Professional Documents

Culture Documents

Corporate Social Responsibility in Emerging Market Economies - Determinants, Consequences, and Future Research Directions

Corporate Social Responsibility in Emerging Market Economies - Determinants, Consequences, and Future Research Directions

Uploaded by

Jana HassanOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Corporate Social Responsibility in Emerging Market Economies - Determinants, Consequences, and Future Research Directions

Corporate Social Responsibility in Emerging Market Economies - Determinants, Consequences, and Future Research Directions

Uploaded by

Jana HassanCopyright:

Available Formats

Corporate Social Responsibility in Emerging Market Economies:

Determinants, Consequences, and Future Research Directions

Narjess Boubakri

Bank of Sharjah Chair in Banking and Finance, American University of Sharjah, UAE

nboubakri@aus.edu

Sadok El Ghoul

Campus Saint-Jean, University of Alberta, Edmonton, AB T6C 4G9, Canada

elghoul@ualberta.ca

Omrane Guedhami

Moore School of Business, University of South Carolina, USA

omrane.guedhami@moore.sc.edu

He (Helen) Wang

John Chambers College of Business and Economics, West Virginia University, USA

helen.wang@mail.wvu.edu

Electronic copy available at: https://ssrn.com/abstract=3718750

Corporate Social Responsibility in Emerging Market Economies:

Determinants, Consequences, and Future Research Directions

Abstract

The last two decades have witnessed a growing interest in corporate social

responsibility (CSR) worldwide by corporations, investors, policy makers, and

researchers across different disciplines. This paper is part of a Special Issue

devoted to CSR practices of firms in emerging market economies (EMEs). It

complements prior research focusing mainly on developed countries. We begin

with an assessment of CSR practices in EMEs, and examine their determinants and

performance implications. We then review key findings in the empirical CSR

literature, including studies published in the Emerging Markets Review Special

Issue. We conclude by describing pertinent avenues for future research.

Keywords: Corporate Social Responsibility; Emerging Markets; Determinants; Valuation;

Cost of Capital

JEL Codes: G32, M14

Electronic copy available at: https://ssrn.com/abstract=3718750

1. Introduction

Corporate social responsibility (CSR), according to Kitzmueller and Shimshack

(2012, p. 53), refers to “corporate social or environmental behavior that goes beyond the

legal or regulatory requirements.” CSR is characterized as voluntary behavior, as

McWilliams and Siegel (2001, p. 117) allude to in their definition of CSR “as actions that

appear to further some social good, beyond the interests of the firm and that which is

required by law.”

Considered a vital element of corporate strategy, CSR has drawn increasing attention

of scholars from various disciplines.1 Corporations are consistently called upon to alter

their business practices by institutes, investment funds, publications, and online

resources. According to the U.S. Social Investment Forum Foundation’s 2018 Report,2

more than one-quarter of funds under professional management (about 26% of the $46.6

trillion in total assets) in the U.S. are invested in a socially responsible manner. A 2017

KPMG survey3 documents significant growth in global CSR reporting rates (75% in

2017, compared to 64% in 2011 and 18% in 2002), and in the number of firms that

include CSR information in their annual reports (60% in 2017, compared to 56% in

2015).

While the KPMG survey reveals that emerging market economies (EMEs) in Africa

and the Middle East, Eastern Europe, and Latin America generally lag behind North

America and Western Europe, it also highlights that two EMEs—Mexico and Taiwan—

1 According to Christensen, Hail, and Leuz (2019), CSR is the most commonly used term in the

literature. “Sustainability,” “environmental, social, and governance (ESG),” “corporate

philanthropy,” and “corporate social performance (CSP)” have similar meanings.

2 https://www.ussif.org/files/US%20SIF%20Trends%20Report%202018%20Release.pdf

3 https://assets.kpmg/content/dam/kpmg/be/pdf/2017/kpmg-survey-of-corporate-responsibility-

reporting-2017.pdf

Electronic copy available at: https://ssrn.com/abstract=3718750

experienced the highest growth in CSR reporting for 2015. Furthermore, four countries—

India, Malaysia, South Africa, and Mexico—are among those with the highest levels of

CSR reporting. The success of ESG (environmental, social, and governance) investing

lies in the numbers in emerging economies. Over the last decade, the MSCI Emerging

Markets ESG Leaders Index outperformed the broader MSCI Emerging Markets Index as

of April 30, 2020, by over 3% at an annualized rate.4

Such growth reflects faster regulatory changes, as well as greater market awareness

and evolving pressure from investors, consumers, and regulators in EMEs. Although this

dynamic context should have led to greater research opportunities in the CSR literature,

EMEs have remained an under-researched area (Doh et al., 2019). Most studies to date

have focused on the U.S. or developed countries, primarily because of data availability

(Baskin and Gordon, 2005).

This paper and this Special Issue seek to address this void in the literature for two

main reasons. First, CSR has become a research discipline in its own right. It is

theoretically grounded in either stakeholder theory (e.g., CSR is considered a long-term

investment aimed at maximizing stakeholder value in the long run through enhanced

reputation and competitive advantage), or agency theory (e.g., CSR results from

managers pursuing their own self-interest, leading to over-investment and hence value

destruction from a stakeholder perspective (Friedman, 1970; Habib and Hasan, 2019; Bae

et al., 2019). In accordance with the stakeholder view of CSR, most studies show that it

positively affects firm reputation and performance over time (Friede et al., 2015; Tetrault

Sirsly and Lvina, 2019), creating incentives for managers to continuously invest in CSR.

4 https://www.msci.com/documents/10199/e744e272-e2c7-446b-8839-b62288962177

Electronic copy available at: https://ssrn.com/abstract=3718750

Second, there are valid reasons why CSR in EMEs should attract more attention. As

mentioned by Tetrault Sisley and Lvina (2019, p.1235), “firms in the developed world

have widely embraced the need to cohabit with the society around them.” Firms choose

to engage in CSR on their own, but also because it is expected by external stakeholders,

the media, and activists, and sometimes due to disclosure regulations (Ali et al., 2017). In

contrast, no such behavior is observed in EMEs. In addition, CSR could help firms in

EMEs overcome institutional voids due to absent or weak market-supporting institutions

(e.g., less developed capital markets, weak regulatory systems, and contract enforcement)

(Khanna and Palepu, 2011; Khanna et al., 2010).

Given their different environments, and their varied formal and informal institutions,

CSR should therefore be “contextualized and locally shaped by multi-level factors and

actors embedded within wider formal and informal governance systems” (Jamali and

Karam, 2018, p. 32). CSR in EMEs “is commonly characterized and less formalized,

more sunken and more philanthropic in nature” (Jamali and Karam, 2018, p. 32). That is

why “it is especially important to investigate CSR in developing countries because of the

pervasive institutional voids that characterize these settings” (Pisani et al., 2017, p. 591).

Consistent with this view, El Ghoul et al. (2017) show that CSR improves a firm’s

competitive advantage in countries with greater institutional voids by reducing

transaction costs and facilitating access to resources.

This paper and this Special Issue aim to answer the calls to study CSR in EMEs by

promoting research on determinants and consequences. To this end, we proceed as

follows. First, we provide a comprehensive analysis of CSR practices in EMEs using

Thomson Reuters’ ASSET4 database, and we compare the CSR performance of firms in

Electronic copy available at: https://ssrn.com/abstract=3718750

EMEs with those in developed markets. We investigate how CSR in EMEs varies by

country, geographic region, economic development level, and industry, and how it is

influenced by country-level characteristics. We complement this analysis by examining

the determinants and valuation. Second, we survey, in the context of EMEs, a select

number of prior studies on the determinants and consequences of CSR, and update the

CSR literature with the papers published in this Special Issue.

The remainder of the paper is organized as follows. In section 2, we provide

summary statistics and regression analyses on CSR, while section 3 reviews the existing

literature. Section 4 concludes with avenues for future research.

2. CSR in EMEs

To provide a fuller picture, we analyze CSR performance, as well as the determinants

and consequences of CSR in EMEs. Specifically, we: 1) compare CSR performance of

firms in EMEs with that of firms in developed markets; 2) examine CSR by country,

geographic region, economic development, and industry; 3) investigate the impact of

country-level characteristics on CSR in EMEs; 4) conduct regression analyses on the

determinants of CSR; and 5) examine the effects of CSR on firm value and cost of capital

in EMEs.

2.1 A Broad View of CSR in EMEs

We begin by comparing the CSR performance of firms in EMEs with that of firms in

developed markets (see Figures 1 and 2). To construct our performance measures

(Environmental, Social, and CSR), we follow prior studies (e.g., Boubakri et al., 2019;

Cheng et al., 2014; El Ghoul et al., 2016, 2017). We also use the ASSET4 ESG

Electronic copy available at: https://ssrn.com/abstract=3718750

(Environmental, Social, Governance) database, which has compiled ESG data and scores

for global companies since 2002.5

ASSET4 measures a firm’s Environmental score along three dimensions: emission

reduction (e.g., CO2 emissions), product innovation (eco-design, lifecycle assessment),

and resource reduction (waste recycling, energy use). It measures a firm’s Social score

along seven dimensions: community (e.g., protecting public health), diversity and

opportunity (e.g., percentage of female employees), employment quality (e.g., pension

benefits), health and safety (e.g., injuries and fatalities), human rights (e.g., forced and

child labor), product responsibility (e.g., protecting customer privacy), and training and

development (e.g., employee skills training and career development). Following standard

practice in the literature, our main CSR measure (CSR) is calculated as the average of a

firm’s Environmental and Social scores.

We use MSCI’s market classification to denote countries as either emerging or

developed,6 and we exclude countries with fewer than five firms. Our final sample

consists of 32,709 firm-year observations, representing 3,785 unique firms for the 2002–

2015 period. Our total sample of 43 countries comprises 21 EMEs (Brazil, Chile, China,

Colombia, Egypt, Greece, India, Indonesia, Malaysia, Mexico, Philippines, Poland,

Qatar, Russian Federation, Saudi Arabia, South Africa, South Korea, Taiwan, Thailand,

Turkey, and United Arab Emirates), and 22 developed economies (Australia, Austria,

Belgium, Canada, Denmark, Finland, France, Germany, Ireland, Israel, Italy, Japan,

5https://my.refinitiv.com/content/dam/myrefinitiv/products/9753/en/BrochuresandF/ASSET4asset

masterExecutiveFactsheet_a4.pdf

6 https://www.msci.com/market-classification

Electronic copy available at: https://ssrn.com/abstract=3718750

Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland,

the U.K., and the U.S.).

Figure 1 reports average CSR, Environmental, and Social scores from 2002 to 2015

for emerging and developed markets. All three measures are higher for developed

markets. Note there is no significant difference between the average Environmental

(53.4) or Social (52.8) score for developed markets, but we observe a higher average

Social (51.4) than Environmental (48.0) for EMEs.

Figure 2 shows the overall CSR trend for both markets from 2002 to 2015. We

observe a relatively stable upward trend for developed markets, but a sharp increase of

over 30% in EMEs.7

Table 1 and Figure 3 focus on the trends of CSR, Environmental, and Social in 21

EMEs. Both Environmental and Social increased significantly from 2002 to 2015, almost

60% for the latter, and 14% for the former. Average scores dropped significantly during

the global financial crisis (2008–2009) but grew steadily subsequently. We delve deeper

into CSR in EMEs in the following section.

[Insert Figure 1 here]

[Insert Figure 2 here]

[Insert Figure 3 here]

[Insert Table 1 here]

7 Table 1 shows the average CSR of EMEs was 40.7 in 2002, and 54.3 in 2015.

Electronic copy available at: https://ssrn.com/abstract=3718750

2.2 A Closer Look at CSR in EMEs

Tables 2 and 3 and Figures 4 to 6 focus on EMEs, and classify CSR by country,

geographic region, economic development, and industry.8

Panel A of Table 2 presents the CSR, Environmental, and Social scores for each

country. We observe a considerable variation across EMEs: South Africa has the highest

CSR (61.2); Qatar has the lowest (15.0).

Panel B of Table 2 and Figure 4 compare CSR across geographic regions: East Asia

& Pacific, Europe & Central Asia, Latin America & Caribbean, Middle East & North

Africa, South Asia, and Sub-Saharan Africa. Figure 4 clearly shows that Middle East &

North Africa has the lowest CSR (24.0), while Sub-Saharan Africa has the highest (61.2).

In Panel B of Table 2, we examine the CSR of each region using East Asia & Pacific as

the benchmark region.9 Compared to the benchmark, 1) Europe & Central Asia shows no

significant difference in CSR, 2) Middle East & North Africa exhibits significantly lower

CSR, and 3) the other three regions have significantly higher CSR.

Panel C of Table 2 and Figure 5 compare CSR across levels of economic

development: high-income OECD, high-income non-OECD, upper-middle-income, and

lower-middle-income. On average, high-income OECD countries exhibit the best CSR

score (53.3), and high-income non-OECD countries exhibit the lowest (43.1). Middle-

income countries fall in the middle.

8 We use the World Bank’s country classifications to denote EMEs by geographic region and

level of economic development.

9 We use East Asia & Pacific as the benchmark because it accounts for nearly half the EME

sample.

Electronic copy available at: https://ssrn.com/abstract=3718750

In Figure 6 and Table 3, we compare CSR by industry, using Fama–French (1997)

12-industry groups. Firms in the Chemicals, Energy, and Utilities industries have the

highest CSR; those in Finance, Healthcare, and Wholesale and Retail have the lowest.

[Insert Table 2 here]

[Insert Figure 4 here]

[Insert Figure 5 here]

[Insert Figure 6 here]

[Insert Table 3 here]

2.3 Country-level Characteristics and CSR in EMEs: Univariate Analyses

In this section, we examine the impact of country-level characteristics—including

macroeconomics, political/legal institutions, and national culture—on CSR in EMEs.

Table 4 presents split-sample results of CSR by macroeconomic condition, proxied

by GDP per Capita, Trade Openness, Market Capitalization, and Market Liquidity (all

from World Bank). GDP per Capita is gross domestic product divided by mid-year

population in current U.S. dollars, and measures economic development. Trade Openness

is the sum of exports and imports of goods and services measured as a share of GDP, and

reflects the openness of an economy. Both Market Capitalization and Market Liquidity

measure the development of financial markets. Market Capitalization is share price times

the number of shares outstanding (including their several classes) for listed domestic

companies as a percentage of GDP, and measures the size of the stock market. Market

Liquidity is the total number of traded shares multiplied by their respective matching

prices as a percentage of GDP, and measures the liquidity of the stock market.

10

Electronic copy available at: https://ssrn.com/abstract=3718750

Table 4 shows that CSR in EMEs is not related to economic development, as there is

no significant difference between countries with high and low GDP per capita. However,

EMEs with open economies and larger and more liquid stock markets tend to have higher

levels of CSR.

Table 5 presents a split-sample analysis of CSR by political and legal institution.

First, we consider the legal protection of investors—Legal Origin and Investor

Protection. Legal Origin, from La Porta et al. (1998), is a dummy variable that equals 1

for a common-law country, and 0 for a civil-law country. La Porta et al. (1998) show that

common‐law countries generally feature stronger legal protection for investors than civil-

law countries. Investor Protection (Revised Antidirector Rights Index), from Djankov et

al. (2008), is an aggregate index of shareholder rights: 1) voting by mail; 2) shares not

deposited; 3) cumulative voting; 4) oppressed minority; 5) pre-emptive rights; and 6)

capital to call a meeting. Table 5 shows that EMEs with stronger legal protection

(common-law and higher investor protection) tend to have higher CSR.

Second, we investigate how political institutions influence CSR in EMEs. We focus

specifically on six political governance measures from the World Governance Indicators

(WGI) dataset: Control of Corruption, Government Effectiveness, Rule of Law,

Regulatory Quality, Political Stability, and Voice and Accountability.10 Control of

Corruption captures “perceptions of the extent to which public power is exercised for

private gain.” Government Effectiveness captures “perceptions of the quality of public

services, the quality of the civil service and the degree of its independence from political

pressures, the quality of policy formulation and implementation, and the credibility of the

10 Detailed descriptions of WGI indicators are found at info.worldbank.org/governance/wgi.

11

Electronic copy available at: https://ssrn.com/abstract=3718750

government's commitment to such policies.” Rule of Law captures “perceptions of the

extent to which agents have confidence in and abide by the rules of society, and in

particular the quality of contract enforcement, property rights, the police, and the courts,

as well as the likelihood of crime and violence.” Regulatory Quality captures

“perceptions of the ability of the government to formulate and implement sound policies

and regulations that permit and promote private-sector development.” Political Stability

captures “perceptions of the likelihood that the government will be destabilized or

overthrown by unconstitutional or violent means, including politically motivated violence

and terrorism.” Voice and Accountability captures “perceptions of the extent to which a

country's citizens are able to participate in selecting their government, as well as freedom

of expression, freedom of association, and free media.” In addition to these individual

WGI indictors, we construct a composite governance index through principal components

analysis.

The split-sample results in Table 5 suggest that CSR is higher for EMEs with more

stable governments (Political Stability) and more freedom of expression (Voice and

Accountability). Overall, those with better governance tend to have higher CSR. Finally,

we compare CSR of democratic countries with that of non-democratic countries. We find

that democratic EMEs have significantly higher CSR than non-democratic ones.

Third, we examine in Table 6 a split-sample analysis of CSR by national culture. We

employ Hofstede’s (2001) four dimensions of national culture, namely Individualism,

Power Distance, Uncertainty Avoidance, and Masculinity.11 Individualism is the extent

to which people feel independent, as opposed to being interdependent as affiliates of

11 For definition, see http://www.geerthofstede.nl/

12

Electronic copy available at: https://ssrn.com/abstract=3718750

larger entities. Power Distance is the extent to which the less powerful members of

organizations and institutions (like a family) accept and expect that power is distributed

unequally. Uncertainty Avoidance deals with a society’s tolerance for uncertainty and

ambiguity. Masculinity is the extent to which the use of force is endorsed socially. The

split-sample results in Table 6 suggest that EMEs with higher levels of individualism

(power distance and masculinity) tend to have higher (lower) CSR. The uncertainty

avoidance dimension appears to be unrelated to CSR in EMEs.12

Overall, we find that CSR in EMEs is significantly associated with economic

openness, financial market development, legal and political institutions, and national

culture.

[Insert Table 4 here]

[Insert Table 5 here]

[Insert Table 6 here]

2.4 Determinants of CSR in EMEs

As shown in Figures 1 and 2, we find clear differences between CSR in developed

and emerging economies, which may stem from heterogeneity of firms in both groups.

To address this issue, we next conduct some regression analyses.

In Table 7, we regress CSR on a dummy variable that indicates emerging economy

(Emerging), several firm-level control variables (Firm Size, ROA, Leverage, and R&D),

and industry and year fixed effects. The firm-level control variables come from

Compustat. Firm Size is measured as the logarithm of total assets in millions of $US.

12Griffin et al. (2020) provide a comprehensive assessment of the role of national culture in

explaining cross-country differences in firm-level CSR practices in 49 countries, and identify the

country- and firm-level channels linking national culture, firms’ CSR practices, and firm value.

13

Electronic copy available at: https://ssrn.com/abstract=3718750

ROA is the ratio of net income before extraordinary items to total assets. Leverage is the

ratio of total debt to total assets. R&D is the ratio of research and development expenses

to total sales. The industry classification follows the Fama–French (1997) 12-industry

classification. The fact that the coefficient of the emerging dummy loads significantly

negatively suggests that average CSR is significantly lower for emerging than developed

economies. Turning to the control variables, Firm Size, ROA, and R&D are positively

associated with CSR. Industries in Consumer Non-durables, Consumer Durables,

Manufacturing, and Chemicals have significantly higher CSR, while Energy, Wholesale

and Retail, and Finance show significantly lower CSR.

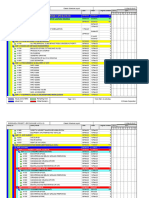

In Table 8, we examine the determinants of CSR in EMEs. Our sample consists of

5,767 firm-year observations from 21 EMEs. We regress CSR on variables of economic

development, institutional environment, and financial crisis. In Column (1) of Table 8,

we consider the set of macroeconomic variables used in Table 4: GDP per Capita, Trade

Openness, Market Capitalization, and Market Liquidity. After controlling for firm and

industry variables, only Trade Openness shows a significantly positive impact on CSR.

In Column (2), we include economic development dummies: High-Income Non-

OECD, Upper-Middle-Income, and Lower-Middle-Income. Using high-income OECD

countries as the baseline, we find that high-income non-OECD countries exhibit

significantly lower CSR, while middle-income countries exhibit no significant difference.

In Column (3), we regress CSR on legal protection (Legal Origin) and political

institutional (Composite Governance Index) variables from Table 5. The results show

positive and significant impacts of legal protection and governance on CSR.

14

Electronic copy available at: https://ssrn.com/abstract=3718750

In Column (4), we examine the effect of financial crises by including a dummy

variable for the years 2008 and 2009. We find that the financial crisis does have a

significantly negative impact on CSR in EMEs.

[Insert Table 7 here]

[Insert Table 8 here]

2.5 Valuation of CSR in EMEs

In this section, we empirically examine the value implications of CSR in EMEs,

specifically how it impacts firm value and the cost of equity capital. We measure firm

value by its market-to-book ratio (MTB), which is calculated as market value divided by

book value. In Column (1) of Table 9, we regress MTB on CSR, the usual firm-level

control variables that are shown to influence firm value, and industry and year fixed

effects. We also include a vector of country-level variables following Table 8: economic

development (GDP per Capita, Trade Openness, Market Capitalization, and Market

Liquidity), institutional environment (Legal Origin and Composite Governance Index),

and national culture (Individualism, Power Distance, Uncertainty Avoidance, and

Masculinity). We exclude observations with missing variables. Our sample consists of

2,882 firm-year observations.

Table 9 reports the results. The coefficient of CSR is positive and significant at the

1% level, suggesting it is associated with higher firm value in EMEs. Economically, a 1-

standard-deviation increase in CSR will result in a 5% increase in firm value in EMEs.13

These findings, based on a sample of EMEs, are consistent with El Ghoul et al. (2017).

They find that CSR is more positively related to valuation in countries with weaker

13 The standard deviation of CSR is 29.108 and the mean of MTB is 1.745.

15

Electronic copy available at: https://ssrn.com/abstract=3718750

market institutions, which is in line with the important role of CSR in overcoming

institutional voids.

To test the impact of CSR on the cost of equity capital, we follow prior literature

(e.g., Boubakri et al., 2012; Dhaliwal et al., 2006; Hail and Leuz, 2006; El Ghoul et al.,

2011). We estimate the implied cost of equity capital according to four models: Easton

(2004), Ohlson and Juettner-Nauroth (2005), Claus and Thomas (2001), and Gebhardt,

Lee, and Swaminathan (2001).14 We use the average of the four estimates as our main

measure of cost of equity (COE) to overcome the possibility of spurious findings

stemming from one particular model (Dhaliwal et al., 2006). We exclude observations

with missing variables. Our sample consists of 2,924 firm-year observations.

In Column (2) of Table 9, we regress COE on CSR and a vector of firm-level control

variables, a vector of country-level control variables, and industry and year fixed effects.

The coefficient of CSR is negative and significant at the 5% level, suggesting it is related

to reduced equity financing costs in EMEs. Economically, a 1-standard-deviation

increase in CSR will decrease the cost of equity financing by 26 basis points.15 These

findings are consistent with El Ghoul et al. (2011) in a U.S. context, and El Ghoul et al.

(2018), Breuer et al. (2018), and Griffin et al. (2020) in international settings.

Taken together, the results in this section show that CSR is associated with higher

firm value and a lower cost of equity, implying that it is highly valued in emerging

economies.

[Insert Table 9 here]

14 See El Ghoul et al. (2018) for detailed descriptions of the four models.

15 The standard deviation of CSR is 29.233.

16

Electronic copy available at: https://ssrn.com/abstract=3718750

3. Select Literature Review on CSR in EMEs

In this section, we discuss some select findings in the literature that relate to the

determinants and consequences of CSR.16 Determinants are factors that influence or

determine policies and implementation. Consequences are the results or outcomes of

those policies and their implementation.

3.1 Determinants of CSR in EMEs

CSR determinants fall into two main categories: country-level and firm-level.

Among country-level determinants, formal institutions, such as legal, political, and

economic development, are important antecedents of CSR. Using data from the 105

largest multinational corporations in Brazil, Russia, India, and China, Li et al. (2010)

investigate CSR motives and reveal that a country’s governance environment is the most

important driving force behind CSR communications intensity. Lin et al. (2015)

investigate how political connections influence China-listed companies' CSR. They find

that, when a mayor is replaced, the level of (and propensity for) CSR activity increases.

Marquis and Qian (2014) find that dependency on the government and risk of

governmental monitoring also influence CSR reporting in China.

Robertson (2009) examines CSR in Singapore, Turkey, and Ethiopia, and suggests it

is responsive to institutional differences. Wang et al. (2018) show that corporate

environmental actions exhibit an inverted U-shape as control of environmental practices

shifts from the central government to the most decentralized administrative level. The

authors infer that state hold on corporate environmental actions in China is multifaceted,

16 For more extensive literature reviews on CSR, including on EMEs, please see Mattingly

(2017), Jamali and Karam (2018), and Pisani et al. (2017), among others. Ali et al. (2017) review

empirical research articles related to the specific aspect of CSR disclosure.

17

Electronic copy available at: https://ssrn.com/abstract=3718750

and subject to “policy-policy decoupling.” Tashman et al. (2019) examine CSR

decoupling of emerging market multinational enterprises and find that such decoupling is

shaped by their dual embeddedness in the home countries and the global institutional

environment.

Liu et al. (2020, in this issue) investigate how turnover of local officials influences

corporate philanthropy. Using a sample of Chinese-listed firms from 2000 to 2015, they

find that Chinese firms tend to increase corporate philanthropy investment when city-

level officials are replaced. This positive impact of official turnovers is stronger for

unexpected turnovers, and for firms with superior performance and/or more state

ownership.

Informal institutions such as religion and culture are also important determinants

of CSR. For example, Beekun and Badawi (2005) suggest that business ethics in Muslim

countries are shaped by Islamic religious beliefs. Similarly, Wang and Juslin (2009) note

that Western CSR concepts do not adapt well to China. They suggest a “Chinese

harmony” approach to CSR as “respecting nature and loving people,” which is inspired

by Confucian interpersonal harmony and Taoist harmony between man and nature.

Kim and Kim’s (2010) survey of Korean public relations practitioners reveals that

social traditionalism values have more explanatory power for CSR attitudes in Korea than

Hofstede’s (2001) cultural dimensions. And Chourou et al. (2020, in this issue) explore

how cross-country differences in empathy can explain variations in CSR. Using firms

from 15 emerging countries over the 2010–2016 period, they show that empathy is

positively associated with CSR. They also use the 2004 Indian Ocean earthquake and

18

Electronic copy available at: https://ssrn.com/abstract=3718750

tsunami as a quasi-natural experiment, and find that firms located in countries with high

empathy donated more money than those in countries with less empathy.

Khan et al. (2020, in this issue) examine the influence of institutional dynamics on

CSR in Pakistan by conducting 23 in-depth interviews with a variety of stakeholders

(CSR managers, national regulators, and members of CSR-promoting institutions). They

find that, in Pakistan, family traditions and religion, followed by peer pressure, are the

primary drivers of CSR. Labidi et al. (2020, in this issue) investigate the impact of

national culture on socially responsible investment (SRI) fund flows. Using a dataset

from 45 countries over the 1997–2019 period, they find that masculinity and uncertainty

avoidance are negatively associated with SRI fund flows.

Beyond the country-level determinants of CSR, which include formal and informal

institutions, firm-level variables and characteristics also affect CSR in EMEs. Such firm-

level determinants include corporate governance, BOD and CEO characteristics,

ownership structure, internationalization, and so on. For example, Jamali (2008) uses a

qualitative study in a Lebanese context, and investigates the interrelationships between

corporate governance and CSR. He finds that the majority of managers perceive

corporate governance as a necessary pillar of sustainable CSR.

Lindgreen et al. (2009) empirically analyze CSR practices of 84 firms in Botswana

and Malawi and show that boards of directors and investors collectively exert significant

influence on CSR policies and practices. Li et al. (2019) aim to shed light on how CEO

characteristics influence CSR in emerging economies, and document that entrepreneurial

Indian firms with religious owners invest more than other firms in CSR. Wen and Song

(2017) explore the importance of managerial background data for a sample of China-

19

Electronic copy available at: https://ssrn.com/abstract=3718750

listed firms. They find that managers with work or study experience abroad tend to

promote CSR performance.

Al-Mamun and Seamer (2020, in this issue) add to the scarce literature on directors’

characteristics using a sample of firms from six Asian emerging economies (India,

Indonesia, Malaysia, Pakistan, the Philippines, and Thailand). They show that board of

director attributes (political influence, international experience, business expertise,

interlocking directorships, and independence) positively affect CSR engagement.

We note that, to date, there is solid evidence that firm ownership structure affects

CSR. For example, using data on publicly traded firms in nine East Asian economies, El

Ghoul et al. (2016) find that family-controlled firms exhibit lower CSR performance than

non-family-controlled matching firms. Relatedly, Cao et al. (2019) show that CSR

reporting quality decreases as ownership concentration and control increase in Chinese

publicly listed firms over 2008–2015.

Furthermore, to shed light on another shareholder type—the State—Zhang et al.

(2009) analyze data on Chinese firms’ response to the 2008 Sichuan earthquake. They

find that the amount of charitable giving and the likelihood of firm response for state-

owned enterprises (SOEs) is lower than that for private firms. Following the same

reasoning, Guo et al. (2018) find that Chinese firms with dual status as business group

members and SOEs have weaker CSR performance. They explain that CSR engagement

in this case may be viewed as a strategy for pursuing political legitimacy from the

government, and legitimacy in general from the public.

Cao et al. (2019) examine the role of multiple large shareholders on CSR using a

sample of Chinese-listed firms. They find that controlling shareholders have an

20

Electronic copy available at: https://ssrn.com/abstract=3718750

entrenchment effect on CSR reporting. This entrenchment effect is mitigated by non-

controlling large shareholders.

The notion of whether and how CSR can be politically motivated is explored further

by Boubakri et al. (2019), who show that, on average, privatized firms exhibit better CSR

performance than other publicly listed firms. They also compare partially (positive state

ownership) and fully (zero state ownership) privatized firms, and find that partial

privatizations exhibit higher CSR intensity than their fully privatized peers. Their results

suggest that, at high levels of residual state ownership, governments’ political motives for

CSR tend to prevail. At lower levels, economic value enhancement and profit-

maximization motives tend to dominate.

Internationalization is another determinant of CSR in EMEs. Based on survey data

from 121 auto parts suppliers in Mexico, Muller and Kolk (2010) find that trade intensity

is an important driver of CSR. Boubakri et al. (2016) find that CSR increases (decreases)

significantly after cross-listing in (delisting from) U.S. markets. Using a sample of 223

Russia-listed companies for the 2012–2015 period, Garanina and Aray (2020, in this

issue) confirm that foreign exposure influences CSR disclosure. They find that foreign

board members and cross-listing are positively related to CSR disclosure.

Wen et al. (2020, in this issue) focus on customer concentration in China. They find

it is negatively associated with CSR performance, especially for firms without foreign

customers or investors, firms without state ownership, and firms in weaker legal

environments.

3.2 Outcomes of CSR in EMEs

21

Electronic copy available at: https://ssrn.com/abstract=3718750

The literature on the consequences of CSR policies in EMEs is generally more

extensive. The consensus is that CSR has a positive impact on firm financial

performance, but with mitigating factors. Arya and Zhang (2009) explore the market

reaction to CSR initiatives in response to institutional reforms in South Africa. Their

study used publicly listed firms that undertook such initiatives from 1996 to 2005. They

find that CSR announcements were viewed positively by investors during the late phase

of institutional reforms. Cheung et al. (2010) also find a positive impact of CSR on

subsequent-year market valuations in ten Asian emerging markets. They suggest that

firms are rewarded by the market for improving CSR practices.

Wang and Qian (2011) use the melamine contamination incident in China as a

natural experiment. They find that CSR affects institutional investors’ buying and selling

behaviors, and, in turn, stock market returns. Institutional investors’ trading behavior was

largely insensitive to firms’ CSR performance before the incident, but it became

significantly dependent when a certain threshold was exceeded. Wang and Qian (2011)

stress that the positive CSR-performance relationship is more pronounced for firms with

higher public visibility, and for those that are not government-owned.

Choi et al. (2013) find that CSR is negatively associated with earnings management

in Korea. However, the relationship is weaker for chaebol firms and for firms with highly

concentrated ownership, suggesting that CSR practices may be used to cover poor

earnings quality.

Wang and Li (2015) examine market reactions to disclosure of first-time stand-alone

CSR reports in China, and find that CSR initiators are associated with higher market

valuations than matched non-initiators. They find further that CSR initiators controlled by

22

Electronic copy available at: https://ssrn.com/abstract=3718750

central and local governments exhibit lower market valuations than CSR non-initiators or

CSR initiators controlled by private shareholders. CSR initiators with high CSR reporting

quality and perceived credibility exhibit higher valuations than those with low quality and

medium or low perceived credibility.

In terms of cost of capital, Ye and Zhang (2011) find a U-shaped relation between

CSR and debt financing costs in the context of China. Specifically, they show that

improved CSR reduces debt financing costs as long as there is no CSR over-investment.

The relation is reversed when CSR investment exceeds a certain threshold. Another

positive outcome of CSR is related to trade credit financing. Zhang et al. (2014) argue

that CSR can help firms attract suppliers and consolidate relationships, which in turn

results in more profitable trade credit financing from suppliers.

Saeed and Zamir (2020, in this issue) find that CSR has a negative impact on

dividends, suggesting a substitution effect. They use a hand-collected dataset of listed

firms from China, India, Indonesia, Korea, Malaysia, Pakistan, Turkey, and the Russian

Federation over the 2010–2018 period. This negative effect is more pronounced for firms

with higher institutional ownership.

As EMEs adopt mandatory CSR disclosure policies, some research has focused on

the potential consequences to firms. For example, Chen et al. (2018) study China’s 2008

mandate that firms disclose CSR activities, and show a negative impact on profitability.

This suggests that mandatory CSR disclosure alters firm behavior, generating positive

externalities at the expense of shareholders.

Hickman et al. (2020, in this issue) investigate the impact of mandatory CSR

reporting on the relation between CSR and earnings management using India’s

23

Electronic copy available at: https://ssrn.com/abstract=3718750

Companies Act of 2013. This Act includes, among other provisions, a unique mandate

that firms must spend a minimum of 2% of reported income on CSR initiatives. In this

context, Hickman et al. (2020) show that firms that voluntarily reported CSR spending

before the Act exhibit more earnings management than other firms. They suggest that

CSR was used manipulatively in the pre-Act period. Once the Act went into effect,

evidence shows firms engaged in less earnings management on average. However,

overall, the results suggest the CSR mandate did not significantly affect earnings

manipulations. Thus, the observed decrease in earnings management in the post-Act

period is likely due to other provisions, such as those related to improving corporate

governance and financial audits.

Within the same context, Aswani et al. (2020, in this issue) examine the value impact

of the Companies Act 2013’s mandate for CSR spending by large and profitable Indian

firms, and find that it is value-decreasing. The value impact is negative, even in firms that

engaged voluntarily in CSR in the past. Profitable firms may benefit from CSR if they

belong to the fast-moving consumer goods sector. However, industrial firms and those

with high capital expenditures tend to be negatively impacted. They conclude that a one-

size-fits-all approach to CSR is suboptimal and value-decreasing.

Recognizing the importance of corporate innovation on firm and economic growth,

Chkir et al. (2020, this issue) examine whether CSR has a material effect on this

outcome. They use a large set of countries that includes EMEs. In particular, they

investigate whether such a relation between CSR and innovation depends on the level of

economic development. Their results show CSR positively affects innovation,

particularly in developed and civil-law countries. The authors suggest that, based on this

24

Electronic copy available at: https://ssrn.com/abstract=3718750

evidence, governments and firms should emphasize CSR more heavily in order to foster

and reap the benefits of innovation and ensure a comparative advantage in a highly

competitive environment.

4. Conclusion and Avenues for Future Research

To some extent, the review of extant literature on CSR in EMEs shows how little we

know about its determinants and outcomes in this specific setting. The papers published

in this Special Issue are a valuable step forward in addressing this lack of research, but

there is still so much that deserves attention. We consider the following possible research

topics and avenues.

It is certainly opportune to begin with data availability (or unavailability thereof).

Newly available databases such as ASSET4 that span numerous countries tackle this

issue. However, a word of caution is needed regarding the way CSR is defined and

reported across countries, as inconsistencies may affect the results. Using data from a

single country may help circumvent this problem.

Turning to the determinants of CSR, we note there is a great deal to cover. For

example, at a firm level, there remains very little research on how corporate governance

affects CSR in a cross-country setting. A few questions worth exploring are: What are the

roles of ownership concentration and blockholder identity (family, state, etc.)? How are

institutional ownership and its characteristics (e.g., long-term vs. short-term horizons;

independent vs. non-independent; norm-constrained vs. unconstrained) related to CSR?

How do board characteristics of size, independence, and heterogeneity (e.g., in terms of

gender, culture, and education; engagement of directors) affect CSR? What about CEO

characteristics such as tenure, ownership, power, political ideology, culture, and

25

Electronic copy available at: https://ssrn.com/abstract=3718750

compensation? With greater data collection (even for single countries), we can shed more

light on these questions.

As additional determinants of CSR, more research on macro-level factors is also

warranted. For example, given that CSR is voluntary, how do macroeconomic changes,

such as board reforms or gender reforms, affect and explain CSR adoption, level of

investment, and disclosure? Moreover, although characterized by rapid economic growth,

EMEs still lag in terms of formal institutional development, and they tend to be hindered

by weak political institutions and political uncertainty. This institutional void leaves more

room for informal institutions and culture to overtake them as drivers of corporate

strategy and decisions, including CSR. In an EME context, it is therefore vital to explore

whether informal institutions and culture, as substitutes for weaker formal ones, are more

relevant determinants of CSR.

Ultimately, we need deeper information on which factor (firm-level or country-level)

is the predominant driver of CSR in EMEs. This is a timely issue, given the increasing

importance of EMEs in global economic growth and their contributions to carbon

emissions and global pollution. Currently, we lack sufficient understanding of how CSR

practices in EMEs should be shaped to reduce such adverse effects. For example, if

macro- and country-level determinants of CSR are more important, regulations may help

achieve these goals. On the other hand, if we can identify the types of firms that are most

damaging to the environment (e.g., family), regulations could be designed to change their

behavior. Investors may also opt to penalize these firms. Indeed, as Habib and Hasan

(2019) describe, firms are incentivized to invest in CSR when positive CSR behavior is

used by mutual funds and other institutional investors to screen stocks.

26

Electronic copy available at: https://ssrn.com/abstract=3718750

With regard to corporate outcomes of CSR in EMEs, several questions remain

unanswered. For example, are socially responsible firms in these weaker institutional

environments more or less likely to manage earnings, avoid taxes, engage in financial

misreporting, and commit fraud? How are these related to CSR disclosure? As we note

above, the literature on the impact of CSR on corporate performance is extensive.

However, we still know little about the potential channels by which it is achieved. Future

work in this direction is warranted (El Ghoul et al., 2017).

Additionally, since firms in EMEs have a long history of exposure to crises (e.g., the

1994 Tequila crisis, the 1997 East Asian financial crisis, Argentina’s long-running

economic woes, the current COVID-19 crisis), we wonder whether the use of CSR could

mitigate the adverse effects of such extreme and disruptive events? In other words, does

CSR in EME firms have particular value during crisis periods? More methodological

studies are needed that can exploit advanced empirical methodologies, such as regression

discontinuity design, difference-in-differences, and instrumental variables.

To conclude, and as discussed above, research on the determinants and consequences

of CSR in EMEs remains scant. This Special Issue aims to fill that gap by contributing

ten novel studies to the literature, and by proposing several avenues for future research.

27

Electronic copy available at: https://ssrn.com/abstract=3718750

References

Ali, W., Frynas, J.G., and Mahmood, Z., 2017. Determinants of corporate social

responsibility (CSR) disclosure in developed and developing countries: A literature

review. Corporate Social Responsibility and Environmental Management, 24, 273-294.

Al-Mamun, A., and Seamer, M., 2020. Board of director attributes and CSR engagement

in emerging economy firms: Evidence from across Asia. Emerging Markets Review (in

this issue).

Arya, B., and Zhang, G., 2009. Institutional reforms and investor reactions to CSR

announcements: Evidence from an emerging economy. Journal of Management

Studies, 46(7), 1089-1112.

Aswani, J., Chidambaran, N.K., and Hasan, I., 2020. Who benefits from mandatory CSR?

Evidence from the Indian Companies Act 2013. Emerging Markets Review (in this issue).

Bae, K. H., El Ghoul, S., Guedhami, O., Kwok, C. C., and Zheng, Y., 2019. Does

corporate social responsibility reduce the costs of high leverage? Evidence from capital

structure and product market interactions. Journal of Banking & Finance, 100, 135-150.

Baskin, J., and Gordon, K., 2005. Corporate responsibility practices of emerging market

companies. OECD Working Papers on International Investment, No. 2005/03, OECD

Publishing, Paris, https://doi.org/10.1787/713775068163.

Beekun, R.I., and Badawi, J.A., 2005. Balancing ethical responsibility among multiple

organizational stakeholders: The Islamic perspective. Journal of Business Ethics, 60(2),

131-145.

Boubakri, N., El Ghoul, S., Wang, H., Guedhami, O., and Kwok, C.C., 2016. Cross-

listing and corporate social responsibility. Journal of Corporate Finance, 41, 123-138.

Boubakri, N., Guedhami, O., Kwok, C.C., and Wang, H.H., 2019. Is privatization a

socially responsible reform? Journal of Corporate Finance, 56, 129-151.

Boubakri, N., Guedhami, O., Mishra, D., and Saffar, W., 2012. Political connections and

the cost of equity capital. Journal of Corporate Finance, 18(3), 541-559.

Breuer, W., Müller, T., Rosenbach, D., and Salzmann, A. 2018. Corporate social

responsibility, investor protection, and cost of equity: A cross-country comparison.

Journal of Banking & Finance, 96, 34-55.

Cao, J., Liang, H., and Zhan, X., 2019. Peer effects of corporate social responsibility.

Management Science, 65(12), 5487-5503.

Cao, F., Peng, S.S., and Ye, K., 2019. Multiple large shareholders and corporate social

responsibility reporting. Emerging Markets Review, 38, 287-309.

28

Electronic copy available at: https://ssrn.com/abstract=3718750

Chen, Y.C., Hung, M., and Wang, Y., 2018. The effect of mandatory CSR disclosure on

firm profitability and social externalities: Evidence from China. Journal of Accounting

and Economics, 65(1), 169-190.

Cheng, B., Ioannou, I., and Serafeim, G., 2014. Corporate social responsibility and access

to finance. Strategic Management Journal, 35(1), 1-23.

Cheung, Y.L., Tan, W., Ahn, H.J., and Zhang, Z., 2010. Does corporate social

responsibility matter in Asian emerging markets? Journal of Business Ethics, 92(3), 401-

413.

Chkir, I., El Haj Hassan, B., Rjiba, H., and Saadi, S., 2020. Does corporate social

responsibility influence corporate innovation? International evidence. Emerging Markets

Review (in this issue).

Choi, B.B., Lee, D., and Park, Y., 2013. Corporate social responsibility, corporate

governance and earnings quality: Evidence from Korea. Corporate Governance: An

International Review, 21(5), 447-467.

Chourou, L., Grira, J., and Saadi, S., 2020. Does empathy matter in corporate social

responsibility? Evidence from emerging markets. Emerging Markets Review (in this

issue).

Christensen, H.B., Hail, L., and Leuz, C., 2019. Adoption of CSR and sustainability

reporting standards: Economic analysis and review. European Corporate Governance

Institute – Finance Working Paper No. 623/2019. http://dx.doi.org/10.2139/ssrn.3427748.

Claus, J., and Thomas, J., 2001. Equity premia as low as three percent? Evidence from

analysts' earnings forecasts for domestic and international stock markets. The Journal of

Finance, 56(5), 1629-1666.

Dhaliwal, D., Heitzman, S., and Li, O.Z., 2006. Taxes, leverage, and the cost of equity

capital. Journal of Accounting Research, 44(4), 691-723.

Djankov, S., La Porta, R., Lopez-de-Silanes, F., and Shleifer, A., 2008. The law and

economics of self-dealing. Journal of Financial Economics, 88(3), 430-465.

Doh, J., Husted, B. W., and Marano, V., 2019. Corporate social responsibility in

emerging markets. In: McWilliams, A., Rupp, D.E., Siegel, D.S., Stahl, G.K., Waldman,

D.A. (Eds.), The Oxford Handbook of Corporate Social Responsibility. Oxford

University Press.

Easton, P.D., 2004. PE ratios, PEG ratios, and estimating the implied expected rate of

return on equity capital. Accounting Review, 79(1), 73-95.

El Ghoul, S., Guedhami, O., and Kim, Y., 2017. Country-level institutions, firm value,

and the role of corporate social responsibility initiatives. Journal of International

Business Studies, 48(3), 360-385.

29

Electronic copy available at: https://ssrn.com/abstract=3718750

El Ghoul, S., Guedhami, O., Kim, H., and Park, K., 2018. Corporate environmental

responsibility and the cost of capital: International evidence. Journal of Business

Ethics, 149(2), 335-361.

El Ghoul, S., Guedhami, O., Kwok, C.C. and Mishra, D.R. 2011. Does corporate social

responsibility affect the cost of capital? Journal of Banking & Finance, 35, 2388-2406.

El Ghoul, S., Guedhami, O., Wang, H., and Kwok, C.C., 2016. Family control and

corporate social responsibility. Journal of Banking & Finance, 73, 131-146.

Fama, E.F., and French, K.R., 1997. Industry costs of equity. Journal of Financial

Economics, 43(2), 153-193.

Friede, G., Busch, T., and Bassen, A. 2015. ESG and financial performance: Aggregated

evidence from more than 2000 empirical studies. Journal of Sustainable Finance &

Investment, 5(4), 210-233.

Friedman, M., 1970. The social responsibility of business is to increase its profits. The

New York Times Magazine, 13, 32-33.

Garanina, T., and Aray, Y., 2020. Enhancing CSR disclosure through foreign ownership,

foreign board members, and cross-listing: Does it work in a Russian context? Emerging

Markets Review (in this issue).

Gebhardt, W.R., Lee, C.M., and Swaminathan, B., 2001. Toward an implied cost of

capital. Journal of Accounting Research, 39(1), 135-176.

Griffin, D.W., Guedhami, O., Li, K., and Lu, G., 2020. National culture and the value

implications of corporate social responsibility (October 31, 2019). Available at SSRN:

https://ssrn.com/abstract=3250222 or http://dx.doi.org/10.2139/ssrn.3250222.

Guo, M., He, L., and Zhong, L., 2018. Business groups and corporate social

responsibility: Evidence from China. Emerging Markets Review, 37, 83-97.

Habib, A., and Hasan, M.M., 2019. Corporate social responsibility and cost stickiness.

Business and Society, 58(3), 453-492.

Hail, L., and Leuz, C., 2006. International differences in the cost of equity capital: Do

legal institutions and securities regulation matter? Journal of Accounting Research, 44(3),

485-531.

Hickman, L.E., Iyer, S., and Jadiyappa, N., 2020. The effect of voluntary and mandatory

corporate social responsibility on earnings management: Evidence from India and the 2%

rule. Emerging Markets Review (in this issue).

Hofstede, G., 2001. Culture’s Consequences: Comparing Values, Behaviors, Institutions,

and Organizations across Nations, 2nd ed. Sage, Thousand Oaks, CA.

30

Electronic copy available at: https://ssrn.com/abstract=3718750

Jamali, D., 2008. A stakeholder approach to corporate social responsibility: A fresh

perspective into theory and practice. Journal of Business Ethics, 82(1), 213-231.

Jamali, D., and Karam, C., 2018. Corporate social responsibility in developing countries

as an emerging field of study. International Journal of Management Reviews, 20(1), 32-

61.

Kim, Y., and Kim, S.Y., 2010. The influence of cultural values on perceptions of

corporate social responsibility: Application of Hofstede’s dimensions to Korean public

relations practitioners. Journal of Business Ethics, 91(4), 485-500.

Khan, M., Lockhart, J., and Bathurst, R., 2020. The institutional analysis of CSR:

Learnings from an emerging country. Emerging Markets Review (in this issue).

Khanna, T., and Palepu, K. G., 2011. Winning in emerging markets: Spotting and

responding to institutional voids. World Financial Review, May–June, 18-20.

Khanna, T., Palepu, K. G., and Bullock, R., 2010. Winning in emerging markets: A road

map for strategy and execution. Harvard Business Press, Boston.

Kitzmueller, M., and Shimshack, J., 2012. Economic perspectives on corporate social

responsibility. Journal of Economic Literature, 50(1), 51-84.

La Porta, R., Lopez-de-Silanes, F., Shleifer, A., and Vishny, R.W., 1998. Law and

finance. Journal of Political Economy, 106(6), 1113-1155.

Labidi, C., Laribi, D., and Ureche-Rangau, L., 2020. National culture and socially

responsible fund flows. Emerging Markets Review (in this issue).

Li, C., Xu, Y., Gill, A., Haider, Z.A., and Wang, Y., 2019. Religious beliefs, socially

responsible investment, and cost of debt: Evidence from entrepreneurial firms in India.

Emerging Markets Review, 38, 102-114.

Li, S., Fetscherin, M., Alon, I., Lattemann, C., and Yeh, K., 2010. Corporate social

responsibility in emerging markets. Management International Review, 50(5), 635-654.

Lin, K.J., Tan, J., Zhao, L., and Karim, K., 2015. In the name of charity: Political

connections and strategic corporate social responsibility in a transition economy. Journal

of Corporate Finance, 32, 327-346.

Lindgreen, A., Swaen, V., and Johnston, W.J., 2009. Corporate social responsibility: An

empirical investigation of US organizations. Journal of Business Ethics, 85(2), 303-323.

Liu, W., De Sisto, M., and Li, W., 2020. How does the turnover of local officials make

firms more charitable? A comprehensive analysis of corporate philanthropy in China.

Emerging Markets Review (in this issue).

31

Electronic copy available at: https://ssrn.com/abstract=3718750

Marquis, C., and Qian, C. 2014. Stakeholder legitimacy and corporate social

responsibility reporting in China. Organization Science, 25(1), 127-148.

Mattingly, E., 2017. Corporate social performance: A review of empirical research

explaining the corporation-society relationship under Kinder, Lydenberg, Domini Social

Rating Data. Business and Society, 56(6), 796-839.

McWilliams, A., and Siegel, D., 2001.Corporate social responsibility: A theory of the

firm perspective. Academy of Management Review, 26, 117-127.

Muller, A., and Kolk, A., 2010. Extrinsic and intrinsic drivers of corporate social

performance: Evidence from foreign and domestic firms in Mexico. Journal of

Management Studies, 47(1), 1-26.

Ohlson, J.A., and Juettner-Nauroth, B.E., 2005. Expected EPS and EPS growth as

determinants of value. Review of Accounting Studies, 10(2-3), 349-365.

Pisani, N., Kourula, A., Kolk, A., and Meijer, R., 2017. How global is international CSR

research? Insights and recommendations from a systematic review. Journal of World

Business, 52, 591-614.

Robertson, D.C., 2009. Corporate social responsibility and different stages of economic

development: Singapore, Turkey, and Ethiopia. Journal of Business Ethics, 88(4), 617-

633.

Saeed, A., and Zamir, F., 2020. How does CSR disclosure affect dividend payments in

emerging markets? Emerging Markets Review (in this issue).

Tashman, P., Marano, V., and Kostova, T., 2019. Walking the walk or talking the talk?

Corporate social responsibility decoupling in emerging market multinationals. Journal of

International Business Studies, 50, 153-171.

Tetrault Sirsly, C.A., and Lvina, E., 2019. From Doing Good to Looking Even Better: The

dynamics of CSR and reputation. Business and Society, 58(6), 1234-1266.

Wang, H., and Qian, C., 2011. Corporate philanthropy and corporate financial

performance: The roles of stakeholder response and political access. Academy of

Management Journal, 54(6), 1159-1181.

Wang, K.T., and Li, D., 2015. Market reactions to the first-time disclosure of corporate

social responsibility reports: Evidence from China. Journal of Business Ethics, 130(1), 1-

22.

Wang, L., and Juslin, H., 2009. The impact of Chinese culture on corporate social

responsibility: The harmony approach. Journal of Business Ethics, 88(3), 433-451.

32

Electronic copy available at: https://ssrn.com/abstract=3718750

Wang, R., Wijen, F., and Heugens, P.P., 2018. Government's green grip: Multifaceted

state influence on corporate environmental actions in China. Strategic Management

Journal, 39(2), 403-428.

Wen, W., Ke, Y., and Liu, X., 2020. Customer concentration and corporate social

responsibility performance: Evidence from China. Emerging Markets Review (in this

issue).

Wen, W., and Song, J., 2017. Can returnee managers promote CSR performance?

Evidence from China. Frontiers of Business Research in China, 11(1), 12.

Ye, K., and Zhang, R., 2011. Do lenders value corporate social responsibility? Evidence

from China. Journal of Business Ethics, 104(2), 197.

Zhang, M., Ma, L., Su, J., and Zhang, W., 2014. Do suppliers applaud corporate social

performance? Journal of Business Ethics, 121(4), 543-557.

Zhang, R., Rezaee, Z., and Zhu, J., 2009. Corporate philanthropic disaster response and

ownership type: Evidence from Chinese firms’ response to the Sichuan earthquake.

Journal of Business Ethics, 91(1), 51-63.

33

Electronic copy available at: https://ssrn.com/abstract=3718750

Figure 1. CSR Performance: Emerging vs. Developed Economies

Notes: This figure reports average CSR, Environmental, and Social scores from 2002 to 2015 for

emerging and developed economies.

34

Electronic copy available at: https://ssrn.com/abstract=3718750

Figure 2. CSR Trend: Emerging vs. Developed Economies

Notes: This figure exhibits the overall CSR trends from 2002 to 2015 for emerging and developed

economies.

35

Electronic copy available at: https://ssrn.com/abstract=3718750

Figure 3. CSR Trend in EMEs

65

60

55

50

45

40

35

30

2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015

CSR Environmental Social

Notes: This figure shows the trends of CSR, Environmental, and Social scores from 2002 to 2015

in EMEs.

36

Electronic copy available at: https://ssrn.com/abstract=3718750

Figure 4. CSR in EMEs: By Geographic Region

Notes: This figure compares the CSR, Environmental, and Social scores in EMEs by geographic

regions.

37

Electronic copy available at: https://ssrn.com/abstract=3718750

Figure 5. CSR in EMEs: By Economic Development

Notes: This figure compares the CSR, Environmental, and Social scores in EMEs by economic

development.

38

Electronic copy available at: https://ssrn.com/abstract=3718750

Figure 6. CSR in EMEs: By Industry

Notes: This figure compares the CSR, Environmental, and Social scores in EMEs by industry,

using Fama–French (1997) 12-industry groups.

39

Electronic copy available at: https://ssrn.com/abstract=3718750

Table 1. CSR Trend in EMEs

Year N CSR Environmental Social

2002 16 40.7 46.7 34.7

2003 16 47.8 46.3 49.4

2004 21 56.7 59.3 54.1

2005 24 53.2 55.1 51.2

2006 25 52.9 54.0 51.7

2007 65 59.7 57.4 62.1

2008 227 49.4 46.9 51.8

2009 336 47.7 44.7 50.7

2010 696 47.3 45.7 49.0

2011 776 47.1 45.4 48.9

2012 859 49.5 47.4 51.6

2013 900 49.8 47.9 51.7

2014 958 49.7 48.4 51.0

2015 848 54.3 53.1 55.4

Notes: This table shows the trends of CSR, Environmental, and Social scores from 2002 to 2015 in

EMEs.

40

Electronic copy available at: https://ssrn.com/abstract=3718750

Table 2. CSR in EMEs

N CSR Environmental Social

Emerging Economies Total 5,767 49.7 48.0 51.4

Panel A by Economy

N CSR Environmental Social Geographic Region Economic Development

Brazil 392 56.1 51.3 61.0 Latin America & Caribbean Upper-middle-income

Chile 150 45.5 44.0 47.1 Latin America & Caribbean High income: OECD

China 508 33.1 33.9 32.4 East Asia & Pacific Upper-middle income

Colombia 60 48.9 42.4 55.4 Latin America & Caribbean Upper-middle income

Egypt 66 23.2 20.1 26.3 Middle East & North Africa Lower-middle income

Greece 218 51.4 50.5 52.3 Europe & Central Asia High income: OECD

India 550 55.8 54.6 57.0 South Asia Lower-middle income

Indonesia 201 52.7 45.2 60.3 East Asia & Pacific Lower-middle income

Malaysia 303 45.5 40.1 50.8 East Asia & Pacific Upper-middle income

Mexico 188 50.6 49.2 52.1 Latin America & Caribbean Upper-middle income

Philippines 128 41.5 39.6 43.4 East Asia & Pacific Lower-middle income

Poland 173 37.3 34.8 39.7 Europe & Central Asia High income: OECD

Qatar 37 15.0 14.3 15.8 Middle East & North Africa High income: Non-OECD

Russian Federation 255 49.3 46.1 52.4 Europe & Central Asia High income: Non-OECD

Saudi Arabia 57 29.3 32.3 26.3 Middle East & North Africa High income: Non-OECD

South Africa 643 61.2 53.3 69.1 Sub-Saharan Africa Upper-middle income

South Korea 678 59.6 61.7 57.6 East Asia & Pacific High income: OECD

Taiwan 776 44.1 47.9 40.4 East Asia & Pacific High income: Non-OECD

Thailand 180 56.6 51.7 61.5 East Asia & Pacific Upper-middle income

Turkey 168 54.8 53.3 56.2 Europe & Central Asia Upper-middle income

United Arab Emirates 36 26.3 28.8 23.8 Middle East & North Africa High income: Non-OECD

41

Electronic copy available at: https://ssrn.com/abstract=3718750

Table 2. Continued

Panel B by Geographic Region

N CSR Environmental Social

East Asia & Pacific 2,774 47.4 47.5 47.2

Europe & Central Asia 814 48.4 46.4 50.5

Latin America & Caribbean 790 52.3 48.7 55.8

Middle East & North Africa 196 24.0 24.2 23.8

South Asia 550 55.8 54.6 57.0

Sub-Saharan Africa 643 61.2 53.3 69.1

CSR Difference (t-statistics)

Europe & Central Asia vs. East Asia & Pacific 1.1 (0.9)

Latin America & Caribbean vs. East Asia & Pacific 4.9*** (4.0)

Middle East & North Africa vs. East Asia & Pacific -23.4*** (-10.7)

South Asia vs. East Asia & Pacific 8.4*** (6.1)

Sub-Saharan Africa vs. East Asia & Pacific 13.8*** (10.9)

Panel C by Economic Development

N CSR Environmental Social

High-income OECD 1,219 53.3 53.7 52.8

High-income Non-OECD 1,161 43.1 45.1 41.1

Upper-middle-income 2,442 50.7 46.6 54.8

Lower-middle-income 945 50.9 48.2 53.7

CSR Difference (t-statistics)

High-income Non-OECD vs. High-income OECD -10.2*** (-8.0)

Upper-middle-income vs. High-income OECD -2.6*** (-2.5)

Lower-middle-income vs. High-income OECD -2.3* (-1.8)

Notes: This table presents the CSR scores in EMEs by country, geographic region, and economic development. Panel A presents the CSR scores for

each emerging economy. Panel B shows the CSR scores across geographic regions and examine the CSR of each region using East Asia & Pacific

as the benchmark. Panel C compares the CSR scores by economic development using high-income OECD countries as the benchmark.

42

Electronic copy available at: https://ssrn.com/abstract=3718750

Table 3. CSR in EMEs: By Industry

Industry N CSR Environmental Social

Business Equipment 499 56.6 58.4 54.8

Chemicals 280 60.4 62.6 58.2

Consumer Durables 162 54.8 58.9 50.7

Consumer Non-durables 343 48.6 46.2 51.1

Energy 369 64.7 62.2 67.2

Finance 1336 40.7 38.1 43.3

Healthcare 147 34.4 30.3 38.5

Manufacturing 631 54.2 55.6 52.9

Telecommunication 368 49.4 43.2 55.7

Utilities 342 57.5 53.9 61.0

Wholesale and Retail 343 40.4 36.5 44.2

Others 947 49.5 47.2 51.8

Notes: This table shows the CSR, Environmental, and Social scores in EMEs by industry, using

Fama–French (1997) 12-industry groups.

43

Electronic copy available at: https://ssrn.com/abstract=3718750

Table 4. CSR in EMEs: Split Sample by Macroeconomics

Difference

N CSR

(t-statistics)

GDP per Capita High 2,501 50.6 0.1

Low 2,490 50.5 (0.1)

Trade Openness High 2,433 51.6 2.5***

Low 2,417 49.1 (3.0)

Market Capitalization High 2,471 54.9 8.3***

Low 2,468 46.5 (10.2)

Market Liquidity High 2,515 52.6 4.0***

Low 2,476 48.6 (4.9)

Notes: This table presents a split-sample analysis of CSR in EMEs by macroeconomic conditions.

GDP per Capita is gross domestic product divided by mid-year population in current U.S. dollars.

Trade Openness is the sum of exports and imports of goods and services measured as a share of

GDP. Market Capitalization is share price times the number of shares outstanding (including their

several classes) for listed domestic companies as a percentage of GDP. Market Liquidity is the total

number of traded shares multiplied by their respective matching prices as a percentage of GDP. t-

statistics are reported in parentheses. The superscript asterisks ∗∗∗, ∗∗, and ∗ denote statistical

significance at the 1%, 5%, and 10% levels, respectively.

44

Electronic copy available at: https://ssrn.com/abstract=3718750

Table 5. CSR in EMEs: Split Sample by Political/Legal Institutions

Difference

N CSR

(t-statistics)

Legal Origin Common 1,769 54.6 7.0***

Civil 3,998 47.6 (8.4)

Investor Protection High 2,566 57.0 12.3***

(Revised Anti-director Rights Index) Low 3,071 44.7 (16.0)

Control of Corruption (WGI) High 2,834 49.9 0.3

Low 2,933 49.6 (0.4)

Government Effectiveness (WGI) High 2,819 49.8 0.1

Low 2,948 49.7 (0.2)

Rule of Law (WGI) High 3,005 50.1 0.7

Low 2,762 49.4 (0.9)

Regulatory Quality (WGI) High 2,782 49.7 -0.1

Low 2,985 49.8 (-0.1)

Political Stability (WGI) High 2,782 50.4 2.4***

Low 2,457 48.0 (2.9)

Voice and Accountability (WGI) High 2,820 52.8 6.1***

Low 2,947 46.8 (7.9)

Composite Governance Index (WGI) High 2,881 50.5 1.4*

Low 2,886 49.0 (1.8)

Democracy Yes 4,280 52.8 11.8***

No 1,487 41.0 (13.6)

Notes: This table presents a split-sample analysis of CSR in EMEs by political and legal institutions.

Legal Origin is a dummy variable that equals 1 for a common-law country, and 0 for a civil-law

country from La Porta et al. (1998). Investor Protection (Revised Antidirector Rights Index) is an

aggregate index of shareholder rights from Djankov et al. (2008).Control of Corruption,

Government Effectiveness, Rule of Law, Regulatory Quality, Political Stability, and Voice and

Accountability are six political governance measures from the World Governance Indicators (WGI)

dataset. Composite Governance Index (WGI) is a composite governance index through principal

components analysis. Democracy is a dummy variable that indicates democratic countries. t-

statistics are reported in parentheses. The superscript asterisks ∗∗∗, ∗∗, and ∗ denote statistical

significance at the 1%, 5%, and 10% levels, respectively.

45

Electronic copy available at: https://ssrn.com/abstract=3718750

Table 6. CSR in EMEs: Split Sample by National Culture

Difference

N CSR

(t-statistics)

Individualism High 2,715 53.9 6.3***

Low 2,856 47.6 (8.1)

Power Distance High 2,758 47.4 -6.5***

Low 2,813 53.8 (-8.3)

Uncertainty Avoidance High 3,058 50.8 0.4

Low 2,513 50.4 (0.5)

Masculinity High 2,771 49.1 -3.1***

Low 2,800 52.2 (-3.9)

Notes: This table presents a split-sample analysis of CSR in EMEs by national culture.

Individualism, Power Distance, Uncertainty Avoidance, and Masculinity are four dimensions of

national culture from Hofstede (2001). Individualism is the extent to which people feel independent,

as opposed to being interdependent as members of larger wholes. Power Distance is the extent to

which the less powerful members of organizations and institutions (like a family) accept and expect

that power is distributed unequally. Uncertainty Avoidance deals with a society’s tolerance for

uncertainty and ambiguity. Masculinity is the extent to which the use of force is endorsed socially.

t-statistics are reported in parentheses. The superscript asterisks ∗∗∗, ∗∗, and ∗ denote statistical

significance at the 1%, 5%, and 10% levels, respectively.

46

Electronic copy available at: https://ssrn.com/abstract=3718750

Table 7. CSR in EMEs: Emerging vs. Developed

(1)

Emerging -5.241***

(-5.285)

Firm Size 9.470***

(48.371)

ROA 21.530***

(5.850)

Leverage 1.705

(0.675)

R&D 46.977***

(4.559)

Industry1 (Consumer Non-Durables) 4.180**

(2.387)

Industry2 (Consumer Durables) 5.599**

(2.355)

Industry3 (Manufacturing) 11.015***

(7.979)

Industry4 (Energy) -3.622**

(-2.117)

Industry5 (Chemicals) 17.620***

(9.978)

Industry6 (Business Equipment) -0.816

(-0.442)

Industry7 (Telecommunication) -2.386

(-1.063)

Industry8 (Utilities) 0.515

(0.278)

Industry9 (Wholesale and Retail) -3.265**

(-1.977)

Industry10 (Healthcare) -3.604

(-1.579)

Industry11 (Finance) -23.333***

(-16.861)

Constant -36.926***

(-18.611)

Year Fixed Effects Yes

Observations 31,550

Adjusted R-squared 0.323

Note: This table presents regression results of CSR on the emerging economy indicator (Emerging),

firm-level control variables, industry and year fixed effects. Firm Size is measured as the logarithm

of total assets in millions of $US. ROA is the ratio of net income before extraordinary items to total

assets. Leverage is the ratio of total debt to total assets. R&D is the ratio of research and

development expenses to total sales. The industry classification follows the Fama–French (1997)

47

Electronic copy available at: https://ssrn.com/abstract=3718750

12-industry classification. t-statistics are reported in parentheses. The superscript asterisks ∗∗∗, ∗∗,

and ∗ denote statistical significance at the 1%, 5%, and 10% levels, respectively.

48

Electronic copy available at: https://ssrn.com/abstract=3718750

Table 8. CSR in EMEs: Economic Development, Institutional Environment, and

Crisis

(1) (2) (3) (4)

Log (GDP per Capita) -5.276

(-0.884)

Trade Openness 0.139*

(1.857)

Market Capitalization -0.033

(-1.351)

Market Liquidity 0.005

(0.642)

High-Income Non-OECD -14.007***

(-5.009)

Lower-Middle-Income -0.766

(-0.285)

Upper-Middle-Income 0.269

(0.110)