Professional Documents

Culture Documents

Retail Bakeries Financial Industry Analysis - Sageworks

Retail Bakeries Financial Industry Analysis - Sageworks

Uploaded by

Michael Enrique Pérez Moreira0 ratings0% found this document useful (0 votes)

14 views4 pagesThe document provides financial data and ratios for the retail bakery industry from 2020, 2019, and previous years. Key metrics include gross profit margins averaging 56-57% over time, current ratios around 3.6x, and net profit margins of 5-6%. Sales declined 18% in the last 12 months while profits grew 56%. Common size income statements show cost of goods sold is 43-57% of sales and overhead is 42-45% of sales.

Original Description:

Original Title

311811 Retail Bakeries Financial Industry Analysis - Sageworks

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document provides financial data and ratios for the retail bakery industry from 2020, 2019, and previous years. Key metrics include gross profit margins averaging 56-57% over time, current ratios around 3.6x, and net profit margins of 5-6%. Sales declined 18% in the last 12 months while profits grew 56%. Common size income statements show cost of goods sold is 43-57% of sales and overhead is 42-45% of sales.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

14 views4 pagesRetail Bakeries Financial Industry Analysis - Sageworks

Retail Bakeries Financial Industry Analysis - Sageworks

Uploaded by

Michael Enrique Pérez MoreiraThe document provides financial data and ratios for the retail bakery industry from 2020, 2019, and previous years. Key metrics include gross profit margins averaging 56-57% over time, current ratios around 3.6x, and net profit margins of 5-6%. Sales declined 18% in the last 12 months while profits grew 56%. Common size income statements show cost of goods sold is 43-57% of sales and overhead is 42-45% of sales.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 4

Industry: 311811 - Retail Bakeries

Sales Range: All Sales Ranges

Location: All Areas

Prepared On: 5/1/2021

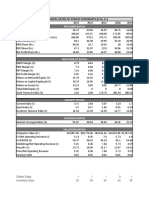

INDUSTRY FINANCIAL DATA AND RATIOS

Average by Year (Number of Financial Statements)

Last 12

2020 2019 Last 5 Years All Years

Financial Metric Months

(26) (52) (359) (1,166)

(24)

Current Ratio 3.67 3.64 5.15 4.10 3.31

Quick Ratio 3.24 3.16 3.52 2.87 2.25

Gross Profit Margin 57.26% 56.72% 55.91% 56.79% 54.45%

Net Profit Margin 5.41% 5.00% 6.25% 6.39% 4.39%

Inventory Days 18.55 21.19 24.10 18.17 19.63

Accounts Receivable

11.09 11.72 15.07 15.65 14.21

Days

Accounts Payable Days 15.31 14.89 61.45 33.50 33.41

Interest Coverage Ratio 9.10 8.41 14.28 17.70 12.78

Debt-to-Equity Ratio 1.97 1.97 1.67 1.61 1.99

Debt Service Coverage

5.44 5.44 4.68 7.37 6.85

Ratio

Return on Equity 56.97% 56.97% 32.00% 38.85% 33.84%

Return on Assets 13.46% 12.95% 21.67% 14.53% 11.07%

Gross Fixed Asset

2.61 2.77 4.94 3.64 3.67

Turnover

Sales per Employee -- -- $67,062 $60,426 $63,133

Profit per Employee -- -- $24,382 $14,968 $2,470

Last 12

2020 2019 Last 5 Years All Years

Growth Metric Months

(9) (32) (229) (659)

(9)

Sales Growth -17.82% -17.82% 10.28% 8.11% 8.82%

Profit Growth 55.90% 55.90% 33.79% 12.43% 24.45%

*This benchmark has been set according to where a healthy business within the industry would perform.

INDUSTRY DATA COMMON SIZE

Average by Year (Number of Financial Statements)

Last 12

2020 2019 Last 5 Years All Years

Income Statement Months

(26) (52) (359) (1,166)

(24)

Sales (Income) 100.00% 100.00% 100.00% 100.00% 100.00%

Cost of Sales (COGS) 56.86% 43.28% 44.09% 43.21% 45.55%

Gross Profit 57.26% 56.72% 55.91% 56.79% 54.45%

Depreciation 1.06% 0.93% 1.98% 2.10% 1.90%

Overhead or S,G,& A

44.94% 41.72% 37.13% 38.36% 39.90%

Expenses

Other Operating

0.00% 0.00% 0.00% 0.01% 0.01%

Income

Other Operating

8.23% 8.19% 9.53% 9.13% 7.59%

Expenses

Operating Profit 7.27% 5.89% 7.23% 7.17% 5.03%

Interest Expense 0.89% 0.89% 0.92% 0.75% 0.76%

Other Income 0.01% 0.01% 0.03% 0.04% 0.04%

Other Expenses 0.00% 0.00% 0.09% 0.08% 0.07%

Net Profit Before Taxes 5.41% 5.00% 6.25% 6.38% 4.24%

Adjusted Owner's

0.00% 0.00% 0.00% 0.01% 0.16%

Compensation

Adjusted Net Profit

5.41% 5.00% 6.25% 6.39% 4.39%

Before Taxes

EBITDA 9.59% 6.82% 9.15% 9.22% 6.90%

Taxes Paid 1.74% 1.12% 1.26%

Net Income 5.80% 5.00% 4.50% 5.25% 2.98%

Last 12

2020 2019 Last 5 Years All Years

Balance Sheet Months

(26) (52) (359) (1,166)

(24)

Cash (Bank Funds) 26.42% 22.43% 16.09% 16.44% 12.92%

Accounts Receivable 3.11% 3.54% 8.95% 9.67% 10.31%

Inventory 4.85% 6.84% 6.93% 6.05% 7.39%

Other Current Assets 1.31% 1.28% 2.54% 1.63% 1.87%

Total Current Assets 55.55% 52.22% 52.92% 47.73% 46.29%

Gross Fixed Assets 101.22% 98.83% 89.14% 103.00% 103.45%

Accumulated

74.91% 58.93% 49.69% 56.88% 56.88%

Depreciation

Net Fixed Assets 43.14% 39.90% 39.44% 46.12% 46.58%

Other Assets 7.88% 7.88% 7.64% 6.16% 7.14%

Total Assets 100.00% 100.00% 100.00% 100.00% 100.00%

Accounts Payable 3.59% 5.84% 8.44% 8.74% 12.06%

Notes Payable / Current

Portion of Long Term 1.62% 2.40% 1.38% 1.11% 0.86%

Debt

Other Current Liabilities 7.96% 12.22% 10.07% 9.11% 12.93%

Total Current Liabilities 19.36% 29.63% 32.33% 28.78% 35.87%

Total Long Term

37.63% 69.99% 43.92% 42.67% 40.22%

Liabilities

Total Liabilities 71.05% 99.62% 76.25% 71.45% 76.09%

Preferred Stock 0.00% 0.00% 0.00% 0.00% 0.00%

Common Stock 0.53% 0.74% 0.49% 0.39% 0.45%

Additional Paid-in

0.57% 0.69% 1.12% 1.28% 0.90%

Capital

Other Stock / Equity 2.88% 3.37% 1.94% 1.80% 1.79%

Ending Retained

14.08% 7.65% 13.93% 20.86% 15.65%

Earnings

Total Equity 2.11% 0.38% 23.75% 28.55% 23.91%

Total Liabilities + Equity 100.00% 100.00% 100.00% 100.00% 100.00%

INDUSTRY DATA COMMON SIZE SUB ACCOUNTS

Average by Year (Number of Financial Statements)

Last 12

Income Statement 2020 2019 Last 5 Years All Years

Months

29.38% 26.88% 23.49% 24.06% 22.47%

Payroll

(8) (9) (35) (235) (682)

6.15% 6.08% 6.24% 6.07% 6.15%

Rent

(17) (18) (34) (222) (668)

1.35% 1.46% 1.24% 1.12% 1.10%

Advertising

(16) (17) (33) (218) (635)

You might also like

- Task 3 - DCF ModelDocument10 pagesTask 3 - DCF Modeldavin nathan50% (2)

- NBA Happy Hour Co - DCF Model v2Document10 pagesNBA Happy Hour Co - DCF Model v2Siddhant Aggarwal50% (2)

- Daktronics Analysis 1Document27 pagesDaktronics Analysis 1Shannan Richards100% (4)

- Project Report On "Symphony Air Cooler"Document47 pagesProject Report On "Symphony Air Cooler"Ronak Jain100% (1)

- Muhammad Farrukh QAMAR - Assessment 2 Student Practical Demonstration of Tasks AURAMA006 V2Document19 pagesMuhammad Farrukh QAMAR - Assessment 2 Student Practical Demonstration of Tasks AURAMA006 V2Rana Muhammad Ashfaq Khan0% (1)

- Solutions. A1Document11 pagesSolutions. A1Annalyn ArnaldoNo ratings yet

- DR Lal Path Labs Financial Model - Ayushi JainDocument45 pagesDR Lal Path Labs Financial Model - Ayushi JainTanya SinghNo ratings yet

- Nba Advanced - Happy Hour Co - DCF Model v2Document10 pagesNba Advanced - Happy Hour Co - DCF Model v2Siddhant AggarwalNo ratings yet

- Schaum's Outline of Basic Business Mathematics, 2edFrom EverandSchaum's Outline of Basic Business Mathematics, 2edRating: 5 out of 5 stars5/5 (2)

- w8 Wizard Lições 181 e 182Document4 pagesw8 Wizard Lições 181 e 182rafaela popovNo ratings yet

- Quality Manager Job DescriptionDocument2 pagesQuality Manager Job DescriptionKhalid Mahmood100% (2)

- Pepsi Lipton Number WorkDocument16 pagesPepsi Lipton Number WorkSachin KamraNo ratings yet

- TB Chapter02Document54 pagesTB Chapter02Dan Andrei BongoNo ratings yet

- Fundamentals Ratios For YPF SA: Growth Rates 2020 2019 2018 2017 2016Document3 pagesFundamentals Ratios For YPF SA: Growth Rates 2020 2019 2018 2017 2016Isra MachicadoNo ratings yet

- Albermarle Financial ModelDocument38 pagesAlbermarle Financial ModelParas AroraNo ratings yet

- AOFSDocument15 pagesAOFS1abd1212abdNo ratings yet

- Task 3 DCF ModelDocument10 pagesTask 3 DCF Modelkrishjain1178No ratings yet

- Ratio Analysis: Liquidity RatiosDocument2 pagesRatio Analysis: Liquidity RatiosSuryakantNo ratings yet

- 2017 4Q Earnings Release Samsung ElectronicsDocument8 pages2017 4Q Earnings Release Samsung ElectronicsAlin RewaxisNo ratings yet

- Investment Valuation Ratios Years Mar-19 Mar-18 Mar-17 Mar-16 Mar-15Document4 pagesInvestment Valuation Ratios Years Mar-19 Mar-18 Mar-17 Mar-16 Mar-15honey08priya1No ratings yet

- Aztecsoft Financial Results Q2 09Document5 pagesAztecsoft Financial Results Q2 09Mindtree LtdNo ratings yet

- Financial RatiosDocument2 pagesFinancial RatiosErubiel ChavezNo ratings yet

- Samsung FY16 Q4 PresentationDocument8 pagesSamsung FY16 Q4 PresentationJeevan ParameswaranNo ratings yet

- Creative Sports Solution-RevisedDocument4 pagesCreative Sports Solution-RevisedRohit KumarNo ratings yet

- Financial Ratios of NHPCDocument2 pagesFinancial Ratios of NHPCsathish kumarNo ratings yet

- Description 2019 2018 2017 2016: Statement of Consolidated Cash FloDocument1 pageDescription 2019 2018 2017 2016: Statement of Consolidated Cash FloAspan FLNo ratings yet

- HDFC Bank LTD - Income Statement 11-Sep-2021 21:22Document7 pagesHDFC Bank LTD - Income Statement 11-Sep-2021 21:22Naman KalraNo ratings yet

- Excel Table DataDocument18 pagesExcel Table DataSamreen malikNo ratings yet

- Estados Financieros Colgate. Analísis Vertical y HorizontalDocument5 pagesEstados Financieros Colgate. Analísis Vertical y HorizontalXimena Isela Villalpando BuenoNo ratings yet

- Marico Financial Model (Final) (Final-1Document22 pagesMarico Financial Model (Final) (Final-1Jayant JainNo ratings yet

- Samsung Electronics: Earnings Release Q2 2016Document8 pagesSamsung Electronics: Earnings Release Q2 2016Syed Mohd AliNo ratings yet

- Tech Mahindra Valuation Report FY21 Equity Inv CIA3Document5 pagesTech Mahindra Valuation Report FY21 Equity Inv CIA3safwan hosainNo ratings yet

- Financial Planning and Strategy Problem 1 Bajaj Auto LTDDocument4 pagesFinancial Planning and Strategy Problem 1 Bajaj Auto LTDMukul KadyanNo ratings yet

- Sambal Owner of ZeeDocument2 pagesSambal Owner of Zeesagar naikNo ratings yet

- Samsung Electronics: Earnings Release Q4 2020Document8 pagesSamsung Electronics: Earnings Release Q4 2020Aidə MəmmədzadəNo ratings yet

- IM ProjectDocument24 pagesIM ProjectDäzzlîñg HärîshNo ratings yet

- CAGR W.R.T First Year: (All Figures in INR Lakhs Unless Stated Otherwise)Document22 pagesCAGR W.R.T First Year: (All Figures in INR Lakhs Unless Stated Otherwise)Garima GulatiNo ratings yet

- Icici 1Document2 pagesIcici 1AishwaryaSushantNo ratings yet

- Financial Ratios of Federal BankDocument35 pagesFinancial Ratios of Federal BankVivek RanjanNo ratings yet

- Aztecsoft Financial Results Q1-09 Press ReleaseDocument5 pagesAztecsoft Financial Results Q1-09 Press ReleaseMindtree LtdNo ratings yet

- AkzoNobel Last Five YearsDocument2 pagesAkzoNobel Last Five YearsNawair IshfaqNo ratings yet

- Shoppers Stop Financial Model - 24july2021Document23 pagesShoppers Stop Financial Model - 24july2021ELIF KOTADIYANo ratings yet

- CG Ratio-Analysis-UnsolvedDocument15 pagesCG Ratio-Analysis-Unsolvedsumit3902No ratings yet

- Ratios FinDocument30 pagesRatios Fingaurav sahuNo ratings yet

- Persistent Annual Report 2022Document2 pagesPersistent Annual Report 2022Ashwin GophanNo ratings yet

- Ratios FinancialDocument16 pagesRatios Financialgaurav sahuNo ratings yet

- Ratios FinDocument16 pagesRatios Fingaurav sahuNo ratings yet

- Ratios FinancialDocument16 pagesRatios Financialgaurav sahuNo ratings yet

- Akash 5yr PidiliteDocument9 pagesAkash 5yr PidiliteAkash Didharia100% (1)

- Activity 3 123456789Document7 pagesActivity 3 123456789Jeramie Sarita SumaotNo ratings yet

- Nba Advanced - Happy Hour Co - DCF Model v2Document10 pagesNba Advanced - Happy Hour Co - DCF Model v221BAM045 Sandhiya SNo ratings yet

- Samsung FY16 Q3 PresentationDocument8 pagesSamsung FY16 Q3 PresentationJeevan ParameswaranNo ratings yet

- Financial RatiosDocument2 pagesFinancial Ratiosranjansolanki13No ratings yet

- TVS Motors Live Project Final 2Document39 pagesTVS Motors Live Project Final 2ritususmitakarNo ratings yet

- Per Share Ratios: Mar ' 09 Mar ' 08 Mar ' 07 Mar ' 06 Mar ' 05Document4 pagesPer Share Ratios: Mar ' 09 Mar ' 08 Mar ' 07 Mar ' 06 Mar ' 05alihayatNo ratings yet

- Himatsingka Seida LTD.: Ratio Analysis SheetDocument1 pageHimatsingka Seida LTD.: Ratio Analysis SheetNeetesh DohareNo ratings yet

- Revised Project reportDocument29 pagesRevised Project reportsanthoshkasani9No ratings yet

- Equity Share Data HDFC Bank Mar-20 SBI Mar-19 HDFC Bank/ SBIDocument8 pagesEquity Share Data HDFC Bank Mar-20 SBI Mar-19 HDFC Bank/ SBIAkshaya LakshminarasimhanNo ratings yet

- Basf RatiosDocument2 pagesBasf Ratiosprajaktashirke49No ratings yet

- Radico KhaitanDocument38 pagesRadico Khaitantapasya khanijouNo ratings yet

- Chocolat AnalysisDocument19 pagesChocolat Analysisankitamoney1No ratings yet

- CCS G4Document14 pagesCCS G4Harshit AroraNo ratings yet

- 2015 04 Investor Presentation 23 27Document5 pages2015 04 Investor Presentation 23 27Abhimanyu SahniNo ratings yet

- Understanding the Mathematics of Personal Finance: An Introduction to Financial LiteracyFrom EverandUnderstanding the Mathematics of Personal Finance: An Introduction to Financial LiteracyNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Middle East and North Africa Quarterly Economic Brief, January 2014: Growth Slowdown Heightens the Need for ReformsFrom EverandMiddle East and North Africa Quarterly Economic Brief, January 2014: Growth Slowdown Heightens the Need for ReformsNo ratings yet

- Research Maliban GarmentsDocument55 pagesResearch Maliban GarmentsDINUNo ratings yet

- Comparative Study On Npa of Public Sector Bank and Private Sector BankDocument45 pagesComparative Study On Npa of Public Sector Bank and Private Sector BankTushar SikarwarNo ratings yet

- Chapter 5 - Marketing Channel - GuideDocument24 pagesChapter 5 - Marketing Channel - GuideJulia CanoNo ratings yet

- Cash Flow Literature ReviewDocument6 pagesCash Flow Literature Reviewelfgxwwgf100% (1)

- Royal Mail Our-Prices-October-2023Document3 pagesRoyal Mail Our-Prices-October-2023LionelNo ratings yet

- CL Suggested Ans - Nov Dec 2019 PDFDocument63 pagesCL Suggested Ans - Nov Dec 2019 PDFMd SelimNo ratings yet

- Environmental Audit Manual EDITED 29 Nov 2010Document79 pagesEnvironmental Audit Manual EDITED 29 Nov 2010JocelynKongSingCheah100% (1)

- Acknowledgement: Chapter OneDocument4 pagesAcknowledgement: Chapter OneElham AliNo ratings yet

- Cash Flow AnalysisDocument7 pagesCash Flow AnalysisDr. Shoaib MohammedNo ratings yet

- S.Y .B.M.S. (Sem. III) (Choice Base) 80308 - Accounting For Managerial Decision-1Document5 pagesS.Y .B.M.S. (Sem. III) (Choice Base) 80308 - Accounting For Managerial Decision-1Bhoomi BhanushaliNo ratings yet

- RA 8751 Countervailing LawDocument6 pagesRA 8751 Countervailing LawAgnus SiorNo ratings yet

- Zeeta Electricals AND Engineering PVT - LTDDocument75 pagesZeeta Electricals AND Engineering PVT - LTDPiyush PatelNo ratings yet

- Wcms 757878Document15 pagesWcms 757878Anjali jangidNo ratings yet

- Topic 1 - Corporate Objectives, Strategy and StructureDocument28 pagesTopic 1 - Corporate Objectives, Strategy and StructureJoseph VillartaNo ratings yet

- Chapter 9 TaxDocument27 pagesChapter 9 TaxJason MalikNo ratings yet

- Framework For Competitor AnalysisDocument2 pagesFramework For Competitor AnalysisPallabi Pattanayak100% (2)

- Robber Barons or Captains of IndustryDocument24 pagesRobber Barons or Captains of IndustryNicholas SchmidtNo ratings yet

- Annual Report and Accounts 2022Document288 pagesAnnual Report and Accounts 2022Mo JoNo ratings yet

- TD RD EncashmentDocument14 pagesTD RD EncashmentJubaida Alam 203-22-694No ratings yet

- Checking Account StatementDocument6 pagesChecking Account StatementGary VibbertNo ratings yet

- Payroll Accounting & Other Selected TransactionDocument29 pagesPayroll Accounting & Other Selected TransactionParamorfsNo ratings yet

- State Bank of India: Batch Number-PAT01IC1921Document23 pagesState Bank of India: Batch Number-PAT01IC1921DIWAKAR KUMARNo ratings yet

- Paryavaran Guidance Manual Jun 2014 (1) - CompressedDocument125 pagesParyavaran Guidance Manual Jun 2014 (1) - Compressedomkar.bhavleNo ratings yet