Professional Documents

Culture Documents

Answers Homework # 12 Cost MGMT 1

Answers Homework # 12 Cost MGMT 1

Uploaded by

Raman AOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Answers Homework # 12 Cost MGMT 1

Answers Homework # 12 Cost MGMT 1

Uploaded by

Raman ACopyright:

Available Formats

IPFC Academy Pvt Ltd

Homework #12: Part I: Sec D: Cost Management - 1

1. Which one of the following items would not be considered a manufacturing cost?

1. a. Cream for an ice cream maker.

2. b. Sales commissions for a car manufacturer.

3. c. Plant property taxes for an ice cream maker.

4. d. Tires for an automobile manufacturer.

You have answered B which is Correct!

Correct answer b. Sales commissions on cars would be part of the cost of the car dealership, not the

manufacturer. Options a and d are direct material costs while option c would be charged to manufacturing

overhead.

2. Taylor Corporation is determining the cost behavior of several items in order to budget for the

upcoming year. Past trends have indicated the following dollars were spent at three different

levels of output.

Unit Levels

10,000 12,000 15,000

Cost A $25,000 $29,000 $35,000

Cost B 10,000 15,000 15,000

Cost C 15,000 18,000 22,500

In establishing a budget for 14,000 units, Taylor should treat Costs A, B, and C, respectively, as

a. semivariable, fixed, and variable.

b. variable, fixed, and variable.

c. semivariable, semivariable, and semivariable.

d. variable, semivariable, and semivariable.

You have answered A which is Correct!

Correct answer a. Cost A appears to be semi-variable or mixed as it varies between quantities but does not

vary consistently so a portion must be fixed and a portion variable. Cost B is fixed in the relevant range

(14,000 units) and Cost C varies consistently for all quantities and therefore must be variable.

3.Which one of the following refers to a cost that remains the same as the volume of activity

decreases within the relevant range?

a. Average cost per unit.

b. Variable cost per unit.

c. Unit fixed cost.

d. Total variable cost.

You have answered B which is Correct!

Correct answer b. The variable cost per unit would remain the same as the volume decreases. All other

costs listed would change with a change in volume.

4. Fowler Co. provides the following summary of its total budgeted production costs at

three production levels.

Volume in Units

1,000 1,500 2,000

Cost A $1,420 $2,130 $2,840

Cost B $1,550 $2,200 $2,900

Cost C $1,000 $1,000 $1,000

Cost D $1,630 $2,445 $3,260

The cost behavior of each of the Costs A through D, respectively, is

a. semi-variable, variable, fixed, and variable.

b. variable, semi-variable, fixed, and semi-variable.

c. variable, fixed, fixed, and variable.

d. variable, semi-variable, fixed, and variable.

You have answered D which is Correct!

Correct answer d. Cost A is variable as it is consistently $1.42 per unit for each quantity. Cost B

is semi-variable as it varies between quantities but not consistently so a portion must be fixed.

Cost C is fixed as it is the same for all quantities. Cost D, like Cost A, is variable at $1.63 per

unit.

5. Roberta Johnson is the manager of SleepWell Inn, one of a chain of motels located

throughout the United States. An example of an operating cost at SleepWell that is semivariable

is

a. the security guard’s salary.

b. electricity.

c. postage for reservation confirmations.

d. local yellow pages advertising.

You have answered B which is Correct!

Correct answer b. The cost of electricity could be semi-variable with a fixed monthly charge plus a per

unit charge for usage. All other costs listed are either fixed (a and d) or variable (c).

6. Indirect and common costs often make up a significant portion of the cost of a product. All of

the following are reasons for indirect cost allocation to cost objects except to

a. reduce total costs identified with products.

b. measure income and assets for external reporting purposes.

c. justify costs for reimbursement purposes.

d. provide information for economic decision making.

You have answered D which is Wrong

Correct answer a. The allocation of indirect costs to cost objects would increase total costs identified with products

rather than reduce total costs identified.

7. The relevant range refers to the activity levels over which

a. cost relationships hold constant.

b. costs fluctuate.

c. production varies.

d. relevant costs are incurred.

You have answered A which is Correct!

Correct answer a. The relevant range is the band of activity or volume over which certain cost relationships such as

fixed costs remain valid.

8. Cell Company has discovered that the cost of processing customer invoices is strictly variable

within the relevant range. Which one of the following statements concerning the cost of

processing customer invoices is incorrect?

a. The total cost of processing customer invoices will increase as the volume of customer

invoices increases.

b. The cost per unit for processing customer invoices will decline as the volume of customer

invoices increases.

c. The cost of processing the 100th customer invoice will be the same as the cost of processing

the first customer invoice.

d. The average cost per unit for processing a customer invoice will equal the incremental cost of

processing one more customer invoice.

You have answered B which is Correct!

Correct answer b. If a cost is strictly variable within the relevant range, the unit cost will be consistently the same

and will not increase or decrease with a change in volume.

9. When identifying fixed and variable costs, which one of the following is a typical assumption

concerning cost behavior?

a. General and administrative costs are assumed to be variable costs.

b. Cost behavior is assumed to be realistic for all levels of activity from zero to maximum

capacity.

c. Total costs are assumed to be linear when plotted on a graph.

d. The relevant time period is assumed to be five years.

You have answered B which is Wrong

Correct answer c. One of the basic assumptions of cost behavior is that a cost can be approximated by a linear cost

function within the relevant range. A linear cost function is one in which the graph of total costs versus the level of

activity is a straight line.

10. Lar Company has found that its total electricity cost has both a fixed component and a

variable component within the relevant range. The variable component seems to vary directly

with the number of units produced. Which one of the following statements concerning Lar’s

electricity cost is incorrect?

a. The total electricity cost will increase as production volume increases.

b. The total electricity cost per unit of production will increase as production volume increases.

c. The variable electricity cost per unit of production will remain constant as production volume

increases.

d. The fixed electricity cost per unit of production will decline as production volume increases.

You have answered B which is Correct!

Correct answer b. The variable per unit component of Lar’s electricity cost will remain

constant over the relevant range and not change with an increase or decrease in volume.

Summary of Performance in this Homework

Percentage score: 80

Remarks :Very Good, Keep this up

Take appropriate corrective actions based on the feedback. A student who attends all

classes, all homework and all mocks and scores just 30% on an average, will move to the 4th

hour of the exam with 95% probability. Those who receive low score, should think that they

have got a chance to become strong and use their time to remain focused towards the

learning objectives. They may have to give some more time for the whiteboard and excel

sheet revisions - which is the basic building block.

Regards,

Sushanta Bala

You might also like

- Chap 4 - CVP AnalysisDocument47 pagesChap 4 - CVP Analysiszyra liam styles93% (14)

- REviewer Cost AccountingDocument3 pagesREviewer Cost AccountingLorena Tuazon100% (1)

- Chapter 3-Predetermined Overhead Rates, Flexible Budgets, and Absorption/Variable CostingDocument32 pagesChapter 3-Predetermined Overhead Rates, Flexible Budgets, and Absorption/Variable Costingmonmon kimNo ratings yet

- Cost Quizlet 2Document7 pagesCost Quizlet 2agm25No ratings yet

- Test Bank - Mgt. Acctg 2 - CparDocument16 pagesTest Bank - Mgt. Acctg 2 - CparChristian Blanza LlevaNo ratings yet

- Macc ReviewerDocument13 pagesMacc ReviewerAnnabel SenitaNo ratings yet

- Cost Accounting Practice TestDocument27 pagesCost Accounting Practice Testaiswift100% (1)

- Quiz 4a Cost BehaviourDocument2 pagesQuiz 4a Cost BehaviourHồng UyênNo ratings yet

- MAS1Document1 pageMAS1Kendrew SujideNo ratings yet

- Chapter 03 TestbankDocument108 pagesChapter 03 TestbankanukshaNo ratings yet

- Quizzes in Cost AccountingDocument31 pagesQuizzes in Cost AccountingRicalyn BugarinNo ratings yet

- Activity Cost and AnalysisDocument40 pagesActivity Cost and AnalysisChan ChanNo ratings yet

- Cost Behavior: True / False QuestionsDocument13 pagesCost Behavior: True / False QuestionsNaddieNo ratings yet

- Quizzer Cost BehaviorDocument6 pagesQuizzer Cost BehaviorMark Ceddrick MioleNo ratings yet

- Acc102 FinalReviewDocument31 pagesAcc102 FinalReviewTiffany Beth CarltonNo ratings yet

- 03 x03 Activity Costs WPDocument21 pages03 x03 Activity Costs WPAzureBlazeNo ratings yet

- Chapter 6-Cost Concepts and Measurement: Multiple ChoiceDocument29 pagesChapter 6-Cost Concepts and Measurement: Multiple Choiceakash deepNo ratings yet

- Strategic Cost Management Final ExamDocument8 pagesStrategic Cost Management Final Examrizzamaybacarra.birNo ratings yet

- MAS Diagnostic ExamDocument10 pagesMAS Diagnostic ExamDanielNo ratings yet

- Cost Accounting 1-2 FinalDocument29 pagesCost Accounting 1-2 FinalChristian Blanza LlevaNo ratings yet

- BB 107 (Spring) Tutorial 6(s)Document4 pagesBB 107 (Spring) Tutorial 6(s)高雯蕙No ratings yet

- CVP AnalysisDocument5 pagesCVP AnalysisANo ratings yet

- 0 Out of 25 CorrectDocument18 pages0 Out of 25 CorrectMika Abucay ReyesNo ratings yet

- Answer2 TaDocument13 pagesAnswer2 TaJohn BryanNo ratings yet

- This Study Resource Was: Preliminary Examination in MANACO1Document7 pagesThis Study Resource Was: Preliminary Examination in MANACO1Sadile May KayeNo ratings yet

- 09 X07 C ResponsibilityDocument9 pages09 X07 C ResponsibilityAnjo PadillaNo ratings yet

- Cost Accounting Reviewer - 01Document8 pagesCost Accounting Reviewer - 01edmark.anclaNo ratings yet

- CVP - QuestionsDocument34 pagesCVP - QuestionsJasmine Bùi100% (1)

- Activity Based Costing TestbanksDocument18 pagesActivity Based Costing TestbanksCharlene MinaNo ratings yet

- StudentDocument71 pagesStudentDave GoNo ratings yet

- Midterm Examination: Cost AccountingDocument12 pagesMidterm Examination: Cost AccountingHardly Dare GonzalesNo ratings yet

- BreakevenDocument14 pagesBreakevenkay_kleirNo ratings yet

- Ch. 07 Practice MCDocument11 pagesCh. 07 Practice MCjohannaNo ratings yet

- Module 4Document14 pagesModule 4Queenie ValleNo ratings yet

- Answers Homework # 7 Performance Management IIDocument6 pagesAnswers Homework # 7 Performance Management IIRaman ANo ratings yet

- Philippine Christian University - Dasmarinas City, CaviteDocument3 pagesPhilippine Christian University - Dasmarinas City, CaviteAnie MartinezNo ratings yet

- ExercisesDocument8 pagesExercisesSTREAM EPIPHANYNo ratings yet

- Prelims Ms1Document6 pagesPrelims Ms1ALMA MORENANo ratings yet

- Midterm Exam AK PDFDocument19 pagesMidterm Exam AK PDFcarms balboaNo ratings yet

- Chapter 06 Cost Behaviour ADocument86 pagesChapter 06 Cost Behaviour Ajji100% (1)

- Module 4Document3 pagesModule 4Queenie ValleNo ratings yet

- Chap 4 CVP AnalysisDocument45 pagesChap 4 CVP AnalysisJessaNo ratings yet

- Cost Classification - Question BankDocument20 pagesCost Classification - Question BankTamaraNo ratings yet

- Managerial Economics QuestionnairesDocument26 pagesManagerial Economics QuestionnairesClyde SaladagaNo ratings yet

- 5 6235268602178568335Document45 pages5 6235268602178568335Maristella Gaton100% (1)

- University of Caloocan City Cost Accounting & Control Quiz No. 1Document8 pagesUniversity of Caloocan City Cost Accounting & Control Quiz No. 1Mikha SemañaNo ratings yet

- Cost Behavior AnalysisDocument2 pagesCost Behavior AnalysisJocelyn ManuyagNo ratings yet

- Quiz 1 SolutionDocument2 pagesQuiz 1 SolutionimagineimfNo ratings yet

- Introduction To Cost AccountingDocument8 pagesIntroduction To Cost AccountingJenny BernardinoNo ratings yet

- Practice Exam I-2024Document5 pagesPractice Exam I-2024juli BeckyNo ratings yet

- Module 4Document5 pagesModule 4NCTNo ratings yet

- ACC 115 - Chapter 21 Quiz - Cost Behavior and Cost-Volume-Profit AnalysisDocument3 pagesACC 115 - Chapter 21 Quiz - Cost Behavior and Cost-Volume-Profit AnalysisJoyNo ratings yet

- Cost Accounting: 6 EditionDocument27 pagesCost Accounting: 6 EditionGiannis SalaNo ratings yet

- TheoryDocument9 pagesTheoryprettyNo ratings yet

- Management Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageFrom EverandManagement Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageRating: 5 out of 5 stars5/5 (1)

- Finance for Non-Financiers 2: Professional FinancesFrom EverandFinance for Non-Financiers 2: Professional FinancesNo ratings yet

- Cost & Managerial Accounting II EssentialsFrom EverandCost & Managerial Accounting II EssentialsRating: 4 out of 5 stars4/5 (1)

- Management Accounting Strategy Study Resource for CIMA Students: CIMA Study ResourcesFrom EverandManagement Accounting Strategy Study Resource for CIMA Students: CIMA Study ResourcesNo ratings yet

- FPQP Practice Question Workbook: 1,000 Comprehensive Practice Questions (2024 Edition)From EverandFPQP Practice Question Workbook: 1,000 Comprehensive Practice Questions (2024 Edition)No ratings yet

- The Entrepreneur’S Dictionary of Business and Financial TermsFrom EverandThe Entrepreneur’S Dictionary of Business and Financial TermsNo ratings yet

- Answers Homework # 13 Cost MGMT 2Document6 pagesAnswers Homework # 13 Cost MGMT 2Raman ANo ratings yet

- Answers Homework # 17 Cost MGMT 6Document6 pagesAnswers Homework # 17 Cost MGMT 6Raman ANo ratings yet

- Answers Homework # 14 Cost MGMT 3Document9 pagesAnswers Homework # 14 Cost MGMT 3Raman ANo ratings yet

- Answers Homework # 15 Cost MGMT 4Document7 pagesAnswers Homework # 15 Cost MGMT 4Raman ANo ratings yet

- Answers Homework # 16 Cost MGMT 5Document7 pagesAnswers Homework # 16 Cost MGMT 5Raman ANo ratings yet

- Answers Homework # 20 - Financial Reporting IIDocument5 pagesAnswers Homework # 20 - Financial Reporting IIRaman ANo ratings yet

- Answers Homework # 21 - Financial Reporting III-CashflowDocument6 pagesAnswers Homework # 21 - Financial Reporting III-CashflowRaman ANo ratings yet

- Answers Homework # 18 Cost MGMT 7Document5 pagesAnswers Homework # 18 Cost MGMT 7Raman ANo ratings yet

- Feedback - MOCKP1A3Document21 pagesFeedback - MOCKP1A3Raman ANo ratings yet

- Feedback - MOCKP1C2Document18 pagesFeedback - MOCKP1C2Raman ANo ratings yet

- Feedback - MOCKP1B1Document24 pagesFeedback - MOCKP1B1Raman ANo ratings yet

- Answers Homework # 10 Performance Management IVDocument6 pagesAnswers Homework # 10 Performance Management IVRaman ANo ratings yet

- Feedback - MOCKP1DEDocument12 pagesFeedback - MOCKP1DERaman ANo ratings yet

- Answers Homework # 8 Performance Management IIDocument6 pagesAnswers Homework # 8 Performance Management IIRaman ANo ratings yet

- Answers Homework # 9 Performance Management III VariancesDocument6 pagesAnswers Homework # 9 Performance Management III VariancesRaman ANo ratings yet

- Answers Homework # 7 Performance Management IIDocument6 pagesAnswers Homework # 7 Performance Management IIRaman ANo ratings yet

- Answers Homework # 4 - BudgetingDocument7 pagesAnswers Homework # 4 - BudgetingRaman ANo ratings yet

- Answers Homework # 3 - BudgetingDocument5 pagesAnswers Homework # 3 - BudgetingRaman ANo ratings yet

- 2024-25 Fee StructureDocument1 page2024-25 Fee StructurefindinrafaNo ratings yet

- Chapter 7. Statistical Intervals For A Single SampleDocument102 pagesChapter 7. Statistical Intervals For A Single SampleNguyen Thi Lan Anh (K15 HL)No ratings yet

- Health Economics - Lecture Ch01Document16 pagesHealth Economics - Lecture Ch01Katherine SauerNo ratings yet

- Review Test Submission - Lecture 8 - Online Assignment - ..Document6 pagesReview Test Submission - Lecture 8 - Online Assignment - ..RishabhNo ratings yet

- Tools, Equipment in Food (Fish) ProcessingDocument61 pagesTools, Equipment in Food (Fish) ProcessingEdmar Anduzon Bustamante100% (2)

- SEERS Si500 Vs HeatPump - Case Study Centralized Hotel 30 RoomsDocument2 pagesSEERS Si500 Vs HeatPump - Case Study Centralized Hotel 30 RoomsAdvantron CorporationNo ratings yet

- Sample MTCDocument1 pageSample MTCheavens indiaNo ratings yet

- CGD Narrative ReportDocument2 pagesCGD Narrative ReportSherry GonzagaNo ratings yet

- ToR MONITORING AND EVALUATION SPECIALIST - May 2023 ENGDocument6 pagesToR MONITORING AND EVALUATION SPECIALIST - May 2023 ENGJoel FANTODJINo ratings yet

- Instrukcja Obslugi ADLER AD 7302Document60 pagesInstrukcja Obslugi ADLER AD 7302kosay52130No ratings yet

- STPDDocument9 pagesSTPDAmit GoelNo ratings yet

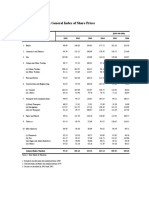

- Aggregate Incomes: QuestionsDocument17 pagesAggregate Incomes: QuestionsZulham IdahNo ratings yet

- Roofing WorkDocument20 pagesRoofing WorkAbdul Fatah MalikeNo ratings yet

- Ril Wear PlateDocument1 pageRil Wear Plateshindemitesh17No ratings yet

- SCInterestDocument6 pagesSCInterestJamaica MoralejaNo ratings yet

- Income From Capital Gain ProjecttDocument124 pagesIncome From Capital Gain ProjecttSAJIDA SHAIKH100% (1)

- Inventory Control ModelsDocument33 pagesInventory Control ModelsSahil TawdeNo ratings yet

- Rbi Assistant (Pre+mains)Document65 pagesRbi Assistant (Pre+mains)pranjan851No ratings yet

- CONTENT1Document4 pagesCONTENT1bhaskar sarmaNo ratings yet

- Hornet SpecDocument2 pagesHornet SpecFredyTThomasNo ratings yet

- CH 5Document103 pagesCH 5asmaNo ratings yet

- Img 20200115 0001Document1 pageImg 20200115 0001KIMBERLY BALISACANNo ratings yet

- Government of Maharashtra'sDocument19 pagesGovernment of Maharashtra'sVijaySarafNo ratings yet

- Chapter 4Document23 pagesChapter 4GHGFYGJNo ratings yet

- Manajemen Strategi (401A223) : Abdullah Sanusi, Se., Mba., PHDDocument21 pagesManajemen Strategi (401A223) : Abdullah Sanusi, Se., Mba., PHDpatricia modyNo ratings yet

- Oracle Subledger Accounting Method - Concept ExplainedDocument2 pagesOracle Subledger Accounting Method - Concept Explainedعبدالرحمن فؤادNo ratings yet

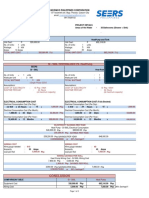

- Elect Bill DecDocument3 pagesElect Bill DecSafwan Abdul GafoorNo ratings yet

- 05 AC212 Lecture 5-Marginal Costing and Absorption Costing PDFDocument22 pages05 AC212 Lecture 5-Marginal Costing and Absorption Costing PDFsengpisalNo ratings yet

- Gen 261Document64 pagesGen 261luigiNo ratings yet