Professional Documents

Culture Documents

Econ Focus 6-20-11

Econ Focus 6-20-11

Uploaded by

Jessica Kister-LombardoCopyright:

Available Formats

You might also like

- Model Business Plan Mango Pineapple Banana 1 1 1Document86 pagesModel Business Plan Mango Pineapple Banana 1 1 1ebubec92% (13)

- Dell Working Capital SolutionDocument10 pagesDell Working Capital SolutionIIMnotes100% (1)

- Sample Project Report For Commercial Vehicle LoanDocument18 pagesSample Project Report For Commercial Vehicle LoanRajveer Mahajan40% (5)

- Short Sales The Current Housing MarketDocument25 pagesShort Sales The Current Housing Marketbrian3332No ratings yet

- Economic Focus Feb. 20, 2012Document1 pageEconomic Focus Feb. 20, 2012Jessica Kister-LombardoNo ratings yet

- Economic Focus April 16 2012Document1 pageEconomic Focus April 16 2012Jessica Kister-LombardoNo ratings yet

- Weekly Economic Commentary 3-26-12Document6 pagesWeekly Economic Commentary 3-26-12monarchadvisorygroupNo ratings yet

- Weekly Economic Commentary 3-26-12Document11 pagesWeekly Economic Commentary 3-26-12monarchadvisorygroupNo ratings yet

- May 2012 RCI ReportDocument24 pagesMay 2012 RCI ReportNational Association of REALTORS®No ratings yet

- Economic Focus 9-19-11Document1 pageEconomic Focus 9-19-11Jessica Kister-LombardoNo ratings yet

- Economic Focus 7-11-11pdfDocument1 pageEconomic Focus 7-11-11pdfJessica Kister-LombardoNo ratings yet

- Economic Focus 1-16-12Document1 pageEconomic Focus 1-16-12Jessica Kister-LombardoNo ratings yet

- Economic Focus 7-18-11Document1 pageEconomic Focus 7-18-11Jessica Kister-LombardoNo ratings yet

- Economic Focus 1-23-12Document1 pageEconomic Focus 1-23-12Jessica Kister-LombardoNo ratings yet

- REALTORS® Confidence Index July 2012Document26 pagesREALTORS® Confidence Index July 2012National Association of REALTORS®No ratings yet

- The Aftermath of The Housing Bubble: James BullardDocument38 pagesThe Aftermath of The Housing Bubble: James Bullardannawitkowski88No ratings yet

- Economic Focus 7-25-11Document1 pageEconomic Focus 7-25-11Jessica Kister-LombardoNo ratings yet

- HOUSINGDocument45 pagesHOUSINGK JagannathNo ratings yet

- RCI April 2012 HighlightsDocument24 pagesRCI April 2012 HighlightsNational Association of REALTORS®No ratings yet

- Freddie Mac August 2012 Economic OutlookDocument5 pagesFreddie Mac August 2012 Economic OutlookTamara InzunzaNo ratings yet

- Beverly Hills Market Watch: Home Prices Up 9.7% in January From Year Earlier, Corelogic ReportsDocument2 pagesBeverly Hills Market Watch: Home Prices Up 9.7% in January From Year Earlier, Corelogic ReportsNanette MarchandNo ratings yet

- Economic Focus 12-12-11Document1 pageEconomic Focus 12-12-11Jessica Kister-LombardoNo ratings yet

- Economic Focus 8-29-11Document1 pageEconomic Focus 8-29-11Jessica Kister-LombardoNo ratings yet

- Greenpath's Weekly Mortgage NewsletterDocument1 pageGreenpath's Weekly Mortgage NewsletterCENTURY 21 AwardNo ratings yet

- Economic Focus August 15, 2011Document1 pageEconomic Focus August 15, 2011Jessica Kister-LombardoNo ratings yet

- Beverly-Hanks & Associates: Second Quarter Market Report 2011Document20 pagesBeverly-Hanks & Associates: Second Quarter Market Report 2011ashevillerealestateNo ratings yet

- Aftershock Moodys Real Estate AnalysisDocument2 pagesAftershock Moodys Real Estate AnalysisRobert IronsNo ratings yet

- Weekly Economic Commentary 06-13-2011Document4 pagesWeekly Economic Commentary 06-13-2011Jeremy A. MillerNo ratings yet

- May 2012 Housing ReportDocument18 pagesMay 2012 Housing Reportamyjbarnett1575No ratings yet

- Housing Data Wrap-Up: December 2012: Economics GroupDocument7 pagesHousing Data Wrap-Up: December 2012: Economics GroupAaron MaslianskyNo ratings yet

- Property Intelligence Report July 2013Document4 pagesProperty Intelligence Report July 2013thomascruseNo ratings yet

- The Kearney Report - Boulder Real Estate Market Report 2011Document8 pagesThe Kearney Report - Boulder Real Estate Market Report 2011neilkearneyNo ratings yet

- The Pensford Letter - 11.26.12Document3 pagesThe Pensford Letter - 11.26.12Pensford FinancialNo ratings yet

- Real Estate Outlook: United StatesDocument29 pagesReal Estate Outlook: United StatestuhindebNo ratings yet

- Economic Focus August 1, 2011Document1 pageEconomic Focus August 1, 2011Jessica Kister-LombardoNo ratings yet

- Economic Focus 9-26-11Document1 pageEconomic Focus 9-26-11Jessica Kister-LombardoNo ratings yet

- Economic Focus 10-17-11Document1 pageEconomic Focus 10-17-11Jessica Kister-LombardoNo ratings yet

- Zillow Q3 Real Estate ReportDocument4 pagesZillow Q3 Real Estate ReportLani RosalesNo ratings yet

- Zezza - The Effects of A Declining Housing Market On The US Economy - 2007Document21 pagesZezza - The Effects of A Declining Housing Market On The US Economy - 2007sankaratNo ratings yet

- Housing Could Help Lead The Post-COVID Economic Recovery - Blog - Joint Center For Housing Studies of Harvard UniversityDocument3 pagesHousing Could Help Lead The Post-COVID Economic Recovery - Blog - Joint Center For Housing Studies of Harvard UniversityMiguel R MoNo ratings yet

- Weekly Economic Commentary 7-19-2012Document7 pagesWeekly Economic Commentary 7-19-2012monarchadvisorygroupNo ratings yet

- Nest Report: Charlottesville Area Real Estate Market Report Q3 2012Document9 pagesNest Report: Charlottesville Area Real Estate Market Report Q3 2012Jonathan KauffmannNo ratings yet

- Economic Focus 12-19-11Document1 pageEconomic Focus 12-19-11Jessica Kister-LombardoNo ratings yet

- Bienville Macro Review (U.S. Housing Update)Document22 pagesBienville Macro Review (U.S. Housing Update)bienvillecapNo ratings yet

- REMAX National Housing Report - July 2012 FinalDocument2 pagesREMAX National Housing Report - July 2012 FinalSheila Newton TeamNo ratings yet

- Move Smartly Report - Aug 2023Document24 pagesMove Smartly Report - Aug 2023subzerohNo ratings yet

- The Subprime Lending Crisis: The Economic Impact On Wealth, Property Values and Tax Revenues, and How We Got HereDocument34 pagesThe Subprime Lending Crisis: The Economic Impact On Wealth, Property Values and Tax Revenues, and How We Got HereForeclosure FraudNo ratings yet

- May 2010 Charleston Market ReportDocument38 pagesMay 2010 Charleston Market ReportbrundbakenNo ratings yet

- Janet Yell en 0323Document14 pagesJanet Yell en 0323ZerohedgeNo ratings yet

- Pioneer 082013Document6 pagesPioneer 082013alphathesisNo ratings yet

- The Pensford Letter - 06.01.2015Document4 pagesThe Pensford Letter - 06.01.2015Pensford FinancialNo ratings yet

- CAForecast 092012Document2 pagesCAForecast 09201237292862No ratings yet

- Change Is Coming Fortigent by Chris Maxey, Ryan Davis August 20, 2013Document6 pagesChange Is Coming Fortigent by Chris Maxey, Ryan Davis August 20, 2013alphathesisNo ratings yet

- Freddie Mac Outlook September 2023Document9 pagesFreddie Mac Outlook September 2023Nicole LuoNo ratings yet

- PositiveAngles - March 1, 2012Document2 pagesPositiveAngles - March 1, 2012Donna KuehnNo ratings yet

- Morningstar - RobertDocument7 pagesMorningstar - Robertcfasr_programsNo ratings yet

- Does New Data Really Suggest A Housing Market BottomDocument4 pagesDoes New Data Really Suggest A Housing Market BottommatthyllandNo ratings yet

- Wakefield Reutlinger Realtors Newsletter 1st Quarter 2013Document4 pagesWakefield Reutlinger Realtors Newsletter 1st Quarter 2013Wakefield Reutlinger RealtorsNo ratings yet

- Personal Finance 101 Canada’S Housing Market Analysis Buying Vs Renting a Home: A Case StudyFrom EverandPersonal Finance 101 Canada’S Housing Market Analysis Buying Vs Renting a Home: A Case StudyNo ratings yet

- False Profits: Recovering from the Bubble EconomyFrom EverandFalse Profits: Recovering from the Bubble EconomyRating: 3 out of 5 stars3/5 (2)

- UK Property Letting: Making Money in the UK Private Rented SectorFrom EverandUK Property Letting: Making Money in the UK Private Rented SectorNo ratings yet

- Economic Focus April 16 2012Document1 pageEconomic Focus April 16 2012Jessica Kister-LombardoNo ratings yet

- Economic Focus 1-23-12Document1 pageEconomic Focus 1-23-12Jessica Kister-LombardoNo ratings yet

- Economic Focus Feb. 20, 2012Document1 pageEconomic Focus Feb. 20, 2012Jessica Kister-LombardoNo ratings yet

- Economic Focus January 30, 2012Document1 pageEconomic Focus January 30, 2012Jessica Kister-LombardoNo ratings yet

- Economic Focus 1-16-12Document1 pageEconomic Focus 1-16-12Jessica Kister-LombardoNo ratings yet

- January Housing StartsDocument1 pageJanuary Housing StartsJessica Kister-LombardoNo ratings yet

- New Home Sales November December) 2011Document1 pageNew Home Sales November December) 2011Jessica Kister-LombardoNo ratings yet

- January Existing Home SalesDocument1 pageJanuary Existing Home SalesJessica Kister-LombardoNo ratings yet

- Economic Focus 12-12-11Document1 pageEconomic Focus 12-12-11Jessica Kister-LombardoNo ratings yet

- Housing Starts December 2011Document1 pageHousing Starts December 2011Jessica Kister-LombardoNo ratings yet

- Economic Focus 12-19-11Document1 pageEconomic Focus 12-19-11Jessica Kister-LombardoNo ratings yet

- Construction Spending Oct. 2011Document1 pageConstruction Spending Oct. 2011Jessica Kister-LombardoNo ratings yet

- Existing Home Sales October 2011Document1 pageExisting Home Sales October 2011Jessica Kister-LombardoNo ratings yet

- Housing StartsDocument1 pageHousing StartsJessica Kister-LombardoNo ratings yet

- Economic Focus 11-14-11Document1 pageEconomic Focus 11-14-11Jessica Kister-LombardoNo ratings yet

- Construction Spending December 2011Document1 pageConstruction Spending December 2011Jessica Kister-LombardoNo ratings yet

- Existing Home SalesDocument1 pageExisting Home SalesJessica Kister-LombardoNo ratings yet

- Economic Focus October 24, 2011Document1 pageEconomic Focus October 24, 2011Jessica Kister-LombardoNo ratings yet

- Economic Focus 12-5-11Document1 pageEconomic Focus 12-5-11Jessica Kister-LombardoNo ratings yet

- November Construction SpendingDocument1 pageNovember Construction SpendingJessica Kister-LombardoNo ratings yet

- Housing Starts September 2011Document1 pageHousing Starts September 2011Jessica Kister-LombardoNo ratings yet

- Economic Focus 10-10-11Document1 pageEconomic Focus 10-10-11Jessica Kister-LombardoNo ratings yet

- Economic Focus 10-17-11Document1 pageEconomic Focus 10-17-11Jessica Kister-LombardoNo ratings yet

- Economic Focus 9-26-11Document1 pageEconomic Focus 9-26-11Jessica Kister-LombardoNo ratings yet

- Housing Starts Oct 2011Document1 pageHousing Starts Oct 2011Jessica Kister-LombardoNo ratings yet

- Economic Focus Sept. 12, 2011Document1 pageEconomic Focus Sept. 12, 2011Jessica Kister-LombardoNo ratings yet

- Existing Home Sales August 2011Document1 pageExisting Home Sales August 2011Jessica Kister-LombardoNo ratings yet

- Economic Focus 9-19-11Document1 pageEconomic Focus 9-19-11Jessica Kister-LombardoNo ratings yet

- Newhome 8-23-11Document1 pageNewhome 8-23-11Jessica Kister-LombardoNo ratings yet

- Economic Focus 9-5-11Document1 pageEconomic Focus 9-5-11Jessica Kister-LombardoNo ratings yet

- ACC 307 Homework CH 1Document2 pagesACC 307 Homework CH 1leelee0302No ratings yet

- TEAM06 Lufthansa Ver.08.25Document33 pagesTEAM06 Lufthansa Ver.08.25Adonis SardiñasNo ratings yet

- Share-Based Payment Share OptionDocument1 pageShare-Based Payment Share OptionKeneth Joe CabungcalNo ratings yet

- Aligning Enterprise Risk Management With Strategy Through The BSC The Bank of Tokyo-Mitsubishi ApproachDocument6 pagesAligning Enterprise Risk Management With Strategy Through The BSC The Bank of Tokyo-Mitsubishi ApproachanushaNo ratings yet

- 4 RPRDocument1 page4 RPRNeel BhattNo ratings yet

- Vasquez v. PNB - Principle of MutualityDocument2 pagesVasquez v. PNB - Principle of MutualityJcNo ratings yet

- Course Map: Intermediate Management AccountingDocument7 pagesCourse Map: Intermediate Management AccountingBondhu GuptoNo ratings yet

- Risk Measurement CalculationsDocument35 pagesRisk Measurement CalculationsChashona BerryNo ratings yet

- Invoice JBL PDFDocument1 pageInvoice JBL PDFDhruv MishraNo ratings yet

- Online MBA SRMDocument14 pagesOnline MBA SRMgiri90No ratings yet

- Unit 9Document11 pagesUnit 9Mohd Hisyamuddin Mohd AminudinNo ratings yet

- Week 4 5 ULOb Lets Analyze Activity 1 SolutionDocument2 pagesWeek 4 5 ULOb Lets Analyze Activity 1 Solutionemem resuentoNo ratings yet

- Banking FDDocument17 pagesBanking FDKumar SouravNo ratings yet

- 1) JSK Has To Determine With Tax Method That It Wishes To Adopt Prior To We Being Able To Go Forward With The Tax SimulationsDocument2 pages1) JSK Has To Determine With Tax Method That It Wishes To Adopt Prior To We Being Able To Go Forward With The Tax SimulationsJSK1 JSK11No ratings yet

- Bir Ruling (Da - (C-228) 589-09)Document3 pagesBir Ruling (Da - (C-228) 589-09)Stacy Liong BloggerAccountNo ratings yet

- How To Use BDO Nomura Online Trading Platform PDFDocument20 pagesHow To Use BDO Nomura Online Trading Platform PDFRaymond PacaldoNo ratings yet

- Miss Juliet September Statement... 2022Document6 pagesMiss Juliet September Statement... 2022adilNo ratings yet

- Chapter 7 Variable Costing A Tool For ManagementDocument34 pagesChapter 7 Variable Costing A Tool For ManagementMulugeta GirmaNo ratings yet

- Howard Bank Case - Analysis ParalysisDocument13 pagesHoward Bank Case - Analysis Paralysisapi-546422400No ratings yet

- Key Fact Sheet (HBL PersonalLoan) - July 2018Document1 pageKey Fact Sheet (HBL PersonalLoan) - July 2018pakistan jobs100% (1)

- Lehman Brother Ethical DilemmaDocument3 pagesLehman Brother Ethical DilemmaVenkatesh KamathNo ratings yet

- Hog Fattening and Marketing (Dadule) FinalDocument20 pagesHog Fattening and Marketing (Dadule) FinalShimmeridel EspañolaNo ratings yet

- المناطق الحرة كأداة فعالة لجذب الاستثمار الاجنبي المباشرDocument14 pagesالمناطق الحرة كأداة فعالة لجذب الاستثمار الاجنبي المباشرAbdalla AqidiNo ratings yet

- Forex Swaps & IRS-An Introduction-VRK100 - 04102009Document10 pagesForex Swaps & IRS-An Introduction-VRK100 - 04102009RamaKrishna Vadlamudi, CFANo ratings yet

- All In: Rates" For AprilDocument1 pageAll In: Rates" For AprilCarlo Garcia, CPANo ratings yet

- Final Assessment Fin 420 - 20224Document6 pagesFinal Assessment Fin 420 - 20224siti nurmaisaraNo ratings yet

- Clenneth CompanyDocument21 pagesClenneth CompanyRich ann belle AuditorNo ratings yet

Econ Focus 6-20-11

Econ Focus 6-20-11

Uploaded by

Jessica Kister-LombardoOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Econ Focus 6-20-11

Econ Focus 6-20-11

Uploaded by

Jessica Kister-LombardoCopyright:

Available Formats

Economic Focus

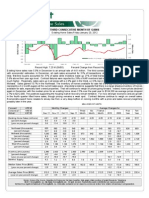

FORECLOSURES PROLONG HOUSING RECOVERY

What do the coming months hold for housing?

Foreclosures are weighing on the housing industry and prolonging the housing recovery. Resolution of the processing issues should be reached by the fall. Housing prices should hit bottom in 2012, as this inventory makes it through the market. These are the projections of many housing observers including economist Celia Chen of Moodys Dismal Scientist. A year ago Dismal Scientist called for a 34% peak-t-trough decline in US housing prices as measured by the Case-Shiller Index, with the bottom hitting in Q3 of this year. But they recently projected the recovery to stretch into Q2 12, for several reasons: The Robo-signing slowed the number of REO sales to third parties by 11% in the first quarter compared with Q4 10. Weakness in the market caused the share of foreclosure sales to increase from 17% to 19%, with an average discount rate of 35%. This caused the Case-Shiller price index to slip by 2%. They had expected that servicers and regulators would resolve the processing issues by this springnot so. The lack of agreement between the servicers and the 50 state attorneys general, as well as from the sustained reduction in foreclosure filings, resolution is likely dragging into this fall.

RELEASE DATE Mon 06/20 1:00 pm et Tue 06/21 10:00 am et Tue 06/21 2:00 pm et Wed 06/22 9:00 am et Wed 06/22 12:30 am et2 Thu 06/23 8:30 am et Thu 06/23 10:00 am et Fri 06/24 8:30 am et Fri 06/24 10:00 am et

1

for the week of June 20, 2011 Volume 15, Issue 24

Key Economic Reports Released This Week

ECONOMIC INDICATORS RELEASED BY Dept. of the Treasury National Association of Realtors Federal Reserve Board Mortgage Bankers Association of America Federal Reserve Board Bur. of Labor Statistics Department of Labor Bureau of the Census Dept. of Commerce Bur. of Econ. Analysis Dept. of Commerce Bureau of the Census Dept. of Commerce CONSENSUS 1 SURVEY N/A 4.90M No rate change Weakness Bias N/A No rate change Neutral Bias 415k 315k 2.0% 1.2% Wt. INFLUENCE ON INTEREST RATES

Weekly Bill Auction Existing Home Sales for May 11 FOMC Meeting Fed Open Market Committee MBA Mtg Apps Survey for week ending 06/17 FOMC Policy Statement Fed Open Market Committee Jobless Claims for week ending 06/18 New Home Sales for May 11 Gross Domestic Product (GDP) rd Q1 11 3 estimate Durable Goods Orders for May 11

** ** **** * **** * ** **** ***

If strong demand If weak demand If above consensus If below consensus

Determines Policy Undetermined Determines Policy

If above consensus If below consensus If above consensus If below consensus If above consensus If below consensus If above consensus If below consensus

Survey courtesy of Insight Economics, LLC

* Low Importance ** Moderate Importance *** Important **** Ver y Important

On The Positive Side Celia Chen sees the slow disposition of homes likely to turn into distress sales has a near-term positive effect on house prices, as fewer distress sales means fewer discounted home sales. Even with the bottom delayed, the remaining decline will be a modest 2% more into Q1 12. It is quite possible that house prices will pick up slightly in the second or third quarter of this year, as foreclosure sales remain depressed while non-distress sales pick up. Job gains will improve, combined with high affordabilitywill help boost sales of non-distressed homes, says Chen. New guidelines will motivate servicers to push foreclosures through as efficiently as possible.

Finally, the seasonal factors for housing prices are relative small in this market and the bottom is still seen in the first quarter of 2012.

Jessica Lombardo Loan Officer Hi-Tech Mortgage 2184 McCulloch Boulevard, # A Lake Havasu City, AZ 86403 jessica@hi-techmortgage.com Office: 866.768.5626 Cell: 916.548.8533 Fax: 916.372.2518

You might also like

- Model Business Plan Mango Pineapple Banana 1 1 1Document86 pagesModel Business Plan Mango Pineapple Banana 1 1 1ebubec92% (13)

- Dell Working Capital SolutionDocument10 pagesDell Working Capital SolutionIIMnotes100% (1)

- Sample Project Report For Commercial Vehicle LoanDocument18 pagesSample Project Report For Commercial Vehicle LoanRajveer Mahajan40% (5)

- Short Sales The Current Housing MarketDocument25 pagesShort Sales The Current Housing Marketbrian3332No ratings yet

- Economic Focus Feb. 20, 2012Document1 pageEconomic Focus Feb. 20, 2012Jessica Kister-LombardoNo ratings yet

- Economic Focus April 16 2012Document1 pageEconomic Focus April 16 2012Jessica Kister-LombardoNo ratings yet

- Weekly Economic Commentary 3-26-12Document6 pagesWeekly Economic Commentary 3-26-12monarchadvisorygroupNo ratings yet

- Weekly Economic Commentary 3-26-12Document11 pagesWeekly Economic Commentary 3-26-12monarchadvisorygroupNo ratings yet

- May 2012 RCI ReportDocument24 pagesMay 2012 RCI ReportNational Association of REALTORS®No ratings yet

- Economic Focus 9-19-11Document1 pageEconomic Focus 9-19-11Jessica Kister-LombardoNo ratings yet

- Economic Focus 7-11-11pdfDocument1 pageEconomic Focus 7-11-11pdfJessica Kister-LombardoNo ratings yet

- Economic Focus 1-16-12Document1 pageEconomic Focus 1-16-12Jessica Kister-LombardoNo ratings yet

- Economic Focus 7-18-11Document1 pageEconomic Focus 7-18-11Jessica Kister-LombardoNo ratings yet

- Economic Focus 1-23-12Document1 pageEconomic Focus 1-23-12Jessica Kister-LombardoNo ratings yet

- REALTORS® Confidence Index July 2012Document26 pagesREALTORS® Confidence Index July 2012National Association of REALTORS®No ratings yet

- The Aftermath of The Housing Bubble: James BullardDocument38 pagesThe Aftermath of The Housing Bubble: James Bullardannawitkowski88No ratings yet

- Economic Focus 7-25-11Document1 pageEconomic Focus 7-25-11Jessica Kister-LombardoNo ratings yet

- HOUSINGDocument45 pagesHOUSINGK JagannathNo ratings yet

- RCI April 2012 HighlightsDocument24 pagesRCI April 2012 HighlightsNational Association of REALTORS®No ratings yet

- Freddie Mac August 2012 Economic OutlookDocument5 pagesFreddie Mac August 2012 Economic OutlookTamara InzunzaNo ratings yet

- Beverly Hills Market Watch: Home Prices Up 9.7% in January From Year Earlier, Corelogic ReportsDocument2 pagesBeverly Hills Market Watch: Home Prices Up 9.7% in January From Year Earlier, Corelogic ReportsNanette MarchandNo ratings yet

- Economic Focus 12-12-11Document1 pageEconomic Focus 12-12-11Jessica Kister-LombardoNo ratings yet

- Economic Focus 8-29-11Document1 pageEconomic Focus 8-29-11Jessica Kister-LombardoNo ratings yet

- Greenpath's Weekly Mortgage NewsletterDocument1 pageGreenpath's Weekly Mortgage NewsletterCENTURY 21 AwardNo ratings yet

- Economic Focus August 15, 2011Document1 pageEconomic Focus August 15, 2011Jessica Kister-LombardoNo ratings yet

- Beverly-Hanks & Associates: Second Quarter Market Report 2011Document20 pagesBeverly-Hanks & Associates: Second Quarter Market Report 2011ashevillerealestateNo ratings yet

- Aftershock Moodys Real Estate AnalysisDocument2 pagesAftershock Moodys Real Estate AnalysisRobert IronsNo ratings yet

- Weekly Economic Commentary 06-13-2011Document4 pagesWeekly Economic Commentary 06-13-2011Jeremy A. MillerNo ratings yet

- May 2012 Housing ReportDocument18 pagesMay 2012 Housing Reportamyjbarnett1575No ratings yet

- Housing Data Wrap-Up: December 2012: Economics GroupDocument7 pagesHousing Data Wrap-Up: December 2012: Economics GroupAaron MaslianskyNo ratings yet

- Property Intelligence Report July 2013Document4 pagesProperty Intelligence Report July 2013thomascruseNo ratings yet

- The Kearney Report - Boulder Real Estate Market Report 2011Document8 pagesThe Kearney Report - Boulder Real Estate Market Report 2011neilkearneyNo ratings yet

- The Pensford Letter - 11.26.12Document3 pagesThe Pensford Letter - 11.26.12Pensford FinancialNo ratings yet

- Real Estate Outlook: United StatesDocument29 pagesReal Estate Outlook: United StatestuhindebNo ratings yet

- Economic Focus August 1, 2011Document1 pageEconomic Focus August 1, 2011Jessica Kister-LombardoNo ratings yet

- Economic Focus 9-26-11Document1 pageEconomic Focus 9-26-11Jessica Kister-LombardoNo ratings yet

- Economic Focus 10-17-11Document1 pageEconomic Focus 10-17-11Jessica Kister-LombardoNo ratings yet

- Zillow Q3 Real Estate ReportDocument4 pagesZillow Q3 Real Estate ReportLani RosalesNo ratings yet

- Zezza - The Effects of A Declining Housing Market On The US Economy - 2007Document21 pagesZezza - The Effects of A Declining Housing Market On The US Economy - 2007sankaratNo ratings yet

- Housing Could Help Lead The Post-COVID Economic Recovery - Blog - Joint Center For Housing Studies of Harvard UniversityDocument3 pagesHousing Could Help Lead The Post-COVID Economic Recovery - Blog - Joint Center For Housing Studies of Harvard UniversityMiguel R MoNo ratings yet

- Weekly Economic Commentary 7-19-2012Document7 pagesWeekly Economic Commentary 7-19-2012monarchadvisorygroupNo ratings yet

- Nest Report: Charlottesville Area Real Estate Market Report Q3 2012Document9 pagesNest Report: Charlottesville Area Real Estate Market Report Q3 2012Jonathan KauffmannNo ratings yet

- Economic Focus 12-19-11Document1 pageEconomic Focus 12-19-11Jessica Kister-LombardoNo ratings yet

- Bienville Macro Review (U.S. Housing Update)Document22 pagesBienville Macro Review (U.S. Housing Update)bienvillecapNo ratings yet

- REMAX National Housing Report - July 2012 FinalDocument2 pagesREMAX National Housing Report - July 2012 FinalSheila Newton TeamNo ratings yet

- Move Smartly Report - Aug 2023Document24 pagesMove Smartly Report - Aug 2023subzerohNo ratings yet

- The Subprime Lending Crisis: The Economic Impact On Wealth, Property Values and Tax Revenues, and How We Got HereDocument34 pagesThe Subprime Lending Crisis: The Economic Impact On Wealth, Property Values and Tax Revenues, and How We Got HereForeclosure FraudNo ratings yet

- May 2010 Charleston Market ReportDocument38 pagesMay 2010 Charleston Market ReportbrundbakenNo ratings yet

- Janet Yell en 0323Document14 pagesJanet Yell en 0323ZerohedgeNo ratings yet

- Pioneer 082013Document6 pagesPioneer 082013alphathesisNo ratings yet

- The Pensford Letter - 06.01.2015Document4 pagesThe Pensford Letter - 06.01.2015Pensford FinancialNo ratings yet

- CAForecast 092012Document2 pagesCAForecast 09201237292862No ratings yet

- Change Is Coming Fortigent by Chris Maxey, Ryan Davis August 20, 2013Document6 pagesChange Is Coming Fortigent by Chris Maxey, Ryan Davis August 20, 2013alphathesisNo ratings yet

- Freddie Mac Outlook September 2023Document9 pagesFreddie Mac Outlook September 2023Nicole LuoNo ratings yet

- PositiveAngles - March 1, 2012Document2 pagesPositiveAngles - March 1, 2012Donna KuehnNo ratings yet

- Morningstar - RobertDocument7 pagesMorningstar - Robertcfasr_programsNo ratings yet

- Does New Data Really Suggest A Housing Market BottomDocument4 pagesDoes New Data Really Suggest A Housing Market BottommatthyllandNo ratings yet

- Wakefield Reutlinger Realtors Newsletter 1st Quarter 2013Document4 pagesWakefield Reutlinger Realtors Newsletter 1st Quarter 2013Wakefield Reutlinger RealtorsNo ratings yet

- Personal Finance 101 Canada’S Housing Market Analysis Buying Vs Renting a Home: A Case StudyFrom EverandPersonal Finance 101 Canada’S Housing Market Analysis Buying Vs Renting a Home: A Case StudyNo ratings yet

- False Profits: Recovering from the Bubble EconomyFrom EverandFalse Profits: Recovering from the Bubble EconomyRating: 3 out of 5 stars3/5 (2)

- UK Property Letting: Making Money in the UK Private Rented SectorFrom EverandUK Property Letting: Making Money in the UK Private Rented SectorNo ratings yet

- Economic Focus April 16 2012Document1 pageEconomic Focus April 16 2012Jessica Kister-LombardoNo ratings yet

- Economic Focus 1-23-12Document1 pageEconomic Focus 1-23-12Jessica Kister-LombardoNo ratings yet

- Economic Focus Feb. 20, 2012Document1 pageEconomic Focus Feb. 20, 2012Jessica Kister-LombardoNo ratings yet

- Economic Focus January 30, 2012Document1 pageEconomic Focus January 30, 2012Jessica Kister-LombardoNo ratings yet

- Economic Focus 1-16-12Document1 pageEconomic Focus 1-16-12Jessica Kister-LombardoNo ratings yet

- January Housing StartsDocument1 pageJanuary Housing StartsJessica Kister-LombardoNo ratings yet

- New Home Sales November December) 2011Document1 pageNew Home Sales November December) 2011Jessica Kister-LombardoNo ratings yet

- January Existing Home SalesDocument1 pageJanuary Existing Home SalesJessica Kister-LombardoNo ratings yet

- Economic Focus 12-12-11Document1 pageEconomic Focus 12-12-11Jessica Kister-LombardoNo ratings yet

- Housing Starts December 2011Document1 pageHousing Starts December 2011Jessica Kister-LombardoNo ratings yet

- Economic Focus 12-19-11Document1 pageEconomic Focus 12-19-11Jessica Kister-LombardoNo ratings yet

- Construction Spending Oct. 2011Document1 pageConstruction Spending Oct. 2011Jessica Kister-LombardoNo ratings yet

- Existing Home Sales October 2011Document1 pageExisting Home Sales October 2011Jessica Kister-LombardoNo ratings yet

- Housing StartsDocument1 pageHousing StartsJessica Kister-LombardoNo ratings yet

- Economic Focus 11-14-11Document1 pageEconomic Focus 11-14-11Jessica Kister-LombardoNo ratings yet

- Construction Spending December 2011Document1 pageConstruction Spending December 2011Jessica Kister-LombardoNo ratings yet

- Existing Home SalesDocument1 pageExisting Home SalesJessica Kister-LombardoNo ratings yet

- Economic Focus October 24, 2011Document1 pageEconomic Focus October 24, 2011Jessica Kister-LombardoNo ratings yet

- Economic Focus 12-5-11Document1 pageEconomic Focus 12-5-11Jessica Kister-LombardoNo ratings yet

- November Construction SpendingDocument1 pageNovember Construction SpendingJessica Kister-LombardoNo ratings yet

- Housing Starts September 2011Document1 pageHousing Starts September 2011Jessica Kister-LombardoNo ratings yet

- Economic Focus 10-10-11Document1 pageEconomic Focus 10-10-11Jessica Kister-LombardoNo ratings yet

- Economic Focus 10-17-11Document1 pageEconomic Focus 10-17-11Jessica Kister-LombardoNo ratings yet

- Economic Focus 9-26-11Document1 pageEconomic Focus 9-26-11Jessica Kister-LombardoNo ratings yet

- Housing Starts Oct 2011Document1 pageHousing Starts Oct 2011Jessica Kister-LombardoNo ratings yet

- Economic Focus Sept. 12, 2011Document1 pageEconomic Focus Sept. 12, 2011Jessica Kister-LombardoNo ratings yet

- Existing Home Sales August 2011Document1 pageExisting Home Sales August 2011Jessica Kister-LombardoNo ratings yet

- Economic Focus 9-19-11Document1 pageEconomic Focus 9-19-11Jessica Kister-LombardoNo ratings yet

- Newhome 8-23-11Document1 pageNewhome 8-23-11Jessica Kister-LombardoNo ratings yet

- Economic Focus 9-5-11Document1 pageEconomic Focus 9-5-11Jessica Kister-LombardoNo ratings yet

- ACC 307 Homework CH 1Document2 pagesACC 307 Homework CH 1leelee0302No ratings yet

- TEAM06 Lufthansa Ver.08.25Document33 pagesTEAM06 Lufthansa Ver.08.25Adonis SardiñasNo ratings yet

- Share-Based Payment Share OptionDocument1 pageShare-Based Payment Share OptionKeneth Joe CabungcalNo ratings yet

- Aligning Enterprise Risk Management With Strategy Through The BSC The Bank of Tokyo-Mitsubishi ApproachDocument6 pagesAligning Enterprise Risk Management With Strategy Through The BSC The Bank of Tokyo-Mitsubishi ApproachanushaNo ratings yet

- 4 RPRDocument1 page4 RPRNeel BhattNo ratings yet

- Vasquez v. PNB - Principle of MutualityDocument2 pagesVasquez v. PNB - Principle of MutualityJcNo ratings yet

- Course Map: Intermediate Management AccountingDocument7 pagesCourse Map: Intermediate Management AccountingBondhu GuptoNo ratings yet

- Risk Measurement CalculationsDocument35 pagesRisk Measurement CalculationsChashona BerryNo ratings yet

- Invoice JBL PDFDocument1 pageInvoice JBL PDFDhruv MishraNo ratings yet

- Online MBA SRMDocument14 pagesOnline MBA SRMgiri90No ratings yet

- Unit 9Document11 pagesUnit 9Mohd Hisyamuddin Mohd AminudinNo ratings yet

- Week 4 5 ULOb Lets Analyze Activity 1 SolutionDocument2 pagesWeek 4 5 ULOb Lets Analyze Activity 1 Solutionemem resuentoNo ratings yet

- Banking FDDocument17 pagesBanking FDKumar SouravNo ratings yet

- 1) JSK Has To Determine With Tax Method That It Wishes To Adopt Prior To We Being Able To Go Forward With The Tax SimulationsDocument2 pages1) JSK Has To Determine With Tax Method That It Wishes To Adopt Prior To We Being Able To Go Forward With The Tax SimulationsJSK1 JSK11No ratings yet

- Bir Ruling (Da - (C-228) 589-09)Document3 pagesBir Ruling (Da - (C-228) 589-09)Stacy Liong BloggerAccountNo ratings yet

- How To Use BDO Nomura Online Trading Platform PDFDocument20 pagesHow To Use BDO Nomura Online Trading Platform PDFRaymond PacaldoNo ratings yet

- Miss Juliet September Statement... 2022Document6 pagesMiss Juliet September Statement... 2022adilNo ratings yet

- Chapter 7 Variable Costing A Tool For ManagementDocument34 pagesChapter 7 Variable Costing A Tool For ManagementMulugeta GirmaNo ratings yet

- Howard Bank Case - Analysis ParalysisDocument13 pagesHoward Bank Case - Analysis Paralysisapi-546422400No ratings yet

- Key Fact Sheet (HBL PersonalLoan) - July 2018Document1 pageKey Fact Sheet (HBL PersonalLoan) - July 2018pakistan jobs100% (1)

- Lehman Brother Ethical DilemmaDocument3 pagesLehman Brother Ethical DilemmaVenkatesh KamathNo ratings yet

- Hog Fattening and Marketing (Dadule) FinalDocument20 pagesHog Fattening and Marketing (Dadule) FinalShimmeridel EspañolaNo ratings yet

- المناطق الحرة كأداة فعالة لجذب الاستثمار الاجنبي المباشرDocument14 pagesالمناطق الحرة كأداة فعالة لجذب الاستثمار الاجنبي المباشرAbdalla AqidiNo ratings yet

- Forex Swaps & IRS-An Introduction-VRK100 - 04102009Document10 pagesForex Swaps & IRS-An Introduction-VRK100 - 04102009RamaKrishna Vadlamudi, CFANo ratings yet

- All In: Rates" For AprilDocument1 pageAll In: Rates" For AprilCarlo Garcia, CPANo ratings yet

- Final Assessment Fin 420 - 20224Document6 pagesFinal Assessment Fin 420 - 20224siti nurmaisaraNo ratings yet

- Clenneth CompanyDocument21 pagesClenneth CompanyRich ann belle AuditorNo ratings yet