Professional Documents

Culture Documents

Deber Capitulo 2 - 3 FIN

Deber Capitulo 2 - 3 FIN

Uploaded by

Miguel TapiaCopyright:

Available Formats

You might also like

- Chapter 3. Solution To End-of-Chapter Comprehensive/Spreadsheet ProblemDocument8 pagesChapter 3. Solution To End-of-Chapter Comprehensive/Spreadsheet ProblemBen Harris100% (1)

- McGraw Hill Connect Question Bank Assignment 2Document2 pagesMcGraw Hill Connect Question Bank Assignment 2Jayann Danielle MadrazoNo ratings yet

- Cheating SheetDocument13 pagesCheating SheetAlfian Ardhiyana PutraNo ratings yet

- Schaum's Outline of Bookkeeping and Accounting, Fourth EditionFrom EverandSchaum's Outline of Bookkeeping and Accounting, Fourth EditionRating: 5 out of 5 stars5/5 (1)

- HW 3 - ACME RoadrunnerDocument7 pagesHW 3 - ACME Roadrunnerkartik lakhotiyaNo ratings yet

- Glenn S Glue Stick IncDocument5 pagesGlenn S Glue Stick IncHenry KimNo ratings yet

- Ch03 Tool KitDocument24 pagesCh03 Tool KitNino Natradze100% (1)

- Group 5 Case of Financial StatementDocument6 pagesGroup 5 Case of Financial StatementDhomas AgastyaNo ratings yet

- Advanced Accounting Exercise 13-3 11edDocument3 pagesAdvanced Accounting Exercise 13-3 11edTough ShotNo ratings yet

- Altruist Customer Management India PVT LTD: Personal DetailsDocument1 pageAltruist Customer Management India PVT LTD: Personal DetailsSampathKPNo ratings yet

- Finance ProblemsDocument50 pagesFinance ProblemsRandallroyce0% (1)

- Assignment SalmanDocument9 pagesAssignment SalmanSalman AtherNo ratings yet

- Week-2-Chapter-3-Financial-Build-A-Mode LDocument7 pagesWeek-2-Chapter-3-Financial-Build-A-Mode LCrusty GirlNo ratings yet

- 3463afdcb438dc833d95f8d1814e4b36_8f5c0d43171d85063d48300fbb6274faDocument4 pages3463afdcb438dc833d95f8d1814e4b36_8f5c0d43171d85063d48300fbb6274faChelsea VisperasNo ratings yet

- Assignment#01Document8 pagesAssignment#01Aaisha AnsariNo ratings yet

- Chapter 3. CH 03-10 Build A Model: AssetsDocument4 pagesChapter 3. CH 03-10 Build A Model: AssetsAngel L Rolon TorresNo ratings yet

- P23-7 (SCF-Direct and Indirect Methods From Comparative Financial Statements) ChapmanDocument4 pagesP23-7 (SCF-Direct and Indirect Methods From Comparative Financial Statements) Chapmanintan dwi cahaya100% (1)

- Practice Problems, CH 12Document6 pagesPractice Problems, CH 12scridNo ratings yet

- IFM11 Solution To Ch08 P15 Build A ModelDocument2 pagesIFM11 Solution To Ch08 P15 Build A ModelDiana Soriano50% (2)

- Excel File For Financial Ratio Activities UpdatedDocument4 pagesExcel File For Financial Ratio Activities Updated0a0lvbht4No ratings yet

- CH2 FinmaDocument3 pagesCH2 Finmamervin coquillaNo ratings yet

- Finance Quiz 3Document43 pagesFinance Quiz 3Peak ChindapolNo ratings yet

- Week 6 Assignment FNCE UCWDocument1 pageWeek 6 Assignment FNCE UCWamyna abhavaniNo ratings yet

- Chapter 7. Student CH 7-14 Build A Model: AssetsDocument5 pagesChapter 7. Student CH 7-14 Build A Model: Assetsseth litchfieldNo ratings yet

- Ch02 P14 Build A Model SolutionDocument6 pagesCh02 P14 Build A Model SolutionSeee OoonNo ratings yet

- Chapter 8. Student Ch08 P 8-15 Build A Model: AssetsDocument2 pagesChapter 8. Student Ch08 P 8-15 Build A Model: Assetsseth litchfield100% (1)

- Karora FS Q1 2021Document16 pagesKarora FS Q1 2021Predrag MarkovicNo ratings yet

- File 000030Document4 pagesFile 000030Nicholas GunnellNo ratings yet

- Optiva Inc. Q2 2022 Financial Statements FinalDocument19 pagesOptiva Inc. Q2 2022 Financial Statements FinaldivyaNo ratings yet

- Case Study 2 (Class)Document6 pagesCase Study 2 (Class)ummieulfahNo ratings yet

- Pro Forma Statement of Financial Position: Warner CompanyDocument6 pagesPro Forma Statement of Financial Position: Warner CompanysunflowerNo ratings yet

- Revisi Tugas Cash Flow AnalysisDocument29 pagesRevisi Tugas Cash Flow AnalysisNovilia FriskaNo ratings yet

- Financial Statement Analysis QuestionsDocument4 pagesFinancial Statement Analysis QuestionsRisha OsfordNo ratings yet

- Rock Company-WPS OfficeDocument2 pagesRock Company-WPS OfficeAngeline BautistaNo ratings yet

- Hira Karim Malik Section B - Financial Ratios Practice AssignmentDocument7 pagesHira Karim Malik Section B - Financial Ratios Practice AssignmenthirakmalikNo ratings yet

- Midterm Practice QuestionsDocument4 pagesMidterm Practice QuestionsGio RobakidzeNo ratings yet

- Problem 2-14 & 2-15Document12 pagesProblem 2-14 & 2-15Qudsiya KalhoroNo ratings yet

- 20190312220046BN001184625Document10 pages20190312220046BN001184625Roifah AmeliaNo ratings yet

- Work Sheet RatiosDocument4 pagesWork Sheet Ratiosmohammad mueinNo ratings yet

- Casos FinanzasDocument20 pagesCasos FinanzasPepe La PagaNo ratings yet

- DifferenceDocument10 pagesDifferencethalibritNo ratings yet

- Practice Problems, CH 5Document7 pagesPractice Problems, CH 5scridNo ratings yet

- Cashflow Exercise - RocastleDocument1 pageCashflow Exercise - RocastleAbrashiNo ratings yet

- MBA 5015 Managerial Finance-Lesson 1-HomeworkDocument3 pagesMBA 5015 Managerial Finance-Lesson 1-HomeworkpravinNo ratings yet

- UntitledDocument11 pagesUntitledKhang ĐặngNo ratings yet

- Financial Report of Kite LTDDocument2 pagesFinancial Report of Kite LTDWisnu Adi PratamaNo ratings yet

- CH 13Document4 pagesCH 13Sri HimajaNo ratings yet

- Business FinanceDocument6 pagesBusiness FinancejolinaNo ratings yet

- F0013 Exercise 12 Problems/Exercises in Financial RatiosDocument3 pagesF0013 Exercise 12 Problems/Exercises in Financial RatiosDuaaaaNo ratings yet

- QuestionsDocument13 pagesQuestionsAriaNo ratings yet

- 5.6 Excel of Financial Statement AnalysisDocument6 pages5.6 Excel of Financial Statement AnalysisTRan TrinhNo ratings yet

- Sadecki Corporation Balance Sheets Dec-31 Assets 2014 2013Document9 pagesSadecki Corporation Balance Sheets Dec-31 Assets 2014 2013mohitgaba19No ratings yet

- Exercises AllDocument9 pagesExercises AllLede Ann Calipus YapNo ratings yet

- 11.0 Enager Industries, Inc. - DataDocument3 pages11.0 Enager Industries, Inc. - DataAliza RizviNo ratings yet

- DBA401 - CS221051: Balance Sheet AssetsDocument10 pagesDBA401 - CS221051: Balance Sheet AssetsAian Kit Jasper SanchezNo ratings yet

- Financial Statement: Balance SheetDocument2 pagesFinancial Statement: Balance SheetChara etangNo ratings yet

- Test 2023Document12 pagesTest 2023paingheinkhanttNo ratings yet

- Problem 1: Cash Flow Statement (Class Practice)Document2 pagesProblem 1: Cash Flow Statement (Class Practice)ronamiNo ratings yet

- Solution Key To Problem Set 1Document6 pagesSolution Key To Problem Set 1Ayush RaiNo ratings yet

- GDL Case AnalysisDocument11 pagesGDL Case AnalysisLourdes PortaNo ratings yet

- Total Current Assets 304 252: Reporting and Interpreting Cash Flows Problem SetsDocument4 pagesTotal Current Assets 304 252: Reporting and Interpreting Cash Flows Problem SetsMostakNo ratings yet

- Chapter 3 National Income Test BankDocument44 pagesChapter 3 National Income Test BankmchlbahaaNo ratings yet

- C 11 em EconomicsDocument90 pagesC 11 em EconomicsNIKITA WAGHELANo ratings yet

- FIN201 MHKB (Latest)Document17 pagesFIN201 MHKB (Latest)Kamrul HasanNo ratings yet

- Inequality in Global City-RegionsDocument6 pagesInequality in Global City-RegionsAnika FordeNo ratings yet

- Macro AauDocument49 pagesMacro AauMohammed AdemNo ratings yet

- Afar Quizzer - Insurance Contracts (Ifrs 17)Document5 pagesAfar Quizzer - Insurance Contracts (Ifrs 17)Ralph Adian Tolentino100% (1)

- Salary Slip Sep-NovDocument3 pagesSalary Slip Sep-NovManoj KumarNo ratings yet

- Financial Analysis of Apollo Hospitals: Presented By: Imran Mohammad Rather 2010MBE09Document19 pagesFinancial Analysis of Apollo Hospitals: Presented By: Imran Mohammad Rather 2010MBE09Vishal GuptaNo ratings yet

- Chap 11 - NPO Exam PracticeDocument9 pagesChap 11 - NPO Exam PracticeAbdullahSaqibNo ratings yet

- HEBEROLA SFExam 12Document22 pagesHEBEROLA SFExam 12Marjorie Joyce BarituaNo ratings yet

- Inbutax 2Document3 pagesInbutax 2Kim Edward TenorioNo ratings yet

- National Income and Related AggregatesDocument8 pagesNational Income and Related Aggregatesnakulshali1No ratings yet

- Computation of Gross ProfitDocument21 pagesComputation of Gross ProfitMariaAngelaAdanEvangelista100% (1)

- Comparative Summaryv of LGU ImposiutionsDocument28 pagesComparative Summaryv of LGU ImposiutionsChairmaine Jacqueline PaulinoNo ratings yet

- Melo - Quiz#6Document4 pagesMelo - Quiz#6tricia meloNo ratings yet

- Over Population in Pakistan, Causes, EffectsDocument15 pagesOver Population in Pakistan, Causes, EffectsRegioal Director, RC Dera Ghazi KhanNo ratings yet

- Jawab SS7-27 - Kertas Kerja Konsolidasi Dengan Transfer PersediaanDocument9 pagesJawab SS7-27 - Kertas Kerja Konsolidasi Dengan Transfer PersediaanPuji LestariNo ratings yet

- BeneDocument2 pagesBeneRiza Mae Alce100% (1)

- Total Financial RatiosDocument2 pagesTotal Financial RatioshoangsubaxdNo ratings yet

- 100 Q&A of Cambridge O Level EconomicsDocument31 pages100 Q&A of Cambridge O Level Economicsoalevels94% (32)

- Supplementary Financial Information (31 December 2020)Document71 pagesSupplementary Financial Information (31 December 2020)YoungRedNo ratings yet

- Enterprise StructureDocument5 pagesEnterprise StructureSurajNo ratings yet

- Basic Household BudgetDocument1 pageBasic Household BudgetJOHN DAVIESNo ratings yet

- The Walt Disney Company Internal AnalysisDocument9 pagesThe Walt Disney Company Internal AnalysisYves GuerreroNo ratings yet

- Chapter 4 Income Measurement and Accrual Accounting-1Document99 pagesChapter 4 Income Measurement and Accrual Accounting-1Lizeth Andrea AcostaNo ratings yet

- Income and Tax Simplified TablesDocument3 pagesIncome and Tax Simplified TablesNiñoMaurinNo ratings yet

- CHAPTER 5 Management StudyDocument62 pagesCHAPTER 5 Management StudyKrystel Ann Demaosa CarballoNo ratings yet

- CONCEPTUAL FRAMEWORK and ACCOUNTING STANDARD - OUTLINEDocument11 pagesCONCEPTUAL FRAMEWORK and ACCOUNTING STANDARD - OUTLINEBABANo ratings yet

Deber Capitulo 2 - 3 FIN

Deber Capitulo 2 - 3 FIN

Uploaded by

Miguel TapiaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Deber Capitulo 2 - 3 FIN

Deber Capitulo 2 - 3 FIN

Uploaded by

Miguel TapiaCopyright:

Available Formats

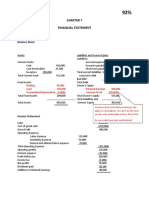

Chapter 3

Questions 26-28

Input area:

Tax rate 35%

SMOLIRA GOLF CORP.

2011 and 2012 Balance Sheets

Assets Liabilities and owners' equity

2011 2012 2011 2012

Current assets Current liabilities

Cash $ 24,046 $ 24,255 Accounts payable $ 23,184 $ 27,420

Accounts receivable 12,448 15,235 Notes payable 12,000 10,800

Inventory 25,392 27,155 Other 11,571 15,553

Total $ 61,886 $ 66,645 Total $ 46,755 $ 53,773

Long-term debt 80,000 95,000

Owners' equity $ 126,755 $ 148,773

Common stock and paid-in surplus $ 40,000 $ 40,000

Fixed assets Accumulated retained earnings 219,826 94,833

Net plant and equipment 324,695 365,734 Total $ 259,826 $ 283,606

Total assets $ 386,581 $ 432,379 Total liabilities and owners' equity $ 386,581 $ 432,379

SMOLIRA GOLF CORP.

2012 Income statement

Sales $ 366,996

Cost of goods sold 253,122

Depreciation 32,220

EBIT $ 81,654

Interest paid 14,300

Taxable income $ 67,354

Taxes (35%) 23,574

Net income $ 43,780

Dividends $ 20,000

Retained earnings 23,780

Output area:

26) Short-term solvency ratios:

2011 Current ratio 1.32

2012 Current ratio 1.24

2011 Quick ratio 0.78

2012 Quick ratio 0.73

2011 Cash ratio 0.51

2012 Cash ratio 0.45

Asset utilization ratios:

Total asset turnover 0.85

Inventory turnover 9.32

Receivables turnover 24.09

Long-term solvency ratios:

2011 Total debt ratio 0.33

2012 Total debt ratio 0.34

2011 Debt-equity ratio 0.49

2012 Debt-equity ratio 0.52

2011 Equity mulitplier 1.49

2012 Equity multiplier 1.52

Times interest earned ratio 5.71

Cash coverage ratio 7.96

Profitability ratios:

Profit margin 11.93%

Return on assets 10.13%

Return on equity 15.44%

27) Return on equity 15.44%

28) SMOLIRA GOLF, INC.

Statement of Cash Flows

For Period Ending December 31, 2012

Cash, beginning of the year $ 24,046

Operating activities

Net income $ 43,780

Plus:

Depreciation 32,220

Increase in accounts payable 4,236

Increase in other current liabilities 3,982

Less:

Increase in accounts receivable 2,787

Increase in inventory 1,763

$ 35,888

Net cash from operating activities $ 79,668

Investment activities

Fixed asset acquisition $ 73,259

Net cash from investment activities $ 73,259

Financing activities

Decrease in notes payable $ (1,200)

Dividends paid 20,000

Increase in long-term debt 15,000

Net cash from financing activities $ (6,200)

Net increase in cash $ 209

Cash, end of year $ 24,255

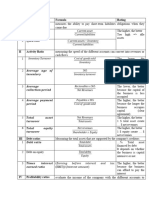

Chapter 4

Question 24

Input area:

Sales $ 743,000 Assets Liabilities and owners' equity

Costs 578,000 Current assets Current liabilities

Other expenses 15,200 Cash $ 20,240 Accounts payable

EBIT $ 149,800 Accounts receivable 32,560 Notes payable

Interest expense 11,200 Inventory 69,520 Total

Taxable income $ 138,600 Total $ 122,320 Long-term debt

Taxes 48,510 Fixed assets

Net income $ 90,090 Net plant and Owners' equity

equipment $ 330,400 Common stock and

Dividends $ 27,027 paid-in surplus

Add. to retained earnings 63,063 Retained earnings

Total

Total liabilities and

Sales increase 20.00% Total assets $ 452,720 owners' equity

Tax rate 35%

Output area:

Dividend payout ratio 0.30

2012 Pro Forma Income Statement Assets Liabilities and owners' equity

Sales $ 891,600 Current assets Current liabilities

Costs $ 693,600 Cash $ 24,288.00 Accounts payable

Other expenses $ 18,240 Accounts receivable $ 39,072.00 Notes payable

EBIT $ 179,760 Inventory $ 83,424.00 Total

Interest expense $ 11,200 Total $ 146,784 Long-term debt

Taxable income $ 168,560 Fixed assets

Taxes $ 58,996 Net plant and Owners' equity

Net income $ 109,564 equipment 396,480 Common stock and

Dividends $ 32,869 paid-in surplus

Add. To RE 76,695 Retained earnings

Total

Total liabilities and

Total assets $ 543,264 owners' equity

External financing $ 2,969

lities and owners' equity

$ 54,400

13,600

$ 68,000

$ 126,000

$ 112,000

146,720

$ 258,720

$ 452,720

lities and owners' equity

$ 65,280

$ 13,600

$ 78,880

126,000

$ 112,000

$ 223,415

$ 335,415

$ 540,295

You might also like

- Chapter 3. Solution To End-of-Chapter Comprehensive/Spreadsheet ProblemDocument8 pagesChapter 3. Solution To End-of-Chapter Comprehensive/Spreadsheet ProblemBen Harris100% (1)

- McGraw Hill Connect Question Bank Assignment 2Document2 pagesMcGraw Hill Connect Question Bank Assignment 2Jayann Danielle MadrazoNo ratings yet

- Cheating SheetDocument13 pagesCheating SheetAlfian Ardhiyana PutraNo ratings yet

- Schaum's Outline of Bookkeeping and Accounting, Fourth EditionFrom EverandSchaum's Outline of Bookkeeping and Accounting, Fourth EditionRating: 5 out of 5 stars5/5 (1)

- HW 3 - ACME RoadrunnerDocument7 pagesHW 3 - ACME Roadrunnerkartik lakhotiyaNo ratings yet

- Glenn S Glue Stick IncDocument5 pagesGlenn S Glue Stick IncHenry KimNo ratings yet

- Ch03 Tool KitDocument24 pagesCh03 Tool KitNino Natradze100% (1)

- Group 5 Case of Financial StatementDocument6 pagesGroup 5 Case of Financial StatementDhomas AgastyaNo ratings yet

- Advanced Accounting Exercise 13-3 11edDocument3 pagesAdvanced Accounting Exercise 13-3 11edTough ShotNo ratings yet

- Altruist Customer Management India PVT LTD: Personal DetailsDocument1 pageAltruist Customer Management India PVT LTD: Personal DetailsSampathKPNo ratings yet

- Finance ProblemsDocument50 pagesFinance ProblemsRandallroyce0% (1)

- Assignment SalmanDocument9 pagesAssignment SalmanSalman AtherNo ratings yet

- Week-2-Chapter-3-Financial-Build-A-Mode LDocument7 pagesWeek-2-Chapter-3-Financial-Build-A-Mode LCrusty GirlNo ratings yet

- 3463afdcb438dc833d95f8d1814e4b36_8f5c0d43171d85063d48300fbb6274faDocument4 pages3463afdcb438dc833d95f8d1814e4b36_8f5c0d43171d85063d48300fbb6274faChelsea VisperasNo ratings yet

- Assignment#01Document8 pagesAssignment#01Aaisha AnsariNo ratings yet

- Chapter 3. CH 03-10 Build A Model: AssetsDocument4 pagesChapter 3. CH 03-10 Build A Model: AssetsAngel L Rolon TorresNo ratings yet

- P23-7 (SCF-Direct and Indirect Methods From Comparative Financial Statements) ChapmanDocument4 pagesP23-7 (SCF-Direct and Indirect Methods From Comparative Financial Statements) Chapmanintan dwi cahaya100% (1)

- Practice Problems, CH 12Document6 pagesPractice Problems, CH 12scridNo ratings yet

- IFM11 Solution To Ch08 P15 Build A ModelDocument2 pagesIFM11 Solution To Ch08 P15 Build A ModelDiana Soriano50% (2)

- Excel File For Financial Ratio Activities UpdatedDocument4 pagesExcel File For Financial Ratio Activities Updated0a0lvbht4No ratings yet

- CH2 FinmaDocument3 pagesCH2 Finmamervin coquillaNo ratings yet

- Finance Quiz 3Document43 pagesFinance Quiz 3Peak ChindapolNo ratings yet

- Week 6 Assignment FNCE UCWDocument1 pageWeek 6 Assignment FNCE UCWamyna abhavaniNo ratings yet

- Chapter 7. Student CH 7-14 Build A Model: AssetsDocument5 pagesChapter 7. Student CH 7-14 Build A Model: Assetsseth litchfieldNo ratings yet

- Ch02 P14 Build A Model SolutionDocument6 pagesCh02 P14 Build A Model SolutionSeee OoonNo ratings yet

- Chapter 8. Student Ch08 P 8-15 Build A Model: AssetsDocument2 pagesChapter 8. Student Ch08 P 8-15 Build A Model: Assetsseth litchfield100% (1)

- Karora FS Q1 2021Document16 pagesKarora FS Q1 2021Predrag MarkovicNo ratings yet

- File 000030Document4 pagesFile 000030Nicholas GunnellNo ratings yet

- Optiva Inc. Q2 2022 Financial Statements FinalDocument19 pagesOptiva Inc. Q2 2022 Financial Statements FinaldivyaNo ratings yet

- Case Study 2 (Class)Document6 pagesCase Study 2 (Class)ummieulfahNo ratings yet

- Pro Forma Statement of Financial Position: Warner CompanyDocument6 pagesPro Forma Statement of Financial Position: Warner CompanysunflowerNo ratings yet

- Revisi Tugas Cash Flow AnalysisDocument29 pagesRevisi Tugas Cash Flow AnalysisNovilia FriskaNo ratings yet

- Financial Statement Analysis QuestionsDocument4 pagesFinancial Statement Analysis QuestionsRisha OsfordNo ratings yet

- Rock Company-WPS OfficeDocument2 pagesRock Company-WPS OfficeAngeline BautistaNo ratings yet

- Hira Karim Malik Section B - Financial Ratios Practice AssignmentDocument7 pagesHira Karim Malik Section B - Financial Ratios Practice AssignmenthirakmalikNo ratings yet

- Midterm Practice QuestionsDocument4 pagesMidterm Practice QuestionsGio RobakidzeNo ratings yet

- Problem 2-14 & 2-15Document12 pagesProblem 2-14 & 2-15Qudsiya KalhoroNo ratings yet

- 20190312220046BN001184625Document10 pages20190312220046BN001184625Roifah AmeliaNo ratings yet

- Work Sheet RatiosDocument4 pagesWork Sheet Ratiosmohammad mueinNo ratings yet

- Casos FinanzasDocument20 pagesCasos FinanzasPepe La PagaNo ratings yet

- DifferenceDocument10 pagesDifferencethalibritNo ratings yet

- Practice Problems, CH 5Document7 pagesPractice Problems, CH 5scridNo ratings yet

- Cashflow Exercise - RocastleDocument1 pageCashflow Exercise - RocastleAbrashiNo ratings yet

- MBA 5015 Managerial Finance-Lesson 1-HomeworkDocument3 pagesMBA 5015 Managerial Finance-Lesson 1-HomeworkpravinNo ratings yet

- UntitledDocument11 pagesUntitledKhang ĐặngNo ratings yet

- Financial Report of Kite LTDDocument2 pagesFinancial Report of Kite LTDWisnu Adi PratamaNo ratings yet

- CH 13Document4 pagesCH 13Sri HimajaNo ratings yet

- Business FinanceDocument6 pagesBusiness FinancejolinaNo ratings yet

- F0013 Exercise 12 Problems/Exercises in Financial RatiosDocument3 pagesF0013 Exercise 12 Problems/Exercises in Financial RatiosDuaaaaNo ratings yet

- QuestionsDocument13 pagesQuestionsAriaNo ratings yet

- 5.6 Excel of Financial Statement AnalysisDocument6 pages5.6 Excel of Financial Statement AnalysisTRan TrinhNo ratings yet

- Sadecki Corporation Balance Sheets Dec-31 Assets 2014 2013Document9 pagesSadecki Corporation Balance Sheets Dec-31 Assets 2014 2013mohitgaba19No ratings yet

- Exercises AllDocument9 pagesExercises AllLede Ann Calipus YapNo ratings yet

- 11.0 Enager Industries, Inc. - DataDocument3 pages11.0 Enager Industries, Inc. - DataAliza RizviNo ratings yet

- DBA401 - CS221051: Balance Sheet AssetsDocument10 pagesDBA401 - CS221051: Balance Sheet AssetsAian Kit Jasper SanchezNo ratings yet

- Financial Statement: Balance SheetDocument2 pagesFinancial Statement: Balance SheetChara etangNo ratings yet

- Test 2023Document12 pagesTest 2023paingheinkhanttNo ratings yet

- Problem 1: Cash Flow Statement (Class Practice)Document2 pagesProblem 1: Cash Flow Statement (Class Practice)ronamiNo ratings yet

- Solution Key To Problem Set 1Document6 pagesSolution Key To Problem Set 1Ayush RaiNo ratings yet

- GDL Case AnalysisDocument11 pagesGDL Case AnalysisLourdes PortaNo ratings yet

- Total Current Assets 304 252: Reporting and Interpreting Cash Flows Problem SetsDocument4 pagesTotal Current Assets 304 252: Reporting and Interpreting Cash Flows Problem SetsMostakNo ratings yet

- Chapter 3 National Income Test BankDocument44 pagesChapter 3 National Income Test BankmchlbahaaNo ratings yet

- C 11 em EconomicsDocument90 pagesC 11 em EconomicsNIKITA WAGHELANo ratings yet

- FIN201 MHKB (Latest)Document17 pagesFIN201 MHKB (Latest)Kamrul HasanNo ratings yet

- Inequality in Global City-RegionsDocument6 pagesInequality in Global City-RegionsAnika FordeNo ratings yet

- Macro AauDocument49 pagesMacro AauMohammed AdemNo ratings yet

- Afar Quizzer - Insurance Contracts (Ifrs 17)Document5 pagesAfar Quizzer - Insurance Contracts (Ifrs 17)Ralph Adian Tolentino100% (1)

- Salary Slip Sep-NovDocument3 pagesSalary Slip Sep-NovManoj KumarNo ratings yet

- Financial Analysis of Apollo Hospitals: Presented By: Imran Mohammad Rather 2010MBE09Document19 pagesFinancial Analysis of Apollo Hospitals: Presented By: Imran Mohammad Rather 2010MBE09Vishal GuptaNo ratings yet

- Chap 11 - NPO Exam PracticeDocument9 pagesChap 11 - NPO Exam PracticeAbdullahSaqibNo ratings yet

- HEBEROLA SFExam 12Document22 pagesHEBEROLA SFExam 12Marjorie Joyce BarituaNo ratings yet

- Inbutax 2Document3 pagesInbutax 2Kim Edward TenorioNo ratings yet

- National Income and Related AggregatesDocument8 pagesNational Income and Related Aggregatesnakulshali1No ratings yet

- Computation of Gross ProfitDocument21 pagesComputation of Gross ProfitMariaAngelaAdanEvangelista100% (1)

- Comparative Summaryv of LGU ImposiutionsDocument28 pagesComparative Summaryv of LGU ImposiutionsChairmaine Jacqueline PaulinoNo ratings yet

- Melo - Quiz#6Document4 pagesMelo - Quiz#6tricia meloNo ratings yet

- Over Population in Pakistan, Causes, EffectsDocument15 pagesOver Population in Pakistan, Causes, EffectsRegioal Director, RC Dera Ghazi KhanNo ratings yet

- Jawab SS7-27 - Kertas Kerja Konsolidasi Dengan Transfer PersediaanDocument9 pagesJawab SS7-27 - Kertas Kerja Konsolidasi Dengan Transfer PersediaanPuji LestariNo ratings yet

- BeneDocument2 pagesBeneRiza Mae Alce100% (1)

- Total Financial RatiosDocument2 pagesTotal Financial RatioshoangsubaxdNo ratings yet

- 100 Q&A of Cambridge O Level EconomicsDocument31 pages100 Q&A of Cambridge O Level Economicsoalevels94% (32)

- Supplementary Financial Information (31 December 2020)Document71 pagesSupplementary Financial Information (31 December 2020)YoungRedNo ratings yet

- Enterprise StructureDocument5 pagesEnterprise StructureSurajNo ratings yet

- Basic Household BudgetDocument1 pageBasic Household BudgetJOHN DAVIESNo ratings yet

- The Walt Disney Company Internal AnalysisDocument9 pagesThe Walt Disney Company Internal AnalysisYves GuerreroNo ratings yet

- Chapter 4 Income Measurement and Accrual Accounting-1Document99 pagesChapter 4 Income Measurement and Accrual Accounting-1Lizeth Andrea AcostaNo ratings yet

- Income and Tax Simplified TablesDocument3 pagesIncome and Tax Simplified TablesNiñoMaurinNo ratings yet

- CHAPTER 5 Management StudyDocument62 pagesCHAPTER 5 Management StudyKrystel Ann Demaosa CarballoNo ratings yet

- CONCEPTUAL FRAMEWORK and ACCOUNTING STANDARD - OUTLINEDocument11 pagesCONCEPTUAL FRAMEWORK and ACCOUNTING STANDARD - OUTLINEBABANo ratings yet