ratings yet

- Hilton6e SM08Document70 pagesHilton6e SM08Eych MendozaNo ratings yet

- Chap 6 - Other Non-Dcf ApproachesDocument31 pagesChap 6 - Other Non-Dcf Approachesrafat.jalladNo ratings yet

- Qualifying Exam Review Qs Final & Answers2Document30 pagesQualifying Exam Review Qs Final & Answers2hy050796x82% (11)

- Loss of Significant InfluenceDocument2 pagesLoss of Significant InfluenceAngeline RamirezNo ratings yet

- IAS 36 Impairment of AssetsDocument45 pagesIAS 36 Impairment of AssetsvidiNo ratings yet

- Problem 3&5Document17 pagesProblem 3&5panda 1No ratings yet

- Practical Accounting 2Document7 pagesPractical Accounting 2Irish Joy AlaskaNo ratings yet

- 100 To 1 in The Stock Market SummaryDocument28 pages100 To 1 in The Stock Market SummaryRamanReet SinghNo ratings yet

- This Study Resource Was: Bonds PayableDocument8 pagesThis Study Resource Was: Bonds PayableAlexis NievesNo ratings yet

- Research Paper On Financial Analysis of A CompanyDocument8 pagesResearch Paper On Financial Analysis of A Companyefg7a0t1No ratings yet

- Exercises Lesson 3 Balance Sheet: Financial AccountingDocument11 pagesExercises Lesson 3 Balance Sheet: Financial AccountingElena LuizaNo ratings yet

- Accounting For Partnership: Part 2Document15 pagesAccounting For Partnership: Part 2Lady Fe DielNo ratings yet

- BookkeepingDocument20 pagesBookkeepingzhanel bekenovaNo ratings yet

- Review Sheet Midterm PDFDocument12 pagesReview Sheet Midterm PDFeleNo ratings yet

- Quiz 1 Final ExamDocument6 pagesQuiz 1 Final ExamNica Jane MacapinigNo ratings yet

- FinTree - FRA Sixty Minute Guide PDFDocument38 pagesFinTree - FRA Sixty Minute Guide PDFkamleshNo ratings yet

- Financial Accounting Chap 4Document119 pagesFinancial Accounting Chap 4Zexi WUNo ratings yet

- 12 Podar International School QPDocument2 pages12 Podar International School QPAkshat KhetanNo ratings yet

- Horizontal and Vertical Analaysis: Karysse Arielle Noel Jalao Financial Management Bsac-2BDocument10 pagesHorizontal and Vertical Analaysis: Karysse Arielle Noel Jalao Financial Management Bsac-2BKarysse Arielle Noel JalaoNo ratings yet

- ChapDocument74 pagesChapTote FrotyNo ratings yet

- Business Combination at The Date of AcquisitionDocument2 pagesBusiness Combination at The Date of AcquisitionDarren Joy CoronaNo ratings yet

- Financial Ratio AnalysisDocument10 pagesFinancial Ratio AnalysisSehat TanNo ratings yet