Professional Documents

Culture Documents

Indo Premier BISI - A Good Start This Year

Indo Premier BISI - A Good Start This Year

Uploaded by

KPH BaliCopyright:

Available Formats

You might also like

- Fundamentals of Corporate Finance Canadian 9th Edition Ross Solutions ManualDocument5 pagesFundamentals of Corporate Finance Canadian 9th Edition Ross Solutions ManualMarcusAndersonsftg100% (69)

- Experience With BRCsDocument33 pagesExperience With BRCsBalaraju DesuNo ratings yet

- Bumi Serpong Damai: Solid Marketing Sales AchievementDocument5 pagesBumi Serpong Damai: Solid Marketing Sales Achievementowen.rijantoNo ratings yet

- PP London Sumatra Indonesia: Equity ResearchDocument6 pagesPP London Sumatra Indonesia: Equity Researchkrisyanto krisyantoNo ratings yet

- Wijaya Karya: Healthiest Balance Sheet Among PeersDocument6 pagesWijaya Karya: Healthiest Balance Sheet Among PeersmidiakbaraNo ratings yet

- Company Update PT Wijaya Karya Beton T BUY: Superior 4Q18 Result - Attractive ValuationDocument4 pagesCompany Update PT Wijaya Karya Beton T BUY: Superior 4Q18 Result - Attractive Valuationkrisyanto krisyantoNo ratings yet

- Pembangunan Perumahan: Better in TimeDocument13 pagesPembangunan Perumahan: Better in TimeadetyarahmawanNo ratings yet

- Cummins - Q1FY16 Results Review 7aug15Document9 pagesCummins - Q1FY16 Results Review 7aug15HimanshuNo ratings yet

- Korea Investment & Sekuritas Indonesia CPIN - The Resilient IntegratorDocument8 pagesKorea Investment & Sekuritas Indonesia CPIN - The Resilient Integratorgo joNo ratings yet

- IP SILO Results Note 171101Document6 pagesIP SILO Results Note 171101gloridoroNo ratings yet

- India Infoline Limited (INDINF) : Next Delta Missing For Steep GrowthDocument24 pagesIndia Infoline Limited (INDINF) : Next Delta Missing For Steep Growthanu nitiNo ratings yet

- Mps LTD: Moderate Topline Growth, Margins Impacted Due To Stronger RupeeDocument6 pagesMps LTD: Moderate Topline Growth, Margins Impacted Due To Stronger RupeeAbhijit TripathiNo ratings yet

- N Amin - Summer 2020 BFII 7/4/2020: The Basics of Capital BudgetingDocument6 pagesN Amin - Summer 2020 BFII 7/4/2020: The Basics of Capital BudgetingMarium OwaisNo ratings yet

- N Amin - Summer 2020 BFII 7/4/2020: The Basics of Capital BudgetingDocument6 pagesN Amin - Summer 2020 BFII 7/4/2020: The Basics of Capital BudgetingMarium OwaisNo ratings yet

- Tanla Platform: Inline Performance With Strong Traction in Platform SegmentDocument7 pagesTanla Platform: Inline Performance With Strong Traction in Platform Segmentprateeksri10No ratings yet

- Supreme Industries: Margin Surprises PositivelyDocument12 pagesSupreme Industries: Margin Surprises Positivelysaran21No ratings yet

- Alembic Pharma - 4QFY19 - HDFC Sec-201905091034594285107Document10 pagesAlembic Pharma - 4QFY19 - HDFC Sec-201905091034594285107Ravikiran SuryanarayanamurthyNo ratings yet

- HDFC Sec Report On Vinati OrganicsDocument21 pagesHDFC Sec Report On Vinati Organicssujay85No ratings yet

- United Tractors BUY: Another Upgrade On Strong ResultsDocument6 pagesUnited Tractors BUY: Another Upgrade On Strong ResultsbenuNo ratings yet

- Jyothy Laboratories LTD Accumulate: Retail Equity ResearchDocument5 pagesJyothy Laboratories LTD Accumulate: Retail Equity Researchkishor_warthi85No ratings yet

- Investor Digest: Equity Research - 20 March 2019Document8 pagesInvestor Digest: Equity Research - 20 March 2019Rising PKN STANNo ratings yet

- Icici Sec Berger PaintsDocument6 pagesIcici Sec Berger PaintsvenugopallNo ratings yet

- Jasa Marga: Equity ResearchDocument7 pagesJasa Marga: Equity ResearchKhorbina SiregarNo ratings yet

- Intp 080318Document3 pagesIntp 080318Cristiano DonzaghiNo ratings yet

- UPL Company Update - 030520 - Emkay PDFDocument15 pagesUPL Company Update - 030520 - Emkay PDFshaikhsaadahmedNo ratings yet

- BUY Avenue Supermarts: Strong Result Maintain Our Investment ThesisDocument9 pagesBUY Avenue Supermarts: Strong Result Maintain Our Investment ThesisjigarchhatrolaNo ratings yet

- Wijaya Karya Beton: A Bit Slow StartDocument10 pagesWijaya Karya Beton: A Bit Slow StartSugeng YuliantoNo ratings yet

- Ascendas Reit - : Growing Its Portfolio InorganicallyDocument4 pagesAscendas Reit - : Growing Its Portfolio InorganicallyphuawlNo ratings yet

- Vinati Organics: Newer Businesses To Drive Growth AheadDocument6 pagesVinati Organics: Newer Businesses To Drive Growth AheadtamilNo ratings yet

- Research Report Maruti Suzuki Ltd.Document8 pagesResearch Report Maruti Suzuki Ltd.Harshavardhan pasupuletiNo ratings yet

- Ciptadana Sekuritas AALI - 1H20 Earnings Beat ExpectationDocument6 pagesCiptadana Sekuritas AALI - 1H20 Earnings Beat ExpectationHamba AllahNo ratings yet

- Matahari Department Store: Equity ResearchDocument6 pagesMatahari Department Store: Equity Researchkrisyanto krisyantoNo ratings yet

- Summary of Financial Statements For Fiscal 2019Document24 pagesSummary of Financial Statements For Fiscal 2019Obisike EmeziNo ratings yet

- Ciptadana Sekuritas PTPP - Lower TP Post Weak ResultsDocument6 pagesCiptadana Sekuritas PTPP - Lower TP Post Weak ResultsKPH BaliNo ratings yet

- Ciptadana Sekuritas KINO - Key Takeaways From MeetingDocument3 pagesCiptadana Sekuritas KINO - Key Takeaways From Meetingbudi handokoNo ratings yet

- Ciptadana Sekuritas ASRI - Growing Recurring IncomeDocument6 pagesCiptadana Sekuritas ASRI - Growing Recurring Incomebudi handokoNo ratings yet

- Care Ratings-Paints Industry Analysis-2017Document12 pagesCare Ratings-Paints Industry Analysis-2017rchawdhry123No ratings yet

- Traders Club - Nov. 21Document5 pagesTraders Club - Nov. 21Peter ErnstNo ratings yet

- Earnings and GDP Drive PCOMP Higher: Week in ReviewDocument2 pagesEarnings and GDP Drive PCOMP Higher: Week in ReviewAhwen 'ahwenism'No ratings yet

- On Track: Bison ConsolidatedDocument9 pagesOn Track: Bison ConsolidatedJOHN SKILLNo ratings yet

- BPI AnalysisDocument8 pagesBPI AnalysisDave Umeran0% (1)

- IDirect PrimaPlastics CoUpdate Jun19Document4 pagesIDirect PrimaPlastics CoUpdate Jun19Alokesh PhukanNo ratings yet

- Indo Premier RALS - Stronger Lebaran 2018 SalesDocument5 pagesIndo Premier RALS - Stronger Lebaran 2018 SalesTanjung YanugrohoNo ratings yet

- Bank Central Asia: Steady Albeit Moderating GrowthDocument6 pagesBank Central Asia: Steady Albeit Moderating GrowthNathanNo ratings yet

- London Sumatra Indonesia TBK: Still Positive But Below ExpectationDocument7 pagesLondon Sumatra Indonesia TBK: Still Positive But Below ExpectationHamba AllahNo ratings yet

- Leong Hup International BHD: TP: RM1.43Document3 pagesLeong Hup International BHD: TP: RM1.43KeyaNo ratings yet

- Investor Digest: Equity Research - 28 March 2019Document9 pagesInvestor Digest: Equity Research - 28 March 2019Rising PKN STANNo ratings yet

- Leong Hup International: Rules The Roost in Poultry IndustryDocument17 pagesLeong Hup International: Rules The Roost in Poultry IndustryKeyaNo ratings yet

- Vodafone Group PLC: DisclaimerDocument17 pagesVodafone Group PLC: DisclaimerTawfiq4444No ratings yet

- Indopremier Company Update SIDO 5 Mar 2024 Reiterate Buy HigherDocument7 pagesIndopremier Company Update SIDO 5 Mar 2024 Reiterate Buy Higherprima.brpNo ratings yet

- Shriram Transport Finance: CMP: INR1,043 Growth DeceleratingDocument14 pagesShriram Transport Finance: CMP: INR1,043 Growth DeceleratingDarshitNo ratings yet

- Barito Pacific: Continuous ImprovementDocument6 pagesBarito Pacific: Continuous ImprovementI Nyoman Sujana GiriNo ratings yet

- Motilal Oswal May 2020Document8 pagesMotilal Oswal May 2020BINNo ratings yet

- (Andy Maslen) 100 Great Copywriting Ideas From LeDocument6 pages(Andy Maslen) 100 Great Copywriting Ideas From LeRio PrihantoNo ratings yet

- Tata Consultancy Services LTD.: Result UpdateDocument7 pagesTata Consultancy Services LTD.: Result UpdateanjugaduNo ratings yet

- 2019 Q1 CushWake Jakarta IndustrialDocument2 pages2019 Q1 CushWake Jakarta IndustrialCookiesNo ratings yet

- Margin Concerns Should Take Precedence Over Improved OutlookDocument15 pagesMargin Concerns Should Take Precedence Over Improved Outlookashok yadavNo ratings yet

- Suherman Santikno - IndoPremier Equity Research - Bank Bumi Arta IndonesiaDocument28 pagesSuherman Santikno - IndoPremier Equity Research - Bank Bumi Arta Indonesiasuherman santiknoNo ratings yet

- Sun Pharma: CMP: INR574 TP: INR675 (+18%)Document10 pagesSun Pharma: CMP: INR574 TP: INR675 (+18%)rishab agarwalNo ratings yet

- Maruti Suzuki: Healthy Realisations Provide Operating Boost BUY'Document5 pagesMaruti Suzuki: Healthy Realisations Provide Operating Boost BUY'SIDNo ratings yet

- Aarti Industries - 1QFY19 RU - KR ChokseyDocument7 pagesAarti Industries - 1QFY19 RU - KR ChokseydarshanmaldeNo ratings yet

- Ciptadana Sekuritas PTPP - Lower TP Post Weak ResultsDocument6 pagesCiptadana Sekuritas PTPP - Lower TP Post Weak ResultsKPH BaliNo ratings yet

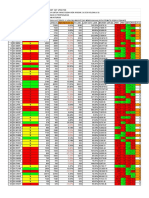

- Semua Data Berdasarkan Data Rti Business Kecuali Last Price, 1Y Low, Dan Market Cap Menggunakan Data Otomatis Google FinanceDocument1 pageSemua Data Berdasarkan Data Rti Business Kecuali Last Price, 1Y Low, Dan Market Cap Menggunakan Data Otomatis Google FinanceKPH BaliNo ratings yet

- ATS - Daily Trading Plan 15maret2019Document1 pageATS - Daily Trading Plan 15maret2019KPH BaliNo ratings yet

- Semua Data Berdasarkan Data Rti Business Kecuali Last Price, 1Y Low, Dan Market Cap Menggunakan Data Otomatis Google FinanceDocument1 pageSemua Data Berdasarkan Data Rti Business Kecuali Last Price, 1Y Low, Dan Market Cap Menggunakan Data Otomatis Google FinanceKPH BaliNo ratings yet

- Semua Data Berdasarkan Data Hots Mirae Kecuali Last Price, 1Y Low, Dan Market Cap Menggunakan Data Otomatis Google FinanceDocument1 pageSemua Data Berdasarkan Data Hots Mirae Kecuali Last Price, 1Y Low, Dan Market Cap Menggunakan Data Otomatis Google FinanceKPH BaliNo ratings yet

- Semua Data Berdasarkan Data Hots Mirae Kecuali Last Price, 1Y Low, Dan Market Cap Menggunakan Data Otomatis Google FinanceDocument1 pageSemua Data Berdasarkan Data Hots Mirae Kecuali Last Price, 1Y Low, Dan Market Cap Menggunakan Data Otomatis Google FinanceKPH BaliNo ratings yet

- MNCN Investor Release FY 2018Document5 pagesMNCN Investor Release FY 2018KPH BaliNo ratings yet

- Ciptadana Sekuritas SILO - Results Update FY18 - Healthy Operations To Support Long Term GrowthDocument9 pagesCiptadana Sekuritas SILO - Results Update FY18 - Healthy Operations To Support Long Term GrowthKPH BaliNo ratings yet

- Weekly Flash Opportunity Accor Indonesia 12032019Document9 pagesWeekly Flash Opportunity Accor Indonesia 12032019KPH BaliNo ratings yet

- Ciptadana Sekuritas PPRO - Company Update - Rapid Growth Through Innovative StrategyDocument8 pagesCiptadana Sekuritas PPRO - Company Update - Rapid Growth Through Innovative StrategyKPH BaliNo ratings yet

- ATS - Daily Trading Plan 8januari2019Document1 pageATS - Daily Trading Plan 8januari2019KPH BaliNo ratings yet

- ATS Active Trader v2.7 Trading System: TELEGRAM ChannelDocument1 pageATS Active Trader v2.7 Trading System: TELEGRAM ChannelKPH BaliNo ratings yet

- ATS - Daily Trading Plan 14januari2019Document1 pageATS - Daily Trading Plan 14januari2019KPH BaliNo ratings yet

- Bedah Saham Road To Investor Gathering 2019Document35 pagesBedah Saham Road To Investor Gathering 2019KPH BaliNo ratings yet

- ATS - Daily Trading Plan 6februari2019Document1 pageATS - Daily Trading Plan 6februari2019KPH BaliNo ratings yet

- ATS Active Trader v2.7 Trading System: TELEGRAM ChannelDocument1 pageATS Active Trader v2.7 Trading System: TELEGRAM ChannelKPH BaliNo ratings yet

- ATS Active Trader v2.7 Trading System: TELEGRAM ChannelDocument1 pageATS Active Trader v2.7 Trading System: TELEGRAM ChannelKPH BaliNo ratings yet

- ATS Active Trader v2.7 Trading System: TELEGRAM ChannelDocument1 pageATS Active Trader v2.7 Trading System: TELEGRAM ChannelKPH BaliNo ratings yet

- ATS - Daily Trading Plan 4april2019Document1 pageATS - Daily Trading Plan 4april2019KPH BaliNo ratings yet

- ATS Active Trader v2.7 Trading System: Happy New Year 2019Document1 pageATS Active Trader v2.7 Trading System: Happy New Year 2019KPH BaliNo ratings yet

- ATS Active Trader v2.7 Trading System: ATS - Daily Stocks ExplorationDocument1 pageATS Active Trader v2.7 Trading System: ATS - Daily Stocks ExplorationKPH BaliNo ratings yet

- ATS Active Trader v2.7 Trading System: TELEGRAM ChannelDocument1 pageATS Active Trader v2.7 Trading System: TELEGRAM ChannelKPH BaliNo ratings yet

- ATS Active Trader v2.7 Trading System: TELEGRAM ChannelDocument1 pageATS Active Trader v2.7 Trading System: TELEGRAM ChannelKPH BaliNo ratings yet

- ATS Active Trader v2.7 Trading System: TELEGRAM ChannelDocument1 pageATS Active Trader v2.7 Trading System: TELEGRAM ChannelKPH BaliNo ratings yet

- ATS Active Trader v2.7 Trading System: TELEGRAM ChannelDocument1 pageATS Active Trader v2.7 Trading System: TELEGRAM ChannelKPH BaliNo ratings yet

- ATS Active Trader v2.7 Trading System: Happy New Year 2019Document1 pageATS Active Trader v2.7 Trading System: Happy New Year 2019KPH BaliNo ratings yet

- ATS Active Trader v2.7 Trading System: TELEGRAM ChannelDocument1 pageATS Active Trader v2.7 Trading System: TELEGRAM ChannelKPH BaliNo ratings yet

- ATS Active Trader v2.7 Trading System: Happy New Year 2019Document1 pageATS Active Trader v2.7 Trading System: Happy New Year 2019KPH BaliNo ratings yet

- ATS Active Trader v2.7 Trading System: TELEGRAM ChannelDocument1 pageATS Active Trader v2.7 Trading System: TELEGRAM ChannelKPH BaliNo ratings yet

- Becc 103 em 2023 24 KPDocument17 pagesBecc 103 em 2023 24 KPGourav SealNo ratings yet

- Instant Download Test Bank For Acquiring Medical Language 2nd Edition by Jones PDF ScribdDocument32 pagesInstant Download Test Bank For Acquiring Medical Language 2nd Edition by Jones PDF Scribdallennguyenexqjnzbkyf100% (20)

- Budget Speech 2009-10 by FM Surendra PandeyDocument50 pagesBudget Speech 2009-10 by FM Surendra PandeyChandan SapkotaNo ratings yet

- Growth Analysis: EPS Net Profit After Tax Preference Share Dividend Number of Ordinary Shares OutstandingDocument5 pagesGrowth Analysis: EPS Net Profit After Tax Preference Share Dividend Number of Ordinary Shares OutstandingRaveena RakhraNo ratings yet

- Case: The European Union's Challenges - 4pts Each (1-5)Document2 pagesCase: The European Union's Challenges - 4pts Each (1-5)Mark OroNo ratings yet

- Fare Payable: Fare Payable: 1515Document1 pageFare Payable: Fare Payable: 1515Balamurugan JPNo ratings yet

- KPPP PortalDocument3 pagesKPPP PortalV doNo ratings yet

- (Intl Investment) Chapter 2 FDIDocument74 pages(Intl Investment) Chapter 2 FDIJane VickyNo ratings yet

- State Bank of India 2Document2 pagesState Bank of India 2Avnish YadavNo ratings yet

- MR Ade Kurniawan AnsharDocument2 pagesMR Ade Kurniawan Ansharandi anugrahNo ratings yet

- Engineering Economics 2Document65 pagesEngineering Economics 2Muktar JemalNo ratings yet

- Foreign Currency TranslationDocument38 pagesForeign Currency TranslationAnmol GulatiNo ratings yet

- ED 241 - Contemporary National DevelopmentDocument9 pagesED 241 - Contemporary National DevelopmentAlmera Mejorada - Paman100% (1)

- Villa Moroccan by Dago Gallery - Villas For Rent in Kecamatan Cimenyan, Jawa Barat, Indonesia - AirbnbDocument7 pagesVilla Moroccan by Dago Gallery - Villas For Rent in Kecamatan Cimenyan, Jawa Barat, Indonesia - AirbnbKeena TariganNo ratings yet

- Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument30 pagesDate Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing Balancemayur ahirNo ratings yet

- MAC2 W4 CH13 SolutionsDocument39 pagesMAC2 W4 CH13 Solutionsshaileen priscoNo ratings yet

- Chapter 9-Guided Reading NotesDocument5 pagesChapter 9-Guided Reading NotesVicky CuiNo ratings yet

- Dimensions of Globalization: TopicDocument4 pagesDimensions of Globalization: TopicMian AbdullahNo ratings yet

- InvoiceDocument1 pageInvoiceManishNo ratings yet

- Exchange Rates and International TradeDocument51 pagesExchange Rates and International TradeĐào Minh NgọcNo ratings yet

- Airtel Bill - JunDocument5 pagesAirtel Bill - JunSaravanan GuruNo ratings yet

- Team TreesDocument12 pagesTeam Treesjakaro dejongNo ratings yet

- August 16, 2019 Strathmore TimesDocument19 pagesAugust 16, 2019 Strathmore TimesStrathmore TimesNo ratings yet

- AGMARKDocument10 pagesAGMARKAnkit SharmaNo ratings yet

- Sberbank Rossii: Account StatementDocument3 pagesSberbank Rossii: Account StatementALEX PEREVERZEWNo ratings yet

- Engineering Econ - InterestDocument37 pagesEngineering Econ - InterestNikolai VillegasNo ratings yet

- Rifandy Elfransyah 185120407121041 KewirausahaanDocument2 pagesRifandy Elfransyah 185120407121041 KewirausahaanMuhammad FarhanNo ratings yet

- 연습문제 (영어) 2Document8 pages연습문제 (영어) 29dm9h2s48kNo ratings yet

Indo Premier BISI - A Good Start This Year

Indo Premier BISI - A Good Start This Year

Uploaded by

KPH BaliOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Indo Premier BISI - A Good Start This Year

Indo Premier BISI - A Good Start This Year

Uploaded by

KPH BaliCopyright:

Available Formats

02 May 2019

Bisi International (BISI IJ)

Results Note

BUY (Unchanged)

Stock Data A good start this year

Target price (Rp) Rp1,750

Earnings increased 129% yoy in 1Q19.

Equity | Indonesia | Commodities

Prior TP (Rp) Rp1,750

Shareprice (Rp) Rp1,505 BISI’s inventory remained high to mitigate bad weather risks.

Upside/downside (%) +16.3 Margin to improve as corn seed demand remained increasing.

Sharesoutstanding (m) 3,000 Maintain Buy rating with 16% to TP of Rp1,750.

Marketcap. (US$ m) 317

Free float (%) 45.9 Good results in 1Q19. BISI recorded net profit of Rp75.2bn in 1Q19, down 55%

Avg. 6m dailyT/O (US$ m) 0.0 qoq (due to high base in 4Q18) but jumped 129% yoy, accounting for 16% of

consensus and our forecast for FY19F. Historically, BISI posted 60%-70% of its

Price Performance

earnings in 2Q and 3Q. Thus, we see these results inline with our estimate.

3M 6M 12M Operating profit reached Rp90bn in 1Q19, down 55% qoq but jumped 204% yoy,

Absolute (%) 4.5 3.8 -21.2 accounting for 16% of the consensus and 15% of our forecast for FY19F. Note

Relative to JCI (%) 7.0 -3.9 -29.1 that last year, BISI’s operating profit in 1Q18 represent only 6% of total operating

profit in FY18. BISI recorded lower revenues of Rp554bn in 1Q19, down 23% qoq

52w high/low (Rp) 1,925 - 1,350

but up 15% yoy to, accounting for 22% of our and consensus’ forecasts for

115 FY19F.

110

105

100 BISI maintained high inventory to mitigate bad weather risk. BISI

95

90 maintained its high inventory level of Rp1.06tn in 1Q19 to anticipate bad weather

85 risks. Last year, BISI recorded poor performance in 1H18 as production fell due to

80

75 bad weather. Despite the company managed to catch up production in 2H18, it

70 missed the opportunity to sell higher volumes in the first corn planting season

Oct-18

Mar-19

May-18

May-18

Jun-18

Jul-18

Jul-18

Jan-19

Jan-19

Aug-18

Sep-18

Sep-18

Nov-18

Nov-18

Dec-18

Apr-19

Apr-19

Feb-19

which occurs usually in the second quarter. Thus, BISI decided to improve its

BISI-Rebase JCI Index-Rebase inventory level in Dec’18 to anticipate bad weather risks earlier this year. These

inventories would help BISI to capture the opportunity to sell high volumes in

Major Shareholders April-June planting season despite possible low productivity if bad weather occurs.

Agrindo Pratama 31.0%

Midsummer Corp 23.1% Margin to improve as demand would remain high. We forecast BISI would

book revenues growth of 11% yoy in FY19F which would allow margins to improve

given the nature of corn seed business which has high operating leverage. We

Estimate Change; Vs. Consensus

forecast BISI’s gross margin would increase to 41.6% in FY19F (from 37.9% in

2019F 2020F FY18) with operating margin of 24.6% (vs. FY18: 22%). Corn seed demand would

Latest EPS (Rp) 154 174 remain improving on the back of government seed provision program. Even after

Vs. Prior EPS (%) 0.0 0.0 the seed provisioning program ended, we believe traditional farmers which

Vs. Consensus (%) 1.0 2.1 previously obtained corn seed from the government, would become the new

customers of BISI’s corn seed due to the experience of higher production yield.

Source: Bloomberg

Maintain Buy with 16% potential upside to unchanged TP of Rp1,750. We

maintain our Buy recommendation for BISI with 16% potential upside to our

unchanged DCF-based (WACC: 13.1%; TG: 4%) target price of Rp1,750. Our TP

implies FY19F-20F P/E of 11.4x-10.1x, respectively.

Year To 31 Dec 2017A 2018A 2019F 2020F 2021F

Revenue (RpBn) 2,310 2,266 2,506 2,826 3,211

EBITDA (RpBn) 524 516 604 682 769

EBITDA Growth (%) 10.9 (1.5) 17.2 12.9 12.7

Net Profit (RpBn) 403 404 462 521 587

EPS (Rp) 134 135 154 174 196

EPS Growth (%) 19.9 0.2 14.4 12.8 12.7

Net Gearing (%) (22.1) 0.2 (27.6) (30.7) (32.4)

PER (x) 11.2 11.2 9.8 8.7 7.7

Frederick Daniel Tanggela PBV (x) 2.1 2.0 1.7 1.5 1.4

PT Indo Premier Sekuritas Dividend Yield (%) 5.8 6.6 3.6 4.1 4.6

frederick.daniel@ipc.co.id EV/EBITDA (x) 9.5 8.7 8.7 7.9 7.3

+62 21 5793 1170 Source: BISI, IndoPremier Share Price Closing as of : 02-May-2019

Refer to Important disclosures in the last page of this report

BISI IJ Results Note

Fig. 1: Rainfall in February 2019 Fig. 2: Revenue breakdown (Rp Bn)

corn seed fruit & vegie rice seed fertilizer & pesticide other

3,500 3,211

3,000 2,826

2,506

2,500 2,311 2,266

1,852

2,000

1,438

1,500

1,000

500

-

2015 2016 2017 2018 2019F 2020F 2021F

Source: BMKG Source: BISI, IndoPremier

Fig. 3: Revenue breakdown Fig. 4: Corn seed sales volumes (k tons)

2018

50

other, 2% 43.1

40 37.5

32.6

pesticide, 33%

30 28.3

26.7

18.6

20

corn seed, 55% 14.3

10

horticulture

seed, 10% -

2015 2016 2017 2018 2019F 2020F 2021F

Source: BISI, IndoPremier Source: BISI, IndoPremier

Fig. 5: Corn seed sales (Rp Bn) Fig. 6: Pesticide sales (Rp Bn)

2500

1,200

1,951 941 969

2000 1,000 914 913

1,601 776

800 756

1500 1,300 1,313

1,166 568

600

1000 816

599 400

500

200

0 -

2015 2016 2017 2018 2019F 2020F 2021F 2015 2016 2017F 2018 2019F 2020F 2021F

Source: BISI, IndoPremier Source: BISI, IndoPremier

Refer to Important disclosures in the last page of this report 2

BISI IJ Results Note

Fig. 7: 1Q19 results summary table

(Rp Bn) 1Q19 1Q18 % Y-Y 1Q19 % Q-Q % Y-Y vs. cons (%) vs. ours (%)

Revenues 554.4 483.2 14.7 554.4 (22.7) 14.7 22.1 22.1

COGS 403.7 397.2 1.6 403.7 7.9 1.6

Gross profit 150.7 86.0 75.3 150.7 (56.1) 75.3 14.5 14.4

G&A expenses 25.4 17.9 42.1 25.4 (51.5) 42.1

Selling expenses 35.4 38.5 (8.0) 35.4 (61.0) (8.0)

Operating profit 89.9 29.6 203.9 89.9 (55.1) 203.9 15.9 14.6

Net interest inc. (exp) (1.6) 3.7 nm (1.6) nm nm

Forex gain (loss) 0.8 (0.2) nm 0.8 (7.7) (589.3)

Other 7.4 9.5 (22.4) 7.4 (27.8) (22.4)

Pretax profit 96.5 42.6 126.4 96.5 (54.2) 126.4 15.5 15.5

Tax 21.2 9.8 117.1 21.2 (50.1) 117.1

Minority Interest 0.0 0.0 20.0 0.0 50.0 20.0

Net profit 75.2 32.8 129.2 75.2 (55.3) 129.2 16.3 16.3

GPM (%) 27.2 17.8 27.2

OPM (%) 16.2 6.1 16.2

Pretax mgn (%) 17.4 8.8 17.4

NPM (%) 13.6 6.8 13.6

Source: BISI, IndoPremier

Refer to Important disclosures in the last page of this report 3

BISI IJ Results Note

Year To 31 Dec (RpBn) 2017A 2018A 2019F 2020F 2021F

Income Statement

Net Revenue 2,310 2,266 2,506 2,826 3,211

Cost of Sales (1,430) (1,407) (1,462) (1,649) (1,878)

Gross Profit 880 859 1,043 1,178 1,333

SG&A Expenses (391) (378) (478) (539) (612)

Operating Profit 489 481 565 639 721

Net Interest 18 8 8 8 8

Forex Gain (Loss) 0 0 0 0 0

Others-Net 11 17 51 58 65

Pre-Tax Income 519 505 624 704 794

Income Tax (116) (102) (162) (183) (206)

Minorities 0 0 0 0 0

Net Income 403 404 462 521 587

Balance Sheet

Cash & Equivalent 536 94 719 904 1,076

Receivable 833 929 968 1,014 1,153

Inventory 634 1,112 681 768 823

Other Current Assets 39 32 34 38 43

Total Current Assets 2,042 2,168 2,401 2,724 3,095

Fixed Assets - Net 512 499 549 604 664

Goodwill 0 0 0 0 0

Non Current Assets 35 60 24 27 31

Total Assets 2,622 2,765 3,029 3,417 3,860

ST Loans 50 100 0 0 0

Payable 139 69 0 181 206

Other Payables 173 227 198 222 253

Current Portion of LT Loans 0 0 0 0 0

Total Current Liab. 362 395 358 403 458

Long Term Loans 0 0 0 0 0

Other LT Liab. 60 60 66 73 81

Total Liabilities 422 455 424 476 540

Equity 405 405 400 400 400

Retained Earnings 1,795 1,905 2,205 2,541 2,920

Minority Interest 0 0 0 0 0

Total SHE + Minority Int. 2,200 2,310 2,605 2,941 3,321

Total Liabilities & Equity 2,622 2,765 3,029 3,417 3,860

Source: BISI, IndoPremier

Refer to Important disclosures in the last page of this report 4

BISI IJ Results Note

Year to 31 Dec 2017A 2018A 2019F 2020F 2021F

Cash Flow

Net Income (Excl.Extraordinary&Min.Int) 403 404 462 521 588

Depr. & Amortization 22 33 33 36 40

Changes in Working Capital 196 (644) 491 (99) (152)

Others (17) (25) 40 (42) (1)

Cash Flow From Operating 604 (232) 1,026 416 475

Capital Expenditure (234) (45) (46) (94) (104)

Others 19 9 9 9 9

Cash Flow From Investing (216) (36) (37) (85) (95)

Loans 50 50 (100) 0 0

Equity 0 0 0 0 0

Dividends (264) (300) (162) (185) (208)

Others 0 (1) (7) (1) (1)

Cash Flow From Financing (214) (251) (269) (186) (209)

Changes in Cash 175 (519) 720 145 170

Financial Ratios

Gross Margin (%) 38.1 37.9 41.6 41.7 41.5

Operating Margin (%) 21.2 21.2 22.6 22.6 22.4

Pre-Tax Margin (%) 22.5 22.3 24.9 24.9 24.7

Net Margin (%) 17.5 17.8 18.4 18.4 18.3

ROA (%) 16.0 15.0 15.9 16.2 16.1

ROE (%) 18.9 17.9 18.8 18.8 18.8

ROIC (%) 19.3 17.7 18.8 19.1 19.1

Acct. Receivables TO (days) 140.5 141.7 137.6 127.1 122.2

Acct. Receivables - Other TO (days) 0.3 0.3 0.6 0.9 0.9

Inventory TO (days) 2.2 1.6 1.6 2.3 2.4

Payable TO (days) 33.3 26.9 28.6 37.7 37.6

Acct. Payables - Other TO (days) 9.4 10.0 11.6 12.3 12.2

Debt to Equity (%) 2.3 4.3 0.0 0.0 0.0

Interest Coverage Ratio (x) 0.0 0.0 0.0 0.0 0.0

Net Gearing (%) (22.1) 0.2 (27.6) (30.7) (32.4)

Source: BISI, IndoPremier

Refer to Important disclosures in the last page of this report 5

Head Office

PT INDO PREMIER SEKURITAS

Wisma GKBI 7/F Suite 718

Jl. Jend. Sudirman No.28

Jakarta 10210 - Indonesia

p +62.21.5793.1168

f +62.21.5793.1167

INVESTMENT RATINGS

BUY : Expected total return of 10% or more within a 12-month period

HOLD : Expected total return between -10% and 10% within a 12-month period

SELL : Expected total return of -10% or worse within a 12-month period

ANALYSTS CERTIFICATION.

The views expressed in this research report accurately reflect the analysts personal views about any and all of the subject securities or issuers; and no part of the

research analyst's compensation was, is, or will be, directly or indirectly, related to the specific recommendations or views expressed in the report.

DISCLAIMERS

This research is based on information obtained from sources believed to be reliable, but we do not make any representation or warranty nor accept any

responsibility or liability as to its accuracy, completeness or correctness. Opinions expressed are subject to change without notice. This document is prepared for

general circulation. Any recommendations contained in this document does not have regard to the specific investment objectives, financial situation and the

particular needs of any specific addressee. This document is not and should not be construed as an offer or a solicitation of an offer to purchase or subscribe or

sell any securities. PT. Indo Premier Sekuritas or its affiliates may seek or will seek investment banking or other business relationships with the companies in this

report.

You might also like

- Fundamentals of Corporate Finance Canadian 9th Edition Ross Solutions ManualDocument5 pagesFundamentals of Corporate Finance Canadian 9th Edition Ross Solutions ManualMarcusAndersonsftg100% (69)

- Experience With BRCsDocument33 pagesExperience With BRCsBalaraju DesuNo ratings yet

- Bumi Serpong Damai: Solid Marketing Sales AchievementDocument5 pagesBumi Serpong Damai: Solid Marketing Sales Achievementowen.rijantoNo ratings yet

- PP London Sumatra Indonesia: Equity ResearchDocument6 pagesPP London Sumatra Indonesia: Equity Researchkrisyanto krisyantoNo ratings yet

- Wijaya Karya: Healthiest Balance Sheet Among PeersDocument6 pagesWijaya Karya: Healthiest Balance Sheet Among PeersmidiakbaraNo ratings yet

- Company Update PT Wijaya Karya Beton T BUY: Superior 4Q18 Result - Attractive ValuationDocument4 pagesCompany Update PT Wijaya Karya Beton T BUY: Superior 4Q18 Result - Attractive Valuationkrisyanto krisyantoNo ratings yet

- Pembangunan Perumahan: Better in TimeDocument13 pagesPembangunan Perumahan: Better in TimeadetyarahmawanNo ratings yet

- Cummins - Q1FY16 Results Review 7aug15Document9 pagesCummins - Q1FY16 Results Review 7aug15HimanshuNo ratings yet

- Korea Investment & Sekuritas Indonesia CPIN - The Resilient IntegratorDocument8 pagesKorea Investment & Sekuritas Indonesia CPIN - The Resilient Integratorgo joNo ratings yet

- IP SILO Results Note 171101Document6 pagesIP SILO Results Note 171101gloridoroNo ratings yet

- India Infoline Limited (INDINF) : Next Delta Missing For Steep GrowthDocument24 pagesIndia Infoline Limited (INDINF) : Next Delta Missing For Steep Growthanu nitiNo ratings yet

- Mps LTD: Moderate Topline Growth, Margins Impacted Due To Stronger RupeeDocument6 pagesMps LTD: Moderate Topline Growth, Margins Impacted Due To Stronger RupeeAbhijit TripathiNo ratings yet

- N Amin - Summer 2020 BFII 7/4/2020: The Basics of Capital BudgetingDocument6 pagesN Amin - Summer 2020 BFII 7/4/2020: The Basics of Capital BudgetingMarium OwaisNo ratings yet

- N Amin - Summer 2020 BFII 7/4/2020: The Basics of Capital BudgetingDocument6 pagesN Amin - Summer 2020 BFII 7/4/2020: The Basics of Capital BudgetingMarium OwaisNo ratings yet

- Tanla Platform: Inline Performance With Strong Traction in Platform SegmentDocument7 pagesTanla Platform: Inline Performance With Strong Traction in Platform Segmentprateeksri10No ratings yet

- Supreme Industries: Margin Surprises PositivelyDocument12 pagesSupreme Industries: Margin Surprises Positivelysaran21No ratings yet

- Alembic Pharma - 4QFY19 - HDFC Sec-201905091034594285107Document10 pagesAlembic Pharma - 4QFY19 - HDFC Sec-201905091034594285107Ravikiran SuryanarayanamurthyNo ratings yet

- HDFC Sec Report On Vinati OrganicsDocument21 pagesHDFC Sec Report On Vinati Organicssujay85No ratings yet

- United Tractors BUY: Another Upgrade On Strong ResultsDocument6 pagesUnited Tractors BUY: Another Upgrade On Strong ResultsbenuNo ratings yet

- Jyothy Laboratories LTD Accumulate: Retail Equity ResearchDocument5 pagesJyothy Laboratories LTD Accumulate: Retail Equity Researchkishor_warthi85No ratings yet

- Investor Digest: Equity Research - 20 March 2019Document8 pagesInvestor Digest: Equity Research - 20 March 2019Rising PKN STANNo ratings yet

- Icici Sec Berger PaintsDocument6 pagesIcici Sec Berger PaintsvenugopallNo ratings yet

- Jasa Marga: Equity ResearchDocument7 pagesJasa Marga: Equity ResearchKhorbina SiregarNo ratings yet

- Intp 080318Document3 pagesIntp 080318Cristiano DonzaghiNo ratings yet

- UPL Company Update - 030520 - Emkay PDFDocument15 pagesUPL Company Update - 030520 - Emkay PDFshaikhsaadahmedNo ratings yet

- BUY Avenue Supermarts: Strong Result Maintain Our Investment ThesisDocument9 pagesBUY Avenue Supermarts: Strong Result Maintain Our Investment ThesisjigarchhatrolaNo ratings yet

- Wijaya Karya Beton: A Bit Slow StartDocument10 pagesWijaya Karya Beton: A Bit Slow StartSugeng YuliantoNo ratings yet

- Ascendas Reit - : Growing Its Portfolio InorganicallyDocument4 pagesAscendas Reit - : Growing Its Portfolio InorganicallyphuawlNo ratings yet

- Vinati Organics: Newer Businesses To Drive Growth AheadDocument6 pagesVinati Organics: Newer Businesses To Drive Growth AheadtamilNo ratings yet

- Research Report Maruti Suzuki Ltd.Document8 pagesResearch Report Maruti Suzuki Ltd.Harshavardhan pasupuletiNo ratings yet

- Ciptadana Sekuritas AALI - 1H20 Earnings Beat ExpectationDocument6 pagesCiptadana Sekuritas AALI - 1H20 Earnings Beat ExpectationHamba AllahNo ratings yet

- Matahari Department Store: Equity ResearchDocument6 pagesMatahari Department Store: Equity Researchkrisyanto krisyantoNo ratings yet

- Summary of Financial Statements For Fiscal 2019Document24 pagesSummary of Financial Statements For Fiscal 2019Obisike EmeziNo ratings yet

- Ciptadana Sekuritas PTPP - Lower TP Post Weak ResultsDocument6 pagesCiptadana Sekuritas PTPP - Lower TP Post Weak ResultsKPH BaliNo ratings yet

- Ciptadana Sekuritas KINO - Key Takeaways From MeetingDocument3 pagesCiptadana Sekuritas KINO - Key Takeaways From Meetingbudi handokoNo ratings yet

- Ciptadana Sekuritas ASRI - Growing Recurring IncomeDocument6 pagesCiptadana Sekuritas ASRI - Growing Recurring Incomebudi handokoNo ratings yet

- Care Ratings-Paints Industry Analysis-2017Document12 pagesCare Ratings-Paints Industry Analysis-2017rchawdhry123No ratings yet

- Traders Club - Nov. 21Document5 pagesTraders Club - Nov. 21Peter ErnstNo ratings yet

- Earnings and GDP Drive PCOMP Higher: Week in ReviewDocument2 pagesEarnings and GDP Drive PCOMP Higher: Week in ReviewAhwen 'ahwenism'No ratings yet

- On Track: Bison ConsolidatedDocument9 pagesOn Track: Bison ConsolidatedJOHN SKILLNo ratings yet

- BPI AnalysisDocument8 pagesBPI AnalysisDave Umeran0% (1)

- IDirect PrimaPlastics CoUpdate Jun19Document4 pagesIDirect PrimaPlastics CoUpdate Jun19Alokesh PhukanNo ratings yet

- Indo Premier RALS - Stronger Lebaran 2018 SalesDocument5 pagesIndo Premier RALS - Stronger Lebaran 2018 SalesTanjung YanugrohoNo ratings yet

- Bank Central Asia: Steady Albeit Moderating GrowthDocument6 pagesBank Central Asia: Steady Albeit Moderating GrowthNathanNo ratings yet

- London Sumatra Indonesia TBK: Still Positive But Below ExpectationDocument7 pagesLondon Sumatra Indonesia TBK: Still Positive But Below ExpectationHamba AllahNo ratings yet

- Leong Hup International BHD: TP: RM1.43Document3 pagesLeong Hup International BHD: TP: RM1.43KeyaNo ratings yet

- Investor Digest: Equity Research - 28 March 2019Document9 pagesInvestor Digest: Equity Research - 28 March 2019Rising PKN STANNo ratings yet

- Leong Hup International: Rules The Roost in Poultry IndustryDocument17 pagesLeong Hup International: Rules The Roost in Poultry IndustryKeyaNo ratings yet

- Vodafone Group PLC: DisclaimerDocument17 pagesVodafone Group PLC: DisclaimerTawfiq4444No ratings yet

- Indopremier Company Update SIDO 5 Mar 2024 Reiterate Buy HigherDocument7 pagesIndopremier Company Update SIDO 5 Mar 2024 Reiterate Buy Higherprima.brpNo ratings yet

- Shriram Transport Finance: CMP: INR1,043 Growth DeceleratingDocument14 pagesShriram Transport Finance: CMP: INR1,043 Growth DeceleratingDarshitNo ratings yet

- Barito Pacific: Continuous ImprovementDocument6 pagesBarito Pacific: Continuous ImprovementI Nyoman Sujana GiriNo ratings yet

- Motilal Oswal May 2020Document8 pagesMotilal Oswal May 2020BINNo ratings yet

- (Andy Maslen) 100 Great Copywriting Ideas From LeDocument6 pages(Andy Maslen) 100 Great Copywriting Ideas From LeRio PrihantoNo ratings yet

- Tata Consultancy Services LTD.: Result UpdateDocument7 pagesTata Consultancy Services LTD.: Result UpdateanjugaduNo ratings yet

- 2019 Q1 CushWake Jakarta IndustrialDocument2 pages2019 Q1 CushWake Jakarta IndustrialCookiesNo ratings yet

- Margin Concerns Should Take Precedence Over Improved OutlookDocument15 pagesMargin Concerns Should Take Precedence Over Improved Outlookashok yadavNo ratings yet

- Suherman Santikno - IndoPremier Equity Research - Bank Bumi Arta IndonesiaDocument28 pagesSuherman Santikno - IndoPremier Equity Research - Bank Bumi Arta Indonesiasuherman santiknoNo ratings yet

- Sun Pharma: CMP: INR574 TP: INR675 (+18%)Document10 pagesSun Pharma: CMP: INR574 TP: INR675 (+18%)rishab agarwalNo ratings yet

- Maruti Suzuki: Healthy Realisations Provide Operating Boost BUY'Document5 pagesMaruti Suzuki: Healthy Realisations Provide Operating Boost BUY'SIDNo ratings yet

- Aarti Industries - 1QFY19 RU - KR ChokseyDocument7 pagesAarti Industries - 1QFY19 RU - KR ChokseydarshanmaldeNo ratings yet

- Ciptadana Sekuritas PTPP - Lower TP Post Weak ResultsDocument6 pagesCiptadana Sekuritas PTPP - Lower TP Post Weak ResultsKPH BaliNo ratings yet

- Semua Data Berdasarkan Data Rti Business Kecuali Last Price, 1Y Low, Dan Market Cap Menggunakan Data Otomatis Google FinanceDocument1 pageSemua Data Berdasarkan Data Rti Business Kecuali Last Price, 1Y Low, Dan Market Cap Menggunakan Data Otomatis Google FinanceKPH BaliNo ratings yet

- ATS - Daily Trading Plan 15maret2019Document1 pageATS - Daily Trading Plan 15maret2019KPH BaliNo ratings yet

- Semua Data Berdasarkan Data Rti Business Kecuali Last Price, 1Y Low, Dan Market Cap Menggunakan Data Otomatis Google FinanceDocument1 pageSemua Data Berdasarkan Data Rti Business Kecuali Last Price, 1Y Low, Dan Market Cap Menggunakan Data Otomatis Google FinanceKPH BaliNo ratings yet

- Semua Data Berdasarkan Data Hots Mirae Kecuali Last Price, 1Y Low, Dan Market Cap Menggunakan Data Otomatis Google FinanceDocument1 pageSemua Data Berdasarkan Data Hots Mirae Kecuali Last Price, 1Y Low, Dan Market Cap Menggunakan Data Otomatis Google FinanceKPH BaliNo ratings yet

- Semua Data Berdasarkan Data Hots Mirae Kecuali Last Price, 1Y Low, Dan Market Cap Menggunakan Data Otomatis Google FinanceDocument1 pageSemua Data Berdasarkan Data Hots Mirae Kecuali Last Price, 1Y Low, Dan Market Cap Menggunakan Data Otomatis Google FinanceKPH BaliNo ratings yet

- MNCN Investor Release FY 2018Document5 pagesMNCN Investor Release FY 2018KPH BaliNo ratings yet

- Ciptadana Sekuritas SILO - Results Update FY18 - Healthy Operations To Support Long Term GrowthDocument9 pagesCiptadana Sekuritas SILO - Results Update FY18 - Healthy Operations To Support Long Term GrowthKPH BaliNo ratings yet

- Weekly Flash Opportunity Accor Indonesia 12032019Document9 pagesWeekly Flash Opportunity Accor Indonesia 12032019KPH BaliNo ratings yet

- Ciptadana Sekuritas PPRO - Company Update - Rapid Growth Through Innovative StrategyDocument8 pagesCiptadana Sekuritas PPRO - Company Update - Rapid Growth Through Innovative StrategyKPH BaliNo ratings yet

- ATS - Daily Trading Plan 8januari2019Document1 pageATS - Daily Trading Plan 8januari2019KPH BaliNo ratings yet

- ATS Active Trader v2.7 Trading System: TELEGRAM ChannelDocument1 pageATS Active Trader v2.7 Trading System: TELEGRAM ChannelKPH BaliNo ratings yet

- ATS - Daily Trading Plan 14januari2019Document1 pageATS - Daily Trading Plan 14januari2019KPH BaliNo ratings yet

- Bedah Saham Road To Investor Gathering 2019Document35 pagesBedah Saham Road To Investor Gathering 2019KPH BaliNo ratings yet

- ATS - Daily Trading Plan 6februari2019Document1 pageATS - Daily Trading Plan 6februari2019KPH BaliNo ratings yet

- ATS Active Trader v2.7 Trading System: TELEGRAM ChannelDocument1 pageATS Active Trader v2.7 Trading System: TELEGRAM ChannelKPH BaliNo ratings yet

- ATS Active Trader v2.7 Trading System: TELEGRAM ChannelDocument1 pageATS Active Trader v2.7 Trading System: TELEGRAM ChannelKPH BaliNo ratings yet

- ATS Active Trader v2.7 Trading System: TELEGRAM ChannelDocument1 pageATS Active Trader v2.7 Trading System: TELEGRAM ChannelKPH BaliNo ratings yet

- ATS - Daily Trading Plan 4april2019Document1 pageATS - Daily Trading Plan 4april2019KPH BaliNo ratings yet

- ATS Active Trader v2.7 Trading System: Happy New Year 2019Document1 pageATS Active Trader v2.7 Trading System: Happy New Year 2019KPH BaliNo ratings yet

- ATS Active Trader v2.7 Trading System: ATS - Daily Stocks ExplorationDocument1 pageATS Active Trader v2.7 Trading System: ATS - Daily Stocks ExplorationKPH BaliNo ratings yet

- ATS Active Trader v2.7 Trading System: TELEGRAM ChannelDocument1 pageATS Active Trader v2.7 Trading System: TELEGRAM ChannelKPH BaliNo ratings yet

- ATS Active Trader v2.7 Trading System: TELEGRAM ChannelDocument1 pageATS Active Trader v2.7 Trading System: TELEGRAM ChannelKPH BaliNo ratings yet

- ATS Active Trader v2.7 Trading System: TELEGRAM ChannelDocument1 pageATS Active Trader v2.7 Trading System: TELEGRAM ChannelKPH BaliNo ratings yet

- ATS Active Trader v2.7 Trading System: TELEGRAM ChannelDocument1 pageATS Active Trader v2.7 Trading System: TELEGRAM ChannelKPH BaliNo ratings yet

- ATS Active Trader v2.7 Trading System: Happy New Year 2019Document1 pageATS Active Trader v2.7 Trading System: Happy New Year 2019KPH BaliNo ratings yet

- ATS Active Trader v2.7 Trading System: TELEGRAM ChannelDocument1 pageATS Active Trader v2.7 Trading System: TELEGRAM ChannelKPH BaliNo ratings yet

- ATS Active Trader v2.7 Trading System: Happy New Year 2019Document1 pageATS Active Trader v2.7 Trading System: Happy New Year 2019KPH BaliNo ratings yet

- ATS Active Trader v2.7 Trading System: TELEGRAM ChannelDocument1 pageATS Active Trader v2.7 Trading System: TELEGRAM ChannelKPH BaliNo ratings yet

- Becc 103 em 2023 24 KPDocument17 pagesBecc 103 em 2023 24 KPGourav SealNo ratings yet

- Instant Download Test Bank For Acquiring Medical Language 2nd Edition by Jones PDF ScribdDocument32 pagesInstant Download Test Bank For Acquiring Medical Language 2nd Edition by Jones PDF Scribdallennguyenexqjnzbkyf100% (20)

- Budget Speech 2009-10 by FM Surendra PandeyDocument50 pagesBudget Speech 2009-10 by FM Surendra PandeyChandan SapkotaNo ratings yet

- Growth Analysis: EPS Net Profit After Tax Preference Share Dividend Number of Ordinary Shares OutstandingDocument5 pagesGrowth Analysis: EPS Net Profit After Tax Preference Share Dividend Number of Ordinary Shares OutstandingRaveena RakhraNo ratings yet

- Case: The European Union's Challenges - 4pts Each (1-5)Document2 pagesCase: The European Union's Challenges - 4pts Each (1-5)Mark OroNo ratings yet

- Fare Payable: Fare Payable: 1515Document1 pageFare Payable: Fare Payable: 1515Balamurugan JPNo ratings yet

- KPPP PortalDocument3 pagesKPPP PortalV doNo ratings yet

- (Intl Investment) Chapter 2 FDIDocument74 pages(Intl Investment) Chapter 2 FDIJane VickyNo ratings yet

- State Bank of India 2Document2 pagesState Bank of India 2Avnish YadavNo ratings yet

- MR Ade Kurniawan AnsharDocument2 pagesMR Ade Kurniawan Ansharandi anugrahNo ratings yet

- Engineering Economics 2Document65 pagesEngineering Economics 2Muktar JemalNo ratings yet

- Foreign Currency TranslationDocument38 pagesForeign Currency TranslationAnmol GulatiNo ratings yet

- ED 241 - Contemporary National DevelopmentDocument9 pagesED 241 - Contemporary National DevelopmentAlmera Mejorada - Paman100% (1)

- Villa Moroccan by Dago Gallery - Villas For Rent in Kecamatan Cimenyan, Jawa Barat, Indonesia - AirbnbDocument7 pagesVilla Moroccan by Dago Gallery - Villas For Rent in Kecamatan Cimenyan, Jawa Barat, Indonesia - AirbnbKeena TariganNo ratings yet

- Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument30 pagesDate Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing Balancemayur ahirNo ratings yet

- MAC2 W4 CH13 SolutionsDocument39 pagesMAC2 W4 CH13 Solutionsshaileen priscoNo ratings yet

- Chapter 9-Guided Reading NotesDocument5 pagesChapter 9-Guided Reading NotesVicky CuiNo ratings yet

- Dimensions of Globalization: TopicDocument4 pagesDimensions of Globalization: TopicMian AbdullahNo ratings yet

- InvoiceDocument1 pageInvoiceManishNo ratings yet

- Exchange Rates and International TradeDocument51 pagesExchange Rates and International TradeĐào Minh NgọcNo ratings yet

- Airtel Bill - JunDocument5 pagesAirtel Bill - JunSaravanan GuruNo ratings yet

- Team TreesDocument12 pagesTeam Treesjakaro dejongNo ratings yet

- August 16, 2019 Strathmore TimesDocument19 pagesAugust 16, 2019 Strathmore TimesStrathmore TimesNo ratings yet

- AGMARKDocument10 pagesAGMARKAnkit SharmaNo ratings yet

- Sberbank Rossii: Account StatementDocument3 pagesSberbank Rossii: Account StatementALEX PEREVERZEWNo ratings yet

- Engineering Econ - InterestDocument37 pagesEngineering Econ - InterestNikolai VillegasNo ratings yet

- Rifandy Elfransyah 185120407121041 KewirausahaanDocument2 pagesRifandy Elfransyah 185120407121041 KewirausahaanMuhammad FarhanNo ratings yet

- 연습문제 (영어) 2Document8 pages연습문제 (영어) 29dm9h2s48kNo ratings yet