Professional Documents

Culture Documents

Computation of Total Income

Computation of Total Income

Uploaded by

2154 taibakhatunOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Computation of Total Income

Computation of Total Income

Uploaded by

2154 taibakhatunCopyright:

Available Formats

Prooie

304

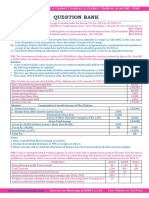

PROBLEM 16

of the income of a

The following

are the particulars

lecturer of Vik

month from which

University 40,000 per 5 is deduct

Salary 7 which the University

fund to contributes 12 eM

provident

allowance 7

1,00,000.

Wardenship

2 bungalow. Rent paid by

the employeris ?

Rent-free

from a domestic company 7 800

4 Dividend received

on Government Loan of 7 5,00

S per cent interest

property 7 12,000.

6Rent from house

7Interest on Postal Savings Bank Deposit 7 500.

&Long-tem Capital

Gain on sale of old car ? 2,50 and jewelery

Short-icm Capital Gain 9,000.

9 remuneration T4,500.

10. Examinership

F 6,O00 in Public Provident Fund. He ah

During the year. he deposited

purchased books worth 7 650 during the same year.

2019-20.

Find out his total income for the Previous Year

Solution

Statement of Total Incomee

for the Previous Year 2019-20)

1. Incomefrom Salary

0Salary 4,80,000

) Wardenship Allowance 1,00,000

(ii) Value of rent-free bungalow

(15% of Salary) or 7 60,000,

whichever is less 60,000

6,40,000

50,000 5,9000

Les: Standard deduction

2. Income

from House Property

Rent Received (A.V.) 12,000 8400

: k of A.V. 3,600

. Capital Gains Long-tem 8,000 17,00

Short-term 9,000

4. Income

from Other Sources:

i) Dividend & Interest on Exempt

P.O.S.B.A/c

u) Examinership remuneration 4,500 490

ii) Int. on Govt. Loan 400 6.20

30

Gross Total Income 7800

Less:

Deduction

( ws 80C 542 0

72,0) + 6,000) t ot

ne Total Income e n o tc h a r g e a b l e

The car in non a

capital anet. It 1sis aa personal

per* asset. Hence,8

Computation of Total Income of Individuals

305

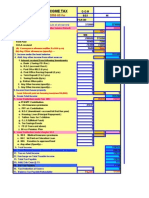

PROBLEM 17

nitte the total income

of Shri R.

Shankar

who is working as

er of Z Co. Ltd., Assessment Year 2020-21. Sales

Mumbai for the

Le received the following income and perquisites in the

ended on 31lst March, 2020: accounting year

(i) Salary

(i) Dearness Allowance asper terms of employment,

7,000 p.m.

it enters into computation of retirement benefits

3,000 p.m.

ii) Employer's contribution to a Recognized Provi-

dent Fund. Shri R.Shankar also contributes a like

amount each month

(iv) Interest credited on Shri R. Shankar's balance in

1,300 p.m.

the Provident Fund@9.5% p.a.

(v) Entertainment Allowance

2,520

12,000 p.a.

(vi) Rent-free unfurnished accommodation, rent paid

by the employer

18,000 p.a.

(vii) Free use of a large motor-car for private and

official purposes. Running and maintenance ex-

penses wholly incurred by the employer

(vii) Dividends from a Co-operative Society 1,200

Shri R. Shankar was resident for the Previous Year 2019-20.

Solution

Computation of Total Income of Shri R. Shankar

for the Assessment Year 2020-21)

Income from Salary

Salary 84,000

Dearness Allowance 36,000

Entertainment Allowance 12,000

Employer's Contribution to R.PF.

in excess of 12% of salary 1,200

Interest on R.P.F. Nil

Value of unfurnished

house 18,000

(15% ofT 84,000+36,000+ 12,000) or

rent paid by employer, whichever is less

Value of car T 2,400x 12) 28,800

Gross Salary 1,80,000

50,000 1,30,000

Less: Standard deduction

ncome from Other Sources 1,200

Dividends from Co-operative Society 1,31,200

Gross Total Income

15,600

Less: Deduction:

u/s 80C Total Income

71,15,600

You might also like

- CFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)From EverandCFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)Rating: 4.5 out of 5 stars4.5/5 (5)

- 14.0 Final Quiz 1 Tax On IndividualsDocument8 pages14.0 Final Quiz 1 Tax On IndividualsRezhel Vyrneth TurgoNo ratings yet

- CFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)From EverandCFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- Furniture Manufacturing Business Plan ExampleDocument27 pagesFurniture Manufacturing Business Plan ExampleMariyam AwitNo ratings yet

- Notes For Income tax-IIDocument10 pagesNotes For Income tax-IIDr.M.KAMARAJ M.COM., M.Phil.,Ph.D100% (1)

- DeductionsDocument20 pagesDeductionsKartikNo ratings yet

- (Revised) - EL: BalanceDocument1 page(Revised) - EL: BalanceGopika G NairNo ratings yet

- Adobe Scan Jan 30, 2023Document6 pagesAdobe Scan Jan 30, 2023Karan RajakNo ratings yet

- Chapter 1 Partnership Account 1Document21 pagesChapter 1 Partnership Account 1Akmal MalikNo ratings yet

- Income Tax Compulsory Paper-3: AHK/KW/19/4101Document6 pagesIncome Tax Compulsory Paper-3: AHK/KW/19/4101Deepak ThomasNo ratings yet

- Taxation Law PDFDocument3 pagesTaxation Law PDFSmag SmagNo ratings yet

- Taxation Law PDFDocument3 pagesTaxation Law PDFSmag SmagNo ratings yet

- IT QuestionDocument3 pagesIT QuestionSathish SmartNo ratings yet

- 027 Practice Test 09 Accounting Test Solution Subjective Udesh RegularDocument6 pages027 Practice Test 09 Accounting Test Solution Subjective Udesh Regulardeathp006No ratings yet

- RTP Dec 18 AnsDocument36 pagesRTP Dec 18 AnsbinuNo ratings yet

- Other Source P1, P2, P3Document3 pagesOther Source P1, P2, P3Suhani RathiNo ratings yet

- PGBPDocument32 pagesPGBPKartikNo ratings yet

- E-Filling of Returns (Shivdas 10 Years)Document122 pagesE-Filling of Returns (Shivdas 10 Years)Unicorn SpiderNo ratings yet

- Single Entry Ques.Document6 pagesSingle Entry Ques.Garima GarimaNo ratings yet

- IPCC Gr.I Paper 4 TaxationDocument10 pagesIPCC Gr.I Paper 4 TaxationAyushi RajputNo ratings yet

- Ty Baf TaxationDocument4 pagesTy Baf TaxationAkki GalaNo ratings yet

- Chapter 5Document19 pagesChapter 5Izzy BNo ratings yet

- Ty Baf TaxationDocument4 pagesTy Baf TaxationAkki GalaNo ratings yet

- Income Taxation ExamDocument2 pagesIncome Taxation ExamyezaqueraNo ratings yet

- SFS U.G. B.com. Income TaxDocument3 pagesSFS U.G. B.com. Income TaxAbinash VeeraragavanNo ratings yet

- Acc203 Tut On LiquidationDocument7 pagesAcc203 Tut On LiquidationShivanjani KumarNo ratings yet

- Tax ProblemsDocument14 pagesTax Problemsrav dano100% (1)

- Case Study 2Document2 pagesCase Study 2Anil NagarajNo ratings yet

- Set Off and Carry Forward of LossesDocument23 pagesSet Off and Carry Forward of LossesKartikNo ratings yet

- Question Paper Code: 3528: Commerce (Direct Tax Laws & Accounts)Document7 pagesQuestion Paper Code: 3528: Commerce (Direct Tax Laws & Accounts)Shyam ji DubeyNo ratings yet

- September: (CBCS) (F +R) (2016-17 and Onwards)Document7 pagesSeptember: (CBCS) (F +R) (2016-17 and Onwards)Gracy GeorgeNo ratings yet

- CBSE Class 12 Accountancy Accounting Ratios WorksheetDocument3 pagesCBSE Class 12 Accountancy Accounting Ratios WorksheetJenneil CarmichaelNo ratings yet

- Ratio AnalysisDocument3 pagesRatio AnalysisYash AgarwalNo ratings yet

- Government College University, FaisalabadDocument1 pageGovernment College University, FaisalabadLadla AnsariNo ratings yet

- BCom Business Taxation Income Tax and Sales Tax Numerical 2018Document5 pagesBCom Business Taxation Income Tax and Sales Tax Numerical 2018AHSAN LASHARINo ratings yet

- M 14 IPCC Taxation Guideline AnswersDocument14 pagesM 14 IPCC Taxation Guideline Answerssantosh barkiNo ratings yet

- CBSE Class 12 Accountancy Accounting For Partnership Firms Sure Shot QuestionsDocument6 pagesCBSE Class 12 Accountancy Accounting For Partnership Firms Sure Shot Questionsdakshrwt06No ratings yet

- Mock Numerical Questions: Model Test PaperDocument12 pagesMock Numerical Questions: Model Test PaperNaman JainNo ratings yet

- Ratio Analysis Numericals Including Reverse RatiosDocument6 pagesRatio Analysis Numericals Including Reverse RatiosFunny ManNo ratings yet

- Commerce (Regular) Accounting For Specialised Institutions (Group A: Accounting and Finance) Paper - 3.5 (A)Document4 pagesCommerce (Regular) Accounting For Specialised Institutions (Group A: Accounting and Finance) Paper - 3.5 (A)Sanaullah M SultanpurNo ratings yet

- Partnership Dissolution LiquidationDocument14 pagesPartnership Dissolution Liquidationmartinez2331999No ratings yet

- TAX 1203 Answers Financial Reporting vs. Tax ReportingDocument1 pageTAX 1203 Answers Financial Reporting vs. Tax Reportingrav dano100% (1)

- Question Bank: Errorless Taxation by Ca Pranav Chandak at Pranav Chandak Academy, PuneDocument4 pagesQuestion Bank: Errorless Taxation by Ca Pranav Chandak at Pranav Chandak Academy, PuneSimran MeherNo ratings yet

- Accountancy Test 5Document2 pagesAccountancy Test 5dixa mathpalNo ratings yet

- National Income and Its AggregatesDocument2 pagesNational Income and Its AggregatesAditya GuptaNo ratings yet

- Financial Analysis ProblemDocument16 pagesFinancial Analysis ProblemShreyashi DasNo ratings yet

- Bba FM 21Document3 pagesBba FM 21Kundan JhaNo ratings yet

- 12 Accountancy Lyp 2015 Foreign Set1Document42 pages12 Accountancy Lyp 2015 Foreign Set1Ashish GangwalNo ratings yet

- Quiz Allowable DeductionsDocument18 pagesQuiz Allowable DeductionsceistNo ratings yet

- IA 3 AssignmentDocument2 pagesIA 3 AssignmentToni Rose Hernandez LualhatiNo ratings yet

- Tax Calculator - Indian Income Tax 2008-09Document7 pagesTax Calculator - Indian Income Tax 2008-09Jayamohan100% (29)

- Time Allowed: 3 Hours Max Marks: 100: Colleges 2nd SimulationDocument4 pagesTime Allowed: 3 Hours Max Marks: 100: Colleges 2nd SimulationKashifNo ratings yet

- I. Income Statement: Income Statement Beccoe Sweet Corporation Year Ended October 2017Document3 pagesI. Income Statement: Income Statement Beccoe Sweet Corporation Year Ended October 2017Jeth Vigilla NangcaNo ratings yet

- Straight Problems Income Tax Bsa2Document2 pagesStraight Problems Income Tax Bsa2dimpy dNo ratings yet

- Adobe Scan 12 Dec 2021Document13 pagesAdobe Scan 12 Dec 2021PurvaNo ratings yet

- ABFT2020 Tutorial 8 and 9 - Relief and Personal TaxationDocument10 pagesABFT2020 Tutorial 8 and 9 - Relief and Personal TaxationHuilunNgoNo ratings yet

- IT Income From Other Sources Pt-2Document7 pagesIT Income From Other Sources Pt-2syedfareed596100% (1)

- 12 Acc Accoun Partner Firm Fundamentals Im6 PDFDocument12 pages12 Acc Accoun Partner Firm Fundamentals Im6 PDFDID You KNOWNo ratings yet

- Second Term Exam-2070 Particulars Debit (RS.) Credit (RS.)Document8 pagesSecond Term Exam-2070 Particulars Debit (RS.) Credit (RS.)ragedskullNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Unit 4 - Management of Working CapitalDocument10 pagesUnit 4 - Management of Working Capital2154 taibakhatunNo ratings yet

- Tax (Important Questions)Document1 pageTax (Important Questions)2154 taibakhatunNo ratings yet

- Unit 6 - Investment DecisionsDocument28 pagesUnit 6 - Investment Decisions2154 taibakhatunNo ratings yet

- Economies and Diseconomies of ScaleDocument7 pagesEconomies and Diseconomies of Scale2154 taibakhatunNo ratings yet

- Unit 2 - Sources of FinanceDocument20 pagesUnit 2 - Sources of Finance2154 taibakhatunNo ratings yet

- E-Way Bill SystemDocument2 pagesE-Way Bill SystemHSCL BacheliNo ratings yet

- FundamentalsOfFinancialManagement Chapter8Document17 pagesFundamentalsOfFinancialManagement Chapter8Adoree RamosNo ratings yet

- RFP KDMCDocument43 pagesRFP KDMCPRACHI MANTRINo ratings yet

- Lecture Notes 2aDocument35 pagesLecture Notes 2aLiviu IordacheNo ratings yet

- Service Tax ConclusionDocument9 pagesService Tax ConclusionAbhas JaiswalNo ratings yet

- 01 Introduction M&ADocument44 pages01 Introduction M&AI DNo ratings yet

- Libby Financial Accounting Chapter9Document11 pagesLibby Financial Accounting Chapter9Jie Bo Ti100% (1)

- Kenya-Finance Act 2021Document47 pagesKenya-Finance Act 2021Meru CityNo ratings yet

- Ensuring Tax Compliance in A Globalized World The International Automatic Exchange of Tax Information PDFDocument374 pagesEnsuring Tax Compliance in A Globalized World The International Automatic Exchange of Tax Information PDFflordeliz12100% (1)

- (Kotak) Insurance, February 02, 2023Document11 pages(Kotak) Insurance, February 02, 2023Deepak KhatwaniNo ratings yet

- Notice To SB CA OD Account Customer Annexure IDocument3 pagesNotice To SB CA OD Account Customer Annexure Imaakabhawan26No ratings yet

- Test Questions - Com Test QuestionsDocument3 pagesTest Questions - Com Test QuestionsΈνκινουαν Κόγκ ΑδάμουNo ratings yet

- Accouting, Tax Management & Audit Vouchering UNDER CA ReportDocument95 pagesAccouting, Tax Management & Audit Vouchering UNDER CA ReportsalmanNo ratings yet

- Rules On Conflicting Provisions SummaryDocument7 pagesRules On Conflicting Provisions SummaryStephanie BasilioNo ratings yet

- Roger Weliner v. CirDocument1 pageRoger Weliner v. CirChiiNo ratings yet

- 53998018952Document12 pages53998018952YASHVINo ratings yet

- 0455 w15 Ms 22 PDFDocument12 pages0455 w15 Ms 22 PDFMost. Amina KhatunNo ratings yet

- Amc 2 Times Tvs Service Bike MinakshiDocument1 pageAmc 2 Times Tvs Service Bike MinakshiprathamNo ratings yet

- Anil Kumar, 1Document2 pagesAnil Kumar, 1bhavesh1.nexusNo ratings yet

- Ufc 3-701-09 Dod Facilities Pricing Guide, Fy2009 (15 September 2009)Document45 pagesUfc 3-701-09 Dod Facilities Pricing Guide, Fy2009 (15 September 2009)Bob VinesNo ratings yet

- A Brief History of AustraliaDocument2 pagesA Brief History of AustraliaLydia Mohammad SarkawiNo ratings yet

- Case A Case BDocument7 pagesCase A Case Byogi fetriansyahNo ratings yet

- Functional AreasDocument9 pagesFunctional Areasvasavi thaduvaiNo ratings yet

- Section I: Instruction To Offerors: 1. Scope of ProposalDocument11 pagesSection I: Instruction To Offerors: 1. Scope of ProposalNoli CorralNo ratings yet

- The Battle For Steel CorpDocument23 pagesThe Battle For Steel CorpKevin Barrion EspinosaNo ratings yet

- Phil. National Construction Corp. Vs Pabion G.R. No. 131715, December 8, 1999Document29 pagesPhil. National Construction Corp. Vs Pabion G.R. No. 131715, December 8, 1999Juni VegaNo ratings yet

- GST 7th Edition PDFDocument366 pagesGST 7th Edition PDFUtkarshNo ratings yet

- Bianca LTD Also Purchased Two Second-Hand Cars On 1 April 2022. Details AreDocument50 pagesBianca LTD Also Purchased Two Second-Hand Cars On 1 April 2022. Details AreJOJONo ratings yet

- Case No. 47 Delpher Trades Corp V IAC PDFDocument1 pageCase No. 47 Delpher Trades Corp V IAC PDFHanna Liia GeniloNo ratings yet