Professional Documents

Culture Documents

Fixed Income Market Report - 25.07.2022

Fixed Income Market Report - 25.07.2022

Uploaded by

Fuaad DodooOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Fixed Income Market Report - 25.07.2022

Fixed Income Market Report - 25.07.2022

Uploaded by

Fuaad DodooCopyright:

Available Formats

25TH JULY 2022

FIXED INCOME MARKET REPORT

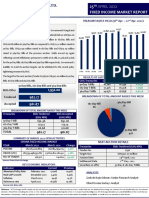

TENDER #1808 TREASURY RATES YIELD (18th July – 22nd July

2022)

FIXED INCOME MARKET HIGHLIGHTS

At last week’s auction, bids tendered substantially exceeded

Government’s target by GH¢1,581.25 million. However, accepted bids

were marginally below tendered bids as GH¢1,273.92 million was

raised in 91-Day Bills, GH¢974.97 million in 182-Day Bills, GH¢158.96

million in 364-Day Bills and GH¢1,116.85 million in 3-Yr FXR Bond as

compared to GH¢886.24 million raised in 91-Day Bills and GH¢202.25

million in 182-Day Bills at the previous auction.

Yields continued to climb up, reflecting current Inflationary pressures

to settle at 26.34%, 28.06%, 27.85% and 29.85% for the 91-Day Bills, 182-

Day Bills, 364-Day Bills and 3-Yr FXR Bond respectively.

ss

The target for the next auction (Tender #1809) is GH¢564.00 million

in 91-Day Bills and 182-Day Bills. RESULTS OF LAST WEEK’S TREASURY BILL AUCTION

GOG Treasuries Current Previous Change

91-Day Bills & 182-Day Bills 91-Day T-Bills 26.34% 25.96% 0.38%

182-Day T-Bills 28.06% 27.46% 0.60%

BOG Offer 1,947.00 364-Day T-Bills 27.85% 27.49% 0.36%

3-Yr FXR Bond 29.85% 25.00% 4.850%

Tendered 3,528.25 BREAKDOWN OF TOTAL AMOUNT RAISED THIS WEEK

Accepted 3,524.70

3-Yr FXR Bond 91-Day Bill

BREAKDOWN OF TOTAL AMOUNT RAISED THIS WEEK 32% 36%

Treasuries Bids Tendered Bids Accepted

(GH¢ MN) (GH¢ MN)

91-Day T-Bill 1,273.93 1,273.92

182-Day T-Bill 975.00 974.97

364-Day T-Bills 162.47 158.96

3-Yr FXR Bond 1,116.85 1,116.85 364-Day Bill

4%

TOTAL 3,528.25 3,524.70 SSS 182-Day Bill

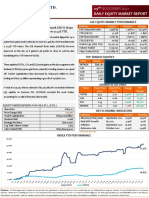

SUMMARY OF JUNE 2022 GFIM ACTIVITIES 28%

GHANA FIXED INCOME MARKET NEXT AUCTION DETAILS

YEAR June 2022 June 2021 Change

Treasuries Bids Tendered (GH¢ MN)

VOLUME 24,924,071,691 18,163,019,415 37.22%

Tender No. 1809

VALUE (GH¢) 24,110,648,890.13 19,287,110,114.77 25.00% Target Size GH¢564.00 million

NO. OF TRADES 45,179 22,750 98.58% Auction Date 29th July, 2022

Source: Ghana Stock Exchange

KEY ECONOMIC INDICATORS Settlement Date 1st August, 2022

Indicator Current Previous Securities on offer 91-Day & 182-Day T-Bills

Monetary Policy Rate July 2022 19.00% 19.00% ANALYSTS

Real GDP Growth December 2021 5.40% 0.40%

Inflation June 2022 29.8% 27.6% Godwin Kojo Odoom: Senior Research Analyst

Reference rate June 2022 20.80% 19.18%

Obed Owusu Sackey: Analyst

Source: GSS, BOG, GBA

Disclaimer - SIC Brokerage and its employees do not make any guarantee or other promise as to any results that may be obtained from using our content. No one should make any investment

decision without first consulting his or her own Investment advisor and conducting his or her own research and due diligence. SIC Brokerage disclaims any and all liabilities in the event that any

Information, commentary, analysis, opinions, advice and/or recommendations prove to be inaccurate, incomplete or unreliable, or result in any investment or other losses.

You might also like

- Principles of Macroeconomics 12Th Edition by Karl E Case Full ChapterDocument41 pagesPrinciples of Macroeconomics 12Th Edition by Karl E Case Full Chapterjulie.mccoach97695% (22)

- iAL Economics Unit 4 Specimen Paper QPDocument24 pagesiAL Economics Unit 4 Specimen Paper QPSamuel KiruparajNo ratings yet

- Econ 1010 NotesDocument11 pagesEcon 1010 NotesDonnyNo ratings yet

- Fixed Income Market Report - 01.08.2022Document1 pageFixed Income Market Report - 01.08.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 18.07.2022Document1 pageFixed Income Market Report - 18.07.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 04.07.2022Document1 pageFixed Income Market Report - 04.07.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 12.07.2022Document1 pageFixed Income Market Report - 12.07.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 30.05.2022Document1 pageFixed Income Market Report - 30.05.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 08.08.2022Document1 pageFixed Income Market Report - 08.08.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 04.05.2022Document1 pageFixed Income Market Report - 04.05.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 29.08.2022Document1 pageFixed Income Market Report - 29.08.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 19.04.2022Document1 pageFixed Income Market Report - 19.04.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 25.04.2022Document1 pageFixed Income Market Report - 25.04.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 12.09.2022Document1 pageFixed Income Market Report - 12.09.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 03.10.2022Document1 pageFixed Income Market Report - 03.10.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 31.01.2022Document1 pageFixed Income Market Report - 31.01.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 22.08.2022Document1 pageFixed Income Market Report - 22.08.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 10.10.2022Document1 pageFixed Income Market Report - 10.10.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 26.09.2022Document1 pageFixed Income Market Report - 26.09.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 28.02.2022Document1 pageFixed Income Market Report - 28.02.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 19.09.2022Document1 pageFixed Income Market Report - 19.09.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 21.02.2022Document1 pageFixed Income Market Report - 21.02.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 17.01.2022Document1 pageFixed Income Market Report - 17.01.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 20.07.2022Document1 pageDaily Equity Market Report - 20.07.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 30.06.2022Document1 pageDaily Equity Market Report - 30.06.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 13.07.2022Document1 pageDaily Equity Market Report - 13.07.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 14.09.2022Document1 pageDaily Equity Market Report - 14.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 02.06.2022Document1 pageDaily Equity Market Report - 02.06.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 05.07.2022Document1 pageDaily Equity Market Report - 05.07.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 18.03.2022Document2 pagesWeekly Capital Market Report - Week Ending 18.03.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 02.08.2022Document1 pageDaily Equity Market Report - 02.08.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 26.05.2022Document1 pageDaily Equity Market Report - 26.05.2022Fuaad DodooNo ratings yet

- Auctresults 1800Document1 pageAuctresults 1800Fuaad DodooNo ratings yet

- Daily Equity Market Report - 08.02.2022Document1 pageDaily Equity Market Report - 08.02.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 01.03.2022Document1 pageDaily Equity Market Report - 01.03.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 22.09.2022Document1 pageDaily Equity Market Report - 22.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 27.07.2022Document1 pageDaily Equity Market Report - 27.07.2022Fuaad DodooNo ratings yet

- ACIGH - Money Markets Update - 20-05-2024Document2 pagesACIGH - Money Markets Update - 20-05-2024KofikoduahNo ratings yet

- Daily Equity Market Report 20.09.2022 2022-09-20Document1 pageDaily Equity Market Report 20.09.2022 2022-09-20Fuaad DodooNo ratings yet

- Daily Equity Market Report - 28.07.2022Document1 pageDaily Equity Market Report - 28.07.2022Fuaad DodooNo ratings yet

- ACIGH - Money Markets Update - 25092023Document1 pageACIGH - Money Markets Update - 25092023KofikoduahNo ratings yet

- Daily Equity Market Report - 09.11.2021Document1 pageDaily Equity Market Report - 09.11.2021Fuaad DodooNo ratings yet

- BOG Notice No 06 FMD T Bills Auctresults 1782 21st Jan 2022Document1 pageBOG Notice No 06 FMD T Bills Auctresults 1782 21st Jan 2022Fuaad DodooNo ratings yet

- Daily Equity Market Report 04.07.2022 2022-07-04Document1 pageDaily Equity Market Report 04.07.2022 2022-07-04Fuaad DodooNo ratings yet

- Daily Equity Market Report - 03.03.2022Document1 pageDaily Equity Market Report - 03.03.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report 18.08.2022 2022-08-18Document1 pageDaily Equity Market Report 18.08.2022 2022-08-18Fuaad DodooNo ratings yet

- Weekly Financial Market Review - Week Ending 26-03-2021Document2 pagesWeekly Financial Market Review - Week Ending 26-03-2021Fuaad DodooNo ratings yet

- Daily Equity Market Report - 18.01.2022Document1 pageDaily Equity Market Report - 18.01.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 08.06.2022Document1 pageDaily Equity Market Report - 08.06.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 26.09.2022Document1 pageDaily Equity Market Report - 26.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 30.08.2022Document1 pageDaily Equity Market Report - 30.08.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 17.10.2022Document1 pageDaily Equity Market Report - 17.10.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 14.01.2022Document2 pagesWeekly Capital Market Report - Week Ending 14.01.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report 07.06.2022 2022-06-07Document1 pageDaily Equity Market Report 07.06.2022 2022-06-07Fuaad DodooNo ratings yet

- Daily Equity Market Report - 09.06.2022Document1 pageDaily Equity Market Report - 09.06.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 13.09.2022Document1 pageDaily Equity Market Report - 13.09.2022Fuaad DodooNo ratings yet

- Market Report For MarchDocument19 pagesMarket Report For MarchFuaad DodooNo ratings yet

- Site Daily Dashboard: Today Report For Week Site Week EndingDocument19 pagesSite Daily Dashboard: Today Report For Week Site Week EndingSHIEVANESAAN RAVEENo ratings yet

- Daily Equity Market Report - 04.01.2022Document1 pageDaily Equity Market Report - 04.01.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 26.07.2022Document1 pageDaily Equity Market Report - 26.07.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report 06.07.2022 2022-07-06Document1 pageDaily Equity Market Report 06.07.2022 2022-07-06Fuaad DodooNo ratings yet

- Daily Equity Market Report 29.09.2021 2021-09-29Document1 pageDaily Equity Market Report 29.09.2021 2021-09-29Fuaad DodooNo ratings yet

- Daily Equity Market Report - 18.10.2022Document1 pageDaily Equity Market Report - 18.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 11.10.2022Document1 pageDaily Equity Market Report - 11.10.2022Fuaad DodooNo ratings yet

- 19th Edition of The Ghana Club 100 Rankings OutcomeDocument3 pages19th Edition of The Ghana Club 100 Rankings OutcomeFuaad DodooNo ratings yet

- Fixed Income Market Report - 10.10.2022Document1 pageFixed Income Market Report - 10.10.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 14.10.2022Document2 pagesWeekly Capital Market Report - Week Ending 14.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 17.10.2022Document1 pageDaily Equity Market Report - 17.10.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 30.09.2022Document2 pagesWeekly Capital Market Report - Week Ending 30.09.2022Fuaad DodooNo ratings yet

- Substandard (Contaminated) Paediatric Medicines Identified in WHODocument4 pagesSubstandard (Contaminated) Paediatric Medicines Identified in WHOFuaad DodooNo ratings yet

- Press Release 2Document1 pagePress Release 2Fuaad DodooNo ratings yet

- Daily Equity Market Report - 06.10.2022Document1 pageDaily Equity Market Report - 06.10.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 03.10.2022Document1 pageFixed Income Market Report - 03.10.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 07.10.2022Document2 pagesWeekly Capital Market Report - Week Ending 07.10.2022Fuaad DodooNo ratings yet

- R9 News Release Gender Inequalities Persist in Ghana Afrobarometer BH MA 4oct22Document4 pagesR9 News Release Gender Inequalities Persist in Ghana Afrobarometer BH MA 4oct22Fuaad DodooNo ratings yet

- Daily Equity Market Report - 28.09.2022Document1 pageDaily Equity Market Report - 28.09.2022Fuaad DodooNo ratings yet

- Press ReleaseDocument1 pagePress ReleaseFuaad DodooNo ratings yet

- Daily Equity Market Report - 05.10.2022Document1 pageDaily Equity Market Report - 05.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 04.10.2022Document1 pageDaily Equity Market Report - 04.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 29.09.2022Document1 pageDaily Equity Market Report - 29.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 27.09.2022Document1 pageDaily Equity Market Report - 27.09.2022Fuaad DodooNo ratings yet

- Regulatory Order To ECG - 221004 - 180752Document6 pagesRegulatory Order To ECG - 221004 - 180752Fuaad DodooNo ratings yet

- Daily Equity Market Report 03.10.2022 2022-10-03Document1 pageDaily Equity Market Report 03.10.2022 2022-10-03Fuaad DodooNo ratings yet

- Fixed Income Market Report - 26.09.2022Document1 pageFixed Income Market Report - 26.09.2022Fuaad DodooNo ratings yet

- Auctresults 1817Document1 pageAuctresults 1817Fuaad DodooNo ratings yet

- Daily Equity Market Report - 26.09.2022Document1 pageDaily Equity Market Report - 26.09.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 23.09.2022Document2 pagesWeekly Capital Market Report - Week Ending 23.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 22.09.2022Document1 pageDaily Equity Market Report - 22.09.2022Fuaad DodooNo ratings yet

- Imf MeetingDocument1 pageImf MeetingFuaad DodooNo ratings yet

- Daily Equity Market Report 20.09.2022 2022-09-20Document1 pageDaily Equity Market Report 20.09.2022 2022-09-20Fuaad DodooNo ratings yet

- Nimed Financial Market Review (16.09.2022)Document4 pagesNimed Financial Market Review (16.09.2022)Fuaad DodooNo ratings yet

- Daily Equity Market Report - 19.09.2022Document1 pageDaily Equity Market Report - 19.09.2022Fuaad DodooNo ratings yet

- Effect of Monetary Policy On Foreign Trade in IndiaDocument8 pagesEffect of Monetary Policy On Foreign Trade in Indiarohan mohapatraNo ratings yet

- Trend LanguageDocument2 pagesTrend LanguageHà Nguyễn ThuNo ratings yet

- Tayabur Rahman - Final - AutumnDocument10 pagesTayabur Rahman - Final - AutumnTayabur RahmanNo ratings yet

- Competency Based Questions Class 11thDocument2 pagesCompetency Based Questions Class 11thraman195321No ratings yet

- 3.1 The Level of Overall Economic ActivityDocument12 pages3.1 The Level of Overall Economic ActivityRaffaella PeñaNo ratings yet

- Trade Cycles 44863Document17 pagesTrade Cycles 44863aathikbasha1448No ratings yet

- Money and Monetary PolicyDocument4 pagesMoney and Monetary PolicyMohammad A. HasanNo ratings yet

- Central Bank and Monetary PolicyDocument16 pagesCentral Bank and Monetary PolicyHitesh MenghwaniNo ratings yet

- Chapter 5 Inflation TEST BANK 1Document20 pagesChapter 5 Inflation TEST BANK 1Marouani RouaNo ratings yet

- 8EC0 02 MSC 202001217Document23 pages8EC0 02 MSC 202001217Afifa At SmartEdgeNo ratings yet

- Economic and Financial IndicatorsDocument11 pagesEconomic and Financial IndicatorscezyyyyyyNo ratings yet

- Alhamra Islamic Income FundDocument28 pagesAlhamra Islamic Income FundARquam JamaliNo ratings yet

- Goldilocks and The Ten Bears of 2021Document5 pagesGoldilocks and The Ten Bears of 2021Jeff McGinnNo ratings yet

- Agexmark Q&a 1Document25 pagesAgexmark Q&a 1Waren LlorenNo ratings yet

- History Reflection - Ratu Putri Dewi XI6 24Document2 pagesHistory Reflection - Ratu Putri Dewi XI6 24Ayesha Dhika SalsabillaNo ratings yet

- Knowledge Organiser 2.5Document3 pagesKnowledge Organiser 2.5Gupi PalNo ratings yet

- Understanding The Inverse Yield CurveDocument8 pagesUnderstanding The Inverse Yield CurveSiyang QuNo ratings yet

- Money and BankingDocument17 pagesMoney and Bankingmuzzammil4422No ratings yet

- AE 322 Financial Markets: Mrs. Carazelli A. Furigay, MbaDocument16 pagesAE 322 Financial Markets: Mrs. Carazelli A. Furigay, MbaDJUNAH MAE ARELLANONo ratings yet

- GPT Prompt From Convert From English To HinglishDocument9 pagesGPT Prompt From Convert From English To Hinglishnoyov22845No ratings yet

- Chapter 2 - DETERMINATION OF INTEREST RATESDocument36 pagesChapter 2 - DETERMINATION OF INTEREST RATES乙คckคrψ YTNo ratings yet

- CH 08Document37 pagesCH 08川流No ratings yet

- Ap 2020exam Sample Questions MacroeconomicsDocument4 pagesAp 2020exam Sample Questions MacroeconomicsKayNo ratings yet

- Assignment 3Document5 pagesAssignment 3Amr MekkawyNo ratings yet

- AmscoDocument2 pagesAmscoEthan BoelhouwerNo ratings yet

- 27 Jan Lecture HandoutsDocument37 pages27 Jan Lecture HandoutsJun Rui ChngNo ratings yet

- Aggregate Demand PPTs-PART 1Document27 pagesAggregate Demand PPTs-PART 1Asim RiazNo ratings yet