Professional Documents

Culture Documents

Govt Regulations

Govt Regulations

Uploaded by

whatsapp statusOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Govt Regulations

Govt Regulations

Uploaded by

whatsapp statusCopyright:

Available Formats

New Regulations about Green Technology

The blockchain industry is growing quickly, as concerns about its environmental impact. The

original and most popular blockchain, Bitcoin, is energy-intensive by design, “mined” by millions

of high-powered computers around the world. That puts enthusiasts in a tough position. They

say blockchain tokens will power a decentralized internet, changing the economics of banking,

finance, gaming, shopping, entertainment, and even human interaction. But if blockchain,

already worth $2 trillion, is the future, this industry like any other can’t afford to ignore climate

change and must embrace sustainability. Either, the second-most popular blockchain, uses a lot

of power, like Bitcoin, but its developers are planning a transition to a mining method that is

more friendly to the environment.

The sale of blockchain is generally only regulated if the sale

(i) constitutes the sale of a security under state or federal law, or

(ii) is considered money transmission under state law or conduct otherwise making the person a money

services business (“MSB”) under Federal law.

In addition, futures, options, swaps, and other derivative contracts that refer to the price of a blockchain

asset that constitutes a commodity are subject to regulation by the CFTC under the Commodity

Exchange Act. In addition, the CFTC has jurisdiction over attempts to engage in market manipulation

concerning those blockchain assets that are considered commodities. The likelihood of the CFTC

asserting its authority to prevent market manipulation is much higher today as a result of both the CBOE

and the CME offering futures linked to the price of Bitcoin.

The SEC generally has regulatory authority over the issuance or resale of any token or another digital

asset that constitutes security. Under U.S. law, security includes “an investment contract,” which has

been defined by the U.S. Supreme Court as an investment of money in a common enterprise with a

reasonable expectation of profits to be derived from the entrepreneurial or managerial efforts of others.

In determining whether a token or other digital asset is an “investment contract,” both the SEC and the

courts look at the substance of the transaction, instead of its form. In 1943, the U.S. Supreme Court

determined that “the reach of the [Securities] Act does not stop with the obvious and commonplace.

The novel, uncommon, or irregular devices, whatever they appear to be, are also reached if it is proved

as a matter of fact that they were widely offered or dealt in under terms or courses of dealing which

established their character in commerce as ‘investment contracts,’ or as ‘any interest or instrument

commonly known as a ‘security’.” SEC v. C.M. Joiner Leasing Corp., 320 U.S. 344, 351 (1943).

It has also been said that “Congress's purpose in enacting the securities laws was to regulate

investments, in whatever form they are made and by whatever name they are called.” Reves v. Ernst &

Young, 494 U.S. 56, 61 (1990).

The blockchain is going popular day by day.

You might also like

- MFT Tax FormsDocument25 pagesMFT Tax FormsJoeSchoffstallNo ratings yet

- Gantt Chart: Plant Pals Operations and Training Plan Muntasim Manzoor LoneDocument5 pagesGantt Chart: Plant Pals Operations and Training Plan Muntasim Manzoor Lonegrowddon75% (4)

- SEC v. Coinbase, Coinbase Pre-Motion Letter - 12 (C) MotionDocument4 pagesSEC v. Coinbase, Coinbase Pre-Motion Letter - 12 (C) Motionjeff_roberts881No ratings yet

- Blockchain Securities, Insolvency Law and The Sandbox ApproachDocument21 pagesBlockchain Securities, Insolvency Law and The Sandbox ApproachHelen Rui FanNo ratings yet

- J 7 IJAL 2019 1 Kkartikeya14 Gmailcom 20200509 000011Document14 pagesJ 7 IJAL 2019 1 Kkartikeya14 Gmailcom 20200509 000011kumar kartikeyaNo ratings yet

- WoodfordDocument4 pagesWoodfordDestiny RiveraNo ratings yet

- Exam Practice Case Study: Flipkart: 1 Explain What Is Meant by Corporate Strategy'. (4 Marks)Document3 pagesExam Practice Case Study: Flipkart: 1 Explain What Is Meant by Corporate Strategy'. (4 Marks)Gazi Kashfi JahanNo ratings yet

- Itc Limited: Is The Corporate Governance Only Skin Deep?Document2 pagesItc Limited: Is The Corporate Governance Only Skin Deep?vidhiNo ratings yet

- 2019 TaxreturnDocument6 pages2019 TaxreturnMARC ANDREWS WOLFFNo ratings yet

- Us Regulation of Digital Assets: March 16, 2021Document45 pagesUs Regulation of Digital Assets: March 16, 2021Khinci KeyenNo ratings yet

- Cryptocurrency 2018: When The Law Catches Up With Game-Changing Technology - Stay Informed - K&L GatDocument4 pagesCryptocurrency 2018: When The Law Catches Up With Game-Changing Technology - Stay Informed - K&L GatChristos FloridisNo ratings yet

- Bit PropertyDocument2 pagesBit Propertycarl vonNo ratings yet

- Some Risks of Tokenization and Blockchainizaition of Private LawDocument7 pagesSome Risks of Tokenization and Blockchainizaition of Private LawAyatulloh Ali SariatiNo ratings yet

- 50-State Review of Cryptocurrency and Blockchain Regulation - Stevens Center For Innovation in FinanceDocument30 pages50-State Review of Cryptocurrency and Blockchain Regulation - Stevens Center For Innovation in FinanceellirafaeladvNo ratings yet

- SEC ICOs Investigative Report DAO 34-81207Document18 pagesSEC ICOs Investigative Report DAO 34-81207CrowdfundInsiderNo ratings yet

- Bitcoin: Questions, Answers, and Analysis of Legal Issues: Craig K. ElwellDocument20 pagesBitcoin: Questions, Answers, and Analysis of Legal Issues: Craig K. ElwellRaian SakibNo ratings yet

- Bitcoin and Securities Enforcement Buffone Law Group 8.9.2023Document27 pagesBitcoin and Securities Enforcement Buffone Law Group 8.9.2023SonnyNo ratings yet

- The Crypto-Tokens DebacleDocument3 pagesThe Crypto-Tokens DebacleSHILADITYA MISHRANo ratings yet

- 1718 - Blockchain Issues For Interactive Entertainment Companies Article 0518Document4 pages1718 - Blockchain Issues For Interactive Entertainment Companies Article 0518Federico AldoNo ratings yet

- SECvCOIN Pleadingsopinion 27 Mar 24Document84 pagesSECvCOIN Pleadingsopinion 27 Mar 24XDL1No ratings yet

- Bitcoin Financial Regulation: Securities, Derivatives, Prediction Markets, and GamblingDocument75 pagesBitcoin Financial Regulation: Securities, Derivatives, Prediction Markets, and GamblingSamuel HammondNo ratings yet

- Blockchain Challenges Traditional Contract Law - Just How Smart ArDocument32 pagesBlockchain Challenges Traditional Contract Law - Just How Smart Armanal jaafarNo ratings yet

- SEC - Gov Statement On The Approval of Spot Bitcoin Exchange-Traded ProductsDocument2 pagesSEC - Gov Statement On The Approval of Spot Bitcoin Exchange-Traded ProductsVeronica SilveriNo ratings yet

- Ku CoinDocument79 pagesKu CoinfleckaleckaNo ratings yet

- Global Legal Insights Guide - Cryptocurrency As A Commodity The CFTCs Regulatory FrameworkDocument8 pagesGlobal Legal Insights Guide - Cryptocurrency As A Commodity The CFTCs Regulatory FrameworkFaruk ĆerimovićNo ratings yet

- USB CryptocurrencyDocument18 pagesUSB CryptocurrencytabNo ratings yet

- The Regulation of Cryptocurrencies - Between A Currency and A FinDocument49 pagesThe Regulation of Cryptocurrencies - Between A Currency and A FinKeamogetse MotlogeloaNo ratings yet

- Cryptocurrencies: From The Trinidad and Tobago Securities and Exchange CommissionDocument3 pagesCryptocurrencies: From The Trinidad and Tobago Securities and Exchange CommissionTNo ratings yet

- Blockchains Government-And-Transportationjanuary-2018Document11 pagesBlockchains Government-And-Transportationjanuary-2018Alí RiveraNo ratings yet

- The Ineluctable Modality of Securities Law DLX Law Discussion Draft Nov. 10 2022Document180 pagesThe Ineluctable Modality of Securities Law DLX Law Discussion Draft Nov. 10 2022Roger BrownNo ratings yet

- Gov Uscourts DCD 213319 59 0 PDFDocument49 pagesGov Uscourts DCD 213319 59 0 PDFForkLogNo ratings yet

- Bi BoxDocument72 pagesBi BoxfleckaleckaNo ratings yet

- Clifford Chance - Distressed CryptoassetsDocument7 pagesClifford Chance - Distressed CryptoassetsAlexNo ratings yet

- SSRN Id3211745Document42 pagesSSRN Id3211745Cypag Asistente Rev fiscalNo ratings yet

- SSRN Id2936294Document70 pagesSSRN Id2936294manal jaafarNo ratings yet

- Federal Reserve & BitcoinDocument20 pagesFederal Reserve & BitcoinCensored News Now100% (1)

- Contracts Ex Machina: Evin Erbach Icolas OrnellDocument70 pagesContracts Ex Machina: Evin Erbach Icolas OrnellPablo ArteagaNo ratings yet

- SEC v. Coinbase, Coinbase Answer To ComplaintDocument177 pagesSEC v. Coinbase, Coinbase Answer To Complaintjeff_roberts881100% (1)

- Blockchain and The LawDocument2 pagesBlockchain and The LawIvan StankovićNo ratings yet

- It Now Trades On 18 ExchangesDocument7 pagesIt Now Trades On 18 ExchangesDouglas SlainNo ratings yet

- A Strategists Guide To Blockchain - PWC PDFDocument17 pagesA Strategists Guide To Blockchain - PWC PDFJorge Ivan Zapata RiverosNo ratings yet

- SSRN Id3265295Document51 pagesSSRN Id3265295NiellaNo ratings yet

- The Vienna Convention On International Sales of GoDocument11 pagesThe Vienna Convention On International Sales of GoHenrique SimõesNo ratings yet

- Recent Guidance - SEC Provides Analytical Tools For Assessing Digital Assets (Harvard Law Review)Document9 pagesRecent Guidance - SEC Provides Analytical Tools For Assessing Digital Assets (Harvard Law Review)PhilAeonNo ratings yet

- A Cyber-Skeptics Concerns About The State of Lex CryptographiaDocument18 pagesA Cyber-Skeptics Concerns About The State of Lex CryptographiaJoelcyo Veras CostaNo ratings yet

- The Regulation of Cryptocurrency-Between Currency and A Financial ProductDocument39 pagesThe Regulation of Cryptocurrency-Between Currency and A Financial ProductEusebio Olindo Lopez SamudioNo ratings yet

- DTC PDFDocument49 pagesDTC PDFEugene S. Globe III100% (2)

- Q5) Do A Research On Bitcoins. Ans: What Is Bitcoin?Document5 pagesQ5) Do A Research On Bitcoins. Ans: What Is Bitcoin?Divya GothiNo ratings yet

- Blockchain-Based Token Sales, Initial Coin Offerings, and The Democratization of Public Capital MarketsDocument115 pagesBlockchain-Based Token Sales, Initial Coin Offerings, and The Democratization of Public Capital MarketsmarpernasNo ratings yet

- SSRN Id4459873Document21 pagesSSRN Id4459873AmadorNo ratings yet

- What Is CryptocurrencyDocument15 pagesWhat Is CryptocurrencyMuhammad FaizanNo ratings yet

- Bitcoin Property Law Seminar PaperDocument27 pagesBitcoin Property Law Seminar PapershacisaNo ratings yet

- Ico ImpDocument43 pagesIco Impm_vamshikrishna22No ratings yet

- 21.1 Alberts Final WebDocument21 pages21.1 Alberts Final WebnepretipNo ratings yet

- Topic: Cryptocurrency: HistoryDocument14 pagesTopic: Cryptocurrency: HistoryVindhya ShankerNo ratings yet

- Block Chain ReportDocument39 pagesBlock Chain Reportantonio gomezNo ratings yet

- Finance For EntrepreneursDocument17 pagesFinance For EntrepreneursAnza FatimaNo ratings yet

- University of Birmingham: Regulation by BlockchainDocument28 pagesUniversity of Birmingham: Regulation by BlockchainEstudio ReynaNo ratings yet

- Implications of Adopting Blockchain Technology On International SDocument28 pagesImplications of Adopting Blockchain Technology On International SDiệu PhanNo ratings yet

- Stikeman Elliott - Blockchain Cryptocurrency Regulation 2024Document16 pagesStikeman Elliott - Blockchain Cryptocurrency Regulation 2024Neil GutierrezNo ratings yet

- An Introduction To Cryptocurrency Laws In The United States: A Simplified And Concise GuideFrom EverandAn Introduction To Cryptocurrency Laws In The United States: A Simplified And Concise GuideNo ratings yet

- Publication Legal Update Crypto and NFT Assets in Fraud and Asset Recovery Litigation 150223Document8 pagesPublication Legal Update Crypto and NFT Assets in Fraud and Asset Recovery Litigation 150223Nguyen Hoang Phuong UyenNo ratings yet

- United States Court of Appeals: USCA Case #22-1142 Document #2014527 Filed: 08/29/2023 Page 1 of 21Document21 pagesUnited States Court of Appeals: USCA Case #22-1142 Document #2014527 Filed: 08/29/2023 Page 1 of 21Diogo CoelhoNo ratings yet

- Article - 04 - Blockchain and Legal Issues in Emerging MarketsDocument10 pagesArticle - 04 - Blockchain and Legal Issues in Emerging MarketsLionelPintoNo ratings yet

- SSRN Id3895404Document8 pagesSSRN Id3895404Eve AthanasekouNo ratings yet

- Earthium Brochure EN - CPDocument24 pagesEarthium Brochure EN - CPwhatsapp statusNo ratings yet

- Green Technology, The Use of Blockchains ArticleDocument3 pagesGreen Technology, The Use of Blockchains Articlewhatsapp statusNo ratings yet

- Why Plate Hates DemocracyDocument2 pagesWhy Plate Hates Democracywhatsapp statusNo ratings yet

- Ways To Turn Unused Space Into The Rooms You NeedDocument5 pagesWays To Turn Unused Space Into The Rooms You Needwhatsapp statusNo ratings yet

- Punctuation: The Value of PunctuationDocument3 pagesPunctuation: The Value of Punctuationwhatsapp statusNo ratings yet

- Untitled DocumentDocument3 pagesUntitled Documentwhatsapp statusNo ratings yet

- FA Dec 2021Document8 pagesFA Dec 2021Shawn LiewNo ratings yet

- Ch. 14 Economic StabilityDocument8 pagesCh. 14 Economic StabilityHANNAH GODBEHERENo ratings yet

- Corporate Law May 2019Document2 pagesCorporate Law May 2019sreehari dineshNo ratings yet

- Arcade Interior Mall LLP: Performa Invoice / QuotationDocument4 pagesArcade Interior Mall LLP: Performa Invoice / QuotationSourabh JaatNo ratings yet

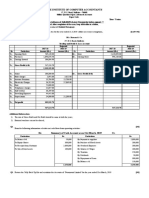

- The Institute of Computer AccountantsDocument1 pageThe Institute of Computer AccountantsankitNo ratings yet

- U.S. Individual Income Tax Return: Filing StatusDocument28 pagesU.S. Individual Income Tax Return: Filing StatusSenae Lopez100% (3)

- Deobhakta-Analysis of Social Costs of Gentrification in Over-the-Rhine ADocument190 pagesDeobhakta-Analysis of Social Costs of Gentrification in Over-the-Rhine AElizabeth KeslacyNo ratings yet

- Understanding Globalisation My NotesDocument4 pagesUnderstanding Globalisation My NotesShania Y. RampaulNo ratings yet

- Inventory MangementDocument58 pagesInventory MangementRazita RathoreNo ratings yet

- RBL Bank AR - 2020Document156 pagesRBL Bank AR - 2020anil1820No ratings yet

- Essentials of Economics 9th Edition Schiller Solutions ManualDocument35 pagesEssentials of Economics 9th Edition Schiller Solutions Manualupwindscatterf9ebp100% (21)

- Complete FormDocument58 pagesComplete FormFazrol RahmanNo ratings yet

- ISB535 Individual AssingmentDocument11 pagesISB535 Individual AssingmentnazrysllNo ratings yet

- Capital Structure, Capitalisation and LeverageDocument53 pagesCapital Structure, Capitalisation and LeverageCollins NyendwaNo ratings yet

- Tax Invoice: Agarwal Impex 21-22/745 5-Feb-2022Document2 pagesTax Invoice: Agarwal Impex 21-22/745 5-Feb-2022bhola.vilesh7No ratings yet

- Annual Report PT Kim 2017 PDFDocument210 pagesAnnual Report PT Kim 2017 PDFMustakimNo ratings yet

- Investment Decision - IciciDocument8 pagesInvestment Decision - Icicimohammed khayyumNo ratings yet

- FN2191 Commentary 2022Document27 pagesFN2191 Commentary 2022slimshadyNo ratings yet

- MoneyCard StatementPDF 14804392Document4 pagesMoneyCard StatementPDF 14804392ade adeNo ratings yet

- Sholihah 2020Document12 pagesSholihah 2020salsabila fitristantiNo ratings yet

- Financial Ratio Analysis of Square Pharmaceuticals Limited: Asif AhmedDocument24 pagesFinancial Ratio Analysis of Square Pharmaceuticals Limited: Asif AhmedMD. MUNTASIR MAMUN SHOVONNo ratings yet

- 45thGIC Re Annual-Report 2016-17 Eng PDFDocument288 pages45thGIC Re Annual-Report 2016-17 Eng PDFMuthu RaveendranNo ratings yet

- Whitepaper 2Document8 pagesWhitepaper 2Minhayati BklNo ratings yet

- Pre Final Examination On Regulatory FrameworkDocument2 pagesPre Final Examination On Regulatory FrameworkAmy Grace MallillinNo ratings yet

- Appendix A - Labuan Substance Listing (Updated) 210201Document2 pagesAppendix A - Labuan Substance Listing (Updated) 210201Shahrani KassimNo ratings yet