Professional Documents

Culture Documents

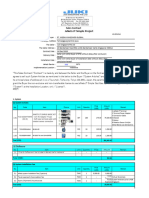

Import Data Processing & Monitoring System - Proposed Process and Estimated Impact

Import Data Processing & Monitoring System - Proposed Process and Estimated Impact

Uploaded by

Sachin BaneOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Import Data Processing & Monitoring System - Proposed Process and Estimated Impact

Import Data Processing & Monitoring System - Proposed Process and Estimated Impact

Uploaded by

Sachin BaneCopyright:

Available Formats

Import Data Processing & Monitoring System – proposed process and

estimated impact

Introduction

The Export Data Processing & Monitoring System (EDPMS), intended to streamline the data

flow pertaining to exports between Customs, RBI, DGFT and the ADs, went live from Apr

2014. The system captures data pertaining to shipping bills issued by customs, and it

enables banks to report realisation and settlement of these shipping bills against inward

remittance received by their clients. From 15 June 2016, the system also captures details of

export advance received by the exporters, and tracks utilisation of these advances within the

mandated time period.

The improvements in tracking and monitoring of exports has resulted in better reporting

discipline by all parties concerned. For banks, it has done away with the manual reporting

processes associated with XOS reporting and the quarterly reporting for unutilized export

advances.

This is only the first step in the initiative to improve the tracking and monitoring mechanism

of cross-border trade, and to reduce the paper-flow associated with the same. Next in line are

import transactions.

Import Data Processing & Monitoring System (IDPMS)

Vide its circular issued on 28 Apr 2016, the Reserve Bank of India notified implementation

of Import Data Processing & Monitoring System or IDPMS, similar to EDPMS. The circular

does not mention the targeted implementation date of the system, but what can be inferred

from the same is that, unlike EDPMS which did not entail any change in the export

processes, implementation of IDPMS will also coincide with some significant changes in

handling of import settlements.

Once IDPMS is implemented, customs authorities will start capturing the AD code of the

importers’ bank in the Bill of Entry, similar to how it is being done for Shipping Bills

currently. Bill of Entry data will then be available to banks, populated under the respective

AD codes. In terms of system functionalities, the system would be similar to EDPMS and we

can expect an AD code transfer process similar to what is available in EDPMS, for handling

Bills of Entry with AD codes of other banks.

Once implemented, the system will become the single reporting platform for all types of

import transactions, including payment of import advances. As the system goes fully online,

manual BEF reporting will stop, as IDPMS will facilitate continuous monitoring.

From the perspective of regulatory guidelines, there are three major changes expected post

implementation of IDPMS:

a. Non-payment (write-off) of import bills either fully or partially will require

approval from the Authorised Dealer or RBI, depending upon the case

b. Import bills will need to be settled within the mandated period, and delaying

payment beyond the specified period will require approval from the AD or

RBI, depending upon the case

© Abin Daya, 2016

Private work. No part may be reproduced without permission of the author.

c. Authorised Dealers will now need to follow up for submission of evidence of

import without consideration of amount involved (this has already started)

Let us look at these in a bit more detail.

Reduction in invoice value

Current Scenario

Importers never had anybody looking over their shoulder (except their suppliers, of course!)

to check whether they were paying the full amount towards their imports. While realisation

and repatriation of export proceeds is religiously tracked, a Bill of Entry remaining unpaid is

not of too much concern to the AD – primarily because the AD would not even be aware of

the same due to non-availability of BoE data at their end.

Today, an importer who has negotiated a discount with his supplier after arrival and

clearance of goods does not need to follow any other process other than to simply make

payment for the reduced value. As long as the amount remitted is not in excess of the BoE

value, the importer does not have any further obligation from a regulatory perspective.

Proposed process

As per the proposed changes in the guidelines, the importer will have to make payment for

the invoice under the Bill of Entry in full, for it to be settled.

In the event the importer is able to negotiate a discount from his supplier on the invoice

amount, an approval from the AD would also be needed to settle the Bill of Entry by paying

the reduced value. For cases where such reduction is due to discounts provided by the

supplier, change in amount of freight, insurance, etc. ADs can approve reduction in value of

up to 5% of the invoice amount. In case the reduction in amount due to these reasons is more

than the 5% specified, the case will need to be referred to RBI for approval.

Where a reduction in amount payable is due to quality issues, short shipment, or destruction

by port/health authorities, ADs can provide approval beyond the 5% cap, and settle the BoE,

provided appropriate documentary evidence is submitted by the importer to validate the

reasons.

A BoE, which has not been fully settled, will remain outstanding in the system, similar to an

export bill remaining outstanding in EDPMS.

Impact on banks

For the banks, this will be a new process, which they have not been doing earlier. Part

payments, multiple invoices under same Bill of Entry, multiple Bills of Entry under same

invoice etc, are various permutations and combinations which they will need to execute

correctly in IDPMS to ensure reporting is not missed out. There will also be cases where

advance payment is done through one bank, and import documents are done through

another bank. The experience from EDPMS will definitely come handy for banks in

migrating to IDPMS

Impact on importers

There is not much clarity on how the approval mechanism, particularly the RBI approval

process, will work. Operationally and logistically, it could be challenging for the importers to

seek AD approval for each and every invoice where there is a difference in amount being

© Abin Daya, 2016

Private work. No part may be reproduced without permission of the author.

remitted. Unless banks can come out with a standard BAU process for these cases, this could

lead to increased workload for both the importers and the banks.

One change in the import clearance process that importers need to be aware of is the

inclusion of AD code in the Bill of Entry, similar to how it is being done for Shipping Bills.

Importers need to ensure that the correct AD code is captured in the BoE, so that the bank

can process the transactions and update the system correctly and avoid any missed

reporting.

Timely settlement of import bills

Current scenario

Currently, in the absence of any data regarding Bills of Entry raised by their clients, ADs do

not have the wherewithal to ensure that import payments are done within the mandated

time period of 180 days from the date of import. Thus, no follow up action gets triggered for

such transactions, either at the AD level or at RBI.

The AD gets involved in the transaction as and when the import documents are submitted

for payment. As per current process, delay in settlement beyond the mandated period only

involves a declaration to the AD stating the reason for delay. Where there is an inordinate

delay (usually crossing 3 years from the date of import), the transaction is referred to RBI for

appropriate approvals.

Proposed process

Subsequent to implementation of IDPMS, banks will have seamless access to Bill of Entry

data for their customers, which they can use to track timely settlement of import bills. RBI

expectation would be for ADs to follow up with their customers for Bills of Entry remaining

unsettled beyond the 180-day time period, and to ensure compliance with the guidelines.

The proposed changes will make the import settlement process similar to that of exports in

the sense that any delay in import settlement (extension of time) will need to be approved by

the AD based on the parameters to be outlined in regulations.

The notification circular states that ADs will have the delegated powers to approve extension

of time up to a period of one year from the date of import, without any limit. For these cases,

ADs would continue to ask for the importer’s declaration stating the reason for such delays,

and base their approvals on the contents of the same.

Where the delay is beyond a period of one year, ADs can grant approval only for those

importers, whose total outstanding does not exceed US$1Mn, or 10% of the average import

remittances of the previous two years, whichever is LOWER (for exports, the HIGHER

amount is considered). Else, the transaction will have to be referred to RBI for approval.

Impact on banks

First and foremost, a lot of these changes will require amendments to the import guidelines

and Master Directions, and banks will be on the lookout for the same.

Further for the banks, there is currently no way of ascertaining the total outstanding for an

importer at their end (assuming that IDPMS will follow the same system of reporting data

under specific AD codes as EDPMS), as the importer could have transactions outstanding

© Abin Daya, 2016

Private work. No part may be reproduced without permission of the author.

with multiple banks. Thus, banks will need to rely on a third party document – a CA

certificate or a Statutory Auditor certificate – to comply with this requirement.

The interesting thing here is that, there is no definition of what constitutes ‘total outstanding

of the importer’. If this is taken as all import bills remaining unpaid (similar to how it is

calculated for exports), then it could create issues for large importers, whose individual bill

sizes will easily cross this limit. Average remittance value of previous two years will become

redundant for such importers, as the lower figure has to be taken. Clarity on this aspect

would definitely be welcome.

Impact on importers

Consider this: for an importer with annual imports of US$11Mn, and who enjoys a 60 day

credit period, the import outstanding would be more than US$1Mn at any point of time.

Similar would be the case for an importer who has imported capital equipment worth more

than US$1Mn, and has availed suppliers’ credit against the same. In both these cases, in case

of a dispute with an overseas supplier dragging on for more than one year, and the

consequent delay in effecting import payment, the importer will need to seek RBI approval

for such delay.

Also, a third party confirmation (CA/SA Certificate) as part of the transaction document

would add to the transaction costs. We have only recently come out of the requirement of

Form 15 CA/CB for import transactions (from 01 Apr 2016 onwards).

A Shipping Bill remaining unrealised and unsettled in EDPMS for more than two years, will

lead to automatic caution listing of the exporter. For import transactions, however, there are

no such penal provisions which have been notified in the current circular for Bills of Entry

remaining unsettled beyond specified periods. Considering that the data is available in the

system, and looking at the way compliance requirements are evolving, this is a distinct

possibility in future which importers should be ready for.

Wholly Owned Subsidiaries of overseas parents

There are many wholly owned subsidiaries of overseas investor corporates who receive

additional support from their parents by way of:

1. Import of raw material from parent either paid late, or not paid at all

2. Import of raw material from third party suppliers outside India, which is paid by the

parent company outside India, with no corresponding payment by the Indian

subsidiary

These transactions are, in essence, quasi-ECB and quasi-FDI, though not reported as such.

Implementation of IDPMS will bring all such transactions out into the open, and could

create trouble for the importer. Penal provisions could be invoked in such cases.

Removal of the limit of US$100,000 for evidence of import

Current process

As per the provisions of FEMA, an importer, making an advance payment to an overseas

supplier, for import of an item into India, is expected to submit to the bank through which

payment was done, the Bill of Entry pertaining to such import. The Bill of Entry serves as

evidence that goods for equivalent value of the outward remittance has been brought into the

country, and hence the country has not suffered any loss on account of the transaction.

© Abin Daya, 2016

Private work. No part may be reproduced without permission of the author.

This submission has to be done within a period of 90 days from the date of advance

payment, and it is the responsibility of the AD who has executed the outward remittance, to

follow up with the importer and ensure its submission. However, currently the guidelines

also give flexibility to the banks to not do the follow up for submission of evidence of import,

where the transaction value is less than US$100,000.

An importer not complying with the demand of the AD to submit the evidence of import will

find his name reported to RBI through the half-yearly BEF reporting process

Proposed process

The process for making outward remittances for advance payments and the timelines for

submitting evidence of import will remain the same as before. Additionally, banks will

capture the details of all advance payments paid on the IDPMS system, post implementation.

This will ensure that the data is available to RBI, ADs and the DGFT on a continuous basis

for reporting and monitoring.

The significant change is that the limit of US$100,000 below which ADs did not need to

follow up with the importers for submission of Bill of Entry, has been removed. Irrespective

of the value of the transaction, importers will now be called upon for submission of BoE.

Failure to do so could attract penal provisions.

Impact on banks

For banks, the follow up process will now become more difficult with the increase in the

number of small value transactions. However, unlike what happens currently, the follow up

will not be restricted to every half-year, but will be an on-going process, as the data will be

updated and monitored on a daily basis. Even without any change in the guidelines, the

follow up process has already started with banks following up with importers for small value

advance payments as well, upon direction from RBI.

As the reporting gets completely online, the manual BEF reporting process will be stopped,

and that should provide some relief to the banks from the report compilation and

preparation activities.

Here too, the applicable FEMA guidelines will need to be changed, and banks will look out

for the same closer to the implementation date.

Impact on importers

The limit of US$100,000 was quite misused by people who wanted to beat the system. The

forex fraud at a large Public Sector Bank where Rs.6,100 Cr was siphoned off in the garb of

import advances is a recent example, and has contributed to the amendment in guidelines.

Another example that comes to mind is of Indian buyers paying for testing samples from

overseas suppliers, which are sent directly to testing laboratories outside the country, where

they are tested and destroyed. The goods, in such cases, never come to India, though

outward remittance is done for the cost of the samples. In cases where the price of the testing

sample is a small amount, the amount gets remitted out as an import advance payment, as

the buyer knows that the bank will not follow up for Bill of Entry for the transaction.

For such transactions, importers will be forced to follow the correct process going forward.

© Abin Daya, 2016

Private work. No part may be reproduced without permission of the author.

Conclusion

While the notification has come out almost 4 months back, there is still no clarity on by when

the same would be implemented. The delay in implementation could mean that we will see

some changes in the guidelines and processes as it has been outlined in the notification

circular and how it will come out in the implementation stage.

As I mentioned, some of these directions will require changes to be made to the import

guidelines, and this could also be one reason why this is taking some time. Additionally,

banks will need to make sure that they are tech-ready for the roll-out since once

implemented, all transactions will need to processed through this system.

eBRC, EDPMS and IDPMS are part of the larger e-Trade project, which looks to streamline

trade processes; the key deliverables being:

a. e-Delivery of services provided by Customs, Airports, Seaports etc. to

importers, exporters and customs agents,

b. e-Filing of export and import documents by exporters and importers to

customs authorities and airports/sea ports, etc.

c. e-Payment of customs duties, licence fees and charges

As we move forward and the entire ecosystem evolves further, the objective is to enable

seamless delivery of various G2X services and thus reduce transaction time, and transaction

costs.

The next step, logically, is to eliminate physical copies of Shipping Bills and Bills of Entry, as

the data pertaining to these documents are already available in the system, and to provide

access to importers and exporters to the respective repositories, similar to how it is being

done for eBRCs today. The benefits accruing from elimination of paper for trade transactions

cannot be overstressed, and one need to only look at the eBRC implementation to draw

conclusions. Hopefully, we will reach there, sooner than later.

© Abin Daya, 2016

Private work. No part may be reproduced without permission of the author.

You might also like

- Pure Nudism GalleryDocument2 pagesPure Nudism GalleryHenry Benjamin0% (4)

- International Trade FinanceDocument302 pagesInternational Trade Financenaveen_ch522100% (1)

- Method Statement For Project Signages Rev 0 AfcDocument16 pagesMethod Statement For Project Signages Rev 0 AfcEchik Kici0% (1)

- Pearce & StevensDocument1,062 pagesPearce & StevensNicoleNo ratings yet

- Swift PaymentsDocument23 pagesSwift PaymentsDharanya VNo ratings yet

- Week2 - Elgin F. Hunt, David C. Colander - Social Science - An Introduction To The Study of Society-Routledge (2016)Document25 pagesWeek2 - Elgin F. Hunt, David C. Colander - Social Science - An Introduction To The Study of Society-Routledge (2016)Muhammet100% (1)

- Foreign Exchange Laws Content LLBDocument6 pagesForeign Exchange Laws Content LLBSudhir Kochhar Fema AuthorNo ratings yet

- New Distributor Evaluation Form 2016Document3 pagesNew Distributor Evaluation Form 2016Ashish SrivastavaNo ratings yet

- EDPMSDocument20 pagesEDPMSrani jeyarajNo ratings yet

- Practical Problems in Transfer Pricing 1203598388238900 3Document17 pagesPractical Problems in Transfer Pricing 1203598388238900 3jmpnv007No ratings yet

- 2020 APAC LC Survey MaterialsDocument61 pages2020 APAC LC Survey MaterialsVikram SuranaNo ratings yet

- How To Hack Facebook Account Through Keylodger - 1Document3 pagesHow To Hack Facebook Account Through Keylodger - 1Joshua JosephNo ratings yet

- War in Afghanistan (2001-Present)Document53 pagesWar in Afghanistan (2001-Present)Frank Martinez T100% (1)

- Presentation On Export CreditDocument21 pagesPresentation On Export CreditArpit KhandelwalNo ratings yet

- CiTF Chapter 15 PDFDocument18 pagesCiTF Chapter 15 PDFlethinha1982No ratings yet

- Trade Finance Work Book Part 1Document25 pagesTrade Finance Work Book Part 1Lakshmi VakkalagaddaNo ratings yet

- Swift-Mx Pacs 008Document202 pagesSwift-Mx Pacs 008habchiNo ratings yet

- Various Methods of Payment in International TradeDocument63 pagesVarious Methods of Payment in International Tradeeknath2000No ratings yet

- Export Financing: Pre-Shipment & Post-Shipment FinanceDocument24 pagesExport Financing: Pre-Shipment & Post-Shipment Financevidhyaaravinthan100% (1)

- RemittancesDocument26 pagesRemittancesEdward JoseNo ratings yet

- Trade For Corporates OverviewDocument47 pagesTrade For Corporates OverviewZayd Iskandar Dzolkarnain Al-HadramiNo ratings yet

- Guidelines For International Trade Finance For Bankers India How To Check International Trade Documents FaqsDocument146 pagesGuidelines For International Trade Finance For Bankers India How To Check International Trade Documents FaqsAnonymous 9kIXZjGSfNNo ratings yet

- International Trade FinanceDocument33 pagesInternational Trade Financemesba_17No ratings yet

- Session. 25. Letters of Credit and Bank GuaranteesDocument30 pagesSession. 25. Letters of Credit and Bank GuaranteesHemant KawalkarNo ratings yet

- Foreign Exchange1Document84 pagesForeign Exchange1Ashwin WasnikNo ratings yet

- Role of FedaiDocument221 pagesRole of Fedaianon_565902225No ratings yet

- Procedural Guidelines1Document69 pagesProcedural Guidelines1sburugulaNo ratings yet

- Trade Finance IIBFDocument8 pagesTrade Finance IIBFAmit Kumar0% (2)

- Knowledge Bank: Fedai RulesDocument10 pagesKnowledge Bank: Fedai RulesRohan Singh100% (1)

- Urr 725 PDFDocument4 pagesUrr 725 PDFAtanu SarkarNo ratings yet

- Export FinanceDocument14 pagesExport Financesamy7541No ratings yet

- CITF Chapter 5-TS STUDENTDocument15 pagesCITF Chapter 5-TS STUDENTAlin RaissaNo ratings yet

- Trade Finance Guru Mantra Part-1Document37 pagesTrade Finance Guru Mantra Part-1sudhir.kochhar3530No ratings yet

- Rethinking Trade and FinanceDocument52 pagesRethinking Trade and FinanceJennifer WatsonNo ratings yet

- Caiib PDFDocument14 pagesCaiib PDFAbhishek KaushikNo ratings yet

- SOP WithdrawalsDocument111 pagesSOP Withdrawalsashoku24007No ratings yet

- The Foreign Exchange Management Act, 1999: Preliminary 1. Short Title, Extent, Application and CommencementDocument22 pagesThe Foreign Exchange Management Act, 1999: Preliminary 1. Short Title, Extent, Application and CommencementSudhir Kochhar Fema AuthorNo ratings yet

- 07 CDCS Chapter7 PDFDocument36 pages07 CDCS Chapter7 PDFadnan100% (2)

- Trade FinanceDocument8 pagesTrade Financesharma bittu0% (2)

- Trade FinanceDocument55 pagesTrade Financedev_dbcNo ratings yet

- Standard Operating Procedure (SOP) For NPS Account Maintenance - Karvy NPSDocument10 pagesStandard Operating Procedure (SOP) For NPS Account Maintenance - Karvy NPSahan verma100% (1)

- Master Direction On Import of Goods and ServicesDocument31 pagesMaster Direction On Import of Goods and Serviceseknath2000No ratings yet

- IMPS FAQsBankers PDFDocument5 pagesIMPS FAQsBankers PDFAccounting & TaxationNo ratings yet

- Factoring and ForfaitingDocument34 pagesFactoring and ForfaitingRahul FouzdarNo ratings yet

- Basics of SFMS StandardsDocument3 pagesBasics of SFMS Standardsgani_scribd0% (1)

- ArbitrageDocument17 pagesArbitrageKamalakannan AnnamalaiNo ratings yet

- Icc Users Handbook For Documentary Credits Under Ucp 600Document10 pagesIcc Users Handbook For Documentary Credits Under Ucp 600AARTICKNo ratings yet

- Forex Exposure ManagementDocument103 pagesForex Exposure ManagementArun KumarNo ratings yet

- DAIBB MA Math Solutions 290315Document11 pagesDAIBB MA Math Solutions 290315joyNo ratings yet

- CITF Study Planner 2019Document1 pageCITF Study Planner 2019Marvin DevannyNo ratings yet

- Documentation 6th Jan 2019Document91 pagesDocumentation 6th Jan 2019adhinayakgoharNo ratings yet

- CFE FED BookletDocument6 pagesCFE FED BookletSudhir Kochhar Fema AuthorNo ratings yet

- Study of Cash Management at Standard Chartered BankDocument115 pagesStudy of Cash Management at Standard Chartered BankVishnu Prasad100% (2)

- URR 725 WordDocument9 pagesURR 725 WordTran TungNo ratings yet

- Export FinancingDocument61 pagesExport FinancingkanikaNo ratings yet

- SCB Tariff 2021Document15 pagesSCB Tariff 2021Fuaad DodooNo ratings yet

- HDFC BankDocument82 pagesHDFC BankNishant ParmarNo ratings yet

- Difference Between LC and SBLC - LC Vs SBLCDocument8 pagesDifference Between LC and SBLC - LC Vs SBLCAnonymous sMqylHNo ratings yet

- Basel III Capital RegulationsDocument328 pagesBasel III Capital Regulationspadam_09100% (1)

- Talking Points GSTDocument2 pagesTalking Points GSTvikaskumar1No ratings yet

- Chapter On Export and Import CreditDocument8 pagesChapter On Export and Import CreditGeorgeNo ratings yet

- eTDS Returns: Basic Business NeedsDocument2 pageseTDS Returns: Basic Business Needspksrikanth1No ratings yet

- Account Receivable Team in Backoffice: Radio/Digital - Entry in WO and Monthly Upload in SAPDocument4 pagesAccount Receivable Team in Backoffice: Radio/Digital - Entry in WO and Monthly Upload in SAPDipesh Jain100% (1)

- 1911 7webDocument72 pages1911 7webKevin Pettit100% (2)

- Intbus 201 Foundations of International Business: Week 12Document34 pagesIntbus 201 Foundations of International Business: Week 12etan540No ratings yet

- Cardi B's Lawsuit Against A Celebrity BloggerDocument43 pagesCardi B's Lawsuit Against A Celebrity BloggerAdam ForgieNo ratings yet

- Searchsafe Active&Sca Esv 582259872&Rlz 1C9BKJA EnGB1066GB1066&Hl en-GB&q Henna+Designs&Tbm Isch&SourceDocument1 pageSearchsafe Active&Sca Esv 582259872&Rlz 1C9BKJA EnGB1066GB1066&Hl en-GB&q Henna+Designs&Tbm Isch&SourceCharlotte KermanNo ratings yet

- SEBI Order Earth Exim 2Document55 pagesSEBI Order Earth Exim 2Shakti SinghNo ratings yet

- Case Study - 2Document5 pagesCase Study - 2Aparna GuptaNo ratings yet

- Analysis About Typhoon HaiyanDocument2 pagesAnalysis About Typhoon HaiyanMary Rose Silva GargarNo ratings yet

- English Test Paper - 12th - 2023-24 (QTS)Document12 pagesEnglish Test Paper - 12th - 2023-24 (QTS)manavsinghal87No ratings yet

- Corporate Finance Pattern in BangladeshDocument20 pagesCorporate Finance Pattern in BangladeshKhanNo ratings yet

- Faa Ac 27-1b Chg3 30-Sep-08 - Certification of Normal Category RotorcraftDocument943 pagesFaa Ac 27-1b Chg3 30-Sep-08 - Certification of Normal Category Rotorcraftharry.nuryantoNo ratings yet

- Making of A Mahatma (Film) by Shyam BenegalDocument4 pagesMaking of A Mahatma (Film) by Shyam BenegalellehcimNo ratings yet

- English Practice Exercises Unit 2 P1 Ko KeyDocument4 pagesEnglish Practice Exercises Unit 2 P1 Ko KeyRS RSNo ratings yet

- Sales Contract For Janets JT Simple - 288sest (PT - Medika Maesindo Global)Document3 pagesSales Contract For Janets JT Simple - 288sest (PT - Medika Maesindo Global)pecorepp.maesindoNo ratings yet

- Rodriguez Camillon Humberto - Paper Revised 4 - LayoutedDocument10 pagesRodriguez Camillon Humberto - Paper Revised 4 - LayoutedCebo DharuNo ratings yet

- Feelings As Instinctive and Trained Response To Moral DilemmasDocument18 pagesFeelings As Instinctive and Trained Response To Moral DilemmasKinjie CuadernalNo ratings yet

- Mains Question Paper 5 (Hindi) - 2019Document6 pagesMains Question Paper 5 (Hindi) - 2019Vipul SinglaNo ratings yet

- Construction and Engineering Management: Engr. AlbertsaludDocument13 pagesConstruction and Engineering Management: Engr. AlbertsaludemmaNo ratings yet

- Laws Related To Our Philippine Monetary SystemDocument49 pagesLaws Related To Our Philippine Monetary SystemJonathan Valdeavilla67% (6)

- Sense of Urgency Book Review by TMYDocument17 pagesSense of Urgency Book Review by TMYtajuddinmy100% (2)

- Tarun Khanna - CVDocument3 pagesTarun Khanna - CVMukund B KaushalNo ratings yet

- CTS Aptitude Exam-Verbal Section Paper4Document9 pagesCTS Aptitude Exam-Verbal Section Paper4Ronald RossNo ratings yet

- Early Childhood Curriculum ModelsDocument5 pagesEarly Childhood Curriculum ModelskrisnahNo ratings yet

- Limitations of Balance SheetDocument6 pagesLimitations of Balance Sheetshoms_007No ratings yet