Professional Documents

Culture Documents

Long-Term Construction

Long-Term Construction

Uploaded by

Dodong0 ratings0% found this document useful (0 votes)

11 views12 pagesOriginal Title

LONG-TERM CONSTRUCTION

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

Download as pdf

0 ratings0% found this document useful (0 votes)

11 views12 pagesLong-Term Construction

Long-Term Construction

Uploaded by

DodongCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

Download as pdf

You are on page 1of 12

Chapter 6 Long Term Construction Contracts 205

6. The percentage of completion of a contract at any statement of financial

position date is estimated on a cumulative basis. Therefore, changes in

estimates are automatically accounted for in the period in which the

change occurs and in future periods, which is in accordance with PAS 8,

Accounting Policies, Changes in Accounting Estimates and Errors.

CONDITIONS NECESSARY TO USE PERCENTAGE OF

COMPLETION ACCOUNTING

Several elements that should be present if percentage-of-completion accounting is

to be used.

1, Dependable estimates can be made of contract revenues, contract costs,

and the extent of progress toward completion.

2. The contract clearly specifies the enforceable rights regarding goods to be

provided and received by the parties, the consideration to be exchanged,

and the manner and terms of settlement.

3. The buyer can be expected to satisfy obligations under the contract.

4. The contractor can be expected to perform the contractual obligation.

; Re EOF

COMPLETION

1. Percentage of completion=

Actual costs incurred to date

‘Actual costs incurred to date + Est. cost to complete

2. Percentage of completion=

Actual costs incurred to date

Total costs at completion

3. Percentage of completion=

Revenue recognized

‘Contract price

206 AFAR

Percentage of Completion method. PAS 11 RECOGNIZES ONLY the percentage

of completion method of recognition of revenues and costs. The completed

contract method whereby no contract revenue or profits are recognized until the

contracts are completed or are substantially complete is not permitted under Pas 11

The stage of completion of a contract can be estimated by a variety of means,

depending on the nature of the contract and as to how it can be best measured: The

third method suggested is the zero profit method (sometimes referred to a cost

recovery method) wherein cost are recorded just like the first two method. The

revenue recorded is jest equal to the cost, so no profit is recorded during years of

construction, The toal profit is recognized upon completion just like completed

‘contract method.

PAS 11 provides that the stage of completion of a contract may be determined

using any of the following methods

‘A. The proportion that costs incurred at the statement of financial position

date bear to expected total costs required to complete the contract This is

the most commonly used (COST TO COST METHOD)

B. Certification of surveys of work performed; (ARCHITEST’S OR

ENGINEER'S ESTO,ATES)

C. Completion of physical proportion of the contract work. Example of this is

comparing the number of floors completed to the total floors required of a

condo,

ILLUSTRATIVE PROBLEM 1

Basic computations for revenues, costs, and profit illustrated. Assume San

Construction Company is constructing a multi-storey building at a fixed price of

20,000,000. Details of costs incurred during the first year of construction

activities are:

Labor cost 1,600,000

Cost of construction materials 3,400,000

Depreciation of equipment used in

construction 500,000

Marketing and selling expenses sale of

some sections of the building 2,600,000

Total 8,100,000

Additional estimated cost to complete ‘P4,500,000

Chapter 6 Long Term Construction Contract 207

Required: (Based on PAS 11)

1. Cost incurred to date

2. Percentage of completion

3. Revenue realized

4, Profit to be recognized for the year

5. Journal entries for the year

PERCENTAGE OF COMPLETION METHOD

1. Labor cost P1,600,000.

Cost of materials 2,400,000

Dépreciation — Equipment 500,000

Cost incurred to date ‘4,500,000

2. Percentage of completion = Cost incurred to date

‘Actual cost + Est. cost tol complete

= 4,500,000

4,500,000 + 7,500,000

= 315%

. 3. Revenue realized = Contract Price x Percentage of completion

= 20,000,000 x 37.5%

= 1,500,000

4. Revenue (20,000,000 x 37, 5%) 7,500,000

Cost (12,000,000 x 37.5%) 4500,

Gross Profit (_ 8,000,000 x 37.5%) 3,000,000

5, Journal entries

a. Construction in progress 4,500,000

‘Acorued payroll 1,600,000,

Materials, 2,400,000

Accumulated depreciation '300,000

To record cost incurred

208

b. Construction cost 4,500,000

‘Construction in progress 3,000,000

Construction revenue 7,500,000

Torecord profit for the year

‘Take note that the balance of the construction in progress account is equal to cost

of 4,500,000 plus gross profit realized P 3,000,000. Revenue realized is also

7,500,000 So if construction in progress is equal to cost incurred plus gross profit

realized and reverue recognized is also equal to cost incurred plus cost incurred

plus gross profit realized. then CIP = Revenue Recognized. To compute revenue

recognized simply multiply Contract Price by the percentage of completion (20,000,000

x37.5%)

COMPLETED CONTRACT METHOD ;

No profit is recognized during the year. The total profit will be recorded on

the year of completion. The entry for the year is only the recording of the

cost.

a. Construction in progress 4,500,000

Accrued payroll 1,600,000

Materials 2,400,000

Accumulated depreciation 500,000

To record cost incurred

ZERO PROFIT METHOD OR COST RECOVERY METHOD.

This is a combination of completed contract method and percentage of

completion method.

‘a. Construction in progress 4,500,000

Acerued payroll 1,600,000

Materials 2,400,000

Accumulated depreciation 500,000

To record cost incurred

b. Construction cost 4,500,000

Construction revenue 4,500,000

To record revenue realized

Chapter 6 Long Term Construction Contract 209

Under this method (ZERO-PROFIT) the revenue realized is equal to cost so no

profit is realized during years of construction..The total profit is reported on the

year of completion.

Iustrative Problem 2

‘At the beginning of 2015, Smart Construction Company received a contract to

build a building for PSO million. The project is to take three years to complete.

‘According to the contract, Smart Construction Company wili bill the buyer in

installments over the construction period according to a prearranged schedule.

Information related to the contract isa follows

2018 2016 2017

Actual costs incurred during the year 15,000,000 10,000,000 16,000,000

Estimated cost to complete at year-end 22,500,000 15,000,000 -0-

Billings during the year 12,000,000 20,000,000 18,000,000

‘Collections during the year 10,000,000 14,000,000 26,000,000

Required:

1. Summary journal entries for the completed contract method.

2. Summary journal entries for the percentage of completion method.

3. Summary journal entries for the zero profit method

‘Completed contract method

2015 2016 2017

‘Construction in progress 15,000,000 10,000,000 16,000,000

Various-accounts 15,000,000 10,000,000 16,000,000

To record construction cost

‘Accounts Receivable 12,000,000. 20,000,000 18,000,000

Progress Billings 12,000,000. 20,000,000 18,000,000

To record billings

Cash 10,000,000 14,000,000 26,000,000

‘Accounts Receivable 10,000,000 14,000,000 26,000,000

To record collections

Entry to record profit recognized

‘Construction Cost 0 41,000,000,

Construction in progress 0- o 9,000,000

Construction Revenue 0 0 0,000,000

210

Progress Billings

Construction in pregress

PERCENTAGE OF COMPLETION METHOD

Construction in progress

‘Various accounts

To record constructon cost

Accounts Receivable

Progress Billings

To record billings

Cash

‘Accounts Receivable

To record collectiors

Entry to record profit recognized

Construction Cost

Construction in progress

Construction Revenue

Progress Billings

Construction in progress

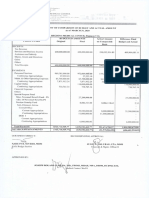

Computations

Contract Price

‘Actual cost incurred curing the year

‘Actual cost ineurred prior years

‘Cumulative actual cos to date

Estimated cost to complete

Total costs

Total gross profit

“Multiplied by of % cf completion

Gross profit earned to date

Gross profit earned prior years

Gross profit recognized this year

Percentage of completion

2015

15,000,000

15,000,000

12,000,000

12,000,000

10,000,000

10,000,000

15,000,000

5,000,000

20,000,000

2016

10,000,000

10,000,000

20,000,000

20,000,000

14,000,000.

14,000,000

10,000,000

1,250,000

11,250,000

0,000,000

50,000,000

2017

16,000,000

16,000,000

18,000,000,

18,000,000

26,000,000

26,000,000,

16,000,000

2,750,000

18,750,000

50,000,000

50,000,000

2017

$0,000,000

16,000,000.

25,000,000

41,000,000

41,000,000

9,000,000

100%

9,000,000

£250,000

2,250,000

41,000,000

41,000,000

AFAR

Chapter 6 Long Term Construction Contracts 211

ENTRIES UNDER ZERO PROFIT METNOD ~ THIS IS A COMBINATION OF

THE PERCENTAGE OF COMPLETION METHOD AND COMPLETED

CONTRACT METHOD (for each of construction year no profit is recognized ~

revenue recorded is equal to cost. Total profit is recorded on the year the contract

is completed just like the completed contract method

2015 2016 2017

‘Construction in progress 15,000,000 10,000,000. 16,000,000

Various accounts 15,000,000 10,000,000 16,000,000

To record construction cost

Accounts Receivable 12,000,000 20,000,000 18,000,000

+ Progress Billings 12,000,000 20,000,000 18,000,000

To record billings

Cash 10,000,000 14,000,000 26,000,000

‘Accounts Receivable 10,000,000 14,000,000 26,000,000

To record collections

Entry to record profit recognized

Construction Cost 15,000,000 41,000,000

Construction in progress 0 - 9,000,000

Construction Revenue 15,000,000 10,000,000 50,000,000

Progress Billings 30,000,000

Construction in progress 0,000,000

COMPARISON OF THE THREE METHODS :

Completed Percentage Zero-profit

Gross profit recognized

2015 None 5,000,000 None

2016 None 1,250,000 None

2017 9,000,000 2,750,000 9,000,000

Total 2,000,000 2,000,000 92,000,000

The total gross profit reported is the same for the three methods. The only

difference is that under the percentage of completion method, the gross profit is

shared by the 3 years of construction while under the completed contract and zero

profit, the total profit was reported on the third year, the year of completion.

212

AFAR

With both the completed contract, percentage of completion methods and zero

profit, all costs cf construction are recorded in an asset account called construction

in progress. This account is similar to the asset

in a manufacturing company. This is logical

essentially an inventory item in process for the

‘Take note that the periodic billings are credited to Progress Bi

is a contra account to the construction

the balances in these two accounts are

compared.

IS GREATER THAN PROGRESS BILLINGS)

financial position as an asset. However, if the

THAN PROGRESS) itis reported as a liability.

ILLUSTRATIVE PROBLEM 3

account work in process inventory

because the construction project is

contractor.

igs. This account

Progress asset. At the end of each period,

Ifthe net amount is a debit(CIP

it is reported in the statement of

net amount is a eredit,(CIP IS LESS.

On January 2, 2017, QUICKBUILD ERECTORS entered into contract to construct

two projects, The following data relate to the construction activities,

Contract price

Cost incurred during 2017

Estimated costs to complete

1. Percentage of completion = a

8,437,500

7,875,000

1,968,750

Actual cost incurred + Est. cost to complete

7,875,000 + 1,968,750

= 20%

3. Contract price

Total cost

Estimated net loss

437,500 x 80%

8,437,500

9,843,750

1,406,250)

Chapter 6 Long Term Construction Contracts 213

7,875,000.

Various Accounts 7,787,000

b. Accounts receivable 5,593,750.

5,593,750

c. Cash 5,000,000

Accounts receivable 5,000,000

d. Construction Cost 7,875,000

Construction in Progress 1,406,250

Construction revenue 6,468,750

The estimated net loss is reported in full (100%) even if the percentage of

‘completion is 80% only. Construction revenue should be (8,437500 x 80%)

6,750,000, but the amount credited was 6,458,750 representing the difference

between cost of 7,875,000 and loss of 1,406,250. AGAIN , WHEN IT IS LIKELY

THAT CONTRACT COSTS WILL EXCEED CONTRACT REVENUE, THEN

THE ENTIRE LOSS MUST BE RECOGNIZED IN THE STATEMENT OF

COMPREHENSIVE INCOME IMMEDIATELY, REGARDLESS OF THE

STAGE OF COMPLETION.

Under Zero-profit method the rule states that no profit should be recognized

during the construction period, however if it is a net loss then THE LOSS IS

REPORTED IN FULL (100%) just like under completed contract and percentage

of completion.

PRESENTATION OF THE CONSTRUCTION IN PROGRESS AND

PROGRESS BILLINGS

‘Construction in Progress = 7.875,000 — 1,406,250) P 6,468,750

Progress Billings 5,593,750

Cost of uncompleted contract in excess of progress billings

or due from customer P__875,000

Construction in Progress exceeds Progress Billings, so the whole package will be

presented among the assets.

214 AFAR

FINANCIAL STATEMENT PRESENTATION OF ACCOUNTS PECULIAR TO.

LONG TERM CONSTRUCTION CONTRACT.

1, Construction in progress - similar to work in process — presented among

the assets if the amount is greater than progress billings.

2. Accounts receivable — presented among the assets just like the trade

‘accounts receivable

3. Progress billings — presented among the liabilities if the amount is greater

than construction in progress.

4. Construction revenue — part of contract price considered as camed.

resented on statement of comprehensive income

$. Construction cost ~ actual cost incurred during the year. Presented on the

statement of comprehensive income.

Disclosures.

‘A. Anentity siall disclose

1. The amount of contract revenue recognized as revenue in the period

2. The methods used to determine the contract revenue recognized in the

period.

3. The methods used to defermine the stage of completion of contracts in

progress at the statement of financial position date

4. For contracts in progress at the statement of financial position date:

(a) The aggregate amount of cost incurred and recognized profits,

less recognized losses, to date

(b) Advances received

(©) Retentions

5. The gross amount due from customers for contract work as an asset

6. The gross amount due to customers for contract work as a liability

B. The gross amount due from customers for contract work is the net amount

of costs incurred plus recognized profits, less the sum of recognized losses

and progress billings for contract in progress for which cost incurred plus

recognized profits, less recognized losses exceeds progress billings.

|

|

CHAPTER 6

LONG TERM CONSTRUCTION

CONTRACTS

LEARNING OBJECTIVES

Upon completion of this chapter, you should be able to

© Know the similarities and differences of completed contract _method,

percentage of completion method and zero profit method of accounting for

Jong —term construction contracts

‘* Know how to compute for the percentage of completion using the different

methods.

* Record transactions for long-term construction contracts using the different

methods.

‘+ Know the financial statement presentation of accounts under the three different

‘methods of recording long-term construction contracts.

In general, revenue is recognized when an earnings process is virtually completed. The

‘general revenue recognition criteria described in the realization principle suggest that

revenue should be recognized when a long term project is finished (that is, when the

‘earings process is virtually complete. This is known as the completed contract method

of revenue recognition. The problem with this methods is that all revenues, expenses,

and resulting income from the project are recognized in the period in which the project

is completed; no revenues or expenses are reported in the income statements of earlier

reporting periods in which much of the work may have been performed. Net income

should provide a measure of périodic accomplishment to help predict future

accomplishments. Clearly, income statements prepared using the completed contract

‘method do not fairly report each period’s accomplishment when a project spans more

than one reporting period. Much of the earings process is far removed the from the

point of delivery.

‘The percentage of completion method of revenue recognition for long term construction

and other projects is designed to help address this problem. By this approach, we

recognize revenues and expenses over time by allocating a share of the project’s

expected revenues and expenses to each period in which the earings process occurs;

that is the contract period. Although the contract usually sj total revenues, the

project’s expenses are not known until completion. Consequently, it is necessary for a

‘company to estimate the project's future costs at the end of each reporting period in

order to estimate total gross profit to be earned on the project.

"NOLLATAWOD

4O JOVIS FHL JO SSIIGUVOTY ‘ATELVIGSWWI AWOONI

AAISNAHAYdWOO JO INAWALVIS 3HL NI GaZINSOOI¥

ga 1SAW SSO1 AYILNa SHL NaHL “ANNAATY LOVYLNOO

GaaOXa THA SISOO LOVYLNOO LVHL ATAMIT SI LI NSHM ‘Ss

“sep worysod jeIoueuly Jo uoWOIS ay) 1 UOHa|du09

Jo aBes ay 01 eououajas Aq paziuosas aq Pinoys sis0> pur anusAal 24] “p

Aiquijas pareumsa

2q uv YeNUOD stp Jo suwosINO 2x uy swooU! aaIsUaYaidwWCD Jo

quawiareys yp UI peziudooal eq Pinoys sis09 1oeENOD pue enuiaAaL IENUOD “_

’ BUCS ayy Jo sua) ay JapuN ajqvatzEyD

_ Ajpeyroads ase se sysoo somo yons (¢) pur ‘sioesU09 0 payeso|ye oq Uv

_—-pue jeusuad ur AWANoB ieAUOD o B[QuINqUMIE axe IY s1S09 (Z) ‘IDBNUOD

-—_aypads ayn 01 én:

NP aWejau YeIp S1$09 (|) JO ysISUOD |TeYS SOD JoRNUOD “7

“paunsvow Aiquyjos

‘Buyoq Jo ajqudeo axe Kaun pue anuanas ut yynsas jy ayy yep aquqoud

SE AE JeYP WuaIXD oY OF SoANUSOU! PUR “sUITeID “sUONELBA YM JyIZO

yoequc. ay) UI pace so1ud yeRIuy ay asiidwiod |JeYs sanuaAas oRNUOD “|

“80D pure sonuanayf 1E-IUO; Jo WoR|UBOIY,

spotiod uonanaystod paisayse

‘247 0} Kjoyeuidoudde s1s00 pur sonuonas ared0jye 01 moy s} ansst ure ayy axojauaip

‘spouad Bununosse jeiongs sosso1 wayo A19A uona|duios sia pue somtanoe

Uuononsysuo9 Jo UwIs el] ‘SIENYED uoHONNsHOS Wal-Buo] YM UONDAUUOD ut

'S1S09 pure Sanuanay 40} JUNODDE O} MOY SI || S¥d

You might also like