Professional Documents

Culture Documents

Problem1 Section 19.2

Problem1 Section 19.2

Uploaded by

SANSKAR JAINCopyright:

Available Formats

You might also like

- Task 3 - DCF ModelDocument10 pagesTask 3 - DCF Modeldavin nathan0% (1)

- Task 1 AnswerDocument9 pagesTask 1 AnswerSiddhant Aggarwal20% (5)

- Canada Packers - Exhibits + Valuation - FionaDocument63 pagesCanada Packers - Exhibits + Valuation - Fiona/jncjdncjdn100% (1)

- CMU 70-371 Operations Management Assignment 1Document2 pagesCMU 70-371 Operations Management Assignment 1Adam LNo ratings yet

- C19a Rio's SpreadsheetDocument8 pagesC19a Rio's SpreadsheetaluiscgNo ratings yet

- Gainesboro SolutionDocument7 pagesGainesboro SolutionakashNo ratings yet

- The Digital Marketing CanvasDocument1 pageThe Digital Marketing Canvasvicente_ortiz_007No ratings yet

- Financial Analysis Coles GroupDocument5 pagesFinancial Analysis Coles GroupAmmar HassanNo ratings yet

- Advanced Business Calculations/Series-3-2011 (Code3003)Document15 pagesAdvanced Business Calculations/Series-3-2011 (Code3003)Hein Linn Kyaw86% (21)

- NFL Annual Report 2019 Compressed PDFDocument130 pagesNFL Annual Report 2019 Compressed PDFZUBAIRNo ratings yet

- Company Info - Print FinancialsDocument2 pagesCompany Info - Print FinancialsHarsh PuseNo ratings yet

- Ratio Analysis of PT TelekomunikasiDocument7 pagesRatio Analysis of PT TelekomunikasiJae Bok LeeNo ratings yet

- RatioDocument11 pagesRatioAnant BothraNo ratings yet

- 2022 01 Bucher Annual-Report 2022 EN 0Document152 pages2022 01 Bucher Annual-Report 2022 EN 0mohammades2006No ratings yet

- Nerolac - On Ratio - SolvedDocument6 pagesNerolac - On Ratio - Solvedricha krishnaNo ratings yet

- Financial RatiosDocument2 pagesFinancial Ratiosranjansolanki13No ratings yet

- Key Financial Ratios of Shree CementsDocument2 pagesKey Financial Ratios of Shree CementsTrollNo ratings yet

- Eq+ RS /Eq+RS+Dbt K 9.14 Equity Portion 0.62 Debt Portion 0.38Document17 pagesEq+ RS /Eq+RS+Dbt K 9.14 Equity Portion 0.62 Debt Portion 0.38sandipandas2004No ratings yet

- Mattel - Financial ModelDocument13 pagesMattel - Financial Modelharshwardhan.singh202No ratings yet

- ANJ AR 2013 - English - Ykds3c20170321164338Document216 pagesANJ AR 2013 - English - Ykds3c20170321164338Ary PandeNo ratings yet

- Black Gold - AnalysisDocument12 pagesBlack Gold - AnalysisAbdulrahman DhabaanNo ratings yet

- Solution To Mini Case (SAPM)Document8 pagesSolution To Mini Case (SAPM)Snigdha IndurtiNo ratings yet

- Ratios v2Document15 pagesRatios v2Janarthanan VtNo ratings yet

- Project of Tata MotorsDocument7 pagesProject of Tata MotorsRaj KiranNo ratings yet

- Presentation 1Document9 pagesPresentation 1Zubair KhanNo ratings yet

- Ratio AnalysisDocument2 pagesRatio AnalysisSEHWAG MATHAVANNo ratings yet

- Practice Exercise - Berger PaintsDocument8 pagesPractice Exercise - Berger PaintsKARIMSETTY DURGA NAGA PRAVALLIKANo ratings yet

- Financial Metrics Calculator - 3Document9 pagesFinancial Metrics Calculator - 3Mihir JainNo ratings yet

- AFM Section C Group 1 Assignment CalculationsDocument12 pagesAFM Section C Group 1 Assignment CalculationsAkshitNo ratings yet

- Baani Milk Producer Co. LTD.: Executive Summary: Mar 2015 - Mar 2018: Non-Annualised: Rs. MillionDocument4 pagesBaani Milk Producer Co. LTD.: Executive Summary: Mar 2015 - Mar 2018: Non-Annualised: Rs. MillionNikku SinghNo ratings yet

- Baani Milk Producer Co. LTD.: Executive Summary: Mar 2015 - Mar 2018: Non-Annualised: Rs. MillionDocument4 pagesBaani Milk Producer Co. LTD.: Executive Summary: Mar 2015 - Mar 2018: Non-Annualised: Rs. MillionNikku SinghNo ratings yet

- SVA ModelDocument15 pagesSVA ModelArshdeep SaroyaNo ratings yet

- Housing For All 2022Document100 pagesHousing For All 2022Pranav TripathiNo ratings yet

- Term Loan Eligibility Calc by BankDocument16 pagesTerm Loan Eligibility Calc by Bankdsp varmaNo ratings yet

- AnswersDocument7 pagesAnswersClarisse AlimotNo ratings yet

- Previous Years : L&T Finance Holding SDocument6 pagesPrevious Years : L&T Finance Holding Srahul gargNo ratings yet

- Indicators Baked Products (KSS) (In INR '000) : Sales 141.8 Cost of Goods 135.95Document6 pagesIndicators Baked Products (KSS) (In INR '000) : Sales 141.8 Cost of Goods 135.95maykNo ratings yet

- Sambal Owner of ZeeDocument2 pagesSambal Owner of Zeesagar naikNo ratings yet

- Kalindee Rail Nirman: Balance SheetDocument9 pagesKalindee Rail Nirman: Balance Sheetrajat_singlaNo ratings yet

- Ratio Analysis: Liquidity RatiosDocument2 pagesRatio Analysis: Liquidity RatiosSuryakantNo ratings yet

- Annual Report 2004Document81 pagesAnnual Report 2004Enamul HaqueNo ratings yet

- Financial Ratios of Hero Honda MotorsDocument6 pagesFinancial Ratios of Hero Honda MotorsParag MaheshwariNo ratings yet

- Teuer B DataDocument41 pagesTeuer B DataAishwary Gupta100% (1)

- Case 1Document3 pagesCase 1Naveen AttigeriNo ratings yet

- Short Form DCFDocument1 pageShort Form DCFjess236No ratings yet

- Nestle ST RatioDocument2 pagesNestle ST Rationeha.talele22.stNo ratings yet

- Reliance GuriDocument2 pagesReliance GurigurasisNo ratings yet

- New York Stock ExchangeDocument9 pagesNew York Stock Exchangeapi-589525395No ratings yet

- Sanitärtechnik Eisenberg GMBH - FinancialsDocument2 pagesSanitärtechnik Eisenberg GMBH - Financialsin_daHouseNo ratings yet

- Hex AwareDocument37 pagesHex Awaretarun slowNo ratings yet

- CH 22: Lease, Hire Purchase and Project FinancingDocument7 pagesCH 22: Lease, Hire Purchase and Project FinancingMukul KadyanNo ratings yet

- FY2018 (12m) FY2017 (12m) FY2016 (12m) FY2015 (12m) FY2014 (12m) FY2013 (12m) FY2012 (12m)Document1 pageFY2018 (12m) FY2017 (12m) FY2016 (12m) FY2015 (12m) FY2014 (12m) FY2013 (12m) FY2012 (12m)Divyank JyotiNo ratings yet

- Problem 4 Unlevered Beta TaxDocument8 pagesProblem 4 Unlevered Beta TaxThuy Tran TrangNo ratings yet

- AcovaDocument5 pagesAcovafutyNo ratings yet

- Akash Cost AssignmentDocument10 pagesAkash Cost AssignmentAkash HedaooNo ratings yet

- This Spreadsheet Supports STUDENT Analysis of The Case "Guna Fibres, LTD." (UVA-F-1687)Document7 pagesThis Spreadsheet Supports STUDENT Analysis of The Case "Guna Fibres, LTD." (UVA-F-1687)karanNo ratings yet

- Airan RatioDocument2 pagesAiran RatiomilanNo ratings yet

- Competitors Bajaj MotorsDocument11 pagesCompetitors Bajaj MotorsdeepaksikriNo ratings yet

- Retail Bakeries Financial Industry Analysis - SageworksDocument4 pagesRetail Bakeries Financial Industry Analysis - SageworksMichael Enrique Pérez MoreiraNo ratings yet

- Corporate Accounting ExcelDocument6 pagesCorporate Accounting ExcelshrishtiNo ratings yet

- 3 Spread Sheet For Corp & ME001 Sultan FeedDocument5 pages3 Spread Sheet For Corp & ME001 Sultan Feedmuhammad ihtishamNo ratings yet

- Star Company Comparative Income Statement December 31, 2016,2017 and 2018Document2 pagesStar Company Comparative Income Statement December 31, 2016,2017 and 2018JonellNo ratings yet

- 2 Statement of Financial PositionDocument51 pages2 Statement of Financial PositionMarlon Ladesma100% (2)

- Leveling Up S&OP: For A Well-Orchestrated Supply ChainDocument6 pagesLeveling Up S&OP: For A Well-Orchestrated Supply ChainSilvia CastilloNo ratings yet

- RGA Investment Advisors Envestnet Slides PDFDocument20 pagesRGA Investment Advisors Envestnet Slides PDFJason Gilbert100% (1)

- 100 Best-Selling Cases, 2008 EditionDocument30 pages100 Best-Selling Cases, 2008 EditionGaurav BasnyatNo ratings yet

- Chapter 03 Productivity, Output and EmploymentDocument44 pagesChapter 03 Productivity, Output and EmploymentSaranjam BeygNo ratings yet

- FBC Holdings Limited (FBCH) Signs Agreement To Purchase Standard Chartered's Business in ZimbabweDocument2 pagesFBC Holdings Limited (FBCH) Signs Agreement To Purchase Standard Chartered's Business in ZimbabweFANNUEL CHAPUPUNo ratings yet

- LK PT Sakti BandungDocument20 pagesLK PT Sakti BandungLusi dwi ApriliaNo ratings yet

- Business Plan CarpentryDocument7 pagesBusiness Plan CarpentrydavidNo ratings yet

- SA 2 - AuditDocument28 pagesSA 2 - AuditJoana TrinidadNo ratings yet

- Environment AUDIT AND ASSURANCEDocument5 pagesEnvironment AUDIT AND ASSURANCENeeraj KumarNo ratings yet

- Chapter 16 Ppe2Document13 pagesChapter 16 Ppe2Kiminosunoo LelNo ratings yet

- Gift Shop Business PlanDocument40 pagesGift Shop Business PlanalexisjonesNo ratings yet

- PAINEL 1 - Transfer Pricing & IntangiblesDocument20 pagesPAINEL 1 - Transfer Pricing & Intangiblesedson souzaNo ratings yet

- Feasibility Study Group 3Document87 pagesFeasibility Study Group 3arado.rachalle.laniogNo ratings yet

- Chapter 3a Value Proposition PDFDocument26 pagesChapter 3a Value Proposition PDFAdrian SingsonNo ratings yet

- Circle 14 ActoDocument96 pagesCircle 14 Actoanon_981731217No ratings yet

- Kiểm soát quản lýDocument41 pagesKiểm soát quản lýJanes VuNo ratings yet

- FI - ConsolidationDocument4 pagesFI - ConsolidationAnanthakumar ANo ratings yet

- Welsh Hotel Cost-Volume-Profit Analysis and UncertaintyDocument6 pagesWelsh Hotel Cost-Volume-Profit Analysis and UncertaintyramondNo ratings yet

- Malt FDDocument5 pagesMalt FDLakshmiRengarajanNo ratings yet

- Cost AccountingDocument5 pagesCost Accountingretchiel love calinogNo ratings yet

- Devis Patmos SaDocument1 pageDevis Patmos SaRavindraNo ratings yet

- New Product Development and Product Life CycleDocument14 pagesNew Product Development and Product Life Cyclebhagshard05No ratings yet

- Org ChartDocument7 pagesOrg ChartIvy Joy UbinaNo ratings yet

- Exchange Rate ForecastingDocument7 pagesExchange Rate ForecastingNikita BangeraNo ratings yet

- Intermediate Accounting IFRS Edition: Kieso, Weygandt, WarfieldDocument34 pagesIntermediate Accounting IFRS Edition: Kieso, Weygandt, WarfieldPaulina RegginaNo ratings yet

- 2024 SPHRi Workbook Module 2 PreviewDocument20 pages2024 SPHRi Workbook Module 2 PreviewShaleena SaraogiNo ratings yet

Problem1 Section 19.2

Problem1 Section 19.2

Uploaded by

SANSKAR JAINOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Problem1 Section 19.2

Problem1 Section 19.2

Uploaded by

SANSKAR JAINCopyright:

Available Formats

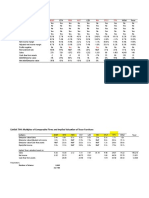

year

0 1 2

Sales 83.60 89.45 95.71

Cost of goods sold 66.19 71.31

EBITDA 23.26 24.41

Depreciation 9.89 10.59

PBT 13.36 13.82

Tax@35% 4.68 4.84

PAT 8.69 8.98

delta fixed assets 4.5 4.9

delta working capital 0.5 0.8

free cash flows 3.72 3.22

Tax rate % 35

WACC 0.09

Long term growth forecast 3

PV free cash flows 20.50

PV Horizon 67.58

PV company 88.08

Assumptions

Sales growth in % 7 7

Cost (percent of sales) 74 74.5

Working capital (percent of sales) 13.3 13 13

Net fixed assets (percent of sales) 79.2 79 79

Depreciation (percent of net fixed assets) 14 14

Fixed assests and Working Capital

Net fixed assets 66.2 70.7 75.6

Net working capital 11.1 11.6 12.4

Note Here working capital means working capital without cash

Here we assume the leverage is not changing

Cost of debt 0.06

Cost of equity 0.124

Marginal tax rate 0.35

Debt ratio 0.4

Equity ratio 0.6

WACC 0.09

3 4 5 6 7 Objectives

102.41 106.51 110.77 115.20 118.66 Calculate WACC

76.30 79.88 83.08 86.98 90.18 Free cash flows

26.12 26.63 27.69 28.22 28.48 Value of firm using WACC

11.33 11.78 12.25 12.74 13.12 Assuming leverage is constant

14.79 14.85 15.44 15.48 15.35

5.18 5.20 5.40 5.42 5.37

9.61 9.65 10.04 10.06 9.98

5.3 3.2 3.4 3.5 2.7

0.9 0.5 0.6 0.6 0.4

3.45 5.88 6.12 5.99 6.80

113.3

7 4 4 4 3

74.5 75 75 75.5 76

13 13 13 13 13

79 79 79 79 79

14 14 14 14 14

80.9 84.1 87.5 91.0 93.7

13.3 13.8 14.4 15.0 15.4

You might also like

- Task 3 - DCF ModelDocument10 pagesTask 3 - DCF Modeldavin nathan0% (1)

- Task 1 AnswerDocument9 pagesTask 1 AnswerSiddhant Aggarwal20% (5)

- Canada Packers - Exhibits + Valuation - FionaDocument63 pagesCanada Packers - Exhibits + Valuation - Fiona/jncjdncjdn100% (1)

- CMU 70-371 Operations Management Assignment 1Document2 pagesCMU 70-371 Operations Management Assignment 1Adam LNo ratings yet

- C19a Rio's SpreadsheetDocument8 pagesC19a Rio's SpreadsheetaluiscgNo ratings yet

- Gainesboro SolutionDocument7 pagesGainesboro SolutionakashNo ratings yet

- The Digital Marketing CanvasDocument1 pageThe Digital Marketing Canvasvicente_ortiz_007No ratings yet

- Financial Analysis Coles GroupDocument5 pagesFinancial Analysis Coles GroupAmmar HassanNo ratings yet

- Advanced Business Calculations/Series-3-2011 (Code3003)Document15 pagesAdvanced Business Calculations/Series-3-2011 (Code3003)Hein Linn Kyaw86% (21)

- NFL Annual Report 2019 Compressed PDFDocument130 pagesNFL Annual Report 2019 Compressed PDFZUBAIRNo ratings yet

- Company Info - Print FinancialsDocument2 pagesCompany Info - Print FinancialsHarsh PuseNo ratings yet

- Ratio Analysis of PT TelekomunikasiDocument7 pagesRatio Analysis of PT TelekomunikasiJae Bok LeeNo ratings yet

- RatioDocument11 pagesRatioAnant BothraNo ratings yet

- 2022 01 Bucher Annual-Report 2022 EN 0Document152 pages2022 01 Bucher Annual-Report 2022 EN 0mohammades2006No ratings yet

- Nerolac - On Ratio - SolvedDocument6 pagesNerolac - On Ratio - Solvedricha krishnaNo ratings yet

- Financial RatiosDocument2 pagesFinancial Ratiosranjansolanki13No ratings yet

- Key Financial Ratios of Shree CementsDocument2 pagesKey Financial Ratios of Shree CementsTrollNo ratings yet

- Eq+ RS /Eq+RS+Dbt K 9.14 Equity Portion 0.62 Debt Portion 0.38Document17 pagesEq+ RS /Eq+RS+Dbt K 9.14 Equity Portion 0.62 Debt Portion 0.38sandipandas2004No ratings yet

- Mattel - Financial ModelDocument13 pagesMattel - Financial Modelharshwardhan.singh202No ratings yet

- ANJ AR 2013 - English - Ykds3c20170321164338Document216 pagesANJ AR 2013 - English - Ykds3c20170321164338Ary PandeNo ratings yet

- Black Gold - AnalysisDocument12 pagesBlack Gold - AnalysisAbdulrahman DhabaanNo ratings yet

- Solution To Mini Case (SAPM)Document8 pagesSolution To Mini Case (SAPM)Snigdha IndurtiNo ratings yet

- Ratios v2Document15 pagesRatios v2Janarthanan VtNo ratings yet

- Project of Tata MotorsDocument7 pagesProject of Tata MotorsRaj KiranNo ratings yet

- Presentation 1Document9 pagesPresentation 1Zubair KhanNo ratings yet

- Ratio AnalysisDocument2 pagesRatio AnalysisSEHWAG MATHAVANNo ratings yet

- Practice Exercise - Berger PaintsDocument8 pagesPractice Exercise - Berger PaintsKARIMSETTY DURGA NAGA PRAVALLIKANo ratings yet

- Financial Metrics Calculator - 3Document9 pagesFinancial Metrics Calculator - 3Mihir JainNo ratings yet

- AFM Section C Group 1 Assignment CalculationsDocument12 pagesAFM Section C Group 1 Assignment CalculationsAkshitNo ratings yet

- Baani Milk Producer Co. LTD.: Executive Summary: Mar 2015 - Mar 2018: Non-Annualised: Rs. MillionDocument4 pagesBaani Milk Producer Co. LTD.: Executive Summary: Mar 2015 - Mar 2018: Non-Annualised: Rs. MillionNikku SinghNo ratings yet

- Baani Milk Producer Co. LTD.: Executive Summary: Mar 2015 - Mar 2018: Non-Annualised: Rs. MillionDocument4 pagesBaani Milk Producer Co. LTD.: Executive Summary: Mar 2015 - Mar 2018: Non-Annualised: Rs. MillionNikku SinghNo ratings yet

- SVA ModelDocument15 pagesSVA ModelArshdeep SaroyaNo ratings yet

- Housing For All 2022Document100 pagesHousing For All 2022Pranav TripathiNo ratings yet

- Term Loan Eligibility Calc by BankDocument16 pagesTerm Loan Eligibility Calc by Bankdsp varmaNo ratings yet

- AnswersDocument7 pagesAnswersClarisse AlimotNo ratings yet

- Previous Years : L&T Finance Holding SDocument6 pagesPrevious Years : L&T Finance Holding Srahul gargNo ratings yet

- Indicators Baked Products (KSS) (In INR '000) : Sales 141.8 Cost of Goods 135.95Document6 pagesIndicators Baked Products (KSS) (In INR '000) : Sales 141.8 Cost of Goods 135.95maykNo ratings yet

- Sambal Owner of ZeeDocument2 pagesSambal Owner of Zeesagar naikNo ratings yet

- Kalindee Rail Nirman: Balance SheetDocument9 pagesKalindee Rail Nirman: Balance Sheetrajat_singlaNo ratings yet

- Ratio Analysis: Liquidity RatiosDocument2 pagesRatio Analysis: Liquidity RatiosSuryakantNo ratings yet

- Annual Report 2004Document81 pagesAnnual Report 2004Enamul HaqueNo ratings yet

- Financial Ratios of Hero Honda MotorsDocument6 pagesFinancial Ratios of Hero Honda MotorsParag MaheshwariNo ratings yet

- Teuer B DataDocument41 pagesTeuer B DataAishwary Gupta100% (1)

- Case 1Document3 pagesCase 1Naveen AttigeriNo ratings yet

- Short Form DCFDocument1 pageShort Form DCFjess236No ratings yet

- Nestle ST RatioDocument2 pagesNestle ST Rationeha.talele22.stNo ratings yet

- Reliance GuriDocument2 pagesReliance GurigurasisNo ratings yet

- New York Stock ExchangeDocument9 pagesNew York Stock Exchangeapi-589525395No ratings yet

- Sanitärtechnik Eisenberg GMBH - FinancialsDocument2 pagesSanitärtechnik Eisenberg GMBH - Financialsin_daHouseNo ratings yet

- Hex AwareDocument37 pagesHex Awaretarun slowNo ratings yet

- CH 22: Lease, Hire Purchase and Project FinancingDocument7 pagesCH 22: Lease, Hire Purchase and Project FinancingMukul KadyanNo ratings yet

- FY2018 (12m) FY2017 (12m) FY2016 (12m) FY2015 (12m) FY2014 (12m) FY2013 (12m) FY2012 (12m)Document1 pageFY2018 (12m) FY2017 (12m) FY2016 (12m) FY2015 (12m) FY2014 (12m) FY2013 (12m) FY2012 (12m)Divyank JyotiNo ratings yet

- Problem 4 Unlevered Beta TaxDocument8 pagesProblem 4 Unlevered Beta TaxThuy Tran TrangNo ratings yet

- AcovaDocument5 pagesAcovafutyNo ratings yet

- Akash Cost AssignmentDocument10 pagesAkash Cost AssignmentAkash HedaooNo ratings yet

- This Spreadsheet Supports STUDENT Analysis of The Case "Guna Fibres, LTD." (UVA-F-1687)Document7 pagesThis Spreadsheet Supports STUDENT Analysis of The Case "Guna Fibres, LTD." (UVA-F-1687)karanNo ratings yet

- Airan RatioDocument2 pagesAiran RatiomilanNo ratings yet

- Competitors Bajaj MotorsDocument11 pagesCompetitors Bajaj MotorsdeepaksikriNo ratings yet

- Retail Bakeries Financial Industry Analysis - SageworksDocument4 pagesRetail Bakeries Financial Industry Analysis - SageworksMichael Enrique Pérez MoreiraNo ratings yet

- Corporate Accounting ExcelDocument6 pagesCorporate Accounting ExcelshrishtiNo ratings yet

- 3 Spread Sheet For Corp & ME001 Sultan FeedDocument5 pages3 Spread Sheet For Corp & ME001 Sultan Feedmuhammad ihtishamNo ratings yet

- Star Company Comparative Income Statement December 31, 2016,2017 and 2018Document2 pagesStar Company Comparative Income Statement December 31, 2016,2017 and 2018JonellNo ratings yet

- 2 Statement of Financial PositionDocument51 pages2 Statement of Financial PositionMarlon Ladesma100% (2)

- Leveling Up S&OP: For A Well-Orchestrated Supply ChainDocument6 pagesLeveling Up S&OP: For A Well-Orchestrated Supply ChainSilvia CastilloNo ratings yet

- RGA Investment Advisors Envestnet Slides PDFDocument20 pagesRGA Investment Advisors Envestnet Slides PDFJason Gilbert100% (1)

- 100 Best-Selling Cases, 2008 EditionDocument30 pages100 Best-Selling Cases, 2008 EditionGaurav BasnyatNo ratings yet

- Chapter 03 Productivity, Output and EmploymentDocument44 pagesChapter 03 Productivity, Output and EmploymentSaranjam BeygNo ratings yet

- FBC Holdings Limited (FBCH) Signs Agreement To Purchase Standard Chartered's Business in ZimbabweDocument2 pagesFBC Holdings Limited (FBCH) Signs Agreement To Purchase Standard Chartered's Business in ZimbabweFANNUEL CHAPUPUNo ratings yet

- LK PT Sakti BandungDocument20 pagesLK PT Sakti BandungLusi dwi ApriliaNo ratings yet

- Business Plan CarpentryDocument7 pagesBusiness Plan CarpentrydavidNo ratings yet

- SA 2 - AuditDocument28 pagesSA 2 - AuditJoana TrinidadNo ratings yet

- Environment AUDIT AND ASSURANCEDocument5 pagesEnvironment AUDIT AND ASSURANCENeeraj KumarNo ratings yet

- Chapter 16 Ppe2Document13 pagesChapter 16 Ppe2Kiminosunoo LelNo ratings yet

- Gift Shop Business PlanDocument40 pagesGift Shop Business PlanalexisjonesNo ratings yet

- PAINEL 1 - Transfer Pricing & IntangiblesDocument20 pagesPAINEL 1 - Transfer Pricing & Intangiblesedson souzaNo ratings yet

- Feasibility Study Group 3Document87 pagesFeasibility Study Group 3arado.rachalle.laniogNo ratings yet

- Chapter 3a Value Proposition PDFDocument26 pagesChapter 3a Value Proposition PDFAdrian SingsonNo ratings yet

- Circle 14 ActoDocument96 pagesCircle 14 Actoanon_981731217No ratings yet

- Kiểm soát quản lýDocument41 pagesKiểm soát quản lýJanes VuNo ratings yet

- FI - ConsolidationDocument4 pagesFI - ConsolidationAnanthakumar ANo ratings yet

- Welsh Hotel Cost-Volume-Profit Analysis and UncertaintyDocument6 pagesWelsh Hotel Cost-Volume-Profit Analysis and UncertaintyramondNo ratings yet

- Malt FDDocument5 pagesMalt FDLakshmiRengarajanNo ratings yet

- Cost AccountingDocument5 pagesCost Accountingretchiel love calinogNo ratings yet

- Devis Patmos SaDocument1 pageDevis Patmos SaRavindraNo ratings yet

- New Product Development and Product Life CycleDocument14 pagesNew Product Development and Product Life Cyclebhagshard05No ratings yet

- Org ChartDocument7 pagesOrg ChartIvy Joy UbinaNo ratings yet

- Exchange Rate ForecastingDocument7 pagesExchange Rate ForecastingNikita BangeraNo ratings yet

- Intermediate Accounting IFRS Edition: Kieso, Weygandt, WarfieldDocument34 pagesIntermediate Accounting IFRS Edition: Kieso, Weygandt, WarfieldPaulina RegginaNo ratings yet

- 2024 SPHRi Workbook Module 2 PreviewDocument20 pages2024 SPHRi Workbook Module 2 PreviewShaleena SaraogiNo ratings yet