Professional Documents

Culture Documents

Inflation: Inancial Year 2021-22

Inflation: Inancial Year 2021-22

Uploaded by

Femi SamOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Inflation: Inancial Year 2021-22

Inflation: Inancial Year 2021-22

Uploaded by

Femi SamCopyright:

Available Formats

Inflation

There are multiple reasons which can cause inflation in an economy. This includes excess

demand in an economy, increased government spending, hoarding, and increased exports. It

can also be due to non-economic factors such as floods, droughts, etc. As of India now, the

current inflation can be attributed to the supply chain disruptions, the Russia-Ukraine war,

increased oil prices, and more. The CPI or the Consumer price inflation basket is used to

calculate inflation. This is further divided into food, shelter, household operations,

furnishings and equipment, clothing and footwear, transportation, health, and personal care,

recreation, etc. There is often a gap between the CPI and WPI. This gap can be attributed to

non-food inflation. The wide gap between WPI and CPI is due to the price pressures on the

input side. If there is a rise in the food prices, the CPI can increase whereas the WPI can

remain the same. Similarly, an increase in the price of manufactured goods can cause an

increase in the WPI, without affecting the CPI.

Stagflation can be said to be a situation where there is high inflation with a low growth rate.

As per certain sources, India seems to be free from the risk of stagflation. Even with the

world on the brink of stagflation, India seems to be somewhat safe from the same.

While India is struggling with inflation, various other countries are also seen battling with the

same. The US CPI is seen to be more than India for the last seven months. As of now, the

CPI of India remained above its upper limit of 6%. Core inflation also remained close to or

above 6% and non-food inflation at 7%. The WPI also came up to double digits. In

comparison to this, the inflation in the United States remains at 8.5% and in the UK, the

inflation hit 9%.

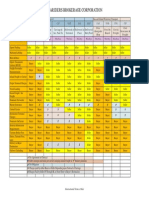

IIP analysis

Financial Year 2021-22

Month Mar Feb Jan Dec Nov Oct Sept Aug Jul Jun May Apr

s 2022 2022 2022 2021 202 202 2021 2021 2021 2021 2021 2021

1 1

Indices 148. 131. 139. 138. 128 135 129. 132. 131. 122. 115. 126.

8 8 3 8 5 4 5 8 1 1

Year on Year analysis:

IIP increased 7.1% year on year in April 2022. It rose upwards 2.2% and beat the expected

5.1 rises. This was the strongest rise since August 2021. In March 2022, India's industrial

production increased 1.9 percent year on year, up from a downwardly revised 1.5 percent

increase the previous month and surpassing market estimates of 1.7 percent growth.

Electricity output increased at a higher rate (6.1 percent vs. 4.5 percent in February) and

TASK 4 FEMI MARIYAM SAM

manufacturing output increased at a faster rate (0.9 percent vs. 0.5 percent), while mining

output decreased (4 percent vs 4.5 percent). Industrial output increased 12.5 percent on a

monthly basis, compared to a 4.9 percent drop the previous month. Production increased 11.3

percent year over year in the April-March period of the 2021-22 year.

Comparative analysis –

March 2022 – Feb 2022

The IIP increased in March 2021 at 24.4%. The manufacturing sector grew 0.9% and the

mining output rose 4%. The power generation in this month also increased by 6.1%.

Compared to the previous month, the IIP increased a 1.9%.

Feb 2022 – Jan 2022

The mining industry rose by 4.5% and electricity generation also grew at 4.4%. The

manufacturing sector expanded by 0.8%. The output shrank by a sharp 5.5%.

Jan 2022 – Dec 2021

Despite the Omicron variant, the IIP grew by 1.32%. This is an improvement from the 0.7%

annual growth in December. The capital goods sector contracted by 1.39% and the

infrastructure goods sectors had a growth of 5.4%.

Dec 2021 – Nov 2021

The IIP grew at 0.4% compared to the previous year and the IIP for mining, manufacturing

and electricity sectors were at 120.3, 138.8, and 162.5 respectively. This was considerably

more than the previous month.

Nov 2021 – Oct 2021

Compared to October, the IIP for Mining, Manufacturing, and Electricity sectors stood at

111.9, 129.6, and 147.9 respectively. The indices for consumer durables and non-consumer

durables stood at 106.7 and 150.3 respectively for the month of November 2021.

Oct 2021 – Sept 2021

The indices stood at 109.7 for the mining sector and 134.7 for the manufacturing sector. The

indices of the primary goods was at 128.5 and that for capital foods was 90.3.

Sept 2021 – August 2021

The IIP for September rose by 3.1% compared last year. The domestic mining output also

grew by 8.6% while manufacturing sector grew by 2.7%. The electricity generation also rose

by 0.9%.

Aug 2021 – July 2021

The indices for the for Mining, Manufacturing and Electricity sectors for the month of

August stood at 103.8, 130.2 and 188.7 respectively. For primary goods, it was at 127.5 and

for capital goods it was at 142.7.

TASK 4 FEMI MARIYAM SAM

July 2021 – June 2021

The Indices of Industrial Production for the Mining, Manufacturing and Electricity sectors for

the month of July 2021 stand at 104.6, 130.9 and 184.7 respectively. Further, the indices for

Consumer durables and Consumer non-durables stand at 119.5 and 146.6 respectively for the

month of July 2021. Compared to June, the mining production increased from 85.7 to 87.5.

Compared to the previous year the growth for the mining sector was 19.5%.

June 2021 – May 2021

The Indices of Industrial Production for the Mining, Manufacturing and Electricity sectors for

the month of June 2021 stand at 105.5, 121.0 and 169.1 respectively. Further, the indices for

Consumer durables and Consumer non-durables stand at 101.7 and 140.8 respectively for the

month of June 2021. Compared to the previous month, there has been a fall in the mining

sector whereas there has been an increase in the manufacturing and the electricity generation.

May 2021 – April 2021

The Indices of Industrial Production for the Mining, Manufacturing and Electricity sectors for

the month of May 2021 stand at 108.0, 113.5 and 161.9 respectively. It was 122.7 for Primary

Goods, 65.6 for Capital Goods, 129.9 for Intermediate Goods and 129.8 for Infrastructure/

Construction Goods. Compared to the previous month of April, the mining sector have

increased considerably whereas there has been a fall in the electricity and manufacturing

sector production.

PMI

Financial Year 2021-22

Months Mar Feb Jan Dec Nov Oct Sept Aug Jul Jun May Apr

202 202 202 202 202 202 202 202 202 202 202 202

2 2 2 1 1 1 1 1 1 1 1 1

Composit 54.3 53.5 53 56.4 59.2 58.7 55.3 55.4 49.2 43.1 48.1 55.4

e PMI

Comparative analysis

March 2022 – Feb 2022

The PMI for March stood at 54.3 which indicated that there was an overall increase compared

to the previous month. A strong expansion is indicated with manufacturers signalling a

sharper increase than the service providers. The growth had slowed in manufacturers but had

increased in the service providers.

Feb 2022 – Jan 2022

After declining for three consecutive months due to the removal of restrictions on contact-

intensive industries as the third wave of the pandemic subsided, India's services activity only

TASK 4 FEMI MARIYAM SAM

slightly increased in February. The PMI for services rose from 51.8 and had improved after

the Omicron variant. There was some dampening in the growth due to competitive pressures,

COVID 19 and higher prices.

Jan 2022 – Dec 2021

The composite PMI fell from 56.4 in December to 53.0 in January. The closer movement to

the 50-mark indicated that there was a slowdown in the business activity from the previous

month. The services PMI dropped from 55.5 in December to 51.5 in January as a result of

weaker growth in new orders and output as well as declining employment levels. In addition,

the manufacturing sector's PMI fell from 55.5 in December to 54.0 in January as a result of

output increases and a four-month low in new orders. At the beginning of the year, a fresh

wave of Covid-19 cases was reported, which was regarded as a major drag on both the

services and industrial sectors.

Dec 2021 – Nov 2021

PMI decreased from 59.2 in November to 56.4 in December. As a consequence, the PMI

increased its distance from the 50-threshold, indicating a slower increase in business activity

than the previous month. As weaker foreign demand held back growth in new orders and

output, the services PMI dropped from 58.1 in November to 55.5 in December. In addition,

the manufacturing sector's PMI dropped from 57.6 in November to 55.5 in December as a

result of slower increases in output and new orders, whereas headcounts barely changed.

Nov 2021 – Oct 2021

From 58.7 in October, the composite PMI increased to 59.2 in November. Consequently, the

PMI increased its distance from the 50-threshold and showed a rise in business activity from

the previous month. The services PMI fell marginally from 58.4 in October to 58.1 in

November as the sector's continued support was provided by output growth and new orders

that persisted. However, the rate of growth in new orders in November was slowed down by a

decline in overseas demand. In addition, on the manufacturing front, the PMI rose from

October's 55.9 to 57.6 in November thanks to more robust increases in output and new

orders, but headcounts only slightly increased.

Oct 2021 – Sept 2021

The composite PMI increased considerably from the previous month. While this remains,

faster losses in output, new orders, and employment were essentially reflected in the headline

print. Additionally, supplier delivery times grew more slowly than they did in September.

The readings for medium-sized and small businesses were significantly below the 50-

threshold, with only the PMI of large organizations remaining in the expansionary zone. Due

to steeper decreases in employment and purchasing activity, the non-Manufacturing PMI

dropped from 53.2 in September to 52.4 in October. When examining each industry

separately, the construction and services sectors both suffered a decline. The recurrence of

Covid-19 cases, power outages, high input costs, and environmental restrictions are likely

causes.

TASK 4 FEMI MARIYAM SAM

Sept 2021 – August 2021

The composite PMI increased from 55.3 in September to 58.7 in October. As a result, the

PMI increased its distance from the 50-threshold, suggesting an increase in business activity

from the previous month. The services PMI increased from 55.2 in September to 58.4 in

October as new orders and production grew more quickly. In addition, the manufacturing

sector's PMI rose from 53.7 in September to 55.9 in October as a result of stronger increases

in output and new orders, but headcounts decreased. From September, businesses' expenses

increased significantly, which survey respondents primarily attributed to rising gasoline,

material, retail, staffing, and transportation prices.

Aug 2021 – July 2021

PMI increased from 49.2 in July to 55.4 in August. The PMI increased beyond the 50-

threshold as a result, signalling an increase in business activity from the previous month. As

new orders and output climbed significantly, the services PMI increased to 56.7 in August

from 45.4 the previous month. Nevertheless, due to weaker growth in output, new orders, and

generally static headcounts, the manufacturing sector's PMI dropped from 55.3 in July to 52.3

in August. The output prognosis for the next year was still favorable, but optimism waned

due to concerns about the pandemic's long-term effects and the detrimental effects of

increased expenses on businesses' finances in addition to a lack of pricing power.

July 2021 – June 2021

From 43.1 in June to 49.2 in July, the PMI climbed. The PMI, therefore, continued to be

below the 50-threshold, suggesting a decline in business activity from the previous month.

The services PMI increased in July compared to the previous month as output and new orders

shrank more slowly. Similarly, the manufacturing PMI increased from 48.1 in June to 55.3 in

July as a result of higher output, new orders, and headcounts. The COVID-19 climate kept

having an impact on how well the service sector, which is so important to the Indian

economy, performed.

June 2021 – May 2021

The PMI fell from 48.1 in May to 23.1 in June. It moved further down the threshold

indicating that there was a decrease in business activity the previous month. The services

PMI decreased from 46.1 to 41.2 with the ongoing spread of the COVID 19 pandemic. There

were also stricter restrictions on employment, new order, and outputs. The manufacturing

PMI also fell due to the flagging output, new orders, etc.

May 2021 – April 2021

The composite PMI fell in May as compared to April and it moved below the threshold limits

suggesting a decrease in business activity from the previous month. The services PMI also

fell due to the increased pandemic cases and the subsequent restrictions. The services

industry suffered during this period whereas the manufacturing industry managed to keep

itself at 50.8.

TASK 4 FEMI MARIYAM SAM

You might also like

- Statement May 2017 0016510001071950502 8757Document3 pagesStatement May 2017 0016510001071950502 8757JunaidNo ratings yet

- Inflation, IIP & PMIDocument6 pagesInflation, IIP & PMIAJAY ARNo ratings yet

- Task 4 - Abin Som - 21FMCGB5Document8 pagesTask 4 - Abin Som - 21FMCGB5Abin Som 2028121No ratings yet

- Economic Analysis - IndiaDocument9 pagesEconomic Analysis - IndiaMeghna B RajNo ratings yet

- Literature ReviewsDocument5 pagesLiterature ReviewsRashi MahajanNo ratings yet

- Economic Update June 2022Document15 pagesEconomic Update June 2022Lahori MundaNo ratings yet

- Eco Watch Issue 50Document2 pagesEco Watch Issue 50CO CHENNAI SOUTH PUNJAB NATIONAL BANKNo ratings yet

- ECONOMYDocument18 pagesECONOMYMukhNo ratings yet

- Economic Update July 2022Document17 pagesEconomic Update July 2022ZubaidaNo ratings yet

- Macroeconomic Report May 2020 Economic DivisionDocument22 pagesMacroeconomic Report May 2020 Economic DivisionTim SheldonNo ratings yet

- Basic Metals Feb 2022Document11 pagesBasic Metals Feb 2022Kec M&BDNo ratings yet

- WPI Last 6 MonthDocument5 pagesWPI Last 6 MonthKQC CONSULTING AND ENGINEERSNo ratings yet

- Analysis of Data of WPIDocument4 pagesAnalysis of Data of WPIsuryaliNo ratings yet

- Eco Watch Issue 51Document2 pagesEco Watch Issue 51CO CHENNAI SOUTH PUNJAB NATIONAL BANKNo ratings yet

- Invesco Factsheet June 2022Document56 pagesInvesco Factsheet June 2022ADARSH GUPTANo ratings yet

- Ienergy Coal Petcoke Import DataDocument18 pagesIenergy Coal Petcoke Import DataSaurabh DugarNo ratings yet

- EssayDocument2 pagesEssayMohitash Nagotra: One Step AheadNo ratings yet

- Task 4Document8 pagesTask 4Anooja SajeevNo ratings yet

- Pib - Gov.in-Press Information BureauDocument8 pagesPib - Gov.in-Press Information BureauCharlie WillsNo ratings yet

- Economic Update 22-24Document17 pagesEconomic Update 22-24Sajjad HussainNo ratings yet

- Cons Inflation, UK March 2022Document38 pagesCons Inflation, UK March 2022Joe FangNo ratings yet

- Sharekhan Special Monthly Economy ReviewDocument10 pagesSharekhan Special Monthly Economy Review05550No ratings yet

- Indian EconomyDocument29 pagesIndian EconomyRishabh KumarNo ratings yet

- Report On Inflation May - 2022Document14 pagesReport On Inflation May - 2022Mariel PeleciaNo ratings yet

- Asia Insights: Indonesia: Q2 GDP Growth Picked Up FurtherDocument6 pagesAsia Insights: Indonesia: Q2 GDP Growth Picked Up FurtherDyah MaharaniNo ratings yet

- Economic Bulletin (Vol. 36 No. 9)Document76 pagesEconomic Bulletin (Vol. 36 No. 9)Republic of Korea (Korea.net)No ratings yet

- Report On Inflation October 2022Document14 pagesReport On Inflation October 2022David Carlo -sadameNo ratings yet

- Consumer Resurgence Drives 2Q GDP Growth Maintain 2022 GDP at +5.1%Document7 pagesConsumer Resurgence Drives 2Q GDP Growth Maintain 2022 GDP at +5.1%Dyah MaharaniNo ratings yet

- Task 3 GDPDocument9 pagesTask 3 GDPAishwaryaNo ratings yet

- IB Economics IA 2Document4 pagesIB Economics IA 2SpicyChildrenNo ratings yet

- San Francisco Fed Economic LetterDocument6 pagesSan Francisco Fed Economic LetterTim MooreNo ratings yet

- Cmonthly WPI May 2021Document5 pagesCmonthly WPI May 2021CuriousMan87No ratings yet

- Avanti SDocument15 pagesAvanti Skimice5490No ratings yet

- Monthly Gazette - October 2022Document5 pagesMonthly Gazette - October 2022bobbyardeaNo ratings yet

- Review of BI Board of Governors 2022-08 (August 2022) MeetingDocument5 pagesReview of BI Board of Governors 2022-08 (August 2022) MeetingAlbert LudiNo ratings yet

- Consumer Price Inflation, UK December 2022Document47 pagesConsumer Price Inflation, UK December 2022DandizzyNo ratings yet

- Market Outlook 17th April 2012Document7 pagesMarket Outlook 17th April 2012Angel BrokingNo ratings yet

- Price Trends: 3.1 OverviewDocument11 pagesPrice Trends: 3.1 OverviewNajihah Mohd KhairiNo ratings yet

- Q4 Fy21 GDPDocument7 pagesQ4 Fy21 GDPsksaha1976No ratings yet

- Consumer Price Inflation, UK: September 2022: NoticeDocument45 pagesConsumer Price Inflation, UK: September 2022: NoticeDuc-Anh NguyenNo ratings yet

- Government of India: Press Information BureauDocument7 pagesGovernment of India: Press Information BureauRavi KumarNo ratings yet

- Economy Watch February 2021Document28 pagesEconomy Watch February 2021Avinash GarjeNo ratings yet

- 3.0 Identify The Key Drivers of InflationDocument9 pages3.0 Identify The Key Drivers of InflationMukhNo ratings yet

- AnnualReport 2019Document7 pagesAnnualReport 2019Thanh thọ TrầnNo ratings yet

- Purchase Mangers Index Is Used To Understand The Economic Trends On The Basis of The Analysis of Manufacturing and Services SectorDocument4 pagesPurchase Mangers Index Is Used To Understand The Economic Trends On The Basis of The Analysis of Manufacturing and Services SectorKatta AshishNo ratings yet

- RBL Monthly Newsletter February 2023Document10 pagesRBL Monthly Newsletter February 2023hharishhNo ratings yet

- Tai Lieu A1Document5 pagesTai Lieu A1vhbangNo ratings yet

- ASCON Industry SurveyDocument16 pagesASCON Industry Surveyjaydip zalaNo ratings yet

- Economy Watch October 2021Document26 pagesEconomy Watch October 2021avinash tolaniNo ratings yet

- IIP Update - October 2012: Growth in Industrial Production Surprises PositivelyDocument5 pagesIIP Update - October 2012: Growth in Industrial Production Surprises PositivelyAngel BrokingNo ratings yet

- Economic Analysis of India and Industry Analysis of Chemical IndustryDocument28 pagesEconomic Analysis of India and Industry Analysis of Chemical IndustrySharanyaNo ratings yet

- India Oecd Economic Outlook June 2023Document4 pagesIndia Oecd Economic Outlook June 2023alekya.nyalapelli03No ratings yet

- 2021 08 09 WU enDocument25 pages2021 08 09 WU enSadiah ayu rahmawatiNo ratings yet

- Echap 09Document33 pagesEchap 09PiroNo ratings yet

- Outlook For U.S. Agricultural TradeDocument21 pagesOutlook For U.S. Agricultural TradeWillfrieds Nong WaingNo ratings yet

- Economic Update August 2022Document15 pagesEconomic Update August 2022Sunny BanyNo ratings yet

- Ey Economy Watch August 2022Document27 pagesEy Economy Watch August 2022pravin.simsrNo ratings yet

- CI2315 Bahrain Economic 2022 ENDocument23 pagesCI2315 Bahrain Economic 2022 ENMaria VidalNo ratings yet

- Nepal Macroeconomic Update 202209 PDFDocument30 pagesNepal Macroeconomic Update 202209 PDFRajendra NeupaneNo ratings yet

- Cost Report 2021 ????Document41 pagesCost Report 2021 ????Sarthak ShuklaNo ratings yet

- Asia Small and Medium-Sized Enterprise Monitor 2021 Volume IV: How Asia’s Small Businesses Survived A Year into the COVID-19 Pandemic: Survey EvidenceFrom EverandAsia Small and Medium-Sized Enterprise Monitor 2021 Volume IV: How Asia’s Small Businesses Survived A Year into the COVID-19 Pandemic: Survey EvidenceNo ratings yet

- BPM Main Brochure 13286 001 (Updated 12062008)Document16 pagesBPM Main Brochure 13286 001 (Updated 12062008)CharitynNo ratings yet

- Carter Page Letter To DoJ Re Election FraudDocument37 pagesCarter Page Letter To DoJ Re Election FraudBrett LoGiurato100% (2)

- Dwnload Full International-Financial-Management-11th-Edition-Madura-Test-Bank PDFDocument35 pagesDwnload Full International-Financial-Management-11th-Edition-Madura-Test-Bank PDFashero2eford100% (14)

- Nca LFP NMCDocument2 pagesNca LFP NMCDaniel Hilario PintoNo ratings yet

- Excise Duty in IndiaDocument3 pagesExcise Duty in IndiaKomma RameshNo ratings yet

- 2 AILS StudyDocument48 pages2 AILS StudyRashid Nisar DarogeNo ratings yet

- Automotive in Myanmar PDFDocument17 pagesAutomotive in Myanmar PDFtnaingooNo ratings yet

- ArmeniaDocument12 pagesArmeniaHamed PiriNo ratings yet

- Zahar EvaDocument23 pagesZahar EvaEngr Fizza AkbarNo ratings yet

- Coral Bay Tax DigestDocument3 pagesCoral Bay Tax DigestJonathan Dela Cruz100% (1)

- AccountingDocument220 pagesAccountingbicky1800% (3)

- TA 202: Introduction To Manufacturing Processes: Prof. Sounak K. ChoudhuryDocument25 pagesTA 202: Introduction To Manufacturing Processes: Prof. Sounak K. ChoudhuryZishan MuzeebNo ratings yet

- AlphaIndicator BONI 20181106Document11 pagesAlphaIndicator BONI 20181106Daniel WigginsNo ratings yet

- Development of NEC Hong KongDocument8 pagesDevelopment of NEC Hong KongOlay KwongNo ratings yet

- Executive SummaryDocument25 pagesExecutive SummaryAvijit GhoshNo ratings yet

- Jaitapur Nuclear Power PlantDocument13 pagesJaitapur Nuclear Power PlantAr Shekhar Kshirsagar0% (1)

- Communication Directory 2019 2020 PDFDocument33 pagesCommunication Directory 2019 2020 PDFAmit GaragNo ratings yet

- Incoterms 2011Document1 pageIncoterms 2011barath1986No ratings yet

- Rebuild in Beauty On The Burnt-Out Coals, Not To The Heart's Desire, But The Soul'sDocument9 pagesRebuild in Beauty On The Burnt-Out Coals, Not To The Heart's Desire, But The Soul'syanjacksonNo ratings yet

- Ormocnet FormDocument2 pagesOrmocnet FormJohn EmmanuelNo ratings yet

- MERS Quality Assurance QRG-1Document5 pagesMERS Quality Assurance QRG-1agilitycapitalNo ratings yet

- Environmental History and British ColonialismDocument19 pagesEnvironmental History and British ColonialismAnchit JassalNo ratings yet

- Weekly Timesheet With Payslip Excel TemplateDocument4 pagesWeekly Timesheet With Payslip Excel TemplateVictor BiacoloNo ratings yet

- in Which Exchange Are Derivatives Traded in Japan?Document3 pagesin Which Exchange Are Derivatives Traded in Japan?kaungwaiphyo89No ratings yet

- Sol. Man. - Chapter 15 - Ppe Part 1 - Ia Part 1B 1Document9 pagesSol. Man. - Chapter 15 - Ppe Part 1 - Ia Part 1B 1Rezzan Joy Camara Mejia100% (1)

- NATL Sugar LyleDocument7 pagesNATL Sugar Lyleakshay87kumar8193100% (2)

- John Carter - Trading The Euro Box It, Squeeze It, Love It, Leave It (Article)Document8 pagesJohn Carter - Trading The Euro Box It, Squeeze It, Love It, Leave It (Article)brufpotNo ratings yet

- Biotechusa KFT Beu24008891Document1 pageBiotechusa KFT Beu24008891peicivek5No ratings yet

- Indictment: United States District Court District of New JerseyDocument12 pagesIndictment: United States District Court District of New JerseyAsbury Park PressNo ratings yet