Professional Documents

Culture Documents

Transaction Statement1656568636

Transaction Statement1656568636

Uploaded by

Gulzar Ali QadriOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Transaction Statement1656568636

Transaction Statement1656568636

Uploaded by

Gulzar Ali QadriCopyright:

Available Formats

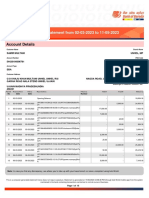

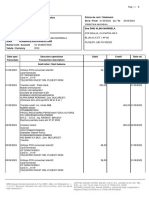

CENTRAL RECORDKEEPING AGENCY

Transaction Statement-ATAL PENSION YOJANA (APY) for the period of:01-Apr-2021 to 31-Mar-2022

Subscriber Details

PRAN : 500574453887 Statement Date : Jun 30, 2022 11:27 AM

Name : SHRI GULJAHAR ALI PRAN Generation

: 04-Sep-2021

Date

: - - DUDHANDA - DUDHANDA TUNGAIL BILPARA

Date Of Birth : 10-Feb-1998

ISLAMPUR (UTTAR DINAJPUR)

WEST BENGAL733129 Saving Bank A/C No. : 20391322794

INDIA

APY-SP Bank Reg. APY-SP Bank Branch

IRA Status : IRA compliant : 7002015 : NPS143395C

no. Reg. No.

Mobile Number : 6296822303 APY-SP Bank Name : STATE BANK OF INDIA APY-SP Bank Branch : SBI-MADANPUR, UTTAR

Name DINAJPUR 09701

Email ID : Pension Amount

: 5000

Selected

Periodicity of

: Monthly

Contribution

Spouse Name

:

AADHAAR :

Nominee Name NAYEMA FIRDOUSH Percentage 100%

The total contribution to your pension account till March 31,2022 was Rs.2226.00

The details of your Transaction are as under

Changes made during the selected period

No change affected in this period

Contribution/ Redemption Details

Contribution

Govt. Co-

Date Particulars Uploaded By Subscriber

Contribution/Overdue Total

Contribution

Charges (Rs)

(Rs)

(Rs)

01-Apr-2021 Opening balance 0.00

08-Sep-2021 By APY Contribution for SEPTEMBER 2021 STATE BANK OF INDIA (7002015), 318.00 0.00 318.00

14-Oct-2021 By APY Contribution for OCTOBER 2021 STATE BANK OF INDIA (7002015), 318.00 0.00 318.00

12-Nov-2021 By APY Contribution for NOVEMBER 2021 STATE BANK OF INDIA (7002015), 318.00 0.00 318.00

10-Dec-2021 By APY Contribution for DECEMBER 2021 STATE BANK OF INDIA (7002015), 318.00 0.00 318.00

07-Jan-2022 By APY Contribution for JANUARY 2022 STATE BANK OF INDIA (7002015), 318.00 0.00 318.00

15-Feb-2022 By APY Contribution for FEBRUARY 2022 STATE BANK OF INDIA (7002015), 318.00 0.00 318.00

10-Mar-2022 By APY Contribution for MARCH 2022 STATE BANK OF INDIA (7002015), 318.00 0.00 318.00

31-Mar-2022 Closing Balance 2,226.00

Billing Summary

Perticulars Amount

Summary of Billing during the statement period (23.57)

Government Co-contribution Details

No records found for the selected period

Notes for Transaction Statement::

1. The section 'Contribution Details' gives the details of the contributions processed in subscriber's account during the period.

The Central Government would co-contribute 50% of the total contribution or Rs.1000 per annum, whichever is lower, to each eligible subscriber for

a period of 5 years, i.e., from Financial Year 2015-16 to 2019-20, who joins APY before March 31, 2016 and who are not members of any statutory

2.

social security scheme & who are not income tax payers. This Government co-contribution is payable into subscriber's savings bank account half

yearly basis in a Financial Year once subscriber has made the entire contribution for six months.

3. The Transaction statement is dynamic. The value and other computations in the Transaction statement depend upon the generation date.

The balances and respective narrations reflecting in your account are based on the contribution amount and details uploaded by your APY bank

4. branch. In case there is no/less/excess contribution for any month or no clarity in the narration, please contact your APY Bank Branch. In case of any

discrepancy, you must contact your APY bank branch immediately.

Contribution amount is invested as per the guidelines of Government of India (upto 85% of the money will be invested in debt and government

5.

securities and upto 15% will be invested in equity).

Legends

Term Description

Under APY, the individual subscribers shall have an option to make the contribution on a monthly, quarterly, half yearly basis. Banks are required to collect additional amount for delayed

payments. The overdue interest for delayed contributions would be as shown below: Overdue interest for delayed contribution:Rs. 1 per month for contribution for every Rs. 100, or part

Overdue interest

thereof, for each delayed monthly payment. Overdue interest for delayed contribution for quarterly / half yearly mode of contribution shall be recovered accordingly. The overdue interest

amount collected will remain as part of the pension corpus of the subscriber.

You might also like

- Screen Euroclear (Grupo Comercial Noinu S.C) 10-02-2018Document24 pagesScreen Euroclear (Grupo Comercial Noinu S.C) 10-02-2018Alberto SarabiaNo ratings yet

- Foreign Currency Solutions: MR John Doe 522 Flinders ST, Melbourne Vic 3000Document6 pagesForeign Currency Solutions: MR John Doe 522 Flinders ST, Melbourne Vic 3000Dani PermanaNo ratings yet

- Almario Bsa2d At6 Fin2Document6 pagesAlmario Bsa2d At6 Fin2Tracy Camille100% (1)

- Statement of AccountDocument2 pagesStatement of AccountSoumya Ranjan Mohanty Pupun100% (1)

- CognizantDocument1 pageCognizantVaibhav GhangaleNo ratings yet

- Icici PolicyDocument2 pagesIcici Policydeepak7837No ratings yet

- Personal Loan AgreementDocument1 pagePersonal Loan AgreementLoraine Corpuz100% (2)

- Transaction Statement1676126669Document1 pageTransaction Statement1676126669Vasanth EllendulaNo ratings yet

- Transaction Statement1676376886Document2 pagesTransaction Statement1676376886mukeshpradhan675No ratings yet

- Transaction Statement1627022355Document1 pageTransaction Statement1627022355RamakantaSahooNo ratings yet

- Transaction Statement1624372022Document1 pageTransaction Statement1624372022RamakantaSahooNo ratings yet

- Transaction Statement1563132579Document1 pageTransaction Statement1563132579Vincent VNo ratings yet

- Transaction Statement1673011931Document1 pageTransaction Statement1673011931SAMIR KUMARNo ratings yet

- Transaction Statement1626153268Document2 pagesTransaction Statement1626153268Rohit PalNo ratings yet

- Welcome To Central Record Keeping Agency PDFDocument2 pagesWelcome To Central Record Keeping Agency PDFparthi janaNo ratings yet

- Transaction Statement1703726923Document2 pagesTransaction Statement1703726923dipuhansda6300No ratings yet

- Welcome To Central Record Keeping Agency 22-23Document2 pagesWelcome To Central Record Keeping Agency 22-23tsvvpkumarNo ratings yet

- Transaction Statement1698469666Document2 pagesTransaction Statement1698469666rk370666No ratings yet

- Transaction Statement1705415418Document1 pageTransaction Statement1705415418bhavanakatakam0No ratings yet

- Wa0007Document2 pagesWa0007sandhya.iyyanar1992No ratings yet

- Transaction Statement1700677173Document2 pagesTransaction Statement1700677173Madhav LungareNo ratings yet

- Transaction Statement1705397004Document2 pagesTransaction Statement1705397004sureshpatil25No ratings yet

- Welcome To Central Record Keeping Agency - PRDocument2 pagesWelcome To Central Record Keeping Agency - PRAbhishek SenguptaNo ratings yet

- Account Statement 2019-2020Document2 pagesAccount Statement 2019-2020suhasNo ratings yet

- Welcome To Central Record Keeping Agency 2019Document2 pagesWelcome To Central Record Keeping Agency 2019pratik patilNo ratings yet

- Welcome To Central Record Keeping Agency 2023Document2 pagesWelcome To Central Record Keeping Agency 2023pratik patilNo ratings yet

- VHCZDocument1 pageVHCZHARRY THE GREATNo ratings yet

- TCIDocument1 pageTCIHARRY THE GREATNo ratings yet

- Welcome To Central Record Keeping AgencyDocument2 pagesWelcome To Central Record Keeping AgencyAbhishek SenguptaNo ratings yet

- WHRBG 1224421 Payslip 02 2019 PDFDocument1 pageWHRBG 1224421 Payslip 02 2019 PDFAmit RamaniNo ratings yet

- Jajulabanda FTODocument1 pageJajulabanda FTOb9042192No ratings yet

- JPPPDocument1 pageJPPPHarmohan GaurNo ratings yet

- Renewal Notice 2825100272185801000 PDFDocument2 pagesRenewal Notice 2825100272185801000 PDFNishant PandeyNo ratings yet

- Print Muster Roll RC Behera 02Document2 pagesPrint Muster Roll RC Behera 02AYUSHNo ratings yet

- Reliance General Insurance Company Limited: "A" Policy For Act Liability Insurance (Two Wheeler) - Policy ScheduleDocument5 pagesReliance General Insurance Company Limited: "A" Policy For Act Liability Insurance (Two Wheeler) - Policy Schedulezaid AhmedNo ratings yet

- PaySlip - June 2023-1Document1 pagePaySlip - June 2023-1Ms khan KirdoliNo ratings yet

- Print Muster Roll S Badjena 02Document1 pagePrint Muster Roll S Badjena 02AYUSHNo ratings yet

- PAYROLLDocument14 pagesPAYROLLJay DeeNo ratings yet

- Acctstmt LDocument2 pagesAcctstmt LNew Age InvestmentsNo ratings yet

- EngineeringDocument25 pagesEngineeringCarl VelascoNo ratings yet

- Guru Dattraju PLWDocument12 pagesGuru Dattraju PLWkailashcfi9930No ratings yet

- Vijay Yogi SipDocument1 pageVijay Yogi SipAmit YadavNo ratings yet

- Acctstmt LDocument3 pagesAcctstmt LIshwaryaNo ratings yet

- Invoice Mobil MamaDocument2 pagesInvoice Mobil MamaYuniarto JulistiawanNo ratings yet

- Annexure KDocument1 pageAnnexure KHeet ShahNo ratings yet

- Awayon Es DPDS Template Q4 Oct 2023Document21 pagesAwayon Es DPDS Template Q4 Oct 2023Wynoaj LucaNo ratings yet

- Form Claim VoucherDocument1 pageForm Claim Voucherwong warasNo ratings yet

- Reimbursement Claim FormDocument1 pageReimbursement Claim FormPushparaj kNo ratings yet

- The Mahatma Gandhi National Rural Employment Guarantee Act: Measurement Book DetailDocument1 pageThe Mahatma Gandhi National Rural Employment Guarantee Act: Measurement Book Detailsopit96137No ratings yet

- Sbi PDFDocument5 pagesSbi PDFshweta pundirNo ratings yet

- Office of The Headmistress Government Girls High School Mir Hazar KhanDocument2 pagesOffice of The Headmistress Government Girls High School Mir Hazar KhanAmmar Bin QasimNo ratings yet

- Dpds Template 125864-OctoberDocument19 pagesDpds Template 125864-OctoberMagnus AidenNo ratings yet

- Acctstmt LDocument4 pagesAcctstmt LNew Age InvestmentsNo ratings yet

- Private Individual Others (Specify in Remarks) Others (Specify in Remarks)Document23 pagesPrivate Individual Others (Specify in Remarks) Others (Specify in Remarks)Salcedo NhsNo ratings yet

- Reliance General Insurance Company Limited: "A" Policy For Act Liability Insurance (Two Wheeler) - Policy ScheduleDocument5 pagesReliance General Insurance Company Limited: "A" Policy For Act Liability Insurance (Two Wheeler) - Policy ScheduleRoshan PatilNo ratings yet

- AxisDocument2 pagesAxisMukeshChoudharyNo ratings yet

- PDFDocument6 pagesPDFShwethaNo ratings yet

- JajulabandaDocument1 pageJajulabandab9042192No ratings yet

- Pradhan Mantri Shram-Yogi Maandhan - (PM-SYM)Document2 pagesPradhan Mantri Shram-Yogi Maandhan - (PM-SYM)Honey Ali33% (3)

- Reliance General Insurance Company Limited: "A" Policy For Act Liability Insurance (Two Wheeler) - Policy ScheduleDocument5 pagesReliance General Insurance Company Limited: "A" Policy For Act Liability Insurance (Two Wheeler) - Policy Schedulezaid AhmedNo ratings yet

- Ediga Paramesh GoudDocument10 pagesEdiga Paramesh GoudgopalNo ratings yet

- 558 /5 Sanghrajka House Adenwala Road Near Five Garden Matunga MUMBAI - 400019 Maharashtra, IndiaDocument2 pages558 /5 Sanghrajka House Adenwala Road Near Five Garden Matunga MUMBAI - 400019 Maharashtra, IndiaPankaj GuptaNo ratings yet

- Abstract: Reverse Mortgage Is A Relatively New Financial Product Which Allows Senior Citizens To Keep Their House orDocument9 pagesAbstract: Reverse Mortgage Is A Relatively New Financial Product Which Allows Senior Citizens To Keep Their House orArunabh ChoudhuryNo ratings yet

- Dịch 1Document2 pagesDịch 1Dung Phạm Hồ ThùyNo ratings yet

- Jjz411 Maths AI SL IADocument20 pagesJjz411 Maths AI SL IAJolly FrancisNo ratings yet

- Telegraphic Transfer Request Form - HSBCDocument2 pagesTelegraphic Transfer Request Form - HSBCstefan.kovar.financeNo ratings yet

- Government of Tamil Nadu: E-ChallanDocument4 pagesGovernment of Tamil Nadu: E-ChallanAravai BDONo ratings yet

- AEC - 12 - Q1 - 0401 - AK - Investments, Interest Rate, and Rental Concerns of Filipino EntrepreneursDocument6 pagesAEC - 12 - Q1 - 0401 - AK - Investments, Interest Rate, and Rental Concerns of Filipino EntrepreneursVanessa Fampula FaigaoNo ratings yet

- DSP Inc 1099-11 Print - CFMDocument1 pageDSP Inc 1099-11 Print - CFMKenneth BarcottNo ratings yet

- XXXXXXXXXX6781 - 20230615160830874376 (1) - UnlockedDocument16 pagesXXXXXXXXXX6781 - 20230615160830874376 (1) - UnlockedRajendra SharmaNo ratings yet

- Probate InventoryDocument4 pagesProbate Inventoryacer paulNo ratings yet

- Polytechnic University of The Philippines: Lopez, Quezon BranchDocument2 pagesPolytechnic University of The Philippines: Lopez, Quezon Branchacurvz20050% (2)

- Atul C56Document7 pagesAtul C56sahilyadav54405No ratings yet

- APY Chart PDFDocument1 pageAPY Chart PDFRahul TadeNo ratings yet

- Statement 2023 OctDocument2 pagesStatement 2023 Octbabyshark9030No ratings yet

- Boost Ur Credit ScoreDocument12 pagesBoost Ur Credit ScoreTamiko Gillespie100% (3)

- ACT4Document8 pagesACT4Leilah DelilahNo ratings yet

- Latihan Soal Akm 1Document2 pagesLatihan Soal Akm 1hamidah candradewiNo ratings yet

- 12.02 Constant-Growth AnnuitiesDocument8 pages12.02 Constant-Growth Annuitiesmusic niNo ratings yet

- Credit Transactions Regulatory Framework Legal Issues in Business 6Document14 pagesCredit Transactions Regulatory Framework Legal Issues in Business 6Melanie AgustinNo ratings yet

- AnnuitiesDocument8 pagesAnnuitiesNasserNo ratings yet

- L5 Liquidity Risk - 20220216Document40 pagesL5 Liquidity Risk - 20220216Marcus WongNo ratings yet

- SV90483973000 2023 09Document9 pagesSV90483973000 2023 09Alina DinuNo ratings yet

- MR - Rinku Tyagi Visit Dial Your Bank: Page 1 of 3 M-76543125-1Document3 pagesMR - Rinku Tyagi Visit Dial Your Bank: Page 1 of 3 M-76543125-1Rinku TyagiNo ratings yet

- 21 Jan 2023Document2 pages21 Jan 2023Malaika GcoboNo ratings yet

- 11-12-2023 (Al Nafie Steel-50% Balance Material 1335)Document1 page11-12-2023 (Al Nafie Steel-50% Balance Material 1335)Ghulam Murtaza Liaqat AliNo ratings yet

- SatuzaDocument2 pagesSatuzaÇınar 33No ratings yet

- கூட்டுறவு கடன் மற்றும் வங்கியல்Document104 pagesகூட்டுறவு கடன் மற்றும் வங்கியல்GC2343 eSevai MaiyamNo ratings yet