Professional Documents

Culture Documents

Unit Plan - Cbse Section: Unit Title / Chapter Name: Accounting For Partnership Firms

Unit Plan - Cbse Section: Unit Title / Chapter Name: Accounting For Partnership Firms

Uploaded by

bhumilimbadiya09_216Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Unit Plan - Cbse Section: Unit Title / Chapter Name: Accounting For Partnership Firms

Unit Plan - Cbse Section: Unit Title / Chapter Name: Accounting For Partnership Firms

Uploaded by

bhumilimbadiya09_216Copyright:

Available Formats

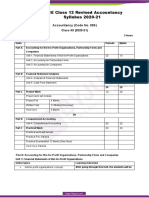

UNIT PLAN – CBSE SECTION

Name of the Teacher: Bhumika Shah

Subject: Accountancy Grade: XII

No of classes/periods required to complete the unit: 49

Date: 03/04/2021 Unit Title / Chapter Name: Accounting for Partnership Firms

CONTENT TO BE GAUGING PRIOR LEARNING OBJECTIVES

COVERED UNDER THE KNOWLEDGE (Details of FOR THIS UNIT

SAID UNIT / CHAPTER activity that will be

done to gauge students

(add more rows if

previous understanding

needed)

about the specific

topic/concept)

1. Partnership: features, Preparation of charts showing 1. Student will develop

Partnership Deed. Provisions of Partners Capital Accounts with understanding on what is

the Indian Partnership Act 1932 Fixed Capital Methods and partnership business and will

in the absence of Partnership Fluctuations Methods , Profit able to state the meaning of

deed Fixed v/s fluctuating and Loss Appropriation partnership, partnership firm

capital accounts. Preparation Account. and partnership deed. describe

of Profit and Loss different types of partners,

Appropriation account- sanctify the characteristic

division of profit among features of partnership and the

partners, guarantee of profits. contents of partnership deed.

Past adjustments (relating to describe different types of

interest on capital, interest on partners, sanctify the

drawing, salary and profit- characteristic features of

sharing ratio). Goodwill: partnership and the contents

nature, factors affecting and of partnership deed.

methods of valuation - average

profit, super profit, and

capitalization.

2. Change in the Profit 2. They will be able to

Sharing Ratio among the Differentiate between fixed

existing partners - sacrificing and fluctuating capital, outline

ratio, gaining ratio, accounting the process and develop the

for revaluation of assets and understanding of preparation

reassessment of liabilities and of Profit and Loss

treatment of reserves and Appropriation Account.

accumulated profits.

CRIMSON ANISHA GLOBAL SCHOOL

Preparation of revaluation

account and balance sheet.

3. Admission of a partner - 3. Develop the understanding

effect of admission of a partner of making past adjustments.

on change in the profit-sharing State the meaning, nature and

ratio, treatment of goodwill (as factors affecting goodwill

per AS 26), treatment for develop the understanding of

revaluation of assets and valuation of goodwill using

reassessment of liabilities, different methods of valuation

treatment of reserves and of goodwill.

accumulated profits,

adjustment of capital accounts

and preparation of balance

sheet.

4. Retirement and death of a 4. Students will be able to

partner: effect of retirement / Describe the meaning of

death of a partner on change in sacrificing ratio, gaining ratio

profit sharing ratio, treatment and the change in profit

of goodwill (as per AS 26), sharing ratio among existing

treatment for revaluation of partners. develop the

assets and reassessment of understanding of accounting

liabilities, adjustment of treatment of assets and

accumulated profits and reassessment of liabilities and

reserves, adjustment of capital distribution of reserves and

accounts and preparation of accumulated profits. Explain

balance sheet. Preparation of the effect of change in profit

loan account of the retiring sharing ratio on admission of a

partner. Calculation of new partner. Develop the

deceased partner’s share of understanding of treatment of

profit till the date of death. goodwill as per IAS-38,

Preparation of deceased treatment of revaluation of

partner’s capital account, assets and re-assessment of

executor’s account and liabilities, treatment of

preparation of balance sheet. reserves and accumulated

profits, adjustment of capital

accounts and preparation of

balance sheet of the new firm

explain the effect of

retirement/deaths of a partner

on change in profit sharing

ratio.

5. Dissolution of a partnership 5. State the meaning of

firm: types of dissolution of a sacrificing ratio. Develop the

firm. Settlement of accounts - understanding of accounting

CRIMSON ANISHA GLOBAL SCHOOL

preparation of realization treatment of goodwill,

account, and other related revaluation of assets and re-

accounts: capital accounts of assessment of liabilities and

partners and cash/bank a/c adjustment of accumulated

(excluding piecemeal profits and reserves on

distribution, sale to a company retirement/deaths of a partner

and insolvency of partners. and adjustment.

MAPPING OF COMPETENCIES / ATTRIBUTES

(highlight the relevant ones in YELLOW)

Competencies (21st Century Skills) CBSE Attributes

Critical Thinking • Responsible

Communication • Confident

Collaboration • Engaged

Creativity • Innovative

• Reflective

RESOURCES TO BE USED VOCABULARY / KEYWORDS THAT WILL BE

(including web-based INTRODUCED TO STUDENTS DURING THIS

resources) UNIT

Add more rows if needed

1. Different e-learning platform e- 1.Partnership business

content- Text, Video Lectures, Sway.

2.Goodwill

3.Sacrifice and gain ratio

4.Reserves and accumulated Profits

CRIMSON ANISHA GLOBAL SCHOOL

TEACHING / LEARNING LEARNING ENGAGEMENTS/ACTIVITIES PLANNED

STRATEGIES THAT FOR ACTIVE LEARNING

WOULD BE USED FOR

THIS UNIT

1.Enhanced Lecture Case studies of real Partnership and their Accounting

information and date

2. Questioning and Discussion

3. Problem-Based Learning

CLASSROOM ASSIGNMENTS / ASSESSMENT PLANNED FOR THIS UNIT

HOMEWORK (homework tasks /

worksheets to be enclosed with

this plan)

1.Solving Exercises and illustration Type of Assessment (Formative / Peer / Self /

Summative):

Peer,Self

2.

3. Details of Assessment Planned (as stated above):

MCQ and Problem solving

4.

PRACTICALS (for Science and Computer Science subjects only)

1.

2.

3.

4.

CRIMSON ANISHA GLOBAL SCHOOL

Principal/Supervisor/Coordinator Feedback:

SELF-REFLECTION: What were the most effective elements of the unit? Why?

What were the least effective elements of the unit? Why?

If I were to repeat the unit what would I change? How could I improve?

(TO BE FILLED IN AFTER THE SAID UNIT HAS BEEN COMPLETED)

CRIMSON ANISHA GLOBAL SCHOOL

You might also like

- Financial and Managerial Accounting The Basis For Business Decisions 18th Edition Williams Solutions ManualDocument87 pagesFinancial and Managerial Accounting The Basis For Business Decisions 18th Edition Williams Solutions ManualEmilyJonesizjgp100% (17)

- ABM-BUSINESS ETHICS - SOCIAL RESPONSIBILITY 12 - Q1 - W2 - Mod2 PDFDocument16 pagesABM-BUSINESS ETHICS - SOCIAL RESPONSIBILITY 12 - Q1 - W2 - Mod2 PDFHannah Joy Lontayao94% (18)

- Zubair Hasan - Islamic BanksDocument19 pagesZubair Hasan - Islamic BanksCANDERA100% (1)

- Polkinghorne V Holland 51 CLR 143Document13 pagesPolkinghorne V Holland 51 CLR 143David LimNo ratings yet

- Accountancy: (Code No. 055) (2021-22) Class Xii - Curriculum (Term-Wise)Document9 pagesAccountancy: (Code No. 055) (2021-22) Class Xii - Curriculum (Term-Wise)Parthiv PattaNo ratings yet

- CBSE Class 12 Accountancy Syllabus 2023 24Document8 pagesCBSE Class 12 Accountancy Syllabus 2023 24kankariya1424No ratings yet

- 2022 23 Accountancy 12-MinDocument8 pages2022 23 Accountancy 12-MinShajila AnvarNo ratings yet

- CBSE Class 12 Accountancy Syllabus 2022 23Document8 pagesCBSE Class 12 Accountancy Syllabus 2022 23SanakhanNo ratings yet

- Reduced SyllabusDocument333 pagesReduced SyllabusRaj Rajeshwer Gupta100% (1)

- CBSE Class 12 Term Wise Accountancy Syllabus 2021 22Document9 pagesCBSE Class 12 Term Wise Accountancy Syllabus 2021 22ILMA UROOJNo ratings yet

- ACCOUNTANCY (Code No. 055) : RationaleDocument11 pagesACCOUNTANCY (Code No. 055) : RationaleIshan MittalNo ratings yet

- Account SyllabusDocument5 pagesAccount Syllabusadityasinghania.gtsNo ratings yet

- Accountancy XII Syllabus 1234Document5 pagesAccountancy XII Syllabus 1234Moheet KumarNo ratings yet

- Final Question Bank Xii Accoutancy-2022-23Document206 pagesFinal Question Bank Xii Accoutancy-2022-23Khushi Sharma100% (1)

- Accountancy (Code No. 055) : Class-XII (2019-20)Document6 pagesAccountancy (Code No. 055) : Class-XII (2019-20)naveenaNo ratings yet

- Accountancy Syllabus (Code No. 055) Term-Wise Class-XII (2021-22)Document7 pagesAccountancy Syllabus (Code No. 055) Term-Wise Class-XII (2021-22)Sarthak PithoriyaNo ratings yet

- Grade 12 AccountancyDocument8 pagesGrade 12 AccountancyPeeyush VarshneyNo ratings yet

- SM 12 Accountancy Eng 201617 PDFDocument424 pagesSM 12 Accountancy Eng 201617 PDFUdit100% (1)

- CBSE Class 12 Revised Accountancy Syllabus 2020-21Document8 pagesCBSE Class 12 Revised Accountancy Syllabus 2020-21Harry AryanNo ratings yet

- ACCOUNTANCY (Code No. 055) : RationaleDocument10 pagesACCOUNTANCY (Code No. 055) : RationaleAshish GangwalNo ratings yet

- Activity 4Document2 pagesActivity 4Alysa dawn CabrestanteNo ratings yet

- Xii - 2022-23 - Acc - RaipurDocument148 pagesXii - 2022-23 - Acc - RaipurNavya100% (1)

- Part B: Computerised AccountingDocument6 pagesPart B: Computerised AccountingSonakshi JainNo ratings yet

- F5BAFSsyllabus16-17 (SingYin)Document4 pagesF5BAFSsyllabus16-17 (SingYin)endickhkNo ratings yet

- Buad 803 Assignment 2Document3 pagesBuad 803 Assignment 2jeff4real2007No ratings yet

- 12 Revised Accountancy 21Document10 pages12 Revised Accountancy 21sarvodayaeducationalgroupNo ratings yet

- ACCT201 Accounting For Special TransactionsDocument7 pagesACCT201 Accounting For Special TransactionsMiles SantosNo ratings yet

- Afar 2 Module CH 4 PDFDocument20 pagesAfar 2 Module CH 4 PDFRazmen Ramirez PintoNo ratings yet

- Course Outline ACC 212Document3 pagesCourse Outline ACC 212fbicia218No ratings yet

- Class XII Commerce TERM - 1 Syllabus-4Document15 pagesClass XII Commerce TERM - 1 Syllabus-4Ashren rijeren TiggaNo ratings yet

- Afar 2 Module CH 1Document13 pagesAfar 2 Module CH 1Razmen Ramirez PintoNo ratings yet

- Accountancy Arihant CBSE TERM 2 Class 12 Question BanksDocument240 pagesAccountancy Arihant CBSE TERM 2 Class 12 Question BanksAT SPiDY75% (8)

- Kvs Student Support Materical Class Xii AccountancyDocument200 pagesKvs Student Support Materical Class Xii Accountancyahujakrishna242No ratings yet

- JAC 12th Accounts Syllabus 2024Document6 pagesJAC 12th Accounts Syllabus 2024ap8204676No ratings yet

- 2 - Partnership OperationsDocument14 pages2 - Partnership Operationslou-924No ratings yet

- Afar 2 Module CH 2Document22 pagesAfar 2 Module CH 2Razmen Ramirez PintoNo ratings yet

- Spectrans M1 M2Document7 pagesSpectrans M1 M2Patricia CruzNo ratings yet

- Accountancy (Code No. 055) Class-XII (2018-19)Document7 pagesAccountancy (Code No. 055) Class-XII (2018-19)saurabhNo ratings yet

- Admission of A New PartnerDocument36 pagesAdmission of A New PartnerSreekanth DogiparthiNo ratings yet

- MBAP Accounting and Finance Learning GuideDocument172 pagesMBAP Accounting and Finance Learning Guidelandu.connieNo ratings yet

- Dwnload Full Financial Accounting 17th Edition Williams Solutions Manual PDFDocument35 pagesDwnload Full Financial Accounting 17th Edition Williams Solutions Manual PDFmargrave.mackinaw.2121r100% (16)

- MODULE FinalTerm FAR 3 Cash and Accrual and Single EntryDocument23 pagesMODULE FinalTerm FAR 3 Cash and Accrual and Single EntryKezNo ratings yet

- Unit 3 Admission of A New Partner PDFDocument30 pagesUnit 3 Admission of A New Partner PDFvivekNo ratings yet

- 61813bos50279 cp8 U3Document34 pages61813bos50279 cp8 U3Vishvanath VishvanathNo ratings yet

- Unit 19 - Partnership AccountsDocument2 pagesUnit 19 - Partnership AccountsMuhammad Umar SalmanNo ratings yet

- Fundamentals of Accountancy, Business and Management 2: Lesson 5 - 6: Financial Statement AnalysisDocument2 pagesFundamentals of Accountancy, Business and Management 2: Lesson 5 - 6: Financial Statement AnalysisJerico MarcelinoNo ratings yet

- Unit Plan - Cbse Section: Unit Title / Chapter Name: Accounting For CompaniesDocument4 pagesUnit Plan - Cbse Section: Unit Title / Chapter Name: Accounting For Companiesbhumilimbadiya09_216No ratings yet

- 2021 Accounting Atp Grade 11 1Document4 pages2021 Accounting Atp Grade 11 1Good LifeNo ratings yet

- Accounting 12Document140 pagesAccounting 12sainimanish170gmailc0% (2)

- Tomas Del Rosario College: Balanga City, Bataan DEPARTMENT: AccountancyDocument14 pagesTomas Del Rosario College: Balanga City, Bataan DEPARTMENT: AccountancyVanessa L. VinluanNo ratings yet

- S1 AfacrDocument3 pagesS1 Afacrmudassar saeedNo ratings yet

- 7.-ISC-Accounts 040424 2025Document20 pages7.-ISC-Accounts 040424 2025jiyadugar037No ratings yet

- ACCOUNTANCYDocument176 pagesACCOUNTANCYSUDHA GADADNo ratings yet

- Unit Plan - Cbse Section: Unit Title / Chapter Name: Analysis of Financial StatementDocument4 pagesUnit Plan - Cbse Section: Unit Title / Chapter Name: Analysis of Financial Statementbhumilimbadiya09_216No ratings yet

- Solution Manual For Financial and Managerial Accounting The Basis For Business Decisions 18Th Edition by Williams Haka Bettner A Full Chapter PDFDocument36 pagesSolution Manual For Financial and Managerial Accounting The Basis For Business Decisions 18Th Edition by Williams Haka Bettner A Full Chapter PDFfrances.langley893100% (11)

- 1271 XII Accountancy Study Material Supplementary Material HOTS and VBQ 2014 15 PDFDocument380 pages1271 XII Accountancy Study Material Supplementary Material HOTS and VBQ 2014 15 PDFBalaji TkpNo ratings yet

- Framework Theory - StudentDocument27 pagesFramework Theory - StudentKrushna MateNo ratings yet

- A 1 Financial StatementsDocument7 pagesA 1 Financial Statementsmohit0503No ratings yet

- Key-Terms and Chapter Summary-5Document3 pagesKey-Terms and Chapter Summary-5Sachin PalNo ratings yet

- Chapter 3 (Edited)Document43 pagesChapter 3 (Edited)Hoang Thi Thanh TamNo ratings yet

- Financial and Managerial Accounting The Basis For Business Decisions 18th Edition by Williams Haka Bettner and Carcello ISBN 125969240X Solution ManualDocument91 pagesFinancial and Managerial Accounting The Basis For Business Decisions 18th Edition by Williams Haka Bettner and Carcello ISBN 125969240X Solution Manuallaurel100% (31)

- Unit Plan - Cbse Section: Unit Title / Chapter Name: Not For Profit OrganizationDocument4 pagesUnit Plan - Cbse Section: Unit Title / Chapter Name: Not For Profit Organizationbhumilimbadiya09_216No ratings yet

- Unit Plan - Cbse Section: Unit Title / Chapter Name: Analysis of Financial StatementDocument4 pagesUnit Plan - Cbse Section: Unit Title / Chapter Name: Analysis of Financial Statementbhumilimbadiya09_216No ratings yet

- Unit Plan - Cbse Section: Unit Title / Chapter Name: Accounting For CompaniesDocument4 pagesUnit Plan - Cbse Section: Unit Title / Chapter Name: Accounting For Companiesbhumilimbadiya09_216No ratings yet

- Notes For Chapter 1 Igcse AccountsDocument4 pagesNotes For Chapter 1 Igcse Accountsbhumilimbadiya09_216No ratings yet

- LU20 - Tax StrategyDocument56 pagesLU20 - Tax StrategyAnil HarichandreNo ratings yet

- Feasib Final OutputDocument139 pagesFeasib Final OutputChristian Rex100% (1)

- Qualifying Exam Reviewer: Financial AccountingDocument26 pagesQualifying Exam Reviewer: Financial AccountingJanine AnzanoNo ratings yet

- CA Foundation - Suggested AnswerDocument22 pagesCA Foundation - Suggested Answeruchihamadara1178No ratings yet

- CHAPTER 12 Partnerships Basic Considerations and FormationsDocument9 pagesCHAPTER 12 Partnerships Basic Considerations and FormationsGabrielle Joshebed AbaricoNo ratings yet

- B.F. by S.K As at 5 May 2005Document316 pagesB.F. by S.K As at 5 May 2005John Munene KarokiNo ratings yet

- Choosing The Best Legal Structure For Your Professional PracticeDocument4 pagesChoosing The Best Legal Structure For Your Professional PracticeFalmata AtNo ratings yet

- Chapter 3Document16 pagesChapter 3Les CariñoNo ratings yet

- Stat Con Case DigestDocument16 pagesStat Con Case DigestEisley Sarzadilla100% (1)

- SVP Commercial Lending Manager in Jacksonville FL Resume Steven KelleyDocument2 pagesSVP Commercial Lending Manager in Jacksonville FL Resume Steven KelleyStevenKelleyNo ratings yet

- View Tax Return PDFDocument16 pagesView Tax Return PDFmwf1806No ratings yet

- Mock Part Ia and Law 2020 With Answers EditedDocument38 pagesMock Part Ia and Law 2020 With Answers EditedLA M AENo ratings yet

- Unlike Shareholders, General Partners May Have Liability Beyond Their Capital BalancesDocument20 pagesUnlike Shareholders, General Partners May Have Liability Beyond Their Capital BalancesLiza Magat MatadlingNo ratings yet

- Ca Foundation Business LawDocument151 pagesCa Foundation Business Lawyopak46456No ratings yet

- PARTNERSHIP ZuluetaDocument35 pagesPARTNERSHIP ZuluetaxjammerNo ratings yet

- Partnership AgreementDocument6 pagesPartnership AgreementDevendren SathasivamNo ratings yet

- Muñasque v. Court of AppealsDocument2 pagesMuñasque v. Court of AppealsChristia Junina AlcantaraNo ratings yet

- PARTNERSHIP AGREEMENT CLG PSDADocument7 pagesPARTNERSHIP AGREEMENT CLG PSDARajni PorwalNo ratings yet

- Admission of PartnerDocument145 pagesAdmission of PartnerTushar sinh ParmarNo ratings yet

- A1 NotesDocument32 pagesA1 NotesLawrence WilsonNo ratings yet

- Understanding TrademarksDocument2 pagesUnderstanding TrademarksChuck EastNo ratings yet

- PFR153Document2 pagesPFR153SHARON100% (2)

- Partnership Note CLVDocument3 pagesPartnership Note CLVCHEENSNo ratings yet

- Partnership Operations ReviewDocument37 pagesPartnership Operations ReviewShin Shan JeonNo ratings yet

- REGISTRATION DEPARTMENT Users Manual SocietyDocument21 pagesREGISTRATION DEPARTMENT Users Manual SocietyBabu KuruvillaNo ratings yet

- Business Law Exam TemplateDocument3 pagesBusiness Law Exam TemplateHussain NizzamiNo ratings yet