Professional Documents

Culture Documents

Koa de Petroperu

Koa de Petroperu

Uploaded by

Nayeli Chancasanampa GomezCopyright:

Available Formats

You might also like

- Zipcar: Influencing Customer BehaviorDocument4 pagesZipcar: Influencing Customer BehaviorSashitaroor100% (1)

- 1 MW - Solar Power Financial ModelDocument15 pages1 MW - Solar Power Financial Modelannu priyaNo ratings yet

- HistoricalinvestDocument1 pageHistoricalinvestSaurabh Kulkarni 23No ratings yet

- Solucionario - PC1 2019-02 EF71Document37 pagesSolucionario - PC1 2019-02 EF71Adrian Pedraza AquijeNo ratings yet

- Stocks T.Bills T.BondsDocument1 pageStocks T.Bills T.BondsCH NAIRNo ratings yet

- Stocks T.Bills T.BondsDocument1 pageStocks T.Bills T.BondsCH NAIRNo ratings yet

- Historicalinvest TDocument1 pageHistoricalinvest TanantNo ratings yet

- HistoricalinvesttempDocument1 pageHistoricalinvesttempLuisAlfonsoFernándezMorenoNo ratings yet

- HistoricalinvestDocument10 pagesHistoricalinvestranvijaygalgotias27No ratings yet

- Ranvijay BaDocument5 pagesRanvijay Baranvijaygalgotias27No ratings yet

- Customized Geometric Risk Premium EstimatorDocument40 pagesCustomized Geometric Risk Premium EstimatorVíctor GómezNo ratings yet

- Calculo Del COK v2Document16 pagesCalculo Del COK v2Liz AguilarNo ratings yet

- Histret SPDocument57 pagesHistret SPLIMANo ratings yet

- AAPL Monthly Vs Weekly W Log ReturnsDocument110 pagesAAPL Monthly Vs Weekly W Log ReturnssgimenezNo ratings yet

- Historical Returns USDocument34 pagesHistorical Returns USYuchen XuNo ratings yet

- (Damodaran) Prima de RiesgoDocument57 pages(Damodaran) Prima de RiesgoDaniel Abad FloresNo ratings yet

- Simulador Interes CompuestoDocument15 pagesSimulador Interes CompuestoiuNo ratings yet

- BreakdownDocument103 pagesBreakdownhandiNo ratings yet

- Rendimiento de AccionesDocument6 pagesRendimiento de AccionesFrancis Ariana Cervantes BermejoNo ratings yet

- Carhart 4 Factor DataDocument26 pagesCarhart 4 Factor DataDilshadNo ratings yet

- Carhart 4 Factor DataDocument26 pagesCarhart 4 Factor Datadheeraj agarwalNo ratings yet

- Nifty: Date Rel Nav Sahara NavDocument8 pagesNifty: Date Rel Nav Sahara Navmayankco84No ratings yet

- Empresas de EnergiaDocument2 pagesEmpresas de EnergiaBruno Henrique CardosoNo ratings yet

- Planilha (Aulas Iniciais) Curso Avançado de ExcelDocument8 pagesPlanilha (Aulas Iniciais) Curso Avançado de ExcelluanaNo ratings yet

- Correlação de AtivosDocument25 pagesCorrelação de AtivosFÁBIO PESSOANo ratings yet

- Investment SpreadsheetDocument37 pagesInvestment Spreadsheetapi-313766620No ratings yet

- Anno Var % Annua Var % Anual PIB A Preços de Mercado (Mihoes Euro) Divida Publica Nominal (Milhoes Euro)Document40 pagesAnno Var % Annua Var % Anual PIB A Preços de Mercado (Mihoes Euro) Divida Publica Nominal (Milhoes Euro)José Jair Campos ReisNo ratings yet

- Rendimientos Mensuales - Portafolios 2023-1Document2 pagesRendimientos Mensuales - Portafolios 2023-1Lucero ÁlvarezNo ratings yet

- Port. de InvDocument7 pagesPort. de InvAdrian Duran ValenciaNo ratings yet

- Riesgo de Mercado Damodaran 0117 07-06-2017Document36 pagesRiesgo de Mercado Damodaran 0117 07-06-2017CristinaNo ratings yet

- Solutions DYNAMISDocument16 pagesSolutions DYNAMISSambeet MallickNo ratings yet

- Date RF MKTRF SMB HML Umd Lnsheq EqmktntrDocument21 pagesDate RF MKTRF SMB HML Umd Lnsheq EqmktntrRaymond WidjajaNo ratings yet

- Customized Geometric Risk Premium EstimatorDocument39 pagesCustomized Geometric Risk Premium EstimatorMilagros Quispe MoyaNo ratings yet

- I Bond Rate ChartDocument1 pageI Bond Rate ChartRandy MarmerNo ratings yet

- Inchang ElectronicsDocument4 pagesInchang ElectronicsVicenteAMartinezGNo ratings yet

- Customized Geometric Risk Premium EstimatorDocument43 pagesCustomized Geometric Risk Premium EstimatorMuhammad ShakoorNo ratings yet

- Oksidasi - XrayDocument3 pagesOksidasi - XrayIntania Anzhal SasyabilNo ratings yet

- IndicesDocument2 pagesIndicesSofia GrinbergNo ratings yet

- LMVTX Legg Mason Value Trust Pcbax Blackrock Asset Allocation FCNTX Fidelity Contrafund Usawx Usaa World GrowthDocument17 pagesLMVTX Legg Mason Value Trust Pcbax Blackrock Asset Allocation FCNTX Fidelity Contrafund Usawx Usaa World GrowthjadgugNo ratings yet

- Índices INPC Tabela HistóricaDocument5 pagesÍndices INPC Tabela HistóricaMarcelo BandeiraNo ratings yet

- Rendimientos LP - Elvis MoralesDocument13 pagesRendimientos LP - Elvis MoralesAlexander MoralesNo ratings yet

- PortfolioModelDocument4 pagesPortfolioModelSem's IndustryNo ratings yet

- Ações AtualDocument18 pagesAções Atualyatan001No ratings yet

- High 2100 TCP Utilized SitesDocument4 pagesHigh 2100 TCP Utilized SitesMark EmakhuNo ratings yet

- High 2100 TCP Utilized SitesDocument4 pagesHigh 2100 TCP Utilized SitesMark EmakhuNo ratings yet

- S&P 500 y BancosDocument5 pagesS&P 500 y BancosJavier D'cNo ratings yet

- UntitledDocument7 pagesUntitledhadi halauiNo ratings yet

- Ej 2 HWDocument2 pagesEj 2 HWSofia GrinbergNo ratings yet

- Part-3Document11 pagesPart-3kami.piotrkieiczNo ratings yet

- Gordugunuz Oranlar (Xg-Experts) Sisteminin Hesaplamis Oldugu Adi OranlardirDocument5 pagesGordugunuz Oranlar (Xg-Experts) Sisteminin Hesaplamis Oldugu Adi OranlardirionspinuNo ratings yet

- PD 2 - SolucionarioDocument32 pagesPD 2 - SolucionarioAdrian Pedraza AquijeNo ratings yet

- Volatilidad - Diana Escobar ODocument148 pagesVolatilidad - Diana Escobar OSeguridad y salud HormigonNo ratings yet

- AnnexuresDocument23 pagesAnnexuresMohit AnandNo ratings yet

- histretSP 2022Document45 pageshistretSP 2022MarianaNo ratings yet

- Taller Costo de Capital ValDocument34 pagesTaller Costo de Capital ValJoseph Rojo ChNo ratings yet

- 02.09 Frontera EficienteDocument11 pages02.09 Frontera Eficientelaila20No ratings yet

- Calculating Adjusted BetasDocument11 pagesCalculating Adjusted BetasMuhammad Ahsan MukhtarNo ratings yet

- Tamzidul Islam Portfolio Optimization MidtermDocument24 pagesTamzidul Islam Portfolio Optimization MidtermTamzidul IslamNo ratings yet

- Var RINDocument2 pagesVar RINRaul Ronaldo Romero TolaNo ratings yet

- United States Census Figures Back to 1630From EverandUnited States Census Figures Back to 1630No ratings yet

- Workbook With KeyDocument3 pagesWorkbook With KeyNayeli Chancasanampa GomezNo ratings yet

- TAREADocument5 pagesTAREANayeli Chancasanampa GomezNo ratings yet

- Ingles 16Document7 pagesIngles 16Nayeli Chancasanampa GomezNo ratings yet

- Universidad Nacional Del Centro Del Perú: AlumnasDocument4 pagesUniversidad Nacional Del Centro Del Perú: AlumnasNayeli Chancasanampa GomezNo ratings yet

- ESA Winne Astronaut Currently Serves As Director of The European Astronaut Center of The European Space Agency in Cologne / GermanyDocument2 pagesESA Winne Astronaut Currently Serves As Director of The European Astronaut Center of The European Space Agency in Cologne / GermanyNayeli Chancasanampa GomezNo ratings yet

- My Hero Is YouDocument1 pageMy Hero Is YouNayeli Chancasanampa GomezNo ratings yet

- Causa Rellena ..: Ingredients For The Filling FOR DecorationDocument1 pageCausa Rellena ..: Ingredients For The Filling FOR DecorationNayeli Chancasanampa GomezNo ratings yet

- Creating Customer ValueDocument109 pagesCreating Customer ValueAnkit GuptaNo ratings yet

- GR 7 Ems Final Exam Paper - 2022 Marking GuidelineDocument9 pagesGR 7 Ems Final Exam Paper - 2022 Marking GuidelineMuhammed ChopdatNo ratings yet

- Comparative Income Statement of Star Company For 2016-2018 Star Company Comparative Income Statement December 31, 2016,2017 and 2018Document5 pagesComparative Income Statement of Star Company For 2016-2018 Star Company Comparative Income Statement December 31, 2016,2017 and 2018JonellNo ratings yet

- Invoice-2024-02-11 11 - 02Document1 pageInvoice-2024-02-11 11 - 02arunkumarmevadaNo ratings yet

- Solved Paper I - 2021Document41 pagesSolved Paper I - 2021Eswar AnaparthiNo ratings yet

- Introduction To OP MGNT. MGT303Document17 pagesIntroduction To OP MGNT. MGT303Julie Ann ManaloNo ratings yet

- Credit Blueprint 1Document12 pagesCredit Blueprint 1Geo Staffan100% (3)

- Unit-2 Sums SheetDocument8 pagesUnit-2 Sums SheetAstha ParmanandkaNo ratings yet

- CarmelaDocument2 pagesCarmelaCatherine PardoNo ratings yet

- Pawan Project-1Document56 pagesPawan Project-1pawan vermaNo ratings yet

- MF Company Wise InformationDocument36 pagesMF Company Wise InformationrgkusumbaNo ratings yet

- H2 Economics 9757 Paper 1 - Answer - MSDocument20 pagesH2 Economics 9757 Paper 1 - Answer - MSAmanda GohNo ratings yet

- Samanvaya Law & PartnersDocument6 pagesSamanvaya Law & PartnersROHIT YADAVNo ratings yet

- Finance ProjectDocument80 pagesFinance ProjectDinoop Devaraj0% (1)

- CXC Principles of Business Exam Guide: Section 6: MarketingDocument5 pagesCXC Principles of Business Exam Guide: Section 6: MarketingAvril CarbonNo ratings yet

- Industy AnalysisDocument5 pagesIndusty AnalysisAlif HaqNo ratings yet

- ECGCDocument19 pagesECGCSOUVIK ROY MBA 2021-23 (Delhi)No ratings yet

- Newsletter July 2022 PDFDocument13 pagesNewsletter July 2022 PDFDwaipayan MojumderNo ratings yet

- Corporate-Level Strategy: Related and Unrelated DiversificationDocument27 pagesCorporate-Level Strategy: Related and Unrelated DiversificationTanvir Ahmad ShourovNo ratings yet

- Bankinng PPT - PPTMDocument19 pagesBankinng PPT - PPTMKeshav ThadaniNo ratings yet

- Amul Case StudyDocument3 pagesAmul Case StudyRohan JainNo ratings yet

- InvestIndia - PLI Textiles - VFDocument44 pagesInvestIndia - PLI Textiles - VFTushar JoshiNo ratings yet

- Portfolio, Programme and Project Offices (P3O®) : Online RepositoryDocument36 pagesPortfolio, Programme and Project Offices (P3O®) : Online RepositoryDelano NsongoNo ratings yet

- Warehousing Management Using 5S Methodology 555Document50 pagesWarehousing Management Using 5S Methodology 555Nirmal ThapaNo ratings yet

- Usdaw Activist 106Document3 pagesUsdaw Activist 106USDAWactivistNo ratings yet

- Final Draft Business Envirnment Assignment Iman HaseebDocument23 pagesFinal Draft Business Envirnment Assignment Iman HaseebimanNo ratings yet

- BBC International LTD 1t 24may2020 UbsDocument19 pagesBBC International LTD 1t 24may2020 Ubspezhmanbayat924No ratings yet

- Lecture - Notes-Week Two Lecture NotesDocument26 pagesLecture - Notes-Week Two Lecture Notesshanky1124No ratings yet

Koa de Petroperu

Koa de Petroperu

Uploaded by

Nayeli Chancasanampa GomezOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Koa de Petroperu

Koa de Petroperu

Uploaded by

Nayeli Chancasanampa GomezCopyright:

Available Formats

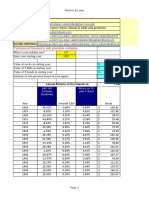

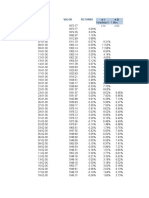

Annual Returns on Investments in Value of $100 invested at star

S&P 500 Baa S&P 500

(includes 3-month US T. Bond Corporate Real Estate (includes

T.Bill

dividends) Bond dividends)3

Year

1928 43.81% 3.08% 0.84% 3.22% 1.49% S/ 143.81

1929 -8.30% 3.16% 4.20% 3.02% -2.06% S/ 131.88

1930 -25.12% 4.55% 4.54% 0.54% -4.30% S/ 98.75

1931 -43.84% 2.31% -2.56% -15.68% -8.15% S/ 55.46

1932 -8.64% 1.07% 8.79% 23.59% -10.47% S/ 50.66

1933 49.98% 0.96% 1.86% 12.97% -3.81% S/ 75.99

1934 -1.19% 0.28% 7.96% 18.82% 2.91% S/ 75.09

1935 46.74% 0.17% 4.47% 13.31% 9.77% S/ 110.18

1936 31.94% 0.17% 5.02% 11.38% 3.22% S/ 145.38

1937 -35.34% 0.28% 1.38% -4.42% 2.56% S/ 94.00

1938 29.28% 0.07% 4.21% 9.24% -0.87% S/ 121.53

1939 -1.10% 0.05% 4.41% 7.98% -1.30% S/ 120.20

1940 -10.67% 0.04% 5.40% 8.65% 3.31% S/ 107.37

1941 -12.77% 0.13% -2.02% 5.01% -8.38% S/ 93.66

1942 19.17% 0.34% 2.29% 5.18% 3.33% S/ 111.61

1943 25.06% 0.38% 2.49% 8.04% 11.45% S/ 139.59

1944 19.03% 0.38% 2.58% 6.57% 16.58% S/ 166.15

1945 35.82% 0.38% 3.80% 6.80% 11.78% S/ 225.67

1946 -8.43% 0.38% 3.13% 2.51% 24.10% S/ 206.65

1947 5.20% 0.60% 0.92% 0.26% 21.26% S/ 217.39

1948 5.70% 1.05% 1.95% 3.44% 2.06% S/ 229.79

1949 18.30% 1.12% 4.66% 5.38% 0.09% S/ 271.85

1950 30.81% 1.20% 0.43% 4.24% 3.64% S/ 355.60

1951 23.68% 1.52% -0.30% -0.19% 6.05% S/ 439.80

1952 18.15% 1.72% 2.27% 4.44% 4.41% S/ 519.62

1953 -1.21% 1.89% 4.14% 1.62% 11.52% S/ 513.35

1954 52.56% 0.94% 3.29% 6.16% 0.92% S/ 783.18

1955 32.60% 1.73% -1.34% 2.04% 0.00% S/ 1,038.47

1956 7.44% 2.63% -2.26% -2.35% 0.91% S/ 1,115.73

1957 -10.46% 3.23% 6.80% -0.72% 2.72% S/ 999.05

1958 43.72% 1.77% -2.10% 6.43% 0.66% S/ 1,435.84

1959 12.06% 3.39% -2.65% 1.57% 0.11% S/ 1,608.95

1960 0.34% 2.88% 11.64% 6.66% 0.77% S/ 1,614.37

1961 26.64% 2.35% 2.06% 5.10% 0.98% S/ 2,044.40

1962 -8.81% 2.77% 5.69% 6.50% 0.32% S/ 1,864.26

1963 22.61% 3.16% 1.68% 5.46% 2.14% S/ 2,285.80

1964 16.42% 3.55% 3.73% 5.16% 1.26% S/ 2,661.02

1965 12.40% 3.95% 0.72% 3.19% 1.66% S/ 2,990.97

1966 -9.97% 4.86% 2.91% -3.45% 1.22% S/ 2,692.74

1967 23.80% 4.31% -1.58% 0.90% 2.32% S/ 3,333.69

1968 10.81% 5.34% 3.27% 4.85% 4.13% S/ 3,694.23

1969 -8.24% 6.67% -5.01% -2.03% 6.99% S/ 3,389.77

1970 3.56% 6.39% 16.75% 5.65% 8.22% S/ 3,510.49

1971 14.22% 4.33% 9.79% 14.00% 4.24% S/ 4,009.72

1972 18.76% 4.07% 2.82% 11.41% 2.98% S/ 4,761.76

1973 -14.31% 7.03% 3.66% 4.32% 3.42% S/ 4,080.44

1974 -25.90% 7.83% 1.99% -4.38% 10.07% S/ 3,023.54

1975 37.00% 5.78% 3.61% 11.05% 6.77% S/ 4,142.10

1976 23.83% 4.97% 15.98% 19.75% 8.18% S/ 5,129.20

1977 -6.98% 5.27% 1.29% 9.95% 14.65% S/ 4,771.20

1978 6.51% 7.19% -0.78% 3.14% 15.72% S/ 5,081.77

1979 18.52% 10.07% 0.67% -2.01% 13.74% S/ 6,022.89

1980 31.74% 11.43% -2.99% -3.32% 7.40% S/ 7,934.26

1981 -4.70% 14.03% 8.20% 8.46% 5.10% S/ 7,561.16

1982 20.42% 10.61% 32.81% 29.05% 0.56% S/ 9,105.08

1983 22.34% 8.61% 3.20% 16.19% 4.75% S/ 11,138.90

1984 6.15% 9.52% 13.73% 15.62% 4.68% S/ 11,823.51

1985 31.24% 7.48% 25.71% 23.86% 7.47% S/ 15,516.60

1986 18.49% 5.98% 24.28% 21.49% 9.61% S/ 18,386.33

1987 5.81% 5.78% -4.96% 2.29% 7.88% S/ 19,455.08

1988 16.54% 6.67% 8.22% 15.12% 7.21% S/ 22,672.40

1989 31.48% 8.11% 17.69% 15.79% 4.38% S/ 29,808.58

1990 -3.06% 7.49% 6.24% 6.14% -0.69% S/ 28,895.11

1991 30.23% 5.38% 15.00% 17.85% -0.16% S/ 37,631.51

1992 7.49% 3.43% 9.36% 12.17% 0.82% S/ 40,451.51

1993 9.97% 3.00% 14.21% 16.43% 2.16% S/ 44,483.33

1994 1.33% 4.25% -8.04% -1.32% 2.51% S/ 45,073.14

1995 37.20% 5.49% 23.48% 20.16% 1.80% S/ 61,838.19

1996 22.68% 5.01% 1.43% 4.79% 2.42% S/ 75,863.69

1997 33.10% 5.06% 9.94% 11.83% 4.02% S/ 100,977.34

1998 28.34% 4.78% 14.92% 7.95% 6.45% S/ 129,592.25

1999 20.89% 4.64% -8.25% 0.84% 7.68% S/ 156,658.05

2000 -9.03% 5.82% 16.66% 9.33% 9.28% S/ 142,508.98

2001 -11.85% 3.39% 5.57% 7.82% 6.67% S/ 125,622.01

2002 -21.97% 1.60% 15.12% 12.18% 9.56% S/ 98,027.82

2003 28.36% 1.01% 0.38% 13.53% 9.82% S/ 125,824.39

2004 10.74% 1.37% 4.49% 9.89% 13.64% S/ 139,341.42

2005 4.83% 3.15% 2.87% 4.92% 13.51% S/ 146,077.85

2006 15.61% 4.73% 1.96% 7.05% 1.73% S/ 168,884.34

2007 5.48% 4.35% 10.21% 3.15% -5.40% S/ 178,147.20

2008 -36.55% 1.37% 20.10% -5.07% -12.00% S/ 113,030.22

2009 25.94% 0.15% -11.12% 23.33% -3.85% S/ 142,344.87

2010 14.82% 0.14% 8.46% 8.35% -4.12% S/ 163,441.94

2011 2.10% 0.05% 16.04% 12.58% -3.88% S/ 166,871.56

2012 15.89% 0.09% 2.97% 10.12% 6.44% S/ 193,388.43

2013 32.15% 0.06% -9.10% -1.06% 10.72% S/ 255,553.31

2014 13.52% 0.03% 10.75% 10.38% 4.51% S/ 290,115.42

2015 1.38% 0.05% 1.28% -0.70% 5.21% S/ 294,115.79

2016 11.77% 0.32% 0.69% 10.37% 5.31% S/ 328,742.28

2017 21.61% 0.93% 2.80% 9.72% 6.21% S/ 399,768.64

2018 -4.23% 1.94% -0.02% -2.76% 4.53% S/ 382,870.94

2019 31.21% 1.55% 9.64% 15.33% 3.69% S/ 502,371.39

2020 18.02% 0.09% 11.33% 10.41% 10.35% S/ 592,914.80

2021 28.47% 0.06% -4.42% 0.93% 16.83% S/ 761,710.83

Arithmetic Average Historical Return

1928-2021 11.82% 3.33% 5.11% 7.19% 4.36%

1972-2021 12.47% 4.42% 7.00% 9.29% 5.41%

2012-2021 16.98% 0.51% 2.59% 6.28% 7.38%

Geometric Average Historical Return

1928-2021 9.98% 3.28% 4.84% 6.93% 4.18%

1972-2021 11.06% 4.37% 6.60% 9.01% 5.25%

2012-2021 16.40% 0.51% 2.40% 6.10% 7.31%

Value of $100 invested at start of 1928 in Annual Risk Premium

Stocks -

3-month T.Bill4 US T. Bond5 Baa Corporate Real Estate2 Stocks - Stocks - Baa Corp

Bond6 Bills Bonds

Bond

S/ 103.08 S/ 100.84 S/ 103.22 S/ 101.49 40.73% 42.98% 40.59%

S/ 106.34 S/ 105.07 S/ 106.33 S/ 99.40 -11.46% -12.50% -11.32%

S/ 111.18 S/ 109.85 S/ 106.91 S/ 95.13 -29.67% -29.66% -25.66%

S/ 113.74 S/ 107.03 S/ 90.14 S/ 87.38 -46.15% -41.28% -28.16%

S/ 114.96 S/ 116.44 S/ 111.41 S/ 78.23 -9.71% -17.43% -32.23%

S/ 116.06 S/ 118.60 S/ 125.86 S/ 75.25 49.02% 48.13% 37.02%

S/ 116.39 S/ 128.05 S/ 149.54 S/ 77.44 -1.47% -9.15% -20.00%

S/ 116.58 S/ 133.78 S/ 169.44 S/ 85.00 46.57% 42.27% 33.43%

S/ 116.78 S/ 140.49 S/ 188.73 S/ 87.73 31.77% 26.93% 20.56%

S/ 117.11 S/ 142.43 S/ 180.39 S/ 89.98 -35.61% -36.72% -30.92%

S/ 117.18 S/ 148.43 S/ 197.05 S/ 89.20 29.22% 25.07% 20.05%

S/ 117.24 S/ 154.98 S/ 212.78 S/ 88.04 -1.14% -5.51% -9.08%

S/ 117.28 S/ 163.35 S/ 231.18 S/ 90.95 -10.71% -16.08% -19.32%

S/ 117.43 S/ 160.04 S/ 242.76 S/ 83.32 -12.90% -10.75% -17.78%

S/ 117.83 S/ 163.72 S/ 255.33 S/ 86.10 18.83% 16.88% 13.99%

S/ 118.28 S/ 167.79 S/ 275.88 S/ 95.95 24.68% 22.57% 17.02%

S/ 118.73 S/ 172.12 S/ 293.99 S/ 111.87 18.65% 16.45% 12.46%

S/ 119.18 S/ 178.67 S/ 313.98 S/ 125.04 35.44% 32.02% 29.02%

S/ 119.63 S/ 184.26 S/ 321.85 S/ 155.18 -8.81% -11.56% -10.94%

S/ 120.35 S/ 185.95 S/ 322.70 S/ 188.17 4.60% 4.28% 4.94%

S/ 121.61 S/ 189.58 S/ 333.79 S/ 192.05 4.66% 3.75% 2.27%

S/ 122.96 S/ 198.42 S/ 351.74 S/ 192.22 17.19% 13.64% 12.93%

S/ 124.44 S/ 199.27 S/ 366.65 S/ 199.22 29.60% 30.38% 26.57%

S/ 126.33 S/ 198.68 S/ 365.95 S/ 211.26 22.16% 23.97% 23.87%

S/ 128.51 S/ 203.19 S/ 382.20 S/ 220.57 16.43% 15.88% 13.71%

S/ 130.94 S/ 211.61 S/ 388.39 S/ 245.98 -3.10% -5.35% -2.83%

S/ 132.17 S/ 218.57 S/ 412.31 S/ 248.25 51.62% 49.27% 46.41%

S/ 134.45 S/ 215.65 S/ 420.74 S/ 248.25 30.87% 33.93% 30.55%

S/ 137.98 S/ 210.79 S/ 410.84 S/ 250.52 4.81% 9.70% 9.79%

S/ 142.43 S/ 225.11 S/ 407.89 S/ 257.33 -13.68% -17.25% -9.74%

S/ 144.95 S/ 220.39 S/ 434.11 S/ 259.03 41.95% 45.82% 37.29%

S/ 149.86 S/ 214.56 S/ 440.95 S/ 259.31 8.67% 14.70% 10.48%

S/ 154.18 S/ 239.53 S/ 470.33 S/ 261.30 -2.55% -11.30% -6.33%

S/ 157.81 S/ 244.46 S/ 494.32 S/ 263.85 24.28% 24.58% 21.54%

S/ 162.19 S/ 258.38 S/ 526.43 S/ 264.70 -11.58% -14.51% -15.31%

S/ 167.31 S/ 262.74 S/ 555.19 S/ 270.38 19.45% 20.93% 17.15%

S/ 173.25 S/ 272.53 S/ 583.85 S/ 273.78 12.87% 12.69% 11.25%

S/ 180.09 S/ 274.49 S/ 602.47 S/ 278.32 8.45% 11.68% 9.21%

S/ 188.84 S/ 282.47 S/ 581.72 S/ 281.72 -14.83% -12.88% -6.53%

S/ 196.98 S/ 278.01 S/ 586.92 S/ 288.25 19.50% 25.38% 22.91%

S/ 207.49 S/ 287.11 S/ 615.36 S/ 300.17 5.48% 7.54% 5.97%

S/ 221.32 S/ 272.71 S/ 602.90 S/ 321.16 -14.91% -3.23% -6.22%

S/ 235.47 S/ 318.41 S/ 636.96 S/ 347.55 -2.83% -13.19% -2.09%

S/ 245.67 S/ 349.57 S/ 726.14 S/ 362.30 9.89% 4.43% 0.22%

S/ 255.68 S/ 359.42 S/ 808.99 S/ 373.08 14.68% 15.94% 7.35%

S/ 273.66 S/ 372.57 S/ 843.92 S/ 385.85 -21.34% -17.97% -18.63%

S/ 295.08 S/ 379.98 S/ 806.95 S/ 424.72 -33.73% -27.89% -21.52%

S/ 312.12 S/ 393.68 S/ 896.12 S/ 453.48 31.22% 33.39% 25.95%

S/ 327.65 S/ 456.61 S/ 1,073.13 S/ 490.57 18.86% 7.85% 4.08%

S/ 344.91 S/ 462.50 S/ 1,179.96 S/ 562.46 -12.25% -8.27% -16.93%

S/ 369.71 S/ 458.90 S/ 1,216.98 S/ 650.90 -0.68% 7.29% 3.37%

S/ 406.93 S/ 461.98 S/ 1,192.53 S/ 740.35 8.45% 17.85% 20.53%

S/ 453.46 S/ 448.17 S/ 1,152.99 S/ 795.11 20.30% 34.72% 35.05%

S/ 517.06 S/ 484.91 S/ 1,250.56 S/ 835.62 -18.73% -12.90% -13.16%

S/ 571.94 S/ 644.04 S/ 1,613.88 S/ 840.33 9.80% -12.40% -8.63%

S/ 621.19 S/ 664.65 S/ 1,875.23 S/ 880.25 13.73% 19.14% 6.14%

S/ 680.35 S/ 755.92 S/ 2,168.13 S/ 921.43 -3.38% -7.59% -9.47%

S/ 731.23 S/ 950.29 S/ 2,685.50 S/ 990.27 23.76% 5.52% 7.37%

S/ 774.95 S/ 1,181.06 S/ 3,262.50 S/ 1,085.46 12.52% -5.79% -2.99%

S/ 819.70 S/ 1,122.47 S/ 3,337.20 S/ 1,170.95 0.04% 10.77% 3.52%

S/ 874.35 S/ 1,214.78 S/ 3,841.62 S/ 1,255.38 9.87% 8.31% 1.42%

S/ 945.28 S/ 1,429.72 S/ 4,448.20 S/ 1,310.38 23.36% 13.78% 15.69%

S/ 1,016.11 S/ 1,518.87 S/ 4,721.33 S/ 1,301.32 -10.56% -9.30% -9.20%

S/ 1,070.73 S/ 1,746.77 S/ 5,564.25 S/ 1,299.27 24.86% 15.23% 12.38%

S/ 1,107.47 S/ 1,910.30 S/ 6,241.54 S/ 1,309.89 4.06% -1.87% -4.68%

S/ 1,140.67 S/ 2,181.77 S/ 7,267.12 S/ 1,338.15 6.97% -4.24% -6.46%

S/ 1,189.11 S/ 2,006.43 S/ 7,171.25 S/ 1,371.72 -2.92% 9.36% 2.65%

S/ 1,254.39 S/ 2,477.55 S/ 8,616.71 S/ 1,396.39 31.71% 13.71% 17.04%

S/ 1,317.18 S/ 2,512.94 S/ 9,029.67 S/ 1,430.13 17.68% 21.25% 17.89%

S/ 1,383.84 S/ 2,762.71 S/ 10,098.32 S/ 1,487.69 28.04% 23.16% 21.27%

S/ 1,449.94 S/ 3,174.95 S/ 10,900.68 S/ 1,583.61 23.56% 13.42% 20.39%

S/ 1,517.20 S/ 2,912.88 S/ 10,992.59 S/ 1,705.23 16.25% 29.14% 20.04%

S/ 1,605.45 S/ 3,398.03 S/ 12,018.16 S/ 1,863.51 -14.85% -25.69% -18.36%

S/ 1,659.84 S/ 3,587.37 S/ 12,957.88 S/ 1,987.87 -15.24% -17.42% -19.67%

S/ 1,686.44 S/ 4,129.65 S/ 14,535.88 S/ 2,178.00 -23.57% -37.08% -34.14%

S/ 1,703.49 S/ 4,145.15 S/ 16,502.87 S/ 2,391.78 27.34% 27.98% 14.82%

S/ 1,726.86 S/ 4,331.30 S/ 18,134.78 S/ 2,717.92 9.37% 6.25% 0.85%

S/ 1,781.19 S/ 4,455.50 S/ 19,026.57 S/ 3,085.18 1.69% 1.97% -0.08%

S/ 1,865.39 S/ 4,542.87 S/ 20,367.63 S/ 3,138.62 10.89% 13.65% 8.56%

S/ 1,946.59 S/ 5,006.69 S/ 21,009.29 S/ 2,969.21 1.13% -4.73% 2.33%

S/ 1,973.16 S/ 6,013.10 S/ 19,945.02 S/ 2,612.92 -37.92% -56.65% -31.49%

S/ 1,976.12 S/ 5,344.65 S/ 24,598.10 S/ 2,512.37 25.79% 37.05% 2.61%

S/ 1,978.82 S/ 5,796.96 S/ 26,651.51 S/ 2,408.91 14.68% 6.36% 6.47%

S/ 1,979.86 S/ 6,726.52 S/ 30,005.47 S/ 2,315.38 2.05% -13.94% -10.49%

S/ 1,981.56 S/ 6,926.40 S/ 33,043.43 S/ 2,464.41 15.80% 12.92% 5.77%

S/ 1,982.72 S/ 6,295.79 S/ 32,694.52 S/ 2,728.54 32.09% 41.25% 33.20%

S/ 1,983.36 S/ 6,972.34 S/ 36,089.82 S/ 2,851.70 13.49% 2.78% 3.14%

S/ 1,984.40 S/ 7,061.89 S/ 35,838.08 S/ 3,000.22 1.33% 0.09% 2.08%

S/ 1,990.70 S/ 7,110.65 S/ 39,552.74 S/ 3,159.52 11.46% 11.08% 1.41%

S/ 2,009.23 S/ 7,309.87 S/ 43,398.81 S/ 3,355.82 20.67% 18.80% 11.88%

S/ 2,048.20 S/ 7,308.65 S/ 42,199.86 S/ 3,507.93 -6.17% -4.21% -1.46%

S/ 2,079.94 S/ 8,012.89 S/ 48,668.87 S/ 3,637.43 29.66% 21.58% 15.88%

S/ 2,081.82 S/ 8,920.90 S/ 53,736.05 S/ 4,013.76 17.93% 6.69% 7.61%

S/ 2,083.06 S/ 8,526.95 S/ 54,237.64 S/ 4,689.35 28.41% 32.88% 27.54%

Risk Premium Standard Error

Stocks - T.Bills Stocks - T.Bonds Stocks - T.BiStocks - T.Bonds

8.49% 6.71% 2.05% 2.17%

8.04% 5.47% 2.44% 2.76%

16.47% 14.39% 3.88% 4.59%

Risk Premium

Stocks - T.Bills Stocks - T.Bonds

6.69% 5.13%

6.70% 4.47%

15.89% 14.00%

Premium Annual Real Returns on

Historical S&P 500

risk Inflation (includes 3-month T. !0-year Baa Corp Real

Rate Bill (Real) T.Bonds Bonds Estate3

premium dividends)2

-1.16% 45.49% 4.29% 2.01% 4.43% 2.68%

0.58% -8.83% 2.56% 3.60% 2.42% -2.63%

-6.40% -20.01% 11.69% 11.68% 7.41% 2.24%

-9.32% -38.07% 12.82% 7.45% -7.02% 1.29%

-10.27% 1.82% 12.64% 21.25% 37.74% -0.21%

0.76% 48.85% 0.20% 1.08% 12.11% -4.54%

1.52% -2.66% -1.22% 6.35% 17.04% 1.37%

2.99% 42.49% -2.74% 1.44% 10.02% 6.58%

1.45% 30.06% -1.26% 3.52% 9.79% 1.74%

2.86% -37.13% -2.51% -1.44% -7.07% -0.29%

-2.78% 32.98% 2.92% 7.19% 12.36% 1.96%

0.00% -1.10% 0.05% 4.41% 7.98% -1.30%

0.71% -11.31% -0.67% 4.65% 7.88% 2.57%

9.93% -20.65% -8.91% -10.87% -4.48% -16.66%

9.03% 9.30% -7.97% -6.18% -3.53% -5.23%

2.96% 21.47% -2.50% -0.46% 4.94% 8.24%

2.30% 16.36% -1.88% 0.27% 4.17% 13.96%

2.25% 32.84% -1.83% 1.52% 4.45% 9.32%

18.13% -22.48% -15.03% -12.70% -13.23% 5.05%

8.84% -3.34% -7.57% -7.27% -7.88% 11.42%

2.99% 2.63% -1.89% -1.01% 0.43% -0.91%

-2.07% 20.81% 3.26% 6.88% 7.61% 2.21%

5.93% 23.48% -4.46% -5.19% -1.60% -2.16%

6.00% 16.68% -4.23% -5.94% -5.84% 0.04%

0.75% 17.27% 0.96% 1.50% 3.66% 3.62%

0.75% -1.94% 1.13% 3.37% 0.86% 10.69%

-0.74% 53.71% 1.69% 4.06% 6.95% 1.68%

0.37% 32.10% 1.35% -1.70% 1.66% -0.37%

2.99% 4.33% -0.35% -5.09% -5.18% -2.01%

2.90% -12.98% 0.32% 3.79% -3.52% -0.18%

1.76% 41.23% 0.01% -3.79% 4.59% -1.08%

1.73% 10.15% 1.63% -4.30% -0.15% -1.59%

6.11% 1.36% -1.01% 1.50% 10.14% 5.23% -0.59%

6.62% 0.67% 25.79% 1.67% 1.38% 4.40% 0.30%

5.97% 1.33% -10.01% 1.42% 4.30% 5.09% -1.00%

6.36% 1.64% 20.63% 1.49% 0.04% 3.76% 0.49%

6.53% 0.97% 15.30% 2.55% 2.73% 4.15% 0.29%

6.66% 1.92% 10.28% 1.99% -1.18% 1.24% -0.26%

6.11% 3.46% -12.98% 1.36% -0.53% -6.67% -2.16%

6.57% 3.04% 20.15% 1.23% -4.48% -2.08% -0.70%

6.60% 4.72% 5.82% 0.59% -1.38% 0.12% -0.56%

6.33% 6.20% -13.60% 0.44% -10.56% -7.74% 0.75%

5.90% 5.57% -1.90% 0.78% 10.59% 0.08% 2.51%

5.87% 3.27% 10.61% 1.03% 6.31% 10.40% 0.95%

6.08% 3.41% 14.84% 0.64% -0.57% 7.74% -0.42%

5.50% 8.71% -21.17% -1.54% -4.64% -4.04% -4.86%

4.64% 12.34% -34.04% -4.01% -9.21% -14.88% -2.02%

5.17% 6.94% 28.11% -1.09% -3.12% 3.85% -0.15%

5.22% 4.86% 18.09% 0.10% 10.60% 14.20% 3.16%

4.93% 6.70% -12.82% -1.34% -5.07% 3.05% 7.45%

4.97% 9.02% -2.30% -1.68% -8.99% -5.39% 6.15%

5.21% 13.29% 4.61% -2.85% -11.14% -13.51% 0.40%

5.73% 12.52% 17.08% -0.96% -13.78% -14.07% -4.55%

5.37% 8.92% -12.51% 4.68% -0.66% -0.42% -3.51%

5.10% 3.83% 15.98% 6.53% 27.92% 24.29% -3.15%

5.34% 3.79% 17.87% 4.64% -0.57% 11.95% 0.92%

5.12% 3.95% 2.11% 5.36% 9.41% 11.23% 0.70%

5.13% 3.80% 26.43% 3.55% 21.11% 19.33% 3.54%

4.97% 1.10% 17.21% 4.83% 22.93% 20.17% 8.42%

5.07% 4.43% 1.32% 1.28% -9.00% -2.05% 3.30%

5.12% 4.42% 11.60% 2.15% 3.64% 10.24% 2.67%

5.24% 4.65% 25.64% 3.31% 12.47% 10.65% -0.25%

5.00% 6.11% -8.64% 1.31% 0.12% 0.03% -6.41%

5.14% 3.06% 26.36% 2.24% 11.59% 14.35% -3.13%

5.03% 2.90% 4.46% 0.52% 6.28% 9.01% -2.02%

4.90% 2.75% 7.03% 0.24% 11.16% 13.32% -0.57%

4.97% 2.67% -1.31% 1.53% -10.43% -3.89% -0.16%

5.08% 2.54% 33.80% 2.88% 20.42% 17.18% -0.72%

5.30% 3.32% 18.74% 1.63% -1.83% 1.42% -0.88%

5.53% 1.70% 30.88% 3.30% 8.10% 9.96% 2.28%

5.63% 1.61% 26.30% 3.11% 13.10% 6.23% 4.76%

5.96% 2.68% 17.72% 1.90% -10.65% -1.79% 4.86%

5.51% 3.39% -12.01% 2.35% 12.83% 5.75% 5.70%

5.17% 1.55% -13.20% 1.81% 3.96% 6.17% 5.04%

4.53% 2.38% -23.78% -0.76% 12.44% 9.57% 7.02%

4.82% 1.88% 25.99% -0.85% -1.48% 11.44% 7.79%

4.84% 3.26% 7.25% -1.82% 1.20% 6.42% 10.05%

4.80% 3.42% 1.37% -0.26% -0.53% 1.45% 9.76%

4.91% 2.54% 12.75% 2.13% -0.57% 4.40% -0.79%

4.79% 4.08% 1.35% 0.26% 5.89% -0.89% -9.11%

3.88% 0.09% -36.61% 1.27% 19.99% -5.15% -12.08%

4.29% 2.72% 22.60% -2.50% -13.47% 20.06% -6.40%

4.31% 1.50% 13.13% -1.34% 6.86% 6.75% -5.53%

4.10% 2.96% -0.84% -2.83% 12.70% 9.35% -6.65%

4.20% 1.74% 13.91% -1.63% 1.21% 8.24% 4.61%

4.62% 1.50% 30.19% -1.42% -10.45% -2.52% 9.08%

4.60% 0.76% 12.67% -0.72% 9.91% 9.56% 3.73%

4.54% 0.73% 0.64% -0.67% 0.55% -1.42% 4.45%

4.62% 2.07% 9.50% -1.72% -1.36% 8.12% 3.17%

4.77% 2.11% 19.09% -1.15% 0.68% 7.46% 4.02%

4.66% 1.91% -6.02% 0.03% -1.89% -4.59% 2.57%

4.83% 2.29% 28.28% -0.72% 7.19% 12.75% 1.38%

4.84% 1.36% 16.44% -1.25% 9.84% 8.93% 8.86%

5.13% 7.00% 20.06% -6.49% -10.67% -5.67% 9.19%

Arithmetic Average Annual Real Return

1928-2021 8.48% 0.35% 2.28% 4.27% 1.27%

1972-2021 8.13% 0.63% 3.42% 5.61% 1.27%

2012-2021 12.39% -1.21% 2.84% 5.59% 3.52%

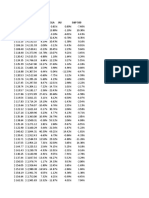

Prima de

adj. Propagación Prima de riesgo riesgo de Prima de

calificación de Moody's predeterminada país acciones riesgo país

Abu Dhabi Aa2 0,42% 0,49% 4,73% 0,49%

Albania B1 3,83% 4,45% 8,69% 4,45%

Argelia NR 5,53% 6,43% 10,67% 6,43%

Andorra (Principado de) Baa2 1,62% 1,88% 6,12% 1,88%

angola B3 5,53% 6,43% 10,67% 6,43%

anguila NR 5,88% 6,83% 11,07% 6,83%

Antigua y Barbuda NR 5,88% 6,83% 11,07% 6,83%

Argentina California 10,21% 11,87% 16,11% 11,87%

Armenia Ba3 3,06% 3,56% 7,80% 3,56%

Aruba Baa2 1,62% 1,88% 6,12% 1,88%

Australia aaa 0,00% 0,00% 4,24% 0,00%

Austria Aa1 0,34% 0,39% 4,63% 0,39%

Azerbaiyán Ba2 2,56% 2,97% 7.21% 2,97%

bahamas Ba3 3,06% 3,56% 7,80% 3,56%

Baréin B2 4,68% 5,44% 9,68% 5,44%

bangladesh Ba3 3,06% 3,56% 7,80% 3,56%

barbados Caa1 6,38% 7,41% 11,65% 7,41%

Bielorrusia B3 5,53% 6,43% 10,67% 6,43%

Bélgica Aa3 0,51% 0,60% 4,84% 0,60%

Belice Caa3 8,51% 9.89% 14,13% 9.89%

Benín B1 3,83% 4,45% 8,69% 4,45%

islas Bermudas A2 0,72% 0,84% 5,08% 0,84%

Bolivia B2 4,68% 5,44% 9,68% 5,44%

Bosnia y Herzegovina B3 5,53% 6,43% 10,67% 6,43%

Botsuana A3 1,02% 1,19% 5,43% 1,19%

Brasil Ba2 2,56% 2,97% 7.21% 2,97%

Islas Vírgenes Británicas NR 5,88% 6,83% 11,07% 6,83%

Brunéi NR 0,72% 0,84% 5,08% 0,84%

Bulgaria Baa1 1,36% 1,58% 5,82% 1,58%

Burkina Faso B2 4,68% 5,44% 9,68% 5,44%

Camboya B2 4,68% 5,44% 9,68% 5,44%

Camerún B2 4,68% 5,44% 9,68% 5,44%

Canadá aaa 0,00% 0,00% 4,24% 0,00%

Cabo Verde B3 5,53% 6,43% 10,67% 6,43%

Islas Caimán Aa3 0,51% 0,60% 4,84% 0,60%

Islas del Canal NR 0,72% 0,83% 5,07% 0,83%

Chile A1 0,60% 0,70% 4,94% 0,70%

Porcelana A1 0,60% 0,70% 4,94% 0,70%

Colombia Baa2 1,62% 1,88% 6,12% 1,88%

Congo (República Democ Caa1 6,38% 7,41% 11,65% 7,41%

Congo (República del) Caa2 7,66% 8,90% 13,14% 8,90%

Islas Cook B1 3,83% 4,45% 8,69% 4,45%

Costa Rica B2 4,68% 5,44% 9,68% 5,44%

Croacia Ba1 2,13% 2,47% 6,71% 2,47%

Cuba California 10,21% 11,87% 16,11% 11,87%

curazao Baa2 1,62% 1,88% 6,12% 1,88%

Chipre Ba1 2,13% 2,47% 6,71% 2,47%

Republica checa Aa3 0,51% 0,60% 4,84% 0,60%

Dinamarca aaa 0,00% 0,00% 4,24% 0,00%

República Dominicana Ba3 3,06% 3,56% 7,80% 3,56%

Ecuador Caa3 8,51% 9.89% 14,13% 9.89%

Egipto B2 4,68% 5,44% 9,68% 5,44%

El Salvador Caa1 6,38% 7,41% 11,65% 7,41%

Estonia A1 0,60% 0,70% 4,94% 0,70%

Etiopía Caa2 7,66% 8,90% 13,14% 8,90%

Islas Malvinas NR 5,88% 6,83% 11,07% 6,83%

Fiyi B1 3,83% 4,45% 8,69% 4,45%

Finlandia Aa1 0,34% 0,39% 4,63% 0,39%

Francia Aa2 0,42% 0,49% 4,73% 0,49%

Guayana Francesa NR 3,26% 3,79% 8,03% 3,79%

Gabón Caa1 6,38% 7,41% 11,65% 7,41%

Gambia NR 4,68% 5,44% 9,68% 5,44%

Georgia Ba2 2,56% 2,97% 7.21% 2,97%

Alemania aaa 0,00% 0,00% 4,24% 0,00%

Ghana B3 5,53% 6,43% 10,67% 6,43%

Gibraltar NR 0,72% 0,83% 5,07% 0,83%

Grecia Ba3 3,06% 3,56% 7,80% 3,56%

Groenlandia NR 0,72% 0,83% 5,07% 0,83%

Guatemala Ba1 2,13% 2,47% 6,71% 2,47%

Guernesey Aa3 0,51% 0,60% 4,84% 0,60%

Guinea NR 7,66% 8,90% 13,14% 8,90%

Guinea-Bisáu NR 5,53% 6,43% 10,67% 6,43%

Guayana NR 3,83% 4,45% 8,69% 4,45%

Haití NR 8,51% 9.89% 14,13% 9.89%

Honduras B1 3,83% 4,45% 8,69% 4,45%

Hong Kong Aa3 0,51% 0,60% 4,84% 0,60%

Hungría Baa2 1,62% 1,88% 6,12% 1,88%

Islandia A2 0,72% 0,84% 5,08% 0,84%

India Baa3 1,87% 2,18% 6,42% 2,18%

Indonesia Baa2 1,62% 1,88% 6,12% 1,88%

Irán NR 5,53% 6,43% 10,67% 6,43%

Irak Caa1 6,38% 7,41% 11,65% 7,41%

Irlanda A2 0,72% 0,84% 5,08% 0,84%

Isla del hombre Aa3 0,51% 0,60% 4,84% 0,60%

Israel A1 0,60% 0,70% 4,94% 0,70%

Italia Baa3 1,87% 2,18% 6,42% 2,18%

Costa de Marfil Ba3 3,06% 3,56% 7,80% 3,56%

Jamaica B2 4,68% 5,44% 9,68% 5,44%

Japón A1 0,60% 0,70% 4,94% 0,70%

Jersey aaa 0,00% 0,00% 4,24% 0,00%

Jordán B1 3,83% 4,45% 8,69% 4,45%

Kazajstán Baa2 1,62% 1,88% 6,12% 1,88%

Kenia B2 4,68% 5,44% 9,68% 5,44%

Corea, RPD NR 10,21% 11,87% 16,11% 11,87%

Kuwait A1 0,60% 0,70% 4,94% 0,70%

Kirguistán B2 4,68% 5,44% 9,68% 5,44%

Laos Caa2 7,66% 8,90% 13,14% 8,90%

letonia A3 1,02% 1,19% 5,43% 1,19%

Líbano C 17,50% 20,34% 24,58% 20,34%

Liberia NR 7,66% 8,90% 13,14% 8,90%

Libia NR 3,83% 4,45% 8,69% 4,45%

Liechtenstein aaa 0,00% 0,00% 4,24% 0,00%

Lituania A2 0,72% 0,84% 5,08% 0,84%

luxemburgo aaa 0,00% 0,00% 4,24% 0,00%

Macao Aa3 0,51% 0,60% 4,84% 0,60%

macedonia Ba3 3,06% 3,56% 7,80% 3,56%

Madagascar NR 5,53% 6,43% 10,67% 6,43%

Malaui NR 7,66% 8,90% 13,14% 8,90%

Malasia A3 1,02% 1,19% 5,43% 1,19%

Maldivas Caa1 6,38% 7,41% 11,65% 7,41%

Malí Caa1 6,38% 7,41% 11,65% 7,41%

Malta A2 0,72% 0,84% 5,08% 0,84%

Martinica NR 3,26% 3,79% 8,03% 3,79%

Mauricio Baa2 1,62% 1,88% 6,12% 1,88%

México Baa1 1,36% 1,58% 5,82% 1,58%

Moldavia B3 5,53% 6,43% 10,67% 6,43%

Mongolia B3 5,53% 6,43% 10,67% 6,43%

montenegro B1 3,83% 4,45% 8,69% 4,45%

Montserrat Baa3 1,87% 2,18% 6,42% 2,18%

Marruecos Ba1 2,13% 2,47% 6,71% 2,47%

Mozambique Caa2 7,66% 8,90% 13,14% 8,90%

Birmania NR 10,21% 11,87% 16,11% 11,87%

Namibia Ba3 3,06% 3,56% 7,80% 3,56%

Países Bajos aaa 0,00% 0,00% 4,24% 0,00%

Antillas Holandesas NR 5,88% 6,83% 11,07% 6,83%

Nueva Zelanda aaa 0,00% 0,00% 4,24% 0,00%

Nicaragua B3 5,53% 6,43% 10,67% 6,43%

Níger B3 5,53% 6,43% 10,67% 6,43%

Nigeria B2 4,68% 5,44% 9,68% 5,44%

Noruega aaa 0,00% 0,00% 4,24% 0,00%

Omán Ba3 3,06% 3,56% 7,80% 3,56%

Pakistán B3 5,53% 6,43% 10,67% 6,43%

Autoridad Palestina NR 1,38% 1,60% 5,84% 1,60%

Panamá Baa2 1,62% 1,88% 6,12% 1,88%

Papúa Nueva Guinea B2 4,68% 5,44% 9,68% 5,44%

Paraguay Ba1 2,13% 2,47% 6,71% 2,47%

Perú Baa1 1,36% 1,58% 5,82% 1,58%

Filipinas Baa2 1,62% 1,88% 6,12% 1,88%

Polonia A2 0,72% 0,84% 5,08% 0,84%

Portugal Baa2 1,62% 1,88% 6,12% 1,88%

Katar Aa3 0,51% 0,60% 4,84% 0,60%

Ras Al Khaimah (Emirato A3 1,02% 1,19% 5,43% 1,19%

Reunión NR 4,51% 5,25% 9,49% 5,25%

Rumania Baa3 1,87% 2,18% 6,42% 2,18%

Rusia Baa3 1,87% 2,18% 6,42% 2,18%

Ruanda B2 4,68% 5,44% 9,68% 5,44%

Santa Lucía NR 5,88% 6,83% 11,07% 6,83%

Arabia Saudita A1 0,60% 0,70% 4,94% 0,70%

Senegal Ba3 3,06% 3,56% 7,80% 3,56%

Serbia Ba2 2,56% 2,97% 7.21% 2,97%

Sharjah Baa3 1,87% 2,18% 6,42% 2,18%

Sierra Leona NR 8,51% 9.89% 14,13% 9.89%

Singapur aaa 0,00% 0,00% 4,24% 0,00%

Eslovaquia A2 0,72% 0,84% 5,08% 0,84%

Eslovenia A3 1,02% 1,19% 5,43% 1,19%

Islas Salomón Caa1 6,38% 7,41% 11,65% 7,41%

Somalia NR 10,21% 11,87% 16,11% 11,87%

Sudáfrica Ba2 2,56% 2,97% 7.21% 2,97%

Corea del Sur Aa2 0,42% 0,49% 4,73% 0,49%

España Baa1 1,36% 1,58% 5,82% 1,58%

Sri Lanka Caa2 7,66% 8,90% 13,14% 8,90%

San Martín Ba2 2,56% 2,97% 7.21% 2,97%

San Vicente y las Granad B3 5,53% 6,43% 10,67% 6,43%

Sudán NR 17,50% 20,34% 24,58% 20,34%

Surinam Caa3 8,51% 9.89% 14,13% 9.89%

Suazilandia B3 5,53% 6,43% 10,67% 6,43%

Suecia aaa 0,00% 0,00% 4,24% 0,00%

Suiza aaa 0,00% 0,00% 4,24% 0,00%

Siria NR 17,50% 20,34% 24,58% 20,34%

Taiwán Aa3 0,51% 0,60% 4,84% 0,60%

Tayikistán B3 5,53% 6,43% 10,67% 6,43%

Tanzania B2 4,68% 5,44% 9,68% 5,44%

Tailandia Baa1 1,36% 1,58% 5,82% 1,58%

Ir B3 5,53% 6,43% 10,67% 6,43%

Trinidad y Tobago Ba2 2,56% 2,97% 7.21% 2,97%

Túnez Caa1 6,38% 7,41% 11,65% 7,41%

Pavo B2 4,68% 5,44% 9,68% 5,44%

Islas Turcas y Caicos Baa1 1,36% 1,58% 5,82% 1,58%

Uganda B2 4,68% 5,44% 9,68% 5,44%

Ucrania B3 5,53% 6,43% 10,67% 6,43%

Emiratos Árabes Unidos Aa2 0,42% 0,49% 4,73% 0,49%

Reino Unido Aa3 0,51% 0,60% 4,84% 0,60%

Estados Unidos aaa 0,00% 0,00% 4,24% 0,00%

Uruguay Baa2 1,62% 1,88% 6,12% 1,88%

Uzbekistán B1 3,83% 4,45% 8,69% 4,45%

Venezuela C 17,50% 20,34% 24,58% 20,34%

Vietnam Ba3 3,06% 3,56% 7,80% 3,56%

Yemen NR 10,21% 11,87% 16,11% 11,87%

Zambia California 10,21% 11,87% 16,11% 11,87%

Zimbabue NR 6,38% 7,41% 11,65% 7,41%

Número de Beta promedio

bre de la industria empresas no apalancada

Publicidad 49 1.1

Aeroespacial 73 1.11

Transporte aéreo 21 0.91

Vestir 39 1.1

Automóviles y Camiones 26 1.02

Autopartes 38 1.21

Banco (Centro de dinero) 7 1.03

Bancos (Regionales) 563 0.84

Bebida (Alcohólica) 21 0.72

Bebida (suave) 32 1.12

Radiodifusión 28 0.81

Corretaje y Banca de Inversión 31 0,67

Materiales de construcción 44 1.09

Servicios para empresas y consumidores 160 0.99

Televisión por cable 11 0,66

Químico (Básico) 35 0,94

Químico (Diversificado) 4 1.21

Químico (Especialidad) 81 1

Carbón y energía relacionada 18 0.82

Servicios informáticos 83 1.06

Computadoras/Periféricos 46 1.25

Suministros de construcción 48 0.98

Diversificado 22 0.7

Medicamentos (Biotecnología) 581 0.97

Drogas (farmacéuticas) 298 1.01

Educación 35 1.1

Equipo eléctrico 104 1.19

Electrónica (consumo y oficina) dieciséis 1.06

Electrónica (general) 137 1.05

Ingeniería/Construcción 48 0.97

Entretenimiento 108 0.96

Servicios ambientales y de residuos 58 1.09

Ganadería/Agricultura 36 0.85

Servicios Financieros. (No bancarios y de seguros) 223 0.15

Procesamiento de alimentos 92 0,63

Mayoristas de comida 15 1.08

Muebles/Muebles para el hogar 32 0.99

Energía verde y renovable 20 1.1

Productos para el cuidado de la salud 244 0.91

Servicios de asistencia sanitaria 131 0,95

Información y Tecnología de la Salud 142 0.91

Construcción de viviendas 29 1.59

Hospitales/Centros de Salud 31 0.96

Hoteles/Juegos 66 1.44

Productos domésticos 118 0,92

Servicios de información 79 1.2

Seguros (Generales) 23 0.81

Seguro (Vida) 24 0.88

Seguro (Prop/Cas.) 52 0.78

Inversiones y gestión de activos 687 0.97

Maquinaria 111 1.18

Metales y Minería 74 1.13

Equipos y servicios de oficina 18 1.11

Petróleo/Gas (Integrado) 4 1.25

Petróleo/Gas (Producción y Exploración) 183 1.13

Distribución de Petróleo/Gas 21 0.86

Servicios/Equipos de yacimientos petrolífero 100 1.18

Embalaje y contenedor 26 0.78

Papel/Productos Forestales 11 1

Energía 50 0,56

Metales preciosos 76 0.99

Publicaciones y periódicos 21 1.46

REIT 238 0.99

Desarrollo inmobiliario) 19 0.74

Bienes Raíces (General/Diversificado) 10 0.83

Bienes Raíces (Operaciones y Servicios) 51 0.87

Recreación 60 1.07

Reaseguro 2 1.3

Restaurante/Restaurante 70 1.33

Minorista (Automotriz) 32 1.12

Venta al por menor (suministros para la cons dieciséis 1.42

Minorista (Distribuidores) 68 1.06

Minorista (General) dieciséis 1.04

Venta al por menor (supermercados y alimen 15 0.21

Venta al por menor (en línea) 60 1.07

Minorista (Líneas Especiales) 76 1.23

Neumáticos de goma 2 0.59

Semiconductor 67 1.14

Equipo de semiconductores 34 1.34

Construcción naval y Marina 8 0.8

Zapato 12 1.19

Software (Entretenimiento) 88 1.21

Software (Internet) 36 0.98

Software (Sistema y Aplicación) 375 1.12

Acero 28 0.98

Telecomunicaciones (inalámbrica) 17 0,63

telecomunicaciones Equipo 82 1.06

telecomunicaciones Servicios 42 0.51

Tabaco dieciséis 0.86

Transporte 17 0.72

Transporte (Ferrocarril) 4 0,65

Camionaje 34 1.28

Utilidad (General) dieciséis 0,60

Utilidad (Agua) 14 0,61

Mercado total 7229 0.91

Mercado Total (sin financieros) 5619 1.04

Beta Correlación Beta

apalancada media con el Beta total no apalancada

promedio mercado apalancada total

1.34 27,79% 3.97 4.82

1.28 43,47% 2.55 2.95

1.58 54,49% 1.68 2.9

1.23 41,64% 2.64 2.95

1.13 31,10% 3.28 3.63

1.4 43,36% 2.8 3.22

1.12 61,35% 1.68 1.82

0.7 42,84% 1.96 1.63

0.82 32,28% 2.23 2.54

1.22 32,78% 3.4 3.71

1.35 36,21% 2.24 3.73

1.17 47,66% 1.41 2.47

1.19 54,38% 2 2.18

1.09 41,66% 2.37 2.61

0.93 58,86% 1.13 1.59

1.16 36,26% 2.58 3.21

1.5 49,50% 2.44 3.04

1.1 41,62% 2.4 2.65

0,92 21,02% 3.9 4.36

1.2 31,41% 3.37 3.82

1.29 35,99% 3.47 3.58

1.11 46,03% 2.13 2.41

0.75 36,86% 1.91 2.05

0.99 25,14% 3.87 3.95

1.08 24,67% 4.09 4.36

1.13 35,12% 3.14 3.21

1.25 31,63% 3.78 3.94

0.98 26,08% 4.05 3.74

1.09 35,13% 2.99 3.09

1.06 42,26% 2.3 2.5

1.01 21,28% 4.53 4.76

1.24 32,89% 3.3 3.77

1.03 36,38% 2.33 2.83

0.93 39,63% 0.38 2.34

0.75 27,17% 2.33 2.76

1.4 35,16% 3.08 3.99

1.11 40,05% 2.48 2.77

1.59 16,24% 6.74 9.78

0,94 33,80% 2.7 2.78

1.06 31,98% 2.97 3.31

0,94 31,96% 2.84 2.95

1.69 59,72% 2.66 2.82

1.41 44,03% 2.19 3.21

1.79 48,99% 2.93 3.66

0.98 24,21% 3.8 4.05

1.25 42,61% 2.83 2.93

0,92 49,28% 1,65 1.87

1.22 57,21% 1.54 2.14

0.86 49,52% 1.58 1.74

1.05 36,48% 2.65 2.87

1.25 48,92% 2.41 2.55

1.17 22,01% 5.13 5.33

1.38 42,80% 2.6 3.23

1.47 63,86% 1.96 2.29

1.32 24,00% 4.7 5.5

1.4 39,19% 2.21 3.56

1.5 30,63% 3.85 4.88

1.01 54,95% 1.42 1.84

1.21 47,04% 2.12 2.58

0.83 62,91% 0.89 1.32

0.99 17,94% 5.5 5.52

1.69 41,66% 3.52 4.07

1.35 59,81% 1,65 2.25

1.06 29,89% 2.48 3.56

0.91 42,27% 1.97 2.14

1.15 32,33% 2.69 3.54

1.23 32,91% 3.26 3.73

1.37 77,54% 1.67 1.77

1.56 49,00% 2.72 3.18

1.4 45,34% 2.47 3.08

1.52 54,08% 2.62 2.82

1.28 42,93% 2.48 2.98

1.12 45,00% 2.31 2.48

0.3 18,16% 1.17 1,65

1.1 26,35% 4.04 4.19

1.44 45,79% 2.68 3.15

1.16 38,84% 1.52 2.98

1.16 45,24% 2.51 2.57

1.34 55,64% 2.41 2.41

0.99 32,42% 2.47 3.06

1.19 48,59% 2.45 2.44

1.2 24,57% 4.91 4.9

1 26,75% 3.65 3.75

1.14 31,23% 3.59 3.66

1.13 44,26% 2.22 2.56

0.96 22,85% 2.74 4.22

1.08 34,50% 3.06 3.14

0.85 25,65% 1.98 3.3

1 33,11% 2.6 3.01

0.79 36,59% 1.96 2.16

0.73 77,60% 0.83 0,94

1.44 49,29% 2.59 2.92

0.89 71,49% 0.83 1.25

0.77 42,88% 1.43 1.78

1.09 36,74% 2.48 2.98

1.15 35,69% 2.91 3.22

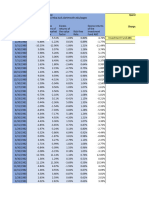

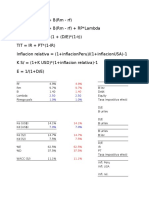

KOA - PETRO PERU

KOA =Rf + B KOA =Rf + B

Rf = Rendimiento de riesgo t -bill o T bonds Rf = Rendimiento de riesgo t -bill o T bonds

B = Riesgo del negocio B = Riesgo del negocio

RM = Rendimiento de mercado S&P RM = Rendimiento de mercado S&P

RP = Riesgo del Pais RP = Riesgo del Pais

Rf 5.11% Rf 5.11%

RM 11.82% RM 11.82%

RP 1,58% RP 1,58%

BETA 0.86 BETA 1.13

KOA DE LA DISTRIBUCION DE PETROLEO/GAS KOA DE PETROLEO/GAS (PRODUCCION Y EXPLOR

KOA = 0.124606 KOA = 0.142723

RENDIMIENDO MINIMO DEL ACCIONISTA DE LA RENDIMIENDO MINIMO DEL ACCIONISTA DE PETRO

DISTRIBUCION DE PETROLEO ES DE 0.12% (PRODUCCION Y EXPLORACION) ES DE 0.14%

OA - PETRO PERU

KOA =Rf + B KOA =Rf + B

nto de riesgo t -bill o T bonds Rf = Rendimiento de riesgo t -bill o T bonds

negocio B = Riesgo del negocio

ento de mercado S&P RM = Rendimiento de mercado S&P

l Pais RP = Riesgo del Pais

Rf 5.11%

RM 11.82%

RP 1,58%

BETA 1.25

ROLEO/GAS (PRODUCCION Y EXPLORACION) KOA DE PETROLEO/GAS (INTEGRADO)

0.142723 KOA = 0.150775

O MINIMO DEL ACCIONISTA DE PETROLEO/GAS RENDIMIENDO MINIMO DEL ACCIONISTA

UCCION Y EXPLORACION) ES DE 0.14% DEPETROLEO/GAS (INTEGRADO) ES DE 0.15%

You might also like

- Zipcar: Influencing Customer BehaviorDocument4 pagesZipcar: Influencing Customer BehaviorSashitaroor100% (1)

- 1 MW - Solar Power Financial ModelDocument15 pages1 MW - Solar Power Financial Modelannu priyaNo ratings yet

- HistoricalinvestDocument1 pageHistoricalinvestSaurabh Kulkarni 23No ratings yet

- Solucionario - PC1 2019-02 EF71Document37 pagesSolucionario - PC1 2019-02 EF71Adrian Pedraza AquijeNo ratings yet

- Stocks T.Bills T.BondsDocument1 pageStocks T.Bills T.BondsCH NAIRNo ratings yet

- Stocks T.Bills T.BondsDocument1 pageStocks T.Bills T.BondsCH NAIRNo ratings yet

- Historicalinvest TDocument1 pageHistoricalinvest TanantNo ratings yet

- HistoricalinvesttempDocument1 pageHistoricalinvesttempLuisAlfonsoFernándezMorenoNo ratings yet

- HistoricalinvestDocument10 pagesHistoricalinvestranvijaygalgotias27No ratings yet

- Ranvijay BaDocument5 pagesRanvijay Baranvijaygalgotias27No ratings yet

- Customized Geometric Risk Premium EstimatorDocument40 pagesCustomized Geometric Risk Premium EstimatorVíctor GómezNo ratings yet

- Calculo Del COK v2Document16 pagesCalculo Del COK v2Liz AguilarNo ratings yet

- Histret SPDocument57 pagesHistret SPLIMANo ratings yet

- AAPL Monthly Vs Weekly W Log ReturnsDocument110 pagesAAPL Monthly Vs Weekly W Log ReturnssgimenezNo ratings yet

- Historical Returns USDocument34 pagesHistorical Returns USYuchen XuNo ratings yet

- (Damodaran) Prima de RiesgoDocument57 pages(Damodaran) Prima de RiesgoDaniel Abad FloresNo ratings yet

- Simulador Interes CompuestoDocument15 pagesSimulador Interes CompuestoiuNo ratings yet

- BreakdownDocument103 pagesBreakdownhandiNo ratings yet

- Rendimiento de AccionesDocument6 pagesRendimiento de AccionesFrancis Ariana Cervantes BermejoNo ratings yet

- Carhart 4 Factor DataDocument26 pagesCarhart 4 Factor DataDilshadNo ratings yet

- Carhart 4 Factor DataDocument26 pagesCarhart 4 Factor Datadheeraj agarwalNo ratings yet

- Nifty: Date Rel Nav Sahara NavDocument8 pagesNifty: Date Rel Nav Sahara Navmayankco84No ratings yet

- Empresas de EnergiaDocument2 pagesEmpresas de EnergiaBruno Henrique CardosoNo ratings yet

- Planilha (Aulas Iniciais) Curso Avançado de ExcelDocument8 pagesPlanilha (Aulas Iniciais) Curso Avançado de ExcelluanaNo ratings yet

- Correlação de AtivosDocument25 pagesCorrelação de AtivosFÁBIO PESSOANo ratings yet

- Investment SpreadsheetDocument37 pagesInvestment Spreadsheetapi-313766620No ratings yet

- Anno Var % Annua Var % Anual PIB A Preços de Mercado (Mihoes Euro) Divida Publica Nominal (Milhoes Euro)Document40 pagesAnno Var % Annua Var % Anual PIB A Preços de Mercado (Mihoes Euro) Divida Publica Nominal (Milhoes Euro)José Jair Campos ReisNo ratings yet

- Rendimientos Mensuales - Portafolios 2023-1Document2 pagesRendimientos Mensuales - Portafolios 2023-1Lucero ÁlvarezNo ratings yet

- Port. de InvDocument7 pagesPort. de InvAdrian Duran ValenciaNo ratings yet

- Riesgo de Mercado Damodaran 0117 07-06-2017Document36 pagesRiesgo de Mercado Damodaran 0117 07-06-2017CristinaNo ratings yet

- Solutions DYNAMISDocument16 pagesSolutions DYNAMISSambeet MallickNo ratings yet

- Date RF MKTRF SMB HML Umd Lnsheq EqmktntrDocument21 pagesDate RF MKTRF SMB HML Umd Lnsheq EqmktntrRaymond WidjajaNo ratings yet

- Customized Geometric Risk Premium EstimatorDocument39 pagesCustomized Geometric Risk Premium EstimatorMilagros Quispe MoyaNo ratings yet

- I Bond Rate ChartDocument1 pageI Bond Rate ChartRandy MarmerNo ratings yet

- Inchang ElectronicsDocument4 pagesInchang ElectronicsVicenteAMartinezGNo ratings yet

- Customized Geometric Risk Premium EstimatorDocument43 pagesCustomized Geometric Risk Premium EstimatorMuhammad ShakoorNo ratings yet

- Oksidasi - XrayDocument3 pagesOksidasi - XrayIntania Anzhal SasyabilNo ratings yet

- IndicesDocument2 pagesIndicesSofia GrinbergNo ratings yet

- LMVTX Legg Mason Value Trust Pcbax Blackrock Asset Allocation FCNTX Fidelity Contrafund Usawx Usaa World GrowthDocument17 pagesLMVTX Legg Mason Value Trust Pcbax Blackrock Asset Allocation FCNTX Fidelity Contrafund Usawx Usaa World GrowthjadgugNo ratings yet

- Índices INPC Tabela HistóricaDocument5 pagesÍndices INPC Tabela HistóricaMarcelo BandeiraNo ratings yet

- Rendimientos LP - Elvis MoralesDocument13 pagesRendimientos LP - Elvis MoralesAlexander MoralesNo ratings yet

- PortfolioModelDocument4 pagesPortfolioModelSem's IndustryNo ratings yet

- Ações AtualDocument18 pagesAções Atualyatan001No ratings yet

- High 2100 TCP Utilized SitesDocument4 pagesHigh 2100 TCP Utilized SitesMark EmakhuNo ratings yet

- High 2100 TCP Utilized SitesDocument4 pagesHigh 2100 TCP Utilized SitesMark EmakhuNo ratings yet

- S&P 500 y BancosDocument5 pagesS&P 500 y BancosJavier D'cNo ratings yet

- UntitledDocument7 pagesUntitledhadi halauiNo ratings yet

- Ej 2 HWDocument2 pagesEj 2 HWSofia GrinbergNo ratings yet

- Part-3Document11 pagesPart-3kami.piotrkieiczNo ratings yet

- Gordugunuz Oranlar (Xg-Experts) Sisteminin Hesaplamis Oldugu Adi OranlardirDocument5 pagesGordugunuz Oranlar (Xg-Experts) Sisteminin Hesaplamis Oldugu Adi OranlardirionspinuNo ratings yet

- PD 2 - SolucionarioDocument32 pagesPD 2 - SolucionarioAdrian Pedraza AquijeNo ratings yet

- Volatilidad - Diana Escobar ODocument148 pagesVolatilidad - Diana Escobar OSeguridad y salud HormigonNo ratings yet

- AnnexuresDocument23 pagesAnnexuresMohit AnandNo ratings yet

- histretSP 2022Document45 pageshistretSP 2022MarianaNo ratings yet

- Taller Costo de Capital ValDocument34 pagesTaller Costo de Capital ValJoseph Rojo ChNo ratings yet

- 02.09 Frontera EficienteDocument11 pages02.09 Frontera Eficientelaila20No ratings yet

- Calculating Adjusted BetasDocument11 pagesCalculating Adjusted BetasMuhammad Ahsan MukhtarNo ratings yet

- Tamzidul Islam Portfolio Optimization MidtermDocument24 pagesTamzidul Islam Portfolio Optimization MidtermTamzidul IslamNo ratings yet

- Var RINDocument2 pagesVar RINRaul Ronaldo Romero TolaNo ratings yet

- United States Census Figures Back to 1630From EverandUnited States Census Figures Back to 1630No ratings yet

- Workbook With KeyDocument3 pagesWorkbook With KeyNayeli Chancasanampa GomezNo ratings yet

- TAREADocument5 pagesTAREANayeli Chancasanampa GomezNo ratings yet

- Ingles 16Document7 pagesIngles 16Nayeli Chancasanampa GomezNo ratings yet

- Universidad Nacional Del Centro Del Perú: AlumnasDocument4 pagesUniversidad Nacional Del Centro Del Perú: AlumnasNayeli Chancasanampa GomezNo ratings yet

- ESA Winne Astronaut Currently Serves As Director of The European Astronaut Center of The European Space Agency in Cologne / GermanyDocument2 pagesESA Winne Astronaut Currently Serves As Director of The European Astronaut Center of The European Space Agency in Cologne / GermanyNayeli Chancasanampa GomezNo ratings yet

- My Hero Is YouDocument1 pageMy Hero Is YouNayeli Chancasanampa GomezNo ratings yet

- Causa Rellena ..: Ingredients For The Filling FOR DecorationDocument1 pageCausa Rellena ..: Ingredients For The Filling FOR DecorationNayeli Chancasanampa GomezNo ratings yet

- Creating Customer ValueDocument109 pagesCreating Customer ValueAnkit GuptaNo ratings yet

- GR 7 Ems Final Exam Paper - 2022 Marking GuidelineDocument9 pagesGR 7 Ems Final Exam Paper - 2022 Marking GuidelineMuhammed ChopdatNo ratings yet

- Comparative Income Statement of Star Company For 2016-2018 Star Company Comparative Income Statement December 31, 2016,2017 and 2018Document5 pagesComparative Income Statement of Star Company For 2016-2018 Star Company Comparative Income Statement December 31, 2016,2017 and 2018JonellNo ratings yet

- Invoice-2024-02-11 11 - 02Document1 pageInvoice-2024-02-11 11 - 02arunkumarmevadaNo ratings yet

- Solved Paper I - 2021Document41 pagesSolved Paper I - 2021Eswar AnaparthiNo ratings yet

- Introduction To OP MGNT. MGT303Document17 pagesIntroduction To OP MGNT. MGT303Julie Ann ManaloNo ratings yet

- Credit Blueprint 1Document12 pagesCredit Blueprint 1Geo Staffan100% (3)

- Unit-2 Sums SheetDocument8 pagesUnit-2 Sums SheetAstha ParmanandkaNo ratings yet

- CarmelaDocument2 pagesCarmelaCatherine PardoNo ratings yet

- Pawan Project-1Document56 pagesPawan Project-1pawan vermaNo ratings yet

- MF Company Wise InformationDocument36 pagesMF Company Wise InformationrgkusumbaNo ratings yet

- H2 Economics 9757 Paper 1 - Answer - MSDocument20 pagesH2 Economics 9757 Paper 1 - Answer - MSAmanda GohNo ratings yet

- Samanvaya Law & PartnersDocument6 pagesSamanvaya Law & PartnersROHIT YADAVNo ratings yet

- Finance ProjectDocument80 pagesFinance ProjectDinoop Devaraj0% (1)

- CXC Principles of Business Exam Guide: Section 6: MarketingDocument5 pagesCXC Principles of Business Exam Guide: Section 6: MarketingAvril CarbonNo ratings yet

- Industy AnalysisDocument5 pagesIndusty AnalysisAlif HaqNo ratings yet

- ECGCDocument19 pagesECGCSOUVIK ROY MBA 2021-23 (Delhi)No ratings yet

- Newsletter July 2022 PDFDocument13 pagesNewsletter July 2022 PDFDwaipayan MojumderNo ratings yet

- Corporate-Level Strategy: Related and Unrelated DiversificationDocument27 pagesCorporate-Level Strategy: Related and Unrelated DiversificationTanvir Ahmad ShourovNo ratings yet

- Bankinng PPT - PPTMDocument19 pagesBankinng PPT - PPTMKeshav ThadaniNo ratings yet

- Amul Case StudyDocument3 pagesAmul Case StudyRohan JainNo ratings yet

- InvestIndia - PLI Textiles - VFDocument44 pagesInvestIndia - PLI Textiles - VFTushar JoshiNo ratings yet

- Portfolio, Programme and Project Offices (P3O®) : Online RepositoryDocument36 pagesPortfolio, Programme and Project Offices (P3O®) : Online RepositoryDelano NsongoNo ratings yet

- Warehousing Management Using 5S Methodology 555Document50 pagesWarehousing Management Using 5S Methodology 555Nirmal ThapaNo ratings yet

- Usdaw Activist 106Document3 pagesUsdaw Activist 106USDAWactivistNo ratings yet

- Final Draft Business Envirnment Assignment Iman HaseebDocument23 pagesFinal Draft Business Envirnment Assignment Iman HaseebimanNo ratings yet

- BBC International LTD 1t 24may2020 UbsDocument19 pagesBBC International LTD 1t 24may2020 Ubspezhmanbayat924No ratings yet

- Lecture - Notes-Week Two Lecture NotesDocument26 pagesLecture - Notes-Week Two Lecture Notesshanky1124No ratings yet