Professional Documents

Culture Documents

Conflicting - Objectives Optimization

Conflicting - Objectives Optimization

Uploaded by

Laiss FernandaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Conflicting - Objectives Optimization

Conflicting - Objectives Optimization

Uploaded by

Laiss FernandaCopyright:

Available Formats

McCarthy P L, 1997.

Third Annual Australian Contract Mining Conference AIC

Conferences Pty Ltd, Sydney.

Conflicting Objectives – Mine Optimisation

and the Underground Contract

By P L McCarthy 1

Maximising the value of an underground mine to its owner Now we know from a detailed analysis of costs at many mines

involves reducing the dilution of ore with waste rock and that the actual costs of development and stoping are no more

following a well thought out plan. These objectives are not than 50% of these rates. The balance of the contractor's costs is

necessarily those of the contractor and in fact may conflict with semi-fixed and is shown in the budget in Table 1 as a semi-

the contractor's objectives. fixed cost of $7 M per year. I say the cost is semi-fixed because

it does in fact vary with the rate of mining activity but the

My perspective is that of the originator of the feasibility study variation is much less than directly proportional. For this model

for a new mine, who hopes to see it developed along sound I have allowed the fixed cost to vary according to the 0.6 power

lines and to be as profitable for the owner as the feasibility of the annual tonnage. That is:

study predicted. I am also asked to prepare technical audits of

existing operations for the owners or often for lending banks. In New fixed cost = budget fixed cost

these situations the conflicting objectives of the owner and the x

contractor are all too apparent. (new tonnage ÷ budget tonnage)0.6

A common complaint by the mine manager or the owner's This is a reasonable approximation which covers the additional

contract manager is as follows: cost of services and the ownership of extra or larger equipment.

The bottom of Table 1 shows how the principal's profit is

"These contractors are very good at development but don't derived. Assuming the resource grade of $70 per tonne, a

seem to handle the stoping as well. Whenever things get revenue figure is derived from which must be deducted the

difficult in the stopes, they just turn around and do more mining cost (the contractor's charge), the treatment cost at $12

development." per tonne and administration at a fixed $1.2 M per annum.

It is understandable that if the stoping gets difficult and less The second column of Table 1 shows a forecast which may

profitable, then resources will be redirected towards the more have been prepared once the mine was up and running and it

profitable activities. This can be very difficult for an was realised that the rate of mining the resource would be less

inexperienced contract manager to resist. The contractor will than expected. This could be due to geological surprises with

argue that he isn't making money on the stoping and that it is the orebody itself, difficult ground conditions or the inability

only fair that he be allowed to increase the development so that for some other reason to advance stopes as quickly as planned.

the unpleasantness of possible latent conditions claims is After dilution, the mining and treatment rate will be only

avoided. 440,000 tonnes per annum. In this situation the contractor's

profit will be reduced to 77% of budget and the owner's profit

In this presentation I have tried to quantify the conflicting to 82% of budget.

objectives of the mine owner and the contractor by working

through a case study for a small underground mine. The mine The third column of Table 1 shows a situation where the budget

budget is shown in the first column of Table 1. The owner plans grade is not realised, although it is possible to mine at the

to mine about 500,000 tpa of diluted ore and to do 1,300 metres budget tonnage rate. The resource grade has dropped from $70

per annum of development. Dilution is expected to be 10%. If per tonne to $65 per tonne so that the owner's profit falls to

all goes to plan, the contractor's profit will be $1.7 M per year 69% of budget. Of course the contractor is achieving budget

and the owner's profit will be $7.3 M per year. metres and tonnes so his profit is unaffected.

The lower part of the Table 1 budget shows the contractor's

income from development at a rate of $1,800 per metre and

from stoping at a rate of $30 per tonne. For simplicity, ground

support and other costs are assumed to be built into these rates.

1. MAusIMM, CPMin, Managing Director, Australian Mining

Consultants Pty Ltd, 19/114 William Street, Melbourne Vic 3000

E-mail: pmccarthy@ausmin.com.au

Conflicting Objectives – Mine Optimisation and the Underground Contract

Table 1 – Budget and forecast shortfalls

Physicals Rate Unit Budget Forecast Tonnage Shortfall Forecast Grade Shortfall

Development m 1,300 1,300 1,300

Resource Mined t 455,000 400,000 455,000

Dilution % 10 10 10

Ore Mined and Treated t 500,500 440,000 500,500

Contractor's Profit $ 1,677,500 1,290,713 1,677,500

Owner's Profit $ 7,289,000 5,980,000 5,014,000

Contractor's Profit 100% 77% 100%

Owner's Profit 100% 82% 69%

Contractor

Developer Income $1,800 m 2,340,000 2,340,000 2,340,000

Stoping Income $30 t 15,015,000 13,200,000.00 15,015,000

Total Income 17,355,000 15,540,000 17,355,000

Development Cost $900 m 1,170,000 1,170,000 1,170,000

Stoping Cost $15 t 7,507,500 6,600,000 7,507,500

Semi-fixed Cost $7,000,000 LS 7,000,000 6479287 7,507,500

Total Cost 15,677,500 14,249,287 16,185,000

Profit 1,677,500 1,290,713 1,170,000

Owner

Resource Grade t $70 $70 $65

Revenue From Resource t 31,850,000 28,000,000 29,575,000

Mining Cost 17,355,000 15,540,000 17,355,000

Treatment Cost $12 t 6,006,000 5,280,000 6,006,000

Admin Cost $1,200,000 LS 1,200,000 1,200,000 1,200,000

Profit 7,289.00 5,980,000 5,014,000

Table 2 shows possible responses by the contractor to a profit would be restored while the contractor's profit was

shortfall in tonnage. Leaving everything else constant, he can reduced to 65% of budget (Column B). A likely compromise by

increase the development rate to 1,730 m per year. The extra the owner would be to cut development to 850 m per year and

profit derived from the additional development will bring him to try to improve dilution from 10% to 7%. This would bring

back to his budgeted profit (Column A). Alternatively he can him back to budgeted profit but would reduce the contractor's

leave the development alone but increase the mining dilution. profit to 48% of budget (Column C). In the long term of course,

This is done by reducing the care taken with production, it is impossible to cut back on the amount of development

drilling and blasting and perhaps deliberately overbreaking into required, particularly if it is a response to a reduced availability

waste rock on the hangingwall. If the dilution is increased to of resource. However this could well be an owner's strategy for

25%, then the budget mining tonnage is restored and his a single year if the problem was thought to be a temporary one.

contract returns to budget profit (Column B). Note that by

increasing development, the contractor reduced the owner's The conflicting objectives of the owner and contractor are

profit to 57% and by increasing dilution, he reduced the owner's highlighted in the above examples. The practical mining

profit to 47% of budget. A realistic approach from the strategies to be adopted underground work in quite opposite

contractor's point of view might be to increase development to directions if the contractor or the owner is to restore his

1,450 m per year and to increase dilution to 20%. The profitability to budget. With the current popularity of partnering

combination of the two effects restores him to 100% profit arrangements, one possibility might be to operate an open book

(Column C). This is not just a hypothetical example but I (agreed profit) contract. In Table 4, the contractor's profit is

believe I have seen the results of it at several mines which I locked in at its budget figure by means of an adjustment shown

have examined. in the contractor's income. With the contractor's profit fixed, we

only need worry about the owner's optimisation of the project.

The owner's perspective is quite different. He can restore Column A shows that even if the development was cut to zero,

profitability by reducing the amount of development to cut his the owner can achieve only 93% of his budgeted profit. If

costs. In Table 3, the development is reduced to 590 m per year development is held at budget but the dilution is cut to zero, the

and the owner's profit is restored while the contractor's profit is owner's profit is 96% of budget (Column B). Taking the

reduced to 39% (Column A). Alternatively the owner can leave practical compromise suggested in Column C (850 m of

development alone but try to reduce dilution. If dilution could development and 7% dilution) the contractor's profit remains at

be reduced to 2% (an impossibility in practice) then the owner's budget while the owner's profit is 88% of budget.

AMC Reference Library – www.ausmin.com.au 2

Conflicting Objectives – Mine Optimisation and the Underground Contract

Table 2 – Contractor’s response to shortfall in tonnage

Physicals Rate Unit Budget Forecast Tonnage Shortfall Forecast Grade Shortfall

Development m 1,730 1,300 1450

Resource Mined t 400,000 400,000 400,000

Dilution % 10 25 20

Ore Mined and Treated t 440,000 500,000 480,500

Contractor's Profit $ 1,677,713 1,677,197 1,678,465

Owner's Profit $ 5,206,000 3,460,000 4,030,000

Contractor's Profit 100% 100% 0%

Owner's Profit 71% 47% 55%

Contractor

Developer Income $1,800 m 3,114,000 2,340,000 2,610,000

Stoping Income $30 t 13,200,000 15,000,000 14,400,000

Total Income 16,314,000 17,340,000 17,010,000

Development Cost $900 m 1,557,000 1,170,000 1,305,000

Stoping Cost $15 t 6,600,000 7,500,000 7,200,000

Semi-fixed Cost $7,000,000 LS 6,479,287 6,995,803 6,826,535

Total Cost 14,636,287 15,665,803 15,331,535

Profit 1,677,713 1,674,197 1,678,465

Owner

Resource Grade t $70 $70 $70

Revenue From Resource t 28,000,000 28,000,000 28,000,000

Mining Cost 16,314,000 17,340,000 17,010,000

Treatment Cost $12 t 5,280,000 6,000,000 5,760,000

Admin Cost $1,200,000 LS 1,200,000 1,200,000 1,200,000

Profit 5,206,000 3,460,000 4,030,000

Table 3 – Owner’s response to shortfall in tonnage

Physicals Rate Unit Budget Forecast Tonnage Shortfall Forecast Grade Shortfall

Development m 590 1,300 850

Resource Mined t 400,000 400,000 400,000

Dilution % 10 2 7

Ore Mined and Treated t 440,000 408,000 428,000

Contractor's Profit $ 651,713 1,097,704 812,324

Owner's Profit $ 7,258,000 7,324,000 7,294,000

Contractor's Profit 39% 65% 48%

Owner's Profit 100% 100% 100%

Contractor

Developer Income $1,800 m 1,062,000 2,340,000 1,530,000

Stoping Income $30 t 13,200,000 12,240,000 12,840,000

Total Income $ 14,262,000 14,580,000 14,370,000

Development Cost $900 m 531,000 1,170,000 765,000

Stoping Cost $15 t 6,600,000 6,120,000 6,420,000

Semi-fixed Cost $7,000,000 LS 6,479,287 6,192,296 6,372,676

Total Cost $ 13,610,287 13,482,296 13,557,676

Profit $ 651,713 1,097,704 812,324

Owner

Resource Grade t $70 $70 $70

Revenue From Resource t 28,000,000 28,000,000 28,000,000

Mining Cost 14,262,000 14,580,000 14,370,000

Treatment Cost $12 t 5,280,000 4,896,000 5,136,000

Admin Cost $1,200,000 LS 1,200,000 1,200,000 1,200,000

Profit $ 7,258,000 7,324,000 7,294,000

AMC Reference Library – www.ausmin.com.au 3

Conflicting Objectives – Mine Optimisation and the Underground Contract

Table 4 – Tonnage shortfall with agreed profit contract

Physicals Rate Unit Budget Forecast Tonnage Shortfall Forecast Grade Shortfall

Development m 0 1,300 850

Resource Mined t 400,000 400,000 400,000

Dilution % 10 0 7

Ore Mined and Treated t 440,000 400,000 428,000

Contractor's Profit $ 1,677,500 1,677,500 1,677,500

Owner's Profit $ 6,763,213 7,033,343 6,428,824

Contractor's Profit 100% 100% 100%

Owner's Profit 93% 96% 88%

Contractor

Developer Income $1,800 m 0 2,340,000 1,530,000

Stoping Income $30 t 13,200,000 12,000,000 12,840,000

Adjustment 1,556,787 626,657 865,176

Total Income 14,756,787 14,966,657 15,235,176

Development Cost $900 m 0 1,170,000 765,000

Stoping Cost $15 t 6,600,000 6,000,000 6,420,000

Semi-fixed Cost $7,000,000 LS 6,479,287 6,119,157 6,372,676

Total Cost 13,079,287 13,289,157 13,557,676

Profit 1,677,500 1,677,500 1,677,500

Owner

Resource Grade t $70 $70 $70

Revenue From Resource t 28,000,000 28,000,000 28,000,000

Mining Cost 14,756,787 14,966,657 15,235,176

Treatment Cost $12 t 5,280,000 4,800,000 5,136,000

Admin Cost $1,200,000 LS 1,200,000 1,200,000 1,200,000

Profit 6,763,213 7,033,343 6,428,824

The compromise outcome in Table 4 might seem reasonable if possible for both contractor and the owner to achieve their

the shortfall in tonnage was in no way the fault of the objectives without penalising one or the other. This is done in

contractor. In that case the owner should bear the responsibility effect by taking the excess profit from the contractor and giving

of his inadequate geological assessment and accept the lower it back to the owner. The contractor still achieves his budget

profit. However, to the extent that the shortfall is due to poor profit and the owner finds it easier to achieve his budget profit

performance by the contractor or his inadequate assessment of despite the adverse grade. This can be achieved at 605,000

ground support requirements and time necessary, then the open tonnes mined and treated with 10% dilution (Column A) or at

book agreed profit scheme remains unfair. 681,000 tonnes mined and treated at 15% dilution (Column B).

The situation with a shortfall in grade is different, and Table 5 The above examples are hypothetical but the principles

shows the owner's options. He can increase the tonnage mined illustrated are at work within every mining contract. With the

and treated to 682,000 tonnes and at the same time, increase the trend to out sourcing, mining companies are increasingly giving

development to 1,771 metres in order to access the additional control of the mining process to contractors. Who will take

stopes needed. This restores his profit but increases the responsibility for long term planning, scheduling and dilution

contractor's profit to 202% (Column A). The contractor's profit control so that the owner's objectives are met? If the contractor

has gone up because of the additional work being done with a becomes involved in these areas, then whose profit is he trying

large component of fixed cost. to maximise? As the mining process becomes the responsibility

of contractors, mining engineers will gain their operational

In chasing a higher tonnage, the owner may acknowledge that experience with contractors rather than with mine owners. They

control of dilution will be somewhat relaxed. A realistic target will absorb operational strategies which meet the contractor's

is shown in Column B where 15% dilution leads to an even objectives but are in conflict with the owner's objectives. How

greater mining and development rate. Now the owner's profit is will they perform when they become planning and scheduling

restored but the contractor's profit has increased to almost engineers or contract administrators?

300%. Column C Table 5 shows the result of reducing dilution

from 10% to 7% while increasing the resource mining rate. In the hypothetical case of a mining contractor who bought a

This increases the contractor's profit to 169% of budget. Table mine and attempted to run it himself, how would he perform? I

5 shows the unfairness of a situation where the owner is in suspect that he would do the development very well and

difficulties and any action he takes will result in an increase of probably exceed the budget metres every month. He would get

profit for the contractor. Again this is a realistic and frequent the stope tonnes although they would be more diluted than the

situation where the ore reserve grade is not achieved in practice feasibility study predicted. By all his normal measures of

once the mine is opened up. performance, he would be doing very well; but would the mine

be profitable?

Table 6 again shows the open book (agreed profit) approach to

the mining contract. In the case of unrealised grade, it is

AMC Reference Library – www.ausmin.com.au 4

Conflicting Objectives – Mine Optimisation and the Underground Contract

Table 5 – Owner’s response to a shortfall in grade

Physicals Rate Unit Budget Forecast Tonnage Shortfall Forecast Grade Shortfall

Development m 1771 2100 1700

Resource Mined t 620,000 735,000 575,000

Dilution % 10 15 7

Ore Mined and Treated t 682,000 845,250 615,250

Contractor's Profit $ 3,396,253 4,982,545 2,835,806

Owner's Profit 7,267,429 7,294,500 7,274,500

Contractor's Profit 202% 297% 169%

Owner's Profit 100% 100% 100%

Contractor

Developer Income $1,800 m 3,188,571 3,780,000 3,060,000

Stoping Income $30 t 20,460,000 25,357,500 18,457,500

Total Income 23,648,571 29,137,500 21,517,500

Development Cost $900 m 1,594,286 1,890,000 1,530,000

Stoping Cost $15 t 10,230,000 12,678,750 9,228,750

Semi-fixed Cost $7,000,000 LS 8,428,033 9,586,205 7,922,944

Total Cost 20,252,318 24,154,955 18,681,694

Profit 3,396,253 4,982,545 2,835,806

Owner

Resource Grade t $65 $65 $65

Revenue From Resource t 40,300,000 47,775,000 37,375,000

Mining Cost 23,648,571 29,137,500 21,517,500

Treatment Cost $12 t 8,184,000 10,143,000 7,383,000

Admin Cost $1,200,000 LS 1,200,000 1,200,000 1,200,000

Profit 7,267,429 7,294,500 7,274,500

Table 6 – Grade shortfall with agreed profit contract

Physicals Rate Unit Budget Forecast Tonnage Shortfall

Development m 1571 1691

Resource Mined t 550,000 592,000

Dilution % 10 15

Ore Mined and Treated t 605,000 680,800

Contractor's Profit $ 1,677,500 1,677,500

Owner's Profit $ 7,279,734 7,279,482

Contractor's Profit 100% 100%

Owner's Profit 100% 100%

Contractor

Developer Income $1,800 m 2,828,571 3,044,571

Stoping Income $30 t 18,150,000 205,424,000

Adjustment (968,305) (1,637,654)

Total Income 20,010,266 21,830,918

Development Cost $900 m 1,414,286 1,522,286

Stoping Cost $15 t 9,075,000 10,212,000

Semi-fixed Cost $7,000,000 LS 7,843,480 8,419,132

Total Cost 18,332,766 20,153,418

Profit 1,677,500 1,677,500

Owner

Resource Grade t $65 $65

Revenue From Resource t 35,750,000 38,480,000

Mining Cost 20,010,266 21,830,918

Treatment Cost $12 t 7,260,000 8,169,600

Admin Cost $1,200,000 LS 1,200,000 1,200,000

Profit 7,279,734 7,279,482

AMC Reference Library – www.ausmin.com.au 5

You might also like

- Lecture Notes - 6 - Methods of ValuationDocument9 pagesLecture Notes - 6 - Methods of ValuationNathaniel Mclean100% (2)

- Cost Planning For The Product Life CycleDocument23 pagesCost Planning For The Product Life CyclesugihartiniNo ratings yet

- Investment Decision Rules: © 2019 Pearson Education LTDDocument22 pagesInvestment Decision Rules: © 2019 Pearson Education LTDLeanne TehNo ratings yet

- Gitman IM ch08 PDFDocument17 pagesGitman IM ch08 PDFdmnque pileNo ratings yet

- Sample Development AppraisalDocument5 pagesSample Development AppraisalchrispittmanNo ratings yet

- Group-7 DPM Phase-1 Rev07Document12 pagesGroup-7 DPM Phase-1 Rev07Riski WijokongkoNo ratings yet

- منهج اقتصاد هندسة نفطDocument5 pagesمنهج اقتصاد هندسة نفطAhmed BeNo ratings yet

- 2 - Volt Energy Investment Project - Work Energy LLC - June 2022Document4 pages2 - Volt Energy Investment Project - Work Energy LLC - June 2022luis jamiltonNo ratings yet

- Project Report On General StoreDocument10 pagesProject Report On General StoreApplication's ManagerNo ratings yet

- Answers To Warm-Up Exercises: AnswerDocument21 pagesAnswers To Warm-Up Exercises: AnswerMeyzla Ativa HuslikNo ratings yet

- MD Rafiullah Project ReportDocument9 pagesMD Rafiullah Project ReportVivek JaiswalNo ratings yet

- Solutions To Problems: LG 2 BasicDocument18 pagesSolutions To Problems: LG 2 BasicHerdiyanaNurcahyantiNo ratings yet

- CGE 660 March - June 2018 ProjectDocument2 pagesCGE 660 March - June 2018 ProjectPejal SahakNo ratings yet

- 11 Chap Solution Gitman BookDocument23 pages11 Chap Solution Gitman BookAsim AltafNo ratings yet

- Name: Shenielyn B. Napolitano BSA 3A Source: Roque Book: QuestionsDocument7 pagesName: Shenielyn B. Napolitano BSA 3A Source: Roque Book: QuestionsEsse ValdezNo ratings yet

- Accounts Paper Answer 24.06.2020Document17 pagesAccounts Paper Answer 24.06.2020Prathmesh JambhulkarNo ratings yet

- Economics Training ManualDocument157 pagesEconomics Training ManualJesus Ponce GNo ratings yet

- Project Report On General StoreDocument10 pagesProject Report On General StoredigitaltechnolifeNo ratings yet

- Bikash Kirtania Project Report FileDocument9 pagesBikash Kirtania Project Report FileVivek JaiswalNo ratings yet

- MD Ekram Project ReportDocument9 pagesMD Ekram Project ReportVivek JaiswalNo ratings yet

- Application of Economic Concepts-Activity 1Document3 pagesApplication of Economic Concepts-Activity 1Katrina Amore VinaraoNo ratings yet

- Finance FIN2704/FIN2704X: Lecture 8: Capital Budgeting 1Document67 pagesFinance FIN2704/FIN2704X: Lecture 8: Capital Budgeting 1oehiohiwegNo ratings yet

- Assignment Nicmar PGCM 21Document19 pagesAssignment Nicmar PGCM 21punyadeep75% (4)

- Engineering Management 3000/5039: Tutorial Set 6Document4 pagesEngineering Management 3000/5039: Tutorial Set 6Sahan100% (1)

- UTS MK 15 Sep 18Document14 pagesUTS MK 15 Sep 18Anonymous KyYdMhfaKXNo ratings yet

- Ifrs 15Document28 pagesIfrs 15Nigar ShiralizadaNo ratings yet

- KotureshwaraDocument9 pagesKotureshwaraVeerabhadreshwar Online CenterNo ratings yet

- Mock Deparmentals MASQDocument6 pagesMock Deparmentals MASQHannah Joyce MirandaNo ratings yet

- Present-Worth Analysis Example 5.1: Conventional-Payback Period: PP 195 - 196Document11 pagesPresent-Worth Analysis Example 5.1: Conventional-Payback Period: PP 195 - 196tan lee huiNo ratings yet

- Project Cost & Profitability - : Anjuna 2000 SQ.MDocument2 pagesProject Cost & Profitability - : Anjuna 2000 SQ.MAnondoNo ratings yet

- Gitman IM Ch08Document17 pagesGitman IM Ch08Ahmad RahhalNo ratings yet

- Gaurav Solanki Section E 447 Assingment 3Document10 pagesGaurav Solanki Section E 447 Assingment 3Praveen Singh ChauhanNo ratings yet

- Application - of - Economic - Concepts-Activity - 1 - Katrina Amore VinaraoDocument3 pagesApplication - of - Economic - Concepts-Activity - 1 - Katrina Amore VinaraoKatrina Amore VinaraoNo ratings yet

- R21 Capital Budgeting Q Bank PDFDocument10 pagesR21 Capital Budgeting Q Bank PDFZidane KhanNo ratings yet

- Capital BudgetDocument59 pagesCapital BudgetScribdTranslationsNo ratings yet

- Appendix - Inv Appraisal ExamplesDocument13 pagesAppendix - Inv Appraisal ExamplesYougal MalikNo ratings yet

- BQ Vila Lestari CompleteDocument43 pagesBQ Vila Lestari CompleteImam FathurrahmanNo ratings yet

- Neha Project ReportDocument13 pagesNeha Project ReportPankaj UpadhyayNo ratings yet

- Brealey Fundamentals of Corporate Finance 10e Ch08 PPT 2022Document25 pagesBrealey Fundamentals of Corporate Finance 10e Ch08 PPT 2022farroohaahmedNo ratings yet

- Background and AnalysisDocument18 pagesBackground and AnalysisOmolara Ajibike MosuroNo ratings yet

- Govind HarvesterDocument9 pagesGovind Harvesterrashidsilwani01No ratings yet

- Projet de Terrasses Radicales Nyankenke 2014-2015Document13 pagesProjet de Terrasses Radicales Nyankenke 2014-2015Bizimenyera Zenza TheonesteNo ratings yet

- 2003 DecemberDocument7 pages2003 DecemberSherif AwadNo ratings yet

- Final Exam EconomicsDocument1 pageFinal Exam Economicsasel ElmadneNo ratings yet

- 10.risiko Ontleding in Kapitaalbegroting HF 10 Oplossings PDFDocument53 pages10.risiko Ontleding in Kapitaalbegroting HF 10 Oplossings PDFThulani NdlovuNo ratings yet

- Project Report On General StoreDocument12 pagesProject Report On General Storeimtaj320haqueNo ratings yet

- Mini Case Capital Budgeting ProcessDocument6 pagesMini Case Capital Budgeting Process032179253460% (1)

- Lecture 28-31capital BudgetingDocument68 pagesLecture 28-31capital BudgetingNakul GoyalNo ratings yet

- 2220 - Fuel Storage Tank at Subang Ptci RabDocument19 pages2220 - Fuel Storage Tank at Subang Ptci RabMIFTAH FIRDAUS100% (8)

- Ekonomi Hans DadiDocument279 pagesEkonomi Hans DadiHans DadiNo ratings yet

- SD17 Hybrid F5 Section C Answers Clean Proof PDFDocument12 pagesSD17 Hybrid F5 Section C Answers Clean Proof PDFShaksham SharmaNo ratings yet

- Topic 8 - Inv App 1 Ans 2019-20Document4 pagesTopic 8 - Inv App 1 Ans 2019-20Gaba RieleNo ratings yet

- Pages 1-8Document7 pagesPages 1-8Kimberly Ann ChavezNo ratings yet

- Restructuring Bulong Debt - 3Document7 pagesRestructuring Bulong Debt - 3Kumar Abhishek100% (1)

- Marking Scheme 2020Document5 pagesMarking Scheme 2020Joanna GarciaNo ratings yet

- Assignment 1Document3 pagesAssignment 1ahmadbinowaidhaNo ratings yet

- Sujata 5lakhDocument9 pagesSujata 5lakhpradeep reddyNo ratings yet

- Seth Box Factory - 231007 - 130659Document38 pagesSeth Box Factory - 231007 - 130659rah20kanNo ratings yet

- Chapter 3 - Project SelectionDocument49 pagesChapter 3 - Project SelectionRavi VarmanNo ratings yet

- Optimization and Business Improvement Studies in Upstream Oil and Gas IndustryFrom EverandOptimization and Business Improvement Studies in Upstream Oil and Gas IndustryNo ratings yet

- Wa0009.Document2 pagesWa0009.Purahar sathyaNo ratings yet

- Tentative Recommendations For Prestressed Concrete-ACI 323 (1958)Document34 pagesTentative Recommendations For Prestressed Concrete-ACI 323 (1958)Alberto Ezequiel León TamayoNo ratings yet

- Al Tronic Ill-Cpu Medium Engines, 2 16 Cylinders Service Instructions FORM Alii-CPU SL 4-91Document8 pagesAl Tronic Ill-Cpu Medium Engines, 2 16 Cylinders Service Instructions FORM Alii-CPU SL 4-91SMcNo ratings yet

- DP Kansas State University 1956Document34 pagesDP Kansas State University 1956Astrid De La Cruz RedheadNo ratings yet

- TITLE: Distillation and Hardness of Water AbstractDocument4 pagesTITLE: Distillation and Hardness of Water AbstractnotmeNo ratings yet

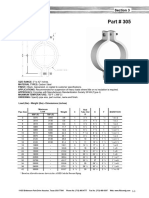

- Part 305 Heavy Pipe ClampDocument1 pagePart 305 Heavy Pipe ClampezhiljananiNo ratings yet

- Applied Economics ReportDocument16 pagesApplied Economics ReportJoyce Ann Agdippa Barcelona100% (1)

- Combined Surface and Subsea P&P Test No. 2Document36 pagesCombined Surface and Subsea P&P Test No. 2tonyNo ratings yet

- Mindfulness Based Cognitive Therapy For Children Results of A Pilot StudyDocument12 pagesMindfulness Based Cognitive Therapy For Children Results of A Pilot StudyAcong KentutNo ratings yet

- The Human Body: An Orientation: Chapter 1 Part BDocument32 pagesThe Human Body: An Orientation: Chapter 1 Part Bterryortiz825No ratings yet

- Maintenance of PSC GirdersDocument10 pagesMaintenance of PSC GirdersradhakrishnangNo ratings yet

- MC Condenser Technical ManualDocument35 pagesMC Condenser Technical Manualjuan manuel guerrero florezNo ratings yet

- NCERT Solutions For Class 12 Physics Chapter 3 Current ElectricityDocument24 pagesNCERT Solutions For Class 12 Physics Chapter 3 Current ElectricityDileep GNo ratings yet

- Main Project Psl360sDocument6 pagesMain Project Psl360sPonatshego Stojaković OnewangNo ratings yet

- Which of The Following Is An External Sorting?: Merge Sort Tree Sort Bubble Sort Insertion SortDocument3 pagesWhich of The Following Is An External Sorting?: Merge Sort Tree Sort Bubble Sort Insertion SortAjay BhoopalNo ratings yet

- Aristo Alhakim IndonesiaDocument2 pagesAristo Alhakim Indonesiaaristo anadyaNo ratings yet

- SPAR International Annual Report 2018 PDFDocument56 pagesSPAR International Annual Report 2018 PDFCristian Cucos CucosNo ratings yet

- Tumor Angiogenesis: Causes, Consequences, Challenges and OpportunitiesDocument26 pagesTumor Angiogenesis: Causes, Consequences, Challenges and OpportunitiesStella NoviaNo ratings yet

- ACCA P1 Study Guide OpenTuitionDocument4 pagesACCA P1 Study Guide OpenTuitionalauddinaloNo ratings yet

- Appendix H PDFDocument59 pagesAppendix H PDFarif_rubinNo ratings yet

- Method Statement For LPG DismantlingDocument8 pagesMethod Statement For LPG DismantlingHusain abidiNo ratings yet

- 27 RevatiDocument4 pages27 RevatiOzy CanNo ratings yet

- Labour Law - GuidelinesDocument21 pagesLabour Law - GuidelinesJames AdesinaNo ratings yet

- HNI67Document1 pageHNI67Arsh AhmadNo ratings yet

- MAin The PEOPLE v. Michael R. TOMANELLIDocument4 pagesMAin The PEOPLE v. Michael R. TOMANELLIcb1998No ratings yet

- Template For Submission of Papers To IETE Technical ReviewDocument6 pagesTemplate For Submission of Papers To IETE Technical ReviewTabassum Nawaz BajwaNo ratings yet

- ProposalDocument15 pagesProposalCourage JuwawoNo ratings yet

- Shreya Dikshit ISSNDocument16 pagesShreya Dikshit ISSNPratikNo ratings yet

- My Comments Are Given in Red Below:-: Sajimon.M.KunjuDocument6 pagesMy Comments Are Given in Red Below:-: Sajimon.M.Kunjupdkprabhath_66619207No ratings yet