Professional Documents

Culture Documents

Q3 Financial Highlights

Q3 Financial Highlights

Uploaded by

Shreyash ShahCopyright:

Available Formats

You might also like

- Manarang Auto Repair Shop Journal by The Month of January 2019Document9 pagesManarang Auto Repair Shop Journal by The Month of January 2019Renz MoralesNo ratings yet

- PG P&G Procter & Gamble CAGNY 2018Document68 pagesPG P&G Procter & Gamble CAGNY 2018Ala BasterNo ratings yet

- FY2122 Q1 Slide Deck FinalDocument12 pagesFY2122 Q1 Slide Deck FinalMatyas LukacsNo ratings yet

- LVMH q3 2022Document28 pagesLVMH q3 2022Damilola OdeyemiNo ratings yet

- Sales and Results FY23Document61 pagesSales and Results FY23JoaoNo ratings yet

- Random Things Just For A CauseDocument16 pagesRandom Things Just For A Causebryan mark santosNo ratings yet

- Q3 & 9M FY22 Financial PerformanceDocument3 pagesQ3 & 9M FY22 Financial PerformanceV RajeshNo ratings yet

- 11152021023003MrsBectors InvestorPresentationQ2andH1FY22Document38 pages11152021023003MrsBectors InvestorPresentationQ2andH1FY22Ronak Pradeep SoniNo ratings yet

- Jefferies Conference - June 2022Document37 pagesJefferies Conference - June 2022Jenil RitaNo ratings yet

- Fy 2019 Ang - A PDFDocument52 pagesFy 2019 Ang - A PDFshamimshawonNo ratings yet

- CAGNY 2023 Presentation PDFDocument46 pagesCAGNY 2023 Presentation PDFEdwin Lam Choong WaiNo ratings yet

- 9M CY2019 Unaudited Results Investor Briefing: Irwin C. Lee Mike P. LiwanagDocument13 pages9M CY2019 Unaudited Results Investor Briefing: Irwin C. Lee Mike P. LiwanagJeninaNo ratings yet

- Study - Id48832 - Food Report Sauces and SpicesDocument10 pagesStudy - Id48832 - Food Report Sauces and SpicesLAgoonNo ratings yet

- DSM 2019Q1 PresentationDocument20 pagesDSM 2019Q1 PresentationzfranklynNo ratings yet

- Carrefour FY 2020 18 02 2021 Complete 1Document58 pagesCarrefour FY 2020 18 02 2021 Complete 1AyaNo ratings yet

- Balance Mercado Libre - Cuarto Trimestre 2020Document19 pagesBalance Mercado Libre - Cuarto Trimestre 2020BAE NegociosNo ratings yet

- Q3 FY 2023 Earnings Slides Web PDFDocument31 pagesQ3 FY 2023 Earnings Slides Web PDFEdwin Lam Choong WaiNo ratings yet

- Presentation To Investors: First Nine Months 2020 ResultsDocument27 pagesPresentation To Investors: First Nine Months 2020 ResultsMiguel García MirandaNo ratings yet

- Investor Presentation Q1FY24 ResultsDocument27 pagesInvestor Presentation Q1FY24 ResultsbrandonxstarkNo ratings yet

- P5Document43 pagesP5Abhishek PandeyNo ratings yet

- Annual Report2017 MARICODocument318 pagesAnnual Report2017 MARICOmiaujNo ratings yet

- Lse GRG 2018Document122 pagesLse GRG 2018rraorohan24No ratings yet

- Heritage FoodsDocument31 pagesHeritage FoodsBskkamNo ratings yet

- Adecco-Group-Q124-Results-Press ReleaseDocument15 pagesAdecco-Group-Q124-Results-Press ReleaseAissa HadjoudjaNo ratings yet

- Q3 2021 RESULTS: Profitable Growth and Record Gross MarginDocument15 pagesQ3 2021 RESULTS: Profitable Growth and Record Gross MarginKanikaNo ratings yet

- Adecco Group Q3 2021 Press ReleaseDocument15 pagesAdecco Group Q3 2021 Press ReleaseKanikaNo ratings yet

- AG Pernod Ricard VF AnDocument144 pagesAG Pernod Ricard VF AnArleneminiNo ratings yet

- Sales For The First Half of 2018: US$237m ( 196m) : - H1 2018 Sales Rose by 27% To US$237m, Up From US$186m in H1 2017Document3 pagesSales For The First Half of 2018: US$237m ( 196m) : - H1 2018 Sales Rose by 27% To US$237m, Up From US$186m in H1 2017Rahul ChoudharyNo ratings yet

- Dan One First Quarter 2022Document5 pagesDan One First Quarter 2022Juan Manuel PattiNo ratings yet

- Arvind Fashions Limited: Investor RoadshowDocument39 pagesArvind Fashions Limited: Investor RoadshowdeepurNo ratings yet

- Q4 Pfizer Earnings Infographic FINAL PDFDocument1 pageQ4 Pfizer Earnings Infographic FINAL PDFRuben ArocaNo ratings yet

- Full-Year Results 2018: Press ConferenceDocument22 pagesFull-Year Results 2018: Press ConferenceDebasish SahooNo ratings yet

- Syngenta Annual Review 2015Document72 pagesSyngenta Annual Review 2015Al Amin SajNo ratings yet

- Pakistan Tobacco Company: A Subsidiary of British American Tobacco (BAT)Document15 pagesPakistan Tobacco Company: A Subsidiary of British American Tobacco (BAT)AbdulRehmanHaschameNo ratings yet

- 2018 Full Year Results Investor PresentationDocument44 pages2018 Full Year Results Investor Presentationabduqodirovas3004No ratings yet

- Corporate Presentation - August 2018Document22 pagesCorporate Presentation - August 2018nehal00284No ratings yet

- Ega Hadi Prayitno Hudiono: Skills Personal Data EducationDocument23 pagesEga Hadi Prayitno Hudiono: Skills Personal Data EducationafriyadiNo ratings yet

- Econ SemproDocument17 pagesEcon SemproAshlley Nicole VillaranNo ratings yet

- GROUP 1 - Final Presentation: Financial Metrics in Business and Services A.Y. 2021-2022Document24 pagesGROUP 1 - Final Presentation: Financial Metrics in Business and Services A.Y. 2021-2022Alberto FrancesconiNo ratings yet

- Colgate's Growing SuccessDocument43 pagesColgate's Growing SuccesshuhuNo ratings yet

- VBL AR 2022 AnnualReportDocument378 pagesVBL AR 2022 AnnualReportPriya JalanNo ratings yet

- Glanbia PLC 2018 Full Year ResultsDocument40 pagesGlanbia PLC 2018 Full Year ResultsavitripsNo ratings yet

- Quarterly Update Q1FY22: Century Plyboards (India) LTDDocument10 pagesQuarterly Update Q1FY22: Century Plyboards (India) LTDhackmaverickNo ratings yet

- HDFC Life Insurance Company: ESG Disclosure ScoreDocument6 pagesHDFC Life Insurance Company: ESG Disclosure ScorebdacNo ratings yet

- Bunzl 2019Document196 pagesBunzl 2019rachel lingNo ratings yet

- Sao PauloDocument59 pagesSao PauloRita RosadoNo ratings yet

- 2018 - Investor - Presentation - Q1-2019 ICICILombard - General - Insurance PDFDocument20 pages2018 - Investor - Presentation - Q1-2019 ICICILombard - General - Insurance PDFRAHUL PANDEYNo ratings yet

- Q4 2019 Earnings Slides FINALDocument46 pagesQ4 2019 Earnings Slides FINALpabloNo ratings yet

- Cleopatra 2021 EnglishDocument14 pagesCleopatra 2021 EnglishAmr ElghazalyNo ratings yet

- Investor Presentation May-2020 PDFDocument41 pagesInvestor Presentation May-2020 PDFshahavNo ratings yet

- Balance Mercado Libre 2Document23 pagesBalance Mercado Libre 2BAE NegociosNo ratings yet

- Oa NH Deutsche Bank 2022 0Document51 pagesOa NH Deutsche Bank 2022 0justineNo ratings yet

- Corp Present Afr 310318 PDFDocument32 pagesCorp Present Afr 310318 PDFhamsNo ratings yet

- Execution Drives Momentum: Full Year ResultsDocument32 pagesExecution Drives Momentum: Full Year ResultsSamir HassanNo ratings yet

- Edenred - 2023 02 21 Fy 2022 Results Presentation VdefDocument70 pagesEdenred - 2023 02 21 Fy 2022 Results Presentation VdefaugustocestariraizenNo ratings yet

- Sme Report - FinalDocument14 pagesSme Report - FinalAKSHATA NEOLENo ratings yet

- M-And-S Ar20 Full 200528Document204 pagesM-And-S Ar20 Full 200528ReswinNo ratings yet

- HDFC Life PresentationDocument66 pagesHDFC Life PresentationShubham BhatiaNo ratings yet

- TSN Tyson Foods CAGNY 2018Document72 pagesTSN Tyson Foods CAGNY 2018Ala BasterNo ratings yet

- Vivo Energy 2019 AraDocument184 pagesVivo Energy 2019 AraJazzi KhanNo ratings yet

- Starch & Vegetable Fats & Oils World Summary: Market Values & Financials by CountryFrom EverandStarch & Vegetable Fats & Oils World Summary: Market Values & Financials by CountryNo ratings yet

- Pradeep CSR FinDocument37 pagesPradeep CSR FinShreyash ShahNo ratings yet

- Pradeep CSR FinDocument81 pagesPradeep CSR FinShreyash ShahNo ratings yet

- Aarti General Management ProjectDocument38 pagesAarti General Management ProjectShreyash ShahNo ratings yet

- New DocumentDocument1 pageNew DocumentShreyash ShahNo ratings yet

- Mayuresh Patil 9162 Marketing Project ReportDocument78 pagesMayuresh Patil 9162 Marketing Project ReportShreyash ShahNo ratings yet

- Pradeep CSRDocument33 pagesPradeep CSRShreyash ShahNo ratings yet

- Sip ReportDocument64 pagesSip ReportShreyash ShahNo ratings yet

- Paint DealDocument6 pagesPaint DealShreyash ShahNo ratings yet

- Sameed Ansari.Document1 pageSameed Ansari.Shreyash ShahNo ratings yet

- Book1 ReportDocument15 pagesBook1 ReportShreyash ShahNo ratings yet

- Wa0000.Document1 pageWa0000.Shreyash ShahNo ratings yet

- General MDocument53 pagesGeneral MShreyash ShahNo ratings yet

- Pradeep SpecDocument68 pagesPradeep SpecShreyash ShahNo ratings yet

- Kullu Manali 5 Days Tour: by King Hills TravelsDocument26 pagesKullu Manali 5 Days Tour: by King Hills TravelsShreyash ShahNo ratings yet

- Work Study and Method Study PresentationDocument14 pagesWork Study and Method Study PresentationShreyash ShahNo ratings yet

- Jubilant Foodworks: More Legs For Growth Reflecting Confidence On CoreDocument11 pagesJubilant Foodworks: More Legs For Growth Reflecting Confidence On CoreShreyash ShahNo ratings yet

- Phiroze Je Jeebhoy Towers,: Dalal StreetDocument11 pagesPhiroze Je Jeebhoy Towers,: Dalal StreetShreyash ShahNo ratings yet

- StateDocument9 pagesStateShreyash ShahNo ratings yet

- Exterior PaintingDocument10 pagesExterior PaintingShreyash ShahNo ratings yet

- Ibcc ReitDocument8 pagesIbcc ReitShreyash ShahNo ratings yet

- Visit: When ToDocument5 pagesVisit: When ToShreyash ShahNo ratings yet

- Company Namcategory Brand + Product Name + Type Size (KG/LT)Document8 pagesCompany Namcategory Brand + Product Name + Type Size (KG/LT)Shreyash ShahNo ratings yet

- Visit Report GoaDocument27 pagesVisit Report GoaShreyash ShahNo ratings yet

- Prohibition 1949Document81 pagesProhibition 1949Shreyash ShahNo ratings yet

- JLL AR 2021 22 - For Website - 300622Document287 pagesJLL AR 2021 22 - For Website - 300622Shreyash ShahNo ratings yet

- Berer 2Document19 pagesBerer 2Shreyash ShahNo ratings yet

- IC Indigo - Paints - MOSLDocument34 pagesIC Indigo - Paints - MOSLShreyash ShahNo ratings yet

- Noc BajajDocument2 pagesNoc BajajSowvik BanerjeeNo ratings yet

- Abhijit Deshmukh, CFA: PROFESSIONAL EXPERIENCE - Financial Markets / BankingDocument2 pagesAbhijit Deshmukh, CFA: PROFESSIONAL EXPERIENCE - Financial Markets / BankingVishnu GautamNo ratings yet

- AIOD - HSBC 12M CNH Twinwin Sharkfin Note Series 1 - 230922 - 152458Document27 pagesAIOD - HSBC 12M CNH Twinwin Sharkfin Note Series 1 - 230922 - 152458jesswjaNo ratings yet

- Training Report - Abhishek SharmaDocument46 pagesTraining Report - Abhishek SharmaHeena KaushalNo ratings yet

- Authority To InvestDocument3 pagesAuthority To InvestThemba MaviNo ratings yet

- The Banking and Financial Sector in NigeriaDocument4 pagesThe Banking and Financial Sector in NigeriatuoizdydxNo ratings yet

- Commercial Bank ManagementDocument38 pagesCommercial Bank ManagementAikya Gandhi100% (1)

- Bank Statement Amita YellewarDocument5 pagesBank Statement Amita Yellewarclientlegalfin2022No ratings yet

- Principles of Mktg-Q4-Module-7Document27 pagesPrinciples of Mktg-Q4-Module-7Sharlyn Marie An Noble-Badillo100% (1)

- Macroeconomics 7th Edition Hubbard Solutions Manual Full Chapter PDFDocument53 pagesMacroeconomics 7th Edition Hubbard Solutions Manual Full Chapter PDFhanhcharmainee29v100% (14)

- Introduction To OP MGNT. MGT303Document17 pagesIntroduction To OP MGNT. MGT303Julie Ann ManaloNo ratings yet

- Quiz 1 SolutionsDocument6 pagesQuiz 1 SolutionsれなNo ratings yet

- Manpower Export in Bangladesh: Problems and Prospects: Sardar Syed Ahamed Dr. Md. Rezaul KarimDocument26 pagesManpower Export in Bangladesh: Problems and Prospects: Sardar Syed Ahamed Dr. Md. Rezaul KarimAbrar SakibNo ratings yet

- The Trading Game T GameDocument2 pagesThe Trading Game T GamebignicehomeNo ratings yet

- ECOMMERCEDocument6 pagesECOMMERCESushwet AmatyaNo ratings yet

- Government of Rajasthan Public Health Engineering Department (Rajasthan)Document29 pagesGovernment of Rajasthan Public Health Engineering Department (Rajasthan)ashutoshpower2007No ratings yet

- Typical Vat Audit ChecklistDocument4 pagesTypical Vat Audit ChecklistROHIT BAJAJNo ratings yet

- Kieso IFRS4 TB ch03Document93 pagesKieso IFRS4 TB ch03John Vincent CruzNo ratings yet

- Mobile Services: Your Account SummaryDocument2 pagesMobile Services: Your Account SummaryayushiqueenNo ratings yet

- Account's MCQDocument7 pagesAccount's MCQMohitTagotraNo ratings yet

- Chaneel Case ArticleDocument6 pagesChaneel Case ArticleMangipudi SeshagiriNo ratings yet

- 10th Bipartite PDFDocument59 pages10th Bipartite PDFoopsmeandyou100% (1)

- IMM Practice Leader JD FINALDocument2 pagesIMM Practice Leader JD FINALMarshay HallNo ratings yet

- University of Perpetual Help System Dalta: Calamba Campus, Brgy. Paciano RizalDocument3 pagesUniversity of Perpetual Help System Dalta: Calamba Campus, Brgy. Paciano RizalJeanette LampitocNo ratings yet

- Funds Flow AnalysisDocument120 pagesFunds Flow Analysisamarnadh allaNo ratings yet

- 2023 Pharmaceutical Manufacturing Supplychain TrendsDocument11 pages2023 Pharmaceutical Manufacturing Supplychain TrendsfresultaNo ratings yet

- 1st Exam Theory PpeDocument4 pages1st Exam Theory PpejustineNo ratings yet

- Write 55g As A Percentage of 2.2kgDocument8 pagesWrite 55g As A Percentage of 2.2kgKatrine Jaya AndrewNo ratings yet

- Mathematics - Question and AnswersDocument9 pagesMathematics - Question and Answersphirihannock43No ratings yet

Q3 Financial Highlights

Q3 Financial Highlights

Uploaded by

Shreyash ShahOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Q3 Financial Highlights

Q3 Financial Highlights

Uploaded by

Shreyash ShahCopyright:

Available Formats

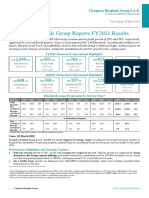

STRONG GROWTH IN THE FOODS BUSINESS – UP 10% TO C RS.108 CRORE.

YTD FOODS GROWTH OF 17%

Total Foods: Q1 Q2 Q3 YTD

AGRO TECH FOODS LTD

Volume + 28% + 13% + 7% + 15%

Q3 FY’22 HIGHLIGHTS

Value + 31% + 14% + 10% + 17%

Ready to Cook Snacks Volumes reflect

Ready to Cook Snacks: Q1 Q2 Q3 YTD

opening up of the economy. Pricing

Volume + 36% + 11% + 5% + 15% actions on Premium end drive Value

Growth faster than Volume.

Value + 39% + 12% + 8% + 18%

RTE Snacks Volume sees acceleration

Ready to Eat Snacks: Q1 Q2 Q3 YTD with opening up of economy. Growth

primarily driven by RTE Popcorn and

Volume + 1% + 18% + 18% + 14% hence Value Growth significantly

Value + 9% + 15% + 32% + 20% higher than Volume.

Pricing actions in Spreads still to be

Spreads & Dips: Q1 Q2 Q3 YTD

fully visible across all Channels.

Volume + 12% + 6% - 3% + 4% Trends very positive where

implemented.

Value + 15% + 7% - 7% + 4%

Cereals see strong YTD growth with

Cereals: Q1 Q2 Q3 YTD further benefits expected due to

improved retailing and market

Volume + 82 % + 55% + 21% + 45% working.

Value + 60 % + 36% + 9% + 28% Duo continues to see steady month

on month growth. PPA

Chocolate confectionery: Q1 Q2 Q3 YTD

implementation largely done on

Volume + 105% + 534% + 153% + 210% Coconut Variant. Testing of Peanut

Variant underway.

Value + 149% + 768% + 208% + 289%

Price Realignment in FY’21 helps to

Premium Edible Oils: Q1 Q2 Q3 YTD

bring Premium Edible Oils (Sundrop

Volume - 12% + 4% + 11% + 1% Superlite & Heart) to a 100+ Index.

Value ahead due to Commodity

Value + 20% + 36% + 35% + 30%

Prices.

Mass Edible Oils: Q1 Q2 Q3 YTD Mass Edible Oils Volumes reflect

reduced dependence on the Category

Volume - 71% - 51% - 67% - 63%

in line with Company Strategy. Crystal

Value - 50% - 26% - 54% - 44% Franchised from Nov-21 onwards.

FINANCIAL HIGHLIGHTS

- Net Sales largely in line with PY with Foods growth of 10% and Pricing on Premium Oils offsetting lower Mass Oil volumes.

- YTD GM of Foods of INR 73 crore lower than PY by INR 11 crore – 15% Input Cost inflation of INR 25 crores only partly offset by increased

pricing and volume growth of INR 14 crore. Expect to see lower input cost inflation in Q4 with continued benefits of increased pricing and

volume growth. YTD GM of Oils of INR 55 crore (lower than PY by INR 4 crore) trending well to Full Year FY’21 of INR 72 crore.

- ATFL thanks all its’ stakeholders for their continued support as it progresses towards joining the ranks of “India’s Best Performing Most

Respected Food Companies”.

You might also like

- Manarang Auto Repair Shop Journal by The Month of January 2019Document9 pagesManarang Auto Repair Shop Journal by The Month of January 2019Renz MoralesNo ratings yet

- PG P&G Procter & Gamble CAGNY 2018Document68 pagesPG P&G Procter & Gamble CAGNY 2018Ala BasterNo ratings yet

- FY2122 Q1 Slide Deck FinalDocument12 pagesFY2122 Q1 Slide Deck FinalMatyas LukacsNo ratings yet

- LVMH q3 2022Document28 pagesLVMH q3 2022Damilola OdeyemiNo ratings yet

- Sales and Results FY23Document61 pagesSales and Results FY23JoaoNo ratings yet

- Random Things Just For A CauseDocument16 pagesRandom Things Just For A Causebryan mark santosNo ratings yet

- Q3 & 9M FY22 Financial PerformanceDocument3 pagesQ3 & 9M FY22 Financial PerformanceV RajeshNo ratings yet

- 11152021023003MrsBectors InvestorPresentationQ2andH1FY22Document38 pages11152021023003MrsBectors InvestorPresentationQ2andH1FY22Ronak Pradeep SoniNo ratings yet

- Jefferies Conference - June 2022Document37 pagesJefferies Conference - June 2022Jenil RitaNo ratings yet

- Fy 2019 Ang - A PDFDocument52 pagesFy 2019 Ang - A PDFshamimshawonNo ratings yet

- CAGNY 2023 Presentation PDFDocument46 pagesCAGNY 2023 Presentation PDFEdwin Lam Choong WaiNo ratings yet

- 9M CY2019 Unaudited Results Investor Briefing: Irwin C. Lee Mike P. LiwanagDocument13 pages9M CY2019 Unaudited Results Investor Briefing: Irwin C. Lee Mike P. LiwanagJeninaNo ratings yet

- Study - Id48832 - Food Report Sauces and SpicesDocument10 pagesStudy - Id48832 - Food Report Sauces and SpicesLAgoonNo ratings yet

- DSM 2019Q1 PresentationDocument20 pagesDSM 2019Q1 PresentationzfranklynNo ratings yet

- Carrefour FY 2020 18 02 2021 Complete 1Document58 pagesCarrefour FY 2020 18 02 2021 Complete 1AyaNo ratings yet

- Balance Mercado Libre - Cuarto Trimestre 2020Document19 pagesBalance Mercado Libre - Cuarto Trimestre 2020BAE NegociosNo ratings yet

- Q3 FY 2023 Earnings Slides Web PDFDocument31 pagesQ3 FY 2023 Earnings Slides Web PDFEdwin Lam Choong WaiNo ratings yet

- Presentation To Investors: First Nine Months 2020 ResultsDocument27 pagesPresentation To Investors: First Nine Months 2020 ResultsMiguel García MirandaNo ratings yet

- Investor Presentation Q1FY24 ResultsDocument27 pagesInvestor Presentation Q1FY24 ResultsbrandonxstarkNo ratings yet

- P5Document43 pagesP5Abhishek PandeyNo ratings yet

- Annual Report2017 MARICODocument318 pagesAnnual Report2017 MARICOmiaujNo ratings yet

- Lse GRG 2018Document122 pagesLse GRG 2018rraorohan24No ratings yet

- Heritage FoodsDocument31 pagesHeritage FoodsBskkamNo ratings yet

- Adecco-Group-Q124-Results-Press ReleaseDocument15 pagesAdecco-Group-Q124-Results-Press ReleaseAissa HadjoudjaNo ratings yet

- Q3 2021 RESULTS: Profitable Growth and Record Gross MarginDocument15 pagesQ3 2021 RESULTS: Profitable Growth and Record Gross MarginKanikaNo ratings yet

- Adecco Group Q3 2021 Press ReleaseDocument15 pagesAdecco Group Q3 2021 Press ReleaseKanikaNo ratings yet

- AG Pernod Ricard VF AnDocument144 pagesAG Pernod Ricard VF AnArleneminiNo ratings yet

- Sales For The First Half of 2018: US$237m ( 196m) : - H1 2018 Sales Rose by 27% To US$237m, Up From US$186m in H1 2017Document3 pagesSales For The First Half of 2018: US$237m ( 196m) : - H1 2018 Sales Rose by 27% To US$237m, Up From US$186m in H1 2017Rahul ChoudharyNo ratings yet

- Dan One First Quarter 2022Document5 pagesDan One First Quarter 2022Juan Manuel PattiNo ratings yet

- Arvind Fashions Limited: Investor RoadshowDocument39 pagesArvind Fashions Limited: Investor RoadshowdeepurNo ratings yet

- Q4 Pfizer Earnings Infographic FINAL PDFDocument1 pageQ4 Pfizer Earnings Infographic FINAL PDFRuben ArocaNo ratings yet

- Full-Year Results 2018: Press ConferenceDocument22 pagesFull-Year Results 2018: Press ConferenceDebasish SahooNo ratings yet

- Syngenta Annual Review 2015Document72 pagesSyngenta Annual Review 2015Al Amin SajNo ratings yet

- Pakistan Tobacco Company: A Subsidiary of British American Tobacco (BAT)Document15 pagesPakistan Tobacco Company: A Subsidiary of British American Tobacco (BAT)AbdulRehmanHaschameNo ratings yet

- 2018 Full Year Results Investor PresentationDocument44 pages2018 Full Year Results Investor Presentationabduqodirovas3004No ratings yet

- Corporate Presentation - August 2018Document22 pagesCorporate Presentation - August 2018nehal00284No ratings yet

- Ega Hadi Prayitno Hudiono: Skills Personal Data EducationDocument23 pagesEga Hadi Prayitno Hudiono: Skills Personal Data EducationafriyadiNo ratings yet

- Econ SemproDocument17 pagesEcon SemproAshlley Nicole VillaranNo ratings yet

- GROUP 1 - Final Presentation: Financial Metrics in Business and Services A.Y. 2021-2022Document24 pagesGROUP 1 - Final Presentation: Financial Metrics in Business and Services A.Y. 2021-2022Alberto FrancesconiNo ratings yet

- Colgate's Growing SuccessDocument43 pagesColgate's Growing SuccesshuhuNo ratings yet

- VBL AR 2022 AnnualReportDocument378 pagesVBL AR 2022 AnnualReportPriya JalanNo ratings yet

- Glanbia PLC 2018 Full Year ResultsDocument40 pagesGlanbia PLC 2018 Full Year ResultsavitripsNo ratings yet

- Quarterly Update Q1FY22: Century Plyboards (India) LTDDocument10 pagesQuarterly Update Q1FY22: Century Plyboards (India) LTDhackmaverickNo ratings yet

- HDFC Life Insurance Company: ESG Disclosure ScoreDocument6 pagesHDFC Life Insurance Company: ESG Disclosure ScorebdacNo ratings yet

- Bunzl 2019Document196 pagesBunzl 2019rachel lingNo ratings yet

- Sao PauloDocument59 pagesSao PauloRita RosadoNo ratings yet

- 2018 - Investor - Presentation - Q1-2019 ICICILombard - General - Insurance PDFDocument20 pages2018 - Investor - Presentation - Q1-2019 ICICILombard - General - Insurance PDFRAHUL PANDEYNo ratings yet

- Q4 2019 Earnings Slides FINALDocument46 pagesQ4 2019 Earnings Slides FINALpabloNo ratings yet

- Cleopatra 2021 EnglishDocument14 pagesCleopatra 2021 EnglishAmr ElghazalyNo ratings yet

- Investor Presentation May-2020 PDFDocument41 pagesInvestor Presentation May-2020 PDFshahavNo ratings yet

- Balance Mercado Libre 2Document23 pagesBalance Mercado Libre 2BAE NegociosNo ratings yet

- Oa NH Deutsche Bank 2022 0Document51 pagesOa NH Deutsche Bank 2022 0justineNo ratings yet

- Corp Present Afr 310318 PDFDocument32 pagesCorp Present Afr 310318 PDFhamsNo ratings yet

- Execution Drives Momentum: Full Year ResultsDocument32 pagesExecution Drives Momentum: Full Year ResultsSamir HassanNo ratings yet

- Edenred - 2023 02 21 Fy 2022 Results Presentation VdefDocument70 pagesEdenred - 2023 02 21 Fy 2022 Results Presentation VdefaugustocestariraizenNo ratings yet

- Sme Report - FinalDocument14 pagesSme Report - FinalAKSHATA NEOLENo ratings yet

- M-And-S Ar20 Full 200528Document204 pagesM-And-S Ar20 Full 200528ReswinNo ratings yet

- HDFC Life PresentationDocument66 pagesHDFC Life PresentationShubham BhatiaNo ratings yet

- TSN Tyson Foods CAGNY 2018Document72 pagesTSN Tyson Foods CAGNY 2018Ala BasterNo ratings yet

- Vivo Energy 2019 AraDocument184 pagesVivo Energy 2019 AraJazzi KhanNo ratings yet

- Starch & Vegetable Fats & Oils World Summary: Market Values & Financials by CountryFrom EverandStarch & Vegetable Fats & Oils World Summary: Market Values & Financials by CountryNo ratings yet

- Pradeep CSR FinDocument37 pagesPradeep CSR FinShreyash ShahNo ratings yet

- Pradeep CSR FinDocument81 pagesPradeep CSR FinShreyash ShahNo ratings yet

- Aarti General Management ProjectDocument38 pagesAarti General Management ProjectShreyash ShahNo ratings yet

- New DocumentDocument1 pageNew DocumentShreyash ShahNo ratings yet

- Mayuresh Patil 9162 Marketing Project ReportDocument78 pagesMayuresh Patil 9162 Marketing Project ReportShreyash ShahNo ratings yet

- Pradeep CSRDocument33 pagesPradeep CSRShreyash ShahNo ratings yet

- Sip ReportDocument64 pagesSip ReportShreyash ShahNo ratings yet

- Paint DealDocument6 pagesPaint DealShreyash ShahNo ratings yet

- Sameed Ansari.Document1 pageSameed Ansari.Shreyash ShahNo ratings yet

- Book1 ReportDocument15 pagesBook1 ReportShreyash ShahNo ratings yet

- Wa0000.Document1 pageWa0000.Shreyash ShahNo ratings yet

- General MDocument53 pagesGeneral MShreyash ShahNo ratings yet

- Pradeep SpecDocument68 pagesPradeep SpecShreyash ShahNo ratings yet

- Kullu Manali 5 Days Tour: by King Hills TravelsDocument26 pagesKullu Manali 5 Days Tour: by King Hills TravelsShreyash ShahNo ratings yet

- Work Study and Method Study PresentationDocument14 pagesWork Study and Method Study PresentationShreyash ShahNo ratings yet

- Jubilant Foodworks: More Legs For Growth Reflecting Confidence On CoreDocument11 pagesJubilant Foodworks: More Legs For Growth Reflecting Confidence On CoreShreyash ShahNo ratings yet

- Phiroze Je Jeebhoy Towers,: Dalal StreetDocument11 pagesPhiroze Je Jeebhoy Towers,: Dalal StreetShreyash ShahNo ratings yet

- StateDocument9 pagesStateShreyash ShahNo ratings yet

- Exterior PaintingDocument10 pagesExterior PaintingShreyash ShahNo ratings yet

- Ibcc ReitDocument8 pagesIbcc ReitShreyash ShahNo ratings yet

- Visit: When ToDocument5 pagesVisit: When ToShreyash ShahNo ratings yet

- Company Namcategory Brand + Product Name + Type Size (KG/LT)Document8 pagesCompany Namcategory Brand + Product Name + Type Size (KG/LT)Shreyash ShahNo ratings yet

- Visit Report GoaDocument27 pagesVisit Report GoaShreyash ShahNo ratings yet

- Prohibition 1949Document81 pagesProhibition 1949Shreyash ShahNo ratings yet

- JLL AR 2021 22 - For Website - 300622Document287 pagesJLL AR 2021 22 - For Website - 300622Shreyash ShahNo ratings yet

- Berer 2Document19 pagesBerer 2Shreyash ShahNo ratings yet

- IC Indigo - Paints - MOSLDocument34 pagesIC Indigo - Paints - MOSLShreyash ShahNo ratings yet

- Noc BajajDocument2 pagesNoc BajajSowvik BanerjeeNo ratings yet

- Abhijit Deshmukh, CFA: PROFESSIONAL EXPERIENCE - Financial Markets / BankingDocument2 pagesAbhijit Deshmukh, CFA: PROFESSIONAL EXPERIENCE - Financial Markets / BankingVishnu GautamNo ratings yet

- AIOD - HSBC 12M CNH Twinwin Sharkfin Note Series 1 - 230922 - 152458Document27 pagesAIOD - HSBC 12M CNH Twinwin Sharkfin Note Series 1 - 230922 - 152458jesswjaNo ratings yet

- Training Report - Abhishek SharmaDocument46 pagesTraining Report - Abhishek SharmaHeena KaushalNo ratings yet

- Authority To InvestDocument3 pagesAuthority To InvestThemba MaviNo ratings yet

- The Banking and Financial Sector in NigeriaDocument4 pagesThe Banking and Financial Sector in NigeriatuoizdydxNo ratings yet

- Commercial Bank ManagementDocument38 pagesCommercial Bank ManagementAikya Gandhi100% (1)

- Bank Statement Amita YellewarDocument5 pagesBank Statement Amita Yellewarclientlegalfin2022No ratings yet

- Principles of Mktg-Q4-Module-7Document27 pagesPrinciples of Mktg-Q4-Module-7Sharlyn Marie An Noble-Badillo100% (1)

- Macroeconomics 7th Edition Hubbard Solutions Manual Full Chapter PDFDocument53 pagesMacroeconomics 7th Edition Hubbard Solutions Manual Full Chapter PDFhanhcharmainee29v100% (14)

- Introduction To OP MGNT. MGT303Document17 pagesIntroduction To OP MGNT. MGT303Julie Ann ManaloNo ratings yet

- Quiz 1 SolutionsDocument6 pagesQuiz 1 SolutionsれなNo ratings yet

- Manpower Export in Bangladesh: Problems and Prospects: Sardar Syed Ahamed Dr. Md. Rezaul KarimDocument26 pagesManpower Export in Bangladesh: Problems and Prospects: Sardar Syed Ahamed Dr. Md. Rezaul KarimAbrar SakibNo ratings yet

- The Trading Game T GameDocument2 pagesThe Trading Game T GamebignicehomeNo ratings yet

- ECOMMERCEDocument6 pagesECOMMERCESushwet AmatyaNo ratings yet

- Government of Rajasthan Public Health Engineering Department (Rajasthan)Document29 pagesGovernment of Rajasthan Public Health Engineering Department (Rajasthan)ashutoshpower2007No ratings yet

- Typical Vat Audit ChecklistDocument4 pagesTypical Vat Audit ChecklistROHIT BAJAJNo ratings yet

- Kieso IFRS4 TB ch03Document93 pagesKieso IFRS4 TB ch03John Vincent CruzNo ratings yet

- Mobile Services: Your Account SummaryDocument2 pagesMobile Services: Your Account SummaryayushiqueenNo ratings yet

- Account's MCQDocument7 pagesAccount's MCQMohitTagotraNo ratings yet

- Chaneel Case ArticleDocument6 pagesChaneel Case ArticleMangipudi SeshagiriNo ratings yet

- 10th Bipartite PDFDocument59 pages10th Bipartite PDFoopsmeandyou100% (1)

- IMM Practice Leader JD FINALDocument2 pagesIMM Practice Leader JD FINALMarshay HallNo ratings yet

- University of Perpetual Help System Dalta: Calamba Campus, Brgy. Paciano RizalDocument3 pagesUniversity of Perpetual Help System Dalta: Calamba Campus, Brgy. Paciano RizalJeanette LampitocNo ratings yet

- Funds Flow AnalysisDocument120 pagesFunds Flow Analysisamarnadh allaNo ratings yet

- 2023 Pharmaceutical Manufacturing Supplychain TrendsDocument11 pages2023 Pharmaceutical Manufacturing Supplychain TrendsfresultaNo ratings yet

- 1st Exam Theory PpeDocument4 pages1st Exam Theory PpejustineNo ratings yet

- Write 55g As A Percentage of 2.2kgDocument8 pagesWrite 55g As A Percentage of 2.2kgKatrine Jaya AndrewNo ratings yet

- Mathematics - Question and AnswersDocument9 pagesMathematics - Question and Answersphirihannock43No ratings yet