Professional Documents

Culture Documents

FVR Curriculum Updated

FVR Curriculum Updated

Uploaded by

prathap0 ratings0% found this document useful (0 votes)

32 views3 pagesThis document provides an overview of several finance modules that cover key topics such as corporate finance, free cash flow analysis, risk and return, derivatives, risk management, equity research, and financial regulations. The modules introduce basic financial concepts, tools for valuation and investment decisions, methods for estimating cash flows and costs of capital, models for measuring risk, important derivative contracts and their applications, techniques for risk measurement and management, approaches for equity research and company analysis, and regulations governing financial institutions. Students will learn skills in areas like discounted cash flow modeling, sensitivity analysis, financial statement analysis, and preparing analyst reports.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document provides an overview of several finance modules that cover key topics such as corporate finance, free cash flow analysis, risk and return, derivatives, risk management, equity research, and financial regulations. The modules introduce basic financial concepts, tools for valuation and investment decisions, methods for estimating cash flows and costs of capital, models for measuring risk, important derivative contracts and their applications, techniques for risk measurement and management, approaches for equity research and company analysis, and regulations governing financial institutions. Students will learn skills in areas like discounted cash flow modeling, sensitivity analysis, financial statement analysis, and preparing analyst reports.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

32 views3 pagesFVR Curriculum Updated

FVR Curriculum Updated

Uploaded by

prathapThis document provides an overview of several finance modules that cover key topics such as corporate finance, free cash flow analysis, risk and return, derivatives, risk management, equity research, and financial regulations. The modules introduce basic financial concepts, tools for valuation and investment decisions, methods for estimating cash flows and costs of capital, models for measuring risk, important derivative contracts and their applications, techniques for risk measurement and management, approaches for equity research and company analysis, and regulations governing financial institutions. Students will learn skills in areas like discounted cash flow modeling, sensitivity analysis, financial statement analysis, and preparing analyst reports.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 3

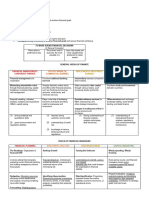

Module Topics Highlights

The three basic principles of corporate finance are

investment, financing, and dividend. Finance

Basic financial concepts such as rate of

professionals are expected to know how to value an

return, time value of money. Also, capital

organization’s assets and make sound financial,

budgeting, bonds, Yield to maturity,

Introduction to investment, and trading decisions.

duration, convexity, introduction to bond

Corporate This module starts with an overview of basic concepts

markets, market conventions, bid-offer

Finance such as cost of capital, rate of return, compounding,

spreads, relative value, floating rate cash

cash flows, present and future value, and discounted

flows, corporate bonds and default risk,

cash flows. By the end of it students will be able to

credit ratings, and stocks.

determine the financial feasibility of investments and

acquisitions, given cost of capital.

Free Cash Flow, or FCF, is an important financial tool to

measure the health of any business. It helps individuals

understand how efficient a business is at generating

cash. Using FCFs, investors can determine whether a

business has enough cash for dividends or share

Enterprise Discounted Cash Flow (DCF

buybacks.

Model), The Free Cash Flows (FCFs),

Free Cash Flow In this module, students will learn about FCF, how

Estimating Future Free Cash Flows, Relative

Analysis financial statements are utilized in estimating FCF, and

Valuation, Financial statements and key

how estimation and utilization of operating profit is

financial ratios

used to calculate FCF. They will also learn of other

means to estimate FCF including Earnings before

Interest and Tax (EBIT), tax shields, Property, Plant &

Equipment (PPE), and Net Operating Working Capital

(NOWC).

In any investment decisions, risk and return are major

considerations; investors/organizations compare the

expected return from an investment with the risk

associated with it. In general, the higher the risk with an

The relation between Risk & Return and investment, the higher the potential return.

CAPM, Applications of the CAPM to In this module students will learn what really defines

Risk & Return

Corporate Finance and the WACC, and Cost risk and the concepts associated with it such as risk

of Capital and WACC discount rate and risk premium. They will also learn

how risk can be measured, both quantitatively and in

the context of a portfolio. Finally, they will examine the

concept of beta as a measure of market risk by utilizing

the Capital Asset Pricing Model (CAPM).

Derivatives are financial contracts whose value is

dependent on an underlying entity, such as an asset or

index. They can be broadly divided into two types,

exchange-traded derivatives and over the counter

derivatives. They can be used for a number of purposes

Futures and forwards, hedging application including hedging, speculation on price movements, or

of forwards, Floating rate cash flows getting access to otherwise difficult assets or markets.

Derivatives

,interest rate swaps, options and option The financial derivatives market has seen a multi-fold

greeks growth in the last couple of decades.This module

explains key concepts associated with derivatives

including market structure of interest rate derivatives

and valuation, futures and forwards contracts, forwards

hedging, floating rate cash flows, interest rate swaps,

options, and option greeks.

Risk management refers broadly to the identification,

measurement, and mitigation of financial risks. By using

certain financial instruments to manage exposure to

sensitivity based risk measures such as financial risks—mainly operational, credit, and market

Risk pvo1, higher order sensitivity measures risk—investors/organizations look to protect their

Management (convexity , gamma etc), value at risk and economic value.

expected shortfall, risk reporting In this module, students will learn how to measure risk

iof various financial instruments.They will learn

sensitivity-based risk measures such as PVO1, value at

risk and expected shortfall, and risk reporting.

Equity research is a discipline where analysts research

public companies and come up with recommendations

for buying, selling, or holding a particular stock; they

Financial statements – income statement, evaluate companies with the goal of making investment

balance sheet and cash flow statements, recommendations.

DCF method, multiples approach to In this module learners will take a deep dive into

valuation, key ratios relevant to companies different methods of equity research to prepare for

Equity

in various sectors (eg: tier ratios for roles such as equities research analysts. They will learn

Research

banking), key themes across sectors (eg: US how to analyse financial statements like income,

sales as %age of revenues for pharma balance sheet, and cash flow. They will also learn about

companies), deep-dive of analyst reports of different valuation methods such as discounted cash

20 blue chip NSE companie flow (DCF) and multiples approach to valuation. Finally,

they will learn about key ratios relevant to companies in

various sectors and key themes across sectors, and

study analyst reports of 20 blue chip NSE companies.

Financial regulations are rules and laws that govern

financial institutions. Their aim is ensuring stability in

the financial system, protection of consumers, and

prevention of financial crimes.In this module students

will learn about the different regulations governing

financial markets and the agencies that enforce them.

Specifically, they will learn about Basel III - an

international regulatory framework for banks, and

Financial

Basel III, FRTB, IFRS and SEBI guidelines Fundamental Review of the Trading Book (FRTB) - a set

Regulations

of proposals by the Basel Committee on Banking

Supervision.They will also learn about International

Financial Reporting Standards (IFRS) accounting

standards issued by the IFRS Foundation and the

International Accounting Standards Board. Finally, they

will learn about the regulatory body for securities and

commodity markets in India, the Securities and

Exchange Board of India (SEBI),

Learners will learn to leverage excel for analysing

Technologies Excel and VBA

financial data

You might also like

- Launching A Real Estate Fund - PELRDocument13 pagesLaunching A Real Estate Fund - PELRalagendraNo ratings yet

- Evaluating Venture Capital Term SheetsDocument21 pagesEvaluating Venture Capital Term Sheetsd88% (8)

- Practice Case Studies - Case Study ExamplesDocument6 pagesPractice Case Studies - Case Study ExamplesTanish GoelNo ratings yet

- Kone Case AnalysisDocument6 pagesKone Case AnalysisNikit Tyagi50% (2)

- Financial Management Term PaperDocument29 pagesFinancial Management Term PaperOmar Faruk50% (2)

- Assignment 3 SolutionsDocument5 pagesAssignment 3 SolutionsFaas1337No ratings yet

- Horniman HorticultureDocument11 pagesHorniman Horticultureangela4620100% (2)

- Finance CourseDocument18 pagesFinance Coursegourav patwekar100% (1)

- FFM Class Outline 2018 - 2019Document5 pagesFFM Class Outline 2018 - 2019Juan SanguinetiNo ratings yet

- Benchmarks: Kevin Webb, CFADocument45 pagesBenchmarks: Kevin Webb, CFAUsurpaNo ratings yet

- ReportDocument6 pagesReportJunaid ShahidNo ratings yet

- Lecture Notes 1 Introduction To FinanceDocument4 pagesLecture Notes 1 Introduction To FinanceJulla Antonette OrtizNo ratings yet

- Corporate FinanceDocument140 pagesCorporate FinanceGerald NjugunaNo ratings yet

- CF - CO Section - BDocument31 pagesCF - CO Section - BAditya SinghNo ratings yet

- Discounted Cash Flow W 021 0210Document7 pagesDiscounted Cash Flow W 021 0210barbieeditha59No ratings yet

- GIOA Book Return and Total Return Good Bad UglyDocument55 pagesGIOA Book Return and Total Return Good Bad UglyrpcampbellNo ratings yet

- FIN101PRELIMSDocument6 pagesFIN101PRELIMSEmily ResuentoNo ratings yet

- The Definition of Structured Finance: Results From A SurveyDocument7 pagesThe Definition of Structured Finance: Results From A Surveybhumika_shah_9No ratings yet

- Subject CA1 - Core Applications Concepts Paper Two Examiners' ReportDocument14 pagesSubject CA1 - Core Applications Concepts Paper Two Examiners' ReportArjun Ajay KavallurNo ratings yet

- Master in Finance CourseDocument9 pagesMaster in Finance CourseHanh NguyenNo ratings yet

- Southern University Bangladesh Department of Business Administration Program: Undergraduate-BBADocument2 pagesSouthern University Bangladesh Department of Business Administration Program: Undergraduate-BBAmaquesurat ferdousNo ratings yet

- Rates 104 - Debt Instruments 1Document42 pagesRates 104 - Debt Instruments 1ssj7cjqq2dNo ratings yet

- Complete Book FM PDFDocument245 pagesComplete Book FM PDFRam IyerNo ratings yet

- Investment Environment and Investment Management ProcessDocument7 pagesInvestment Environment and Investment Management ProcessAGONCILLO SOPIA NICOLENo ratings yet

- Research PaperDocument13 pagesResearch PaperShuvajit BhattacharyyaNo ratings yet

- Lesson 5 Capital Structure and The Cost of CapitalDocument57 pagesLesson 5 Capital Structure and The Cost of CapitalNombulelo NdlovuNo ratings yet

- Introduction To Financial SystemDocument37 pagesIntroduction To Financial SystemPauline BiancaNo ratings yet

- Activity 4Document2 pagesActivity 4Alysa dawn CabrestanteNo ratings yet

- Individualization of Robo-AdviceDocument8 pagesIndividualization of Robo-AdviceDaniel Lee Eisenberg JacobsNo ratings yet

- Previous 308Document2 pagesPrevious 308dbadhon2021No ratings yet

- Adi XroDocument2 pagesAdi Xroankitraj318No ratings yet

- BAC 203 NtesDocument12 pagesBAC 203 NtesBrian MutuaNo ratings yet

- CF - Co - MaDocument32 pagesCF - Co - MaANKIT GUPTANo ratings yet

- Tutorial 1 SolutionsDocument4 pagesTutorial 1 SolutionsnatashaNo ratings yet

- Bac 203 Complete NotesDocument39 pagesBac 203 Complete NotesBrian MutuaNo ratings yet

- Mba3 Fin b1p3Document103 pagesMba3 Fin b1p3Divya JainNo ratings yet

- MCO 07 EM 2024 @ignouallqueries1Document10 pagesMCO 07 EM 2024 @ignouallqueries1surbhi_sharma_2613No ratings yet

- Module 4 Building and Enhancing New Literacies Across The Curriculum PDFDocument9 pagesModule 4 Building and Enhancing New Literacies Across The Curriculum PDFHenry Cargando IINo ratings yet

- Finance101 ReviewerDocument2 pagesFinance101 Reviewerzenyasula13No ratings yet

- Semana 13 Videoconferencia Gabriela ValderramaDocument15 pagesSemana 13 Videoconferencia Gabriela ValderramaRamses Montes SalinasNo ratings yet

- A Sensible Mutual Fund Selection ModelDocument14 pagesA Sensible Mutual Fund Selection Modeljigsan5No ratings yet

- Without This Message by Purchasing Novapdf : Print To PDFDocument35 pagesWithout This Message by Purchasing Novapdf : Print To PDFShweta VijayNo ratings yet

- Lesson 3 Time Value of MoneyDocument77 pagesLesson 3 Time Value of MoneyNombulelo NdlovuNo ratings yet

- Topic 1 IPMDocument22 pagesTopic 1 IPMmeshack mbalaNo ratings yet

- Bofi ReviewerDocument20 pagesBofi ReviewerJared PaulateNo ratings yet

- B.St. CH 9,10 NotesDocument9 pagesB.St. CH 9,10 NotesPraveen KumarNo ratings yet

- Adobe Scan 03 Aug 2023Document3 pagesAdobe Scan 03 Aug 2023Amedorme WisdomNo ratings yet

- Jyell Optional Business Risk Management Preliminary Examination A.Y. 2020 2021Document5 pagesJyell Optional Business Risk Management Preliminary Examination A.Y. 2020 2021jyell cabigasNo ratings yet

- Chapter 10 DerivativesDocument47 pagesChapter 10 DerivativessherlNo ratings yet

- Corporate Finance and Model of Financial Control - Substantiate Enterprise Controlling: Descriptive AnalysisDocument9 pagesCorporate Finance and Model of Financial Control - Substantiate Enterprise Controlling: Descriptive AnalysisPuttu Guru PrasadNo ratings yet

- Af-302 - Financial Markets and InstitutionsDocument2 pagesAf-302 - Financial Markets and InstitutionsFuadNo ratings yet

- Unit 2Document16 pagesUnit 2Sharine ReyesNo ratings yet

- Spectrum of HF InvestorsDocument7 pagesSpectrum of HF InvestorsalgunoshombresNo ratings yet

- What Is The Capital Asset Pricing ModelDocument10 pagesWhat Is The Capital Asset Pricing ModelshlakaNo ratings yet

- Pej PPT Notes 3Document29 pagesPej PPT Notes 3phalguni bNo ratings yet

- Management of Funds Entire SubjectDocument85 pagesManagement of Funds Entire SubjectMir Wajahat Ali100% (1)

- Capital Structure and DividendsDocument29 pagesCapital Structure and Dividendsnithya-mbaNo ratings yet

- Mse 6203 - Corporate FinanceDocument18 pagesMse 6203 - Corporate FinanceSri VarriNo ratings yet

- Activity 3Document3 pagesActivity 3Jacqueline OrtegaNo ratings yet

- Viva SolveDocument8 pagesViva Solvemoi828720No ratings yet

- A Study On Investors' Perception Towards Mutual Funds and Its Scopes in IndiaDocument5 pagesA Study On Investors' Perception Towards Mutual Funds and Its Scopes in IndiaEditor IJTSRDNo ratings yet

- Ey Collateral OptimizationDocument15 pagesEy Collateral OptimizationpromckingzscribdNo ratings yet

- Discounted Cash Flow Budgeting: Simplified Your Path to Financial ExcellenceFrom EverandDiscounted Cash Flow Budgeting: Simplified Your Path to Financial ExcellenceNo ratings yet

- Tactical Objective: Strategic Maneuvers, Decoding the Art of Military PrecisionFrom EverandTactical Objective: Strategic Maneuvers, Decoding the Art of Military PrecisionNo ratings yet

- Discounted Cash Flow Demystified: A Comprehensive Guide to DCF BudgetingFrom EverandDiscounted Cash Flow Demystified: A Comprehensive Guide to DCF BudgetingNo ratings yet

- Mat ProcurementDocument10 pagesMat Procurementtpitts25No ratings yet

- TEST Paper 1 Full TestDocument9 pagesTEST Paper 1 Full Testjohny SahaNo ratings yet

- Financial Markets and ServicesDocument47 pagesFinancial Markets and ServicesHarishNo ratings yet

- Vi. Manipulation, Fraud, and Insider Trading Manipulation of Security Prices Devices and PracticesDocument9 pagesVi. Manipulation, Fraud, and Insider Trading Manipulation of Security Prices Devices and PracticesJasfher CallejoNo ratings yet

- Younity Community & EdTech ModuleDocument91 pagesYounity Community & EdTech ModuleTanay ManeNo ratings yet

- Simulation and Strategic Options: Decision Tools, 3 Edition, 2012Document18 pagesSimulation and Strategic Options: Decision Tools, 3 Edition, 2012mrtz87No ratings yet

- A Conceptual Framework For Analyzing The Financial EnvironmentDocument42 pagesA Conceptual Framework For Analyzing The Financial EnvironmentNoelNo ratings yet

- Specification of Stock OptionDocument1 pageSpecification of Stock OptionPuthpura PuthNo ratings yet

- Melinda Cooper - Turbulent WorldsDocument24 pagesMelinda Cooper - Turbulent WorldsZeynep OguzNo ratings yet

- Credit Flux Credit Index Trading 2004Document51 pagesCredit Flux Credit Index Trading 2004meth8177No ratings yet

- Derivatives and HedgingDocument13 pagesDerivatives and HedgingDeo Corona100% (1)

- Call Option Payoff Patterns: Time 0 Time TDocument23 pagesCall Option Payoff Patterns: Time 0 Time TSyed Ameer Ali ShahNo ratings yet

- IFRS 9financial InstrumentsDocument33 pagesIFRS 9financial InstrumentsMirzakarimboy AkhmadjonovNo ratings yet

- Review Test QuestionsDocument24 pagesReview Test QuestionsKent Mathew BacusNo ratings yet

- The Theoretical and Methodological Basis of Startups ValuationDocument6 pagesThe Theoretical and Methodological Basis of Startups ValuationClaudio JuniorNo ratings yet

- Futures and OptionsDocument42 pagesFutures and OptionsMallikarjun RaoNo ratings yet

- Algorithmic Trading SoftwareDocument281 pagesAlgorithmic Trading SoftwareSamNo ratings yet

- Introduction To The Investment EnvironmentDocument51 pagesIntroduction To The Investment EnvironmentSaish ChavanNo ratings yet

- Share Based Compensation LectureDocument2 pagesShare Based Compensation LectureKimberly AsuncionNo ratings yet

- Trading Price Action For Day Traders by Kiran Bala-V1.0Document73 pagesTrading Price Action For Day Traders by Kiran Bala-V1.0sNo ratings yet

- ST213 2022 ExamDocument4 pagesST213 2022 Examweiyu wangNo ratings yet

- Option: Offers The Right (But Imposes No Obligation)Document3 pagesOption: Offers The Right (But Imposes No Obligation)meetwithsanjayNo ratings yet

- Fiv20403 Fe Financial Derivatives Answer SchemeDocument5 pagesFiv20403 Fe Financial Derivatives Answer SchemeAmir Abidin Bashir MohammedNo ratings yet

- Group Assignment-2 AnswerDocument6 pagesGroup Assignment-2 AnswerFarhanie NordinNo ratings yet

- Ch.4 Redemption of DebenturesDocument14 pagesCh.4 Redemption of DebenturesNidhi LathNo ratings yet