Professional Documents

Culture Documents

To Whomsoever It May Concern Statement For Claiming Deductions Under Sections 24 (B) & 80 (C) (2) (Xviii) OF THE INCOME TAX ACT, 1961

To Whomsoever It May Concern Statement For Claiming Deductions Under Sections 24 (B) & 80 (C) (2) (Xviii) OF THE INCOME TAX ACT, 1961

Uploaded by

Vinod Kumar PandeyCopyright:

Available Formats

You might also like

- MR Parmar Krishnarajsinh 554/1, Satyam Society, Sector-22, Gandhinagar, GANDHINAGAR-382021Document1 pageMR Parmar Krishnarajsinh 554/1, Satyam Society, Sector-22, Gandhinagar, GANDHINAGAR-382021parmarkrishnarajsinh100% (1)

- This Study Resource Was: Busse PlaceDocument4 pagesThis Study Resource Was: Busse PlaceRohit Singh KushwahaNo ratings yet

- PAGE1Document1 pagePAGE1Joeyq MoyaNo ratings yet

- NPS CertificateDocument2 pagesNPS CertificateSatish Tiwari100% (1)

- Capital Structure and Cost of CapitalDocument7 pagesCapital Structure and Cost of CapitalĐào Thanh Tùng100% (1)

- To Whomsoever It May Concern Statement For Claiming Deductions Under Sections 24 (B) & 80C (2) (Xviii) of The Income Tax ACT, 1961Document1 pageTo Whomsoever It May Concern Statement For Claiming Deductions Under Sections 24 (B) & 80C (2) (Xviii) of The Income Tax ACT, 1961senthil kumarNo ratings yet

- SBI Insurance 2021Document1 pageSBI Insurance 2021personal listNo ratings yet

- Reg No: Dl8Cav0116: Registration Certificate For VehicleDocument1 pageReg No: Dl8Cav0116: Registration Certificate For Vehicleh4ckerNo ratings yet

- To Whomsoever It May Concern Statement For Claiming Deductions Under Sections 24 (B) & 80C (2) (Xviii) of The Income Tax ACT, 1961Document1 pageTo Whomsoever It May Concern Statement For Claiming Deductions Under Sections 24 (B) & 80C (2) (Xviii) of The Income Tax ACT, 1961Potu RavinderreddyNo ratings yet

- Statement For Claiming Deductions Under Sections 24 (B) & 80C (2) (Xviii) of The Income Tax ACT, 1961Document1 pageStatement For Claiming Deductions Under Sections 24 (B) & 80C (2) (Xviii) of The Income Tax ACT, 1961Ankur ChowdharyNo ratings yet

- Branch Code:02186 Bank's PAN: Branch Name:: To Whomsoever It May Concern Provisional Home Loan Interest CertificateDocument1 pageBranch Code:02186 Bank's PAN: Branch Name:: To Whomsoever It May Concern Provisional Home Loan Interest Certificatesudarsan kingNo ratings yet

- Premium Paid Acknowledgement PDFDocument1 pagePremium Paid Acknowledgement PDFsanto02No ratings yet

- Premium Receipt PDFDocument1 pagePremium Receipt PDFChidambaram VNo ratings yet

- LBTRU00005805276 IT Certificate 2021-22Document2 pagesLBTRU00005805276 IT Certificate 2021-22siva kumar reddy kNo ratings yet

- Homeloan IT Lcertificate Mithun 2023Document1 pageHomeloan IT Lcertificate Mithun 2023yaligartechNo ratings yet

- View CertificateDocument1 pageView CertificateadiNo ratings yet

- Home Loan - Certificate - 2022-23Document1 pageHome Loan - Certificate - 2022-23cont2chandu100% (1)

- Provisional Certificate 2018-2019Document1 pageProvisional Certificate 2018-2019RohanNo ratings yet

- HL IT - Certificate - 621058739 FY 23-24 SampleDocument1 pageHL IT - Certificate - 621058739 FY 23-24 SampleGouravpurvi100% (1)

- HDFC 1Document1 pageHDFC 1Vivekananda PenumarthiNo ratings yet

- Provisional Interest CertificateDocument2 pagesProvisional Interest Certificateashutosh sahuNo ratings yet

- Lbhyd00002731694 IciciDocument1 pageLbhyd00002731694 IciciSurya GoudNo ratings yet

- To Whomsoever It May Concern Statement For Claiming Deductions Under Sections 24 (B) & 80C (2) (Xviii) OF THE INCOME TAX ACT, 1961Document1 pageTo Whomsoever It May Concern Statement For Claiming Deductions Under Sections 24 (B) & 80C (2) (Xviii) OF THE INCOME TAX ACT, 1961APURV UPADHYAYNo ratings yet

- To Whomsoever It May Concern Statement For Claiming Deductions Under Sections 24 (B) & 80C (2) (Xviii) of The Income Tax ACT, 1961Document1 pageTo Whomsoever It May Concern Statement For Claiming Deductions Under Sections 24 (B) & 80C (2) (Xviii) of The Income Tax ACT, 1961Ameya SudameNo ratings yet

- ProvisionalInterestCertificate H403HHL0576456Document1 pageProvisionalInterestCertificate H403HHL0576456AyazNo ratings yet

- Provisional Certificate For The Financial Year 2020-2021: To Whomsoever It May ConcernDocument1 pageProvisional Certificate For The Financial Year 2020-2021: To Whomsoever It May ConcernVenkateshNo ratings yet

- Sanction LetterDocument7 pagesSanction LetterPrimon KarmakarNo ratings yet

- Lony3004 00000037809338867 HDocument1 pageLony3004 00000037809338867 HlimcysebastinNo ratings yet

- 524243536624287Document1 page524243536624287support marenNo ratings yet

- HDFC Life Premium Receipts Nov 2022Document1 pageHDFC Life Premium Receipts Nov 2022kapsekunalNo ratings yet

- Exide OctoberDocument1 pageExide OctoberSasidharKalidindiNo ratings yet

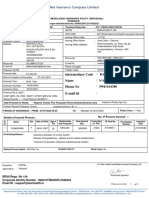

- Kannan S: MR - Chandramouli R BA0000113734 Intermediary Code NameDocument3 pagesKannan S: MR - Chandramouli R BA0000113734 Intermediary Code NameSeshadri KannanNo ratings yet

- Veeravenkata Mallikarjuna Rao KarriDocument1 pageVeeravenkata Mallikarjuna Rao KarriArjunNo ratings yet

- IT CertificateDocument2 pagesIT CertificatePrashant TiwariNo ratings yet

- AROHI SONI SBI InsuranceDocument13 pagesAROHI SONI SBI InsurancePankaj GaurNo ratings yet

- Chandra496 - Provisional Interest CertificateDocument2 pagesChandra496 - Provisional Interest CertificateChandrasekhar Nandigam100% (1)

- Branch Code:03257 Branch Name: Bank's PAN:: To Whomsoever It May Concern Provisional Home Loan Interest CertificateDocument1 pageBranch Code:03257 Branch Name: Bank's PAN:: To Whomsoever It May Concern Provisional Home Loan Interest CertificateRishaan Ranjan100% (1)

- 80D CertificateDocument2 pages80D CertificateSiva KadaliNo ratings yet

- Rajendra Prasad ShrivastavaDocument2 pagesRajendra Prasad ShrivastavaSourabh ShrivastavaNo ratings yet

- Rent Paid Receipt: Revenue Stamp Rs.1Document1 pageRent Paid Receipt: Revenue Stamp Rs.1Pankaj AgarwalNo ratings yet

- Provisional Certificate For The Financial Year 2021-2022: To Whomsoever It May ConcernDocument2 pagesProvisional Certificate For The Financial Year 2021-2022: To Whomsoever It May ConcernKumar AbhisshekNo ratings yet

- Subject: Risk Assumption Letter: LAN Number: 19020618531140 Policy Number: 4111/EPP/164559158/00/000Document2 pagesSubject: Risk Assumption Letter: LAN Number: 19020618531140 Policy Number: 4111/EPP/164559158/00/000shekarNo ratings yet

- Home Loan ReceiptDocument1 pageHome Loan ReceiptJoshua Dcunha100% (1)

- KK EV Auto Loan CertificateDocument1 pageKK EV Auto Loan CertificateKranthi Kumar KingNo ratings yet

- Ravi Education Loan Interest-2023Document1 pageRavi Education Loan Interest-2023Cut Copy PateNo ratings yet

- CERTIFICATE For Claiming Deduction Under Section 24 (B) & 80C (2) (Xviii) of INCOME TAX ACT, 1961Document1 pageCERTIFICATE For Claiming Deduction Under Section 24 (B) & 80C (2) (Xviii) of INCOME TAX ACT, 1961Raman SharmaNo ratings yet

- Premium Paid AcknowledgementDocument1 pagePremium Paid Acknowledgementharsh421No ratings yet

- Group Activ Travel - Certificate of Insurance: Insured Person DetailsDocument2 pagesGroup Activ Travel - Certificate of Insurance: Insured Person Detailsabhinay anandNo ratings yet

- Tata AIA Life MahaLife Gold DadDocument1 pageTata AIA Life MahaLife Gold DadMirzaNo ratings yet

- F D Bond GeneraterDocument1 pageF D Bond GeneraterJayprakash VermaNo ratings yet

- Statement of Public Provident Fund Account: Ms - Neha Raghubar YadavDocument2 pagesStatement of Public Provident Fund Account: Ms - Neha Raghubar YadavNeha100% (1)

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument2 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferenceKuldeep JadhavNo ratings yet

- HDFC Tli - Converted - by - AbcdpdfDocument1 pageHDFC Tli - Converted - by - Abcdpdfharshim guptaNo ratings yet

- Max Bupa Premium Reeipt Parents PDFDocument1 pageMax Bupa Premium Reeipt Parents PDFSatyaNo ratings yet

- InterestDocument1 pageInterestsatya.undapalliNo ratings yet

- Star HealthDocument1 pageStar HealthpalanivelNo ratings yet

- Policy DocDocument6 pagesPolicy DocSoma Shekar ANo ratings yet

- Homeloancertificate - 38180652 DBFDBDocument1 pageHomeloancertificate - 38180652 DBFDBKRIS BARSAGADE100% (1)

- MR Javed Mohammad Monis B295, Chattarpur Enclave, PHASE 2, NEW DELHI-110074Document1 pageMR Javed Mohammad Monis B295, Chattarpur Enclave, PHASE 2, NEW DELHI-110074javedmonis07No ratings yet

- IT CertificateDocument1 pageIT CertificateManoj DasNo ratings yet

- keyFactStatement PDFDocument8 pageskeyFactStatement PDFINAM JUNG GUJJARNo ratings yet

- 2024-25-6--20-38-15-ITCertificateDocument2 pages2024-25-6--20-38-15-ITCertificatekvs kummiNo ratings yet

- SUSNEHADocument2 pagesSUSNEHAsusnehanalam47No ratings yet

- Irr and Incremental IrrDocument10 pagesIrr and Incremental IrrrashiNo ratings yet

- Cash Management DemoDocument29 pagesCash Management DemoShakti ShivanandNo ratings yet

- Chapter 3-Comparison and Selection Among AlternativesDocument35 pagesChapter 3-Comparison and Selection Among AlternativesSaeed KhawamNo ratings yet

- Andal, Camille ADocument5 pagesAndal, Camille ACamille AlcarazNo ratings yet

- Report of Collections and Deposits: AppendixDocument3 pagesReport of Collections and Deposits: Appendixhehehedontmind me100% (1)

- F 51124304Document3 pagesF 51124304hanamay_07No ratings yet

- The Garden Spot Year OneDocument2 pagesThe Garden Spot Year OneJellyBeanNo ratings yet

- BSNL Bill - Jan2016Document1 pageBSNL Bill - Jan2016ritbhaiNo ratings yet

- TXN Date Value Date Description Ref No./Cheque No. Branch Code Debit Credit BalanceDocument4 pagesTXN Date Value Date Description Ref No./Cheque No. Branch Code Debit Credit BalanceMANISH VYASNo ratings yet

- Financial RiskDocument8 pagesFinancial RiskAnusha ButtNo ratings yet

- Ganesh Metal Industry Trial Balance, December 31, 2008 Account Debit (RS) Credit (RS)Document11 pagesGanesh Metal Industry Trial Balance, December 31, 2008 Account Debit (RS) Credit (RS)ayushsapkota907No ratings yet

- Stern Corporation Case SolutionDocument4 pagesStern Corporation Case SolutionAmanNo ratings yet

- Petgas 060420111Document13 pagesPetgas 060420111Sky KhooNo ratings yet

- Chap 025Document26 pagesChap 025latifa hnNo ratings yet

- Draft Letter of AbatementDocument1 pageDraft Letter of AbatementShammy GallanosaNo ratings yet

- China'S Fleet ExpansionDocument30 pagesChina'S Fleet ExpansiongiannoudakiNo ratings yet

- Week 4Document5 pagesWeek 4Erryn M. ParamythaNo ratings yet

- Accounts PT 1Document8 pagesAccounts PT 1vyshnaviNo ratings yet

- Zestmoney StatementDocument2 pagesZestmoney StatementSanthosh KRNo ratings yet

- Proof of Payment UnifiDocument1 pageProof of Payment UnifihowzellaNo ratings yet

- Demonitization and Its Impact On Indian EconomyDocument59 pagesDemonitization and Its Impact On Indian EconomyMohit Agarwal100% (1)

- Statement of Cash FlowsDocument15 pagesStatement of Cash FlowsSrujana GantaNo ratings yet

- Lecture 9Document18 pagesLecture 9Thiery FranitaNo ratings yet

- One For All For One Fin ManDocument3 pagesOne For All For One Fin ManArly Kurt TorresNo ratings yet

- DividendsDocument17 pagesDividendsZafrul ZafNo ratings yet

- 100 Financial Confessions Fron The SripturesDocument8 pages100 Financial Confessions Fron The SripturesRusheen RossNo ratings yet

- Lecture 05 - Capital BudgetingDocument141 pagesLecture 05 - Capital BudgetingSagorNo ratings yet

To Whomsoever It May Concern Statement For Claiming Deductions Under Sections 24 (B) & 80 (C) (2) (Xviii) OF THE INCOME TAX ACT, 1961

To Whomsoever It May Concern Statement For Claiming Deductions Under Sections 24 (B) & 80 (C) (2) (Xviii) OF THE INCOME TAX ACT, 1961

Uploaded by

Vinod Kumar PandeyOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

To Whomsoever It May Concern Statement For Claiming Deductions Under Sections 24 (B) & 80 (C) (2) (Xviii) OF THE INCOME TAX ACT, 1961

To Whomsoever It May Concern Statement For Claiming Deductions Under Sections 24 (B) & 80 (C) (2) (Xviii) OF THE INCOME TAX ACT, 1961

Uploaded by

Vinod Kumar PandeyCopyright:

Available Formats

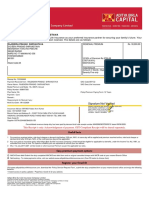

TO WHOMSOEVER IT MAY CONCERN

STATEMENT FOR CLAIMING DEDUCTIONS UNDER SECTIONS 24 (b) &

80 (c)(2) (xviii) OF THE INCOME TAX ACT, 1961

This is to state that Ms./Mr Vinodkumar J Pandey & Kiran Vinodkumar Pandey has/have been granted a Housing

Loan for purchase/construction of house property for an amount of Rs. 10120000/-, the details of which are provided

as below:

Loan Account Number : LBMUM00005167466

Application Form Number : 7722997015

Date of Sanction : 28-NOV-19

Date of Disbursal : 27-DEC-19

Address of the property : I/G 42,1st Flr Vashi Plot No 13,Navi Mumbai 400703,Mumbai,Navi

Mumbai-400703

The above loan is repayable in Equated Monthly Installments (EMIs) comprising of principal and interest wherein the

calculation of interest levied on a monthly basis has been computed on the basis of the terms of sanction as agreed

upon by the Borrower(s) including any amendments to such terms from time to time (or basis request/s received for

change in rate of interest (ROI)).

The break-up of the EMI amount for the above loan into principal and interest is as follows:

Month Installment Interest Principal Interest Principal

Amount (Payable) (Payable) (Paid) (Paid)

(EMI)

Total

* As on date of issuance of the instant certificate the residual/balance tenor of repayment stands at 186 , which

may undergo change/s (by either increasing or decreasing) in future basis changes in applicable ROI.

The variable amounts in principal and interest as mentioned aforesaid are on account of revision of ROI. Please refer

to the communication on reset of ROI issued by way of letter/email / sms, on the address and mobile number

registered as per the records of the Bank and/or by way of post in case of the aforesaid details not having been

registered/updated with the Bank. You may alternatively, also refer to your Repayment Schedule by visiting your

nearest branch or logging into the internet banking portal on the ICICI Bank website.

Please Note -

*Deduction under section 24(b) of the Income-tax Act, 1961, in respect of the interest on the borrowed principal

amount & under section 80C of the Income-tax Act, 1961 in respect of repayment of the principal amount can be

claimed subject to fulfillment of the conditions as per the prevailing Income Tax provision.

*The utilization/end use of the loan is as per the Borrower's discretion, and is required to be in accordance with the

details provided in the loan application and the undertakings given, if any, in the Loan Agreement, which, where such

details has been provided, have been solely relied upon.

*Calculation of Interest/additional interest and other charges are done on monthly basis, number of days in a month

being 30. Broken Period Pre-EMI interest is apportioned on actual number of days for which interest is due as against

360 days in a year.

For ICICI BANK Limited,

(Acting for itself and / or as duly constituted attorney on behalf of ICICI Home Finance Co. Limited)

Date: July 8, 2022

Address of borrower(s) :

Vinodkumar J Pandey & Kiran Vinodkumar Pandey

G 42 R H 1 Plot No 13

Sector 7

Sector 7

Navi Mumbai

Navi Mumbai-400703

Regd Off: ICICI Bank Tower, Near Chakli Circle, Old Padra Road, Vadodara, Gujarat - 390 007. CIN:

L65190GJ1994PLC021012. PAN No: AAACI1195H

Corp Off: ICICI Bank Towers, Bandra Kurla Complex, Mumbai - 400051. India. Website: www.icicibank.com

You can access your loan details through ICICI Bank iMobile app. To download, SMS iMobile to 5676766.

This is a system generated letter. Hence, it does not require any signature.

AOG_SR200931900_24052022

You might also like

- MR Parmar Krishnarajsinh 554/1, Satyam Society, Sector-22, Gandhinagar, GANDHINAGAR-382021Document1 pageMR Parmar Krishnarajsinh 554/1, Satyam Society, Sector-22, Gandhinagar, GANDHINAGAR-382021parmarkrishnarajsinh100% (1)

- This Study Resource Was: Busse PlaceDocument4 pagesThis Study Resource Was: Busse PlaceRohit Singh KushwahaNo ratings yet

- PAGE1Document1 pagePAGE1Joeyq MoyaNo ratings yet

- NPS CertificateDocument2 pagesNPS CertificateSatish Tiwari100% (1)

- Capital Structure and Cost of CapitalDocument7 pagesCapital Structure and Cost of CapitalĐào Thanh Tùng100% (1)

- To Whomsoever It May Concern Statement For Claiming Deductions Under Sections 24 (B) & 80C (2) (Xviii) of The Income Tax ACT, 1961Document1 pageTo Whomsoever It May Concern Statement For Claiming Deductions Under Sections 24 (B) & 80C (2) (Xviii) of The Income Tax ACT, 1961senthil kumarNo ratings yet

- SBI Insurance 2021Document1 pageSBI Insurance 2021personal listNo ratings yet

- Reg No: Dl8Cav0116: Registration Certificate For VehicleDocument1 pageReg No: Dl8Cav0116: Registration Certificate For Vehicleh4ckerNo ratings yet

- To Whomsoever It May Concern Statement For Claiming Deductions Under Sections 24 (B) & 80C (2) (Xviii) of The Income Tax ACT, 1961Document1 pageTo Whomsoever It May Concern Statement For Claiming Deductions Under Sections 24 (B) & 80C (2) (Xviii) of The Income Tax ACT, 1961Potu RavinderreddyNo ratings yet

- Statement For Claiming Deductions Under Sections 24 (B) & 80C (2) (Xviii) of The Income Tax ACT, 1961Document1 pageStatement For Claiming Deductions Under Sections 24 (B) & 80C (2) (Xviii) of The Income Tax ACT, 1961Ankur ChowdharyNo ratings yet

- Branch Code:02186 Bank's PAN: Branch Name:: To Whomsoever It May Concern Provisional Home Loan Interest CertificateDocument1 pageBranch Code:02186 Bank's PAN: Branch Name:: To Whomsoever It May Concern Provisional Home Loan Interest Certificatesudarsan kingNo ratings yet

- Premium Paid Acknowledgement PDFDocument1 pagePremium Paid Acknowledgement PDFsanto02No ratings yet

- Premium Receipt PDFDocument1 pagePremium Receipt PDFChidambaram VNo ratings yet

- LBTRU00005805276 IT Certificate 2021-22Document2 pagesLBTRU00005805276 IT Certificate 2021-22siva kumar reddy kNo ratings yet

- Homeloan IT Lcertificate Mithun 2023Document1 pageHomeloan IT Lcertificate Mithun 2023yaligartechNo ratings yet

- View CertificateDocument1 pageView CertificateadiNo ratings yet

- Home Loan - Certificate - 2022-23Document1 pageHome Loan - Certificate - 2022-23cont2chandu100% (1)

- Provisional Certificate 2018-2019Document1 pageProvisional Certificate 2018-2019RohanNo ratings yet

- HL IT - Certificate - 621058739 FY 23-24 SampleDocument1 pageHL IT - Certificate - 621058739 FY 23-24 SampleGouravpurvi100% (1)

- HDFC 1Document1 pageHDFC 1Vivekananda PenumarthiNo ratings yet

- Provisional Interest CertificateDocument2 pagesProvisional Interest Certificateashutosh sahuNo ratings yet

- Lbhyd00002731694 IciciDocument1 pageLbhyd00002731694 IciciSurya GoudNo ratings yet

- To Whomsoever It May Concern Statement For Claiming Deductions Under Sections 24 (B) & 80C (2) (Xviii) OF THE INCOME TAX ACT, 1961Document1 pageTo Whomsoever It May Concern Statement For Claiming Deductions Under Sections 24 (B) & 80C (2) (Xviii) OF THE INCOME TAX ACT, 1961APURV UPADHYAYNo ratings yet

- To Whomsoever It May Concern Statement For Claiming Deductions Under Sections 24 (B) & 80C (2) (Xviii) of The Income Tax ACT, 1961Document1 pageTo Whomsoever It May Concern Statement For Claiming Deductions Under Sections 24 (B) & 80C (2) (Xviii) of The Income Tax ACT, 1961Ameya SudameNo ratings yet

- ProvisionalInterestCertificate H403HHL0576456Document1 pageProvisionalInterestCertificate H403HHL0576456AyazNo ratings yet

- Provisional Certificate For The Financial Year 2020-2021: To Whomsoever It May ConcernDocument1 pageProvisional Certificate For The Financial Year 2020-2021: To Whomsoever It May ConcernVenkateshNo ratings yet

- Sanction LetterDocument7 pagesSanction LetterPrimon KarmakarNo ratings yet

- Lony3004 00000037809338867 HDocument1 pageLony3004 00000037809338867 HlimcysebastinNo ratings yet

- 524243536624287Document1 page524243536624287support marenNo ratings yet

- HDFC Life Premium Receipts Nov 2022Document1 pageHDFC Life Premium Receipts Nov 2022kapsekunalNo ratings yet

- Exide OctoberDocument1 pageExide OctoberSasidharKalidindiNo ratings yet

- Kannan S: MR - Chandramouli R BA0000113734 Intermediary Code NameDocument3 pagesKannan S: MR - Chandramouli R BA0000113734 Intermediary Code NameSeshadri KannanNo ratings yet

- Veeravenkata Mallikarjuna Rao KarriDocument1 pageVeeravenkata Mallikarjuna Rao KarriArjunNo ratings yet

- IT CertificateDocument2 pagesIT CertificatePrashant TiwariNo ratings yet

- AROHI SONI SBI InsuranceDocument13 pagesAROHI SONI SBI InsurancePankaj GaurNo ratings yet

- Chandra496 - Provisional Interest CertificateDocument2 pagesChandra496 - Provisional Interest CertificateChandrasekhar Nandigam100% (1)

- Branch Code:03257 Branch Name: Bank's PAN:: To Whomsoever It May Concern Provisional Home Loan Interest CertificateDocument1 pageBranch Code:03257 Branch Name: Bank's PAN:: To Whomsoever It May Concern Provisional Home Loan Interest CertificateRishaan Ranjan100% (1)

- 80D CertificateDocument2 pages80D CertificateSiva KadaliNo ratings yet

- Rajendra Prasad ShrivastavaDocument2 pagesRajendra Prasad ShrivastavaSourabh ShrivastavaNo ratings yet

- Rent Paid Receipt: Revenue Stamp Rs.1Document1 pageRent Paid Receipt: Revenue Stamp Rs.1Pankaj AgarwalNo ratings yet

- Provisional Certificate For The Financial Year 2021-2022: To Whomsoever It May ConcernDocument2 pagesProvisional Certificate For The Financial Year 2021-2022: To Whomsoever It May ConcernKumar AbhisshekNo ratings yet

- Subject: Risk Assumption Letter: LAN Number: 19020618531140 Policy Number: 4111/EPP/164559158/00/000Document2 pagesSubject: Risk Assumption Letter: LAN Number: 19020618531140 Policy Number: 4111/EPP/164559158/00/000shekarNo ratings yet

- Home Loan ReceiptDocument1 pageHome Loan ReceiptJoshua Dcunha100% (1)

- KK EV Auto Loan CertificateDocument1 pageKK EV Auto Loan CertificateKranthi Kumar KingNo ratings yet

- Ravi Education Loan Interest-2023Document1 pageRavi Education Loan Interest-2023Cut Copy PateNo ratings yet

- CERTIFICATE For Claiming Deduction Under Section 24 (B) & 80C (2) (Xviii) of INCOME TAX ACT, 1961Document1 pageCERTIFICATE For Claiming Deduction Under Section 24 (B) & 80C (2) (Xviii) of INCOME TAX ACT, 1961Raman SharmaNo ratings yet

- Premium Paid AcknowledgementDocument1 pagePremium Paid Acknowledgementharsh421No ratings yet

- Group Activ Travel - Certificate of Insurance: Insured Person DetailsDocument2 pagesGroup Activ Travel - Certificate of Insurance: Insured Person Detailsabhinay anandNo ratings yet

- Tata AIA Life MahaLife Gold DadDocument1 pageTata AIA Life MahaLife Gold DadMirzaNo ratings yet

- F D Bond GeneraterDocument1 pageF D Bond GeneraterJayprakash VermaNo ratings yet

- Statement of Public Provident Fund Account: Ms - Neha Raghubar YadavDocument2 pagesStatement of Public Provident Fund Account: Ms - Neha Raghubar YadavNeha100% (1)

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument2 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferenceKuldeep JadhavNo ratings yet

- HDFC Tli - Converted - by - AbcdpdfDocument1 pageHDFC Tli - Converted - by - Abcdpdfharshim guptaNo ratings yet

- Max Bupa Premium Reeipt Parents PDFDocument1 pageMax Bupa Premium Reeipt Parents PDFSatyaNo ratings yet

- InterestDocument1 pageInterestsatya.undapalliNo ratings yet

- Star HealthDocument1 pageStar HealthpalanivelNo ratings yet

- Policy DocDocument6 pagesPolicy DocSoma Shekar ANo ratings yet

- Homeloancertificate - 38180652 DBFDBDocument1 pageHomeloancertificate - 38180652 DBFDBKRIS BARSAGADE100% (1)

- MR Javed Mohammad Monis B295, Chattarpur Enclave, PHASE 2, NEW DELHI-110074Document1 pageMR Javed Mohammad Monis B295, Chattarpur Enclave, PHASE 2, NEW DELHI-110074javedmonis07No ratings yet

- IT CertificateDocument1 pageIT CertificateManoj DasNo ratings yet

- keyFactStatement PDFDocument8 pageskeyFactStatement PDFINAM JUNG GUJJARNo ratings yet

- 2024-25-6--20-38-15-ITCertificateDocument2 pages2024-25-6--20-38-15-ITCertificatekvs kummiNo ratings yet

- SUSNEHADocument2 pagesSUSNEHAsusnehanalam47No ratings yet

- Irr and Incremental IrrDocument10 pagesIrr and Incremental IrrrashiNo ratings yet

- Cash Management DemoDocument29 pagesCash Management DemoShakti ShivanandNo ratings yet

- Chapter 3-Comparison and Selection Among AlternativesDocument35 pagesChapter 3-Comparison and Selection Among AlternativesSaeed KhawamNo ratings yet

- Andal, Camille ADocument5 pagesAndal, Camille ACamille AlcarazNo ratings yet

- Report of Collections and Deposits: AppendixDocument3 pagesReport of Collections and Deposits: Appendixhehehedontmind me100% (1)

- F 51124304Document3 pagesF 51124304hanamay_07No ratings yet

- The Garden Spot Year OneDocument2 pagesThe Garden Spot Year OneJellyBeanNo ratings yet

- BSNL Bill - Jan2016Document1 pageBSNL Bill - Jan2016ritbhaiNo ratings yet

- TXN Date Value Date Description Ref No./Cheque No. Branch Code Debit Credit BalanceDocument4 pagesTXN Date Value Date Description Ref No./Cheque No. Branch Code Debit Credit BalanceMANISH VYASNo ratings yet

- Financial RiskDocument8 pagesFinancial RiskAnusha ButtNo ratings yet

- Ganesh Metal Industry Trial Balance, December 31, 2008 Account Debit (RS) Credit (RS)Document11 pagesGanesh Metal Industry Trial Balance, December 31, 2008 Account Debit (RS) Credit (RS)ayushsapkota907No ratings yet

- Stern Corporation Case SolutionDocument4 pagesStern Corporation Case SolutionAmanNo ratings yet

- Petgas 060420111Document13 pagesPetgas 060420111Sky KhooNo ratings yet

- Chap 025Document26 pagesChap 025latifa hnNo ratings yet

- Draft Letter of AbatementDocument1 pageDraft Letter of AbatementShammy GallanosaNo ratings yet

- China'S Fleet ExpansionDocument30 pagesChina'S Fleet ExpansiongiannoudakiNo ratings yet

- Week 4Document5 pagesWeek 4Erryn M. ParamythaNo ratings yet

- Accounts PT 1Document8 pagesAccounts PT 1vyshnaviNo ratings yet

- Zestmoney StatementDocument2 pagesZestmoney StatementSanthosh KRNo ratings yet

- Proof of Payment UnifiDocument1 pageProof of Payment UnifihowzellaNo ratings yet

- Demonitization and Its Impact On Indian EconomyDocument59 pagesDemonitization and Its Impact On Indian EconomyMohit Agarwal100% (1)

- Statement of Cash FlowsDocument15 pagesStatement of Cash FlowsSrujana GantaNo ratings yet

- Lecture 9Document18 pagesLecture 9Thiery FranitaNo ratings yet

- One For All For One Fin ManDocument3 pagesOne For All For One Fin ManArly Kurt TorresNo ratings yet

- DividendsDocument17 pagesDividendsZafrul ZafNo ratings yet

- 100 Financial Confessions Fron The SripturesDocument8 pages100 Financial Confessions Fron The SripturesRusheen RossNo ratings yet

- Lecture 05 - Capital BudgetingDocument141 pagesLecture 05 - Capital BudgetingSagorNo ratings yet