Professional Documents

Culture Documents

Far460 - Set 1 - Feb 2021 - Suggested Solutions

Far460 - Set 1 - Feb 2021 - Suggested Solutions

Uploaded by

Ruzaikha razaliOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Far460 - Set 1 - Feb 2021 - Suggested Solutions

Far460 - Set 1 - Feb 2021 - Suggested Solutions

Uploaded by

Ruzaikha razaliCopyright:

Available Formats

CONFIDENTIAL 1 AC/FEB 2021/FAR460/SET 1/SOLUTION

FAR460 | SET 1 | FEB 2021 |SUGGESTED SOLUTIONS

QUESTION 1

a. Indicate whether the machine is an asset of Corona Textiles Berhad

The machine is an asset, as it is a resource controlled by the company as a result of past

events (purchased) √. Future economic benefits are expected to flow to the company, as

it will be used to produce products to be sold by the company√.

(√2 x 1= 2 marks)

b. Explain briefly whether the machine is a property, plant and equipment (PPE) in

accordance with the MFRS 116: Property, Plant and Equipment.

The machinery satisfies the definition of property, plant and equipment due to:

• It is a tangible asset that has physical substance √

• It is held for use in the production line to produce the entity’s product √

• It is expected to be used by the entity for more than one accounting period √

(√3 x 1 = 3 marks)

c. Discuss the initial cost of the machine and the carrying amount in the Statement of

Financial Position as at 31 December 2018.

The cost of the machine comprises:

• Its purchase price√ including import duties and non-refundable purchase taxes√ after

deducting trade discount and rebates√.

• Any cost attributable to bringing the asset to the location and condition√ for its

intended use√.

Initial measurement

RM

Invoice price less trade discount (650,000 x 0.95) √√617,500

Insurance on shipment √18,000

Import duties and taxes √25,000

Delivery and transportation costs √5,000

Wages for offloading and internal delivery to the factory √8,800

Installation charges (32,000-9,300) √√22,700

Start-up and pre-production costs √8,000

Dismantling cost√ √45,000

INITIAL COST 750,000

Note: The machine to be depreciated within 120 months.

Depreciation = (750,000 – 75,000) / 120 = RM5,625 per month.

© Hak Cipta Universiti Teknologi MARA CONFIDENTIAL

CONFIDENTIAL 2 AC/FEB 2021/FAR460/SET 1/SOLUTION

Carrying Amount in SOFP as at 31 Dec 2018

RM

1 July 2016 Cost √750,000

Acc. Depn (750,000-75,000)/120 X 30 months √√√ (168,750)

31 Dec 2018 Carrying Amount 581,250

(√20 x ½ = 10 marks)

d. Explain the subsequent measurement of the Machine as at 1 July 2019.

There was an indication of impairment√ as there was some technical problems. The

carrying amount of the machine on 1 July 2019 should be compared with its recoverable

amount√, i.e. the higher of value in use (RM515,000) and net realizable value

(RM525,000) √.

The carrying amount of the machine amounted to RM547,500√√ is higher than the

recoverable amount of RM525,000√, therefore there is an indication of impairment loss.

The differences of RM22,500√√ is charged as impairment loss√ in SOPL. √

RM

Cost 750,000

Acc. Depreciation (750,000 -75,00)/120 x 36 (202,500)

Carrying amount as at 1 July 2019 547500

Recoverable amount (525,000)

Impairment loss 22,500

(√10 x ½ = 5 marks)

e. Compute the gain or loss on disposal of the machine and prepare the related journal

entries on 31 December 2019.

Cost 750,000

Acc. Depn (from Jul 2016 to Jul 2019) (202,500)

Acc. Impairment loss (22,500)

Acc. Depn (525,000/84 X 6) – Jul to Dec 2019 √√ (37,500)

Carrying amount as at 31 Dec 2019 487,500

Disposal value √ (485,000)

Loss on disposal√ √ 2,500

DR CR

Bank 485,000√

Acc. Depn (from Jul 16 to Dec 19) 240,000√

Acc. Impairment loss 22,500√

Loss on disposal (SOPL) 2,500√

Machine 750,000√

(√10 x ½ = 5 marks)

(Total: 25 marks)

© Hak Cipta Universiti Teknologi MARA CONFIDENTIAL

CONFIDENTIAL 3 AC/FEB 2021/FAR460/SET 1/SOLUTION

QUESTION 2

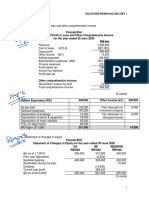

a. Statement of Profit and Loss and Other Comprehensive Income of Ebony Bhd for the year

ended 31 December 2019

RM

Revenues 24,244,812 /

Cost of sales (13,176,688+10,000) (13,186,688) //

Gross profit 11,058,124

Increase in FV IP (1,200+750-2,050) 100,000 // /

Administrative expenses (4,698,000) // // /

Selling and distribution expenses (2,020,000) /

Finance expenses (480,000) //

Profit before tax 3,960,124

Income tax expense (1,000,000) /

Profit after tax 2,960,124

Other comprehensive income:

Deficit on land (15,850 – 15,500) // (350,000)

Surplus on revaluation of building (5,080 – 540) – 4,800 /// 260,000

Total comprehensive income 2,870,124

20/

Workings:

Admin. exp S & Dist. exp Fin. exp

RM RM RM

As per Trial Balance 2,890,000 / 2,020,000 / 380,000 /

Depreciation on building 192,000 /

Depreciation on plant 588,000 /

Depreciation on machinery 140,000 /

Restructuring cost 888,000 /

Interest on bank loan (accrued) 100,000 /

Total 4,698,000 2,020,000 480,000

(20/ x 1/2 = 10 marks)

b. Statement of changes in equity of Ebony Bhd for the year ended 31 December 2019

Ordinary Retained Asset revaluation

shares earning reserve

RM RM RM

Bal as at 1 January 2019 29,540,0000/ 4,129,944/ 729,000/

Profit for the year/ 2,960,124

Surplus on revaluation building 260,000/

Deficit on revaluation land/ (350,000)/

Interim dividend (400,000)/

Bal as at 31 December 2019 29,540,000 6,690,068 639,000

(8/ x ½ = 4 marks)

© Hak Cipta Universiti Teknologi MARA CONFIDENTIAL

CONFIDENTIAL 4 AC/FEB 2021/FAR460/SET 1/SOLUTION

c. Statement of financial position of Ebony Bhd as at 31 December 2019 together with Notes to

the Property Plant and Equipment.

Non-current assets RM

Property, plant and equipment / 24,580,000

Investment property (1.2M + 750,000+100,000) 2,050,000 // /

Biological assets 2,990,000 /

Currents assets

Inventories (448,080-10,000) 438,080 //

Trade receivables 1,200,000 /

Tax recoverable (1,050,000-1,000,000) 50,000 //

Bank (13,620,812-750,000) 12,870,812 //

44,178,892

Equity

Share capital / 29,540,000

Reserves / 7,329,068

Non-current liabilities

8% Bank Loan 6,000,000 /

Current liabilities

Trade payables 321,824 /

Provision for restructuring / 888,000 /

Accrued interest on debentures / 100,000 /

44,178,892

20/

Note on PPE

Land Buildings Plant Machinery Total

Cost/valuation RM RM RM RM RM

As at 1 Jan 2019 15,850,000 / 5,080,000 / 5,880,000 / 1,400,000 /

Surplus 260,000 /

Deficit (350,000) /

Elimination of acc. dep (540,000) /

As at 31 Dec 2019 15,500,000 4,800,000 5,880,000 1,400,000

Acc. Depreciation

As at 1 Jan 2019 - 540,000 / 1,380,000 / 700,000 /

Elimination of acc. dep - (540,000) /

Current year depn. - 192,000 / 588,000 / 140,000 /

As at 31 Dec 2019 - 192,000 1,968,000 840,000

Carrying amount 15,500,000 4,608,000 3,912,000 560,000 24,580,000

14/

(32/ x ½ =16 marks)

(Total: 30 marks)

© Hak Cipta Universiti Teknologi MARA CONFIDENTIAL

CONFIDENTIAL 5 AC/FEB 2021/FAR460/SET 1/SOLUTION

QUESTION 3

a. On 1 September 2019, the compensation is to be disclosed in the notes to account

as contingent asset as the company's lawyer was in the opinion that the company

would probably win the case. √ No recognition of compensation receivable on this

date. However, on 28 December 2019, since the court has ordered the payment of

RM275,000 is to be made by Tool & Tool Bhd, √ the compensation receivable now

becomes virtually certain and can be recognised as an asset√. The amount

RM275,000 shall be recognised as income in SOPL√ and compensation receivable

classified as an asset in SOFP for the year ended 31 December 2019√.

(√5 x 1 = 5 marks)

b. Journal entries

Besi Teguh Bhd

Dr Compensation receivable√ 275,000√

Cr SOPL – compensation receivable√ 275,000

Tools & Tools Bhd

Dr SOPL – compensation cost√ 275,000

Cr Provision for compensation cost√ 275,000

(√5 x 1 = 5 marks)

c. Statement of Profit or Loss (extract) for the year ended 31 December 2019

Other Income√

Decrease in provision for warranty cost (320,000 – 210,000) RM110,000√√

Statement of Financial Position (extract) as at 31 December 2019

Current Liability√

Provision for warranty cost RM210,000√

(√5 x 1 = 5 marks)

d. Non-cancellable rental agreement is an onerous contract√ under MFRS137 Provision,

Contingent Liabilities and Contingent Assets. An onerous contract is a contract in which

the unavoidable costs of meeting the obligation under the contract exceed the

economic benefits expected to be received from it.√ Since it is onerous contract, if

the company proceeds with rental, the company needs to pay RM480,000√ (RM240,000

X 2) for the remaining 2 years period. However, should the company cancel the rental

agreement, the company needs to pay RM300,000 penalty, being the amount agreed

after negotiation. Therefore, as at 30 December 2019, the company needs to make a

provision of RM300,000 √ being the lower amount of not fulfilling the contract, as provision

for penalty (onerous contract) in SOFP and charged the same amount as expenses for

penalty in SOPL. √

(√5 x 1 = 5 marks)

(Total: 20 marks)

© Hak Cipta Universiti Teknologi MARA CONFIDENTIAL

CONFIDENTIAL 6 AC/FEB 2021/FAR460/SET 1/SOLUTION

© Hak Cipta Universiti Teknologi MARA CONFIDENTIAL

CONFIDENTIAL 7 AC/FEB 2021/FAR460/SET 1/SOLUTION

QUESTION 4

a. Statement of Cash Flows of Teja Bhd. for the year ended 31 December 2019

CASH FLOWS FROM OPERATING ACTIVITIES / RM RM

Net profit before tax (12,500 + 6,760) 19,260,000 //

Adjustments:

Depreciation expense 4,350,000 /

Loss on sale of plant 2,000,000 /

Amortization of intangible assets 2,400,000 /

Deficit on revaluation of land 400,000 /

Interest income (230,000) /

Finance costs 900,000 /

Operating profit before working capital changes 29,080,000

Working capital changes:

Increase in inventories (5,000 - 4,000) (1,000,000) /

Decrease in accounts receivable (2,000 – 4,180) 2,180,000 /

Increase in accounts payable (3,750 - 2,000) 1,750,000 /

Increase in prepayment (30 – 20) (10,000) /

Cash generated from operations 32,000,000

Interest paid (750+900-1,100) (550,000) //

Taxes paid (250+6,760+155) (7,165,000) // /

Net cash Inflow from operating activities 24,285,000

CASH FLOWS FROM INVESTING ACTIVITIES /

Purchased of PPE (24,434,000) // ///

Proceeds from sale of plant 6,000,000 /

Purchased of investment (1,950 – 2,300) X 90% (315,000) //

Interest income 230,000 /

Net cash outflow from investing activities (18,519,000)

CASH FLOWS FROM FINANCING ACTIVITIES /

Proceeds from issue of shares (31,150-28,150-1,500) 1,500,000 //

Proceeds from issue of 6% debentures (6,000 – 4,000) 2,000,000 /

Received bank loan (6,800 – 5,000) 1,800,000 /

Dividend paid (10,450,000) // // /

Net cash outflow from financing activities (5,150,000)

Net increase in cash and cash equivalents / 616,000

Cash and cash equivalents at beginning of year

(4,334 + (1,950 x 10%)) 4,529,000 //

Cash and cash equivalents at the end of the year

(5,000 + (2,300 x 10%) - 85) 5,145,000 // /

(44/ x 1/2 = 22 marks)

Finance Payable

© Hak Cipta Universiti Teknologi MARA CONFIDENTIAL

CONFIDENTIAL 8 AC/FEB 2021/FAR460/SET 1/SOLUTION

RM RM

Bank 550,000 b/d 750,000

c/d 1,100,000 / SOCI 900,000 /

Tax payable / Tax Recoverable

RM RM

Bank 7,165,000 b/d 250,000 /

SOCI 6,760,000 /

c/d 155,000 /

PPE

RM RM

b/d 29,316,000 Disposal 8,000,000 /

Ordinary share capital 1,500,000 / Depreciation 4,350,000 /

ARR 1,000,000 / SOCI - Deficit 400,000 /

Bank 24,434,000 c/d 43,500,000

Investment

RM RM

b/d (1,950 x 90%) / 1,755,000 Bank 315,000

c/d (2,300 x 90%) / 2,070,000

Intangible Assets

RM RM

b/d 7,900,000 Amortisation 2,400,000 /

c/d 5,500,000

Retained Earnings

RM RM

Dividend 11,850,000 b/d 5,750,000

c/d 6,400,000/ NPAT 12,500,000 /

Dividend Payable

RM RM

Bank 10,450,000 b/d 1,800,000/

c/d 3,200,000/ Retained earnings 11,850,000 /

Ordinary share capital

RM RM

b/d 28,150,000

PPE 1,500,000 /

c/d 31,150,000 / Bank 1,500,000

b. Interpret the performance of Teja Bhd based on the Statement of Cash Flows prepared

above

• The net increase in cash and cash equivalents shows that the company’s liquidity position

is good. /

• The company has enough cash to meet its obligations. /

• The company’s operating performance shows a positive cash flow and this shows that the

company is doing well in its main activities. /

• The company’s investing activities shows a negative outflow due to large payment on

acquisition of property, plant and equipment. /

• The company’s financing activities shows negative cash flow due to payment made for

dividends. /

(Any 3/ x 1 = 3 marks)

(Total = 25 marks)

© Hak Cipta Universiti Teknologi MARA CONFIDENTIAL

You might also like

- Tax267 Jul2022 SSSDocument9 pagesTax267 Jul2022 SSSLENNY GRACE JOHNNIE100% (1)

- Lazar Blue Book Chapter 4 Solution (1 To 14 Only)Document27 pagesLazar Blue Book Chapter 4 Solution (1 To 14 Only)Shuhada Shamsuddin75% (4)

- FAR210 - Feb 2023 - SSDocument11 pagesFAR210 - Feb 2023 - SSfarisha aliahNo ratings yet

- Chapter 5 - Computation of Statutory Business Income LatestDocument3 pagesChapter 5 - Computation of Statutory Business Income LatestAnonymous iQuwAQTH71% (7)

- CRG660 Past Year AnswersDocument85 pagesCRG660 Past Year AnswersMuhammad Zulhisyam100% (3)

- Fin533-Family Financial PlanningDocument10 pagesFin533-Family Financial PlanningMUHAMMAD NUR IMAN NOR AZLI100% (1)

- Fin420.540 Jan 2018 Q2-5Document8 pagesFin420.540 Jan 2018 Q2-5Amar AzuanNo ratings yet

- 2023 Common Test AIS205 SSDocument4 pages2023 Common Test AIS205 SSsyafiah sofianNo ratings yet

- Answer Tutorial 5 Basis Period ChangesDocument2 pagesAnswer Tutorial 5 Basis Period Changesathirah jamaludinNo ratings yet

- REVISED SS CT FAR270 May 2021 With ExplanationDocument4 pagesREVISED SS CT FAR270 May 2021 With Explanationsharifah nurshahira sakinaNo ratings yet

- Far410 - SS - Feb 2022Document9 pagesFar410 - SS - Feb 2022AFIZA JASMANNo ratings yet

- Answer Tutorial 3 Partnership Part 2Document3 pagesAnswer Tutorial 3 Partnership Part 2athirah jamaludin100% (1)

- Answer Tutorial 6 Capital AllowanceDocument3 pagesAnswer Tutorial 6 Capital Allowanceathirah jamaludin100% (2)

- Solution JAN 2018Document12 pagesSolution JAN 2018anis izzati100% (1)

- FAR 570 Test Mac July 2021 - QQDocument3 pagesFAR 570 Test Mac July 2021 - QQAthira Adriana Bt RemlanNo ratings yet

- Transmile Group Assignment - Project Paper SampleDocument42 pagesTransmile Group Assignment - Project Paper SampleRied-Zall Hasan100% (11)

- Confidential 1 AC/TEST MAY 2021/FAR270Document5 pagesConfidential 1 AC/TEST MAY 2021/FAR270Lampard AimanNo ratings yet

- Tax 267 Feb21 PyqDocument8 pagesTax 267 Feb21 PyqKenji HiroNo ratings yet

- Chapter Two:: Measuring National IncomeDocument42 pagesChapter Two:: Measuring National IncomeArni Ayuni100% (1)

- Universiti Teknologi Mara Final Examination: Confidential AC/DEC 2019/TAX517Document11 pagesUniversiti Teknologi Mara Final Examination: Confidential AC/DEC 2019/TAX517Diyana NabihahNo ratings yet

- Taxation II Tutorial 8 Industrial Building Allowance: Answer SchemeDocument3 pagesTaxation II Tutorial 8 Industrial Building Allowance: Answer Schemeathirah jamaludinNo ratings yet

- Cash To Accrual Basis, Single Entry and Error CorrectionDocument7 pagesCash To Accrual Basis, Single Entry and Error CorrectionHasmin Saripada AmpatuaNo ratings yet

- Ajinomoto DocumentDocument30 pagesAjinomoto Documentandy0% (2)

- Solution FAR270 APRIL 2022Document6 pagesSolution FAR270 APRIL 2022Nur Fatin Amirah100% (1)

- FAR Revision Answer Scheme Jul 2017Document8 pagesFAR Revision Answer Scheme Jul 2017Nurul Farahdatul Ashikin RamlanNo ratings yet

- Solution FAR270 NOV 2022Document6 pagesSolution FAR270 NOV 2022Nur Fatin AmirahNo ratings yet

- Solution Far410 Jun 2019Document9 pagesSolution Far410 Jun 2019Nabilah NorddinNo ratings yet

- Tax 467 Common Test July 2022 PDFDocument5 pagesTax 467 Common Test July 2022 PDFkhaiNo ratings yet

- Ss - Maf551 Feb 22Document7 pagesSs - Maf551 Feb 22izwanNo ratings yet

- FAR460 - JAN 2023 Group Assignment B Published Financial Statements Instructions To StudentsDocument5 pagesFAR460 - JAN 2023 Group Assignment B Published Financial Statements Instructions To StudentsAmniNo ratings yet

- Tax 467 Common Test July 2022 - SS PDFDocument5 pagesTax 467 Common Test July 2022 - SS PDFkhaiNo ratings yet

- SS CT 1 FAR270 Sem MAC2022 StudentDocument4 pagesSS CT 1 FAR270 Sem MAC2022 Studentsharifah nurshahira sakinaNo ratings yet

- 21 FAR460 SS SET 1 Dec21 Kel - StudentDocument9 pages21 FAR460 SS SET 1 Dec21 Kel - StudentRuzaikha razaliNo ratings yet

- Tax667 - SS Feb 2023Document13 pagesTax667 - SS Feb 2023hilman100% (2)

- Tax267 Jul2022 QQDocument9 pagesTax267 Jul2022 QQLENNY GRACE JOHNNIENo ratings yet

- Answer Far270 Feb2021Document8 pagesAnswer Far270 Feb2021Nur Fatin AmirahNo ratings yet

- TAX317 SS JUN2019. (Rate 2021.for Students)Document10 pagesTAX317 SS JUN2019. (Rate 2021.for Students)izzahNo ratings yet

- MAF551 - Exercise 1 - Answer Question 4 - Karrimost SDN BHD - Ridzuan Bin Saharun - 2017700141Document3 pagesMAF551 - Exercise 1 - Answer Question 4 - Karrimost SDN BHD - Ridzuan Bin Saharun - 2017700141RIDZUAN SAHARUNNo ratings yet

- Tax267 Ss Feb2022Document10 pagesTax267 Ss Feb20228kbnhhkwppNo ratings yet

- Solution DEC 19Document8 pagesSolution DEC 19anis izzatiNo ratings yet

- Solution JUN 2018Document7 pagesSolution JUN 2018anis izzatiNo ratings yet

- MAF 451 Suggested SolutionDocument7 pagesMAF 451 Suggested Solutionanis izzatiNo ratings yet

- Solution DEC 2018Document7 pagesSolution DEC 2018anis izzatiNo ratings yet

- Sample Law446Document3 pagesSample Law446Nor Alia ShafiaNo ratings yet

- Ss Jan2023Document6 pagesSs Jan2023AFIQAH NAJWA MOHD TALAHANo ratings yet

- SS CT Dec 2021 FAR270Document4 pagesSS CT Dec 2021 FAR270sharifah nurshahira sakinaNo ratings yet

- MAF551 - 2015 To 2019 ANSWERDocument83 pagesMAF551 - 2015 To 2019 ANSWERShah z100% (1)

- Group Project 2 - Published Account DEC2019 FAR270 - SSDocument6 pagesGroup Project 2 - Published Account DEC2019 FAR270 - SSHaru BiruNo ratings yet

- FAR270 JULY 2022 SolutionDocument8 pagesFAR270 JULY 2022 SolutionNur Fatin Amirah100% (2)

- Ais275 Jan18 Suggested SolutionsDocument7 pagesAis275 Jan18 Suggested SolutionsMUHAMMAD AJMAL HAKIM MOHD MISRONNo ratings yet

- Fin 552 Individual AssignmentDocument14 pagesFin 552 Individual Assignment2022978231No ratings yet

- SS - TEST FAR270 - NOV 2022 Set 2 StudentDocument5 pagesSS - TEST FAR270 - NOV 2022 Set 2 Studentsharifah nurshahira sakinaNo ratings yet

- CT SS For Student Oct2019Document7 pagesCT SS For Student Oct2019Nabila RosmizaNo ratings yet

- FAR270 - FEB 2022 SolutionDocument8 pagesFAR270 - FEB 2022 SolutionNur Fatin AmirahNo ratings yet

- Tutorial 3 MFRS 116 QDocument15 pagesTutorial 3 MFRS 116 QN FrzanahNo ratings yet

- Maf251 Oct2016 DianaDocument2 pagesMaf251 Oct2016 DianaSITI NUR DIANA SELAMATNo ratings yet

- MKT243 Common Test Quick NotesDocument3 pagesMKT243 Common Test Quick NotesAyda S.No ratings yet

- Far570 SS Test December 2022Document5 pagesFar570 SS Test December 2022fareen faridNo ratings yet

- Fin645 Final AssessmentDocument3 pagesFin645 Final Assessmentmark50% (2)

- Far410 Feb2022 Nacab1b 04062023Document15 pagesFar410 Feb2022 Nacab1b 04062023Rabi'atul Addawiyah NoorNo ratings yet

- Acc117 Test 2 July 2022 - Tapah BRS SSDocument3 pagesAcc117 Test 2 July 2022 - Tapah BRS SSNajmuddin AzuddinNo ratings yet

- Far270 - Q Test May 2023Document5 pagesFar270 - Q Test May 20232022896776No ratings yet

- Universiti Teknologi Mara Common Test 1 Suggested Solution: Confidential AC/APR2019/FAR320Document5 pagesUniversiti Teknologi Mara Common Test 1 Suggested Solution: Confidential AC/APR2019/FAR320iqbalhakim123100% (1)

- Solution Far460 - Jun 2019Document7 pagesSolution Far460 - Jun 2019Ruzaikha razaliNo ratings yet

- Solution Far460 Dec 2019 - SDocument7 pagesSolution Far460 Dec 2019 - SRuzaikha razaliNo ratings yet

- FAR460 - S - June 2018 - StudentsDocument6 pagesFAR460 - S - June 2018 - StudentsRuzaikha razaliNo ratings yet

- 21far460 Ss Set 1 Jun21 - StudentDocument9 pages21far460 Ss Set 1 Jun21 - StudentRuzaikha razaliNo ratings yet

- 20solution Far460 - Jun 2020 - StudentDocument10 pages20solution Far460 - Jun 2020 - StudentRuzaikha razaliNo ratings yet

- 21 FAR460 SS SET 1 Dec21 Kel - StudentDocument9 pages21 FAR460 SS SET 1 Dec21 Kel - StudentRuzaikha razaliNo ratings yet

- Assignment 01Document48 pagesAssignment 01sujan vikumNo ratings yet

- Solution: Opening CapitalDocument19 pagesSolution: Opening CapitalBOHEMIAN GAMINGNo ratings yet

- Balance Sheet Prepare and AnalyseDocument9 pagesBalance Sheet Prepare and AnalyseSatyarth GaurNo ratings yet

- Appendix 73 - Instructions - RPCPPEDocument1 pageAppendix 73 - Instructions - RPCPPETesa GDNo ratings yet

- March 2020 Diploma in Accountancy Programme Question and AnswerDocument102 pagesMarch 2020 Diploma in Accountancy Programme Question and Answerethel100% (1)

- Fixed Asset Register NotesDocument9 pagesFixed Asset Register NotesNeema EzekielNo ratings yet

- AC213 Ch03 ExerciseSolutionsDocument24 pagesAC213 Ch03 ExerciseSolutionsJoshua Miguel R. SevillaNo ratings yet

- Background: Manual Accounting Practice Set Disc-O-Tech, Australasian Edition 3Document5 pagesBackground: Manual Accounting Practice Set Disc-O-Tech, Australasian Edition 3muller1234No ratings yet

- FR - Intro To AS - Ind As 16 - Theory - Bhavik ChokshiDocument14 pagesFR - Intro To AS - Ind As 16 - Theory - Bhavik Chokshikrsindhu2412No ratings yet

- Guidance Note On AOC 4Document103 pagesGuidance Note On AOC 4Pranoti PatilNo ratings yet

- DPR For Walnut ProcessingDocument74 pagesDPR For Walnut ProcessingMohd touseefNo ratings yet

- MPSAS 17 - Property, Plant and EquipmentDocument30 pagesMPSAS 17 - Property, Plant and EquipmentinfineumNo ratings yet

- Statement of Cash FlowDocument7 pagesStatement of Cash Flowvdj kumarNo ratings yet

- 2010 LCCI Level 3 Series 2 Question Paper (Code 3012)Document8 pages2010 LCCI Level 3 Series 2 Question Paper (Code 3012)mappymappymappyNo ratings yet

- Financial Modeling Dabur Template-DCFDocument87 pagesFinancial Modeling Dabur Template-DCFSidharthNo ratings yet

- Intermediate Accounting 1Document8 pagesIntermediate Accounting 1Margielyn SuniNo ratings yet

- 2016 Vol 3 CH 3 AnsDocument9 pages2016 Vol 3 CH 3 AnsPauline Kisha CastroNo ratings yet

- Foreign Branches QuestionsDocument12 pagesForeign Branches QuestionsNicole TaylorNo ratings yet

- Chart of Account - Manufactur IndustryDocument3 pagesChart of Account - Manufactur IndustryBenedicto Nunzio75% (4)

- NTPC - Annual Report - 20-21-423-431Document9 pagesNTPC - Annual Report - 20-21-423-431devrishabhNo ratings yet

- FA Part-2 BS 45-1Document131 pagesFA Part-2 BS 45-1Phạm Duy Long Đinh100% (1)

- 27 Advanced AccountingDocument24 pages27 Advanced AccountingDeepti Arora100% (1)

- Buttons: AP/10/723,724, BUTTONS, ANCHAL Anchal GSTIN:32KDFPS7807P1ZPDocument9 pagesButtons: AP/10/723,724, BUTTONS, ANCHAL Anchal GSTIN:32KDFPS7807P1ZPRahul NathNo ratings yet

- Cash Flow Statements - Pas 7Document1 pageCash Flow Statements - Pas 7JyNo ratings yet

- Depreciation Accounting (As 10)Document7 pagesDepreciation Accounting (As 10)Aman SinghNo ratings yet

- Cash Flow Statement ConsolidatedDocument2 pagesCash Flow Statement Consolidatedsamarth rajvaidNo ratings yet

- Cash Flows Statements Practice Revision - Ias 7 Format: Exercise 1Document15 pagesCash Flows Statements Practice Revision - Ias 7 Format: Exercise 1Đỗ LinhNo ratings yet