Professional Documents

Culture Documents

Prelim Module 3

Prelim Module 3

Uploaded by

Marvin MolatoCopyright:

Available Formats

You might also like

- SOP - Finance and Accounting DepartmentDocument52 pagesSOP - Finance and Accounting Departmentcoffee Dust100% (23)

- School Operational Work Plan WordDocument7 pagesSchool Operational Work Plan Wordkiptewit girls100% (2)

- Government Accounting SyllabusDocument12 pagesGovernment Accounting SyllabusJean Diane JoveloNo ratings yet

- Admin Assistant III IPCRFDocument8 pagesAdmin Assistant III IPCRFJunjun Jonah JunjonNo ratings yet

- Macroperspective of Tourism and Hospitality by Cruz 2018Document7 pagesMacroperspective of Tourism and Hospitality by Cruz 2018joker hakeckn0% (2)

- Cfas Test BanksDocument6 pagesCfas Test Bankspehik100% (1)

- Allapacan Company Bought 20Document18 pagesAllapacan Company Bought 20Carl Yry BitzNo ratings yet

- Government-Accounting PH 2021Document14 pagesGovernment-Accounting PH 2021Vince Perolina100% (3)

- Admin Assistant III IPCRFDocument4 pagesAdmin Assistant III IPCRFRhon T. Bergado83% (6)

- Problem 1.6Document1 pageProblem 1.6SamerNo ratings yet

- Chapter 3 Reviewer - Gov AccoDocument2 pagesChapter 3 Reviewer - Gov AccoRobin de CastroNo ratings yet

- Chapter 1: Overview of Government Accounting: Exam ReviewerDocument22 pagesChapter 1: Overview of Government Accounting: Exam ReviewerStudent 101No ratings yet

- Government AccountingDocument3 pagesGovernment AccountingMariella CatacutanNo ratings yet

- Chapter 3Document2 pagesChapter 3Kristine TiuNo ratings yet

- Module 9 - Government Accounting ProcessDocument10 pagesModule 9 - Government Accounting ProcessJeeramel TorresNo ratings yet

- Budget ProcessDocument14 pagesBudget Processanna paulaNo ratings yet

- Chapter 3Document4 pagesChapter 3luzespinosa602No ratings yet

- LARGE Day 1 Budget RelatedDocument86 pagesLARGE Day 1 Budget Relatedromioflorante22No ratings yet

- The Government Accounting ProcessDocument2 pagesThe Government Accounting ProcessrochNo ratings yet

- Name: - Section: - Schedule: - Class Number: - DateDocument7 pagesName: - Section: - Schedule: - Class Number: - DateChristine Nicole BacoNo ratings yet

- Concept MapDocument2 pagesConcept MapPhilip Jhon BayoNo ratings yet

- Government Accounting REVIEWERDocument2 pagesGovernment Accounting REVIEWERMichelle Galapon LagunaNo ratings yet

- Npo NotesDocument4 pagesNpo Notessky wayNo ratings yet

- Government Accounting (Notes)Document2 pagesGovernment Accounting (Notes)Michelle Galapon LagunaNo ratings yet

- GAM-govacco NotesDocument3 pagesGAM-govacco NoteshoxhiiNo ratings yet

- Gov Act Reviewer (Punzalan)Document13 pagesGov Act Reviewer (Punzalan)Kenneth WilburNo ratings yet

- Government Accounting PHDocument14 pagesGovernment Accounting PHrylNo ratings yet

- Government Accounting and AuditingDocument190 pagesGovernment Accounting and AuditingCharles John Palabrica CubarNo ratings yet

- Government AccountingDocument56 pagesGovernment AccountingJoleaNo ratings yet

- Features of The Government Accounting Manual For National Government AgenciesDocument30 pagesFeatures of The Government Accounting Manual For National Government AgenciesMay Joy ManagdagNo ratings yet

- Regional Revenue and Expenditure BudgedDocument20 pagesRegional Revenue and Expenditure BudgedMonika SinagaNo ratings yet

- HO 5 - Comprehensive Illustrative Accounting Entries in Government AccountingDocument4 pagesHO 5 - Comprehensive Illustrative Accounting Entries in Government AccountingMaureen Kaye PaloNo ratings yet

- Chapter 3 - GovernmentDocument3 pagesChapter 3 - GovernmentMary Ann ArenasNo ratings yet

- 1 Government Accounting An Overview PDFDocument3 pages1 Government Accounting An Overview PDFWillen Christia M. MadulidNo ratings yet

- Chapter 03 The Government Accounting ProcessDocument20 pagesChapter 03 The Government Accounting ProcessRygiem Dela CruzNo ratings yet

- Government Acctg 2Document6 pagesGovernment Acctg 2Jayvee OrfanoNo ratings yet

- Act 132 Government Accounting Summary Dion David C. Remata Ii Mindanao State University-General Santos CityDocument2 pagesAct 132 Government Accounting Summary Dion David C. Remata Ii Mindanao State University-General Santos Citymax pNo ratings yet

- AGEDocument3 pagesAGECeslhee AngelesNo ratings yet

- Ngaslecture NewDocument56 pagesNgaslecture NewGenelyn LangoteNo ratings yet

- Recio, Angelic A-IpcrDocument18 pagesRecio, Angelic A-IpcrAngelic RecioNo ratings yet

- Chapter 3 - The Government Accounting ProcessDocument14 pagesChapter 3 - The Government Accounting ProcessMohammadNo ratings yet

- Acctg For NGASDocument5 pagesAcctg For NGASMicha SubaNo ratings yet

- Recio, Angelic ADocument18 pagesRecio, Angelic AAngelic RecioNo ratings yet

- Revised Local Water District Manual MaCRODocument68 pagesRevised Local Water District Manual MaCROCatherine Marie ReynosoNo ratings yet

- CHAPTER 5 Accounting ProcessDocument15 pagesCHAPTER 5 Accounting Processreviewrecord.rr2No ratings yet

- OBE SYLLABUS - GOVT ACCTG ACCTG FOR NPOs FAT 41 - SUMMERDocument10 pagesOBE SYLLABUS - GOVT ACCTG ACCTG FOR NPOs FAT 41 - SUMMERAngela DizonNo ratings yet

- Sop Finance and Accounting DepartmentDocument54 pagesSop Finance and Accounting DepartmentNurul Nadhilah RoslainiNo ratings yet

- DAO Syllabus-Part-1Document13 pagesDAO Syllabus-Part-1Syed Yasir Ali Gillani67% (3)

- Special AppropriationsDocument8 pagesSpecial AppropriationsCharles D. FloresNo ratings yet

- AFAR011 Government-AccountingDocument5 pagesAFAR011 Government-AccountingSummer KorapatNo ratings yet

- GovAcc HO No. 3 - The Government Accounting ProcessDocument9 pagesGovAcc HO No. 3 - The Government Accounting Processbobo kaNo ratings yet

- CHAPTER 4 Accounting For NGAsDocument4 pagesCHAPTER 4 Accounting For NGAsreviewrecord.rr2No ratings yet

- Government Accounting SyllabusDocument12 pagesGovernment Accounting SyllabusJean Diane JoveloNo ratings yet

- Financial Accounting System: CHR Reengineering ProjectDocument23 pagesFinancial Accounting System: CHR Reengineering ProjectnicahNo ratings yet

- The Government Accounting ProcessDocument26 pagesThe Government Accounting ProcessAldrin John TungolNo ratings yet

- DDO Instructions3Document65 pagesDDO Instructions3Sarfraz BhuttoNo ratings yet

- CL 1.2 Financial AccountingDocument267 pagesCL 1.2 Financial AccountingnushathNo ratings yet

- MLB 2009-03Document182 pagesMLB 2009-03Justine CastilloNo ratings yet

- Chap 001Document33 pagesChap 001mohamedfayez93.mfNo ratings yet

- Finacial Management FrameworkDocument66 pagesFinacial Management FrameworkRani Arun ShakarNo ratings yet

- This Study Resource Was: Quiz 1: Public Accounting and BudgetingDocument6 pagesThis Study Resource Was: Quiz 1: Public Accounting and BudgetingReggie AlisNo ratings yet

- Wiley GAAP for Governments 2018: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsFrom EverandWiley GAAP for Governments 2018: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsNo ratings yet

- Depreciation Reports in British Columbia: The Strata Lots Owners Guide to Selecting Your Provider and Understanding Your ReportFrom EverandDepreciation Reports in British Columbia: The Strata Lots Owners Guide to Selecting Your Provider and Understanding Your ReportNo ratings yet

- GEN 005 ReviewerDocument4 pagesGEN 005 ReviewerKath MalongNo ratings yet

- M. Com. I Management Concepts Paper-I AllDocument95 pagesM. Com. I Management Concepts Paper-I AllatuldipsNo ratings yet

- Project Outline: Oman Car Wash Mobile ApplicationDocument1 pageProject Outline: Oman Car Wash Mobile ApplicationUsama MunirNo ratings yet

- Proposal csc264 Group Assingment 1 - CompressDocument22 pagesProposal csc264 Group Assingment 1 - CompressIsyraf AzriNo ratings yet

- Case Study - Michelin Tyres: Interview With Ms. Helen TattersallDocument2 pagesCase Study - Michelin Tyres: Interview With Ms. Helen Tattersallshubham kumar0% (1)

- SocialMediainthePublicSector Mergel 2016 EncyPAPS.1Document5 pagesSocialMediainthePublicSector Mergel 2016 EncyPAPS.1Kenio FilhoNo ratings yet

- ERI Titles EnglishDocument2 pagesERI Titles Englishtrravi1983No ratings yet

- Cracking The CaseDocument17 pagesCracking The CaseK60 Đào Phạm Lan AnhNo ratings yet

- Understanding Devops Critical Success Factors and Organizational PracticesDocument8 pagesUnderstanding Devops Critical Success Factors and Organizational PracticesLuis Gustavo NetoNo ratings yet

- Asia Theme ParksDocument18 pagesAsia Theme ParksAsanga W.No ratings yet

- MBA Final Internship ReportDocument55 pagesMBA Final Internship ReportAvneesh KumarNo ratings yet

- Registration Form - : Directorate General of Immigration and Passports Islamabad, Ministry of InteriorDocument2 pagesRegistration Form - : Directorate General of Immigration and Passports Islamabad, Ministry of InteriorShoaib LiaqatNo ratings yet

- Ent300 Case StudyDocument17 pagesEnt300 Case StudyAlya DiyanahNo ratings yet

- Assessment Information Packet - SGP (v3.1 January 2016)Document16 pagesAssessment Information Packet - SGP (v3.1 January 2016)Wahab BahkatNo ratings yet

- ITC Utilization in DRC-03 For GSTR-9 Amp GSTR-9CDocument6 pagesITC Utilization in DRC-03 For GSTR-9 Amp GSTR-9CChaithanya RajuNo ratings yet

- Presidential Decree No. 1096, Also Known As The National Building Code of The Philippines IsDocument2 pagesPresidential Decree No. 1096, Also Known As The National Building Code of The Philippines IsMigaeaNo ratings yet

- Muhammad Saiful (Proposal0Document73 pagesMuhammad Saiful (Proposal0noralizan azizNo ratings yet

- Additional Notes - Chapter 5 - Overview of Risk and ReturnDocument7 pagesAdditional Notes - Chapter 5 - Overview of Risk and ReturnPaupauNo ratings yet

- Questions: Strong Cloud GovernanceDocument4 pagesQuestions: Strong Cloud GovernanceBrayanNo ratings yet

- Dhatu Tantra April 2021Document34 pagesDhatu Tantra April 2021Dhananjay PatilNo ratings yet

- Dynanet DN2 Eq Broch enDocument2 pagesDynanet DN2 Eq Broch enDaniloNo ratings yet

- Streamhub: Versatile Transceiver PlatformDocument2 pagesStreamhub: Versatile Transceiver PlatformBanidula WijesiriNo ratings yet

- Account Statement/Confirmation of Transactions: Settled Position(s)Document1 pageAccount Statement/Confirmation of Transactions: Settled Position(s)mohammad qadafiNo ratings yet

- Lecture - 9 Introduction To Business and EntrepreneurshipDocument19 pagesLecture - 9 Introduction To Business and Entrepreneurshipwajahat badshahNo ratings yet

- 10.1 AXIATA IA Manual V3Document86 pages10.1 AXIATA IA Manual V3aroshansNo ratings yet

- Monthly Departmental Meeting For The Month of DECEMBER - 2020Document14 pagesMonthly Departmental Meeting For The Month of DECEMBER - 2020atiqNo ratings yet

- Logitech Wireless Mouse m210 DriverDocument4 pagesLogitech Wireless Mouse m210 DriverKlmcc Klmcc KlmccNo ratings yet

Prelim Module 3

Prelim Module 3

Uploaded by

Marvin MolatoOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Prelim Module 3

Prelim Module 3

Uploaded by

Marvin MolatoCopyright:

Available Formats

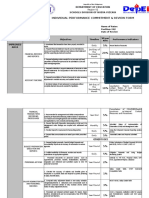

Prelim Period

Burauen Community College Modular Home Instruction

Poblacion District 9, San Diego, Burauen, Third Year Professional Courses

Second Semester, SY 2021- 2022

Leyte

Accounting for Government and

Non-Profit Organizations

(for BCC use only)

Module 3:

THE GOVERNMENT ACCOUNTING PROCESS

Prepared by:

Melchor D. Lantajo, CPA, CFMP

THE GOVERNMENT ACCOUNTING PROCESS 1

Prelim Period

Burauen Community College Modular Home Instruction

Poblacion District 9, San Diego, Burauen, Third Year Professional Courses

Second Semester, SY 2021- 2022

Leyte CHAPTER 3

THE GOVERNMENT ACCOUNTING PROCESS

At the end of this chapter, the student is expected to:

Learn to record the basic transactions of a government entity

Identify the books of accounts and registries that will be used in recording basic transactions

Know the major classification of expenditures in government accounting

_______________________________________________________________________________________________

GOVERNMENT ACCOUNTING

Definition comprises the activities of analysing, recording, classifying, summarizing

and communicating transactions involving the RECEIPT and

DISPOSITION of government funds and property, and interpreting the

results thereof

same to that of a business entity, except that it incorporates budgetary

controls, such as recording in the budget registries and preparing periodic

budget accountability reports.

Books of Accounts 1. Journals

(Journals and Ledgers) a. General Journal (GJ)

and Registries b. Cash Receipts Journal (CRJ)

c. Cash Disbursements Journal (CDJ)

d. Check Disbursements Journal (CKDJ)

2. Ledgers

a. General Ledgers

b. Subsidiary Ledgers

3. Registries maintained by Accounting Department

a. Registry of Allotments and Notice of Cash Allocation (RANCA)

b. Registry of Allotment and Notice of Transfer of Allocation

(RANTA)

4. Registries maintained by Budget Department

a. Registry of Revenue and Other Receipts (RROR)

b. Registry of Appropriations and Allotments (RAPAL)

c. Registry of Allotments, Obligations and Disbursements (RAOD)

d. Registry of Budget, Utilization and Disbursements (RBUD)

JOURNALS and LEDGERS - maintained by Accounting Department

BUDGET REGISTRIES

Registries of Revenue Registries of Allotments, Registries of Budget,

Registries of Appropriations

and Other Receipts Obligations and Utilization and

and Allotments (RAPAL)

(RROR) Disbursements (RAOD) Disbursements (RBUD)

o budgeted amounts o appropriations o allotments received o approved special

o actual collections o allotments o obligations incurred budget

o remittances of ROR o actual disbursements o corresponding

utilizations and

allotment ≤ appropriations obligation ≤ allotment disbursement charged

disbursement ≤ obligation to retained income

i. RAOD-PS i. RBUD-PS

ii. RAOD-MOOE ii. RBUD-MOOE

iii. RAOD-FE iii. RBUD-FE

iv. RAOD-CO RBUD-CO

THE GOVERNMENT ACCOUNTING PROCESS 2

Prelim Period

Burauen Community College Modular Home Instruction

Poblacion District 9, San Diego, Burauen, Third Year Professional Courses

Second Semester, SY 2021- 2022

Leyte

Appropriations

Unreleased

Allotment

Appropriation

Unobligated

Amount Obligation

Disbursement Accounts Payable

Due and Not yet Due and

Demandable AP Demandable AP

OBJECT OF EXPENDITURES – major classification of expenditures in government accounting

a. Personnel Services all types of employee benefits

(PS) o salaries and wages

o bonuses

o allowances

o cash gifts

o incentives etc.

b. Maintenance and Other various operating expenses other than employee benefits and financial

Operating Expenses expenses

(MOOE) o travelling and training expenses

o telephone expenses (landline and mobile)

o utilities expenses (water, electricity, cable subscription etc.)

o supplies expenses (office supplies, drugs and medicines etc.)

c. Financial Expenses finance costs

(FE) o interest expense / bank charges

o losses on foreign exchange transactions

d. Capital Outlay capitalizable expenditures (material amounts)

(CO) o equipment

o land acquisition

o construction of infrastructure projects

The Commission on Audit shall keep the general accounts of the government and

preserve the vouchers and other supporting documents.

Basic Recording of Government Transaction (Illustrative Examples)

Appropriation ex. Entity A (a government agency) receives its 2022 GAA consisting of the following:

a. Personnel Services (PS) 100,000.00

b. Maintenance and Other Operating Expenses (MOOE) 60,000.00

c. Financial Expenses (FE) 0.00

d. Capital Outlay (CO) 200,000.00

Total Appro under 2022 GAA 360,000.00

Registry to be maintained: Registries of Appropriations and Allotments (RAPAL)

REGISTRY OF APPROPRIATIONS AND ALLOTMENTS

For the year 2022

Entity Name : Entity A

Fund Cluster : Regular Agency Fund

Reference Appropriations Allotments

Maintenance Total Maintenance Total

Personnel and Other Financial Capital Appropriation Personnel and Other Financial Capital

GAA/SA/ MFO/ Allotments

Date Services Operating Expenses Outlays s Services Operating Expenses Outlays

Date GARO/ PAP

Expenses Expenses

SARO No.

(1)+(2)+(3)+(4) (16)+(17)+(18)

(1) (2) (3) (4) (16) (17) (18) (19)

= (5) + (19)=(20)

1/1/2022 GAA xxxxx 100,000 60,000 0 200,000 360,000

THE GOVERNMENT ACCOUNTING PROCESS 3

Prelim Period

Burauen Community College Modular Home Instruction

Poblacion District 9, San Diego, Burauen, Third Year Professional Courses

Second Semester, SY 2021- 2022

AllotmentLeyte ex. Entity A (a government agency) receives its allotment from the DBM consisting of the

following:

a. Personnel Services (PS) 90,000.00

b. Maintenance and Other Operating Expenses (MOOE) 40,000.00

c. Financial Expenses (FE) 0.00

d. Capital Outlay (CO) 170,000.00

Total allotment received 300,000.00

Registry to be maintained:

Registries of Appropriations and Allotments (RAPAL)

Registries of Allotments, Obligations and Disbursements (RAOD)

RAPAL:

REGISTRY OF APPROPRIATIONS AND ALLOTMENTS

For the year 2022

Entity Name : Entity A

Fund Cluster : Regular Agency Fund

Reference Appropriations Allotments Unreleased Appropriations

Maintenance Total Maintenance Maintenance

Total Total Unreleased

Personnel and Other Financial Capital Appropriation Personnel and Other Financial Capital Personnel and Other Financial Capital

GAA/SA/ MFO/ Allotments Appropriations

Date Services Operating Expenses Outlays s Services Operating Expenses Outlays Services Operating Expenses Outlays

Date GARO/ PAP

Expenses Expenses Expenses

SARO No.

(1)+(2)+(3)+(4) (16)+(17)+(18) (31)+(32)+(33)

(1) (2) (3) (4) (16) (17) (18) (19) (31) (32) (33) (34)

= (5) + (19)=(20) +(34)= (35)

1/1/2022 GAA 100,000 60,000 0 200,000 360,000

1/2/2022 GARO no. 90,000 40,000 0 170,000 300,000 10,000 20,000 0 30,000 60,000

RAOD-PS:

REGISTRY OF ALLOTMENTS, OBLIGATIONS AND DISBURSEMENTS

PERSONNEL SERVICES

For the year 2022

Entity Name: Entity A

Fund Cluster : Regular Agency Fund MFO/PAP : ___________________________

Legal Basis : GAA 2022 Sheet No. : _____________________

Reference Unpaid Obligations

UACS Object

Unobligated

Date Code/ Allotments Obligations Disbursements

Allotments Due and Not Yet Due and

Date Serial Number Expenditures

Demandable Demandable

1/2/2022 GARO No. xxx 90,000

RAOD-MOOE:

REGISTRY OF ALLOTMENTS, OBLIGATIONS AND DISBURSEMENTS

MAINTENANCE AND OTHER OPERATING EXPENSES

For the year 2022

Entity Name: Entity A

Fund Cluster : Regular Agency Fund MFO/PAP : ___________________________

Legal Basis : GAA 2022 Sheet No. : _____________________

Reference Unpaid Obligations

UACS Object

Unobligated

Date Code/ Allotments Obligations Disbursements

Allotments Due and Not Yet Due and

Date Serial Number Expenditures

Demandable Demandable

1/2/2022 GARO No. xxx 40,000

RAOD-CO:

REGISTRY OF ALLOTMENTS, OBLIGATIONS AND DISBURSEMENTS

CAPITAL OUTLAY

For the year 2022

Entity Name: Entity A

Fund Cluster : Regular Agency Fund MFO/PAP : ___________________________

Legal Basis : GAA 2022 Sheet No. : _____________________

Reference Unpaid Obligations

UACS Object

Unobligated

Date Code/ Allotments Obligations Disbursements

Allotments Due and Not Yet Due and

Date Serial Number Expenditures

Demandable Demandable

1/2/2022 GARO No. xxx 170,000

THE GOVERNMENT ACCOUNTING PROCESS 4

Prelim Period

Burauen Community College Modular Home Instruction

Poblacion District 9, San Diego, Burauen, Third Year Professional Courses

Second Semester, SY 2021- 2022

INCURRENCE

Leyte OF OBLIGATION

Obligation Request and Status All obligations are incurred through the issuance of ORS.

(ORS)

Requesting Office Head of the Requesting

Office Head of the Budget

o prepares the Division

documents like o certifies the necessity

disbursement and legality of the o certifies the

voucher, payroll, obligation and the availability of the

purchase order and validity of the allotment

others. supporting documents

ex. On February 1, 2022, Entity A enters into the following transactions:

a. PS Payroll received for salaries of employees for

January 1-30, 2022, Php 70,000.00.

b. MOOE Purchase order received for office supplies, Papel

ni Marites Inc., Php 25,000.00.

c. CO Purchase order for printer for use by one of the

Accounting Staff, Printot Company Php 30,000.00

Issuance of ORS

a. Payroll received for salaries of employees for January 1-30, 2022, Php 70,000.00.

OBLIGATION REQUEST AND STATUS Serial No. : 2022-02-01

Entity A Date : February 1, 2022

Entity Name Fund Cluster : Regular Agency Fund GAA PS

Payee

Juan Dela Cruz, et al.

UACS Object

Responsibility Center Particulars MFO/PAP Amount

Code

Payment for the Salaries of Juan Dela Cruz, et al 70,000.00

for payroll period, January 1-30, 2022 xx xx

Total 70,000.00

A. Certified: Charges to appropriation/alloment are B. Certified: Allotment available and obligated

necessary, lawful and under my direct supervision;and for the purpose/adjustment necessary as

supporting documents valid, proper and legal indicated above

Signature : signed Signature : signed

Printed Name: Paro Paro Gebs Printed Name: Kokak Podiquit

Position : Chief Administrative Officer Position : Budget Officer II

Head, Requesting Office/Authorized Head, Budget Division/Unit/Authorized

Representative Representative

Date : ___________________________________ Date : ____________________________

C. STATUS OF OBLIGATION

Reference Amount

Balance

ORS/JEV/Check/ Obligation Payable Payment Due and

Date Particulars Not Yet Due

ADA/TRA No. Demandable

(a) (b) (c) (a-b) (b-c)

02/01/22 Payment for the Salaries of

Juan Dela Cruz, et al for

payroll period, January 1- 2022-02-01

30, 2022 70,000.00

THE GOVERNMENT ACCOUNTING PROCESS 5

Prelim Period

Burauen Community College Modular Home Instruction

Poblacion District 9, San Diego, Burauen, Third Year Professional Courses

Second Semester, SY 2021- 2022

Leyte

b. Purchase order received for office supplies, Php 25,000.00.

Appendix 11

OBLIGATION REQUEST AND STATUS Serial No. : 2022-02-01

Entity A Date : February 1, 2022

Entity Name Fund Cluster : Regular Agency Fund GAA MOOE

Payee

Papel Ni Marites Inc.

UACS Object

Responsibility Center Particulars MFO/PAP Amount

Code

Purchase order received for office supplies, Papel 25,000.00

ni Marites Inc., xx xx

Total 25,000.00

A. Certified: Charges to appropriation/alloment are B. Certified: Allotment available and obligated

necessary, lawful and under my direct supervision;and for the purpose/adjustment necessary as

supporting documents valid, proper and legal indicated above

Signature : signed Signature : signed

Printed Name: Paro Paro Gebs Printed Name: Kokak Podiquit

Position : Chief Administrative Officer Position : Budget Officer II

Head, Requesting Office/Authorized Head, Budget Division/Unit/Authorized

Representative Representative

Date : ___________________________________ Date : ____________________________

C. STATUS OF OBLIGATION

Reference Amount

Balance

ORS/JEV/Check/ Obligation Payable Payment Due and

Date Particulars Not Yet Due

ADA/TRA No. Demandable

(a) (b) (c) (a-b) (b-c)

02/01/22

Purchase order received

for office supplies, Papel 2022-02-01

ni Marites Inc., 25,000.00

c. Purchase order for printer for use by one of the Accounting Staff, Printot Company Php 30,000.00.

Appendix 11

OBLIGATION REQUEST AND STATUS Serial No. : 2022-02-01

Entity A Date : February 1, 2022

Entity Name Fund Cluster : Regular Agency Fund GAA CO

Payee

Printot Company

UACS Object

Responsibility Center Particulars MFO/PAP Amount

Code

Purchase order for printer for use by one of the 30,000.00

Accounting Staff, Printot Company Php 30,000.00 xx xx

Total 30,000.00

A. Certified: Charges to appropriation/alloment are B. Certified: Allotment available and obligated

necessary, lawful and under my direct supervision;and for the purpose/adjustment necessary as

supporting documents valid, proper and legal indicated above

Signature : signed Signature : signed

Printed Name: Paro Paro Gebs Printed Name: Kokak Podiquit

Position : Chief Administrative Officer Position : Budget Officer II

Head, Requesting Office/Authorized Head, Budget Division/Unit/Authorized

Representative Representative

Date : ___________________________________ Date : ____________________________

C. STATUS OF OBLIGATION

Reference Amount

Balance

ORS/JEV/Check/ Obligation Payable Payment Due and

Date Particulars Not Yet Due

ADA/TRA No. Demandable

(a) (b) (c) (a-b) (b-c)

02/01/22 Purchase order for printer

for use by one of the

Accounting Staff, Printot 2022-02-01

Company Php 30,000.00 30,000.00

THE GOVERNMENT ACCOUNTING PROCESS 6

Prelim Period

Burauen Community College Modular Home Instruction

Poblacion District 9, San Diego, Burauen, Third Year Professional Courses

Second Semester, SY 2021- 2022

RAOD-PS:

Leyte

REGISTRY OF ALLOTMENTS, OBLIGATIONS AND DISBURSEMENTS

PERSONNEL SERVICES

For the year 2022

Entity Name: Entity A

Fund Cluster : Regular Agency Fund MFO/PAP : ___________________________

Legal Basis : GAA 2022 Sheet No. : _____________________

Reference Unpaid Obligations

UACS Object

Unobligated

Date Code/ Allotments Obligations Disbursements

Allotments Due and Not Yet Due and

Date Serial Number Expenditures

Demandable Demandable

1/2/2022 GARO No. xxx 90,000

2/1/2022 70,000 20,000

RAOD-MOOE:

REGISTRY OF ALLOTMENTS, OBLIGATIONS AND DISBURSEMENTS

MAINTENANCE AND OTHER OPERATING EXPENSES

For the year 2022

Entity Name: Entity A

Fund Cluster : Regular Agency Fund MFO/PAP : ___________________________

Legal Basis : GAA 2022 Sheet No. : _____________________

Reference Unpaid Obligations

UACS Object

Unobligated

Date Code/ Allotments Obligations Disbursements

Allotments Due and Not Yet Due and

Date Serial Number Expenditures

Demandable Demandable

1/2/2022 GARO No. xxx 40,000

2/1/2022 25,000 15,000

RAOD-CO:

REGISTRY OF ALLOTMENTS, OBLIGATIONS AND DISBURSEMENTS

CAPITAL OUTLAY

For the year 2022

Entity Name: Entity A

Fund Cluster : Regular Agency Fund MFO/PAP : ___________________________

Legal Basis : GAA 2022 Sheet No. : _____________________

Reference Unpaid Obligations

UACS Object

Unobligated

Date Code/ Allotments Obligations Disbursements

Allotments Due and Not Yet Due and

Date Serial Number Expenditures

Demandable Demandable

1/2/2022 GARO No. xxx 170,000

2/1/2022 30,000 140,000

THE GOVERNMENT ACCOUNTING PROCESS 7

Prelim Period

Burauen Community College Modular Home Instruction

Poblacion District 9, San Diego, Burauen, Third Year Professional Courses

Second Semester, SY 2021- 2022

Leyte

Adjustment in the Obligated Amount

Notice of Obligation Request and Status Adjustment used to reflect adjustment in the ORS and RAOD as

(NORSA) a result of positive entry (addition) or negative entry

(deduction), as appropriate

Appendix 12

NOTICE OF OBLIGATION REQUEST AND STATUS ADJUSTMENT Serial No. : _________

_______________________________ Date : _____________

Entity Name Fund Cluster : ______

For: The Budget Officer:

Budget Division/Unit

Please adjust ORS No. ___________________dated ___________________

due to the following changes:

Responsibility Center to ___________________________

Particulars to ___________________________

MFO/PAP to ___________________________

Account Code to ___________________________

Amount to P ___________________________

Please adjust RAOD for excess/under obligation per attached

JEV No. ___________dated ____________.

A. B.

Prepared by: Approved by:

____________________________ _____________________________

Accounting Staff-in-Charge Chief Accountant/Head of Accounting

Division/Unit

C. D.

Certified Correct: Verified by:

Head of Requesting Office/ Head of Budget Division/Unit/

Authorized Representative Authorized Representative

Up to this point, nothing is recorded yet in the accounting books. The recordings above are made on the

budget registries. Journal entries shall only be made for:

a. after processing of the payroll

b. after delivery and inspection of the supplies with complete documentation attached to the voucher

c. after delivery and inspection of the printer with complete documentation attached to the voucher

ACCOUNTING REGISTRIES

Registry of Allotments and Notice of Cash Allocation Registry of Allotment and Notice of Transfer of Allocation

(RANCA) (RANTA)

o determine the amount of allotments not covered o determine the amount of allotments not covered

by NCA and to monitor the available balance of by NTA and to monitor the available balance of

NCA NTA

DISBURSEMENT AUTHORITY

Recording receipt of NCA / NTA ex. On January 2, 2022, Entity A received Notice of Cash Allocation (NCA) for

the first quarter of 2022 from the DBM amounting to Php 200,000.00, net of

tax.

JE to record NCA:

Cash, Modified Disbursement System, Regular 200,000.00

Subsidy from National Government 200,000.00

To record receipt of NCA from DBM

THE GOVERNMENT ACCOUNTING PROCESS 8

Prelim Period

Burauen Community College Modular Home Instruction

Poblacion District 9, San Diego, Burauen, Third Year Professional Courses

Second Semester, SY 2021- 2022

RANCA: Leyte

Appendix 30

REGISTRY OF ALLOTMENTS AND NOTICE OF CASH ALLOCATION

For the period January to December 2022

Entity Name : ______________________________

Entity A Fund Cluster : Regular Agency Fund

Sheet Number : xxxx

AMOUNT

Notice of Cash Allocation Balance

Allotment

Date Reference Unutilized Unfunded

Received Received Utilized

NCA Allotment

(a) (b) ( c) (b - c) (a - b)

1/2/2022 300,000.00 200,000.00 0 200,000.00 100,000.00

JOURNALS

a. General Journal (GJ) record transactions not recorded in the special journal

Appendix 1

GENERAL JOURNAL

Month ______________

Entity Name : _____________________________

Fund Cluster : ____________________________ Sheet No. : ___________

JEV UACS Amount

Date Particulars P

No. Object Code Debit Credit

Special Journals

b. Cash Receipts Journal record the Report of Collection and Deposit and Cash Receipts Register of

(CRJ) Collecting Officers

Appendix 2

CASH RECEIPTS JOURNAL

Month _________________

Entity Name : _______________________________

Fund Cluster : ______________________________ Sheet No. : __________

COLLECTIONS DEPOSITS

Name of CREDIT DEBIT

RCD/

Date JEV No. Collecting SUNDRY SUNDRY

CRReg No.

Officer DEBIT UACS UACS CREDIT

Object P Amount Object P Amount

Code Code

o Report of Collection and Deposit (RCD)

prepared by a collecting officer to report his/her collections and

deposits to an Authorized Government Depository Bank

(AGDBs)

Appendix 26

REPORT OF COLLECTIONS AND DEPOSITS

Entity Name : _________________________________ Sheet No. : _______________________

Fund Cluster : ________________________________ Date : ___________________________

Amount

Official Receipt/ Report of

Responsibility Breakdown of Collections

Collections by Sub-Collector Payor Particulars MFO/PAP

Center Code Total per OR Taxes Fees

Date Number 40101010 40201010

Total

Summary:

Undeposited Collections per last Report P xxx.xx

Collections per OR Nos. __________to____________ xxx.xx

Deposits

Date: ________________ P xxx.xx

Date: ________________ xxx.xx

xxx.xx

Undeposited Collections, this Report P xxx.xx

THE GOVERNMENT ACCOUNTING PROCESS 9

Prelim Period

Burauen Community College Modular Home Instruction

Poblacion District 9, San Diego, Burauen, Third Year Professional Courses

Second Semester, SY 2021- 2022

Leyte o Cash Receipts Register (CRReg)

used by field office without a complete set of books to record

their cash collections and deposits in the books of their mother

office (central, regional, division office)

Appendix 27

CASH RECEIPTS REGISTER

Entity Name : ___________________________________________ Name of Collecting Officer/Cashier : ______________________

Sub-Office/District/Division : ______________________________ Fund Cluster : _________________________________________

Municipality/City/Province : ______________________________ Sheet No. : ___________________________________________

Date : ________________________________________________

Official Receipt/ Cash - Collecting Officer BREAKDOWN OF RECEIPTS

Deposit Slip (10101010) OTHERS

Clearance Fines and

Payor Deposits Permit and Penalties -

Registration UACS

Receipts Balance Fees Certificatio Service

Date Number National Fess Account Description Object Amount

AGDB n Fees Income

Treasury Code

(+) (-) (-) (=) (40201010) (40201020) (40201040) (40201140)

c. Cash Disbursements record the cash disbursements of the Disbursing Officer

Journal (CDJ)

Appendix 3

CASH DISBURSEMENTS JOURNAL

Month _________________

Entity Name : ___________________________

Fund Cluster : __________________________ Sheet No. : __________

CREDIT DEBIT

Name of Advances Advances to SUNDRY SUNDRY

RCDisb Office Transportation Fuel, Oil and

DATE JEV No. Disbursing Advances for for Special

Supplies and Delivery Lubricants

Water

No. Payroll Operating Disbursing UACS Expenses UACS

Officer Account Expenses Expenses Expenses Account

(19901020) Expenses Officer Object P Amount (50204010) Object P Amount

Title (50203010) (50299040) (50203090) Title

(19901010) (19901030) Code Code

d. Check Disbursements record the check disbursements of the Disbursing Officer

Journal (CKDJ)

Appendix 4

CHECK DISBURSEMENTS JOURNAL

Month __________________

Entity Name : _____________________________________

Fund Cluster : ____________________________________ Sheet No. : ______________________

CREDIT DEBIT

Serial No. of Checks Name of

SUNDRY SUNDRY

DATE JEV No. RCI/DV No. Disbursing

UACS Object UACS Object

From To Officer P Amount P Amount

Code Code

LEDGERS

a. General Ledger summarizes all transactions recorded in the journals. Accounts are

arranged according to their sequence in the Revised Chart of Accounts.

Appendix 5

GENERAL LEDGER

Entity Name: _______________________ Fund Cluster : ___________________

Account Title: ______________________ UACS Object Code: _______________

Amount

Date Particulars Ref.

Debit Credit Balance

THE GOVERNMENT ACCOUNTING PROCESS 10

Prelim Period

Burauen Community College Modular Home Instruction

Poblacion District 9, San Diego, Burauen, Third Year Professional Courses

Second Semester, SY 2021- 2022

b. Subsidiary

Leyte Ledger show details of each control account in the general ledger

Appendix 6

SUBSIDIARY LEDGER

Entity Name : ______________________________ Fund Cluster : ___________________________

Account of: ___________________________________________________________ Account Code

Office/Address: ________________________________________________________ GL _____________________

Contact Person: _______________________________________________________ SL _____________________

Contact Number/Email Address: _________________________________________

Amount

Date Particulars Ref.

Debit Credit Balance

DISBURSEMENTS----------------------------------------------------------------------------------------------------------------------------- --------

Illustrative Example:

Transaction:

Employees of Entity A have rendered services for January 2022 and are now entitled

to compensation.

Journal entries shall be made because the financial statement elements of the entity are affected

which may result to an increase in the expenses and increase in liability or decrease in cash.

Salaries and Wages 50,000.00

Personnel Economic Relief Allowance (PERA) 2,000.00

Laundry Allowance 150.00

Hazard Pay – Magna Carta for PHW 12,500.00

Subsistence Allowance 1,500.00

Gross Compensation 66,150.00

Deductions: Withholding Tax 7,500.00

GSIS 4,500.00

PhilHealth 900.00

Pag-IBIG 100.00

Total Deductions (13,000.00)

Net Take-home Pay 53,150.00

a) Set-up of payable to officers and employees upon approval of the payroll

date Salaries and Wages - Regular 50,000.00

Personnel Economic Relief Allowance (PERA) 2,000.00

Laundry Allowance 150.00

Hazard Pay – Magna Carta for PHW 12,500.00

Subsistence Allowance 1,500.00

Due to BIR 7,500.00

Due to GSIS 4,500.00

Due to PhilHealth 900.00

Due to Pag-IBIG 100.00

Due to Officers and Employees 53,150.00

To recognize payable to officers and

employees upon approval of the payroll

THE GOVERNMENT ACCOUNTING PROCESS 11

Prelim Period

Burauen Community College Modular Home Instruction

Poblacion District 9, San Diego, Burauen, Third Year Professional Courses

Second Semester, SY 2021- 2022

b)

Leyte Posting of payable to Section C of ORS

c) Grant of Cash Advance for Payroll (assuming employees do not have yet their payroll accounts)

date Advances for Payroll 53,150.00

Cash – Modified Disbursement System, MDS, 53,150.00

Regular

To recognize grant of cash advance for

payroll

d) Posting of disbursements to the payment column of Section C of the ORS and disbursement column

of the RAOD

e) Liquidation of Payroll Fund (Advances for Payroll)

date Due to Officers and Employees 53,150.00

Advances for Payroll 53,150.00

To recognize liquidation of payroll fund

Remittance of Amounts Withheld

Entity A remits the following amounts withheld to the other government agencies.

Withholding Tax 7,500.00

GSIS 4,500.00

PhilHealth 900.00

Pag-IBIG 100.00

Total Deduction 13,000.00

Remittance of Withholding Tax

Tax Remittance Advice

The TRA is used to recognize:

In the books of government In the books of BIR and BOC, In the books of Bureau of

agencies, Treasury (BTr),

a) the constructive remittance b) the constructive receipt of c) the constructive receipt of

of taxes withheld to Bureau taxes revenue and taxes and customs duties

of Internal Revenue (BIR) customs duties; and remitted.

or customs duties withheld

to Bureau of Customs

(BOC), and the

constructive receipt of NCA

for those taxes and

customs duties;

THE GOVERNMENT ACCOUNTING PROCESS 12

Prelim Period

Burauen Community College Modular Home Instruction

Poblacion District 9, San Diego, Burauen, Third Year Professional Courses

Second Semester, SY 2021- 2022

Leyte Books of Entity A

date Cash – Tax Remittance Advice 7,500.00

Subsidy from National Government 7,500.00

To recognize the constructive receipt of

NCA for TRA

date Due to BIR 7,500.00

Cash – Tax Remittance Advice 7,500.00

To recognize the constructive remittance

of taxes withheld to the BIR through TRA

Books of BIR

date Cash – Tax Remittance Advice 7,500.00

Income Tax 7,500.00

To recognize constructive receipt of taxes

withheld by National Government

Agencies (NGAs) through TRA

Books of BTr

date Subsidy to National Government Agencies 7,500.00

Cash – Tax Remittance Advice 7,500.00

To recognize constructive receipt of

remittance of taxes withheld by NGAs

through TRA

Remittance to GSIS, Pag-IBIG and PhilHealth

date Due to GSIS 4,500.00

Due to Pag-IBIG 100.00

Due to PhilHealth 900.00

Cash, MDS, Regular 5,500.00

To recognize remittance to GSIS, Pag-

IBIG and PhilHealth

BILLINGS, COLLECTIONS AND REMITTANCES

Illustrative Examples:

a) Entity A bills revenue of P 100,000.00 for rental income.

date Accounts Receivable 100,000.00

Rent / Lease Income 100,000.00

To recognize billing of rent income

b) Entity A collects the sum of amount from the billed revenue and remits the collections to the BTr.

date Cash, Collecting Officers 100,000.00

Accounts Receivable 100,000.00

To recognize collection of income

date Cash – Treasury / Agency Deposit, Regular 100,000.00

Cash, Collecting Officers 100,000.00

To recognize remittance of income to BTr

THE GOVERNMENT ACCOUNTING PROCESS 13

Prelim Period

Burauen Community College Modular Home Instruction

Poblacion District 9, San Diego, Burauen, Third Year Professional Courses

Second Semester, SY 2021- 2022

Leyte P.D. No. 1445 requires that all collections must be remitted to the National Treasury, unless

another law specifically allows otherwise.

The billing of revenue is recorded in the General Journal while the collections and remittance

are recorded in the Cash Receipts Journal.

REVERSION OF UNUSED NOTICE OF CASH ALLOCATION (NCA)

Government entities are required to revert any unused NCA at the end of the accounting period.

The unused NCA is computed as follows:

Cash – Modified Disbursement System

Receipt of NCA 200,000.00

53,150.00 Advances for Payroll

5,500.00 Remittance to GSIS etc.

141,350.00 end

date Subsidy from National Government 141,350.00

Cash – Modified Disbursement System 141,350.00

To recognize reversion of unused NCA

Notice that the entry above is the exact opposite of the entry to record the receipt of

the NCA.

References:

Commission on Audit – Government Accounting Manual for National Government Agencies Volume 1

Accounting Policies, Guidelines and Procedures, and Illustrative Accounting Entries

Commission on Audit – Government Accounting Manual for National Government Agencies Volume 2

The Accounting Books, Registries, Records, Forms and Reports

THE GOVERNMENT ACCOUNTING PROCESS 14

You might also like

- SOP - Finance and Accounting DepartmentDocument52 pagesSOP - Finance and Accounting Departmentcoffee Dust100% (23)

- School Operational Work Plan WordDocument7 pagesSchool Operational Work Plan Wordkiptewit girls100% (2)

- Government Accounting SyllabusDocument12 pagesGovernment Accounting SyllabusJean Diane JoveloNo ratings yet

- Admin Assistant III IPCRFDocument8 pagesAdmin Assistant III IPCRFJunjun Jonah JunjonNo ratings yet

- Macroperspective of Tourism and Hospitality by Cruz 2018Document7 pagesMacroperspective of Tourism and Hospitality by Cruz 2018joker hakeckn0% (2)

- Cfas Test BanksDocument6 pagesCfas Test Bankspehik100% (1)

- Allapacan Company Bought 20Document18 pagesAllapacan Company Bought 20Carl Yry BitzNo ratings yet

- Government-Accounting PH 2021Document14 pagesGovernment-Accounting PH 2021Vince Perolina100% (3)

- Admin Assistant III IPCRFDocument4 pagesAdmin Assistant III IPCRFRhon T. Bergado83% (6)

- Problem 1.6Document1 pageProblem 1.6SamerNo ratings yet

- Chapter 3 Reviewer - Gov AccoDocument2 pagesChapter 3 Reviewer - Gov AccoRobin de CastroNo ratings yet

- Chapter 1: Overview of Government Accounting: Exam ReviewerDocument22 pagesChapter 1: Overview of Government Accounting: Exam ReviewerStudent 101No ratings yet

- Government AccountingDocument3 pagesGovernment AccountingMariella CatacutanNo ratings yet

- Chapter 3Document2 pagesChapter 3Kristine TiuNo ratings yet

- Module 9 - Government Accounting ProcessDocument10 pagesModule 9 - Government Accounting ProcessJeeramel TorresNo ratings yet

- Budget ProcessDocument14 pagesBudget Processanna paulaNo ratings yet

- Chapter 3Document4 pagesChapter 3luzespinosa602No ratings yet

- LARGE Day 1 Budget RelatedDocument86 pagesLARGE Day 1 Budget Relatedromioflorante22No ratings yet

- The Government Accounting ProcessDocument2 pagesThe Government Accounting ProcessrochNo ratings yet

- Name: - Section: - Schedule: - Class Number: - DateDocument7 pagesName: - Section: - Schedule: - Class Number: - DateChristine Nicole BacoNo ratings yet

- Concept MapDocument2 pagesConcept MapPhilip Jhon BayoNo ratings yet

- Government Accounting REVIEWERDocument2 pagesGovernment Accounting REVIEWERMichelle Galapon LagunaNo ratings yet

- Npo NotesDocument4 pagesNpo Notessky wayNo ratings yet

- Government Accounting (Notes)Document2 pagesGovernment Accounting (Notes)Michelle Galapon LagunaNo ratings yet

- GAM-govacco NotesDocument3 pagesGAM-govacco NoteshoxhiiNo ratings yet

- Gov Act Reviewer (Punzalan)Document13 pagesGov Act Reviewer (Punzalan)Kenneth WilburNo ratings yet

- Government Accounting PHDocument14 pagesGovernment Accounting PHrylNo ratings yet

- Government Accounting and AuditingDocument190 pagesGovernment Accounting and AuditingCharles John Palabrica CubarNo ratings yet

- Government AccountingDocument56 pagesGovernment AccountingJoleaNo ratings yet

- Features of The Government Accounting Manual For National Government AgenciesDocument30 pagesFeatures of The Government Accounting Manual For National Government AgenciesMay Joy ManagdagNo ratings yet

- Regional Revenue and Expenditure BudgedDocument20 pagesRegional Revenue and Expenditure BudgedMonika SinagaNo ratings yet

- HO 5 - Comprehensive Illustrative Accounting Entries in Government AccountingDocument4 pagesHO 5 - Comprehensive Illustrative Accounting Entries in Government AccountingMaureen Kaye PaloNo ratings yet

- Chapter 3 - GovernmentDocument3 pagesChapter 3 - GovernmentMary Ann ArenasNo ratings yet

- 1 Government Accounting An Overview PDFDocument3 pages1 Government Accounting An Overview PDFWillen Christia M. MadulidNo ratings yet

- Chapter 03 The Government Accounting ProcessDocument20 pagesChapter 03 The Government Accounting ProcessRygiem Dela CruzNo ratings yet

- Government Acctg 2Document6 pagesGovernment Acctg 2Jayvee OrfanoNo ratings yet

- Act 132 Government Accounting Summary Dion David C. Remata Ii Mindanao State University-General Santos CityDocument2 pagesAct 132 Government Accounting Summary Dion David C. Remata Ii Mindanao State University-General Santos Citymax pNo ratings yet

- AGEDocument3 pagesAGECeslhee AngelesNo ratings yet

- Ngaslecture NewDocument56 pagesNgaslecture NewGenelyn LangoteNo ratings yet

- Recio, Angelic A-IpcrDocument18 pagesRecio, Angelic A-IpcrAngelic RecioNo ratings yet

- Chapter 3 - The Government Accounting ProcessDocument14 pagesChapter 3 - The Government Accounting ProcessMohammadNo ratings yet

- Acctg For NGASDocument5 pagesAcctg For NGASMicha SubaNo ratings yet

- Recio, Angelic ADocument18 pagesRecio, Angelic AAngelic RecioNo ratings yet

- Revised Local Water District Manual MaCRODocument68 pagesRevised Local Water District Manual MaCROCatherine Marie ReynosoNo ratings yet

- CHAPTER 5 Accounting ProcessDocument15 pagesCHAPTER 5 Accounting Processreviewrecord.rr2No ratings yet

- OBE SYLLABUS - GOVT ACCTG ACCTG FOR NPOs FAT 41 - SUMMERDocument10 pagesOBE SYLLABUS - GOVT ACCTG ACCTG FOR NPOs FAT 41 - SUMMERAngela DizonNo ratings yet

- Sop Finance and Accounting DepartmentDocument54 pagesSop Finance and Accounting DepartmentNurul Nadhilah RoslainiNo ratings yet

- DAO Syllabus-Part-1Document13 pagesDAO Syllabus-Part-1Syed Yasir Ali Gillani67% (3)

- Special AppropriationsDocument8 pagesSpecial AppropriationsCharles D. FloresNo ratings yet

- AFAR011 Government-AccountingDocument5 pagesAFAR011 Government-AccountingSummer KorapatNo ratings yet

- GovAcc HO No. 3 - The Government Accounting ProcessDocument9 pagesGovAcc HO No. 3 - The Government Accounting Processbobo kaNo ratings yet

- CHAPTER 4 Accounting For NGAsDocument4 pagesCHAPTER 4 Accounting For NGAsreviewrecord.rr2No ratings yet

- Government Accounting SyllabusDocument12 pagesGovernment Accounting SyllabusJean Diane JoveloNo ratings yet

- Financial Accounting System: CHR Reengineering ProjectDocument23 pagesFinancial Accounting System: CHR Reengineering ProjectnicahNo ratings yet

- The Government Accounting ProcessDocument26 pagesThe Government Accounting ProcessAldrin John TungolNo ratings yet

- DDO Instructions3Document65 pagesDDO Instructions3Sarfraz BhuttoNo ratings yet

- CL 1.2 Financial AccountingDocument267 pagesCL 1.2 Financial AccountingnushathNo ratings yet

- MLB 2009-03Document182 pagesMLB 2009-03Justine CastilloNo ratings yet

- Chap 001Document33 pagesChap 001mohamedfayez93.mfNo ratings yet

- Finacial Management FrameworkDocument66 pagesFinacial Management FrameworkRani Arun ShakarNo ratings yet

- This Study Resource Was: Quiz 1: Public Accounting and BudgetingDocument6 pagesThis Study Resource Was: Quiz 1: Public Accounting and BudgetingReggie AlisNo ratings yet

- Wiley GAAP for Governments 2018: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsFrom EverandWiley GAAP for Governments 2018: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsNo ratings yet

- Depreciation Reports in British Columbia: The Strata Lots Owners Guide to Selecting Your Provider and Understanding Your ReportFrom EverandDepreciation Reports in British Columbia: The Strata Lots Owners Guide to Selecting Your Provider and Understanding Your ReportNo ratings yet

- GEN 005 ReviewerDocument4 pagesGEN 005 ReviewerKath MalongNo ratings yet

- M. Com. I Management Concepts Paper-I AllDocument95 pagesM. Com. I Management Concepts Paper-I AllatuldipsNo ratings yet

- Project Outline: Oman Car Wash Mobile ApplicationDocument1 pageProject Outline: Oman Car Wash Mobile ApplicationUsama MunirNo ratings yet

- Proposal csc264 Group Assingment 1 - CompressDocument22 pagesProposal csc264 Group Assingment 1 - CompressIsyraf AzriNo ratings yet

- Case Study - Michelin Tyres: Interview With Ms. Helen TattersallDocument2 pagesCase Study - Michelin Tyres: Interview With Ms. Helen Tattersallshubham kumar0% (1)

- SocialMediainthePublicSector Mergel 2016 EncyPAPS.1Document5 pagesSocialMediainthePublicSector Mergel 2016 EncyPAPS.1Kenio FilhoNo ratings yet

- ERI Titles EnglishDocument2 pagesERI Titles Englishtrravi1983No ratings yet

- Cracking The CaseDocument17 pagesCracking The CaseK60 Đào Phạm Lan AnhNo ratings yet

- Understanding Devops Critical Success Factors and Organizational PracticesDocument8 pagesUnderstanding Devops Critical Success Factors and Organizational PracticesLuis Gustavo NetoNo ratings yet

- Asia Theme ParksDocument18 pagesAsia Theme ParksAsanga W.No ratings yet

- MBA Final Internship ReportDocument55 pagesMBA Final Internship ReportAvneesh KumarNo ratings yet

- Registration Form - : Directorate General of Immigration and Passports Islamabad, Ministry of InteriorDocument2 pagesRegistration Form - : Directorate General of Immigration and Passports Islamabad, Ministry of InteriorShoaib LiaqatNo ratings yet

- Ent300 Case StudyDocument17 pagesEnt300 Case StudyAlya DiyanahNo ratings yet

- Assessment Information Packet - SGP (v3.1 January 2016)Document16 pagesAssessment Information Packet - SGP (v3.1 January 2016)Wahab BahkatNo ratings yet

- ITC Utilization in DRC-03 For GSTR-9 Amp GSTR-9CDocument6 pagesITC Utilization in DRC-03 For GSTR-9 Amp GSTR-9CChaithanya RajuNo ratings yet

- Presidential Decree No. 1096, Also Known As The National Building Code of The Philippines IsDocument2 pagesPresidential Decree No. 1096, Also Known As The National Building Code of The Philippines IsMigaeaNo ratings yet

- Muhammad Saiful (Proposal0Document73 pagesMuhammad Saiful (Proposal0noralizan azizNo ratings yet

- Additional Notes - Chapter 5 - Overview of Risk and ReturnDocument7 pagesAdditional Notes - Chapter 5 - Overview of Risk and ReturnPaupauNo ratings yet

- Questions: Strong Cloud GovernanceDocument4 pagesQuestions: Strong Cloud GovernanceBrayanNo ratings yet

- Dhatu Tantra April 2021Document34 pagesDhatu Tantra April 2021Dhananjay PatilNo ratings yet

- Dynanet DN2 Eq Broch enDocument2 pagesDynanet DN2 Eq Broch enDaniloNo ratings yet

- Streamhub: Versatile Transceiver PlatformDocument2 pagesStreamhub: Versatile Transceiver PlatformBanidula WijesiriNo ratings yet

- Account Statement/Confirmation of Transactions: Settled Position(s)Document1 pageAccount Statement/Confirmation of Transactions: Settled Position(s)mohammad qadafiNo ratings yet

- Lecture - 9 Introduction To Business and EntrepreneurshipDocument19 pagesLecture - 9 Introduction To Business and Entrepreneurshipwajahat badshahNo ratings yet

- 10.1 AXIATA IA Manual V3Document86 pages10.1 AXIATA IA Manual V3aroshansNo ratings yet

- Monthly Departmental Meeting For The Month of DECEMBER - 2020Document14 pagesMonthly Departmental Meeting For The Month of DECEMBER - 2020atiqNo ratings yet

- Logitech Wireless Mouse m210 DriverDocument4 pagesLogitech Wireless Mouse m210 DriverKlmcc Klmcc KlmccNo ratings yet