Professional Documents

Culture Documents

Mutual Fund Review: Equity Markets Update

Mutual Fund Review: Equity Markets Update

Uploaded by

maitre6669Copyright:

Available Formats

You might also like

- C 10Document344 pagesC 10Anonymous yxFeWtNo ratings yet

- Ipu Admit Card PDFDocument4 pagesIpu Admit Card PDFAbhinav DixitNo ratings yet

- ICICIdirect MonthlyMFReportDocument27 pagesICICIdirect MonthlyMFReportGanesh RajNo ratings yet

- J Street Volume 259Document10 pagesJ Street Volume 259JhaveritradeNo ratings yet

- MF Review: Budget 2009-10: Nothing To Rejoice On FM's SilenceDocument5 pagesMF Review: Budget 2009-10: Nothing To Rejoice On FM's SilencePartha Pratim MitraNo ratings yet

- HSBC Mid-Month Equity Investment Strategy: Release Date: 25 June 2010 For Distributor / Broker Use OnlyDocument7 pagesHSBC Mid-Month Equity Investment Strategy: Release Date: 25 June 2010 For Distributor / Broker Use OnlyBabar_Ali_Khan_2338No ratings yet

- J-Street Vol-257 PDFDocument10 pagesJ-Street Vol-257 PDFJhaveritradeNo ratings yet

- Key Indices 30-Sep-11 31-Aug-11 % Change: FII MFDocument30 pagesKey Indices 30-Sep-11 31-Aug-11 % Change: FII MFshah_aditkNo ratings yet

- Monthly Fund FactsheetDocument27 pagesMonthly Fund FactsheetAshik RameshNo ratings yet

- House View: June 7, 2012Document15 pagesHouse View: June 7, 2012techkasambaNo ratings yet

- JSTREET Volume 319Document10 pagesJSTREET Volume 319JhaveritradeNo ratings yet

- The Money Navigator April 2016Document36 pagesThe Money Navigator April 2016JhaveritradeNo ratings yet

- EIC Project Report On Pharmaceutical IndustryDocument52 pagesEIC Project Report On Pharmaceutical IndustrykalpeshsNo ratings yet

- Financials Result ReviewDocument21 pagesFinancials Result ReviewAngel BrokingNo ratings yet

- Sharekhan's Top Equity Mutual Fund Picks: August 23, 2011Document6 pagesSharekhan's Top Equity Mutual Fund Picks: August 23, 2011ravipottiNo ratings yet

- SEB Report: Asian Recovery - Please Hold The LineDocument9 pagesSEB Report: Asian Recovery - Please Hold The LineSEB GroupNo ratings yet

- Hallenges For The Indian Economy in 2017Document7 pagesHallenges For The Indian Economy in 2017Asrar SheikhNo ratings yet

- IndiaEconomicsOverheating090207 MFDocument4 pagesIndiaEconomicsOverheating090207 MFsdNo ratings yet

- Helping You Spot Opportunities: Investment Update - August, 2013Document55 pagesHelping You Spot Opportunities: Investment Update - August, 2013akcool91No ratings yet

- Indian Financials: Tryst With DestinyDocument28 pagesIndian Financials: Tryst With DestinyJohnny HarlowNo ratings yet

- J Street Volume 297Document10 pagesJ Street Volume 297JhaveritradeNo ratings yet

- Market Commentary - June 2016Document2 pagesMarket Commentary - June 2016kejriwal_itNo ratings yet

- Markets For You - 27.03.12Document2 pagesMarkets For You - 27.03.12Bharat JadhavNo ratings yet

- Recovery FundDocument31 pagesRecovery FundRohitOberoiNo ratings yet

- Kotak BankDocument44 pagesKotak BankPrince YadavNo ratings yet

- Helping You Spot Opportunities: Investment Update - October, 2012Document56 pagesHelping You Spot Opportunities: Investment Update - October, 2012Carla TateNo ratings yet

- Equity Market Review Jan-11Document23 pagesEquity Market Review Jan-11Shailendra GaurNo ratings yet

- Investor 2015Document61 pagesInvestor 2015rajasekarkalaNo ratings yet

- Analysis of Indian EconomyDocument41 pagesAnalysis of Indian EconomySaurav GhoshNo ratings yet

- Rates View - IndonesiaDocument5 pagesRates View - IndonesiaEfi Yuliani H. SantosaNo ratings yet

- LG Zi 39285932Document28 pagesLG Zi 39285932erlanggaherpNo ratings yet

- Askari Investment Management: Fund Manager ReportDocument4 pagesAskari Investment Management: Fund Manager ReportSeth ValdezNo ratings yet

- Market Outlook Market Outlook: Dealer's DiaryDocument15 pagesMarket Outlook Market Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Crisil Sme Connect Jul10Document44 pagesCrisil Sme Connect Jul10atia2kNo ratings yet

- JSTREET Volume 325Document10 pagesJSTREET Volume 325JhaveritradeNo ratings yet

- An UpDocument25 pagesAn UpAyush AgarwalNo ratings yet

- Niveshak Niveshak: Rationalization or Revamp?Document36 pagesNiveshak Niveshak: Rationalization or Revamp?Niveshak - The InvestorNo ratings yet

- Crisil Sme Connect Dec09Document32 pagesCrisil Sme Connect Dec09Rahul JainNo ratings yet

- Daily: Economic PerspectiveDocument3 pagesDaily: Economic PerspectiveDEEPAK KUMAR MALLICKNo ratings yet

- Reliance Single PremiumDocument80 pagesReliance Single Premiumsumitkumarnawadia22No ratings yet

- RBI Policy Review Oct 2011 Highlights and RecommendationDocument7 pagesRBI Policy Review Oct 2011 Highlights and RecommendationKirthan Ψ PurechaNo ratings yet

- Market View: Market Is at Crucial JunctionDocument10 pagesMarket View: Market Is at Crucial JunctionJhaveritradeNo ratings yet

- C O M P A N Y P R O F I L E: Achal Gupta Managing Director & Chief Executive OfficerDocument61 pagesC O M P A N Y P R O F I L E: Achal Gupta Managing Director & Chief Executive OfficervipinkathpalNo ratings yet

- Report On Macroeconomics and Banking: April 3, 2010Document17 pagesReport On Macroeconomics and Banking: April 3, 2010pratiknkNo ratings yet

- Opening Bell: Market Outlook Today's HighlightsDocument8 pagesOpening Bell: Market Outlook Today's HighlightsdineshganNo ratings yet

- Vol.5 No.4 December 2010 Quarterly Moharram 1432 A.HDocument24 pagesVol.5 No.4 December 2010 Quarterly Moharram 1432 A.HAyeshaJangdaNo ratings yet

- LinkDocument12 pagesLinkManali KambleNo ratings yet

- Market Outlook: Dealer's DiaryDocument12 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Equity Morning Note 13 August 2013-Mansukh Investment and Trading SolutionDocument3 pagesEquity Morning Note 13 August 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Rbi Bulletin August 2015Document74 pagesRbi Bulletin August 2015Accounting & Taxation100% (1)

- Investment Banking Industry Analysis Report PDFDocument46 pagesInvestment Banking Industry Analysis Report PDFricky franklinNo ratings yet

- Invesco Factsheet July 2023Document56 pagesInvesco Factsheet July 2023Akhilesh ksNo ratings yet

- Top Pick SMFDocument5 pagesTop Pick SMFDebjit DasNo ratings yet

- Fearful Symmetry Nov 2011Document4 pagesFearful Symmetry Nov 2011ChrisBeckerNo ratings yet

- Highlights of December Edition: Best Performers Mom (%)Document36 pagesHighlights of December Edition: Best Performers Mom (%)vjvijay88No ratings yet

- Macro Economics SnapshotDocument12 pagesMacro Economics SnapshotmanjeetsrccNo ratings yet

- Finance AnalysisDocument3 pagesFinance AnalysisGirish BhangaleNo ratings yet

- Listen Up TiggerDocument32 pagesListen Up TiggerFlorentina Motca100% (1)

- ELECTRICAL QUESTIONS AND ANSWERS-MCQ-9A - ETO - Electro Technical OfficerDocument11 pagesELECTRICAL QUESTIONS AND ANSWERS-MCQ-9A - ETO - Electro Technical Officeramit100% (2)

- En - S8018II Spec SheetDocument3 pagesEn - S8018II Spec SheetAndrea PaoNo ratings yet

- OCEANSDocument4 pagesOCEANSamna hamidNo ratings yet

- GregormendelandhispeasreadingandquestionsDocument2 pagesGregormendelandhispeasreadingandquestionsapi-248015505No ratings yet

- CCBoot Manual - Server SettingsDocument89 pagesCCBoot Manual - Server SettingsHasnan IbrahimNo ratings yet

- License Plate RecognitionDocument3 pagesLicense Plate RecognitionSen PaiiNo ratings yet

- STC1 S2 Slickline I v.2Document165 pagesSTC1 S2 Slickline I v.2Siew Qian100% (1)

- Target GamesDocument7 pagesTarget Gamesapi-245732877No ratings yet

- Physics Education Thesis TopicsDocument4 pagesPhysics Education Thesis TopicsPaperWriterServicesCanada100% (2)

- Panasonic hc-vx870 hc-vx878 hc-v770 hc-v777 Series SMDocument71 pagesPanasonic hc-vx870 hc-vx878 hc-v770 hc-v777 Series SMhector mirandaNo ratings yet

- Spe 199993 MSDocument28 pagesSpe 199993 MSHussam AgabNo ratings yet

- Pediatric Vestibular Disorders PDFDocument10 pagesPediatric Vestibular Disorders PDFNati GallardoNo ratings yet

- Upper Gastrointestinal BleedingDocument4 pagesUpper Gastrointestinal BleedingRazi HaiderNo ratings yet

- CNotice LogDocument15 pagesCNotice LogAzertyuioptotoNo ratings yet

- Vocabulary Extra Unit 3Document3 pagesVocabulary Extra Unit 3MariaInesMartinefskiNo ratings yet

- 1672298032245-ICE CE-29 - RevisionDocument86 pages1672298032245-ICE CE-29 - RevisionSoumyaranjan NayakNo ratings yet

- SM-Personal Finance-Unit1to3Document176 pagesSM-Personal Finance-Unit1to3Priyanshu BhattNo ratings yet

- Byzantine ArmyDocument7 pagesByzantine ArmyDimitris Mavridis100% (1)

- Hambardzumyan InfDocument102 pagesHambardzumyan InfAnush AsrianNo ratings yet

- Matrix - An IntroductionDocument10 pagesMatrix - An IntroductionMajid AbNo ratings yet

- Ba 6238Document8 pagesBa 6238Antony BurgersNo ratings yet

- Ds Adams-Machinery LTR WDocument2 pagesDs Adams-Machinery LTR WAydinNo ratings yet

- Conviction in Cheque Bounce CaseDocument24 pagesConviction in Cheque Bounce CaseArvind PatilNo ratings yet

- Maxey Mark Pauline 1965 JapanDocument28 pagesMaxey Mark Pauline 1965 Japanthe missions networkNo ratings yet

- BIO Genetics Eukaryote TranscriptionDocument23 pagesBIO Genetics Eukaryote TranscriptionAnonymous SVy8sOsvJDNo ratings yet

- BEY, Marquis - Black Trans FeminismDocument305 pagesBEY, Marquis - Black Trans FeminismSilvana SouzaNo ratings yet

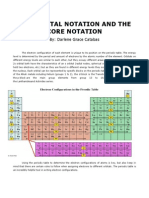

- Catabas Darlene - Orbital Core NotationDocument9 pagesCatabas Darlene - Orbital Core Notationapi-233267698No ratings yet

Mutual Fund Review: Equity Markets Update

Mutual Fund Review: Equity Markets Update

Uploaded by

maitre6669Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Mutual Fund Review: Equity Markets Update

Mutual Fund Review: Equity Markets Update

Uploaded by

maitre6669Copyright:

Available Formats

ICICI Securities Limited

Mutual Fund Review

January 19, 2011

CY10 was a year of choppy rise

6500 6300 6100 5900 5700 5500 5300 5100 4900 4700 4500 Jan-10 Apr-10 Jul-10

Equity markets Update In 2010, the BSE Sensex delivered 16% return. It is down around 4% in the last month ending January 15, 2011 while the Midcap index was down around 5%

17 % up move

The year 2011, so far, has not been good for the markets as it has witnessed around 8% correction in the first half of the first calendar month of the new year Heavy selling pressure was witnessed across all sectors on concerns of a rate hike by the central bank later this month to contain surging inflation Persistent high inflation, particularly primary and food inflation, is a worrying factor for the economy as well as for the Indian equity markets as it will force regulators to slow down the economy to suppress demand. The same is already seen in the RBI raising rates and on low IIP data FIIs were seen as net sellers in January as high valuation and perceived risk of moderation in economic activity due to rising interest rates and inflation resulted in some profit booking Mutual funds were seen as net buyers in the recent correction and have bought around | 500 crore in the first half of January 2011

Jan-11

Nifty

Source: Bloomberg, ICICIdirect.com Research

At the fag end of CY10 the mid & small caps underperformed the Sense x stocks

17 16 16 15 15 14 14 13 13

Return (%)

16.0

15.3

15.3

14.8

Oct-10

Realty continued to underperform on the negative impact of interest rate hike. The auto sector witnessed profit booking on rate hike and slowdown in sales after record sales in the last quarter while FMCG and healthcare outperformed the broader markets Global markets remained positive with most markets outperforming the Indian markets, and, thereby, providing support to the markets Outlook The recent market correction in the first half of January has provided investors an opportunity to invest in a staggered way. From current levels, every dip should be utilised by investors to invest in equity markets The appetite for equity investment from domestic institutional investors at lower levels seems strong Global news flows regarding tightening monetary policy to prevent rising inflation and sovereign risk may have a negative impact on the global equity markets

14.5 BSE Midcap

Source: Bloomberg, ICICIdirect.com Research

Consumption oriented sectors outperformed .

80 65 60 40 20 0 -20 -40 35 34 32 31 31

23

16

1 -1 -2 -8 -26

BSE Small Cap

BSE 500

BSE 200

BSE Sensex

BSE 100

13.9

Higher commodity prices, including crude, are a major concern for the Indian economy Foreign institutional flows may be volatile on global news flows. This may have its impact on Indian markets as they continue to be dominant market participants Indias domestic economy continues to remain on a strong footing with visible growth prospects. The same is expected to drive the equity market over a longer period of time Investors should avoid taking high cash call as fund managers themselves manage the portfolio in accordance with market development Large cap biased funds offer a better risk adjusted opportunity for investors

Source: Bloomberg, ICICIdirect.com Research

Analysts name

Sachin Jain sachin.ja@icicisecurities.com Sheetal Ashar sheetal.ashar@icicisecurites.com

ICICIdirect.com | Mutual Fund

Con.Dur Auto Healthcare Banking IT FMCG Teck Sensex Cap.Goods Oil Metals PSU Power Reality

ICICI Securities Limited

Debt markets

Yield curve flattens as short-term yields inch higher due to tight liquidity condition

9 8 7 (%) 6 5 4 3 3.7 3 mnth 4.3 10 Year 1 Year 3 Year 5 Year 6.4 7.1 7.5 7.8 7.9 8.2

Update

The year 2010 has not been good for Indian debt markets as interest rate increased, particularly short-term rates. Short-term rates (three months CD rates) have increased by around 5% in 2010 putting pressure on returns of short-term debt funds The RBI has raised interest rates (repo rate) six times by 150 bps from 4.75% to 6.25% in 2010 to control inflation as economic recovery picked up pace and rising commodity prices put upward pressure on prices The liquidity scenario turned negative with large ticket size public issues hitting the market and sucking liquidity putting pressure yields across the curve Longer duration debt funds also witnessed pressure due to the rise in longer duration yields as rising inflation and high government borrowing put pressure on yields of longer duration government securities Corporate bond yields remained range bound in 2010 as lack of any new issuances helped it to contain a rise in yields at the longer duration. As a result, the spread compared to G-Sec narrowed to around 80 bps as compared to 100 bps at the start of 2010 In the last month, yields remain volatile as high WPI and food inflation at 8.43% and 16.91%, respectively, prevented yields from coming down Global markets witnessed a fall in longer duration sovereign yields till the last quarter of 2010 as the slow economic recovery resulted in low inflationary expectations. However, in the last quarter, positive economic data, particularly from the US, resulted in improved inflationary expectations and better equity market outlook. Therefore, money was seen flowing from global debt funds to global equity funds Commodity prices, particularly crude, have been rising swiftly in the later part of 2010. The same is fuelling inflation and is a major threat for the debt market

7.2

7.6

1-Jan-10

14-Jan-11

Source: Bloomberg, ICICIdirect.com Research

Liquidity remains tight for whole of the second half leading to increase in short-term lending rates

1500 1000 500 | Cr. 0 -500

-1000 -1500 -2000 Nov-10 Jan-10 Mar-10 May-10 Sep-10 Jan-11 Jul-10

Source: Bloomberg, ICICIdirect.com Research

Credit spreads widen in the later half

170 150 130 110 90 70 50 1yr 3yr 14-Jan-11 5yr 1-Jan-10 10 yr 83 159 137 116 121 99 81 105

Outlook

We believe that 2011 will be good for the debt market and investments in all categories, viz. ultra short-term funds, shortterm funds and income funds should deliver good returns Inflation, although stubborn in recent times, is expected to come down in the coming months. This will be beneficial for the debt market and debt funds Currently, short-term debt funds offer better return opportunity as short-term rates have already risen sharply due to tight liquidity. They are expected to moderate from current levels Ultra short-term funds also offer good returns due to tight liquidity and elevated rates on short maturity money market instruments Fixed maturity plans are also offering the opportunity to lock in current higher rates. We expect longer duration G-sec yields to ease off further by around 20-30 bps from current levels. The same may add to the total returns

Source: Bloomberg, ICICIdirect.com Research

ICICIdirect.com | Mutual Fund

Page 2

ICICI Securities Limited

Institutional fund flow

Higher market valuation and redemption pressure led to mutual funds being net sellers during 2010

Exhibit 1: Throughout CY10 mutual funds sold heavily

2000 99 -961 -3170 -4405 -6161 -5801 Aug-10 Nov-10 Oct-10 Mar-10 Dec-10 Jun-10 Apr-10 Jul-10 Jan-10 May-10 Sep-10 Jan-11 6300 24770 18966 6000 5700 5400 -9175 Aug-10 Nov-10 Oct-10 Jan-10 Jun-10 Apr-10 Mar-10 Jul-10 May-10 Sep-10 Feb-10 -2495 -3181 5100 4800 Dec-10 Jan-11 Feb-10 -100 1131 434.8 6300 6000 -1428 -3807 5700 5400 5100 4800

However, things are likely to improve as the mutual fund industry has adjusted to the regulatory changes and market correction will lead to larger incremental inflows in 2011

0 | Cr -2000 -1311 -718 -4000 -6000 -8000

Net MF Investment

Source: Bloomberg , ICICIdirect.com Research

CNX Nifty (RHS)

Exhibit 2: . contrary to MFs, FIIs were buyers throughout CY10

Indian stocks continued to sparkle in the eyes of FIIs as their holding in indices like the Nifty, Sensex and BSE midcap is currently at peak levels of 17.9%, 15.9% and 13.6%, respectively

40000 30000 20000 | Cr 10000 0 -10000 -20000 -1136 2114 18834 9900 9708 17658 11186

29196

Net FII Investment

Source: Bloomberg , ICICIdirect.com Research

CNX Nifty (RHS)

Exhibit 3: FII flows are at decade high indicating India has been their preferred investment

On the global liquidity front, we believe India is unlikely to see any major impairment in FII inflows as the western world is unlikely to commence rate tightening in CY11 in a hurry In addition, healthy participation in disinvestment programme of | 49865 crore during CY10 and likely strong pipeline of | 51,000 crore in 2011 would keep FII interest alive for Indian equities

destination

150000 100000 50000 0 CY01 -50000 -56778 -100000 FII Investment (RHS) Sensex CY02 CY03 CY04 CY05 CY06 CY07 CY08 CY09 30793 3576 38763 48060 37603 74902 84269

133050 25000 20000 15000 10000 CY10 5000 0

| Crore

12820

Source: Bloomberg , ICICIdirect.com Research

ICICIdirect.com | Mutual Fund

Page 3

ICICI Securities Limited

Industry Synopsis

The AUM declined 17% YoY as the industry witnessed outflows to the extent ~| 1 lakh crore

Exhibit 4: Assets under management

declined..

900000 800000 700000 600000 500000 Mar-10 May-10 Nov-10 Jan-10 Jul-10 Sep-10 Dec-10, 626314

Exhibit 5: Outflows continued

200000 150000 100000 50000 0 -50000 -100000 -150000

Source: AMFI, ICICIdirect.com Research

143774

CY10 -90722

CY09

Source: AMFI, ICICIdirect.com Research

In CY10, regulatory changes w.r.t valuation of debt securities, Sebi asking banking to put a strict check on their MF holdings and closure of the liquid plus funds category led to lesser inflows in to income funds and their share dropped from 62% in January 2010 to 47%in December 2010 Equity funds and Gold ETFs gained share among total AUM in 2010

Exhibit 6: Regulatory changes affect income and money market fund rather than equity funds

35 30 25 % 20 15 10 5 0 9.4 2.31.2 Mar-10 Jun-10 Apr-10 Jan-10 May-10 Feb-10 11.4 2.8 1.4 Aug-10 Nov-10 Oct-10 Jul-10 Sep-10 62.0 25.1 32.2 52.1 47.6 14.2 33.2 65 60 55 45 % 50

40 3.1 35 1.9 30 Dec-10

Equity

Balanced

Money Market

Others

Income (RHS)

Source: AMFI, ICICIdirect.com Research

AAUM for the last quarter CY10 stood at |6.75 lakh crore, down from AAUM of | 7.14 lakh crore for September 2010 Reliance Mutual Fund continues to be the market leader in terms of AAUM followed by HDFC Mutual Fund with AAUM of ~| 1 lakh crore and | 0.8 lakh crore, respectively Among major AMCs, LIC Mutual Fund saw a decline in the share whereas Franklin Templeton Mutual Fund and DSP Black Rock Mutual Fund garnered higher share of the total pie

Exhibit 7: AAUM and market share September 2010

16 14 % Share 12 10 8 6 4 Aug-10 Jan-10 Jun-10 Mar-10 May-10 Sep-10 UTI Apr-10 Feb-10 Jul-10 Q4

Reliance Birla Sun Life

HDFC SBI

ICICI Prudential Franklin

Source: AMFI, ICICIdirect.com Research

ICICIdirect.com | Mutual Fund

Page 4

ICICI Securities Limited

Category Analysis

Equity funds

In the equity funds category, except for technology funds all other fund gave negative returns for the one month period ending January 14, 2010. Banking funds continued to be laggards as also infrastructure funds

Exhibit 8: Sub-category wise fund returns vs. respective BSE indices

Category Return (%) 4 2 0 -2 -4 -6 -8 -10 -12 -14 -16 2.17 0.21 0.53 Index Return (%)

-2.25

Returns (%)

-5.03

-5.23

-5.13

major gainers. For CY11, we expect the Indian equity performance to be growth induced. It would mirror the trajectory of economic and corporate growth We do not expect sector rotation/preference to undergo much change on the likely levers of higher growth even though valuation multiples appear to be rich

-2.52

-2.46

For CY10, it was sector funds - pharma & banking, which were

-5.37

-6.23

-6.08

Technology

Pharma

FMCG

Diversified

Infrastructure

Mid cap

Banking

Source: CRISIL Fund Analyser, ICICIdirect.com Research Note : % Returns are absolute 1 month returns as on January 14, 2011

Exhibit 9: Net fund flow: Worst seems to be over

Outflows moderated considerably during November and December and saw some decent inflows, giving some comfort to AMCs

4500 2500 Net Inflow ( | Cr ) 500 -1500 -3500 -5500 -7500 -9500 Aug-10 Mar-10 Nov-10 Jun-10 Jul-10 Jan-10 Apr-10 Oct-10 May-10 Dec-10 Feb-10 Sep-10 -7011 980 1514 -1133 1256 -41 -1446 -3400 -2890 -2869 -2016

-10.01

On account of a lack of push to the product and profit booking at 20000+ levels on the Sensex, the equity funds category witnessed outflows to the tune of ~| 16,100 crore for CY10

Source: Crisil Fund Analyser, ICICIdirect.com Research

Exhibit 10: Deployment of funds by equity schemes (including ELSS * Balanced Schemes)

16.1 13.6

Banking being the sector with highest weightage in the index continues to be a major sector After the recent correction, fund managers continued to increase their holdings as seen from the increase in share to 16% in December 2010 from 13% in January 2010 IT, pharma and auto still continue to be in favour Capital goods and power saw some shift of interest

20 % of Equity AUM 16 12 8 4 0

8.5 7.7

6.8 6.0

6.6 7.9

6.4 6.6

4.8 6.1

5.7 5.7

4.1 3.0

3.8 4.5

Power

IT

Consum. Durab

Pertroleum

Banking

Cap.Goods

Finance

Pharma

Auto

Dec-10

Source: SEBI, , ICICIdirect.com Research

Jan-10

ICICIdirect.com | Mutual Fund

Oil

3.8 4.1

Page 5

-9.81

877

ICICI Securities Limited

Equity Diversified Funds

View Short-term: Neutral Long-term: Positive CY10 was good for Indian equities as FIIs pulled the index by over 16%. Equities were also one of the highest yielding asset classes. Equity diversified funds have performed in line with the broader markets However, CY11, so far, has not been good with around 8% correction in the first half of the first month

Staggered investment through SIP is the best way to approach the market in 2011

The correction in our view can be used as an opportunity to invest for the long-term in diversified funds. Diversified large-cap oriented funds should be preferred and core portfolio investment in these funds should be done in a staggered manner utilising each major dip as an opportunity to buy for the long-term Indias domestic economy continues to remain on a strong footing with visible growth prospects. The same is expected to drive the equity market over a longer period of time Exhibit 11: Category average vs. benchmark

20 15 10 7.3 3.1 2.5 14.2 14.3

Return (%)

5.1

5 0 -5 -10 -15 1M -5.0 -5.2 -9.4 -10.1 3M

-2.9

-4.6

6M Category Average

1Yr BSE 200

3Yr

5Yr

Source: CRISIL Fund Analyser, ICICIdirect.com Research Note : % Returns are as on Jan 14, 2010 Returns above 1 yr are CAGR returns

Exhibit 12: Positive & negative bias funds

Top Recomeded Equity Diversiifed Funds Scheme Name Fidelity Equity ICICI Prudential Focused Bluechip Equity Fund HDFC Top 200 Fund Birla Sun Life Frontline Equity Fund - Plan A Reliance Regular Savings Fund - Equity Benchmark - BSE 200 Category Average Negative Bias Funds Scheme Name Reliance Equity Fund JM Contra Fund HSBC Progressive Themes Fund Birla Sun Life Advantage Fund Principal Growth Fund Benchmark - BSE 100 Category Average 6M 4.64 8.25 5.78 5.28 2.96 2.50 3.12 6M -5.92 -6.87 -8.20 -9.94 0.08 2.50 3.12 1 Yr 16.22 15.95 14.18 7.95 7.28 5.13 7.30 1 Yr -8.34 -7.27 -6.99 0.26 3.05 5.13 7.30 3 Yr 3.31 N.A 7.12 3.19 1.10 -4.58 -2.89 3 Yr -7.58 -24.71 -15.49 -6.89 -12.22 -4.58 -2.89

Source: CRISIL Fund Analyser, ICICIdirect.com Research Note : % Returns are as on Jan 14, 2011, Returns above 1 yr are CAGR returns

ICICIdirect.com | Mutual Fund

Page 6

ICICI Securities Limited

Equity Midcap Funds

View Short-term: Neutral Long-term: Positive Midcap stocks tumbled the most in the recent market correction as news flows over price rigging and the Sebi probe resulted in risk aversion from the segment Midcap category funds are more volatile but also offer better return potential The funds offer a good opportunity for an investment horizon of over three to five years to ward off the interim volatility

SIP investment in midcap funds should be able to outperform in the next two or three years

In this category, stock selection as well as fund selection plays a greater role as it is a high-risk high-return game with huge deviation in returns among the best and worst performers Exhibit 13: Category average vs. Benchmark Indices

20 15 10 Return (%) 5 0 -5 -10 -15 1M -5.4 -6.1 -12.0 -13.5 3M -0.3 -1.6 -6.0 -3.2 6.1 5.7 12.0 14.3

Midcap funds are alpha generators. However, they are risky bets with higher variation in the best and worst fund performance, Proper selection plays a key role.

6M

1 YR CNX MidCap

3YR

5YR

Category Average

Source: CRISIL Fund Analyser, ICICIdirect.com Research Note : % Returns are as on Jan 14, 2011, Returns above 1 yr are CAGR returns

Exhibit 14: Negative & positive bias funds

Top Recomeded Equity Mid Cap Funds Scheme Name IDFC Premier Equity Fund - Plan A ICICI Prudential Discovery Fund Sundaram BNP Paribas Select Midcap Benchmark - CNX Midcap Category Average Negative Bias Funds Scheme Name SBI Magnum Midcap Fund JM Emerging Leaders Fund JM Small and Midcap Fund CNX Midcap Category Average 6M 5.47 4.38 4.51 -1.62 -0.31 6M 2.94 -7.32 -11.20 -1.62 -0.31 1 Yr 15.51 15.19 7.87 5.73 6.11 1 Yr -0.51 -9.60 -14.58 5.73 6.11 3 Yrs 4.61 10.23 1.75 -3.18 -6.01 3 Yrs -13.66 -26.07 -32.46 -3.18 -6.01

Source: CRISIL Fund Analyser, ICICIdirect.com Research Note : % Returns are as on Jan 14, 2011, Returns above 1 yr are CAGR returns

ICICIdirect.com | Mutual Fund

Page 7

ICICI Securities Limited

Equity Infrastructure Fund

View Short-term: Neutral Long-term: Positive The infrastructure sector underperformed the broader markets in CY10 despite a bulging order book This was led by factors such as execution delays due to political uncertainty in the major region of Andhra Pradesh, delay in financial closure at client specific and captive BOT orders, prolonged monsoons, etc. and negative impact of rising interest for the capital intensive sector Going forward, we are positive on the capital goods space but neutral to negative on construction and power companies Significant earnings growth can only be seen in H2CY11 with a benign interest rate scenario Exhibit 15: Category average vs. fund return

20 10 Return (%) 0 -10 -20 -30 1M 3M 6M Category Average 1 YR BSE 100 3YR 5YR -6.2 -5.1 -13.3 -5.8 -5.1 -7.9 -4.6 5.0 17.4 14.6 3.0

-9.8

Source: CRISIL Fund Analyser, ICICIdirect.com Research Note : % Returns are as on Jan 14, 2011, Returns above 1 yr are CAGR returns

Exhibit 16: Positive bias funds

Top Recomeded Equity Infrastructure Funds Scheme Name Canara Robeco Infrastructure Franklin Build India Fund Birla Sun Life Infrastructure Fund - Plan A ICICI Prudential Infrastructure Fund Sundaram BNP Paribas CAPEX Opportunities Fund Reliance Diversified Power Sector Fund Benchmark - BSE 100 Category Average 6M -1.51 -2.39 -4.23 0.84 -7.73 -8.95 2.96 5.14 1 Yr 2.87 -0.41 -3.06 1.26 -6.94 -6.59 4.95 7.25 3 Yrs -6.2 N.A -7.1 -5.92 -9.87 -3.84 -4.62 -3.10

Source: CRISIL Fund Analyser, ICICIdirect.com Research Note : % Returns are as on Jan 14, 2011, Returns above 1 yr are CAGR returns

ICICIdirect.com | Mutual Fund

Page 8

ICICI Securities Limited

Equity Banking Funds

View Short-term: Neutral Long-term: Positive The banking sector, a heavyweight on the BSE Sensex with a 17% share, has emerged stronger in CY10 with the Banking Index delivering 30%+ returns for CY10 The short-term performance may be muted due to significant outperformance in 2010 and near term pressure on interest margins and over ownership among investors Near term pressure on NIM persists but the effect of base rate and BPLR hikes will come into play and FY12E NIM should not see any further erosion We continue our positive stance on the sector over a longer period of time as stable economic growth and more than 20% credit growth will continue to help them to grow

The BFSI space, which has ~17 weightage in the Nifty, lifted the index in the recent rallyHowever, the past few sessions saw the banking index paring some of the gains

Exhibit 17: Category average vs. fund return

20.7 19.7 22.6 -2.1 3YR -1.9 30 20 3.4 4.6 10 Return (%) 0 -10.0 -9.8 -10 -20 -30 1M 3M 6M Category Average 1 YR Bankex 5YR 18.0

-17.7

Source: CRISIL Fund Analyser, ICICIdirect.com Research Note : % Returns are as on Jan 14, 2011 Returns above 1 yr are CAGR returns

ICICIdirect.com | Mutual Fund

-17.3

Page 9

ICICI Securities Limited

View Short-term: Positive Long-term: Positive

Equity Pharma Funds

Pharma funds have delivered the highest return among sector funds in CY10 of ~25% The outperformance is expected to continue although with a lower gap We expect major pharma players to clock ~18-20% kind of growth in domestic formulations driven by strong growth in chronic therapies such as anti-diabetics, cardiovascular (CVS), central nervous system (CNS) and oncology Rapid urbanisation, changing lifestyles, demographic transition and growing health insurance coverage are some of the obvious factors that will drive the chronic growth In 2010, almost all domestic players increased their field force. This will start yielding a positive effect from the second half of CY11 onwards. This incremental field force will complement the added capacities since 2009 On the exports front, we see a continuance of the three pronged strategy of risk mitigation adopted by major generic players a. to increase the presence in regulated markets of the US, Japan and EU by aggressive product filing and making their facilities regulatory compliant and b. expanding their presence in the so called pharmerging countries (BRIC nations ex-India, Mexico, Turkey and South Korea) via marketing and distribution agreements with the pharma MNCs and c. forming alliances for licensing and distribution with leading pharma MNCs as per their requirements

We do not see significant headwinds from either currency or crude based derivatives that may suppress the EBITDA margins of the companies Given the relative certainty of growth in earnings, the sector is likely to benefit from a change in investor sentiment in its favour Exhibit 18: Fund returns vs. Benchmark

Around 5-10% can be invested in Reliance Pharma Fund to capture the sector momentum and add the alpha to the portfolio

30 25 20 Returns (%) 15 10 5 0 -5 -2.25 1M 0.45 0.12 1.71 4.35 13.68

27.60 25.57

25.84

15.59

3M

6M

1 Yr BSE Healthcare

3 Yr

Reliance Pharma Fund

Source: CRISIL Fund Analyser, ICICIdirect.com Research Note : % Returns are as on Jan 14, 2011, Returns above 1 yr are CAGR returns

ICICIdirect.com | Mutual Fund

Page 10

ICICI Securities Limited

Equity FMCG

View Short-term: Neutral Long-term: Positive Currently, the BSE FMCG index is trading at 32.7x with YTD upside of 26.7%. Hence, with the FMCG P/E of 1.8x to that of the Sensex P/E, the valuation for the sector seems to be expensive with the sectors historical premium being ~0.4-1.2x Though we believe revenue growth will continue its uptrend in CY11, margin pressure and high valuations could keep the premium capped. Hence, we remain neutral on the performance of the sector Exhibit 19: Category average vs. fund return

other sectors. Volatility in the markets always tends to move funds to these low beta sectors Segmental or category risk seems less as compared to

Returns %

-1.1

-0.2

0 -2.5 -10

0.53

1M Franklin FMCG Fund

-7.1

3M

-5.4

-1.97

-3.1

4.4

10

7.9

6M Magnum SFU - FMCG Fund

8.4

12.6

20

ICICI Pru FMCG Fund

BSE FMCG

Source: CRISIL Fund Analyser, ICICIdirect.com Research Note : % Returns are as on Jan 14, 2011, Returns above 1 yr are CAGR returns

Equity Technology Funds

View Short-term: Neutral Long-term: Neutral The IT sector had a favourable year led in part by strong volume growth as clients across continents continued to spend top dollars on driving efficiencies through IT. Business spending revived adequately but wage inflation and attrition worries continue We believe CY11 could be a year of discretionary spends led earnings upgrade We are positive on the sector for CY11. However, sector funds may not be suitable for long-term investment Exhibit 20: Fund return vs. Benchmark

Manufacturing and retail verticals saw demand uptick led by consumer technology and hi-tech sectors while telecom and Europe, the weak link in prior quarters, bounced back..

50 30.2 30 3.7 10 -10 -0.7 -2.9 0 4.1 3.5 1.5 4.9 8.4 9.4 4.1 7.6 10.8 20 0.6 20.4 27.6 13.5 20.2 40 Returns %

43.4

1M

-4.8

3M

6M

15.3 14.5

1 Yr

Birla Sun Life New Millennium Fund Franklin Infotech Fund SBI Magnum Sector Umbrella - Infotech Fund

DSP BlackRock Technology Fund ICICI Prudential Technology Fund BSE IT

Source: CRISIL Fund Analyser, ICICIdirect.com Research Note : % Returns are as on Dec 15, 2010, Returns above 1 yr are CAGR returns

ICICIdirect.com | Mutual Fund

21.0 29.2

20.5 1 Yr

30

Page 11

28.68

30.1

40

39.7

50

ICICI Securities Limited

Arbitrage Funds

View Short-term: Neutral Long-term: Neutral Arbitrage funds are generally considered a better option against liquid funds. They are classified as equity funds for tax treatment. Hence, the dividends declared are tax free Arbitrage opportunities keep on arising from time to time depending on market volatility. Therefore, the investment horizon should be longer to capitalise on the opportunity that may arise from time to time Arbitrage funds should be used as a liquid investment and should not be a major part of the investors portfolio Exhibit 21: Category average vs. Benchmark

10 9 8 Absolute Return % 7 6 5 4 3 2 1 0 1M 3M Category Average

Source: Crisil Fund Analyser, , ICICIdirect.com Research Note : Annualised returns % as on Jan 14,2011 Arbitrage funds offer alternate investment option to liquid funds...

9.3 7.5

9.4 8.5 7.0 6.4

6.1 5.3

6M Crisil Liquid Fund Index

1 YR

Exhibit 22: Top recommended funds

Top Recommended Arbritage Funds Scheme Name ICICI Prudential Equity and Derivatives Fund - Income Optimiser Plan HDFC Arbitrage Fund - Retail Kotak Equity Arbitrage Fund UTI SPrEAD Fund CRISIL Liquid Fund Index Category Average

Source: CRISIL Fund Analyser, ICICIdirect.com Research Note : Annualised return (%)as on Jan 14, 2011

1M 11.62 8.97 9.28 8.27 7.47 9.32

3M 11.67 9.51 9.75 7.68 7.00 9.42

6M 9.70 8.69 8.49 6.52 6.39 8.53

ICICIdirect.com | Mutual Fund

Page 12

ICICI Securities Limited

Exchange Traded Funds (ETF)

In India, there are three kinds of ETFs available : Equity Index ETFs, Liquid ETFs and Gold ETFs An equity index ETF tracks a particular equity index such as the BSE Sensex, NSE Nifty, Nifty Junior, etc An equity index ETF scores higher than index funds on several grounds. The expense of investing in ETFs is relatively less by 0.50-1.00% in comparison to an index fund. Expense ratio for ETFs is in the range of 0.50-0.75% excluding brokerage while for index funds the expense ratio varies in the range of 1.0-1.5%. However, brokerage (which varies) is applicable on ETFs while there are no entry loads now on index funds The tracking error, which explains the extent of deviation of returns from the underlying index, is usually low in ETFs as it tracks the equity index on a real time basis whereas it is done only once in a day for index funds

..Tracking error, though it should be considered, is not the deciding factor as variation among funds is not huge...

..Traded volumes should be the major criterion that is used while deciding on investment in ETFs. Higher volume ensures lower spread and better pricing to investors...

ETFs also provide liquidity as they are traded on stock exchanges and investors may subscribe or redeem on an intra-day basis also. This is not available in index funds, which are subscribed/redeemed on a closing NAV basis only There are over 400 ETFs traded globally. ETFs are transparent and cost efficient. The decision on which ETF to buy should be largely governed by the decision of getting exposure in that asset class

..Volumes are higher only in Benchmark ETFs and tracking error is also lowest at 0.08%. Therefore, it is our top pick for investors wanting Nifty-linked returns

Exhibit 23: Top Recommended ETF

Top Recommended ETF Scheme Name Nifty Benchmark Exchange Traded Scheme - Nifty BeES S&P CNX Nifty 6M 5.16 4.98 1Yr 8.29 7.50 3Yr -2.33 -3.06

Source: Crisil Fund Analyser, , ICICIdirect.com Research Note : Returns above one year are Compounded Annualised return as on Dec 15, 2010

ICICIdirect.com | Mutual Fund

Page 13

ICICI Securities Limited

Balanced Funds

View Short-term: Neutral Long-term: Neutral Equity markets are dwindling and G Sec yields are at their structurally upward trend. Hence, balanced funds may not yield good returns in the near term Balanced funds have more than 65% invested into equities. Hence, they offer tax savings as any capital gain over a one year period becomes tax free. Therefore, even the 35% debt portion is not subjected to tax However, the return also gets reduced over diversified peers owing to the debt component. Even in downward trending equity markets well performing diversified funds have the capability to outperform the balance funds Investors with a limited investible surplus and a lower risk appetite but with a willingness to invest into equities can look to invest in these funds

Investors interest towards the balanced fund category has been one of total imbalance

Exhibit 24: Imbalanced inflows

600

Exhibit 25: Balanced returns

11.3 12.3 14.2 6.1 6.8 7.3 0.1 1.3 1 YR 3YR 5YR Category Average Crisil Balance fund Index Diversified Funds

Source: Crisil Fund analyser, ICICIdirect.com Research Note: % Returns as on Jan 14, 2011 Returns above 1 yr are CAGR returns

20 Returns (%)

Net Inflow ( | Cr )

400 200 0 -200 -400 -600 56 88 206 -40 -57 -51 -43

398 26

326 255

15 10 5 0 -5

-414 Aug-10 May-10 Nov-10 Jun-10 Sep-10 Jan-10 Feb-10 Apr-10

Source: AMFI, ICICIdirect.com Research

Exhibit 26: Positive & negative bias funds

Scheme Name HDFC Prudence Fund Reliance Regular Savings Fund - Balanced Birla Sun Life 95 Fund DSP BlackRock Balanced Fund Crisil Balanced Fund Index Category Average Negative Bias Funds Scheme Name JM Balanced Fund Birla Sun Life Freedom Fund Crisil Balanced Fund Index Category Average 6M 4.73 4.45 4.41 3.16 3.96 1.74 6M -1.39 -0.92 3.96 1.74 1 Yr 17.06 13.94 11.98 8.01 6.81 6.13 1 Yr 6.19 -2.03 6.81 6.13 3 Yrs 8.75 9.58 4.47 4.23 1.29 0.05 3 Yrs -11.84 -3.89 1.29 0.05 5 Yrs 19.35 17.19 17.68 17.09 12.33 11.33 3 Yrs 6.12 7.37 12.33 11.33

Source: Crisil Fund Analyser, ICICIdirect.com Research Note: % Absolute Returns as on Jan 14, 2011

ICICIdirect.com | Mutual Fund

-2.9

Page 14

ICICI Securities Limited

Monthly Income Plans (MIP)

View Short-term: Positive Long-term: Positive An MIP offers investors an option to invest in debt with some participation in equity, approximately 10-15% of the portfolio Investors who want higher returns compared to debt funds and are comfortable with nominal risk in returns may look to invest in MIPs The equity portion of the funds provides extra return to the fund while the debt part acts as a cushion towards any fall in equity and provides regular income In the current month, the volatility in G Sec yields and a correction in the equity market muted the returns Investors should invest in MIPs with lower equity allocation to avoid capital erosion and earn stable returns Exhibit 27: Category average vs. benchmark

9 8 7 6 Absolute Retur(%) 5 4 3 2 1 0 -1 -2 -0.4 1M -0.4 3M -0.8 -0.6 6M Category Average 1 YR Crisil MIPEX 3YR 5YR 1.8 2.2 4.5 5.2 5.1 4.9 7.8 7.5

Source: Crisil Fund Analyser, ICICIdirect.com Research Note :% Returns as on Jan 14, 2011, Returns above 1 yr are CAGR returns

Exhibit 28: Top recommended funds

Scheme Name HDFC Monthly Income Plan - LTP Reliance Monthly Income Plan Birla Sun Life MIP II - Savings 5 Plan Crisil MIP Index Category Average

Source: Crisil Fund Analyser, ICICIdirect.com Research Note : Returns are annualized returns as on Jan 14,2011

1 Yr 8.25 6.50 5.53 5.18 4.46

3 Yrs 9.32 12.37 11.23 4.91 5.11

5 Yrs 11.50 11.76 9.75 7.52 7.83

ICICIdirect.com | Mutual Fund

Page 15

ICICI Securities Limited

Debt funds

Short-term rates are at 7% plus levels and, therefore, ultra short-term and liquid funds have higher yields

Exhibit 29: Debt fund returns

8

The yield curve rose across the curve and more at the shorter end. After the policy, the yield eased off from the high levels, which helped the debt fund to close positive on an MoM basis.

7 Annulaised Returns(%) 6 5 4 3 2 1 0 Income UST Liquid Crisil Income LiquiFex ST Crisil STBx Gilt MT< Gilt ST I-SEC Income Crisil Com.Gilt ComBex 7.32 7.28 7.27 6.88 6.03 5.83

5.59

5.17

4.69

4.14

Source: Crisil Fund Analyser ICICIdirect.com Research Note : Returns are annualised returns for one month ending Jan 14, 2011

With three months CP/CD rates skyrocketing, the maturity profile slightly increased at the shorter end

Exhibit 30: Deployment of funds

64.04% 58.2% 70.0% 60.0% 50.0% 40.0% 14.6% 16.0% 13.7% 30.0% 20.0% 10.0% 0.0% < 90 days 90 days to 182 days Jul-10

Source: SEBI, ICICIdirect.com Research Note : Holding as % of total AUM

62.98%

63.87%

12.5%

12.1%

11.0%

11.2%

182 days to 1 year Sep-10 Oct-10

1year and above

Aug-10

The yield curve flattened as shorter duration yield rose amid a tight liquidity scenario likely to be maintained by the RBI

Exhibit 31: G-Sec yield curve

9 8 7 (%) 6 5 4 3 3.7 3 mnth 4.3 1 Year 3 Year 5 Year 10 Year 6.4 7.1 7.5 7.8 7.9 8.2

Exhibit 32: Credit spread

170 150 7.6 130 110 90 70 50 1yr 3yr 14-Jan-11 5yr 1-Jan-10 10 yr 83 159 137 116 121 99 81 105

7.2

1-Jan-10

14-Jan-11

Source: Bloomberg, ICICIdirect.com Research

Source: Bloomberg, ICICIdirect.com Research

ICICIdirect.com | Mutual Fund

10.5%

12%

12%

Page 16

12.5%

13%

ICICI Securities Limited

View Positive

Liquid Funds

The liquidity crunch continues with the RBI lending close to ~| 1 lakh crore on a daily basis Liquidity, though, eased off a bit for another month in the wake of the last leg of government borrowing, forthcoming IPOs and advance tax outflows Call rates are hovering in a 67% range. Short-term yields on money market papers, particularly three to six months CP/CDs, are offering good yields due to the prevailing liquidity crunch Liquid funds will continue to offer better returns in the debt funds category

Liquidity crunch has kept call rates volatile in the higher range of 4.5-6.5%

Exhibit 33: Call rates have risen on account of liquidity crunch

10 9 8 Rate (%) 7 6 5 4 3 Aug-10 Nov-10 Oct-10 Mar-10 May-10 Dec-10 Jun-10 Jan-10 Apr-10 Jul-10 Sep-10 Feb-10 9.15 9.6

3M CD

3M CP

Source: Bloomberg, ICICIdirect.com Most fund managers see the liquidity crunch continuing for some more days

Exhibit 34: Liquidity as measured under LAF...

500 0 -500 -1000 -1500 -2000 16-Jul 23-Jul 30-Jul 6-Aug 13-Aug 20-Aug 27-Aug 3-Sep 10-Sep 17-Sep 24-Sep 1-Oct 8-Oct 15-Oct 22-Oct 29-Oct 5-Nov 12-Nov 19-Nov 26-Nov 3-Dec 10-Dec 17-Dec 24-Dec 31-Dec 7-Jan 14-Jan

Source: Bloomberg, ICICIdirect.com Research

ICICIdirect.com | Mutual Fund

Page 17

ICICI Securities Limited

Exhibit 35: Net fund flow (Total purchase Total sales)

Liquidity crunch faced by India Inc has reduced inflows into these funds

60000 45000 Net Inflow ( | Cr ) 30000 15000 0 -15000 -30000 -45000 Aug-10 Nov-10 Oct-10 Mar-10 May-10 Dec-10 Jun-10 Jan-10 Apr-10 Jul-10 Sep-10 Feb-10 -10218 -29334 -516 3971 9275 17029 34303 21922 2283 6111 -12500 -36108

After October 2009, when the regulatory change came into effect, liquid funds had lost their sheen. It is now that these funds offer some investment opportunity as call rates have risen sharply

Source: AMFI, , ICICIdirect.com Research

Exhibit 36: High call rates have helped funds post higher return

8.00 7.00 Annualised Returns %

In the debt funds category, liquid funds will continue to provide stable and highest 6% plus annualised returns in the current scenario

7.29 7.27

7.28 7.47

6.80 7.00

6.19 6.39

6.00 5.00 4.00 3.00 2.00 1.00 0.00 7 Days Category Average 1M 3M 6M Bench mark - Crisil liquid Fund Index

Source: Crisil Fund Analyser, , ICICIdirect.com Research Note : Annualised returns as on Jan 14, 2011

Exhibit 37: Top recommended funds

Top recommended Liquid Funds Particulars/Period 7 Days 1M 3M 6M 1 Yr

HDFC Cash Management Fund - Savings Plan UTI Money Market Fund HDFC Liquid Fund - Growth Birla Sun Life Cash Manager Reliance Liquid Fund - Treasury Plan Bench mark - Crisil liquid Fund Index Category Average

Source: Crisil Fund Analyser, ICICIdirect.com Research Note : Annualised returns as on Jan 14, 2011

7.67 7.41 7.48 7.46 7.48 7.27 7.29

7.49 7.45 7.31 7.27 7.11 7.47 7.28

6.98 6.68 6.79 6.76 6.49 7.00 6.80

6.39 6.03 6.19 6.24 5.91 6.39 6.19

5.55 5.11 5.30 5.29 5.14 5.30 5.31

ICICIdirect.com | Mutual Fund

Page 18

ICICI Securities Limited

Income Funds

We believe that 2011 will be good for debt market and investments in all the category viz. ultra short-term funds, shortterm funds and income funds should deliver good returns Currently, short-term debt funds offer better return opportunity as short-term rates have already risen sharply due to tight liquidity and are expected to moderate from current levels Ultra short-term funds also offer good returns due to tight liquidity and elevated rates on short maturity money market instruments Exhibit 38: Net fund flow (Total purchase Total sales)

Tight liquidity conditions and upward trending interest rates have led inflows into longer duration income funds

View Ultra-short term: Positive Short-term: Positive Long-term: Positive

200000 150000 100000 Net Inflows(Rs.Cr) 50000 0 -50000 -100000 -150000 -200000 Jan-10 Mar-10 Feb-10 4887 106092

177773

Rising interest rate environment make this fund less attractive

475 -35084

16561 -28637

-5305

11307 -32698

-134354 -164487 Aug-10 Nov-10

1 Yr

Oct-10

Source: AMFI, , ICICIdirect.com Research

Exhibit 39: Average maturity profile (Sept 2010)

Ultra Short Term Funds Short Term Funds Long term income Funds 0-0.5 1-2.6 3 -12.03

Source: Crisil Fund Analyser, ICICIdirect.com Research

Exhibit 40: Income fund average returns

Ultra short-term funds continue to yield good returns with less risk on account of lower maturity

Annualised Return % 6.0 4.0 2.0 0.0 1M 3M Ultra Short Term Short Term 6M Long term income 8.0 7.3 6.9 4.7 7.4 6.8 4.9 5.2 4.4 4.6

May-10

6.2 4.9 5.0

Source: CRISIL Fund Analyser, ICICIdirect.com Research Note : Annualised Returns (%)as on Jan 14, 2011

ICICIdirect.com | Mutual Fund

Page 19

Dec-10

Apr-10

Jun-10

Jul-10

Sep-10

ICICI Securities Limited

Exhibit 41: Top recommended ultra short-term funds

Top Recommended Funds Particulars/Period

Ultra-short term...can be looked upon for one to three months horizon...

7 Days

1M

3M

6M

1 Yr

Tata Floater Fund Reliance Money Manager Fund - Retail BNP Paribus Money Plus Fund HDFC Cash Management Fund - Treasury Advt. ICICI Prudential Flexible Income Plan Crisil liquid Fund Index Average

Source: CRISIL Fund Analyser, ICICIdirect.com Research Note : Annualised Returns(%)as on Jan 14, 2011

8.41 7.80 7.52 7.59 6.75 7.27 7.32

8.41 7.80 7.66 7.59 6.75 7.27 7.32

8.07 7.42 7.08 7.41 7.27 7.47 7.41

7.36 6.78 6.41 6.78 6.37 7.00 6.78

6.71 6.10 5.67 6.20 5.79 6.39 6.15

Exhibit 42: Top recommended short-term funds

Short-term funds will benefit as sharply rising yields are likely to decline first compared to long-term yields

Top Recommended Funds Particulars/Period

7 Days

1M

3M

6M

1 Yr

Birla Sun Life Dynamic Bond Fund Templeton India Short Term Income Plan ICICI Prudential Short Term Plan Reliance Regular Savings Fund HDFC High Interest Fund - Short Term Plan Crisil Short Term Bond Fund Index Average

Source: CRISIL Fund Analyser, ICICIdirect.com Research Note : Annualised Returns(%)as on Jan 14, 2011

0.97 0.69 -0.66 -0.04 -3.28 1.47 3.67

8.69 6.31 5.73 4.96 4.89 6.03 6.88

4.25 4.14 3.35 3.23 2.80 4.48 4.89

4.45 4.06 3.12 3.21 3.36 4.15 4.43

5.55 5.52 4.35 4.62 4.90 4.65 4.85

Exhibit 43: Top recommended income long-term funds

Invest for a one year plus horizon as these funds have maturity of over four years and can be volatile on account of a hike in interest rates....

Top Recommended Funds Particulars/Period

7 Days

1M

3M

6M

1 Yr

Canara Robeco Income HDFC High Interest Fund Templeton India Income Fund ICICI Prudential Income Plan BNP Paribas Flexi Debt Fund Crisil Composite Bond Fund Index Category Average

Source: CRISIL Fund Analyser, ICICIdirect.com Research Note : Annualised Returns(%)as Jan 14, 2011

-0.26 -5.77 0.83 -5.70 0.16 -5.36 -2.14

7.51 3.61 6.09 3.27 5.10 4.14 4.69

5.38 3.48 3.70 2.52 1.66 3.20 5.16

3.73 3.59 3.45 1.96 1.71 3.28 4.62

4.77 4.87 3.46 2.67 3.68 4.54 5.03

ICICIdirect.com | Mutual Fund

Page 20

ICICI Securities Limited

View Short-term: Neutral Long-term: Positive

Gilt Funds

A rate hike of 25 bps in the policy meeting on January 25, has already been factored in the yields taking the benchmark 10 Year G sec yields to 8.15-8.20 levels Inflation, although stubborn in recent times, is expected to come down in the coming months. This will ease off the yields We expect longer duration G-Sec yields to ease off from higher levels of post 8.20. The same may add to the total returns Aggressive or long-term investors with an investment horizon of around one year may consider government securities funds Exhibit 44: Net fund flow (Total purchase Total sales)

Trading opportunity in gilt fund is available as the yields are above 8% levels and are expected to come down by 30-40 bps...

1000 500 Net Inflow ( | Cr ) 267 0 -257 -500 -1000 -1500 Aug-10 Nov-10 Oct-10 Mar-10 May-10 Dec-10

5.1 4.1 3.3 4.3 3.6 4.2

1 Yr

521 -49 -96 40 55 117

431

-185

-132

-369

Jan-10

Apr-10

Jun-10

Feb-10

Jul-10

Source: AMFI, , ICICIdirect.com Research

Exhibit 45: G-Sec funds return analysis

7.0 6.0 5.0 4.0 3.0 2.0 1.0 0.0 1M Gilt Short term 3M Gilt Medium to long term 6M I-SEC Composite Gilt Index 1 Yr 5.6 5.8 5.2 5.1

4.9

4.9

Source: Crisil Fund Analyser, ICICIdirect.com Research Note : Returns are annualised returns as on Jan 14, 2011

Exhibit 46: Top recommended gilt funds

Top recommended Gilt Funds Particulars/Period 7 Days 1M 3M 6M

ICICI Prudential Gilt - Investment - PF Option Birla Sun Life Gilt Plus - Regular Plan I-SEC Composite Gilt Index

Source: Crisil Fund Analyser, , ICICIdirect.com Research Note : Returns are annualized returns as on Jan 14, 2011

1.01 5.54 -3.40

5.75 9.71 5.17

Sep-10

6.94 5.70 4.92

6.20 4.52 3.59

4.94 3.07 5.12

ICICIdirect.com | Mutual Fund

Page 21

ICICI Securities Limited

Gold($/Ounce)

1500 1400 1300 1200 1100 1000 Nov-10 Jan-10 Mar-10 May-10 Sep-10 Jan-11 Jul-10 25 % return for

Gold ETF In 2010, gold outperformed all other asset classes. Demand picked up on account of flight-to-quality flows associated with the financial crisis and the measures put in place to remedy it (namely, quantitative easing from the worlds central banks), increase in gold holding by central banks and currency wars. All this has led to gold making successive new highs in 2010 Gold continued to maintain its strength as depreciation in the dollar helped it to gain 2.5% in December 2010 Silver continued its outperformance and delivered around 8% return in December 2010 in dollar terms World Gold Council estimates during the week indicated that India imported 624 tonnes of gold till the third quarter of 2010 ahead of 559 tonnes in the entire year of 2009 despite higher prices The European sovereign crises, geo-political tensions and currency volatility are also keeping demand for gold upbeat Silver prices have seen a smarter run-up recently outperforming all commodities including gold. ETF holding in iShare Silver Trust continued to see record levels and stands at around 10,900 tonnes as on December 31, 2010 as compared to 10780 as at the start of December 2010

Price ($/Ounce)

Source: Bloomberg, , ICICIdirect.com Research

Gold (Mumbai Spot)

22000 21000 20000 19000 18000 17000 16000 15000 Nov-10 Jan-10 Mar-10 May-10 Sep-10 Jan-11 Jul-10 23 % return for CY10

Strong investment demand, higher gold price, ongoing recovery in industrial demand and no real potential threat to prices from higher scrap or government sales will continue to support silver prices We continue to remain positive on gold. However, at these levels, one should remain a little cautious while making a fresh entry, as a pause in the US dollar could trigger some correction in the short-term. However, any turbulence in the global economy would restrict a significant fall Exhibit 47: Gold rising to new highs supported by dollar depreciation

Source: Bloomberg, , ICICIdirect.com Research

5

Fund flow (total purchase- total sales)

3464 3097 3800 2849 3400 2639 3000 1939 1972 2600 1711 1425 1583 1590 2200 1800 1400 1000 Aug-10 Nov-10 Oct-10 Mar-10 May-10 Dec-10 Jun-10 Apr-10 Jan-10 Jul-10 Sep-10 Feb-10 1837 3516

1450 1400 1350 1300 1250 1200 1150 1100 1050 1000 Aug-10 Nov-10 May-10 Dec-10 Sep-10 Apr-10 Jul-10 91 89 87 85 83 81 79 77 75

Gold ETFs AUM

Source: AMFI, , ICICIdirect.com Research

Dollar Index(RHS)

Source: Bloomberg, ICICIdirect.com Research

Gold(LHS)

ICICIdirect.com | Mutual Fund

Page 22

ICICI Securities Limited

Model Portfolios

Equity funds model portfolio

Investors who are wary of investing directly into equities can still get returns almost as good as equity markets through the mutual fund route. We have designed three mutual fund model portfolios, namely, conservative, moderate and aggressive mutual fund portfolios. These portfolios have been designed keeping in mind various key parameters like investment horizon, investment objective, scheme ratings and fund management.

Aggressive portfolio Change in allocation No change Moderate portfolio Change in allocation No change Conservative portfolio Change in allocation No change Allocation Current Previous Allocation Current Previous Allocation Current Previous

Exhibit 48: Equity model portfolio

Particulars Aggressive Moderate Conservative Time Horizon 1 2 Years 2- 3 Years Above 3 Years Review Interval Monthly Monthly Quarterly Risk Return High Risk- High Return Medium Risk - Medium Low Risk - Low Return % Allocation Funds Allocation Core Birla Sunlife Frontline Equity 20 20 20 Franklin India Prima Plus 20 20 10 HDFC Top 200 20 20 20 ICICI Prudential Focissed Bluechip Eq. 20 ICICI Prudential Dynamic Plan 10 20 Fidelity Equity Fund 20 20 Sub Total(a) 80 90 90 Satellite Sundarm Select Midcap 20 10 Sub total(b) 20 10 0 Debt Biral Sunlife Dynamic Bond Fund 10 Sub total (c ) 0 0 10 Grand Total(a+b+c) 100 100 100

Source: , ICICIdirect.com Research

Exhibit 49: CY10 - all portfolios have outperformed BSE 100 indices

12.0 10.1 6.0 4.2 3.5 0.0 -4.2 -4.3 -3.0 -6.0 -9.0 -12.0 1M Aggressive 3M Moderate 6M Conservative BSE 100 1YR 3.1 3.6 3.0 -3.7 -5.0 -5.0 8.7 10.0 9.0

-7.0

-6.8

Source: Crisil Fund Analyser, ICICIdirect.com Research Returns as on Jan 14, 2011

ICICIdirect.com | Mutual Fund

-8.3

Page 23

7.1

ICICI Securities Limited

Exhibit 50: Value of investment of | 1,00,000 since inception

180000 160000 140000 120000 100000

Conservative Moderate Aggressive BSE 100

166372

160867

156271

154330

Growth of Rs. 1 Lakh

Source: Crisil Fund Analyser,, ICICIdirect.com Research Returns as on Jan 14, 2011 Date of inception of portfolios: May 15, 2009

Major Contributors: Debt Funds ICICI Prudential Dynamic Plan

Major Draggers: Sundaram Select Midcap ICICI Prudential Focussed Blue chip Equity fund

ICICIdirect.com | Mutual Fund

Page 24

ICICI Securities Limited

Debt funds model portfolio

We have designed three different mutual fund model portfolios for different investment duration namely less than six months, six months to one year and above one year. These portfolios have been designed keeping in mind various key parameters like investment horizon, interest rate scenarios, credit quality of the portfolio and fund management, etc. Exhibit 51: Debt funds model portfolio

Particulars

What Changed?

0-6 Month Portfolio No change 6M-1Yr Portfolio No change Above 1 Yr Portfolio No change Allocation Allocation Allocation

Time Horizon 0 6 months 6months - 1 Year Liquidity with moderate return Monthly Medium Risk Medium Return % Allocation 20 20 20 20 20 100 Above 1 Year Above FD Quarterly Low Risk - High Return

Objective Review Interval Risk Return Funds Allocation Ultra Short term Funds Fortis Money Plus DWS Ultra Shorterm Plan Short Term Debt Funds HDFC High Interest Short Term Fund Birla Sun Life Dynamic Bond Fund Reliance Short term plan Long Term Debt Funds ICICI Prudential Gilt Inv. PF Plan Fortis Flexi Debt Canara Robeco Income Fund Total

Source: ICICIdirect.com Research

Liquidity Monthly Very Low Risk Nominal Return

20 20 20 20 20 100

20 20 20 20 20 100

Exhibit 52: Model portfolio performance since inception

8.00 6.03 7.00 6.00 5.00 4.00 3.00 1.00 0.00 0-6 Months 6 Mnths - 1Yr Portfolio Index Above 1 Yr 1.16

6 months-1 year Crisil Short term Index Above 1 year: 80% Crisil Composite Bond Index + 20% Isec Libex

7.41

5.33

5.36

2.00

Source: Crisil Fund Analyser, , ICICIdirect.com Research Note : Returns are one month Annualised return % as on Jan 14 ,2011

*Index: 0-6 months portfolio Crisil Liquid Fund Index,

ICICIdirect.com | Mutual Fund

3.87

Page 25

ICICI Securities Limited

Investment Strategy

With around 8% correction in the first half of January 2011, markets are providing an opportunity to start deploying funds particularly for those investors who have been underweight on equities or are under owned as compared to their risk appetite...

Short-term debt funds and FMPs offer a better opportunity to capture the return potential

Gilt funds provide good investment opportunity with investment horizon of one year as we expect G-Sec yields to moderate and inflation to come down going forward

We expect the performance of the Indian equity market in 2011 to be growth induced. It would mirror the trajectory of economic and corporate profitability growth We expect the Sensex to grow in line with earnings CAGR of 21% over FY10-12E EPS to 23165 levels (17x weighted average of FY12-13 EPS of 1363, 16% upside). In our bear case, we expect the Sensex to find comfort at 16924 levels (14x FY12E EPS of 1209, 15% downside), which could emanate from events such as fading of US growth outlook, no respite on Euro zone worries, a spike in commodities and geopolitical tensions With the US recovery still at a nascent stage, the US Fed will continue with its loose monetary policy for an extended period of time to stimulate growth and ensure unemployment rates drop to more reasonable levels. A low interest rate in the US would lead to larger capital inflows towards emerging markets like India Global commodity prices, which have risen 25-30% in the last four months, are a major worry for the Indian economy as well as for Indian equity markets like India. Negative news flows from Europe and China may also have a negative impact on the Indian markets In the short-term, volatility is expected as markets will take cues from the third quarter results and foreign liquidity flows We have been maintaining that we do not expect a major correction in the markets. We continue to maintain that any sharp dip, as seen recently, should be utilised as an investment opportunity to increase equity exposure We believe the debt market is offering good investment opportunities both at the shorter end of the curve (three months to one year) as well as at the longer end of the curve Short-term and conservative investors should invest in ultra short term or short-term funds to take advantage of the current higher yields due to liquidity crunch Aggressive investors may look at investing some portion of the portfolio in the longer duration G-Sec funds with an investment horizon of around one year

Exhibit 53: Market dips are excellent opportunity to buy equities

Indian markets are taking cues from the global market. However, India has outperformed its global peers and the same is expected to continue in the longer period...

20500 19500 18500 17500 16500 15500 14500 Nov-09 Aug-09 Aug-10 Mar-10 May-10 Nov-10 Oct-09 Dec-09 Jun-10 Jan-10 Apr-10 Sep-09 Feb-10 Sep-10 Oct-10 Jul-09 Jul-10 Buying at dips strategy would have yielded better results

ICICIdirect.com | Mutual Fund

Page 26

ICICI Securities Limited

Exhibit 54: BSE Sensex target scenario

27000 25000 23000 21000 19000 17000 15000 13000 11000 9000 7000 Dec-07 Jun-08 Bull Case Base Case 18882.25 Bear Case 16924 25451 23165

The risk-return trade-off seems to be favourable to start investment at current levels as potential downside of ~10% is less than base case scenario potential upside of ~20%...

Dec-08

Dec-09

Dec-10

Source: ICICIdirect.com Research

Exhibit 55: Sensex target scenario analysis

Sensex Target Scenario Key Parameters Global Factors Economic Data flow Geopolitical Tension Commodity Prices Domestic Growth Inflation Earnings Growth Policy Reforms Market Related variables Premium/Discount to Global Indices multiples Low >20% Very High Rise in Divergence Robust Inflows 18 FY13E 1414 25451 7642 Moderate 15%-20% High High <15% Low Robust Low Low Moderate Low Moderate Worsening High High Bull Case Base Case Bear Case

Portfolio Flows P/E Multiple (X) Earnings Discounting Sensex EPS CY11 BSE Sensex Target Equivalent Nifty Target

Source: ICICIdirect.com Research

In line with historical trends Divergence narrows In line with CY10 trends Huge Redemptions 17 75% x FY13E EPS x FY12E EPS 1,363 23165 6956 14 +25% FY12E 1,209 16924 5080

ICICIdirect.com | Mutual Fund

Page 27

Dec-11

Jun-09

Jun-10

Jun-11

ICICI Securities Limited

Exhibit 56: Fund Manager Survey

Questions Where will you position the broader Indian equity market on a valuation scale Options Grossly Undervalued Slightly Undervalued Fairly Valued Slightly Overvalued Grossly Overvalued How do you rate your medium term (3 months) view about the broader market? Very bullish Bullish Neutral Bearish What equity market strategy would you suggest right now? Very Bearish A B C D E Where do you expect the BSE Sensex after 1 Year? > 20000 22000-24000 18000 -22000 16000-18000 < 16000 Will India continue to command valuation premium over other Emerging markets? Yes. Will continue to enjoy Yes. But premium may reduce No What could be the major global risk for Indian Equity markets? Higher Crude Oil prices Slow US economic recovery European sovereign crises China economic slowdown Geo-political tensions How much corporate earnings growth you are expecting for FY 2011-12 and FY 2012-13? FY 2011-12 Less than 10% 10-15% 15-20% >20% FY 2012-13 Less than 10% 10-15% 15-20% >20% Which segment of the market you prefer for investment horizon of 1 year? Rank the sector according to your preference? Largecaps Midcaps Pharma IT BFSI Metals FMCG Auto Telecom Capital Goods Cement Oil and Gas Media Construction Aviation

Source: ICICIdirect.com Research

Response 0 9 55 36 0 0 18 64 18 0 0 27 64 9 0 9 64 27 0 0 27 73 0 73 9 27 0 0 0 9 82 9 9 27 55 0 82 18 13 12 11 10 9 8 7 6 5 4 3 2 1

ICICIdirect.com | Mutual Fund

Page 28

ICICI Securities Limited

Exhibit 57: Fund Manager Survey

Questions Do you see Indian equity markets underperforming other emerging markets in the next 1 year? Which global equity market do you expect to outperform in the next 1 year? Options Yes No US Brazil China European countries Any other: Where do you Benchmark 7.80% 10 year G-Sec yield in 3 months? Above 8.20% 8-8.20% 7.75-8% Below 7.75% With 6 months horizon, which segment of the debt market you expect to deliver better returns? G-Sec Fund Income Funds Short term Funds Ultra short term funds With asset class do you think will outperform in the year 2011? Indian equity Global equity Indian Debt Gold Agro commodities

Source: ICICIdirect.com Research

Response 18 82 73 18 9 0 0 27 45 27 0 9 9 45 27 18 18 18 9 55

ICICIdirect.com | Mutual Fund

Page 29

ICICI Securities Limited

Exhibit 58: Top picks

Category Short Term Equity Largecaps Neutral Positive Birla Sunlife Frontline Equity Fund HDFC Top 200 ICICI Pru Focussed Equity Fund Fidelity Equity Reliance Regular Savings Equity Midcaps Neutral Positive Sundarm Select Midcap Fund IDFC Premier Equity ICICI Prudential Discovery Fund ELSS Positive Positve HDFC Tax Saver ICICI Prudential Tax Plan Fidelity Tax saver Debt Liquid Funds Short Term Debt Funds Positive Positive Positive HDFC Cash Mgmnt Saving Plan Reliance Liquid Treasury Plan HDFC High Interest Short Term Fund Birla Sun Life Dynamic Bond Fund ICICI Prudential Short term plan Ultra Short Term Positve Fortis Money Plus Fund DWS Ultra Short Term Fund ICICI Pru Flex. Income Premium Income Funds Neutral Positive Fortis Flexi Debt ICICI Prudential Income Fund HDFC High Interest Fund Gilts Funds MIP Neutral Positive Positive Positive ICICI Pru Gilt Inv. PF Plan Birla Sunlife Gilt Plus Birla Sun Life MIP II Savings- 5 Reliance Monthly Income Plan HDFC MIP - LTP Arbritage Neutral Neutral UTI SPREAD Fund ICICI Prudential Eq. & Deriv. Fund Opt. HDFC Arbritage

Source: ICICIdirect.com Research

Outlook Long Term

Top Picks

ICICIdirect.com | Mutual Fund

Page 30

ICICI Securities Limited

Pankaj Pandey

Head Research ICICIdirect.com Research Desk, ICICI Securities Limited, 7th Floor, Akruti Centre Point, MIDC Main Road, Marol Naka, Andheri (East) Mumbai 400 093 research@icicidirect.com

pankaj.pandey@icicisecurities.com

Disclaimer

ICICI Securities Ltd. - AMFI Regn. No.: ARN-0845. Registered office of I-Sec is at ICICI Securities Ltd. - ICICI Centre, H. T. Parekh Marg, Churchgate, Mumbai - 400020, India. The selection of the Mutual Funds for the purpose of including in the indicative portfolio does not in any way constitute any recommendation by ICICI Securities Limited (hereinafter referred to as ICICI Securities) with respect to the prospects or performance of these Mutual Funds. The same should also not be considered as solicitation of offer to buy or sell these securities/units. The investor has the discretion to buy all or any of the Mutual Fund units forming part of any of the indicative portfolios on icicidirect.com. Before placing an order to buy the securities/units forming part of the indicative portfolio, the investor has the discretion to deselect any of the securities/units, which he does not wish to buy. Nothing in the indicative portfolio constitutes investment, legal, accounting and tax advice or a representation that any investment or strategy is suitable or appropriate to the investor's specific circumstances. The details included in the indicative portfolio are based on information obtained from public sources and sources believed to be reliable, but no independent verification has been made nor is its accuracy or completeness guaranteed. The securities included in the indicative portfolio may not be suitable for all investors, who must make their own investment decisions, based on their own investment objectives, financial positions and needs. This may not be taken in substitution for the exercise of independent judgement by any investor. The investor should independently evaluate the investment risks. ICICI Securities and affiliates accept no liabilities for any loss or damage of any kind arising out of the use of this indicative portfolio. Past performance is not necessarily a guide to future performance. Actual results may differ materially from those set forth in projections. ICICI Securities may be holding all or any of the securities/units included in the indicative portfolio from time to time. Please note that Mutual Fund Investments are subject to market risks, read the offer document carefully before investing for full understanding and detail. ICICI Securities Limited is not providing the service of Portfolio Management Services (Discretionary or Non Discretionary) to its clients. The information contained herein is strictly confidential and meant solely for the selected recipient and may not be altered in any way, transmitted to, copied or distributed, in part or in whole, to any other person or to the media or reproduced in any form, without prior written consent of ICICI Securities Limited. The contents of this mail are solely for informational purpose and may not be used or considered as an offer document or solicitation of offer to buy or sell or subscribe for securities or other financial instruments or any other product. While due care has been taken in preparing this mail, I-Sec and affiliates accept no liabilities for any loss or damage of any kind arising out of any inaccurate, delayed or incomplete information nor for any actions taken in reliance thereon. This mail is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction, where such distribution, publication, availability or use would be contrary to law, regulation or which would subject I-Sec and affiliates to any registration or licensing requirement within such jurisdiction.

ICICIdirect.com | Mutual Fund

Page 31

You might also like

- C 10Document344 pagesC 10Anonymous yxFeWtNo ratings yet

- Ipu Admit Card PDFDocument4 pagesIpu Admit Card PDFAbhinav DixitNo ratings yet

- ICICIdirect MonthlyMFReportDocument27 pagesICICIdirect MonthlyMFReportGanesh RajNo ratings yet

- J Street Volume 259Document10 pagesJ Street Volume 259JhaveritradeNo ratings yet

- MF Review: Budget 2009-10: Nothing To Rejoice On FM's SilenceDocument5 pagesMF Review: Budget 2009-10: Nothing To Rejoice On FM's SilencePartha Pratim MitraNo ratings yet

- HSBC Mid-Month Equity Investment Strategy: Release Date: 25 June 2010 For Distributor / Broker Use OnlyDocument7 pagesHSBC Mid-Month Equity Investment Strategy: Release Date: 25 June 2010 For Distributor / Broker Use OnlyBabar_Ali_Khan_2338No ratings yet

- J-Street Vol-257 PDFDocument10 pagesJ-Street Vol-257 PDFJhaveritradeNo ratings yet

- Key Indices 30-Sep-11 31-Aug-11 % Change: FII MFDocument30 pagesKey Indices 30-Sep-11 31-Aug-11 % Change: FII MFshah_aditkNo ratings yet

- Monthly Fund FactsheetDocument27 pagesMonthly Fund FactsheetAshik RameshNo ratings yet

- House View: June 7, 2012Document15 pagesHouse View: June 7, 2012techkasambaNo ratings yet

- JSTREET Volume 319Document10 pagesJSTREET Volume 319JhaveritradeNo ratings yet

- The Money Navigator April 2016Document36 pagesThe Money Navigator April 2016JhaveritradeNo ratings yet

- EIC Project Report On Pharmaceutical IndustryDocument52 pagesEIC Project Report On Pharmaceutical IndustrykalpeshsNo ratings yet

- Financials Result ReviewDocument21 pagesFinancials Result ReviewAngel BrokingNo ratings yet

- Sharekhan's Top Equity Mutual Fund Picks: August 23, 2011Document6 pagesSharekhan's Top Equity Mutual Fund Picks: August 23, 2011ravipottiNo ratings yet

- SEB Report: Asian Recovery - Please Hold The LineDocument9 pagesSEB Report: Asian Recovery - Please Hold The LineSEB GroupNo ratings yet

- Hallenges For The Indian Economy in 2017Document7 pagesHallenges For The Indian Economy in 2017Asrar SheikhNo ratings yet

- IndiaEconomicsOverheating090207 MFDocument4 pagesIndiaEconomicsOverheating090207 MFsdNo ratings yet

- Helping You Spot Opportunities: Investment Update - August, 2013Document55 pagesHelping You Spot Opportunities: Investment Update - August, 2013akcool91No ratings yet

- Indian Financials: Tryst With DestinyDocument28 pagesIndian Financials: Tryst With DestinyJohnny HarlowNo ratings yet

- J Street Volume 297Document10 pagesJ Street Volume 297JhaveritradeNo ratings yet

- Market Commentary - June 2016Document2 pagesMarket Commentary - June 2016kejriwal_itNo ratings yet

- Markets For You - 27.03.12Document2 pagesMarkets For You - 27.03.12Bharat JadhavNo ratings yet

- Recovery FundDocument31 pagesRecovery FundRohitOberoiNo ratings yet

- Kotak BankDocument44 pagesKotak BankPrince YadavNo ratings yet

- Helping You Spot Opportunities: Investment Update - October, 2012Document56 pagesHelping You Spot Opportunities: Investment Update - October, 2012Carla TateNo ratings yet

- Equity Market Review Jan-11Document23 pagesEquity Market Review Jan-11Shailendra GaurNo ratings yet

- Investor 2015Document61 pagesInvestor 2015rajasekarkalaNo ratings yet

- Analysis of Indian EconomyDocument41 pagesAnalysis of Indian EconomySaurav GhoshNo ratings yet

- Rates View - IndonesiaDocument5 pagesRates View - IndonesiaEfi Yuliani H. SantosaNo ratings yet

- LG Zi 39285932Document28 pagesLG Zi 39285932erlanggaherpNo ratings yet

- Askari Investment Management: Fund Manager ReportDocument4 pagesAskari Investment Management: Fund Manager ReportSeth ValdezNo ratings yet

- Market Outlook Market Outlook: Dealer's DiaryDocument15 pagesMarket Outlook Market Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Crisil Sme Connect Jul10Document44 pagesCrisil Sme Connect Jul10atia2kNo ratings yet

- JSTREET Volume 325Document10 pagesJSTREET Volume 325JhaveritradeNo ratings yet

- An UpDocument25 pagesAn UpAyush AgarwalNo ratings yet

- Niveshak Niveshak: Rationalization or Revamp?Document36 pagesNiveshak Niveshak: Rationalization or Revamp?Niveshak - The InvestorNo ratings yet

- Crisil Sme Connect Dec09Document32 pagesCrisil Sme Connect Dec09Rahul JainNo ratings yet

- Daily: Economic PerspectiveDocument3 pagesDaily: Economic PerspectiveDEEPAK KUMAR MALLICKNo ratings yet

- Reliance Single PremiumDocument80 pagesReliance Single Premiumsumitkumarnawadia22No ratings yet