Professional Documents

Culture Documents

Aafr Ias 36 Icap Past Papers With Solution

Aafr Ias 36 Icap Past Papers With Solution

Uploaded by

Tsegay ArayaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Aafr Ias 36 Icap Past Papers With Solution

Aafr Ias 36 Icap Past Papers With Solution

Uploaded by

Tsegay ArayaCopyright:

Available Formats

IAS-36 IMPAIRMENT LOSS ICAP PAST PAPERS WITH SOLUTION

Question 1 (D-19)

Krona Limited (KL) produces various nutrition products through its three production facilities

located at Karachi, Lahore and Peshawar. Each facility is considered as a separate cash-generating

unit (CGU).

In May 2019, several contamination cases of KL's products were reported on social media as well as

on TV channels. The adverse publicity badly affected all the products and consequently their sales

were reduced significantly. Therefore, KL conducted impairment test of all CGUs as on 30 June

2019, though KL does not have any intention to sell any CGU in near future.

Following information was made available on 30 June 2019: Assets of CGUs:

Particulars Karachi Lahore Peshawar

------------Rs In Millions------

Carrying Amount before impairment 160 100 125

Value in Use 155 115 164

Fair Value less CTS 152 110 169

Remaining useful life

Average in years 10 8 6

Corporate Assets:

Particulars Carrying amount before Remaining average

impairment useful life

Head office Assets 84 15

Product Development Centre 26 5

The operations are conducted from the head office. Product development centre supports Karachi

and Lahore facilities only.

Required:

Compute carrying amounts of each CGU and corporate asset after incorporating impairment losses

under the following independent situations:

PREPARED BY FAHAD IRFAN 1

IAS-36 IMPAIRMENT LOSS ICAP PAST PAPERS WITH SOLUTION

Question 2 (D-17)

The following details relate to a cash generating unit (CGU) of Khyber Ltd. (KL) as at 30 June 2017:

Carrying value Fair value less cost to sell

---------- Rs. in million ----------

Building (revaluation model)* 22 21.7

Machinery (cost model) 15 16

Equipment (cost model) 19 No measureable

License (cost model) 20 18

Investment property (fair value model) 22 22

Investment property (cost model) 8 Not measureable

Goodwill 3 Not measureable

Inventory at NRV 8 8

*Balance of surplus on revaluation of building as on 30 June 2017 amounted to Rs. 3 million.

Value in use and fair value less cost to sell of the CGU at 30 June 2017 were Rs. 100 million and Rs.

95 million respectively.

Required:

Compute the amount of impairment and allocate it to individual assets. Also calculate the amount to be

charged to profit or loss account for the year ended 30 June 2017. There has been a significant decline in

budgeted net cash flows of the CGU.

PREPARED BY FAHAD IRFAN 2

IAS-36 IMPAIRMENT LOSS ICAP PAST PAPERS WITH SOLUTION

Question 3 (D-16)

On 1 July 2013, GYO Movers Limited (GML) acquired a business engaged in providing

transportation service and recognized goodwill of Rs. 10 million. The business operates three

different bus routes namely Green, Yellow and Orange. The business had been running

exceptionally well. However, during the year ended 30 June 2016 entrance of new competitors has

affected its performance.

GML considers each route as a separate Cash-Generating Unit (CGU). As on 30 June 2016, following

information is available in respect of each CGU:

Green Yellow Orange

Number of buses* 80 50 40

Expected remaining useful life (in 20 15 10

years)

-------------------- Rs. in million --------------------

Carrying amount of buses 225 150 95

Other assets - carrying value 400 350 100

- fair value Not Available

Fair values less cost to sell of the CGU 500 450 250

Expected net cash flows per annum 70 60 50

*Assume that all buses are of same make and model.

Carrying amount of corporate assets used interchangeably by all segments are as follows:

Particulars Carrying amount Fair value

---------- Rs. in million ----------

Head office building 100 Not available

Computer network 55 46

Equipment 45 60

For impairment testing of each CGU, following quotations were obtained from three different

showrooms located in different cities.

Particulars Showroom-1 Showroom-2 Showroom-3

---------- Rs. in million ----------

Average sale price for each bus 2.52 2.62 2.50

Estimated transaction cost for disposal of 0.05 0.20 0.10

each bus

Pre-tax discount rate of GML is 12%.

Required:

Prepare relevant extracts from the statement of financial position as at 30 June 2016 in accordance with

International Financial Reporting Standards.

PREPARED BY FAHAD IRFAN 3

IAS-36 IMPAIRMENT LOSS ICAP PAST PAPERS WITH SOLUTION

Question 4 (D-15)

Beta Foods Limited (BFL) is in process of finalizing its consolidated financial statements for the year

ended 30 June 2015. Following information pertains to BFL’s intangible assets.

(i) Value of intangible assets as at 30 June 2013:

Goodwill Patents

Rs. in million

Cost 1,500 400

Accumulated amortization / impairment 300 160

(ii) On 1 July 2013, BFL acquired the entire shareholdings of Gamma Enterprises (GE) for Rs. 5,400

million. The value of patents, development expenditure and other net assets of GE on the date of

acquisition was Rs. 2,100 million, Rs. 48 million and Rs. 1,430 million respectively.

The break-up of development expenditure was as follows:

Products Rs. in million

A – 214 25

B – 917 23

Total 48

(iii) Research and development expenditure during the year ended 30 June 2014 and 2015 was as

follows:

Year Product Name Research Development

Rs. in million

2014 A – 214* --- 08

B – 917 10 45

2015 B – 917 --- 50

*because of certain reasons the management had decided to abandon this project in May 2014.

(iv) Trial production of B-917 commenced in March 2015. Net cost of trial production up to 30 June

2015 amounted to Rs. 22 million.

(v) Patents are amortized over their remaining useful life of 10 years on straight line method.

(vi) Recoverable amounts of assets having indefinite life, determined as a result of impairment

testing, were as follows:

2015 2014

Rs. in million

Goodwill 2,800 2,550

Product B – 917 160 65

Required:

Prepare a note on intangible assets, for inclusion in BFL’s consolidated financial statements for the year

ended 30 June 2015 in accordance with the requirements of International Financial Reporting Standards.

PREPARED BY FAHAD IRFAN 4

IAS-36 IMPAIRMENT LOSS ICAP PAST PAPERS WITH SOLUTION

Question 5 (D-12)

On 1 July 2011, PL acquired 20% shares of Goose Limited (GL), a listed company, when GL’s

retained earnings stood at Rs. 250 million and the fair value of its net assets was Rs. 350 million.

The purchase consideration was two million ordinary shares of PL whose market value on the date

of purchase was Rs. 33 per share. PL is in a position to exercise significant influence in finalizing the

financial and operational policies of GL.

The summarized statement of financial position of GL at 30 June 2012 was as follows:

Rs. in million

Share capital (Rs. 10 each) 100

Retained earnings 280

380

Net assets 380

Recoverable amount of GL’s net assets at 30 June 2012 was Rs. 370 million.

Question 6 (S-11)

On April 1, 2006 Kahkashan Limited had acquired a plant at a cost of Rs. 30 million. The useful life of the

plant was estimated at 15 years and it is being depreciated under the straight-line method. On October

1, 2010 the plant suffered physical damage but is still working. A valuation was carried out to determine

the impairment loss. The following information is available from the valuer’s report received on April 5,

2011:

Value in use Rs. 16 million

Selling price, net of costs to sell Rs. 12 million

Estimated remaining useful life as of October 1, 2010 5 years

Depreciation for the year ended March 31, 2011 has been accounted for without considering the

impact of the valuer’s report.

Required:

Prepare a relevant extract of statement of comprehensive income for the year ended March 31, 2011 in

accordance with International Financial Reporting Standards.

PREPARED BY FAHAD IRFAN 5

IAS-36 IMPAIRMENT LOSS ICAP PAST PAPERS WITH SOLUTION

Question 7 (S-09)

On January 1, 2008, Misbah Holding Limited, dealing in textile goods, acquired 90% ownership

interest in Salman Limited (SL), a ginning company, against cash payment of Rs. 450 million. At that

date, SL’s net identifiable assets had a book value of Rs. 350 million and fair value of Rs. 400 million.

It is the policy of the company to measure the non-controlling interest at their proportionate share

of SL’s net identifiable assets. During the year ended December 31, 2008, SL incurred a net loss of

Rs. 150 million. The impairment testing exercise carried out at the end of the year, by a firm of

consultants, showed that the recoverable amount of SL’s business is Rs. 200 million. However, the

Board of Directors is inclined to take a second opinion as they estimate that the recoverable amount

is Rs. 390 million.

Required:

Based on each of the two valuations, compute the amounts to be reported in the consolidated

statement of financial position as of December 31, 2008 in respect of:

1. Goodwill;

2. Net identifiable assets, and

3. Non-controlling interest

PREPARED BY FAHAD IRFAN 6

IAS-36 IMPAIRMENT LOSS ICAP PAST PAPERS WITH SOLUTION

Solution 1

PREPARED BY FAHAD IRFAN 7

IAS-36 IMPAIRMENT LOSS ICAP PAST PAPERS WITH SOLUTION

In (a)(ii) above, due to non-availability of reasonable basis for allocation of corporate assets,

impairment has been assessed on overall basis. This results in lesser loss in this situation.

Peshawar CGU is not impaired and its recoverable amount is more that the carrying value by Rs. 24

million. So on overall impairment assessment, the excess of Rs. 24 million resulted in lesser

impairment loss.

PREPARED BY FAHAD IRFAN 8

IAS-36 IMPAIRMENT LOSS ICAP PAST PAPERS WITH SOLUTION

Solution 2

PREPARED BY FAHAD IRFAN 9

IAS-36 IMPAIRMENT LOSS ICAP PAST PAPERS WITH SOLUTION

Solution 3

PREPARED BY FAHAD IRFAN 10

IAS-36 IMPAIRMENT LOSS ICAP PAST PAPERS WITH SOLUTION

Solution 4

Solution 5

Rs in Million

Consideration 66

FV of NA acquired 70

Bargain Purchase Gain 4

Change in NA 6

Consideration 66

Net Assets 76

74

Recoverable Amount

Imp loss (2)

PREPARED BY FAHAD IRFAN 11

IAS-36 IMPAIRMENT LOSS ICAP PAST PAPERS WITH SOLUTION

Solution 6

Solution 7

PREPARED BY FAHAD IRFAN 12

IAS-36 IMPAIRMENT LOSS ICAP PAST PAPERS WITH SOLUTION

PREPARED BY FAHAD IRFAN 13

You might also like

- Gmap Revised Global Management Accounting PrinciplesDocument84 pagesGmap Revised Global Management Accounting PrinciplesSANG HOANG THANHNo ratings yet

- Detailed Lesson Plan in English IV - COMPOUND SENTENCEDocument12 pagesDetailed Lesson Plan in English IV - COMPOUND SENTENCEMadhie Gre Dela Provi94% (16)

- FR QM - Section B PDFDocument74 pagesFR QM - Section B PDFRishi KumaarNo ratings yet

- Blood Sorcery Rites of Damnation Spell Casting SummaryDocument3 pagesBlood Sorcery Rites of Damnation Spell Casting SummaryZiggurathNo ratings yet

- 4 Digital Signal Processing in Simulink 2007 PDFDocument58 pages4 Digital Signal Processing in Simulink 2007 PDFhananel_forosNo ratings yet

- Aafr Ifrs 5 Icap Past Papers With SolutionDocument8 pagesAafr Ifrs 5 Icap Past Papers With SolutionTsegay ArayaNo ratings yet

- PM Book - FinalDocument372 pagesPM Book - FinalThu Hà Phan ThịNo ratings yet

- Paper - 8: Cost Accounting Bit QuestionsDocument56 pagesPaper - 8: Cost Accounting Bit Questionslaale dijaanNo ratings yet

- CMA MCQ MergedDocument224 pagesCMA MCQ Mergedsaikat karmakarNo ratings yet

- SFM Theory Booklet PDFDocument132 pagesSFM Theory Booklet PDFManoj VenkatNo ratings yet

- Commercial & Industrial Laws: Nobbodoy PublicationDocument84 pagesCommercial & Industrial Laws: Nobbodoy PublicationRasel UddinNo ratings yet

- CIMA Revision Notes - BA2Document255 pagesCIMA Revision Notes - BA2Clint NarsiNo ratings yet

- CAF09 QB 2017 Revised PDFDocument203 pagesCAF09 QB 2017 Revised PDFAsad ZahidNo ratings yet

- 2019 - Afc-3 QM PDFDocument472 pages2019 - Afc-3 QM PDFM HASSAN SHAKILNo ratings yet

- Business Technology and Finance 2020 Question Bank For Vietnam Da Mo KhoaDocument169 pagesBusiness Technology and Finance 2020 Question Bank For Vietnam Da Mo Khoak20b.lehoangvuNo ratings yet

- P2 September 2014 PaperDocument20 pagesP2 September 2014 PaperAshraf ValappilNo ratings yet

- Assurance 1Document247 pagesAssurance 1phuongthaosally10xNo ratings yet

- Caf 3Document187 pagesCaf 3Shaheryar ShahidNo ratings yet

- PRC 2 QM 2022 - 220310 - 204809Document420 pagesPRC 2 QM 2022 - 220310 - 204809Innovation RoomNo ratings yet

- Business & Finance PDFDocument63 pagesBusiness & Finance PDFpronab sarkerNo ratings yet

- Way To Bhutan Via Siliguri From BangladeshDocument17 pagesWay To Bhutan Via Siliguri From Bangladeshrajeshaisdu009No ratings yet

- C02 Sample Questions Feb 2013Document20 pagesC02 Sample Questions Feb 2013Elizabeth Fernandez100% (1)

- Adv Accounts Icai FullDocument890 pagesAdv Accounts Icai Fullnsaiakshaya16No ratings yet

- Management Accounting: Pilot Paper From December 2011 OnwardsDocument23 pagesManagement Accounting: Pilot Paper From December 2011 OnwardsTaskin Reza KhalidNo ratings yet

- HSC Ev Higher Mathematics 1st Paper 3rd Chapter Note PDFDocument19 pagesHSC Ev Higher Mathematics 1st Paper 3rd Chapter Note PDFUdit kumarNo ratings yet

- QMS - Question Bank - 2013Document99 pagesQMS - Question Bank - 2013Syed Haseeb Naqvi0% (1)

- Essentials of Corporate Financial Management 2ndDocument99 pagesEssentials of Corporate Financial Management 2ndcharlisyuenNo ratings yet

- Ias 16Document3 pagesIas 16CandyNo ratings yet

- SL 1 Advanced Business ReportingDocument300 pagesSL 1 Advanced Business Reportingsanu sayed100% (1)

- CA Admit Card May-19Document15 pagesCA Admit Card May-19NEERNo ratings yet

- Exam Form (Application Stage)Document5 pagesExam Form (Application Stage)Akash79No ratings yet

- Dynamics Practice Sheet (FRB)Document10 pagesDynamics Practice Sheet (FRB)abidrhymeNo ratings yet

- Tareq Ahmed (Faisal) M.J.Abedin & CoDocument49 pagesTareq Ahmed (Faisal) M.J.Abedin & Cotusher pepolNo ratings yet

- f8 RQB 15 Sample PDFDocument98 pagesf8 RQB 15 Sample PDFChandni VariaNo ratings yet

- Cost Behavior and Cost-Volume RelationshipsDocument75 pagesCost Behavior and Cost-Volume RelationshipsRahul112012No ratings yet

- CAF - 02 - Economics - Study - Notes - and - MCQs-1 2 PDFDocument198 pagesCAF - 02 - Economics - Study - Notes - and - MCQs-1 2 PDFShaheryar ShahidNo ratings yet

- Accounts GRP 1 BitsDocument40 pagesAccounts GRP 1 BitskalyanikamineniNo ratings yet

- Objective Questions PDFDocument118 pagesObjective Questions PDFFahad Khan TareenNo ratings yet

- Management Level Exam Blueprints 2023 2024 Final For WebDocument29 pagesManagement Level Exam Blueprints 2023 2024 Final For WebSANG HOANG THANHNo ratings yet

- 1.7advanced Audit and AssuranceDocument276 pages1.7advanced Audit and AssuranceAhmad Ali AyubNo ratings yet

- Financial Accounting & Reporting 1Document232 pagesFinancial Accounting & Reporting 1Its Ahmed100% (1)

- Management AccountingDocument306 pagesManagement Accountinggordonomond2022100% (2)

- Cima Ba1 2020Document138 pagesCima Ba1 2020Clint NarsiNo ratings yet

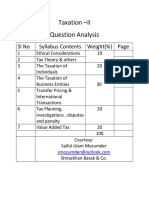

- Question Analysis ICAB Application Level TAXATION-II (Syllabus Weight Based)Document68 pagesQuestion Analysis ICAB Application Level TAXATION-II (Syllabus Weight Based)Optimal Management SolutionNo ratings yet

- Business and Commercial Law by Prashanta & RajibDocument46 pagesBusiness and Commercial Law by Prashanta & RajibIQBALNo ratings yet

- Assurance (A Combination Between Manual & Suggested Answers Upto May-June '2019) PDFDocument110 pagesAssurance (A Combination Between Manual & Suggested Answers Upto May-June '2019) PDFS M Tanjilur RahmanNo ratings yet

- Syllabus of Knowledge Level For ICABDocument24 pagesSyllabus of Knowledge Level For ICABhridimamalik100% (2)

- Phy. 1st Paper For FRB 2023Document32 pagesPhy. 1st Paper For FRB 2023Ibne TarifNo ratings yet

- Cfap 2 2021 PKDocument288 pagesCfap 2 2021 PKMaham FatimaNo ratings yet

- ACCA FIA - Accountant in Business (AB) - Teaching Slides - 2019Document1,007 pagesACCA FIA - Accountant in Business (AB) - Teaching Slides - 2019Vimala RavishankarNo ratings yet

- Cost & Management AccountingDocument181 pagesCost & Management AccountingBikash Kumar Nayak100% (1)

- Paper - 9: The Institute of Cost Accountants of IndiaDocument44 pagesPaper - 9: The Institute of Cost Accountants of IndiaTasneemaWaquarNo ratings yet

- Chapter - 1: Concept of and For Assurance. Q. What Is Assurance?Document51 pagesChapter - 1: Concept of and For Assurance. Q. What Is Assurance?IQBALNo ratings yet

- Accounting Chapter 2 MCQ by Nobel Professional AcademyDocument16 pagesAccounting Chapter 2 MCQ by Nobel Professional AcademytafsirmhinNo ratings yet

- Icag New Syllabus 2024Document98 pagesIcag New Syllabus 2024ekadanu CAGL100% (1)

- Cfap 4 PKDocument300 pagesCfap 4 PKmuhammad osamaNo ratings yet

- Cima C01 Samplequestions Mar2013Document28 pagesCima C01 Samplequestions Mar2013Abhiroop Roy100% (1)

- Pages From BPP CIMA C1 COURSE NOTE 2012 New SyllabusDocument50 pagesPages From BPP CIMA C1 COURSE NOTE 2012 New Syllabusadad9988100% (1)

- Ex-8 MAH Corporate AssetsDocument1 pageEx-8 MAH Corporate AssetsSyed SalmanNo ratings yet

- Chap 4 - IAS 36 (Questions)Document4 pagesChap 4 - IAS 36 (Questions)Kamoke LibraryNo ratings yet

- Advanced Accounting and Financial ReportingDocument5 pagesAdvanced Accounting and Financial ReportingRamzan AliNo ratings yet

- Financial Accounting and Reporting-IIDocument7 pagesFinancial Accounting and Reporting-IIRochak ShresthaNo ratings yet

- ACCA - F7 Financial Reporting Mock Exam December 2009Document7 pagesACCA - F7 Financial Reporting Mock Exam December 2009ACCALIVE100% (2)

- Investment PropertyDocument16 pagesInvestment PropertyTsegay ArayaNo ratings yet

- Aafr Ifrs 5 Icap Past Papers With SolutionDocument8 pagesAafr Ifrs 5 Icap Past Papers With SolutionTsegay ArayaNo ratings yet

- Ethiopia - Capital Markets Proclamation-Zero Draft For CommentsDocument63 pagesEthiopia - Capital Markets Proclamation-Zero Draft For CommentsTsegay ArayaNo ratings yet

- IAS 37 Provisions, Contingent Liabilities and Contingent AssetsDocument33 pagesIAS 37 Provisions, Contingent Liabilities and Contingent AssetsTsegay ArayaNo ratings yet

- Aafr Ias 19 Icap Past Papers With SolutionDocument12 pagesAafr Ias 19 Icap Past Papers With SolutionTsegay ArayaNo ratings yet

- FM One - Ch2Document15 pagesFM One - Ch2Tsegay ArayaNo ratings yet

- Aafr Ias 12 Icap Past Paper With SolutionDocument16 pagesAafr Ias 12 Icap Past Paper With SolutionTsegay ArayaNo ratings yet

- Chapter One: Overview of Managerial FinanceDocument7 pagesChapter One: Overview of Managerial FinanceTsegay ArayaNo ratings yet

- Chapter Three: Documenting Accounting Information SystemsDocument20 pagesChapter Three: Documenting Accounting Information SystemsTsegay ArayaNo ratings yet

- Chapter Four: Entity-Relationship (E-R) Diagrams and Relational Database For AISDocument35 pagesChapter Four: Entity-Relationship (E-R) Diagrams and Relational Database For AISTsegay ArayaNo ratings yet

- CH 1& 2 AisDocument69 pagesCH 1& 2 AisTsegay ArayaNo ratings yet

- Title: Relationship Between PH and Chemiluminescence of Luminol Author: Rolando Efraín Hernández RamírezDocument2 pagesTitle: Relationship Between PH and Chemiluminescence of Luminol Author: Rolando Efraín Hernández RamírezEfraínNo ratings yet

- MAD Practical 6Document15 pagesMAD Practical 6DIVYESH PATELNo ratings yet

- ManualeDelphi IngleseDocument86 pagesManualeDelphi IngleseoxooxooxoNo ratings yet

- SBAS35029500001ENED002Document20 pagesSBAS35029500001ENED002unklekoNo ratings yet

- Prayerbooklet 1st-EditionDocument16 pagesPrayerbooklet 1st-EditionRexelle Jane ManalaysayNo ratings yet

- Emmanuel Levinas - God, Death, and TimeDocument308 pagesEmmanuel Levinas - God, Death, and Timeissamagician100% (3)

- Simulation and ModulationDocument89 pagesSimulation and ModulationGuruKPO67% (6)

- Biogas ProductionDocument7 pagesBiogas ProductionFagbohungbe MichaelNo ratings yet

- Cognizant Test 1Document20 pagesCognizant Test 1Veeraragavan SubramaniamNo ratings yet

- Andrea Kaneb - Group - 15Document4 pagesAndrea Kaneb - Group - 15Sibi KrishnaNo ratings yet

- Rikki Tikki Tavi Story Lesson PlanDocument3 pagesRikki Tikki Tavi Story Lesson Planapi-248341220No ratings yet

- Optimizing The Lasing Quality of Diode Lasers by Anti-Reflective CoatingDocument21 pagesOptimizing The Lasing Quality of Diode Lasers by Anti-Reflective CoatingDannyNo ratings yet

- Muhammad Fauzi-855677765-Fizz Hotel Lombok-HOTEL - STANDALONEDocument1 pageMuhammad Fauzi-855677765-Fizz Hotel Lombok-HOTEL - STANDALONEMuhammad Fauzi AndriansyahNo ratings yet

- Jackson - Chimu Sculptures of Huaca TaycanamoDocument27 pagesJackson - Chimu Sculptures of Huaca TaycanamoJose David Nuñez UrviolaNo ratings yet

- Understanding Organizational Behavior: de Castro, Donna Amor Decretales, Thea Marie Estimo, Adrian Maca-Alin, SaharaDocument41 pagesUnderstanding Organizational Behavior: de Castro, Donna Amor Decretales, Thea Marie Estimo, Adrian Maca-Alin, SaharaAnna Marie RevisadoNo ratings yet

- 3M CorporationDocument3 pages3M CorporationIndoxfeeds GramNo ratings yet

- Summary 2Document2 pagesSummary 2Admin OfficeNo ratings yet

- Electro-Chemiluminescence Immunoassay (ECLIA) For The Quantitative Determination of CA 15-3 in Human Serum and PlasmaDocument2 pagesElectro-Chemiluminescence Immunoassay (ECLIA) For The Quantitative Determination of CA 15-3 in Human Serum and PlasmayantuNo ratings yet

- IIA IPPF PG - Quality Assurance and Improvement Program March 2012Document29 pagesIIA IPPF PG - Quality Assurance and Improvement Program March 2012Denilson MadaugyNo ratings yet

- Iridium Satellite System (Iss) : Wireless CommunicationDocument11 pagesIridium Satellite System (Iss) : Wireless CommunicationSmrithi K MNo ratings yet

- 11a - Advanced - Turkish Grammar - NotesDocument79 pages11a - Advanced - Turkish Grammar - Notesfardousa ibNo ratings yet

- Ovarian Cancer ThesisDocument8 pagesOvarian Cancer ThesisDon Dooley100% (1)

- MalappuramDocument20 pagesMalappuramFayizNo ratings yet

- Fs Tco Battery Diesel Delivery Trucks Jun2022Document3 pagesFs Tco Battery Diesel Delivery Trucks Jun2022The International Council on Clean TransportationNo ratings yet

- Blue Yellow Playful Illustration Self Care Infographic PosterDocument7 pagesBlue Yellow Playful Illustration Self Care Infographic PosterAin NurasyikinNo ratings yet

- $50SAT - Eagle2 - Communications - Release Version V1 - 2Document25 pages$50SAT - Eagle2 - Communications - Release Version V1 - 2Usman ShehryarNo ratings yet