Professional Documents

Culture Documents

Exam 2

Exam 2

Uploaded by

tamene woldeCopyright:

Available Formats

You might also like

- Ten Steps To Improving College Reading S PDFDocument1 pageTen Steps To Improving College Reading S PDFCat girl jhoselin0% (1)

- 05continuous Univariate Distributions, Vol. 1 PDFDocument769 pages05continuous Univariate Distributions, Vol. 1 PDFUsherAlexander0% (1)

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- CPAR87 Final PB - AFARDocument15 pagesCPAR87 Final PB - AFARLJ AggabaoNo ratings yet

- Advance Financial Accounting and Reporting (AFAR) : Cost Accounting Cost AccumulationDocument18 pagesAdvance Financial Accounting and Reporting (AFAR) : Cost Accounting Cost AccumulationGwen Sula LacanilaoNo ratings yet

- BudgetingDocument28 pagesBudgetingJade Gomez50% (2)

- Assignment1 Answer KahootDocument5 pagesAssignment1 Answer KahootLysss EpssssNo ratings yet

- Project TwoDocument4 pagesProject TwoAliyi BenuraNo ratings yet

- Exam 1Document3 pagesExam 1tamene woldeNo ratings yet

- Accounting Level IV Coc: Project OneDocument5 pagesAccounting Level IV Coc: Project OneTewodros BekeleNo ratings yet

- MASPDocument3 pagesMASPSteeeeeeeephNo ratings yet

- Chap # 3 Job Order Costing All ProblemsDocument4 pagesChap # 3 Job Order Costing All ProblemsDaniyal PervezNo ratings yet

- Problem 1: (LO 1, 2, 3, 4, 5), AP Lott Company Uses A Job Order Cost System andDocument4 pagesProblem 1: (LO 1, 2, 3, 4, 5), AP Lott Company Uses A Job Order Cost System andIvan BorresNo ratings yet

- Level Four Code 4Document4 pagesLevel Four Code 4biniam100% (1)

- AFAR - Mastery Class Batch 2Document5 pagesAFAR - Mastery Class Batch 2Antonette Eve CelomineNo ratings yet

- Quiz Audit of Inventories and PPEsDocument6 pagesQuiz Audit of Inventories and PPEsGet BurnNo ratings yet

- 2.advanced Cost Accounting Test One 2017Document4 pages2.advanced Cost Accounting Test One 2017smlingwaNo ratings yet

- Project One and TwoDocument3 pagesProject One and TwoAliyi BenuraNo ratings yet

- This Paper Carries Six Questions. 2. Answer Any Four Questions. 3. Each Question Carries 25 Marks. 4. Use of Non-Programmable Calculators Only Is AllowedDocument6 pagesThis Paper Carries Six Questions. 2. Answer Any Four Questions. 3. Each Question Carries 25 Marks. 4. Use of Non-Programmable Calculators Only Is AllowedtawandaNo ratings yet

- Test Series: March, 2022 Mock Test Paper - 1 Intermediate: Group - I Paper - 3: Cost and Management AccountingDocument7 pagesTest Series: March, 2022 Mock Test Paper - 1 Intermediate: Group - I Paper - 3: Cost and Management AccountingMusic WorldNo ratings yet

- Advanced Financial Accounting and Reporting: ConceptualDocument6 pagesAdvanced Financial Accounting and Reporting: ConceptualYeji BabeNo ratings yet

- Cost Notes888Document29 pagesCost Notes888yojNo ratings yet

- Rift Valley University Assignment On Fundamental of Accounting II Submission Date January 10/2022Document2 pagesRift Valley University Assignment On Fundamental of Accounting II Submission Date January 10/2022Kat SullvianNo ratings yet

- P2Document7 pagesP2chowchow123No ratings yet

- Model Exit 2015Document104 pagesModel Exit 2015naolmeseret22No ratings yet

- Activity # 2Document3 pagesActivity # 2Beboy TorregosaNo ratings yet

- Pract 2, March 2010Document8 pagesPract 2, March 2010jjjjjjjjjjjjjjjNo ratings yet

- Review Problem: Budget Schedules: RequiredDocument8 pagesReview Problem: Budget Schedules: RequiredShafa AlyaNo ratings yet

- Chap07 Rev. FI5 Ex PR 1Document10 pagesChap07 Rev. FI5 Ex PR 1Beyond ThatNo ratings yet

- Job Order Assignment PDFDocument3 pagesJob Order Assignment PDFAnne Marie100% (1)

- Lumban ProbsDocument3 pagesLumban ProbsShinjiNo ratings yet

- Level 4 ModelDocument7 pagesLevel 4 Modelsolomon asfawNo ratings yet

- Comprehensive Examination Afar - Reviewer - For PrintingDocument9 pagesComprehensive Examination Afar - Reviewer - For PrintingRamos JovelNo ratings yet

- Revision Excercises Midterm Cost Accounting CA232Document6 pagesRevision Excercises Midterm Cost Accounting CA232Chacha gmidNo ratings yet

- 04 Budgeting 15PROBLEMSDocument5 pages04 Budgeting 15PROBLEMSNicoleNo ratings yet

- Cost Attemptwise PPDocument317 pagesCost Attemptwise PPHassnain SardarNo ratings yet

- Week 1 Activity Cost Classification and BehaviorDocument4 pagesWeek 1 Activity Cost Classification and BehaviorJosh YuuNo ratings yet

- M2 Q Cfs and FinplnDocument7 pagesM2 Q Cfs and FinplnLeane MarcoletaNo ratings yet

- 4 5868563740395309829Document3 pages4 5868563740395309829Abdi0% (1)

- AaaaDocument11 pagesAaaaJessica JaroNo ratings yet

- Cost Accounting Self Assessment Materials Labor and OverheadDocument4 pagesCost Accounting Self Assessment Materials Labor and OverheadDarwyn HonaNo ratings yet

- Level Four Code 5-1Document5 pagesLevel Four Code 5-1EdomNo ratings yet

- Cost Acc Nov06Document27 pagesCost Acc Nov06api-3825774100% (1)

- Chap07 Rev. FI5 Ex PRDocument11 pagesChap07 Rev. FI5 Ex PRKhryzha Hanne Dela CruzNo ratings yet

- Final ExamDocument4 pagesFinal ExamJojo EstebanNo ratings yet

- Exercises Budgeting and Responsibility Problems W - Solutions 1Document10 pagesExercises Budgeting and Responsibility Problems W - Solutions 1Kristine NunagNo ratings yet

- Project One: Hana PLC. Is Unable To Reconcile The Bank Balance at September 30, 2018 Bank Reconciliation As FollowDocument6 pagesProject One: Hana PLC. Is Unable To Reconcile The Bank Balance at September 30, 2018 Bank Reconciliation As FollowYesakNo ratings yet

- Cost Accounting-QUIZ 2Document6 pagesCost Accounting-QUIZ 2Reynaldo BandiolajrNo ratings yet

- Gujarat Technological UniversityDocument3 pagesGujarat Technological UniversityMehul VarmaNo ratings yet

- Advanced Financial Accounting and Reporting Preweek LectureDocument19 pagesAdvanced Financial Accounting and Reporting Preweek LectureVanessa Anne Acuña DavisNo ratings yet

- Afar 93 PW Selftest 1Document19 pagesAfar 93 PW Selftest 1Harold Dan AcebedoNo ratings yet

- Cost QP CIA IIDocument4 pagesCost QP CIA IIPrasanna PNo ratings yet

- ExercisesDocument3 pagesExercisesGerald B. GarciaNo ratings yet

- Practical Accounting 2Document6 pagesPractical Accounting 2Jessica Marie B. Mendoza0% (1)

- Aud Prob QuizDocument3 pagesAud Prob QuizitsyeoboNo ratings yet

- Basic Operating BudgetDocument6 pagesBasic Operating BudgetalyNo ratings yet

- MGT 308Document2 pagesMGT 308HasnainNo ratings yet

- Inventories Comprehensive ExerciseDocument4 pagesInventories Comprehensive ExerciseBryan FloresNo ratings yet

- Cost Accounting: InstructionsDocument2 pagesCost Accounting: InstructionsSYED ALI SHAH SYED MUKHTIYAR ALINo ratings yet

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisFrom EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNo ratings yet

- Form-F-Nomination-Gratuity SampleDocument3 pagesForm-F-Nomination-Gratuity SampleVENKATESAN BNo ratings yet

- General Education - SET C - Part 3Document4 pagesGeneral Education - SET C - Part 3Zoe Xhien Consolacion LasolaNo ratings yet

- 2021 Rev For First Test - 11thsDocument3 pages2021 Rev For First Test - 11thsWhy do You careNo ratings yet

- KL 5th WorldDocument14 pagesKL 5th WorldMOHD AZAMNo ratings yet

- Relationship of S.V. Montessori Inc. Integrated Marketing Communication Strategies On Its Corporate BrandingDocument99 pagesRelationship of S.V. Montessori Inc. Integrated Marketing Communication Strategies On Its Corporate BrandingMary Grace Arroyo-VasquezNo ratings yet

- LISTEN Activity 1Document1 pageLISTEN Activity 1Sherlyn Miranda GarcesNo ratings yet

- Cybercrime and Cybercrime TrendsDocument4 pagesCybercrime and Cybercrime Trendsjim peterick sisonNo ratings yet

- Lemontree - Present ContinuousDocument3 pagesLemontree - Present ContinuousHripsimeNo ratings yet

- Responding A Demand LetterDocument2 pagesResponding A Demand LetterkilluaNo ratings yet

- Giving InstructionDocument4 pagesGiving InstructionKadek Puja AstutiNo ratings yet

- Item Description Amount QR.: Section 01 Labors 58,776.47 Section 2 Plants 137,588.24Document191 pagesItem Description Amount QR.: Section 01 Labors 58,776.47 Section 2 Plants 137,588.24AdamNo ratings yet

- Ashley KingDocument3 pagesAshley KingKing_AshleyMNo ratings yet

- Exotic PlantsDocument164 pagesExotic PlantsKenneth100% (9)

- BDS VAM®+TOP+Casing Regular 9.625 47.00 RegularDocument1 pageBDS VAM®+TOP+Casing Regular 9.625 47.00 RegularFajar PutraNo ratings yet

- Operator'S Manual: Rowind/Rowind PlusDocument5 pagesOperator'S Manual: Rowind/Rowind PlusOger1No ratings yet

- Argumentative Essay Outline: Hook Thesis StatementDocument2 pagesArgumentative Essay Outline: Hook Thesis StatementHafizah NORHAFIZAH BINTI SYOFIYAN100% (1)

- Residential Building Submission Drawing (30'x40') DWG Free Download-ModelDocument1 pageResidential Building Submission Drawing (30'x40') DWG Free Download-ModelShashank SinhaNo ratings yet

- Lecture-12 Practice-3Document5 pagesLecture-12 Practice-3Muhammad ZainNo ratings yet

- Experiment 2: StoichiometryDocument9 pagesExperiment 2: StoichiometryNURFASYA ATIKA BINTI ROSLI / UPMNo ratings yet

- Itinerary - SiargaoDocument4 pagesItinerary - SiargaoGennnielou Bianca BaluyanNo ratings yet

- Nature of Life Insurance ContractDocument20 pagesNature of Life Insurance ContractMickeyMathewD'Costa0% (1)

- Unit 2 Carbohydrates 2018Document109 pagesUnit 2 Carbohydrates 2018Christine Annmarie TapawanNo ratings yet

- Rpms - Minutes and Attendance SheetsDocument3 pagesRpms - Minutes and Attendance SheetsAnonymous VYXAA63100% (3)

- Swot Analysis - MBADocument8 pagesSwot Analysis - MBASara OlsonNo ratings yet

- Edenham Newsletter No17 21 July 2017Document6 pagesEdenham Newsletter No17 21 July 2017mattwebbeNo ratings yet

- Question Bank Rdm2020Document18 pagesQuestion Bank Rdm2020Afad Khan100% (1)

- Bench Marking in Logistics SectorDocument20 pagesBench Marking in Logistics SectorShashank ChauhanNo ratings yet

- Grade 11 Career Guidance: Module 1: Road To The Right ChoiceDocument10 pagesGrade 11 Career Guidance: Module 1: Road To The Right ChoiceIrah GalabinNo ratings yet

Exam 2

Exam 2

Uploaded by

tamene woldeOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Exam 2

Exam 2

Uploaded by

tamene woldeCopyright:

Available Formats

Exam 2

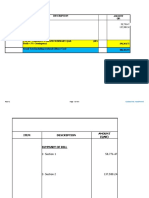

Project one

Xyz company

Payroll register

For month april 2013

Name Of Basic Overtime Gross Income Pension Total Net Pay Sign

Ser.N Employee Salary Earning Tax Deduction

o

01 Tirusew 735

02 Nigatu 2,379

03 Getasew

04 Yemariyam 155.40

05 Nitsu

Total

Additional Information

1. Tirusew And Nigatu Have Paid The Same Income Tax For The Month

2. Getasew Pension Contribution Is 150% Of Tirusew Pension Contribution

3. The Total(Employer And Employee)Pension Contribution Of Nitsuh Is Equal To That Of Yemariam Pension

Contribution

4. Pension Contribution Is 7% By Employee And 11% By Employer

Required

a) Finalize The Incomplete Payroll Register Given Above

b) If Salary Is Paid In MAY(Next Month),Journalize

1) Salary And Other Benefits

2) Payment Of Paybles

3) Payroll Tax Or Company Pension Contribution

Project Two Units Of Competence Covered

The Account In The Ledger Of Bbc Company,With The Unadjusted Balance On December 31,2010 The End Of The Fiscal Year

Are As Follows

Fees Recevable

Prepaid Insurance 3,725

Supplies 675

Pre-Paid Advertising

Salaries Payable

Unearned Rent

Income Summary

Fees Earned 62,250

Salaries Expense 41,700

Advertising Expense 10,340

Supplies Expense

Insurance Expense

Rent Income 9,100

Data Needed For Yearend Adjustments Are As Follows

1. Unbilled Fees On June 30, Br 7,750

2. Insurance Expired During The Year, Br 2,100

3. Supplies Inventory On June 30, R 190

4. Of The Prepayment Of Birr 1,000 Advertising In Ethiopia Herald News Paper 75% Has Been Used

5. Salary Accrued Is Br, 1,140

6. Rent Collected In Advance That Will Not Be Earned Is Br 700

Required Task 1.Prepare The Necessary Adjusting Entries

Task 2. Prepare Profit And Loss Statement And Balance Sheet

Project four

Unit of competency covered

Prepare operational budget

Kaliti steel factory-manufactures two products A and B:

Desired inventory:

Product A product B

Desired inventory:ending for each month 20,000 10,000

Estimated beginning inventory;for each month 21,000 9,00

Sells price per unit 50 70

Estimated sales unit:

January February march total

Area 1: A 6,500 6,900 6,600 20,000

B 1,950 1,500 1,500 4,950

Area 2:A 2,500 3,000 4,500 10,000

B 500 600 1,500 2,600

For the production of A and B,kaliti steel factory uses the following raw material

MATERIAL UNIT COST poroductA product

Sand 0.50 20kg 15kgperunit

Steel 1 10kg 15kg perunit

Chemichel 5 10lit 15lit

Required

1. Prepare sales budget for the current quarter

2. Prepare production budget for current quarter

3. Prepare raw material purchase budget for current quarter

Project five

During the month of January the following transaction will occur to produce three products

1. Material purchase on account

Sand 500

Steel 790

Chemichel 4,500

2. Direct material issued and factory labor cost

Materials direct labor cost

Job#1. 227.50 160

Job#2. 780 210

Job#3. 3,900 175

3. Factory overhead is 60% of direct labor cost

4. Finished goods sold for Br 7,200

Required

A. Record journal entries

B. Calculate each job cost

C. Calculate gross profit

Project six

the following were selected from among the transaction completed by DAT, A VAT registered merchandising firm,during

January of the current year

1. Recived cash from sales of furniture Br 250,000

2. Paid entertainment expense Br 5,000

3. Purchase raw materials for Br 49,000 for cash

4. Paid utility expense Br 20,000

5. Sales of furniture on account Br 80,00

6. Paid salary expense Br 20,000

7. Doubtful account expense Br 8,000

Required

A. Record the necessary journal entries related to the transaction

B. Determine amount of vat payable/recivable from to ERCA

C. Prepare income statement for the month of jan, for tax purpose and calculate profite tax liability(business profit

TAX 30%)

Project seven

Firfax manufacturing has the following information in relation to commodity D2 for july

Inventory:

July 1 15units @ 30

July 4 sales 5units @35

July 10 purchase 10units @ 32

July 14 sales 12 units @ 39

July 22 sales 3units @ 40

July 30 purchase 10 units @ 33

Required

1. If the company used perpetual inventory system and FIFO costing method

A. Determine cost of good sold

B. Determine ending inventory on hand at end of year

C. Determine amount of gross profite

2. If the company used periodic inventory system and LIFO costing method

A. Determine cost of good sold

B. Determine ending inventory on hand at end of year

C. Determine amount of gross profite

You might also like

- Ten Steps To Improving College Reading S PDFDocument1 pageTen Steps To Improving College Reading S PDFCat girl jhoselin0% (1)

- 05continuous Univariate Distributions, Vol. 1 PDFDocument769 pages05continuous Univariate Distributions, Vol. 1 PDFUsherAlexander0% (1)

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- CPAR87 Final PB - AFARDocument15 pagesCPAR87 Final PB - AFARLJ AggabaoNo ratings yet

- Advance Financial Accounting and Reporting (AFAR) : Cost Accounting Cost AccumulationDocument18 pagesAdvance Financial Accounting and Reporting (AFAR) : Cost Accounting Cost AccumulationGwen Sula LacanilaoNo ratings yet

- BudgetingDocument28 pagesBudgetingJade Gomez50% (2)

- Assignment1 Answer KahootDocument5 pagesAssignment1 Answer KahootLysss EpssssNo ratings yet

- Project TwoDocument4 pagesProject TwoAliyi BenuraNo ratings yet

- Exam 1Document3 pagesExam 1tamene woldeNo ratings yet

- Accounting Level IV Coc: Project OneDocument5 pagesAccounting Level IV Coc: Project OneTewodros BekeleNo ratings yet

- MASPDocument3 pagesMASPSteeeeeeeephNo ratings yet

- Chap # 3 Job Order Costing All ProblemsDocument4 pagesChap # 3 Job Order Costing All ProblemsDaniyal PervezNo ratings yet

- Problem 1: (LO 1, 2, 3, 4, 5), AP Lott Company Uses A Job Order Cost System andDocument4 pagesProblem 1: (LO 1, 2, 3, 4, 5), AP Lott Company Uses A Job Order Cost System andIvan BorresNo ratings yet

- Level Four Code 4Document4 pagesLevel Four Code 4biniam100% (1)

- AFAR - Mastery Class Batch 2Document5 pagesAFAR - Mastery Class Batch 2Antonette Eve CelomineNo ratings yet

- Quiz Audit of Inventories and PPEsDocument6 pagesQuiz Audit of Inventories and PPEsGet BurnNo ratings yet

- 2.advanced Cost Accounting Test One 2017Document4 pages2.advanced Cost Accounting Test One 2017smlingwaNo ratings yet

- Project One and TwoDocument3 pagesProject One and TwoAliyi BenuraNo ratings yet

- This Paper Carries Six Questions. 2. Answer Any Four Questions. 3. Each Question Carries 25 Marks. 4. Use of Non-Programmable Calculators Only Is AllowedDocument6 pagesThis Paper Carries Six Questions. 2. Answer Any Four Questions. 3. Each Question Carries 25 Marks. 4. Use of Non-Programmable Calculators Only Is AllowedtawandaNo ratings yet

- Test Series: March, 2022 Mock Test Paper - 1 Intermediate: Group - I Paper - 3: Cost and Management AccountingDocument7 pagesTest Series: March, 2022 Mock Test Paper - 1 Intermediate: Group - I Paper - 3: Cost and Management AccountingMusic WorldNo ratings yet

- Advanced Financial Accounting and Reporting: ConceptualDocument6 pagesAdvanced Financial Accounting and Reporting: ConceptualYeji BabeNo ratings yet

- Cost Notes888Document29 pagesCost Notes888yojNo ratings yet

- Rift Valley University Assignment On Fundamental of Accounting II Submission Date January 10/2022Document2 pagesRift Valley University Assignment On Fundamental of Accounting II Submission Date January 10/2022Kat SullvianNo ratings yet

- P2Document7 pagesP2chowchow123No ratings yet

- Model Exit 2015Document104 pagesModel Exit 2015naolmeseret22No ratings yet

- Activity # 2Document3 pagesActivity # 2Beboy TorregosaNo ratings yet

- Pract 2, March 2010Document8 pagesPract 2, March 2010jjjjjjjjjjjjjjjNo ratings yet

- Review Problem: Budget Schedules: RequiredDocument8 pagesReview Problem: Budget Schedules: RequiredShafa AlyaNo ratings yet

- Chap07 Rev. FI5 Ex PR 1Document10 pagesChap07 Rev. FI5 Ex PR 1Beyond ThatNo ratings yet

- Job Order Assignment PDFDocument3 pagesJob Order Assignment PDFAnne Marie100% (1)

- Lumban ProbsDocument3 pagesLumban ProbsShinjiNo ratings yet

- Level 4 ModelDocument7 pagesLevel 4 Modelsolomon asfawNo ratings yet

- Comprehensive Examination Afar - Reviewer - For PrintingDocument9 pagesComprehensive Examination Afar - Reviewer - For PrintingRamos JovelNo ratings yet

- Revision Excercises Midterm Cost Accounting CA232Document6 pagesRevision Excercises Midterm Cost Accounting CA232Chacha gmidNo ratings yet

- 04 Budgeting 15PROBLEMSDocument5 pages04 Budgeting 15PROBLEMSNicoleNo ratings yet

- Cost Attemptwise PPDocument317 pagesCost Attemptwise PPHassnain SardarNo ratings yet

- Week 1 Activity Cost Classification and BehaviorDocument4 pagesWeek 1 Activity Cost Classification and BehaviorJosh YuuNo ratings yet

- M2 Q Cfs and FinplnDocument7 pagesM2 Q Cfs and FinplnLeane MarcoletaNo ratings yet

- 4 5868563740395309829Document3 pages4 5868563740395309829Abdi0% (1)

- AaaaDocument11 pagesAaaaJessica JaroNo ratings yet

- Cost Accounting Self Assessment Materials Labor and OverheadDocument4 pagesCost Accounting Self Assessment Materials Labor and OverheadDarwyn HonaNo ratings yet

- Level Four Code 5-1Document5 pagesLevel Four Code 5-1EdomNo ratings yet

- Cost Acc Nov06Document27 pagesCost Acc Nov06api-3825774100% (1)

- Chap07 Rev. FI5 Ex PRDocument11 pagesChap07 Rev. FI5 Ex PRKhryzha Hanne Dela CruzNo ratings yet

- Final ExamDocument4 pagesFinal ExamJojo EstebanNo ratings yet

- Exercises Budgeting and Responsibility Problems W - Solutions 1Document10 pagesExercises Budgeting and Responsibility Problems W - Solutions 1Kristine NunagNo ratings yet

- Project One: Hana PLC. Is Unable To Reconcile The Bank Balance at September 30, 2018 Bank Reconciliation As FollowDocument6 pagesProject One: Hana PLC. Is Unable To Reconcile The Bank Balance at September 30, 2018 Bank Reconciliation As FollowYesakNo ratings yet

- Cost Accounting-QUIZ 2Document6 pagesCost Accounting-QUIZ 2Reynaldo BandiolajrNo ratings yet

- Gujarat Technological UniversityDocument3 pagesGujarat Technological UniversityMehul VarmaNo ratings yet

- Advanced Financial Accounting and Reporting Preweek LectureDocument19 pagesAdvanced Financial Accounting and Reporting Preweek LectureVanessa Anne Acuña DavisNo ratings yet

- Afar 93 PW Selftest 1Document19 pagesAfar 93 PW Selftest 1Harold Dan AcebedoNo ratings yet

- Cost QP CIA IIDocument4 pagesCost QP CIA IIPrasanna PNo ratings yet

- ExercisesDocument3 pagesExercisesGerald B. GarciaNo ratings yet

- Practical Accounting 2Document6 pagesPractical Accounting 2Jessica Marie B. Mendoza0% (1)

- Aud Prob QuizDocument3 pagesAud Prob QuizitsyeoboNo ratings yet

- Basic Operating BudgetDocument6 pagesBasic Operating BudgetalyNo ratings yet

- MGT 308Document2 pagesMGT 308HasnainNo ratings yet

- Inventories Comprehensive ExerciseDocument4 pagesInventories Comprehensive ExerciseBryan FloresNo ratings yet

- Cost Accounting: InstructionsDocument2 pagesCost Accounting: InstructionsSYED ALI SHAH SYED MUKHTIYAR ALINo ratings yet

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisFrom EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNo ratings yet

- Form-F-Nomination-Gratuity SampleDocument3 pagesForm-F-Nomination-Gratuity SampleVENKATESAN BNo ratings yet

- General Education - SET C - Part 3Document4 pagesGeneral Education - SET C - Part 3Zoe Xhien Consolacion LasolaNo ratings yet

- 2021 Rev For First Test - 11thsDocument3 pages2021 Rev For First Test - 11thsWhy do You careNo ratings yet

- KL 5th WorldDocument14 pagesKL 5th WorldMOHD AZAMNo ratings yet

- Relationship of S.V. Montessori Inc. Integrated Marketing Communication Strategies On Its Corporate BrandingDocument99 pagesRelationship of S.V. Montessori Inc. Integrated Marketing Communication Strategies On Its Corporate BrandingMary Grace Arroyo-VasquezNo ratings yet

- LISTEN Activity 1Document1 pageLISTEN Activity 1Sherlyn Miranda GarcesNo ratings yet

- Cybercrime and Cybercrime TrendsDocument4 pagesCybercrime and Cybercrime Trendsjim peterick sisonNo ratings yet

- Lemontree - Present ContinuousDocument3 pagesLemontree - Present ContinuousHripsimeNo ratings yet

- Responding A Demand LetterDocument2 pagesResponding A Demand LetterkilluaNo ratings yet

- Giving InstructionDocument4 pagesGiving InstructionKadek Puja AstutiNo ratings yet

- Item Description Amount QR.: Section 01 Labors 58,776.47 Section 2 Plants 137,588.24Document191 pagesItem Description Amount QR.: Section 01 Labors 58,776.47 Section 2 Plants 137,588.24AdamNo ratings yet

- Ashley KingDocument3 pagesAshley KingKing_AshleyMNo ratings yet

- Exotic PlantsDocument164 pagesExotic PlantsKenneth100% (9)

- BDS VAM®+TOP+Casing Regular 9.625 47.00 RegularDocument1 pageBDS VAM®+TOP+Casing Regular 9.625 47.00 RegularFajar PutraNo ratings yet

- Operator'S Manual: Rowind/Rowind PlusDocument5 pagesOperator'S Manual: Rowind/Rowind PlusOger1No ratings yet

- Argumentative Essay Outline: Hook Thesis StatementDocument2 pagesArgumentative Essay Outline: Hook Thesis StatementHafizah NORHAFIZAH BINTI SYOFIYAN100% (1)

- Residential Building Submission Drawing (30'x40') DWG Free Download-ModelDocument1 pageResidential Building Submission Drawing (30'x40') DWG Free Download-ModelShashank SinhaNo ratings yet

- Lecture-12 Practice-3Document5 pagesLecture-12 Practice-3Muhammad ZainNo ratings yet

- Experiment 2: StoichiometryDocument9 pagesExperiment 2: StoichiometryNURFASYA ATIKA BINTI ROSLI / UPMNo ratings yet

- Itinerary - SiargaoDocument4 pagesItinerary - SiargaoGennnielou Bianca BaluyanNo ratings yet

- Nature of Life Insurance ContractDocument20 pagesNature of Life Insurance ContractMickeyMathewD'Costa0% (1)

- Unit 2 Carbohydrates 2018Document109 pagesUnit 2 Carbohydrates 2018Christine Annmarie TapawanNo ratings yet

- Rpms - Minutes and Attendance SheetsDocument3 pagesRpms - Minutes and Attendance SheetsAnonymous VYXAA63100% (3)

- Swot Analysis - MBADocument8 pagesSwot Analysis - MBASara OlsonNo ratings yet

- Edenham Newsletter No17 21 July 2017Document6 pagesEdenham Newsletter No17 21 July 2017mattwebbeNo ratings yet

- Question Bank Rdm2020Document18 pagesQuestion Bank Rdm2020Afad Khan100% (1)

- Bench Marking in Logistics SectorDocument20 pagesBench Marking in Logistics SectorShashank ChauhanNo ratings yet

- Grade 11 Career Guidance: Module 1: Road To The Right ChoiceDocument10 pagesGrade 11 Career Guidance: Module 1: Road To The Right ChoiceIrah GalabinNo ratings yet