Professional Documents

Culture Documents

TCS Tendu

TCS Tendu

Uploaded by

Swetha KarthickOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

TCS Tendu

TCS Tendu

Uploaded by

Swetha KarthickCopyright:

Available Formats

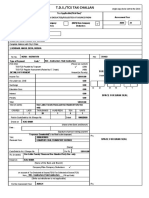

T.C.S.

TAX CHALLAN Single Copy (to be sent to ZAO)

Tax Applicable (Tick one)* Assessment Year

CHALLAN

No./ ITNS TAX COLLECTED AT SOURCE FROM

2023-24

281

(0020) COMPANY DEDUCTEES (0021) NON-COMPANY DEDUCTEES P

Tax Deduction Account No. (T.A.N).

Full Name

MKS

Complete Address with City & State

Tamil Nadu

Tel. No. Pin:

Type of Payment Code *

TCS Payable by Taxpayer (200) P FOR USE IN RECEIVING BANK

TCS Regular Assessment (Raised by I.T. Deptt.) (400) Debit to A/c / Cheque credited on

DETAILS OF PAYMENTS

Amount (in Rs. Only) DD MM YY

Income Tax 15,500.00

Fee under sec. 234E SPACE FOR BANK SEAL

Surcharge

Education Cess

Interest

Penalty

Total 15,500.00

Total (in words):

CRORES LACS THOUSANDS HUNDREDS TENS UNITS

Zero Zero Fifteen Five Zero Zero

Paid in Cash/ Debit to A/c /Cheque No. Dated 31-May-22

Drawn on - Rs. 15,500.00

(Name of the Bank and Branch)

Date : 1-Jan-04 Signature of person making payment

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - Tear Here - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - --------

Taxpayers Counterfoil (To be filled up by taxpayer)

TAN SPACE FOR BANK SEAL

Received from M K S

(Name)

Cash/ Debit to A/c /Cheque No. For Rs. 15,500

Rs.(in words) Fifteen Thousand Five Hundred Only.

Drawn on -

(Name of the Bank and Branch)

on account of Tax Collected at Source(TCS) from for the Assessment Year 2 0 2 3 -2 4

Rs. 15,500.00

You might also like

- Fina 3203 HW1Document5 pagesFina 3203 HW1ChiTat LoNo ratings yet

- Cryptocurrency and Its Impact On Insolvency and Restructuring - 2019Document58 pagesCryptocurrency and Its Impact On Insolvency and Restructuring - 2019Daniel Chan100% (1)

- Fin Tech MonthlyDocument53 pagesFin Tech Monthlysl7789No ratings yet

- For Payment From July 2005 OnwardsDocument1 pageFor Payment From July 2005 Onwardsvijay123*75% (4)

- ITNS 280: Challan No. Challan No. ITNS 281Document1 pageITNS 280: Challan No. Challan No. ITNS 281Sar-Im Teron AcousticNo ratings yet

- Income Tax - Bank Remittance CHALLANDocument1 pageIncome Tax - Bank Remittance CHALLANvivek anandanNo ratings yet

- Income Tax Challan - 280Document1 pageIncome Tax Challan - 280Subrata SarkarNo ratings yet

- TDS ChallanDocument1 pageTDS ChallanJainsanjaykumarNo ratings yet

- Challan No. ITNS 281Document1 pageChallan No. ITNS 281jagdish412301No ratings yet

- Tds ChallanDocument2 pagesTds Challannilesh vithalaniNo ratings yet

- Itns-281 TDS ChallanDocument1 pageItns-281 TDS Challanvirendra36999100% (2)

- Challan No. / Itns 280: Tax Applicable (Tick One) Assessment YearDocument1 pageChallan No. / Itns 280: Tax Applicable (Tick One) Assessment YearKaran AsodariyaNo ratings yet

- Challan No. ITNS 280Document2 pagesChallan No. ITNS 280RAHUL AGARWALNo ratings yet

- Self Assessment Tax Challan NiDocument1 pageSelf Assessment Tax Challan NiNitin KarwaNo ratings yet

- TDS ChallanDocument1 pageTDS ChallanJayNo ratings yet

- Challan Salary 192 PDFDocument1 pageChallan Salary 192 PDFVipin Kumar ChandelNo ratings yet

- Challan 280Document2 pagesChallan 280Rahul SinglaNo ratings yet

- Challan No./ Itns 280: Details of Payments For Use in Receiving BankDocument3 pagesChallan No./ Itns 280: Details of Payments For Use in Receiving BankSatish BatchaNo ratings yet

- Challanitns 280Document1 pageChallanitns 280saritabh05No ratings yet

- Challan - 281Document1 pageChallan - 281Kelly WilliamsNo ratings yet

- Challanitns 280Document2 pagesChallanitns 280VENKATALAKSHMINo ratings yet

- Form 281 Candeur Constructions - 92bDocument1 pageForm 281 Candeur Constructions - 92bReddeppa Reddy BisaigariNo ratings yet

- Ganapati TDS ChalanDocument3 pagesGanapati TDS ChalanPruthiv RajNo ratings yet

- T.D.S. / T.C.S. Tax Challan: To Any Person or Web Site For Publication or For Commercial or Any Other UseDocument10 pagesT.D.S. / T.C.S. Tax Challan: To Any Person or Web Site For Publication or For Commercial or Any Other UseHARDEEPTHAPARNo ratings yet

- Tds/Tcs Tax Challan: AADP12345KDocument3 pagesTds/Tcs Tax Challan: AADP12345KC.A. Ankit JainNo ratings yet

- Tds Challan 281 Nov'2021Document6 pagesTds Challan 281 Nov'2021tojendra laltenNo ratings yet

- ChallanDocument1 pageChallanYash KavteNo ratings yet

- ImportantDocument1 pageImportantWilliam SureshNo ratings yet

- Challan No./ ITNS 282: Tax Applicable (Tick One)Document2 pagesChallan No./ ITNS 282: Tax Applicable (Tick One)satishkumar.mandora.smNo ratings yet

- Single (Copy To Be Sent The ZAO)Document1 pageSingle (Copy To Be Sent The ZAO)James GonzalezNo ratings yet

- T.D.S. / Tcs Tax Challan: Zero Zero One Two Seven OneDocument5 pagesT.D.S. / Tcs Tax Challan: Zero Zero One Two Seven OneSachin KumarNo ratings yet

- Ganraj ConstructionDocument2 pagesGanraj ConstructionSUNIL GAIKWADNo ratings yet

- Ashima Kalra 194 CDocument1 pageAshima Kalra 194 CSudhanshu JaiswalNo ratings yet

- D D MM Y Y Yy: (Separate Forms Need To Be Filled For Each Tax Type)Document3 pagesD D MM Y Y Yy: (Separate Forms Need To Be Filled For Each Tax Type)nikhil kumarNo ratings yet

- Challan 280Document1 pageChallan 280Jayesh BajpaiNo ratings yet

- AQSPS8791C: 1, Pithampur, PITHAMPUR, MADHYA PRADESH-454001Document1 pageAQSPS8791C: 1, Pithampur, PITHAMPUR, MADHYA PRADESH-454001pavanNo ratings yet

- Itns 285Document2 pagesItns 285Anurag SharmaNo ratings yet

- GST FormatDocument3 pagesGST FormatAnmol GoyalNo ratings yet

- 1form 16 Novopay PDFDocument2 pages1form 16 Novopay PDFTirupathi Rao TellaputtaNo ratings yet

- Draft Challan IchhaDocument1 pageDraft Challan IchhaSneha SharmaNo ratings yet

- Income Tax Department E-Filing Anyhere Antrne: 95XXXXXX93 4502) 89193)Document1 pageIncome Tax Department E-Filing Anyhere Antrne: 95XXXXXX93 4502) 89193)DilleshNo ratings yet

- Tds Challan 281 Excel FormatDocument459 pagesTds Challan 281 Excel FormatSaravana Kumar0% (1)

- SA Tax Challan KharnareDocument1 pageSA Tax Challan KharnareCorman LimitedNo ratings yet

- PrintTDSChallan (281) 2020-2021 PDFDocument1 pagePrintTDSChallan (281) 2020-2021 PDFAmeyNo ratings yet

- Form No. 16A: From ToDocument2 pagesForm No. 16A: From ToRajesh AntonyNo ratings yet

- (0021) Non Company Deductees BPLJ01048F: T.D.S./T.C.S. Tax Challan Challan No./ ITNS 281 2021-22 BPLJ01048FDocument1 page(0021) Non Company Deductees BPLJ01048F: T.D.S./T.C.S. Tax Challan Challan No./ ITNS 281 2021-22 BPLJ01048FAngad MundraNo ratings yet

- Sri Ram SilksDocument1 pageSri Ram SilksMathanagopal KNo ratings yet

- T.D.S. / Tcs Tax Challan: DD MM YyDocument1 pageT.D.S. / Tcs Tax Challan: DD MM Yyar8ku9sh0aNo ratings yet

- TRACES Annual Tax StatementDocument1 pageTRACES Annual Tax StatementabhitesplNo ratings yet

- (0021) Non Company Deductees A: T.D.S./T.C.S. Tax ChallanDocument3 pages(0021) Non Company Deductees A: T.D.S./T.C.S. Tax ChallanRambabuNo ratings yet

- 1form 16 Novopay PDFDocument2 pages1form 16 Novopay PDFTirupathi Rao TellaputtaNo ratings yet

- Tax Payment Challan 280Document2 pagesTax Payment Challan 280analystbankNo ratings yet

- Itax Form 2006Document4 pagesItax Form 2006AliMuzaffarNo ratings yet

- Challan No. ITNS 280: Tax Applicable Assessment YearDocument1 pageChallan No. ITNS 280: Tax Applicable Assessment YearNalini SenthilkumarNo ratings yet

- Challan Advance TaxDocument1 pageChallan Advance Taxamit22505No ratings yet

- HSRPM9590K Q3 2023-24Document3 pagesHSRPM9590K Q3 2023-24jishna mathewNo ratings yet

- Form 16 ADocument2 pagesForm 16 AParminderSinghNo ratings yet

- Certificate of Creditable Tax Withheld at Source: (MM/DD/YYYY) (MM/DD/YYYY)Document32 pagesCertificate of Creditable Tax Withheld at Source: (MM/DD/YYYY) (MM/DD/YYYY)Sakura AvhrynNo ratings yet

- Advance Tax (100) Surtax (102) Self Assessment Tax (300) Tax On Distributed Profits of Domestic Companies (106) Tax On Regular Assessment (400) Tax On Distributed Income To Unit HoldersDocument1 pageAdvance Tax (100) Surtax (102) Self Assessment Tax (300) Tax On Distributed Profits of Domestic Companies (106) Tax On Regular Assessment (400) Tax On Distributed Income To Unit HoldersAnujaNo ratings yet

- LoanApplication 23660000180829Document12 pagesLoanApplication 23660000180829vijaybhaskar damireddyNo ratings yet

- Chuẩn mực - YODocument35 pagesChuẩn mực - YOGiang Thái HươngNo ratings yet

- Loan Cheat Sheet by Jocelyn PredovichDocument1 pageLoan Cheat Sheet by Jocelyn PredovichJocelyn Javernick PredovichNo ratings yet

- Securities Market Question Paper 3Document18 pagesSecurities Market Question Paper 3studysks2324No ratings yet

- BGP-620: International Macroeconomics Syllabus, Spring 2018Document8 pagesBGP-620: International Macroeconomics Syllabus, Spring 2018italos1977No ratings yet

- AFC 2012 Sem 1Document8 pagesAFC 2012 Sem 1Ollie WattsNo ratings yet

- Chap 013Document102 pagesChap 013limed1No ratings yet

- Configuration Steps of Bank Account in S4 HANADocument2 pagesConfiguration Steps of Bank Account in S4 HANApermendra.kumarficoNo ratings yet

- Ics Exams 2013 Questions SFDocument2 pagesIcs Exams 2013 Questions SFDeepak Shori100% (1)

- Lecture 5 - 2023 PDFDocument52 pagesLecture 5 - 2023 PDFpim bakenNo ratings yet

- Banking LawDocument3 pagesBanking LawtrizahNo ratings yet

- Accounting For Partnerships-4Document21 pagesAccounting For Partnerships-4DangCongKhoiNo ratings yet

- Financial Statement Analysis Zoom Session 3Document7 pagesFinancial Statement Analysis Zoom Session 3MANSOOR AHMEDNo ratings yet

- Ratio AnalysisDocument11 pagesRatio Analysisbhatriyan606No ratings yet

- Current Liabilities ManagementDocument7 pagesCurrent Liabilities ManagementJack Herer100% (1)

- Nil Q &a 1987 - 2017Document38 pagesNil Q &a 1987 - 2017Ma FajardoNo ratings yet

- Cfa 2009 Level 3 - Exam Mock PM ErrataDocument2 pagesCfa 2009 Level 3 - Exam Mock PM ErratabunnyblasterNo ratings yet

- Notes ReceivableDocument3 pagesNotes Receivablepcdesktop.brarNo ratings yet

- 2GO: H1 ResultsDocument99 pages2GO: H1 ResultsBusinessWorld100% (1)

- Chapter 2 Bus FinDocument19 pagesChapter 2 Bus FinMickaella DukaNo ratings yet

- Gild MITC Visa Platinum Doc Updated 13may2022 FinalDocument9 pagesGild MITC Visa Platinum Doc Updated 13may2022 FinalravindraiNo ratings yet

- Caef Anubhav MishraDocument41 pagesCaef Anubhav Mishramessisingh1706No ratings yet

- Sukanya Samriddhi Calculator VariableDocument38 pagesSukanya Samriddhi Calculator VariablehotalamNo ratings yet

- Qualitative Methods Quantitativ e Methods: DefinitionDocument11 pagesQualitative Methods Quantitativ e Methods: Definitionvinay dugar100% (1)

- Bonds and Their ValuationDocument50 pagesBonds and Their ValuationhumaidjafriNo ratings yet

- Taxguru - In-Exemption Under Section 54 54EC Amp 54F - FAQs Amp Case LawsDocument9 pagesTaxguru - In-Exemption Under Section 54 54EC Amp 54F - FAQs Amp Case LawsSanketh T MeriNo ratings yet