Professional Documents

Culture Documents

IRS Demand Letter - 14 July 2022

IRS Demand Letter - 14 July 2022

Uploaded by

KPLC 7 NewsCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

IRS Demand Letter - 14 July 2022

IRS Demand Letter - 14 July 2022

Uploaded by

KPLC 7 NewsCopyright:

Available Formats

Department of the Treasury

~ ·

Internal Revenue Service

Small Business / Self-Employed Division

IRS 4021-AAMBASSADOR CAFFERY, STE 172

LAFAYETTE, LA 70503-5281

f/wv) J:e It' v L/Li-f ~ -I y -JD{;)~

--rna,/e_d ~ -t -AoM

Date:

06/06/2022

Person to contact:

BEAUREGARD PARISH SCHOOL 8D Name:

PO BOX 938 Employee I

DERIDDER, LA 70634 Telephone:

Taxpayer ID number: (last 4 digits)

You still owe the federal tax listed below, plus applicable penalty and interest as provided by law, computed to

1Odays from the date of this letter.

You can pay in person or by mail. Please make your check or money order payable to "United States

Treasury". Write your social security number or employer identification number on your payment. To pay by

mail, send your payment to the address at the top left hand corner of this letter. If you've recently paid this tax,

cannot pay it, or t,ave questions about your account, please call me at the telephone number above.

The unpaid amount from prior notices shown on the following page(s) may include tax, applicable penalties,

and interest you still owe us. It also includes any credits and payments we received since we sent our last

notice to you.

Interest charges

We are required by law to charge interest when you do not pay your liability on time. Generally, we calculate

interest from the due date of you return (regardless of extensions) until you pay the amount you owe in full,

including accrued interest and any applicable penalty charges. Interest on some applicable penalties accrues

from the date we notify you of the applicable penalty until it is paid in full. Interest on other applicable penalties,

such as failure to file a tax return, starts from the due date or extended due date of the return. Interest rates

are variable and may change quarterly. (Internal Revenue Code Section 6601)

Page 1 Letter 728 (Rev. 1-2017)

Catalog Number: 107388

Date of this letter: 06/06/2022

Taxpayer Identification Number:

Failure-to-pay penalty

When you pay your taxes after the due date, we charge a penalty of 0.5% (reduced to 0.25% on installment

agreements) of the unpaid amount due per month, up to 25% of the amount due. Beginning 10 days after we

issue a Notice of Intent to Levy, the penalty increases to 1.0% for each month the amount remains unpaid. We

count part of a month as a full month. (Internal Revenue Code Section 6651)

If you have questions about your account or would like a further detailed explanation of the applicable penalty

and interest charges, you can call me at the telephone number on the first page of this letter.

Thank you for your cooperation.

Sincerely,

Additional

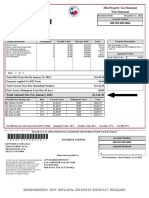

Fonn Tax Unpaid amount

applicable

Additional

Amount you owe

number period from prior notices interest

penalty

CIVPEN 12/31/2017 $292,654.41 $0.00 $9,270.00 $301,924.41

1

CIVPEN 12/31/2018 $663,580.96 $0.00 $16,266.83 $679,847.79

941 06/30/2021 , -$46,386.02 $0.00 $265.07 $46,651.09

941 09/30/2021 ~$15,289.59 I . $0.00 $0.00 $15,289.59

,,.,

Total: $1,043,712.88

Page2 Letter 728 (Rev. 1-2017)

Catalog Number: 10738B

You might also like

- Report Into Allegations of Misconduct by Some Members of Beauregard Electric Cooperative's Board of Directors.Document21 pagesReport Into Allegations of Misconduct by Some Members of Beauregard Electric Cooperative's Board of Directors.KPLC 7 News100% (1)

- Lottery Prize Claim FormDocument2 pagesLottery Prize Claim FormMaria100% (1)

- Boston Tea PartyDocument6 pagesBoston Tea Partyyasser AnwarNo ratings yet

- Info Sys Salary SlipDocument2 pagesInfo Sys Salary SlipGurpreetS Myvisa100% (1)

- USXXE2220181025: Page 1 of 3Document37 pagesUSXXE2220181025: Page 1 of 3JOHNNo ratings yet

- Loan Approval LetterDocument7 pagesLoan Approval LetterShawn DawsonNo ratings yet

- Calcasieu Sheriff Response To Ray Lawrence Wrongful Death LawsuitDocument7 pagesCalcasieu Sheriff Response To Ray Lawrence Wrongful Death LawsuitKPLC 7 NewsNo ratings yet

- Bank of America.: Payment NotificationDocument2 pagesBank of America.: Payment NotificationSimon Ineneji0% (3)

- RefundDocument2 pagesRefundJess AcostaNo ratings yet

- Sample Marriage Certificate ApplicationDocument3 pagesSample Marriage Certificate ApplicationKristen HammerNo ratings yet

- Compensation LetterDocument2 pagesCompensation LetterJohn SmithNo ratings yet

- Change of Ownership OnlineDocument2 pagesChange of Ownership OnlineFlorin Alexandru StoicaNo ratings yet

- United States V Steven Michael RubinsteinDocument9 pagesUnited States V Steven Michael RubinsteinpunktlichNo ratings yet

- Banking Ombudsman Compaint FormDocument2 pagesBanking Ombudsman Compaint FormNeelakanta KallaNo ratings yet

- Bank Verfication Letter FormatDocument1 pageBank Verfication Letter Formatnetcity143100% (1)

- Tel: +447010995652 Email: From Desk of The Secretary-General World Bank Group, London, United Kingdom Payment Approval From World Bank London United KingdomDocument2 pagesTel: +447010995652 Email: From Desk of The Secretary-General World Bank Group, London, United Kingdom Payment Approval From World Bank London United Kingdomarnav saikiaNo ratings yet

- Proof of Ownership KennethDocument1 pageProof of Ownership KennethRhoda TylerNo ratings yet

- Unclaimed Balances and Dormant Account Directives 2021 - Final-1Document13 pagesUnclaimed Balances and Dormant Account Directives 2021 - Final-1Fuaad DodooNo ratings yet

- IRS Fines Ron Paul's Campaign For LibertyDocument4 pagesIRS Fines Ron Paul's Campaign For Libertytshoes100% (1)

- Payment ApprovalDocument1 pagePayment ApprovalkanthigaduNo ratings yet

- United Nations Organization Irrevocable Payment OrderDocument1 pageUnited Nations Organization Irrevocable Payment OrderYuenNo ratings yet

- EconomicDocument1 pageEconomicZeki ZekijaNo ratings yet

- Financial Intelligence Centre South AfricaDocument1 pageFinancial Intelligence Centre South AfricaShahab UllahNo ratings yet

- RE: TRANSFER OF (US$24,600,000.00) INTO YOUR Nominated Bank AccountDocument2 pagesRE: TRANSFER OF (US$24,600,000.00) INTO YOUR Nominated Bank Accountapi-16593595No ratings yet

- Federal Ministry of FinanceDocument1 pageFederal Ministry of Financebayoesunaryo0% (1)

- The Declaration-Cum-Undertaking Under Sec 10 (5), Chapter III of FEMA, 1999 Is Enclosed As UnderDocument1 pageThe Declaration-Cum-Undertaking Under Sec 10 (5), Chapter III of FEMA, 1999 Is Enclosed As UnderarvinfoNo ratings yet

- Yahoo! MSN NotificationDocument2 pagesYahoo! MSN NotificationTahmidur RahmanNo ratings yet

- Refund Request FormatDocument1 pageRefund Request FormatRam Narasimha100% (1)

- Council Special Agenda 6.28.22. 1Document19 pagesCouncil Special Agenda 6.28.22. 1Live 5 NewsNo ratings yet

- Shell Official Winning NotificationDocument1 pageShell Official Winning NotificationChun Ming LamNo ratings yet

- E.N.F Inc National Headquarters LondonDocument6 pagesE.N.F Inc National Headquarters LondonSonu Kumar100% (2)

- Approval ContractDocument3 pagesApproval Contractosas RichardNo ratings yet

- Yusr Loan For Pensioners Eng PDFDocument10 pagesYusr Loan For Pensioners Eng PDFAbdulkadir Al-OthiamNo ratings yet

- Canada Inheritance and Death TaxDocument6 pagesCanada Inheritance and Death TaxAbo Ahmed TarekNo ratings yet

- SC How To CollectDocument4 pagesSC How To CollectDSG_GANo ratings yet

- Demand LetterDocument3 pagesDemand LetterRose Lustre100% (1)

- Wire Deposit Form PDFDocument1 pageWire Deposit Form PDFphuiyeeNo ratings yet

- Example of ScamDocument5 pagesExample of Scamamira3112No ratings yet

- The Army LawyerDocument80 pagesThe Army LawyerChris Lombardi100% (1)

- AIG World Gold FundDocument8 pagesAIG World Gold FundDrashti Investments100% (1)

- Application For Lottery Prize ClaimDocument3 pagesApplication For Lottery Prize ClaimAMit PrasadNo ratings yet

- Introduction and Brief History of Fund (Read Deligently)Document2 pagesIntroduction and Brief History of Fund (Read Deligently)አረጋዊ ሐይለማርያምNo ratings yet

- US Internal Revenue Service: p4163Document134 pagesUS Internal Revenue Service: p4163IRSNo ratings yet

- Probate Inheritance Tax Form (IHT400 Notes)Document88 pagesProbate Inheritance Tax Form (IHT400 Notes)internichtNo ratings yet

- Account Transcript - NICH - 103569728089Document2 pagesAccount Transcript - NICH - 103569728089Ashley Marie NicholsNo ratings yet

- EI Fund Transfer Intnl TT Form V3.0Document1 pageEI Fund Transfer Intnl TT Form V3.0Tosin SimeonNo ratings yet

- Jpmorgan Chase Bank, N.A. P O Box 182051 Columbus, Oh 43218 - 2051 October 22, 2020 Through October 30, 2020 Account NumberDocument2 pagesJpmorgan Chase Bank, N.A. P O Box 182051 Columbus, Oh 43218 - 2051 October 22, 2020 Through October 30, 2020 Account NumberKrystal MomentNo ratings yet

- Day 3 - BTC Drawbacks and The BTCV Opportunity.Document6 pagesDay 3 - BTC Drawbacks and The BTCV Opportunity.patson sichambaNo ratings yet

- What Is Bitcoin (The Summary) 2Document3 pagesWhat Is Bitcoin (The Summary) 2jackNo ratings yet

- Task 1Document29 pagesTask 1Jitendra JoshiNo ratings yet

- PCH (Policy Change), Effective Date 20221027, Transaction 00270Document14 pagesPCH (Policy Change), Effective Date 20221027, Transaction 00270Pete PoliNo ratings yet

- Using TANF To Finance Out-of-School Time Initiatives: June 2007Document32 pagesUsing TANF To Finance Out-of-School Time Initiatives: June 2007Valerie F. LeonardNo ratings yet

- Retainer Agreement: Info@thinkimmigration - MeDocument7 pagesRetainer Agreement: Info@thinkimmigration - MeSarfaraz Khan100% (1)

- Untitled Document 1Document25 pagesUntitled Document 1gghhjjkk1213No ratings yet

- Wire Request FormDocument3 pagesWire Request Formkhushbu25No ratings yet

- WF Approval LetterDocument6 pagesWF Approval LetterSteve Mun GroupNo ratings yet

- Military Leave Approval LetterDocument2 pagesMilitary Leave Approval LetterMy love of Life100% (1)

- Certificate of Ownership of Funds 21st Sept 2005Document1 pageCertificate of Ownership of Funds 21st Sept 2005api-3728882No ratings yet

- MSC Securty RefundDocument2 pagesMSC Securty Refundgolu100% (1)

- Irrevocable Payment Order Via Atm CardDocument2 pagesIrrevocable Payment Order Via Atm CardNasir Naveed0% (1)

- Bank CreditsDocument11 pagesBank CreditsAlexander DeckerNo ratings yet

- My Online Dating Experience: I Believe in My Success and Yours TooFrom EverandMy Online Dating Experience: I Believe in My Success and Yours TooNo ratings yet

- Methods to Overcome the Financial and Money Transfer Blockade against Palestine and any Country Suffering from Financial BlockadeFrom EverandMethods to Overcome the Financial and Money Transfer Blockade against Palestine and any Country Suffering from Financial BlockadeNo ratings yet

- Public Education & Information Committee July 2024 Program DraftDocument8 pagesPublic Education & Information Committee July 2024 Program DraftKPLC 7 NewsNo ratings yet

- Cameron Sample AVC Ballots For 11-18-23Document4 pagesCameron Sample AVC Ballots For 11-18-23KPLC 7 NewsNo ratings yet

- Cain Ruling - LNGDocument62 pagesCain Ruling - LNGNick PopeNo ratings yet

- DeRidder Third Amended PetitionDocument13 pagesDeRidder Third Amended PetitionKPLC 7 NewsNo ratings yet

- DeRidder Third Amended PetitionDocument13 pagesDeRidder Third Amended PetitionKPLC 7 NewsNo ratings yet

- Lake Charles LC Rebound Covenant.Document3 pagesLake Charles LC Rebound Covenant.KPLC 7 NewsNo ratings yet

- La. Public Service Commission's Data Request For Beauregard ElectricDocument5 pagesLa. Public Service Commission's Data Request For Beauregard ElectricKPLC 7 NewsNo ratings yet

- Mayor Kesia Lemoine LawsuitDocument9 pagesMayor Kesia Lemoine LawsuitKPLC 7 NewsNo ratings yet

- SWLA Delegation Letter Regarding Urgent Need For Adequate Funding For I-10 Bridge Over Calcasieu River.Document2 pagesSWLA Delegation Letter Regarding Urgent Need For Adequate Funding For I-10 Bridge Over Calcasieu River.KPLC 7 NewsNo ratings yet

- Beauregard Sample AVC Ballots For 11-18-23Document6 pagesBeauregard Sample AVC Ballots For 11-18-23KPLC 7 NewsNo ratings yet

- FERC Opinion Regarding Louisiana Public Service Commission v. System Energy ResourcesDocument165 pagesFERC Opinion Regarding Louisiana Public Service Commission v. System Energy ResourcesKPLC 7 NewsNo ratings yet

- Calcasieu Sample AVC Ballots For 11-18-23Document25 pagesCalcasieu Sample AVC Ballots For 11-18-23KPLC 7 NewsNo ratings yet

- 2022 Louisiana House Bill 450Document7 pages2022 Louisiana House Bill 450KPLC 7 NewsNo ratings yet

- Secretary Kalivoda's Letter To The Transportation Committee About Calcasieu River BridgeDocument4 pagesSecretary Kalivoda's Letter To The Transportation Committee About Calcasieu River BridgeKPLC 7 NewsNo ratings yet

- Ray Lawrence Wrongful Death LawsuitDocument5 pagesRay Lawrence Wrongful Death LawsuitKPLC 7 NewsNo ratings yet

- Calcasieu School Board Election Redistricting Plan ADocument1 pageCalcasieu School Board Election Redistricting Plan AKPLC 7 NewsNo ratings yet

- Louisiana DeathsDocument4 pagesLouisiana DeathsKPLC 7 NewsNo ratings yet

- Current Calcasieu Parish School Board Election DistrictsDocument1 pageCurrent Calcasieu Parish School Board Election DistrictsKPLC 7 News0% (1)

- Calcasieu School Board Election Redistricting Plan ADocument1 pageCalcasieu School Board Election Redistricting Plan AKPLC 7 NewsNo ratings yet

- Calcasieu Parish School Board Policy On Bullying.Document7 pagesCalcasieu Parish School Board Policy On Bullying.KPLC 7 NewsNo ratings yet

- Gregory Green Lawsuit Against Westlake ChemicalDocument12 pagesGregory Green Lawsuit Against Westlake ChemicalKPLC 7 NewsNo ratings yet

- 2021 LHSAA Nonselect Football Playoffs - Week 1Document5 pages2021 LHSAA Nonselect Football Playoffs - Week 1KPLC 7 News100% (2)

- Bennie McKenzie Lawsuit Against Westlake Chemical, Cardinal Culinary, Wastewater SpecialtiesDocument9 pagesBennie McKenzie Lawsuit Against Westlake Chemical, Cardinal Culinary, Wastewater SpecialtiesKPLC 7 NewsNo ratings yet

- PAR Const Amendment Nov 13Document14 pagesPAR Const Amendment Nov 13KPLC 7 NewsNo ratings yet

- 2021 LHSAA Select Football Playoffs - Week 1Document4 pages2021 LHSAA Select Football Playoffs - Week 1KPLC 7 NewsNo ratings yet

- Alberta Garnishee Worksheet Per Pay PeriodDocument1 pageAlberta Garnishee Worksheet Per Pay PeriodJason MyerNo ratings yet

- Years Ago at P 500, 000 With FMV at Date of Donation Equal To P 600, 000 But With Unpaid Mortgage of P 50, 000 Assumed by The Donee?Document4 pagesYears Ago at P 500, 000 With FMV at Date of Donation Equal To P 600, 000 But With Unpaid Mortgage of P 50, 000 Assumed by The Donee?Prince PierreNo ratings yet

- Second Statement: The Status of A VAT Registered Person" As A VAT Registered PersonDocument2 pagesSecond Statement: The Status of A VAT Registered Person" As A VAT Registered PersonJen Bernadette CiegoNo ratings yet

- Packages of The Comprehensive Tax Reform Program (CTRP)Document2 pagesPackages of The Comprehensive Tax Reform Program (CTRP)VERA FilesNo ratings yet

- Difference Between OPC and SPDocument2 pagesDifference Between OPC and SPrahulkapur87No ratings yet

- Amc Charges PDFDocument1 pageAmc Charges PDFRiYa ChitkaraNo ratings yet

- Bengal Tiger Line Pte Ltd. Vs DCIT ITAT ChennaiDocument40 pagesBengal Tiger Line Pte Ltd. Vs DCIT ITAT ChennaiArulnidhi Ramanathan SeshanNo ratings yet

- Course Outline Advnced Business TaxationDocument4 pagesCourse Outline Advnced Business TaxationjohnNo ratings yet

- Income Tax Law and Accounts: Ruchi Mehta Assistant Professor Department of Commerce St. Mary's College ThrissurDocument13 pagesIncome Tax Law and Accounts: Ruchi Mehta Assistant Professor Department of Commerce St. Mary's College ThrissurAnju ShajuNo ratings yet

- CIR Vs BOAC-Collector Vs LaraDocument6 pagesCIR Vs BOAC-Collector Vs LaraEmmanuel OrtegaNo ratings yet

- A Mere "Yes" or "No" Answer Without Any Corresponding Explanation or Discussion May Not Be Given Full CreditDocument2 pagesA Mere "Yes" or "No" Answer Without Any Corresponding Explanation or Discussion May Not Be Given Full Crediterica insiongNo ratings yet

- 010 CELAJE Secretary of Finance V LazatinDocument1 page010 CELAJE Secretary of Finance V LazatinJosh CelajeNo ratings yet

- 2021 Renewal of Professional Tax Receipt (PTR) and Filing of Income Tax Return (Itr)Document2 pages2021 Renewal of Professional Tax Receipt (PTR) and Filing of Income Tax Return (Itr)Celmer Charles Q. VillarealNo ratings yet

- Business Taxes in This Exercise Suppose That Your Hamburger BusinessDocument3 pagesBusiness Taxes in This Exercise Suppose That Your Hamburger Businesstrilocksp SinghNo ratings yet

- CIR Vs Manila Mining CorpDocument2 pagesCIR Vs Manila Mining CorpBRYAN JAY NUIQUENo ratings yet

- SSPUSADVDocument1 pageSSPUSADVLuz AmparoNo ratings yet

- 127.CIR Vs PLDTDocument9 pages127.CIR Vs PLDTClyde KitongNo ratings yet

- AnswersDocument3 pagesAnswersBlancaNo ratings yet

- Appointment Letter (Saurav IndiGo)Document2 pagesAppointment Letter (Saurav IndiGo)Saurav PanchalNo ratings yet

- Taxation 1 Case Analysis No. 1Document2 pagesTaxation 1 Case Analysis No. 1regine rose bantilanNo ratings yet

- Foreign Trade Policy: - Listing and Describing of Incentives Provided For Exports FromDocument9 pagesForeign Trade Policy: - Listing and Describing of Incentives Provided For Exports FromShubham SinghNo ratings yet

- Allied Thread Co., Inc. vs. City Mayor of Manila, 133 SCRA 338, November 21, 1984 (SITUS OF LOCAL TAXATION)Document7 pagesAllied Thread Co., Inc. vs. City Mayor of Manila, 133 SCRA 338, November 21, 1984 (SITUS OF LOCAL TAXATION)Daniela SandraNo ratings yet

- Commission of Internal Revenue V. San Miguel Corp. (G.R. No. 205045, January 25, 2017)Document2 pagesCommission of Internal Revenue V. San Miguel Corp. (G.R. No. 205045, January 25, 2017)Digna LausNo ratings yet

- AffidavitDocument5 pagesAffidavitAKSHAY GUTKANo ratings yet

- TaxationDocument31 pagesTaxationdaljeet singhNo ratings yet

- NPC v. BenguetDocument2 pagesNPC v. BenguetAlexa Valaree SalugsuganNo ratings yet

- Direct Tax NotesDocument65 pagesDirect Tax NotesJeevan T RNo ratings yet

- Part 2 Basic Taxation Syllabus Local TaxationDocument5 pagesPart 2 Basic Taxation Syllabus Local TaxationMackz KevinNo ratings yet