Professional Documents

Culture Documents

Problem 3: Multiple Choice - COMPUTATIONAL 1. B

Problem 3: Multiple Choice - COMPUTATIONAL 1. B

Uploaded by

Charizza Amor TejadaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Problem 3: Multiple Choice - COMPUTATIONAL 1. B

Problem 3: Multiple Choice - COMPUTATIONAL 1. B

Uploaded by

Charizza Amor TejadaCopyright:

Available Formats

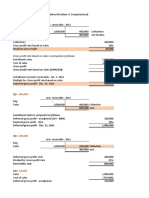

Problem 3: Multiple Choice - COMPUTATIONAL

1. B.

Installment sales 1,000,000.00

Less: Installment account receivable (600,000.00)

Total collections 400,000.00

Multiply by: Gross profit rate based on sales 20%

Realized gross profit 80,000.00

Sales 1,000,000.00

Cost of sales (800,000.00)

Deferred gross profit 200,000.00

Less: Realized gross profit (80,000.00)

Deferred gross profit 120,000.00

2. C.

Deferred gross profit 200,000.00

Divide by: Gross profit rate based on sales 20%

Installment sales 1,000,000.00

Less: Collections during the year (400,000.00)

Installment receivable 600,000.00

3. C.

Deferred gross profit 200,000.00

Divide by: Gross profit rate based on sales 25%

Installment receivable 800,000.00

Installment sales 1,000,000.00

Less: Installment receivable (800,000.00)

Collections during the year 200,000.00

4. D.

Installment sales 1,000,000.00

Cost of sales (750,000.00)

Gross profit 250,000.00

Less: Deferred gross profit (200,000.00)

Realized gross profit 50,000.00

5. D.

Installment sales 1,000,000.00

Cost of sales (750,000.00)

Gross profit 250,000.00

Less: Realized gross profit (220,000.00)

Deferred gross profit 30,000.00

6. A.

Realized gross profit 180,000.00

Divide by: Gross profit rate based on sales 25%

Collections during the year 720,000.00

Installment sales 1,000,000.00

Less: Collections during the year (720,000.00)

Installment receivable 280,000.00

7. B.

Realized gross profit 160,000.00

Divide by: Gross profit rate based on sales 25%

Installment receivable 640,000.00

8. B.

Deferred gross profit - beg. 200,000.00

Less: Realized gross profit (squeeze) (140,000.00)

Deferred gross profit - end 60,000.00

Realized gross profit 140,000.00

Divide by: Gross profit rate based on sales 25%

Total collections 560,000.00

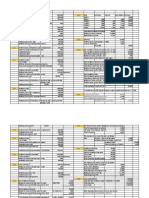

9. B.

20X1 installment accounts 16,250.00

Multiply by: 20X1 GPR based on sales 23%

DGP from 20X1 sales (adjusted balance) 3,750.00

20X2 installment accounts 90,000.00

Multiply by: 20X2 GPR based on sales 25%

DGP from 20X2 sales (adjusted balance) 22,500.00

Deferred gross profit (before adjustment) 38,000.00

DGP from 20X1 sales (adjusted balance) (3,750.00)

DGP from 20X2 sales (adjusted balance) (22,500.00)

Realized gross profit in 20X2 11,750.00

Expenses relating to installment sales in 20X2 (1,500.00)

20X2 profit from installment sales 10,250.00

10. A.

20X1 20X2

Installment sales 300,000.00 375,000.00

Cost of sales 225,000.00 285,000.00

Gross profit 75,000.00 90,000.00

Gross profit rate based on sales 25% 24%

20X1 Deferred gross profit, Dec. 31, 20X3 -

Divide by: Gross profit rate 25%

20X1 Installment receivable, Dec. 31, 20X3 -

20X2 Deferred gross profit, Dec. 31, 20X3 9,000.00

Divide by: Gross profit rate 24%

20X2 Installment receivable, Dec. 31, 20X3 37,500.00

20X3 Deferred gross profit, Dec. 31, 30X3 72,000.00

Divide by: Gross profit rate 30%

20X3 Installment receivable, Dec. 31, 20X3 240,000.00

Total installment receivable, Dec. 31, 20X3 277,500.00

11. C.

20X1 Deferred gross profit, Dec. 31, 20X2 15,000.00

Divide by: Gross profit rate 25%

20X1 Installment accounts receivable, Dec. 31, 20X2 60,000.00

20X1 Installment accounts receivable, Dec. 31, 20X3 -

Collection in 20X3 from 20X1 sales 60,000.00

20X2 Deferred gross profit, Dec. 31, 20X2 54,000.00

Divide by: Gross profit rate 24%

20X2 Installment accounts receivable, Dec. 31, 20X2 225,000.00

20X2 Installment accounts receivable, Dec. 31, 20X3 37,500.00

Collection in 20X3 from 20X2 sales 187,500.00

Installment sales - 20X3 360,000.00

20X3 Installment accounts receivable, Dec. 31, 20X3 240,000.00

Collection in 20X3 from 20X3 sales 120,000.00

Total collections in 20X3 367,500.00

12. D.

Collection in 20X3 from 20X1 sales 60,000.00

Multiply by: Gross profit rate - 20X1 sales 25%

Realized gross profit in 20X3 from 20X1 sales 15,000.00

Collection in 20X3 from 20X2 sales 187,500.00

Multiply by: Gross profit rate - 20X2 sales 24%

Realized gross profit in 20X3 from 20X2 sales 45,000.00

Collection in 20X3 from 20X3 sales 120,000.00

Multiply by: Gross profit rate - 20X3 sales 30%

Realized gross profit in 20X3 from 20X3 sales 36,000.00

Total realized gross profit in 20X3 96,000.00

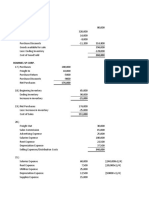

13. C.

Date Collection Interest

9/30/X1

9/30/X1 4,800.00 -

10/31/X1 4,800.00 432.00

11/30/X1 4,800.00 388.00

12/31/X1 4,800.00 344.00

Totals 19,200.00 1,164.00

Total ammortization 18,036.00

Multiply by: (a) 38%

Realized gross profit 6,763.50

a) (48,000-30,000) / 48,000 = 37.50%

14. A.

Inventory 16,800.00

Deferred gross profit 11,236.50

Loss on repossession (squeeze) (1,927.50)

Receivable 29,964.00

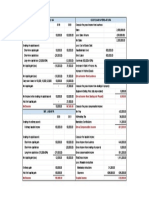

15. D.

Inst. Receivable - 20X1

1/1/X3 135,000.00 22,500.00

52,500.00

60,000.00

Inst. Receivable - 20X2

1/1/X3 300,000.00

105,000.00

195,000.00

Inst. Receivable - 20X3

Sales 495,000.00

105,000.00

390,000.00

Collections in 20X3 from:

20X1 sales 15,750.00

20X2 sales 42,000.00

20X3 sales 36,750.00

Total realized gross proift 94,500.00

16. C.

Inventory 15,000.00

Deferred gross profit 6,750.00

Loss on repossession (squeeze) (750.00)

Installment account receivable 22,500.00

17. C.

Inventory - traded-in 12,000.00

Installment account receivable (squeeze) 24,000.00

Installment sale 32,000.00

Under allowance 4,000.00

18. C.

Fair value of old merchandise traded-in 12,000.00

Collections 12,000.00

Total 24,000.00

Multiply by: Gross profit rate 44.44%

Realized gross profit in year of sale 10,665.60

19. D.

Cash down payment 600,000.00

Collection from installment payment 1,140,000.00

Total collections 1,740,000.00

Cost of sale (4,000,000.00)

Excess of collection over cost (2,260,000.00)

Since the total collections do not exceed yet the cost of the

inventory sold, Sound Co. does not recognize any income

yet.

20. C.

Total collections from 20X1 sales 20,000.00

Cost of 20X1 sales (16,000.00)

Excess collection in 20X2 4,000.00

Total collections from 20X2 sales 24,000.00

Cost of 20X2 sales (18,000.00)

Excess collection in 20X2 6,000.00

Gross profit recognized in 20X2 10,000.00

TATIONAL

20X3

360,000.00

252,000.00

108,000.00

30%

Ammortization Principal

48,000.00

4,800.00 43,200.00

4,368.00 38,832.00

4,412.00 34,420.00

4,456.00 29,964.00

18,036.00

Write-off

Collections

12/31/X3

Collections

12/31/X3

Collections

12/31/X3

You might also like

- Test Bank 2 - Ia 3Document31 pagesTest Bank 2 - Ia 3Xiena100% (6)

- 27 Flights Controls PDFDocument186 pages27 Flights Controls PDFAaron Harvey100% (3)

- Sol. Man. Chapter 10 Installment Sales Method 2020 EditionDocument13 pagesSol. Man. Chapter 10 Installment Sales Method 2020 EditionJam Surdivilla100% (1)

- The McGraw-Hill 36-Hour Course: Finance for Non-Financial Managers 3/EFrom EverandThe McGraw-Hill 36-Hour Course: Finance for Non-Financial Managers 3/ERating: 4.5 out of 5 stars4.5/5 (6)

- Colgate Case StudyDocument10 pagesColgate Case Studyapi-350427360100% (3)

- Business Enhancement 2nd Summative TextDocument16 pagesBusiness Enhancement 2nd Summative TextCams DlunaNo ratings yet

- Chapter 10 - Teacher's Manual - Afar Part 1Document20 pagesChapter 10 - Teacher's Manual - Afar Part 1Angelic67% (3)

- Q1 PR2 LAS WEEK 3 Kinds of VariablesDocument16 pagesQ1 PR2 LAS WEEK 3 Kinds of VariablesAnalie Cabanlit100% (4)

- Installment Sales MethodDocument11 pagesInstallment Sales MethodJanella Umieh De UngriaNo ratings yet

- Jennie Ann Moderacion TpspecialDocument7 pagesJennie Ann Moderacion Tpspecialjennieann moderacionNo ratings yet

- Chapter 10 Installment Sales AccountingDocument13 pagesChapter 10 Installment Sales AccountingFaithful FighterNo ratings yet

- Sol. Man. - Chapter 10 - Installment Sales Method - 2021 Edition 1Document12 pagesSol. Man. - Chapter 10 - Installment Sales Method - 2021 Edition 1amad.hannah0913No ratings yet

- Module 10Document4 pagesModule 10PaupauNo ratings yet

- Installment T SalesDocument31 pagesInstallment T SalesNiki DimaanoNo ratings yet

- StratCost Quiz 2Document6 pagesStratCost Quiz 2ElleNo ratings yet

- Chapter 10Document6 pagesChapter 10Love FreddyNo ratings yet

- Illustration Problem & SolutionDocument4 pagesIllustration Problem & SolutionClauie BarsNo ratings yet

- Bud GettingDocument8 pagesBud GettingLorena Mae LasquiteNo ratings yet

- 04 FAR04-answersDocument12 pages04 FAR04-answersBea GarciaNo ratings yet

- P6-18 Unrealized Profit On Upstream SalesDocument4 pagesP6-18 Unrealized Profit On Upstream Salesw3n123No ratings yet

- TaxationDocument5 pagesTaxationPauline Jasmine Sta AnaNo ratings yet

- Short Term Budgeting 3Document13 pagesShort Term Budgeting 3Jillian Dela CruzNo ratings yet

- Financial Accounting 3A Assignment 2tendai MakosaDocument5 pagesFinancial Accounting 3A Assignment 2tendai MakosaTendai MakosaNo ratings yet

- CostDocument4 pagesCostJanna Grace Dela CruzNo ratings yet

- Relevant CostingDocument3 pagesRelevant CostingPatrick SalvadorNo ratings yet

- Inventory Estimation 1Document6 pagesInventory Estimation 1Kriza CabilloNo ratings yet

- Midterms MADocument10 pagesMidterms MAJustz LimNo ratings yet

- Responsiblity Accounting IllustrationDocument14 pagesResponsiblity Accounting IllustrationRianne NavidadNo ratings yet

- Sol. Man. - Chapter 9 - Interim Financial ReportingDocument6 pagesSol. Man. - Chapter 9 - Interim Financial ReportingAEDRIAN LEE DERECHONo ratings yet

- Income Taxation 2023 DiscussionsDocument16 pagesIncome Taxation 2023 DiscussionsKenjay SarcoNo ratings yet

- Key To Correction - Intermediate Accounting - Midterm - 2019-2020Document10 pagesKey To Correction - Intermediate Accounting - Midterm - 2019-2020Renalyn ParasNo ratings yet

- Advance Accounting Installment Sales Manual MillanDocument14 pagesAdvance Accounting Installment Sales Manual MillanHades AcheronNo ratings yet

- 268,800 Rommel SP CorpDocument10 pages268,800 Rommel SP CorpnovyNo ratings yet

- TAX Final Preboard Examination - Solutions PDFDocument15 pagesTAX Final Preboard Examination - Solutions PDF813 cafeNo ratings yet

- DAIBB MA Math Solutions 290315Document11 pagesDAIBB MA Math Solutions 290315joyNo ratings yet

- Module 7 InstallmentDocument12 pagesModule 7 InstallmentNiki DimaanoNo ratings yet

- Spectra NDocument5 pagesSpectra NRichelle Mea B. PeñaNo ratings yet

- Intermediate Accounting 1 - Meeting 2 (Answers Sheets)Document4 pagesIntermediate Accounting 1 - Meeting 2 (Answers Sheets)WILLIAM CHANDRANo ratings yet

- Insurance Expense Allocated To The Quarter: SolutionDocument4 pagesInsurance Expense Allocated To The Quarter: Solutionasdfghjkl zxcvbnmNo ratings yet

- Novelyn AIDocument3 pagesNovelyn AInovyNo ratings yet

- Semi-Finals Solutions MartinezDocument10 pagesSemi-Finals Solutions MartinezGeraldine Martinez DonaireNo ratings yet

- Bài tập chương 13Document10 pagesBài tập chương 132021agl12.phamhoangdieumyNo ratings yet

- Chapter 10 Teacherx27s Manual Afar Part 1 - Compress PDFDocument20 pagesChapter 10 Teacherx27s Manual Afar Part 1 - Compress PDFddddddaaaaeeeeNo ratings yet

- Installed Cost of Proposed Machine 400,000Document5 pagesInstalled Cost of Proposed Machine 400,000Mariame Abasola CagabhionNo ratings yet

- Activity 1 Man. Acct.Document2 pagesActivity 1 Man. Acct.Aia Sophia SindacNo ratings yet

- Chapter 8Document12 pagesChapter 8Sarah May Tigue TalagtagNo ratings yet

- Management Accounting 1Document4 pagesManagement Accounting 1Tax TrainingNo ratings yet

- Problem 1: Ritchelle G. Reyes Mr. Marvin Dente 2.1 Bsa-Cy1 Financial ManagementDocument4 pagesProblem 1: Ritchelle G. Reyes Mr. Marvin Dente 2.1 Bsa-Cy1 Financial ManagementRavena ReyesNo ratings yet

- Homework Chapter 6Document6 pagesHomework Chapter 6Lê Vũ Phương DungNo ratings yet

- Quiz - Chapter 10 - Installment Sales Method - 2021 EditionDocument5 pagesQuiz - Chapter 10 - Installment Sales Method - 2021 EditionYam SondayNo ratings yet

- Chapter 5 Tutorial ExerciseDocument5 pagesChapter 5 Tutorial ExerciseFarheen AkramNo ratings yet

- Installment SalesDocument12 pagesInstallment SalesRusselle Therese DaitolNo ratings yet

- Psa 2 Key AnswerDocument3 pagesPsa 2 Key AnswerDjunah ArellanoNo ratings yet

- 06 Quiz 1 Income TaxDocument1 page06 Quiz 1 Income TaxKarylle ComiaNo ratings yet

- Itemized: Gross Income From OperationsDocument9 pagesItemized: Gross Income From OperationsLyka RoguelNo ratings yet

- Inclusion To Gross Income - Part 3 (TORREON, Kimberly Shane) - Sheet3Document1 pageInclusion To Gross Income - Part 3 (TORREON, Kimberly Shane) - Sheet3Shane TorrieNo ratings yet

- BAFACR16 04 Answer Key To Post TestsDocument5 pagesBAFACR16 04 Answer Key To Post TestsThats BellaNo ratings yet

- ACCCOB3Document10 pagesACCCOB3Jenine YamsonNo ratings yet

- InstallmentDocument10 pagesInstallmentNiki DimaanoNo ratings yet

- Advanced Accounting Solutions Chapter 7 ProblemsDocument2 pagesAdvanced Accounting Solutions Chapter 7 Problemsjohn carlos doringoNo ratings yet

- Answer-Key-Chapter-5-BC DeJesusDocument15 pagesAnswer-Key-Chapter-5-BC DeJesusMerel Rose FloresNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Private Debt: Yield, Safety and the Emergence of Alternative LendingFrom EverandPrivate Debt: Yield, Safety and the Emergence of Alternative LendingNo ratings yet

- Entre AssignmentDocument5 pagesEntre AssignmentPunum JaggNo ratings yet

- An Analytical Methodology For Acousmatic Music: Teaching, Learning and Research Support Dept, University of MelbourneDocument4 pagesAn Analytical Methodology For Acousmatic Music: Teaching, Learning and Research Support Dept, University of MelbourneJoan MilenovNo ratings yet

- Chapter 7 Fiduciary RelationshipDocument18 pagesChapter 7 Fiduciary RelationshipMarianne BautistaNo ratings yet

- Script TemplateDocument8 pagesScript TemplateamberkaplanNo ratings yet

- ARAVIND - Docx PPPDocument3 pagesARAVIND - Docx PPPVijayaravind VijayaravindvNo ratings yet

- Nadine Rose DissertationDocument7 pagesNadine Rose DissertationWebsiteThatWillWriteAPaperForYouSavannah100% (1)

- How To Write A Paragraph - by MR - Mustafa MansourDocument51 pagesHow To Write A Paragraph - by MR - Mustafa MansourBob NorNo ratings yet

- Electro QB BansalDocument20 pagesElectro QB BansalAnshul TiwariNo ratings yet

- Schizophrenia Spectrum and Other Psychotic DisordersDocument8 pagesSchizophrenia Spectrum and Other Psychotic DisordersJR BetonioNo ratings yet

- Module 3 Literature ActivitiesDocument3 pagesModule 3 Literature ActivitiesAlexis Joy P. DangoNo ratings yet

- Gonzales Gene08 Ethics Course SyllabusDocument7 pagesGonzales Gene08 Ethics Course SyllabusQueenie Gonzales-AguloNo ratings yet

- Grammar BeGoingTo1 18821-1Document1 pageGrammar BeGoingTo1 18821-1CristinaNo ratings yet

- Ethics in OBGYNDocument2 pagesEthics in OBGYNAbdulmajeed AltamimiNo ratings yet

- Step 7 Err Code125936644Document37 pagesStep 7 Err Code125936644mohammadNo ratings yet

- Topic 5Document41 pagesTopic 5Nurul FarhanahNo ratings yet

- Stricklin I WOULD NOT...Document17 pagesStricklin I WOULD NOT...Karl LammNo ratings yet

- Assignement 2Document3 pagesAssignement 2Ma Vanessa Rose TacuyanNo ratings yet

- (123doc) - De-Dap-An-Chuyen-Anh-Tphcm-2008-2009Document14 pages(123doc) - De-Dap-An-Chuyen-Anh-Tphcm-2008-2009Đình HảiNo ratings yet

- 2nd Q Tos and Test-Math3-2023-2024Document10 pages2nd Q Tos and Test-Math3-2023-2024Jessica MoranoNo ratings yet

- Abbotsford Law Court Provincial AdvanceDocument108 pagesAbbotsford Law Court Provincial Advancesampv90No ratings yet

- Bidding Docs For DBWD Nlif May Final 2013projectDocument158 pagesBidding Docs For DBWD Nlif May Final 2013projectrain06021992No ratings yet

- Rrl-Team 5Document10 pagesRrl-Team 5Alea AicoNo ratings yet

- CvaDocument170 pagesCvaApril Jumawan ManzanoNo ratings yet

- 01 Reinforcement Material AnswersDocument5 pages01 Reinforcement Material Answerspicoleta2No ratings yet

- Readings in Philippine History: (Activity)Document6 pagesReadings in Philippine History: (Activity)Calvin CempronNo ratings yet

- Kasilag v. Roque: G.R. No. 46623 - December 7, 1939Document6 pagesKasilag v. Roque: G.R. No. 46623 - December 7, 1939Remus CalicdanNo ratings yet

- Lesson 1 Principles and TheoriesDocument11 pagesLesson 1 Principles and TheoriesJoycee BoNo ratings yet