Professional Documents

Culture Documents

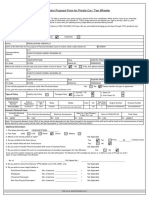

Car Shield - Private Car Package Policy Proposal Form: IMPORTANT (All Fields Are Mandatory)

Car Shield - Private Car Package Policy Proposal Form: IMPORTANT (All Fields Are Mandatory)

Uploaded by

rampa 78Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Car Shield - Private Car Package Policy Proposal Form: IMPORTANT (All Fields Are Mandatory)

Car Shield - Private Car Package Policy Proposal Form: IMPORTANT (All Fields Are Mandatory)

Uploaded by

rampa 78Copyright:

Available Formats

CAR SHIELD - PRIVATE CAR PACKAGE POLICY

PROPOSAL FORM

Proposal No.

FOR OFFICE USE ONLY Sales Referrence : Policy No : VPN0068759000104

IMPORTANT(All Fields are mandatory)

• Please complete the form in CAPITAL LETTERS, using a black pen. • The liability of the Company does not commence until the Company has accepted the Proposal

Form duly filled in all respects and the full premium is paid. For any clarification on the cover, terms, etc., please contact Royal Sundaram. • All questions in the form

must be answered and it must be signed and dated. Continue on a separate sheet if necessary and attach as part of the Proposal Form. • Attach latest proof of No Claim

Bonus if applicable. • Attach any other information material to the risk proposed. • It is an offence under the Motor Vehicles Act 1988 to make a false statement or

withhold any material information for the purpose of obtaining a Certificate of Motor Insurance.

ABOUT YOURSELF

Title Mr.

Name JANAVARAPU SRINIVAS .

Date of Birth 30/08/1983 Are you Married Yes No

Communication JANAVARAPU SRINIVAS .

Address S/O J RAGHAVA RAO

DOOR NO.20/5/3

RAMALINGAIAH STREET

CHINARAVURU

City TENALI

State ANDHRA PRADESH Pincode 522201

Daytime Phone(s) Mobile Number 99xxxxxx04

PAN No.

Email RAM*****@GMAIL.COM

Occupation: Please tick against the applicable description, if you fall under any of the below listed categories. If you fall under more than one of the

listed titlesbelow, please tick against all the applicable heads.

Pvt.Sector Govt.Employee Self Employed RS Employee Film Industry Real Estate

Employee - IT and ITES Heads of States or of Governments Sports Person Senior Government/Judicial/Military Officer

Senior Executives of State - Owned Corporations Student Senior Politician Important Political Party Official

House wife Retired Employee Company Owned

AADHAR NUMBER

a) For Individual Customer:

Name as per Aadhar

Aadhar Number Date of birth of Insured 30/08/1983 Gender Female

b) For Corporate Customer:

Principal Officer Name

as per Aadhar

Aadhar Number Date of birth of Insured Gender

GST NUMBER

Name as per GST Certificate

Registered GST Number

Address as per GST Certificate

District and State as per GST

Certificate

ELECTRONIC INSURANCE ACCOUNT(EIA) NUMBER

Do you have Electronic Insurance Account Yes No (If yes please provide)

Account No

Repository Name

Nominee Name

Nominee Age Nominee Relationship

ABOUT YOUR BANK DETAILS Please attach a copy of cancelled cheque for verification of details, remittance of claim payment/refund if any

Bank Name Branch

Type of Account: Saving Current Account No:

IFSC Code: MICR Code:

Customers are requested to remit the premium by way of cheque or demand draft or credit card. Cash remittance to be avoided.

UIN: IRDAN102RP0004V02201617 1 Private Car Package Policy Form

ABOUT YOUR VEHICLE Please give full details:

Date of Registration 30/10/2016 Date of delivery of vehicle to proposer

Registering Authority: AP07

The address is same as above Yes No

Address as per JANAVARAPU SRINIVAS .

Registration Certificate S/O J RAGHAVA RAO,DOOR NO.20/5/3

RAMALINGAIAH STREET,

City TENALI

State ANDHRA PRADESH Pincode 522201

Period of Insurance:From 31/10/2021 Time 00:00:00 To 30/10/2022 Time 23:59:59

Registration No. AP07CX2149 Engine Number REVTRNO1HTYP29068

Make and Model TATA MOTORS LTD. & Bolt Chassis Number MAT608074GPH28260

XMS

Year Of Manufacture 2016 Cubic Capacity 1193.0 Seating Capacity 5(including driver)

Current Ownership Personal Type of fuel Petrol

Vehicle mostly driven City Roads

Present value of your car & accessories

For the Car For extra Electronic & Electrical For extra Non-Electrical Total 'Insured's Declared Value'

(Insured’s Declared Value) accessories fitted to the car* accessories fitted to the car* of the car including accessories

Rs. 325,000 Rs. 0 Rs. 0 Rs. 325,000

* If extra accessories are to be insured please provide the details below (attach sheet if necessary):

SI No. Make : Model : Estimated Value: Rs

If the car is fitted with a Bi-fuel system ? Type : Model : Estimated Value Rs.

1 . Is the Vehicle financed? Yes No

Hire Purchase Hypothecation Lease Name and Address of finance company: STATE BANK OF INDIA

2.Is the car fitted with an anti-theft device approved by Automobile Research Association of India(ARAI), Pune and the installation certified by a recognized

Automobile Association?

If Yes attach full details, including copies of by purchase & installation and Automobile Association approval documents.

3.Is there any other Safety features installed in your car? ABS Airbags Others (Please Specify)____________________________

4.Whether the vehicle is driven by non-conventional source of power? Yes No

If Yes please give details______________________________________

5.Whether the vehicle is used for driving tuitions? Yes No

If Yes please give details______________________________________

6.Whether extension of geographical area to the following countries required? Yes No

Bangladesh, Bhutan, Maldives, Nepal, Pakistan and Sri Lanka.

If Yes state the name of the countries 1)_________________________________ 2)_________________ 3)____________________________

7.Whether use of vehicle is limited to own premises? Yes No

8.Whether vehicle is used for Commercial purposes ? Yes No

9.Whether vehicle belongs to foreign embassy / consulate ? Yes No

10.Whether the car is certified as Vintage car by Vintage and Classic Car Club of India ? Yes No

11.Whether vehicle is designed for use of Blind/ Handicapped/ mentally challenged persons and duly endorsed as such by RTA ? Yes No

12.Whether the vehicle is fitted with fibre glass tank ? Yes No

13.Are you a member of Automobile Association of India? Yes No

If Yes please state a) Name of Association____________________ b) Membership No.____________________ c) Date of expiry__________________

BENEFITS UNDER OUR POLICY:

Compulsory Personal Accident (CPA) Cover For Owner Driver Yes No Duration : 1 Years 3 Years

If Yes, Capital Sum Insured 1,500,000 (15 lakhs to 50 Lakhs) *Multiples of Lakhs

Nomination for PA Cover Age Relationship Name of the Appointee (if Nominee is a minor)

UMADEVI 31 WIFE

If No, Tick any of the three options

Registered owner does not have valid driving license

Registered owner having CPA cover with other motor policies

Registered owner having PA cover of Rs.15 lakhs and above

The Standard Coverage for Third Party Property Damage is

Rs. 750,000 /-. Do you wish to restrict the same to Rs.6,000/- only, as per Motor Vehicles Act to avail applicable discount

UIN: IRDAN102RP0004V02201617 2 Private Car Package Policy Form

Personal Accident Cover: For a maximum capital sum insured of Rs.2,00,000/- covering Death and Disablement benefits for:

a) Any named person other than paid driver and/or cleaner (Please enclose the details of the persons to be insured)

Name AgeNominee Relationship Capital Sum Insured Rs.

b) Paid driver(s)

Yes No If Yes Capital Sum Insured opted Rs.____________________________

c) Unnamed occupants other than the insured, his paid driver and/or cleaner, limited to the registered carrying capacity of the vehicle

Yes No If Yes Capital Sum Insured opted Rs.____________________________

Wider legal liability to paid driver Yes No

Legal liability for your employees Yes No (Maximum restricted to seating capacity)

If 'Yes' number of employees__________________

Additional Towing charges of Rs.500 or Rs.1000 or Rs.1500 opted for over and above the limit prescribed in the policy

If you wish to include this cover, state the limits required.Rs.________________________

PRIVATE CAR PACKAGE POLICY PROPOSAL FORM FOR ADD-ON COVERS

These covers can be opted only for vehicles that are insured under a Package Policy with us.

This proposal is an addendum to the Private Car Package Policy Form for insurance of your Private Car.

Cover Name Cover Code Description

Depreciation Waiver Clause RSMOAC001 Would you like the Depreciation applicable on parts to be waived, in case of a partial loss claim. Yes No

Windshield Glass Clause RSMOAC002 In the event of Breakage of Windshield Glass, would you like to avail replacement without affecting your Yes No

No Claim Bonus.

Facilities in lieu of Spare Car RSMOAC003 In the event of the vehicle meeting with an accident, you may choose one of the following compensation Yes No

Clause slabs, to reduce any inconvenience to you:

Compensation Slabs in Rs.

Example : Rs 150 Rs 300 Rs 500 Rs 600 Rs 750 Rs 1500

Full Invoice PriceInsurance RSMOAC004 Would you like to insure the vehicle for its full Manufacturers Listed Selling Price: Yes No

Clause

Life-time Road Tax Clause RSMOAC005 Would you like to include the Life Time Road Tax paid by you on your vehicle.If yes, please give Yes No

the following details

Amount of tax paid. Date of Payment State in which tax was paid Validity period of the

RC

Voluntary Deductible Clause RSMOAC006 Would you like to opt for Voluntary Deductible under your policy. Yes No

What limit would you like to opt for :0

Rs 1,500 Rs 2,500 Rs 5,000 Rs 7,500 Rs 10,000 Rs 15,000

Loss Of Baggage Clause RSMOAC007 Would you like to cover your Baggage againt accidental damage or loss whilst being kept in the insured Car Yes No

What limit would you like to opt for :2500

Example : Rs 2,500 Rs 5,000 Rs 7,500 Rs 10,000

No Claim Bonus Protector RSMOAC008 Would you like to protect your existing No Claims bonus in the event of claims Yes No

(Option I)

Aggravation (Damage) Cover RSMOAC009 Would you like to opt for Engine Protector cover Yes No

Clause(Without Deductible)

Tyre Cover Clause RSMOAC010 Would you like to opt for Tyre Cover Clause? Yes No

Key Replacement RSMOAC011 Would you like to opt for Key Replacement? Yes No

Clause(Without Deductible)

Enhanced PA Cover RSMOAC013 Would you like to opt for Enhanced PA Cover? Yes No

What limit would you like to opt for PA to Owner-Driver (Rs.) 0 (In lakhs)

What limit would you like to opt for PA to each Unnamed Passengers (Rs.) 0 (In lakhs)

What limit would you like to opt for PA to Paid Driver (Rs.) 0 (In lakhs)

What limit would you like to opt for each Named Passengers (Rs.) 0 (In lakhs)

I have read the literature explaining the above covers and have opted for them after fully understanding its benefits

UIN: IRDAN102RP0004V02201617 3 Private Car Package Policy Form

PREVIOUS HISTORY

1.Is the car in a roadworthy condition and free from damage? Yes No If No please give details

If No please give full details:__________________________________________________________________________________________________________

2. Will the vehicle be used exclusively for:

a. Private, social, domestic, pleasure & professional purposes Yes No ________________________________________________________________

b. Carriage of goods other than samples or personal baggage Yes No ___________________________________________________________________

3. Name and address of the previous insurer ROYAL SUNDARAM GENERAL INSURANCE CO. LIMITED Royal Sundaram General Insurance Co.

Limited, Plot No 46, Whites road, Chennai, TamilNadu ,

5. Previous Policy No. VPN0068759000103 Policy period: 30/10/2021

6. Type of cover Liability only cover Package cover Others (specify)______________________________________________________________

7. Has any insurance company ever:

a) Declined the proposal Yes No

b) Cancelled & refused to renew Yes No

(If Yes reasons there of _________________________________________________________________________________________________________

c) Imposed special condition or excess Yes No

(If Yes reasons and details there of)_______________________________________________________________________________________________

DECLARATION - NO CLAIM BONUS

Are you entitled to No Claim Bonus Yes No (If Yes please submit proof from your previous insurer.)

I hereby declare that I have not made claim (or) I have made claim under my previous Policy No. VPN0068759000103 issued by ROYAL SUNDARAM

GENERAL INSURANCE CO. LIMITED.I/We declare that the rate of NCB of 50% claimed by me/us is correct and that no claim has arisen in the expiring policy

period (copy of the policy enclosed). I/We further undertake that if this declaration is found to be incorrect, all benefits under the policy in respect of Section I of the

Policy will stand forfeited.

Does the vehicle have valid Pollution Under Control (PUC) Certificate? Yes No

Pollution Certificate Number (PUC) : PUC expiry date :

*In line with the Central Motor Vehicle Act, 1989 and as per the directive of Hon'ble Supreme Court of India, it is mandated that insured must produce a valid

"Pollution Under control" Certificate as and when asked by the insurer and it is the responsibility of the insured to renew the same before expiry of the validity of the

PUC certificate. Absence of Valid certificate may lead to cancellation of insurance

PAYMENT DETAILS: Please tick payment option

Cheque/DD Number___________________ Credit Card Debit Card Payzaap Paytm Bill Desk

Bank____________________________________________________________________________________________________________________

NEFT RS Account No__________________________ Transaction Ref No_____________________

Date__________________________ Amount__________________________________ Cash Cash Amount_________________________

*Payment must be made favouring Royal Sundaram General Insurance Co. Limited

Authorization for electronic policy fulfilment and service communications (Please read carefully and put a check mark against each before signing)

I hereby consent that the proposal status, policy details and renewal reminders may be sent to me by email and SMS .

I hereby consent to and authorize Royal Sundaram General Insurance Co. Limited (Company) to make welcome calls, service calls or any other communication (electronic or

otherwise) with respect to the proposed or existing policy of Company from time to time.

PREMIUM COMPUTATION SUMMARY

IDV 325,000 TP Basic 3,221.00

OD Discount % Other TP Covers 0.00

OD Premium 6,208.00 Total TP 3,536.00

Other OD Covers 0.00 Total OD + TP 10,558.00

NCB 50% -3,104.00 GST 0.00

Total OD Premium 7,022.00 Premium inclusive of GST 12,458.44

COMPULSORY DEDUCTIBLE

The Policy excludes the first portion of each claim for loss or damage to the Motor Car. The amount of the Deductible is Rs.1,000/- for cars with cubic capacity not

exceeding 1500cc and Rs.2,000/- for cars with cubic capacity exceeding 1500cc.

ABOUT OUR POLICY

Usage of the car : The Policy covers use of the car for social, domestic and pleasure purposes and also for professional purposes of the Insured or use by the

Insured's employees for such purposes. The Policy does not cover use for hire or reward, racing, pace making, reliability trial, speed testing, the carriage of goods

(other than samples) in connection with professional purpose or use for any purpose in connection with the Motor Trade.

DECLARATION

Before signing the Declaration check your answers carefully, particularly if this Proposal Form was completed by another person on your behalf. I/we declare that to

the best of my/our knowledge and belief the answers given are true and all material information has been disclosed. I/we agree that if any answers have been

completed by any other person such person shall for that purpose be regarded as my/our agent and acting on my/our behalf and not the agent of Royal Sundaram

General Insurance Co. Limited.

I/we declare that this Proposal Form is for insurance in the normal terms and conditions of the Insurers Policy and shall be incorporated in and form part of the

insurance contract. If any additions or alterations are carried out after the submission of this proposal form then the same would be conveyed to the Insurers

immediately. I / We agree to download the policy terms, conditions, exceptions and applicable endorsements by logging on to the website www.royalsundaram.in

(or) mail to customer.services@royalsundaram.in to obtain a hard copy of the same.

Date :

Place : Signature of the proposer (Vehicle Owner)

Section - 41 of Insurance Act, 1938 Prohibition of Rebates

1. No person shall allow or offer to allow either directly or indirectly as an inducement to any person to take out or renew or continue an insurance in respect of any

kind of risk relating to lives or property in India any rebate of the whole or part of the commission payable or any rebate of the premium shown on the policy nor

shall any person taking out or continuing the policy accept any rebate except such rebate as may be allowed in accordance with the published prospectus or tables of

the Insurer.

Royal Sundaram General Insurance Co. Limited

(Formerly known as Royal Sundaram Alliance Insurance Company Limited)

Corporate Office: Vishranthi Melaram Towers, No. 2 / 319, Rajiv Gandhi Salai (OMR), Karapakkam, Chennai - 600097. Registered Office: 21, Patullos Road, Chennai - 600 002.

Royal Sundaram IRDAI Registration No.102 | CIN:U67200TN2000PLC045611

Call: 1860 425 0000,1860 258 0000 | Mail:customer.services@royalsundaram.in | Website: www.royalsundaram.in

UIN: IRDAN102RP0004V02201617 4 Private Car Package Policy Form

2. If any person fails to comply with sub-regulation (1) above, he shall be liable to payment of a fine which may extend to Ten Lakh Rupees.

Insurance is the subject matter of solicitation.

Royal Sundaram General Insurance Co. Limited

(Formerly known as Royal Sundaram Alliance Insurance Company Limited)

Corporate Office: Vishranthi Melaram Towers, No. 2 / 319, Rajiv Gandhi Salai (OMR), Karapakkam, Chennai - 600097. Registered Office: 21, Patullos Road, Chennai - 600 002.

Royal Sundaram IRDAI Registration No.102 | CIN:U67200TN2000PLC045611

Call: 1860 425 0000,1860 258 0000 | Mail:customer.services@royalsundaram.in | Website: www.royalsundaram.in

UIN: IRDAN102RP0004V02201617 4 Private Car Package Policy Form

You might also like

- Next Renewal Is On 05/07/2021Document3 pagesNext Renewal Is On 05/07/2021Rajiv RanjanNo ratings yet

- Standard Proposal Form For "Liability Only" PolicyDocument4 pagesStandard Proposal Form For "Liability Only" PolicySubhajit ChatterjeeNo ratings yet

- Prrivate Car Proposal Form July 2015Document2 pagesPrrivate Car Proposal Form July 2015Md RashidNo ratings yet

- Terms & Conditions of PolicyDocument11 pagesTerms & Conditions of PolicyVishwa KachhwahaNo ratings yet

- Tata AIG Motor Policy Schedule 3188 6301442007-00Document5 pagesTata AIG Motor Policy Schedule 3188 6301442007-00indbatch2022No ratings yet

- PACKAGE2w PC Proposal Form PDFDocument4 pagesPACKAGE2w PC Proposal Form PDFDHAWAL SHARMANo ratings yet

- Bajaj Allianz General Insurance Company LTDDocument5 pagesBajaj Allianz General Insurance Company LTDGaurav GehlotNo ratings yet

- Ajay PolicyDocument4 pagesAjay PolicyAJAY SOLANKINo ratings yet

- Og 22 9906 1801 00068245Document7 pagesOg 22 9906 1801 00068245RAJALINGAM SNo ratings yet

- Dear Gaurav Kadam,: Policy DetailsDocument10 pagesDear Gaurav Kadam,: Policy DetailsGaurav KadamNo ratings yet

- Motor Policy: Ref. No. W84763804 Date: Jan 10, 2020Document4 pagesMotor Policy: Ref. No. W84763804 Date: Jan 10, 2020Robins KumarNo ratings yet

- Tata AIG Motor Policy Schedule - 3184 - 6201884780-00Document4 pagesTata AIG Motor Policy Schedule - 3184 - 6201884780-00Điwakar MudhirajNo ratings yet

- Bajaj Two Wheeler Insurance PolicyDocument7 pagesBajaj Two Wheeler Insurance PolicyManjunath BNo ratings yet

- Insurance 8892Document5 pagesInsurance 8892Vivek Kumar sharmaNo ratings yet

- E-Proposal - Policy Schedule Cum Certification of Insurance Motor Private Car Package PolicyDocument7 pagesE-Proposal - Policy Schedule Cum Certification of Insurance Motor Private Car Package PolicyRajesh kannan VNo ratings yet

- Bajaj Allianz General Insurance Company LTDDocument2 pagesBajaj Allianz General Insurance Company LTDImran KhanNo ratings yet

- Insurance and RC BookDocument7 pagesInsurance and RC BookMani GNo ratings yet

- Dear Raj Raj,: Policy DetailsDocument6 pagesDear Raj Raj,: Policy Detailsdrraj23121No ratings yet

- Motor Proposal FormDocument3 pagesMotor Proposal FormALOKNo ratings yet

- TWO WHEELER Phonepe COI2304181126529116339294Document3 pagesTWO WHEELER Phonepe COI2304181126529116339294Santosh KumarNo ratings yet

- United India Insurance Company LimitedDocument11 pagesUnited India Insurance Company LimitedRanjith KumarNo ratings yet

- VPS0146736000101Document4 pagesVPS0146736000101yogishkamathNo ratings yet

- 3003 284259619 00 000 PyDocument3 pages3003 284259619 00 000 Pydexs80097No ratings yet

- Policy Schedule DocDocument9 pagesPolicy Schedule DocNikhil Vinayakrao BajpaiNo ratings yet

- Tata AIG Motor Policy Schedule - 3184 - 6201750755-00Document5 pagesTata AIG Motor Policy Schedule - 3184 - 6201750755-00venkatreddys27.vrNo ratings yet

- Private Motor 4 Wheeler: Customer - Care@sbigeneral - inDocument12 pagesPrivate Motor 4 Wheeler: Customer - Care@sbigeneral - inpooran singh chaudharyNo ratings yet

- Motor Policy: Ref. No. W106868953 Date: Aug 19, 2021Document4 pagesMotor Policy: Ref. No. W106868953 Date: Aug 19, 2021Zakir SzaNo ratings yet

- Tata AIG Motor Policy Schedule 3188 6301125574-00Document5 pagesTata AIG Motor Policy Schedule 3188 6301125574-00BOC ClaimsNo ratings yet

- Tata AIG Motor Policy Schedule - 3189 - 6300379952-00Document6 pagesTata AIG Motor Policy Schedule - 3189 - 6300379952-00Pawan KumarNo ratings yet

- Ka20c9211 Pradeep ValmikiDocument5 pagesKa20c9211 Pradeep Valmikigowdaramu19No ratings yet

- VPC1712403000100Document4 pagesVPC1712403000100Think Online ServiceNo ratings yet

- United India Insurance Company LimitedDocument11 pagesUnited India Insurance Company LimitedJatinNo ratings yet

- United India Insurance Company LimitedDocument11 pagesUnited India Insurance Company Limitedpradeeplathwal95No ratings yet

- MR Magan Lal: Private Motor 4 WheelerDocument12 pagesMR Magan Lal: Private Motor 4 WheelerAjay KumarNo ratings yet

- Ananda Nadarajan S-1Document10 pagesAnanda Nadarajan S-1Dayananda SagarNo ratings yet

- Motor Private Car Proposal Form: Instructions To The ApplicantDocument7 pagesMotor Private Car Proposal Form: Instructions To The ApplicantKunal VermaNo ratings yet

- Car Policy 2020 PDFDocument5 pagesCar Policy 2020 PDFSusheel Kumar TiwariNo ratings yet

- United India Insurance Company LimitedDocument11 pagesUnited India Insurance Company LimitedSky PhysicsNo ratings yet

- USN2023112552451568 ProposalDocument5 pagesUSN2023112552451568 ProposalGuru AssociateNo ratings yet

- BUYERBuyer Insurance-961710Document10 pagesBUYERBuyer Insurance-961710Arwal BranchNo ratings yet

- ComputerDocument3 pagesComputerKiran DNo ratings yet

- PolicySchedule OG 23 9906 1805 00111414 519762156Document5 pagesPolicySchedule OG 23 9906 1805 00111414 519762156dqr99hkzvqNo ratings yet

- FOUR WHEELER Phonepe COI2306060106124310134211Document5 pagesFOUR WHEELER Phonepe COI2306060106124310134211Mohd IbrahimNo ratings yet

- Tata AIG Motor Policy Schedule - 3184 - 6201916990-00Document5 pagesTata AIG Motor Policy Schedule - 3184 - 6201916990-00samNo ratings yet

- United India Insurance Company LimitedDocument4 pagesUnited India Insurance Company LimitedpoojaNo ratings yet

- Policy Copy 300531053011200000Document3 pagesPolicy Copy 300531053011200000Deepak Kumar Study IDNo ratings yet

- Policy 3101424237Document8 pagesPolicy 3101424237Manish VermaNo ratings yet

- DownloadDocument3 pagesDownloadBalakrishna VegiNo ratings yet

- Krunal PatelDocument4 pagesKrunal Patelpkrunal643No ratings yet

- United India Insurance Company LimitedDocument11 pagesUnited India Insurance Company LimitedRYPNo ratings yet

- Screenshot 2023-12-20 at 9.03.05 AMDocument5 pagesScreenshot 2023-12-20 at 9.03.05 AMsatyamchaudhary8505No ratings yet

- Darius John Vales Ga03r5799 23-24 PolicyDocument4 pagesDarius John Vales Ga03r5799 23-24 PolicyShreyansh AnkitNo ratings yet

- United India Insurance Company LimitedDocument9 pagesUnited India Insurance Company LimitedgvsubbaiahNo ratings yet

- Job Card PppattyDocument1 pageJob Card PppattysundarsureshNo ratings yet

- Motor Proposal Form For Private Car / Two Wheeler: Customer Type: Insured DetailsDocument2 pagesMotor Proposal Form For Private Car / Two Wheeler: Customer Type: Insured DetailssrinadhNo ratings yet

- Og 24 1701 1871 00070062Document10 pagesOg 24 1701 1871 00070062Kama Raju DivanamNo ratings yet

- Dear Shreyanka Shyamsunder ,: Policy DetailsDocument7 pagesDear Shreyanka Shyamsunder ,: Policy DetailsaamirazamNo ratings yet

- Atibha Verma 2Document11 pagesAtibha Verma 2Aangry VermaNo ratings yet

- Everthing You Need To Know To Start An Auto DealershipFrom EverandEverthing You Need To Know To Start An Auto DealershipRating: 5 out of 5 stars5/5 (1)

- Green Entrepreneurship PDFDocument1 pageGreen Entrepreneurship PDFDurban Chamber of Commerce and IndustryNo ratings yet

- PROJECTDocument13 pagesPROJECTRoshiney AntonittaNo ratings yet

- Unit 1 Introduction To Managerial EconomicsDocument8 pagesUnit 1 Introduction To Managerial EconomicsRahul GoyalNo ratings yet

- The First Meat Sector IPO CASEDocument3 pagesThe First Meat Sector IPO CASEabiraNo ratings yet

- 奥巴马演讲 - 华尔街改革Document2 pages奥巴马演讲 - 华尔街改革范仁瑋No ratings yet

- ResumeDocument1 pageResumeRithik RoyNo ratings yet

- Purbanchal University College of Information Technology and Engineering Tinkune, KathmanduDocument21 pagesPurbanchal University College of Information Technology and Engineering Tinkune, KathmanduBrish WinstonNo ratings yet

- HIgh Level Political Forum On Sustainable DevelopmentDocument3 pagesHIgh Level Political Forum On Sustainable DevelopmentFrank KaufmannNo ratings yet

- Carlo Recio Case Study: Far Eastern UniversityDocument7 pagesCarlo Recio Case Study: Far Eastern UniversityMaryrose SumulongNo ratings yet

- CH # 10, PricingDocument35 pagesCH # 10, PricingSaad MunirNo ratings yet

- TheEtsySuccessRoadmap LoveLissyDocument6 pagesTheEtsySuccessRoadmap LoveLissyPhát Nguyễn LýNo ratings yet

- Business Ethics Question BankDocument3 pagesBusiness Ethics Question BankSakshi RoyNo ratings yet

- Training Plan Template 10Document4 pagesTraining Plan Template 10Kaviya SureshNo ratings yet

- C10Document2 pagesC10Siddharth Rohilla (M22MS074)No ratings yet

- Information Technology 1-3Document19 pagesInformation Technology 1-3Merlina CuareNo ratings yet

- The Effect of Book Keeping On The Performance of Finanacial InstitutionsDocument15 pagesThe Effect of Book Keeping On The Performance of Finanacial InstitutionsJamil KamaraNo ratings yet

- Income Based ValuationDocument25 pagesIncome Based ValuationApril Joy ObedozaNo ratings yet

- SSP AssignmentDocument7 pagesSSP AssignmentAnant MishraNo ratings yet

- Supporting Your Small Business ClientsDocument13 pagesSupporting Your Small Business ClientsRichard Rhamil Carganillo Garcia Jr.No ratings yet

- Soumik Saha - Resume 2023Document1 pageSoumik Saha - Resume 2023Career EdgeNo ratings yet

- Qmethods & Manscie Prelim Transportation (Vam)Document13 pagesQmethods & Manscie Prelim Transportation (Vam)Dylan GutierrezNo ratings yet

- Code Structural EngrDocument1 pageCode Structural EngrdjdavidNo ratings yet

- Managing Cultural Diversity in The Hospitalit and Tourism IndustryDocument30 pagesManaging Cultural Diversity in The Hospitalit and Tourism IndustryEmelita Sto. Tomas100% (1)

- National Agriculture Market (ENAM) and ENWRDocument34 pagesNational Agriculture Market (ENAM) and ENWRsatishchpantNo ratings yet

- End-Term ExaminationDocument5 pagesEnd-Term ExaminationRishab AgarwalNo ratings yet

- HDFC Board ResolutionDocument2 pagesHDFC Board ResolutionLaxminarayana PallapuNo ratings yet

- 6403 en Speedi-SleevesDocument44 pages6403 en Speedi-Sleevesdestro3000No ratings yet

- Gedalyn PlomedaDocument2 pagesGedalyn PlomedaGedalyn PlomedaNo ratings yet

- Tison New CV 2023Document4 pagesTison New CV 2023Tison ThomasNo ratings yet

- Olazo V TingaDocument14 pagesOlazo V TingaAlexis John Solomon CastroNo ratings yet