Professional Documents

Culture Documents

Profit Prior To Incorporation

Profit Prior To Incorporation

Uploaded by

Kalash SharmaCopyright:

Available Formats

You might also like

- Operation and Instruction Manual Model DB PumpDocument54 pagesOperation and Instruction Manual Model DB PumpJustin Zimmerman100% (6)

- FNCE 6018 Group Project: Hedging at PorscheDocument2 pagesFNCE 6018 Group Project: Hedging at PorschejorealNo ratings yet

- Accounting For Managers (Assignment One (E-Finance) ) Question OneDocument7 pagesAccounting For Managers (Assignment One (E-Finance) ) Question OnehananNo ratings yet

- Boeing Current Market Outlook 2021Document20 pagesBoeing Current Market Outlook 2021VaibhavNo ratings yet

- Act1111 Final ExamDocument7 pagesAct1111 Final ExamHaidee Flavier SabidoNo ratings yet

- Profit Prior To Incorporation: Important Points of Our Notes/BooksDocument6 pagesProfit Prior To Incorporation: Important Points of Our Notes/BooksmaheshNo ratings yet

- Profit Prior To IncorporationDocument5 pagesProfit Prior To IncorporationKartik Mirji100% (1)

- 1 Profit Prior To Incorporate Extra QuestionsDocument3 pages1 Profit Prior To Incorporate Extra QuestionsMahima tiwariNo ratings yet

- Sybcom PpiDocument6 pagesSybcom PpiMaxson Miranda100% (2)

- Statement of Comprehensive IncomeDocument4 pagesStatement of Comprehensive Incomebobo tangaNo ratings yet

- Asdos Pert 2Document2 pagesAsdos Pert 2mutiaoooNo ratings yet

- Questions Business IncomeDocument8 pagesQuestions Business IncomeMbeiza MariamNo ratings yet

- P&L Prior To IncorporationDocument2 pagesP&L Prior To Incorporationpraveena lNo ratings yet

- VELLORE, CHENNAI-632 002: Answer The Following QuestionsDocument5 pagesVELLORE, CHENNAI-632 002: Answer The Following QuestionsJayanthiNo ratings yet

- Review 2 Set K Problem 1Document3 pagesReview 2 Set K Problem 1Marinel AbrilNo ratings yet

- Sunway T3 (TX4014) Tax Computation 2020Document3 pagesSunway T3 (TX4014) Tax Computation 2020Ee LynnNo ratings yet

- Advance AccountsDocument7 pagesAdvance Accountsashish.jhaa756No ratings yet

- Unit 3 - Business Finance - AppendixDocument5 pagesUnit 3 - Business Finance - Appendixmhmir9.95No ratings yet

- Profitability RatiosDocument4 pagesProfitability RatiosShakthiNo ratings yet

- Q1Document6 pagesQ1Maxson MirandaNo ratings yet

- Corporate Taxes Part 1 (VAT, EWT and Income Tax) CaseDocument4 pagesCorporate Taxes Part 1 (VAT, EWT and Income Tax) CaseMikaela L. RoqueNo ratings yet

- CE Interim ReportingDocument2 pagesCE Interim ReportingalyssaNo ratings yet

- Profit & Loss Pre and Post Incorporation - QBDocument16 pagesProfit & Loss Pre and Post Incorporation - QBHindutav aryaNo ratings yet

- Ty Baf TaxationDocument4 pagesTy Baf TaxationAkki GalaNo ratings yet

- Ty Baf TaxationDocument4 pagesTy Baf TaxationAkki GalaNo ratings yet

- Questions On AccountancyDocument34 pagesQuestions On AccountancyAshwin ChoudharyNo ratings yet

- RTP May 2018 New Gr1Document122 pagesRTP May 2018 New Gr1subhanvts7781No ratings yet

- Cases Inhouse ClassDocument5 pagesCases Inhouse ClassKevin DeswandaNo ratings yet

- FSA Vertical FormatDocument10 pagesFSA Vertical FormatMayank BahetiNo ratings yet

- Fabm2 Statement of Comprehensive Income Practice Problems Answer KeyDocument3 pagesFabm2 Statement of Comprehensive Income Practice Problems Answer KeyMounicha Ambayec0% (1)

- Fabm2 - Statement of Comprehensive Income (Practice Problems) - Answer KeyDocument3 pagesFabm2 - Statement of Comprehensive Income (Practice Problems) - Answer KeyMounicha Ambayec100% (4)

- CC 1 QuestionDocument3 pagesCC 1 Questionalya atiqahNo ratings yet

- Solutions For Cash Flow Sums OnlyDocument11 pagesSolutions For Cash Flow Sums OnlyS. GOWRINo ratings yet

- Adjusting EntriesDocument5 pagesAdjusting EntriesM Hassan BrohiNo ratings yet

- Cap II Group I RTP Dec2023Document84 pagesCap II Group I RTP Dec2023pratyushmudbhari340No ratings yet

- Accounting TestDocument4 pagesAccounting Testdinda ardiyaniNo ratings yet

- Financial Accounting Cat 1 JonathanDocument14 pagesFinancial Accounting Cat 1 JonathanjonathanNo ratings yet

- CFS - ProblemsDocument5 pagesCFS - Problemskatasani likhithNo ratings yet

- Financial Analysis ProblemDocument16 pagesFinancial Analysis ProblemShreyashi DasNo ratings yet

- CC 1Document11 pagesCC 1谦谦君子No ratings yet

- No.2 FA Assignment 3 Amato FIXDocument3 pagesNo.2 FA Assignment 3 Amato FIXKevin DeswandaNo ratings yet

- Is and BS For FinalsDocument5 pagesIs and BS For FinalsRehan FarhatNo ratings yet

- Financial Statement AnalysisDocument3 pagesFinancial Statement AnalysisAsad Rehman100% (1)

- Unit-5 Final AccountsDocument7 pagesUnit-5 Final AccountsSanthosh Santhu0% (1)

- Assignment1 - Profit and Loss Exercise E FinanceDocument8 pagesAssignment1 - Profit and Loss Exercise E Financees.eldeebNo ratings yet

- Imp QuesDocument2 pagesImp QueskaveriNo ratings yet

- CA Inter RTP Nov 2018 Small PDFDocument281 pagesCA Inter RTP Nov 2018 Small PDFSANKAR SIVANNo ratings yet

- Nov 18Document43 pagesNov 18Prabhat Kumar MishraNo ratings yet

- Profit Prior To IncorporationDocument6 pagesProfit Prior To IncorporationKitty CattyNo ratings yet

- TAXN 1016 FE - Long ProblemsDocument11 pagesTAXN 1016 FE - Long ProblemsCrystel Kate MananganNo ratings yet

- The Balance of Prepaid Expenses On January 1, 2018 Is P24,675. What Is The Balance of Prepaid Expense As of December 31, 2018?Document3 pagesThe Balance of Prepaid Expenses On January 1, 2018 Is P24,675. What Is The Balance of Prepaid Expense As of December 31, 2018?Tahani Awar Gurar0% (1)

- Ias 07Document72 pagesIas 07Hannan Fatima EllahiNo ratings yet

- A211 CC 1 StudentDocument6 pagesA211 CC 1 StudentWon HaNo ratings yet

- Study Note - 7.3, Page 535-541Document7 pagesStudy Note - 7.3, Page 535-541s4sahith100% (1)

- Department AccountingDocument12 pagesDepartment AccountingRajesh NangaliaNo ratings yet

- Ac208 2019 11Document6 pagesAc208 2019 11brian mgabi100% (1)

- Domondon - Acctg 3 - Prelim Quiz 2Document2 pagesDomondon - Acctg 3 - Prelim Quiz 2Prince Anton DomondonNo ratings yet

- Soal Tugas Akm Is - ST o FP - CFDocument6 pagesSoal Tugas Akm Is - ST o FP - CFElyssa Fiqri Fauziah0% (1)

- PKP 3 - Cash Flow Statement-Direct MethodDocument5 pagesPKP 3 - Cash Flow Statement-Direct MethodIR WanNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Mergers and AcquisitionDocument28 pagesMergers and AcquisitionKalash SharmaNo ratings yet

- Computer VirusDocument2 pagesComputer VirusKalash SharmaNo ratings yet

- Kalash HarshitDocument9 pagesKalash HarshitKalash SharmaNo ratings yet

- Buissness Laws Main Topic For ExamsDocument5 pagesBuissness Laws Main Topic For ExamsKalash SharmaNo ratings yet

- Kalash J Tushar J WaseemDocument28 pagesKalash J Tushar J WaseemKalash SharmaNo ratings yet

- AssignmentDocument5 pagesAssignmentpankajjaiswal60No ratings yet

- BBA Unit IIIDocument9 pagesBBA Unit IIIPriya NandhakumarNo ratings yet

- Demographic Effects On Labor Force Participation RateDocument7 pagesDemographic Effects On Labor Force Participation RatemichaelNo ratings yet

- Lowy Institute 2023 Asia Power Index Key Findings ReportDocument36 pagesLowy Institute 2023 Asia Power Index Key Findings ReportDimitris VgNo ratings yet

- Permasalahan Dan Potensi Pesisir Di Kabupaten SampangDocument5 pagesPermasalahan Dan Potensi Pesisir Di Kabupaten Sampangsupriyadi de kcongNo ratings yet

- ItineraryDocument2 pagesItineraryQasim JummaniNo ratings yet

- Chapter 9 Mechanics of Options MarketsDocument4 pagesChapter 9 Mechanics of Options MarketsTU Tran AnhNo ratings yet

- 18ES51 Module 4Document19 pages18ES51 Module 4satishsNo ratings yet

- LESSONSDocument151 pagesLESSONSsmile.wonder12No ratings yet

- Astm F 1183Document4 pagesAstm F 1183Ivan AlanizNo ratings yet

- Marx TheoryDocument12 pagesMarx Theoryharshnigam9No ratings yet

- India Multi Brand Car Service Market Report:2020-Ken ResearchDocument14 pagesIndia Multi Brand Car Service Market Report:2020-Ken Researchsam662223No ratings yet

- Answers 11Document6 pagesAnswers 11Nguyễn Ngọc ÁnhNo ratings yet

- Asean & OpecDocument20 pagesAsean & OpeckjohnabrahamNo ratings yet

- Use of Plastic Bottels in Concrete BlocksDocument17 pagesUse of Plastic Bottels in Concrete BlocksParthiv MistryNo ratings yet

- Case Study Chapter 4 - Ias 16Document3 pagesCase Study Chapter 4 - Ias 16Thị Thanh Viên CaoNo ratings yet

- CBM Assignment 2Document3 pagesCBM Assignment 2Abhishek ChopraNo ratings yet

- Tension & Shear CapacityDocument5 pagesTension & Shear CapacityFaridUddinNo ratings yet

- Financial Performance of Publicly-Traded Agribusinesses (Food Processing Firms) 2013 16pDocument16 pagesFinancial Performance of Publicly-Traded Agribusinesses (Food Processing Firms) 2013 16pdainesecowboyNo ratings yet

- Discounted Cash Flow ValuationDocument33 pagesDiscounted Cash Flow ValuationShadow IpNo ratings yet

- CapelloDocument23 pagesCapelloreissitamu1No ratings yet

- Exploring Ghanaian Death Rituals and Funeral PracticesDocument8 pagesExploring Ghanaian Death Rituals and Funeral PracticesSunil ChandraNo ratings yet

- NCBA-Quiz LAWDocument2 pagesNCBA-Quiz LAWRONZALES, Genie RoseNo ratings yet

- Silk Route To G20Document15 pagesSilk Route To G20aaravstudy24No ratings yet

- GST Sales AmbikaDocument1 pageGST Sales Ambikakoradiyagautam.bNo ratings yet

- 2021 HSC EconomicsDocument24 pages2021 HSC EconomicspotpalNo ratings yet

- Annex F - Salesperson'S Checklist On Customer Due Diligence (CDD) For Rental TransactionsDocument10 pagesAnnex F - Salesperson'S Checklist On Customer Due Diligence (CDD) For Rental Transactionshatoris1987No ratings yet

Profit Prior To Incorporation

Profit Prior To Incorporation

Uploaded by

Kalash SharmaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Profit Prior To Incorporation

Profit Prior To Incorporation

Uploaded by

Kalash SharmaCopyright:

Available Formats

COC Education Topers List

Website:- www.coceducation.com Mob. No. 9999631597/8448322142/7303445575

COCEDUCATION.COM PPI CA/CMA Santosh kumar

CHAPTER - PROFIT PRIOR TO INCORPORATION

A newly incorporated company may take over a running business as from a certain date which is prior to the date of

incorporation. Thus company incorporated on 1st April, 2008 may take over the business of a partnership as from 1st

January, 2008. If the business is to be purchased from the date of incorporation, stock taking must be completed and

the balances of various assets and liabilities must be extracted, if this date does not coincide with the end of the

financial year for which the partnership has prepared its last final accounts. To avoid all this trouble, the business is

conveniently purchased from the date of last balance sheet. In order to calculate profit or loss prior to incorporation

date, the following steps are recommended:

(a) Prepare one trading account for the whole period falling between the date of purchase and date of final

accounts. The date of incorporation does not affect the calculation of gross profit.

(b) Calculate the following two ratios;

i. Time Ratio. This is calculated by considering the period falling between the last date of balance

sheet and the date of incorporation and the period between the date of incorporation and the

date of present final accounts.

ii. Sales Ratio. Ascertain sales for the pre-incorporation and post-incorporation periods and

calculate the sales ratio.

(c) Now prepare a statement for calculating the net profits for pre and post-incorporation periods separately.

This is done as follows:

i. Divide the gross profit of the full period into two parts on the basis of sales ratio. This gives gross

profit separately for pre- and post incorporation periods.

ii. Divide all expenses of fixed nature, viz., rent, salary, depreciation, interest in time ratio and other

expenses in sales ratio.

iii. There are certain expenses, i.e., salary of partners, salary of directors, preliminary expenses which

are not divided because they belong exclusively to a certain period. In the above cases the salary

of partners is debited to the pre-incorporation period and preliminary expenses and directors'

salary to the post-incorporation period.

Question:1 Ganesh Ltd. was incorporated on 1st August 1999. It took over the business of M/s Shanker and Siva

with effect from 1st April 1999. From the following figures relating to the year ending 31st March 2000 ascertain

profit prior to incorporation and profit after incorporation.

i. Sales for the year were Rs. 60, 00,000 out of which sales up to 1st August 1999 were Rs. 25, 00,000.

ii. Gross profit for the year was Rs. 18, 00,000.

iii. The expenses debited to profit and loss account were as follows:

Rent 90,000

Salaries 1,50,000

Directors fees 38,000

Interest of debentures 60,000

Audit fees 15,000

Discount on sales 36,000

Depreciation 2,40,000

General expenses 48,000

Advertising 1,80,000

Stationery and printing 36,000

Commission on sales 60,000

Interests to vendors on purchase consideration 30,000

Up to 1st October 1999

Bad debts 15,000

(Rs. 5,000 of bad debts mentioned above relate to debts created prior to incorporation.)

Question:2. A company incorporated on 1st April, 2000 took over a running business from 1st January, 2000. The

company prepared its first final accounts on 31st December, 2000. From the following information, you are required

to calculate the sales ratio of pre and post-incorporation periods:

(a) Sales from January 2000—December, 2000 Rs. 3,60,000, (b) Sales for the month of January twice the average

sales; for the month of February—equal to average sale; sales for four months from May to August—1/4th of the

average sale of each month; and sales for October and November three times the average sale.

1 COCEDUCATION.COM Ph. No. 9999631597, 7303445575, 8448322142

COCEDUCATION.COM PPI CA/CMA Santosh kumar

Question:3 New Ventures Ltd. was incorporated on 1st January, 2000 with an authorized capital consisting of 5,000

equity shares of Rs. 10 each to take over the running business of Rundown Brothers as from 1st October, 1999. The

following is the summarized profit and loss account for the year ended 30th September, 2000:

Rs. Rs.

Cost of sales for the year 16,000 Sales

Administration expenses 1,768 1st October, 1999 to

Selling commission 875 31st Dec, 1999 6,000

Goodwill written off 200 1st January, 2000 to

Interest paid to vendors (Loan 30th Sept., 2000 19,000 25,000

repaid on 1st February 373

Distribution expenses (60 per

cent variable) 1,250

Preliminary expenses written off 330

Debenture interest 320

Depreciation 444

Directors' fees 100

Net profit 3,340

25,000 25,000

The company deals in one type of product. The unit cost of sales was reduced by 10 per cent in the post-

incorporation period as compared to the pre-incorporation period in the year. You are required to apportion the net

profit amount between pre-incorporation and post-incorporation periods showing the basis of apportionment.

Question: 4 The partners of Maitri Agencies decided to convert the partnership into a private limited company called

MA (P) Ltd. with effect from 1st January, 2007. The consideration was agreed at Rs. 1,17,00,000 based on the firm's

Balance Sheet as at 31st December, 2006. However due to some procedural difficulties, the company could be

incorporated only on 1st April, 2007. Meanwhile the business was continued on behalf of the company and the

consideration was settled on that day with interest at 12% per annum. The same books of accounts were continued by the

company which closed its account for the first time on 31st March, 2008 and prepared the following summarized profit

and loss account.

Sales 2,34,00,000

Cost of goods sold: 1,63,80,000

Salaries 11,70,000

Depreciation 1,80,000

Advertisement 7,02,000

Discounts 11,70,000

Managing Director's remuneration 90,000

Miscellaneous office expenses 1,20,000

Office-cum-show room rent 7,20,000

Interest 9,51,000

2,14,83,000

Profit 19,17,000

The company's only borrowing was a loan of Rs. 50,00,000 at 12% p.a. to pay the purchase consideration due to the

firm and for working capital requirements.

2 COCEDUCATION.COM Ph. No. 9999631597, 7303445575, 8448322142

COCEDUCATION.COM PPI CA/CMA Santosh kumar

The company was able to double the average monthly sales of the firm, from 1st April, 2007 but the salaries trebled

from that date. It had to occupy additional space from 1st July, 2007 for which rent was Rs. 30,000 per month.

Prepare a profit and loss account in a columnar form apportioning cost and revenue between ore-incorporation and

post-incorporation periods. Also, suggest how the pre-incorporation Profits are to be dealt with.

Question:5 ABC Ltd. was incorporated on 1.5.2006 to take over the business of DEF and Co. from 1.1.2006. The

Profit and Loss Account as given by ABC Ltd. for the year ending 31.12.2005 is as under:

Profit and Loss Account

To Rent and Taxes 90,000 By Gross Profit 10,64,000

To Salaries including manager's 3,31,000 By Interest on Investments 36,000

salary of Rs. 85,000 14,000

To Carriage Outwards

To Printing and Stationery 18,000

To Interest on Debentures 25,000

To Sales Commission 30,800

To Bad Debts (related to sales) 91,000

To Underwriting Commission 26,000

To Preliminary Expenses 28,000

To Audit Fees 45,000

To Loss on Sale of Investments 11,200

To Net Profit 3,90,000

11,00,000 11,00,000

Prepare a Statement showing allocation of pre-incorporation and post-incorporation profits after considering the

following information:

(i) G.P. ratio was constant throughout the year.

(ii) Sales for January and October were 1 ½ times the average monthly sales while sales for December were

twice the average monthly sales.

(iii) Bad Debts are shown after adjusting a recovery of Rs. 7,000 of Bad Debt for a sale made in July, 2003.

(iv) Manager's salary was increased by Rs. 2,000 p.m. from 1.5.2006.

(v) All investments were sold in April, 2006.

Question 6: The partners of Shri Enterprises decided to convert the partnership firm into a Private Limited

st st

Shreya (p) Ltd. with effect from 1 January 2008 however, company could be incorporated only on 1 June,

2008. The business was continued on behalf of the company and the consideration of Rs. 6, 00,000 was settled

on that day along with interest @ 12% per annum. The company availed loan of Rs. 9, 00,000 @ 10% per

st

annum on 1 June, 2008 to pay purchase consideration and for working capital. The company closed its

accounts for the first time on 31st March, 2009 and presents you the following summarized profit and loss

account:

Sales 19,80,000

Cost of goods sold 11,88,000

Discount to dealers 46,200

Directors' remuneration 60,000

3 COCEDUCATION.COM Ph. No. 9999631597, 7303445575, 8448322142

COCEDUCATION.COM PPI CA/CMA Santosh kumar

Salaries 90,000

Rent 1,35,000

Interest 1,05,000

Depreciation 30,000

Office expenses 1,05,000

Sales promotion expenses 33,000

Preliminary expenses

(To be written off in first year itself) 15,000

Profit 1,72,800

Sales from June, 2008 to December, 2008 were 2 ½ times of the average sales, which further increased to 3 ½

times in January to March quarter, 2009. The company recruited additional work force to expand the business.

The salaries from July, 2008 doubled. The company also acquired additional showroom at monthly rent of Rs.

10,000 from July, 2008.

You are required to prepare a Profit and Loss Account showing apportionment of cost and revenue

between pre-incorporation and post-incorporation periods. Also suggest how the pre-incorporation

profits/losses are to be dealt with. (CA- MAY 2008) 10 MARKS

Answer:

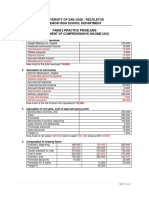

Particulars Pre. inc. Pos. inc. Particulars Pre. inc. Pos. inc.

(5 months) (10 months) (5 months) (10 months)

To Cost of sales 1,80,000 10,08,000 By-Sales (W.N.1) 3,00,000 16,80,000

To Gross profit 1,20,000 6,72,000

3,00,000 16,80,000 3,00,000 16,80,000

To Discount to dealers 7,000 39,200 By G.P. 1,20,000 6,72,000

To Directors' remuneration — 60,000 By Loss 750

To Salaries (W.N.2) 18,750 71,250

To Rent (W.N.3) 15,000 1,20,000

To Interest (W.N.4) 30,000 75,000

To Depreciation 10,000 20,000

To Office expenses 35,000 70,000

To Preliminary expenses — 15,000

To Sales promotion expenses 5,000 28,000

To Net profit — 1,73,550

1,20,750 6,72,000 1,20,750 6,72,000

4 COCEDUCATION.COM Ph. No. 9999631597, 7303445575, 8448322142

COCEDUCATION.COM PPI CA/CMA Santosh kumar

Treatment of pre-incorporation loss: Pre-incorporation loss may, either be considered as a reduction from any

capital reserve accruing in relation to the transaction or be treated as goodwill.

Working Notes: 1.Computation of sales ratio:

Let the average sales per month in pre-incorporation period be a Average Sales (Pre-incorporation) = a x5 = 5a

Sales (Post incorporation) from June to December, 2008 = 2 ½ a x 7 = 17.5a

From January to March, 2009 =3 ½ ax3= 10.5a

Total Sales 28.0a

Sales ratio of pre-incorporation & post incorporation is 5a : 28a

2. Computation of ratio for salaries :

Let the average salary be a

Pre-incorporation salary = a x 5 = 5a

Post incorporation salary

June, 2008= a

July to March, 2009 = a x 9 x 2 = 18a

19a Ratio is 5:19

3. Computation of Rent:

Total rent 1,35,000

Less/Additional rent for 9 months @ 10,000 p.m. 90,000

Rent of old premises apportioned in time ratio 45,000

Apportionment Pre Inc. Post Inc.

Old premises rent 15,000 30,000

Additional Rent 90,000

15,000 1,20,000

4. Computation of interest:

Pre-incorporation period from January, 2008 to May 2008

( )

Post incorporation period from June, 2008 to March 2009

( )

= 1, 05,000

Question 7: A firm M/s. Alag, which was carrying on business from 1st July, 2010 gets itself incorporated as a

st

company on 1 November, 2010. The first accounts are drawn up to March 31, 2011. The gross profit for the

period is Rs. 56,000. The general expenses are Rs. 14,220; Director's fees Rs. 12,000 p.a.; incorporation

expenses Rs.1, 500. Rent up to 31st December was Rs. 1,200 p.a., after which it is increased to Rs. 3,000 p.a.

Salary of the manager, who upon incorporation of the company was made a director, is Rs. 6,000 p.a. His

remuneration thereafter is included in the above figure of fees to the directors.

Give Profit and Loss Account showing pre and post incorporation profit. The net sales are Rs. 8, 20,000, the

monthly average of which for the first four months is one-half of that of the remaining period. The company

earned a uniform profit. Interest and tax may be ignored. (CA-IPCC GROUP 1)

Question 8: Sutanu formed a private Limited Company under the name of Sutanu(P)Ltd.to take over his

st st

existing business as from 1 January,2015 but the Company was not incorporated until 1 April,2015.No

entries relating to transfer of the business were entered in the books, which were carried on without a break

st st

until 31 December,2015. The following trial balance was extracted from the books as on 31 December (end

of the year)

5 COCEDUCATION.COM Ph. No. 9999631597, 7303445575, 8448322142

COCEDUCATION.COM PPI CA/CMA Santosh kumar

Particulars Debit Credit

st

Stock in Trade as at 1 January 4,300

Purchases and sales 18,900 27,800

Carriage Outwards 330

Travelers` Commission 750

Office Salaries and Expenses 21,00

Rent and Rates 1,200

st

Sutanu`s Capital Account as 1 January 23,000

Directors` fee 1,800

Fixed Assets 13,400

Current Liabilities 3,700

Current Assets(Other than Stock-in-Trade) 11,200

Preliminary Expenses 520

Total 54,500

You are also given the following information:

(1) Stock as at 31.12.15(end of the year) is.4,400

(2) Purchase Consideration was agreed at 30,000 to be settled by issue of 3,000 Equity Shares of 10 each.

(3) The Gross Profit Margin is constant and the monthly sales in January, November and December are

double the monthly sales for the remaining months of the year.

(4) Assume that Carriage Outwards and traveler`s Commission vary in direct proportion to sales.

st

You are required to prepare Trading and profit and Loss Account for the year ended 31 December

apportioning the periods before and after incorporation and a balance sheet as on that date. Ignore

depreciation and taxation.

st

Question.9 MOURYA LTD. incorporated on 1 may 2015 received the certificate to commence business. On

st st

31 may,2015 It had acquired a running business from Gopal and Co with effect from 1 January,2015.The

Purchase Consideration was Rs.50,00,000 of which Rs.10,00,000 was to be paid in cash and Rs.40,00,000 in

the form of fully paid shares.

The company also issued shares for Rs.40,00,000 for cash. Machinery Costing Rs.25,00,000 was then installed.

Assets acquired from the vendors were :Machinery Rs.30,00,000;Stock Rs.6,00,000;and patents Rs.4,00,000.

st

During the year ended 31 December,2015 the total sales ware Rs.1,80,00,000. The sales per month in the first

half year being one half of what they were in the latter half year.

The net profit of the company, after charging the following expenses, was Rs.10,00,000:

Particulars Rs.

Depreciation 5,40,000

Director`s fees 86,000

Preliminary Expenses 10,000

Office Expenses 2,40,000

Selling Expenses 1,98,000

Interest to vendors 50,000

6 COCEDUCATION.COM Ph. No. 9999631597, 7303445575, 8448322142

COCEDUCATION.COM PPI CA/CMA Santosh kumar

Ascertain the pre-incorporation and post-incorporation Profits and prepare the Balance Sheet of the Company

st

as on 31 December,2015. The Closing Stock was valued at Rs.7,00,000. Purchase consideration was settled on

st

31 may,2015.

Question.10. A,B and C are in partnership sharing Profit and Losses in the ration 1/2:1/3:1/6.The Partnership

Deed states that each partner is entitled to 6% Interest on Capital. The firm was taken over by Swagata ltd for

a total consideration of Rs.8,10,000.On the date of takeover, the Firm`s net Assets, represented by the

partner`s Capital Accounts were-A-Rs.3,10,000;B-Rs.2,50,000 and C-Rs.1,90,000.

The firm wants to indicate the mode of settlement of purchase Consideration to the company, keeping in mind

that the partner`s interests should be equitably retained in the company. The company can issue Equity

shares of Rs.10 each and preference shares(rate to be decided)of Rs.100 each. You are required to decide

upon the scheme for settlement of purchase consideration.

7 COCEDUCATION.COM Ph. No. 9999631597, 7303445575, 8448322142

Experienced Faculties, Daily Doubt sessions,

Ready to counsel any query, Supportive

Technical Team

COC Education goal is to provide conceptual knowledge to all or any commerce

students instead of mugging up books. Video classes are provided for

CA/CMA/CS/B.Com-M.Com Class XI-XII(Commerce) students in Pen-Drive/SD

card/Download link mode which may run on Windows 7 & above laptop/computer

or android phone.

We promise you that, if we see you bringing one step forward then we'll take you to

level up by our support and care in getting the concepts clear for once and all.

OUR ROOTS: COC Education Pvt. Ltd. (COC Education)

In 2006, CA/CMA Santosh Kumar started an educational institute after

leaving his well-paying corporate job with mission to solve problem of

quality education to student preparing for CA, CS and CMA. With the

commitment to excellence, in less than a decade time - 4 institutes were

opened in different corners of Delhi and we provided education to more

than 45,000 students. But the vision was bigger, to provide the same

quality of education at reasonable price to all commerce students

throughout the world.

And then the revolution in video classes started and COC Education was

formed. With the virtue of excellent teaching methodology and the team

with dedication and devotion toward student success in every challenge

we reached to 245k+ students online and more than 50,000 students

have enrolled with us in different courses in the span of just 3 years.

Website: -www.coceducation.com Enquiry. No. 9999631597/8448322142/7303445575

We have the vision to become global leader in providing exemplary

education for betterment of individual. We have evolved, developed and

implemented strategies to be the pioneer in every stage.

Our Video Lectures edge over market:

1. Unlimited Views till exam

2. Best Quality Video

3. Study Material, Past attempts(s) questions, and questions

from practice manual

4. Better understanding of the students all the lectures are

given in simple and understandable language.

5. Covers the entire study material, past attempts(s) questions,

and questions from practice manual

6. Fortnight Live Interactive Session with Faculties

CONTACT US:

• For any Purchases Inquiry- Call/WhatsApp - 8448322142,

9999631597, 7303445575

• For any Purchase Inquiry Mail, us @

enquiry.coceducation@gmail.com

• For Technical Support- 9811455109, 9354257700, 9311281468

• For Technical Support- Mail us @ coceducation.technical@gmail.com

• For Management – E-Mail @ official@coceducation.com

Address:

COC Education Pvt. Ltd.

1201, Tower B, I-Thum, Sector 62,

Noida Pin code- 201309

Website:- www.coceducation.com Enquiry No. 9999631597/8448322142/7303445575

You might also like

- Operation and Instruction Manual Model DB PumpDocument54 pagesOperation and Instruction Manual Model DB PumpJustin Zimmerman100% (6)

- FNCE 6018 Group Project: Hedging at PorscheDocument2 pagesFNCE 6018 Group Project: Hedging at PorschejorealNo ratings yet

- Accounting For Managers (Assignment One (E-Finance) ) Question OneDocument7 pagesAccounting For Managers (Assignment One (E-Finance) ) Question OnehananNo ratings yet

- Boeing Current Market Outlook 2021Document20 pagesBoeing Current Market Outlook 2021VaibhavNo ratings yet

- Act1111 Final ExamDocument7 pagesAct1111 Final ExamHaidee Flavier SabidoNo ratings yet

- Profit Prior To Incorporation: Important Points of Our Notes/BooksDocument6 pagesProfit Prior To Incorporation: Important Points of Our Notes/BooksmaheshNo ratings yet

- Profit Prior To IncorporationDocument5 pagesProfit Prior To IncorporationKartik Mirji100% (1)

- 1 Profit Prior To Incorporate Extra QuestionsDocument3 pages1 Profit Prior To Incorporate Extra QuestionsMahima tiwariNo ratings yet

- Sybcom PpiDocument6 pagesSybcom PpiMaxson Miranda100% (2)

- Statement of Comprehensive IncomeDocument4 pagesStatement of Comprehensive Incomebobo tangaNo ratings yet

- Asdos Pert 2Document2 pagesAsdos Pert 2mutiaoooNo ratings yet

- Questions Business IncomeDocument8 pagesQuestions Business IncomeMbeiza MariamNo ratings yet

- P&L Prior To IncorporationDocument2 pagesP&L Prior To Incorporationpraveena lNo ratings yet

- VELLORE, CHENNAI-632 002: Answer The Following QuestionsDocument5 pagesVELLORE, CHENNAI-632 002: Answer The Following QuestionsJayanthiNo ratings yet

- Review 2 Set K Problem 1Document3 pagesReview 2 Set K Problem 1Marinel AbrilNo ratings yet

- Sunway T3 (TX4014) Tax Computation 2020Document3 pagesSunway T3 (TX4014) Tax Computation 2020Ee LynnNo ratings yet

- Advance AccountsDocument7 pagesAdvance Accountsashish.jhaa756No ratings yet

- Unit 3 - Business Finance - AppendixDocument5 pagesUnit 3 - Business Finance - Appendixmhmir9.95No ratings yet

- Profitability RatiosDocument4 pagesProfitability RatiosShakthiNo ratings yet

- Q1Document6 pagesQ1Maxson MirandaNo ratings yet

- Corporate Taxes Part 1 (VAT, EWT and Income Tax) CaseDocument4 pagesCorporate Taxes Part 1 (VAT, EWT and Income Tax) CaseMikaela L. RoqueNo ratings yet

- CE Interim ReportingDocument2 pagesCE Interim ReportingalyssaNo ratings yet

- Profit & Loss Pre and Post Incorporation - QBDocument16 pagesProfit & Loss Pre and Post Incorporation - QBHindutav aryaNo ratings yet

- Ty Baf TaxationDocument4 pagesTy Baf TaxationAkki GalaNo ratings yet

- Ty Baf TaxationDocument4 pagesTy Baf TaxationAkki GalaNo ratings yet

- Questions On AccountancyDocument34 pagesQuestions On AccountancyAshwin ChoudharyNo ratings yet

- RTP May 2018 New Gr1Document122 pagesRTP May 2018 New Gr1subhanvts7781No ratings yet

- Cases Inhouse ClassDocument5 pagesCases Inhouse ClassKevin DeswandaNo ratings yet

- FSA Vertical FormatDocument10 pagesFSA Vertical FormatMayank BahetiNo ratings yet

- Fabm2 Statement of Comprehensive Income Practice Problems Answer KeyDocument3 pagesFabm2 Statement of Comprehensive Income Practice Problems Answer KeyMounicha Ambayec0% (1)

- Fabm2 - Statement of Comprehensive Income (Practice Problems) - Answer KeyDocument3 pagesFabm2 - Statement of Comprehensive Income (Practice Problems) - Answer KeyMounicha Ambayec100% (4)

- CC 1 QuestionDocument3 pagesCC 1 Questionalya atiqahNo ratings yet

- Solutions For Cash Flow Sums OnlyDocument11 pagesSolutions For Cash Flow Sums OnlyS. GOWRINo ratings yet

- Adjusting EntriesDocument5 pagesAdjusting EntriesM Hassan BrohiNo ratings yet

- Cap II Group I RTP Dec2023Document84 pagesCap II Group I RTP Dec2023pratyushmudbhari340No ratings yet

- Accounting TestDocument4 pagesAccounting Testdinda ardiyaniNo ratings yet

- Financial Accounting Cat 1 JonathanDocument14 pagesFinancial Accounting Cat 1 JonathanjonathanNo ratings yet

- CFS - ProblemsDocument5 pagesCFS - Problemskatasani likhithNo ratings yet

- Financial Analysis ProblemDocument16 pagesFinancial Analysis ProblemShreyashi DasNo ratings yet

- CC 1Document11 pagesCC 1谦谦君子No ratings yet

- No.2 FA Assignment 3 Amato FIXDocument3 pagesNo.2 FA Assignment 3 Amato FIXKevin DeswandaNo ratings yet

- Is and BS For FinalsDocument5 pagesIs and BS For FinalsRehan FarhatNo ratings yet

- Financial Statement AnalysisDocument3 pagesFinancial Statement AnalysisAsad Rehman100% (1)

- Unit-5 Final AccountsDocument7 pagesUnit-5 Final AccountsSanthosh Santhu0% (1)

- Assignment1 - Profit and Loss Exercise E FinanceDocument8 pagesAssignment1 - Profit and Loss Exercise E Financees.eldeebNo ratings yet

- Imp QuesDocument2 pagesImp QueskaveriNo ratings yet

- CA Inter RTP Nov 2018 Small PDFDocument281 pagesCA Inter RTP Nov 2018 Small PDFSANKAR SIVANNo ratings yet

- Nov 18Document43 pagesNov 18Prabhat Kumar MishraNo ratings yet

- Profit Prior To IncorporationDocument6 pagesProfit Prior To IncorporationKitty CattyNo ratings yet

- TAXN 1016 FE - Long ProblemsDocument11 pagesTAXN 1016 FE - Long ProblemsCrystel Kate MananganNo ratings yet

- The Balance of Prepaid Expenses On January 1, 2018 Is P24,675. What Is The Balance of Prepaid Expense As of December 31, 2018?Document3 pagesThe Balance of Prepaid Expenses On January 1, 2018 Is P24,675. What Is The Balance of Prepaid Expense As of December 31, 2018?Tahani Awar Gurar0% (1)

- Ias 07Document72 pagesIas 07Hannan Fatima EllahiNo ratings yet

- A211 CC 1 StudentDocument6 pagesA211 CC 1 StudentWon HaNo ratings yet

- Study Note - 7.3, Page 535-541Document7 pagesStudy Note - 7.3, Page 535-541s4sahith100% (1)

- Department AccountingDocument12 pagesDepartment AccountingRajesh NangaliaNo ratings yet

- Ac208 2019 11Document6 pagesAc208 2019 11brian mgabi100% (1)

- Domondon - Acctg 3 - Prelim Quiz 2Document2 pagesDomondon - Acctg 3 - Prelim Quiz 2Prince Anton DomondonNo ratings yet

- Soal Tugas Akm Is - ST o FP - CFDocument6 pagesSoal Tugas Akm Is - ST o FP - CFElyssa Fiqri Fauziah0% (1)

- PKP 3 - Cash Flow Statement-Direct MethodDocument5 pagesPKP 3 - Cash Flow Statement-Direct MethodIR WanNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Mergers and AcquisitionDocument28 pagesMergers and AcquisitionKalash SharmaNo ratings yet

- Computer VirusDocument2 pagesComputer VirusKalash SharmaNo ratings yet

- Kalash HarshitDocument9 pagesKalash HarshitKalash SharmaNo ratings yet

- Buissness Laws Main Topic For ExamsDocument5 pagesBuissness Laws Main Topic For ExamsKalash SharmaNo ratings yet

- Kalash J Tushar J WaseemDocument28 pagesKalash J Tushar J WaseemKalash SharmaNo ratings yet

- AssignmentDocument5 pagesAssignmentpankajjaiswal60No ratings yet

- BBA Unit IIIDocument9 pagesBBA Unit IIIPriya NandhakumarNo ratings yet

- Demographic Effects On Labor Force Participation RateDocument7 pagesDemographic Effects On Labor Force Participation RatemichaelNo ratings yet

- Lowy Institute 2023 Asia Power Index Key Findings ReportDocument36 pagesLowy Institute 2023 Asia Power Index Key Findings ReportDimitris VgNo ratings yet

- Permasalahan Dan Potensi Pesisir Di Kabupaten SampangDocument5 pagesPermasalahan Dan Potensi Pesisir Di Kabupaten Sampangsupriyadi de kcongNo ratings yet

- ItineraryDocument2 pagesItineraryQasim JummaniNo ratings yet

- Chapter 9 Mechanics of Options MarketsDocument4 pagesChapter 9 Mechanics of Options MarketsTU Tran AnhNo ratings yet

- 18ES51 Module 4Document19 pages18ES51 Module 4satishsNo ratings yet

- LESSONSDocument151 pagesLESSONSsmile.wonder12No ratings yet

- Astm F 1183Document4 pagesAstm F 1183Ivan AlanizNo ratings yet

- Marx TheoryDocument12 pagesMarx Theoryharshnigam9No ratings yet

- India Multi Brand Car Service Market Report:2020-Ken ResearchDocument14 pagesIndia Multi Brand Car Service Market Report:2020-Ken Researchsam662223No ratings yet

- Answers 11Document6 pagesAnswers 11Nguyễn Ngọc ÁnhNo ratings yet

- Asean & OpecDocument20 pagesAsean & OpeckjohnabrahamNo ratings yet

- Use of Plastic Bottels in Concrete BlocksDocument17 pagesUse of Plastic Bottels in Concrete BlocksParthiv MistryNo ratings yet

- Case Study Chapter 4 - Ias 16Document3 pagesCase Study Chapter 4 - Ias 16Thị Thanh Viên CaoNo ratings yet

- CBM Assignment 2Document3 pagesCBM Assignment 2Abhishek ChopraNo ratings yet

- Tension & Shear CapacityDocument5 pagesTension & Shear CapacityFaridUddinNo ratings yet

- Financial Performance of Publicly-Traded Agribusinesses (Food Processing Firms) 2013 16pDocument16 pagesFinancial Performance of Publicly-Traded Agribusinesses (Food Processing Firms) 2013 16pdainesecowboyNo ratings yet

- Discounted Cash Flow ValuationDocument33 pagesDiscounted Cash Flow ValuationShadow IpNo ratings yet

- CapelloDocument23 pagesCapelloreissitamu1No ratings yet

- Exploring Ghanaian Death Rituals and Funeral PracticesDocument8 pagesExploring Ghanaian Death Rituals and Funeral PracticesSunil ChandraNo ratings yet

- NCBA-Quiz LAWDocument2 pagesNCBA-Quiz LAWRONZALES, Genie RoseNo ratings yet

- Silk Route To G20Document15 pagesSilk Route To G20aaravstudy24No ratings yet

- GST Sales AmbikaDocument1 pageGST Sales Ambikakoradiyagautam.bNo ratings yet

- 2021 HSC EconomicsDocument24 pages2021 HSC EconomicspotpalNo ratings yet

- Annex F - Salesperson'S Checklist On Customer Due Diligence (CDD) For Rental TransactionsDocument10 pagesAnnex F - Salesperson'S Checklist On Customer Due Diligence (CDD) For Rental Transactionshatoris1987No ratings yet