Professional Documents

Culture Documents

Kent County August Races

Kent County August Races

Uploaded by

WXMIOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Kent County August Races

Kent County August Races

Uploaded by

WXMICopyright:

Available Formats

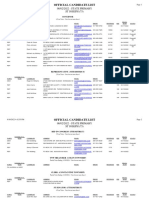

Updated 5/31/2022 11:50 AM Kent County

Unofficial Candidate List

August 2, 2022 Primary Election

Filing Method Filing Date Withdrew

PARTISAN SECTION

STATE

Governor 4 Year Term

Vote for not more than 1

DEM Gretchen Whitmer PO Box 15282 Lansing MI 48901 Petitions 3/17/2022

REP Donna Brandenburg 6842 Byron Shores Ct Byron Center MI 49315 Petitions 4/14/2022 Disqualified

REP Michael Brown 5957 Ponderosa Dr. Stevensville MI 49127 Petitions 4/12/2022 Disqualified

REP James Craig 11 Sand Bar Ln Detroit MI 48214 Petitions 4/18/2022 Disqualified

REP Tudor M. Dixon PO Box 21085 Lansing MI 48909 Petitions 4/19/2022

REP Perry Johnson 297 Canterbury Rd Bloomfield Hills MI 48304 Petitions 4/19/2022 Disqualified

REP Ryan D. Kelley 11275 Wild Duck Ln. Allendale MI 49401 Petitions 4/13/2022

REP Michael Jay Markey Jr 14745 Mercury Dr Grand Haven MI 49417 Petitions 3/18/2022 Disqualified

REP Ralph Rebandt 20806 Deerfield Farmington Hills MI 49335 Petitions 4/12/2022

REP Kevin Rinke 6805 Colby Ln Bloomfield Hills MI 48301 Petitions 4/18/2022

REP Garrett Soldano 8357 Barony Pt Mattawan MI 49071 Petitions 1/19/2022

CONGRESSIONAL

Representative in Congress - 2nd District 2 Year Term

Vote for not more than 1

DEM Jerry Hilliard 2743 Eland Ct Mt. Pleasant MI 48858 Petitions 4/19/2022

REP John Moolenaar PO Box 2192 Midland MI 48641 Petitions 3/30/2022

REP Thomas J. Norton 11281 Myers Lake Ave NE Courtland Twp. MI 49341 Petitions 4/19/2022

Representative in Congress - 3rd District 2 Year Term

Vote for not more than 1

DEM Hillary Scholten PO Box 6233 Grand Rapids MI 49516 Petitions 4/18/2022

REP John Gibbs 6836 Byron Center Ave SW Byron Center MI 49315 Petitions 4/13/2022

REP Gabi Manolache PO Box 114 Grandville MI 49468 Petitions 4/13/2022 Disqualified

REP Peter Meijer PO Box 68554 Grand Rapids MI 49516 Petitions 4/12/2022

LEGISLATIVE

State Senator - 18th District 4 Year Term

Vote for not more than 1

DEM Kai W. Degraaf 10530 Scenic Bluff Ln SE Ada MI 49301 Fee 4/18/2022

REP Thomas A. Albert 30 Flat River Dr SE Lowell MI 49331 Fee 1/14/2022

REP Ryan P. Mancinelli 6891 Braden Ct. SE Alto MI 49302 Fee 3/25/2022

State Senator - 20th District 4 Year Term

Vote for not more than 1

DEM Kim Jorgensen Gane PO Box 1522 Benton Harbor MI 49023 Fee 4/1/2022

REP Kaleb M. Hudson 717 72nd St SE Grand Rapids MI 49548 Fee 3/9/2022

REP Austin Kreutz PO Box 94 Allegan MI 49010 Fee 2/24/2022

REP Aric Nesbitt PO Box 400 Lawton MI 49065 Fee 3/29/2022

State Senator - 29th District 4 Year Term

Vote for not more than 1

DEM Winnie Brinks 2060 Osceola Dr SE Grand Rapids MI 49506 winnie@winniebrinks.com Fee 1/12/2022

REP Tommy Brann 4335 56th St. SW Wyoming MI 49418 tombrann@branns.com Fee 2/11/2022

REP Andrew Kroll 4593 Brooklyn SE Kentwood MI 49508 616andrewkroll@gmail.com Fee 4/19/2022 Disqualified

State Senator - 30th District 4 Year Term

Vote for not more than 1

DEM David LaGrand 126 Lafayette Ave. NE Grand Rapids MI 49503 Fee 3/22/2022

REP Keith Hinkle 3722 Grand River Dr NE Grand Rapids MI 49525 Fee 4/19/2022

REP Mark Huizenga 3841 Butterworth St. Walker MI 49534 Fee 3/24/2022

August 2, 2022 Primary Election Page 1 of 9

Updated 5/31/2022 11:50 AM Kent County

Unofficial Candidate List

August 2, 2022 Primary Election

State Senator - 33rd District 4 Year Term

Vote for not more than 1

DEM Mark Bignell 506 Gary St Greenville MI 48838 Fee 1/24/2022

REP Rick Outman 6481 N Miles Rd Six Lakes MI 48886 Fee 3/3/2022

REP Andrew Jackson Willis 5400 13 Mile Rd Rockford MI 49341 Fee 4/19/2022 Date Unknown

State Representative - 78th District 2 Year Term

Vote for not more than 1

DEM Leah M. Groves 1700 Sibley St. Lowell MI 49331 Fee 4/18/2022

REP Christine E. Barnes PO Box 33 Mulliken MI 48861 Fee 1/19/2022

REP Ben Geiger 404 Middle St Nashville MI 49073 Fee 4/14/2022

REP Gina Johnsen 411 Pineview Dr. Lake Odessa MI 48849 Fee 3/22/2022

REP Sandy Pearson 8308 Carriage Ln Portland MI 48875 Fee 3/1/2022 Date Unknown

REP Jon Rocha PO Box 304 Alto MI 49302 Fee 2/18/2022 Disqualified

State Representative - 79th District 2 Year Term

Vote for not more than 1

DEM Kimberly Y. Kennedy-Barrington 892 Bellview Meadow Dr SW Byron Center MI 49315 Fee 3/1/2022

REP Ryan Gallogly 1044 Cobblestone Way Dr. Byron Center MI 49315 Fee 4/11/2022

REP Jeremiah Keeler 2050 Blackmountain Dr SE Caledonia MI 49316 Fee 2/11/2022

REP Angela Rigas 6748 Chapin Ave SE Alto MI 49302 Fee 2/18/2022

State Representative - 80th District 2 Year Term

Vote for not more than 1

DEM Lily Cheng-Schulting P.O. Box 120003 Grand Rapids MI 49528 lilyformichigan@gmail.com Fee 2/14/2022

DEM Phil Skaggs 2615 Hall St SE Grand Rapids MI 49506 Phil@philskaggs.com Fee 3/22/2022

REP Dean Brandt 3283 47th St Hamilton MI 49419 Fee 7/26/2021 Date Unknown

REP Nevin P. Cooper-Keel 3127 127th Ave Allegan MI 49010 Fee 8/27/2021 Date Unknown

REP Jeffrey Johnson 2168 Thornapple River Dr Grand Rapids MI 49546 jeff@jj4mi.com Fee 2/23/2022

REP Rachelle M. Smit 216 124th Ave. Shelbyville MI 49344 Fee 5/19/2021 Date Unknown

State Representative - 81st District 2 Year Term

Vote for not more than 1

DEM Rachel Hood 28 Guild NE Grand Rapids MI 49505 rachel@hoodforthehouse.com Fee 3/10/2022

DEM Emily Lombard 3106 Plaza Dr. NE, Apt. D8 Grand Rapids MI 49525 lombardemily92@gmail.com Fee 4/18/2022 4/21/2022

REP Lynn Afendoulis P.O. Box 150823 Grand Rapids MI 49515 lynnafendoulis@comcast.net Fee 1/20/2022

State Representative - 82nd District 2 Year Term

Vote for not more than 1

DEM Salim Mohammed Al-Shatel 42 Dennis Ave SE Grand Rapids MI 49506 salim.alshatel@gmail.com Fee 3/25/2022

DEM Kristian Grant 429 Elliot St. SE Grand Rapids MI 49507 contact@electkristiangrant.com Fee 3/18/2022

DEM Robert Womack 909 Hancock St. SE Grand Rapids MI 49507 wygr32@yahoo.com Fee 3/29/2022

REP William Alexander 1431 Boston St. SE Grand Rapids MI 49507 wmalxndr@yahoo.com Fee 4/19/2022

REP Ryan Malinoski 701 Ardmore St SE Grand Rapids MI 49507 malinoski616@gmail.com Fee 3/17/2022

State Representative - 83rd District 2 Year Term

Vote for not more than 1

DEM Arthur Bowman 3826 Bend St. SW, Apt. 4 Wyoming MI 49418 artie@artieforcongress.com Fee 3/15/2022 Date Unknown

DEM Keith Courtade 1018 Floyd Ct. SW Wyoming MI 49509 courtadek@yahoo.com Fee 1/14/2022 Disqualified

DEM Ivan Diaz 926 Underhill Ave SW Grand Rapids MI 49503 ivandiazforoffice@gmail.com Fee 1/3/2022 Date Unknown

DEM John Fitzgerald 1780 Glenvale Ct. SW Wyoming MI 49519 john@johnformi.com Fee 2/28/2022

DEM Jose Flores 1052 Grandville Ave SW Grand Rapids MI 49503 drjflores1@gmail.com Fee 2/22/2022

REP Lisa DeKryger 5238 Rischow Ct SW Wyoming MI 49509 sldekryger@ameritech.net Fee 1/7/2022

August 2, 2022 Primary Election Page 2 of 9

Updated 5/31/2022 11:50 AM Kent County

Unofficial Candidate List

August 2, 2022 Primary Election

State Representative - 84th District 2 Year Term

Vote for not more than 1

DEM Carol Glanville PO Box 140976 Grand Rapids MI 49514 info@voteglanville.com Fee 3/30/2022

REP Mike Milanowski Jr. 1070 Sunrise Lane, NW Walker MI 49534 Fee 3/18/2022

REP Justin Noordhoek 3466 Cheyenne Dr Grandville MI 49418 jnoord85@gmail.com Fee 3/3/2022

REP Robert Regan PO Box 68285 Grand Rapids MI 49516 rjregan@aol.com Fee 3/8/2022

REP John Wetzel 3854 Crystal St. SW Grandville MI 49418 jwetzel@pureposinc.com Fee 4/18/2022

State Representative - 89th District 2 Year Term

Vote for not more than 1

DEM Sharon McConnon 380 Moon Ct. Casnovia MI 49318 Fee 4/15/2022

REP Luke Meerman 14250 60th Ave Coopersville MI 49404 Fee 2/24/2022

State Representative - 90th District 2 Year Term

Vote for not more than 1

DEM Meagan Hintz 82 Rockview Dr. NE Rockford MI 49341 mlknop86@gmail.com Fee 4/7/2022

REP Kathy Clark 6050 Pickerel Dr. Rockford MI 49341 indeosperavi@comcast.net Fee 4/19/2022

REP Gidget Groendyk 3407 Meadowlark Rockford MI 49341 bonnie_langford@aol.com Fee 4/19/2022 Disqualified

REP Bryan Posthumus 8755 Belding Rd, Apt. 2 Rockford MI 49341 bryan@posthumusformichigan.com Fee 3/21/2022

State Representative - 91st District 2 Year Term

Vote for not more than 1

DEM Tammy L. DeVries 14235 Myers Lake Ave Cedar Springs MI 49319 Fee 4/18/2022

DEM Frank J. LaFata 504 E. Pearl St. Greenville MI 48838 Fee 4/15/2022

REP Pat Outman 6397 N. Miles Rd. Six Lakes MI 48886 Fee 3/24/2022

COUNTY

County Commission -1st District 2 Year Term

Vote for not more than 1

DEM Jerry D. Berta 11050 Summit Ave. NE Rockford MI 49341 jerryberta@gmail.com Fee 4/14/2022

REP Ben Greene 1935 Four Mile Rd NE Grand Rapids MI 49525 bgreene.mi@gmail.com Fee 2/4/2022

REP Mark Jordan 1905 Timberview St NE Grand Rapids MI 49525 Mark@thejordanfamily.org Fee 2/21/2022

County Commission -2nd District 2 Year Term

Vote for not more than 1

DEM Rebecca Diffin 432 Netherfield St Comstock Park MI 49321 beckydiffin@gmail.com Fee 4/18/2022

REP Thomas Antor 9341 Laubach Ave Sparta MI 49345 toma911@att.net Fee 3/16/2022

County Commission -3rd District 2 Year Term

Vote for not more than 1

DEM Janalee Keegstra 10594 7 Mile Rd NE Rockford MI 49341 jimandjan@gmail.com Fee 4/18/2022

REP Mark Laws PO Box 361 Cedar Springs MI 49319 markdlaws@hotmail.com Fee 4/19/2022

REP Jennifer Merchant 13500 Beckwith Dr. NE Lowell MI 49331 electjennmerchant@gmail.com Fee 4/4/2022

County Commission -4th District 2 Year Term

Vote for not more than 1

DEM Judy Wood 5414 Kies St Rockford MI 49341 Fee 4/19/2022

REP Katie DeBoer 7210 Ramsdell Dr NE Rockford MI 49341 katie@katie4kent.com Fee 2/21/2022

REP Diane Jones 6561 Laguna Vista Dr NE Rockford MI 49341 Fee 1/25/2022

County Commission -5th District 2 Year Term

Vote for not more than 1

DEM Vanessa Lee 412 Pettis Ave SE Ada MI 49301 camptown@gmail.com Fee 4/15/2022

REP Stefanie Boone 2205 Knollpoint Dr. NE Ada MI 49301 booneforkcc5@gmail.com Fee 2/14/2022

REP Dave Hildenbrand 2700 Timpson Ave SE Lowell MI 49331 davehildenbrand@hotmail.com Fee 1/24/2022

August 2, 2022 Primary Election Page 3 of 9

Updated 5/31/2022 11:50 AM Kent County

Unofficial Candidate List

August 2, 2022 Primary Election

County Commission -6th District 2 Year Term

Vote for not more than 1

DEM Nicholas H. Vander Veen 1435 Blythe Dr. NW Grand Rapids MI 49504 nicholas@votevanderveen.com Fee 4/15/2022

REP Stan Stek 1274 Whitepine SW Walker MI 49534 stanstek@gmail.com Fee 1/31/2022

County Commission -7th District 2 Year Term

Vote for not more than 1

DEM Sue Merrell 2871 Porter St. SW Grandville MI 49418 merrellsue@gmail.com Fee 4/15/2022

REP Stan Ponstein 3967 Edgewood Grandville MI 49418 sjponstein@gmail.com Fee 1/27/2022

County Commission -8th District 2 Year Term

Vote for not more than 1

DEM Jennie Chatman 3737 Oriole Ave SW Wyoming MI 49509 Fee 4/18/2022

REP Dan Burrill 2879 Barcroft Dr SW Wyoming MI 49418 dan@danburrillforkent.com Fee 1/20/2022

County Commission -9th District 2 Year Term

Vote for not more than 1

DEM Chip LaFleur 9797 Clyde Park Ave SW Byron Center MI 49315 chip@lafleur.marketing Fee 4/18/2022

REP Matt Kallman 4099 108th St SW Byron Center MI 49315 matt@mattkallman.com Fee 2/22/2022

County Commission -10th District 2 Year Term

Vote for not more than 1

DEM Julie Humphreys 1775 Crescent Pointe Dr SE Caledonia MI 49316 humphreys.julie61@gmail.com Fee 4/15/2022

REP Emily Post Brieve 7438 Missoula Dr SE Caledonia MI 49316 emilypostbrieve@gmail.com Fee 1/25/2022

REP Bill Hirsch 8005 Breton Ave SE Caledonia MI 49316 Hirsch3@me.com Fee 3/25/2022

County Commission -11th District 2 Year Term

Vote for not more than 1

DEM John Considine 4286 Greenbriar Ct. SE Grand Rapids MI 49546 considinej1@gmail.com Fee 4/14/2022

REP AJ Hoff 4732 Hidden Highland Dr. NE Rockford MI 49341 ajhoff71@gmail.com Fee 4/19/2022

REP Lindsey Thiel 510 Arrowhead SE Grand Rapids MI 49546 lkthiel12@gmail.com Fee 1/25/2022

County Commission -12th District 2 Year Term

Vote for not more than 1

DEM Monica Sparks 4764 Wolf Run Ave SE Kentwood MI 49548 urbansparks1@gmail.com Fee 2/24/2022

REP Adam R. Palasek 722 Boss St Wyoming MI 49509 adamrpal@hotmail.com Fee 4/19/2022

REP Lee White 4891 Madison Kentwood MI 49548 leewhitejc@yahoo.com Fee 4/18/2022

County Commission -13th District 2 Year Term

Vote for not more than 1

DEM Michelle McCloud 4699 Raintree Dr SE Kentwood MI 49512 michellemccloudkentco@gmail.com Fee 2/22/2022

REP Tom McKelvey 3038 WindyWood Kentwood MI 49512 tom.mckelvey22@gmail.com Fee 4/18/2022

REP Nick Prill 1838 Forest Lake Dr. SE Grand Rapids MI 49546 nickprill4kent@gmail.com Fee 4/12/2022

County Commission -14th District 2 Year Term

Vote for not more than 1

DEM Carol Hennessy 1510 Kenan Ave NW Grand Rapids MI 49504 cmhenn@aol.com Fee 2/25/2022

REP Jerri Schmidt 3109 Woodglen St. NW Grand Rapids MI 49504 schmidte9318@sbcglobal.net Fee 4/6/2022

County Commission -15th District 2 Year Term

Vote for not more than 1

DEM Lisa S. Oliver-King 2024 Ontonagon SE Grand Rapids MI 49506 lisaoliverking@gmail.com Fee 4/8/2022

REP Brian Boersema 3420 Giddings Ave. SE Grand Rapids MI 49508 beskboersema@yahoo.com Fee 4/1/2022

August 2, 2022 Primary Election Page 4 of 9

Updated 5/31/2022 11:50 AM Kent County

Unofficial Candidate List

August 2, 2022 Primary Election

County Commission -16th District 2 Year Term

Vote for not more than 1

DEM Melissa LaGrand 255 College Ave SE Grand Rapids MI 49503 mjblagrand@gmail.com Fee 2/24/2022

DEM Jim Talen 30 College Ave SE, Apt. 78 Grand Rapids MI 49503 jim@jimtalen.com Petitions 4/8/2022

REP John Brooks Twist 826 Burke Ave NE Grand Rapids MI 49503 brookstwist@gmail.com Fee 4/18/2022

County Commission -17th District 2 Year Term

Vote for not more than 1

DEM Tony Baker 455 Madison Ave SE Grand Rapids MI 49503 tonbaker3@gmail.com Fee 2/28/2022

DEM James Vaughn 1288 Cambridge Dr SE Grand Rapids MI 49506 james_V@att.net Fee 4/19/2022 4/22/2022

DEM Victor Williams 1221 Johnston St SE Grand Rapids MI 49507 Fee 4/19/2022

REP Jason Gillikin 617 Prospect Ave. SE Apt 1 Grand Rapids MI 49503 jason@jegillikin.com Fee 2/22/2022

County Commission -18th District 2 Year Term

Vote for not more than 1

DEM Stephen Wooden PO Box 3684 Grand Rapids MI 49501 votewooden@gmail.com Fee 2/24/2022

REP Tim Allen 2236 Bradford Ct NE Grand Rapids MI 49505 tim.allen.05@gmail.com Fee 3/23/2022

REP Josie Kornev 2190 Knapp St NE Grand Rapids MI 49505 josie_bbc@yahoo.com Fee 3/24/2022

County Commission -19th District 2 Year Term

Vote for not more than 1

DEM Dave Bulkowski 322 Woodmere SE Grand Rapids MI 49506 dave@davebulkowski.com Fee 3/1/2022

DEM Kris Pachla 3012 Hall St. SE Grand Rapids MI 49506 Kristofer.pachla@gmail.com Fee 4/1/2022

REP Jeremiah Bannister 1121 Benjamin Ave. SE Grand Rapids MI 49506 jeremiah.bannister@gmail.com Fee 4/19/2022

REP Samuel R. Carstens 820 Fairmont St. SE, Apt. 1 Grand Rapids MI 49506 samuelcarstens1@gmail.com Fee 4/1/2022

County Commission -20th District 2 Year Term

Vote for not more than 1

DEM Ivan Diaz 926 Underhill Ave SW Grand Rapids MI 49503 ivandiazforoffice@gmail.com Fee 2/22/2022

REP Elisa Rodriguez 440 Beacon St SW Grand Rapids MI 49503 elisamanrique13@gmail.com Fee 2/16/2022

County Commission -21st District 2 Year Term

Vote for not more than 1

DEM Charles Howe 8170 Jason Ct SE Caledonia MI 49316 zipcodech@gmail.com Fee 4/18/2022

REP Alan Bolter 2097 Steketee Woods Ln Grand Rapids MI 49546 Alan_Bolter@yahoo.com Fee 1/31/2022

REP Walter Bujak 6639 Thornapple River Dr. Alto MI 49302 lindawally@charter.net Fee 4/19/2022

TOWNSHIP

Bowne Township

Township Clerk Partial Term Ending 11/20/2024

Vote for not more than 1

REP Karen Hendrick 12366 92nd Street Alto MI 49302 hendrickkaren@aol.com Petitions 4/14/2022

Township Treasurer Partial Term Ending 11/20/2024

Vote for not more than 1

REP Bonnie S. Lent-Davis 12340 84th St SE Alto MI 49302 blentdavis@gmail.com Petitions 4/18/2022

Grand Rapids Charter Township

Township Trustee Partial Term Ending 11/20/2024

Vote for not more than 1

DEM Andy Shackelford 3143 Midland Dr SE Grand Rapids MI 49506 ashackelford@gmail.com Fee 4/19/2022

REP Meghan Mott 1874 Leffingwell Ave NE Grand Rapids MI 49525 meghanmott7@gmail.com Petitions 2/25/2022

August 2, 2022 Primary Election Page 5 of 9

Updated 5/31/2022 11:50 AM Kent County

Unofficial Candidate List

August 2, 2022 Primary Election

Tyrone Township

Township Supervisor Partial Term Ending 11/20/2024

Vote for not more than 1

REP Dave Ignasiak 17595 Callem Ave. Kent City MI 49330 dave@orchardhillmechanical.com Petitions 3/31/2022

REP Dennis Kaminski 2333 19 Mile Rd Kent City MI 49330 dkamhasker@gmail.com Petitions 4/19/2022

Township Trustee Partial Term Ending 11/20/2024

Vote for not more than 1

REP David Loew 15065 Tyrone Ave Kent City MI 49330 dloew@ymail.com Petitions 4/12/2022

REP Douglas R. Tawney 62 E. Division St Casnovia MI 49318 douglas.r.tawney@gmail.com Petitions 4/19/2022

NONPARTISAN SECTION

City of Wyoming

Mayor 4 Year Term

Vote for not more than 1

Sam Bolt 2629 Meyer Ave. SW Wyoming MI 49519 marvin_bolt@yahoo.com Petitions 4/13/2022

Cliff Tompkins PO Box 9222 Wyoming MI 49509 tompkinscliff@yahoo.com Petitions 11/8/2021

Kent Vanderwood 5183 Olsen Springs Ct SW Wyoming MI 49509 kentvanderwood@att.net Petitions 3/14/2022

PROPOSAL SECTION

City/Township Proposals

Kent County Millage For Senior Citizen Services

SHALL KENT COUNTY LEVY .50 OF ONE MILL WHICH EQUALS 50 CENTS PER $1,000 OF THE TAXABLE VALUE ON ALL REAL AND PERSONAL PROPERTY SUBJECT TO TAXATION FOR THE PERIOD 2022 THROUGH 2029, INCLUSIVE, FOR THE PURPOSE

OF PLANNING, EVALUATING, AND PROVIDING SERVICES TO PERSONS AGE 60 YEARS OR OLDER? MILLAGE FOR THIS PURPOSE WAS APPROVED IN 1998, 2006 AND 2014. IT IS THE SAME AS THE .50 OF ONE MILL LEVY FOR THE ABOVE LISTED

SERVICES APPROVED BY VOTERS THAT EXPIRED IN 2021. THE AMOUNT RAISED BY THE LEVY IN THE FIRST CALENDAR YEAR IS ESTIMATED AT $13,800,000.

In Kent County there are 31 local authorities that capture and use, for authorized purposes, tax increment revenues from property taxes levied by the County. Such capture could include a portion of this millage levy. The 24 tax

increment authorities in Kent County, capturing a portion of this tax levy, include the following:

Ada Township – Brownfield Redevelopment Authority

Bowne Township – Downtown Development Authority

Byron Township – Brownfield Redevelopment Authority

Cascade Charter Township – Downtown Development Authority

Cedar Springs, City of – Downtown Development Authority, Brownfield Redevelopment Authority

Grand Rapids, City of – Downtown Development Authority, Monroe North-Tax

Increment Finance Authority, Smart Zone Local Development Finance

Authority, Corridor Improvement Finance Authority, Brownfield Redevelopment Authority

Grand Rapids Township – Brownfield Redevelopment Authority

Grandville, City of – Downtown Development Authority, Brownfield Redevelopment Authority

Kent City, Village of – Downtown Development Authority

Kentwood, City of – Brownfield Redevelopment Authority

Lowell, City of - Downtown Development Authority

Rockford, City of – Downtown Development Authority, Brownfield Redevelopment

Authority

Sparta, Village of – Downtown Development Authority, Brownfield Redevelopment Authority

Walker, City of – Downtown Development Authority, Brownfield Redevelopment

Authority

Wyoming, City of – Brownfield Redevelopment Authority

August 2, 2022 Primary Election Page 6 of 9

Updated 5/31/2022 11:50 AM Kent County

Unofficial Candidate List

August 2, 2022 Primary Election

Kent County Millage For Veterans Services

SHALL KENT COUNTY LEVY .050 MILL WHICH IS EQUAL TO FIVE CENTS PER $1,000 OF THE TAXABLE VALUE ON ALL REAL AND PERSONAL PROPERTY SUBJECT TO TAXATION FOR THE PERIOD 2022 THROUGH 2029, INCLUSIVE, FOR THE PURPOSE

OF PROVIDING SERVICES IN KENT COUNTY, INCLUDING COSTS TO ADMININSTER OR PROVIDE SUCH SERVICES, TO HONORABLY DISCHARGED VETERANS OF UNITED STATES MILITARY SERVICE, NATIONAL GUARD, AND RESERVES, AND THEIR

DEPENDANTS? THIS CONTINUES THE .050 MILL FOR VETERANS SERVICES ORIGINALLY APPROVED BY VOTERS IN 2014. THE AMOUNT RAISED BY THE LEVY IN THE FIRST CALENDAR YEAR IS ESTMIATED AT $1,327,856.

In Kent County there are 31 local authorities that capture and use, for authorized purposes, tax increment revenues from property taxes levied by the County. Such capture could include a portion of this millage levy. The 31 tax

increment authorities in Kent County, capturing a portion of this tax levy, include but are not limited to the following:

Ada Township – Brownfield Redevelopment Authority

Bowne Township – Downtown Development Authority

Byron Township – Brownfield Redevelopment Authority

Cascade Charter Township – Downtown Development Authority

Cedar Springs, City of – Downtown Development Authority, Brownfield Redevelopment Authority

Grand Rapids, City of – Downtown Development Authority, Monroe North-Tax

Increment Finance Authority, Smart Zone Local Development Finance

Authority, Corridor Improvement Finance Authority, Brownfield Redevelopment Authority

Grand Rapids Township – Brownfield Redevelopment Authority

Grandville, City of – Downtown Development Authority, Brownfield Redevelopment Authority

Kent City, Village of – Downtown Development Authority

Kentwood, City of – Brownfield Redevelopment Authority

Lowell, City of - Downtown Development Authority

Rockford, City of – Downtown Development Authority, Brownfield Redevelopment

Authority

Sparta, Village of – Downtown Development Authority, Brownfield Redevelopment

Authority

Walker, City of – Downtown Development Authority, Brownfield Redevelopment

Authority

Wyoming, City of – Brownfield Redevelopment Authority

City of Kentwood

Charter Amendment Proposal To Authorize a New Additional Millage For Parks, Trails, and Recreation of 1.0 Mill

Shall Section 8.1, Chapter VIII, of the City of Kentwood Charter be amended to authorize a permanent additional millage of 1.0 mill ($1.00 per $1,000.00 of taxable value) to be levied solely for parks, trails and recreational improvements and

activities? (If levied, the additional 1.0 mill is estimated to raise $2,345,537 in the first calendar year of the levy. To the extent required by law, a portion of the revenues from this millage will be captured and disbursed to the City's Brownfield

Redevelopment Fund.)

Ada Township Police and Fire Protection

Millage Proposal - Renewal and Increase

For a Total of 1.4 Mills

Shall the expired previously voted increase in the tax rate limitation imposed under Article IX, Sec. 6 of the Michigan Constitution on general ad valorem taxes within Ada Township of 0.95 mills ($0.95 per $1,000 of taxable value), as reduced to

0.9322 mills ($0.9322 per $1,000 of taxable value) by the required rollbacks, be renewed and increased by 0.4678 mills ($0.4678 per $1,000 of taxable value) for a total of 1.4 mills ($1.40 per $1,000 of taxable value) annually for five (5) years,

2022 through 2026, inclusive, to provide funds for police protection within the Township and for maintenance, equipment, and operation of the Township's Fire Department?

If approved and levied, this millage would raise an estimated $1,631,290 in the first year of levy. All or a portion of the revenues from this millage will be disbursed to the Kent County Sheriff’s Department for police services within Ada

Township. To the extent required by law, a portion of the revenues from this millage will be captured within the district of and disbursed to the Ada Township Downtown Development Authority and the Ada Township Brownfield

Redevelopment Authority.

Cannon Township

Resolution to Approve Ballot Proposal For Fire Fighter Wages, and to Provide 24-Hour Staffing at the Fire Stations

Shall Cannon Township increase by .5 mills ($0.50 per $1,000 of taxable value) the tax rate limitation imposed under Article IX, Sec. 6 of the Michigan Constitution and levy it for 10 years, 2022 through 2031 inclusive, for firefighter wages and

benefits, and to provide continuous 24- hour staffing at the Township fire stations? This is a new additional millage which will be disbursed to Cannon Township and will raise an estimated $400,000 in the first year the millage is levied.

August 2, 2022 Primary Election Page 7 of 9

Updated 5/31/2022 11:50 AM Kent County

Unofficial Candidate List

August 2, 2022 Primary Election

Grand Rapids Charter Township

Renewal of Previously-Approved Millage 0.9179 Mill for Public Safety Purposes

Shall the previously-approved increase in the Charter Township of Grand Rapids tax rate limitation, last levied in the amount of 0.9179 mill ($0.9179 per $1,000 of taxable value), be renewed and levied in the years 2024-2033, both inclusive,

subject to reduction as provided by law, to continue to provide funds for public safety purposes within the Township?

It is estimated that a levy of 0.9179 mill would provide revenue of $1,133,844 in the first calendar year. The revenue from this renewed millage levy will be disbursed to the Charter Township of Grand Rapids.

Lowell Charter Township

Fire Protection and Emergency Services Millage Proposal

For the purpose of providing funds for fire protection and emergency services within Lowell Charter Township, shall the authorized charter millage for Lowell Charter Township established at 1.1 mills ($1.10 per $1,000 of taxable value) and

reduced to 0.7360 mills ($0.7360 per $1,000 of taxable value) by the required millage rollbacks, be increased by 1.0 mill ($1.00 per $1,000 of taxable value) annually for eight (8) years, 2022 through 2029, inclusive, and levied for the

aforementioned purpose?

The following is for informational purposes:

If approved and levied, this millage would raise an estimated $282,290 in the first year of the levy.

Tyrone Township Proposal

*Millage Renewal 1 Mill for 4 Years for Fire Operations

“Shall the previous voted increase in the tax limitations imposed under Article IX Sec.6 of the Michigan Constitution in Tyrone Township, of 1 mill($1 per $1,000 of taxable value), reduced to .9526mills($.9526 per $1,000 of taxable value) by the

required millage rollbacks, be renewed at up to .9526 mills(($.9526 per $1,000 of taxable value) and levied for 4 years, 2023-2026 inclusive, for fire department operations; raising an estimated $158,320.00 in the first year the millage is

levied”?

Tyrone Township Proposal

*Millage Ballot Question, 1 Mill for Fire Dept. Maintaining Operations

“Shall Tyrone Township impose an increase of up to 1 mill ($1 per $1,000 of taxable value) in the tax limitation imposed under Article IX, Sec. 6 of the Michigan Constitution and levy it for 4 years, 2023-2026 inclusive for maintaining fire

department operations; which 1 mill increase will raise an estimated $166,198.00 in the first year the millage is levied”?

Local School District

Grant Public Schools

Operating Millage Proposal

This proposal will allow the school district to continue to levy the statutory rate of not to exceed 18 mills on all property, except principal residence and other property exempted by law, required for the school district to receive its full revenue

per pupil foundation allowance and restores millage lost as a result of the reduction required by the "Headlee" amendment to the Michigan Constitution of 1963.

Shall the currently authorized millage rate limitation on the amount of taxes which may be assessed against all property, except principal residence and other property exempted by law, in Grant Public Schools, Newaygo, Kent and Muskegon

Counties, Michigan, be renewed by 18.118 mills ($18.118 on each $1,000 of taxable valuation) for a period of 4 years, 2023 to 2026, inclusive, and also be increased by .5 mill ($0.50 on each $1,000 of taxable valuation) for a period of 4 years,

2023 to 2026, inclusive, to provide funds for operating purposes; the estimate of the revenue the school district will collect if the millage is approved and 18 mills are levied in 2023 is approximately $1,110,335 (this millage is to renew millage

that will expire with the 2022 levy and to restore millage lost as a result of the reduction required by the "Headlee" amendment to the Michigan Constitution of 1963 and will be levied only to the extent necessary to restore that reduction)?

Tri County Area Schools

Operating Millage Renewal Proposal

This proposal will allow the school district to continue to levy the statutory rate of not to exceed 18 mills on all property, except principal residence and other property exempted by law, required for the school district to receive its revenue per

pupil foundation allowance and renews millage that will expire with the 2022 tax levy.

Shall the currently authorized millage rate limitation of 18 mills ($18.00 on each $1,000 of taxable valuation) on the amount of taxes which may be assessed against all property, except principal residence and other property exempted by law,

in Tri County Area Schools, Montcalm, Kent and Newaygo Counties, Michigan, be renewed for a period of 2 years, 2023 and 2024, to provide funds for operating purposes; the estimate of the revenue the school district will collect if the millage

is approved and levied in 2023 is approximately $2,424,637 (this is a renewal of millage that will expire with the 2022 tax levy)?

August 2, 2022 Primary Election Page 8 of 9

Updated 5/31/2022 11:50 AM Kent County

Unofficial Candidate List

August 2, 2022 Primary Election

Wayland Union School District

Bonding Proposal

Shall Wayland Union School District, Allegan, Barry and Kent Counties, Michigan, borrow the sum of not to exceed Forty-Eight Million Five Hundred Thousand Dollars ($48,500,000) and issue its general obligation unlimited tax bonds therefor,

in one or more series, for the purpose of:

erecting, furnishing and equipping a new pool addition to the high school; remodeling, furnishing and refurnishing and equipping and re-equipping school buildings; acquiring and installing instructional technology and instructional technology

equipment for school buildings; and developing, equipping and improving athletic fields and facilities, parking areas and sites?

The following is for informational purposes only:

The estimated millage that will be levied for the proposed bonds in 2022, under current law, is 0.0 mill ($0.00 on each $1,000 of taxable valuation) for a 0.0 mill net increase over the prior year’s levy. The maximum number of years the bonds

of any series may be outstanding, exclusive of any refunding, is twenty-five (25) years. The estimated simple average annual millage anticipated to be required to retire this bond debt is 2.01 mills ($2.01 on each $1,000 of taxable valuation).

The school district expects to borrow from the State School Bond Qualification and Loan Program to pay debt service on these bonds. The estimated total principal amount of that borrowing is $1,952,296 and the estimated total interest to be

paid thereon is $1,261,756. The estimated duration of the millage levy associated with that borrowing is 8 years and the estimated computed millage rate for such levy is 8.40 mills. The estimated computed millage rate may change based on

changes in certain circumstances.

The total amount of qualified bonds currently outstanding is $47,435,000. The total amount of qualified loans currently outstanding is $3,512.

(Pursuant to State law, expenditure of bond proceeds must be audited and the proceeds cannot be used for repair or maintenance costs, teacher, administrator or employee salaries, or other operating expenses.)

August 2, 2022 Primary Election Page 9 of 9

You might also like

- ECF 1 - ComplaintDocument35 pagesECF 1 - ComplaintWXMI88% (8)

- May 14 Probate Court HearingDocument22 pagesMay 14 Probate Court HearingWXMINo ratings yet

- MSP Investigation Into Shooting Death of 5-Year-OldDocument49 pagesMSP Investigation Into Shooting Death of 5-Year-OldWXMINo ratings yet

- MSP Investigation Into Shooting Death of 5-Year-OldDocument49 pagesMSP Investigation Into Shooting Death of 5-Year-OldWXMINo ratings yet

- Boer Statement 4.17.24Document2 pagesBoer Statement 4.17.24WXMI100% (1)

- W2 & Earnings: Vanessa Sapien GonzalezDocument4 pagesW2 & Earnings: Vanessa Sapien GonzalezVANESSA SAPIEN GONZALEZNo ratings yet

- 2020 - PmaDocument2 pages2020 - Pmalaniya rossNo ratings yet

- Early Evidence On The Use of Foreign Cash Following The Tax Cuts and Jobs Act of 2017Document53 pagesEarly Evidence On The Use of Foreign Cash Following The Tax Cuts and Jobs Act of 2017GlennKesslerWPNo ratings yet

- Application For Texas Driver License or Identification Card: For Department Use OnlyDocument2 pagesApplication For Texas Driver License or Identification Card: For Department Use OnlyShnen SarmientoNo ratings yet

- 900 - A Patriot Library For You - . .Document1 page900 - A Patriot Library For You - . .David E Robinson0% (1)

- Sales Finance Loan Application Form: SalariedDocument6 pagesSales Finance Loan Application Form: SalariedKrishna KumarNo ratings yet

- Form 1099GDocument2 pagesForm 1099GMarcus KreseNo ratings yet

- Statements 5957Document4 pagesStatements 5957spark johnsonNo ratings yet

- GloriaDocument2 pagesGloriaGloria DiazNo ratings yet

- Claimant Information - All Fields Are Required Unless IndicatedDocument7 pagesClaimant Information - All Fields Are Required Unless IndicatedIllest Alive206No ratings yet

- Corick Woods Paystub Feb 26 2024Document1 pageCorick Woods Paystub Feb 26 2024Fake Documents of Simply Jodan's LLCNo ratings yet

- FloridaDocument1 pageFloridaSue StevenNo ratings yet

- Application 18802654 20191029044618 PDFDocument10 pagesApplication 18802654 20191029044618 PDFAnna GassettNo ratings yet

- ListDocument2 pagesListRoland FurugutaNo ratings yet

- Return of Organization Exempt From Income Tax: WWW - Irs.gov/form990Document37 pagesReturn of Organization Exempt From Income Tax: WWW - Irs.gov/form990the kingfishNo ratings yet

- Changed Circumstance Detail Form: Melissa Marie JonesDocument11 pagesChanged Circumstance Detail Form: Melissa Marie JonesMelissa JonesNo ratings yet

- Repayment Application DocumentDocument10 pagesRepayment Application DocumentPratham TiwariNo ratings yet

- Copy B For Student 1098-T: Tuition StatementDocument1 pageCopy B For Student 1098-T: Tuition Statementqqvhc2x2prNo ratings yet

- Business Loan Application PacketDocument9 pagesBusiness Loan Application PacketSupreet Kaur100% (1)

- KatzDocument28 pagesKatzRendy MomoNo ratings yet

- 2019 Joint PersonalDocument36 pages2019 Joint Personalapi-167637329No ratings yet

- Direct DepositDocument1 pageDirect DepositMike BelmoreNo ratings yet

- Business Account Services ApplicationDocument9 pagesBusiness Account Services ApplicationZaccheus JulesNo ratings yet

- 0LH47 0LH47 0429 20180101 1095report 001Document1 page0LH47 0LH47 0429 20180101 1095report 001charly4877No ratings yet

- 1.0 David and Lynette Landry 2021 1040 - Draft PDFDocument33 pages1.0 David and Lynette Landry 2021 1040 - Draft PDFDavid LandryNo ratings yet

- P010 636211442428322820 T14385011dupD1 PDFDocument1 pageP010 636211442428322820 T14385011dupD1 PDFAnonymous pY5EUXUpaNo ratings yet

- Enterprise PA AgreementDocument4 pagesEnterprise PA AgreementMadelyn VasquezNo ratings yet

- Access Florida Application Details 810968014Document11 pagesAccess Florida Application Details 810968014Samantha DuffNo ratings yet

- Wage and Tax StatementDocument4 pagesWage and Tax StatementMark OasayNo ratings yet

- Greenleaf RhodeIslandDOCSDocument95 pagesGreenleaf RhodeIslandDOCSTimothy TuckNo ratings yet

- FTF 2023-02-04 1675540608948Document4 pagesFTF 2023-02-04 1675540608948kelsey abrahamNo ratings yet

- Information SheetDocument3 pagesInformation SheetTen Jean HNo ratings yet

- 2013 AgriSafe 990Document28 pages2013 AgriSafe 990AgriSafeNo ratings yet

- 05a6eb82-1bcd-4d3d-a087-8c5a61bf3a7fDocument3 pages05a6eb82-1bcd-4d3d-a087-8c5a61bf3a7fDonna WoodallNo ratings yet

- Federal Direct Stafford/Ford Loan Federal Direct Unsubsidized Stafford/Ford Loan Master Promissory Note William D. Ford Federal Direct Loan ProgramDocument10 pagesFederal Direct Stafford/Ford Loan Federal Direct Unsubsidized Stafford/Ford Loan Master Promissory Note William D. Ford Federal Direct Loan ProgramPratham TiwariNo ratings yet

- Governor Brian P. Kemp Commissioner Spencer R. MooreDocument1 pageGovernor Brian P. Kemp Commissioner Spencer R. MoorePanda HelpNo ratings yet

- Closing Disclosure: Loan TermsDocument3 pagesClosing Disclosure: Loan TermsSupreet KaurNo ratings yet

- DNSP 0000003971Document2 pagesDNSP 0000003971negrapujolsNo ratings yet

- Matthew Wozniak W2 2021 W2 202233131923Document3 pagesMatthew Wozniak W2 2021 W2 202233131923MwNo ratings yet

- DeniedQuitSep Quit Personal TerraMyers20170316Document3 pagesDeniedQuitSep Quit Personal TerraMyers20170316TERRA MYERSNo ratings yet

- Reliance Two Wheeler Package Policy - Schedule: Policy Number: 920222223121261091 Proposal/Covernote No: R01052205931Document6 pagesReliance Two Wheeler Package Policy - Schedule: Policy Number: 920222223121261091 Proposal/Covernote No: R01052205931MuraliMohanNo ratings yet

- 2014 GUTHRIE SHEET METAL, INC Form 1120 Corporations Tax Return - RecordsDocument42 pages2014 GUTHRIE SHEET METAL, INC Form 1120 Corporations Tax Return - Recordsellen guthrie100% (1)

- Spending Account StatementDocument2 pagesSpending Account Statementdaniel floydNo ratings yet

- Imigracion 2Document15 pagesImigracion 2erickNo ratings yet

- Timothy W Janssen 4812 LITTLE Fox Court Imperial MO 63052Document2 pagesTimothy W Janssen 4812 LITTLE Fox Court Imperial MO 63052TJ JanssenNo ratings yet

- Devolucion TabletDocument1 pageDevolucion TabletBLAS DOLORES JAVIER ALDHAIRNo ratings yet

- Yob 1945Document153 pagesYob 1945luis enrique0% (1)

- 2022TaxReturn StarnesDocument17 pages2022TaxReturn StarnesjpneebNo ratings yet

- 10000017582Document2,275 pages10000017582Chapter 11 DocketsNo ratings yet

- MyComputerCareercom at Raleigh LLC-Aretha J BosireDocument1 pageMyComputerCareercom at Raleigh LLC-Aretha J BosireAretha JBNo ratings yet

- 16 540-SignedDocument5 pages16 540-Signedapi-352277890No ratings yet

- PANV9752698 Proof of InsuranceDocument1 pagePANV9752698 Proof of InsuranceUdappa MikelsomNo ratings yet

- L. Schneider Transunion Credit ReportDocument1 pageL. Schneider Transunion Credit Reportlarry-612445No ratings yet

- Home Loan Complete ProcessDocument3 pagesHome Loan Complete ProcessMkb Prasanna Kumar100% (1)

- NJ Ifta Quarterly Tax ReturnDocument5 pagesNJ Ifta Quarterly Tax ReturnSandro osorioNo ratings yet

- Advia Credit Union 2Document1 pageAdvia Credit Union 2kathyNo ratings yet

- Img 0173 1Document1 pageImg 0173 1Samantha DuffNo ratings yet

- Household Statement W - Summary For December 2023Document12 pagesHousehold Statement W - Summary For December 2023Randy WrightNo ratings yet

- 1013 ALC Quotation ALCSN201029001 20201111080153Document2 pages1013 ALC Quotation ALCSN201029001 20201111080153TRABAJANDIÑO PEREZNo ratings yet

- Berrien County, Michigan August 2, 2022 - UNOFFICIAL Candidate ListDocument6 pagesBerrien County, Michigan August 2, 2022 - UNOFFICIAL Candidate ListWXMINo ratings yet

- St. Joseph County August CandidatesDocument14 pagesSt. Joseph County August CandidatesWXMINo ratings yet

- Diocese of Kalamazoo Report May 20 2024Document144 pagesDiocese of Kalamazoo Report May 20 2024WXMINo ratings yet

- We Are Greenville - Black Field ProposalDocument3 pagesWe Are Greenville - Black Field ProposalWXMINo ratings yet

- 2019 Pedestrians Traffic Safety Fact Sheet - NHTSADocument14 pages2019 Pedestrians Traffic Safety Fact Sheet - NHTSAWXMINo ratings yet

- Robart Arraignment TranscriptsDocument24 pagesRobart Arraignment TranscriptsWXMINo ratings yet

- Hastings Schools Investigation Into SixberryDocument1 pageHastings Schools Investigation Into SixberryWXMINo ratings yet

- Fact Sheet On Airline Consumer Protection RulesDocument4 pagesFact Sheet On Airline Consumer Protection RulesWXMINo ratings yet

- Schurr Appeal To MI Supreme CourtDocument63 pagesSchurr Appeal To MI Supreme CourtWXMINo ratings yet

- Officer Compensation Resolution 2526Document2 pagesOfficer Compensation Resolution 2526WXMINo ratings yet

- Ada History Info - Ada HotelDocument2 pagesAda History Info - Ada HotelWXMINo ratings yet

- Clarification and Resolution of Discrepancy in Cares Act ApplicationDocument1 pageClarification and Resolution of Discrepancy in Cares Act ApplicationWXMI100% (1)

- Boil Water Advisory Muskegon Heights RevisedDocument1 pageBoil Water Advisory Muskegon Heights RevisedWXMINo ratings yet

- North Kent Co PFAS Exposure Assessment Second ReportDocument61 pagesNorth Kent Co PFAS Exposure Assessment Second ReportWXMINo ratings yet

- FHPS Letter Regarding School Employee March 25-2024Document1 pageFHPS Letter Regarding School Employee March 25-2024WXMINo ratings yet

- Scott Simmons Victim Statement ReleaseDocument1 pageScott Simmons Victim Statement ReleaseWXMINo ratings yet

- I 196 BL Holland FlyerDocument1 pageI 196 BL Holland FlyerWXMINo ratings yet

- Gibbs VerBeek CorrespondenceDocument3 pagesGibbs VerBeek CorrespondenceWXMINo ratings yet

- John Gibbs V Ottawa Co ComplaintDocument41 pagesJohn Gibbs V Ottawa Co ComplaintWXMINo ratings yet

- FAQs Regarding EmployeeDocument2 pagesFAQs Regarding EmployeeWXMINo ratings yet

- FHPS Letter To Families 3.21.24Document1 pageFHPS Letter To Families 3.21.24WXMINo ratings yet

- Letter From Legal CounselDocument7 pagesLetter From Legal CounselWZZM News100% (1)

- Karamo Appeal ResponseDocument7 pagesKaramo Appeal ResponseWXMINo ratings yet

- Letter Regarding Employee Placed On LeaveDocument1 pageLetter Regarding Employee Placed On LeaveWXMINo ratings yet

- Karamo AppealDocument20 pagesKaramo AppealWXMINo ratings yet

- Hambley Stipulation and Order To DismissDocument5 pagesHambley Stipulation and Order To DismissWXMINo ratings yet

- Karamo Appeal Motion For StayDocument6 pagesKaramo Appeal Motion For StayWXMINo ratings yet

- Summary Ch.9 MankiwDocument3 pagesSummary Ch.9 MankiwExza XNo ratings yet

- FAIZDocument83 pagesFAIZMohammad RizwanNo ratings yet

- 05 Task Performance 1 THAKURDocument1 page05 Task Performance 1 THAKURArianne Najah ThakurNo ratings yet

- Lecture: Public Finance: Finance-Art and Science of Managing Financial ResourcesDocument5 pagesLecture: Public Finance: Finance-Art and Science of Managing Financial ResourcesEfren ChanNo ratings yet

- International Economics, 7e (Husted/Melvin) Chapter 19 Alternative International Monetary StandardsDocument15 pagesInternational Economics, 7e (Husted/Melvin) Chapter 19 Alternative International Monetary Standardsjermaine brownNo ratings yet

- Three Gap Model - Presentation - 01-1Document13 pagesThree Gap Model - Presentation - 01-1SANA ZAMANNo ratings yet

- The French Revolution As A Bourgeois Revolution: A Critique of The RevisionistsDocument35 pagesThe French Revolution As A Bourgeois Revolution: A Critique of The RevisionistsAdrian HernandezNo ratings yet

- Parmar SSCDocument14 pagesParmar SSC19EBKEC005BHUPESH KULHARINo ratings yet

- Customer Statement of Acct Promasidor f12Document59 pagesCustomer Statement of Acct Promasidor f12adiriobinna1532No ratings yet

- Economic Analysis: Ashok Kumar RawaniDocument14 pagesEconomic Analysis: Ashok Kumar RawaniAman RajNo ratings yet

- Chapter 7 Equilibrium Input and OutputDocument40 pagesChapter 7 Equilibrium Input and OutputhakkudadaNo ratings yet

- Profit, Loss, and Perfect Competition: Compiler: Dr. Precila R. BautistaDocument12 pagesProfit, Loss, and Perfect Competition: Compiler: Dr. Precila R. BautistaJANNA CAFENo ratings yet

- Basic Economic Problems and The Economic SystemDocument5 pagesBasic Economic Problems and The Economic System8H13Ida Ayu Kade Cika PrameswariNo ratings yet

- Factor Affecting Exchange RateDocument5 pagesFactor Affecting Exchange Ratedangthaibinh0312No ratings yet

- 1 (I) Explain The Main Types of Banking InnovationsDocument4 pages1 (I) Explain The Main Types of Banking InnovationsJackson KasakuNo ratings yet

- Marxist Criminology: Submitted By: Pranav Prakash REG NO: 20204012527118Document11 pagesMarxist Criminology: Submitted By: Pranav Prakash REG NO: 20204012527118pranav prakashNo ratings yet

- The Keynesian Model: The Multiplier, The Paradox of Thrift, Savings and Investment, Fiscal Policy, and The Tax MultiplierDocument40 pagesThe Keynesian Model: The Multiplier, The Paradox of Thrift, Savings and Investment, Fiscal Policy, and The Tax Multiplierpooja kharatmolNo ratings yet

- Simple and Compound Interests Module in General Mathematics 2nd QuarterDocument58 pagesSimple and Compound Interests Module in General Mathematics 2nd QuarterBetchemar B. GonzalesNo ratings yet

- Math of Invest Business Math Review Formula PDFDocument59 pagesMath of Invest Business Math Review Formula PDFDarwin MacaraegNo ratings yet

- Fiscal, Monetary & Supply Side Policies (4.3, 4.4 & 4.5 in Syllabus)Document17 pagesFiscal, Monetary & Supply Side Policies (4.3, 4.4 & 4.5 in Syllabus)Bianca WoanyahNo ratings yet

- Monetary Policy - Managerial EconomicsDocument2 pagesMonetary Policy - Managerial EconomicsPrincess Ela Mae CatibogNo ratings yet

- Important Questions For CBSE Class 12 Macro Economics Chapter 5Document8 pagesImportant Questions For CBSE Class 12 Macro Economics Chapter 5Ayush JainNo ratings yet

- June 2020 QP - Paper 2 Edexcel (A) Economics As-LevelDocument32 pagesJune 2020 QP - Paper 2 Edexcel (A) Economics As-LevelSailesh GoenkkaNo ratings yet

- Class Monopoly Rent and The Contemporary Neoliberal CityDocument12 pagesClass Monopoly Rent and The Contemporary Neoliberal CityLuisNo ratings yet

- Tut 7Document2 pagesTut 7ksfksfdsfNo ratings yet

- David RicardoDocument2 pagesDavid RicardoJennie Rose UmipigNo ratings yet

- Aida 13 January Economic Translation 1Document2 pagesAida 13 January Economic Translation 1Ahmet AsgerovNo ratings yet

- Money Banking and Financial Markets 3rd Edition Cecchetti Test BankDocument25 pagesMoney Banking and Financial Markets 3rd Edition Cecchetti Test BankRhondaJonesfxgokNo ratings yet

- S11. Exercise - DiscussionDocument3 pagesS11. Exercise - DiscussionAzka AliNo ratings yet