Professional Documents

Culture Documents

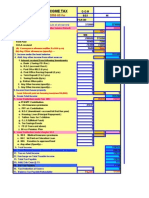

F0RM NO. 16 (See Rule 31 (1) (A) ) (Annexure-B) : (B) Tax On Employment

F0RM NO. 16 (See Rule 31 (1) (A) ) (Annexure-B) : (B) Tax On Employment

Uploaded by

Sourabhthakral_10 ratings0% found this document useful (0 votes)

29 views1 page1. This document is an income tax form (Form 16) certifying taxes deducted at source from the salary of an employee named Preethi Agarwal.

2. It provides details of her gross salary, deductions, total taxable income, taxes paid, and a small tax refund.

3. The certifying officer declares that a total of Rs. 505,000 was deducted as TDS from her salary and deposited with the central government.

Original Description:

Original Title

AFFPA9950B

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document1. This document is an income tax form (Form 16) certifying taxes deducted at source from the salary of an employee named Preethi Agarwal.

2. It provides details of her gross salary, deductions, total taxable income, taxes paid, and a small tax refund.

3. The certifying officer declares that a total of Rs. 505,000 was deducted as TDS from her salary and deposited with the central government.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

29 views1 pageF0RM NO. 16 (See Rule 31 (1) (A) ) (Annexure-B) : (B) Tax On Employment

F0RM NO. 16 (See Rule 31 (1) (A) ) (Annexure-B) : (B) Tax On Employment

Uploaded by

Sourabhthakral_11. This document is an income tax form (Form 16) certifying taxes deducted at source from the salary of an employee named Preethi Agarwal.

2. It provides details of her gross salary, deductions, total taxable income, taxes paid, and a small tax refund.

3. The certifying officer declares that a total of Rs. 505,000 was deducted as TDS from her salary and deposited with the central government.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

F0RM NO.

16 [See rule 31(1)(a)] (Annexure-B)

Certificate u/s 203 of the I T Act, 1961 for T D S from income chargeable under the head "salaries"

Name and address of the Employer Quarter Ackn. Number Employee Name PREETI AGARWAL

ONAL HIGHER EDUCATION OFFICER MEERUT Ist Father Name

PAN IInd Date of Birth

TAN MRTR00075F IIIrd Employee Age

TDS Circle where Annual Return/Sratement IVth PAN/GIR NO . AFFPA9950B

u/s 206 is to be filed-MEERUT 01.04.21 TO 31.03.22 Assessment Year 2022-23

1. Gross Salary,a)Salary as per provisions contained in section 17(1) 2420901

b)Value of perquisites u/s 17(2)/Profits in lieu of salary u/s 17(3)(as per FormNo.12BA,Wherever applicable) 0

2. Less: STANDARD DEDUCTION in lieu of travel, medical expense reimbursement and other allowances

House Rent Allowance 0 STANDARD DEDUCTION 50000

Any Other Exempted Receipts/ allowances Rs. 0 50000.00

3. Deduction: (a)Entertainment allowance 0 (b)Tax on Employment 0 0.00

4. Income chargeable under the head 'Salaries'(1-2-3) Rs. 2370901.00

5.A- Add: Any Interest received by the employee 0

B-Less: Exemption on Home Loan Interest (Sec 24) 0 0

C-Less:Additional tax exemption for First Time Home Buyers 0 0

D-Interest paid on Home Improvement Loan (max 30,000) 0 0 0

6. Gross total income (4+5) Rs. 2370901.00

7.(A)-Deduction under chapter VI-A(Sections 80C,80CCC and 80CCD OR OTHERS UP TO 1,50,000)

Tuition fees 0 GPF/NPS 203699 Gross Amt. Dedble.Amt.

N.S.C 0 G.I.S/CGEIS 4200

Tax Saving Mutual Fund 0 NPS 0

Sukanya Samriddhi A/c 50000 PPF 150000

Pension Plan 0 Housing. Loan (Principal Repayment) 0

Senior Citizen’s Saving Scheme 0 LIC 98677 506576 150000

Less: Additional Deduction U/S 80CCD (1b)(NPS upto 50000) 0 0 0

U/S 80CCD(2)( 14% Salary Contribution by Employer in NPS) 0 0 0

(B)under Chapter VI A (U/S 80D) Medical Insurance premium 0 0

( U/S 80 DD) Medical Treatment of handicapped Dependent 0 0

(U/S 80DDB) Exp.on Selected Medical Treatment for self/ dependent 0 0

(U/S 80E) Interest Paid on Education Loan 0 0

(U/S 80G, 80GGA, 80GGC) Donation to approved funds 0 0

(U/S 80 TTA) Interest received on Saving Bank Deposit 0 0

(U/S 80U) For Physically Disable Assesse 0 0

U/S 80EEA (Interest on Home Loan for Affordable Home) 0 0

U/S 80 U 0 0

8.Aggregate deductible amount Under chapter VI-A Rs. 150000

9.Total Taxable Income Rs. 2220901

10.Tax on total income Rs. 478770.3

U/S 87A (IF INCOME BELOW 5 LAKH) Rs. 0.0

12.Education Cess ( on tax computed at S.No.11) Rs. 19,151

13.Tax Payable (11+12+13-10) Rs. 497921.1

14.Relief under section 89 (attach details) Rs.

15.Tax Payable (14-15) Rs. 497921.1

16.Less:(a) Tax deducted at source u/s 192 (1) Rs. 505000

(b) Tax paid by the employer on behalf of the employee u/s 192(1A)on perquisite u/s 17(2). Rs.

16. Net Tax Payable (- INDICATE TAX PAYABLE) REFUNDABLE (+ INDICATE TAX REFUNDABLE) 7078.9

DEDUCTED AND DEPOSITED INTO CENTRAL GOVERNMENT

TDS QUARTERLY STATEMENT AS PER FORM NO 16 ANNEXED AS TRACES

I, DR. RAJIV KUMAR GUPTA son/daughter of Shri working in the capacity of

REGIONAL HIGHER EDUCATION OFFICER do hereby certify that a sum of Rs. 505000.00 has been deducted at source

and paid to the credit of the central govt. I further certify that the information are correct and based on the books of accounts,

documents and other available records .

Signature of the PRINCIPAL DAV COLLEGE,MUZAFFARNAGAR

Signature of the person responsible for deduction of tax

Place MEERUT NAME : DR. RAJIV KUMAR GUPTA

Date 30-05-2022 DESIGNATION:

REGIONAL HIGHER EDUCATION OFFICER

SERVICES PROVIDED-E-FILLING,INCOME-TAX,GST,AUDIT,GEM,E-TENDRING & DIGITAL SIGNATURE

CONTACT- A L F A-PREET VIHAAR,DELHI ROAD,HAPUR(MOB.-8273925472 ,78 OR 963)

You might also like

- KOHO Bank StatementDocument2 pagesKOHO Bank Statementt.biller3No ratings yet

- C - Program Files (x86) - Folklore Payroll - ITReports - FORM16 - FORM16 - 02358756 PDFDocument5 pagesC - Program Files (x86) - Folklore Payroll - ITReports - FORM16 - FORM16 - 02358756 PDFPrudhvi Raj ChowdaryNo ratings yet

- Rmo 19-2007Document3 pagesRmo 19-2007Jema Abreu0% (1)

- IT Calculator 2018 LiteDocument6 pagesIT Calculator 2018 LiteHr PoonamNo ratings yet

- Income Tax CalculatorDocument9 pagesIncome Tax Calculatorchandu halwaeeNo ratings yet

- Income Tax Calculator Fy 2020 21 v1Document11 pagesIncome Tax Calculator Fy 2020 21 v1nach.nachiketNo ratings yet

- Income Tax Calculator Fy 2020 21 v1Document8 pagesIncome Tax Calculator Fy 2020 21 v1Yogesh BajajNo ratings yet

- Income Tax Calculator Fy 2020 21 v2Document12 pagesIncome Tax Calculator Fy 2020 21 v2Anonymous Clm40C1No ratings yet

- Amma Income TaxDocument5 pagesAmma Income Taxraghuraman1511No ratings yet

- Pravin Shinde-ARMS-01-TDS-FY 2019-20Document12 pagesPravin Shinde-ARMS-01-TDS-FY 2019-20Udaysinh PatilNo ratings yet

- Income Tax Calculator Fy 2021 22 v2Document15 pagesIncome Tax Calculator Fy 2021 22 v2KumardasNsNo ratings yet

- Income Tax Calculator Fy 2019 20 v4Document9 pagesIncome Tax Calculator Fy 2019 20 v4Anil KesarkarNo ratings yet

- Income TaxDocument11 pagesIncome Taxci_balaNo ratings yet

- IT Calculation New RegimeDocument4 pagesIT Calculation New Regimeyelrihs23No ratings yet

- Employee Declaration Form 1Document4 pagesEmployee Declaration Form 1rifas caNo ratings yet

- Form 1607062022 182100Document2 pagesForm 1607062022 182100Manveer Rori AlaNo ratings yet

- Income Tax Calculator For F.Y 2020 21 A.Y 2021 22 ArthikDishaDocument7 pagesIncome Tax Calculator For F.Y 2020 21 A.Y 2021 22 ArthikDishaSARAVANAN PNo ratings yet

- Form 1615012023 135230 PDFDocument3 pagesForm 1615012023 135230 PDFSahil ThakurNo ratings yet

- Income Tax Calculator For F.Y 2020 21 A.Y 2021 22 ArthikDishaDocument8 pagesIncome Tax Calculator For F.Y 2020 21 A.Y 2021 22 ArthikDishaGeetanjali BarejaNo ratings yet

- Res FormDocument1,320 pagesRes FormAnonymous pKsr5vNo ratings yet

- Form 1622072023 022228Document2 pagesForm 1622072023 022228Kajal RandiveNo ratings yet

- Quarter Receipt Numbers of Original Statements of Amount of Tax Deducted Amount of Tax Deducted/remitted TDS Under Sub-Section (3) of Section 200 in Respect of The Employee in Respect of The EmployeeDocument2 pagesQuarter Receipt Numbers of Original Statements of Amount of Tax Deducted Amount of Tax Deducted/remitted TDS Under Sub-Section (3) of Section 200 in Respect of The Employee in Respect of The EmployeeSanjoy SamantaNo ratings yet

- Latest Tax CalculatIor 3.3.2Document16 pagesLatest Tax CalculatIor 3.3.2Bijender Pal Choudhary100% (3)

- Booklet of Forms For House Building AdvanceDocument2 pagesBooklet of Forms For House Building AdvanceJITHU MNo ratings yet

- Tax Template HCCI FY20-21FinalDocument16 pagesTax Template HCCI FY20-21FinalBaba FakhruddinNo ratings yet

- Sushma ViewReportIncomeTaxAssessmentDocument2 pagesSushma ViewReportIncomeTaxAssessmentKashvi DevNo ratings yet

- Calculation FormatDocument13 pagesCalculation FormatSahil Swaynshree SahooNo ratings yet

- IT Form 16 Back - WWW - Ibadi.inDocument1 pageIT Form 16 Back - WWW - Ibadi.inKATHI JAYANo ratings yet

- Form 16 - TCSDocument3 pagesForm 16 - TCSBALANo ratings yet

- CONVEYANCE Exemption HRA Exemption: 9394 Rs. Rs. 0Document2 pagesCONVEYANCE Exemption HRA Exemption: 9394 Rs. Rs. 0Akshay ShettyNo ratings yet

- Form 1617082023 112227Document2 pagesForm 1617082023 112227rinsha.sherinNo ratings yet

- IT Form 16 Back - WWW - Ibadi.inDocument1 pageIT Form 16 Back - WWW - Ibadi.inGOKUL HD LIVE EVENTSNo ratings yet

- Income Tax Planner FY 2020-21Document12 pagesIncome Tax Planner FY 2020-21RedNo ratings yet

- Form 16 - BLMPB2218K - 2019-20 - Part B PDFDocument6 pagesForm 16 - BLMPB2218K - 2019-20 - Part B PDFUmair BaigNo ratings yet

- Details of Salary Paid and Any Other Income and Tax DeductedDocument3 pagesDetails of Salary Paid and Any Other Income and Tax DeductedRajesh KharmaleNo ratings yet

- 2021-2022 Shrikant Jadhav Form 16-Part B PDFDocument6 pages2021-2022 Shrikant Jadhav Form 16-Part B PDFVidya JadhavNo ratings yet

- Anil Ganvir Form 16 (21 22)Document3 pagesAnil Ganvir Form 16 (21 22)DrAndrew WillingtonNo ratings yet

- Form 1621052023 115217Document2 pagesForm 1621052023 115217sandeep kumarNo ratings yet

- Income Tax Calculator 2018-19Document15 pagesIncome Tax Calculator 2018-19Raju Ranjan SinghNo ratings yet

- Form 1615052023 141937Document3 pagesForm 1615052023 141937Pawan KumarNo ratings yet

- (C) Profits in Lieu of Salary Under Section 17 (3) (As Per Form No.12BA, Wherever Applicable)Document2 pages(C) Profits in Lieu of Salary Under Section 17 (3) (As Per Form No.12BA, Wherever Applicable)Yashwant KumarNo ratings yet

- Form 1625062023 043026Document2 pagesForm 1625062023 043026SHIV BHAJANNo ratings yet

- HDFC Bank Limited: Dear Mr. Vijay Anand A.Document5 pagesHDFC Bank Limited: Dear Mr. Vijay Anand A.A Vijay AnandNo ratings yet

- Wa0016Document3 pagesWa0016Vinay DahiyaNo ratings yet

- ANIL GANVIR Old New Regime ComputationDocument1 pageANIL GANVIR Old New Regime ComputationDrAndrew WillingtonNo ratings yet

- StatementDocument2 pagesStatementabinand29No ratings yet

- Employee Declaration Form 15Document4 pagesEmployee Declaration Form 15Bliss BilluNo ratings yet

- Form 1608112023 131300Document3 pagesForm 1608112023 131300baisanebuddheshNo ratings yet

- Principles of Taxation - DeductionsDocument7 pagesPrinciples of Taxation - Deductions20047 BHAVANDEEP SINGHNo ratings yet

- 2018-19 - Part B - 1Document4 pages2018-19 - Part B - 1Shivam DixitNo ratings yet

- Form 1607022022 205546Document2 pagesForm 1607022022 205546Mahesh VayiboyinaNo ratings yet

- Form 1609042024 112352Document3 pagesForm 1609042024 112352rs3071029No ratings yet

- Itr-1 Sahaj Individual Income Tax Return: Acknowledgement Number: 804939620180718 Assessment Year: 2018-19Document5 pagesItr-1 Sahaj Individual Income Tax Return: Acknowledgement Number: 804939620180718 Assessment Year: 2018-19CHRISTY JOSENo ratings yet

- Bose Tax 2024Document2 pagesBose Tax 2024placementcell Govt ITI AttingalNo ratings yet

- TaxComputation SYEDL PUN0157 2023 2024Document2 pagesTaxComputation SYEDL PUN0157 2023 2024nitin patilNo ratings yet

- Tax Calculator - Indian Income Tax 2008-09Document7 pagesTax Calculator - Indian Income Tax 2008-09Jayamohan100% (29)

- Employee Declaration FormDocument3 pagesEmployee Declaration Formmeshakjunior13No ratings yet

- Income Tax Deductions List - Deductions On Section 80C, 80CCC, 80CCD and 80D - FY 2022-23 (AY 2023-24) - Tax2winDocument26 pagesIncome Tax Deductions List - Deductions On Section 80C, 80CCC, 80CCD and 80D - FY 2022-23 (AY 2023-24) - Tax2winJaydeep DasadiyaNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisFrom EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNo ratings yet

- JKPRO-Invoice - Genset UsgaeDocument2 pagesJKPRO-Invoice - Genset UsgaeBiinson SamuelNo ratings yet

- Climax TextDocument2 pagesClimax TextRajkumarNo ratings yet

- D17 F6RUS-Section B Ans CleanDocument6 pagesD17 F6RUS-Section B Ans CleanZulaikha AbdulmuminNo ratings yet

- Jhon'S Garlic Chili Sauce: Kiosk Accu. Dep.Document3 pagesJhon'S Garlic Chili Sauce: Kiosk Accu. Dep.juvie disionNo ratings yet

- IRS Form 1040es 2016Document12 pagesIRS Form 1040es 2016Freeman Lawyer100% (2)

- House Rent Allowance (HRA) DECLARATION (FY 2021-22) : Self Declaration by EmployeeDocument1 pageHouse Rent Allowance (HRA) DECLARATION (FY 2021-22) : Self Declaration by EmployeesamNo ratings yet

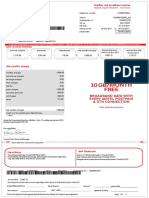

- Fixedline and Broadband Services: Telephone Number 01204916521 User Id 012036102556 - DSLDocument2 pagesFixedline and Broadband Services: Telephone Number 01204916521 User Id 012036102556 - DSLVishal AwasthiNo ratings yet

- View Invoice - ReceiptDocument1 pageView Invoice - ReceiptJarrod GlandtNo ratings yet

- Winet Services: QuotationDocument1 pageWinet Services: QuotationAnusia ThevendaranNo ratings yet

- Generic ATM Interface User GuideDocument90 pagesGeneric ATM Interface User Guidegustavrusso888989% (9)

- TEMPLATE PO 1.xlsx CV - MerdekaDocument5 pagesTEMPLATE PO 1.xlsx CV - Merdekahusen alhusadaNo ratings yet

- Tax ReviewerDocument3 pagesTax ReviewerGlendaMendozaNo ratings yet

- WHT Chart Subj Wise TY - 2022Document8 pagesWHT Chart Subj Wise TY - 2022Anam IqbalNo ratings yet

- MEPCO Online Consumer BillDocument2 pagesMEPCO Online Consumer BillDanielNo ratings yet

- Hdfcbank Credit CtalogueDocument1 pageHdfcbank Credit CtalogueDrSudhanshu MishraNo ratings yet

- Account STDocument1 pageAccount STSadiq PenahovNo ratings yet

- Pointers To Review BUSINESS TAXATIONDocument4 pagesPointers To Review BUSINESS TAXATIONFaizal MutiaNo ratings yet

- It SiaDocument180 pagesIt Siasupriya gupta100% (1)

- Hetzner 2016-03-16 R0005690880Document1 pageHetzner 2016-03-16 R0005690880ArminNo ratings yet

- Your Electricity Account: Account Number Invoice No Issue DateDocument2 pagesYour Electricity Account: Account Number Invoice No Issue DateHamza HanifNo ratings yet

- Facture Att LaurisDocument4 pagesFacture Att LauriscedricNo ratings yet

- Treasury Challan Codes For Bond, DhakaDocument2 pagesTreasury Challan Codes For Bond, DhakaMd. Mohsin KamalNo ratings yet

- Estmt - 2021 08 27Document6 pagesEstmt - 2021 08 27Andrea IñiguezNo ratings yet

- Tax BulletinDocument72 pagesTax BulletinSamuel Mervin NathNo ratings yet

- Ibrahim Calling Report Tuition Fee ECE 024-047Document1 pageIbrahim Calling Report Tuition Fee ECE 024-047Shashikanth MohrirNo ratings yet

- Reliance Retail Limited Tax Invoice: Original For RecipientDocument2 pagesReliance Retail Limited Tax Invoice: Original For RecipientMainpal YadavNo ratings yet

- B1AIP30 - Data Migration Object ListDocument16 pagesB1AIP30 - Data Migration Object ListYongWLNo ratings yet

- CIR vs. Filinvest Dev't Corp.Document2 pagesCIR vs. Filinvest Dev't Corp.Direct LukeNo ratings yet