Professional Documents

Culture Documents

Sales Literature: SUD Life Pradhan Mantri Jeevan Jyoti Bima Yojana

Sales Literature: SUD Life Pradhan Mantri Jeevan Jyoti Bima Yojana

Uploaded by

Trijal guptaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Sales Literature: SUD Life Pradhan Mantri Jeevan Jyoti Bima Yojana

Sales Literature: SUD Life Pradhan Mantri Jeevan Jyoti Bima Yojana

Uploaded by

Trijal guptaCopyright:

Available Formats

Sales Literature

SUD Life Pradhan Mantri Jeevan Jyoti Bima Yojana –

A Non-Linked Non- Participating One Year Renewable Group Term Insurance product

SUD Life Pradhan Mantri Jeevan Jyoti Bima Yojana is a one-year renewable group term insurance scheme that

provides life cover at low cost to the members who is account holder of Bank/Post Office.

Benefits payable:

Death Benefit:

In case of death of the Insured Member, the fixed Sum Assured of Rs. 2,00,000 will be payable to the Nominee/

Beneficiary subject to lien period. On payment of death benefit, all insurance cover provided under the Master policy

for the Insured Member will automatically terminate.

Lien Period

The assurance granted under the scheme is subject to an initial lien period of 30 days from the date of

commencement of risk of the Insured Member and no claim is admissible for deaths during such lien period.

However, the Lien Period is not applicable in case of death of the Insured Member due to Accident where “Accident”

refers to a sudden, unforeseen and involuntary event caused by external, violent and visible means.

In case the Insured Member exits the scheme and later rejoins provided they are eligible to re-join the scheme, then

the lien period of 30 days will be applicable once again.

Maturity Benefit:

No maturity benefit is payable under this plan.

Surrender Benefit:

No surrender benefit is payable under this plan to either the Master Policyholder or the Member. However In case

of surrender of the Master Policy, Individual Members of the group, on such surrender, have an option to continue

the coverage till the expiry of coverage term as mentioned in Certificate Of Insurance.

Eligibility Criteria:

Entry Age ➢ Min: 18 years (age as at last birthday)

➢ Max: 50 years (age nearer birthday)

Policy Term One year renewable (Period of Insurance: 01st June to 31st May)

Max Maturity Age 55 Years (age nearer birthday subject to annual renewal upto that date)

Sum Assured Fixed Sum Assured of Rs.2,00,000 per Member

Annual Premium Rs. 330* (Rs 300 in case of direct enrolment) + taxes, if any. (Member enrolls

between 01st June and 31st August).

(However, pro-rata premium will be payable in case of enrolment at a later stage,

as stated hereunder)

Premium periodicity Annual

Group Size Min:

10 members

Max:

No Limit

*Account holders can enroll in the scheme at a later stage (post 31 st August of any policy year) through payment of

pro-rata premium. Thus, if the enrolment takes place during the months of –

UIN: 142G047V02 Page 1 of 4

Sales Literature SUD Life Pradhan Mantri Jeevan Jyoti Bima Yojana

Sales Literature

a) For enrolment in June, July and August – Full Annual Premium of Rs.330/- is payable.

b) For enrolment in September, October, and November – pro rata premium of Rs. 258/- is payable

c) For enrolment in December, January and February – pro rata premium of Rs. 172/- is payable.

d) For enrolment in March, April and May – pro rata premium of Rs. 86/- is payable.

In case of voluntary enrolment into the scheme by Insured Members through electronic means, the premium

payable (as stated above) for such Insured Members will be reduced by offering discount to the extent of

reimbursement of expenses payable to the agents/ intermediaries, as per the scheme rules.

Appropriation of Premium: Reimbursement of expenses

4th quarter of risk period 7.50/-

3rd quarter of risk period 15.00/-

2nd quarter of risk Period 22.50/-

Full Annual Premium of Rs.330/- collected 30.00/-

Terms and conditions:

Grace Period & Reinstatement conditions:

At the end of the policy term i.e. 31st May of subsequent year, the master policy can be renewed within a grace

period of 30 days by payment of the premium then payable and complying with the other terms and conditions

specified by the Company. If the master policy is not renewed, the policy lapses.

The Master Policyholder shall recover the premium from Insured members in one instalment on or before the due

date(s) through auto-debit process. The recovered amount shall be remitted to Us on or before 30th June every year

in case of regular enrolment and in other cases, in the same month of receipt of premium from Insured member.

At the time of renewal, irrespective to the initial date of entry into the scheme, all insured members will be required

to pay full year’s premium. However, in case of delayed enrolment, pro-rata premium will be payable by the Insured

Members.

In case the Bank/ Post Office account is deactivated/ closed, the insurance cover will continue for a period for which

premium(s) has already been paid. Subsequently cover cannot be renewed.

The premium will be modified on any annual renewal date or any other date as amended by the Government of India

under the Pradhan Mantri Jeevan Jyoti Bima Yojana

Benefit under Lapsed Policy:

No benefit is payable on lapsed policy to either the Master Policyholder or the Member.

Free Cover Limit:

No provision of free cover limit.

Suicide Claim:

No exclusion on suicide death.

Suspension of Life Cover:

UIN: 142G047V02 Page 2 of 4

Sales Literature SUD Life Pradhan Mantri Jeevan Jyoti Bima Yojana

Sales Literature

In case the insurance cover is ceased due to insufficient balance on due date or due to exit from the scheme, the

same can be reinstated on receipt of appropriate premium provided the Insured Member is eligible to re-join the

scheme and is subject to a Lien Period of 30 days.

Termination of Assurance:

The assurance on the life of the insured member shall automatically cease on occurrence of any of the following

events and no benefit will become payable thereunder:

• Termination of the Master Policy

• On attainment of 55 Years (age nearer birthday) subject to on annual renewal up to that date

• Closure of account with Bank/ Post Office or insufficiency of balance to keep the insurance in force

• On expiry of the period of insurance cover term for the Insured Member.

• On intimation/settlement of the death of the Insured Member.

• Upon intimation of exit of the Insured Member by the Master Policyholder.

• In case the Insured Member is covered under PMJJBY scheme with any other Insurance Company through

more than one account and premium is received by the Company, insurance cover will be restricted to Rs.

2 lakh and the premium paid for duplicate insurance(s) shall be liable to be forfeited.

Renewal of Master Policy

The Master Policyholder may renew this Master Policy on every Annual Renewal Date for a period of one year, by

making payment of appropriate premium then payable and complying with the other terms and conditions specified

by the Company

Free Look cancellation:

In case the Master Policyholder or Insured Member is not satisfied with the terms and conditions of the Master

policy/ Certificate of Insurance, he/she may return the policy within the free look period by stating the reasons for

his/her objections. The free look period is 15 days (as this product is not sourced through distance marketing) from

the date of receipt of the Policy Document / Certificate of Insurance. In such event, Member will be entitled to a

refund of the amount of premium received by us excluding expenses incurred by us (i.e. stamp duty and

proportionate risk related charges for the period of cover). All the rights under this Policy shall immediately stand

extinguished at the cancellation of the Policy.

Nomination:

Nomination will be in accordance to Section 39 of The Insurance Act 1938 as amended from time to time.

Assignment:

Assignment of this policy will be in accordance to Section 38 of The Insurance Act 1938 as amended from time to

time.

Exclusions:

No exclusions except the lien period of 30 days as stated under earlier section.

This is a traditional group term non participating product. The contract i.e. the Master Policy will be governed by

the terms expressed in the Master Policy document.

PROHIBITION OF REBATES

Section 41 of the Insurance Act, 1938 as amended from time to time:

“(1) No person shall allow or offer to allow, either directly or indirectly, as an inducement to any person to take out

or renew or continue an insurance in respect of any kind of risk relating to lives or property in India, any rebate of

UIN: 142G047V02 Page 3 of 4

Sales Literature SUD Life Pradhan Mantri Jeevan Jyoti Bima Yojana

Sales Literature

the whole or part of the commission payable or any rebate of the premium shown on the policy, nor shall any person

taking out or renewing or continuing a policy accept any rebate, except such rebate as may be allowed in accordance

with the published prospectus or tables of the insurer:

(2) Any person making default in complying with the provisions of this section shall be punishable with fine which

may extend to ten lakh rupees.”

Income Tax Benefits:

Income tax benefits are as per Section 80C and Section 10(10D) of Income Tax Act, 1961 which are subject to change

from time to time. Please consult your tax advisor for more details.

Goods and Service Tax:

Currently, tax is not applicable to this product. However, if made applicable in future, will be levied as per the extant

tax laws. The Master Policyholder will be liable to pay all applicable taxes/charges as levied by the Government from

time to time.

Star Union Dai-ichi Life Insurance Company Limited is the name of the Insurance Company and “SUD Life Pradhan

Mantri Jeevan Jyoti Bima Yojana” is the name of the plan. Neither the name of the insurance company nor the name

of the plan in anyway indicates the quality of the plan, its future prospects or returns.

SUD Life Pradhan Mantri Jeevan Jyoti Bima Yojana (UIN: 142G047V02)

Star Union Dai-ichi Life Insurance Company Limited

IRDAI Regn: 142 | CIN: U66010MH2007PLC174472

Registered Office: 11th floor, Vishwaroop I.T. Park, Plot No. 34, 35 & 38, Sector 30A of IIP, Vashi, Navi Mumbai-400

703 I Contact No: 022 71966200 (charges apply), 1800 266 8833 (Toll Free) |Timing: 9:30 am – 6:30 pm (Mon- Sat) I

Email ID: customercare@sudlife.in. For more details visit: www.sudlife.in

Participation by the Bank’s customers in Insurance Business shall be purely on a voluntary basis. It is strictly on a

non-risk participation basis from the Bank. Trade-logo displayed belongs to M/s Bank of India, M/s Union Bank of

India and M/s Dai-ichi Life International Holdings LLC and are being used by Star Union Dai-ichi Life Insurance Co.

Ltd. under license.

BEWARE OF SPURIOUS PHONE CALLS: IRDAI is not involved in activities like selling insurance policies, announcing

bonus or investment of premiums. Public receiving such phone calls are requested to lodge a police complaint.

SUD-SB-10-21-1708

UIN: 142G047V02 Page 4 of 4

Sales Literature SUD Life Pradhan Mantri Jeevan Jyoti Bima Yojana

You might also like

- Cyber Security Training ProposalDocument3 pagesCyber Security Training ProposalAsfac TasfacNo ratings yet

- My Pay PDFDocument1 pageMy Pay PDFbuckwheat122507No ratings yet

- Time Inc's Entry Into Entertainment IndustryDocument35 pagesTime Inc's Entry Into Entertainment Industryluv neha100% (2)

- MGVCL Payment ReceiptDocument1 pageMGVCL Payment Receiptnalluriimp53% (17)

- Kotak Endowment PlanDocument2 pagesKotak Endowment PlanMichael GreenNo ratings yet

- Life BrochureDocument8 pagesLife BrochureHar DonNo ratings yet

- LIC's New One Year Renewal Group Term Assurance Plan - IDocument3 pagesLIC's New One Year Renewal Group Term Assurance Plan - Ilove05kumar05No ratings yet

- Full Year's Premium at Rs 330/-Would Be Payable at The Time of Renewal Under The SchemeDocument5 pagesFull Year's Premium at Rs 330/-Would Be Payable at The Time of Renewal Under The SchemeArun Kumar SharmaNo ratings yet

- Faqs On Pradhan Mantri Jeevan Jyoti Bima Yojana (Pmjjby) Q1. What Is The Nature of The Scheme?Document6 pagesFaqs On Pradhan Mantri Jeevan Jyoti Bima Yojana (Pmjjby) Q1. What Is The Nature of The Scheme?dharmadhikarighanshyam54No ratings yet

- PMJJBY RulesDocument3 pagesPMJJBY Rulesyogesh kumarNo ratings yet

- Rules PMJBYDocument5 pagesRules PMJBYBijay TiwariNo ratings yet

- Pradhan Mantri Vaya Vandana Yojana 05052018Document5 pagesPradhan Mantri Vaya Vandana Yojana 05052018Sagar HaralNo ratings yet

- 825 E-Term 288V01 SLDocument5 pages825 E-Term 288V01 SLIncredible MediaNo ratings yet

- LIC PM Vaya Vandana YojanaDocument6 pagesLIC PM Vaya Vandana YojanaShaji MathewNo ratings yet

- Final Rules PMJJBYDocument3 pagesFinal Rules PMJJBYsdawdwsqNo ratings yet

- Kotak Money Back PlanDocument2 pagesKotak Money Back PlanRupran RaiNo ratings yet

- Sales Brochure Pradhan Mantri Vaya Vandana Yojana PDFDocument5 pagesSales Brochure Pradhan Mantri Vaya Vandana Yojana PDFMuzammil SayedNo ratings yet

- Kotak Money Back PlanDocument2 pagesKotak Money Back PlanDriptendu MaitiNo ratings yet

- PMJJBYRules2018 19Document4 pagesPMJJBYRules2018 19Shivam kesarwaniNo ratings yet

- Rules For The Pradhan Mantri Suraksha Bima Yojana: ST ST ST STDocument4 pagesRules For The Pradhan Mantri Suraksha Bima Yojana: ST ST ST STBhanu Satya SaiNo ratings yet

- Ko Tak Term PlanDocument8 pagesKo Tak Term PlanRKNo ratings yet

- Certificate of InsuranceDocument4 pagesCertificate of Insurancekurundwadesandy007No ratings yet

- Coi PmjjbyDocument4 pagesCoi Pmjjbyashok1259No ratings yet

- MN230823064415795Document7 pagesMN230823064415795Dare KarNo ratings yet

- Sales Brochure LIC-s E-Term Rev PDFDocument3 pagesSales Brochure LIC-s E-Term Rev PDFRamesh ThumburuNo ratings yet

- Smart Platina Plus Brochure - BRDocument3 pagesSmart Platina Plus Brochure - BRSumit RpNo ratings yet

- Insurance Policy BIDocument5 pagesInsurance Policy BILakshav KapoorNo ratings yet

- Insurance Ia 2Document6 pagesInsurance Ia 2Vikrant SinghNo ratings yet

- Contact Your Agent/Branch or Visit Our Website WWW - Licindia.in or SMS YOUR CITY NAME TO 56767474 (Eg. MUMBAI)Document12 pagesContact Your Agent/Branch or Visit Our Website WWW - Licindia.in or SMS YOUR CITY NAME TO 56767474 (Eg. MUMBAI)RustyNo ratings yet

- Jeevan Anurag: Assured BenefitDocument10 pagesJeevan Anurag: Assured BenefitMandheer ChitnavisNo ratings yet

- Sbi Life - Pradhan Mantri Jeevan Jyoti Bima Yojana (Uin: 111G102V01)Document1 pageSbi Life - Pradhan Mantri Jeevan Jyoti Bima Yojana (Uin: 111G102V01)Doel MajumderNo ratings yet

- Bima Nivesh Triple Cover Table NoDocument3 pagesBima Nivesh Triple Cover Table Noravirawat15No ratings yet

- Preferred Term Plan: Financial Protection For Your Loved Ones. AssuredDocument7 pagesPreferred Term Plan: Financial Protection For Your Loved Ones. AssuredpankajzapNo ratings yet

- A Nu RagDocument9 pagesA Nu RagHarish ChandNo ratings yet

- Sales Brochure LIC S Jeevan Lakshya PDFDocument11 pagesSales Brochure LIC S Jeevan Lakshya PDFamit_saxena_10No ratings yet

- Marketing of Financial Services: Course Code:-MKT354Document14 pagesMarketing of Financial Services: Course Code:-MKT354Sabab ZamanNo ratings yet

- JeevanBeema9 4 2023Document2 pagesJeevanBeema9 4 2023Mr. PerfectNo ratings yet

- Pradhan Mantri Jeevan Jyoti Bima Yojana - Features, Benefits and EligibilityDocument6 pagesPradhan Mantri Jeevan Jyoti Bima Yojana - Features, Benefits and EligibilityAshirbad NayakNo ratings yet

- Aviva I-Growth BrochureDocument1 pageAviva I-Growth BrochureVarun SharmaNo ratings yet

- Endowment Plus: in This Policy, The Investment Risk in Investment Portfolio Is Borne by The PolicyholderDocument13 pagesEndowment Plus: in This Policy, The Investment Risk in Investment Portfolio Is Borne by The Policyholderas12df34gh56No ratings yet

- Preferred Term Plan: Faidey Ka InsuranceDocument7 pagesPreferred Term Plan: Faidey Ka InsurancePratik JainNo ratings yet

- Sales Brochure LIC S Single Premium Endowment PlanDocument9 pagesSales Brochure LIC S Single Premium Endowment Plansantosh kumarNo ratings yet

- LIC S Bima Gold - 512N231V01 PDFDocument8 pagesLIC S Bima Gold - 512N231V01 PDFPooja ReddyNo ratings yet

- Ko Tak Term PlanDocument8 pagesKo Tak Term Plansarvesh.bhartiNo ratings yet

- Lic Pension PlansDocument5 pagesLic Pension PlansMarsh JainNo ratings yet

- 251021-Revised Rules For PMSBY Wef 16.10.2021Document3 pages251021-Revised Rules For PMSBY Wef 16.10.2021Ravindra RathoreNo ratings yet

- LIC's Jeevan Umang (UIN: 512N312V02) (A Non-Linked, Participating, Individual, Life Assurance Savings (Whole Life) Plan)Document14 pagesLIC's Jeevan Umang (UIN: 512N312V02) (A Non-Linked, Participating, Individual, Life Assurance Savings (Whole Life) Plan)manoj gokikarNo ratings yet

- Wealth Secure PlanDocument19 pagesWealth Secure PlanKartik R RaoNo ratings yet

- Pradhan Mantri Jeevan Jyoti Bima YojanaDocument4 pagesPradhan Mantri Jeevan Jyoti Bima YojanaEthan HuntNo ratings yet

- Super Endowment BrochureDocument13 pagesSuper Endowment BrochuremiteshtakeNo ratings yet

- 2.whole Life PlansDocument3 pages2.whole Life PlansKoshyNo ratings yet

- Dhan Vriddhi English Sales BrochureDocument16 pagesDhan Vriddhi English Sales BrochureNimesh PrakashNo ratings yet

- JeevanBeema AkashDocument2 pagesJeevanBeema Akashakashuniversal20No ratings yet

- Basics of Investments - HandoutDocument13 pagesBasics of Investments - Handoutsumit.zara1993No ratings yet

- LIC's JEEVAN RAKSHAK (UIN: 512N289V01) - : Policy DocumentDocument11 pagesLIC's JEEVAN RAKSHAK (UIN: 512N289V01) - : Policy DocumentSaravanan DuraiNo ratings yet

- Rules DDDocument3 pagesRules DDsubrahmanyamNo ratings yet

- ABSLI Fortune Elite Plan PresentationDocument20 pagesABSLI Fortune Elite Plan PresentationijarNo ratings yet

- LIC Jeevan Anand HomeDocument3 pagesLIC Jeevan Anand HomeAnkit AgarwalNo ratings yet

- ICICI Savings Suraksha BrochureDocument8 pagesICICI Savings Suraksha BrochureJetesh DevgunNo ratings yet

- Metlife Group Accident Death Benefit Plus Rider - Sales Literature - tcm47-66271Document4 pagesMetlife Group Accident Death Benefit Plus Rider - Sales Literature - tcm47-66271Amit PrasadNo ratings yet

- Birla Sun Life Annuity PlansDocument6 pagesBirla Sun Life Annuity PlansSmruti IyerNo ratings yet

- Textbook of Urgent Care Management: Chapter 9, Insurance Requirements for the Urgent Care CenterFrom EverandTextbook of Urgent Care Management: Chapter 9, Insurance Requirements for the Urgent Care CenterNo ratings yet

- Giorno 1 ComDocument34 pagesGiorno 1 ComLuciano FizzottiNo ratings yet

- Pre Market UpdateDocument8 pagesPre Market UpdateGaurav PatelNo ratings yet

- Tcs Company Stock Value Date Op. Price High Price Low Price Cl. Price Traded Value January Stock PriceDocument4 pagesTcs Company Stock Value Date Op. Price High Price Low Price Cl. Price Traded Value January Stock PriceGopal Chandra SahaNo ratings yet

- Financial and Monetary System of BangladeshDocument24 pagesFinancial and Monetary System of BangladeshM.g. Mostofa OheeNo ratings yet

- Mobile Banking and Mobile Money Adoption For Financial InclusionDocument13 pagesMobile Banking and Mobile Money Adoption For Financial InclusionJacob PossibilityNo ratings yet

- IBDP Mathematics Topic 1 To Topic 4 Revision WorksheetDocument42 pagesIBDP Mathematics Topic 1 To Topic 4 Revision Worksheetq9zfyx5wzfNo ratings yet

- Raj Kumar CVDocument2 pagesRaj Kumar CVRaju DixitNo ratings yet

- Factors Influencing Corporate GovernanceDocument5 pagesFactors Influencing Corporate GovernanceShariq Ansari M100% (2)

- Analysis of Indian EconomyDocument41 pagesAnalysis of Indian EconomySaurav GhoshNo ratings yet

- Credit Schemes in HDFC, Nizamabad: Project Report Submitted To Jawaharlal Nehru Technological University, HyderabadDocument40 pagesCredit Schemes in HDFC, Nizamabad: Project Report Submitted To Jawaharlal Nehru Technological University, HyderabadBnaren NarenNo ratings yet

- Chapter 18 Issues in INternational AccountingDocument3 pagesChapter 18 Issues in INternational AccountingindraakhriaNo ratings yet

- Islamic Finance Sweden 201Document38 pagesIslamic Finance Sweden 201Khin SweNo ratings yet

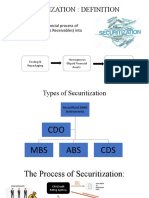

- SECURITIZATIONDocument5 pagesSECURITIZATIONASHISH KUMARNo ratings yet

- FWD: Nesl - Request To Authenticate: Nesliu@Nesl - Co.InDocument2 pagesFWD: Nesl - Request To Authenticate: Nesliu@Nesl - Co.InSagar GuptaNo ratings yet

- Cash and Cash EquivalentsDocument33 pagesCash and Cash EquivalentsJohn kyle Abbago100% (2)

- Appendix 33 - PayrollDocument1 pageAppendix 33 - PayrollLALAINE BONILLA100% (1)

- 0452 Specimen Paper Answers Paper 2 (For Examination From 2020)Document26 pages0452 Specimen Paper Answers Paper 2 (For Examination From 2020)Divya SinghNo ratings yet

- Star River Electronics Ltd.Document10 pagesStar River Electronics Ltd.jack stauberNo ratings yet

- Chanakya National Law University: Topic-Pledge and Hypothecation Subject - Law of Contract IiDocument23 pagesChanakya National Law University: Topic-Pledge and Hypothecation Subject - Law of Contract IiashishNo ratings yet

- Bookassetmgtnew PDFDocument516 pagesBookassetmgtnew PDFMayank Sahu100% (1)

- The Micro Credit Sector in South Africa - An Overview of The History, Financial Access, Challenges and Key PlayersDocument9 pagesThe Micro Credit Sector in South Africa - An Overview of The History, Financial Access, Challenges and Key PlayerstodzaikNo ratings yet

- Chapter 15 - Long-Term Financing: An IntroductionDocument33 pagesChapter 15 - Long-Term Financing: An IntroductionHà HoàngNo ratings yet

- U.S. Income Tax Return For Cooperative AssociationsDocument5 pagesU.S. Income Tax Return For Cooperative AssociationsbhanuprakashbadriNo ratings yet

- Introduction To Project AppraisalDocument3 pagesIntroduction To Project AppraisalGerald Maginga100% (2)

- 9th STD Tamil Sample Study MaterialsDocument46 pages9th STD Tamil Sample Study Materialsk KavithaNo ratings yet

- Entrepreneurship and Business Ownership: COMM 1010: Business in A Global ContextDocument15 pagesEntrepreneurship and Business Ownership: COMM 1010: Business in A Global ContextAbeer ArifNo ratings yet